Wheelock Properties' Monaco Marine

in Kai Tak will launch the first round of sales of 308 flats this

Saturday, the first new property sales since the fifth Covid wave hit

the city in January.

Among the 308 flats, 306 will be on the price list, while the other two will be sold via tender, the developer said.

Homes

in the price lists comprise 66 one-bedroom units, 179 two-bedroom

units, and 61 three-bedroom units, and the average price per square foot

is HK$25,788 after discounts, around 10 percent lower than other new

projects in the same area, said managing director Ricky Wong Kwong-yiu.

The

discounted prices of the homes in the three lists range from HK$7.96

million to HK$20.4 million, and the value in total reaches HK$3.7

billion, Wong said.

The

306 flats were 8.8 times oversubscribed with 3,000 checks, and the sales

will take place at the Prince Hotel in Tsim Sha Tsui.

The third price list was released late Monday, offering 118 units at an average price of HK$26,293 per sq ft after discounts.

Monaco Marine's

launch will be followed by the Grand Mayfair I on Yuen Long's Kam

Sheung Road, whose first price list of over 143 homes is expected to be

unveiled this week.

The

715-flat property is phase 1A of a 2,200-flat mega project that is being

jointly developed by Sino Land (0083), K Wah International (0173), and

China Overseas Land and Investment (0688).

The

list will comprise one- to three-bedroom units and sales could be

launched within this month, said the developers. They said showrooms are

under preparation and will open to the public in the week.

In

Tai Kok Tsui, the Quinn Square Mile with 614 flats is set to reveal the

first price list as well as open show flats this week, said the builder

Henderson Land Development (0012).

(The Standard)

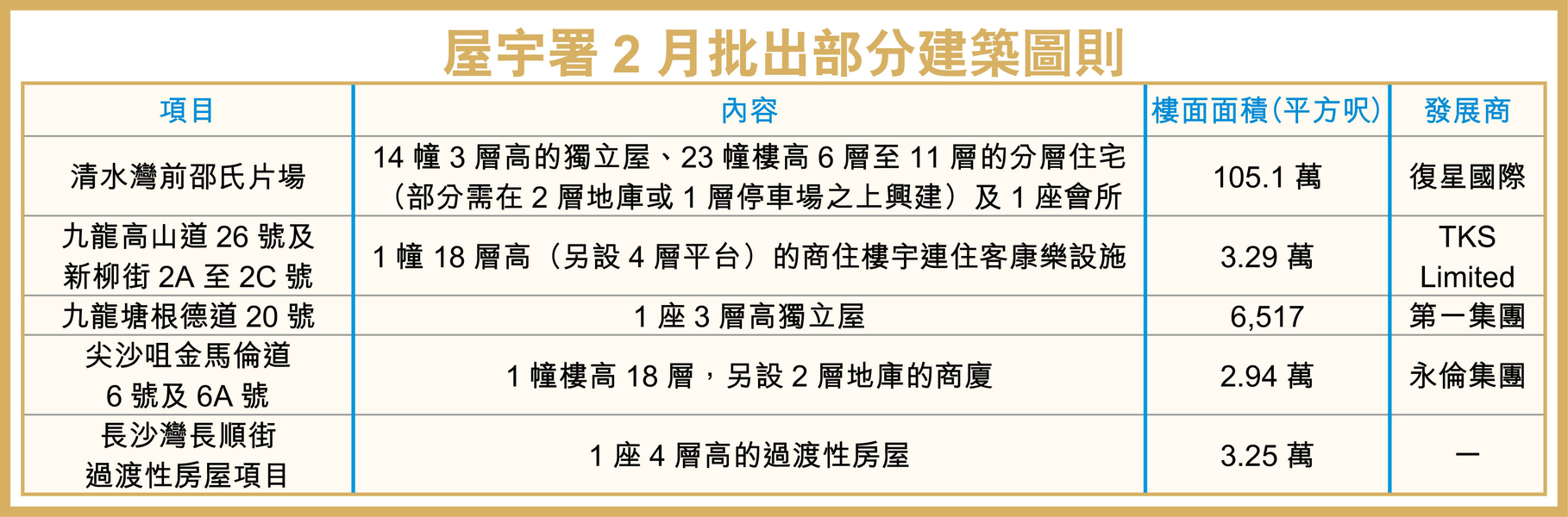

Historic Shaw Studios to give way to new homes

A

site in Clearwater Bay which was the former home of Shaw Studios and

TVB's old headquarters is to be turned into 37 low-rise residential

buildings and houses.

The landmark studio was opened in 1961 by Sir Run Run Shaw and produced Chinese movies until the 1990s.

The site, which included TVB's old headquarters, was vacated since 2003 and has been targeted for redevelopment several times.

It was sold to Fosun International (0656) in 2013 for HK$1.5 billion.

The

Antiquities Advisory Board declared the complex a site of cultural

significance in 2015 and said any redevelopment plans would have to

include measure to preserve the existing structures.

Fourteen

three-story single-family houses and 23 residential buildings ranging

from 6 to 11 stories, as well as a clubhouse - providing a gross floor

area of 97,628 square meters in total - will be built on the site, data

from the department showed yesterday.

The

project is one of the 11 building plans approved by the Buildings

Department in February. Of the 11, eight are residential developments.

A

project in To Kwa Wan, which was acquired by TKS through a compulsory

auction last year, has been given the green light for an 18-story

building which will provide a gross floor area of 2,545 sq m of private

homes and 512 sq m for commercial use.

In

Kowloon Tong, a three-story single-family house covering a gross floor

area of 605 sq m has also won the go-ahead from the authorities.

Among

commercial buildings, a plan for an 18-story tower on 6 and 6A Cameron

Road in Tsim Sha Tsui was approved by the government. The project of the

Winland Group is expected to provide a gross floor area of 2,734 sq m

upon completion.

In the

same month, the authorities gave consent for work to start on six

building projects which, when completed, will provide 3,839 sq m of

gross floor area for domestic use involving 70 units, and 4,712 sq m of

gross floor area for non-domestic use.

The

department said it has received notification of commencement of

superstructure works for only one residential building project in

February, involving just seven units, compared to none in January.

This

means construction started on only on seven flats in the first two

months of this year, a 99.4 percent plunge from a year ago, and the

lowest number since 1996, according to a property agency.

(The Standard)

Hong Kong Office Rents Down 2% in Q1 as Banks Cut Back on Space

Cryptocurrency

has begun to show its real-world utility as demand for office space

from start-ups dealing in bitcoin, NFT and blockchain is helping to

offset downsizing from multinational banks and other traditional

occupiers in Hong Kong, according to a property agency’s research.

Despite

experiencing a quarter when measures to control the city’s fifth wave

of the COVID-19 pandemic, stock market turbulence, the Russian invasion

of Ukraine and the lockdown of major mainland cities made the city

noticeably quiet in terms of transaction volume, average Grade A office

rents slid just 2 percent compared with the final three months of 2021,

the agency’s analysts said.

Monthly

rents in the quarter averaged HK$55 (about $7) per square foot, down

27.2 percent from their peak in the second quarter of 2019, the agency

said in its Hong Kong Office Leasing report, with the firm predicting an

extended period of challenges for owners of older buildings.

“A

total of 17.2 million square feet (1.6 million square metres) net of

available Grade A office space over the next four years may mean a long

road to recovery for the office sector with tenant preferences shifting

towards contemporary builds and green certified space,” agent said.

Upgrade Opportunities

The

agency noted that multinational banks in Hong Kong have downsized their

offices by at least 312,000 square feet since the second half of 2020,

including a 104,000 square foot give-back by Deutsche Bank at the ICC and Standard Chartered Bank giving up 65,000 square feet at its headquarters in the Standard Chartered Bank Building in Central. Also minimising were Japan’s Nomura, which gave up 56,000 square feet at Two International Finance Centre, and UBS, which handed back 33,000 square feet across its Two International Finance Centre and Li Po Chun Chambers locations.

“Considering

the impact of (work from home) and the reduction in office space

take-up, Grade A office rents are likely to continue to drift down over

the near term,” agent said.

While

the retreat of the major banks has created openings for upstarts in the

fintech sector, these smaller firms are most often finding space in

newer buildings with higher levels of vacancy, including new leases

signed at properties like H Code and The Wellington in Central during the period.

Also finding new tenants during the first quarter were The Chelsea and 33 Des Voeux Road West in Sheung Wan and Tower 535 in Causeway Bay.

Hong

Kong’s existing vacancy of 6.2 million square feet and a pipeline of

new supply totalling 11 million square feet from 2022 to 2025 will offer

plenty of upgrade opportunities in the years ahead, the agency said. At

the same time, the trend towards green-certified buildings will pose a

challenge to owners of older properties who have not kept the assets up

to date.

Staying Positive

In

its own first-quarter report, another agency said that Hong Kong’s

office rents stayed stable in January before leasing activities

substantially slowed as the COVID situation worsened in February.

In

Greater Central, which includes all of Central, Admiralty and Sheung

Wan, monthly rents in the first three months of the year averaged

HK$97.80 per square foot, down 0.5 percent from both the prior quarter

and the year-earlier period, the agency said.

Rents

in Prime Central, defined as 12 key office buildings in Greater

Central, averaged $113.70, down 0.8 percent from the last quarter of

2021 and 1.3 percent from the first quarter of 2021. Only Hong Kong East

and Hong Kong South showed notable drops in rental levels, down 2.2 and

1.5 percent respectively.

The

city recorded positive net absorption over three consecutive quarters

as of the first quarter of 2022, amounting to 245,100 square feet, with

the banking and finance sector accounting for the lion’s share of new

leasing transactions in the first quarter with 34.7 percent, followed by

consumer products and manufacturing at 12.8 percent.

“We

estimate a total net absorption of 300,000 to 500,000 square feet in

2022, with the banking and finance sector leading demand for office

space, while the professional services and logistics sectors will also

remain active,” agent said.

(Mingtiandi)

For more information of Office for Lease at International Commerce Centre please visit: Office for Lease at International Commerce Centre

For more information of Grade A Office for Lease in Tsim Sha Tsui please visit: Grade A Office for Lease in Tsim Sha Tsui

For more information of Office for Lease at Standard Chartered Bank Building please visit: Office for Lease at Standard Chartered Bank Building

For more information of Office for Lease at International Finance Centre please visit: Office for Lease at International Finance Centre

For more information of Grade A Office for Lease in Central please visit: Grade A Office for Lease in Central

For more information of Office for Lease at Li Po Chun Chambers please visit: Office for Lease at Li Po Chun Chambers

For more information of Office for Lease at The Wellington please visit: Office for Lease at The Wellington

For more information of Office for Lease at The Chelsea please visit: Office for Lease at The Chelsea

For more information of Office for Lease at 33 Des Voeux Road West please visit: Office for Lease at 33 Des Voeux Road West

For more information of Grade A Office for Lease in Sheung Wan please visit: Grade A Office for Lease in Sheung Wan

For more information of Office for Lease in Tower 535 please visit: Office for Lease in Tower 535

For more information of Grade A Office for Lease in Causeway Bay please visit: Grade A Office for Lease in Causeway Bay

機構疫後再出發 租務下半年改善

第5波疫情衝擊本港商業氣氛,不少人擔心本港有外資撤出及營商環境受動搖。中環商廈大業主置地等相信,疫情緩和後機構將重新出發,寫字樓仍有一定需求,租務活動下半年將明顯改善。當中,有營運共享寫字樓跨國集團認為,疫情下靈活辦公概念將加強,相關的租務將上升。

本港1月份爆發第5波疫情,對商業活動造成嚴重衝擊,因睇樓活動大減,加上中港通關暫緩,令寫字樓新租務個案減少。同時,本港檢疫條例較為嚴格,個別外資機構把部分業務遷往其他亞太地區,令人憂慮本港營商環境前景因疫情下受嚴重衝擊。

外資代理行:甲廈3季錄正吸納

寫字樓租務可反映商業活動表現,置地為中環甲廈大業主,置地公司執行董事周明祖指出,即使受第5波疫情衝擊,仍接獲不少新的租務查詢,上月更有新租客進駐。對於本港營商前景,他認為基本因素仍然非常穩健,香港為國際金融中心,給予外資進軍內地市場的戰略重點,對香港前景信心十足,更指出中環的地點便利、與環球跨國企業連接的獨特性進一步加強,區內租務勢反彈。

據一外資行數據顯示,本年首季甲廈吸納量,為連續第3個季度錄得正數,達24.5萬平方呎,租賃成交以銀行及金融行業租戶 (34.7%) 佔比最大。據了解,由於去年下半年氣氛轉好,不少新租務成交於本年初落實,因此疫下市場仍錄正吸納量。

該行代理指出,近月有個別公司撤出香港,該代理認為情況並不普遍,有些機構或把旗下部分業務遷至其他亞太地區,而並非全綫撤出,另外,該代理指撤出機構基本上規模不大,故此對商廈市場大局影響輕微。

寫字樓租務前景上,該代理認為亞太區整體增長動力高,而中國是投資者看重的市場,而香港有資金自由進出等優勢,因此認為香港金融角色及地位不變,商廈需求在疫情緩和後便轉好。該代理指,去年第4後疫情後,金融業租務較旺,除了中小型的資產管理、對冲基金等,相關專業服務業如律師樓、會計師樓亦擴充,今年情況將近似。

共享空間品牌 租全幢商廈

近月最活躍的外資機構在港擴充,相信為主打靈活辦公室,共享空間品牌IWG,最近集團租用灣仔皇后大道東8號全幢商廈約8萬平方呎樓面,成今年最大手租務。

IWG

香港及大灣區區域經理 Paul MacAndrew

認為,本港疫情緩和,商務活動勢復常,寫字樓租務活動將增加。他指,疫情下出現新常態,機構傾向採用靈活辦公室計劃,員工亦享受不一定在傳統單一辦公點上班,故靈活辦公室疫下需求大。他指,去年第4波疫情完結,集團旗下香港租務,第2季及第3季按季分別升20%及34%,前景上因靈活辦公室既提供便利包括寫字樓裝修及基本設施,租約亦較靈活,未來在港發展空間甚大。

(經濟日報)

更多皇后大道東8號寫字樓出租樓盤資訊請參閱:皇后大道東8號寫字樓出租

更多灣仔區甲級寫字樓出租樓盤資訊請參閱:灣仔區甲級寫字樓出租

商廈新供應續來 租金短期難回升

疫情緩和後,商廈租務勢增加,惟空置率高加上大量新供應續來,租金難有升幅,而真正反彈則要待通關落實。

全港達960萬呎空置 歷來最多

商廈租務市場與經濟發展關係密切,在第5波疫情下各項商業活動叫停,經濟即時受打擊,商廈租務活動自然淡靜。相反,疫情4月份漸受控,各項社交距離措施即將放寬,商業活動開始復常,租務活動定陸續出現。據不少業界人士指,近日商廈睇樓活動漸恢復,可以預期第二季租務上升。

租務活動增加,但不代表租金可以回升。商廈租金調整逾兩年,直至去年尾漸喘定。據一外資代理行表示,最新甲廈空置率約11.6%,而全港達960萬呎空置樓面,數量屬歷來最多。同時間,今明兩年為甲廈供應高峰期,單計今年已有360多萬呎新落成樓面。因空置樓面多,業主為吸引租客,定開出優惠條件,故此即使疫後租務增加,租金也難向上,調整期預計持續至明年。

在社會運動及疫情前,本港商廈每年吸納量逾百萬平方呎,高峰期更高見200萬平方呎,惟疫下封關,內地及海外機構難在港擴充業務,而疫情下ipo活動減少,同樣令金融機構等租務淡靜。換言之,商廈租務市場轉旺,租金要出現反彈,關鍵還是通關,要待內地企業及歐美機構新需求來港招展,商廈市場才穩步發展。

(經濟日報)

外資基金再現身 大額吸工商物業

大額物業投資市場上,外資不僅未見撤出,近一年更是積極入市,成大手買賣市場主力買家。

業界指本港物業前景佳,加上個別範疇價格有明顯調整,今年續吸引外資基金入市。

自去年下半年起,本港逾億元大額工商物業買賣,外資基金成主要買家,去年本港多幢工廈均由基金承接。今年第5波疫情爆發,整體交投氣氛轉差,惟近一個月外資基金再現身,包括月初美資基金Nuveen旗下Asia Pacific Cities Fund (APCF) 以約29億元購入葵涌貨櫃碼頭路集運中心全幢,成今年最大額買賣。

價格調整 現投資價值

有外資代理行代理認為,低息環境下外資籌集一定資金,本港物業如商廈、舖位等,價格出現明顯調整,在亞太區市場中,跌幅較日本、韓國及新加坡等為高,開始出現投資價值。他指,基金投資物業的年期一般3至5年以上,現時疫情明顯緩和,本港不明朗因素漸消失,故相信下半年外資基金仍活躍投資本港物業。

Weave Living夥美資 購酒店

近期市場其中一宗大額買賣,為共居空間營運商Weave

Living,以13.75億購入大角咀九龍珀麗酒店,將轉作共居用途。據了解,是次Weave Living夥拍美資基金入市購酒店,Weave

Living副總裁彭德仁指出,不少過往多年未有在港投資的基金,近日亦出手買酒店,反映外資看好本港市場前景。

(經濟日報)

清水灣前邵氏片場 批建23幢分層及14獨立屋

評為一級歷史建築的清水灣前邵氏片場,獲屋宇署批建14幢3層獨立屋,以及23幢樓高6層至11層的分層住宅,總樓面約105.1萬平方呎,將成為區內大型住宅項目。

總樓面面積達105萬呎

位於清水灣道的前邵氏片場,早於60年代開幕,曾是全球最大私營影城,並於2015年評為一級歷史建築。業主先後於2006年及2014年向城規會申請將項目發展為商住項目,而業主復星國際於2018年9月再就項目向城規會申請興建住宅及商業等綜合項目,擬建749個住宅單位、183間酒店客房等,而邵氏行政大樓、比鄰的片倉、配音室等均會原址保留,2019年3月獲城規會批准,而住宅部分亦獲屋宇署批出。

該項目最新獲屋宇署批准興建14幢3層高的獨立屋、23幢樓高6層至11層的分層住宅 (部分需在2層地庫或1層停車場之上興建) 及1座會所,總樓面面積約105.1萬平方呎。

另外,屋宇署亦批出九龍高山道26號及新柳街2A至2C號項目,最新獲批1幢18層高 (另設4層平台) 的商住樓宇連住客康樂設施,住用總樓面涉約2.74萬平方呎,非住用樓面則涉約5,515平方呎。上述地盤去年進行強拍,並由TKS Limited以底價1.36億元成功統一業權。

而去年由第一集團以2.5億元購入的九龍塘根德道20號項目,最新獲該署批准興建1座3層高的獨立屋,總樓面約6,517平方呎。

商業項目方面,由永倫集團購入的尖沙咀金馬倫道6號及6A號項目亦獲批建1幢樓高18層的商廈,總樓面面積約2.94萬平方呎。

(經濟日報)

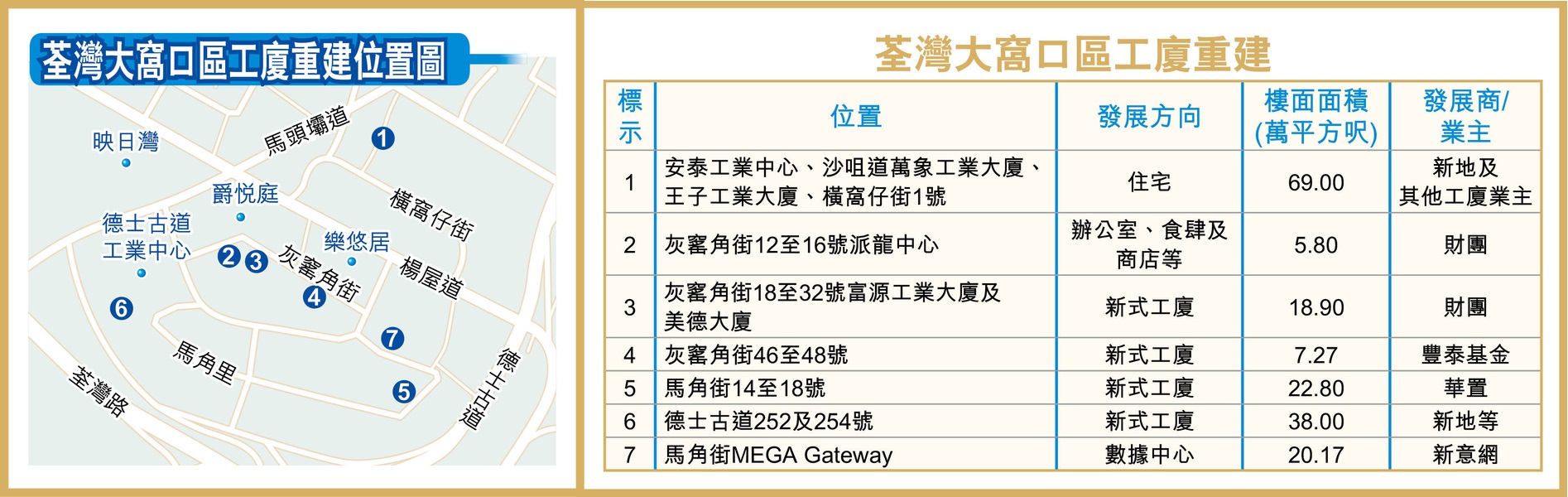

大窩口7工廈重建 增建1330伙住宅

荃灣大窩口工業區一帶,近年有不少工廈重建,目前仍有7個項目,涉及約182萬平方呎樓面正在進行,當中沙咀道一帶漸轉型成住宅區,包括新地 (00016) 牽頭的住宅項目,提供約1,330伙。

荃灣區工業發展集中在兩個區域,包括東面的大窩口工業區,以及西面的柴灣角工業區,當中大窩口工業區近年至少有7個工廈重建計劃,將會提供約182萬平方呎樓面供應。若果進一步細分,大窩口工業區分為南北兩個部分,北面的德士古道、沙咀道及楊屋道交界,早年已經獲規劃署改劃成「綜合發展區」,目標是推動轉型成住宅發展,包括由政府主導的居屋項目尚翠苑。

分4期發展 首期料建465伙

至於私人方面,位於沙咀道及聯仁街交界的安泰工業中心、王子工業大廈及亞洲脈絡中心等4幢工廈,其中一個業主新地近年積極推動重建。發展商計劃以地積比率6.1倍重建,當中6倍作為住宅用途,將會興建5幢31層高分層住宅,總單位數目約1,330伙。

項目將繼續分為4期發展,當中新地旗下安泰工業中心位於第1期,將會興建1幢31層高住宅,總樓面約20.1萬平方呎,預計提供約465伙。

增87萬呎新式工廈樓面

至於楊屋道以南的部分,目前仍然規劃「工業」用途,故此範圍內的6個工廈重建計劃之中,亦有4個計劃重建成新式工廈,預計可帶來約87萬平方呎樓面。當中規模最大屬於新地等重建的德士古道252及254號項目,前身為半島工業大廈,按照2014年批出的建築圖則,將會興建2幢27層高工廈,涉及近38萬平方呎樓面。

另外,華人置業 (00127) 於2020年向「舖王」鄧成波以約3.6億元購入的馬角街14至18號栢獅電子大廈重建項目一半權益,計劃重建成1幢23層高的工廈,總樓面約22.8萬平方呎,預計於2024年底前完成。

財團今年初申請將灰窰角街18至32號的富源工業大廈、美德大廈,放寬地積比率至11.4倍,以准許作工業用途,並計劃重建1幢22層高的工廈,另設2層地庫,涉及總樓面面積約18.9萬平方呎。

除了工廈重建外,新意網 (01686) 在2018年以約7.26億元購入的前馬角街熟食中心工業地,則將會用來興建高端數據中心,涉及樓面約20.17萬平方呎。

(經濟日報)

PLAZA 88 呎租貼近東九龍

荃灣區內近年愈來愈多商廈及新式工廈落成,當中近年新入伙的楊屋道PLAZA 88商廈,目前呎租達23至29元,逐漸貼近九龍東觀塘、九龍灣水平。

每呎租金23至29

由億京發展的PLAZA 88,屬於楊屋道商住用地的一部分,楊屋道項目由4幢大樓組成,其中3幢住宅大樓屬於私樓映日灣,餘下1幢35層高商廈則為PLAZA 88,總樓面約65萬平方呎,屬於荃灣區內指標商廈之一。

據代理行數據顯示,近半年該商廈呎租約23至29元不等。據早前有消息指,中聯辦亦以月租近88萬元租用一層半單位,合共面積約3.5萬平方呎,平均呎租約25元,屬於長達5年租約,並擁有續租權。至於去年底PLAZA

88另一間高層單位,面積963平方呎,以約2.6萬元租出,平均呎租約27元。

而同區南豐中心等商廈雖然樓齡較舊,但由於鄰近港鐵荃灣站,故此租金亦維持不俗水平。近期南豐中心平均呎租介乎約18至30元不等,部分低層單位作為零售商舖之用,租金較為理想,例如低層一個面積約505平方呎單位,月租約1.5萬元,平均呎租約30元;而另一個中層單位面積約661平方呎,平均呎租25元。

(經濟日報)

第一集團根德道批建洋房

近年本港房屋供應短缺,政府有序地增加房屋供應,屋宇署昨公布,今年2月批出8份住宅及商住發展,除最矚目的屹立逾半個世紀歷史的西貢清水灣邵氏片場獲批38幢建築物外,其他獲批項目均以單幢項目為主,如第一集團持有的九龍塘根德道20號項目、獲批建1幢3層高洋房。

2月共批11份建築圖則

據屋宇署資料顯示,該署今年2月共批出11份建築圖則,其中港島2份、九龍5份及新界4份;上述批出的圖則包括8項住宅及商住發展、1項商業發展,以及2項社區服務發展;上述獲批住宅圖則中不乏豪宅項目、由第一集團去年斥資2.5億購入的九龍塘根德道20號,獲批建1幢3層洋房,涉及可建總樓面約6517方呎。

資料顯示,第一集團於去年10月以2.5億購入上述項目,當時每方呎樓面地價3.8萬。發展商曾指,而該幢大屋將提供私人車位、泳池及花園,預計於2023年落成。

高山道26號批建商住項目

另外,亦有舊樓併購項目獲批圖則,由財團TKS

Limited去年以1.36億循強拍途徑購入的土瓜灣高山道26號及新柳街2A至2C號,獲批建一幢樓高18層、另有4層平台的商住物業,住宅部分可建總樓面約27403方呎,另有5515方呎非住宅樓面,整個項目可建樓面約32918方呎。

由財團持有的上環樂古道10號,獲批建1幢樓高5層,另有1層平台的商住項目,住宅部分涉及可建總樓面約2032方呎,另有1340方呎非住宅樓面,整個項目可建總樓面約3372方呎。

此外,該署今年2月僅批出1項商業項目獲批圖則,為永倫集團去年斥資3.68億購入的尖沙嘴金馬倫道6號及6A號,亦獲批建一幢18層高、另有2層地庫的商業樓宇,涉及可建總樓面約29434方呎。

(星島日報)