The Grand Mayfair I

in Yuen Long has unveiled its first price list of 168 flats with an

average price per square foot of around HK$17,608 after discounts,

compared to more than HK$20,000 in nearby new projects.

The

batch comprises 52 one-bedroom units, 98 two-bedroom units, and 18

three-bedroom units, with prices ranging from HK$6.08 million to

HK$13.99 million after discounts, or from HK$16,008 to HK$19,004 per sq

ft.

The cheapest flat with a bedroom, measuring 354 sq ft, costs HK$17,175 per sq ft.

The

715-flat property is phase 1A of a 2,200-flat mega project that is

being jointly developed by Sino Land (0083), K Wah International (0173),

and China Overseas Land and Investment (0688).

Sino

Land said the price of the project is around 20 percent lower than

other new developments along the Tuen Ma Line and its prices increase in

the future.

Show flats are available for viewing from today and sales could start this month, the developers said.

The

price list came as a survey showing that more Hongkongers are looking

at property purchases amid to the easing Covid outbreak in the city.

The

survey of 324 respondents done last week showed the percentage of

people looking at buying a home in the next six months has risen by 14.1

percentage points to a three-year high of 46.6 percent.

The

survey showed that 31.5 percent of the respondents believed property

prices will rise in the coming six months, which is almost 20 percentage

points higher than that of a similar poll conducted in early March.

The

percentage of those who believed that property prices will fall sank by

31.3 percentage points from 74.5 percent to 43.2 percent.

Separately,

Henderson Land Development (0012) has released the sales brochure of

the Henley II in Kai Tak, which offers 301 homes.

Flats in the residential project have areas from 379 sq ft to 1,365 sq ft with layouts from one to three bedrooms.

In Cheung Sha Wan, Henderson's other project The Harmonie released the sixth price list which includes 40 units, and will launch the sale of 114 flats next Tuesday.

The

latest batch consists of two-bedroom units ranging from 322 to 338 sq

ft and are priced from HK$7.45 million and HK$8.37 million after

discounts, the developer said.

(The Standard)

Sino Land, Wheelock unleash cheaper flats to boost sales as Hong Kong emerges from ‘lost months’ of strict Covid-19 measures

‘Developers lost the first three months of property sales, so their primary goal is to speed up sales,’ a surveyor said

Sino and Wheelock both priced hundreds of new flats roughly 12 per cent below comparable projects launched last year

Hong Kong developers are launching hundreds of flats at knock-down prices in a bid to make up for lost time as the city begins to emerge from months of strict social-distancing measures that have made house sales all-but impossible.

Sino Land priced the first batch of 168 units at its Grand Mayfair I

project above Kam Sheung Road MTR station at an average price of

HK$17,608 per square foot after factoring in a discount of up to 16 per

cent.

The

price, unveiled on Wednesday, is about 12 per cent lower than the

average launch price in December of HK$19,899 per square foot at The YOHO Hub at Yuen Long station, one stop away from Kam Sheung Road station.

Wheelock Properties has also priced flats at its Monaco Marine

development in Kai Tak 12 per cent lower than a nearby project that

went on sale last summer. It will release 308 units for sale on

Saturday.

“Developers lost the first three months of property sales, so their primary goal is to speed up sales,” a surveyor said.

Henderson Land Development joined the rush to get flats onto the market after the hiatus, though it has left its prices the same as in previous batches.

It revealed on Wednesday that it will offer 108 units, with sizes ranging from 322 to 377 square feet, at The Harmonie

in Cheung Sha Wan for sale next Tuesday. The units are priced from

HK$6.89 million to HK$9.45 million, or HK$20,972 to HK$25,544 per square

foot.

Sales

of new homes in the first quarter plummeted 64 per cent to just 1,679

transactions, from 4,633 deals in the last three months of 2021,

according to a property agency.

“It was the lowest number in the past six years,” the agent said.

It was also 23 per cent fewer than the 2,186 deals recorded in the first quarter of 2020, when the Covid-19 pandemic started.

“The slump reflected the devastating impact of the fifth wave of Covid-19 on property sales,” the agent said.

The government is due to relax social-distancing measures from today.

Restaurants

will be allowed to operate dine-in services until 10pm with four people

per table, while gyms, massage parlours, cinemas and theme parks will

be able to reopen after more than three months of being shuttered up.

The first batch of flats at Grand Mayfair I,

with sizes ranging from 354 sq ft to 762 sq ft, were priced at HK$6.07

million to HK$13.99 million, or HK$17,175 per sq ft to HK$18,365 per sq

ft. The project is due to be completed in October, 2024.

Victor Tin, group associate director at Sino, described them as “super-happy prices”.

Developers began to lower their prices amid a slew of gloomy predictions about the market outlook.

Goldman

Sachs predicted home prices will fall by 20 per cent between now and

2025 as borrowing costs increase and demand slumps because of rising

unemployment.

The

American investment bank said every 25 basis-point increase in interest

rates would need a 5 per cent rise in income or a 5 per cent decline in

property prices to maintain affordability.

The US Federal Reserve has suggested it could lift interest rates six more times, up to a total of 100 basis points, this year.

Hong Kong’s lived-in home prices have dropped 4 per cent from a peak in September last year.

(South China Morning Post)

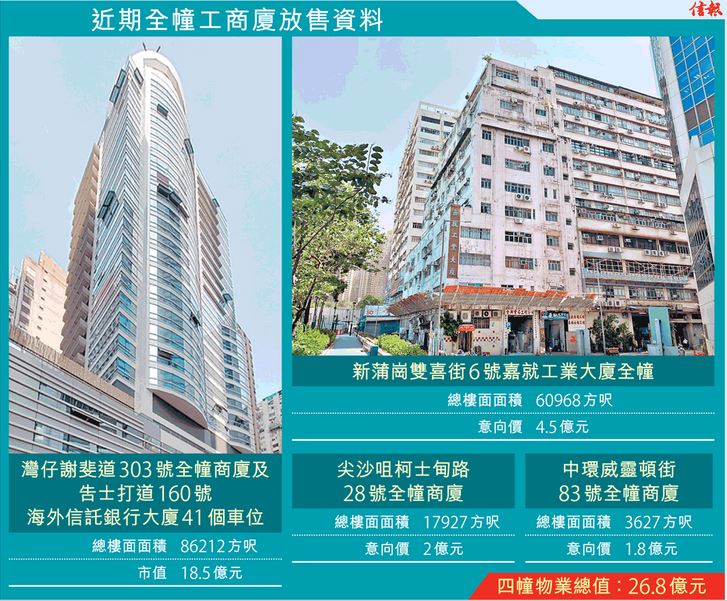

4工商廈本月放售 總值27億 灣仔前王子酒店及毗鄰車位最貴重

受第五波疫情影響,大額投資物業成交大減,但隨着疫情緩和,業主亦開始放售物業。綜合市場資訊,本月至今已有最少4幢商廈或工廈推出市場放售,總市值高達26.8億元。當中,私募房地產投資基金凱龍瑞集團標售灣仔謝斐道303號全幢商廈及毗鄰的海外信託銀行大廈41個車位最貴重,市值共約18.5億元。

有代理指出,有基金以公開招標形式出售謝斐道303號全幢商業大廈及毗鄰的告士打道160號海外信託銀行大廈41個私家車車位,截標日期為6月8日。

謝斐道303號前身為王子酒店,樓高25層,總建築面積約86212方呎,地下商舖現分別租予健身中心及美容院,1樓至9樓承租予多間食肆,中高層單位由辦公空間租用,現時出租率約80%。是次出售包括毗連海外信託銀行大廈的41個車位,月租收入逾20萬元,新買家可連同謝斐道303號一併購入,亦可分別獨立購入。據了解,謝斐道303號市值約17億元,呎價約1.97萬元;海外信託銀行大廈的車位約值1.5億元,即合共市值18.5億元。

新蒲崗嘉就工廈意向4.5億

凱龍瑞集團於2017年底向資深投資者鄧成波家族以13.5億元購入謝斐道303號,以及斥1億元買入海外信託銀行大廈的車位。凱龍瑞集團中國香港首席執行官何震東表示,購入謝斐道303號後,斥資1.8億元作大型翻新,改裝為商廈。若新買家購入作長線投資,可提供即時租金回報,另亦適合大型企業作集團總部之用。

新蒲崗雙喜街6號嘉就工業大廈現集合全部業權出售。另一代理稱,上述物業現狀為一幢11層高的工業大廈,建於1968年,地盤面積約6670方呎,總建築面積約60968方呎,意向價4.5億元,呎價約7381元。嘉就工業大廈曾於2018年中標售,當時僅50%業權份數參與,現時則出售全數業權,新買家可即時進行重建。項目可重建成新式工廈或按工廈重建的標準金額補地價先導計劃,補地價作商業發展。

尖沙咀中環兩項目規模較細

而本月另有兩幢規模較細的全幢商廈推出市場放售,如位於尖沙咀柯士甸路28號的全幢商廈,地盤面積約1531方呎,全幢總建築面積約17927方呎,由銀主以意向價約2億元交吉放售,呎價約1.12萬元。

此外,中環威靈頓街83號全幢商廈近日同樣放賣,物業為樓高7層的商業大廈、另設一層地庫,總面積約3627方呎,意向價約1.8億元,呎價約4.96萬元。

(信報)

更多海外信託銀行大廈寫字樓出售樓盤資訊請參閱:海外信託銀行大廈寫字樓出售

更多灣仔區甲級寫字樓出售樓盤資訊請參閱:灣仔區甲級寫字樓出售

疫情緩和,不少買家前往拍賣場尋寶,惟出價仍相當審慎,昨日有兩場拍賣,其中一間拍賣行承拍14項物業,該拍賣行發言人指,現場拍出唯一物業為尖沙嘴永安廣場低層8及9室,面積2318方呎,屬辦公室銀主盤,開拍價2230萬,獲買家以一口價購入,呎價9620元,低市價約兩成。昨日拍賣會約20人出席,競投氣氛一般,買家出價仍然審慎不會追價入市。

至於另一拍賣行則承拍16項物業,現場未有成交。其中較多人查詢為屯門小坑村天逸峰8號18座地下連花園及1樓複式戶,面積1366方呎,連809方呎花園,開拍價920萬,呎價6735元,低市價約兩成。

(星島日報)

更多永安廣場寫字樓出售樓盤資訊請參閱:永安廣場寫字樓出售

更多尖沙咀區甲級寫字樓出售樓盤資訊請參閱:尖沙咀區甲級寫字樓出售

觀塘行動區申撥款 加快釋商地

發展局申請6.1億元撥款為觀塘行動區商業項目進行道路及基建工程,將加快釋出大型商業地,將提供約93.3萬平方呎樓面,作為辦公室、零售及餐飲設施等用途。

市場估地皮值42億至47億

該觀塘行動區鄰近觀塘碼頭,包括觀塘碼頭廣場寵物公園及巴士總站等位置,按照政府計劃,可提供約93.3萬平方呎樓面,除了作為辦公室、商店、服務行業或食肆等用途外,還會提供公共交通交滙處,以及公眾休憩空間。

由於屬於觀塘臨海地段,加上發展具規模,足以打造甲級商廈,市場估計地皮市值約42億至47億元,每呎樓面地價約4,500至5,000元。

現時政府申請6.1億元撥款,計劃為用地興建多條新的道路、一條約50米長有蓋行人天橋,並且重置現有觀塘碼頭公共運輸交滙處、重整現有觀塘汽車渡輪碼頭,以及提供比鄰的海濱長廊及休憩用地。

按照政府估算,在獲批撥款後工程將在約4年內完成,換句話,該幅觀塘商業用地有機會在2026年前後推出。

(經濟日報)