Sales of flats at The Henley

II in Kai Tak may kick off this month and a new batch with at least 31

units will be revealed soon, said the developer Henderson Land

Development (0012).

It may raise the price in the forthcoming batch

depending on the market response, said Thomas Lam Tat-man, a general

manager of the sales department.

The developer has received 252 checks for 61 homes

on the first price list, making them over three times oversubscribed,

Lam said.

Meanwhile, Henderson's other project in Tai Kok Tsui - The Quinn Square Mile - has released a new price list, offering 65 units with prices starting from HK$5.61 million after discounts.

The batch, which comprises flats from 208 square feet to 382 sq ft, costs from HK$22,113 to HK$27,337 per sq ft.

Mark Hahn Ka-fai, the other general manager of the sales department, said sales could be announced this week at the earliest.

Also developed by Henderson, The Harmonie in Cheung Sha Wan sold 38 units in just one hour after launching sales last night.

A total of 108 flats were put on the market, priced from HK$6.9 million to HK$9.46 million after discounts.

In Yuen Long, The Grand Mayfair I was 25 times oversubscribed yesterday with 10,000 checks for the 388 units on offer.

Separately, a report submitted by the HKMA to

LegCo showed that of the 12,500 mortgage applications approved this year

as of April 20, 1,160 were under the new coverage after the mortgage

issuance program revisions.

(The Standard)

Office Upgrades on the Rise After Omicron Slowed Hong Kong Market in Q1

Corporate tenants in Hong Kong are enjoying

greater opportunities to relocate to upgraded premises this year as the

city’s struggles with the Omicron variant slow leasing activity and open

up more office space, according to recent research by a property

agency.

“Office leasing activities will be largely

focusing on flight-to-quality relocation, space optimisation or

consolidation moves over the year, as most office occupiers are looking

for cost-saving options, and they are now presented with more leasing

options in the market given 4.5 million square feet (418,000 square

metres) is scheduled to complete in 2022,” property agent said.

With many companies unable to visit office

locations during the first quarter, vacancy across the city climbed by

0.9 percentage points compared to the same period a year earlier to 10.9

percent by the end of March, according to the agency’s figures. The

slowdown in leasing has meant reductions in office rents for occupiers,

with overall leasing rates down 1.3 percent in the first quarter. This

is helping to make office locations which were once beyond the budget of

some occupiers into more attractive options.

The market challenges have also had an impact on

investment activity, which was dominated by bargain hunters in the

industrial and retail sectors during the first quarter, as trades of

income-earning property assets fell by 46 percent compared to the

October to December period to total just HK$11.2 billion ($1.4 billion),

the agency’s data shows.

Flexibility Needed

Net take-up of office space in Hong Kong grew by

157,000 square feet during the first quarter, mostly supported by new

supply completion and leases negotiated since end-2021 and closed in

early Q1, according to the agency.

The cooling in Hong Kong’s traditional business

hubs means that vacancy in Central climbed to 8.3 percent during the

first quarter, with rents, which now average HK$103 per square foot per

month in the district, expected to slide by a total of 5 percent during

2022.

While the waning of the latest COVID wave is

already allowing more workers back to the office, with the

Russian-Ukrainian war and uncertainties over when Hong Kong’s border

with the mainland will be reopened, the agency predicts a muted 2022 for

the city’s office market and encourages asset owners to stay in

dialogue with potential tenants.

“Market uncertainties since the start of 2022,

including the outbreak of Omicron, geo-political tensions and stock

market volatilities, have disrupted the decision-making process of

investors and occupiers, hence slowing office leasing and investment

momentum in Q1,” agent said. “With cash-rich investors still keen on

acquiring quality assets, and landlords becoming more flexible in

negotiation to retain tenants or secure new leases, we are hopeful of a

gradual improvement in market sentiment and momentum in H2.”

Kowloon Boon

While tenants have been slow to act in the city’s

traditional business core, some occupiers looking for upgrades took

advantage of the downturn to pick up large spaces in emerging locations

in Kowloon.

During the first quarter a consumer goods firm leased 44,100 square feet at the NEO project in Kowloon East, while a social services organisation took up 27,900 square feet at the nearby One Kowloon.

Even pricier locations in Kowloon remained active

during the period, with a financial services firm agreeing to lease

26,000 square feet at Sun Hung Kai’s International Commerce Centre (ICC) in West Kowloon.

That activity was reflected in leasing rates with

average rents in Tsim Sha Tsui climbing by 1.6 percent during the

quarter, while pricing in Kowloon East climbed by 0.2 percent compared

to the preceding three months. While Kowloon East continues to have the

highest level of vacancy of the city’s major commercial hubs, that rate

stayed flat at 14.1 percent in the first quarter, despite the broader

slowdown.

Industrial in Style

While investment activity during the first quarter

fell sharply compared to the last three months of 2021, the HK$11.2

billion in deals recorded still represented an increase of 19 percent

compared to the same period a year earlier, with industrial and retail

trades constituting 74 percent of total transactions, according to the

agency.

“Overall, investors are still eager to look for

acquisition opportunities while pricing remains attractive for most

sectors,” another said.

The agency predicts that with investors showing

resilient demand for data centre and cold storage facilities, industrial

assets, which accounted for 38 percent of investment transaction volume

during the first quarter, will continue to be sought after.

With deals such as PGIM Real Estate’s HK$850

million acquisition of the Travelodge Central hotel during the first

quarter becoming more common, the agent foresees more investors picking

up hospitality assets for conversion into co-living or quarantine

facilities during the coming months. The agency also expects office

deals delayed during the Omicron wave to get back on track during the

second half of the year.

While the city is fighting its way back from the

most recent COVID bout, the agency cautioned that restrictions on the

mainland border would keep the investment market subdued this year.

The agent said that, “Whilst the timeline of

mainland-Hong Kong border reopening remains uncertain, this could limit

flow of cross-border capital from mainland investors, who used to be one

of the key drivers before the pandemic but only accounted for 2 percent

of investment market volume in Q1.”

In the absence of big ticket asset trades in the

coming months, the agency now forecasts that investment transactions in

Hong Kong will slip by 5 percent in 2022 to HK$70 billion, representing

an adjustment from the firm’s previous forecast of 15 percent growth

this year.

(Mingtiandi)

For more information of Office for Lease at NEO please visit: Office for Lease at NEO

For more information of Office for Lease at One Kowloon please visit: Office for Lease at One Kowloon

For more information of Grade A Office for Lease in Kowloon Bay please visit: Grade A Office for Lease in Kowloon Bay

For more information of Office for Lease at International Commerce Centre please visit: Office for Lease at International Commerce Centre

For more information of Grade A Office for Lease in Tsim Sha Tsui please visit: Grade A Office for Lease in Tsim Sha Tsui

Property

agency based in U.S. picks a down-time to open Hong Kong office,

betting on recovery in the world’s most expensive commercial property

market

The

agency with its head office on New York’s Park Avenue, has leased

shared space from Atlaspace in Hong Kong’s Tsim Sha Tsui area to house

even staff

The office is on the 16th floor of the Harbour City building

The

property agency has opened its first office in Hong Kong, as one of

America’s biggest listed commercial real estate consultancies picked a

down-market moment to establish a foothold in the world’s most expensive

property market.

The

agency with its head office on New York’s Park Avenue, has leased

shared space from Atlaspace in Hong Kong’s Tsim Sha Tsui area to house

seven staff, most of them hired from other agency firms. The office is

on the 16th floor of the Harbour City building.

The

Hong Kong space expands the agency’s global footprint of 160 offices,

with 6,200 employees and US$2.9 billion in revenue last year. The city’s

economy and property market are reeling from a devastating Covid-19

outbreak that crippled hundreds of small businesses, drove tens of thousands of residents to emigrate and expanded the ranks of the unemployed to nine-month highs.

“A

lot of Hong Kong investors are focusing on local retail because they

expect the retail market to bounce back pretty quickly during the course

of this year, so they seek opportunities there,” agent said. “We’ll

still see a steady flow of capital from China coming into Hong Kong

[later this year] for the right product.”

The agency will initially focus on the industrial and office segments before adding retail to its services, executives said.

“Industrial property

continues to be strong with capital from around the world, and we expect

the office market to slowly pick up,” the agent said. “The retail

sector will be dominated by local investors this time.”

Hong

Kong’s property deals declined 46 per cent in the first quarter,

compared with the final three months of 2021, according to another

property agency.

Still,

the value of transactions rose 19 per cent from the low base a year ago

to HK$11.2 billion (US$1.4 billion), with half of the deals negotiated

in 2021, the agency added.

One

notable transaction in the first quarter was the sale of Fu Tung

Holdings’ stake in two car parks in Godown Buildings in Chai Wan and

Hung Hom for HK$5.82 billion to LINK REIT, with another agency advising

on the sale.

Hong

Kong’s luxury retail segment is particularly under strain, as a dearth

of mainland Chinese tourists since 2019 left scores of upmarket stores

empty and scurrying for the exit. Over the past 12 months, numerous

brands including Burberry, Prada and La Perla have downsized in Hong Kong,

shutting their Causeway Bay outlets on Russell Street, which used to

surpass New York’s Fifth Avenue as the world’s costliest retail strip.

“The

luxury market will take time to recover, and we anticipate the recovery

of the retail market will lag behind other markets in Hong Kong,” agent

said. “We have seen reasonable activity from the [food and beverage]

sector as companies take advantage of rental pressure and increased

supply to secure strategic locations to expand their businesses.”

Before joining this

agency, this agent was the vice-chairman of advisory and transaction

services in Hong Kong for another agency. Thea gent handled the largest

grade A office leasing deal in Hong Kong in almost two years in April

2021, when Manulife Hong Kong leased around 145,000 square feet of

office space at Manulife Place (formerly known as International Trade Tower) in Kwun Tong.

Other property consultants are looking further into the year for recovery in the office and retail sectors.

“As

social-distancing measures have been relaxed recently, the office

leasing and investment momentum are expected to have a mild growth in

the third and fourth quarters of 2022, and the transaction volume for

offices in Central is expected to have higher growth among other areas

in the market,” another agent said.

With no known time frame for a reopening of the border with China, the outlook remains uncertain.

“If

we assume mainland Chinese tourists to Hong Kong rebound to 30 per cent

of the pre-Covid-19 level after a partial reopening of the border, this

suggests a potential of 1.2 million tourists per month entering Hong

Kong,” the agent said. “A full recovery is likely contingent on global

travel resumption, which we expect to come in 2023 or beyond.”

(South China Morning Post)

For more information of Office for Lease at Manulife Place please visit: Office for Lease at Manulife Place

For more information of Grade A Office for Lease in Kwun Tong please visit: Grade A Office for Lease in Kwun Tong

Hong Kong developers set to rush 800 flats to market as easier Covid-19 rules break lull in home sale

Loosening Covid-19 restrictions are helping to revive property sales after three months of anaemic sales

Wheelock Properties raked in HK$3 billion of sales last weekend, showing some pent-up demand for housing

Hong Kong developers

are wasting no time to rush more new residential homes for sale in the

coming days, after the government’s decision to ease Covid-19 curbs in

the city helped reinvigorate the housing market from a three-month lull.

More

than 800 flats from four projects in Kowloon and New Territories will

be made available in the coming two weeks, according to data compiled

from impending property launches. Wheelock Properties collected at least HK$3 billion (US$382 million) last weekend, the first major sales launch in the city since late January.

The

government removed some social distancing measures from April 21 as

health officials put the Covid-19 outbreak under some control, giving

businesses a shot in the arm. The local economy may barely grow this

quarter, after probably contracting 2.9 per cent in the first three

months this year, the University of Hong Kong forecast.

“When

the pandemic stabilises, everyone will speed up [sales activity],” said

Ricky Wong, managing director of Wheelock Properties. “Developers had

no way to do it in the last few months. It was impossible to launch a

new project [due to the pandemic curbs],” he added.

Sales of new homes are

likely to hit 1,200 units in April, a property agent said. If so, it

will be the busiest month since 1,493 units recorded in December,

according to Land Registry data. They could reach a 10-month high of

2,000 in May, the agent predicted.

Wheelock will sell another batch of 112 flat at the Monaco Marine

project in Kai Tak on Thursday, a follow-up to its robust taking on

Saturday as homebuyers unleashed pent-up demand in so-called “revenge

spending”.

Henderson Land offered 114 units at The Harmonie

in Cheung Sha Wan on Tuesday, while arrangements are progressing to

launch 188 flats at The Quinn Square Mile in Tai Kok Tsui next month. The Grand Mayfair I

in Yuen Long, developed by Sino Land, K Wah International and China

Overseas Land and Investment, will sell 388 flats on Friday.

Sun

Hung Kai Properties’ Silicon Hill development in Pak Shek Kok and

Prince Central in Ho Man Tin may be on sale in May, it said last week.

The

impending launches may help the developers catch buyers seeking to

pre-empt higher financing costs. The Federal Reserve is seen tightening

its policy with rapid increases in interest rates to fight inflation at

four-decade high. The Hong Kong Monetary Authority can be expected to

raise its base rate in lockstep under the city’s linked exchange rate

system to maintain the currency peg.

With

developers taking new orders from buyers every day this week, the

offers in April would be a big jump from just 162 units sold in March

and 474 in February, according to government data. There were 1,073

units logged in January.

Still, the slump in stock

prices in Hong Kong and mainland China has eroded equity wealth,

weakening purchasing strength. The citywide lockdown in Shanghai since

late March continues to hurt sentiment and prices, while an undetected

outbreak in Beijing has stoked concerns about equally drastic curbs in

the capital.

The

current property market sentiment has noticeably improved, said

Wheelock’s Wong, especially against March when infection cases were

running in tens of thousands and domestic banks were forced to shut

about a quarter of their branches.

He

expects home prices to rise 3 per cent in the second quarter, recouping

the decline in the preceding quarter. Easier mortgage financing

measures, as announced by Financial Secretary Paul Chan Mo-po in the

Budget in February, will support home demand.

“The

local property market is likely to recover in the second quarter of

this year, and will rebound strongly in the third and fourth quarter,”

said Victor Lui Ting, deputy managing director at Sun Hung Kai

Properties. Prices are expected to rise 5 to 10 per cent through the

year, he added.

(South China Morning Post)

Hong Kong government rejects all bids for Tuen Mun site, the first land sale to carry minimum flat size requirement

The Tuen Mun site is the first to be subject to the Hong Kong government’s 280 sq ft minimum flat size requirement

All five tenders received for site were rejected as their bids did not meet the government’s reserve price

The

Hong Kong government on Tuesday rejected all five bids received for a

1.3 million square feet residential site in Tuen Mun, the first to be

subject to a 280 sq ft minimum flat size requirement, as all tenders were below the reserve price.

“All

five tenders received for the sale of a residential site in Tuen Mun

town lot no. 561 at Castle Peak Road – Tai Lam, Tuen Mun, have been

rejected as their tendered premiums did not meet the government’s

reserve price for the site,” the Lands Department said in a statement.

“The government will not sell a site if no bid reaches the reserve price

as assessed by the government’s professional valuers. This is to ensure

that the government gets a fair and reasonable return in the interest

of protecting public revenue.”

Bids

were submitted by Sun Hung Kai Properties, Henderson Land Development,

Sino Land Company, K Wah International Holdings and CK Asset Holdings.

With

the government introducing the minimum size requirement for all private

flats in February, the site was estimated to yield 2,020 units.

Surveyors had expected

the parcel to fetch between HK$7.1 billion (US$905 million) and HK$9

billion, or HK$5,500 to HK$6,900 per square foot.

“Notwithstanding

the cancellation of this tender, the government will continue to apply

the minimum flat size requirement to government land sale sites, railway

property development projects and projects of the Urban Renewal

Authority,” a spokesman for the Development Bureau said.

This was being done with the aim of enhancing living space and responding to the aspirations of society, he added.

Over

the last five years, the government had put 70 sites for tender, of

which six, including the Tuen Mun parcel, were cancelled due to bids

being below the reserve prices, the Lands Department said.

The

previous five cancelled tenders involved four commercial sites and one

residential plot. One of the commercial sites and the residential site

were subsequently successfully re-tendered. The other three commercial

sites are undergoing re-zoning procedures for residential use.

As the tenders received

for the Tuen Mun site were lower than expected, it shows that the five

developers had bid conservatively and, therefore, did not meet the

government’s reserve price, a property agent said.

The

agent said that the government and developers were likely to shrug off

this disappointment as the outlook for the residential market was

optimistic.

“Looking

forward, there are quite a lot of residential sites of various sizes

that will be available for tender,” the agent said.

(South China Morning Post)

中環中心呎租70元跌30%

受疫情衝擊,甲廈淪為重災區,租金持續下滑。消息指,由「磁帶大王」陳秉志持有的中環中心高層單位,交吉約九個月後,以每呎約70元租出,較舊租金跌逾三成,低市價逾15%。

交吉9個月始租出

市場消息指出,中環中心高層單位,建築面積約2856方呎,以每呎約70元租出,月租約20萬,上址舊租金每呎約105元,租戶去年8月遷出交吉,單位交吉九個月後租出,租金急挫約33%;據代理行資料顯示,同類高層單位承租個案則需追溯至去年7月,為該廈高層1室,建築面積7099方呎,當時以每呎約85元租出,較該廈最新成交租金差距約17%。

外資代理行:酒店投資按年升46%

此外,有外資代理行昨日發表的酒店行業趨勢報告指出,去年亞太區酒店投資成交額大幅反彈至121億美元,按年增長46%.

時貿呎價5867元沽

另外,有代理表示,荃灣美環街1至6號時貿中心23樓7室,建築面積約651方呎,以交吉形式易手,作價約382萬,呎價約5867元,買家為用家。原業主於2002年以約76.8萬購入,持貨近20年升值約3.97倍。

(星島日報)

更多中環中心寫字樓出租樓盤資訊請參閱:中環中心寫字樓出租

更多中環區甲級寫字樓出租樓盤資訊請參閱:中環區甲級寫字樓出租

美資代理行趁疫市攻港 代理:大手買賣升溫

疫情逐步回穩,帶動工商鋪交投轉活。有美資地產代理行亦趁勢進駐本港「插旗」,該代理行進軍亞太區,並於本港開設首個辦公室,料工商鋪市場有力迅速復甦,大手買賣升溫。

該行負責人指,該行將首度進駐亞太區市場,於香港開設首間辦公室,位於尖沙嘴港威中心,僱用約十名經紀,進攻本港工商鋪市場。

該代理指,儘管受新冠肺炎疫情打擊,工商鋪租務及投資市場交投稍放緩,惟市場近期依然連錄多宗大手買賣,反映本港經濟基礎良好,隨疫情近期逐步回穩,市場交投整體氣氛已見改善,加上政府已逐步放寬防疫措施,料工商鋪市場有力迅速復甦,大手買賣陸續有來。

外資基金「吼準」數據中心

當被問及甲廈市場於今年走勢時,該行另一代理稱,受疫情衝擊,環球經濟備受打擊,本港亦難以獨善其身,但現今市場仍具活力,部份企業於疫市下仍然對優質商廈具一定需求,嶄新的工作模式亦應運而生,以共享工作空間為例,於市場上備受追捧。

該代理續指出,儘管現今商廈市場空置率高鋸不下,市場同時亦面對龐大供應,因受疫情影響,現時中小企承租取態較保守審慎,大多不願以3至6年長租約承租物業,令市場需求轉投半年至一年相對較靈活的租約,帶動共享工作空間備受追捧。

甲廈租金料跌5%

該代理亦指出,市場正處供應高峰期,故料整體甲廈市場租金仍備受壓力,料今年調整幅度約5%。該行另一代理稱,隨網絡發展一日千里,數據中心備受追捧,數年前已成為環球大趨勢,不少跨國基金均「吼準」歐美及亞太區,加上自疫情爆發以來,網上購物及居家工作日趨普及化,更令數據中心需求進一步升溫。

(星島日報)

西半山全幢住宅6.2億將易手

近期大手買賣升溫,罕有的全幢住宅更受捧,禹洲地產旗下西半山UPPER CENTRAL全幢住宅,獲財團以6.2億洽購至尾聲,料短期內易手。

平均呎價2.88萬

禹洲地產旗下的堅道48號UPPER CENTRAL,年前放售,業主意向價6.5億,市場消息透露,近日獲準買家出價6.2億,業主落實將物業售予該名準買家,項目進入盡職審查中,將於短期內易手。本報昨日致電禹洲地產,惟直至截稿時未獲回覆。

市場消息則指出,該項目總樓面21480方呎 (實用面積),以涉資6.2億計算,平均呎價約2.88萬,與目前區內新樓呎價3至4萬比較,留有一定水位,新買家除了長綫出租外,不排除拆售,項目以細單位主導,相信受市場歡迎。

連租約沽售

UPPER

CENTRAL樓高22層,提供82個開放式戶,以及3個2房戶,實用面積由167方至388方呎,擁有會所Upper

Club,位於5樓及頂層,5樓設健身室、活動室、閱讀室或私人影院,頂層設按摩浴池及燒烤空間等。發展商年前透過代理招租,呎租介乎80至100元,月租1.4萬起,今番連租約易手。

項目位於堅道48號,禹洲地產於2014年8月購入舊樓

(前身),作價3.738億,連同印花稅3453萬,總收購代價4.08億,及後重建發展商住宅,當時預計項目建築成本約1.2億,計及總投資成本約5.3億,預期出售能獲得利潤,惟前後歷時長達8年,利潤不算可觀。

(星島日報)

佐敦全幢酒店作價2.2億 投資者李栢景沽貨 10年升值41%

疫情持續放緩,為工商鋪市場釋出曙光,投資老手亦趁勢沽貨。消息指,由資深投資者李栢景持有、由商住樓改建的佐敦官涌街全幢酒店,以約2.2億易手,平均每個房間售價約289萬;李栢景月內連沽兩幢商用樓,套現約4.2億。

疫市下工商鋪市場再錄大手成交。市場消息指出,佐敦官涌街52至56號全幢以約2.2億易手,項目地盤面積約2899方呎,早前為一座12層高的混合式住宅大樓,項目早前獲城規會批准改為酒店用途,以9倍地積比率發展,可建樓面約2.61萬方呎,以易手價計,呎價約8429元,此外,該項目將提供76個房間,平均每個房間約289萬。

每個房間289萬

原業主為資深投資者李栢景,早於2012年以1.55億購入,故持貨10年帳面獲利約6500萬,物業期間升值約41.9%。本報就上述消息向李栢景查詢,惟他表示不作回應。

據業內人士指出,上述物業早前以意向價3.8億放售,先後獲多名準買家洽購,經多番議價磋商後,最終減價至2.2億售出,成交價屬市價水平。

事實上,李栢景近期頻頻沽貨,資料顯示,李氏於本月亦以約2億售出同區四海玉器中心全幢商廈,呎價約2.57萬,原業主持貨11年帳面獲利約8900萬,物業期間升值逾八成。該成交亦為市場近期矚目「大刁」,據業內人士指,上址去年底委託外資行標售,意向價2.8億,最新成交價較叫價低約28.5%,該項目1954年落成,樓齡達68年,周邊人流量亦不高,甚至出現「吉鋪處處」的情況,故成交價明顯屬「進取價」,較市價高近兩成,料有機會為發展商收購,料合併毗鄰地盤發展。

太原街商住樓8800萬售

此外,灣仔區亦錄全幢商住物業買賣,市場消息指出,灣仔太原街11號全幢商住樓連天台以約8800萬易手,項目地鋪建築面積約559.74方呎,1樓至5樓則為住宅,每層面積約541.05方呎,住宅總面積約2705方呎,若計及鋪位,項目總樓面約3264.7方呎,以易手價計,平均呎價約26955元。

據悉,上址原業主早於1974年12月以30萬買入,持貨48年帳面獲利約8770萬,物業期間升值約292.3倍。

(星島日報)

鰂魚涌海裕街40萬呎樓面 增零售酒店

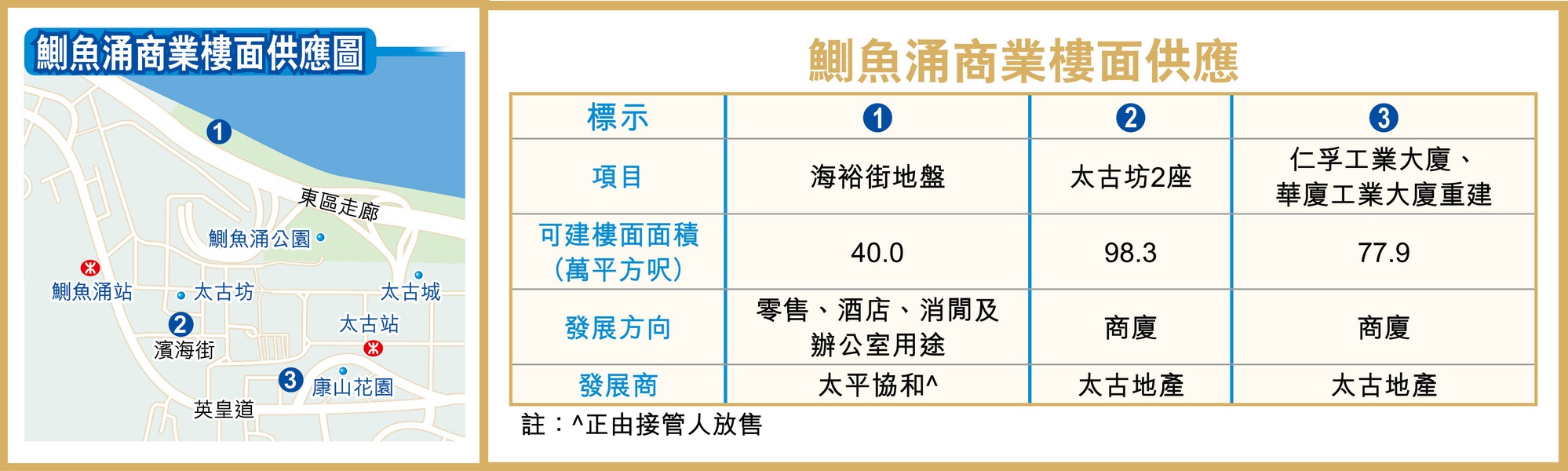

隨着近年鰂魚涌一帶舊樓、工廈逐步重建成商廈,令到區內商業氣氛進一步增強,當中臨海位置的海裕街將會打造成一排商廈及酒店群,涉及約40萬平方呎樓面。

鰂魚涌昔日屬於住宅及工業為主的社區,但隨着區內大地主太古地產 (01972)

陸續將區內廠房、工廈重建成為太古坊的商廈群,逐漸變成第二個商業延伸區,近年發展商更進一步展開區內工廈、舊樓作重建,加快地區轉型。目前區內正在進行的工商業重建項目至少有3個,合共提供約216.2萬平方呎的商業樓面供應。

擬招標出售 估值約40億

當中位於鰂魚涌海旁的海裕街地盤,由太平協和所持有,在2000年代初曾經有意打造成為名為「老香港」的懷舊主題公園及商業旅遊項目,相隔20年,發展商近年才跟發展局達成協議,同意原址換地,發展商將把兩個合共2.7萬平方呎的私人地段交予政府,政府則把9.2萬平方呎官地批出作興建商廈及酒店群。

根據之前提交城規會的設計方案定為「我的新中環」,仿效昔日香港海旁形態,計劃包括1層零售平台,及平台上以不規則設計的5幢建築,總樓面約40萬平方呎,其中4幢為酒店,涉及約18.9萬平方呎樓面,可提供約400間客房;餘下1幢13層高辦公室,樓面面積約8.7萬平方呎。

至於地下商舖及零售平台,則會提供約12.4萬平方呎樓面,公眾可使用園景平台。目前海裕街地盤獲接管人接管,正在部署招標出售,市場估計市值約40億元,買家在發展前須先跟政府補地價。

太古兩重建項目 作辦公及商業用

屬於鰂魚涌大地主的太古,亦在區內有兩個大型重建項目,包括康和大廈、常盛大廈及和域大廈,並已陸續重建成太古坊一座及太古坊二座,共提供逾200萬平方呎商業樓面,其中太古坊一座已於2018年入伙,接着入伙的將會是太古坊二座可提供約98.3萬平方呎商業樓面。

另外,太古經過逾10年收購,集團於2018年已經就仁孚工業大廈及比鄰的船塢里8號華廈工業大廈申請強拍,將計劃重建作辦公樓及其他商業用途,涉及的總樓面面積約77.9萬平方呎,有望進一步擴大區內範圍。至於太古在區內收購的鰂魚涌濱海街16至94號及英皇道983至987A號舊樓,向城規會申請重建為兩幢32層高的商廈,但申請終遭會方拒絕,相信現時將維持作住宅項目之用。

(經濟日報)

更多太古坊一座寫字樓出租樓盤資訊請參閱:太古坊一座寫字樓出租

更多太古坊二座寫字樓出租樓盤資訊請參閱:太古坊二座寫字樓出租

更多鰂魚涌區甲級寫字樓出租樓盤資訊請參閱:鰂魚涌區甲級寫字樓出租

富國銀行 續租太古城中心兩層

鰂魚涌商業區日漸成熟,太古坊一帶商廈呎租由40至50多元不等,當中富國銀行早前續租太古城中心兩層樓面,月租逾200萬元,平均呎租逾40元。

月租逾200萬 呎租40餘

據消息指,富國銀行續租的兩層商廈為太古灣道12號 (前稱太古城中心四座) 7至8樓全層,面積合共約51,308平方呎,由富國銀行承租多年,疫市下續租,新租金由舊租金每平方呎46元減逾10%,亦有消息指租金雖然維持舊有水平,惟業主給予租客優惠。

另外區內近年新入伙的鰂魚涌英皇道1001號銀座式商廈,由大鴻輝興業持有,亦因應疫情推出租賃優惠,招租意向呎租約35元起。

最新租出6樓半層樓面,面積約3,792平方呎,成交呎租約30元,新租客經營攀石場,該項目目前已獲餐廳、銀行及教育中心租用,現餘下7至9及18至21樓待租,提供面積由約5,402至6,681平方呎,其中8及9樓附設平台。

至於 K11 ATELIER King's Road 據代理行數據顯示,今年初租出一層高層單位,面積達2萬平方呎,月租約111.45萬元,平均呎租約56元。而樓齡較大的華懋交易廣場,低層兩個合共3063平方呎單位月租約8.66萬元,平均呎租28元。

(經濟日報)

更多太古城中心寫字樓出租樓盤資訊請參閱:太古城中心寫字樓出租

更多英皇道1001號寫字樓出租樓盤資訊請參閱:英皇道1001號寫字樓出租

更多K11 Atelier King's Road寫字樓出租樓盤資訊請參閱:K11 Atelier King's Road 寫字樓出租

更多鰂魚涌區甲級寫字樓出租樓盤資訊請參閱:鰂魚涌區甲級寫字樓出租

首幅限呎地流標 發展局:政策續推

梁志堅:與限呎無關 無損屯門區樓價

屯門首幅「限呎地」流標收場,惟發展局強調,將繼續落實「限呎地」政策,改善港人居住質素。業界則認為,流標與限呎無關,相信主要因為投資規模較大,而流標對該區樓價不構成負面影響。

該地皮於上周五截標,僅接獲5份標書,參與競投的主要為本地「大孖沙」,包括新地 (00016)、長實

(01113)、恒地 (00012)、信置 (00083) 及嘉華

(00173)。不過,地政總署昨公布,由於發展商出價未達到政府就該用地所定的底價,所以不接納所收標書。

東涌地去年流標 半年第二宗

翻查資料,對上一幅流標的住宅官地屬於2018年10月山頂文輝道地皮,而計及「一鐵一局」項目,對上一幅流標地皮為去年10月截標的東涌牽引配電站項目,這意味短短近半年內,已經共有兩幅住宅地皮流標收場。

在過去5個財政年度,政府合共就賣地進行超過70次招標,當中6次 (計入是次招標)

因為標價低於底價而取消有關賣地,其中5次取消的招標涉及4幅商業用地及1幅住宅用地,當中1幅商業地及該幅住宅用地隨後經重新招標後成功售出,其餘3幅商業用地則正進行改劃用作住宅用途。

政府表示,不會就投標者出價的考慮作出揣測,亦認為出價往往視乎各因素,例如投標者如何評估用地的吸引力和市場情況,及其企業情況及發展策略等。發展局發言人指,雖然這次未能成功招標,但政府會繼續將最低單位面積要求落實於所有政府賣地項目、鐵路物業發展項目、市建局項目,及其他涉及換地或契約修訂的私人住宅發展項目,以改善市民的居住空間和回應社會訴求。當局又指,過去很多設有最低單位面積要求的市建局及港鐵項目,均成功招標,並會考慮在適當時候重新出售是次流標用地。

測量師:本財年住宅地有選擇

會德豐地產主席梁志堅表示,相信發展商是次出價已經「計過數」,出價已考慮項目規模較大、周邊環境、建築成本等因素,又強調加入280平方呎最低單位面積條款與地皮流標完全無關係。他亦認為是次流標對該區的住宅樓價及成交不會構成負面影響。有測量師指,由於這幅地的規模較大,附近供應亦都比較多,而且今個財政年度還有多幅住宅地可供發展商考慮,因此發展商可能暫時應採取觀望態度,但相信發展商對後市看法仍然樂觀。

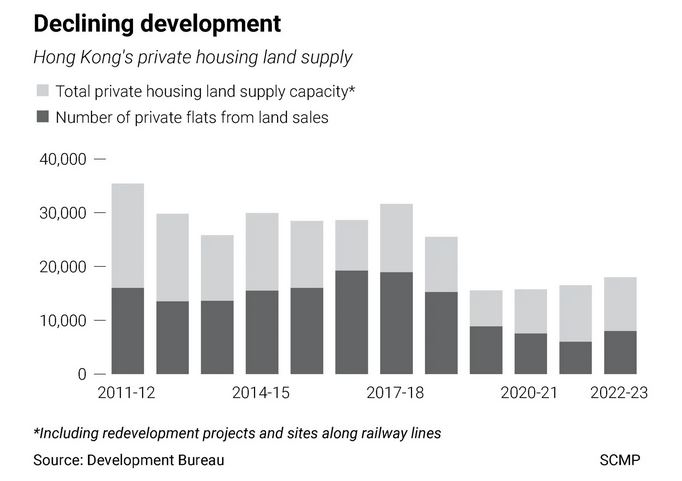

政府今年2月估算2021/22年度私人住宅土地供應合共約2.06萬伙,受今次屯門「限呎地」流標影響,將會損失約2,000伙供應,降至約1.86萬伙,但仍然較政府推地目標的1.29萬伙高出5,700伙或44%,不影響土地供應進度。

上述地皮位於永泰 (00369) 旗下 OMA by the Sea 旁邊,佔地約36.3萬平方呎,最高可建樓面總面積約130.6萬平方呎。地皮截標前市場估值介乎72億至90億元,每呎樓面地價約5,500元至6,900元。

(經濟日報)

3大因素 揭屯門地流標之謎

拆解今次屯門「限呎地」流標有3大因素,包括項目規模龐大、建築難度高,以及屯門區未來供應多,而地皮涉及「限呎」因素,相信只是催化劑,而不是地皮流標的主因。

總投資額料高達150億

今次屯門地皮可建樓面多達130.6萬平方呎,屬於2018年5月啟德第1F區1號地皮後,近4年規模最大的住宅官地,按照截標前地皮的估值72億至90億元,若果再加上每呎至少5,000元的建築成本,總投資額將會高達150億元,有能力進入的發展商只有數間大型發展商,或者以合組財團形式。

同時,地皮本身有不少「先天缺陷」,包括並非市區地皮、大部分位置處斜坡上,拉高建築費及日後的維修費用,加上地盤中央前方有一個加油站,相信這對項目設計及成本上亦存有部分影響,再加上地皮位於青山公路及屯門公路之間,噪音問題亦增加建築成本。

至於地皮身邊的屯門區亦有未來供應重鎮,有望未來2至3年推出的中、大型新盤至少仍有3個,涉及超過2,200伙,包括長實

(01113) 等小秀村項目 (涉573伙)、路勁 (01098) 等管翠路項目

(涉698伙),而「玩具大王」蔡志明購入的青山公路地盤亦涉及逾千伙供應。

地皮方面除了今次推出的「限呎地」外,區內亦有另一幅同樣涉及逾百萬平方呎樓面的屯門第48區 (帝御旁邊) 地皮有待推出,有可區內供應需要時間消化,發展商出價自然較為保守。

過去幾年屯門掃管笏一帶的新盤為加快去貨,發展商打造成「上車天堂」,區內涉及逾千伙的大型新盤均出現200多平方呎「納米樓」,最細更只有201平方呎,當政府收緊了「限呎」要求,不能夠再以細銀碼吸引,銷售周期加快,發展商投地出價難免更保守。

(經濟日報)

灣仔西營盤住宅地 估值降逾5%

首幅「限呎地」流標未影響政府推動杜絕納米樓的決心,即將推出的灣仔、西營盤兩幅住宅地會否有「限呎」要求引起關注,有測量師則因應今次「流標」,下調兩幅用地估值5%至10%。

兩地估值 共19.4億至32.9億

政府由推出首幅的屯門「限呎地」,到今年初發展局公布賣地計劃亦稱,「今年賣地表地皮都會加入 (限呎) 要求,除非個別情況不許可」,而在地皮流標後政府亦強調未改變當局改善居住環境決心,會繼續推「限呎」政策。

因此已經公布將在今年推出的灣仔皇后大道東、西營盤醫院道兩幅住宅地,設有「限呎」要求將引起市場關注。兩幅用地合共提供270伙,均屬於市區中小型地盤,合共市值約19.4億至32.9億元。

今次未有入標屯門「限呎地」的會德豐地產,主席梁志堅認為,兩幅地招標反應將會理想,主因是兩地均位於市區,而集團亦有興趣,正研究會否入標。

不過,有測量師則指,除了今次屯門「限呎地」流標外,近月市建局的項目及政府的工商業地招標,中標價均為市場估值的下限,顯示了土地市場轉弱的訊號。該測量師又指,將會調低接着推出住宅地地價大約5%至10%。

灣仔、西營盤兩幅住宅地之中,以醫院道地皮規模較小,地盤面積只有5,371平方呎,可建樓面約4.8萬平方呎,因為地盤面積較窄小,加上位於斜坡地段,相信加入「限呎」要求,有機會對日後發展商開則或設計布局有一定影響,目前地皮估值6.75億至13億元,每呎樓面地約1.4萬至2.7萬元。

至於另一幅灣仔皇后大道東地皮地盤面積相對較大,涉及1.32萬平方呎,可建樓面約11.6萬平方呎,最高估值約19.8億元。

(經濟日報)