Hong Kong's property prices in May were just 0.8

percent away from their peak, as developer TDS released a price list for

flats at Poho starting at HK$32,000 per square foot.

The private domestic price indices rose 0.64

percent last month to 393.7 points, a 23-month high, according to data

from the Rating and Valuation Department.

The index has risen for five consecutive months,

rising 1.97 percent year-on-year. It hit a record high of 396.9 points

in May 2019.

Prices of property with an area of 431 sq ft or

below is already at a record high of 439.9 points, 0.05 percent higher

than the previous peak, and some analysts expect overall property prices

to hit a new high very soon.

Property agency expects property prices to hit a record high in July.

Another property agency predicts property prices

will rise 5 percent in the next half of the year. If the border reopens

earlier in the second half of the year, increase in property prices may

reach 13-15 percent.

Meanwhile, another property agency expects

property price to hit a record high in the third quarter but the rental

return will remain low. The rental indices rose 0.28 percent

month-on-month to 177.9 points.

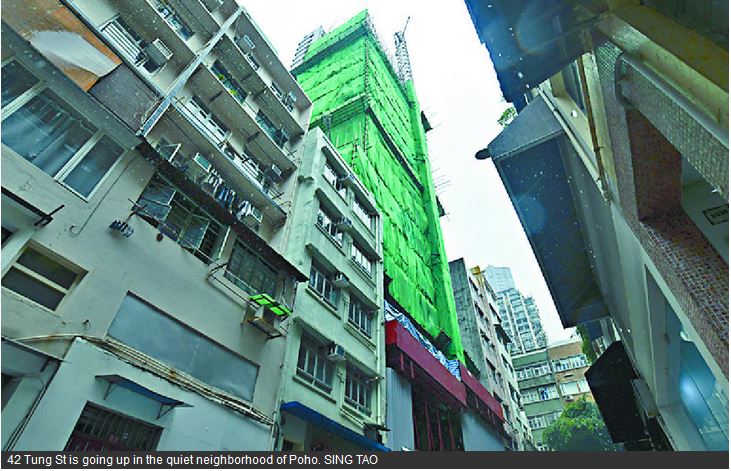

In the primary market, TDS unveiled a price list

for 42 Tung St in Poho, with the first eight simplex units ranging from

HK$32,889 to HK$38,889 per sq ft after discounts.

The average price per sq ft for the eight 585-sq-ft flats is HK$35,968 after discounts.

The cheapest two-bedroom flat on level six costs

HK$19.24 million while the most expensive unit in the batch is worth

HK$22.75 million after discounts.

The remaining five flats, including four 1,157-sq-ft duplex units, will be sold by tender from August 1 to September 30.

The 23-story tower is a six-minute walk away from the Sheung Wan Station and a 15-minute walk from Central Station.

It is expected to be completed at the end of September 2022.

Meanwhile, a potential buyer of a 359-sq-ft flat

in The Pavilia Farm III in Tai Wai forfeited a deposit of HK$430,000

after canceling a one-bedroom deal.

The Pavilia Farm III has recorded six forfeited cases.

In other news, the one-month Hong Kong Interbank Offered Rate rose 0.37 points to 0.09286 percent, a two-month high.

(The Standard)

Hong Kong property market to remain resilient even in the midst of exodus, REDA chief Keith Kerr says

Positive

uptrend in the property market to continue for the rest of the year,

barring any unforeseen circumstances, says Keith Kerr, president of REDA

Property

prices, which have increased 3.1 per cent so far this year, could clock

gains of between 5 and 10 per cent for the full year, property agent

says

Hong Kong is unlikely to

see a significant impact on housing demand from the growing emigration

wave, according to the president of the Real Estate Developers

Association of Hong Kong (REDA), joining a chorus of market observers

who expect prices to continue rising this year.

“I know some people are

leaving, but some people are moving here to Hong Kong,” said Keith Kerr,

president of REDA and a former chairman and chief executive at Swire

Properties. “For every person moving out, there’s probably at least the

same number, if not more people coming in, so I don’t think that really

is going to affect demand in the medium to longer term.”

There would be “a

positive uptrend for the rest of the year, barring any unforeseen

circumstances” as the market is relatively strong at the moment, said

Kerr, who set up his boutique property firm known as The Development

Studio (TDS) after he retired from Swire in 2009.

“The economy is picking

up, stock market is active, and I think the demand for residential

accommodation will remain strong,” he added.

Since the introduction of

the national security law in June last year, many Hongkongers have been

looking to move overseas to escape what they perceive to be the erosion

of certain freedoms by an increasingly bold and assertive Beijing. The

number of applications for certificates required for visas, and

withdrawals of Mandatory Provident Fund savings on the grounds of

permanent departure from Hong Kong has risen in recent months.

But the exodus will probably not translate into a slowdown in the housing market, analysts said.

In fact, sentiment in

Hong Kong’s property market has improved over the past few months amid a

brightening economic outlook, falling unemployment rate as the

coronavirus pandemic in the city has largely been brought under control.

An index measuring

secondary home prices rose 0.6 per cent in May to a 23-month high of

393.7, a mere 0.8 per cent from its May 2019 historical peak, according

to data released by the Rating and Valuation Department this week.

US investments banks

Goldman Sachs and Morgan Stanley are bullish on the city’s property

prices. Goldman said in a June 4 report that it expected a 5 per cent

rise this year given the low interest rates and an improving economy.

Morgan Stanley was slightly more restrained in its report released in

April, forecasting a 3 per cent rise this year.

With residential property

prices having already risen 3.1 per cent so far this year, according to

data from the Rating and Valuation Department, property consultants

expect prices to rise further.

“If we can control the Covid-19 situation, the full-year increase will be between 5 and 10 per cent,” property agent said.

Another

agencies which are two of the city’s biggest property agencies, also

expect home prices to rise to new highs as the current levels are

marginally below the peak in 2019.

Separately,

Kerr’s TDS on Monday announced the pricing of its 42 Tung St.

residential project, near Central. The 23-storey building, comprising

only 13 apartments – nine simplex and four duplex units, will be ready

in September next year.

The

company said it would sell eight simplex units of 585 sq ft each at

prices ranging from HK$19.24 million (US$2.48 million) to HK$22.75

million, or HK$32,889 to HK$38,889 per square foot after discounts.

TDS plans to sell the four duplex units measuring 1,157 sq ft and a 346 sq ft simplex unit by tender from August 1.

Agent

said that Swire Properties sold homes in its nearby Eight Star Street

project at about $40,000 psf, with some fetching as much as HK$50,000

psf.

Kerr’s

first residential development project with TDS was 28 Aberdeen St. in

Sheung Wan in 2017. He said that project gave the firm the experience to

deal with the complexities of undertaking a project like 42 Tung St. on

a small site. Its difficulty was “not in the building process”, but

regulatory issues and securing approvals for matters such as traffic

flow.

“Real

estate development in Hong Kong is a complicated business, especially

in the urban areas, so it did take time to get a few issues resolved,”

Kerr said. “But now we’re [already building] the 15th floor, so we’re

well under construction for completion next year.”

(South China Morning Post)

Hong Kong’s second-hand home prices soar to a 23-month high as property bull run feeds on cheap money

An

index of lived-in home prices rose to a 23-month high in May, a mere

0.8 per cent from its historical peak, according to government data

Prices of second-hand homes smaller than 431 square feet (40 square metres) increased 1.1 per cent last month to a record

Housing affordability,

one of the issues fuelling political strife in Hong Kong over the past

few years, is rearing its head again as low interest rates fuel a

speculative real estate frenzy while the economy grapples with budding

signs of recovery from a pandemic-led recession.

An index measuring the

prices of all lived-in homes rose 0.6 per cent in May to a 23-month high

of 393.7, a mere 0.8 per cent from its May 2019 historical peak,

according to data released by the Rating and Valuation Department.

Prices of second-hand homes smaller than 431 square feet (40 square

metres) increased 1.1 per cent last month to a record 439.9, from a year

ago.

The latest data shows how

Hong Kong’s housing market has regained its footing from the street

protests of 2019 and the coronavirus pandemic of 2020 to resume its bull

run, as the trillions of dollars of low-interest capital unleashed by

global central banks have found their way into fixed assets. Several new

property projects such as New World Development’s The Pavilia Farm III

project in Tai Wai and Henderson Land Development’s The Upper South in Ap Lei Chau were snapped up by buyers when they launched.

“Market sentiment has

improved now,” property agent said. “Supply is not high in the secondary

market, so small homes have shown the most significant increases as

[they appeal to] the mass market, with the strongest demand. Usually

this happens in a rising market.”

Transactions of

second-hand homes could top 5,500 in June, the fourth consecutive month

for more than 5,000 residences to change hands, according to another

property agency, which shows how the property bull market has extended

into the lived-in segment. That’s also the longest streak of increases

since November 2012.

The market’s momentum could also stretch into June and July, with this month’s price index expected to rise by 1 per cent.

“A lot of capital has

flowed into the physical assets market under quantitative easing because

that is relatively more stable, with [better] prospect for

appreciation,” the agent said, adding that June’s index is likely to set

a record.

The increase in the

second half of 2021 is likely to be around 5 per cent, adding to the

full-year total of about 10 per cent, the agent said. The increase may

even widen to between 13 and 15 per cent, if Hong Kong’s northern border

with mainland China were to reopen, which would open the doors for

mainland Chinese investors to return to the city’s real estate market.

“Everyone is optimistic

that in the longer-term, home prices will rise, so the capital keeps

flowing into the housing market, promoting continued increases in

property prices,” the agent said, adding that the increases are too mild

to prompt any intervention by the Hong Kong authorities. Local

authorities across mainland China had been imposing market cooling

measures from cracking down on fake divorces to putting caps on loans to

control runaway prices.

Historically, Hong Kong’s

government would not resort to cooling measures unless the price index

were to rise by more than 2 per cent over two consecutive months, he

said. Local authorities don’t have many measures at their disposal to

tame increasing prices anyway, the agent said.

(South China Morning Post)

上環新紀元廣場 配套理想交通便

新紀元廣場位於上環商廈心臟地段,配套理想,為區內指標商廈之一。

上環新紀元廣場位於皇后大道中181號,具地利及交通優勢,比鄰中環商業區、港澳碼頭及多幢著名甲廈商厦。值得一提,物業鄰近港鐵站、巴士站、電車站及渡輪,亦有多條巴士綫可到達;而物業正對港鐵上環站E2出口,只是一街之隔,或可步行至中環商業區只須約10分鐘,交通便利。

物業位於香港中環核心商業地段,鄰近中遠大廈、中環中心、無限極廣場、南豐大廈及永安中心等著名甲廈。飲食配套上,上班一族可到附近鴨巴甸街及歌賦街,有多間茶餐廳、酒樓、特色小店、咖啡室及甜點蛋糕店可供選擇,若下雨天不想外出覓食也可選擇物業基座,亦有商舖設有不少食肆提供。

間隔實用 合中小企

大廈於1998年落成,物業設有永樂街及皇后大道中入口,該廈分為舖位及寫字樓用途,基座為商舖,而樓層為寫字樓。大廈共有8部升降機,高低層各4部,讓繁忙時段可分流客人,不用電梯大堂過分擠迫,而該廈提供專用載貨升降機。

物業與中遠大廈之間為廣場,平常人流暢旺,而兩大廈間有噴水池及園景,打造成「城市小花園」,氣派感十足,略勝同區大廈。物業雖沒有停車場,但駕車人士可從到附近中遠大廈停車場,同樣方便。

標準樓面全層面積約15,451平方呎,樓高28層,該廈用家為商業用途,整體樓層間隔實用及企理裝修,特別適合中小型企業使用,比如商業、銀行及保險公司等。

物業位於商業區,大廈兩旁是高樓大廈,而與中遠大廈間相隔小花園,因此不會感到擠迫,而單位主要望向城市景觀,尚算開陽。

買賣方面,2016年物業中高層全層,面積約15,451平方呎,以約3.090億元易手,呎價高見20,000元,比同年另一宗買賣交易,呎價17,022元更創新高。近期一宗交易於2019年,同樣中高層,面積約2,225平方呎,以約4,450萬元易手,呎價同為20,000元。

(經濟日報)

更多皇后大道中181號寫字樓出租樓盤資訊請參閱:皇后大道中181號寫字樓出租

更多中遠大廈寫字樓出租樓盤資訊請參閱:中遠大廈寫字樓出租

更多無限極廣場寫字樓出租樓盤資訊請參閱:無限極廣場寫字樓出租

更多南豐大廈寫字樓出租樓盤資訊請參閱:南豐大廈寫字樓出租

更多永安中心寫字樓出租樓盤資訊請參閱:永安中心寫字樓出租

更多上環區甲級寫字樓出租樓盤資訊請參閱:上環區甲級寫字樓出租

更多中環中心寫字樓出租樓盤資訊請參閱:中環中心寫字樓出租

更多中環區甲級寫字樓出租樓盤資訊請參閱:中環區甲級寫字樓出租

更多皇后大道中181號寫字樓出售樓盤資訊請參閱:皇后大道中181號寫字樓出售

更多上環區甲級寫字樓出售樓盤資訊請參閱:上環區甲級寫字樓出售

觀塘東瀛遊廣場極高層全層單位,現以每平方呎約23元放租。

代理表示,有業主放租觀塘鴻圖道83號東瀛遊廣場極高層全層連3個車位,面積約10,875平方呎,意向租金約25萬元,每平方呎租約23元。

面積10875呎 意向租金25萬

該代理表示,單位間隔四正實用,實用率高達約8成,外望開揚海景,獨立全層私隱度極高。

單位樓底極高,達約3.85米,空間感十足,適合上市公司及跨國企業作為集團總部之用。大廈設有5部客梯及1部貨梯,用戶上落極為方便,加上設有4層停車場,提供123個私家車位及8個貨車位,方便駕駛人士出入。

5月份物業錄得一宗成交,物業極高層全層,面積約11,575平方呎,成交呎租約21.5元。

(經濟日報)

更多東瀛遊廣場寫字樓出租樓盤資訊請參閱:東瀛遊廣場寫字樓出租

更多觀塘區甲級寫字樓出租樓盤資訊請參閱:觀塘區甲級寫字樓出租

沙田商廈W LUXE低層 3年蝕33萬

土地註冊處資料顯示,沙田商廈耀安街W LUXE低層N8室,建築面積約521平方呎,原業主2018年底以613萬元購入,剛以580萬元易手,持貨3年帳面蝕讓約33萬元離場。

另外,油麻地彌敦道現時點商場1樓雙號舖,原業主2014年以270萬元購入,剛以235萬元易手,持貨7年帳面損手35萬離場。

(經濟日報)

鄧成波家族近月頻沽貨 套近70億

再沽2屋邨商場 陳秉志等13億接貨

鄧成波家族沽貨停不了,消息指,波叔早年向領展 (00823) 購入葵涌安蔭商場及荃灣石圍角商場,現以13億元沽予「磁帶大王」陳秉志等財團,持貨5年帳面雖平手離場,惟需蝕逾1億元印花稅。單計近一個月沽貨,家族已套現近70億元。

近期鄧成波家族頻頻放售物業,個別大樓面舖位獲承接。據悉,家族旗下葵涌安蔭及荃灣石圍角商場,兩項目合共以約13億元沽出。兩物業均為民生區商場,葵涌安蔭商場樓高兩層,地下設有街市,總樓面約40,889平方呎;租客包括洗衣店、便利店等民生商戶,出租率約77%,每月租金收入約218.4萬元。

兩物業共提供933個車位

另一項物業為石圍角商場,亦包括街市,總樓面約13.2萬平方呎,現由超市、麥當勞快餐店等租用,出租率約79%,每月租金收入約314.5萬元。值得一提,兩項物業均設有停車場,分別提供355及578個車位,共涉933個。

據悉,兩項物業合獲「磁帶大王」陳秉志、資深投資者林子峰等,以約13億元承接,回報率約5厘,而由於物業尚未完全租出,故尚有提升租金空間。

翻查資料,陳秉志及林子峰過往多年,先後多次向領展購入商場,包括大埔運頭塘塘商場、將軍澳翠林商場等,合共涉及十多個商場,如今再增購相關物業。

過去林子峰購入的商場,多進行車位拆售,如2014年以3.18億元向領展購入屯門兆麟苑商場及車位,於2015年拆售,全數449個車位短時間內沽清,套現約3.42億元,已高於整項物業購入價。

帳面平手離場 惟蝕1億印花稅

2016年,領展標售5項商場,分布於青衣長康、荃灣石圍角、葵涌安蔭、大圍新田圍等商場,結果全數售出。其中鄧成波以7.33億及5.628億元,投得石圍角商場及安蔭商場,合共涉約13億元。如今5年後以13億元轉售給陳秉志,帳面平手離場。不過,由於當年購入兩項商場需付雙倍印花稅,故蝕約1.1億元。

舖王鄧成波於5月突離世,其後家族成員加快沽貨步伐,單計近一星期,集團已沽出多項大額物業,包括分別以約17億及7億元,沽出屯門東亞紗廠工業大廈及粉嶺勉勵龍中心,由中資物業中心承接。另外,集團亦以約4億元,售出九龍城聯合道2至16號舊樓地盤7成業權,若連同沽出的各區舖位、分層工廈等,近一個多月家族已沽出近70億元物業。

(經濟日報)

大樓面舖位呎價低 吸長綫投資者

舖位交投保持平穩,而市場紛錄大樓面舖位成交。由於大樓面舖位呎價較低,風險較低,故成長綫投資者較穩健之選。

近月商舖買賣頗理想,而大樓面舖位承接力理想。其中鰂魚涌英皇道1060號栢蕙苑高層地下商舖,以2.6億元易手。該舖面積約20,277平方呎,目前由幼稚園及超級市場租用,呎價1.3萬元。

據了解,該舖位由麥當勞快餐店持有,集團早於1989年,以1.5億元購入該廈高層地下及低層地下,高層地下曾租予健身中心,而低層地下作快餐店自用,如今售出一直收租的商舖樓面。

麥當勞2.6億 沽栢蕙苑巨舖

翻查資料,麥當勞於2019年中委託外資測量師行放售旗下6個物業,市值高達15億,最貴重為為尖沙咀星光行地下1及2號鋪,市值約10億。

另外,油尖旺錄大樓面舖位成交,包括佐敦庇利金街42號地下及1樓,以約7,200萬元易手。物業面積合共約6,180平方呎,現由餐廳等租用,月租約18萬元,回報率約3厘。原業主於2013年舖市高峰期以8,500萬元購入,持貨8年轉手,蝕約1,300萬元離場。

鄧成波家族 8100萬沽酒樓舖

頻頻沽貨的鄧成波家族,亦連環沽出旺角大樓面舖位,包括以約8,100萬沽出油麻地新填地街142至144號地下至2樓酒樓舖位,面積合共約8,030平方呎,物業由酒樓以每月18.7萬元租用。業主原叫價約8,500萬元,減價約5%沽出。據悉該物業早於1992年以約600萬元購入,持貨29年轉手,獲利約7,500萬元離場。另外,旗下荃灣楊屋道118號立坊地舖連1樓,地舖面積4,492平方呎,而1樓約5,088平方呎,合共約9,580平方呎,以約1.2億元沽出。

至於非核心區方面,沙田京瑞廣場連錄兩鋪位成交,涉資約3.1億元,包括2期一地舖,面積約6,743平方呎,以1.82億元售出,呎價約26,991元,鋪位由食肆以37萬承租,回報率約2.4厘。同廈另一地舖,面積3,223平方呎,以1.28億元易手。

分析指,隨着疫情緩和,市民外出消費興趣提高,商舖租售價亦止跌回穩,加上整體投資氣氛轉好,商舖買賣明顯增加。大樓面舖位勝在呎價相對便宜,涉及約1萬至2萬元,風險較低,而租客多為民生相關,受疫情下旅客減少的衝擊較細,故吸引長綫投資者承接。

(經濟日報)

更多星光行寫字樓出售樓盤資訊請參閱:星光行寫字樓出售

更多尖沙咀區甲級寫字樓出售樓盤資訊請參閱:尖沙咀區甲級寫字樓出售

更多京瑞廣場寫字樓出售樓盤資訊請參閱:京瑞廣場寫字樓出售

更多石門區甲級寫字樓出售樓盤資訊請參閱:石門區甲級寫字樓出售

工商舖5月錄632宗買賣

投資氣氛轉好,統計指,5月工商舖買賣錄632宗成交,按月回落約9%。

代理表示,工商舖旺勢持續,料單月略為整固後,6月及第3季均繼續看好。根據代理行的資料所得,2021年5月全港共錄得632宗工商舖物業買賣登記

(數字主要反映2至4星期前市場實際狀況),較4月的693宗回落9%,但仍處於近24個月的次高水平,且連續3個月錄逾600宗,為2018年第4季以來

(即逾兩年半) 最旺的市況;至於月內買賣合約總值錄得76.89億元,按月下跌42%,主要是月內逾億元的大額登記有所減少。

按工商舖3個物業類別劃分,工廈按月登記量維持最多,續處逾300宗的相對高位波動。5月全月工廈錄得351宗登記,按月跌8%,佔整體工商舖成交達55.5%。

商廈買賣登記量表現繼續穩中向好,錄得連續3個月的升勢,反映經濟好轉,對商廈市道有支持,刺激5月份商廈買賣登記共錄127宗,按月再升2%。

至於店舖買賣登記量方面,經過連月大升後,5月份略為回氣,但仍處於近34個月的三甲位置,料後市續反覆向好。5月份店舖錄得154宗登記,按月減少17%,為工商舖中跌幅最大的類別。

經濟復甦 投資者入市信心增

該代理指出,工商舖整體登記量已連續3個月企穩在逾600至近700宗的水平,料6月份仍可承接如此旺勢,市場亦已確認目前是落注及加碼的好時機。受惠疫情轉緩及疫苗持續接種,通關之日又邁進一大步;加上整體經濟復甦,失業及破產情況有改善,相信可加強投資者入市信心,配合8月份消費券推出料可進一步帶旺消費市道,因此預期本月及第3季工商舖將可看高一綫。

(經濟日報)

企業廣場二期全層 持貨8年賬蝕870萬

近年有不少外資沽售本港的工商物業,日本體育用品公司迪桑特 (DESCENTE) 的香港子公司以6380萬元賣出九龍灣企業廣場二期全層單位,持貨8年,賬面虧損870萬元離場。

土地註冊處資料顯示,九龍灣企業廣場二期12樓全層連兩個車位,建築面積約9540方呎,以6380萬元易手,呎價約6688元。

據了解,前述物業曾以6990萬元放售,終減價610萬元或8.7%沽出,新買家為盈健醫療 (01419)。資料顯示,是次成交為企業廣場二期自2012年6月後,再有單位的買賣呎價低於7000元。

原業主為香港迪桑特貿易有限公司,於2013年8月斥資7250萬元購入上址,現沽出賬面蝕870萬元,貶值12%。迪桑特是於1935年成立的日本體育用品公司,旗下品牌包括法國運動品牌le coq sportif及水上運動服裝品牌arena等。

(信報)

更多企業廣場寫字樓出售樓盤資訊請參閱:企業廣場寫字樓出售

更多九龍灣區甲級寫字樓出售樓盤資訊請參閱:九龍灣區甲級寫字樓出售

億京中心32樓連5車位賣1.5億

九龍灣商廈億京中心B座32樓全層連5個車位,建築面積12678方呎,以約1.52億元售出,呎價約1.2萬元。單位由港新集團有限公司於2010年9月以7496.46萬元一手購入,據公司註冊處資料,該公司已被接管;賬面升值7703.54萬元或逾1倍。

(信報)

更多億京中心寫字樓出售樓盤資訊請參閱:億京中心寫字樓出售

更多九龍灣區甲級寫字樓出售樓盤資訊請參閱:九龍灣區甲級寫字樓出售