Hong Kong's property market seems

to be on track for recovery with primary market sales in the pipeline

and secondary transactions rebounding.

Sun Hung Kai Properties's (0016) Regency Bay II in Tuen Mun released the last price list yesterday, offering 28 units at an average price of HK$20,474 per square foot.

The

eighth list comprises units from 255 sq ft to 501 sq ft and is priced

from HK$5.1 million to HK$11.8 million after discounts.

A new round of sales with 10 flats will take place on Saturday, the developer said.

Meanwhile,

a new project at Kam Sheung Road in Yuen Long, which offers 715 flats,

is expected to kick off sales soon. The project, named Grand Mayfair I,

is co-developed by Sino Land (0083), K Wah International (0173), and

China Overseas Land and Investment (0688).

The

developers believe the government will speed up the presale consent

approval process after the resumption of work and the permit will be

granted very soon.

They

said the showrooms are under preparation and will make reference to the

transaction prices of adjacent projects when setting the prices,

emphasizing that they will not be too conservative or aggressive in

pricing.

In other news,

rental accommodation provider Weave Living said it acquired Rosedale

Hotel Hong Kong in West Kowloon for HK$1.38 billion with a global real

estate asset manager.

The

435-room hotel, which covers a gross floor area of 111,000 sq ft, will

undergo a complete renovation, including the reconfiguration of some of

the rooms, to transform the property into a modern rental space, Weave

Living said.

The

renovated project is expected to open in mid-2023 and the firm will own

and operate over 1,500 rooms with a total asset value of nearly US$1

billion (HK$7.8 billion) by then, it added.

(The Standard)

Hong Kong buyers give nano flats a wide berth as buyers armed with larger mortgage amounts eye bigger homes

Only

92 small flats, or those under 280 sq ft in size, were transacted on

the secondary market in March, 24 per cent lower than February

Average price fell 0.7 per cent month on month to HK$4.03 million in March

The popularity of tiny homes took a beating last month after the Hong Kong government relaxed mortgage rules, bringing larger homes within reach of first-time buyers.

Only

92 small flats, under 280 square feet, were transacted on the secondary

market between March 1 and 28.24 per cent lower than February,

according to a property agency. The average price eased 0.7 per cent to

HK$4.03 million, bringing the decline from its May 2021 peak to 4.8 per

cent.

The

decline in sales and prices of tiny flats mirrors the overall downturn

the local property market is experiencing because of the ongoing

coronavirus outbreak and the government’s recent higher mortgage amounts

for homebuyers, another property agent said.

“The

reason people were interested [earlier] in nano flats was that they did

not have sufficient funds but still wanted to buy their own homes, but

now the [the new mortgage rules] allow buyers to buy larger flats with

larger loans,” the agent said.

Financial Secretary Paul Chan Mo-po, in his annual budget presented in

late February, raised the mortgage amount on homes with a loan-to-value

ratio of 80 per cent to HK$12 million from HK$10 million, making larger

abodes more affordable to first-time buyers.

Last

week, a 193 sq ft studio flat at One Prestige in North Point sold for

HK$4.18 million, 14 per cent lower than the HK$4.86 million the owner

paid in May 2017, according to agents.

In

response to criticism of shrinking homes, the government announced in

late February that all private homes to be built in Hong Kong will have

to be at least 280 sq ft, unless in rare cases where developers face

site constraints or dated leases that may not be subject to the new

rule.

Some

developers have blamed the government for tight land supply and high

prices, arguing that they have no choice but to build smaller, more

affordable flats.

Before

the announcement on the minimum size, the property agency had predicted

that over 2,000 flats measuring less than 215 sq ft will be built this

year, more than double the 960 in 2021.

The government’s restriction supports the view that nano flats are “uninhabitable”, according to a surveyor.

“Homebuyers’ impression of nano flats has become more negative, which affects market sentiment,” the surveyor said.

Nano

flats are popular among first-time homebuyers and investors with tight

budgets, but they may now consider bigger alternatives given the

changing landscape, the surveyor added.

Another

property agent suggested that the new mortgage policies would mainly

affect high-income individuals. Demand for nano flats would continue to

remain strong among low-income, first-time buyers, the agent said.

“The

relaxed mortgage policy would shift the property ambitions of

high-income families away from nano flats to larger homes,” the agent

added.

“There

will be no new nano flat [projects], but the current market still has

around 20,000 units,” the agent said, adding that with the fall in

supply and existing demand, their prospects were not entirely gloomy.

The

agent expects that prices to remain stable, especially as nano flats’

rental yields are higher than larger flats, while noting that the

pandemic has had a greater impact on the overall market.

(South China Morning Post)

Hong

Kong shared living firm Weave, unnamed property manager acquire

Rosedale Hotel in US$175 million deal, to turn Kowloon property into

co-living space

Rosedale acquisition shows operators are finding value in co-living segment, property agent said

The property is Weave’s biggest and is expected to open in mid-2023

Shared

living spaces operator Weave Living has with an unnamed global real

estate asset manager acquired the 435-room Rosedale Hotel in Kowloon for

HK$1.37 billion (US$175 million), it said on Tuesday.

The

acquisition is part of a US$200 million joint venture, of which Weave

will own 10 per cent, said Sachin Doshi, the Hong Kong-based company’s

founder and group CEO. It will also be the asset, development and

operations manager of the venture and its assets.

“Weave

Living has been looking at potential acquisition opportunities in core

locations in Hong Kong, as we see there has been a strong demand for

quality and stylish rental accommodation,” he said. “The newly acquired

property is conveniently connected to other urban areas with efficient

transport … We have already been operating Weave Studios-Olympic in the

district and we believe the latest acquisition can bring about further

operational efficiency and synergy.”

In

co-living, tenants have their own bedrooms but share other spaces such

as kitchens and living rooms, which typically suits students or young

professionals living away from their families for the first time in

their lives. This concept gives them privacy as well as the opportunity

to find a community and build relationships.

The

Rosedale acquisition shows operators are finding value in the co-living

segment, a property agent said. “The co-living sector has been

performing well over the past two years. Despite the slow down during

the first outbreak [of Covid-19], the sector has shown high-growth

potential, due to its relatively high return in terms of per square

footage,” the agent said.

“It

is expected the sector will continue to perform well and some hotels

could be converted into co-living [spaces]. Some of the operating brands

are also likely to expand in Hong Kong, as there could be economies of

scale for operations,” the agent added.

The

Rosedale will be Weave’s biggest property. It has a total gross floor

area of around 111,000 sq ft and its acquisition price values it at

HK$12,400 per square foot. As part of a renovation plan, the property’s

29 floors may be transformed into a new rental accommodation offering

amenities such as work-from-home facilities, wellness areas, living

spaces and entertainment hubs. The property is expected to open in

mid-2023.

“We expect the property to have a similar number of rooms after its extensive refurbishment,” Doshi said.

Besides

co-living, the firm also offers traditional residential options under

the Weave Studios, Weave Suites and Weave Residences brands. The company

had a consistent occupancy rate of more than 90 per cent, Doshi said.

Last

month, the company said it had bought a row of conservation shophouses

in Singapore for US$56 million. Over the next 12 months, Weave will

double the number of units it owns and manages to more than 1,500, with a

gross asset value of about US$1 billion, as part of its regional

development plan.

“Weave … is constantly evaluating potential properties in both Hong Kong and other Asia-Pacific gateway cities,” Doshi said.

(South China Morning Post)

工商鋪錄358宗註冊 代理行:按月跌16.2%

受疫情打擊,工商鋪交投錄價量齊挫。據代理行綜合土地註冊處資料顯示,上月工商鋪買賣註冊量錄358宗,按月下跌約16.2%,註冊金額則錄45.18億,按月跌約6.4%;該行預期,隨近期疫情走勢稍放緩,料後市交投有機會逐步回穩。

該代理行綜合土地註冊處資料顯示,今年3月工商鋪註冊量錄358宗,按月下跌約16.2%,並屬2020年8月以來首度跌破400宗,創過去19個月新低水平;至於註冊買賣金額亦同步下滑,錄45.18億,按月跌約6.4%。

19個月首度跌破400宗

若以各類工商物業範籌劃分,工廈及商鋪註冊量分別按月下降約19%及16.5%,最新分別錄234及71宗,商廈註冊量則按月持平,最新報53宗。

商廈註冊量最新報53宗

該行代理表示,早前第五波疫情對本港工商鋪市場的影響繼續反映在近月註冊數字上,惟近期確診數字明顯回落,市場憧憬政府將會本月下旬有機會放寬社交距離措施,為工商舖市場注入信心,預料後市交投會有所回穩。

(星島日報)

保時捷200萬預租灣仔巨鋪 樓高三層涉兩萬呎 平均呎租100元

疫下市場不乏「動力」,巨鋪有捧場客,合和旗下、位於灣仔皇后大道東興建中商廈,其基座三層高巨鋪涉及2萬呎,剛由保時捷預租,月租約200萬,平均呎租約100元,消息指,保時捷將在此地標商廈設立陳列室。

上址為皇后大道東153至167號興建中的商廈,消息人士透露,該廈地下至3樓,為三層複式巨鋪,合共2萬方呎,剛由保時捷預租,月租約200萬,平均呎租100元,屬於長租約,梗約加續租長達10年,期間租金有加幅。

梗約加續租長達10年

知情人士指出,保時捷現時據點位處區內告士打道,該街道車行陳列室成行成市,新據點則位處核心地段皇后大道東,毗鄰興建中的合和二期,區內將呈現新景象,由於疫市下遊客消失,奢侈品牌「退出」市場,車行才得以進駐此灣仔黃金地段。

該知情人士續說,近年在市場上炙手可熱的Tesla,陳列室亦設於皇后大道東

(202號地下1至2號鋪),不過,由於多年前承租,當時租金昂貴,樓底高、而且車行合用的鋪位少,Tesla承租的鋪位,面積相對「迷你」,作為體驗中心,大約1415方呎,Tesla於2018年1月以每月22.284萬續租,當時平均呎租約157元,較高峰期舊月租40萬,跌幅約44%。

保時捷發言人:不予置評

本報就上述消息,向保時捷查詢,該公司發言人表示不予置評;本報亦向合和查詢,惟直至截稿時,未獲回覆。

據了解,保時捷目前設於告士打道151號資本中心的陳列室,面積約16606方呎,去年亦剛續約,月租128萬。而新據點目前仍是樓花,興建當中,是次屬於預租。

有代理分析,告士打道集中商廈,大部分地鋪「高頭大馬」,門面闊,樓底高,最適合車行陳列室使用,形成傳統與特色的「車行街」,該街道人流未算十分暢旺,租金相對黃金地段低。旺市時,皇后大道東於旺市時,競爭大,鋪租昂貴,車行未必能選址於此,現時隨着旺區整體租金回落,令車行有升呢「進駐」機會。

該代理續說,該地段聚集大機構,老闆及公司要員集中在此上班,可方便他們買車試車。

(星島日報)

更多資本中心寫字樓出租樓盤資訊請參閱:資本中心寫字樓出租

更多灣仔區甲級寫字樓出租樓盤資訊請參閱:灣仔區甲級寫字樓出租

油塘將建逾萬伙成供應庫 財團插旗涉八項目 恒基擁最大土儲

本港近年土地供應短缺,享有海景的油塘工業區,近年吸引不少財團於區內密密插旗發展,據統計區內至少有8個項目陸續登場,涉及逾1萬伙新供應,可見油塘區變天在即,未來有望由工業區搖身一變轉型成住宅發展重鎮。

據本報統計,未來區內至少有8個項目陸續登場,涉及約1.03萬伙。最新為上月由宏安申請強拍的油塘四山街18至20號工業大廈第4座,據土地審裁處文件顯示,安宏持有約80.21%業權,而市場對整個項目估值約6.1807億。該項目地盤面積約4.17萬方呎,涉及可建總樓面約25萬方呎,預計統一業權後,將會進行「工轉住」補地價,以重建為住宅項目,料重建後部分單位將可享油塘灣及港島東海景。

油塘灣可建6236單位

油塘區未來最大型供應,為恒基等牽頭發展的油塘灣「巨無霸」住宅項目,該項目籌備超過20年,並細分6期發展,早前已通過城規會兼獲批建築圖則,可建總樓面約408.8萬方呎,擬建30幢商住樓宇,預計提供約6236個私人住宅單位,規劃相等於半個太古城;消息指,該項目去年曾獲地政總署批出補地價,惟金額過高發展商未有接納,並已提出上訴,據指一旦達成補價協議,可隨即上馬。

而長實旗下東源街5及8號項目,地盤面積約8.61萬方呎,涉及可建總樓面約41.83萬方呎,料建4座樓高9至32層的住宅大廈,可提供約903伙,該項目於2020年獲批准重建。

另外,越秀地產發展的東源街10號越秀冷藏倉庫,面積約13.2萬方呎,興建5幢23至29層高的住宅,涉及可建總樓面約66萬方呎,共提供1393伙,並於2021年通過城規會。而青建國際2018年斥資5.3億購入的東源街18號,佔地約4.98萬方呎,計畫分兩期興建兩幢24及21層高分層住宅,提供約224個單位,可建總樓面約23.34萬方呎。

包玉剛家族四山街建商住

另外,已故「船王」包玉剛家族旗下康世集團持有的油塘四山街8號世運貨倉,計畫重建商住發展,地盤面積約3.86萬方呎,將重建一幢樓高30層的商住大樓,住宅樓面約19.31萬方呎預計提供約483個單位。

同亦保利置業及尚嘉合作發展的高超道地皮,地盤面積約3.96萬方呎,涉及可建總樓面約35.65萬方呎,提供約634伙。

另外,由信和及資本策略發展的港鐵油塘通風樓項目,可建樓面約32.53萬方呎,料可提供約500伙。據了解,現存區內兩幅營運長達30年的預拌混凝土廠房用地,有意在5年內撤出,騰出現址約6萬方呎用地,並會向政府申請補地價後自行發展,稍後再視乎區內需求,決定興建住宅或商業項目。

混凝土廠五年內撤出

有測量師表示,受惠於工廈重建「標準金額」補地價先導計畫,有利加快工廈重建的修契程序。油塘區靠近港鐵站,加快重建轉型步伐,由工業區轉型成為新一個住宅區,並適合發展中小型住宅單位。

(星島日報)

恒地南角道項目擴地盤 納新地景輝閣合併重建

樓齡不足30年的舊樓亦獲重建,恒地 (00012) 九龍城南角道項目擴大地盤,加入新地 (00016) 旗下29年樓齡的景輝閣一併重建,擴大地盤至1.3萬平方呎。

位於九龍城的南角道4至24號地盤,比鄰宋皇臺港鐵站出口,當中南角道4至22號的一排舊樓由恒地近年成功收購,佔地約1萬平方呎。發展商近日透過合作方式,將地盤擴大至南角道24號,增重建規模。

當中新增的南角道24號景輝閣,屬於新地發展物業。據EPRC經濟地產庫資料顯示,項目由1993年入伙至今,一直未有拆售,相信仍由新地所持有。跟南角道一帶的舊樓樓齡普遍逾50年不同,景輝閣樓齡只有29年,屬於相對較新的物業。

不過,由於景輝閣現址只是5層高的商住大樓,由多間地舖及13個住宅單位組成,相信仍然有一定剩餘地積比,故此即使樓齡不算太舊,仍有一定重建潛力。

地盤擴至1.3萬呎 可建逾200伙

事實上,今次恒地跟新地聯手,將景輝閣併入南角道地盤後,可望將地盤面積擴3成至1.3萬平方呎;以地積比率9倍發展,可建樓面料達11.8萬平方呎,估計可興建200至300伙細單位。

據本報記者現場所見,南角道2至24號的整排物業,包括景輝閣均已經拆卸重建變成一個長條形地盤。

有業內人士估計,在上世紀90年代景輝閣興建的時候,舊啟德機場未搬出,飛機航道問題影響到九龍灣一帶住宅物業的高度,令物業發展未能用盡地積比。

除了南角道地盤外,恒地近年在九龍城一帶亦積極收購重建,包括福佬村道67至83號地盤,近年發展的曉薈亦是舊樓重建而成。其他同區新盤則有嘉華 (00173) 位於嘉林邊道的洋房項目嘉琳、碧桂園 (02007) 位於賈炳達道的瓏碧等。

(經濟日報)

禹洲堅道服務住宅 獲6.2億洽購

項目涉85伙 呎價約2萬元

不少內房在港放售物業套現,消息指,禹洲集團 (01628) 旗下堅道48號UPPER CENTRAL全幢服務式住宅,獲6.2億元洽購。該項目涉85伙,實用面積167呎起,兩年前曾招租。

市場消息指,位於堅道48號的UPPER CENTRAL,正獲財團洽購,出價約6.2億元。物業樓高27層,1至2樓為餐廳,7至30樓為住宅單位,按該物業總樓面約3.1萬平方呎計,呎價約2萬元。

據了解,該項目由內房禹洲集團持有,翻查資料,地盤原由豐泰集團持有,早年進行併購並原打算重建酒店,2014年豐泰以3.74億元,把地盤售予禹洲,集團自行發展項目,興建成樓高27層,合共85伙住宅,提供82個開放式單位及3個2房單位,命名為「UPPER

CENTRAL」。

兩年前曾招租 月租1.4萬起

兩年前項目落成並進行招租,單位實用面積167至388平方呎,租金由約1.4萬元起,呎租高達80餘元。該盤單位戶戶配備基本家電及智能家居配置,部分高層單位可飽覽中環及維港景致,並提供會所Upper Club,有健身室、私人電影院,天台設有泳池等,質素甚佳。

市場人士透露,去年業主有意放售物業,最初叫價約8億元,直至近期再降低至6億餘元。

禹洲地產成立於1994年,主要業務是發展住宅及商業物業,項目主要分布於福建、北京和上海,2009年在港上市。除了住宅外,集團在港亦持有甲廈樓面,包括2019年以近9億元,購入中環中心58樓全層甲廈樓面,呎價約3.6萬元

近月不少內房在港沽物業套現,如中國奧園 (03883) 以9億元沽出西半山羅便臣道舊樓,帳面損手近1.8億元離場。

(經濟日報)

更多中環中心寫字樓出售樓盤資訊請參閱:中環中心寫字樓出售

更多中環區甲級寫字樓出售樓盤資訊請參閱:中環區甲級寫字樓出售

文輝道地王批拆樓 重建4幢豪宅

屋宇署上月批出的拆樓紙涉及多個豪宅項目,包括九龍倉 (00004) 以120億元,投得的山頂文輝道地王展開重建4幢分層豪宅。

此外,而華潤置地 (01109) 高價購入的南區壽山村道屋地經過3年半時間,亦終於啟動重建。

早前獲批拆樓紙 (拆卸同意書) 的文輝道2至8號,前身屬於政府的高級公務員宿舍,在2020年12月招標出售,最終由九倉以120億元投得,每呎樓面地價約4.6萬元,創下當時住宅官地的呎價紀錄。

隨着發展商在去年11月獲屋宇署批出建築圖則,獲准興建4幢樓高11層至12層的分層住宅,總樓面25.93萬平方呎,地盤亦隨即展開拆樓重建,由投得地皮至動工重建,大約花了1年多時間。

壽山村道39號屋地 建10幢洋房

至於同期獲批拆樓紙的壽山村道39號屋地,則是華潤置地在2018年以59億元向周壽臣家族購入,每呎樓面地價達8萬元,相隔近3年半時間,期間發展商曾在2019年及2020年兩度獲批出建築圖則,將會興建10幢3層高洋房,總樓面近6.9萬平方呎。

(經濟日報)

WEAVE LIVING近14億 購九龍珀麗酒店

共居品牌WEAVE LIVING宣布,與環球房地產資產公司落實收購大角咀九龍珀麗酒店,成為集團旗下迄今規模最大的物業。

項目位於九龍大角咀道86號,總樓面面積約為11.1萬平方呎,成交價13.75億元,每平方呎價約12,400元。項目現時提供435間客房,WEAVE LIVING將進行全面翻新,包括為部分房間重新布局,將物業打造成時尚、配套完備、靈活租期的現代住宿空間。

(經濟日報)

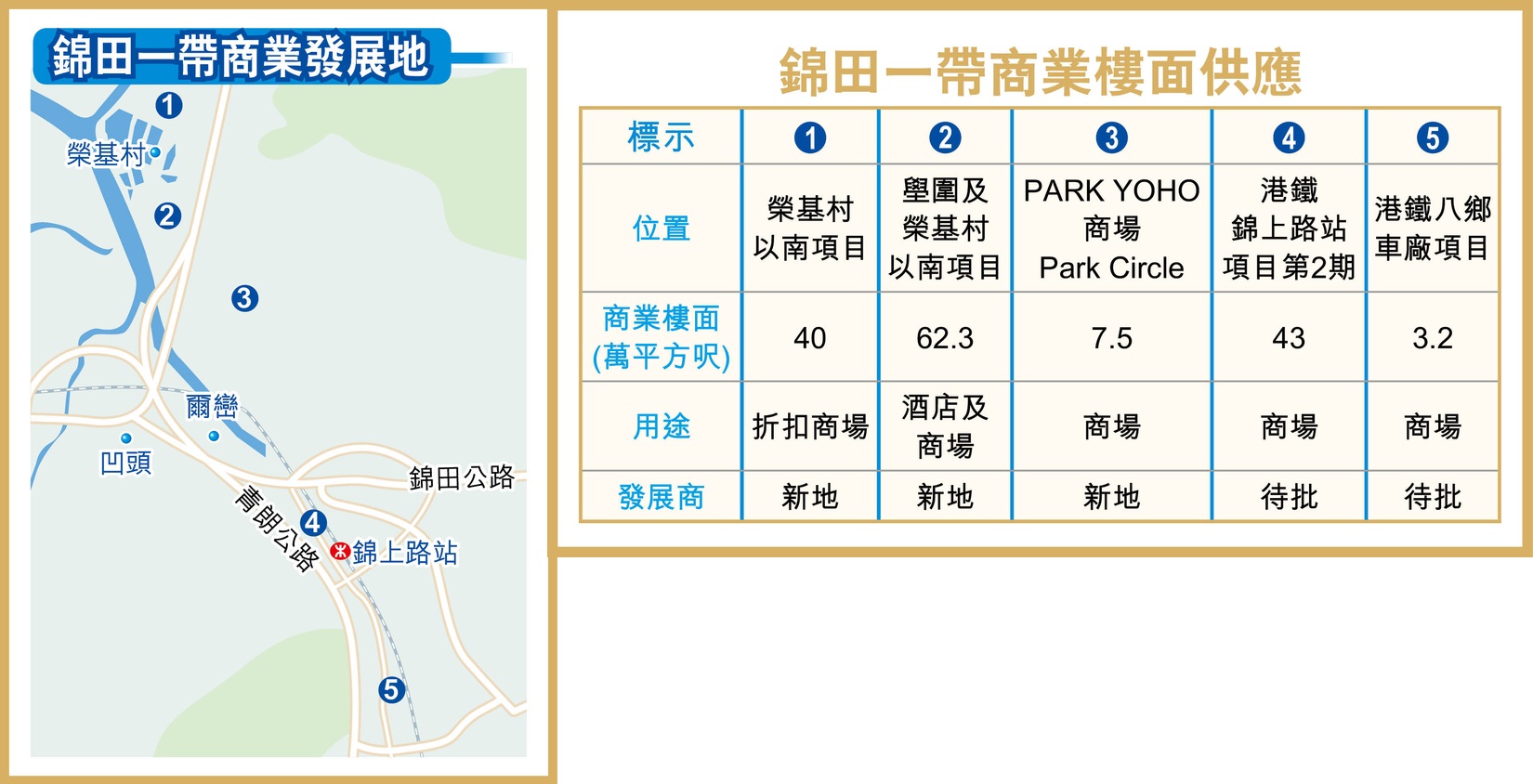

錦田增逾150萬樓面 添零售商業配套

近年錦田發展加快,區內多個大型屋苑陸續落成,未來區內亦有多個商業項目將會發展,合共提供逾150萬平方呎商業樓面,將會新增不少零售配套等。

錦田一帶近幾年有不少大型住宅項目陸續落成,包括新地 (00016) 旗下爾巒 (涉800伙)、同系PARK YOHO系列,路勁 (01098) 旗下山水盈,以及即將推出的港鐵錦上路站1期柏瓏。至於未來亦將再有被視為爾巒2期的下高埔村項目、以及長春新村項目,隨着區內人口將會大幅增加,區內對零售配套的需求將會大增。

近沙埔村項目 備700間酒店房

據資料顯示,現時錦田一帶至少有5個商業項目,合共涉及156萬平方呎樓面,當中規模最大屬於新地在榮基村以南、貼近沙埔村的項目,佔地41.5萬平方呎,將興建1座大型商場及酒店,總樓面逾62萬平方呎,當中商場部分零售樓面近41.23萬平方呎,另提供700間客房。

錦上路站2期 設大型商場

鄰近另外一幅用地佔地更達100萬平方呎,過往曾經獲批以地積比率0.4倍發展,興建一幢12層高的折扣商場,總樓面約40萬平方呎。有關用地因應抗疫需要,新地早前借出給政府興建「方艙醫院」。

而港鐵錦上路站方面,由於上蓋將會興建大型私人屋苑,按照規劃將會在第2期內設有一個面積達43萬平方呎的大型商場,相信日後將會提供不少零售、餐飲或者其他生活配套的商舖。不過,目前錦上路站第2期未推出招標,相信商場的落成仍然需要一段時間。至於,鄰近的港鐵八鄉車廠,亦將會興建約6,000伙的大型屋苑,但只會設有一個面積約3.2萬平方呎的小型商場,相信只能提供基金民生需求。

在短期的商業配套方面,最新要數新地PARK YOHO設有的屋苑商場Park Circle,據資料顯示,該商場面積約7.5萬平方呎,設有15間商舖,包括超級市場、便利店等,早在2016年已經開幕。

除了上述幾個商場及商業項目外,值得留意的是,錦上路站東南面的錦上路第1、4A及6號地盤,將會興建27幢的公營房屋,涉及約9,000伙,除了提供幼稚園及政府社區設施外,相信亦會提供不少的零售商舖,為區內社區提供服務。

(經濟日報)