Hong Kong's property prices rose

only 3.6 percent year-on-year last year, far slower than the 11 percent

rise of the global property price index tracking 150 cities around the

world by a property agency.

The

Asian financial hub ranked only the 123rd in the index and was lower

than Guangzhou with an 8.7 percent price hike and Shenzhen with 4.8

percent, which placed at 80th and 113th, respectively.

Other

cities in Asia, like the 59th Tokyo, saw its average home price go up

by 10.7 percent, and that of Singapore also grew by 10.6 percent ranking

the 61st.

Istanbul in

Turkey saw the highest increase in the home price of 63 percent while

Kuala Lumpur in Malaysia recorded a year-on-year drop of 5.7 percent

last year, and became the worst performer among the 150 cities.

The

real estate consultancy said home prices were rising at their fastest

rate in almost 18 years in 2021 and of the 140 cities seeing prices

increase last year, 44 percent of them registered over 10 percent annual

price growth.

Cities

in the Americas posted the strongest jump averaging 15 percent annual

growth compared to 11 percent in the Europe, the Middle East, and Africa

region and 9 percent across Asia-Pacific, the agency added.

Though the overall property market remained dull amid the latest Covid outbreak, luxury apartments did not seem to be affected.

Sino

Land (0083) sold a house at 133 Portofino in Sai Kung for HK$100

million, a record high for the project via tender yesterday. The 3,491

sq ft house with five bedrooms cost HK28,645 per sq ft.

The

developer has raked in over HK$980 million after selling 26 units in

the project, and only seven more - two houses and five flats - are left.

In

the office market news, another property agency expects that rents of

Grade A offices this year to drop up to 5 percent this year due to the

ample supply.

The

property consultancy said a reasonable level of vacant space of Grade A

offices is around 4 million sq ft but the completion of new supply

ensured vacant space reached another record high of 9.6 million sq ft in

the first quarter, and there are 7 million more to be added in this

year and next.

It

believes it will take years for the office market to recover given the

current economic situation and the rents will be under pressure for a

long time.

(The Standard)

Nuveen Acquires Hong Kong Data Centre, Osaka Apartments for APAC Core Fund

Nuveen

announced the addition of four assets to its Asia Pacific core

investment strategy today with the acquisition of a data centre in Hong

Kong’s New Territories and a set of three multi-family properties in

Japan’s second largest city.

The

completed acquisitions across two of the industry’s hottest sectors

were made on behalf of Nuveen’s $2 billion Asia Pacific Cities Fund,

with the US investment firm highlighting its Hong Kong acquisition as

its first in the city, and as an opportunity to leverage growing demand

for data infrastructure while diversifying its portfolio.

“Hong

Kong is a critical financial and technology hub and one of the most

mature data centre markets in Asia with rich network connectivity,

robust infrastructure and healthy market fundamentals, making this an

important strategic investment for the Asia Pacific Cities Fund,” said

Louise Kavanagh, chief investment officer and head of Asia Pacific for

Nuveen’s real estate division. “We will continue to diversify its

portfolio geographically and into sectors which match its investment

objectives.”

A report

published by a property agency earlier this year ranked Hong Kong as the

sixth most attractive location globally for operating data centres,

thanks to a robust development pipeline, excellent networks and the

availability of all major cloud services, with Nuveen fitting into a

growing number of regional and global institutions pursuing digital

infrastructure opportunities in the city.

Kwai Chung Asset in Demand

Nuveen’s

Hong Kong digital prize is the Cargo Consolidation Complex, according

to market sources who spoke with Mingtiandi, with the fund manager

having paid a reported HK$2.88 billion ($371.7 million) to purchase the

property near the Kwai Tsing container terminal from local investor Loh

Shou-nin.

The 270,000

square foot data centre is currently fully-leased to local telecom

leader PCCW, with all but the ground and first floors under contract

through 2035, should the tenant decide to exercise options included in

the lease..

The sale

illustrates the rising demand for data centre assets in the city, with

Lou having acquired the property from PAG in 2018 for HK$2 billion,

providing the investor with a more than 30 percent gain in less than

four years. PAG had purchased the asset from Goodman for HK$1.35 billion

in February 2016, according to data from another property agency, after

the Australian developer had already converted the property for data

centre use.

That kind of

return has not escaped the attention of some of Nuveen’s competitors,

with ESR last November having acquired the Brilliant Cold Storage Tower 2

in Kwai Chung – less than one kilometre from the Cargo Consolidation

Complex – for $230.8 million. The Hong Kong-listed fund manager says it

will convert the cold storage facility into a 40MW data centre.

In

September last year Blackstone paid $36 million to purchase Yip’s

Chemical Building at 13 Yip Cheong Street in Hong Kong’s Fanling area,

with that asset located within a few blocks of data centre projects by

Singapore’s Mapletree and Sun Hung Kai Properties SUNeVision.

Osaka on the Rise

With

Nuveen’s Asia Pacific Cities Fund focusing on core assets for what it

terms “future-proof cities” the firm’s other acquisition announced today

also nodded to a fast-rising alternative sector by adding 342

multi-family units to the vehicle’s portfolio.

Pointing

to an overall occupancy rate of from 96 to 98 percent across Osaka’s

multi-family market, Nuveen described the purchase as “an attractive

investment opportunity in Japan as a resilient and defensive asset

class.”

“The Japan

market is seeing an upward trend in rental residential properties which

our fund is able to take advantage of,” Kavanagh said. “Osaka’s economy,

while less diversified than Tokyo’s, is manufacturing-based, a sector

which has benefitted from increased global demand as well as the move to

bring supply chains onshore following the Tohoku earthquake.”

While

not providing specifics on the properties or the scale of the

investment, the fund manager expressed confidence that, given the

assets’ location advantages, including proximity to the city centre and

access to rail stations, the properties would be able to attract and

retain professional tenants and provide stable income streams.

In

2020 Nuveen had invested $140 million purchasing 10 multi-family assets

in Tokyo and Osaka, with those acquisitions from fund manager PAG also

on behalf of its Asia Pacific Cities fund.

House Party

In

visiting the Osaka properties in preparation for the acquisition,

Kavanagh and her team may have run into a few familiar faces from

competing investment managers, as global institutions increasingly put

multi-family acquisitions near the top of their target lists.

With

Japan being the top location in Asia Pacific for the sector, in late

March Goldman Sachs Asset Management said that it had established a

joint venture which would be investing $300 million to acquire rental

apartment properties in the country this year, and would be budgeting

$500 million annually for such opportunities thereafter.

Providing

a clearer picture of investor activity in the sector is the late March

announcement by UK’s M&G Real Estate that it had acquired 1,575

apartments across Tokyo, Osaka and Nagoya for JPY 109.3 billion ($942.6

million), with Mingtiandi having identified the seller as Blackstone.

Also

during March, Canada’s Manulife Investment Management said that it had

agreed to form a JPY 19.8 billion joint venture with Japan’s Kenedix to

acquire multi-family assets in Greater Tokyo, Osaka and Nagoya.

In

addition to the acquisitions announced today, Nuveen in December closed

on its $472 million purchase of a half-stake in One George Street – a

23-storey office building in Singapore – on behalf of its Asia Pacific

Cities fund.

(Mingtiandi)

Hong Kong in bottom quadrant once again as home prices rose to about two-decade high globally in 2021, property agency said

Property prices across 150 cities tracked by an agency’s index rose on average by 11 per cent last year

Hong Kong ranked 123rd, same spot it held in 2020, with a growth rate of 3.6 per cent

Home prices grew by the most in about 18 years globally

last year, as significant savings built up during two years of the

Covid-19 pandemic triggered a desire to either upgrade homes or acquire a

second property, a property agency said in a report on Wednesday.

Property

prices across 150 cities tracked by its global residential index rose

on average by 11 per cent last year, with 140 of these urban centres

recording increments, up from 122 in 2020. Home prices in Hong Kong

languished in the bottom quadrant of the index, ranking 123rd with a

growth rate of 3.6 per cent. The city held the same spot in 2020, when

its home prices declined by 0.1 per cent.

With

monetary authorities across the world winding down loose policies to

temper rising consumer prices as job markets recovered, the trend of

surging home prices was unlikely to be sustained, property agent said.

“The

current high growth rates for housing prices are not expected to be

sustained in the long term due to rising interest rates and increasing

base prices. Some cities also face an inflation problem and thus the

real housing price growth is not as high as it appears based on nominal

values. That said, housing price growth will stay in positive territory

for the foreseeable future,” the agent said.

The agency’s report comes after the US Federal Reserve

increased interest rates for the first time since 2018 on March 16. A

day later, the United Kingdom’s central bank also hiked interest rates

for a third time since December last year. Central banks in the Middle

East and Hong Kong also raised interest rates last month.

In Hong Kong, US-based investment bank Goldman Sachs forecast that home prices were likely to fall by a fifth

over a four-year period, as borrowing costs rose and demand slumped

because of rising unemployment. Goldman cut its forecast from flat

prices this year, followed by 5 per cent declines in 2023 and 2024 and a

return to flat prices again in 2025, with a 5 per cent decline in each

year between 2022 and 2025.

Elsewhere,

Istanbul, Turkey’s economic, historical and cultural hub, topped the

index with a growth of 63.2 per cent in a year. Overall, however, cities

in the Americas saw the highest average annual growth of 15 per cent,

outstripping the 11 per cent rise seen in Europe, Middle East and

Africa, and the 9 per cent recorded in Asia-Pacific.

“US

households not only accrued significant savings during successive

lockdowns, but the equity in their homes expanded significantly too. In

some cases, this wealth has been used to upgrade existing homes or to

purchase a second property,” the report said.

“A

typical home in Phoenix, the US city with the fastest rising prices in

2021, was worth US$298,000 the end of 2020, according to Zillow. By the

end of 2021, its value had jumped 32.5 per cent to US$394,850, adding

almost US$97,000 in one year to a homeowners’ pool of equity. This surge

isn’t atypical of cities in advanced economies,” it added.

In

the US, household wealth jumped to a record US$150.3 trillion in the

last quarter of 2021, according to a report released by the Fed last

month.

(South China Morning Post)

甲廈吸納量首季負轉正 扭轉9季逆勢 外資代理行料租賃增

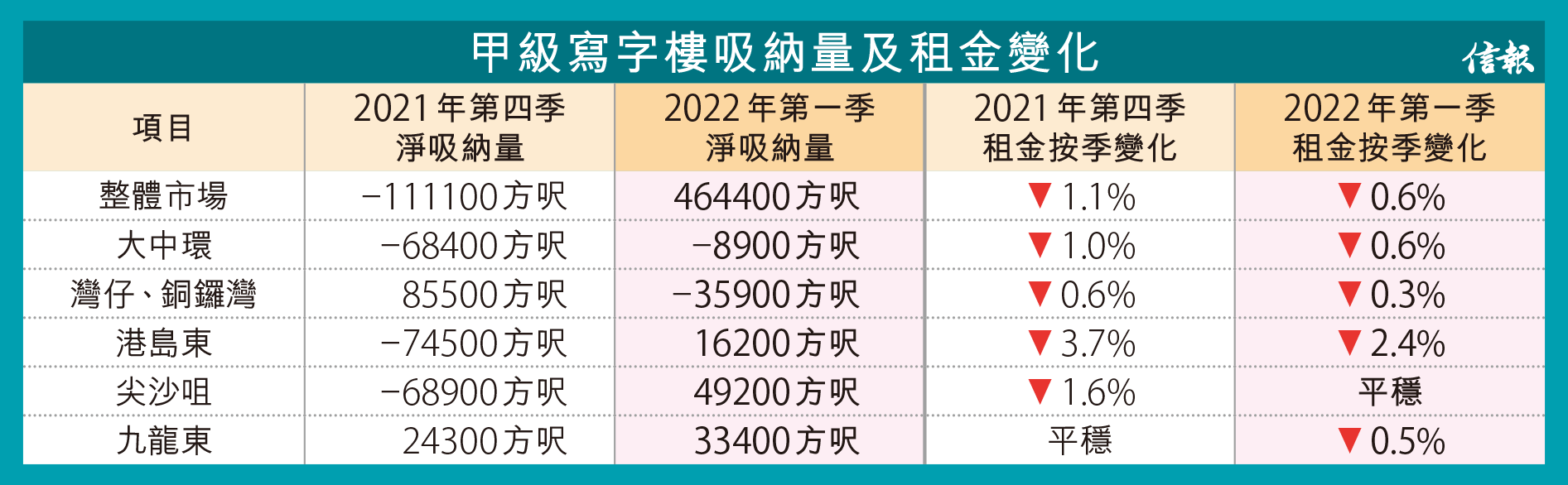

甲級寫字樓市場過去3年先後受到社會運動和新冠肺炎疫情連環打擊,吸納量和租金表現都受到影響,惟市場前景初露曙光。有外資代理行指出,甲級寫字樓的淨吸納量於今年首季出現正數 (即整體新租出樓面多於遷出騰空的樓面),錄得46.44萬方呎,打破2019年第四季至去年第四季連續9個季度錄得負數的困局,該行預計今年下半年租賃活動勢進一步增加。

該代理行最新發表的香港商業房地產市場報告顯示,本港整體甲級寫字樓的淨吸納量由去年第四季錄得負11.11萬方呎 (即整體遷出騰空的樓面多於新租出樓面),轉為今年首季錄得正數,達46.44萬方呎。

大中環區改善 尖咀省鏡

該行解釋,雖然今年首季受到疫情衝擊,寫字樓租賃勢頭減弱,但受去年帶到今年的租務磋商完成所推動下,今年首季甲級寫字樓總租賃量錄得91.5萬方呎,按季增加9%,其中今年1月的租賃量佔該季度總數約五成。

而5大分區比較,「大中環」區今年首季雖然仍錄得負吸納量,但情況已經大為改善,由去年第四季的6.84萬方呎,大減約87%,至今年首季僅錄得負8900方呎。

港島東、尖沙咀和九龍東均錄得正數,介乎1.62萬至4.92萬方呎,其中尖沙咀表現最搶眼,去年第四季錄得負6.89萬方呎,今年首季則錄得4.92萬方呎的正吸納量。

總空置樓面960萬呎破頂

由於新商廈供應投入市場,今年首季總空置甲級寫字樓樓面約有960萬方呎,創該行有記錄以來的新高,以全港指標甲級寫字樓中環國際金融中心二期 (IFC 2) 全幢總樓面面積約200萬方呎計,空置樓面接近5幢國際金融中心二期。

該行代理說,雖然甲級寫字樓的淨吸納量於今年首季變成正數,但新落成的項目租賃活動於首季較緩慢,整體甲級寫字樓的空置率按季不變,今年首3個月維持11.6%,大中環區空置率最新錄得7.7%,是5區之中最低,按季微升0.1個百分點。

該行另一代理補充,今年首季以共享辦公室、財富管理公司和保險公司表現較活躍,隨着今年陸續有新甲級寫字樓登場,以及市況好轉,相信下半年甲級寫字樓租賃活動將增加。

整體租金全年將挫5%

租金表現也相對平穩,該代理透露,今年首季整體甲級寫字樓租金按季降0.6%,是過去3年最小跌幅的一個季度,較去年第四季跌1.1%改善0.5個百分點,大中環區的按季租金跌幅,由去年第四季的1%,改善至最新跌約0.6%。

不過,代理坦言,在現時的經濟基調下,要吸納接近1000萬方呎的甲級寫字樓樓面有難度,估計寫字樓的復甦步伐需時有機會以年計。

另外,該行估計,今年全年甲級寫字樓租金料仍有約5%下跌空間。

事實上,無論官方和業界數據,都顯示寫字樓吸納情況有所好轉,例如差餉物業估價署 (差估署) 3月底公布的《香港物業報告2022》初步統計數字顯示,去年全年甲級寫字樓的負吸納量為19.38萬方呎,已經較2020年的負203.44萬方呎大減約90.5%。

另一代理行近日提到,租戶對超甲級寫字樓的需求強勁,以中環情況尤其明顯,而很多內地企業,以及金融和法律行業的大型公司都正在考慮擴充其於優質寫字樓物業的面積,相信核心區優質寫字樓的需求仍然堅挺,估計政府放寬社交距離措施後,核心區寫字樓的吸納量和租金會迅速反彈。

(信報)

更多國際金融中心寫字樓出租樓盤資訊請參閱:國際金融中心寫字樓出租

更多中環區甲級寫字樓出租樓盤資訊請參閱:中環區甲級寫字樓出租

CASETiFY擴充 租觀塘綠景NEO大廈5萬呎

個別品牌進行擴充,手機配件CASETiFY租用觀塘綠景NEO大廈5萬呎樓面,呎租約30元。該品牌原租用同區工廈,是次大幅擴充。

市場消息指,觀塘綠景NEO大廈錄得大手租務,涉及中層兩層樓面,合共近5萬平方呎,成交呎租約30元。

涉中層兩層 呎租約30元

據了解,新租客為手機配件連鎖店CASETiFY,該品牌原租用同區工廈天星中心,涉及約1萬平方呎,如今大幅擴充至約5萬平方呎,屬近期罕有擴充個案。

該品牌近年在港積極擴充,主力於商場開設分店,包括中環置地廣場、尖沙咀K11 Musea、沙田新城市廣場等;另於荃灣、觀塘等亦設門市。近日更趁舖租低,租銅鑼灣地帶商場地下舖位,面積約2,000平方呎,月租約30萬元。

觀塘綠景NEO大廈為區內質素較新甲廈,租金水平較高,本年初物業低層約31,500平方呎,以每呎約30元租出,新租客為香港都會大學,作後勤部門之用

另消息指,銅鑼灣時代廣場第二座高層08至11室,面積約4,062平方呎,以每平方呎60元租出。

(經濟日報)

更多綠景NEO大廈寫字樓出租樓盤資訊請參閱:綠景NEO大廈寫字樓出租

更多觀塘區甲級寫字樓出租樓盤資訊請參閱:觀塘區甲級寫字樓出租

更多置地廣場寫字樓出租樓盤資訊請參閱:置地廣場寫字樓出租

更多中環區甲級寫字樓出租樓盤資訊請參閱:中環區甲級寫字樓出租

更多時代廣場寫字樓出租樓盤資訊請參閱:時代廣場寫字樓出租

更多銅鑼灣區甲級寫字樓出租樓盤資訊請參閱:銅鑼灣區甲級寫字樓出租

美基金28.8億購葵涌數據中心 大數據時代掀「經濟革命」 外資爭地盤

隨網絡發展步入大數據時代,令數據中心需求急增,政府早前推出的數據中心用地更一度獲港資財團爭奪,以及市場不少工廈紛改劃用途或被財團購入等,都顯示數據中心未來的重要性,本報獲悉,剛有美資基金亦加入搶地盤行列,該基金剛斥資二十八億八千萬購入葵涌集運中心全幢,該物業現作數據中心用途,為今年以來市場最大手買賣,每呎造價一萬零八百元,亦創區內新高水平。業界指出,受到過去兩年疫情持續影響,令居家工作及網上購物趨普及,令到數據中心的需求大增,進入大數據「經濟革命」年代,勢必掀起財團搶購數據中心。

本報地產組

網絡發展一日千里,帶動數據中心備受追捧,工廈物業於疫市下罕現大手買賣。據市場消息指出,葵涌貨櫃碼頭路四十三號集運中心全幢,新獲美資基金Nuveen旗下The Asia Pacific Cities Fund (APCF) 以約二十八億八千萬元承接,以項目總樓面約二十六萬六千二百方呎計,每呎造價達一萬零八百元,現時由一家電訊公司作數碼中心用途,亦為該基金於本港首項投資。據悉,上址原業主為資深投資者羅守寧家族持有,早於二○一八年八月以約二十億購入,持貨約三年半帳面獲利八億八千萬,物業期間升值約百分之四十四。

每呎造價約一萬創區內新高

業界人士指,受到過去兩年疫情持續肆虐影響,令到居家工作及網上購物趨普及化,數據中心的需求大增,而進入大數據「經濟革命」年代,數據中心有強勁的需求,預期將掀起港資及外資財團搶購數據中心的熱潮。

有代理指出,隨網絡發展一日千里,數據中心備受追捧,早於數年前已成為環球大趨勢,不少跨國基金於歐美及亞太區均「吼準」該類物業,並準備充裕資金作大手收購,加上自疫情爆發以來,網上購物及居家工作日趨普及化,更令數據中心需求進一步升溫,同時,現今市場可作數據中心用途的全幢工廈已買少見少,令該類物業於疫市下有價有市,備受各路買家追捧。

業界:疫市改變家居網購需求

另一代理稱,現今市場上的可作數據中心的用地相當緊絀,若以舊式工廈改裝,涉及的成本相當高昂、技術亦為複雜,令全幢數據中心為「兵家必爭之地」,租金回報亦較一般工廈為高,故對投資者甚具吸引力,環顧現今為網絡大時代,將刺激數據儲存需求持續飆升,故料相關大手買賣將持續浮現。

供應緊絀 全幢工廈有價有市

事實上,政府近年大力推動創新科技發展,銳意將本港打造成為國際創科中心,而且疫情推動網絡連接需求上升,加速對數據中心的需求,不少工廈業主更率先改劃旗下項目作數據中心發展;其中,葵涌工業區就掀起重建數據中心熱潮,據本報統計,區內至少有八個項目改劃作同類發展,涉及逾二百萬方呎樓面。

(星島日報)

數據中心需求勁 財團變招購工廈轉用途

在疫情下推動網絡連接需求上升,加速對數據中心的需求,本港數據中心市場正以前所未見的速度擴張,惟近年政府批出可作數據中心用地有限,不少財團轉向工廈埋手、購入後隨即改劃數據中心發展,可見近期數據中心用地及全幢工廈備受市場追捧。

近年本港數據中心市場正以前所未見的速度擴張,據本報統計,政府由二零一八年起至今批出約五幅可作數據中心發展的賣地表地皮,涉及可建總樓面約三百八十三萬方呎。最新為上月底由華懋斥資約二十七億七千八百萬奪得、曾於二零二零年流標的東涌第五十七區商業地,鄰近私樓昇薈、毗鄰公屋迎東邨,地盤面積約十三萬二千多方呎,可建總樓面約一百二十六萬一千三百多方呎,華懋指,計畫在上述地皮興建商場、辦公室及數據中心。政府於去年底調整上述用地招標條款,約七成樓面可作數據中心或商業用途,更是首次在商業地上容許作數據中心發展,而餘下三成樓面則用作零售等用途。

華懋月前奪東涌數據中心地

另外,佳明亦曾於二零二零年七月透過私人市場、以約三億五千六百萬購入粉嶺安居街、安福街共兩幅地皮,佔地面積共約三萬七千方呎,若以地積比率五倍發展,涉及可建總樓面約十八萬五千方呎,每方呎樓面地價約一千九百多元,上述用地計畫興建數據中心。

由於近年賣地表推出可作數據中心用地供應不多,不少財團轉向工廈埋手,併購後隨即向城規會申請改劃,而葵涌工業區則掀起重建數據中心熱潮,據本報統計,現時區內至少有八個工廈項目改劃作數據中心,涉及可建總樓面約二百一十萬五千方呎樓面,有潛力打造成本港新一個數據中心供應重鎮。

(星島日報)

財團收購大角嘴富貴大廈 每呎出價1.4萬至1.6萬 較市建局收購價為低

近年市區優質地皮供應罕有,不少舊樓難免成為財團收購對象,樓齡約62年的大角嘴富貴大廈東座及西座,早年多次被財團吼中,最終因出價低而拉倒,最新再獲財團出價收購,並於月前接觸業主出價收購,據了解,住宅部分每方呎收購價大約1.4萬至1.6萬不等。

該項目位於大角嘴富貴街12號,由東座及西座組成,合共提供約470伙,另有地鋪,東座涉及195個業權,西座則有涉及318個業權。地盤面積約17222方呎,若以地積比9倍作重建發展,涉及可建總樓面約15.5萬方呎。該舊樓早於1960年起陸續落成,至今有約62年樓齡,符合強拍門檻。

已集齊逾五成半業權

據財團向小業主發出的文件顯示,該併購財團指,撇除近月疫情嚴峻影響,於短短幾個月時間內收集各業主的踴躍簽約回覆

(目前已集齊超過55%),加上配合政府年內調低收購門檻政策至6成至7成,發展商對是次收購項目仍然持樂觀態度,有信心隨着疫情減退,將於2022年底前完成今次收購。

就記者現場所見,該廈位於博文街、大角嘴道及富貴街等交界,屬大單邊位置,地下為商鋪,如設有不少特色食肆、日常用品商店等,鄰近商鋪均以民生商店為主;而樓上則屬住宅樓層,該舊樓同時毗鄰奧海城商場,可見周遭日常配套設施十分齊全。隨着市區更新,近年大角嘴一帶逐漸變天,區內有不少新盤相繼落成,如利奧坊系列樓盤等;同時鄰近港鐵奧運站,出入便利,極具重建價值。

有財團2018年收購失敗

舊樓曾於2018年初獲財團收購,惟當年因未集齊業權而拉倒,最新獲另一財團收購,據了解,目前該財團以每方呎出價約1.4萬至1.6萬不等向小業主提出收購,是次收購價對比市建局於2018年11月以每方呎出價約1.8萬、收購同區橡樹街/埃華街發展項目低出約11%。參考鄰近私樓平均呎價約2萬,如栢景灣上月底1座中層G室,以998萬易手,以單位面積466方呎計,呎價約21416元;而海桃灣最近成交為2座中層D室,面積611方呎,以1288萬易手,呎價約21080元;新盤方面,傲寓最新平均成交呎價約2.3萬,而利奧坊凱岸最新平均成交呎價約2.7萬。

業主指收購價太低

對於是次收購計畫,該廈業主劉小姐表示,近期有出價財團收購大廈,並透露其面積約300方呎的單位,收購價大約430萬,呎價約1.4萬,坦言收購價太低;惟其居住的單位已「成間屋爛晒」,現時初步傾向會接受該財團收購。

地鋪業主關先生指出,鋪位早於40年多前購入後,並一直從事印刷業至今,其地鋪建築面積約500方呎,另有相同面積即約500方呎的閣樓,透露現時收購財團並未有出價收購,但有與該財團接觸、對方會率先收購住宅部分,其後才到地鋪。有商戶表示,該廈並不是首次被收購,早年曾有收購公司嘗試收購,惟最終因未集齊業權而不了了之;認為目前收購舊樓業權困難重重,有業主反對,亦有業主已移民或去世,使想重建的舊樓業主陷入困局。

(星島日報)

恒基區內頻併購 可建樓面逾28萬呎

市區優質地皮供應罕有,近年不少財團透過舊樓併購、作重建增加私人住宅供應;其中恒基近年密密併購大角嘴一帶舊樓發展,其併購範圍包括嘉善街、博文街、萬安街及大角嘴道等一帶多條街道,涉及可建總樓面約28.62萬方呎。

2.7億購萬安街舊樓

近年大角嘴一帶除有不少新盤推出,如利奧坊系列樓盤、傲寓等外,區內亦有發展商積極收購舊樓發展,恒基曾於去年9月曾以底價2.7億成功摘下大角嘴萬安街24至30號舊樓業權,若以可建總樓面約28854方呎,每方呎樓面地價約9357元。

上述項目位於大角嘴萬安街東面,在萬安街與福利街交界,現址為4幢6層高的商住物業,地下為商鋪,樓上則為住宅,而該舊樓早於1958年落成,至今樓齡約64年。地盤面積約3206方呎,現規劃為「住宅 (甲類)」用途,涉及可建總樓面28854方呎。另外,恒基已持有萬安街16至22號舊樓全數業權,料將與上述項目整合發展,地盤面積擴展至6418方呎,可建總樓面約57762方呎;預料將會重建成「利奧坊」系列樓盤之一。

據恒基年報顯示,該公司於大角嘴嘉善街、角祥街、博文街、萬安街及大角嘴道一帶有多個併購項目,總地盤面積約3.18萬方呎,若以地積比9倍重建發展,可建總樓面約28.62萬方呎。

宏安3.3億統一洋松街業權

此外,宏安地產曾於2020年12月以底價3.2683億、成功統一該區洋松街56至62號和菩提街6及8號舊樓業權;據該公司年報顯示,該項目地盤面積約6800方呎,擬議住宅及商業發展,涉及可建總樓面約61500方呎,料於2024年落成。

(星島日報)