Chinachem wins Tung Chung site

Chinachem has won the bid for a commercial site at Tung Chung Town for HK$2.78 billion, which is lower than estimated.

The site, at lot No 45 in area 57, was worth HK$2,202 per square foot, close to the bottom end of market expectations.

Chief

executive Donald Choi Wun-hing said he is pleased that the developer

has won the site and that malls, offices and data centers will be built

upon it.

Tenders for the

site closed last Friday and a total of five bids were received from Sun

Hung Kai Properties (0016), Sino Land (0083), K&K Property,

Chinachem and K Wah International (0173).

The site covers 132,800 sq ft and has a buildable floor area of 1,261,300 sq ft.

It was put up for tender in October 2020 but only three bids were received, and the sale was cancelled.

In other news, the government has applied a land premium mechanism to Kwu Tong North and Fanling North to speed up supply.

The

Development Bureau announced the arrangements for charging land premium

at standard rates for lease modifications in New Development Areas

yesterday.

(The Standard)

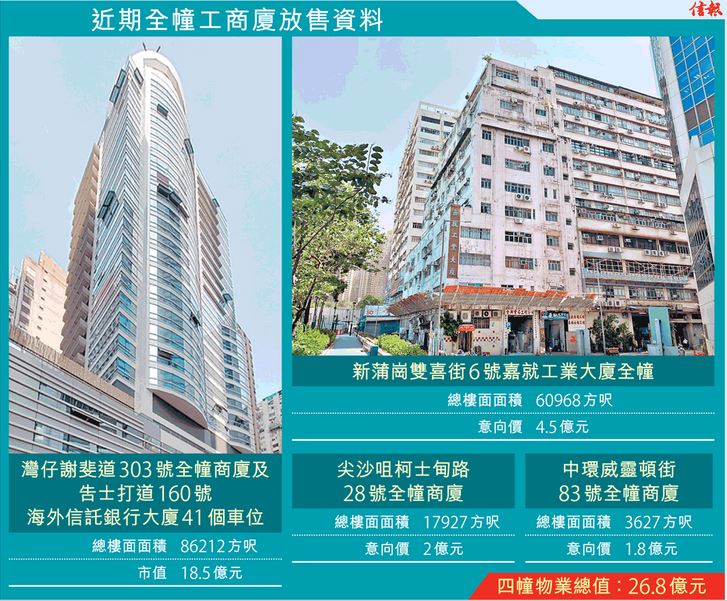

甲廈需求回暖 吸納量改善九成

本港經濟於去年顯著復甦,市場對寫字樓需求漸回暖。據差餉物業估價署昨日公布的《香港物業報告2022》初步統計數字,2021年本港私人甲級寫字樓空置樓面超過1100萬方呎,空置率按年略增0.7個百分點,達到12.5%,再創2004年後新高。不過,去年私人甲廈使用量錄得負19.38萬方呎 (負吸納量,即整體遷出騰空的樓面多於新租出樓面),按年大幅縮減超過九成,反映需求增加。

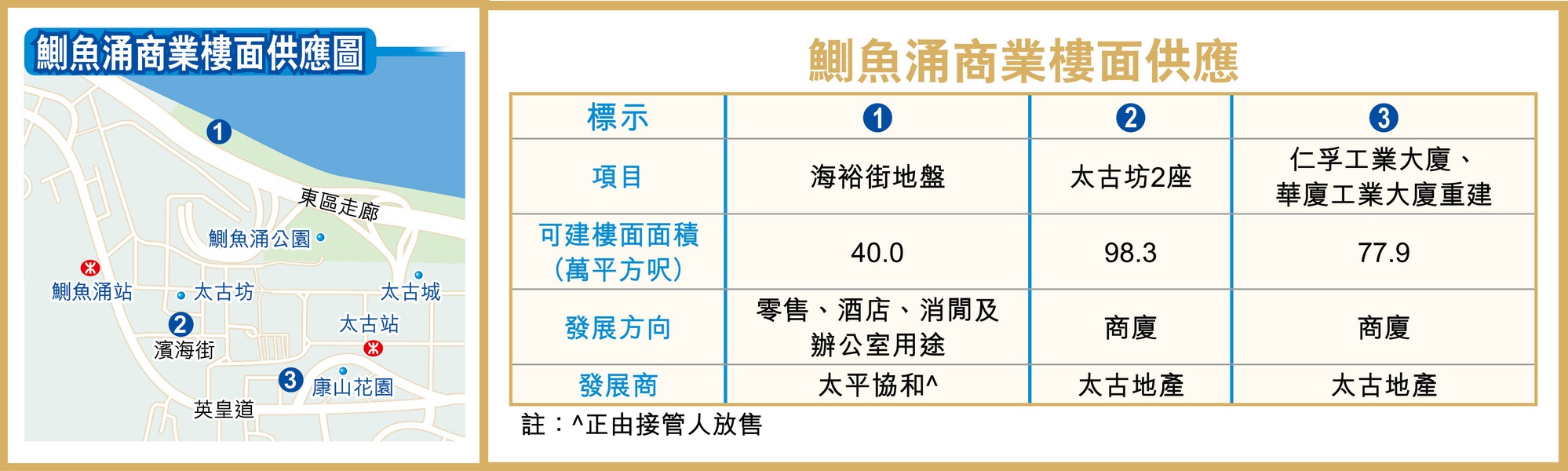

差估署指出,去年底本港整體私人寫字樓空置率連升3年,由2020年底的11.5%,上升至2021年的12.3%,涉及樓面約1658.73萬方呎。其中,甲級寫字樓空置率由2020年底的11.8%,增加至2021年底的12.5%,屬2004年錄得13.1%後近17年新高。除中區和北角/鰂魚涌分區外,其餘分區的甲級寫字樓錄得雙位數字空置率。

1101萬呎樓面丟空創新高

截至去年底,甲廈空置樓面達1101.16萬方呎,較2020年的1027.96萬方呎,進一步增多73.2萬方呎,是差估署自1985年有統計以來,甲級寫字樓空置樓面最多的一年。以全港指標商廈中環國際金融中心二期 (IFC 2) 全幢總樓面面積約200萬方呎計,3個月前甲廈的空置面積相等於逾5.5幢國際金融中心二期。

雖然甲級寫字樓空置樓面續創新高,但市場需求已經有明顯改善。去年底私人甲廈的負吸納量僅19.38萬方呎,而2020年底的負吸納量則為203.44萬方呎,即2021年大幅縮減約90.5%。

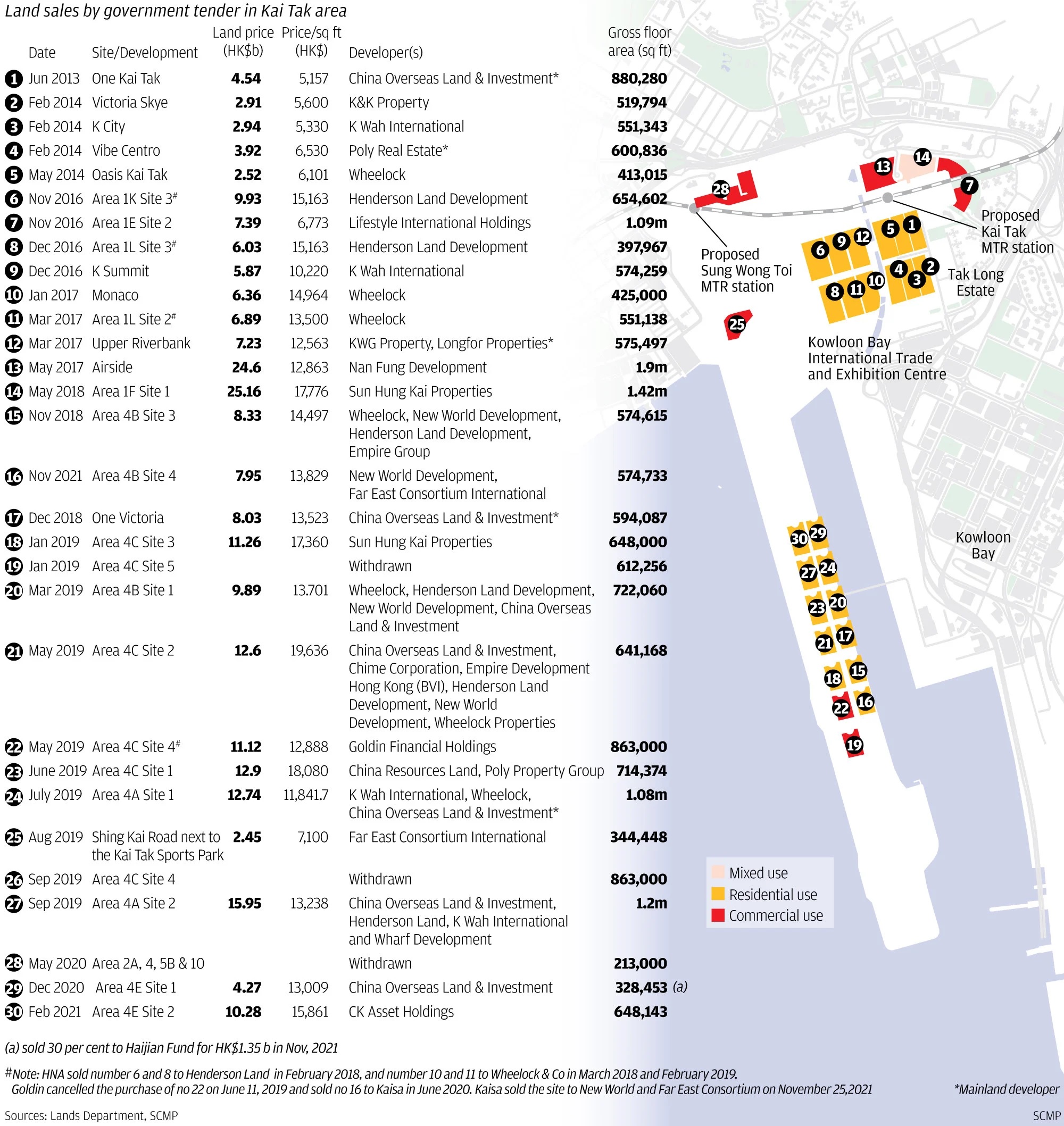

至於整體私人寫字樓落成量,去年輕微增至約75.35萬方呎,當中52.74萬方呎屬於甲級寫字樓,主要分布在深水埗和荃灣。預計2022及2023年整體私人寫字樓落成量分別約376.74萬及約276.63萬方呎。今年甲廈落成量將有約303.54萬方呎,當中佔27%來自九龍城。據了解,今年主要落成的甲級寫字樓為南豐集團旗下九龍東啟德的 AIRSIDE。

中環寫字樓空置率跌至7.4%

差估署在報告中提到,2021年寫字樓市場氣氛有所改善,整體寫字樓售價錄得1.3%升幅,當中甲級寫字樓漲2.5%。同期整體寫字樓租金平穩,錄得0.6%輕微升幅,惟甲廈租金下跌0.4%,反映跨國企業和大型公司在全球經濟不明朗的市況下,對承租甲級寫字樓持審慎態度。

事實上,因為過去兩年本港甲廈租金大降,加上全球經濟在去年下半年逐步恢復,個別企業已重拾租用辦公室甚至擴充的步伐,主要商業區的甲級寫字樓租賃交投增加。

去年較矚目的甲級寫字樓租務成交有國際評級機構標普租用中環交場廣場2.2萬方呎樓面,市場估計月租達264萬元,呎租120元。

據代理行數據顯示,由去年10月至今年2月,本港甲級寫字樓租賃市場已連續5個月錄得正吸納量;中環甲廈空置率由去年12月的8%,回落至今年2月的7.4%,租金亦開始有輕微升幅。

企業復擴充 今年租金看漲5%

該行代理表示,目前甲級寫字樓已經在下行周期的尾聲,快將見底,不少金融、資產管理企業在去年底起制定一系列擴充或升級辦公室計劃,有望今年內落實。由於中環近兩年的租金調整幅度較深,故不少企業都有意在該區重新租用辦公樓面。他預期,今年甲級寫字樓市場租金看升5%以內。

另一代理直言,第五波疫情無疑拖慢近一兩個月寫字樓租賃市場步伐,但今年首季甲級寫字樓市場仍會錄得正吸納量。由於不少行業對未來經濟恢復信心,只要限聚令放寬,商業活動回復正常,今年寫字樓市場依然樂觀,估計全年租金將扭轉過去兩年多的下跌局面,朝向平穩發展。

(信報)

更多國際金融中心寫字樓出租樓盤資訊請參閱:國際金融中心寫字樓出租

更多中環區甲級寫字樓出租樓盤資訊請參閱:中環區甲級寫字樓出租

更多AIRSIDE寫字樓出租樓盤資訊請參閱:AIRSIDE 寫字樓出租

更多啟德區甲級寫字樓出租樓盤資訊請參閱:啟德區甲級寫字樓出租

甲廈空置率升至12.5% 創17年高

疫情衝擊商業活動,甲廈空置率上升,差估署報告指,本港去年甲廈空置率升至12.5%,創17年新高;而今明兩年為商廈落成高峰期,合共逾600萬平方呎新供應,料對租金有一定壓力。

差估署公布《香港物業報告2022》初步統計數字,疫情下寫字樓需求仍較低。去年寫字樓的整體使用量縮減至負43萬平方呎,而當中甲廈錄負19.3萬平方呎,已屬連續2年出現負吸納量。

因新租務個案較少,整體空置率升至12.3%,而甲廈空置率則由11.8%,升至去年的12.5%,連續3年上升,並創自2004年後新高。除中區和北角/ 鰂魚涌區外,其餘各區寫字樓錄得雙位數字空置率。

今明2年供應高峰 租金添壓

甲廈租務空置率屬近年偏高水平,同時間落成量亦將維持高水平。報告指,今明兩年整體落成量分別為約377萬及277萬平方呎,而今年甲廈落成量約304萬平方呎,當中27%來自九龍城。據了解,最大型商廈為南豐旗下啟德 AIRSIDE,涉及120萬平方呎樓面。

另太古地產旗下太古坊二座、新世界長沙灣荔枝角道888號,亦於今年落成。至於明年甲廈供應亦高,今明兩年商廈新供應達654萬平方呎,而甲廈涉及552萬平方呎。

有代理指出,第5波疫情令商務租務減慢,相信上半年租金仍少許調整。該代理預計隨着疫情緩和,下半年整體租務會增加,而新甲廈入伙亦加快租務活動,租金可望企穩。空置率上,該代理指因今年將有大型項目落成,空置率難免再上升,預計會維持一段時間,直至租務活動全面回復才回落。

(經濟日報)

更多AIRSIDE寫字樓出租樓盤資訊請參閱:AIRSIDE 寫字樓出租

更多啟德區甲級寫字樓出租樓盤資訊請參閱:啟德區甲級寫字樓出租

更多太古坊二座寫字樓出租樓盤資訊請參閱:太古坊二座寫字樓出租

更多鰂魚涌區甲級寫字樓出租樓盤資訊請參閱:鰂魚涌區甲級寫字樓出租

更多荔枝角道888號寫字樓出租樓盤資訊請參閱:荔枝角道888號寫字樓出租

更多長沙灣區甲級寫字樓出租樓盤資訊請參閱:長沙灣區甲級寫字樓出租

疫下商廈租賃放緩 租金暫企穩

第5波疫情令商廈活動放緩,萊坊報告指,各區商廈租金按月無起跌,租金暫企穩,該行料社交距離措施放寬後,港島區租務將轉活躍。

據代理行每月商廈統計,全港各區商廈租金,按月均無起跌,反映在第5波疫情下,因租務活動近乎停頓,令各區租金均不變。若與去年同期比較,中環整體商廈租金更錄0.1升幅,反映核心區甲廈租金已喘定,反觀其他邊緣商業區如灣仔、銅鑼灣等,按年仍錄不少跌幅。

近日市場則錄一宗大手租務,共享空間品牌IWG表示,租用灣仔皇后大道東8號全幢逾8萬平方呎樓面,為今年暫錄最大手商廈租務。

IWG租灣仔全幢 今年最大宗

IWG集團表示,租用灣仔皇后大道東8號全幢 (8QRE),開設Spaces辦公中心,而8QRE Spaces預計於2022年7月開幕。集團指,該中心將提供超過900個辦公位置及70間私人辦公室,同時預留5層空間作企業專屬套間。除了服務式辦公室,其中兩層更將改造「商務俱樂部」,供會員作流動辦公和非正式會議之用。

IWG香港及大灣區區域經理Paul MacAndrew表示,8QRE 的新Spaces中心是品牌於香港的第7個據點。該品牌先後於銅鑼灣希慎廣場、觀塘海濱滙等開設分店,而是次租用8萬平方呎樓面,亦暫為本年最大手商廈租務個案。業內人士預計,是次成交呎租料約45元,而據了解,是次品牌與業主屬合作關係作營運。

該廈總樓面約8萬平方呎,原由忠利保險租用,該品牌早前遷往太古城。據悉,2019年共享空間品牌WeWork亦曾預租該廈全幢,惟最終取消,如今由IWG接手。

有代理行指,港島區甲廈租務暫緩,主因第5波疫情下的收緊措施持續,令商務洽談過程放緩,不過,該行指不少大型企業,包括中資金融機構及律師行等,正考慮在中環超甲廈如遮打大廈、國際金融中心二期等進行擴充。該行亦指,在疫情下很多大業主仍願意以較優惠租金及租務條件,吸引租客續租,令出租率維持高水平。

料放寬防疫措施後 市場轉活

九龍區方面,該行指2月份租務活動大減,而市場上較大手續租個案,為中資電訊商華為,以及半導體公司,分別續租尖沙咀港威大廈7.6萬及1.5萬平方呎樓面。

後市方面,該行指核心區租務需求強勁,社交距離措施預計即將放寬,港島區租務活動將非常活躍,有明顯反彈。至於九龍區,該行指由於不少公司因疫情關係,有需要降低成本,故會尋求搬遷。該行料因經濟前景仍不明朗,九龍區租務活動仍會較淡靜,租金將輕微回調。

(經濟日報)

更多皇后大道東8號寫字樓出租樓盤資訊請參閱:皇后大道東8號寫字樓出租

更多灣仔區甲級寫字樓出租樓盤資訊請參閱:灣仔區甲級寫字樓出租

更多遮打大廈寫字樓出租樓盤資訊請參閱:遮打大廈寫字樓出租

更多國際金融中心寫字樓出租樓盤資訊請參閱:國際金融中心寫字樓出租

更多中環區甲級寫字樓出租樓盤資訊請參閱:中環區甲級寫字樓出租

更多港威大廈寫字樓出租樓盤資訊請參閱:港威大廈寫字樓出租

更多尖沙咀區甲級寫字樓出租樓盤資訊請參閱:尖沙咀區甲級寫字樓出租

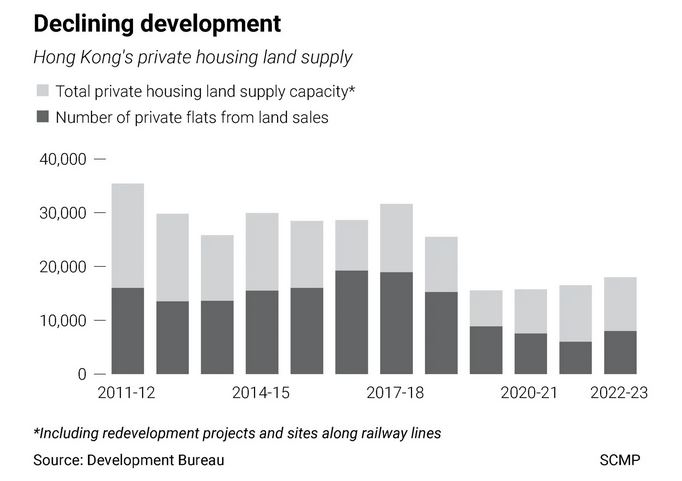

住商工舖落成大潮 遠超過去5年

昨日差餉物業估價署公布《香港物業報告》的初步統計數字,不管中小型住宅、大型單位、寫字樓、商舖、甚至分層工廈,今年都迎來一次大型入伙潮,即使到了明年,落成量仍處相對高位。

2022年及2023年私樓分別有22,850及21,850伙落成,高於2017至2021過去5年平均每年落成量17,536伙。中小型住宅方面,過去5年平均每年16,256伙,大型單位平均1,280伙,今明兩年中小型住宅落成量均超過2萬伙、而今年大單位落成量亦高見1,750伙。

未來兩年 654萬呎寫字樓落成

除了受市民關注的住宅,將有大量新盤入伙之外,其中私人寫字樓迎來另一個海量入伙潮,整體私人寫字樓,過去5年平均每年落成量約為169萬平方呎,其中2020年及2021年屬低點,各只落成約75萬平方呎,但附表顯示,未來兩年分別有多達377萬及277萬平方呎樓面落成,總計達到654萬平方呎需要消化,當中551萬平方呎,亦即84%屬於價值最高的甲級寫字樓。

更要留意是2020年及2021年寫字樓使用量均呈現負值 (負數顯示年內使用的樓面面積出現減少的情況),而截至2021年,寫字樓樓面空置量達到1,659萬平方呎,空置率高見12.3%,空置加上未來兩年入伙的樓面,達到驚人的2,313萬平方呎樓面,可以預見商廈的租金及價位壓力相當大。另外,乙級商廈在今年亦是落成高峰,達72萬平方呎,超過過去5年落成量總和58萬平方呎,這些都需時消化。

至於私人商業樓宇,亦即商舖,一如商廈,經過2020年及2021年落成量低位後,同樣步入落成現貨供應的高峰,兩年合計是347萬平方呎,雖然空置率由2020年的高位11.4%減至2021年的10.2%,但今年上半年疫潮洶湧,商舖需求相信仍相當疲弱。

住宅、商廈及商舖之外,連私人分層工廠大廈都遇上落成大潮,2017至2021年,工廈落成量5年合計有202萬平方呎,但單計今年就有174萬平方呎落成,明年還有75萬平方呎新落成樓面。至於工貿大廈,過去5年均未有供應。

市場需求偏弱 樓面需時消化

2022年虎年果然是不容易度過的一年,第5波疫情、經濟收縮、失業率上升、股票市場低位反覆、內地通關及海外旅港恢復無期,市場需求偏弱剛好又遇上全綫各類型物業的入伙大潮,不論是住宅、工商廈及商舖,均需時間消化。不過,唐榮早前已提及,第5波疫情預計亦會對建築材料運輸、地盤工程施工進度以及政府審批入伙紙等構成影響,要留意會否今年延去明年、明年延去後年的情況出現,稍減供應壓力。

(經濟日報)

50大指標甲廈 上月僅錄3買賣

商廈買賣市場同樣淡靜,有代理行資料顯示,上月指標甲廈買賣,僅3宗成交。

上月商廈市場交投淡靜。該代理行發表表報告指出,2月50大指標甲廈成交量大幅回落,僅錄得3宗買賣,指標甲、乙廈售價雙雙錄得輕微下跌,分別按月減少0.9%及0.3%。

灣仔今年累跌17%

該行代理表示,在疫情肆虐下,經濟低迷,企業承接核心甲級商廈意慾偏低,拖累呎價持續向下。當中灣仔的甲廈售價繼續下挫,今年首兩個月累積跌近17.2%,最新呎價跌至24,108元。

該代理又指,第5波疫情似乎難以在短時間內受控,經濟前景不明朗,預計市場氣氛仍審慎觀望,寫字樓成交及租金相信會持續受壓。

(經濟日報)

第一集團2.4億沽長沙灣工廈 涉兩層樓面連命名權 東方國際承接

工廈物業於疫市表現硬淨,市場再錄大手成交。由第一集團發展的長沙灣工廈環球商貿廣場三期,該項目兩層全層獲東方國際 (集團) 以2.4億獲命名權承接,並命名為東方國際大廈,此外,該盤頂層以呎價1.3萬售出,創該項目呎價新高。

第一集團董事魏深儀指出,該集團旗下長沙灣大南西街1018號環球商貿廣場三期 (GCC3),當中兩層全層,分別為該廈29樓及16樓,總樓面約2萬方呎,連命名權獲東方國際 (集團) 承接,作價2.4億,平均呎價1.2萬,並命名為東方國際大廈,購入上址作自用用途。

呎價1.3萬創項目新高

魏深儀亦指出,該項目29樓成交呎價更高見約1.3萬,創該項目呎價新高。該項目樓高26層,提供154個單位,將於今年第二季竣工,累沽逾三份之一樓面,套現逾10億元。

她亦指出,東方國際 (集團) 從事製造業與現代服務業的國內企業,亦是中國最大的紡織服裝集團和最大的紡織品服裝出口企業,名列中國企業500強第175位,中國服務業企業500強第71位。相信是次擴充將為該公司帶來全新商機,有助拓展本港業務。

命名為東方國際大廈

資料顯示,該集團積極於區內發展,於2020年3月先後以7.9億購入長沙灣道926號全幢工業大廈,再以6.4億收購毗鄰918號,連同2018年以12.5億購入的大南西街1018 號 (廣隆泰大廈),發展成三幢新式工廈,並命名為環球商貿廣場 (GCC) 1至3期。

其中,今番錄大手買賣的GCC3樓高26層,設有3層地庫停車場,2樓至29樓為工作室樓層,共設154個單位,單位面積由1451方呎至全層10842方呎,另設有特色單位,享獨立平台,項目所有單位以裝修標準交樓,方便買家即收樓即使用,預計於2022年第二季落成。由該廈步行兩分鐘即達荔枝角港鐵站。

(星島日報)

葉慶寧為金鐘鋪位減租 受影響租戶劃一減30%

疫市下鋪位減租蔚成風氣,旅行社東主協會會長葉慶寧持有的金鐘統一中心多個鋪位,租客包括「重災」的行業珠寶店、快餐店及咖啡室,月租2萬多至10萬,他主動提出為受影響的租客減租,幅度劃一30%。身為旅遊業經營者,在遊客絕迹下,旗下生意大受打擊,感同身受,從而更關心租客的處境。

租客包括珠寶店及咖啡室等

葉氏亦是統一中心業主委員會主席,除了為租客減租外,他更爭取大廈多輪減收管理費,他說,鋪位管理費普遍都由租客支付,「這樣做,多少再給他們一點幫忙。」事實上,甲級商廈管理費並不平宜,統一中心寫字樓管理費每呎三點九元,商場每呎五點七三元,繼年前減收一半管理費,為期十五個月後,今年四月一日實施新計畫,減幅為兩成五,為期三個月。「雖然力度未及上次,但起碼叫做爭取,細水長流,大家同心協力捱過疫市。」他誠懇而熱切地說。

成功爭取減管理費

葉慶寧續說,疫市以來的管理費減收計畫,令該廈少收二千五百萬,受惠用戶則超過一百五十家,問及大廈最新盈餘數目,他未肯正面回答,只說:「法團歷屆主席及全體委員,堅守謹慎理財,量入為出,建立豐厚財政儲備,以應付不時之需。」他大聲呼籲,全港其他大廈,很應該效法他的做法!

統一中心擁有不少大機構,包括多家大型銀行、航空公司、德國、印度、菲律賓領使館等,但更不乏小商戶,包括位處商場的食肆,以至形形色色的零售業,由於大廈是金鐘區最早落成的商廈,實用率較高 (達80%),樓齡最舊 (逾40年),租金相對平 (寫字樓呎租約40元),受務求實際的中小企所愛。

(星島日報)

更多統一中心寫字樓出租樓盤資訊請參閱:統一中心寫字樓出租

更多統一中心寫字樓出售樓盤資訊請參閱:統一中心寫字樓出售

更多金鐘區甲級寫字樓出租樓盤資訊請參閱:金鐘區甲級寫字樓出租

更多金鐘區甲級寫字樓出售樓盤資訊請參閱:金鐘區甲級寫字樓出售

華懋27.78億奪東涌商業地 每呎2202元平過粉嶺地 作數據中心吸引力增

本港數據中心用地供應緊絀,加上在疫情下推動網絡連接需求上升,加速對數據中心的需求。曾於2020年流標的東涌第57區商業地,政府調整招標條款如容許作數據中心發展等後,上周重新截標,最終由華懋以27.78億力壓4財團奪標,每方呎樓面地價約2202元,屬市場估值下限價。

數據中心用地需求殷切,在疫市下「捲土重來」重新招標的東涌第57區商業地,有七成樓面可作數據中心等發展,大增項目吸引力,上周截收5標書,昨日招標結果終於揭盅,地政總署公布,由華懋以27.78億力壓4財團奪標,每方呎樓面地價約2202元,屬市場估值下限價。惟是次地價對比上一幅可作數據中心用途的粉嶺安居街工業地,去年1月由其士國際以每方呎樓面地價約3387元,低出約35%。

蔡宏興:發展商場寫字樓數據中心

華懋集團執行董事兼行政總裁蔡宏興表示,集團計畫在上述地皮興建商場、辦公室及數據中心。而且東涌東將發展成為新市鎮,該項目鄰近港珠澳大橋及屯赤隧道,享有快速連接廣東省及澳門的優勢;加上政府正積極進行東涌新市鎮擴展計畫,集團對東涌的發展非常有信心。除中標的華懋外,其餘入標發展商包括新地、信和、嘉華國際及建灝地產。

資料顯示,華懋對上一次中標商業地、為2021年5月夥拍希慎以197.78億奪得的銅鑼灣加路連山道商業地,當時每方呎樓面地價約18374元。換言之,華懋相隔不足一年連奪兩幅商業地。

2020年限作商業地流標收場

有測量師指出,該用地周遭交通配套未完善,佔地面積大,而政府以數據中心為誘因、成功吸引發展商到新地區作「開荒牛」,故不排除政府因而以低市場估值批出;惟在疫情下數據中心的需求大增,認為發展數據中心的租金回報較寫字樓為高。

另一測量師表示,上述東涌東商業地樓面地價可見財團在目前市道下出價審慎,由於區內發展及配套未成形,料東涌東發展步伐仍需頗長時間,預期項目落成後仍需一段時間防守。另外,華懋有發展數據中心的經驗,由於數據中心建築成本高昂,每呎建築費往往近萬元,因此發展成本亦反映在地價上。另外,本港可作寫字樓的商業用地供應多,加上活化工廈可轉作商業用地,作寫字樓用途,然而工廈就未能轉化作數據中心,相對下數據中心用地供應相當少有。

粉嶺地每呎3387元

上述用地位於東涌第57區 (東涌市地段第45號),鄰近私樓昇薈、毗鄰公屋迎東邨,地盤面積約13.28萬方呎,涉及可建總樓面約126.13萬方呎,政府於2020年9月首次推出招標時,規定約有91%樓面須作寫字樓用途,只有約11.5萬方呎樓面作零售用途,當時僅有3家財團入標競投,結果全部出價未達要求而流標收場。而去年底政府調整招標條款重新推出招標,其中有約70%樓面可容許作數據中心或商業用途,更是首次在商業地上容許作數據中心發展,而餘下30%樓面則用作零售等用途,即約37.8萬方呎,讓中標財團有較多選擇。

(星島日報)

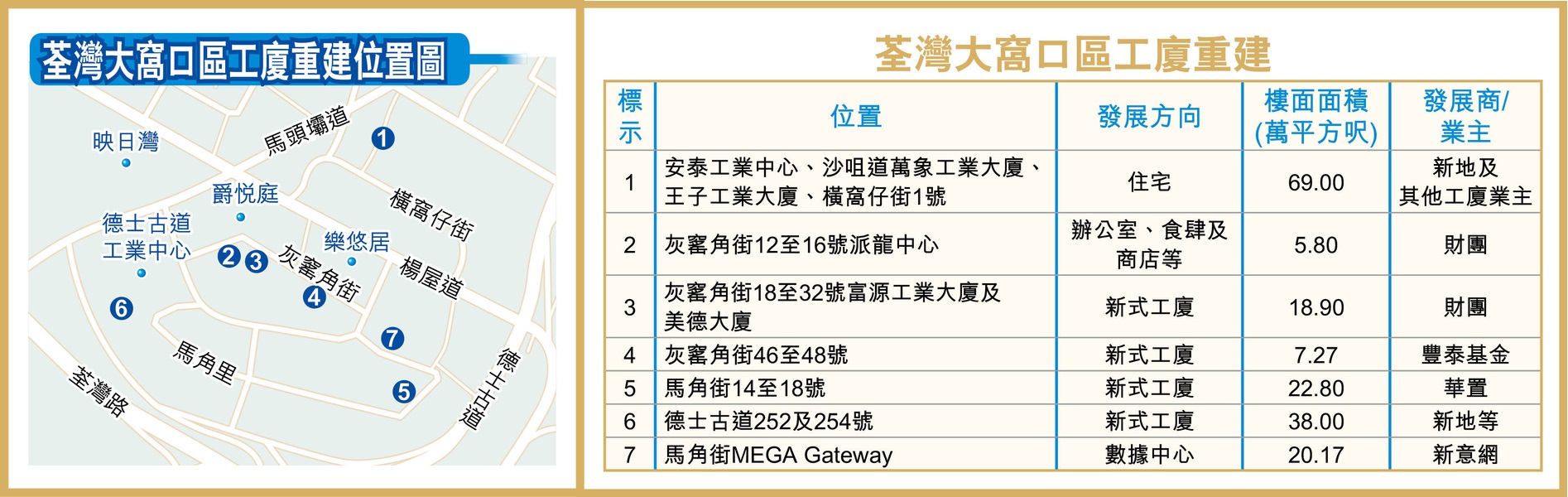

5G時代來臨 工廈紛轉型增優勢

政府大力推動創新科技發展,銳意打造成為國際創科中心,企業為了投入5G時代,應用人工智能及工業互聯網等科技,搶佔市場領導地位,對數據中心需求日益增加。近年除有政府數據中心用地批出外,葵涌工業區更掀起重建數據中心熱潮,據本報統計,現時區內至少有8個項目改劃作同類發展,涉及可建總樓面約210.5萬方呎樓面,有潛力打造成新晉數據中心重鎮。

其士佳明購粉嶺工業地

發展商紛出手加快傳統工業區數碼轉型。其士國際於本年1月以2.974億投得粉嶺安居街工業地,地盤面積約17559方呎,可建總樓面約87797方呎,每方呎樓面地價約3387元,可作數據中心用途。

佳明亦於2020年7月以3.56億購入粉嶺2地,計畫興建數據中心,包括區內安居街3號地皮,佔地約1.79萬方呎,作價1.68億;安福街7號地皮,佔地約1.91萬方呎,作價1.88億。

EDGE放棄重建新式工廈

葵涌作為新晉數據中心重心地區,區內有眾多改劃個案,最新一宗為由外資基金安祖高頓持有的工廈活化項目EDGE,再向城規會提交新發展方案,最新放棄重建新式工廈,改劃作數據中心發展。

文件顯示,項目位於葵榮路30至34號,現時屬「其他指定用途」註明「商貿」地帶,該項目曾於去年申請重建1幢樓高22層的新式工業大廈,惟已撤回申請,最新則申請擬議略為放寬地積比率限制,以作准許的資訊科技及電訊業發展,惟整體發展參數與舊方案新式工廈方案大致相約。

上址地盤面積約27470方呎,申請放寬地積比率約20%發展,由9.5倍增加至11.4倍,以重建為一幢22層高 (包括1層地庫) 的數據中心,涉及可建總樓面約313155方呎。據發展圖則顯示,該項目由地下高層至20樓用作為數據中心發展,而另低層地下及地庫,設兩層停車場。葵涌區日趨商業化,近年有不少大型企業、酒店及數據中心進駐,受機構投資者及大型企業垂青,當中包括安樂工程以5.85億購入國瑞路45至51號Toppy

Tower全幢工廈,以及萬國數據購入多個地段擬重建為數據中心。

(星島日報)

Secondary home sales nearing one-year high

Home viewing appointments of

blue-chip estates in Hong Kong rose over the weekend, driving the number

of transactions up to a nearly one-year high.

A

total of 590 appointments were recorded in a property agency's top ten

housing estates during the weekend, up by 15 percent from a week ago and

reaching a nearly half-year high. Six out of the ten estates saw rising

appointments ranging from 10 percent to 33.3 percent.

The

number of deals also increased by 4, or 19 percent to 25, the highest

since last May, and has been above 20 cases for three weeks, the real

estate agency said.

Property

agent said that the market sentiment is obviously improving as the

number of daily Covid confirmed cases continues to fall. The pent-up

purchasing power, coupled with the relaxation of the mortgage loan

insurance as well as the lack of sales in the primary market has

accelerated homebuyers' pace of entering the property market, the agent

added.

Its rival, another

property agecy, also saw both home viewing appointments and

transactions up over the weekend. The appointments of its 15 indicator

estates climbed by 8.2 percent to 411 in the past two days and the

figure of deals in the 10 major estates also advanced by 18.2 percent

week-on-week to a 45-week high of 26, the agency said.

"We are seeing a 'seasonal boom' in real estate," agent said.

"When the sales of new projects launch later this month, the momentum of the property market will be even stronger."

Among

the major housing estates, Mei Foo Sun Chuen in Kowloon with seven

deals recorded over the weekend was the bestseller, according to the

agency.

A 531-square-foot flat there changed hands at HK$6.45 million, or at HK$12,147 sq ft, the agency said.

The

vendor slashed the asking price by 16 percent in four months but still

managed to book a paper gain of 76 percent, or HK$2.78 million, through

the deal after holding the two-bedroom unit for 11 years.

The

second place was taken by Tin Shui Wai's Kingswood Villas with five

deals recorded while South Horizons in Hong Kong Island became the only

estate that saw no transactions over the weekend.

(The Standard)

力寶中心低層每呎42元跌20% 交吉逾兩年始租出

受疫情打擊,甲廈市場淪為「重災區」,拖累租金急下滑,金鐘力寶中心一座低層單位,於交吉逾兩年後,以每呎約42元租出,較舊租金急跌逾兩成。

疫市下甲廈租金急下滑,市場消息指出,金鐘力寶中心一座中層06室,建築面積1570方呎,以每呎約42元租出,月租約65940元。據地產代理指出,上址對上一手租金每呎達53元,惟商戶於2019年底已遷出,業主於翌年一月放租,當時每呎叫租約51元,惟新冠肺炎隨即爆發,令甲廈租務交投急轉直下,於市場承租力疲弱下,單位一直交吉至今,單位事隔兩年再租出,租金下跌約兩成。

租金屬貼市價水平

代理亦指出,上址外望低層園景,最新租金已屬貼市價水平。

資料顯示,該甲廈近期頻錄減租個案,其中,該甲廈二座中層10室,建築面積約1876方呎,於交吉約三年後,於本月初以每呎約36元租出,月租約67636元,較舊租金急跌逾4成,低市價約15%。

據業內人士指出,由於力寶中心業權分散,業主議價空間較闊,加上第五波疫情大爆發,整體市況正處水深火熱,並指該廈近期低層單位以每呎僅約30元放租,令市場感到嘩然。

據本報統計資料顯示,力寶中心於去年第四季平均呎租約54.1元,較兩年前急挫34%,屬十大甲廈中於疫市期間跌幅「最傷」甲廈。

(星島日報)

更多力寶中心寫字樓出租樓盤資訊請參閱:力寶中心寫字樓出租

更多金鐘區甲級寫字樓出租樓盤資訊請參閱:金鐘區甲級寫字樓出租

羅素街鋪位租售價料大反彈 投資者汪敦敬:鋪市「跌過龍」

近期差估署數字截至去年10月,未計第五波疫情,羅素街鋪租按年普遍跌逾20%,該地段鋪主之一、投資者汪敦敬認為,羅素街以至核心區鋪市「跌過龍」,一旦疫市過去,回復正常運作,租售價勢必大反彈。

汪敦敬表示,近年羅素街充斥低價短租,轉長租時,租金倍升,短約不能作為衡量標準,數據未能充分鋪位真正價值。

「疫情前 經濟作強烈復甦」

他續說,早在第五波疫情爆發前,香港經濟作了強烈復甦,GDP增幅6.4%,加上通脹及利息低企,利好因素一直並沒有消失。現時,走在羅素街與波斯富街交界的「最旺點」,人流如鰂,汪氏指出:「現時沒有內地客,亦缺乏遊客,本地消費力則因疫情大減,惟街道人流眾多,未來很難差過現在!」他指出,市場湧現一股消費動力,他的租客不乏咖啡店及餅店,走高檔路綫,成功吸引年輕人追捧,「都是嶄新強勁的租客,代表市場新常態。」

「口罩店餅店等成為新動力」

放眼所見,銅鑼灣有不少漂亮的口罩店 (羅素街共6家),汪敦敬強調,作為業主,他留意市場新動力,口罩店、咖啡店及餅店,就是新動力所在。「市場上有很多年輕人,新潮人參予,這就是活力!」雖然經濟環境面對調節,但不要低估市場上的機會與活力。

頂得住「強大的壓力測試」

市場經歷高山低谷,羅素街鋪租高位瀉逾80%,去年5月,他購入面向時代廣場地鋪,造價僅高峰期「四折」而己!問及此鋪位,他靦腆回說:「當時,我向毗鄰朋友 (鋪王業主) 說聲,不好意思,明天有新聞見報。」

他購入的波斯富大廈地下M號鋪,面向時代廣場,實用123方呎,作價6680萬,平均每呎54萬;毗鄰為全港「呎價鋪王」(N號鋪), 2014年1月由資本策略相關人士以1.8億購入,實用122方呎,平均呎價147萬。他的M號鋪擁有「來去水位」,在網購年代,可做食肆等「濕貨」自然炙手可熱;「鋪王」則沒有來去水位,只能做「乾貨」等零售業。

「我是幸運的,我覺得,這個鋪位有錢買不到。」他分析道,淡市下業主仍有條件止賺,原因早年購入,持貨幾代人。「不能由這一次成交,斷定羅素街鋪價下跌,我覺得自己幸運

(執平貨),希望再有機會,可是羅素街至今未有新成交。」此地段卻不乏重建項目,包括橫跨波斯富街及利園山道地標商廈,勿地臣街亦有大規模舊樓收購,帶動區內變天。

他續說, 2019年後,市場從未「正常運作」,在「強大的壓力測試」下,大家仍「頂得住」,將來一定美好。被問及何時重返高峰期﹖他回說:「公道地說,現在與最高峰期相比,市場因素改變了,包括融資問題及方式,能否回復最高峰期,要拭目以待,但肯定地說,現在過分下跌

(跌過龍),靚鋪價格早在一年前見底。」

(星島日報)

多項基建落成 東九商業前景看俏

代理行:洪水橋可吸機構設分公司

基建配套可以帶動商業活動,有代理行指,未來香港將有多項大型基建落成,中短期上,今年港鐵沙中綫落成,加上6號幹綫分階段通車,將令東九龍商業區更為便利。長綫上,政府大力發展北部都會區,預計日後洪水橋商業區,以及屯門一帶物流業發展迅速。

該代理行最近完成一份關於本港大型基建與商業發展報告,提及本港未來多項基建推出時間,以及附近一帶商業區如何形成。該行代理指出,過往數年本港多項大型基建落成包括高鐵、中環灣仔繞道、以及新增港鐵站等,帶動不少地區發展。他指,基建往往是新發展區重要一環,「起樓可能3年完成,但鐵路、公路需時達10年或至以上,政府規劃新發展區,顧及出行便利性,交通不便難吸引家庭搬入及企業進駐,若有基建藍圖,財團才買地作長遠投資興趣,要有基建才有信心。」

東鐵綫過海段 年中通車

中短綫基建方面,該代理指出東九龍將會是焦點之一。港鐵屯馬綫去年通車,惟由啟德前往港島區仍需時較長,東鐵綫過海段今年中通車,會展站等落成,屆時灣仔、金鐘、紅磡及啟德接通,「政府積極打造東九龍為CBD2,而在核心區中環

(CBD1) 前往啟德,目前仍是要較長時間,如通車後,CBD1可直達CBD2,將會非常方便。」

另外,6號幹綫亦是重要基建,連接西九龍和將軍澳的幹綫公路,從油麻地交滙處起,途經道路有中九龍幹綫、東南九龍T2主幹路、藍田隧道及將軍澳等,今年至2026年分階段通車,「將軍澳前往藍田段今年通車,當全面開通後,東西九龍行車距離大大縮短,對東九龍及啟德一帶商業氣氛肯定提升。」事實上,今年啟德將有大型商業項目落成,涉及南豐旗下

AIRSIDE,提供近200萬平方呎甲廈及商場樓面。

積極打造北都 涉大基建

至於長綫發展,政府積極打造北部都會區,當中涉及多項大型基建,多條鐵路綫如北環綫、洪水橋往深圳前海的港深西部鐵路等。該代理指,北部都會區在基建配合下,將帶動商業及物流業,「規劃上有兩大重點,中間部分為新田科技城,將滙集科研產業,作科技重鎮。西南邊有洪水橋發展區,有鐵路連接深圳前海,幾分鐘車程由洪水橋往前海,商業氣氛肯定不俗。」該代理指,「因洪水橋位處北部都會區中最接近前海,可能10分鐘車程,洪水橋會成為一個新CBD,吸引機構開設分公司。」

另外,該代理指屯門及洪水橋,亦會因基建配合下,成重點物業中心,「傳統葵涌、荃灣物流業集中地,自從屯赤隧道去年開通,已有個別物流中心集團於屯門增設據點。龍鼓灘一帶料將發展成現代物流園,而日後機場三跑完成,空運量大幅提升,屯門與機場交通轉便利,故看好屯門物業流前景。」

(經濟日報)

更多AIRSIDE寫字樓出租樓盤資訊請參閱:AIRSIDE 寫字樓出租

更多啟德區甲級寫字樓出租樓盤資訊請參閱:啟德區甲級寫字樓出租

Pace picks up in property market

Hong Kong's property market seems

to be on track for recovery with primary market sales in the pipeline

and secondary transactions rebounding.

Sun Hung Kai Properties's (0016) Regency Bay II in Tuen Mun released the last price list yesterday, offering 28 units at an average price of HK$20,474 per square foot.

The

eighth list comprises units from 255 sq ft to 501 sq ft and is priced

from HK$5.1 million to HK$11.8 million after discounts.

A new round of sales with 10 flats will take place on Saturday, the developer said.

Meanwhile,

a new project at Kam Sheung Road in Yuen Long, which offers 715 flats,

is expected to kick off sales soon. The project, named Grand Mayfair I,

is co-developed by Sino Land (0083), K Wah International (0173), and

China Overseas Land and Investment (0688).

The

developers believe the government will speed up the presale consent

approval process after the resumption of work and the permit will be

granted very soon.

They

said the showrooms are under preparation and will make reference to the

transaction prices of adjacent projects when setting the prices,

emphasizing that they will not be too conservative or aggressive in

pricing.

In other news,

rental accommodation provider Weave Living said it acquired Rosedale

Hotel Hong Kong in West Kowloon for HK$1.38 billion with a global real

estate asset manager.

The

435-room hotel, which covers a gross floor area of 111,000 sq ft, will

undergo a complete renovation, including the reconfiguration of some of

the rooms, to transform the property into a modern rental space, Weave

Living said.

The

renovated project is expected to open in mid-2023 and the firm will own

and operate over 1,500 rooms with a total asset value of nearly US$1

billion (HK$7.8 billion) by then, it added.

(The Standard)

Hong Kong buyers give nano flats a wide berth as buyers armed with larger mortgage amounts eye bigger homes

Only

92 small flats, or those under 280 sq ft in size, were transacted on

the secondary market in March, 24 per cent lower than February

Average price fell 0.7 per cent month on month to HK$4.03 million in March

The popularity of tiny homes took a beating last month after the Hong Kong government relaxed mortgage rules, bringing larger homes within reach of first-time buyers.

Only

92 small flats, under 280 square feet, were transacted on the secondary

market between March 1 and 28.24 per cent lower than February,

according to a property agency. The average price eased 0.7 per cent to

HK$4.03 million, bringing the decline from its May 2021 peak to 4.8 per

cent.

The

decline in sales and prices of tiny flats mirrors the overall downturn

the local property market is experiencing because of the ongoing

coronavirus outbreak and the government’s recent higher mortgage amounts

for homebuyers, another property agent said.

“The

reason people were interested [earlier] in nano flats was that they did

not have sufficient funds but still wanted to buy their own homes, but

now the [the new mortgage rules] allow buyers to buy larger flats with

larger loans,” the agent said.

Financial Secretary Paul Chan Mo-po, in his annual budget presented in

late February, raised the mortgage amount on homes with a loan-to-value

ratio of 80 per cent to HK$12 million from HK$10 million, making larger

abodes more affordable to first-time buyers.

Last

week, a 193 sq ft studio flat at One Prestige in North Point sold for

HK$4.18 million, 14 per cent lower than the HK$4.86 million the owner

paid in May 2017, according to agents.

In

response to criticism of shrinking homes, the government announced in

late February that all private homes to be built in Hong Kong will have

to be at least 280 sq ft, unless in rare cases where developers face

site constraints or dated leases that may not be subject to the new

rule.

Some

developers have blamed the government for tight land supply and high

prices, arguing that they have no choice but to build smaller, more

affordable flats.

Before

the announcement on the minimum size, the property agency had predicted

that over 2,000 flats measuring less than 215 sq ft will be built this

year, more than double the 960 in 2021.

The government’s restriction supports the view that nano flats are “uninhabitable”, according to a surveyor.

“Homebuyers’ impression of nano flats has become more negative, which affects market sentiment,” the surveyor said.

Nano

flats are popular among first-time homebuyers and investors with tight

budgets, but they may now consider bigger alternatives given the

changing landscape, the surveyor added.

Another

property agent suggested that the new mortgage policies would mainly

affect high-income individuals. Demand for nano flats would continue to

remain strong among low-income, first-time buyers, the agent said.

“The

relaxed mortgage policy would shift the property ambitions of

high-income families away from nano flats to larger homes,” the agent

added.

“There

will be no new nano flat [projects], but the current market still has

around 20,000 units,” the agent said, adding that with the fall in

supply and existing demand, their prospects were not entirely gloomy.

The

agent expects that prices to remain stable, especially as nano flats’

rental yields are higher than larger flats, while noting that the

pandemic has had a greater impact on the overall market.

(South China Morning Post)

Hong

Kong shared living firm Weave, unnamed property manager acquire

Rosedale Hotel in US$175 million deal, to turn Kowloon property into

co-living space

Rosedale acquisition shows operators are finding value in co-living segment, property agent said

The property is Weave’s biggest and is expected to open in mid-2023

Shared

living spaces operator Weave Living has with an unnamed global real

estate asset manager acquired the 435-room Rosedale Hotel in Kowloon for

HK$1.37 billion (US$175 million), it said on Tuesday.

The

acquisition is part of a US$200 million joint venture, of which Weave

will own 10 per cent, said Sachin Doshi, the Hong Kong-based company’s

founder and group CEO. It will also be the asset, development and

operations manager of the venture and its assets.

“Weave

Living has been looking at potential acquisition opportunities in core

locations in Hong Kong, as we see there has been a strong demand for

quality and stylish rental accommodation,” he said. “The newly acquired

property is conveniently connected to other urban areas with efficient

transport … We have already been operating Weave Studios-Olympic in the

district and we believe the latest acquisition can bring about further

operational efficiency and synergy.”

In

co-living, tenants have their own bedrooms but share other spaces such

as kitchens and living rooms, which typically suits students or young

professionals living away from their families for the first time in

their lives. This concept gives them privacy as well as the opportunity

to find a community and build relationships.

The

Rosedale acquisition shows operators are finding value in the co-living

segment, a property agent said. “The co-living sector has been

performing well over the past two years. Despite the slow down during

the first outbreak [of Covid-19], the sector has shown high-growth

potential, due to its relatively high return in terms of per square

footage,” the agent said.

“It

is expected the sector will continue to perform well and some hotels

could be converted into co-living [spaces]. Some of the operating brands

are also likely to expand in Hong Kong, as there could be economies of

scale for operations,” the agent added.

The

Rosedale will be Weave’s biggest property. It has a total gross floor

area of around 111,000 sq ft and its acquisition price values it at

HK$12,400 per square foot. As part of a renovation plan, the property’s

29 floors may be transformed into a new rental accommodation offering

amenities such as work-from-home facilities, wellness areas, living

spaces and entertainment hubs. The property is expected to open in

mid-2023.

“We expect the property to have a similar number of rooms after its extensive refurbishment,” Doshi said.

Besides

co-living, the firm also offers traditional residential options under

the Weave Studios, Weave Suites and Weave Residences brands. The company

had a consistent occupancy rate of more than 90 per cent, Doshi said.

Last

month, the company said it had bought a row of conservation shophouses

in Singapore for US$56 million. Over the next 12 months, Weave will

double the number of units it owns and manages to more than 1,500, with a

gross asset value of about US$1 billion, as part of its regional

development plan.

“Weave … is constantly evaluating potential properties in both Hong Kong and other Asia-Pacific gateway cities,” Doshi said.

(South China Morning Post)

工商鋪錄358宗註冊 代理行:按月跌16.2%

受疫情打擊,工商鋪交投錄價量齊挫。據代理行綜合土地註冊處資料顯示,上月工商鋪買賣註冊量錄358宗,按月下跌約16.2%,註冊金額則錄45.18億,按月跌約6.4%;該行預期,隨近期疫情走勢稍放緩,料後市交投有機會逐步回穩。

該代理行綜合土地註冊處資料顯示,今年3月工商鋪註冊量錄358宗,按月下跌約16.2%,並屬2020年8月以來首度跌破400宗,創過去19個月新低水平;至於註冊買賣金額亦同步下滑,錄45.18億,按月跌約6.4%。

19個月首度跌破400宗

若以各類工商物業範籌劃分,工廈及商鋪註冊量分別按月下降約19%及16.5%,最新分別錄234及71宗,商廈註冊量則按月持平,最新報53宗。

商廈註冊量最新報53宗

該行代理表示,早前第五波疫情對本港工商鋪市場的影響繼續反映在近月註冊數字上,惟近期確診數字明顯回落,市場憧憬政府將會本月下旬有機會放寬社交距離措施,為工商舖市場注入信心,預料後市交投會有所回穩。

(星島日報)

保時捷200萬預租灣仔巨鋪 樓高三層涉兩萬呎 平均呎租100元

疫下市場不乏「動力」,巨鋪有捧場客,合和旗下、位於灣仔皇后大道東興建中商廈,其基座三層高巨鋪涉及2萬呎,剛由保時捷預租,月租約200萬,平均呎租約100元,消息指,保時捷將在此地標商廈設立陳列室。

上址為皇后大道東153至167號興建中的商廈,消息人士透露,該廈地下至3樓,為三層複式巨鋪,合共2萬方呎,剛由保時捷預租,月租約200萬,平均呎租100元,屬於長租約,梗約加續租長達10年,期間租金有加幅。

梗約加續租長達10年

知情人士指出,保時捷現時據點位處區內告士打道,該街道車行陳列室成行成市,新據點則位處核心地段皇后大道東,毗鄰興建中的合和二期,區內將呈現新景象,由於疫市下遊客消失,奢侈品牌「退出」市場,車行才得以進駐此灣仔黃金地段。

該知情人士續說,近年在市場上炙手可熱的Tesla,陳列室亦設於皇后大道東

(202號地下1至2號鋪),不過,由於多年前承租,當時租金昂貴,樓底高、而且車行合用的鋪位少,Tesla承租的鋪位,面積相對「迷你」,作為體驗中心,大約1415方呎,Tesla於2018年1月以每月22.284萬續租,當時平均呎租約157元,較高峰期舊月租40萬,跌幅約44%。

保時捷發言人:不予置評

本報就上述消息,向保時捷查詢,該公司發言人表示不予置評;本報亦向合和查詢,惟直至截稿時,未獲回覆。

據了解,保時捷目前設於告士打道151號資本中心的陳列室,面積約16606方呎,去年亦剛續約,月租128萬。而新據點目前仍是樓花,興建當中,是次屬於預租。

有代理分析,告士打道集中商廈,大部分地鋪「高頭大馬」,門面闊,樓底高,最適合車行陳列室使用,形成傳統與特色的「車行街」,該街道人流未算十分暢旺,租金相對黃金地段低。旺市時,皇后大道東於旺市時,競爭大,鋪租昂貴,車行未必能選址於此,現時隨着旺區整體租金回落,令車行有升呢「進駐」機會。

該代理續說,該地段聚集大機構,老闆及公司要員集中在此上班,可方便他們買車試車。

(星島日報)

更多資本中心寫字樓出租樓盤資訊請參閱:資本中心寫字樓出租

更多灣仔區甲級寫字樓出租樓盤資訊請參閱:灣仔區甲級寫字樓出租

油塘將建逾萬伙成供應庫 財團插旗涉八項目 恒基擁最大土儲

本港近年土地供應短缺,享有海景的油塘工業區,近年吸引不少財團於區內密密插旗發展,據統計區內至少有8個項目陸續登場,涉及逾1萬伙新供應,可見油塘區變天在即,未來有望由工業區搖身一變轉型成住宅發展重鎮。

據本報統計,未來區內至少有8個項目陸續登場,涉及約1.03萬伙。最新為上月由宏安申請強拍的油塘四山街18至20號工業大廈第4座,據土地審裁處文件顯示,安宏持有約80.21%業權,而市場對整個項目估值約6.1807億。該項目地盤面積約4.17萬方呎,涉及可建總樓面約25萬方呎,預計統一業權後,將會進行「工轉住」補地價,以重建為住宅項目,料重建後部分單位將可享油塘灣及港島東海景。

油塘灣可建6236單位

油塘區未來最大型供應,為恒基等牽頭發展的油塘灣「巨無霸」住宅項目,該項目籌備超過20年,並細分6期發展,早前已通過城規會兼獲批建築圖則,可建總樓面約408.8萬方呎,擬建30幢商住樓宇,預計提供約6236個私人住宅單位,規劃相等於半個太古城;消息指,該項目去年曾獲地政總署批出補地價,惟金額過高發展商未有接納,並已提出上訴,據指一旦達成補價協議,可隨即上馬。

而長實旗下東源街5及8號項目,地盤面積約8.61萬方呎,涉及可建總樓面約41.83萬方呎,料建4座樓高9至32層的住宅大廈,可提供約903伙,該項目於2020年獲批准重建。

另外,越秀地產發展的東源街10號越秀冷藏倉庫,面積約13.2萬方呎,興建5幢23至29層高的住宅,涉及可建總樓面約66萬方呎,共提供1393伙,並於2021年通過城規會。而青建國際2018年斥資5.3億購入的東源街18號,佔地約4.98萬方呎,計畫分兩期興建兩幢24及21層高分層住宅,提供約224個單位,可建總樓面約23.34萬方呎。

包玉剛家族四山街建商住

另外,已故「船王」包玉剛家族旗下康世集團持有的油塘四山街8號世運貨倉,計畫重建商住發展,地盤面積約3.86萬方呎,將重建一幢樓高30層的商住大樓,住宅樓面約19.31萬方呎預計提供約483個單位。

同亦保利置業及尚嘉合作發展的高超道地皮,地盤面積約3.96萬方呎,涉及可建總樓面約35.65萬方呎,提供約634伙。

另外,由信和及資本策略發展的港鐵油塘通風樓項目,可建樓面約32.53萬方呎,料可提供約500伙。據了解,現存區內兩幅營運長達30年的預拌混凝土廠房用地,有意在5年內撤出,騰出現址約6萬方呎用地,並會向政府申請補地價後自行發展,稍後再視乎區內需求,決定興建住宅或商業項目。

混凝土廠五年內撤出

有測量師表示,受惠於工廈重建「標準金額」補地價先導計畫,有利加快工廈重建的修契程序。油塘區靠近港鐵站,加快重建轉型步伐,由工業區轉型成為新一個住宅區,並適合發展中小型住宅單位。

(星島日報)

恒地南角道項目擴地盤 納新地景輝閣合併重建

樓齡不足30年的舊樓亦獲重建,恒地 (00012) 九龍城南角道項目擴大地盤,加入新地 (00016) 旗下29年樓齡的景輝閣一併重建,擴大地盤至1.3萬平方呎。

位於九龍城的南角道4至24號地盤,比鄰宋皇臺港鐵站出口,當中南角道4至22號的一排舊樓由恒地近年成功收購,佔地約1萬平方呎。發展商近日透過合作方式,將地盤擴大至南角道24號,增重建規模。

當中新增的南角道24號景輝閣,屬於新地發展物業。據EPRC經濟地產庫資料顯示,項目由1993年入伙至今,一直未有拆售,相信仍由新地所持有。跟南角道一帶的舊樓樓齡普遍逾50年不同,景輝閣樓齡只有29年,屬於相對較新的物業。

不過,由於景輝閣現址只是5層高的商住大樓,由多間地舖及13個住宅單位組成,相信仍然有一定剩餘地積比,故此即使樓齡不算太舊,仍有一定重建潛力。

地盤擴至1.3萬呎 可建逾200伙

事實上,今次恒地跟新地聯手,將景輝閣併入南角道地盤後,可望將地盤面積擴3成至1.3萬平方呎;以地積比率9倍發展,可建樓面料達11.8萬平方呎,估計可興建200至300伙細單位。

據本報記者現場所見,南角道2至24號的整排物業,包括景輝閣均已經拆卸重建變成一個長條形地盤。

有業內人士估計,在上世紀90年代景輝閣興建的時候,舊啟德機場未搬出,飛機航道問題影響到九龍灣一帶住宅物業的高度,令物業發展未能用盡地積比。

除了南角道地盤外,恒地近年在九龍城一帶亦積極收購重建,包括福佬村道67至83號地盤,近年發展的曉薈亦是舊樓重建而成。其他同區新盤則有嘉華 (00173) 位於嘉林邊道的洋房項目嘉琳、碧桂園 (02007) 位於賈炳達道的瓏碧等。

(經濟日報)

禹洲堅道服務住宅 獲6.2億洽購

項目涉85伙 呎價約2萬元

不少內房在港放售物業套現,消息指,禹洲集團 (01628) 旗下堅道48號UPPER CENTRAL全幢服務式住宅,獲6.2億元洽購。該項目涉85伙,實用面積167呎起,兩年前曾招租。

市場消息指,位於堅道48號的UPPER CENTRAL,正獲財團洽購,出價約6.2億元。物業樓高27層,1至2樓為餐廳,7至30樓為住宅單位,按該物業總樓面約3.1萬平方呎計,呎價約2萬元。

據了解,該項目由內房禹洲集團持有,翻查資料,地盤原由豐泰集團持有,早年進行併購並原打算重建酒店,2014年豐泰以3.74億元,把地盤售予禹洲,集團自行發展項目,興建成樓高27層,合共85伙住宅,提供82個開放式單位及3個2房單位,命名為「UPPER

CENTRAL」。

兩年前曾招租 月租1.4萬起

兩年前項目落成並進行招租,單位實用面積167至388平方呎,租金由約1.4萬元起,呎租高達80餘元。該盤單位戶戶配備基本家電及智能家居配置,部分高層單位可飽覽中環及維港景致,並提供會所Upper Club,有健身室、私人電影院,天台設有泳池等,質素甚佳。

市場人士透露,去年業主有意放售物業,最初叫價約8億元,直至近期再降低至6億餘元。

禹洲地產成立於1994年,主要業務是發展住宅及商業物業,項目主要分布於福建、北京和上海,2009年在港上市。除了住宅外,集團在港亦持有甲廈樓面,包括2019年以近9億元,購入中環中心58樓全層甲廈樓面,呎價約3.6萬元

近月不少內房在港沽物業套現,如中國奧園 (03883) 以9億元沽出西半山羅便臣道舊樓,帳面損手近1.8億元離場。

(經濟日報)

更多中環中心寫字樓出售樓盤資訊請參閱:中環中心寫字樓出售

更多中環區甲級寫字樓出售樓盤資訊請參閱:中環區甲級寫字樓出售

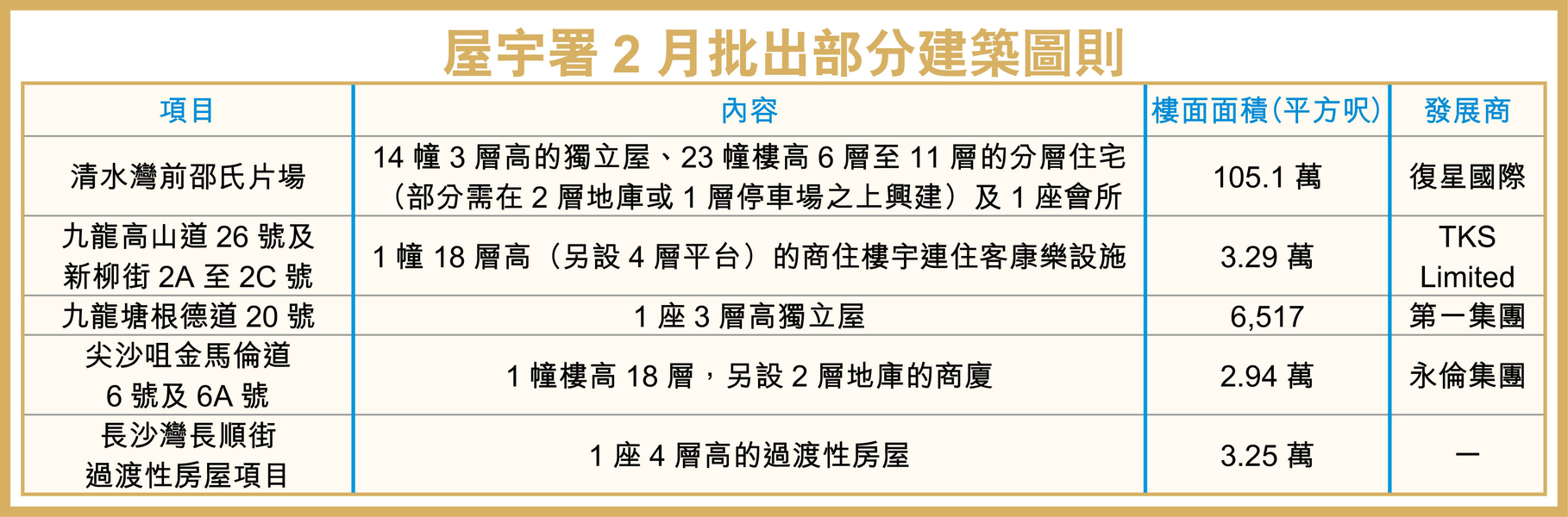

文輝道地王批拆樓 重建4幢豪宅

屋宇署上月批出的拆樓紙涉及多個豪宅項目,包括九龍倉 (00004) 以120億元,投得的山頂文輝道地王展開重建4幢分層豪宅。

此外,而華潤置地 (01109) 高價購入的南區壽山村道屋地經過3年半時間,亦終於啟動重建。

早前獲批拆樓紙 (拆卸同意書) 的文輝道2至8號,前身屬於政府的高級公務員宿舍,在2020年12月招標出售,最終由九倉以120億元投得,每呎樓面地價約4.6萬元,創下當時住宅官地的呎價紀錄。

隨着發展商在去年11月獲屋宇署批出建築圖則,獲准興建4幢樓高11層至12層的分層住宅,總樓面25.93萬平方呎,地盤亦隨即展開拆樓重建,由投得地皮至動工重建,大約花了1年多時間。

壽山村道39號屋地 建10幢洋房

至於同期獲批拆樓紙的壽山村道39號屋地,則是華潤置地在2018年以59億元向周壽臣家族購入,每呎樓面地價達8萬元,相隔近3年半時間,期間發展商曾在2019年及2020年兩度獲批出建築圖則,將會興建10幢3層高洋房,總樓面近6.9萬平方呎。

(經濟日報)

WEAVE LIVING近14億 購九龍珀麗酒店

共居品牌WEAVE LIVING宣布,與環球房地產資產公司落實收購大角咀九龍珀麗酒店,成為集團旗下迄今規模最大的物業。

項目位於九龍大角咀道86號,總樓面面積約為11.1萬平方呎,成交價13.75億元,每平方呎價約12,400元。項目現時提供435間客房,WEAVE LIVING將進行全面翻新,包括為部分房間重新布局,將物業打造成時尚、配套完備、靈活租期的現代住宿空間。

(經濟日報)

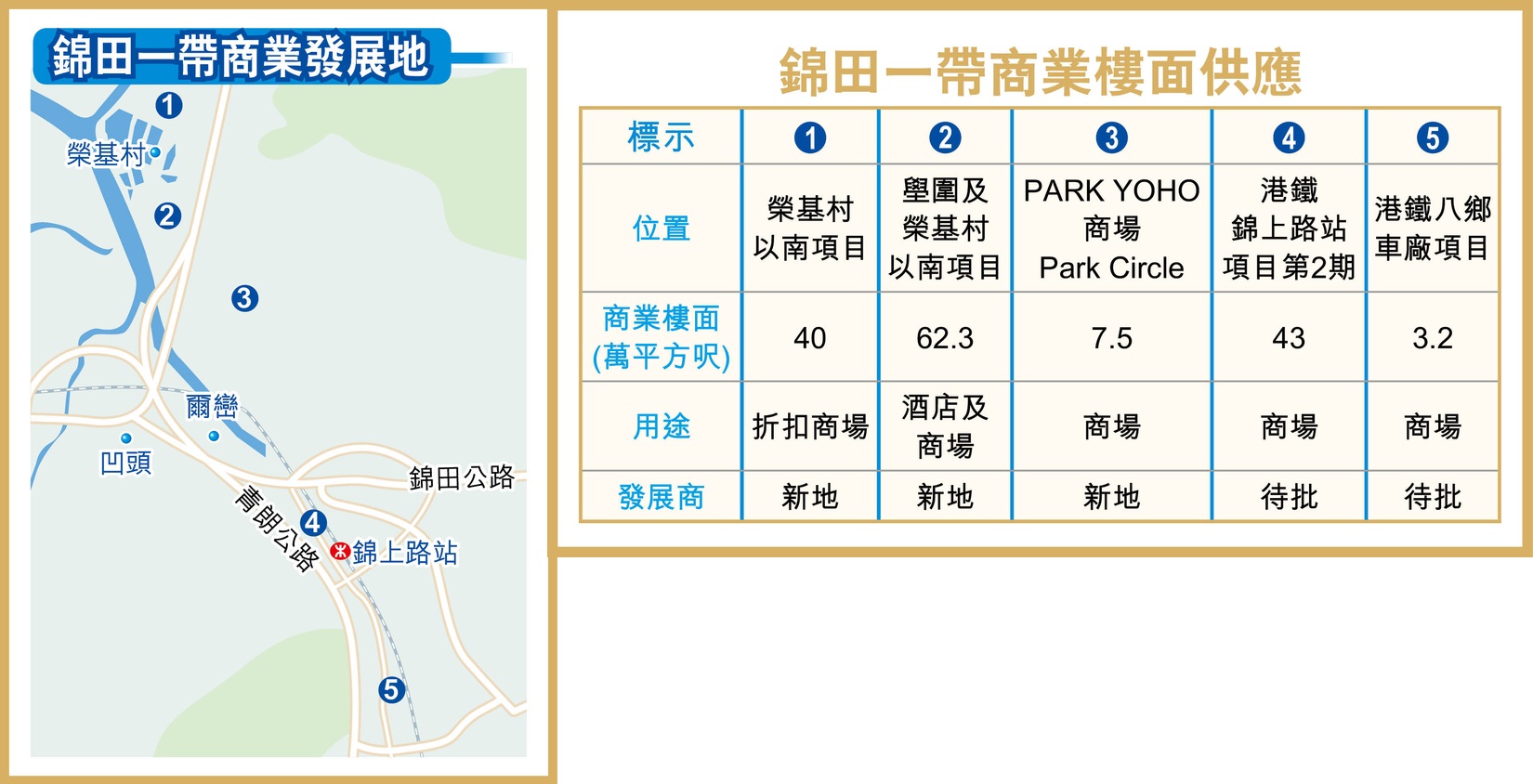

錦田增逾150萬樓面 添零售商業配套

近年錦田發展加快,區內多個大型屋苑陸續落成,未來區內亦有多個商業項目將會發展,合共提供逾150萬平方呎商業樓面,將會新增不少零售配套等。

錦田一帶近幾年有不少大型住宅項目陸續落成,包括新地 (00016) 旗下爾巒 (涉800伙)、同系PARK YOHO系列,路勁 (01098) 旗下山水盈,以及即將推出的港鐵錦上路站1期柏瓏。至於未來亦將再有被視為爾巒2期的下高埔村項目、以及長春新村項目,隨着區內人口將會大幅增加,區內對零售配套的需求將會大增。

近沙埔村項目 備700間酒店房

據資料顯示,現時錦田一帶至少有5個商業項目,合共涉及156萬平方呎樓面,當中規模最大屬於新地在榮基村以南、貼近沙埔村的項目,佔地41.5萬平方呎,將興建1座大型商場及酒店,總樓面逾62萬平方呎,當中商場部分零售樓面近41.23萬平方呎,另提供700間客房。

錦上路站2期 設大型商場

鄰近另外一幅用地佔地更達100萬平方呎,過往曾經獲批以地積比率0.4倍發展,興建一幢12層高的折扣商場,總樓面約40萬平方呎。有關用地因應抗疫需要,新地早前借出給政府興建「方艙醫院」。

而港鐵錦上路站方面,由於上蓋將會興建大型私人屋苑,按照規劃將會在第2期內設有一個面積達43萬平方呎的大型商場,相信日後將會提供不少零售、餐飲或者其他生活配套的商舖。不過,目前錦上路站第2期未推出招標,相信商場的落成仍然需要一段時間。至於,鄰近的港鐵八鄉車廠,亦將會興建約6,000伙的大型屋苑,但只會設有一個面積約3.2萬平方呎的小型商場,相信只能提供基金民生需求。

在短期的商業配套方面,最新要數新地PARK YOHO設有的屋苑商場Park Circle,據資料顯示,該商場面積約7.5萬平方呎,設有15間商舖,包括超級市場、便利店等,早在2016年已經開幕。

除了上述幾個商場及商業項目外,值得留意的是,錦上路站東南面的錦上路第1、4A及6號地盤,將會興建27幢的公營房屋,涉及約9,000伙,除了提供幼稚園及政府社區設施外,相信亦會提供不少的零售商舖,為區內社區提供服務。

(經濟日報)

Hong Kong’s housing deals hit a 26-month low in March, are expected to bounce back in April as fifth Covid-19 wave recedes

Buyers

feared a further fall in home prices amid worsening Covid-19 situation,

delayed their purchases in first quarter, property agent said

City’s

total number of transactions including those of homes, shops,

industrial units and car parking spaces also hit a 26-month low in March

Housing

transactions in Hong Kong hit a 26-month low in March because of higher

borrowing costs and a devastating fifth wave of the coronavirus

pandemic.

In

fact, the city’s total number of transactions including those involving

homes, shops, industrial units and car parking spaces also hit a

26-month low in March. This number dropped to 3,828 deals valued at

HK$34.8 billion (US$4.4 billion) last month, representing a

month-on-month decline of 3.4 per cent, according to property agency’s

data.

“Buyers

delayed their purchases out of fear of a further fall in home prices

amid the city’s worsening Covid-19 situation. As a result, we saw the

market become dormant in the first quarter,” a property agent said.

The

city has been battling an exponential surge in Covid-19 infections

since late February. With about 8,200 deaths as of April 4, the city’s

mortality rate is among the highest globally. Meanwhile, its strict

Covid-19 containment measures have become too much to bare for foreign

nationals and firms, and have led to an exodus of expats, which has

worsened a slide in home prices across the city.

An

index of Hong Kong’s lived-in home prices dropped to a 13-month low

after falling 2.1 per cent to 382.1 points in February, shows data

published by the Rating and Valuation Department on March 29.

Last week, Goldman Sachs lowered its forecast,

from flat prices this year, followed by 5 per cent declines in 2023 and

2024 and a return to flat prices again in 2025, with a 5 per cent

decline each year between 2022 and 2025. “This cumulative 20 per cent

price fall from year-end 2021 levels would be enough to compensate for

the 230 to 240 basis points higher borrowing costs, as it restores

affordability along with an expected pickup in household income of 10 to

15 per cent by then,” the bank said in a report published last Monday.

The Hong Kong Monetary Authority, the city’s de facto central bank, raised the city’s base lending rate by 25 basis points

to 0.75 per cent last month, following an interest hike made by the US

Federal Reserve, to maintain Hong Kong’s currency peg with the US

dollar.

The

Fed raised its key rate by 25 basis points, from a target range of zero

to 0.25 per cent to a range of 0.25 per cent to 0.5 per cent, at a

meeting on March 15 and multiple interest hikes are anticipated this

year.

Market

observers said recently that the fifth wave had shown some signs of

improving, and more buyers could be expected to enter the market to snap

up cheap homes.

“Following more relaxations in social distancing rules, homebuyers

will be more willing to go on a house hunting tour, and we expect a

recovery in market transactions in April,” another agent said.

The brokerage expects that about 5,100 properties will be sold this month, about 30 per cent more than in March.

(South China Morning Post)

康宏廣場享地利 尖東指標商廈

尖東商廈林立,當中康宏廣場外形新,單位更享開揚景觀,多年來均為尖東商廈指標。

康宏廣場位處尖東科學館道,位置上,較接近紅磡方向,由紅磡港鐵站出口,通過天橋再連接新東海商業中心,步行至該廈僅需數分鐘。由港鐵尖東或紅磡站前往該廈約10分鐘,值得一提,東鐵綫過海段今年中通車,屆時紅磡前往灣仔及金鐘非常便利,有利尖東一帶商廈。

另外,物業近紅隧,故過海巴士選擇多,大廈地下為巴士總站,交通相當便利。

飲食配套方面,尖東餐廳種類多,既有平價茶餐廳,亦有多間5星級酒店,上班人士亦可選擇到漆咸道南、THE ONE商場一帶用膳。其他配套上,由大廈門口可步行至尖東噴水池及海傍一帶,適合公餘時散步。

尖東為傳統商業區,商廈林立,惟不少外形上頗舊,而康宏廣場質素明顯較新,以紅及藍色玻璃幕牆。物業升降機大堂設於1樓,大廈入口有扶手電梯前往,另駕車人士或的士可直接前往1樓,門口有寬闊的上落客區。

分層約2.9萬呎 每層設17單位

物業樓高28層,分為南座及北座而同時打通,電梯大堂亦分南北座,樓底高具氣派,為尖東最高質素電梯大堂,每層各設有4部升降機可供使用,有效疏導人流。

分層樓面約2.9萬平方呎,原則每層設有17個單位,面積由約800平方呎起,適合中小型公司使用,部分單位間隔角位較多,柱位靠邊方面進行間隔。

南座及北座單位互通,用戶可穿過每層中間通道進出兩座。1至8號屬南座,另9至17號單位屬於北座。景觀上,南座單位可望向維港海景,至於北座單位望向漆咸道南樓景,亦可遠眺京士柏山一帶,非常開揚舒適。當中每層的15至17室,以及5至8室,最接近樓層電梯大堂。

買賣方面,該廈今年未錄成交,對上成交為2020年9月,物業中高層09至11室,面積約2,842平方呎,以約4,490萬元成交,呎價約1.58萬元,而同年11月,物業1017室,面積約2,290平方呎,以約2,854萬元易手,呎價約12,463元。

(經濟日報)

更多康宏廣場寫字樓出租樓盤資訊請參閱:康宏廣場寫字樓出租

更多康宏廣場寫字樓出售樓盤資訊請參閱:康宏廣場寫字樓出售

更多新東海商業中心寫字樓出租樓盤資訊請參閱:新東海商業中心寫字樓出租

更多新東海商業中心寫字樓出售樓盤資訊請參閱:新東海商業中心寫字樓出售

更多尖沙咀區甲級寫字樓出租樓盤資訊請參閱:尖沙咀區甲級寫字樓出租

更多尖沙咀區甲級寫字樓出售樓盤資訊請參閱:尖沙咀區甲級寫字樓出售

甲廈租賃連續5個月 錄正吸納量

有代理行報告指,2月份甲廈租賃市場連續5個月錄得正吸納量,而空置率跌至9.1%。

該代理行最新發表的香港地產市場報告指出,在香港爆發第5波新冠疫情的情況下,2月甲級寫字樓租賃市場連續第5個月錄得正吸納量。

受到嚴格的社交距離措施影響,2月寫字樓租賃市場較淡靜。然而,由於租戶租賃需求持續恢復,整體甲級寫字樓市場仍錄得276,500平方呎的淨吸納量。

整體商廈空置率 2月跌至9.1%

其中一宗矚目的成交為萬通保險租用旺角新世紀廣場二座和尖沙咀港威大廈六座,合共17,400平方呎樓面作為經紀的新辦公室。

截至2月底,整體商廈市場的空置率跌至9.1%。中環空置率回落至7.4%,九龍東空置率為12.4%,仍然為各主要分區市場中最高。2月整體市場租金保持平穩,中環錄得輕微租金升幅。

該行代理表示,與2020年首次爆發疫情比較,新一波的疫情對寫字樓租賃市場的影響較小,主要原因是企業的決策者早已面對此情況,大部分的長遠租賃計劃依然繼續。

(經濟日報)

更多新世紀廣場寫字樓出租樓盤資訊請參閱:新世紀廣場寫字樓出租

更多旺角區甲級寫字樓出租樓盤資訊請參閱:旺角區甲級寫字樓出租

更多港威大廈寫字樓出租樓盤資訊請參閱:港威大廈寫字樓出租

更多尖沙咀區甲級寫字樓出租樓盤資訊請參閱:尖沙咀區甲級寫字樓出租

財團強拍中環舊樓底價5.29億

市區地皮供應量有限,令區內舊樓成財團併購目標,其中,位於中環士丹頓街47至57號舊樓,獲財團申請強拍,昨日亦批出強拍令,底價為5.29億,較2020年申請時的市場估值,高出約30%。

較2020年估值高30%

據土地審裁處文件顯示,獲財團申請強拍的中環士丹頓街47至57號舊樓,目前獲批出強拍令,底價為5.29億,對於該財團於2020年9月申請時,市場估值約4.0684億,高出30%。

可建樓面逾4.3萬呎

項目地盤面積約4334方呎,若以住宅形式發售,地積比率可達10倍,可建樓達43340方呎。而該財團目前已購入約85.714%至91.67%業權,現址為3幢約7層高的商住物業,分別於1968及1971年落成,樓齡約51及54年。

至於申請強拍的Holly Property Company Limited,公司董事為鄒小岳及文玉嬋。而項目鄰近元創方 (PMQ),以及中環至半山的自動扶手電梯,出入亦算方便。

項目鄰近半山行人電梯

今年樓市受疫情影響,但未有阻礙財團併購舊樓的步伐,尤其是港島區物業,包括上月會德豐地產夥培新集團以底價17.32億,統一跑馬地雲地利道15號舊樓業權,發展商表示,地盤將發展為優質豪宅項目,約3年後推出市場。

地盤面積約17595方呎,現時規劃為「住宅 (乙類) 6」用途,若以地積比率約5倍重建發展計,預計可建總樓面約87975方呎,以上述強拍價計算,每呎樓面地價約19687元。項目位於跑馬地黃泥涌道及雲地利道的豪宅地段,落成後料不少單位可享馬場景色。

(星島日報)

受疫情影響,本港經濟備受壓力,拖累核心區指標甲廈租金同步下滑。消息指,中環國際金融中心二期低層相連單位以每呎約165元租出,屬該甲廈兩年來新低水平。

每月租金66萬

據市場消息指出,中環國際金融中心二期低層10至12室,建築面積4021方呎,以每呎約165元租出,月租約663465元。據代理行資料顯示,該廈近期交投較疏落,對上一宗租務需追溯至去年10月,當時該廈二期17室,建築面積1221方呎,以每呎約165元租出,月租約201645元。

同時,據該行資料顯示,自疫情於2020年初爆發以來,國際金融中心二期僅錄7宗租務成交,成交呎租介乎165元至210元,故最新租金屬該甲廈疫市兩年以來新低。

信德中心每呎58元租出

另一方面,上環信德中心招商局大廈亦錄承租個案,該甲廈中層18室,建築面積約1528方呎,以每呎約58元租出,月租約88624元。

據外資行統計資料顯示,現今甲廈空置樓面約910萬方呎,創歷來新高水平,今年及明年亦是市場供應高峰期,加上受疫情影響,故料今年整體甲廈租金將持續調整。

(星島日報)

更多國際金融中心寫字樓出租樓盤資訊請參閱:國際金融中心寫字樓出租

更多中環區甲級寫字樓出租樓盤資訊請參閱:中環區甲級寫字樓出租

更多信德中心寫字樓出租樓盤資訊請參閱:信德中心寫字樓出租

更多上環區甲級寫字樓出租樓盤資訊請參閱:上環區甲級寫字樓出租

Chinachem Wins Third HK Site in 15 Months With $350M Tung Chung Bargain Bid

Hong

Kong-listed developer Chinachem won its third government land sale in

15 months late last week when it took advantage of a tepid development

market to pick up a commercial site near Hong Kong’s international

airport at a bargain price, according to an announcement by the city’s

Lands Department.

Chinachem

bested four other developers to win the rights to develop up to 1.3

million square feet (121,000 square metres) of space on the site in

Lantau Island’s Tung Chung area for HK$2.78 billion ($350 million). That

acquisition came at a rate below most analyst projections despite the

government having revised the tender conditions to allow for data centre

development as well as office and retail, following a failed attempt to

auction the land in 2020.

“Given

the developer will have high flexibility to use the land for data

centre and office or retail, our firm expected the price could be

between HK$4 billion and $4.4 billion,” a surveyor said.

The

surveyor said that other analysts had estimated premiums for the site

from HK$5 billion down to HK$2.8 billion, putting the final sale price

below expectations as Hong Kong’s developers showed limited appetite for

a commercial project near an airport that has been transformed from a

bustling transport hub to a little-used shell by the city’s strict

quarantine policies and flight bans.

Tung Chung Reclaimed

Chinachem’s

top leadership sees its bet on Tung Chung Town Lot 45, a 132,773 square

foot plot near the planned Tung Chung East MTR station, as a way to

leverage the government’s development plans for the newly reclaimed Tung

Chung New Town Extension, which is expected to be completed by the end

of next year.

“Tung

Chung East will be developed into a new town by the government in line

with its Tung Chung New Town expansion plans,” Chinachem CEO Donald Choi

said in a release. “The site is also adjacent to the Hong

Kong-Zhuhai-Macao Bridge and Tuen Mun Chek Lap Kok Tunnel, enjoying the

advantage of excellent connectivity with Guangdong province and Macau.

Given these factors, we are confident about this project and plan to

develop shopping malls, offices and a data centre.”

Chinachem

is paying the equivalent of HK$2,202 per square foot of accommodation

for its Lantau Island site, with a brief on the tender from property

consultancy Savills citing a pre-tender valuation range of HK$2,200 to

HK$4,000 per square foot for the plot, which is eligible for development

on a strata title basis and is expected to be connected to the upcoming

MTR station via a footbridge.

Other

bids for the 50-year land grant parcel 15 minutes’ drive from the Hong

Kong airport came from local developers CK Asset Holdings, K Wah

Properties, K&K Property and Sino Land, the Lands Department said.

Upcoming land tenders will make available residential, hotel and

additional commercial projects in the Tung Chung East area.

Second Time Lucky

The

Tung Chung site was initially put up for sale by the government in

2020, but the tender was withdrawn in October of that year after all

three bids submitted failed to meet the government’s reserve price. The

contestants in that round were CK Asset, Sun Hung Kai Properties and a

joint venture of Sino Land and Kerry Properties.

Since

that earlier attempt, the Lands Department revised the terms of the

tender to increase the site’s appeal by adding permission to develop the

site entirely for data centre use as the city’s market for server

facilities continues to boom.

However,

the surveyor sees the site as a difficult fit for data centre purposes.

“It reflects that the data centre operators/developers are not willing

to invest in land with a long constructing period,” the surveyor said.

“The subject land is located in a newly reclaimed area where

infrastructure is not yet readily available.”

Other

changes to the tender included removing the cap on office use, whereas

the previous tender had allowed for no more than 91 percent office

accommodation, and the added flexibility also permits boosting the cap

on retail development to 30 percent from 9 percent in the earlier

tender.

Pipeline Bulge

Chinachem

has been the most active player in Hong Kong’s government land sales

market since 2021, winning three development sites for a combined

HK$12.06 billion, according to data compiled by another property agency.

In

addition to the latest triumph, Chinachem and joint venture partner

Hysan Development bested five other bidders last May to secure a

Causeway Bay commercial site for HK$19.8 billion ($2.6 billion), with

Chinachem’s 40 percent stake accounting for HK$7.91 billion of the

amount.

The

partners plan to develop a premium commercial building with community

facilities on the 159,327 square foot site near Hysan’s Lee Garden Six commercial tower on Leighton Road, with a maximum allowable gross floor area of 1,076,390 square feet.

In

December, Chinachem entered the winning bid of HK$1.37 billion for a

New Territories residential site on which it plans to build a mixed

development of low-density houses and apartments. The 150,716 square

foot site in Tai Po Kau can yield a gross floor area of 226,000 square

feet.

(Mingtiandi)

For more information of Office for Lease in Lee Garden Six please visit: Office for Lease in Lee Garden Six

For more information of Grade A Office for Lease in Causeway Bay please visit: Grade A Office for Lease in Causeway Bay

康宏廣場中層戶意向價5997萬

有代理行表示,尖沙咀康宏廣場中層14至15室,面積約4284方呎,以呎價約1.4萬元放售,意向價約5997萬元,可以公司股權轉讓形式交易。

該行指出,物業享有開揚景致,另設精緻寫字樓裝修、經理房、會議室及茶水間等隔間,為買家節省一筆裝修費及時間。買家可靈活按需要作自用或收租,彈性十足;而目前業主亦以每方呎約33元招租。

(信報)

更多康宏廣場寫字樓出售樓盤資訊請參閱:康宏廣場寫字樓出售

更多尖沙咀區甲級寫字樓出售樓盤資訊請參閱:尖沙咀區甲級寫字樓出售

老鳳祥半價續租百德新街鋪

受第五波疫情打擊,核心區鋪位租金持續下滑。消息指,由「百年老店」老鳳祥銀樓承租的銅鑼灣百德新街地鋪以約30萬續租,呎租約300元,較舊租金66萬急挫約54%,租金亦重回當年「沙士」水平。

據市場消息指出,由銅鑼灣百德新街22至36號翡翠明珠廣場地下32號鋪,建築面積約1000方呎,新獲老鳳祥銀樓以約30萬元續租,平均呎租約300元。

據地產代理指出,老鳳祥銀樓早於2017年10月起租用上址,上一手租金為66萬,故租金急挫約54.5%,此外,該鋪於2010年由另一連鎖金行租用,當時正值鋪市高峰期,租金高達90萬,故是次租金較高峰期大幅回落約66%。

舊租每月66萬元

據大型代理行資料顯示,該鋪早於2002年至2004年期間,由連鎖時裝店以約29萬租用,故該鋪最新租金已重回當年「沙士」水平。

有代理指,受第五波疫情重擊,零售市道疲弱不堪,加上遊客近絕迹,令鐘表珠寶等奢侈品成疫市「重災區」,營商環境持續收縮,同時,該類商戶於數年前以高價搶租核心區一綫街道鋪位,造成現時租金大幅回落,整體幅度逾五成,可說是「打回原形」!

(星島日報)

星光行高層單位意向租金3.3萬

有代理行表示,尖沙咀星光行高層單位,面積約920方呎,業主意向租金約3.3萬元,呎租約35元。

該行指出,單位間隔方正及無柱設計,非常實用,配備簇新裝修。物業向南,擁無敵維港海景。

在疫情下,不少用戶都非常關注大廈冷氣系統,上述單位採用獨立冷氣,用戶可以安心使用。大廈配備9部載客電梯及2部載貨電梯,方便用戶出入。

(信報)

更多星光行寫字樓出租樓盤資訊請參閱:星光行寫字樓出租

更多尖沙咀區甲級寫字樓出租樓盤資訊請參閱:尖沙咀區甲級寫字樓出租

HK property prices rise 3.6pc, fail to match 11pc global spurt

Hong Kong's property prices rose

only 3.6 percent year-on-year last year, far slower than the 11 percent

rise of the global property price index tracking 150 cities around the

world by a property agency.

The

Asian financial hub ranked only the 123rd in the index and was lower

than Guangzhou with an 8.7 percent price hike and Shenzhen with 4.8

percent, which placed at 80th and 113th, respectively.

Other

cities in Asia, like the 59th Tokyo, saw its average home price go up

by 10.7 percent, and that of Singapore also grew by 10.6 percent ranking

the 61st.

Istanbul in

Turkey saw the highest increase in the home price of 63 percent while

Kuala Lumpur in Malaysia recorded a year-on-year drop of 5.7 percent

last year, and became the worst performer among the 150 cities.

The

real estate consultancy said home prices were rising at their fastest

rate in almost 18 years in 2021 and of the 140 cities seeing prices

increase last year, 44 percent of them registered over 10 percent annual

price growth.

Cities

in the Americas posted the strongest jump averaging 15 percent annual

growth compared to 11 percent in the Europe, the Middle East, and Africa

region and 9 percent across Asia-Pacific, the agency added.

Though the overall property market remained dull amid the latest Covid outbreak, luxury apartments did not seem to be affected.

Sino

Land (0083) sold a house at 133 Portofino in Sai Kung for HK$100

million, a record high for the project via tender yesterday. The 3,491

sq ft house with five bedrooms cost HK28,645 per sq ft.

The

developer has raked in over HK$980 million after selling 26 units in

the project, and only seven more - two houses and five flats - are left.

In

the office market news, another property agency expects that rents of

Grade A offices this year to drop up to 5 percent this year due to the

ample supply.

The

property consultancy said a reasonable level of vacant space of Grade A

offices is around 4 million sq ft but the completion of new supply

ensured vacant space reached another record high of 9.6 million sq ft in

the first quarter, and there are 7 million more to be added in this

year and next.

It

believes it will take years for the office market to recover given the

current economic situation and the rents will be under pressure for a

long time.

(The Standard)

Nuveen Acquires Hong Kong Data Centre, Osaka Apartments for APAC Core Fund

Nuveen

announced the addition of four assets to its Asia Pacific core

investment strategy today with the acquisition of a data centre in Hong

Kong’s New Territories and a set of three multi-family properties in

Japan’s second largest city.

The

completed acquisitions across two of the industry’s hottest sectors

were made on behalf of Nuveen’s $2 billion Asia Pacific Cities Fund,

with the US investment firm highlighting its Hong Kong acquisition as

its first in the city, and as an opportunity to leverage growing demand

for data infrastructure while diversifying its portfolio.

“Hong

Kong is a critical financial and technology hub and one of the most

mature data centre markets in Asia with rich network connectivity,

robust infrastructure and healthy market fundamentals, making this an

important strategic investment for the Asia Pacific Cities Fund,” said

Louise Kavanagh, chief investment officer and head of Asia Pacific for

Nuveen’s real estate division. “We will continue to diversify its

portfolio geographically and into sectors which match its investment

objectives.”

A report

published by a property agency earlier this year ranked Hong Kong as the

sixth most attractive location globally for operating data centres,

thanks to a robust development pipeline, excellent networks and the

availability of all major cloud services, with Nuveen fitting into a

growing number of regional and global institutions pursuing digital

infrastructure opportunities in the city.

Kwai Chung Asset in Demand

Nuveen’s

Hong Kong digital prize is the Cargo Consolidation Complex, according

to market sources who spoke with Mingtiandi, with the fund manager

having paid a reported HK$2.88 billion ($371.7 million) to purchase the

property near the Kwai Tsing container terminal from local investor Loh

Shou-nin.

The 270,000

square foot data centre is currently fully-leased to local telecom

leader PCCW, with all but the ground and first floors under contract

through 2035, should the tenant decide to exercise options included in

the lease..

The sale

illustrates the rising demand for data centre assets in the city, with

Lou having acquired the property from PAG in 2018 for HK$2 billion,

providing the investor with a more than 30 percent gain in less than

four years. PAG had purchased the asset from Goodman for HK$1.35 billion

in February 2016, according to data from another property agency, after

the Australian developer had already converted the property for data

centre use.

That kind of

return has not escaped the attention of some of Nuveen’s competitors,

with ESR last November having acquired the Brilliant Cold Storage Tower 2

in Kwai Chung – less than one kilometre from the Cargo Consolidation

Complex – for $230.8 million. The Hong Kong-listed fund manager says it

will convert the cold storage facility into a 40MW data centre.

In

September last year Blackstone paid $36 million to purchase Yip’s

Chemical Building at 13 Yip Cheong Street in Hong Kong’s Fanling area,

with that asset located within a few blocks of data centre projects by

Singapore’s Mapletree and Sun Hung Kai Properties SUNeVision.

Osaka on the Rise

With

Nuveen’s Asia Pacific Cities Fund focusing on core assets for what it

terms “future-proof cities” the firm’s other acquisition announced today

also nodded to a fast-rising alternative sector by adding 342

multi-family units to the vehicle’s portfolio.

Pointing

to an overall occupancy rate of from 96 to 98 percent across Osaka’s

multi-family market, Nuveen described the purchase as “an attractive

investment opportunity in Japan as a resilient and defensive asset

class.”

“The Japan

market is seeing an upward trend in rental residential properties which

our fund is able to take advantage of,” Kavanagh said. “Osaka’s economy,

while less diversified than Tokyo’s, is manufacturing-based, a sector

which has benefitted from increased global demand as well as the move to

bring supply chains onshore following the Tohoku earthquake.”

While

not providing specifics on the properties or the scale of the

investment, the fund manager expressed confidence that, given the

assets’ location advantages, including proximity to the city centre and

access to rail stations, the properties would be able to attract and

retain professional tenants and provide stable income streams.

In

2020 Nuveen had invested $140 million purchasing 10 multi-family assets

in Tokyo and Osaka, with those acquisitions from fund manager PAG also

on behalf of its Asia Pacific Cities fund.

House Party

In

visiting the Osaka properties in preparation for the acquisition,

Kavanagh and her team may have run into a few familiar faces from

competing investment managers, as global institutions increasingly put

multi-family acquisitions near the top of their target lists.

With

Japan being the top location in Asia Pacific for the sector, in late

March Goldman Sachs Asset Management said that it had established a

joint venture which would be investing $300 million to acquire rental

apartment properties in the country this year, and would be budgeting

$500 million annually for such opportunities thereafter.

Providing

a clearer picture of investor activity in the sector is the late March

announcement by UK’s M&G Real Estate that it had acquired 1,575

apartments across Tokyo, Osaka and Nagoya for JPY 109.3 billion ($942.6

million), with Mingtiandi having identified the seller as Blackstone.

Also

during March, Canada’s Manulife Investment Management said that it had

agreed to form a JPY 19.8 billion joint venture with Japan’s Kenedix to

acquire multi-family assets in Greater Tokyo, Osaka and Nagoya.

In

addition to the acquisitions announced today, Nuveen in December closed

on its $472 million purchase of a half-stake in One George Street – a

23-storey office building in Singapore – on behalf of its Asia Pacific

Cities fund.

(Mingtiandi)

Hong Kong in bottom quadrant once again as home prices rose to about two-decade high globally in 2021, property agency said

Property prices across 150 cities tracked by an agency’s index rose on average by 11 per cent last year

Hong Kong ranked 123rd, same spot it held in 2020, with a growth rate of 3.6 per cent

Home prices grew by the most in about 18 years globally

last year, as significant savings built up during two years of the

Covid-19 pandemic triggered a desire to either upgrade homes or acquire a

second property, a property agency said in a report on Wednesday.

Property

prices across 150 cities tracked by its global residential index rose

on average by 11 per cent last year, with 140 of these urban centres

recording increments, up from 122 in 2020. Home prices in Hong Kong

languished in the bottom quadrant of the index, ranking 123rd with a

growth rate of 3.6 per cent. The city held the same spot in 2020, when

its home prices declined by 0.1 per cent.

With

monetary authorities across the world winding down loose policies to

temper rising consumer prices as job markets recovered, the trend of

surging home prices was unlikely to be sustained, property agent said.

“The

current high growth rates for housing prices are not expected to be

sustained in the long term due to rising interest rates and increasing

base prices. Some cities also face an inflation problem and thus the

real housing price growth is not as high as it appears based on nominal

values. That said, housing price growth will stay in positive territory

for the foreseeable future,” the agent said.

The agency’s report comes after the US Federal Reserve

increased interest rates for the first time since 2018 on March 16. A

day later, the United Kingdom’s central bank also hiked interest rates

for a third time since December last year. Central banks in the Middle

East and Hong Kong also raised interest rates last month.

In Hong Kong, US-based investment bank Goldman Sachs forecast that home prices were likely to fall by a fifth

over a four-year period, as borrowing costs rose and demand slumped

because of rising unemployment. Goldman cut its forecast from flat

prices this year, followed by 5 per cent declines in 2023 and 2024 and a

return to flat prices again in 2025, with a 5 per cent decline in each

year between 2022 and 2025.

Elsewhere,

Istanbul, Turkey’s economic, historical and cultural hub, topped the

index with a growth of 63.2 per cent in a year. Overall, however, cities

in the Americas saw the highest average annual growth of 15 per cent,

outstripping the 11 per cent rise seen in Europe, Middle East and

Africa, and the 9 per cent recorded in Asia-Pacific.

“US

households not only accrued significant savings during successive

lockdowns, but the equity in their homes expanded significantly too. In

some cases, this wealth has been used to upgrade existing homes or to

purchase a second property,” the report said.

“A

typical home in Phoenix, the US city with the fastest rising prices in

2021, was worth US$298,000 the end of 2020, according to Zillow. By the

end of 2021, its value had jumped 32.5 per cent to US$394,850, adding

almost US$97,000 in one year to a homeowners’ pool of equity. This surge

isn’t atypical of cities in advanced economies,” it added.

In

the US, household wealth jumped to a record US$150.3 trillion in the

last quarter of 2021, according to a report released by the Fed last

month.

(South China Morning Post)

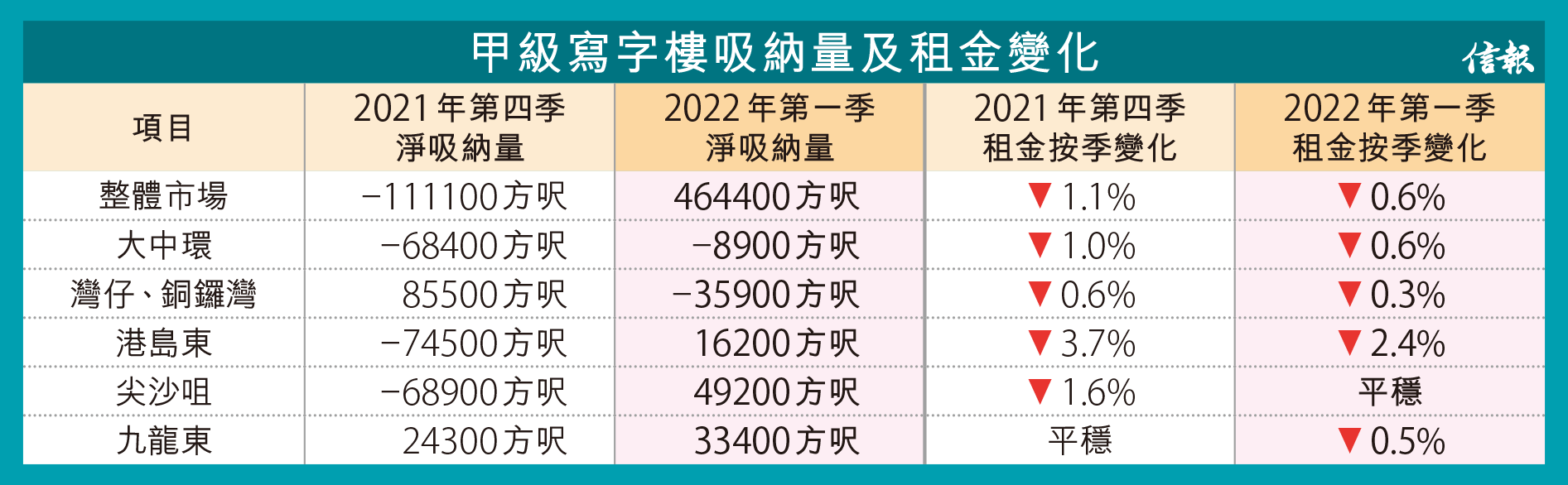

甲廈吸納量首季負轉正 扭轉9季逆勢 外資代理行料租賃增

甲級寫字樓市場過去3年先後受到社會運動和新冠肺炎疫情連環打擊,吸納量和租金表現都受到影響,惟市場前景初露曙光。有外資代理行指出,甲級寫字樓的淨吸納量於今年首季出現正數 (即整體新租出樓面多於遷出騰空的樓面),錄得46.44萬方呎,打破2019年第四季至去年第四季連續9個季度錄得負數的困局,該行預計今年下半年租賃活動勢進一步增加。

該代理行最新發表的香港商業房地產市場報告顯示,本港整體甲級寫字樓的淨吸納量由去年第四季錄得負11.11萬方呎 (即整體遷出騰空的樓面多於新租出樓面),轉為今年首季錄得正數,達46.44萬方呎。

大中環區改善 尖咀省鏡

該行解釋,雖然今年首季受到疫情衝擊,寫字樓租賃勢頭減弱,但受去年帶到今年的租務磋商完成所推動下,今年首季甲級寫字樓總租賃量錄得91.5萬方呎,按季增加9%,其中今年1月的租賃量佔該季度總數約五成。

而5大分區比較,「大中環」區今年首季雖然仍錄得負吸納量,但情況已經大為改善,由去年第四季的6.84萬方呎,大減約87%,至今年首季僅錄得負8900方呎。

港島東、尖沙咀和九龍東均錄得正數,介乎1.62萬至4.92萬方呎,其中尖沙咀表現最搶眼,去年第四季錄得負6.89萬方呎,今年首季則錄得4.92萬方呎的正吸納量。

總空置樓面960萬呎破頂

由於新商廈供應投入市場,今年首季總空置甲級寫字樓樓面約有960萬方呎,創該行有記錄以來的新高,以全港指標甲級寫字樓中環國際金融中心二期 (IFC 2) 全幢總樓面面積約200萬方呎計,空置樓面接近5幢國際金融中心二期。

該行代理說,雖然甲級寫字樓的淨吸納量於今年首季變成正數,但新落成的項目租賃活動於首季較緩慢,整體甲級寫字樓的空置率按季不變,今年首3個月維持11.6%,大中環區空置率最新錄得7.7%,是5區之中最低,按季微升0.1個百分點。

該行另一代理補充,今年首季以共享辦公室、財富管理公司和保險公司表現較活躍,隨着今年陸續有新甲級寫字樓登場,以及市況好轉,相信下半年甲級寫字樓租賃活動將增加。

整體租金全年將挫5%

租金表現也相對平穩,該代理透露,今年首季整體甲級寫字樓租金按季降0.6%,是過去3年最小跌幅的一個季度,較去年第四季跌1.1%改善0.5個百分點,大中環區的按季租金跌幅,由去年第四季的1%,改善至最新跌約0.6%。

不過,代理坦言,在現時的經濟基調下,要吸納接近1000萬方呎的甲級寫字樓樓面有難度,估計寫字樓的復甦步伐需時有機會以年計。

另外,該行估計,今年全年甲級寫字樓租金料仍有約5%下跌空間。

事實上,無論官方和業界數據,都顯示寫字樓吸納情況有所好轉,例如差餉物業估價署 (差估署) 3月底公布的《香港物業報告2022》初步統計數字顯示,去年全年甲級寫字樓的負吸納量為19.38萬方呎,已經較2020年的負203.44萬方呎大減約90.5%。

另一代理行近日提到,租戶對超甲級寫字樓的需求強勁,以中環情況尤其明顯,而很多內地企業,以及金融和法律行業的大型公司都正在考慮擴充其於優質寫字樓物業的面積,相信核心區優質寫字樓的需求仍然堅挺,估計政府放寬社交距離措施後,核心區寫字樓的吸納量和租金會迅速反彈。

(信報)

更多國際金融中心寫字樓出租樓盤資訊請參閱:國際金融中心寫字樓出租

更多中環區甲級寫字樓出租樓盤資訊請參閱:中環區甲級寫字樓出租

CASETiFY擴充 租觀塘綠景NEO大廈5萬呎

個別品牌進行擴充,手機配件CASETiFY租用觀塘綠景NEO大廈5萬呎樓面,呎租約30元。該品牌原租用同區工廈,是次大幅擴充。

市場消息指,觀塘綠景NEO大廈錄得大手租務,涉及中層兩層樓面,合共近5萬平方呎,成交呎租約30元。

涉中層兩層 呎租約30元

據了解,新租客為手機配件連鎖店CASETiFY,該品牌原租用同區工廈天星中心,涉及約1萬平方呎,如今大幅擴充至約5萬平方呎,屬近期罕有擴充個案。

該品牌近年在港積極擴充,主力於商場開設分店,包括中環置地廣場、尖沙咀K11 Musea、沙田新城市廣場等;另於荃灣、觀塘等亦設門市。近日更趁舖租低,租銅鑼灣地帶商場地下舖位,面積約2,000平方呎,月租約30萬元。

觀塘綠景NEO大廈為區內質素較新甲廈,租金水平較高,本年初物業低層約31,500平方呎,以每呎約30元租出,新租客為香港都會大學,作後勤部門之用

另消息指,銅鑼灣時代廣場第二座高層08至11室,面積約4,062平方呎,以每平方呎60元租出。

(經濟日報)

更多綠景NEO大廈寫字樓出租樓盤資訊請參閱:綠景NEO大廈寫字樓出租

更多觀塘區甲級寫字樓出租樓盤資訊請參閱:觀塘區甲級寫字樓出租

更多置地廣場寫字樓出租樓盤資訊請參閱:置地廣場寫字樓出租

更多中環區甲級寫字樓出租樓盤資訊請參閱:中環區甲級寫字樓出租

更多時代廣場寫字樓出租樓盤資訊請參閱:時代廣場寫字樓出租

更多銅鑼灣區甲級寫字樓出租樓盤資訊請參閱:銅鑼灣區甲級寫字樓出租

美基金28.8億購葵涌數據中心 大數據時代掀「經濟革命」 外資爭地盤

隨網絡發展步入大數據時代,令數據中心需求急增,政府早前推出的數據中心用地更一度獲港資財團爭奪,以及市場不少工廈紛改劃用途或被財團購入等,都顯示數據中心未來的重要性,本報獲悉,剛有美資基金亦加入搶地盤行列,該基金剛斥資二十八億八千萬購入葵涌集運中心全幢,該物業現作數據中心用途,為今年以來市場最大手買賣,每呎造價一萬零八百元,亦創區內新高水平。業界指出,受到過去兩年疫情持續影響,令居家工作及網上購物趨普及,令到數據中心的需求大增,進入大數據「經濟革命」年代,勢必掀起財團搶購數據中心。

本報地產組

網絡發展一日千里,帶動數據中心備受追捧,工廈物業於疫市下罕現大手買賣。據市場消息指出,葵涌貨櫃碼頭路四十三號集運中心全幢,新獲美資基金Nuveen旗下The Asia Pacific Cities Fund (APCF) 以約二十八億八千萬元承接,以項目總樓面約二十六萬六千二百方呎計,每呎造價達一萬零八百元,現時由一家電訊公司作數碼中心用途,亦為該基金於本港首項投資。據悉,上址原業主為資深投資者羅守寧家族持有,早於二○一八年八月以約二十億購入,持貨約三年半帳面獲利八億八千萬,物業期間升值約百分之四十四。

每呎造價約一萬創區內新高

業界人士指,受到過去兩年疫情持續肆虐影響,令到居家工作及網上購物趨普及化,數據中心的需求大增,而進入大數據「經濟革命」年代,數據中心有強勁的需求,預期將掀起港資及外資財團搶購數據中心的熱潮。

有代理指出,隨網絡發展一日千里,數據中心備受追捧,早於數年前已成為環球大趨勢,不少跨國基金於歐美及亞太區均「吼準」該類物業,並準備充裕資金作大手收購,加上自疫情爆發以來,網上購物及居家工作日趨普及化,更令數據中心需求進一步升溫,同時,現今市場可作數據中心用途的全幢工廈已買少見少,令該類物業於疫市下有價有市,備受各路買家追捧。

業界:疫市改變家居網購需求

另一代理稱,現今市場上的可作數據中心的用地相當緊絀,若以舊式工廈改裝,涉及的成本相當高昂、技術亦為複雜,令全幢數據中心為「兵家必爭之地」,租金回報亦較一般工廈為高,故對投資者甚具吸引力,環顧現今為網絡大時代,將刺激數據儲存需求持續飆升,故料相關大手買賣將持續浮現。

供應緊絀 全幢工廈有價有市

事實上,政府近年大力推動創新科技發展,銳意將本港打造成為國際創科中心,而且疫情推動網絡連接需求上升,加速對數據中心的需求,不少工廈業主更率先改劃旗下項目作數據中心發展;其中,葵涌工業區就掀起重建數據中心熱潮,據本報統計,區內至少有八個項目改劃作同類發展,涉及逾二百萬方呎樓面。

(星島日報)

數據中心需求勁 財團變招購工廈轉用途

在疫情下推動網絡連接需求上升,加速對數據中心的需求,本港數據中心市場正以前所未見的速度擴張,惟近年政府批出可作數據中心用地有限,不少財團轉向工廈埋手、購入後隨即改劃數據中心發展,可見近期數據中心用地及全幢工廈備受市場追捧。

近年本港數據中心市場正以前所未見的速度擴張,據本報統計,政府由二零一八年起至今批出約五幅可作數據中心發展的賣地表地皮,涉及可建總樓面約三百八十三萬方呎。最新為上月底由華懋斥資約二十七億七千八百萬奪得、曾於二零二零年流標的東涌第五十七區商業地,鄰近私樓昇薈、毗鄰公屋迎東邨,地盤面積約十三萬二千多方呎,可建總樓面約一百二十六萬一千三百多方呎,華懋指,計畫在上述地皮興建商場、辦公室及數據中心。政府於去年底調整上述用地招標條款,約七成樓面可作數據中心或商業用途,更是首次在商業地上容許作數據中心發展,而餘下三成樓面則用作零售等用途。

華懋月前奪東涌數據中心地

另外,佳明亦曾於二零二零年七月透過私人市場、以約三億五千六百萬購入粉嶺安居街、安福街共兩幅地皮,佔地面積共約三萬七千方呎,若以地積比率五倍發展,涉及可建總樓面約十八萬五千方呎,每方呎樓面地價約一千九百多元,上述用地計畫興建數據中心。

由於近年賣地表推出可作數據中心用地供應不多,不少財團轉向工廈埋手,併購後隨即向城規會申請改劃,而葵涌工業區則掀起重建數據中心熱潮,據本報統計,現時區內至少有八個工廈項目改劃作數據中心,涉及可建總樓面約二百一十萬五千方呎樓面,有潛力打造成本港新一個數據中心供應重鎮。

(星島日報)

財團收購大角嘴富貴大廈 每呎出價1.4萬至1.6萬 較市建局收購價為低

近年市區優質地皮供應罕有,不少舊樓難免成為財團收購對象,樓齡約62年的大角嘴富貴大廈東座及西座,早年多次被財團吼中,最終因出價低而拉倒,最新再獲財團出價收購,並於月前接觸業主出價收購,據了解,住宅部分每方呎收購價大約1.4萬至1.6萬不等。

該項目位於大角嘴富貴街12號,由東座及西座組成,合共提供約470伙,另有地鋪,東座涉及195個業權,西座則有涉及318個業權。地盤面積約17222方呎,若以地積比9倍作重建發展,涉及可建總樓面約15.5萬方呎。該舊樓早於1960年起陸續落成,至今有約62年樓齡,符合強拍門檻。

已集齊逾五成半業權

據財團向小業主發出的文件顯示,該併購財團指,撇除近月疫情嚴峻影響,於短短幾個月時間內收集各業主的踴躍簽約回覆

(目前已集齊超過55%),加上配合政府年內調低收購門檻政策至6成至7成,發展商對是次收購項目仍然持樂觀態度,有信心隨着疫情減退,將於2022年底前完成今次收購。

就記者現場所見,該廈位於博文街、大角嘴道及富貴街等交界,屬大單邊位置,地下為商鋪,如設有不少特色食肆、日常用品商店等,鄰近商鋪均以民生商店為主;而樓上則屬住宅樓層,該舊樓同時毗鄰奧海城商場,可見周遭日常配套設施十分齊全。隨着市區更新,近年大角嘴一帶逐漸變天,區內有不少新盤相繼落成,如利奧坊系列樓盤等;同時鄰近港鐵奧運站,出入便利,極具重建價值。

有財團2018年收購失敗

舊樓曾於2018年初獲財團收購,惟當年因未集齊業權而拉倒,最新獲另一財團收購,據了解,目前該財團以每方呎出價約1.4萬至1.6萬不等向小業主提出收購,是次收購價對比市建局於2018年11月以每方呎出價約1.8萬、收購同區橡樹街/埃華街發展項目低出約11%。參考鄰近私樓平均呎價約2萬,如栢景灣上月底1座中層G室,以998萬易手,以單位面積466方呎計,呎價約21416元;而海桃灣最近成交為2座中層D室,面積611方呎,以1288萬易手,呎價約21080元;新盤方面,傲寓最新平均成交呎價約2.3萬,而利奧坊凱岸最新平均成交呎價約2.7萬。

業主指收購價太低

對於是次收購計畫,該廈業主劉小姐表示,近期有出價財團收購大廈,並透露其面積約300方呎的單位,收購價大約430萬,呎價約1.4萬,坦言收購價太低;惟其居住的單位已「成間屋爛晒」,現時初步傾向會接受該財團收購。

地鋪業主關先生指出,鋪位早於40年多前購入後,並一直從事印刷業至今,其地鋪建築面積約500方呎,另有相同面積即約500方呎的閣樓,透露現時收購財團並未有出價收購,但有與該財團接觸、對方會率先收購住宅部分,其後才到地鋪。有商戶表示,該廈並不是首次被收購,早年曾有收購公司嘗試收購,惟最終因未集齊業權而不了了之;認為目前收購舊樓業權困難重重,有業主反對,亦有業主已移民或去世,使想重建的舊樓業主陷入困局。

(星島日報)

恒基區內頻併購 可建樓面逾28萬呎

市區優質地皮供應罕有,近年不少財團透過舊樓併購、作重建增加私人住宅供應;其中恒基近年密密併購大角嘴一帶舊樓發展,其併購範圍包括嘉善街、博文街、萬安街及大角嘴道等一帶多條街道,涉及可建總樓面約28.62萬方呎。

2.7億購萬安街舊樓

近年大角嘴一帶除有不少新盤推出,如利奧坊系列樓盤、傲寓等外,區內亦有發展商積極收購舊樓發展,恒基曾於去年9月曾以底價2.7億成功摘下大角嘴萬安街24至30號舊樓業權,若以可建總樓面約28854方呎,每方呎樓面地價約9357元。

上述項目位於大角嘴萬安街東面,在萬安街與福利街交界,現址為4幢6層高的商住物業,地下為商鋪,樓上則為住宅,而該舊樓早於1958年落成,至今樓齡約64年。地盤面積約3206方呎,現規劃為「住宅 (甲類)」用途,涉及可建總樓面28854方呎。另外,恒基已持有萬安街16至22號舊樓全數業權,料將與上述項目整合發展,地盤面積擴展至6418方呎,可建總樓面約57762方呎;預料將會重建成「利奧坊」系列樓盤之一。

據恒基年報顯示,該公司於大角嘴嘉善街、角祥街、博文街、萬安街及大角嘴道一帶有多個併購項目,總地盤面積約3.18萬方呎,若以地積比9倍重建發展,可建總樓面約28.62萬方呎。

宏安3.3億統一洋松街業權

此外,宏安地產曾於2020年12月以底價3.2683億、成功統一該區洋松街56至62號和菩提街6及8號舊樓業權;據該公司年報顯示,該項目地盤面積約6800方呎,擬議住宅及商業發展,涉及可建總樓面約61500方呎,料於2024年落成。

(星島日報)

Office market bouncing back says Link Asset

Hong Kong's office market has begun

to bounce back while online and traditional retail channels are not

mutually exclusive, said Greg Chubb, the new international chief

operating officer at Link Asset Management.

He

wrote in an article that there is an obvious shift taking place as

occupiers move from secondary quality buildings and locations to better

quality office precincts and newer buildings with superior

infrastructure, services, and other features that contribute positively

to well-being.

The

hybrid work model was common before the pandemic, but the office remains

as an integral part of doing business as nothing can beat face-to-face

and in-person interactions, Chubb said.

He

also pointed out that online and brick-and-mortar retailers are not a

zero-sum game and in fact, their coexistence is probably the best way

for all retailers to maximize their profits.

Omnichannel retailing is a hugely valuable strategy for businesses, and physical store networks play an important role.

For

instance, the "click and collect" model has been especially successful

for supermarkets, as it is a very convenient way for families to quickly

pick up their groceries on their way home, Chubb said.

(The Standard)

金鐘力寶中心每呎38元租出

近日疫情稍緩,甲廈亦連錄承租,不過租金仍維持低水平,力寶中心一個中層單位,建築面積600多呎,以每呎38元租出。

市場消息透露,上址為力寶中心二座中層06室,建築面積約685方呎,以每呎38元租出,月租2.6萬,該單位望高等法院景觀,向着馬路,質素一般,租金屬於市場水平。

日前,該廈一座中層06室,建築面積1570方呎,以每呎約42元租出,月租約65940元,該單位外望低層園景,舊租客2019年底遷出,業主翌年1月放租,每呎叫租約51元,惟新冠肺炎隨即爆發,令甲廈需求大減,單位交吉兩年始租出,租金跌約20%。

有代理表示,力寶中心業權分散,業主議價空間較闊,因此,在疫情下頻錄大幅減價承租。

都薈一周錄三宗買賣

聯誠建築旗下葵涌都薈METRO一周內錄3宗成交,有代理表示,物業為葵豐街2至16號鍾意恆勝中心中層戶,面積約193方呎,以約132萬易手,平均呎價約6839元,買家為同區迷你倉租客,有意購入自用,市值月租約5500元,料回報達5厘。

(星島日報)

更多力寶中心寫字樓出租樓盤資訊請參閱:力寶中心寫字樓出租

更多金鐘區甲級寫字樓出租樓盤資訊請參閱:金鐘區甲級寫字樓出租

投資者連環沽貨止賺離場 陳宗武售兩鋪 蔡志忠拆柴灣車場

早前市場沉寂多時,近期疫情放緩,市場漸有生氣,一眾投資者亦際此出動,連環沽貨止賺離場,蔡志忠亦趁勢拆售旗下柴灣永利中心車位,一日內售罄43個車位;陳宗武沽出大圍及油麻地2個鋪位,持貨約一年,物業升值20%。

疫情從高峰回落,加上本月底放寬防疫措施,資深投資者蔡志忠趁機推售旗下柴灣永利中心一批車位,現時由建盈停車場管理,首批43個車位,僅一日全數沽清,套現逾4000萬。

一日沽清43個車位

蔡志忠回應本報指,該車場擁有200個車位,於2015年以1億買入,即時拆售120個,收回成本,餘貨持有至今7年,一直作為收租,今番所售出貨尾全部利潤。

窩打老道鋪10個月升21%

永利中心「餘貨」車位約80個,近日首推23個「試水溫」,售價由90萬至99萬不等,瞬間售罄,結果加推20個,合共43個車位即日沽清。他表示,項目不乏大手買家,其中有投資者動用近1000萬,一口氣買入10個車位收租。此次車位分布車場3及4樓,月租約3000元,回報3.6至4厘,餘下30幾個貨尾位處2樓,屬於最靚樓層,不排除加價加推。

鋪市氣氛暢旺,投資者陳宗武趁勢沽出兩個鋪位,油麻地窩打老道9至15號榮德大廈11A及A1鋪,建築面積約430方呎,現址小食店,以2180萬沽出,於2021年6月以1800萬入,持貨10個月帳面賺380萬,物業升值21%。接近砵蘭街及港鐵站出口,人流甚為暢旺。

大圍村南道鋪5200萬易手

另一個為大圍村南道77至81號地下B及C鋪連入則閣,地鋪實用面積1000方呎,以5200萬沽出,入則閣實用面積1000方呎,租客港興大飯店,月租22萬,租期至2023年3月,陳忠武於2021年4月以4300萬購入,持貨一年獲利900萬,物業升值20%。

投資者蔡伯能亦拆售鰂魚涌英皇道993號萬利廣場,建築面積158方呎起至336方呎,呎價由8000多元起,入場逾100多萬。業主提供一年期八成按揭,年息5厘,還息不還本,成交期3個月至長達5個月。

(星島日報)

亞皆老街巨鋪意向呎租逾50元

旺角向來是商業及消費核心地段,際此消費券發放之時,業主亦高調放租鋪位,亞皆老街33號商廈基座招租,呎租由50元至192元。

地鋪意向60萬 每呎192元

有代理表示,亞皆老街33號地下、閣樓至3樓,地鋪建築面積3110方呎,整個基座為15920方呎,其中,地鋪建築面積約3110方呎,意向60萬,樓上每層亦是3000多呎,意向月租15萬,呎租約50元。他表示,租客可承租地鋪,或連同樓上一起租,極具彈性。

據了解,該物業早年由中銀自用,業主購入後,年前開始工程,加設升降機,令樓層負重增加,物業不再局限寫字樓用途,可經營零售或飲食,每層備有洗手間及來去水,適合行業廣泛。項目更設有巨型廣告位,由1樓直達3樓,更配合樓上2幅由5樓直達19樓巨型廣告。

該代理續指,物業位處亞皆老街及上海街雙馬路口,鄰近旺角地標朗豪坊,附近的「618上海街」為市建局保育項目,距離港鐵站出口需時約3分鐘步程,附近有小巴及多條巴士綫往來各區,何氏又指,此地段為旺角商業和消費核心地段,聚集酒店、銀行及餐廳等。

(星島日報)

3月工商舖358成交 按月跌16.2%

有代理行綜合土地註冊處資料顯示,工商舖3月份註冊量錄358宗 (主要反映2月份市況),按月下跌約16.2%,註冊金額則錄45.18億元,按月跌約6.4%。

3月份工商舖各板塊註冊宗數及金額個別發展。工廈及商舖註冊量分別按月下降約19%及16.5%,最新分別錄234及71宗。商廈註冊量則按月持平,最新報53宗。

過億元註冊按月升1倍

若按金額劃分,3月份註冊量最多的為500萬元以下的物業,共錄190宗,按月跌約21.5%。逾500萬元至1,000萬元的物業,共錄69宗,按月下跌約13.8%。逾2,000萬至5,000萬元物業則錄得13.8%的按月升幅,3月共錄33宗。逾5,000萬至1億元物業的表現最差,註冊宗數僅錄得4宗登記,按月大挫55.5%。

逾1億元的物業表現不俗,註冊宗數按月急升100%,3月錄得8宗,按月增加4宗,當中4宗為工廈物業註冊,包括紅磡馬頭圍道21號義達工業大廈多個單位連7個車位,及旺角中華漆廠大廈1至9樓全層單位,分別以約3.5億元及2.88億元成交,而商廈物業及舖位物業則分別佔1宗及3宗註冊登記。

該行代理表示,早前第5波疫情對本港工商舖市場的影響繼續反映在近月註冊數字上。昨開始發放首期消費券,惟受疫情影響,本港的社交距離措施仍未能放寬,因此料消費券對零售業的幫助未必能即時反映出來,相信暫時主要以民生類消費較能受惠,現時的重中之重仍然是穩定疫情。

該代理又指,雖然近日本港確診宗數仍然在每日幾千宗水平,但隨着確診數字明顯回落,市場憧憬政府將會在4月21日後放寬社交距離措施,本港經濟有望逐漸回復正軌,為工商舖市場注入信心,而近日市場交投有稍微回暖迹象,預料後市交投會有所回穩。

(經濟日報)

甲廈連續三季錄淨吸納

本港商業活動受第五波疫情影響,原本穩步復甦的寫字樓市場突然降溫。有外次代理行指出,本港甲級寫字樓市場連續3個季度錄得淨吸納量,但整體租金在今年第一季仍下跌約0.9%。

上季租金跌0.9%

該行代理指出,今年2月起因疫情趨嚴峻,租賃活動明顯轉靜,令今年首季整體甲級寫字樓的租金按季回落約0.9%,按年則跌3.1%。其中,中環超甲級寫字樓租金按季挫0.8%,按年下降1.3%;港島東租金跌幅較大,按季下滑2.2%,比去年同期低5.7%。

吸納量方面,今年首季初段有不少租賃成交個案,其後因收緊防疫措施,令不少業主及租戶暫停睇樓,導致成交減少,但第一季仍錄得24.51萬方呎淨吸納量,連續第三個季度錄得淨吸納。

該代理認為,隨着疫情有望受控及社交距離措施逐步放寬,加上租金已較高位累跌27%,相信寫字樓租金大跌空間有限,預計第二季只有約0.5%至1%的下行空間,下半年租賃活動會陸續恢復,租金走勢可望回復平穩。該代理預計今年全年將錄得30萬至50萬方呎的淨吸納量,當中銀行及金融業將成為今年寫字樓需求的主力。不過,下半年非核心區將有3個大型項目相繼落成,總樓面面積約230萬方呎,整體市場的待租率料由現時13.6%,推高至約16%至17%水平。

另外,另一代理稱,在第五波疫情衝擊下,今年首季四大核心零售區商舖租金跌幅由2.7%至4.5%。由於社交距離措施將陸續放寬,加上政府推出新一輪消費券,預計整體租金第二季下降空間不大,並有望於第三季逐漸復甦。

(信報)

Wheelock

Properties said it has recorded over 100,000 online viewings for its

new project named Monaco Marine in Kai Tak in the past two days before

unveiling its first price list.

This came as the number of transactions in the 10 major housing estates fell slightly over the weekend.

The

developer's managing director Ricky Wong Kwong-yiu said the price list

may be released this week and the sales could take place this month.

Three

showrooms, including a 713-square-feet flat with three bedrooms, will

open to the public during the four-day Easter holiday and more than

8,000 prospective buyers have made home viewing appointments, Wong said.

Located

at 10 Muk Tai Street, the project provides 559 flats ranging from 324

sq ft to 1,708 sq ft - the smallest flats have one bedroom while the

biggest ones are equipped with four bedrooms. But around 80 percent of

units are in between - they have two to three bedrooms.

In

the secondary market, the number of deals recorded in a property

agency's top 10 housing estates dropped by five, or 20 percent, to 20

over the weekend, but remained at or above the 20-number level for the

fourth consecutive week.

Property

agent said that the room for price negotiation has narrowed in the

buoyant second-hand market as Covid gradually subsides.

Some

home buyers even need to offer price hikes before they can reach a deal

with the owners, while others are looking for cheaper flats in less

well-known housing estates, the agent said, though he believes the

transaction volume could maintain at this level for several weeks.

Among

the estates, Kingswood Villas in Tin Shui Wai saw the most transactions

- five homes changed hands in the weekend, while Kornhill in Hong Kong

Island was the only estate that recorded no transactions.

A

633-sq-ft flat with three bedrooms sold at HK$6.65 million or HK$10,506

per sq ft after the seller agreed to slightly cut the price by

HK$50,000, according to another property agency.

The

vendor, who purchased the property at HK$4.08 million in 2016, gained

HK$2.57 million, or 63 percent through the deal, the agency said.

(The Standard)

Shop rentals set for recovery, says agent

One

of the largest local property agency expects that the rental volume of

street shops to increase by 50 percent this quarter from last quarter,

spurred by the distribution of the Consumption Voucher and the economic

recovery.

The agency

said street shops will benefit most from the voucher and the improving

Covid situation will help increase the public's desire to go out and

spend money, especially when the restrictions are lifted later this

month.

Property agent

said that both the rental and transaction volumes of shops plunged amid

the fifth wave of the pandemic but the leasing market suffered more.

About

775 rental deals were recorded in the first quarter, down by 42 percent

from a year ago and 23 percent lower than the December quarter.

The value of the leases also slid by 37 percent year-on-year, or 27 percent quarter-on-quarter, according to the agent.

Shop

vacancy rates in core areas continue to hover at high levels due to

sluggish rental demand. The rate in Causeway Bay has remained at 5

percent for months, and that in Central has stayed at about 14 percent,

the agency's data showed.

But there are also opportunities apart from risks.

While

Hong Kong's residents have not been able to travel in more than two

years, some Japanese brands have taken advantage of the purchasing power

of Hongkongers and entered the city's market. Japanese cosmetics brand

Matsumoto Kiyoshi has opened its first shop at APM shopping mall in Kwun

Tong and several more are expected to come soon, the agent said, adding

that this reflects retailers' confidence in the SAR.

(The Standard)

中環中心低層呎租40 外資同廈轉租省一半

中環中心放盤多、租金低,令企業有選擇地搬遷。一家外資軟件公司原租用中環中心極高層,現轉租同廈低層全層,呎租約40元,料可節省近半租金。

市場消息指,中環中心錄得一宗中低層全層單位成交,物業面積約2.5萬平方呎,成交呎租僅約40元。

據了解,由於單位屬中低層,未能享有海景景觀,造價上較低,加上目前該廈放盤甚多,故以較低呎租水平成交。

原租極高層 呎租料逾75元

據了解,新租為一家英資軟件公司租用,該機構主要業務為提供金融交易軟件。該機構原租用同廈極高層單位,呎租料約75至80元,如今於同廈進行搬遷,相信主因可節省一半租金成本。

翻查資料,該廈對上一宗較大手租務為上月錄得,中環中心中低層1至3室,面積約7,125平方呎,最新以每月34.2萬元租出,呎租約48元,較去年同期呎租水平已下跌。如今新租中低層全層個案,租金再出現下挫。

空置樓面多 租金水平偏低

第5波疫情下,甲廈租務再轉淡靜。據一外資代理行資料顯示,中區甲廈空置率約7.7%,較2021年尾上升約1個百分點,而散業權商廈因業主對後市各持不同睇法,叫租差距甚大,空置樓面不少。中環中心自數年前拆售後,現時由多名投資者持有,據悉現時大廈空置樓面頗多,故租金水平偏低。

九龍區方面,消息指,九龍灣恩浩國際中心中高層C室,面積約1,305平方呎,以每呎約22元租出;另同廈中層E室,面積約2,435平方呎,成交呎租約21元。

(經濟日報)

更多中環中心寫字樓出租樓盤資訊請參閱:中環中心寫字樓出租

更多中環區甲級寫字樓出租樓盤資訊請參閱:中環區甲級寫字樓出租

更多恩浩國際中心寫字樓出租樓盤資訊請參閱:恩浩國際中心寫字樓出租

更多九龍灣區甲級寫字樓出租樓盤資訊請參閱:九龍灣區甲級寫字樓出租

次季有望反彈 甲廈旺舖可趁低吸

代理:港息有機加半厘 市場未添壓

首季投資市場受疫情衝擊,交投放緩,有代理認為,隨着疫情緩和,第2季起投資市場將反彈顯著,該代理又看好調整較深的甲廈及核心區舖位,屬趁低吸納的時機。

去年大額投資市場暢旺,原本以為今年可承接強勢,怎料年初爆發第5波疫情,投資市場即轉淡靜。該代理分析,疫情為主要窒礙投資的主要因素,「大家最初不知道第5波疫情有多巨大,感染人數突然跳至每日數萬人。投資者擔心疫情惡化,政府不斷收緊防疫措施,經濟會進一步轉差,決定採觀望態度。」

該代理指最近疫情緩和,政府亦放寬措施,經濟向好,「市民感染後免疫,而疫苗接種率高,疫情可望明顯紓緩,預計第2季起市況反彈,力度會強勁持續至年尾。事實上,投資者開始相信疫情總會過去,很多物業價格已跌至低水平,現在投資照計無得輸。」

外資看好香港 資金續來

該代理認為,第2季市況反彈只是開始,因看好經濟前景,資金流向也能反映,「本港資金非常充裕,外資亦投資本港物業,反映各路資金有信心。另外,政府效率加快,不論基建、造地起樓等,漸簡化程序,有利經濟發展。」該代理指,外資投資本港,正因睇好前景,「基金向錢看,有利可圖便入市。睇本港經濟、基建發展等,最近批出基建撥款達2,000多億元,未來發展更為成熟。此外,外資投資揀選香港,因本港安定、財政健全,香港過往一兩年動用大筆資金作抗疫,但財政仍是有盈餘,可見不論政府、大財團及市民,財政狀況亦理想,給予外資信心。」

至於另一影響投資市場為息口,美國已開始加息,袁志光指,美國剛加息1/4厘,香港未有跟隨,「大部分投資者目前借貸成本僅2厘,美國加息步伐加快,香港或部分跟隨,有機會升半厘左右,在實際利率在3厘以下,對市場未構成壓力。」

過去年多 甲廈價跌20至25%

投資範疇上,去年工業佔大額成交近半,最近似乎強勢不減,日前美資基金斥近29億元,購入葵涌集運中心全幢,暫為今年最大額成交。另外,新加坡迷你倉集團,數月內以近9億吸納多項工廈,該代理指工廈勝在用途廣,「疫情下大家多上網,亦多在網上購物,數據使用量高,故數據中心受捧。疫情下網購增,不論物流、航運公司盈利多,以前貨品放在舖位,現在儲在物流中心,因此相關物業需求強勁。」另外,近日酒店交投亦加快,該代理謂酒店用途在改變,「以前只是招待旅客之用,如今可以改成共居,對象以香港人為主,因為本港住宅租務需求大。」

近一兩年,甲廈及核心區舖位價格調整,投資市場上備受冷落,該代理則認為,此時是趁低吸納時間,「在過去一年多,甲廈價格已跌20至25%,跌幅顯著,價格已跌至吸引水平,租金同樣已喘定。疫情完結後,會有很多內地公司包括資產管理機構來港開業,整個市況大不同。」至於商舖,該代理指傳統購物區如尖沙咀及銅鑼灣,過去3年受衝擊非常嚴重,「舖價回調顯著,作為投資者,並非睇短綫,可能3至5年甚至更長,絕對是入市時機。」

(經濟日報)

受第五波疫情打擊,商廈市場觀望氣氛籠罩,並錄蝕讓買賣。消息指,尖沙嘴新文華中心高層單位以792萬易手,呎價約1.03萬,原業主持貨七年實蝕約80萬離場。

平均呎價1.03萬

據地產代理指出,尖沙嘴新文華中心A座高層17室,建築面積約769方呎,以約792.07萬易手,呎價約1.03萬,原業主於2015年6月以約807.45萬購入,故持貨近7年帳面蝕讓約15萬,惟計及印花稅及代理佣金等開支,料實蝕約80萬離場。

據業內人士指出,上址位處高層,坐享開揚市景,惟受第五波疫情影響,商廈市場交投急下滑,令整體成交價備受壓力,因市場需求疲弱,令議價空間逐步擴闊,上述成交價已屬貼市價水平。

據本港一間代理行資料顯示,該廈近期成交疏落,對上一宗買賣追溯至去年9月,為A座8樓16至17室,建築面積1509方呎,以1434萬售出,呎價約9500元。

業內人士指出,尖東甲廈有其賣點,個別大廈更位處沿海位置,享維港景,呎租對比港島指標商廈有明顯折讓,吸引企業遷入。

(星島日報)

更多新文華中心寫字樓出售樓盤資訊請參閱:新文華中心寫字樓出售

更多尖沙咀區甲級寫字樓出售樓盤資訊請參閱:尖沙咀區甲級寫字樓出售

基金追捧全幢酒店工廈 代理:疫情回穩帶動買賣

疫情逐步放緩,為投資市場釋出曙光。有外資代理行代理指出,儘管第五波疫情令人措手不及,拖累市場首季交投受壓,但常言道有危才有機,近期疫情喘定回穩,推動投資市場於今季迅速復甦,外資基金及機構投資者蠢蠢欲動,全幢酒店及工廈最「搶手」,有力突圍跑出,大手買賣將陸續有來,未來六個月是撈底的好時機。

該代理指出,據該行統計資料顯示,今年首季逾億元的工商物業買賣錄31宗,較去年第四季的45宗按季跌約30%,期間成交金額錄約112億,按季同步下挫約46%,受第五波疫情肆虐影響,加上美國聯儲局加息、俄烏戰爭等負面因素影響,市場觀望濃厚,導致首季市況交投明顯放緩,並錄價量齊挫,惟受近期疫情漸見放緩,為市場釋出曙光。

首季逾億買賣挫三成

該代理續指出,參考去年市場於第四波疫情後有力迅速反彈復甦,該代理對後市仍感樂觀,政府近期推出消費券帶動,對零售及整體商場活動將帶來正面影響,儘管加息陰霾揮之不去,但現今市場資金仍然充裕,當中以外資基金最為活躍,市場料於今年及後時間「追落後」,以去年全年投資市場錄733億成交計,料今年成交金額波幅約5%。

外資基金機構投資者活躍

近期疫情稍回穩,對於投資市場能否突圍而出。該代理指出,參考亞太區多個主要城市,於疫情回穩後經濟活動均能迅速反彈,故令他對後市仍具信心,香港為亞太區主要金融中心之一,受外資基金追捧,部分準備大手在港作收購,早前疫情肆虐,相關買賣變得滯後,隨着防疫措施有機會本月底放寬,將帶動交投氣氛轉活,近期市場已頻錄大手買賣,料今季已見復甦反彈。

該代理續指出,受疫情等因素衝擊,全幢酒店及工廈已從高位回落約三成,受第五波疫情衝擊,酒店議價空間更高達兩成,故備受買家追捧,主要購買力為外資基金及機構投資 (INSTITUTIONAL BUYER),市場近期矚目買賣為葵涌集運中心全幢,於本月獲美資基金Nuveen旗下The Asia Pacific Cities Fund (APCF) 以約28.8億承接,呎價約1.08萬,將作數據中心用途。該代理評論指,隨網絡發展一日千里,令數據中心備受追捧,於數年前已成為環球大趨勢,加上自疫情爆發以來,網上購物及居家工作日趨普及化,更令數據中心需求進一步升溫,現今市場可作數據中心用途的全幢工廈買少見少,令該類物業疫下有價有市,備受各路買家追捧。

(星島日報)

代理行承租海富中心3伙 涉1.86萬呎

個別機構作出擴充,本地其中一間最大的代理行租用金鐘海富中心3單位,涉逾1.8萬平方呎。

消息指,金鐘海富中心錄得3宗租務,全部位於項目1座,其中601室,面積約7,135平方呎,以每平方呎約40元租出。另1107室,面積約5,400平方呎,以每呎約35元租出;而同廈1804室,面積約6,100平方呎,成交呎租約40元。

屬同廈擴充 呎租35至40元

據了解,3單位面積合共約1.86萬平方呎,均由該代理行租用,該公司一直租用海富中心中層單位約1.6萬平方呎,作集團寫字樓代理、後勤及測量師行業務等使用,如今同時租用3單位,分散不同部門,料可加強管理,而樓面上亦有擴充。

同區租務方面,消息指,中環環貿中心低層03室,面積約1,670平方呎,以約5.5萬元租出,呎租約33元。

新文華中心中層 呎售1.03萬

另九龍商廈買賣方面,市場消息指,尖東新文華中心A座中層17室,面積約約769平方呎,以約792萬易手,呎價約1.03萬元。

租務方面,九龍灣億京中心錄多宗成交,其中億京中心A座高層A至C室,面積約8,426平方呎,成交呎租約23元。另同廈中層D室,面積約2,173平方呎,以每呎約21元租出。

(經濟日報)

更多海富中心寫字樓出租樓盤資訊請參閱:海富中心寫字樓出租

更多金鐘區甲級寫字樓出租樓盤資訊請參閱:金鐘區甲級寫字樓出租

更多環貿中心寫字樓出租樓盤資訊請參閱:環貿中心寫字樓出租

更多中環區甲級寫字樓出租樓盤資訊請參閱:中環區甲級寫字樓出租

更多新文華中心寫字樓出售樓盤資訊請參閱:新文華中心寫字樓出售

更多尖沙咀區甲級寫字樓出售樓盤資訊請參閱:尖沙咀區甲級寫字樓出售

更多億京中心寫字樓出租樓盤資訊請參閱:億京中心寫字樓出租

更多九龍灣區甲級寫字樓出租樓盤資訊請參閱:九龍灣區甲級寫字樓出租Hysan, Chinachem Add Cultural Space to Causeway Bay Commercial Project

Hysan

Development and its partner Chinachem Group are turning to culture to

boost the value of a HK$28 billion ($3.5 billion) commercial project

they are developing in Hong Kong’s Causeway Bay area, according to a

planning application submitted by the joint venture last month.

The

partners submitted designs created by architects Ronald Lu and Partners

to add performing arts and cultural facilities, a communal garden and a

larger public open space to the project being developed on Caroline

Hill Road near Hysan’s Causeway Bay headquarters, while also requesting

permission to expand the floor area of the project.

“Upon

the project’s completion in 2026, the public will have direct access to

a community space of over 110,000 square feet, which includes a park of