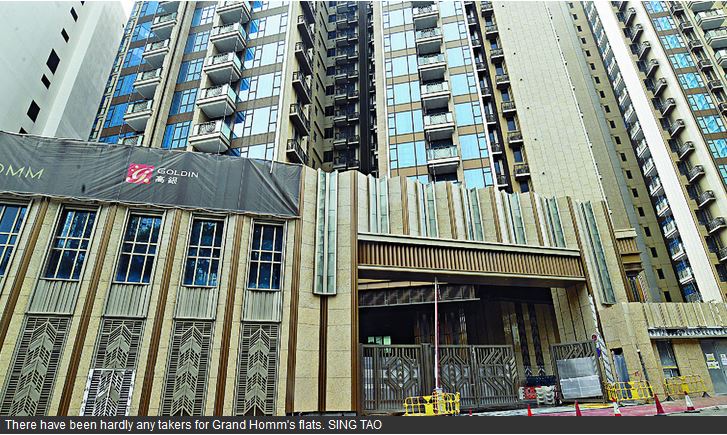

Delayed project raises fears over completion

Debt-laden Goldin Financial (0530) has sold just

around 7 percent of 401 flats on offer at Grand Homm in Ho Man Tin, and

the developer has delayed delivery of the homes to buyers for more than

six months now.

The firm previously missed the delivery date in

late November and the project is stoking fears that it may become an

unfinished real-estate project, which is rarely seen in the city.

The developer said on Sunday the homes are expected to be completed on July 6, due to the impact of the pandemic and weather.

Meanwhile, property agencies reportedly dropped

the sales work on the project six months ago and have not received the

commission from the previous deals.

Grand Homm marks Goldin Financial's first residential project in Hong Kong, with six residential buildings.

It offers 401 standard units and 26 special ones, covering an area ranging from 848 square feet to 1,447 sq ft.

Goldin Financial, chaired by tycoon Pan Sutong, incurred a net loss of more than HK$8 billion in 2020, and its Goldin Financial Global Centre in Kowloon Bay was taken over by its creditors and sold for HK$14.3 billion.

In the primary market, New World Development

(0017) will launch at least 90 units of the third phase of The Pavilia

Farm on top of Tai Wai Station after receiving more than 11,000

registrations of intent from potential buyers for the 182 flats in three

days.

The developer expected to launch the first round of sales as soon as this Saturday, involving about 300 units.

In other news, a luxury house at Wing On Towers 12, Jardines Lookout, is up for sale for more than HK$610 million, agent said.

In May, secondary transactions at 10 major estates fell 4.8 percent to 358 from a month ago as home prices continued to rise.

(The Standard)

For more information of Office for Lease at Goldin Financial Global Centre please visit: Office for Lease at Goldin Financial Global Centre

For more information of Grade A Office for Lease in Kowloon Bay please visit: Grade A Office for Lease in Kowloon Bay

Hong Kong developers take to wining and dining office tenants, step up restaurant and bar openings

Most Hong Kong developers are expanding their F&B offerings to better serve and retain tenants amid a rise in vacancy rates

We see a growing demand for lifestyle spaces among office tenants, Hysan executive says

Hong Kong property

developers and landlords are welcoming more restaurants and bars to

their office buildings, as they look to offer more entertainment options

to their tenants in an otherwise soft office market.

More than five new food

and beverage (F&B) outlets are set to open in and around Taikoo

Place this year, for instance. These include trendy Australian seafood

restaurant Catch, boutique cafe HAVN, Lady M, which is famous for its

cakes, and Japanese hand rolled sushi and sake bar TMK.

“Taikoo Place needs to

appeal to younger members of the world … we need to make sure that it

has all the amenities and restaurants and bars, and I think we have

achieved that,” said Don Taylor, the director of office at Swire

Properties. The developer owns and operates Taikoo Place and is a major

landlord in Quarry Bay.

Most Hong Kong developers

are putting more effort into expanding their F&B offerings to

better serve and retain tenants amid a rise in vacant spaces in their

office buildings. The vacancy rate for grade A offices rose to 7.9 per

cent in Central in April, 12.4 per cent in Wan Chai and 7.5 per cent in

Causeway Bay, according to property agency.

“Office tenants nowadays

are, in general, more demanding, while landlords would like to enhance

the image of their building and provide extra amenities to tenants,”

agent said.

Swire Properties, which

recently launched Two Taikoo Place, a 41-storey building, could go a

step further and improve the F&B offering across the whole of Taikoo

Place, Taylor said. “We will put more higher-end dining in place to

cater to the demand of executives of our corporate tenants, who can

entertain their clients here. We are currently looking at a number of

different spaces within Taikoo Place and are speaking to a number of

different operators,” he added.

Hysan Development, the

biggest landlord in Causeway Bay, will feature alfresco dining among

other F&B options in a new grade A office tower it hopes to unveil

in the district by 2026-27. “We see a growing demand for lifestyle

spaces among our office tenants,” said Ricky Lui, Hysan’s chief

operating officer.

Last summer, 132-year-old

landlord and developer Hongkong Land launched Basehall, a food court

with nine stalls run by some of the city’s trendiest F&B operators,

including Honbo, Co Thanh and Young Master Brewery, in the basement of Jardine House.

The company, which owns about 450,000 square metres of prime office and

retail properties in Central, will offer more “innovative and trendy”

dining places in the next six to 12 months, it said.

“It has become slightly

more apparent recently that we are seeing F&B elements not just in

the basements and lobbies, but also on rooftops, floors with balconies …

We have had some discussions with various landlords on this,” agent

said.

“F&B operators, they

are always up for unique locations. So rooftops and balcony floors are

always interesting options for them,” the agent added.

(South China Morning Post)

For more information of Office for Lease at Jardine House please visit: Office for Lease at Jardine House

For more information of Grade A Office for Lease in Central please visit: Grade A Office for Lease in Central

英皇西環舊樓批強拍高陞大樓收逾91%業權項目底價2.59億

市區地皮供應有限,財團積極收購舊樓,由英皇收購的西環高陞大樓,新獲批強拍令,目前已收約91.89%業權,底價為2.59億,較19年市場估值約2.4億高約8%。

據土地審裁處資料,目前英皇持有高陞大樓91.89%,僅餘3伙未獲收購,分別為1樓A室、C室及3樓B室,涉及3組小業主。據判詞指出,該項目樓齡已高,不少單位狀況甚差,現時強拍申請人已持有逾80%業權,故重建屬合理做法。

可建樓面約1.9萬呎

項目底價為2.59億,較19年申請強拍時,市場估值2.4億高出約8%。該項目為商住物業,地盤面積2144方呎,可建樓面約1.9萬方呎,樓齡約55年,鄰近西營盤港鐵站,具有一定重建價值。

翻查資料,英皇去年宣布與慈善機構新家園協會合作,並將上述項目約22個單位發展成「共.融舍」房屋共享計畫,並以象徵式1元租金租予新家園負責營運,為期1年。

底價較19年高8%

私人土地供應減少,使發展商也積極透過舊樓收購增加土地儲備,英皇近年頻以強拍重建增加土地儲備。

業主阻尖區舊樓強拍敗訴

資料顯示,英皇集團早前向土地審裁處申請強拍筲箕灣南安街仲齊大廈,項目估值約1.75億,項目地盤面積3000方呎,現為樓高8層商住物業,早於1964年落成入伙,樓齡55年。

該集團於鄰近亦有收購項目,如筲箕灣南安街73號德福樓、75號的合榮大廈,以及77號的茂發樓,料將會整合發展。

另外,鄧成波家族旗下尖沙嘴加連威老道65至73號舊樓,原於去年7月批出強拍,底價逾19億,惟於拍賣前夕,遭小業主向高等法院提出反對,並批出暫緩令。據法院最新資料顯示,法庭判小業主敗訴,維持原有強拍安排。

(星島日報)

渣甸山屋地意向價逾6.1億

渣甸山為港島傳統豪宅地段,其中區內布思道12號 (見圖) 各業主近期達成共識,推出該地段放售。資料顯示,物業其中一位業主為大律師公會前主席林孟達,早於2002年6月以950萬購入。

該地盤面積約8138方呎,以地積比率0.75倍計算,可建約6137方呎,意向價逾6.1億,樓面呎價逾99397元。代理稱,項目景觀開揚,私隱度高,新買家可重建4層高連車庫的獨立屋。

(星島日報)

有成行物流全幢2.17億售

本報早前率先報道的粉嶺安樂門街38號有成行物流中心全幢以2.17億易手。據土地註冊處資料顯示,該買家以公司名義EAGLE

SWIFT LIMITED登記,為海外註冊公司,原業主為廣大食品有限公司 (KWONG TAI SIK PUNG COMPANY

LIMITED),註冊董事包括梁冠禧、沈濟福等人,為有成行辦館相關人士,早於2001年以2000萬購入,持貨20年帳面獲利1.97億,期間升值近9.85倍。

20年升值9.85倍

據業人士指出,上址總樓面約46278方呎,以易手價計,平均呎價約4689元。

甲廈亦錄租賃成交,市場消息指出,中環美國銀行中心中層09室,面積約674方呎,以每呎54.9元租出,月租約37002.6元。據業內人士指出,上述單位屬較細面積,租金屬市價水平。

同時,商廈市場亦罕有銀主盤買賣。消息指,旺角上海中心中層單位,為銀主盤,面積828方呎,以443.8萬售出,呎價約5360元,低市價約一成。

(星島日報)

更多美國銀行中心寫字樓出租樓盤資訊請參閱:美國銀行中心寫字樓出租

更多中環區甲級寫字樓出租樓盤資訊請參閱:中環區甲級寫字樓出租

運輸署22元呎 租九龍灣宏天廣場全層

整體東九龍租務淡靜,九龍灣宏天廣場全層,以每呎約22元租出,新租客為政府部門。

消息指,九龍灣宏天廣場中層全層,面積約2.8萬平方呎,以每月62萬元租出,呎租約22元,租金較去年跌約1成。據了解,新租客為政府部門,料作運輸署辦公室之用。事實上,該廈不少樓面亦由政府部門租用,包括社會福利署等。

月租62萬 較去年跌1成

近期整體租務未見活躍,消息指,觀塘綠景NEO大廈一單位獲洽租,面積約6,000平方呎,每平方呎約28元。據悉,該公司為健身器材設計生產商,早前租用尖沙咀港威大廈單位。而租用觀塘較大單位,可容納更多員工,租金較尖沙咀便宜。

核心區甲廈租務方面,消息指,美國銀行中心中層09室,面積約674平方呎,以每呎約55元租出。另同安蘭街18號中層,面積約2,464平方呎,成交呎租約45元。

(經濟日報)

更多宏天廣場寫字樓出租樓盤資訊請參閱:宏天廣場寫字樓出租

更多九龍灣區甲級寫字樓出租樓盤資訊請參閱:九龍灣區甲級寫字樓出租

更多綠景NEO大廈寫字樓出租樓盤資訊請參閱:綠景NEO大廈寫字樓出租

更多觀塘區甲級寫字樓出租樓盤資訊請參閱:觀塘區甲級寫字樓出租

更多港威大廈寫字樓出租樓盤資訊請參閱:港威大廈寫字樓出租

更多尖沙咀區甲級寫字樓出租樓盤資訊請參閱:尖沙咀區甲級寫字樓出租

更多美國銀行中心寫字樓出租樓盤資訊請參閱:美國銀行中心寫字樓出租

更多中環區甲級寫字樓出租樓盤資訊請參閱:中環區甲級寫字樓出租

灣仔海外信託銀行大廈位處告士打道,最大優點是享有無遮擋全維港海景,非常舒適。

告士打道為灣仔商廈集中地,交通上,由港鐵灣仔站步行至該廈約10分鐘,附近亦有多條巴士綫可到達。值得一提,物業樓下有接駁天橋,前往灣仔北,而日後亦鄰近港鐵會展站,屆時交通可望更便利。物業設有多層停車場,駕車人士可從大廈謝斐道入口進入停車場。

飲食配套上,上班一族可到附近謝斐道及駱克道,有多間茶餐廳以及酒樓可供選擇,或前往灣仔北新鴻基中心及華潤大廈,不僅有酒樓、酒吧等,亦有新落成的酒店,有特色餐廳提供。

實用達8成 全層用家為主

大廈於1978年落成,樓高29層,物業分別設有告士打道及謝斐道入口,均可前往物業電梯大堂。大廈入口、電梯大堂等早年曾翻新,加設電子水牌,整體觀感仍勝同區乙廈。

標準樓面全層面積由6,999至7,344平方呎,該廈主要為全層用家為主,較少間細單位。間隔上四正,實用率高達8成。

位處單邊 享優質海景

物業最大優點在景觀上,因大廈位處單邊,前面亦沒有任何遮擋,可享優質海景。

買賣方面,2015年,由中原地產創辦人施永青等持有的灣仔海外信託銀行大廈20樓連車位,以1.16億元成交,呎價15,797元,持貨5年帳面獲利逾半億元,呎價一度創新高。

2017年,物業中高層全層,面積約6,984平方呎,以約1.222億元易手,呎價高見17,500元。大廈對上一宗買賣為2019年,物業全層單位連車位,以7,800萬易手,平均呎價1.13萬,買家為上市公司海峽石油化工控股 (00852) 。

租務上,去年大廈錄3宗租務成交,其中低層單位,面積約7,344平方呎,以每月約26.4萬元租出,呎租約36元。今年物業僅錄一宗租務,涉及中層全層,面積約7,344平方呎,成交呎租約28元。

(經濟日報)

更多海外信託銀行大廈寫字樓出租樓盤資訊請參閱:海外信託銀行大廈寫字樓出租

更多新鴻基中心寫字樓出租樓盤資訊請參閱:新鴻基中心寫字樓出租

更多華潤大廈寫字樓出租樓盤資訊請參閱:華潤大廈寫字樓出租

更多灣仔區甲級寫字樓出租樓盤資訊請參閱:灣仔區甲級寫字樓出租

更多海外信託銀行大廈寫字樓出售樓盤資訊請參閱:海外信託銀行大廈寫字樓出售

更多灣仔區甲級寫字樓出售樓盤資訊請參閱:灣仔區甲級寫字樓出售

商務氣氛轉好 旺角錄疫後最大租務

資料顯示,今年第一季錄得約1,304宗舖位租賃成交,總金額約1.35億元,比上季約1,442宗及1.38億元水平相若,至於按年比較則上升逾五成。踏入第二季,疫情進一步緩和,租務活動轉活,各核心區均錄舖位租務成交。

迪生創建300萬 租彌敦道舖

旺角區方面,近日錄得數宗商舖租務個案,更罕有出現數百萬月租成交個案。迪生創建指,與招商永隆銀行達成協議,租用旺角彌敦道636號銀行中心廣場地下01至03、06至19號舖及1樓17號舖,租期由2021年8月至2027年,為期6年,涉及租金約2.1626億元,月租涉及約300萬元。

涉及物業旺角銀行中心廣場,為區內核心零售地段,旁為港鐵站出口,人流暢旺。舖位面積約1.2萬平方呎,現時由周大福、屈臣氏等租用。是次新租務涉及月租約300萬元,按金額計為去年疫情爆發後,最大宗舖位租務成交。對上一宗較大手商租務,為中環興瑋大廈兩層,獲恒生銀行以每月120萬元租用。

迪生創建業務主要為時裝、手錶等,旗下品牌包括百貨Harvey Nichols、美容專門店BEAUTY AVENUE等,而集團位於旺角朗豪坊商場的BEAUTY AVENUE涉及逾萬平方呎,據悉租約即將屆滿。業界人士估計,不排除租用銀行中心舖作搬遷。

BALENO亞皆老街舖 月租60萬

另外,區內錄得時裝店租務,涉及旺角亞皆老街24至26號地下連閣樓,面積合共約2,556平方呎,由時裝連鎖店BALENO以每月60萬承租,平均呎租234元。該時裝店去年尾曾短租舖位,涉及約半年,如今轉為長租。翻查資料,舖位曾由蘋果牌牛仔服裝自用,兩年前遷出。

旺角吉舖數目多,個別舖位由短租店承接。旺角西洋菜南街14至24號榮地下,面積約1,600平方呎,獲佐丹奴以月約20萬元短租。該品牌早年曾租用物業,今年初完結遷出,如今以短租形式重返。據了解,品牌早年以90萬元租用舖位,新租金跌逾77%。

分析指,疫情緩和,消費氣氛轉好,令零售商感興趣開業,加上舖租較高峰期大跌,租務明顯上升。旺角區向來集合本地及旅客消費,旅客暫未重返,仍有本土客支持,令零售商趁租金下跌,重新租舖開業迎商機。

疫情緩和下,整體商務氣氛轉好,過往集合本地及旅客消費的旺角區,租務個案增加,更錄得疫後最大宗商舖租務。

(經濟日報)

鄧成波家族勝訴 尖沙咀舊樓准強拍

底價19.26億 合併鄰地重建供13萬呎

舊樓收購進入收成期,三個舊樓強拍重建項目陸續獲批,涉資約24.9億元,預計能帶來18.1萬平方呎樓面,其中已故舖王鄧成波生前收購的尖沙咀加連威老道舊樓,獲法庭批准繼續強拍。

舖王鄧成波家族在2017年就加連威老道65至73號收購至逾8成業權之後,向土地審裁處申請強制拍賣,並在去年6月獲批出強拍令,拍賣程序原定在去年7月舉行,但當時遇上有一名小業主向高等法院反對,並批出暫緩令。

該小業主律師質疑加連威老道73號與75號共用同一條樓梯,若果73號重建後,小業主在75號持有的單位亦無法使用,認為《舊樓強拍條例》是重建整幢物業,而不是物業的一部分。

不過,據法庭判詞指出,香港現有業權制度以地段 (lot) 為單位,而並認為73號跟75號屬於不同公契,彼此獨立,而屋宇署亦會審批方案確保73號拆卸後不會影響75號的運作,才批出拆樓紙,故此最終拒絕小業主的上訴申請。

按照資料顯示,加連威老道65至73號拍賣底價達19.26億元,若果合併地盤重建,將可提供約13萬平方呎樓面。

永義紅磡舊樓今拍賣

另外,英皇國際 (00163)

收購的的西營盤皇后大道西高陞大樓,最新獲土地審裁處批出強拍令,項目底價為2.59億元。高陞大樓位於西營盤皇后大道西78至80號及荷李活道265至267號,比鄰荷李活道公園。據文件顯示,英皇相關人士目前已持有大廈業權約91.89%。項目地盤面積約2,144平方呎,可建樓面涉約1.9萬平方呎。

另外,永義國際 (01218) 持有大部分業權的紅磡漆咸道北472號、474號、476號及478號,將於今日上午10時進行強拍,底價為3億元。項目現為兩幢5至6層高的舊樓,分別於1956及1957年落成,其地盤面積約3,562平方呎。

(經濟日報)

Henderson Land enters the fray for prime site

Henderson Land Development (0012) co-chairman

Martin Lee Ka-shing said the developer will submit a tender for Site 3

of the New Central Harbourfront in Central.

Bids for the commercial site close on June 18.

Lee described the plot as "superior land" but did not reveal to whether it would bid on its own or through a joint venture.

He believes rents of grade A offices will remain

stable as many tenants like large multinational companies and financial

institutions are interested in offices in prime areas.

Commercial buildings in prime locations will not

have major problems in finding tenants, he said pointing out that

offices of vacating tenants at the International Finance Centre in Central were soon filled up after they left.

Lee was satisfied with property sales so far this

year and said the group is pushing ahead with the transformation of

agricultural land into residential land. He said he backed the

government's move to take private land, under the Lands Resumption

Ordinance, for building public housing and infrastructure.

Lee revealed that Henderson Land's Miramar Hotel

and Investment (0071) had average occupancy rates of 40 percent this

year, with to 60-70 percent over the weekends. Henderson Land raised its

stake in Miramar Hotel and Investment to over 50 percent last month,

and Lee said the plan to raise its stake in the subsidiary was a

"long-term goal."

(The Standard)

For more information of Office for Lease at International Finance Centre please visit: Office for Lease at International Finance Centre

For more information of Grade A Office for Lease in Central please visit: Grade A Office for Lease in Central

Pavilia Farm III prices go up 6.8pc in second list

New World Development (0017) released the second

price list involving 149 units of The Pavilia Farm's Phase Three atop

Tai Wai Station.

The new price list came in with an average price

of HK$21,368 per square foot after discounts, suggesting a 6.8 percent

increase when compared to the first price list.

It covers 19 studio flats, 60 two-room units, 51 three-room units and 19 four-room flats.

The units cover an area ranging from 310 sq ft to 1,022 sq ft with a selling price from HK$7.54 million to HK$25.30 million.

This suggests an average price ranging from HK$17,999 to HK$25,781 per sq ft after discounts.

Subscriptions for the project close tomorrow

before the developer kicks off the first round of sales this Saturday,

putting 331 units in the two price lists for sale.

In other news, Tang Shing-bor's family sold street shops for nearly HK$300 million after the property tycoon died last month.

A street shop at Yee Wo Street in Causeway Bay,

measuring around 5,150 sq ft, was reportedly sold for HK$210 million its

asking price was cut by HK$10 million. Tang or a related person had

brought the shop for HK$204 million in 2016, suggesting a loss of

HK$11.34 million after taxes.

(The Standard)

50大甲廈首5月78買賣 按年升1.6倍

甲廈買賣增,有代理統計指,首5月指標甲廈錄78宗買賣,重返2019年社會運動前水平。

代理數據顯示,今年首5個月50大甲廈共錄得78宗買賣,相對去年同期的30宗,按年急彈近1.6倍,期內成交面積約32.7萬平方呎,按年亦上升逾1.3倍。至於2019年同期共錄得79宗買賣,意味着今年首5個月的成交量,已經重返2019社會運動前的水平。

上月共錄15宗買賣

不過,若與2018年同期,即中美貿易戰剛爆發時的116宗,以及2017年商廈大牛市時的167宗比較,最新成交量仍然屬偏低的水平。

單計上月,50大甲廈共錄得15宗買賣,包括中環指標甲廈皇后大道中九號連錄2宗買賣,為該廈近32個月首錄成交;另一指標項目金鐘力寶中心上月也錄得2宗成交個案。

代理表示,受到工商舖撤辣及疫情回穩帶動,部分新晉投資者入市購入寫字樓,帶動交投回穩,總計今年首5個月,交投水平亦重返社會運動前的水平,顯示市場正穩步復甦,但與2017至18年貿易戰前的旺市水平,仍然有一段距離。後市上,代理認為銅鑼灣加路連山道地王早前以高價批出,市場亦憧憬中環新海濱地王賣地價或有驚喜,部分業主因而採取觀望態度,不急於大幅減價求售,令到短期商廈交投或會回落。

(經濟日報)

更多皇后大道中九號寫字樓出售樓盤資訊請參閱:皇后大道中九號寫字樓出售

更多中環區甲級寫字樓出售樓盤資訊請參閱:中環區甲級寫字樓出售

更多力寶中心寫字樓出售樓盤資訊請參閱:力寶中心寫字樓出售

更多金鐘區甲級寫字樓出售樓盤資訊請參閱:金鐘區甲級寫字樓出售

屯馬綫效應 加快新蒲崗工業轉型

隨着屯馬綫於6月全綫通車,意味由各區往返新蒲崗會更方便,大大提升該區的潛力。事實上,近年新蒲崗工業區加快轉型,區內未來有不少新式工廈供應,料可提供約150萬平方呎樓面。

7項目發展 增150萬呎工商樓面

鑑於新蒲崗鄰近啟德舊機場,上世紀吸引不少輕工業落戶。不過,在起動九龍東效應,及活化工廈2.0的推動下,區內收購重建活動加快,令到該區逐漸轉型成商貿區。現時區內有7個發展項目,合共提供約150萬平方呎樓面,而屯馬綫將於6月全綫通車,故料可進一步提高新蒲崗工商廈的升值潛力。

由長江製衣 (00294)

持有,位於新蒲崗大有街20至24號的項目,早前申請放寬地積比率,由原本的12倍增至14.896倍,並擬建一幢樓高29層 (包括3層地庫)

的新型工廈,作非污染性工廈用途,涉及樓面約38.5萬平方呎,上述申請已獲城規會在有條件下批准。而大有街20號現為香港安全印刷大廈,而22至24號前身是長江製衣廠大廈。業主早於2012年曾建議將項目發展為樓高31層的酒店,提供約1,144個酒店房間,並獲城規會批准申請,惟業主最終於2016年宣布撤回重建方案,及再就項目提交最新議案。

七寶街1號新式工廈 料6月底推售

同時,附近亦有新式工廈即將推出,其中位處七寶街1號,前身為美華工廠大廈,屬於房地產基金麒豐資本的頭炮項目,早前擬重建一幢樓高26層物業,作非污染工業用途。據麒豐資本指出,項目可提供逾200伙,涉資約25億元,計劃於6月底推售。

受惠於起動九龍東計劃,加上附近基建漸見成熟,近年大型發展商亦積極計劃為旗下項目重建。新世界

(00017)

旗下六合街21號的工業地盤正部署進行重建,發展商早前已就項目申請重建成一幢22層高的新式工廈,預計提供約12萬平方呎總樓面。此外,新世界亦已成功在2017年以逾3.5億元,統一鄰近的六合街9號中溪工業大廈的業權,項目目前屬於一幢11層高工廈,料日後可活化為商廈,提供寫字樓、餐飲及零售商舖等用途。值得一提,新世界早年亦將工廈改裝為九龍貝爾特酒店,酒店於2013年落成,屬區內首間酒店,供應695個客房。

(經濟日報)

鄧成波家族單日連沽4舖 套逾4億

怡和街舖減價逾2成 2.1億平手離場

舖王鄧成波離世後,其家族沽貨速度明顯加快,消息指,該家族剛沽出銅鑼灣、旺角等舖位,合共套現逾4億元。據悉,部分物業略為減價,例如銅鑼灣怡和街舖位,減價逾2成以2.1億元易手,僅平手離場。

近日舖位市場焦點,盡在鄧成波家族沽貨上,早前市場流出其家族放售的數以十項物業,總值逾百億元,最近適逢舖市轉旺,沽貨加快。

消息指,昨日其家族一口氣沽出4舖位,其中最貴重為銅鑼灣怡和街46至54號地下及地庫,地下面積1,230平方呎,地庫面積約6,121平方呎,合共約7,351平方呎,現由電訊店以每月45.5萬元租用,以約2.1億元成交。據悉,鄧成波於2016年以2.038億元購入,早前曾以約2.8億元放售,直至最近再降價,終以約2.1億元易手,減價約25%。持貨5年轉手,僅平手離場。

新填地街8千呎舖8100萬沽

另外,該家族亦連環沽出旺角大樓面舖位,包括以約8,100萬沽出新填地街142至144號地下至2樓酒樓舖位,面積合共約8,030平方呎,現由酒樓以每月18.7萬元租用。據悉,業主原叫價約8,500萬元,減價約5%沽出。據悉該物業早於1992年以約600萬元購入,持貨29年轉手,獲利約7,500萬元離場。

此外,同區廣東道1037號全幢,剛以約9,000萬元易手,物業樓高5層,面積4,800平方呎。翻查資料,鄧成波於2016年以約4,850萬元購入,沽貨亦獲利。連同區上海街舖,單日連沽4舖,已套現4.13億元;若連同上星期售出的荃灣楊屋道舖、元朗地皮等,已合共售出逾6億元物業。

廣東道1037號全幢 9千萬易手

整體商舖買賣明顯轉多,惟個別亦錄蝕讓情況。消息指佐敦庇利金街42號地下及一樓,以約7,200萬元易手。物業面積合共約6,180平方呎,現由餐廳等租用,月租約18萬元,回報率約3厘。

據悉,原業主於2013年舖市高峰期以8,500萬購入,持貨8年轉手,蝕約1,300萬元離場。

(經濟日報)

鄧成波家族2.4億沽三物業銅鑼灣鋪2.1億獲洽

「鋪王」鄧成波於上月突離世,該家族陸續沽貨套現,最新以2.4億連沽三項物業;其中,旺角廣東道一籃子商住物業,獲資深投資者馮國寶以9230萬承接。另外銅鑼灣及油麻地鋪兩項目則獲洽購,該家族於過去半個月合共售出10項目,合共套現約7億。

本報昨日就上述消息向鄧成波孻子鄧耀昇創立的陞域集團查詢,該集團發言人指,集團對市場傳聞不予評論。

知情人士透露,鄧成波家族最新沽出旺角廣東道1037號全幢及1035A號C及D鋪,作價約9230萬,其中,1037號全幢為商住物業,地鋪1259方呎,1至5樓為住宅,每層540方呎,總樓面3959方呎,至於1035號C及D鋪,面積分別為1000及950方呎。

陞域集團:不予評論

據土地註冊處資料顯示,上址原業主於2017年以4831萬購入,持貨4年帳面獲利約4399萬,期間升值約91%。

此外,市場人士指出,由該家族持有的油麻地新填地街142至144號地下至2樓,總樓面8030方呎,以8300萬易手,呎價約10336元,以該鋪租金18.78萬計,料買家享租金回報約2.78厘。據土地註冊處資料顯示,原業主於1992年以600萬購入,以公司名義麗威發展有限公司持有,註冊董事為鄧成波及鄧耀昇,持貨29年帳面獲利7500萬,期間升值約12.5倍。

同時,市場消息指,由該家族持有旺角洗衣街165號地鋪,面積2500方呎,以6200萬成交,呎價約2.48萬,該鋪由零售連鎖店以15萬承租,料買家享租金回報約2.9厘,原業主於2017年以5250萬購入,若交易落實,持貨4年帳面獲利950萬,期間升值約18%。

半月沽10物業涉七億

另外,市場消息指出,銅鑼灣怡和街46至54號麥當奴大廈地下A及F地鋪及地庫全層,總樓面約7566方呎,獲準買家出價約2.1億洽購,若成交最終落實,呎價約27756元。代理指出,上址現時由連鎖通訊商以45.5萬承租,租約期至明年8月。

據土地註冊處顯示,業主於2017年1月以2.038億購入,以公司名義朗屯中心III有限公司持有,註冊董事為鄧成波、葉少萍及鄧耀昇,若上述成交最終落實,持貨4年,帳面獲利620萬,升值約3%。

上海街鋪獲洽購

另外,油麻地上海街387號鋪,面積700方呎,市傳獲買家以3200萬獲洽購。

鄧成波家族於過去半個月合共沽售10項物業,合共套現約7億,其中荃灣楊屋道118號立坊地下連1樓基座商鋪,作價1.2億售出,地下及1樓建築面積各約4492方呎及約5088方呎,合共約9580方呎,呎價約1.25萬。

此外,觀塘開源道63號福昌大廈1樓全層工廈,建築面積10640方呎,成交價8512萬,呎價8000元,該單位於2009年以3000萬購入,帳面獲利5512萬元,升值1.8倍。

(星島日報)

永義統一紅磡舊樓業權

市區土地供應有限,發展商積極收購重建。紅磡漆咸道北舊樓昨進行強拍,由申請強拍的永義以底價3億統一業權,樓面呎價約9358元,項目料合併毗鄰地盤發展。

該項目為漆咸道北472號至478號舊樓,永義於無對手下,以底價3億統一業權,項目佔地約3562方呎,以地積比9倍發展,可建樓32058方呎,樓面呎價約9358元。

底價三億購漆咸道北舊樓

上述舊樓於1950年落成,消息指,發展商同時已收購毗鄰470號全數業權,料作合併發展,項目佔地面積將增至約4680方呎,可建樓面則增至4.2萬方呎,料作商住項目發展。

有測量師指,紅磡區內舊樓近年頻獲發展商作收購重建,上述強拍項目配套不俗,發展潛力不俗,並認為上述強拍成交價屬市價水平,

該測量師亦指出,受疫情影響,今年發展商申請強拍的宗數少於去年,暫時錄約5至6宗,惟部分強拍申請陸續進入聆訊階段,故預計今年批出的拍賣令有機會多於去年。

(星島日報)

Hong Kong home prices join global surge

Global house prices are rising at their fastest

rate since 2006, with home prices in Hong Kong rising 2.1 percent for

the year ended March, the latest report by property agency shows.

Its Global House Price Index, which covers average

prices across 56 countries and territories, increased 7.3 percent in

the year to March.

Hong Kong was placed 46th on the list in terms of 12-months growth among those markets.

In Hong Kong, Wing Tai Properties (0369) will launch 37 units of Oma Oma in Tuen Mun on Sunday, 5-7 percent more expensive than the last batch.

The developer revealed a new price list yesterday.

It covers studio flats to three-room units with an average price of

HK$14,678 per square foot after discounts. Among them, 31 flats are

priced at below HK$10 million.

In other news, Hip Shing Hong named its project at

No 5 Victory Avenue in Ho Man Tin as Madera Garden. The developer plans

to start sales this month. It will upload the brochure and price list

and open a show flat to homebuyers within the month.

David Fong Man Hung, managing director of the

developer, estimated housing prices would rise by 5 percent to 7 percent

this year. However, he said he did not expect prices to surge as

citizens are facing challenges to afford a home.

In the commercial market, more properties of the

late property tycoon Tang Shing-bor, also known as Uncle Bor, were sold

by the family.

Tang's family sold a shop at 39 Chatham Road South

in Tsim Sha Tsui and another at 165 Sai Yee Street in Mong Kok for

HK$324 million combined.

This means that the family has sold a total of 10 properties in the past couple of weeks, cashing in more than HK$900 million.

Separately, Chow Sang Sang Jewellery (0116) said

the company's sales in recent quarters have recovered, thanks to a low

base from a year earlier, and it is maintaining a target of opening 100

stores this year.

The company said it will install Octopus devices in local jewelry stores to prepare for the upcoming digital voucher scheme.

(The Standard)

Hong Kong’s rising home prices, luxury flat sales push property deals to a two-year high at US$11.3 billion in May

Turnover

rose 2.9 per cent month on month to HK$87.6 billion (US$11.3 billion)

last month, the highest after HK$90.32 billion reached in May 2019

Property

agent expects first-half turnover to reach an all-time high of HK$395

billion, surpassing the previous record set in the first half of 1997

Bullish investors pushed

the value of property transactions in Hong Kong to a 24-month high last

month, helped by rising house prices and luxury flat sales.

The value of transactions

rose 2.9 per cent month on month to HK$87.6 billion (US$11.3 billion)

in May, according to figures from Land Registry on Wednesday. It was the

highest since May 2019, when the turnover stood at HK$90.32 billion.

However, overall

transactions, including homes, shops, industrial and office units, eased

2 per cent month on month to 8,965 in May, the government data showed.

“The data indicates more

demand for expensive properties, as homes worth more than HK$10 million

recorded significant growth last month,” property agent said. The trend

will continue this month, the agent added.

Amid growing optimism

over the strength of Hong Kong’s economic recovery and the pandemic

being brought under control in the city, an increasing number of

investors are choosing to park their capital in property. Hong Kong

ended six consecutive quarters of economic decline caused by the

coronavirus pandemic, posting a 7.8 per cent growth in the first

quarter, the strongest in 11 years. Unemployment fell to 6.4 per cent in

April from 7.2 per cent in February.

The agent pointed to the

success of new project launches, most of which were sold out last month.

He said close to 300 out of 380 units at South Land

project near Wong Chuk Hang MTR station were sold at an average price

of over HK$20 million, while the number of transactions of lived-in

homes costing more than HK$10 million climbed to 1,064 deals, the

highest in two years.

Hong Kong’s lived-in home

prices also extended gains for the fourth straight month in April,

taking them to their highest level since July 2019, data from Rating and

Valuation Department showed last week. They are within about 1.5 per

cent of a historic high recorded in May 2019, before the anti-government

protests kicked off.

With more potential

investors hastening their buying decisions fearing further increase in

home prices, the number of new homes sold jumped 47.8 per cent month on

month in May to 1,558, while their value rose to HK$26.9 billion, the

most since HK$32.6 billion reached in May 2019, property agency said.

Apart

from luxury flats, investors were also channelling capital into car

parking spaces, taking advantage of the removal of extra stamp duty on

non-residential transactions in November.

The agent said sales of car parking bays jumped 18 per cent month on month in May.

the

property agency said that the buoyant property market sentiment could

push first-half transactions to an all-time high of HK$395 billion and

in the process overtake the previous record of HK$388.8 billion set in

the first half of 1997.

(South China Morning Post)

The

Executive Centre bought by KKR and Tiga Investments as pandemic spurs

consolidation of Hong Kong’s flexible workspace sector

Deal marks the latest consolidation in an industry that has been restructuring amid the global downturn triggered by Covid-19

TEC

has more than 150 centres in 32 cities and 14 markets, including China,

Japan, South Korea, Southeast Asia, Australia and the Middle East

Hong Kong-based flexible

workspace provider The Executive Centre has been acquired by

private-equity firm KKR and Tiga Investments for an undisclosed amount,

the company announced on Tuesday.

It marks the latest consolidation in an industry that has been restructuring amid the global downturn triggered by Covid-19.

“We are pleased to

welcome KKR and Tiga Investments to The Executive Centre as our new

investors,” said Paul Salnikow, founder and chief executive officer of

TEC. “It’s a powerful partnership, well matched to drive the continued

performance and growth of TEC.”

The acquisition indicates

the confidence of investors in the flexible office space segment,

according to analysts, even as the likes of US-based WeWork have been

giving up space in Hong Kong.

WeWork has reduced its

footprint by more than half since the coronavirus pandemic triggered

widespread work-from-home arrangements last year.

The consortium of KKR and

Singapore-based Tiga acquired its stake from funds advised by HPEF

Capital Partners and CVC Capital Partners, which owned 70 and 20 per

cent of TEC respectively. HPEF was an investor in TEC since 2005, and

CVC since 2014.

TEC declined to discuss

the acquisition terms but in 2019, amid the social unrest that brought

Hong Kong to a standstill, the company paused its decision to go public

and sell shares for US$750 million, which would have allowed HPEF and

CVC to dispose of their stake in the company.

“KKR and Tiga are

acquiring a strongly profitable business at every level,” said Salnikow,

who reiterated that the company is still pursuing a long-term growth

target of 20 per cent in terms of expansion. TEC currently has more than

150 centres in 32 cities and 14 markets, including China, Japan, South

Korea, Southeast Asia, Australia and the Middle East. Its annual

turnover is in excess of US$237 million.

“The long-term growth

rate of 20 per cent is still something that we want to achieve over the

next five years, but will we continue to grow 20 per cent this year,

next year, and the year after? Unlikely. The right opportunity [will

come from being] more thoughtful about expansion this year and taking

advantage of market opportunities more aggressively in 2022 and 2023,”

said Salnikow.

TEC is adding more centres this year in Tokyo, Hong Kong and India and has a line-up of expansions in Australia.

The acquisition of TEC was “expected”, given that the segment has been consolidating, according to property agent.

“With the economy

rebounding, many businesses are taking a cautiously optimistic approach

to expanding,” the agent said. “Flexible working space provides are a

perfect platform for these companies as they do not need much upfront

capital investment to set up.”

The flexible office

space, or co-working, segment can provide a solution for companies

adapting to a new normal in which employees spend more time working from

home.

“We believe flexible office leasing will remain a long-term strategy for occupiers,” another agent said.

The consolidation in the

industry in Hong Kong began in 2019, when the city was riven by

political instability, and continued last year when the pandemic hit.

This served to “eliminate some weak players”, according to another

agent.

“In the long term,

co-working space is viable, but operators should provide more

value-added services to tenants such as organising business activities

and seminars,” the agent said.

(South China Morning Post)

Hong Kong’s street shops in flux as pandemic upends businesses, creates new opportunities

April

saw 186 shop transactions, an 18 per cent increase over March,

stretching a rally of three months and marking a 56-month high

The worst has passed, as far as shops are concerned, market observer says

Hong Kong’s street shop

landscape has transformed dramatically following the outbreak of the

coronavirus pandemic, reflecting the changing fortunes of investors and

industries amid the unprecedented dislocation it has caused.

Some investors, including

property industry heavyweights, are buying shops at low prices while

others are selling them, partly because some businesses are struggling.

According to the Land Registry, shop transactions rose for a third month

in April, adding 18 per cent over March to 186 , and marking a 56-month high.

“Many of those active

before the coronavirus outbreak are [now] selling shops. Very often,

those who sell shops are in industries affected [by the pandemic]”, said

Edwin Lee, founder and chief executive of Bridgeway Prime Shop Fund

Management.

The buying and selling of

shops reflects the changing fortunes of industries, with banks,

cosmetic chains, bakery chains and investors related to The Center acquisition

selling shops since the coronavirus pandemic started, Lee said. For

instance, banks were selling shops because of virtual banks – they do

not need so many branches now, he said.

Many of those who are

buying now are those who had stayed silent in the market for a long time

and wanted to “buy low”, Lee said. There are also new investors who are

exploring alternative property investments, or shops for their own use.

“The worst time for the

shop market has passed,” Lee said, adding that the prospect of travel

bubbles, consumption vouchers and the government’s plan to buy shops had

led to a feeling of optimism. Transaction volumes will surge by one to

1.5 times this year from about 1,000 deals last year, Lee said. Shop

prices in residential districts will appreciate by 20 per cent to 30 per

cent, while those in core districts will rise 10 per cent to 15 per

cent, he predicted.

E-commerce, particularly

during the pandemic, had also triggered a change of fortunes. Every

consumption market sees changes, property agent said. “This time, the

difference is big,” the agent said. “This does not [diminish] the

importance of shops. Shops will be [used] for new industries.”

The agent has spent about

HK$168 million (US$21.7 million) on three shops since February. These

include a shop in Percival House, across Times Square in Causeway Bay, which cost him HK$66.8 million.

“We think the shop market

has bottomed out. So we started to enter the market for investments. It

starts with prime [properties]. Shops in core districts are

particularly valuable – it was not easy to buy one in the past 10

years,” the agent said. “In the last two years, there has been social

unrest and the coronavirus outbreak. So the market was very unusually

battered, time after time.”

Founder of an agency

group said his charity foundation bought a shop for recurrent income

recently. The 1,400 sq ft property at Lee Hing Building in Mong Kok cost

about HK$47 million.

“The timing was about

right, as rents had fallen quite a lot. [But] the pandemic is about to

fade -investors need to take a step early [and] consider the prospects,”

the agent said. The agent also attributed the “difficult” business of

shops to a wave targeting and scaring away mainland Chinese consumers

during the city’s anti-government protests.

But Beijing will, in the

long term, encourage people to visit and shop in Hong Kong as “China and

the US are struggling” and “Beijing wants to prove that, even under US

sanctions, Hong Kong has room for development”, the agent said.

Some investors, however,

are looking to shrink their portfolios. The family of “shop king” Tang

Shing-bor, who died recently, has set its asking prices for 39

properties worth about HK$4.15 billion that it is putting up for sale,

according to a list recently circulated by agents and confirmed by the

Stan Group, Tang’s company.

The most valuable

property on the list is the 14-storey Woon Yin Building in Wan Chai,

which has been priced at HK$390 million. It was listed by property

agency in September last year at an indicative price of HK$400 million.

“The group will continue

to sell noncore projects in response to market opportunities, as well as

actively look for local potential investment projects to optimise its

investment portfolio,” Stan Group’s spokeswoman said.

(South China Morning Post)

For more information of Office for Sale in The Center please visit: Office for Sale in The Center

For more information of Grade A Office for Sale in Central please visit: Grade A Office for Sale in Central

For more information of Office for Lease in Times Square please visit: Office for Lease in Times Square

For more information of Grade A Office for Lease in Causeway Bay please visit: Grade A Office for Lease in Causeway Bay

foodpanda擴充 平25%租時代廣場 2層

疫情衝擊商務活動,不過亦有個別行業疫市下生意不跌反升,更可趁商廈租金下跌有所擴充。外賣平台foodpanda,租用銅鑼灣時代廣場兩層寫字樓,達3.8萬平方呎,作為擴充業務及升級。至於經營網購的HKTVmall,據悉亦擴充物流中心樓面。業內人士指,租金下跌加上疫情緩和,個別企業近期重啟擴充,惟僅佔少數。

市場消息指,銅鑼灣時代廣場寫字樓錄得大手租務,涉及2座23及24樓全層,每層面積約1.9萬平方呎,合共約3.8萬平方呎,以每平方呎約45元租出。據悉,該廈高峰期呎租高見60元,如今回調約25%,亦是近期較少錄得大手租務。

涉3.8萬呎樓面 呎租約45元

據了解,新租客為外賣平台foodpanda,該品牌最近從多方面宣傳,包括請來知名藝人拍廣告。事實上,疫情期間因晚市禁堂食及市民減少外出,叫外賣的比例大幅增加,令該平台甚受歡迎。

今年首4個月,foodpanda在香港外賣市場市佔率達51%,位居首位。據悉,該公司目前租用上環商廈,如今預租時代廣場兩層作擴充業務,亦可升級至銅鑼灣地標商廈。

另外,支付服務商BBPOS亦有所擴充業務,消息指,集團原租用荃灣如心廣場低層單位約1.6萬平方呎,如今擴充至全層,面積約2.1萬平方呎,呎租料22元。該公司為全球大型支付終端供應商及首批供應行動刷卡機公司。

除了商廈外,亦有企業擴充物流中心樓面。消息指,青衣豐樹物流中心全層單位,面積約14.7萬平方呎,以每平方呎約15元租出。

據了解,新租客為經營網購的HKTVmall,集團早於2016年,租該廈全層樓面,如今擴充業務。

疫情期間市民網購需求上升,該公司生意在疫情下大增,故需要更多樓面,作儲倉等之用。

代理:機構控成本 租金仍向下

對於有個別行業進行擴充,代理分析,疫情下涉及網購、外賣及科技等公司,生意沒受明顯影響,甚至上升,經過一年疫情後,相關機構預計後市轉好,有擴充業務空間。

同時,商廈租金過去一年下跌,機構若生意保持穩定,便趁租平擴充寫字樓。整體市況上,該代理指出近一兩個月市場上漸有機構查詢擴充業務,情況是去年極罕見,惟整體來說不算多,機構仍以控制成本為主,故相信商廈租金仍會向下,空置率未見明顯回落,而九龍區因租金較便宜,亦吸引機構搬遷省租金,跌幅較低,全年料跌1至2%。

(經濟日報)

更多時代廣場寫字樓出租樓盤資訊請參閱:時代廣場寫字樓出租

更多銅鑼灣區甲級寫字樓出租樓盤資訊請參閱:銅鑼灣區甲級寫字樓出租

中環甲廈呎租111.8元 跌1.1%

商廈空置率偏高,租金持續向下。數據顯示,中環整體甲廈租金按月仍跌約1.1%,過去一年租金跌約14%。

較去年跌約14.1%

據代理每月商廈租金統計顯示,中環整體甲廈呎租報111.8元,按月跌約1.1%,較去年跌約14.1%,而區內超甲廈呎租為131.3元。

中環租金跌幅略為收窄,而上月甲廈租金跌幅,主要來自邊綫地區,如銅鑼灣最新呎租為60.5元,按月跌3.1%,而鰂魚涌租金亦較上月跌約2.3%,兩區跌幅較核心區為高。

近期市場錄得租務不算多,中區租務主要來自搬遷活動,包括中國人壽富蘭克林資產管理租用交易廣場全中高層全層,面積約1.3萬平方呎,呎租約120元,機構原租用同區長江集團中心 3樓,如今作出搬遷。此外,同區亦錄律師樓租用約克大廈 3層,亦屬同區搬遷。

外資預租太古坊二座 港島最大

本年港島區最大宗租務成交於港島東錄得,私人銀行瑞士寶盛,預租明年落成的太古坊二座多層,涉約9.2萬平方呎樓面,平均呎租約65元。機構現租用中環國金一期等樓面,搬遷料可節省大筆租金。

代理指出,疫情下機構「去中環化」大勢持續,以節省租金支出,該行預計港島東有新商廈落成,吸引中環租客遷至,料該區租金水平及空置率相對穩定。

(經濟日報)

更多交易廣場寫字樓出租樓盤資訊請參閱:交易廣場寫字樓出租

更多長江集團中心寫字樓出租樓盤資訊請參閱:長江集團中心寫字樓出租

更多約克大廈寫字樓出租樓盤資訊請參閱:約克大廈寫字樓出租

更多中環區甲級寫字樓出租樓盤資訊請參閱:中環區甲級寫字樓出租

更多銅鑼灣區甲級寫字樓出租樓盤資訊請參閱:銅鑼灣區甲級寫字樓出租

更多鰂魚涌區甲級寫字樓出租樓盤資訊請參閱:鰂魚涌區甲級寫字樓出租

本地疫情緩和下,市場接連錄得多宗商廈大樓面租賃成交,當中不乏核心區甲廈獲青睞,反映企業對經濟前景重拾信心,對設立辦公室據點態度轉趨樂觀,而中環商業地王截標在,勢必進一步推高核心地段甲廈市場氣氛,誘使不少業主乘時推售單位,而屬金鐘指標甲廈的力寶中心及海富中心,分別有連裝修優質單位放盤。

力寶中心連裝修戶 每呎叫租40

代理指,有業主放租金鐘區甲級寫字樓,分別為金鐘道89號力寶中心一座高層07至08室,面積約1,680平方呎,現以每平方呎約40餘元招租,單位望山景,景致舒適開揚,同時附有寫字樓全裝修,並已分間經理房及會議室等,亦將連部份傢俬出租,為準租客節省一大筆裝修費及翻新時間,屬現時市場上最受歡迎的租盤之一。

海富中心中高層連約 呎價3.5萬

至於,另外兩個單位,均位處金鐘夏愨道18號海富中心一座,分別放租及放售,出租單位位處中高層20室,面積約946平方呎,意向呎租約45元;單位已備有寫字樓裝修,租客可即租即用,為物業增加吸引力;而放售的單位屬同層21室,面積約943平方呎,現以意向呎價約3.5萬元放售,上址連租約,現時每平方呎租金收入約48元,租期至2023年,適合投資者購入收租。

參考市場上兩幢甲級寫字樓新近成交,其中力寶中心一座中層10至11室,面積約2,440平方呎,以約14.6萬元租出,平均呎租約60元,而海富中心一座新近租務成交,可參考高層單位,面積約2,041平方呎,月租約10.9萬元,平均呎租達53元。

該代理指,受社會事件及新冠肺炎疫情影響,與經濟環境相聯繫的寫字樓市場已沉寂好一段時間,而經過近兩年調整期,疫苖面世加上通關事宜逐步落實,寫字樓市場漸露曙光,外資及內地企業過去一段時間都難抵港物色寫字樓,而隨着經濟市道有所好轉,本港核心區甲級商廈價格又見回調,料上述租、賣甲廈單位可吸引租客及投資者青睞。

(經濟日報)

更多力寶中心寫字樓出租樓盤資訊請參閱:力寶中心寫字樓出租

更多海富中心寫字樓出租樓盤資訊請參閱:海富中心寫字樓出租

更多金鐘區甲級寫字樓出租樓盤資訊請參閱:金鐘區甲級寫字樓出租

更多海富中心寫字樓出售樓盤資訊請參閱:海富中心寫字樓出售

更多金鐘區甲級寫字樓出售樓盤資訊請參閱:金鐘區甲級寫字樓出售

商業活動需時恢復 空置續高企

環球疫情緩和,惟商業活動需時恢復,機構仍以收縮業務為主,需求未見反彈,加上供應漸多,空置率高企料維持一段時間。

第4波疫情近尾聲,市民接種疫苗加快,本地疫情受控,商業活動陸續重啟,包括市民重新外出消費,帶動零售市場。至於寫字樓租務市場,始終關鍵是環球局勢。歐美接種疫苗加快下,疫情大幅改善,陸續放寬防疫措施,商業活動慢慢恢復。

4月甲廈空置9.5% 升0.1百分點

本港甲廈新租務需求,多來自外資跨國機構租樓面,疫情期間環球封關,令甲廈活動大減,商廈連續多季錄得負吸納情況。目前環球疫情改善,惟跨國企業重新擴充海外業務,仍要待各國通關,現時似乎尚有一段距離。

據代理最新數字顯示,4月底整體甲廈空置率為9.5%,按月升0.1個百分點,而中環甲廈空置率為7.5%,按月升0.2個百分點,而尖沙咀及東九龍,仍維持雙位數。從而可見,甲廈租務活動仍疲弱,最近錄得租務,多來自機構搬遷,包括中環同區搬遷,或遷出中環以節省租金,卻極少擴充個案,故整體甲廈吸納情況未有明顯改善。

下半年展望上,目前為止環球仍有不少地區疫情仍頗嚴峻,環球商務活動仍難以短時間回復疫情前,相信新需求難以大幅反彈,令本港甲廈商廈高空置情況仍持續。值得留意,明年將為甲廈高峰期,多達300萬平方呎樓面推出,並分布在核心區中環、非核心區港島東,新興商業區啟德,供應大幅增加,機構更多選擇作搬遷,令租金進一步受壓,而空置率料短期也難回調。

(經濟日報)

更多中環區甲級寫字樓出租樓盤資訊請參閱:中環區甲級寫字樓出租

更多尖沙咀區甲級寫字樓出租樓盤資訊請參閱:尖沙咀區甲級寫字樓出租

更多九龍灣區甲級寫字樓出租樓盤資訊請參閱:九龍灣區甲級寫字樓出租

更多觀塘區甲級寫字樓出租樓盤資訊請參閱:觀塘區甲級寫字樓出租

麥格理再退租國金一期樓面 中金公司每呎120元頂租 平舊約33%

在新冠肺炎疫情下,不少企業改變工作模式,減少租用寫字樓樓面,從而節省租金開支。澳洲投資銀行麥格理原租用中環超甲級商廈國際金融中心一期 (下稱國金一期) 4層共8萬方呎樓面,去年初提早退租1.6萬方呎樓面後,新近再退租多1萬方呎樓面,先後撤出共2.6萬方呎樓面,逾一年內縮減32.5%租用面積。最新退租的18樓1萬方呎樓面,已由中資的中金公司頂租,呎租120元,較麥格理承租的租金下跌33.3%。

僅餘5.4萬呎 較首次入駐縮55%

據了解,麥格理自2008年起租用國金一期18樓至23樓共6層,總租用面積約12萬方呎,作為香港區總部。經多年續約及減租樓面後,在2019年續租時只餘下18、20、22及23樓共4層,租用面積共約8萬方呎,呎租約180元,涉及月租約1440萬元,租期至2022年9月底。

不過,其後本港受社會事件及新冠肺炎疫情的連番打擊,經濟環境急轉直下,不少跨國企業收縮規模以節省開支。麥格理去年4月率先提早逾兩年退租20樓3室至15室共13個單位,租用面積共1.6萬方呎,令該層只餘下約4000方呎繼續租用。據悉,該1.6萬方呎提早退租單位,已由共享工作空間承接。

雖然麥格理去年已減租樓面,但縮減規模的步伐持續,最新再進一步減租18樓5室至14室共10個單位,涉及租用面積共1萬方呎,只繼續租用該層一半樓面。連同去年4月退租的20樓在內,麥格理在過去超過一年時間內,共減少租用2.6萬方呎樓面,佔2019年續租總面積約32.5%。現時只餘下5.4萬方呎樓面繼續租用,較2008年首度租用國金一期的樓面,大幅削減55%規模。

市場人士表示,麥格理早在去年底推出18樓的樓面招頂租,至近期因應市況好轉,獲得中資中金公司洽租,終以每呎120元頂租相關樓面,月租約120萬元,呎租較麥格理兩年前續租時的180元低33.3%。資料顯示,中金公司在國金一期早已承租兩層半樓面,但依然在同一大廈內尋求位置作擴充。

私銀寶盛港總部遷太古坊二座

反之,外資以縮減規模、節省支出為主,瑞士私人銀行寶盛集團 (Julius Baer Group Ltd) 早前亦決定,把香港總部由國金一期遷到明年落成的鰂魚涌甲級商廈太古坊二座。該行現時租用國金一期37樓至39樓共3層,租用面積共4.8萬方呎;另在同區交易廣場二座承租兩層,面積共2.5萬方呎,日後將一併整合中環兩個辦公室至非核心區商廈,料可減少租金開支最少逾六成。

(信報)

更多國際金融中心寫字樓出租樓盤資訊請參閱:國際金融中心寫字樓出租

更多交易廣場寫字樓出租樓盤資訊請參閱:交易廣場寫字樓出租

更多中環區甲級寫字樓出租樓盤資訊請參閱:中環區甲級寫字樓出租

嘉民斥3.68億購九龍灣貨運中心

工廈物業有價有市,再錄大手成交,九龍灣三湘九龍灣貨運中心高層全層,以3.68億連8個貨車位售出,買家為澳洲嘉民物流集團。

據土地註冊處資料顯示,三湘九龍灣貨運中心高層全層,於上月中以3.68億成交,買家以公司名義TAI

YIP INVESTMENTS NO.2 LIMITED登記,公司創辦成員為GOODMAN ASIA

LIMITED,註冊董事為李偉豪及BAGGIE HUGH JOHN SIDDELEY。

據業內人士指出,上述成交連8個上落貨車位,全層面積約69700方呎,呎價約5279元;同時,資料顯示,嘉民物流集團於今年3月以1.82億購入該廈低層B室,連4個上落貨車位成交,故該集團於3個月內合共斥資5.5億購入該廈單位。

面積約6.97萬呎

該外資集團近期於本港頻頻購入工廈物業,資料顯示,於今年2月以5.7億向森信紙業購入觀塘海裕工業中心半幢業權。該集團於多區均設有物流中心。於2018年更以27.51億投得屯門小冷水路物流地皮,樓面呎價約3228元。

另一方面,甲廈市場亦錄租賃成交,市場消息指出,金鐘力寶中心一座低層01室,面積約1991方呎,以約79640元租出,呎租約40元,屬市價水平。

(星島日報)

更多力寶中心寫字樓出租樓盤資訊請參閱:力寶中心寫字樓出租

更多金鐘區甲級寫字樓出租樓盤資訊請參閱:金鐘區甲級寫字樓出租

耀才葉茂林2.1億購怡和街鋪 鄧成波家族連環沽貨 佳明兩億購鐵路大廈鋪

「鋪王」鄧成波於上月突離世,該家族陸續沽貨套現,最新售出銅鑼灣怡和街麥當奴大廈地鋪,由耀才證券主席葉茂林以2.1億承接,另外,旗下尖沙嘴漆咸道南鐵路大廈地鋪亦以2.068億售出,買家為佳明集團。鄧成波家族於兩日內連環沽出6項物業,套現約6.85億。

佳明集團昨日公布,以2.068億購入鐵路大廈地下B鋪,面積約6700方呎,呎價30866元,而連同毗鄰的商鋪 (現為旗下新盤明翹匯售樓處),該集團全數擁有鐵路大廈地下商鋪業權。

葉茂林:疫情回穩睇好後市

佳明集團營業及市務總監顏景鳳表示,是次成交價屬合理水平,該物業具穩定租金回報,並可配合集團物業發展大方向,市區優質鋪位屬罕有供應,鐵路大廈位處區內商業區,各項配套均不俗。

該集團現時全數持有鐵路大廈地下連地庫及1樓鋪位,樓面約3.05萬方呎,另外,該集團總部亦設於同一辦公大樓的18、19及22樓,總樓面積約6.29萬方呎。

顏景鳳:具穩定租金回報

據土地註冊處資料顯示,原業主以公司名義財邦有限公司持有,註冊董事為鄧成波及鄧耀昇。

兩日售六物業套現6.85億

另一方面,該家族亦售出銅鑼灣怡和街46至54號麥當奴大廈地下A及F地鋪及地庫全層,作價約2.1億,買家為耀才證券主席葉茂林,以總樓面約7566方呎計,呎價約27756元。資料顯示,鄧成波家族於2016年以2.038億購入,持貨5年帳面獲利僅620萬,物業期間升值約3%。

葉茂林昨日向本報表示,該鋪位處核心區地段,租金收入達45萬,享租金回報約2.57厘,屬不俗水平,隨疫情逐步回穩,他對後市感樂觀,環球經濟持續量寬,手上資金亦需尋找出路。

(星島日報)

更多鐵路大廈寫字樓出售樓盤資訊請參閱:鐵路大廈寫字樓出售

更多尖沙咀區甲級寫字樓出售樓盤資訊請參閱:尖沙咀區甲級寫字樓出售

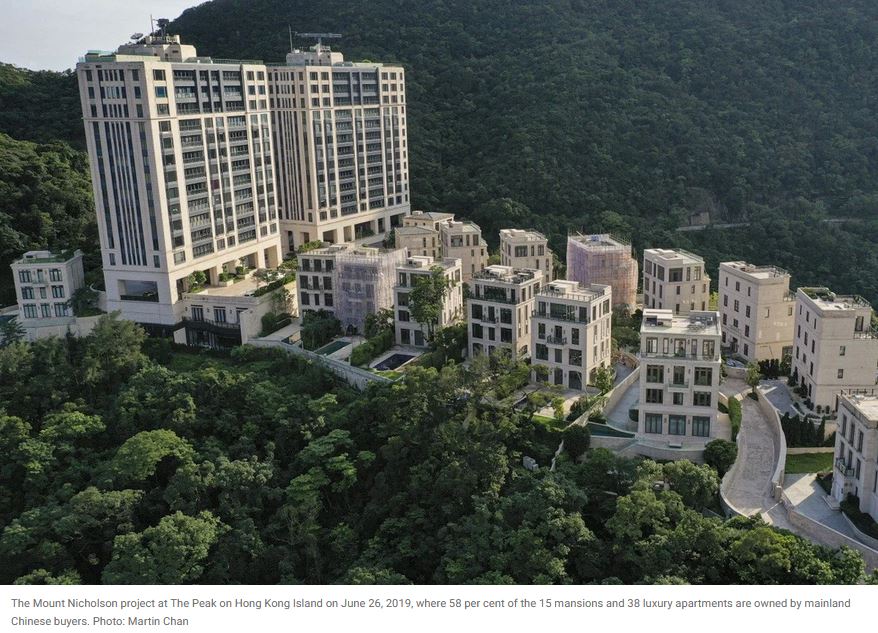

Honk if you're shocked: parking space on Peak sells for $10.2m

A

parking space in Mount Nicholson on The Peak has been sold for HK$10.2

million - more than 50 percent higher than the previous record of HK$6.6

million in Ultima at Homantin Hill and enough to buy a two-room unit in

upscale Tai Koo Shing.

It

is believed to be the most expensive parking spot in the world, agent

said. The agent noted that there are parking spaces in Manhattan's SoHo

district in New York City that are priced at US$1 million each (HK$7.8

million).

As the prices

of luxury flats soar and the rich are willing to pay, it is natural for

parking spot prices to grow accordingly, agent said.

Mount

Nicholson was codeveloped by Nan Fung Group and Wharf, with Wheelock

Properties responsible for sales. The developers have sold several

parking spaces recently by tender, with a minimum price of HK$9.3

million, according to a property agent.

The

late tycoon Stanley Ho Hung-sun's fourth wife, Angela Leong On-ki - who

spent HK$1.3 billion for four flats in Mount Nicholson as gifts for her

two daughters - is also among the buyers of parking spaces, said Terry

Ng Sze-yuen, chief executive at L'Avenue, the holding company for

Leong's properties.

Wheelock

chairman Stewart Leung Chi-kin said the prices were at market level

after discussion with the residents since the project is facing a

shortage of parking spaces. A spokesperson of the developer confirmed

that parking spaces in the luxury project were launched via tender

earlier.

The brochure

showed that each space covers 135 square feet, which is slightly bigger

than the smallest unit of T Plus in Tuen Mun which is 128 sq ft.

The per-sq-ft price of the HK$10.2 million parking space comes in at around HK$75,556.

Mount

Nicholson is being developed in three phases, offering 67 units in

total, including 19 houses and 48 flats. Since 76 parking spaces were

put for sale in phase two and phase three, this suggests a

parking-space-to-unit ratio of nearly 1.5 times.

In

2017, developers sold two flats in Mount Nicholson for nearly HK$1.17

billion combined, with an average price of HK$132,100 per sq ft, making

them the priciest flats in Asia at the time.

The

record was broken in February by CK Asset's project at 21 Borrett Road.

The selling price was HK$460 million, with an average price of

HK$136,000 per sq ft.

(The Standard)

Pavilia Farm draws rush to register

New

World Development (0017) received about 27,000 registrations of intent

from potential buyers for the 331 flats in the first two price lists of

the third phase of The Pavilia Farm above Tai Wai Station.

The flats were nearly 80 times oversubscribed, the highest number of registrations since 1997.

The

developer previously released 149 flats in the second price list of the

third phase at an average price of HK$21,368 per sq ft after discounts,

6.9 percent higher than the first batch.

The developer will offer 331 flats in the first two price lists for sale tomorrow.

The first phase of the project received more than 22,700 registrations of interest in the first round of sale.

Meanwhile,

Henderson Land Development (0012) will offer 28 flats at The Upper

South in Ap Lei Chau for sale today. They are offered at between HK$4.39

million and HK$7.2 million, or between HK$23,606 per sq ft and

HK$27,381 per sq ft after discounts.

In

the luxury property market, Chen Yongyan, the wife of former Olympic

gymnast Li Ning, bought a 2,945-sq-ft flat at 21 Borrett Road in

Mid-Levels for HK$232.8 million, or HK$79,049 per sq ft.

And Sun Hung Kai Properties (0016) sold a 2,760-sq-ft house at Shouson Peak for HK$194 million.

(The Standard)

代理料今年甲廈租金跌8%

受疫情等因素重創,甲廈觀望氣氛瀰漫,租金跌勢未止。有外資代理行指,受空置率持續高企影響,料今年整體甲廈租金下跌5%至8%。

該代理昨日發表了最新的市場報告。代理認為,中環核心區甲廈空置率今年4月沒有進一步惡化,惟高空置率對租金構成一定壓力,租金向下趨勢持續,預計今年港島區甲廈全年下跌5至8%。

明年上半年料反彈1%至3%

代理續指,雖然有部分寫字樓仍有較高空置率,惟疫情持續緩和,經濟環境改善,投資者恢復信心和失業率下跌,相信整體港島區甲廈租金將於今年下半年穩定下來,港島區甲級寫字樓租金將有機會在2022年上半年反彈,租金有望回升1至3%。

代理指,去年總零售銷貨額按年跌近25%,受疫情影響,令網購更普及化,相信比例持續上升,因此對商鋪需求或減少而令市場對租金長遠受壓,料整體鋪租今年跌約10%至15%。

代理指,隨着疫情回穩,預期今年一、二手住宅銷售量將達至約6至6.2萬宗,高於去年的5.9萬宗。現今樓價僅較2019年高位低2.2%,在現時購買力仍然強勁下,新盤銷情理想,相信有機會蔓延到二手市場,預期今年住宅樓價表現比預期好,預計一般住宅樓價上升3%,豪宅樓價料上升5%。整體而言,以600萬至1000萬中細價物業及超級豪宅表現較好。

(星島日報)

工商舖買賣高位反覆 6月試衝700宗

代理表示,工商舖市道進一步好轉,相信登記量會受盤源多寡影響而偶有波動,但目前升市大方向未改,6月登記量有望試上700宗。根據代理資料所得,2021年4月全港共錄得693宗工商舖物業買賣登記 (數字主要反映2至4星期前市場實際狀況),較3月的618宗上升12%,連升2個月,創下24個月新高,已走出社會事件及疫情陰霾;至於期內買賣合約總值錄得132.23億元,按月勁升99%,主要受惠月內有較多逾億元的大額登記刺激。

按工商舖3個物業類別劃分,工廈按月登記量仍然佔最多,並逐漸逼近400宗水平,創24個月高位。4月全月工廈錄得382宗登記,按月上升9%,佔整體工商舖成交達55%。當中升幅貢獻有不少來自銀碼介乎1,000萬至2,000萬元以內及2,000萬至5,000萬元以內組別的登記,期內分別錄得43宗及20宗,按月各升72%及150%。而在中高價類別登記暢旺下,4月工廈買賣金額大升87%,錄得約53.28億元。

商廈125成交 按月升13%

商廈買賣登記量則穩步向好,但仍是3類物業中,宗數佔比最少者。隨着整體經濟出現復甦,買賣漸趨熱鬧,帶動4月商廈登記進一步上升,4月商廈買賣登記共有125宗,按月升13%;當中尤以1億元或以上的大銀碼表現較亮麗,單月錄得8宗登記,較對上1個月的零成交明顯加快,亦帶動4月整體商廈買賣登記金額按月激增3.84倍,錄得近53.31億元。

至於店舖買賣登記量方面,4月繼續拾級上升,連漲3個月,印證零售消費市道持續回暖。數據顯示,4月店舖錄得186宗登記,按月再升18%,為工商舖中升幅最大的類別。不過,升幅主要集中在細價物業,而5,000萬元以上者則錄得跌幅,故亦拖累月月內店舖買賣登記總額背馳回落,只錄得25.63億元,按月減少4%。

代理指出,目前整體市場氣氛依然旺盛,復甦勢頭持續,料在輕微整固後,預期落入6月的整體工商舖登記量可再次回升,並嘗試突破700宗的又一關口。

(經濟日報)

疫情穩定 舖位交投明顯加快

近一個月疫情明顯穩定,零售及餐飲氣氛轉好,帶動商舖交投明顯加快,由大碼至中、細碼商舖,均錄得成交。

利嘉閣(工商舖)工商舖資料顯示,2021年4月全港共錄186宗店舖買賣登記﹙數字主要反映2至4星期前的實際市況﹚,較3月的158宗再升18%,連升3個月並創56個月(即逾4年半)以來新高,反映店舖市道進一步轉旺。

按物業價格劃分,在7個價格組別當中,共有3個組別的登記量報升,升幅介乎15%至156%不等。當中以200萬至500萬元以內組別的登記量升幅最可觀,由前月的16宗增至上月的41宗,升幅多達1.56倍。至於2,000萬至5,000萬元以內及500萬至1,000萬元以內的2個價組別亦分別升17%至35宗。

耀才證券葉茂林2.1億購銅鑼灣舖

最近商舖成交焦點,盡在鄧成波家族旗下物業上,舖王波叔早前離世,其家族近日明顯加快沽貨。近日沽出較貴重物業為銅鑼灣怡和街46至54號地下及地庫,地下面積1,230平方呎,地庫面積約6,121平方呎,合共約7,351平方呎,現由電訊店以每月45.5萬元租用,以約2.1億元成交。據悉,鄧成波於2016年以2.038億元購入,早前曾以約2.8億元放售,直至最近再降價,終以約2.1億元易手,減價約25%。持貨5年轉手,僅平手離場,據知,新買家為耀才證券葉茂林。

另外,該家族亦連環沽出旺角大樓面舖位,包括以約8,100萬沽出新填地街142至144號地下至2樓酒樓舖位,面積合共約8,030平方呎,現由酒樓以每月18.7萬元租用。據悉,業主原叫價約8,500萬元,減價約5%沽出。據悉該物業早於1992年以約600萬元購入,持貨29年轉手,獲利約7,500萬元離場。另外,旗下荃灣楊屋道118號立坊地舖連1樓,地舖面積4,492平方呎,而1樓則大約5,088平方呎,合共約9,580平方呎,以約1.2億元沽出。

投資者炒灣仔道舖 月內賺600萬

市場買賣成交增,更錄得短綫獲利個案。如灣仔道87號地下及閣樓,面積合共約1,100平方呎,以約3,700萬元易手,舖位以交吉交易。原業主為投資者,上月初以約3,100萬元購入,持貨不足1個月,獲利約600萬元。另西營盤第三街56至72號地下,面積約800平方呎,以約2,750萬元成交,原業主持貨5個月,獲利約900萬元。

分析指,疫情近期轉穩定,市民重新外出消費,令商舖買賣氣氛轉好,加上個別投資者如鄧成波家族積極沽貨,吸引投資者重投舖市,令成交量及金額同步上升。預計疫情持續穩定下,整體市況亦向好,若下半年中港通關,舖市投資氣氛料更為熾熱。

(經濟日報)

Mount Nicholson車位1020萬售 全球最貴

造價可買太古城2房 會德豐:屬市價

香港樓價冠全球,連帶車位造價亦貴絕全球。山頂Mount Nicholson以招標形式發售車位,其中一個車位以1,020萬元售出,問鼎全球最貴車位,銀碼足夠購買一個太古城的2房單位。

九倉 (00004) 及南豐合作發展的山頂Mount

Nicholson,早年推售時12樓C及D室以11.65億元售出,平均呎價13.21萬元,登上全亞洲最貴分層樓王寶座,紀錄近月才被打破。據了解,發展商4月份開始以招標形式推售15個車位,招標文件顯示該批車位底價介乎880萬至950萬元,惟項目業主全屬超級富豪,出手相當闊綽,有指1號車位以1,020萬元售出,另一個92號車位則以930萬元售出,兩者均打破全港車位造價新高紀錄,1號車位更問鼎全球最貴車位寶座。

不過,相關車位目前仍未於成交紀錄冊顯示,發展商回應指,Mount

Nicholson早前以招標形式推售車位,暫未有詳情公布。會德豐地產主席梁志堅回應傳媒查詢指,Mount

Nicholson車位是一般市價,銷售價格已經與住戶商討過才推出。又指已經應承住戶車位價錢,不會額外提高。

賭王四太掃入6個車位

據資料顯示,Mount

Nicholson共提供48伙分層單位及19幢洋房,而分配予分層單位的車位則共有76個,平均每戶有1.5個,比例應該足夠。惟業主全屬超級富豪,車位需求殷切,有指持有2套相連單位的賭王四太梁安琪購入6個車位,大鴻輝集團梁紹鴻則購入4個車位。尚嘉執行董事兼行政總裁吳士元回應查詢指,四太有買入Mount

Nicholson車位,但不是買最貴那個。

資料顯示,原本全港最貴車位由何文田天鑄去年以660萬元創造,消息指中半山寶珊道1號有車位以690萬易手打破紀錄。但新紀錄旋即被Mount Nicholson造價拋離。

有指Mount Nicholson昨日又有20個車位發售,有造價達1,200萬元,若以每個車位面積135平方呎計,呎價約8.9萬元,貴過不少中半山豪宅。

資深投資者吳賢德認為,從投資角度看,逾千萬元買車位未必有投資價值,但因為物業屬山頂超豪宅,車位對於豪宅業主屬必需品,相信他們買入車位亦不是用作投資收租;加上物業戶戶價值逾數億元,一個車位逾千萬元其實亦合乎比例。

(經濟日報)

李寧妻2.3億 首置21 BORRETT ROAD

中層2945呎5房間隔 呎價約79049

名人接連入市本港豪宅新盤,根據土地註冊處資料,半山區西部波老道21號新盤21 BORRETT ROAD第1期中層單號室,實用面積2,945平方呎,屬5房間隔,近日以2.328億元,連兩個車位成交,呎價約79,049元。

資料顯示,新買家為陳永妍 (CHEN YONG YAN),與中國退役體操運動員、有「體操王子」之稱、兼中國體育品牌李寧 (02331) 的創辦人及主席,李寧的妻子陳永妍之姓名相同,故不排除為同一人。

據EPRC經濟地產庫資料,陳永妍早於2015年中以695萬元買入灣仔嘉薈軒中層11室,實用面積約358平方呎,呎價約19,413元,惟陳氏於本年5月中以700萬元將上述單位轉售給其丈夫李寧,意味她上月「甩名」後,可以重獲首置身份。

除名自製首置 慳稅逾2500萬

而是次陳永妍購入21 BORRETT ROAD單位,需付相等於樓價4.25%的印花稅,反映她以首置名義入市,變相慳稅逾2,500萬。

另外,中半山花園台3座中層B室,4月底以1.02億元,並連兩個車位成交。EPRC經濟地產庫顯示,上述單位的實用面積為2,943平方呎,屬3房間隔,呎價約34,659元。

而土地註冊處資料顯示,新買家為關陳燕坤,相信是曾擔任監警會委員、建造業訓練局主席、匯賢智庫成員及香港建造商會副會長等多項職務的關治平的家族成員。

原業主早於1998年底以1850萬元承接「摸貨」,他持貨近23年,現時易手帳面獲利8350萬元,物業升值約4.5倍。

(經濟日報)

太興主席銅鑼灣商廈 持貨6年賬蝕463萬

太興集團 (06811) 主席陳永安及相關人士去年起連番蝕讓沽出物業,新近再以3537萬元售出銅鑼灣怡和街22號3樓全層商廈單位,持貨6年,賬面虧損463萬元離場。

土地註冊處資料顯示,銅鑼灣怡和街22號3樓1至3室,建築面積合共2493方呎,以3537萬元易手,呎價約14188元。據了解,該單位去年曾以4000萬元放售,今年初減至3600萬元,成交價較最初叫價低11.6%。上述單位由3間不同公司持有,但公司董事俱為太興集團主席陳永安、執行董事劉漢基及袁志明,於2015年8月以合共4000萬元購入,賬面蝕463萬元,貶值11.6%。陳永安及相關人士今年3月以4380萬元售出中環威靈頓街174至178號低層地下

(Lower Ground Floor) C舖,持貨近4年,賬面虧損620萬元或12.4%。

另外,長沙灣活化工廈作商業用途的永康街79號創匯國際中心亦錄得蝕讓,單位為5樓A室,建築面積約1149方呎,以1034萬元成交,呎價約8999元。原業主於2017年5月向恒地 (00012) 一手購入,當時作價約1097.63萬元,現沽出賬面虧損63.63萬元,4年間物業跌價5.8%。

(信報)

更多創匯國際中心寫字樓出售樓盤資訊請參閱:創匯國際中心寫字樓出售

更多長沙灣區甲級寫字樓出售樓盤資訊請參閱:長沙灣區甲級寫字樓出售

Pavilia Farm sells out as more flats put on market

New World

Development (0017) has released 338 flats in the third price list for

the third phase of The Pavilia Farm above Tai Wai Station at an average

price of HK$22,600 per square foot after discounts, 13 percent higher

than the first price list.

The 338 flats measure between 307 sq ft and 1,022 sq ft.

The

cheapest flat, measuring 307 sq ft, is offered at HK$6.89 million, or

HK$22,440 per sq ft, after a maximum 20 percent discount is applied.

NWD expects to launch the second round of sales on Saturday.

The

developer has collected about HK$4.37 billion after selling all the 331

flats in the first two price lists at the third phase on Saturday.

NWD

had received about 27,000 registrations of intent from potential buyers

for the 331 flats, making them 80 times oversubscribed, and the highest

number of registrations since 1997.

Meanwhile, CK Asset (1113) has raked in about HK$640 million after selling three flats at 21 Borrett Road in the Mid-Levels.

In

the secondary market, an property agency reported 19 secondary deals at

10 blue-chip housing estates over the past weekend, down by 9.5 percent

from a week before.

A 284-sq-ft flat at City One Shatin in Sha Tin changed hands for HK$5.68 million, or HK$20,000 per sq ft.

The seller, who bought the flat for HK$1.05 million in 2001, will gain HK$4.63 million.

(The Standard)

商用物業價料見底 冀通關反彈

樓市轉暢旺,豐泰地產投資管理合夥人暨投資長朱惠德認為,本港住宅長期供不應求,故疫情下價格沒回調,下半年仍向好。至於受正面衝擊的商用物業,他謂價格已見底,惟等待通關才有望反彈。

近兩個多月疫情緩和,住宅市場即轉旺,新盤銷售熾熱。朱惠德分析,住宅樓價一直沒回調,基本因素是供應不足,「住宅已提過很多年供不應求,半年前疫情期間,我亦表示睇好住宅市場,因為剛性需求好強,特別低息環境。現時不夠供應,累積需求很大,近期成交如中價物業、豪宅造價均理想,新盤銷情已反映。」

豪宅市場上,他指即使成交量不多,造價屢創新高,亦反映整體市況甚佳,下半年樓價相信仍硬淨,「量化寬鬆下,全世界股市暢旺,兼享低息環境,樓價硬淨。要留意通脹是短暫還是長遠,全球量化寬鬆下短暫出現通脹,長遠要睇經濟動力。下半年樓價是否尚有很大升幅?可能僅平穩發展輕微向升,成交量肯定會多。」

農地轉用途 指政府實在太慢

豐泰透過收舊樓增加土地儲備,發展住宅,關於供應不足,他則一再提到政府應該簡化批則過程,令發展商加快興建以增加供應。「政府在農地轉用途上實在太慢,舊樓重建以前快得多,現在很多限制。」他又以海外物業發展與港比較,「豐泰在日本、韓國及澳洲起樓,批則快得多,在日本興建酒店,涉及百多間房,由買地至入伙僅23個月,香港要4年半時間。當地一個政府部門處理,香港卻由多個部門進行,流程太慢。」

住宅項目上,集團與資本策略合作的山頂道項目現推售中,據悉部分單位亦獲承接。

相比之下,疫情對商用物業衝擊,明顯較住宅高,因商務活動叫停,旅遊業一潭死水,寫字樓、商舖屢現空置,租金向下,朱惠德指,香港是國際金融中心,旅遊城市,疫情可謂「食到應」。香港一直依靠國際機構、歐美或內地產業,封關很難有增長,國際機構不能派員來港視察。他認為,近日工商物業買賣及租務成交,造價回穩,已是轉好迹象,「租售價從高位回調1至2成或以上,相信已見底,通關後反彈可望加快,而通關的基本條件是打疫苗。」

餐飲不可代替 商舖有需求

零售物業上,以地區商場表現較佳,豐泰早年購入將軍澳全新商場項目,目前出租率達9成,包括人氣超市donki,「香港人無得去旅行,留在港消費,支持本土零售及餐飲。受疫情最大衝擊是核心區商舖及酒店,因涉及旅遊業。但民生區商舖租金表現好,生意穩定。」

環球疫情持續一年多,市民為免感染,減少外出上班或消費,衍生了「在家工作」,並增加網購。當中涉及商廈及舖位樓面,需求會否出現結構改變?他則認為,亞洲區住屋細,較難在家工作,效率頗低未必會長久,機構或採個別日子容許員工在家工作,但租用樓面沒減少。

網上購物方面,他指電子商貿無疑是趨勢,香港發展較慢,惟餐飲是不可代替,必定對商舖有需求。

(經濟日報)

上海街四幢物業叫價4.5億

代理表示,旺角上海街712、714、716及718號共4幢5層高的全幢物業,意向價約4.5億元,將以現狀及連現有租約出售。

項目總地盤面積約3990方呎,面向上海街,被規劃為住宅 (甲類) 用途,按項目地積比率9倍計算,最高可建樓面面積約35910方呎,重建發展潛力優厚。

同時,物業座落於旺角核心地段,步行前往港鐵太子站或旺角站出口僅約3至4分鐘步程,突顯其位置優越。

(信報)

星光行中層戶叫價1800萬

代理表示,尖沙咀星光行中層14室連租約出售,面積約878方呎,業主意向售價約1800萬元,呎價2.05萬元。

該代理行指出,單位間隔四正實用,坐擁罕有維港全海景觀,光猛開揚。物業設有9部客梯及2部貨梯,單位鄰近其中一個電梯大堂,用戶上落方便,同時配備獨立冷氣系統,適合用戶安排彈性工作時間。

(信報)

更多星光行寫字樓出售樓盤資訊請參閱:星光行寫字樓出售

更多尖沙咀區甲級寫字樓出售樓盤資訊請參閱:尖沙咀區甲級寫字樓出售

天星中心全層意向5060萬

觀塘區近年發展迅速,區內工廈亦備受追捧。天星中心高層全層以意向價5060萬放售,為海景優質戶,呎價約8800元。

代理表示,上述放售物業為觀塘鴻圖道35號天星中心高層全層,面積約5750方呎,以意向價約5060萬放售,呎價約8800元。鄒氏表示,是次屬罕有高層,單位間隔實用,擁有特高樓底,更可享有壯闊全海景,景觀開揚。大堂設計時尚,設有3部載客升降機,上落方便快捷,大廈亦設有多個私家車及貨車停車位,適合各大集團進駐作總部,屬投資首選。

高層5750呎

據代理資料顯示,該工廈近期成交為中層全層,面積5687方呎,於去年5月以4750萬售出,呎價約8352元;另一宗成交為高層全層,面積5042方呎,於2019年5月以5300萬易手,呎價約10512元。

至於租賃方面,該廈低層1室,面積1670方呎,於今年5月以3.2萬租出,平均呎租約19元;另一宗為高層06至07室,面積2760方呎,於今年2月以49680元,平均呎租約18元。

(星島日報)

更多觀塘區甲級寫字樓出售樓盤資訊請參閱:觀塘區甲級寫字樓出售

深水埗數舖5千萬成交 持貨51年升值125倍

細價舖交投仍旺,深水埗大埔道地下多個舖位,以約5,000萬成交,51年升值125倍。

深水埗大埔道76至84號華僑大廈地下1、2、3、4號舖位易手,涉及面積合共約4,000平方呎,現由遊戲機中心、眼鏡舖、髮廊及水果檔等租用,月租合共約14.4萬元,物業以約5,000萬元易手,呎價約1.25萬元,回報率約3.5厘。

據悉買家為盛滙商舖基金,該基金指打算分間成約10間舖位出售,每間舖定價約1,000萬至1,200萬元,預期套現約1億至1.2億元。

原業主1970年3月以39.5萬買入,早前以約6,500萬元放售,現減價約23%沽貨。持貨51年轉手,升值約125倍。

另代理表示,觀塘鴻圖道35號天星中心高層全層放售,合共約5,750平方呎,意向售價約5,060萬元,折合每平方呎約8,800元。

(經濟日報)

New World’s latest property launch sells out as Hong Kong’s homebuyers return in droves amid buoyant sentiments

The developer of The Pavilia Farm Phase III in Tai Wai sold all 331 flats before 8pm, with 27,000 bids received

Unsuccessful buyers today may be able to bid for the next batch of property released at a later date

New World Development has

reported another sell-out property launch, as Hong Kong’s real estate

investors piled into the city’s biggest weekend sale since November,

their confidence boosted by a tapering coronavirus situation in the

city.

The developer of The

Pavilia Farm Phase III in Tai Wai sold all 331 flats on offer before 8pm

for HK$4.37 billion (US$563.4 million) in sales revenue. A record

27,000 registrations of interest were received through

New World’s smartphone

application, or 82 bids for every available flat on average.

Unsuccessful buyers today may be able to bid for the next batch of

property released at a later date.

“The economy is gradually

improving, with the gross domestic product rising and unemployment rate

falling,” property agent said, adding that the agent expects today’s

offerings to “definitely sell out.” “The pandemic is also beginning to

be under control. These are beneficial to the overall housing market.”

The brisk transactions at

The Pavilia Farm put Hong Kong’s residential property prices on track

to set a record and race ahead of the tentative recovery in the city’s

economic growth pace. Hong Kong could see more than 2,500 new homes sold

and up to 6,000 lived-in homes changing hands this month, Po said.

Homes prices could rise 2 per cent this month and break records soon,

the agent added.

The Pavilia Farm, a joint

project with Hong Kong’s subway operator MTR Corporation, features

3,090 apartments of various sizes. Up to 2,100 units in phases I and II

had been sold since October 2020. Phase III, due for completion in June

2023, comprises 892 flats. The units on offer today started at 310

square feet, going up to 1,022 sq ft (95 square metres), priced from

HK$6.7 million to HK$24 million.

The average price in

today’s sale rose to HK$19,999 per square foot even with up to 20 per

cent in discounts, 0.8 per cent higher than Phase II last October and 6

per cent higher than Phase I.

There

were 54 bulk purchases, involving buyers who snapped up more than one

property each, the biggest deal being one valued at HK$69 million,

agents said.

The

recent ease in pandemic and anticipation for border reopening are

heating market sentiment and adding to buyers’ confidence, another agent

said, adding that the robust demand could accommodate a price increase

of between 3 and 5 per cent in the upcoming launches.

“The

Pavilia Farm [has broken] a 20-year record for subscriptions for the

second time,” said New World’s chief executive Adrian Cheng. “The group

will develop more patented products to deliver sophistication and

convenience to residents, satisfying their need for a higher quality and

healthier lifestyle.”

The

project is also located with proximity to public transport and

amenities such as shopping centres. The lack of new property

developments in the neighbourhood, reasonable pricing and robust rental

yields are all contributing to The Pavilia Farm’s success, said Po.

(South China Morning Post)

Hong Kong parking spot sells for record US$1.3 million, bolstering Mount Nicholson’s claim as world’s most expensive address

A parking bay in the tiny neighbourhood of Mount Nicholson on The Peak fetched over HK$10 million (US$1.3 million)

The previous world record for a parking bay was also in Hong Kong, when it went for HK$7.6 million in October 2019

A car parking bay at the

exclusive Mount Nicholson development on The Peak sold for more than

HK$10 million (US$1.3 million), smashing a world record set in 2019,

according to a source familiar with the sale.

The developers Wharf

(Holdings) and Nan Fung Group sold 29 parking spaces in phase two and

three of the luxury project through a closed tender to homeowners last

month, with one of the spots selling for over HK$10 million, the source

said.

With a standard parking

space measuring around 134.5 sq ft (12.5 square metres), the transacted

price works out to HK$74,350 per square foot. The previous record was

HK$7.6 million, set in October 2019, at The Center, a 73-storey office tower in Central.

“It is definitely the most expensive car parking spot in Hong Kong,” property agent said.

Car-parking space is so

expensive in Hong Kong that it has turned into a subsector in itself,

for speculators to buy and sell parking bays in rapid succession to make

a quick profit. At the height of the speculative fervour, 8,968 slots

worth HK$16.64 billion were recorded in 2018, the most since records

began in 1996, according to the agency.

The asset class is again

witnessing increasing transactions as sentiment improves among property

investors, who are taking advantage of the extra stamp duty on

non-residential transactions that was eliminated in November. Another

property agency said on Wednesday that sales of car parking bays jumped

18 per cent month on month in May.

For flats ranging from

4,200 sq ft to 4,600 sq ft each, costing between HK$400 million and

HK$600 million each at Mount Nicholson, the agent said that the owners

spending around HK$10 million for a parking spot was not a big deal.

“What

concerns them most is that they need space to park their cars and not

the money. They have bought it for their own use and not as an

investment,” the agent said.

One owner, who did not want to be named amid concerns for his safety, told the South China Morning Post

that he paid more than HK$36 million for four parking bays last month,

each costing over HK$9 million. He said the developers’ starting price

was HK$8.8 million per spot.

He said each flat owner

had the right to buy 1.5 parking spots. As he owned three flats, he said

he was able to buy four parking spots, adding that one his neighbours

bought six as she owned four flats.

All the transactions for the parking spaces were conducted last month, the source said.

Stewart Leung, chairman

of Wheelock Properties, the sales agent of Mount Nicholson, said the

prices of the parking spaces were in line with the market.

“We consulted the owners

before finalising the estimated value for the parking bays,” he said. He

declined to disclose the selling prices.

Mount Nicholson sealed its reputation as the priciest address in Hong Kong, with the most expensive unit in Asia in 2017.

In November 2017, a buyer

named Lin Zhong-min paid HK$1.16 billion for two units on the same day,

according to Land Registry records. That buyer paid HK$560 million for a

4,242 sq ft four-bedroom unit, about HK$132,000 per square foot, on the

12th floor. On a square-footage basis, it is now the second most

expensive residence in Asia. The same buyer also paid HK$600 million, or

HK$131,000 per square foot, for a 4,579 sq ft unit on the same floor.

In February, a buyer

named Yin Xi paid HK$459.4 million, or HK$136,000 per sq ft for a 3,378

sq ft apartment at CK Asset Holdings’ 21 Borrett Road luxury residential

project in Mid-Levels, making it Asia’s most expensive apartment on a

square foot basis.

Other

flat owners at Mount Nicholson include Alice Ho Chiu-yan, daughter of

the late Macau casino tycoon Stanley Ho Hung-sun, who paid HK$646

million for two adjoining units on the ninth floor. Sabrina Ho

Chiu-yeng, her sister, bought two adjoining units on the 10th floor for

HK$644.6 million in 2017.

Industry

observers said that the supply of parking spaces in exclusive

developments such as Mount Nicholson would be limited, as the price of

land in Hong Kong’s most exclusive address has surged over the past 10

years because of low supply.

“If

there is a demand for parking spaces, owners have to buy it from the

developer, and they won’t sell it cheap,” property agent said.

(South China Morning Post)

For more information of Office for Lease in The Center please visit: Office for Lease in The Center

For more information of Grade A Office for Lease in Central please visit: Grade A Office for Lease in Central

Exodus of Hongkongers triggered by national security law unlikely to dent city’s home prices, say analysts

The

city’s famously lofty home prices, which were subdued by the pandemic,

are once again on the rise and approaching previous highs

They

are unlikely to be tamed by a wave of people leaving in the wake of the

controversial security law seen as limiting their freedoms

A

wave of people leaving Hong Kong in the wake of 2019’s social unrest

and the later introduction of a controversial national security law has

proved insufficient to dampen the city’s famously lofty property market.

Home

prices, which took a small hit from the coronavirus pandemic, are once

again on the rise and approaching previous record highs. The reasons are

numerous, and include a lack of supply and the fact not everyone

leaving chooses to sell up, according to analysts.

“While

a higher level of migration may be unfavourable to residential prices,

the negative effect is likely to be minimal as it is insufficient to

turn around the severe supply-demand imbalance,” agent said. “In fact,

on the contrary, this current wave of migration may have the net effect

of triggering a higher transaction volume, supporting mass residential

prices.”

The

number of applications for certificates required for visas, and

withdrawals of Mandatory Provident Fund (MPF) savings on the grounds of

permanent departure from Hong Kong has risen in recent months. Many

Hongkongers are looking to move overseas to escape what they perceive to

be the erosion of certain freedoms by an increasingly bold Beijing.

For

instance, in the third quarter of 2020, withdrawals from the city’s

retirement savings scheme reached 8,100 cases, compared to a quarterly

average of 7,600 cases in 2019, according to data from Mandatory

Provident Fund Schemes Authority.

But the exodus will probably not translate to a slowdown in the housing market, say analysts.

“Historical

precedence shows that a higher level of migration out of Hong Kong,

with the assumption that many of them sell their properties, was not

necessarily going to drive prices down,” agent said.

Between 1985 and 1997, about 576,000 residents emigrated from Hong Kong, according to BBC Chinese citing Security Bureau data.

During

that period, mass residential prices climbed by more than 7.5 times, at

an average of 19.6 per cent per year, according to the government’s

Rating and Valuation Department, while the economy enjoyed average

annual nominal growth of 14.2 per cent. Residential prices appeared to

be little affected by the wave of migration, according to property

agency.

“Not

everyone who leaves has a property,” said Kevin Tsui, associate

professor at Clemson University in South Carolina, a Hongkonger who

often comments on the city’s affairs. “For those leaving Hong Kong, not

everyone sells their homes. Many of them heard about [people] leaving

around 1997 selling their properties and not being able to afford one

again after that.”

Tsui

said some of those emigrating because of Hong Kong’s political

situation are likely to wait and see what happens, and may decide to

come back one day.

There

are also a lot of “new Hongkongers” – mainland Chinese who have

recently acquired permanent residency in the city – ready to snap up

homes vacated by emigrants. “This leads to a minimal change in overall

demand,” Tsui said.

The

Chinese or Hong Kong governments may try to offset any possible changes

in home prices caused by emigration, with measures such as relaxing the

restrictions on home purchases by mainlanders, Tsui added.

Hong

Kong’s secondary home prices could rise by 5 to 10 per cent in 2021,

driven by the highest loan-to-value ratios in a decade and ample

liquidity, said Patrick Wong, senior industry analyst at Bloomberg

Intelligence.

“Average

home prices rose 4.7 per cent year-to-date according to property

agency’s data, suggesting that we have many more buyers to bid up the

prices despite the increase [in the] number of sellers due to the wave

of emigration,” Wong said.

The

recent spike of households planning to leave Hong Kong could boost the

value of annual secondary home sales to the highest level since 1997,

Wong said. The number of such transactions could increase 35 to 45 per

cent year-over-year to somewhere between 56,000 to 60,000 units this

year.

(South China Morning Post)Two South Horizons homes fetch $23m

The

lawmaker for the insurance sector, Chan Kin-por, has sold two connected

units at South Horizons for HK$23 million, which is HK$3 million lower

than the asking price, while some new projects in Southern District were

well-received.

Market sources said Chan sold the

1,279-square-foot flat for HK$24.5 million but he clarified the selling

price was HK$23 million.

The two three-bedroom units were originally offered for HK$26 million.

Chan bought the two flats in 2011 for HK$6.87 million and HK$7.01 million.

Henderson Land (0012) recorded the first forfeited case for The Upper South at Ap Lei Chau.

The prospective buyer of a 183-sq-ft flat, worth HK$4.34 million, forfeited the deposit of HK$216,800 after canceling the deal.

The Upper South had sold 54 units in the first round of sales as of yesterday.

The tender sale of Jumbo Court Carpark in Wong

Chuk Hang, comprising eight stories of car-parks which provide a total

of 509 parking spaces, will be opened until July 15.

Meanwhile, the chairman and chief executive of

Miramar Group (0071), Martin Lee Ka-shing, said that the hotel's

occupancy rate ranged from about 30 percent to 50 percent in the first

half, rebounding by more than 10 percent year-on-year.

Lee said at the annual meeting that he believes

the occupancy rate will recover to somewhere near the pre-Covid level as

long as more people get vaccinated and the economy fully recovers.

Staff can enjoy paid leave of two days for

receiving one vaccination, the group said, adding that it may offer

HK$1,000 cash if the vaccination rate among staff increases to 70

percent and HK$2,000 for 85 percent.

(The Standard)

As rents decline to 2003 levels in major Hong Kong shopping districts, retailers lock in long-term leases at cheaper rents

Rents in Central, Causeway Bay, Tsim Sha Tsui and Mong Kok have returned to 2003 levels

Some

retailers even expect to make a profit in the next three to four years,

once the border with China reopens, property agent said

Retail rents in some

of Hong Kong’s main shopping districts have fallen to levels last seen

in 2003 – and this has prompted some to lock in long-term leases for

street shops.

Rents in Central,

Causeway Bay, Tsim Sha Tsui and Mong Kok, four of Hong Kong’s major

shopping areas, have returned to 2003 levels, when the city’s retail

sector largely relied on local spending.

“Retailers think they

can survive at current rent levels,” property agent said. Some even

think they could make a profit in the next three to four years, once the

border with mainland China reopens, the agent added.

Over the past 18

months, the sector has recorded its worst downturn on record. And as the

likes of Topshop, Gap and JCrew have either exited or scaled down

operations in Hong Kong amid political unrest and the Covid-19 pandemic,

others are taking advantage of lower rents to expand or even move into

better locations.

These retailers were

also optimistic about a potential rise in consumption, agent said. They

were betting on spending sentiment being boosted by the rewards worth

more than HK$80 million (US$10.3 million) being offered by the city’s

business community to drum up interest in vaccinations, as well as the

government’s electronic consumption voucher scheme being rolled out as

early as August.

Retailers dealing in

daily necessities and lifestyle products were committing to street shops

because rents were so low, another agent said. “They are expected to

have a better sales performance than the luxury sector, whose sales rely

highly on tourists,” he said.

Elsewhere, US fashion

brand Brandy Melville was taking over a shop vacated by luxury

watchmaker Rolex on Russell Street in Causeway Bay. The brand operates a

store in IFC Mall in Central, but this will be its first street shop in

Hong Kong. It is paying HK$600,000 (US$77,335) a month for the space,

70 per cent less than the HK$2 million that Rolex paid, according to

industry experts.

Last month, luxury goods retailer Dickson Concepts

(International), which operates the Harvey Nichols department store in

Hong Kong, agreed to pay HK$205.3 million for a two-storey shop in Bank

Centre Mall, next to Mong Kok MTR Station, for a period of six years,

according to its filing with the Hong Kong stock exchange. The lease,

which starts from August this year, translates to about HK$3 million per

month.

“[The Dickson Concepts

deal] is the largest retail leasing transaction so far this year, in

our records, in terms of monthly rent,” agent said. “Retail rents will

be bottoming out in the second half of this year, with drops in rents

narrowing,” the agent added.

Earlier, Aeon Stores

(Hong Kong), which operates retail chains under the Aeon brand,

including Aeon Supermarket, committed to taking up 25,000 sq ft on the

ground and first floors of Gala Place in Mong Kok. The lease, for six years, cost it HK$85.5 million, according to the company’s filing with the Hong Kong exchange.

Both Dickson Concepts and Aeon Stores declined to disclose further details about their deals.

The volume of leasing

transactions will increase, but rents are still going to decline, when

compared with last year, another agent said. “I believe we will see more

transactions in the near term, driven mainly by food and beverage

operators, edutainment as well as retailtainment, which is something

less common in the past,” the agent said.

(South China Morning Post)

For more information of Office for Lease in Gala Place please visit: Office for Lease in Gala Place

For more information of Grade A Office for Lease in Mong Kok please visit: Grade A Office for Lease in Mong Kok

疫情緩和租金回落 中環商廈租賃趨活躍

今年疫情漸見緩和,盡管現時寫字樓租賃市場仍然疲弱,但反而有利租戶爭取最佳的租賃條件,近期企業考慮搬遷寫字樓的意慾明顯增加,帶動過去數月甲級寫字樓租賃交投較去年同期顯著增加,租賃市況略見改善,各商業區中以中環最受租戶注意。

由於部分於過去數年承租新興商業區的企業陸續遷出中環或縮減在區內的規模,中環近來多了優質及大小不一的寫字樓樓面選擇,租戶較以往易於爭取較優惠的租務條款,遂吸引企業趁現時市況回落在中環承租寫字樓。

內地企業 重啟擴充計劃

現時積極在中環物色樓面的企業多為跨國企業及已在香港開設辦公室的內地企業,除了企業希望在同區搬遷以提升辦公室質素外,內地企業亦重啟擴充計劃,部分企業則為了重整辦公室的運用及設計,始終疫情改變了企業運用辦公室的策略及推出靈活工作安排的措施,有企業計劃增加員工平均佔用的辦公空間,以增加社交距離,其他則希望增加協作、會議及喘息空間,打造理想及健康的辦公室。

去年這批租戶因疫症及經濟前景未明,不願貿然承租辦公室,今年疫症緩和,加上市場預期年底經濟可望改善,決定重投租賃市場。值得注意是,現時的租賃市場主要倚賴本地跨國及內地企業的需求,若疫情持續受控及緩和,如果未來內地與港順利通關後,預期將有從未在香港開設辦公室的內地企業來港承租辦公室,租賃市場表現可望進一步改善。

內地企業一般也最鍾情中環寫字樓,有意租用中環辦公室的其他企業在通關後將面對不少競爭,若寫字樓空置率隨租務交投活躍而回落,租金的議價空間難免會收窄。中環租賃交投增加亦有望帶動其他商業區的租賃活動,對整體商廈市場有支持作用。

超甲廈將落成 中環成焦點

展望未來,2023年中環將有恒地 (00012) 發展的美利道商業項目及長實 (01113)

的長江集團中心二期兩座超甲級寫字樓落成,加上,中環新海濱商業地王亦將於今年內批出,定必吸引區內大業主競投以提升區內物業的價值,其他大型發展商相信亦極感興趣。中環已有逾10年沒有超甲級寫字樓落成,相信新海濱地王發展項目落成後,連同區內多幢新商廈,將鞏固中環作為商業核心的地位,再次成為市場焦點。

(經濟日報)

力寶中心高層戶 意向呎租40

近期市場接連錄得寫字樓大樓面租賃個案,當中不乏核心區如中環等,反映企業對經濟前景信心回升,對設立辦公室據點態度轉趨樂觀。現金鐘力寶中心高層單位招租,呎租約40元。

面積1680呎 可望山景

代理表示,金鐘區甲廈單位現正放租及放售,其中涉及較大面積為金鐘道89號力寶中心一座高層07至08室,面積約1,680平方呎,現以每平方呎約40餘元招租。代理稱,單位可望山景,整體舒適開揚。

另外,物業附有寫字樓全裝修,已分間經理房及會議房等,同時將連部分寫字樓傢俬出租,為準租客節省一大筆裝修費及時間。

海富中心中高層 呎價叫3.5萬

該代理續稱,至於另外兩個單位則位處金鐘海富中心一座,分別出租及出售。出租單位位於大廈中高層20室,面積約946平方呎,意向呎租約45元。單位已備有寫字樓裝修,租客可即租即用,為物業增加吸引力。

而放售單位則位處同層21室,面積約943平方呎,叫價每平方呎約3.5萬元。該物業將以連租約形式出售,現收呎租約48元,租期至2023年。

(經濟日報)

更多力寶中心寫字樓出租樓盤資訊請參閱:力寶中心寫字樓出租

更多海富中心寫字樓出租樓盤資訊請參閱:海富中心寫字樓出租

更多金鐘區甲級寫字樓出租樓盤資訊請參閱:金鐘區甲級寫字樓出租

更多海富中心寫字樓出售樓盤資訊請參閱:海富中心寫字樓出售

更多金鐘區甲級寫字樓出售樓盤資訊請參閱:金鐘區甲級寫字樓出售

英皇商業中心位處中環心臟地段,正對港鐵出口及交通要道,非常便利,樓面亦適合中小型企業使用。

英皇商業中心位於中環德輔道中,屬於中環傳統商業核心段,鄰近環球大廈、置地廣場,另一邊為中環街市,後方為干諾道中,亦可前往國際金融中心一期及二期,故物業絕對是處心臟地段。

正對港鐵站 交通便利

交通方面,大廈正對港鐵香港站出口,而德輔道中為巴士、電車要道,非常便利。飲食配套上,上班人士既可選擇附近大廈地舖,價格較相宜的茶餐廳、米綫店等,亦可前往置地廣場、國金2期等,有更多高格調餐廳可選擇。

每層2680呎 合中小企

物業樓高17層,即使大廈樓齡較舊,但業主曾為物業進行翻新,目前地下由銀行租用,而大廈入口位處側面。中環商廈普遍樓面不算大,而該廈每層面積約2,680平方呎,多屬全層用家,正合中小型公司。物業提供兩部升降機,通往各樓層。

間隔上,單位算四正,頗為實用,景觀方面,則主要望向德輔道中一帶樓景。

大廈租戶方面,除了傳統行業包括銀行、律師樓,亦因位處中環,亦有半零售及服務行業包括醫務所、美容中心及健身室等,針對中環高收入及消費客群。

該廈由英皇集團持有,集團於2015年,以13億元購入中環永傑中心全幢。項目樓高17層,作寫字樓用途,地下及1樓由星展銀行承租,2至17樓為共14層寫字樓,總面積約39,027平方呎,以13億元成交價計,呎價約3.3萬元。

英皇指,購入作物業投資之用。以成交價計,原業主為永傑集團,於2005年以3億元購入該廈,持貨10年轉手,大幅獲利約10億元。

(經濟日報)

更多英皇商業中心寫字樓出租樓盤資訊請參閱:英皇商業中心寫字樓出租

更多環球大廈寫字樓出租樓盤資訊請參閱:環球大廈寫字樓出租

更多置地廣場寫字樓出租樓盤資訊請參閱:置地廣場寫字樓出租

更多國際金融中心寫字樓出租樓盤資訊請參閱:國際金融中心寫字樓出租

更多中環區甲級寫字樓出租樓盤資訊請參閱:中環區甲級寫字樓出租

九龍甲廈租金穩 下半年續錄擴充

疫情有所緩和,漸有個別機構略為擴充寫字樓。代理預計,九龍區甲廈租金漸見穩定,下半年可望續有擴充個案,租金或有輕微反彈。

據代理的每月商廈統計,4月份甲廈租金整體向上,惟核心區跌幅收窄,如中環整體甲廈租金跌約1.1%,每呎約111.8元;至於上環區及灣仔區,則錄輕微跌幅。過往跌幅較細的港島東,4月份單月跌約2.3%,屬該區近期跌幅較大的月份。九龍區方面,尖沙咀及東九龍跌幅續收窄,跌約0.3%。

代理指中環核心區甲級寫字樓的空置率4月份沒有進一步攀升,維持7.9%,與3月份相若。不過,非核心商業區的空置寫字樓在本月繼續上升,灣仔及銅鑼灣的空置率則上升至12.4%及7.5%。

時代廣場寫字樓 3.8萬呎獲租

銅鑼灣時代廣場寫字樓錄得大手租務,涉及2座23及24樓全層,每層面積約1.9萬平方呎,合共約3.8萬平方呎,以每平方呎約45元租出。據悉,該廈高峰期呎租高見60元,如今回調約25%。新租客為外賣平台foodpanda,該公司目前租用上環商廈,如今預租時代廣場兩層作擴充,亦可升級至銅鑼灣地標商廈。

另外,港島東太古坊一座3層樓面,合共約6萬平方呎,以每平方呎約50元租出。據悉,該3層樓面原由一家廣告公司租用,因業務有新部署決定棄租,並於市場放盤求頂租。新租客為免稅店DFS集團,原租用尖東華懋廣場多層,如今轉租新甲廈太古坊一座,可提升物業質素。

九龍及新界區方面,支付服務商BBPOS亦有所擴充。消息指,集團原租用荃灣如心廣場低層約1.6萬平方呎,如今擴充至全層,面積約2.1萬平方呎,呎租料22元。該公司為全球大型支付終端供應商及首批供應行動刷卡機公司。

九龍灣宏天廣場呎租22 跌1成

另九龍灣宏天廣場中層全層,面積約2.8萬平方呎,以每月62萬元租出,呎租約22元,較去年跌約1成。據了解,新租客為政府部門,料作運輸署辦公室之用。

代理指,疫情令很多消費者選擇網上購物,因此擁有在綫平台的企業增長速度最快。一些奢侈時裝品牌的網購平台正在積極尋找樓面更大和建築規格更高的寫字樓,以合理租金整合後勤部門、陳列室和客戶服務中心。

九龍區方面,甲廈租賃氣氛不俗,租戶查詢和預約睇樓數字增加。大部分租賃活動集中東九龍,成交面積主要為3,000至4,000平方呎單位。後市上,該代理行指過去幾個月租金大致穩定,且考慮到失業率趨穩,料九龍區甲廈租金在未來數月將維持不變,到今年第三至第四季將出現溫和的U形復甦,市場將錄得更多的擴充宗數。

(經濟日報)

更多時代廣場寫字樓出租樓盤資訊請參閱:時代廣場寫字樓出租

更多銅鑼灣區甲級寫字樓出租樓盤資訊請參閱:銅鑼灣區甲級寫字樓出租

更多太古坊一座寫字樓出租樓盤資訊請參閱:太古坊一座寫字樓出租

更多鰂魚涌區甲級寫字樓出租樓盤資訊請參閱:鰂魚涌區甲級寫字樓出租

更多華懋廣場寫字樓出租樓盤資訊請參閱:華懋廣場寫字樓出租

更多尖沙咀區甲級寫字樓出租樓盤資訊請參閱:尖沙咀區甲級寫字樓出租

更多宏天廣場寫字樓出租樓盤資訊請參閱:宏天廣場寫字樓出租

更多九龍灣區甲級寫字樓出租樓盤資訊請參閱:九龍灣區甲級寫字樓出租

更多上環區甲級寫字樓出租樓盤資訊請參閱:上環區甲級寫字樓出租

更多灣仔區甲級寫字樓出租樓盤資訊請參閱:灣仔區甲級寫字樓出租

工商舖連續3月企600成交

疫苗接種計劃及通關有望,市場的不明朗逐漸消退,帶動工商舖穩定發展。有代理綜合土地註冊處資料顯示,5月份工商舖註冊共錄得640宗,按年升1.4倍,並連續3個月穩守600宗以上的水平。

該代理行指,5月份註冊金額亦錄76.5億元,按年升近54%。5月份各板塊均錄按年上升,工廈及商廈註冊量分別最新報350及136宗,按年分別升2.1及1.4倍。商舖註冊量亦按年升64%,最新錄154宗。5月份工商舖整體共錄得640宗註冊,按年升1.4倍,更是連續3個月企穩600宗以上,為自2017年3月到2018年9月以後首次。5月份整體註冊金額亦錄76.5億元,按年升近54%。

首5月2993宗 佔去年近8成

總計今年首5個月,工商舖註冊量合共錄2,993宗,已經佔去年全年的78%,註冊金額累積錄得366.1億元,佔去年全年的75%。

若按金額劃分,今年首5個月註冊量最多的為500萬以下的物業,共錄1,423宗,按年升158.7%,並以工廈為主。其次為500萬至1,000萬元的物業,累計734宗,按年升2.2倍。逾1,000萬至2,000萬物業錄得433宗登記,按年升約2.2倍;逾2,000萬至5,000萬亦錄得317宗,按年升1.4倍。另外,今年首5個月共錄得30宗億元買賣,按年增14宗。

代理表示,疫苗接種計劃推行及中港通關有望,市場上的不明朗因素消退,帶動工商舖交投量。工商舖註冊量已連續3個月錄得600宗以上,為近兩年半以來首次,反映市場逐漸轉趨穩定。

該代理又指,受新盤餘貨推售帶動,市場氣氛不俗,加上鄧氏家族近期大量放售物業,將進一步刺激交投並支撑後市,短期內成交量可望平穩發展,預料平均每月的註冊量可以保持在600宗以上水平。

(經濟日報)

黃竹坑珍寶閣停車場 新濠國際5億標售

車位近期投資價值升溫,現新濠國際 (00200) 標售黃竹坑惠福道3號珍寶閣停車場,合共提供509個車位,叫價約5億,平均每個近100萬

共509車位 市值月租達230萬

代理表示,港島南區黃竹坑惠福道3號珍寶閣停車場現正標售,項目為黃竹坑區內罕有大型停車場,樓高8層,合共提供509個車位,截標日期為2021年7月15日

(星期四) 下午3時正。據悉,物業市值約5億元,平均每個車位價值約98萬元。代理稱,該批車位市值月租可達230萬元。

據了解,物業由新濠國際持有,消息指,集團亦早於數年前曾標售物業,結果獲一買家以約5億元購入,惟最終撻訂,業主殺訂約5,000萬元,如今再度標售。

(經濟日報)

旺角百寶利3樓舖 25萬租跌逾半

FOREVER 21曾租用多層 健身中心進駐

早年國際品牌租用旗艦店,現分拆樓面出租。旺角百寶利商業中心多層舖,原由FOREVER 21租用,品牌遷出交吉一年多,現其中3樓獲健身中心租用,月租料約25萬元,租金跌逾半。

旺角百寶利商業中心多層樓面,曾由國際連鎖時裝品牌FOREVER