第5波疫情冲击本港商业气氛,不少人担心本港有外资撤出及营商环境受动摇。中环商厦大业主置地等相信,疫情缓和后机构将重新出发,写字楼仍有一定需求,租务活动下半年将明显改善。当中,有营运共享写字楼跨国集团认为,疫情下灵活办公概念将加强,相关的租务将上升。

本港1月份爆发第5波疫情,对商业活动造成严重冲击,因睇楼活动大减,加上中港通关暂缓,令写字楼新租务个案减少。同时,本港检疫条例较为严格,个别外资机构把部分业务迁往其他亚太地区,令人忧虑本港营商环境前景因疫情下受严重冲击。

外资代理行:甲厦3季录正吸纳

写字楼租务可反映商业活动表现,置地为中环甲厦大业主,置地公司执行董事周明祖指出,即使受第5波疫情冲击,仍接获不少新的租务查询,上月更有新租客进驻。对于本港营商前景,他认为基本因素仍然非常稳健,香港为国际金融中心,给予外资进军内地市场的战略重点,对香港前景信心十足,更指出中环的地点便利、与环球跨国企业连接的独特性进一步加强,区内租务势反弹。

据一外资行数据显示,本年首季甲厦吸纳量,为连续第3个季度录得正数,达24.5万平方呎,租赁成交以银行及金融行业租户 (34.7%) 佔比最大。据了解,由于去年下半年气氛转好,不少新租务成交于本年初落实,因此疫下市场仍录正吸纳量。

该行代理指出,近月有个别公司撤出香港,该代理认为情况并不普遍,有些机构或把旗下部分业务迁至其他亚太地区,而并非全綫撤出,另外,该代理指撤出机构基本上规模不大,故此对商厦市场大局影响轻微。

写字楼租务前景上,该代理认为亚太区整体增长动力高,而中国是投资者看重的市场,而香港有资金自由进出等优势,因此认为香港金融角色及地位不变,商厦需求在疫情缓和后便转好。该代理指,去年第4后疫情后,金融业租务较旺,除了中小型的资产管理、对冲基金等,相关专业服务业如律师楼、会计师楼亦扩充,今年情况将近似。

共享空间品牌 租全幢商厦

近月最活跃的外资机构在港扩充,相信为主打灵活办公室,共享空间品牌IWG,最近集团租用湾仔皇后大道东8号全幢商厦约8万平方呎楼面,成今年最大手租务。

IWG 香港及大湾区区域经理 Paul MacAndrew 认为,本港疫情缓和,商务活动势復常,写字楼租务活动将增加。他指,疫情下出现新常态,机构倾向採用灵活办公室计划,员工亦享受不一定在传统单一办公点上班,故灵活办公室疫下需求大。他指,去年第4波疫情完结,集团旗下香港租务,第2季及第3季按季分别升20%及34%,前景上因灵活办公室既提供便利包括写字楼装修及基本设施,租约亦较灵活,未来在港发展空间甚大。

(经济日报)

更多皇后大道东8号写字楼出租楼盘资讯请参阅:皇后大道东8号写字楼出租

更多湾仔区甲级写字楼出租楼盘资讯请参阅:湾仔区甲级写字楼出租

商厦新供应续来 租金短期难回升

疫情缓和后,商厦租务势增加,惟空置率高加上大量新供应续来,租金难有升幅,而真正反弹则要待通关落实。

全港达960万呎空置 历来最多

商厦租务市场与经济发展关係密切,在第5波疫情下各项商业活动叫停,经济即时受打击,商厦租务活动自然淡静。相反,疫情4月份渐受控,各项社交距离措施即将放宽,商业活动开始復常,租务活动定陆续出现。据不少业界人士指,近日商厦睇楼活动渐恢復,可以预期第二季租务上升。

租务活动增加,但不代表租金可以回升。商厦租金调整逾两年,直至去年尾渐喘定。据一外资代理行表示,最新甲厦空置率约11.6%,而全港达960万呎空置楼面,数量属历来最多。同时间,今明两年为甲厦供应高峰期,单计今年已有360多万呎新落成楼面。因空置楼面多,业主为吸引租客,定开出优惠条件,故此即使疫后租务增加,租金也难向上,调整期预计持续至明年。

在社会运动及疫情前,本港商厦每年吸纳量逾百万平方呎,高峰期更高见200万平方呎,惟疫下封关,内地及海外机构难在港扩充业务,而疫情下ipo活动减少,同样令金融机构等租务淡静。换言之,商厦租务市场转旺,租金要出现反弹,关键还是通关,要待内地企业及欧美机构新需求来港招展,商厦市场才稳步发展。

(经济日报)

外资基金再现身 大额吸工商物业

大额物业投资市场上,外资不仅未见撤出,近一年更是积极入市,成大手买卖市场主力买家。

业界指本港物业前景佳,加上个别范畴价格有明显调整,今年续吸引外资基金入市。

自去年下半年起,本港逾亿元大额工商物业买卖,外资基金成主要买家,去年本港多幢工厦均由基金承接。今年第5波疫情爆发,整体交投气氛转差,惟近一个月外资基金再现身,包括月初美资基金Nuveen旗下Asia Pacific Cities Fund (APCF) 以约29亿元购入葵涌货柜码头路集运中心全幢,成今年最大额买卖。

价格调整 现投资价值

有外资代理行代理认为,低息环境下外资筹集一定资金,本港物业如商厦、铺位等,价格出现明显调整,在亚太区市场中,跌幅较日本、韩国及新加坡等为高,开始出现投资价值。他指,基金投资物业的年期一般3至5年以上,现时疫情明显缓和,本港不明朗因素渐消失,故相信下半年外资基金仍活跃投资本港物业。

Weave Living伙美资 购酒店

近期市场其中一宗大额买卖,为共居空间营运商Weave Living,以13.75亿购入大角咀九龙珀丽酒店,将转作共居用途。据了解,是次Weave Living伙拍美资基金入市购酒店,Weave Living副总裁彭德仁指出,不少过往多年未有在港投资的基金,近日亦出手买酒店,反映外资看好本港市场前景。

(经济日报)

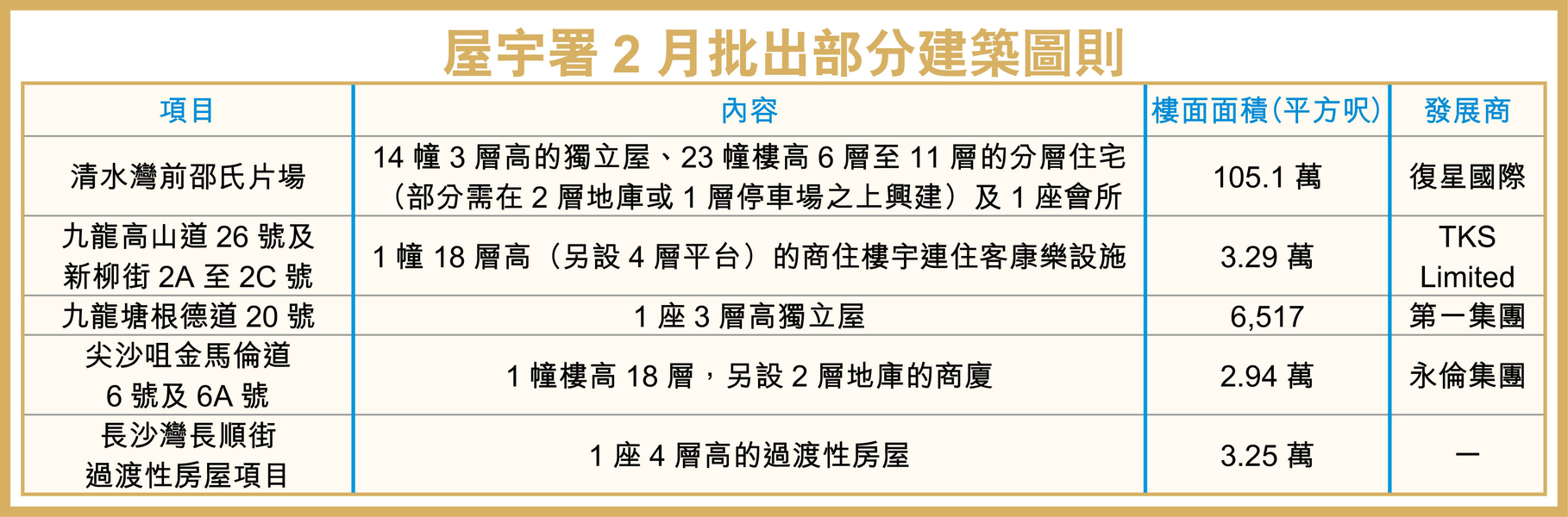

清水湾前邵氏片场 批建23幢分层及14独立屋

评为一级历史建筑的清水湾前邵氏片场,获屋宇署批建14幢3层独立屋,以及23幢楼高6层至11层的分层住宅,总楼面约105.1万平方呎,将成为区内大型住宅项目。

总楼面面积达105万呎

位于清水湾道的前邵氏片场,早于60年代开幕,曾是全球最大私营影城,并于2015年评为一级历史建筑。业主先后于2006年及2014年向城规会申请将项目发展为商住项目,而业主復星国际于2018年9月再就项目向城规会申请兴建住宅及商业等综合项目,拟建749个住宅单位、183间酒店客房等,而邵氏行政大楼、比邻的片仓、配音室等均会原址保留,2019年3月获城规会批准,而住宅部分亦获屋宇署批出。

该项目最新获屋宇署批准兴建14幢3层高的独立屋、23幢楼高6层至11层的分层住宅 (部分需在2层地库或1层停车场之上兴建) 及1座会所,总楼面面积约105.1万平方呎。

另外,屋宇署亦批出九龙高山道26号及新柳街2A至2C号项目,最新获批1幢18层高 (另设4层平台) 的商住楼宇连住客康乐设施,住用总楼面涉约2.74万平方呎,非住用楼面则涉约5,515平方呎。上述地盘去年进行强拍,并由TKS Limited以底价1.36亿元成功统一业权。

而去年由第一集团以2.5亿元购入的九龙塘根德道20号项目,最新获该署批准兴建1座3层高的独立屋,总楼面约6,517平方呎。

商业项目方面,由永伦集团购入的尖沙咀金马伦道6号及6A号项目亦获批建1幢楼高18层的商厦,总楼面面积约2.94万平方呎。

(经济日报)

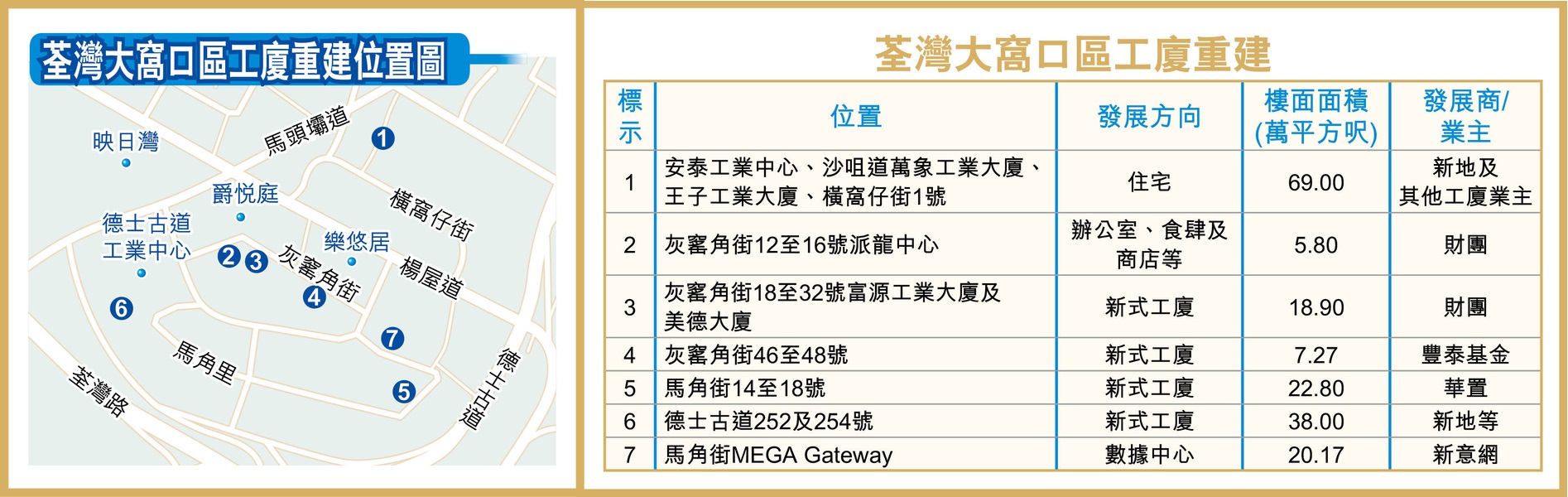

大窝口7工厦重建 增建1330伙住宅

荃湾大窝口工业区一带,近年有不少工厦重建,目前仍有7个项目,涉及约182万平方呎楼面正在进行,当中沙咀道一带渐转型成住宅区,包括新地 (00016) 牵头的住宅项目,提供约1,330伙。

荃湾区工业发展集中在两个区域,包括东面的大窝口工业区,以及西面的柴湾角工业区,当中大窝口工业区近年至少有7个工厦重建计划,将会提供约182万平方呎楼面供应。若果进一步细分,大窝口工业区分为南北两个部分,北面的德士古道、沙咀道及杨屋道交界,早年已经获规划署改划成「综合发展区」,目标是推动转型成住宅发展,包括由政府主导的居屋项目尚翠苑。

分4期发展 首期料建465伙

至于私人方面,位于沙咀道及联仁街交界的安泰工业中心、王子工业大厦及亚洲脉络中心等4幢工厦,其中一个业主新地近年积极推动重建。发展商计划以地积比率6.1倍重建,当中6倍作为住宅用途,将会兴建5幢31层高分层住宅,总单位数目约1,330伙。

项目将继续分为4期发展,当中新地旗下安泰工业中心位于第1期,将会兴建1幢31层高住宅,总楼面约20.1万平方呎,预计提供约465伙。

增87万呎新式工厦楼面

至于杨屋道以南的部分,目前仍然规划「工业」用途,故此范围内的6个工厦重建计划之中,亦有4个计划重建成新式工厦,预计可带来约87万平方呎楼面。当中规模最大属于新地等重建的德士古道252及254号项目,前身为半岛工业大厦,按照2014年批出的建筑图则,将会兴建2幢27层高工厦,涉及近38万平方呎楼面。

另外,华人置业 (00127) 于2020年向「铺王」邓成波以约3.6亿元购入的马角街14至18号栢狮电子大厦重建项目一半权益,计划重建成1幢23层高的工厦,总楼面约22.8万平方呎,预计于2024年底前完成。

财团今年初申请将灰窰角街18至32号的富源工业大厦、美德大厦,放宽地积比率至11.4倍,以准许作工业用途,并计划重建1幢22层高的工厦,另设2层地库,涉及总楼面面积约18.9万平方呎。

除了工厦重建外,新意网 (01686) 在2018年以约7.26亿元购入的前马角街熟食中心工业地,则将会用来兴建高端数据中心,涉及楼面约20.17万平方呎。

(经济日报)

PLAZA 88 呎租贴近东九龙

荃湾区内近年愈来愈多商厦及新式工厦落成,当中近年新入伙的杨屋道PLAZA 88商厦,目前呎租达23至29元,逐渐贴近九龙东观塘、九龙湾水平。

每呎租金23至29

由亿京发展的PLAZA 88,属于杨屋道商住用地的一部分,杨屋道项目由4幢大楼组成,其中3幢住宅大楼属于私楼映日湾,餘下1幢35层高商厦则为PLAZA 88,总楼面约65万平方呎,属于荃湾区内指标商厦之一。

据代理行数据显示,近半年该商厦呎租约23至29元不等。据早前有消息指,中联办亦以月租近88万元租用一层半单位,合共面积约3.5万平方呎,平均呎租约25元,属于长达5年租约,并拥有续租权。至于去年底PLAZA 88另一间高层单位,面积963平方呎,以约2.6万元租出,平均呎租约27元。

而同区南丰中心等商厦虽然楼龄较旧,但由于邻近港铁荃湾站,故此租金亦维持不俗水平。近期南丰中心平均呎租介乎约18至30元不等,部分低层单位作为零售商铺之用,租金较为理想,例如低层一个面积约505平方呎单位,月租约1.5万元,平均呎租约30元;而另一个中层单位面积约661平方呎,平均呎租25元。

(经济日报)

第一集团根德道批建洋房

近年本港房屋供应短缺,政府有序地增加房屋供应,屋宇署昨公布,今年2月批出8份住宅及商住发展,除最瞩目的屹立逾半个世纪历史的西贡清水湾邵氏片场获批38幢建筑物外,其他获批项目均以单幢项目为主,如第一集团持有的九龙塘根德道20号项目、获批建1幢3层高洋房。

2月共批11份建筑图则

据屋宇署资料显示,该署今年2月共批出11份建筑图则,其中港岛2份、九龙5份及新界4份;上述批出的图则包括8项住宅及商住发展、1项商业发展,以及2项社区服务发展;上述获批住宅图则中不乏豪宅项目、由第一集团去年斥资2.5亿购入的九龙塘根德道20号,获批建1幢3层洋房,涉及可建总楼面约6517方呎。

资料显示,第一集团于去年10月以2.5亿购入上述项目,当时每方呎楼面地价3.8万。发展商曾指,而该幢大屋将提供私人车位、泳池及花园,预计于2023年落成。

高山道26号批建商住项目

另外,亦有旧楼併购项目获批图则,由财团TKS Limited去年以1.36亿循强拍途径购入的土瓜湾高山道26号及新柳街2A至2C号,获批建一幢楼高18层、另有4层平台的商住物业,住宅部分可建总楼面约27403方呎,另有5515方呎非住宅楼面,整个项目可建楼面约32918方呎。

由财团持有的上环乐古道10号,获批建1幢楼高5层,另有1层平台的商住项目,住宅部分涉及可建总楼面约2032方呎,另有1340方呎非住宅楼面,整个项目可建总楼面约3372方呎。

此外,该署今年2月仅批出1项商业项目获批图则,为永伦集团去年斥资3.68亿购入的尖沙嘴金马伦道6号及6A号,亦获批建一幢18层高、另有2层地库的商业楼宇,涉及可建总楼面约29434方呎。

(星岛日报)

Monaco Marine sales kick off this weekend

Wheelock Properties' Monaco Marine in Kai Tak will launch the first round of sales of 308 flats this Saturday, the first new property sales since the fifth Covid wave hit the city in January.

Among the 308 flats, 306 will be on the price list, while the other two will be sold via tender, the developer said.

Homes in the price lists comprise 66 one-bedroom units, 179 two-bedroom units, and 61 three-bedroom units, and the average price per square foot is HK$25,788 after discounts, around 10 percent lower than other new projects in the same area, said managing director Ricky Wong Kwong-yiu.

The discounted prices of the homes in the three lists range from HK$7.96 million to HK$20.4 million, and the value in total reaches HK$3.7 billion, Wong said.

The 306 flats were 8.8 times oversubscribed with 3,000 checks, and the sales will take place at the Prince Hotel in Tsim Sha Tsui.

The third price list was released late Monday, offering 118 units at an average price of HK$26,293 per sq ft after discounts.

Monaco Marine's launch will be followed by the Grand Mayfair I on Yuen Long's Kam Sheung Road, whose first price list of over 143 homes is expected to be unveiled this week.

The 715-flat property is phase 1A of a 2,200-flat mega project that is being jointly developed by Sino Land (0083), K Wah International (0173), and China Overseas Land and Investment (0688).

The list will comprise one- to three-bedroom units and sales could be launched within this month, said the developers. They said showrooms are under preparation and will open to the public in the week.

In Tai Kok Tsui, the Quinn Square Mile with 614 flats is set to reveal the first price list as well as open show flats this week, said the builder Henderson Land Development (0012).

(The Standard)

Historic Shaw Studios to give way to new homes

A site in Clearwater Bay which was the former home of Shaw Studios and TVB's old headquarters is to be turned into 37 low-rise residential buildings and houses.

The landmark studio was opened in 1961 by Sir Run Run Shaw and produced Chinese movies until the 1990s.

The site, which included TVB's old headquarters, was vacated since 2003 and has been targeted for redevelopment several times.

It was sold to Fosun International (0656) in 2013 for HK$1.5 billion.

The Antiquities Advisory Board declared the complex a site of cultural significance in 2015 and said any redevelopment plans would have to include measure to preserve the existing structures.

Fourteen three-story single-family houses and 23 residential buildings ranging from 6 to 11 stories, as well as a clubhouse - providing a gross floor area of 97,628 square meters in total - will be built on the site, data from the department showed yesterday.

The project is one of the 11 building plans approved by the Buildings Department in February. Of the 11, eight are residential developments.

A project in To Kwa Wan, which was acquired by TKS through a compulsory auction last year, has been given the green light for an 18-story building which will provide a gross floor area of 2,545 sq m of private homes and 512 sq m for commercial use.

In Kowloon Tong, a three-story single-family house covering a gross floor area of 605 sq m has also won the go-ahead from the authorities.

Among commercial buildings, a plan for an 18-story tower on 6 and 6A Cameron Road in Tsim Sha Tsui was approved by the government. The project of the Winland Group is expected to provide a gross floor area of 2,734 sq m upon completion.

In the same month, the authorities gave consent for work to start on six building projects which, when completed, will provide 3,839 sq m of gross floor area for domestic use involving 70 units, and 4,712 sq m of gross floor area for non-domestic use.

The department said it has received notification of commencement of superstructure works for only one residential building project in February, involving just seven units, compared to none in January.

This means construction started on only on seven flats in the first two months of this year, a 99.4 percent plunge from a year ago, and the lowest number since 1996, according to a property agency.

(The Standard)

Hong Kong Office Rents Down 2% in Q1 as Banks Cut Back on Space

Cryptocurrency has begun to show its real-world utility as demand for office space from start-ups dealing in bitcoin, NFT and blockchain is helping to offset downsizing from multinational banks and other traditional occupiers in Hong Kong, according to a property agency’s research.

Despite experiencing a quarter when measures to control the city’s fifth wave of the COVID-19 pandemic, stock market turbulence, the Russian invasion of Ukraine and the lockdown of major mainland cities made the city noticeably quiet in terms of transaction volume, average Grade A office rents slid just 2 percent compared with the final three months of 2021, the agency’s analysts said.

Monthly rents in the quarter averaged HK$55 (about $7) per square foot, down 27.2 percent from their peak in the second quarter of 2019, the agency said in its Hong Kong Office Leasing report, with the firm predicting an extended period of challenges for owners of older buildings.

“A total of 17.2 million square feet (1.6 million square metres) net of available Grade A office space over the next four years may mean a long road to recovery for the office sector with tenant preferences shifting towards contemporary builds and green certified space,” agent said.

Upgrade Opportunities

The agency noted that multinational banks in Hong Kong have downsized their offices by at least 312,000 square feet since the second half of 2020, including a 104,000 square foot give-back by Deutsche Bank at the ICC and Standard Chartered Bank giving up 65,000 square feet at its headquarters in the Standard Chartered Bank Building in Central. Also minimising were Japan’s Nomura, which gave up 56,000 square feet at Two International Finance Centre, and UBS, which handed back 33,000 square feet across its Two International Finance Centre and Li Po Chun Chambers locations.

“Considering the impact of (work from home) and the reduction in office space take-up, Grade A office rents are likely to continue to drift down over the near term,” agent said.

While the retreat of the major banks has created openings for upstarts in the fintech sector, these smaller firms are most often finding space in newer buildings with higher levels of vacancy, including new leases signed at properties like H Code and The Wellington in Central during the period.

Also finding new tenants during the first quarter were The Chelsea and 33 Des Voeux Road West in Sheung Wan and Tower 535 in Causeway Bay.

Hong Kong’s existing vacancy of 6.2 million square feet and a pipeline of new supply totalling 11 million square feet from 2022 to 2025 will offer plenty of upgrade opportunities in the years ahead, the agency said. At the same time, the trend towards green-certified buildings will pose a challenge to owners of older properties who have not kept the assets up to date.

Staying Positive

In its own first-quarter report, another agency said that Hong Kong’s office rents stayed stable in January before leasing activities substantially slowed as the COVID situation worsened in February.

In Greater Central, which includes all of Central, Admiralty and Sheung Wan, monthly rents in the first three months of the year averaged HK$97.80 per square foot, down 0.5 percent from both the prior quarter and the year-earlier period, the agency said.

Rents in Prime Central, defined as 12 key office buildings in Greater Central, averaged $113.70, down 0.8 percent from the last quarter of 2021 and 1.3 percent from the first quarter of 2021. Only Hong Kong East and Hong Kong South showed notable drops in rental levels, down 2.2 and 1.5 percent respectively.

The city recorded positive net absorption over three consecutive quarters as of the first quarter of 2022, amounting to 245,100 square feet, with the banking and finance sector accounting for the lion’s share of new leasing transactions in the first quarter with 34.7 percent, followed by consumer products and manufacturing at 12.8 percent.

“We estimate a total net absorption of 300,000 to 500,000 square feet in 2022, with the banking and finance sector leading demand for office space, while the professional services and logistics sectors will also remain active,” agent said.

(Mingtiandi)

For more information of Office for Lease at International Commerce Centre please visit: Office for Lease at International Commerce Centre

For more information of Grade A Office for Lease in Tsim Sha Tsui please visit: Grade A Office for Lease in Tsim Sha Tsui

For more information of Office for Lease at Standard Chartered Bank Building please visit: Office for Lease at Standard Chartered Bank Building

For more information of Office for Lease at International Finance Centre please visit: Office for Lease at International Finance Centre

For more information of Grade A Office for Lease in Central please visit: Grade A Office for Lease in Central

For more information of Office for Lease at Li Po Chun Chambers please visit: Office for Lease at Li Po Chun Chambers

For more information of Office for Lease at The Wellington please visit: Office for Lease at The Wellington

For more information of Office for Lease at The Chelsea please visit: Office for Lease at The Chelsea

For more information of Office for Lease at 33 Des Voeux Road West please visit: Office for Lease at 33 Des Voeux Road West

For more information of Grade A Office for Lease in Sheung Wan please visit: Grade A Office for Lease in Sheung Wan

For more information of Office for Lease in Tower 535 please visit: Office for Lease in Tower 535

For more information of Grade A Office for Lease in Causeway Bay please visit: Grade A Office for Lease in Causeway Bay