九龙区甲厦呎租叫价较具竞争力,个别企业进驻。据代理统计,5月份九龙区整体甲级商厦空置率录得约12.61%,比4月份减少0.49个百分点,而相比去年同期则见轻微反弹,按年递增1.12个百分点。

观塘空置率 跌1.44百分点

统计4区空置情况,在尖沙咀、旺角、九龙湾及观塘中,以观塘表现最突出,最新甲厦空置率为12.83%,比上月下跌1.44个百分点。

代理表示,观塘甲厦供应充足令空置率长期维持于双位数字水平,但租金比尖沙咀及旺角一带商厦相对相宜,且个别业主叫价有所下调,因此近期亦吸引不少租客首选进驻。如观塘万兆丰中心高层D室,面积约1,915平方呎,新近以呎租约24元租出,对比旧呎租约33元,减低约27%。

至于比邻的九龙湾表现则较平稳,5月份区内甲厦空置率录得约21.13%,按月微升0.02个百分点。而旺角甲厦空置情况也有不俗改善,由4月约9.05%,回落至最新约7.98%,跌幅约1.07个百分点。

(经济日报)

更多万兆丰中心写字楼出租楼盘资讯请参阅:万兆丰中心写字楼出租

更多观塘区甲级写字楼出租楼盘资讯请参阅:观塘区甲级写字楼出租

更多尖沙咀区甲级写字楼出租楼盘资讯请参阅:尖沙咀区甲级写字楼出租

更多九龙湾甲级写字楼出租楼盘资讯请参阅:九龙湾甲级写字楼出租

更多旺角区甲级写字楼出租楼盘资讯请参阅:旺角区甲级写字楼出租

观塘陆续变天 旧楼重建前景看俏

万科香港购定富街旧楼9成业权 涉逾5亿

随着多个大型重建项目落成,加上政府有意将东九龙一带发展成为第二个核心商业区,观塘陆续变天,区内旧楼重建价值备受看好,市场消息指万科香港正收购牛头角定富街3幢旧楼逾9成业权,涉资逾5亿元。

据了解,牛头角定富街45至63号共3幢6层高的旧楼,楼龄约49至50年,共提供50个住宅单位及10个铺位,住宅单位主要为400平方呎以下中小型单位,二手买卖并不活跃。

市场消息透露,有财团对该批旧楼进行收购,目前已集齐逾9成业权。土地註册处资料显,上述旧楼日前录得2宗铺位买卖登记,成交价均为1,700万元,其中定胜楼地下3号铺,原业主2015年以225万元购入,刚以1,700万售出,6年间劲升近7倍。

新买家为119 Limited,该公司董事为马伟业、CHOI TAK SHING,前者今年2月透过逸发投资有限公司名义,为万科香港併购深水埗海坛街旧楼地盘,相信是次出手收购的背后财团为万科香港。

可建楼面约6.8万呎

市场消息透露,发展商已收购大部分住宅单位,每伙收购价介乎580万至630万元,实用呎价约1.6万元,直逼丽港城、德福花园等大型屋苑呎价水平。

不过,资料显示,上述3幅旧楼地盘面积共7,595平方呎,以重建地积比9倍计,可建楼面约68,355平方呎,估计总收购金额逾5亿元计,楼面呎价有机会低于8,000元,算是吸引价。

事实上,上述旧楼距离牛头角站不远,多年来一直有发展商低调进行收购。土地註册处资显示,一家本地大型发展商早于10年前,便透过百辉创富有限公司名义,成功购入多个单位,接近2成业权,惟收购进度缓慢,最终由万科香港成功收购。

领航集团主席高兆霆指出,市区大面积地盘极为罕有,故发展商对观塘区睇高一綫,而地盘可重建楼高65米,而且面向全海景,可远望中上环一带及红磡海景。另外,发展商睇好将来租金有上升空间,因为对面是观塘工商区,将来租盘绝对没有压力。

(经济日报)

丰华工业大厦今强拍 底价8亿

有代理称,高山企业 (00616) 旗下九龙青山道646、648及648A号丰华工业大厦今日进行强拍,拍卖底价为8亿元。项目的地盘面积约9,205.5平方呎,以地积比率约12倍计,可建楼面约11.05万平方呎。

(经济日报)

柴湾加快转型 发展商购工厦重建

受惠于活化工厦政策推动,柴湾工业区转型加快,有发展商更进驻收购工厦重建,其中兴胜创建 (00896) 购入利眾街两幢工厦申请放宽地积比重建,涉及楼面约24.7万平方呎。

柴湾区内工业发展分为两部分,包括在港铁柴湾站周边的利眾街、祥利街一带,以及常安街邻近的码头区,在上世纪70年代陆续有不少工厂大厦建成,发展成为新兴工业区。

利眾街4项目 楼面47.3万呎

当中利眾街一带的工业区邻近港铁柴湾站,范围约44.7万平方呎,由31幢工厦组成,大部分属于老龄工厦,业权亦比较分散,只有5至6幢属于单一业权,近年则至少有4幢工厦计划全幢改装或重建,合共涉及47.3万平方呎楼面。

以往利眾街一带工业区转型比较慢,但近年在活化工厦政策推动之下,以豁免2成楼面作为诱引,吸引发展商进驻收购,加快了区内转型步伐,连同早前获批出的工厦活化项目,区内4个发展项目,合共提供约47.3万平方呎楼面。

德昌广场重建 增6成楼面

当中,中小型发展商兴胜创建,在去年先后以合共近17亿元购入区内德昌广场以及美利仓大厦,并陆续申请进行重建。

其中规模比较大为利眾街14至16号德昌广场,兴胜创建伙拍南丰以约9.48亿元购入并合作发展,将原本的11层高工厦,总楼面面积约9.6万平方呎,申请放宽地积比率由12倍增加20%至14.4倍,以地盘面积约10,515平方呎计算,可重建1幢28层高,非污染工业用途,即新式工厦,总楼面约15.14平万方呎,较现有楼面多出58%。

另外,一幢位于利眾街18号的美利仓大厦,佔地约6,685平方呎,目前为16层高工厦,于1980年落成,楼龄接近40年,原本于2015年由迷你仓集团以约3.95亿元购入作营运,总楼面6.8万平方呎。该厦同样在去年由兴胜创建以约7.35亿元购入,在4年间楼价升86%,并且提出申请放宽地积比率至14.4倍重建,拟兴建1幢26层高的新式工厦,作为非污染工业用途,可建楼面约9.6万平方呎,相较原有楼面6.8万平方呎,增加4成多楼面。

(经济日报)

高振顺2940万扫Mount Nicholson三车位

九龙仓 (00004) 及南丰发展的山顶聂歌信山道8号MOUNT NICHOLSON,自拆售车位以来,买家身份继续揭盅,最新曝光为有「低调壳王」之称的高振顺,斥资2940万元连购3个相连车位。

据土地註册处显示,MOUNT NICHOLSON有3个相连车位于上月底售出,每个车位成交价钱划一为980万元,登记买家为高振顺 (KO CHUN SHUN JOHNSON),现为先丰服务集团 (00500) 执行董事兼副主席、同时为BC科技集团 (00863) 执行董事等。

资料显示,高振顺于2016年10月以「一约多伙」形式购入MOUNT NICHOLSON第二期中层A及B单位,涉资共约6.52亿元,以总实用面积8855方呎计算,呎价约7.4万元。

MOUNT NICHOLSON自上月拆售车位以来,已录得21宗註册登记 (包括1宗为发展商多名高层人士购入),总成交金额约2.09亿元。

(信报)

葵涌海暉全层3600万沽裕泰兴罗守耀承接

罗氏地产旗下葵涌海暉中心低层全层,以「摸货」形式由裕泰兴罗守耀及相关人士以3600万承接,呎价约4416元,属市价水平。

土地註册处资料显示,罗氏地产旗下葵涌海暉中心低层全层,上月底以3600万售出,买家力远投资有限公司,註册董事包括罗守耀及邓嘉玲等人,分别为裕泰兴董事总经理及其妻子。

平均每呎4416元

据代理指出,上址由6伙单位组成,总面积8152方呎,附设4000方呎平台,以易手价计,每呎造价约4416元,属市价水平,并指该层为该工厦现今唯一全层放售盘。

事实上,上址以「摸货」形式再度售出,上址于今年5月初以2.17亿易手,买家为宏鉅投资有限公司,註册董事为何智勇,资料显示,该名投资者早前为罗氏地产购入该厦40伙及一篮子车位,随即推出市场拆售,单位面积介乎1278方呎至8152方呎,累沽26伙,料套现逾1.4亿。

据业内人士指出,上述资深投资者外号「石油何」,向来活跃于工厦买卖,并于荔枝角持有多个工厦物业作长綫收租用途。

(星岛日报)

Coronavirus Hong Kong: luxury property awaits Shenzhen border opening for the next leap upwards

Property buyers from mainland China bought 38 per cent of Hong Kong’s luxury homes – each more than HK$100 million – in the first four months.

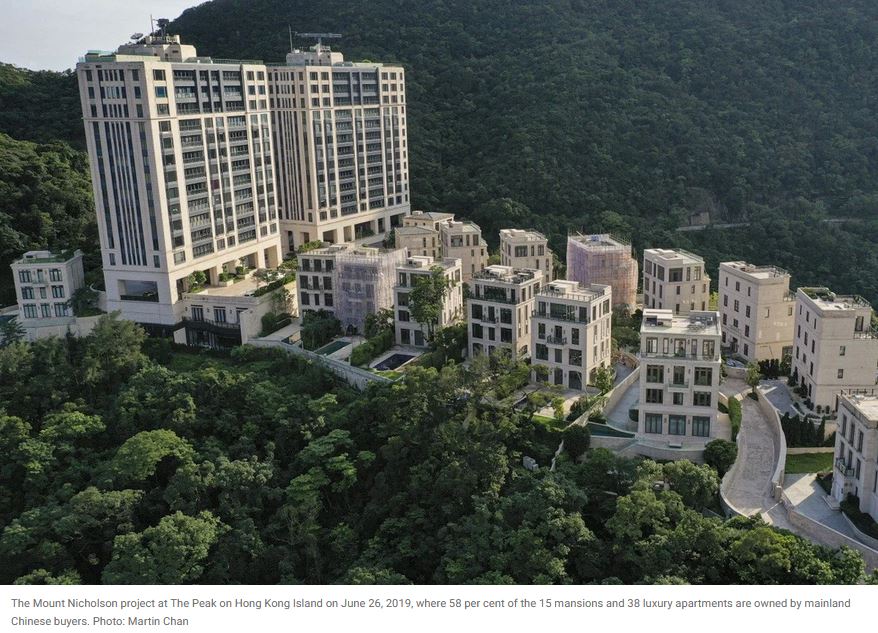

At two of Hong Kong’s most exclusive addresses, 21 Borrett Road and Mount Nicholson, “new Hongkongers” already make up more than half the owners.

An influx of mainland Chinese buyers into Hong Kong’s super-deluxe developments since early this year could further fuel home prices in the world’s most expensive property market, and the trend will become more obvious once the border open.

Buyers who settled in Hong Kong from mainland China, dubbed “new Hongkongers” unlike locally born residents, have already made their presence felt in the local real estate market. They bought 38 per cent of Hong Kong’s luxury homes – each priced more than HK$100 million (US$13 million) – in the first four months, 2 percentage points more than the whole of 2020, and more than 32.9 per cent in 2019, according to data provided by property agency.

“When the border reopens, we expect mainland Chinese to [return] to snap up residential property,” agent said.

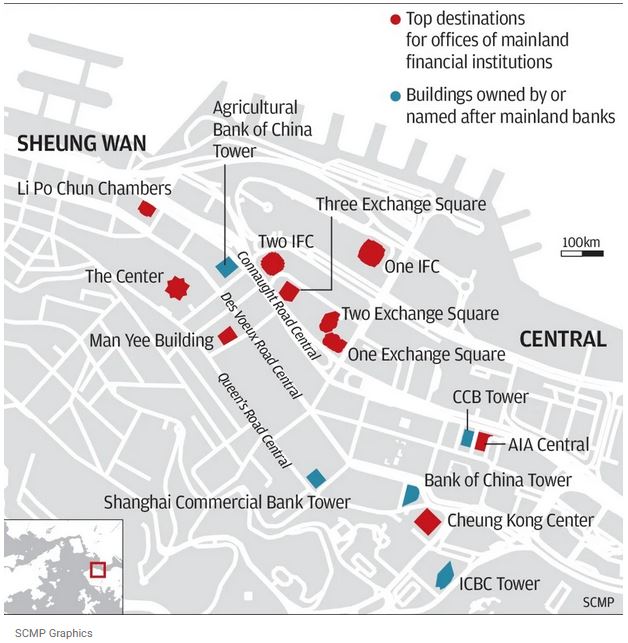

Individual and corporate real estate investors from the mainland had been the lifeblood that had sustained the eye-popping prices of Hong Kong’s property industry in the past decade, from multimillion dollar mansions to some of the world’s most expensive offices in marquee addresses in Central. Their presence in the city, muted since the street protests of 2019, could resume when Hong Kong’s northern border with Shenzhen reopens with the easing of the coronavirus outbreak, allowing business travellers, tourists and investors to return.

New Hongkongers already make up 60 per cent of the owners in two of the city’s most exclusive residential neighbourhoods: CK Asset Holdings’ 21 Borrett Road luxury apartments at the Mid-Levels, as well as Mount Nicholson on The Peak by Wharf Holdings and Nan Fung Development, according to land title searches conducted by South China Morning Post.

Mainland Chinese buyers snapped up four of eight apartments at 21 Borrett Road since February, paying a total of HK$1.3 billion for them, including a buyer named Yin Xi who paid HK$459.4 million for a five-bedroom unit that broke Asia’s price record.

At Mount Nicholson, two daughters of the late casino tycoon Stanley Ho, now find 58 per cent of their neighbours being new Hongkongers. Buyers featuring pinyin names, the romanisation system used in mainland China, bought nine houses and 22 apartments out of the project’s 15 mansions and 38 units for a combined HK$14 billion since their launch in late 2016.

Several of these buyers had also set new price benchmarks. Before Yin’s purchase, the record for the most expensive home was set by Lin Zhongming, chairman of Shenzhen developer AIM Investment Group. Lin liked the project so much that he paid HK$1.16 billion for two adjoining apartments at Mount Nicholson in 2017, paying HK$132,060 per square foot, or HK$560.02 million, for unit 12C and another HK$604.7 million for unit 12D.

“Some of the rich mainland Chinese businessman share one thought: to send their money out of China to park in a safe place,” said Kevin Tsui, an associate professor at the Clemson University’s College of Business in South Carolina, adding that the influx of mainland capital would cause prices to soar in Hong Kong. “That explains why they are willing to pay for a big premium, or even higher taxes, than local residents for property in Hong Kong and overseas.”

China’s government had also been mounting a series of campaigns across the country to tamp down on runaway property prices, which had added to the push for tycoons to diversify their holdings abroad, he said.

“It is likely encouraging individuals whose wealth quickly accumulated after they float their firms in Hong Kong or in the mainland stock market to seek other investment alternatives. Hong Kong property market is one of their favourite options,” he said.

Payments of the buyers’ stamp duty (BSD), a 15 per cent surcharge on the price of property sold to non-permanent residents with less than seven years in Hong Kong, soared last month to HK$913 million, a 23 per cent jump from April, while the number of transactions jumped 84 per cent to 114, according to data provided by the Inland Revenue Department.

“We also noticed a growing number of mainlanders who become Hong Kong permanent residents making property purchases,” agent said.

(South China Morning Post)

Hong Kong’s retail landlords consider increasing rent for the first time in two years amid ongoing economic recovery

Retail landlords have started engaging tenants in discussions on rent increases for the upcoming lease renewals, say market observers

Tenants however say that landlords must hold back on the rent increases as they were yet to recover fully from the slowdown

With Hong Kong’s economic recovery gathering pace and domestic consumption improving, retail landlords have started mulling rent increases for the first time since the correction started two years ago in the wake of the social unrest.

While landlords of shopping centres and street shops seem optimistic and expect retailers to receive a boost from mainland tourists following the eventual opening of cross-border travel, tenants, however, remain cautious, with many saying that business is yet to recover from levels before the protests started in mid-2019.

Market observers, however, expect only a nominal increase in rent, noting that a stop to rent concessions by landlords is a good indication rents may be on the way up.

Retail landlords have started engaging tenants in discussions on rent increases for the upcoming lease renewals since Lunar New Year, property agent said. “These new or renewed leases might see a freeze for the first year, followed by a mild increase of around 5 to 10 per cent for the second and third years” amid a predicted recovery for the city’s economy and revival in cross-border tourism, the agent said.

Hong Kong’s economy expanded by 7.9 per cent in the first three months of the year, the biggest quarterly growth in 11 years which also ended six quarters of recession. Given the economy continues to recover from the pandemic, the government expects full-year growth to be at the upper end of the forecast of between 3.5 per cent and 5.5 per cent. Hong Kong’s retail sales have also continued to recover, with retail sales in the first four months of 2021 estimated to have grown 8.5 per cent compared to the same period last year.

Some landlords think that the worst is over, another agent said.

“As retail sales have returned to positive growth, they have had internal discussions to increase the headline rents,” the agent said.

Another agent said that the overall rent level in Hong Kong was currently 30 per cent to 50 per cent lower than the first half of 2019. He said he expects rents of retail properties to fluctuate by less than 5 per cent this year. Link Reit, Asia’s largest real estate investment trust with a portfolio of 9 million sq ft of retail and office space in Hong Kong, said it was optimistic about the overall market.

As the pandemic has stabilised locally and restrictions have eased, the scope for discussions on lease renewals with tenants is much better compared to six months ago as their prospects have improved, George Hongchoy, chief executive of Link Reit, said last week.

But small business owners beg to differ, saying they were worried that landlords were jumping the gun as their operations were yet to stabilise from the disruption brought about by the pandemic.

Among them is Vincent Wong. The owner of a music centre in Tai Kok Tsui said he could be paying higher rents when his lease comes up for renewal in September.

“We had asked for a rent cut but the landlord turned down our proposal. We are now requesting them to freeze the rents for one year, but we have not heard back,” said Wong.

“We lost as much as 50 per cent of students at the beginning of the pandemic. We see students gradually coming back but the business is still at two-thirds of the pre-pandemic level.”

(South China Morning Post)