佔據中環心臟位置的新海濱3號商業地王,將於周五截標;區內擁有地標項目的大型發展商,如持有國金 (IFC)的恒地 (00012) 已表態一定會參與競投,英資怡和旗下的置地有機會進一步擴大商業版圖,連同會德豐地產等財團,勢掀一場「地王爭霸戰」。

經歷長達半年招標期的中環新海濱3號商業地王,終在本周五 (18日) 截標。這幅地皮位於怡和大廈對出,比鄰國際金融中心一期及二期,旁邊亦是知名旅遊景點香港摩天輪。地皮面積近52萬平方呎,最高可建樓面約161.5萬平方呎。中標財團另需興建約23萬平方呎的政府設施,包括重置現時的郵政總局等。地皮市場估值330億至553億元。

梁志堅:靚地吸本地龍頭入標

貴為中環核心地段的罕有大型商業地,市場預計,地皮會吸引本港多間一綫發展商競投。持有國際金融中心一期及二期的恒地,已表明一定會參與競投,因為地皮屬「靚地」,加上其發展潛力大;惟現階段未可透露發展方案及投資額。即使在疫情打擊下,中環的甲級寫字樓空置率攀升,但是集團依然十分看好中環的商業前景,又形容「國金的租客退租後,即有新租客承接」。

至於屬英資怡和旗下的置地,目前在中環亦擁有多個商業項目,包括比鄰地皮的怡和大廈、交易廣場、置地廣場及太子大廈等,屬「中環大地主」。而怡和已經多年未有參與競投本港地皮,但今次中環地王位於集團商業王國版圖內,或會吸引置地罕有出手競投。雖然置地公司執行董事周明祖日前未有正面回答集團是否有意入標地皮,惟他形容,集團對於所有中環區的項目都感興趣,又稱得悉很多人有留意這幅地皮。

其次,會德豐地產主席梁志堅表示,集團已經思考了很久,並正考慮會否入標,因為入標前的工作繁多,坦言「有好多事要理會」,並有意發展商場及寫字樓。他直言,鑑於地皮位處市區地段,估計一定會吸引本地龍頭發展商入標。

測量師估 中資參與機會不大

值得一提的是,近年本港官地不乏中資參與,例如中資平安人壽去年以約113億元購入西九高鐵站上蓋商業地王辦公室部分的30%業權,因此中資亦有機會競投上述地王。

有測量師預計,雖中資有能力承擔高昂的投地金額,惟他們對香港的熟悉度始終不及本港發展商,因此他預計中資入標的機會不太大,或有可能夥拍本地發展商競投。不過,由於中資希望在中環「插旗」,因而不排除他們日後會收購地皮的整座商廈,並取得命名權。以目前市況推斷,地皮商廈部分落成後呎租可達80至100元水平。

(經濟日報)

更多國際金融中心寫字樓出租樓盤資訊請參閱:國際金融中心寫字樓出租

更多怡和大廈寫字樓出租樓盤資訊請參閱:怡和大廈寫字樓出租

更多交易廣場寫字樓出租樓盤資訊請參閱:交易廣場寫字樓出租

更多置地廣場寫字樓出租樓盤資訊請參閱:置地廣場寫字樓出租

更多太子大廈寫字樓出租樓盤資訊請參閱:太子大廈寫字樓出租

更多中環區甲級寫字樓出租樓盤資訊請參閱:中環區甲級寫字樓出租

置地靈活辦公空間 租期3個月起

置地近日在公爵大廈開設兩層共2.5萬平方呎的靈活的辦公空間「Centricity Flex」,租約期短至3個月起,希望打造生態圈,為其中環商廈群引入更多租戶。

公爵大廈Centricity Flex 涉2.5萬呎

該Centricity Flex設在公爵大廈17樓及18樓,合共面積2.5萬平方呎,最多可放置320張工作枱,每次須承租至少300平方呎空間或8張工作枱。跟置地旗下商廈多以長租約為主不同,Centricity Flex租約期為3個月至3年不等。據指已有一家國際金融機構將成為主要租戶,首次進駐中環。

同時,Centricity Flex亦設有16個單人或雙人辦公隔間、7間會議室、22張流動座位 (Hot desks)。單人辦公室時租介乎50至100元,而會議室時租則介乎400至1,700元。置地指,以項目的位置及質素,定位為高端產品,但在市場中並不屬於最貴的一類。

置地執行董事周明祖指,置地旗下中環物業為租戶提供一站式解決方案,小至辦公隔間、大至超過十萬平方呎的多層辦公空間,租約期短至數月、長至10年以上,以滿足企業不同階段的增長需求。

Centricity Flex目標租戶是優質企業,尤其是希望以更靈活的租賃條款物色辦公室的金融機構及專業服務機構。周明祖稱,希望能夠建立起生態圈,豐富中環商廈群的商戶組合。至於Centricity主管班立德則指,Centricity Flex為企業的業務增長和靈活發展提供支持。

(經濟日報)

更多置地廣場寫字樓出租樓盤資訊請參閱:置地廣場寫字樓出租

更多中環區甲級寫字樓出租樓盤資訊請參閱:中環區甲級寫字樓出租

粉嶺安樂村 轉發展數據中心

踏入5G年代,市場對數據中心的需求大大增加,不少財團積極購入本港工業地發展相關業務。觀乎近年粉嶺安樂村工業區有不少新發展,區內7個工廈興建或活化項目,共提供約114萬平方呎樓面,當中有部分已落實發展為數據中心,包括已批予外資的安樂門街工業官地,涉約21.7萬平方呎樓面。

鄰近粉嶺聯和墟的安樂村工業區,範圍達351.1萬平方呎,現時屬於「工業」規劃用途。區內由98幢工業大廈,及政府持有的20幅休憩用地、臨時停車場等組成。有見社會對工廈、貨倉仍然有相當需求,因此規劃署之前決定保留該區作為「工業」規劃用途,並放寬規劃發展限制。

7項目 提供逾114萬呎樓面

隨着資訊發達,並吸引不少本地及外地發展商在港買地發展數據中心。近年政府陸續推出該區的政府工業用地,其中最新於本年初,以約8.1294億元批出的的粉嶺安樂門街工業地,亦將會發展為數據中心。地皮位於粉嶺安樂門街、安全街與安居街交界,面積約4.34萬平方呎,以地積比率約5倍發展,最高可建樓面約21.7萬平方呎,以每平方呎樓面地價約3,750元計,創下新界北區工業地呎價新高,可見相關用地需求上升。

上述地皮最終由新加坡豐樹產業奪得,集團考慮到電子商務、雲端運算及5G網絡日漸盛行,上述業務對數據中心的需求逐步增加等因素,決定在此地皮設立集團首個位於香港的數據中心,並計劃出租予終端使用者或數據中心營運商等。該數據中心除了服務本地用家外,亦會提供良好及快速的網絡予深圳的雲端用家,及其餘內地主要城市的用家。

佳明兩地皮 建出租用數據中心

值得一提的是,去年佳明旗下兩間全資附屬公司,亦分別以約1.68億及約1.88億元,購入粉嶺安居街3號及粉嶺安福街7號地皮。兩幅地皮面積分別約1.79萬及1.91萬平方呎。如以地積比率5倍發展,經補地價後,分別可以興建約8.95萬及約9.55萬平方呎樓面的工廈。佳明亦表示,購入地皮後,將興建兩座數據中心,並作租賃用途。另一方面,區內亦有其他新式工廈或活化項目,包括區內對上一幅批出,於2018年由億京奪得的安樂村用地。該地皮已獲批興建1幢15層高(1層地庫上)的新型工廈,涉及總樓面約30.18萬平方呎,料主要作工業物流等用途。若以中標價計,每平方呎樓面地價約2,430元。

同時,已故舖王「波叔」鄧成波於2014年購入的勉勵龍中心,總樓面約15.3萬平方呎,已獲批活化用途,可重建作商店及食肆,重建後樓面最高約21.19萬平方呎。

(經濟日報)

荷李活道全幢商廈4.3億售

中環荷李活道全幢以4.3億易手,呎價約1.8萬,屬市價水平,買家為資深投資者。

市場消息透露,上址為中環荷李活道35至37號C Wisdom Centre全幢,以總樓面23889方呎計算,平均呎價約1.8萬,上址於2019年以3.8億以股權轉讓方式易手,原業主持貨僅兩年,帳面獲利5000萬,期間升值約13%。

據代理指,該廈樓高26樓,成交價屬市價,買家為資深投資者。物業由低層地下至3樓為商鋪用途,6樓至26樓為寫字樓,5樓為平台花園,基座樓面約1300方呎,寫字樓每層約950方呎。

廖偉麟拆售有線大樓全層

另一代理表示,由資深投資者廖偉麟持有的荃灣有線電視大樓30樓全層拆售,全層樓面共分14伙,其中3伙早前率先獲預留,推售單位面積約1380至3418方呎,意向呎價由約5500元起,入場價約759萬。項目提供長短成交期,由3個月起至最長達12個月,項目開售後隨即獲買家青睞,以約1253.38萬購入30樓01室,面積約2161方呎,呎價約5800元。

該代理續表示,現時待售的10個餘貨單位以連約出售,月租由約1.86萬至相連戶約11萬餘元不等,租期最短至2021年8月,最長至2024年初。

(星島日報)

Ho Man Tin project prices released

Vanke Property Hong Kong released 17 flats in the second price list of VAU Residence in Ho Man Tin at an average price of HK$25,131 per square foor after discounts, 2.5 percent higher than the first price list.

The cheapest flat, measuring 209 sq ft, is offered at HK$5.5 million, or HK$26,344 per sq ft after discount.

Henderson Land Development (0012) expects to launch The Henley II for sales next month.

CK Asset (1113) sold two flats at 21 Borrett Road in the Mid-Levels for about HK$380 million in total.

Centralcon Properties has applied to the Town Planning Board to build 60 residential flats in the Tai Hang Road project and to relax the plot ratio.

(The Standard)

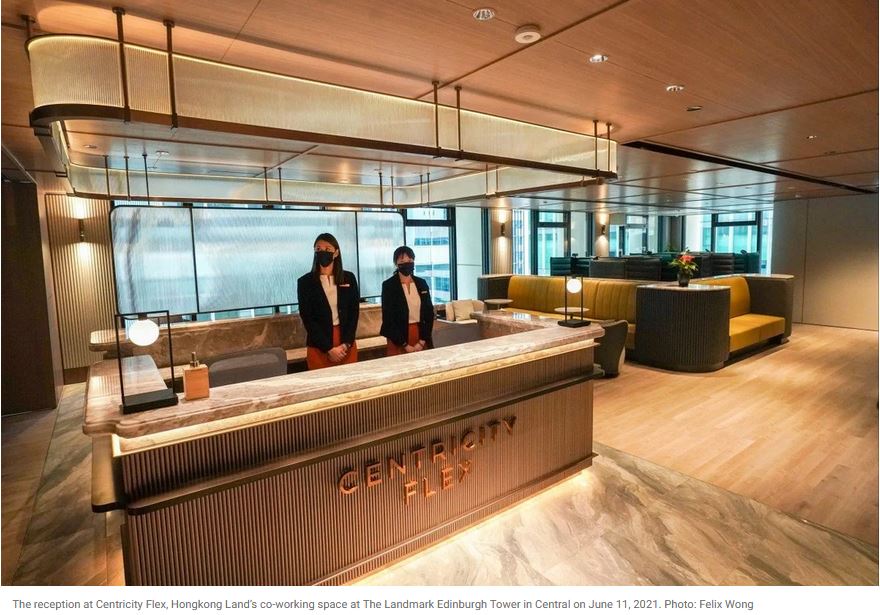

Hongkong Land opens its Centricity Flex space in Central, embracing flexible work as more people work from home

Hongkong Land’s Centricity Flex, with 25,000 square feet (2,322 square metres) of space, opens today on the 17th and 18th floor of the Landmark Edinburgh Tower on Queen’s Road Central

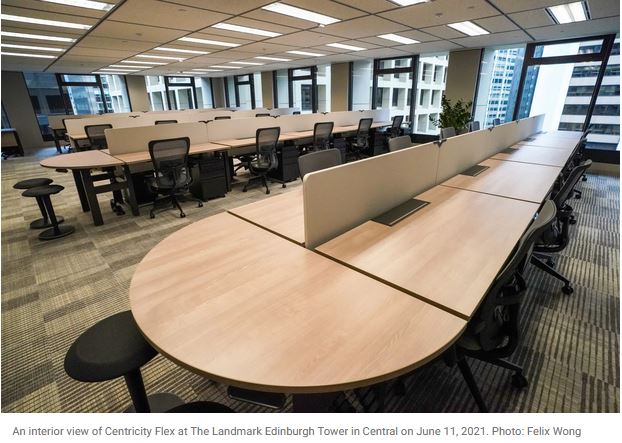

Private suites range from 900 sq ft to 2,300 sq ft on the 17th floor while those on the 18th can be configured subject to client’s needs

Hongkong Land, the biggest commercial landlord in the city’s Central business district, has opened a flexible work environment at one of the world’s most expensive office addresses, in a U-turn to its reticence to develop co-working space.

The developer’s Centricity Flex, featuring 25,000 square feet (2,322 square metres) opens today on the 17th and 18th floor of the Landmark Edinburgh Tower on Queen’s Road Central. Other tenants in the tower include the audit firm PwC, the Swiss private bank Bank J. Safra Sarasin and the white-shoe legal practices K&L Gates and Skadden Arps.

An international financial services firm has signed on as the first tenant of Centricity Flex, occupying a private office suite, Hongkong Land said without disclosing the customer’s name.

“We would like to offer companies that are similar to those in our current tenants portfolio an option to traditional leases,” said the developer’s executive director Raymond Chow. “By working in Centricity Flex, tenants can get a first impression of being part of Hongkong Land’s community.”

The market for flexible working space is picking up again in Hong Kong after the initial slump brought by tough social-distancing rules during the early months of the coronavirus pandemic.

Co-working space operators, who often sublet space to other tenants, have developed a bad name, as the market shrank in the past year. WeWork, the global pioneer of the co-working space concept, gave up 90,000 square feet of space over eight floors in Causeway Bay in March, shrinking its real estate footprint as more people chose to work from home.

With office vacancy rates soaring to a 15-year record of 7.5 per cent, a change in behaviour is under way: co-working space is becoming attractive again as firms eschew office space that cost tens of millions of dollars in annual rent for flexible arrangements during the post-coronavirus era that include a mix of working from home and working in the office. The up shot is cheaper overhead, whilst maintaining the prestige of an office address in Central.

Hongkong Land, 50 per cent owned by the conglomerate Jardine Matheson Holdings, is not the only developer to embrace the co-working concept. Great Eagles Holdings, the owner of The Langham chain of hotels, opened its fifth Eaton Club flexible space at its Great Eagle Centre towers in Wan Chai in December. China Resources, one of the largest mainland Chinese conglomerates in Hong Kong, opened its China Resources Building Business Lounge at its building in the same neighbourhood two months earlier.

Swire Properties, the real estate unit of the Swire Group that already operates the Blueprint flexible workspace, is considering adding more space at its Two Taikoo Place commercial property in Quarry Bay, scheduled for completion in 2022.

“Across the entire market, landlords have increased the flexibility they offer to tenants,” property agent said. “There is increased emphasis from portfolio landlords to offer greater occupier amenity and experience, and it ranges from flexible office space, communal meeting and conferencing facilities.”

Hongkong Land owns about 450,000 square metres (4.84 million square feet) of prime office and retail space in Central. About 40 per cent of the company’s tenants are financial service institutions, while 30 per cent are law firms, Hongkong Land said.

The private suites at Centricity Flex range from 900 sq ft to 2,300 sq ft on the 17th floor while those on the 18th can be configured subject to client’s needs. Tenants of Centricity Flex can rent any of the seven meeting rooms, hot desks and working pods on an hourly basis.

The average monthly rent for grade A office space in Central has fallen to HK$100 per square foot, according to another property agent. The falling cost has attracted some tenants back to the area, with S&P moving back to Three Exchange Square in Central, from the International Commerce Centre (ICC) in West Kowloon, paying HK$2.2 million a month.

Co-working space with 50 desks at Centricity Flex costs an estimated HK$230,000 a month based on calculations by South China Morning Post, and comes with access to all services, including discounts at any of the restaurants in Hongkong Land’s portfolio such as the Michelin-starred Amber, with a month-long reservations waiting list.

“We want to have a relationship with you and then we move that relationship forward for many years, so it’s not just a short-term relationship; we want to have a relationship for generations,” Chow said. “It is also an extension of our services to our current tenants as all facilities in Centricity Flex are open to them. It’s not really co-working, but flexible facilities.”

(South China Morning Post)

For more information of Office for Lease at The Landmark please visit: Office for Lease at The Landmark

For more information of Office for Lease at Exchange Square please visit: Office for Lease at Exchange Square

For more information of Grade A Office for Lease in Central please visit: Grade A Office for Lease in Central

For more information of Office for Lease at Great Eagle Centre please visit: Office for Lease at Great Eagle Centre

For more information of Office for Lease at China Resources Building please visit: Office for Lease at China Resources Building

For more information of Grade A Office for Lease in Wan Chai please visit: Grade A Office for Lease in Wan Chai

For more information of Office for Lease at International Commerce Centre please visit: Office for Lease at International Commerce Centre

For more information of Grade A Office for Lease in Tsim Sha Tsui please visit: Grade A Office for Lease in Tsim Sha Tsui