九龍區甲廈呎租叫價較具競爭力,個別企業進駐。據代理統計,5月份九龍區整體甲級商廈空置率錄得約12.61%,比4月份減少0.49個百分點,而相比去年同期則見輕微反彈,按年遞增1.12個百分點。

觀塘空置率 跌1.44百分點

統計4區空置情況,在尖沙咀、旺角、九龍灣及觀塘中,以觀塘表現最突出,最新甲廈空置率為12.83%,比上月下跌1.44個百分點。

代理表示,觀塘甲廈供應充足令空置率長期維持於雙位數字水平,但租金比尖沙咀及旺角一帶商廈相對相宜,且個別業主叫價有所下調,因此近期亦吸引不少租客首選進駐。如觀塘萬兆豐中心高層D室,面積約1,915平方呎,新近以呎租約24元租出,對比舊呎租約33元,減低約27%。

至於比鄰的九龍灣表現則較平穩,5月份區內甲廈空置率錄得約21.13%,按月微升0.02個百分點。而旺角甲廈空置情況也有不俗改善,由4月約9.05%,回落至最新約7.98%,跌幅約1.07個百分點。

(經濟日報)

更多萬兆豐中心寫字樓出租樓盤資訊請參閱:萬兆豐中心寫字樓出租

更多觀塘區甲級寫字樓出租樓盤資訊請參閱:觀塘區甲級寫字樓出租

更多尖沙咀區甲級寫字樓出租樓盤資訊請參閱:尖沙咀區甲級寫字樓出租

更多九龍灣甲級寫字樓出租樓盤資訊請參閱:九龍灣甲級寫字樓出租

更多旺角區甲級寫字樓出租樓盤資訊請參閱:旺角區甲級寫字樓出租

觀塘陸續變天 舊樓重建前景看俏

萬科香港購定富街舊樓9成業權 涉逾5億

隨着多個大型重建項目落成,加上政府有意將東九龍一帶發展成為第二個核心商業區,觀塘陸續變天,區內舊樓重建價值備受看好,市場消息指萬科香港正收購牛頭角定富街3幢舊樓逾9成業權,涉資逾5億元。

據了解,牛頭角定富街45至63號共3幢6層高的舊樓,樓齡約49至50年,共提供50個住宅單位及10個舖位,住宅單位主要為400平方呎以下中小型單位,二手買賣並不活躍。

市場消息透露,有財團對該批舊樓進行收購,目前已集齊逾9成業權。土地註冊處資料顯,上述舊樓日前錄得2宗舖位買賣登記,成交價均為1,700萬元,其中定勝樓地下3號舖,原業主2015年以225萬元購入,剛以1,700萬售出,6年間勁升近7倍。

新買家為119 Limited,該公司董事為馬偉業、CHOI TAK SHING,前者今年2月透過逸發投資有限公司名義,為萬科香港併購深水埗海壇街舊樓地盤,相信是次出手收購的背後財團為萬科香港。

可建樓面約6.8萬呎

市場消息透露,發展商已收購大部分住宅單位,每伙收購價介乎580萬至630萬元,實用呎價約1.6萬元,直逼麗港城、德福花園等大型屋苑呎價水平。

不過,資料顯示,上述3幅舊樓地盤面積共7,595平方呎,以重建地積比9倍計,可建樓面約68,355平方呎,估計總收購金額逾5億元計,樓面呎價有機會低於8,000元,算是吸引價。

事實上,上述舊樓距離牛頭角站不遠,多年來一直有發展商低調進行收購。土地註冊處資顯示,一家本地大型發展商早於10年前,便透過百輝創富有限公司名義,成功購入多個單位,接近2成業權,惟收購進度緩慢,最終由萬科香港成功收購。

領航集團主席高兆霆指出,市區大面積地盤極為罕有,故發展商對觀塘區睇高一綫,而地盤可重建樓高65米,而且面向全海景,可遠望中上環一帶及紅磡海景。另外,發展商睇好將來租金有上升空間,因為對面是觀塘工商區,將來租盤絕對沒有壓力。

(經濟日報)

豐華工業大廈今強拍 底價8億

有代理稱,高山企業 (00616) 旗下九龍青山道646、648及648A號豐華工業大廈今日進行強拍,拍賣底價為8億元。項目的地盤面積約9,205.5平方呎,以地積比率約12倍計,可建樓面約11.05萬平方呎。

(經濟日報)

柴灣加快轉型 發展商購工廈重建

受惠於活化工廈政策推動,柴灣工業區轉型加快,有發展商更進駐收購工廈重建,其中興勝創建 (00896) 購入利眾街兩幢工廈申請放寬地積比重建,涉及樓面約24.7萬平方呎。

柴灣區內工業發展分為兩部分,包括在港鐵柴灣站周邊的利眾街、祥利街一帶,以及常安街鄰近的碼頭區,在上世紀70年代陸續有不少工廠大廈建成,發展成為新興工業區。

利眾街4項目 樓面47.3萬呎

當中利眾街一帶的工業區鄰近港鐵柴灣站,範圍約44.7萬平方呎,由31幢工廈組成,大部分屬於老齡工廈,業權亦比較分散,只有5至6幢屬於單一業權,近年則至少有4幢工廈計劃全幢改裝或重建,合共涉及47.3萬平方呎樓面。

以往利眾街一帶工業區轉型比較慢,但近年在活化工廈政策推動之下,以豁免2成樓面作為誘引,吸引發展商進駐收購,加快了區內轉型步伐,連同早前獲批出的工廈活化項目,區內4個發展項目,合共提供約47.3萬平方呎樓面。

德昌廣場重建 增6成樓面

當中,中小型發展商興勝創建,在去年先後以合共近17億元購入區內德昌廣場以及美利倉大廈,並陸續申請進行重建。

其中規模比較大為利眾街14至16號德昌廣場,興勝創建夥拍南豐以約9.48億元購入並合作發展,將原本的11層高工廈,總樓面面積約9.6萬平方呎,申請放寬地積比率由12倍增加20%至14.4倍,以地盤面積約10,515平方呎計算,可重建1幢28層高,非污染工業用途,即新式工廈,總樓面約15.14平萬方呎,較現有樓面多出58%。

另外,一幢位於利眾街18號的美利倉大廈,佔地約6,685平方呎,目前為16層高工廈,於1980年落成,樓齡接近40年,原本於2015年由迷你倉集團以約3.95億元購入作營運,總樓面6.8萬平方呎。該廈同樣在去年由興勝創建以約7.35億元購入,在4年間樓價升86%,並且提出申請放寬地積比率至14.4倍重建,擬興建1幢26層高的新式工廈,作為非污染工業用途,可建樓面約9.6萬平方呎,相較原有樓面6.8萬平方呎,增加4成多樓面。

(經濟日報)

高振順2940萬掃Mount Nicholson三車位

九龍倉 (00004) 及南豐發展的山頂聶歌信山道8號MOUNT NICHOLSON,自拆售車位以來,買家身份繼續揭盅,最新曝光為有「低調殼王」之稱的高振順,斥資2940萬元連購3個相連車位。

據土地註冊處顯示,MOUNT NICHOLSON有3個相連車位於上月底售出,每個車位成交價錢劃一為980萬元,登記買家為高振順 (KO CHUN SHUN JOHNSON),現為先豐服務集團 (00500) 執行董事兼副主席、同時為BC科技集團 (00863) 執行董事等。

資料顯示,高振順於2016年10月以「一約多伙」形式購入MOUNT NICHOLSON第二期中層A及B單位,涉資共約6.52億元,以總實用面積8855方呎計算,呎價約7.4萬元。

MOUNT NICHOLSON自上月拆售車位以來,已錄得21宗註冊登記 (包括1宗為發展商多名高層人士購入),總成交金額約2.09億元。

(信報)

葵涌海暉全層3600萬沽裕泰興羅守耀承接

羅氏地產旗下葵涌海暉中心低層全層,以「摸貨」形式由裕泰興羅守耀及相關人士以3600萬承接,呎價約4416元,屬市價水平。

土地註冊處資料顯示,羅氏地產旗下葵涌海暉中心低層全層,上月底以3600萬售出,買家力遠投資有限公司,註冊董事包括羅守耀及鄧嘉玲等人,分別為裕泰興董事總經理及其妻子。

平均每呎4416元

據代理指出,上址由6伙單位組成,總面積8152方呎,附設4000方呎平台,以易手價計,每呎造價約4416元,屬市價水平,並指該層為該工廈現今唯一全層放售盤。

事實上,上址以「摸貨」形式再度售出,上址於今年5月初以2.17億易手,買家為宏鉅投資有限公司,註冊董事為何智勇,資料顯示,該名投資者早前為羅氏地產購入該廈40伙及一籃子車位,隨即推出市場拆售,單位面積介乎1278方呎至8152方呎,累沽26伙,料套現逾1.4億。

據業內人士指出,上述資深投資者外號「石油何」,向來活躍於工廈買賣,並於荔枝角持有多個工廈物業作長綫收租用途。

(星島日報)

Coronavirus Hong Kong: luxury property awaits Shenzhen border opening for the next leap upwards

Property buyers from mainland China bought 38 per cent of Hong Kong’s luxury homes – each more than HK$100 million – in the first four months.

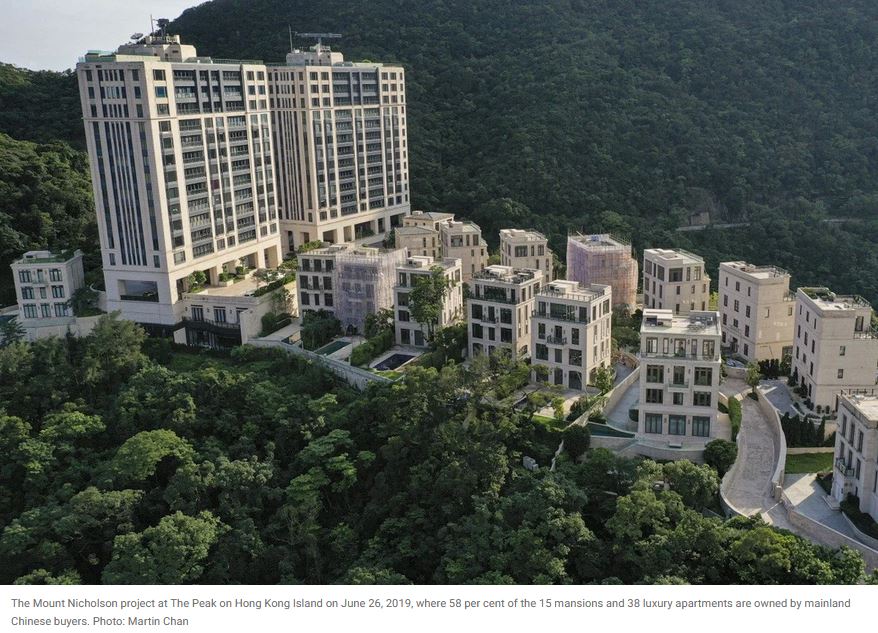

At two of Hong Kong’s most exclusive addresses, 21 Borrett Road and Mount Nicholson, “new Hongkongers” already make up more than half the owners.

An influx of mainland Chinese buyers into Hong Kong’s super-deluxe developments since early this year could further fuel home prices in the world’s most expensive property market, and the trend will become more obvious once the border open.

Buyers who settled in Hong Kong from mainland China, dubbed “new Hongkongers” unlike locally born residents, have already made their presence felt in the local real estate market. They bought 38 per cent of Hong Kong’s luxury homes – each priced more than HK$100 million (US$13 million) – in the first four months, 2 percentage points more than the whole of 2020, and more than 32.9 per cent in 2019, according to data provided by property agency.

“When the border reopens, we expect mainland Chinese to [return] to snap up residential property,” agent said.

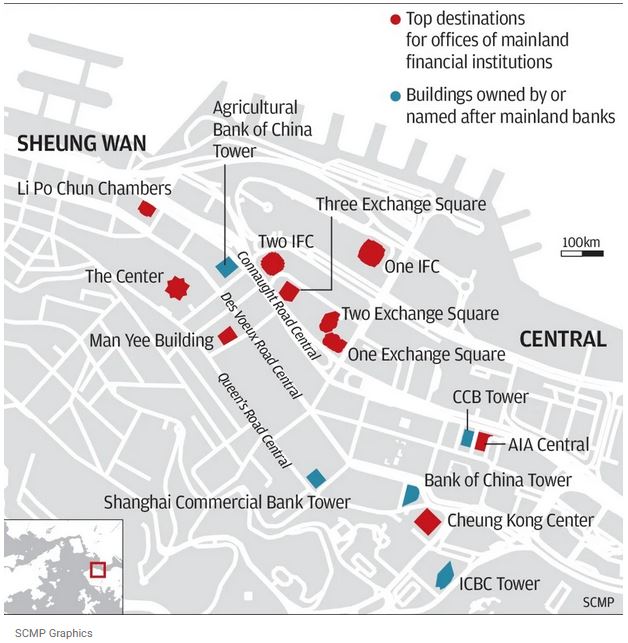

Individual and corporate real estate investors from the mainland had been the lifeblood that had sustained the eye-popping prices of Hong Kong’s property industry in the past decade, from multimillion dollar mansions to some of the world’s most expensive offices in marquee addresses in Central. Their presence in the city, muted since the street protests of 2019, could resume when Hong Kong’s northern border with Shenzhen reopens with the easing of the coronavirus outbreak, allowing business travellers, tourists and investors to return.

New Hongkongers already make up 60 per cent of the owners in two of the city’s most exclusive residential neighbourhoods: CK Asset Holdings’ 21 Borrett Road luxury apartments at the Mid-Levels, as well as Mount Nicholson on The Peak by Wharf Holdings and Nan Fung Development, according to land title searches conducted by South China Morning Post.

Mainland Chinese buyers snapped up four of eight apartments at 21 Borrett Road since February, paying a total of HK$1.3 billion for them, including a buyer named Yin Xi who paid HK$459.4 million for a five-bedroom unit that broke Asia’s price record.

At Mount Nicholson, two daughters of the late casino tycoon Stanley Ho, now find 58 per cent of their neighbours being new Hongkongers. Buyers featuring pinyin names, the romanisation system used in mainland China, bought nine houses and 22 apartments out of the project’s 15 mansions and 38 units for a combined HK$14 billion since their launch in late 2016.

Several of these buyers had also set new price benchmarks. Before Yin’s purchase, the record for the most expensive home was set by Lin Zhongming, chairman of Shenzhen developer AIM Investment Group. Lin liked the project so much that he paid HK$1.16 billion for two adjoining apartments at Mount Nicholson in 2017, paying HK$132,060 per square foot, or HK$560.02 million, for unit 12C and another HK$604.7 million for unit 12D.

“Some of the rich mainland Chinese businessman share one thought: to send their money out of China to park in a safe place,” said Kevin Tsui, an associate professor at the Clemson University’s College of Business in South Carolina, adding that the influx of mainland capital would cause prices to soar in Hong Kong. “That explains why they are willing to pay for a big premium, or even higher taxes, than local residents for property in Hong Kong and overseas.”

China’s government had also been mounting a series of campaigns across the country to tamp down on runaway property prices, which had added to the push for tycoons to diversify their holdings abroad, he said.

“It is likely encouraging individuals whose wealth quickly accumulated after they float their firms in Hong Kong or in the mainland stock market to seek other investment alternatives. Hong Kong property market is one of their favourite options,” he said.

Payments of the buyers’ stamp duty (BSD), a 15 per cent surcharge on the price of property sold to non-permanent residents with less than seven years in Hong Kong, soared last month to HK$913 million, a 23 per cent jump from April, while the number of transactions jumped 84 per cent to 114, according to data provided by the Inland Revenue Department.

“We also noticed a growing number of mainlanders who become Hong Kong permanent residents making property purchases,” agent said.

(South China Morning Post)

Hong Kong’s retail landlords consider increasing rent for the first time in two years amid ongoing economic recovery

Retail landlords have started engaging tenants in discussions on rent increases for the upcoming lease renewals, say market observers

Tenants however say that landlords must hold back on the rent increases as they were yet to recover fully from the slowdown

With Hong Kong’s economic recovery gathering pace and domestic consumption improving, retail landlords have started mulling rent increases for the first time since the correction started two years ago in the wake of the social unrest.

While landlords of shopping centres and street shops seem optimistic and expect retailers to receive a boost from mainland tourists following the eventual opening of cross-border travel, tenants, however, remain cautious, with many saying that business is yet to recover from levels before the protests started in mid-2019.

Market observers, however, expect only a nominal increase in rent, noting that a stop to rent concessions by landlords is a good indication rents may be on the way up.

Retail landlords have started engaging tenants in discussions on rent increases for the upcoming lease renewals since Lunar New Year, property agent said. “These new or renewed leases might see a freeze for the first year, followed by a mild increase of around 5 to 10 per cent for the second and third years” amid a predicted recovery for the city’s economy and revival in cross-border tourism, the agent said.

Hong Kong’s economy expanded by 7.9 per cent in the first three months of the year, the biggest quarterly growth in 11 years which also ended six quarters of recession. Given the economy continues to recover from the pandemic, the government expects full-year growth to be at the upper end of the forecast of between 3.5 per cent and 5.5 per cent. Hong Kong’s retail sales have also continued to recover, with retail sales in the first four months of 2021 estimated to have grown 8.5 per cent compared to the same period last year.

Some landlords think that the worst is over, another agent said.

“As retail sales have returned to positive growth, they have had internal discussions to increase the headline rents,” the agent said.

Another agent said that the overall rent level in Hong Kong was currently 30 per cent to 50 per cent lower than the first half of 2019. He said he expects rents of retail properties to fluctuate by less than 5 per cent this year. Link Reit, Asia’s largest real estate investment trust with a portfolio of 9 million sq ft of retail and office space in Hong Kong, said it was optimistic about the overall market.

As the pandemic has stabilised locally and restrictions have eased, the scope for discussions on lease renewals with tenants is much better compared to six months ago as their prospects have improved, George Hongchoy, chief executive of Link Reit, said last week.

But small business owners beg to differ, saying they were worried that landlords were jumping the gun as their operations were yet to stabilise from the disruption brought about by the pandemic.

Among them is Vincent Wong. The owner of a music centre in Tai Kok Tsui said he could be paying higher rents when his lease comes up for renewal in September.

“We had asked for a rent cut but the landlord turned down our proposal. We are now requesting them to freeze the rents for one year, but we have not heard back,” said Wong.

“We lost as much as 50 per cent of students at the beginning of the pandemic. We see students gradually coming back but the business is still at two-thirds of the pre-pandemic level.”

(South China Morning Post)