香港中央紡織二廠 申重建工廈

嘉民亞洲持有的荃灣香港中央紡織一至五廠,據城規會文件顯示,其中二廠申請重建20層高工廈,樓面約11萬平方呎。

擬建20層高新式工廈

據城規會資料顯示,發展商近日申請將二廠地盤面積作重建,屬於「其他指定(商貿)」用途,佔地9,725平方呎,申請人申請將地積比率9.5倍放寬至約11.4倍,幅度約2成,興建一幢20層高的新式工廈,最高建築物高度為主水平基準以上100米,總樓面面積約11萬平方呎。

申請人認為,計劃符合政府活化工廈的政策,可加快荃灣柴灣角商貿區的轉型。而申請人會沿着半山街劃設一條8米寬的「非建築用地」,以擴闊現有行人路,從而提高該處視覺及空氣流通;另會沿着西南面地段界綫劃設一條4.5米寬行人通道,提供一條新行人通道由半山街通往沙咀道,亦會在面向半山街的地下加裝垂直綠化,以改善周邊環境、街道景觀及公共空間的景觀質素,申請人認為,如此不會帶來負面交通及排污影響。

資料顯示,嘉民亞洲早於2012年時,以9.45億元買入中央紗廠一至五號廠,去年8月份時,嘉民已申請將一廠地盤重建,同樣放寬地積比率2成至11.4倍,興建一幢21層高的新式工廈,涉及約57萬平方呎樓面。

(經濟日報)

Hong Kong homebuyers turn up in droves to snap up Wetland

Seasons flats, ignoring US action to revoke city’s trade status

Hong Kong’s homebuyers snapped up

hundreds of new flats on Saturday, turning out in droves to defy an amber

rainstorm warning and the US President Donald Trump’s threat to revoke the city’s

special trade privileges amid an escalation of tensions with China.

Sun Hung Kai Properties (SHKP), Hong

Kong’s largest developer by market value, sold 291 of 298 flats, or 98 per cent

of units offered in the second batch of the second phase of its Wetland Seasons

Park project in Tin Shui Wai as of 7.10pm, according to sales agents.

“So far, customers are still very

enthusiastic in coming out to pick the flats, and the crowd didn’t shrink

because of the overnight news” of US actions on Hong Kong, property agent said,

adding that the agent expects the batch to be sold out by the end of the day.

SHKP raised the price for some of

the best units in the second batch by 2 per cent, compared with last Saturday,

after its encouraging result of selling more than 80 per cent of the flats. The

first batch was sold at 18 per cent discounts.

Coming fresh on the heels of one of

the White House’s much-heralded punitive action on Hong Kong amid the lowest

point in US-China relations, SHKP’s strong showing underscores how the city’s

residential property market may be finding a temporary respite from its

year-long slump. As many as 25 buyers registered to bid for every single

available flat unit.

Mass-market residential projects are

likely to hold up better than commercial and high-end properties, as there is

still a lot of demand by local residents who want to buy flats for their own

use while supply is scarce, according to analysts and agents.

In an indication of the strong

demand, a total of 7,631 buyers put down a deposit to enter a lottery for the

298 flats at Wetland Seasons Park. The flats, located in northwestern New

Territories, are priced at HK$10,842 to HK$15,670 (US$2,021) per square foot,

with sizes ranging from 331 to 816 square feet (76 square metres).

The value of the city’s new and

secondary home transactions plunged 52 per cent to HK$33.7 billion in April

from last year, according to government data. Property agency index, which

tracks prices of used flats, declined about 6 per cent since a high in June 2019,

when the anti-government protests started.

(South China Morning Post)

US government invites bids on six multibillion-dollar Hong

Kong mansions, even as White House revokes city’s trade status

The United States government is

calling for bids on a cluster of residential properties in the world’s most

expensive real estate market, even as Hong Kong is turning into the latest pawn

in an escalating rivalry between the US and China.

A plot of land with six multistorey

mansions located at 37 Shouson Hill Road near the city’s Ocean Park resort was

put on the market this week. The six mansions, each with as many as 10

bedrooms, measure about 47,382 square feet (4,400 square metres) in total,

according to a tender document seen by South China Morning Post.

The project offers breathtaking

views of Deep Water Bay from a gated community accessible via a private

driveway from Shouson Hill Road. A small swimming pool is shared by the two

largest of the six houses, complete with a gazebo between them.

The entire project including the six

houses is estimated at between HK$3.1 billion and up to HK$5 billion (US$645

million) according to valuers. That’s less than the HK$5.93 billion fetched in

June 2018 at a neighbouring site of a comparable size, according to the tender

document.

“The luxury housing market has cooled down over the past

two years, and it takes longer time to sell high-end villas right now, which

would make developers more cautious,” real estate consultant said.

The US government bought the land in June 1948 for an

unknown price when Hong Kong was still a British colony, according to public

records at the Land Registry. Construction on the site was completed in 1983.

“The State Department’s Bureau of Overseas Buildings

Operations regularly reviews the US Government’s overseas real estate holdings

as part of its global reinvestment programme,” according to a statement by the

US Consulate Genera in Hong Kong. “As part of that programme, the State Department

has decided to sell the Shouson Hill property, and at the same time, invest in

enhancing other US Government-owned assets in Hong Kong, including the US

Consulate General’s office building. The reinvestment program reinforces the US

Government’s presence in Hong Kong by ensuring its facilities are able to

perform to the highest long-term standards.”

The neighbouring plot was sold to

China Resources in 2018, agents said.

“Taking into account the current

political and economic sentiment, the price should be 10 to 20 per cent lower

than the average price of HK$85,000 per sq ft” of the neighbouring project, an

agent said, who values 37 Shouson Hill Road at HK$3.2 billion. “Mainland

Chinese used to be the buyers of luxury properties. Will they buy property from

the US government now? That is a question in many people’s mind.”

It is unclear how many properties

the US government owns in the city. A property agency has been assigned as

sales agent for the project. The agents were not immediately available to comment.

The project is being sold on an “as is” basis, with all six mansions, with an

agreement to lease it back. Interested buyers can bid for the project as a

whole, and can tear the project down to rebuild on its floor plate measuring

92,000 square feet.

Details of the tender came to light

hours after Trump announced that he would revoke Hong Kong’s special customs

status, in response to the Chinese legislature’s announcement last week of

introducing a national security law for the city. Trump’s plan would affect a

“full range of agreements” from an extradition treaty to commercial relations, the

agent said, after his Secretary of State Mike Pompeo said Hong Kong could no

longer be considered be a region that is autonomous from Beijing’s rule.

(South

China Morning Post)

低市價50%租約期一年海防道鋪每呎112元租出

疫情重擊核心區,鋪租持續下滑。尖沙嘴海防道一個地鋪,自從舊租客藥房撤出,丟空近兩個月,以每呎112元租出,低市價約50%,新租客為影音手機配件店,租約期一年。

土地註冊處資料顯示,上述為尖沙嘴海防道31號地鋪,於本月13日以10萬租出,以鋪位面積893方呎計,呎租約112元,租約至明年5月,租約期僅約1年,租戶為寶栢貿易有限公司(PROSPEX TRADING LIMITED),董事羅真雄。現場所見,該家租客已開門營業,售賣影音用品,手影碟及手機配件等,鋪面裝修簡單,與短租客甚至相似。

每月租金10萬

市場人士指,該名新租客簽約1年,有別一般長租至少簽2年,亦不是「試水溫」式的短租,簽約3個月至半年,可見租客儘管接受該租金水平,對前景仍存不確定因素,傾向較保守。

盛滙商舖基金創辦人李根興形容,該鋪最新租金甚至平過「沙士」,月租僅10萬,平均呎租約100餘元,不少民生旺段都是此水平,惟租約期僅1年,故實為「短租價」,或不排除涉及營業額分成條款。受示威及疫症影響,核心區遊客近絕迹,海防道成為「重災區」,珠寶店及藥房「天價」搶租盛況不再,拖累租金急速下滑。

李根興:平過沙士時期

資料顯示,該鋪原租客藥房,早於去年反修例運動後,藥房公布9月底約滿不再續租,當時月租約50萬,業主以短約留住租客,租金減至20萬,故上述租金較舊租金下跌約50%。另外,該鋪於2013年由米蘭站以99萬租用,至2015年租金更增加至102萬,故最新租金較高峰期回落逾九成。代理指出,該鋪位由於接近廣東道,屬於「龍頭鋪」。論租金亦是過去5年來,該街道最平租的鋪位(包括短租在內)。

據悉,早於1997年,該鋪由許留山以16.7萬承租,及後經歷鋪市高低起伏,直至2013年3月,月租雖已加至60萬,惟米蘭站以每月100萬搶租,及至2015年7月,續租仍錄輕微加幅,月租約102萬,惟後來,零售業表現不如前,儘管鋪租節節下跌,米蘭站仍撤出,鋪位獲藥房進駐,大幅減租50%。

事實上,受市場淡風吹襲影響,該街道早前已頻錄減租個案。資料顯示,海防道35號至37號地鋪入口,1樓及2樓,地鋪入口建築面積約300方呎,1樓及2樓面積各約1800方呎,合共樓面3900方呎,自從連鎖化妝品2個月前遷出,剛獲連鎖超市以20萬承租,平均呎租約51元。舊租客連鎖化妝品莎莎,自2011年9月預租,並於翌年3月進駐,當時月租50萬,有代理指,於2014年鋪租高峰期,月租曾高達70多萬,惟新年再回落至50萬,此水平租金一直維持至撤出之前,故最新租金較舊租金跌約60%。

(星島日報)

力寶銀主盤呎售2.8萬重返三年前水平

受多項不明朗因素影響,甲廈市場觀望氣氛瀰漫,成交價持續下滑。消息指,金鐘力寶中心高層2伙銀主盤,合共面積3652方呎,以每呎造價約2.8萬沽出,涉資逾1.02億,低市價約5%,並重返3年前水平。

低市價5%

市場消息指出,成交為力寶中心2座高層05至06室,合共面積約3652方呎,為銀主盤,以每呎約2.8萬沽出,涉資逾1.02億。業內人士指出,上述成交低市價約5%,並重返3年前水平,同時亦為甲廈市場過去一年首宗甲廈億元銀主盤成交。

年內首宗億元銀主成交

據土地註冊處資料顯示,原業主於2017年分別以8577萬及2376萬,合共1.09億購入,以公司名義東營魯方金屬材料(香港)有限公司,DONGYING LUFANG METALS MATERIAL(HONG KONG)COMPANY LIMITED持有,註冊董事為顏姓及崔姓人士,惟及後淪為銀主盤,最新成交價亦較購入價低約6.4%。

據代理資料顯示,該甲廈2座低層單位,面積2450方呎,於2017年6月以6860萬成交,平均呎價約2.8萬,成交呎價與上述成交價相同。

(星島日報)

大昌李永修:總投資額20億鴨脷洲住宅地興建中小戶

鴨脷洲海旁道住宅地皮,由近年主力發展港島豪宅的大昌集團以逾13.3億奪得,相隔8年再次得手,大昌執行董事李永修稱,是次地價屬合理市價之內,預計投資額約20億,並主力發展中小型單位。

大昌集團近年主力發展港島區豪宅,對於集團再次奪得地皮。李永修表示,是次出價屬合理市價,投資額涉及約20億,料以純住宅單位為主,並將會發展中小型單位為主,另部分單位作特色戶。對於投地方面,他再指,集團對不同地皮均有興趣,亦需補充土地儲備,而目前優質地皮罕有。

他再指,港區國安法推出,對樓市及投資者影響不大,目前樓市仍以用家為主導,加上未來土地及房屋供應仍不足,市場剛性置業需求大。

地價屬合理市價

近年該公司主力發展港島豪宅,對上一次奪得地皮為8年前,於12年5月以16.68億奪得的淺水灣道豪宅地皮,當時每方呎樓面地價約39672元;現時已發展為豪宅新盤淺水灣108,由8幢大屋組成,面積4963至8694方呎,並曾於去年2月公布該盤樓書,惟至今暫未公布銷售安排。另外,同系山頂賓吉道3號,由6幢洋房組成,早年已沽出1伙,現尚餘5幢大屋待售。

落成後料享海景

測量師認為,當區細單位供應不多,均主打大單位,而該盤主力發展細單位可迎合市場需求,由於地皮呈長條形,料日後落成後不少單位可享避風塘及深灣遊艇會一帶的海景,缺點為公共交通配套不足。而且是次標價反映近期一手市場熾熱,增加發展商對後市的信心。

是次批出的地皮位於鴨脷洲海旁道,地盤佔地面積約12150方呎,最高可建樓面約88282方呎。地皮呈長窄型,位置臨海,近海旁的一面可望向香港仔避風塘及深灣一帶,另一面則鄰近利東邨,生活配套完善。另外,賣地章程亦要求興建私家車及電單車車位,並要保養項目毗鄰的一幅斜坡。

此外,是次海旁道地皮的樓面地價,若與17年2月批出的同區利南道地皮,每方呎樓面22117元相比,短短3年間回落約31%。

(星島日報)

疫情受控商舖交投低位反彈

本港疫情受控,消費市道有改善,而商舖投資者亦趁業主減價,重啟入市,令近日舖位買賣明顯從低位反彈。

2至4月份疫情嚴峻,商舖買賣甚少,而直至近一個月,疫情受控下,投資氣氛轉好,商舖買賣漸多。如上環文咸東街一巨舖易手,涉及地段84至90號地下A舖及1樓,地下面積約2,321平方呎,1樓面積約5,661平方呎,合共約7,982平方呎,以約9,600萬元成交,呎價約1.2萬元。

據悉,該舖曾由餐廳租用,現已遷出。消息指,新買家為一家內地背景金融機構,擬購入舖位自用。原業主早於1988年,以1,258萬元購入,早前以1.2億元放售,現減價2成沽出。持貨32年轉手,獲利約8,342萬元,舖位升值6.6倍。

宏安沽大圍舖 15年升值3倍

另大圍道55至65號金禧花園地下6號舖,面積約674平方呎,以約6,680萬元沽出,現時由便利店以每月約15萬租用,回報率約2.7厘。據了解,舖位原由宏安持有,早前以8,000萬元放售,最終減價16.5%沽貨。原業主於2005年1月用1,630萬元買入,持貨15年,升值3倍。

至於中細碼舖位,成交同樣增加,如灣仔謝斐道130號地下,面積約800平方呎,以約2,780萬元成交,舖位由茶餐廳以每月約6.8萬元租用,回報率約2.9厘。原業主早前以約3,500萬元放售,減價約2成沽舖。

旺角連錄舖位成交

旺角區亦錄兩宗買賣,如投資者李耀華以約4,400萬,購入旺角通菜街190號地下舖位,面積約1,100平方呎,現時舖位由水族用品店以約11.8萬元租用,回報率約3.2厘。至於同區咸美頓街14至20號地下舖位,以約1,980萬元成交。物業面積約500平方呎,現由餐廳以每月4.9萬元租用,回報率約2.7厘。翻查資料,原業主於2011年以2,200萬元購入該舖,以及比鄰砵蘭街88號地下舖位,持貨9年轉手套現。據悉,業主仍持有砵蘭街88號地下,市值約1,500萬元。

分析指,疫症年初爆發,令零售及餐飲生意大跌,商舖租售價即回落,投資者亦乏興趣入市。近期舖位業主漸減價放售舖位,正值疫情漸受控,令投資者重啟入市興趣,故在減價效應下,舖位交投量回升。預計本地消費市道漸平穩下,料舖位交投向好。

(經濟日報)

上環酒店基座餐飲樓面招租每層約8萬

上環AKVO酒店基座餐飲樓面現招租,單位附設裝修及用具,意向月租每層8萬元。

代理表示,上環蘇杭街57號AKVO酒店1及2樓,1樓面積約2,052平方呎,2樓面積則約2,100平方呎,每層意向月租約8萬元,租客可分開或一併租用,物業現已交吉。

附設裝修及廚房設施

代理稱,項目位處酒店基座,配合周遭上班一族及居民,客源有一定保證,適合食肆、酒吧或會所類租客進駐,同時舖位已備有裝修及廚房設施等,租客可即租即用,節省一大筆裝修費用,減輕營運成本。代理補充,1樓附有露台,可作露天進餐區,為物業增添特色。

(經濟日報)

莊士上環兩舊樓強拍底價3.3億

莊士(00367)旗下公司早前向土地審裁處申請強拍,位於上環結志街16號及18號兩幢舊樓,審裁處昨日(28日)頒下判詞批出強拍令,底價為3.32億元。

申請人為FAVOUR DAY LIMITED;答辯人為10名業主。根據判詞指出,申請強拍大廈位於上環結志街16號及18號,一幢6層高大廈,包括地舖及住宅單位。

結志街16及18號 6層高大廈

申請人於2019年3月提出申請時,已收購了逾82%業權,當時共涉10名答辯人,其後答辯人分別退出訴訟或已達成協議,部分則質疑重建後之估值,惟沒有任何答辯人就此呈交專家報告或任何證供,或出席聆訊。

審裁官最終裁定所涉大廈應該進行強拍,並接納專家及測量師的意見,認為涉案大廈日久失修,雖然花費維修可延長大廈壽命,但隨着時間過去,大廈損毁情況只會愈見嚴重,所花維修費用有增無減,故批出強拍令,並訂下底價為3.32億元。

(經濟日報)

華懋深水埗地中標價高次標2.9%

財團搶市區地激烈首5標書出價差距10%內

市區中小型住宅地競爭激烈,早前批出的市建局深水埗東京街,以及旺角豉油街兩幅地公布入標價。前者華懋中標價9.1億元,較次高標僅高2.9%,而由建材商奪得的旺角地亦只是較次高價高4.2%。

市建局上月以約9.1億元批出深水埗東京街/福榮街項目予華懋,剛公布餘下16份標書的入標價。發展商中標價僅高於次高標價2.9%,而且最高價的5份標書出價差距僅10%內,反映發展商競爭激烈。

地皮在4月7日截標時,接獲17份標書,最後由華懋以9.128億元奪得,每呎樓面地價約8,770元,較2018年10月同區青山道市建局項目每呎樓面地價8,565元,僅略高205元或2.4%,不過由於青山道項目的商業樓面要交還市建局,實際可出售樓面的每呎地價為1.02萬元,因此意味該區地價在1年半下跌約15%。

據當局公布的其餘入標價,連同中標財團,整體入標價介乎2.88億至9.12億元不等,每呎樓面地價介乎2,767至8,770元不等,高低價差距2.2倍,中位數為6.6億元,即每呎約6,341元。若果以最高價的5份標書計,均高於8億元,差距在10%內,反映整體發展商的競爭尚算激烈。

豉油街蚊型地價高次標4.2%

至於另一幅位於旺角豉油街蚊型地,亦在上月底由展光有限公司以4.67億元投得,政府剛公布餘下26份標書的入標價。發展商中標價僅高於次高標價4.2%,首5份標書出價差距大約15%。

該幅地皮位於豉油街及上海街交界,可建樓面60,595平方呎,在4月中獲27份標書,最終由展光有限公司以4.67億元投得,每呎樓面地價約7,710元,但若果扣除地契內規定撥出1萬平方呎作政府設施,實際住宅樓面只有50,497平方呎,即每呎樓面地價9,252元。

地政總署公布餘下26份標書出價,整體出價介乎1.38億至4.67億元不等,以純住宅樓面計,每呎地價介乎2,733至9,252元不等,高低差距2.4倍,中位數為3.18億元或每呎6,297元,整體分布算是平均。

最高價的5份標書出價約4億元或以上,差距在15%左右之內,中標價4.67億元只是較次高標價4.48億元,略高4.2%或1,900萬元。

(經濟日報)

觀塘天星中心全層 4750萬易手

觀塘工廈獲買家追捧,天星中心17樓單位以4,750萬元易手,買家為太陽娛樂(08082)主席唐才智。

買家為太陽娛樂主席唐才智

資料顯示,天星中心17樓全層,面積5,687平方呎,以4,750萬元成交,呎價8,352元。原業主於2012年以3,326萬元購入單位,帳面賺1,424萬元,升幅約42%。登記買家為Nextra Management Limited,公司董事為唐才智。

據資料顯示,數月前唐才智及其妻,以2.3億元購入清水灣新盤傲瀧兩個特色單位。至於原業主熙樂有限公司,於2012年以3,326萬元購入單位,持貨8年帳面賺1,424萬元。

銀龍斥675萬購南豐中心單位

另外,土地註冊處資料顯示,荃灣南豐中心12樓一個單位,以675萬元售出,登記買家為銀龍粉麵茶餐廳有限公司。據了解,相關公司於早前已動用485萬元購入南豐中心9樓一單位,兩伙合共涉資1,160萬元。

代理表示,銅鑼灣希雲街27號地下舖位推出放售,面積約700平方呎,門闊約16呎,意向價約3,100萬元,平均呎價約44,285元。項目連租約出售,現由高級男士髮廊承租,月租約5.6萬元,租期至明年中。

(經濟日報)

國安法落實地產界料短期影響微

暫未見外資退租企業需時判斷

港區國安法立法決定昨日正式獲人大通過,學者及地產業界普遍態度較觀望,有意見認為,美國短期內行動不會多,樓市暫未見影響,商廈市場方面暫未見外資退租潮,有測量師預計企業需時間判斷信息。

隨着港區國安法立法落實,加上美國不保證香港繼續享有特殊待遇,會否對香港經濟、樓市造成影響?若有外資撤走又會否影響商廈市道?

本報向多名地產業界及學者了解,普遍認為樓市、商廈市場未見有即時衝擊,在港外資企業需時判斷信息,即使有美資企業逐步撤出市場,豪宅、商廈的退租潮亦不至於短期內發生。

身為中原集團主席、創辦人的施永青認為,美國收緊香港特殊地位,並不是現時才出現,而是持續的趨勢,「遲早都會處理」,不過他相信美國短時間內會做的事情不多,例如取消港幣美元結算等不會立即做,會視乎自己的利益、「準備好幾多」才實施制裁。

至於樓市暫時未見受影響,施永青稱,樓市不是全民參與,買樓的業主取態有可能比較保守,覺得國安法的保障更加多。

或影響入市信心樓價難大跌

美國克林信大學經濟系副教授徐家健亦認同,須視乎美國對港出招的程度,而且香港樓市有本地及內地客的實質需求,故即使美國撤香港特殊地位,對樓市的影響,主要體現於信心方面,很難觸發樓價下跌一半。即使有美資逐步撤出香港,豪宅、商廈物業或出現退租情況,不過情況不會在短期內發生。

「美國對上海及深圳也沒有特殊待遇,但樓價也不斷升,所以對香港不會有太大影響。」嶺南大學潘蘇通滬港經濟政策研究所高級研究員何濼生更認為,深圳的樓價亦能媲美香港,反映國安法不會令樓價大跌。

不過,資深投資者林一鳴擔心,若果美國不再保證香港繼續獲特殊待遇,會對經濟有影響,而打擊對象集中在中產人士,香港樓價就有機會下跌;惟仍要觀察多方面因素,例如美國總統特朗普能否連任,都有機會影響形勢。

在商廈市場方面,持有不少商廈收租的大鴻輝興業主席梁紹鴻則指,美國是否撤香港特殊地位及細則尚未清楚,暫未見機構撤資,本港甲廈近年受內地機構支撑,旗下甲廈主要為本地公司及內企,涉及美資不多,暫看不到有衝擊。

至於戴德梁行香港董事總經理蕭亮輝亦指,由於在港外資企業需時判斷相關信息,故暫時不會有任何撤離或收縮動作,而一般寫字樓租務涉及2至3年,現階段未出現機構取消租約。今年寫字樓市場主要受環球疫情影響,全年甲廈租金料跌逾1成。

另本港主要發展商代表的香港地產建設商會發表聲明稱,全力訂立港區維護國家安全法將有助於維護國家安全,捍衞一國兩制行穩致遠,對保障市民生命財產、促進社會繁榮穩定以及香港長治久安起積極作用。

(經濟日報)

Emperor's Mid-Levels flats in hot demand

The first batch of flats at Central 8 in Mid-Levels has been 2.8 times oversubscribed, with developer Emperor International (0163) receiving 260 checks for the 68 flats on offer.

The first batch has an average price of HK$30,814 per square foot after discounts, and 34 units were sold as of 9 pm yesterday.

Meanwhile, Vanke Property (Hong Kong) released 47 flats in the third price list of The Campton in Cheung Sha Wan at an average price of HK$17,896 per square foot after discounts, 9 percent higher than the first price list. The cheapest 369-sq-ft flat was offered at HK$6.57 million, or HK$17,875 per sq ft after discounts. The Campton's first batch of 188 units was 37 times oversubscribed on Wednesday.

And Sun Hung Kai Properties (0016) received 7,000 checks for 298 flats at Wetland Seasons Park Phase 2 in Tin Shui Wai, 22 times oversubscribed. The second batch of sales will be launched on Saturday, worth over HK$1.8 billion in total after discounts. The cheapest flat, a one-bedroom unit, is offered at HK$3.98 million.

The project put 155 additional units on sale on Tuesday at an average price of HK$12,783 per sq ft.

Also, Henderson Land Development (0012) is launching sales of several large flats at Double Cove in Ma On Shan due to increasing demand, with seven such flats sold in the past two weeks. A 2,742-sq-ft show flat of Flat B on the 36th and 37th floor of Double Cove Starview opens today.

Meanwhile, the Town Planning Board has given the green light to SHKP on a residential development project in Lam Tei, Tuen Mun, offering 96 flats. The board previously rejected the application in 2018.

Elsewhere, the Urban Renewal Authority has announced the failed bids for the Tonkin Street/Fuk Wing Street Development Project in Sham Shui Po, which Chinachem won for HK$912.8 million. The lowest offer was only HK$288 million, with only three tenders offering more than HK$800 million.

In the secondary market, a prospective buyer forfeited deposits of HK$470,000 after calling off the purchase of a 484-sq-ft flat at Century Link in Tung Chung.

In other news, the one-month Hong Kong Interbank Offered Rate, which is linked to the mortgage rate, up to 1.06441 percent.

(The Standard)

上環鋪每呎1.53萬低15%售位處文咸東街交吉逾一年

受政經不明朗因素困擾,工商鋪市場觀望氣氛未散,惟市區鋪位仍備受追捧。消息指,上環文咸東街巨鋪,面積逾6000方呎,前身為中式食肆,結業後交吉逾一年,該鋪剛以9600萬成交,平均呎價約1.53萬,低市價約15%。

市場消息指出,上址為上環文咸東街84號至90號地下A鋪及1樓,地鋪面積約1691方呎,1樓面積約4581方呎,合共面積約6272方呎,於去年10月以1.6億放售,今年4月放售價調整至1億,最終以9600萬成交,呎價約1.53萬。有代理指出,該鋪址前身為桃花源小廚,惟一年前結業,業主一度以30萬放租,最後決定只售不租。

料回報率逾三厘

盛滙商舖基金創辦人李根興指出,該巨鋪位處中高檔消費地段,因地鋪及樓上鋪均屬大樓面,適合經營健身中心、護老院及超市,加上鋪位前方可泊車,屬市場罕有供應,成交價低市價約15%,料買家享逾3厘回報。

據土地註冊處資料顯示,上址原業主於1988年以718萬購入,並採用公司名義TENG FUH COMPANY LIMITED,註冊董事為林姓人士,持貨32年,帳面獲利8882萬,物業期間升值約12.3倍。

市場消息指出,灣仔謝斐道130至146號地鋪,面積約850方呎,以2780萬成交,呎價約32706元,該鋪由食肆以6.8萬承租,料回報約3厘。原業主於2008年以870萬購入,持貨12年,帳面獲利1910萬,升值約2.2倍;市場人士指,上述鋪位闊約14呎、深約45呎,成交價低市價約一成。

謝斐道鋪2780萬成交

另外,民生區鋪位亦錄成交。市場消息指出,大圍道55至65號金禧花園地下6號鋪,面積674方呎,以6680萬成交,呎價約99110元,該鋪由便利店以約14.95萬承租,料回報率約2.7厘。原業主於2005年以1630萬買入,故持貨15年,帳面獲利5050萬,升值約3倍。

(星島日報)

企廣一期每呎5800元重返十年前水平

受多項不明朗因素夾擊,甲廈市場觀望氣氛濃厚,租售價均備受壓力。消息指,九龍灣企業廣場1期低層單位,以每呎約5800元售出,低市價約20%,造價更重返十年前水平。

市場消息指出,上述九龍灣企業廣場1期1座低層02室,面積約9532方呎,以每呎約5800元售出,涉資約5528.5萬。據區內代理指出,單位位於低層,不由電梯大堂直接直往,是由扶手電梯抵達,對商戶而言,吸引力自然較遜色,是次成交價較市價低約20%,造價更重回約十年前水平。

低市價20%易手

據代理資料顯示,該甲廈近期1宗成交為1期1座高層單位,於本月以4692萬成交,以單位面積7447方呎計,呎價約6300元。

力寶每呎43元租出

甲廈亦頻錄低市價承租。市場消息指,金鐘力寶中心1座高層04室,面積743方呎,以每呎43元租出,涉資約31949元,低市價約一成。

(星島日報)

大昌逾13億奪鴨脷洲地每呎15097元較三年前同區地低31%

疫情持續,以及將推出港區國安法,發展商仍積極購地,上周五截標的鴨脷洲海旁道地皮,於昨日開標,由大昌集團以逾13億,力壓其餘18間財團得手,每呎樓面地價15097元,高於市場估值,為該集團8年以來首奪地皮,另外,若與17年2月批出的同區地皮,每呎樓面地價22117元相比,3年間地價回落約31%。

地政總署公布,鴨脷洲海旁道住宅地,由大昌集團以13.328億奪得,力壓其餘18間入標財團,以地皮可建樓面88282方呎計,每方呎樓面地價15097元。

市場原先估值約11.8億至12.2億,樓面呎價約1.2萬至1.3萬,目前較市場估值高。至於大昌執行董事李永修於上周五截標時曾指出,該地將發展中小型單位,而港區國安法,對投資者信心沒有太大影響,因本港房屋供應不足,而且需求大。

至於大昌屬老牌地產商,近年鍾情於港島豪宅地皮,對上一次奪得地皮,為約8年前,於12年5月以16.68億奪得淺水灣道豪宅地,每方呎樓面地價39672元,目前已發展為豪宅新盤淺水灣108,由8幢大屋組成,面積4963至8694方呎。

相隔八年再奪地

此外,大昌亦於02年4月亦以1億投得赤柱環角道豪宅地,其後發展為洋房項目環角道33號。而是次海旁道地皮的樓面地價,若與17年2月批出的同區利南道地皮,每方呎樓面22117元相比,3年間回落約31%。

高於市場估值

另外,地皮於上周五截標時,接獲19份標書,入標財團包括新地、會德豐地產、信和、新世界、嘉里、佳明、其士集團、中國海外、佳兆業;另嘉華夥莊士中國競投。

有測量師稱,地皮中標價較預期好,反映發展商對豪宅後市仍有信心,估計總投資額約22億至26億,項目落成後呎價由約2.8萬起。至於該地皮鄰近豪宅項目南灣,單位落成後可享避風塘一帶海景,由於地皮呈長條形,估計發展商主力發展中型單位,令較多單位可享海景。

另一測量師稱,地皮雖然交通不算便利,但具海景優勢,而且面積適中,投資風險較易控制,估計日後發展商會興建中小型單位為主,現時雖然市場波動,但地皮以理想價格售出,足證發展商對樓市發展具信心。

(星島日報)

88 more Oma flats hit the market

Wing Tai Properties (0369) released 88 flats in the fifth price list of Oma by the Sea in Tuen Mun, at an average price of HK$13,746 per square foot after discounts, 9.5 percent higher than the first price list. The cheapest 338-sq-ft flat was offered at HK$4.44 million, or HK$13,133 per sq ft.

Meanwhile, Vanke Property (Hong Kong) sold all 188 flats on offer for The Campton in Cheung Sha Wan in only eight hours, raking in a total of HK$1.4 billion.

And Sino Land (0083) sold the last 3,070-sq-ft duplex at The Palazzo in Fo Tan to mobile game developer Terence Tsang Kin-ho for HK$80 million, or HK$26,059 per sq ft, while a 1,554-sq-ft duplex flat at La Cresta in Cove Hill sold for HK$36.63 million, or HK$23,571 per sq ft, by tender.

In the secondary market, Salenda Lau, the former general manager of sales and marketing at Sino Land, purchased a 2,579-sq-ft unit at luxury residential estate Hong Lok Yuen in Tai Po for HK$42 million, or HK$16,285 per sq ft.

And a 509-sq-ft flat at K.City in Kai Tak changed hands for HK$10.6 million, or HK$20,825 per sq ft, after HK$1 million was slashed from the initial asking price.

(The Standard)

上環6重建項目增建116萬呎商用樓面

上環近年有不少舊樓收購重建,成為區內新增商業樓面供應來源,區內6個重建項目,將提供約116.3萬平方呎樓面供應,包括早前永泰地產(00369)、資本策略(00497)等旗下的嘉咸街項目,獲批興建兩幢商廈及酒店,涉逾43萬平方呎樓面。

由於鄰近中環核心商業區,加上缺乏新增的土地供應,隨着商業區向周邊擴大,上環區內一帶的舊樓亦獲財團及發展商收購並進行重建。粗略估計,區內目前有6個重建項目,合共涉及約116.3萬平方呎樓面。

嘉咸街地皮料建商廈及酒店

當中規模最大為嘉咸街項目C地盤,由市建局展開收購,並在2017年10月由永泰地產、資本策略以約116億元奪得發展權,可建樓面逾43萬平方呎,按照屋宇署最近公布的建築圖則。項目將分別重建成1幢32層高商廈,以及1幢27層高酒店,基座則為4層平台商場及2層地庫。

大鴻輝積極收購涉約46萬呎樓面

大鴻輝興業則是區內最積極收購舊樓的財團之一,在區內持有干諾道西,以及德輔道西兩個地盤,當中在干諾道西94號至103號、德輔道西99至101號的地盤面積達2萬平方呎,可建樓面最多約30萬平方呎,將重建成甲級海景商廈,投資額估計逾70億元。至於集團所收購的德輔道中212至214號德輔商業中心,並計劃收購比鄰的永樂街舊樓一併重建,地盤面積約1.1萬平方呎,將建25層高商廈,連3層平台及1層地庫,總樓面約16萬平方呎。

內地房地產私募基金凱龍瑞亦參與進行收購重建,2017年以約2.2億元購入永樂街78及80號兩幢舊式寫字樓,之後再收購入永樂街82至86號、88至90號多幢物業,組成約4,400平方呎地盤,預計可興建成1幢6.6萬平方呎的商廈。

至於持有干諾道西152號港島太平洋酒店的信置(00083)黃氏家族,亦向屋宇署申請建築圖則,研究將項目重建成25層高商廈,可建樓面面積約14萬平方呎。該酒店在1999年開幕,樓高29層,共提供約343間客房。

同時,由資本策略收購的威靈頓街曾昭灝大廈,該物業佔地約4,206平方呎,屬於「商業」規劃用途,地積比率15倍,可建樓面約6.3萬平方呎。中上環一帶舊樓收購重建活躍,除了重建成為商業樓面供應外,還有不少重建成住宅或者商廈項目,預計舊區的面貌將會有所改變。

(經濟日報)

老牌家族放售九龍塘洋房

豪宅物業有價有市,老牌家族亦趁勢放售。代理指出,九龍塘施他佛道13號獨立屋(見圖),地盤面積5166方呎,實用面積約3804方呎,現為1幢2層洋房,附設前後花園及空中花園,並連有蓋半地庫車房,以意向價2.2億放售。

代理續指,項目業主為九龍塘老牌家族,早於2005年購入屋地,自行興建後,一直惜售保留自住,直到最近放售物業。

(星島日報)

旺角通菜街地鋪4450萬售

鋪市觀望氣氛濃,惟核心區鋪位仍備受追捧。近期頻入貨的資深投資者李耀華再度「出手」,斥資4450萬購入旺角通菜街「寵物段」一個地鋪,平均呎價4.45萬,回報逾3厘,成交價低市價約18%。

市場消息透露,上址為旺角通菜街190號地鋪連入則閣,面積約1000方呎,作價4450萬成交,每呎造價約4.45萬,買家為資深投資者李耀華,該鋪門闊約14呎6吋,現時由水族用品店以11.8萬承租,料回報約3.2厘。

投資者李耀華承接

李耀華接受本報查詢時,證實他購入上述鋪位,他表示,雖然近期市場受多項不明朗因素困擾,觀望氣氛未散,惟該鋪地點相當不俗,受社會運動影響亦較小,購入價為合理水平,該地鋪位租金處低於市價水平,故將來租金有機會作調整,可長綫收租,若「啱價」的話,亦可考慮出售;李耀華又說,儘管近期鋪市觀望氣氛仍濃厚,惟他仍睇好後市,料市場交投氣氛有力逐步回穩。

有代理分析道,該鋪位目前回報逾3厘,有上調空間,相對零售行業,寵物街受網購影響相對細,成交價低市價約18%。

每呎4.45萬低市價18%

據土地註冊處資料顯示,上址原業主於2007年以公司名義洋帆有限公司(SAILING STAR LIMITED)購入鋪位,作價2320萬,註冊董事黃姓及姜姓人士,持貨13年,帳面獲利2130萬,物業升值約92%。

咸美頓街地鋪1980萬沽

資料顯示,李耀華近年頻頻入市,他於去年4月以約3980萬,購入觀塘協和街169號至197號合和大廈地下23號鋪,地下約600方呎,另加閣樓約600方呎,平均呎價6.63萬,租客分別為樂康軒閣樓及K2 SALON,月租10.25萬,料回報3.09厘。

另外,據土地註冊處資料顯示,旺角咸美頓街14號地鋪,於本月18日以1980萬成交,以鋪位面積500方呎計,平均呎價約3.96萬,原業主於2011年以一籃子方式作價2200萬購入,以公司名義宏嘉發展有限公司持有,註冊董事為吳姓及張姓人士。

(星島日報)

Tai Cheung secures Ap Lei Chau site for HK$1.3b

Tai Cheung (0088) won the tender for a residential plot on Praya Road in Ap Lei Chau for HK$1.33 billion, or HK$15,097 per buildable square feet, close to the upper end of market valuation.

Tai Cheung outbid 18 other developers; among them are Wheelock Properties, Hang Lung Properties (0101), New World Development (0017), Sino Land (0083) and Sun Hung Kai Properties (0016).

The site covers a total of 12,150.3 sq ft. The maximum gross floor area for private residential purposes that may be attained is 88,281.2 sq ft.

(The Standard)

$222m sale new high for Jardine's Lookout

A 2,848-square-foot unit at Dukes Place on Jardine's Lookout was sold through tender for HK$222 million, or around HK$78,000 per sq ft, with the per-sq-ft price hitting a new high at the estate.

The developers - Couture Homes Properties, Grosvenor Asia Pacific and Asia Standard International - have collected about HK$1 billion after selling five units at the project this year.

Dukes Place provides 16 units, measuring between 2,846 sq ft and 6,867 sq ft.

In the secondary market, a 3,804-sq-ft luxury house on 13 Stafford Road in Kowloon Tong is available for sale for HK$220 million.

A mainland investor suffered a loss of around HK$650,000 after selling a 381-sq-ft flat at Homantin Hillside in Hung Hom for HK$7.5 million, or HK$19,685 per sq ft, after slashing HK$2 million from the initial asking price.

A 363-sq-ft flat at Metro City in Tseung Kwan O changed hands for HK$6.8 million, or HK$18,733 per sq ft, after HK$100,000 was cut from the original asking price.

A 443-sq-ft flat at Telford Gardens in Kowloon Bay fetched HK$5.78 million, or HK$13,047 per sq ft, hitting a three-month low, according to property agency.

A 337-sq-ft flat at Sunshine City in Ma On Shan sold for HK$5.9 million, or HK$17,507 per sq ft, after HK$100,000 was cut from the first asking price, according to another property agency.

In the primary market, Sun Hung Kai Properties (0016) released 155 flats in the fifth price list at Wetland Seasons Park Phase 2 in Tin Shui Wai, at an average price of HK$12,783 per sq ft after discounts, about 12 percent higher than the first price list.

The cheapest 346-sq-ft flat was priced at HK$4.13 million. SHKP will put 298 flats for sale on Saturday.

The overall Hong Kong Interbank Offered Rate saw a pullback on Tuesday. The one-month Hibor, which is linked to the mortgage rate, dropped to 0.96369 percent.

(The Standard)

新近有業主因應市場走勢,將灣仔地標寫字樓會展廣場辦公大樓全層近兩萬呎單位推出市場放租,單位備有基本裝修,意向呎租約50餘元,對比去年該廈普遍成交呎租下調約兩至三成。

較去年4月減價3成

代理表示,位處灣仔港灣道1號的會展廣場辦公大樓近日有全層單位招租,為大廈中層全層,面積約19,180平方呎,意向呎租約50餘元。

代理稱,單位享有海景景觀,提供基本天花、地台及牆身裝修,可為租客節省部分費用。資料指出,單位於去年4月叫租每平方呎約80元,至近月市況欠佳,最新叫價已大幅下調逾3成,相信對租客吸引力上升。全層近兩萬呎單位罕有,是次物業更備有基本天花、地台及牆身裝修,業主叫價亦見合理,相信可獲企業洽租。

代理續稱,除了全層單位外,會展廣場辦公大樓亦有優質中小型單位選擇,例如大廈中層05A室,面積約1,275平方呎,望城市及園景,同樣備有寫字樓裝修,意向呎租約50餘元,為不同類型租客提供多種選擇。

(經濟日報)

名錶店Franck Muller 棄租銅鑼灣旗艦店

3層舖月租250萬將搬回中環自置物業

疫情加上社會事件,零遊客下鐘錶珠寶店持續收縮。瑞士名錶Franck Muller銅鑼灣霎東街3層旗艦店,月租涉250萬元,近日約滿決定遷出,放棄多層旗艦店,搬回中環新落成自置物業,以省卻開支。

位於霎東街15號Oliv商廈基座部分,由瑞士名錶Franck Muller租用,近日品牌約滿並遷出,舖位正進行裝修工程,料將重新招租。該地段比鄰時代廣場,即使人流暢旺程度不及羅素街,仍有不少零售、飲食品牌落戶。

翻查資料,Franck Muller於2015年,即Oliv入伙時,以250萬租用物業地下至3樓,面積約9,500平方呎,打造成複式旗艦店,甚具氣派。

創新概念美食腕錶crossover

品牌開店時加入創新概念,把美食與腕錶品牌crossover,開設Francesco by Franck Muller日式意大利餐。品牌兩年前續約,上月約滿,相信因應市況轉差,品牌決定節省開支而放棄多層旗艦店,日後搬回中環自置物業。

金利豐朱李月華擔任該手錶品牌亞太區主席,而她於2014年,以16億購入中環皇后大道中35號全幢,地盤面積約為2,805平方呎,現重建成一幢4萬呎寫字樓,近日正式落成,商舖部分保留作Franck Muller之用,將可省回大幅租金開支。

Franck Muller屬高級名錶,獲不少本港名人捧場,包括藝人張智霖2013年起擔任亞太區品牌大使,去年尾他亦出席品牌宣傳活動。

疫情下奢侈品消費急跌,高級鐘錶品牌減據點,如勞力士(Rolex)銅鑼灣羅素街專門店,面積約2,693平方呎,品牌經營多年後即將約滿,預計將遷出,業主以150萬元放租。

另外,Swatch Group旗下手錶品牌寶璣(Breguet),寶珀(Blancpain),均於尖沙咀1881商場租用大樓面舖位,月租合共約600萬元,集團亦放棄據點。

首季4大零售區跌租顯著

據代理資料顯示,首季4大核心零售區租金跌幅顯著,如中環呎租最新報534元,按季跌2成,而其餘3區跌幅亦達15%。空置率上升,而旺角核心主要購物地區空置率,由2019年第四季12.7%,急升至最新20%。

由於本港經濟轉差,加上封關下欠旅客到訪,料核心區吉舖數字持續上升,租金續有下跌壓力。

(經濟日報)

疫情放緩投資者趁機入市

早前業主減價放售物業,隨着本港疫情受控,投資者趁機入市,令近一星期市場出現數宗大手成交。

近日投資市場氣氛轉好,亦出現數宗工商舖大額成交。過去一星期,最大手買賣為上環新紀元廣場中遠大廈地下、1樓及2樓之商業單位以及位於3樓之辦公室單位,以及車位,以5億元成交,買家為結好控股(00064) 。該集團不時投資物業,如數年前以約3.5億元,購入紅磡商業中心全幢,其後加以翻新。

據了解,涉及中遠大廈每層面積由3,590至11,608平方呎不等,合共約27,808平方。該舖位曾由健身中心租用,亦曾作發展商售樓廠,現時交吉。按5億元成交價計,呎價近1.8萬元,另項目連同2樓及7樓停車場,合共19個車位,每個車位價值約400萬至500萬元。

新世界減價逾4成沽貨

翻查資料,物業原由新世界(00017)持有,今年初於市場放售,意向價約9億元。其後因應市況轉差,商舖價值下跌,現減價逾4成沽貨。

同區亦錄另一宗大手成交,上環干諾道中128號豫泰商業大廈多層,以約3.5億元沽出。涉及物業地下至3樓、8至11樓,合共8層樓面,總面積約1.72萬平方呎,以約3.5億元成交,呎價約2萬元。物業原由凱龍瑞基金持有,2017年以3.8億元購入大廈13層樓面,其後進行翻新工程包括大堂及外牆,並進行拆售,售出5層樓面後,如今8層獲一買家承接,全數沽出並獲利。

優品360 購觀塘商廈自用

另優品360 (02360)日前宣布,以1.77億元,購入觀塘絲寶國際大廈11樓全層,面積約1.68萬平方呎,呎價約1.05萬元,項目連同3個車位。該集團表示,現時租用同區寫字樓,購入寫字樓作總部之用。事實上,該廈上月亦錄買賣,國際皮具品牌Coach,以約1.85億元,沽出觀塘絲寶國際大廈15樓全層,呎價約1.1萬元。

早前疫情影響投資氣氛,特別商業市場,令工商舖買賣大幅下跌。隨着近一個月疫情受控,投資氣氛略轉好。此外,業主漸願減價放盤,令個別投資者認為可趁機入市,相信在疫情憂慮減低下,本地財團將重啟投資部署,料成交回升。

(經濟日報)

疫情影響承租力藥房轉攻民生舖

受新冠肺炎疫症影響,零售行業首當其衝,過去受自由行旅客直接拉動的行業,包括藥房、化粧品店等等可謂首當其衝,承租力大不如前。綜合近日所錄藥房租賃個案,租金普遍出現回落迹象,紛紛轉租民生區街舖,平均呎租介乎47至175元。

據資料顯示,新界區近月錄得數宗藥房租賃個案,屯門德政圍3至29號松苑地下01號舖位,面積約750平方呎,連同閣樓750平方呎,月租約7萬元,平均呎租約47元,租金較上年髮型屋每月月租10.4萬,下跌約33%。

同區的啟民徑1至13號地下E舖,面積將800平方呎,亦獲藥房承租,月租約14萬元,平均呎租約175元,租金較上手財務公司每月15.8萬下跌約11%。

元朗福德街藥房12.8萬續租

此外,元朗福德街18至36號地下2號舖,面積約1,200平方呎,原本由藥房承租多年,日前獲續租,新租金每月約12.8萬元,平均呎租約107元。

業界人士指出,受內地自由行旅客帶動,近年不少藥房以天價搶租零售核心區旺舖,一度成為租金急升的其中一個推動力。惟近期內地客完全絕迹,不少藥房退租核心舖位,例如尖沙咀海防道31號,面積約890平方呎,原由藥房租用,月租約50餘萬元,藥房3月退租,業主減至約20萬元放租,較前租金減半,可見藥房行業收縮,對舖租構成一定衝擊。

代理表示,經濟不景氣影響,相繼出現店舖倒閉潮,導致舖位租金普遍回落,空置率急速上升,因此吸引部分民生行業包括藥房重新部署,趁租金低企四出吸納承租優質舖位。代理指,受疫情衝擊下,個人及家庭抗疫之消毒衞生用品銷售急速上升,直接帶動藥房的經營利潤,故承租力較其他行業強勁,又指藥房首選民生區一綫地段落戶,選舖面積大約500至850平方呎,並鍾情門面寬敞舖位。

(經濟日報)

1001 King's Road港島東全新項目

港島東成為近年新商業中心,鰂魚涌太古坊一帶有不少商廈供應,其中位於英皇道的1001 King's Road,新近落成,將為區內帶來新供應。

1001 King's Road由大鴻輝發展,屬銀座式商廈。項目前身為住宅金山樓,由集團於2014年以底價6.6億元,強拍統一鰂魚涌金山樓業權,並計劃投資12億元,重建成商廈。

1001 King's Road樓高25層,外牆為玻璃幕牆設計。物業電梯大堂需經由扶手電梯向上,顯氣派之餘亦更有私隱度。電梯大堂以樓層分流,每邊設有2至3部客用升降機,有效分流。而大堂亦設有2個小食店位置,設有來去水位,可作輕食店之用。

物業分為兩部分,3至12樓可作寫字樓或餐飲用途,當中8至9樓附有露台,整體景觀大致開揚;而17至22樓則為商業及半零售樓層,多擁翠綠山景。

每層4600至7200呎

全層面積由4,699至7,200平方呎不等,當中設有特色戶,連有天台或露台。另23及25樓為項目頂層複式單位,面積分別約5,411及4,699平方呎,該單位備有空中花園天台,可飽覽開揚城市及海景景觀,適合特色餐廳及食肆進駐。

項目位於英皇道,屬港島東區主要道路,出入交通相當方便。物業樓下設有多條巴士綫,亦可以選擇以電車出入港島多區。步行至太古或鰂魚涌亦方便。

周邊甲廈呎租約50餘元

項目比鄰太古坊,區內商業條氛濃厚,參考比鄰的大廈成交,多盛大廈高層01至03及11室單位,面積5,583平方呎,於去年11月,以月租約318,231元租出,呎租約57元。同座的中低層01、09及11室,面積5,066平方呎,亦以268,498元租出,呎租53元。

中區商廈矜罕性高,但相對租金亦較高,因而近年部分企業在重組業務的考慮上,傾向把個別部門搬離核心商業區,以節省相關租金成本;加上近年北角至鰂魚涌一帶有多個全新落成的商廈項目,樓齡新,配套設施齊備,加上交通便利,因而吸引不少企業看好鰂魚涌商業群前景亮麗而進駐。

此外,港島東居住人口持續上升,太古城、康怡、南豐新村等龐大中產集中地,消費力不容忽視,對零售及飲食需求強勁,不論商業或零售樓面均見渴市。

(經濟日報)

盈信約3.3億購洗衣街全幢老牌家族持70年沽貨升值近3300倍

市區商住舊樓有價有市,再錄大手成交。消息指,旺角洗衣街181至183號全幢物業,作價約3.3億成交,屬市價水平,買家為盈信控股,料作重建用途,可建樓面約31445方呎,每方呎地價約10495元。原業主老牌家族持貨70年,帳面獲利獲利逾3.29億,升值達3299倍。

代理表示,洗衣街181至183號全幢商住物業以公司轉讓形式售出,市傳造價約3.3億,以總面積8161方呎計,呎價約40436元,屬市價水平,該物業地鋪由家具店以13萬承租,樓上住宅租金則約40萬,料買家享租金回報約2厘。

重建約3.1萬呎

代理續指,上述買家為盈信控股,購入作重建用途,項目地盤面積約3310方呎,以地積比率9.5倍計,可建樓面約31445方呎,每呎地價約10495元。

據土地註冊處資料顯示,原業主早於1950年購入,為黃姓人士,當年作價僅10萬,故持貨70年帳面獲利獲利逾3.29億,物業期間升值約3299倍。據另一代理資料顯示,旺角洗衣街對上一宗買賣為155至161A號地鋪,於2018年8月以5320萬成交,以鋪位面積1200方呎計,呎價約44333元。

以買賣公司形式成交

另外,市場消息指出,上環荷李活道0159至0163號鋪,市傳以9600萬成交,以地鋪1400方呎、低層地下約3200方呎及1樓約3200方呎計,合共面積約7800方呎,成交呎價約12308元。據悉,上述鋪位現時由食肆以29.4萬承租,料買家享租金回報約3.67厘。

荷李活道鋪傳9600萬沽

此外,民生區鋪位亦備受追捧,再錄成交個案。市場消息指出,由資深投資者郭木財持有的大圍村南道1至39號富嘉花園地下01號鋪,作價約3300萬沽出。據土地註冊處資料顯示,上址原業於2004年以718萬購入,以公司名義寶島實業有限公司(TREASURE ISLAND INDUSTRIAL COMPANY LIMITED)持有,註冊董事分別為郭順成、郭立賢及郭創華,持貨16年帳面獲利約2582萬,物業期間升值約3.6倍。

(星島日報)

觀塘絲寶全層1.76億沽

雖然市場觀望氣氛未散,惟市場不乏億元大手成交。消息指,觀塘絲寶國際大廈中層全層,作價1.76億成交,每呎造價約10449元,低市價約兩成。

市場消息指出,上述為觀塘絲寶國際大廈中層樓全層,面積約16844方呎,作價1.76億成交,平均呎價約10449元。據代理指出,該廈市值呎價約1.3萬起,故是次成交價低市價約2成。

企業廣場1722.5萬售

據土地註冊處資料顯示,上址原業主於2011年以9450萬購入,以公司名義協弘有限公司(ALLIED WIDE LIMITED)登記,註冊董事為李慧敏、陸扣英及李維勳,故持貨9年帳面獲利約8150萬,物業期間升值約86%。

事實上,該商廈於今年3月亦錄成交,為由國際品牌手袋零售商COACH持內的中層全層,作價逾1.85億易手,以全層建築面積約16841方呎計算,平均每呎約1.1萬,造價重返7年前水平,買家料回報逾3.1厘。

另外,九龍灣區內商廈亦頻錄成交,市場消息指出,企業廣場1期3座低層樓02室,面積約2650方呎,以1722.5萬成交,呎價約6500元;同區南豐商業中心中層樓19室,面積約1187方呎,以730萬易主,呎價約6150元。

(星島日報)

成運工廈呎價5592元兩年貶值15%

受多項不明朗因素困擾,市場觀望氣氛瀰漫,投資者蝕讓沽貨離場。消息指,由投資者持有的觀塘成運工業大廈中層單位,作價345萬成交,原業主持貨2年,帳面蝕讓63萬,期間貶值約15%。

工廈市場錄蝕讓成交。代理表示,由投資者持有的觀塘成運工業大廈中層31室,原業主因經濟狀況受壓,以345萬沽出單位,以面積617方呎計,呎價約5592元,屬市價水平,以單位市值租金約17元計,料買家享租金回報約3.6厘。據土地註冊處資料顯示,原業主於2018年以408萬購入,期間更兩度向財務公司承造借貸,故持貨僅2年,帳面蝕讓63萬,物業期間貶值約15%。

單位345萬沽

據代理資料顯示,該工廈近期頻錄成交個案,其中,該工廈中層單位,於本月22日以490萬成交,以單位面積617方呎計,呎價約7942元;另一宗成交為中層22室,於本月6日以338萬成交,以單位面積617方呎,呎價約5478元。

美興1025萬易手

另外,同區工廈美興工業大廈亦錄成交,代理指,該工廈B座單位,面積2385方呎,以1025萬成交,平均呎價4298元。代理續指,上址原業主於1993年以170萬購入,故持貨27年帳面獲利855萬,物業期間升值約5倍。

另外,長沙灣區內工廈租賃活躍,頻錄承租個案。市場消息指出,長沙灣安泰工業大廈低層單位,面積約3000方呎,以4.2萬租出,呎租約14元;同區內鴻昌工廠大廈低層D室,面積約2523方呎,以3.8萬租出,呎租約15元。

(星島日報)

西環皇后酒店意向4.5億

近期當旅遊業大受打擊,酒店高空置率前所未有,有準買家於此時吼準低水酒店,有投資者則趁勢放售,西環皇后大道西皇后酒店全幢放售,意向4.5億,平均每呎1.68萬,料回報逾2厘。

上址西環皇后大道西199號全幢,現址為皇后酒店,樓高23層,總建築面積約26779方呎,以意向價4.5億計算,平均呎價16804元,物業現為一幢酒店,設有40個房間,平均每個房間涉資1125萬。

設有40個房間

代理表示,是次出售物業緊貼西營盤港鐵站A1出口,業主於十五年前購入,並改裝為酒店,至今經營十餘年,現時物業內裝雖然較舊,但房間面積均寬敞實用,新買家購入後可將物業裝修或改裝重新定位。代理指出,目前該全幢酒店出租予酒店營運商,每月租金40萬,由於現時為非常時期,若然市況回復正常,加上業主為酒店增值,料每月租金可提升至80萬,回報逾2厘。

代理又說,由於物業落成時為一幢寫字樓,買家可以把現有的酒店拆卸,並回復作寫字樓用途,或將酒店房間裝修,重新定位為服務式住宅/共享生活空間Co-living Space等,將回報進一步提高。

自從去年以來,反修例運動留下後遺症,加上肺炎肆虐,令投資市場急速降溫,根據高力資料顯示,鋪位及酒店成為重災區,自從去年以來,全幢酒店價格由高位回落約30%,由於價格下跌,成為財團吼準目標,希望在淡市撈底,而且酒店出路較多,可變身大增值。

可還原作寫字樓

過去數月,市場不乏酒店及服務式住宅成交,價格較高位顯著回落20%至30%,最差時刻正帶來「撈底」良機。該行指出,環顧未來5年酒店供應相當稀少,以核心區為甚,況且,酒店用途多,可打造服務式住宅或者高質素的安老中心。

(星島日報)

登打士街鋪頻錄減租幅度介乎20%至60%位處旺角「小食街」租金持續受壓

香港經歷示威及疫症後,飲食零售業大受打擊,鋪租急速回落,旺角鬧市的「小食街」登打士街,到處見吉鋪,近月紛錄承租,租金減幅由20%至逾60%不等,平均呎租逾100元,業內人士指,該街道吉鋪需時消化。

近期登打士街連錄承租,涉及43P至43S號鴻輝大廈地下10號鋪,該鋪位於丟空逾半年後,近期以每月11.2萬租出,以建築面積約600方呎計算,平均呎租約186元,租客為連鎖餅店,租期為3年梗約,再加2年生約。前身為三文治小食店,早於10年前進駐,經歷鋪市高峰低谷,去年中,該鋪位月租14萬,業主因應市況轉差,將月租減至11.2萬,惟租客還是捱不住,最終選擇遷出。

租金返20年前水平

土地註冊處資料顯示,該鋪位曾於1997年中樓市高峰期,與一家涼茶店訂下6年租約,當時月租15萬,並指明於第五及六年,最高月租不能超過20.5萬,後於1999年2月時由便利店承租,月租11萬,現時最新月租重返20年前水平。

租約期五年

該街道亦有飲品店「轉場」,大位搬細位,每月節省五萬,涉及為43H號登打士廣場地下6號鋪,建築面積約300方呎,以每月約11萬租出,租客來自同一條街道的KOI The台式珍珠奶茶。

該台式珍珠奶茶店本來承租的53至55號鴻達樓地下2號鋪,建築面積約600方呎,入則閣約300方呎,月租16萬,有見租客離場,業主即以每月17萬放租鋪位,惟結果該鋪位獲手機配件散貨場以6萬短租,平均呎租約100元,較舊租金16萬急跌約62.5%,而毗鄰單號鋪為一家台式飲品店,面積約370方呎,入則閣約370方呎,現租金6.8萬,呎租約184元。業內人士指,上述飲品店大鋪搬細鋪,月租節省5萬,旺市時不算大數目,市況淡靜時則可觀,此金額足以聘請數名員工,或相等於逾千杯的飲品。

飲品店大鋪搬細鋪

代理指出,登打士街「小食街」,位處旺角鬧市,去年中街道聚集本地客及自由行客,往往水泄不通,自示威以來,自由行客大減,生意大跌。由於其位置接近西洋菜街及彌敦道,示威高峰期時,小食店往往被逼停業。雖然如此,一些時段還是開門做生意,近期再受疫症困擾,由於人流少,晚上惟有提早關門。

由於人流減少,登打士街有家找換店,在今年3月期滿前雖未見營業卻一直如常交租。不過,當時,該鋪位鐵閘被貼滿街招,代理問業主該鋪位放租多少?業主錯愕話:「放租?我有租客租緊,仲準時交租喎!」業主了解之下,才發現原來市況差,旺角自由行客大減,租客做不到生意,找換店索性關門節省成本不開門,但履行合約,租照交。地產界人士盛讚好租客,市況差,要求減租或拖租情況普遍,難得有租客遵守合約精神,抵讚!該鋪位為登打士街43A至43G號達利商業大廈地下5號鋪,面積約150方呎。

(星島日報)

Security law rattles homebuyers

Homebuyers are backing out of deals amid fears of a price slump sparked by Beijing's introduction of the new national security law, with K Wah International (0173) recording nine cases of forfeited deposits at Solaria in Tai Po, totaling HK$11.83 million.

The nine flats, measuring between 325 square feet and 597 sq ft, are offered at HK$6.28 million to HK$10.92 million.

Meanwhile, a prospective homebuyer forfeited deposits of about HK$380,000 after calling off the purchase of a 327-sq-ft flat at The Vertex in Cheung Sha Wan, which was offered at HK$7.69 million.

Another buyer gave up deposits of around HK$460,000 after canceling the purchase of a 484-sq-ft flat at Seaside Sonata in Sham Shui Po that was priced at HK$9.13 million.

In Tuen Mun, however, Wing Tai Properties (0369) sold a 619-sq-ft flat at OMA by the Sea for HK$10.05 million, or HK$16,244 per sq ft, a new high at the estate.

In the commercial property market, "Shop King" Tang Shing-bor is planning to sell five street shop premises in Yau Ma Tei, Shau Kei Wan, Prince Edward, Jordan and Wan Chai, respectively, worth about HK$1.5 billion in total.

In the secondary market, a 604-sq-ft flat at Serenity Place in Tseung Kwan O changed hands for HK$7.4 million, or HK$12,252 per sq ft, after HK$280,000 was cut from the initial asking price.

In Tsuen Wan, a 659-sq-ft flat at D Park fetched HK$10.8 million, or HK$16,388 per sq ft, after HK$1.2 million was cut from the original asking price.

Elsewhere, the overall Hong Kong Interbank Offered Rate saw a rally yesterday. The one-month Hibor, which is linked to the mortgage rate, increased to 1.13345 percent.

(The Standard)

力寶意向呎租50元

受疫情影響,核心區甲廈租售價回緩,金鐘力寶中心2伙優質海景戶,以每方呎50元放租。

代理表示,金鐘力寶中心2座中層01室,面積約1565方呎;另高層05至06室,面積約7110方呎,以意向呎租約50元起。代理續表示,2個單位均面向電梯大堂,並坐享開揚海景,備有基本寫字樓裝修,租客可即租即用,屬市場極罕有指標商廈正面向海寫字樓優質單位。資料顯示,前述放租的高層單位前呎租約73元,業主因應近期市況而擴大議價空間,相信可增加物業競爭力,吸引實力租客洽詢。

對正電梯望開揚海景

代理續稱,該甲廈位處金鐘港鐵站上蓋,近期市況受疫情衝擊,令該廈議價空間逐步增加,吸引個別實力租戶趁低進駐,冀以實惠租金落戶優質商廈以提升品牌形象。代理表示,是次招租單位分別位於大廈中層及高層,單位面積選擇多,租客可按需要選擇合適單位,且物業裝修及家具齊備,可即租即用。

中遠3961萬放售

另一代理指,上述放售物業為上環皇后大道中183號中遠大廈11樓08室,面積約1343方呎,意向呎價約2.95萬,涉資逾3961萬,以交吉形式出售,亦可以股份轉讓形式交易。

(星島日報)

九龍塘玫瑰苑申強拍 市值近10億

多個市傳與新世界 (00017) 相關的舊樓收購項目申請強拍,當中九龍塘玫瑰苑收購至逾8成業權,市值約10億元。

玫瑰苑位於又一村玫瑰街23至34號,在1967年落成,樓齡約53年,由22幢3層高的分層住宅組成,合共66伙,並附設66個車位,由去年開始獲財團展開收購,每伙收購價介乎2,332.4萬至3,319.7萬元不等。財團成功收購至80.3%業權,達至申請強拍門檻,餘下13個單位尚未獲收購。物業現時市值大約9.95億元。

項目佔地約38,960平方呎,屬「住宅(丙類)」用途,最高重建地積比3倍,可建樓面11.69萬平方呎,相較現有的總樓面5.9萬平方呎,多近一倍;再加上位處豪宅地段,鄰近的海棠路62號洋房項目,每伙的成交價達1.1億至2億元,呎價亦達4至5萬元,故此頗具重建價值。物業現時由BREMONT

INVESTMENTS LIMITED申請強拍,消息指為新世界或相關人士。

至於另一個項目,則為西營盤德輔道西331至341號,位於新世界旗下瑧璈對面,現為6幢6層高舊樓,樓齡介乎59至64年不等,部分獲財團收購至6成至9成業權不等,亦有部分地段已完成收購,現時則申請透過強拍統一整個項目業權。

新世界相關3項目 值逾17億

按照測量師報告指,項目現時市值約3.66億元,而地盤面積約5,062平方呎,現時是「住宅(甲類)」用途,如果以地積比率9倍發展,可建樓面約4.5萬平方呎。項目由Rising Radiant Limited等公司申請強拍,市傳亦與新世界有關。

此外,中環擺花街11至17號亦獲財團強拍,現為4幢舊樓,樓齡均逾50年,獲收購62.5%至92.86%業權不等,部分街號完成收購,平均不少於80%。據土地註冊處資料顯示,早前住宅每伙收購價約1,100萬至近1,373萬元,呎價約2.7萬元。

據了解,收購由威銘置業有限公司提出,董事包括黎曉萌及龍燕燕,不排除或與新世界發展有關。目前物業估值約4.1億元,地盤面積約3,000平方呎左右,現為「商業」規劃用途,最高地積比率15倍計,可建樓面約4.5萬平方呎,財團或連同旁邊的擺花街9號及19號一併重建,地盤擴大至約4,500平方呎。

綜合上述3個料與新世界相關的舊樓強拍項目,合共市值逾17億元。

最後一宗,則為西半山西摩臺4號及羅便臣道62E號,現時估值約1.42億元,料為恒地 (00012) 或相關人士,該財團在羅便臣道一帶成功併購多幢舊樓項目。

(經濟日報)

鄧成波放售5商舖 意向價約15億

投資者見市況略轉好出貨減磅,舖王鄧成波放售5項商舖,意向價約15億。

據代理表示,有業主放售5項商舖物業。該5項物業全屬大樓面商舖,面積逾萬平方呎,並多由老人院租用。該批商舖均由波叔持有,相信因應市況略向好,即趁勢推出。

油麻地舖1.88萬呎 叫價3.8億

5項商舖物業中,位置較佳應為油麻地窩打老道40號1至2樓,面積約1.88萬平方呎,意向價約3.8億元。該舖位處彌敦道及窩打老道交界,外觀甚佳。商舖曾由其兒子鄧耀昇旗下婚禮統籌公司拉斐特使用,去年底遷出,及後獲安老院以100萬元預租。

另外,位於佐敦吳松街42至52號大觀樓地下至4樓,面積約2萬平方呎,意向價約2.8億元。翻查資料,波叔於2018年中,以2.5億元購入商舖。至於筲箕灣中心地下及1樓,面積約2.4萬平方呎,市值約3.6億元。5項商舖物業,合共意向價約15億元。

舖王鄧成波近兩年活躍於投資市場,即使近月處於疫市,他仍不時購入商舖,包括向本地老牌時裝品牌雞仔嘜,購入荃灣、油麻地及長沙灣3個該時裝品牌自用舖位,涉資約7,500萬元。事實上,近期他亦曾棄購旺角新填地街酒店,現放售5項物業,應該是趁市況轉好出貨減磅。

(經濟日報)

鴨脷洲海旁道地皮 截收19標書

鴨脷洲海旁道中型地皮昨日截標,共收19份標書,除大型發展商如長實 (01113)及新地 (00016) 等外,亦有多家中資如佳兆業 (01638)、中國海外 (00688) 等參與。部分認為不擔心國安法對樓市影響。

吸大型發展商及中資入標

項目吸引不少大型發展商入標,長實、新地、新世界 (00017))、信置 (00083) 、嘉華國際 (00173) 、嘉里建設 (00683) 及中國海外等獨資入標;亦有不少中小型發展商入標,其中麗新發展 (00488))則夥拍建灝地產合資入標;其餘發展商有大昌集團 (00088) 、其士國際 (00025) 、佳明集團 (01271) 及佳兆業集團。

大昌集團執行董事李永修指,是次獨資入標,若中標預計將興建中小型單位。李氏指,疫情難免對樓市有所影響,惟疫情減退後樓市會恢復。至於國安法料對樓市影響不大,因為現時買樓都為用家,樓市仍有需求。

佳明集團控股項目經理曾嘉敏指,出價方面審慎,屬市場預期價之內。多方因素影響下,料樓價短期有波幅,長遠「雨過天晴」。

佳兆業集團資本市場部總監蔡晉指,港島地皮尤其南區較為罕有,是次出價合理。至於樓價方面,蔡氏指本港屬「大灣區9+2規劃」內,受惠於大灣區概念,未來發展穩定。

(經濟日報)

葵涌中央工業大廈 申建酒店

新冠肺炎疫情下,市場仍對酒店前景具信心,由「舖王」鄧成波持有的葵涌中央工業大廈,申請重建成酒店,提供近1,200個房間。

鄧成波持有的葵涌打磚坪街57至61號中央工業大廈,申請重建成酒店並放寬地積比率,擬建成一幢31層高酒店,提供1,196個房間,地積比率約11.4倍,總樓面不多於27.6萬平方呎,物業一樓將為職員辦公室,2樓為接待處、餐飲及花園空間,3至29樓則為酒店客房。

申請人認為,是次發展符合區內由工業轉為商業用途的趨勢,透過擴闊的行人道及提供綠化,改裝計劃有助改善大廈附近街道環境。

(經濟日報)

Hong Kong homebuyers enter the market, as developers

dangle discounts to end nine weeks of slumping property sales

Hong Kong’s homebuyers came off the

sidelines to nibble at more than 200 flats offered at two projects, as

developers slashed prices to end nine consecutive weeks of sales flops.

Sun Hung Kai Properties (SHKP), the

city’s most valuable developer, managed to sell 162 of 200 flats, or 80 per

cent of units offered in the first batch of the second phase of its Wetland

Seasons Park project in Tin Shui Wai as of 9:30pm after cutting prices by up to

18 per cent. Easyknit International found buyers for eight of 26 units at The Ayton in Kowloon with discounts of as much as

8 per cent, sales agents said.

The sales result, which still pales

in comparison with launches six months ago, is a minor cause for relief among

developers, as they struggle to find customers to commit to big-ticket

financial commitments during Hong Kong’s worst recession in decades. The city’s

property sales flopped for the sixth time in nine weeks last weekend, as

investors find themselves spoilt for choices while the residential real estate

market slumps under a combination of a supply glut and recessionary woes.

“There is increased appetite to buy

Hong Kong property,” a property agent said. “With everybody unable to travel,

it’s giving [buyers] more time to focus on the market and take advantage of

some discounts.”

SHKP dangled discounts of up to

18 per cent to keep the average price at Wetland Seasons Park at HK$11,368 (US$1,466)

per square foot, with apartments in the 699-unit complex ranging from 416 to

721 square feet. The cheapest flat was a 499-sq ft unit at HK$4.9 million.

“Wetland Seasons Park continues

to be popular [among] buyers, especially younger customers, who make up about

80 per cent of the buyers,” another agent. “About 40 per cent of the buyers are

investors.”

The Ayton, with sizes between 228 sq and 677 sq ft, were priced at HK$29,800

per sq ft. A 228-sq ft flat was offered at HK$6.6 million in the 60-unit

project.

The weekend’s new launch of

projects came amid heightened political tension in the city, following the

proposed national security law by China’s legislature, which could undo the

improving interest of residents in the city to buy property, agents said.

“Buyers are becoming more focused

on Hong Kong over other markets and investing money at home over international

markets such as the US, which is showing increasing aggression toward China,” the

agent said. “However, we will have to wait [and] see if the sentiment holds

with the proposed introduction” of the national security law in China, aqent

said.

The Hang Seng Index fell to a

near five-year low as Beijing prepared to vote on the law that would allow it

to tighten its grip on Hong Kong. Investors are known to be more cautious and

generally stay away from the real estate market when the equity market is down.

Reports from Chinese media quoted

buyers saying that they were not worried about the proposed law.

A buyer surnamed Chong, who

bought a four-bedroom unit at the Wetland Seasons for HK$14 million, reckoned

the legislation would only have a “short-term” impact on the property market.

“Home prices will be determined

more by supply instead of political reasons. If the government cannot solve the

housing shortage, prices will increase further,” he said.

Another buyer, who also bought a

four-bedroom unit for HK$18 million, said he liked the project’s location and

noted that the property would be more expensive if it was in an urban district.

(South

China Morning Post)

旺角舖2250萬售 56年升211倍

舖位月租6.2萬 享回報約3.3厘

疫情影響商舖價值,老牌業主近期沽貨。旺角新填地街舖位以約2,250萬成交,原業主持貨56年轉手,舖位升值211倍。

消息指,旺角新填地街316至320號永福大樓地下B號舖及閣樓,以約2,250萬元易手。物業總面積約1,150平方呎,呎價近2萬元。據悉,舖位月租約6.2萬元,新買家享回報率約3.3厘。

新填地街地下連閣樓 呎價2萬

據悉,原業主於1964年以10.6萬元購入,早前以約3,000萬元放售,現今減價約25%沽貨,持貨56年升值211倍。

近月本港零售受疫情影響,商舖租售人均向下,而個別持舖老牌業主見物業已累積極大升幅,故願意沽貨套現。如同區旺角彌敦道644號地下,面積約1,200平方呎,以約8,500萬元成交,原業主於1964年,以70萬購入,持貨56年轉手,獲利約8,430萬元,升值120倍。另灣仔百年老店楊春雷特效涼茶舖,早前以5,000萬成交,舖位48年升值277倍。

另商廈租金亦向下,代理表示,灣仔會展廣場辦公大樓中層全層,面積約19,180平方呎,意向呎租約50餘元。代理稱,單位享有海景景觀,提供基本天花、地台及牆身裝修,單位於去年4月叫租每平方呎約80元,至近月市況欠佳,最新叫價已大幅下調逾三成。

(經濟日報)

投資氣氛略轉好 工廈拆售趁勢推

本港疫情受控,而樓市氣氛轉好,業主趁機即推工廈拆售項目,入場銀碼較細,料吸引投資者。

近日市場上出現數個工廈拆售項目,代理表示,由THE BLOCK GROUP持有,位於葵涌永業街14至20號華榮工業大廈7樓B室的工廈工作室項目THe BLocK近日重推單位放售。並錄得一宗買賣成交,該單位為B01室,面積約293平方呎,以逾142萬元售出,平均呎價約4,850元。

葵涌THe BLocK 95萬入場

THe BLocK共提供11個單位,面積約226至431平方呎不等;項目已沽出2伙,餘下9間工作室待售,售價約95萬元至213萬元。

代理指,9伙中有7個單位將連租約放售,租金回報約4厘;另有兩個以交吉形式推售的工作室。代理補充,項目每個工作室都備有獨立冷氣系統及電子密碼鎖,大堂亦設有智能化門鎖系統及24小時CCTV監察。

另外,理想集團的工廈工作室項目觀塘The Icon,近日加推單位放售,發展商同時推出全新「至理想」付款優惠,買家只需付兩成首期,即享有物業兩年使用權,變相成交期長達兩年,吸引買家入市,短短兩星期內已售出10伙;項目現餘下約20個精選單位,入場費由約274萬元起,呎價低至約7,100餘元。

觀塘The Icon 呎價近萬元

成交方面,近日The Icon中高層05室,工作室面積約279平方呎,以約276.6萬元沽出,平均呎價約9,914元。代理稱,短短兩星期累售10個單位,當中約四成是因新付款優惠計劃吸引,決定由租轉買。發展商見市場反應熱烈,遂加推約20個工作室,單位面積約279至740平方呎,入場費由約274萬餘元起,平均呎價約7,100餘元至10,000餘元。

同區有另一工廈拆售項目,另一代理表示,位於觀塘怡生工業中心A座3樓的塘K ONE 2項目,尚餘約30伙,單位面積約74至299平方呎不等,入場費由約66.5萬元起,連同置業優惠等計算在內,呎價約6,300元。是次推售單位呎價對比早前開售價,減幅由約15%至28%不等。

由於本港疫情受控,樓市氣氛轉好,投資市場方面,業主趁市況轉好,即重推工廈拆售項目。據了解,因入場費較便宜,風險相對較低,在投資市場未全面回勇下,可吸引個別投資者入市。

(經濟日報)

銅鑼灣劏場鋪350萬七年蝕讓40%

受市場淡風吹襲,劏場鋪位再錄蝕讓個案,銅鑼灣一個劏場鋪位,以350萬售出,平均呎價約5.7萬,原業主持貨7年,帳面虧蝕238萬,物業期間貶值40%。

核心區商鋪再錄蝕讓個案,土地註冊處資料顯示,上址為銅鑼灣地帶1樓160號鋪位,於本月5日以350萬成交,買家以個人名義登記,該鋪位原業主於2013年以588萬購入,並以個人名義登記,為翁姓人士,持貨7年,帳面虧蝕238萬,物業期間貶值約四成。有代理指出,該鋪位面積約61方呎,平均呎價約57377元,儘管成交呎價不算低,但仍錄大幅蝕讓。

呎價57377元

該商場位處銅鑼灣區內一綫街道怡和街,惟受社會運動於去年年中萌芽發酵,加上新冠肺炎於今年年初爆發,該地段首當其衝受影響。

資料顯示,該商場1樓單號鋪位,於去年7月以1800萬成交,原業主分別姓肖及姓孫,屬普通話拼音,於2013年以聯名形式購入,當年作價2622.5萬,持貨6年,帳面虧蝕822.5萬,物業貶值約31%。

另一方面,商廈市場租賃仍然活躍,頻錄承租個案。市場消息指出,灣仔守時商業大廈低層B室,面積約1144方呎,以每呎29.5元租出,月租約33748元;佐敦四海大廈中層02A室,面積約605方呎,以每呎30元,月租約18150元;尖沙嘴富好中心低層單位,面積約1375方呎,以每呎26.9元租出,月租約36987元。

(星島日報)

鴨脷洲地皮今截標財團出價趨保守

近期政府在疫情下接連推出地皮招標,其中鴨脷洲海旁道於今日截標。業界人士指,整體經濟轉差,前景未明,估值對比去年下跌15%,發展商在出價上轉趨保守,最新市場估值約11.8億至12.2億,每方呎樓面地價約12000至13000元。

每呎估值1.2至1.3萬

因應項目位於豪宅地段,加上區內缺乏新供應,市場預期將備受財團爭奪。有測量師表示,由於是次地皮規模適中,總投資金額不高,加上港島區地皮較罕有,預計可以吸引中小型發展商入標,預計是次入標反應熱烈;由於地皮呈長條形,興建市場較受歡迎的中小單位的話,後未必所有單位都可享海景,發展商需在開則上要多花心思。最新市場估值約11.8億至12.2億,每方呎樓面地價約12000至13000元。

較去年跌15%

測量師表示,在疫情下,目前經濟下行以及失業率上升等因素下,估計發展商在出價審慎及保守,最新估值比去年中下跌15%。由於該地皮屬中型豪宅項目,享海景,涉及投資額不大,同時發展商亦需補充土地儲備,料有吸引不少財團入標。料會興建中型單位為主,以吸引家庭客及換樓客。

該地盤位於鴨脷洲海旁道,地盤佔地約12150方呎,最高可建樓面約88282方呎。地皮呈長窄型,位置臨海,近海旁的一面可望向香港仔避風塘及深灣一帶,另一面則鄰近利東邨,生活配套完善。另外,賣地章程亦要求興建私家車及電單車車位,並要保養項目毗鄰的一幅斜坡。

(星島日報)

19 tenders for Ap Lei Chau residential site

The tender for a medium-sized residential site, Ap Lei Chau inland lot No 137 at Ap Lei Chau Praya Road, which ended today, has received a total of 19 tenders.

CK Asset (1113), Sino Land (0083), New World Development (0017), Lai Sun Development (0488) and K&K Property, China Overseas Land and Investment (0688), K Wah International (0173), Kerry Properties (00683), Yai Cheung (0088), Grand Ming (1271), Chevalier International (0025), Kaisa (1638) and seven consortiums have tendered for the site.

This is the first site to be tendered in over three years in the district. The project has to be completed before March 2025. The market has valued to site at between HK$770 million and HK$1.41 billion.

Surveyors have valued the site at HK$1.06 billion, or HK$12,000 per square foot.

(The Standard)

Hong Kong’s Urban Renewal Authority to build more than 3,000 flats at redeveloped Kowloon City site

Hong Kong’s Urban Renewal Authority (URA) on Friday took the wraps off its biggest-ever project, a plan they say will turn housing blocks once allocated for civil servants into more than 3,000 residential flats, a fivefold increase from the site’s current number.

The two pilot projects in Kowloon City, first proposed by Chief Executive Carrie Lam Cheng Yuet-ngor in 2018, are expected to entail more than HK$10 billion (US$1.29 billion) in acquisition costs as the authority goes about the process of negotiating with existing residents.

URA director of planning and design Wilfred Au Chun-ho said the site was chosen due to the age of the housing blocks as well as their low density, which has not fully maximised the available space.

Other advantages included the buildings’ location near existing public housing estates, lack of competing acquisition actions by private developers, and relatively large size.

“The redevelopment will generate about five times the number of existing flats, from about 600 to 3,000, boosting housing supply,” Au said.

That number will easily outdistance the ongoing Kwun Tong town centre redevelopment, which will produce about 2,300 units.

The two Kowloon City sites, which currently host an estimated 610 households, are located on Shing Tak Street and Ma Tau Chung Road, as well as Kau Pui Lung Road and Chi Kiang Street. The first has a total area of about 5,160 square meters and is expected to yield about 640 residential flats by 2029.

The second, much larger site – near the future To Kwa Wan MTR station – boasts an area of about 16,470 square meters, and will encompass 2,500 flats by 2030-2031. An unknown number of units, to occupy about a third of the area, will be reserved for public housing.

Au said the area’s revamp will also create a “better pedestrian environment and more liveable community” through replanning and landscaping. Wider pavements, an underground shopping street connected to the future MTR station and an underground car park providing some 400 parking spaces will be among the improvements.

The existing flats were built under the Civil Servants’ Co-operative Building Society Scheme, which was in operation between 1952 and the mid-1980s. The government granted land to those who formed co-operatives – usually at a third of market value – to build their homes.

The owners, however, cannot sell their properties unless at least 75 per cent of members agree to dissolve the society. An owner wishing to sell also needs to pay the government a land premium – defined as the difference in the value of the property before and after redevelopment.

Currently, many of the flats are run down and vacant. Most do not have lifts and some are occupied by ageing retired civil servants. But redevelopment plans with private developers in the past have stalled due to disagreements over the land premium.

Of the 238 civil servants’ co-operative building societies in Hong Kong, 191 have been dissolved but only 12 have been redeveloped.

The URA will facilitate the legal process of dissolving the cooperative societies and the property acquisition by providing free legal consultation services to the flat owners.

Affected owners living at the site will have the option of purchasing subsidised flats via the Hong Kong Housing Society or other flats provided by the URA.

Lawmaker Tony Tse Wai-chuen, who represents the architectural, surveying, planning and landscape sector, said the plan was long overdue, as the old civil servants’ homes represented a huge reservoir of housing resources the city could tap into.

“It should not take nine to 10 years to complete the reconstruction. The URA should speed up the process to relieve Hong Kong’s housing crunch,” he said.

Leung Tak-yee, a retired civil servant affected by the development, said she welcomed the plan as her property that was built in the 1960s suffered from many structural problems, including roof that leaked when it rained.

The 72-year-old, who bought the flat in 1992 and lives there with three family members, demanded more clarity from the government.

“I want to know how much I need to pay back to the government in terms of land premium, because my compensation may be worth a lot less and not enough for me to buy other homes,” she said.

(South China Morning Post)

Mid-Levels flats as low as $4.8m hit market

Emperor International (0163) has launched the first batch of 30 units at Central 8 in Mid-Levels, at an average price of HK$29,820 per square foot. A 181-sq-ft foot unit only costs HK$4.88 million.

The prices of all 30 units are below HK$10 million. The cheapest 181-sq-ft flat is a studio unit on the fifth floor, with a per sq ft price of HK$27,006 after discounts. The average per sq ft price of this project is 0.6 percent lower than that of The Richmond's first batch.

Sun Hung Kai Properties (0016) has received around 10,000 purchase offers for Wetland Seasons Park Phase 2 in Tin Shui Wai, the highest so far among new projects this year. The project will launch sales for 200 units tomorrow meaing the batch was 49 times oversubscribed.

Altissimo in Ma On Shan, jointly developed by Country Garden (2007) and Wang On Properties (1243), will launch 115 leftover units on Sunday, with 66 of them offered by tender until August 19.

In the secondary market, a three-bedroom unit in The Belcher's was sold for HK$37.5 million or HK$32,780 per sq ft.

The Pacifica in Cheung Sha Wan has recorded eight transactions so far this month, with a 501-sq-ft flat selling for HK$8.88 million, or HK$17,725 per sq ft.

In the commercial market, a 470-sq-ft unit at a building on Sharp Street in Causeway Bay changed hands for HK$28.8 million or HK$61,227 per sq ft.

Hysan Development (0014) meanwhile is offering nine refurbished units at Bizhouse in Pak Sha Road as home offices, with a monthly rent of HK$19,000 to HK$40,000 while a 19,180-sq-ft office at Convention Plaza Office Tower is only asking for a monthly rent of HK$50 per sq ft.

In other news, the one-month Hong Kong Interbank Offered Rate, rallied for the second day, up 3.04 basis points to 0.62827 percent.

(The Standard)

大鴻輝統一西環舊樓業權協成行斥八億購義德樓

市區土地供應緊張,近年不少財團透過強拍增加土地儲備,昨日連錄兩宗強拍,其中,大鴻輝昨以底價7億,統一西環德輔道西安慶樓舊樓業權。另外,協成行亦8.04億統一筲箕灣東大街義德樓業權。

大鴻輝昨亦以底價7億,統一西環德輔道西326至332號及西安里11A至11D號安慶樓業權。該項目強拍時大鴻輝已集齊約91.41%業權,最終在沒有對手競爭下,以底價7億統一權業發展。而項目地盤面積約6172方呎,「住宅(甲類)6」用途。

梁紹鴻:重建作商住樓

大鴻輝主席梁紹鴻回應指,項目即將着手拆樓及入則,計畫興建一幢28層高的商住樓,主打面積約400方呎的細單位,估計數目100多個,總投資額約9億。

代理表示,即使受疫情影響,惟財團收樓步伐未有放緩,認為早前法庭及土地審裁處因疫情關係而停擺,積壓不少個案。透露,未來集團仍有3宗強拍申請。

另外,協成行昨在無對手下,以底價8.04億,統一筲箕灣東大街義德樓業權。該項目強拍時,發展商已增持至96%業權,該項目地盤面積約7680方呎,屬「住宅(甲類)」用途,最高地積比率為9倍,可建樓面涉及6.9萬方呎。

方添輝:疫情下未放緩收購

協成行總經理方添輝表示,即使在疫情下,集團並未放緩收購步伐,並會按不同地區項目出價,同時在目前市況下亦會調整價錢。對於樓市發展,認為本港住屋剛性需求強,料樓市平穩發展,並不會重演2003年沙士時期樓價大跌情況。

另一代理表示,疫情之下發展商並未減緩收樓步伐,因許多項目一早已經開始進行,惟發展商會於收購時考慮疫情、中美貿易戰等因素,衡量風險才出價,料傾向保守。樓市方面,現時疫情緩和,買家重新出來物色樓盤,加上土地、屋房供不應求,縱然近期出現波動,但樓價出現斷崖式下跌的機率不高。

(星島日報)

上環豫泰商業大廈多層 3.5億沽

消息指,上環干諾道中128號豫泰商業大廈多層,以約3.5億元沽出。

成交涉及物業地下至3樓、8至11樓,合共8層樓面,總面積約1.72萬平方呎,以約3.5億元成交,呎價約2萬元。

據悉,物業原由凱龍瑞基金持有,2017年以3.8億元購入大廈13層樓面,其後進行翻新工程包括大堂及外牆,並進行拆售,售出5層樓面後,如今8層獲一買家承接,全數沽出並獲利。

(經濟日報)

鴨脷洲地明截標 料吸中小財團

測量師:有望挑戰港島標書新高

港島中型地皮供應不多,鴨脷洲海旁道地皮周五(22日)截標,市值最高14億元,由於規模適中,有測量師認為吸引中資及中小型財團入標,有望挑戰港島標書新高。

項目估值最高14億

去年底截標的東半山大坑道地皮收25份標書、創港島官地紀錄,是次鴨脷洲海旁道地皮,測量師表示,預計地皮涉資額約15億至20億元,相信中小型財團有能力亦願意競投。

該測量師預計,投標反應好理想,加上同類地皮在賣地表供應少,大多數都是近百億計的市區地,「渴地」的中小型發展商會踴躍出價。惟現時環球經濟不明朗,地皮質素縱然不錯,發展商出價會計算安全系數,不會太進取,會反映相關風險。

該測量師指,地皮位置適合發展豪宅,一梯兩伙,可興建面積約1,500至2,000平方呎的3、4房大單位,開則相信主要面向深灣一帶景觀,地盤周邊有樓盤遮擋,考發展商心思布局。

區內民生配套較少,相信要依靠附近樓盤或利東邨商場,前方亦有不少造船廠和維修廠,預計會有噪音問題。由於地皮呈窄長條形,靠山一邊未來開則難度較高,預計最好集中地皮的前方發展景觀較開揚。

賣地章程顯示,地皮最低3層可作商場發展,該測量師指,用地未設樓面上限,住宅樓面最高近9萬平方呎,未用盡地積比,可透過運算調整,要視乎發展商對區內商業未來的需求變化去設計。如以商業部分以2倍地積比計算,可建總樓面達9.9萬平方呎,總值約16億元。

(經濟日報)

華懋何文田站2期 批建4幢涉千伙

首季私樓685戶動工 10年同期新低

華懋港鐵何文田站2期項目,獲批建4幢分層住宅,預計將提供約900至1,000伙,屬未來區內大型新盤供應。另疫情令首季私樓動工量偏低,3月份私樓動工量涉685伙,創10年首季新低。

華懋於2018年10月投得港鐵何文田站2期項目,3月份獲屋宇署批出建築圖則,批建4幢26層高分層住宅,另設4層低層地下及1層地庫,住宅樓面約639,381平方呎。

據賣地條款顯示,何文田站2期將提供約900至1,000伙單位,以可建樓面計,平均每伙約640平方呎,發展商曾透露將主打2至3房單位,最快明年推售樓花。

何文田屬傳統豪宅地段,何文田站上蓋項目將為區內新供應主力,相信項目將繼天鑄、皓畋之後,成為該區矚目全新項目。

英皇駿景酒店舊址 批建住宅

此外,英皇國際 (00163)旗下跑馬地宏德街1號前英皇駿景酒店,可重建成1幢25層高分層住宅另加兩層地庫,可建住宅樓面約57,845平方呎。

而西半山寶珊道8號,亦獲批重建成1幢20層高住宅,涉10.5萬平方呎樓面,據悉由新地 (00016) 郭氏家族及恒生銀行(00011)創辦人之一何添家族共同持有。

商業項目方面,永泰 (00369)、資本策略 (00497)及市建局合作的中環結志街、嘉咸街、威靈頓街、吉士笠街的商業地盤,獲批建1幢32層高商廈,以及1幢27層高酒店,涉及商業樓面約427,113平方呎。

另一方面,疫情使今年首季私宅動工量處低水平。根據屋宇署數字顯示,3月份有4個私人住宅項目動工(按屋宇署接獲上蓋建築工程動工通知為準),涉及685伙,終止連續兩個月均為零動工淡況。由於首季僅3月份有私樓動工,較去年同期2,020伙減少66%,創10年首季新低。按單一季度計算,為過去40個季度新低。

3月1413伙落成 按月減25%

落成量方面,3月份有6個私人住宅項目落成,涉1,413伙,較2月份1,892伙減少25%,但數量仍有千伙之上。而今年首季共有3,726伙私宅落成,佔全年預測目標僅約18%,惟較去年同期大增約2.8倍。

(經濟日報)

企廣呎租12元低20%重返10年前水平

甲廈再錄低價承租,市場消息指出,九龍灣企業廣場1期2座低層03室,面積約3418方呎,以每呎12元租出,月租約41016元。

據代理指出,上址位處走廊末段,質素一般,租金比市值低約20%,重返10年前水平。反映甲廈租金備受壓力。據代理資料顯示,該甲廈近期1宗租賃為同座高層6室,面積4218方呎,於去年2月以每呎22元租出,與是次租金相差逾四成。

力寶呎租40元低10%

金鐘力寶中心亦錄低市價承租,消息指,該甲廈2座高層04室,面積1341方呎,以每呎約40元租出,月租約5.36萬,低市價約一成。

觀塘區內再有工廈推長成交期吸客,有代理表示,觀塘怡生工業中心A座3樓K ONE 2項目,尚餘約30伙,業主推出「730置業好幫手」,買家於個半月內付20%樓價,餘款80%於730日後繳付,期間差餉地租及雜費由業主負責,面積約74至299方呎不等,入場費約66.5萬起,呎價低至約6300元。較2018年11月推售價,今次減價15%至28%。

觀塘工廈推730日成交期

早前觀塘The

Icon推新付款方法,買家付20%首期入場,成交期長達2年,項目面積介乎279至740方呎,入場價約274萬。

(星島日報)

Four-year Kowloon low for Vanke's new launch

Vanke Property (Hong Kong) has

launched the first batch of units at The Campton

in Cheung Sha Wan, offering 94 flats at an average price of HK$16,411 per

square foot after discounts, the lowest in Kowloon in nearly four years.

The batch has offered 11 studio

flats, 27 one-bedroom flats and 56 two-bedroom flats, ranging from 287 sq ft to

539 sq ft.

Wing Tai Properties (0369) will

launch the sales of 108 units at OMA by the Sea

in Tuen Mun on Sunday through a price list and will sell another 53 flats by

tender from Monday.

The developer has sold 217 units for

the project, worth a total of HK$1.13 billion.

Henderson Land Development (0012)

will open the sales of Aquila Square Mile in Mong Kok on Sunday as well,

offering at least 88 units, mainly one-bedroom.

After discounts, 17 of its units are

below HK$5 million.

Meanwhile, Emperor International (0163)

has named its serviced apartment project providing 99 units in the Mid-Levels

as Central 8 and opened a show flat.

Elsewhere, Hip Shing Hong won the

bid of an old building at Shau Kei Wan Main Street East at the reserve price of

HK$804 million with no competitor.

In another bid, the redevelopment of

an old building on Des Voeux Road West in Sai Ying Pun was awarded to Tai Hung

Fai Enterprise at the reserve price of HK$700 million.

The Buildings Department approved 18

building plans in March, with five on Hong Kong Island, eight in Kowloon and

five in the New Territories.

In the secondary market, a one-room

unit at Corinthia by the Sea changed hands for HK$8.9 million, the second most

expensive ever in Tseung Kwan O.

In Yuen Long, a 423-sq-ft flat at

The Reach was sold to a first-time buyer for HK$5.8 million, or HK$13,712 per

sq ft, after HK$200,000 was cut from the initial asking price.

(The

Standard)

16 MTRC projects to offer 22,000 homes

MTR Corporation (0066) chairman Rex

Auyeung Pak-kuen said the company will launch 16 property projects in the next

six years, offering around 22,000 units, while also revealing the company was

facing heavy financial pressures amid the Covid-19 pandemic.

MTRC is still in discussions with

the government about the proposed comprehensive residential and commercial

development atop Siu Ho Wan Depot in Lantau Island, he said at the annual

general meeting. The project is expected to provide around 14,000 private and

public home units in the medium to long term.

The company has obtained the Consent

Scheme for Phase 8 of Lohas Park in Tseung Kwan O and plans to apply to the

scheme for Phase 10 of Lohas Park and the project atop the Tai Wai Station,

which are expected to offer a batch of small- and middle-sized units, said

property director David Tang Chi-fai.

Auyeung said risks brought about by

the global economic slowdown, rising unemployment rates and decreases in

tourism have heavily impacted the company's financial condition and also

predicted these negative impacts could last longer.

MTRC's passenger revenue and

advertising revenue both slid amid the pandemic, while the company also needed

to provide rent relief for commercial tenants at MTR stations, he said, adding

that a weak economy may also impact the valuation of its investment properties.

When asked whether MTRC's dividend

distribution would be impacted by the outbreak and social unrest, Auyeung said

the board would maintain its current dividend policy, which depends on the

company's business performance, capital expenditures, and financial conditions.

The company declared a final dividend of 98 HK cents last year, totaling

HK$1.23 per share for 2019.

Auyeung mentioned that the company

has expended railway projects in China, Europe and Australia, and stressed that

the financial situation was still stable.

Meanwhile, MTRC appointed Bunny Chan

Chung-bun as an independent non-executive director (INED) of the board.

Chan has over 30 years of experience

in the garment industry and is the founder and chairman of Prospectful

Holdings. He is also an INED of Li Ning (2331), Great Harvest Maeta (3683),

Speedy Global (0540) and Glorious Sun Enterprises (0393). Chan is currently a

member of the Hong Kong delegation to the National People's Congress of the

People's Republic of China and the Council for Sustainable Development.

(The

Standard)

樓面呎價4546元較兩年前私樓地低60%安達臣道首置地49億批出長實力壓八財團奪標

在疫情仍未受控及經濟下行陰影下,於上周五截標的觀塘安達臣道首置盤地皮,在昨日開標,由長實以四十九億五千一百萬元勇奪,擊退其餘八家財團,每方呎樓面地價四千五百多元,符合市場預期,惟比對○八年初同區批出的私樓地皮,每呎地價達一萬二千元,跌幅逾六成。

本報地產組

安達臣道首置盤地皮為港人上車盤先導項目,亦為首個作混合式發展項目,該項目於上周五截標,當時吸引九家財團入標,主要為本地藍籌發展商之爭。地政總署昨日公布,由長實以四十九億五千一百萬奪地,樓面呎價約四千五百四十六元,力壓其餘八家財團得手,而其餘入標發展商分別為會德豐地產、華懋、信和、嘉華、佳明、中國海外、另外恒基、遠展及帝國集團則合資。

近兩年來首奪大型項目

長實執行董事吳佳慶回應查詢時指,集團對投得安達臣道地皮感欣喜,冀透過有關發展項目為香港房屋供應作出貢獻。

是次亦打破該公司接近兩年來未有投得地皮的悶局,該集團於一八年八月取得黃竹坑站三期「巨無霸」商住項目;而以政府地皮計,對上則為一六年九月、以十九億五千三百萬奪得九肚麗坪路地皮。

吳佳慶:冀對房屋供應作貢獻

該地盤佔地約二十一萬七千方呎,可建樓面約一百零九萬方呎,為第二個「港人首置上車盤」先導項目,受不同的限呎及條款「捆綁」,並反映在地價上。區內對上一幅私人土地為一八年初、華懋以逾三十一億一千萬奪得,樓面呎價約一萬二千元,比較是次地價兩年間低逾六成;此後,政府將安達臣區內六幅私樓地皮撥作公營房屋,另一幅則為是次招標的首置地,令區內發展規模大變天,並以公營房屋主導。業內人士指,是次出價符合市場預期,惟現樓形式推售,無法預售樓花,對日後開售的時間表有所約束,及增加風險。

有測量師認為,中標價屬合理,且該區以公營房屋為主導,及以現樓形式推售,加上同一樓盤的私營公營比例對地價很有大影響,認為發展商出價已經考慮上述因素;另外,指該首置單位加私樓的混合發展模式對日後有指標作用。

業界:地價具指標作用

另一測量師表示,中標價已反映政府亦有因應市場最新情況,以及地皮本身的發展模式而調整底價,屬隨行就市。另外,賣地條款複雜,首置單位數量亦多,地區配套不足、投資額大等因素都影響出價。指該地皮有指標作用,亦了解發展商對發展首置盤的反應正面。相信政府會在未來一些合適的地皮如東北發展區出售上加入相關「首置」條款,以私人發展商的力量去加快公共房屋的興建。估計落成後每呎可售約一萬五千元起。

(星島日報)

疫情影響 灣仔乙廈呎租低見20元

受到疫情所影響,商廈租金亦明顯下跌,當中灣仔乙級商廈新銀集團中心早前有低層單位,呎租低見20元,比起東九龍的工廈活化項目租金更低。

新銀集團中心呎租 十年新低

位於告士打道的新銀集團中心一個低層單位,以呎租僅20元租出,為該廈過去10年來最低呎租個案。相較之下,現時觀塘區由工廈改裝而成的商廈呎租不少達20元左右。上址業主早於2011年以2,468萬元購入,現租金回報約2.9厘。據悉,該廈對上一宗最低呎租租務成交,同為上述單位,於2009年12月以呎租20元租出。

另外,同區樂基中心業主新近收回9至12樓4層樓面,改裝成為全新辦公室及多用途空間,翻新後再分間成每層11伙的多用途辦公室出租,單位面積由289至578平方呎,呎租約36元起,即月租由10,404元起。

由於樓層前身為酒店,故業主保留單位內去水位等設計,大部分單位均設有24小時熱水淋浴間及洗手間,方便租戶工作,單位亦可按租戶要求提供辦公室家具,方便租戶即租即用。而項目目標租戶亦多元化,由工作坊、樓上商店及美容等亦見合適。

(經濟日報)

舊樓重建增 灣仔添186萬呎商用樓面

近年灣仔區有不少重建項目,發展商將收購得來的舊樓重建成商廈,爭取更高地積比率,區內6發展項目,預計可為該區帶來約186.2萬平方呎新商用樓面。

合和中心2期 建綜合商業大型項目

灣仔位於中環金鐘核心商業區,以及銅鑼灣的零售旺區中間,過往區內住宅、商業混雜發展,謝斐道以北比較多商業大廈,而灣仔道以南則屬住宅段,不過近年由於核心區商業土地供應不足,區內舊樓重建成商廈的趨勢有所蔓延。

目前區內共有6個重建項目,合共提供約186.2萬平方呎新商用樓面,包括區內兩大地主太古地產 (01972) 及合和均積極在區內擴展版圖。當中合和以皇后大道東的合和中心為根據地,向周邊進行收購重建,而規劃逾30年的合和中心2期項目亦已展開,將會興建成酒店、辦公室及零售的綜合商業大型項目,可建樓面約109.4萬平方呎。而比鄰的皇后大道東153至167號項目,將會興建1幢小型銀座式商廈,以配合合和中心1期及2期的發展,估計項目最快於2021至2022年分別落成。

至於太古則由早年購入前域多利兵房的用地,興建成金鐘太古廣場的旗艦項目之後,亦向灣仔區擴大版圖,包括在永豐街、星街一帶收購,並重建成太古廣場3期。

太古重建項目 料2023年落成

近年太古的收購版圖進一步擴大,就皇后大道東的寶華大廈、比鄰晏頓街2至12號及蘭杜街1至11號舊樓集齊業權後,並展開重建。項目佔地約1.44萬平方呎,預計將重建成1幢28層高商廈,樓面涉約21.8萬平方呎,預計2023年落成。同系於星街小區也有部署,其中永豐街21至31號舊樓完成收購,將會興建一幢商住樓宇,預計明年可推售樓花。

另外,友邦保險 (01299) 亦將位於司徒拔道1號的總部友邦大廈,重建成1幢18層高連4層地庫的商廈,樓面涉約25.5萬平方呎,預計重建後會保留為集團自用,估計需時約4年。

至於鄰近港鐵灣仔站的軒尼詩道及駱克道一帶不少舊樓物業林立,新地 (00016)則就天樂里附近的祥樂大樓統一全數業權,將計劃重建作寫字樓發展,涉及可建樓面約13.1萬平方呎。

(經濟日報)

土瓜灣舊樓 中資財團申強拍

梁朝偉擁1舖位 估值839萬較購入跌4成

近年財團活躍收購舊樓,連影帝梁朝偉亦遇上收購強拍,其在2013年以1,500萬元購入的土瓜灣地舖,遭中資龐源集團申請強拍,最新該舖市值估值只有839萬元,較購入價大跌4成。

上述提及的舖位位於新柳街2A號,梁朝偉在2013年年底以1,500萬元購入。舖位所在的高山道26號、新柳街2A及2B號舊樓,去年底開始獲龐源集團收購,近期購入至逾83%業權後,向土地審裁處申請強制拍賣餘下的3間舖位。

根據財團提交的測量師報告指,梁朝偉所持有的新柳街2A號舖,最新市值只有839萬元,比起7年前的購入價1,500萬元低44%,而旁邊的新柳街2B號、高山道26號舖位就分別市值998萬及1,096萬元。據測量師報告指,估值考慮到疫情、舖位面積、舖面寬度等因素而下調估值。

不過,由於估值報告只是反映物業現時市值,法庭會考慮其重建價值,按照過往情況,最終拍賣底價大多為市值1倍以上,故此梁朝偉最終亦未必需要蝕讓。

恒地加快旺角舊樓收購

另外,旺角利奧坊•曦岸近期推售,發展商恒地 (00012)亦加快同區的舊樓收購,就大角咀道177至191號申請進行強拍,將會作為利奧坊第7期項目。該批舊樓樓齡63年,市值約3.9億元,已收購8至9成業權,可建樓面約8.1萬呎,估計可提供約200多伙,據知已經規劃作為利奧坊第7期。

此外,中資財團亦強拍深水埗醫局街227至233號單號舊樓,估值約1.6億元;裕泰興家族羅守弘旗下的文化村,則就油麻地廟街181及183號申請強拍,樓齡57年,估值約6,191萬元。

(經濟日報)

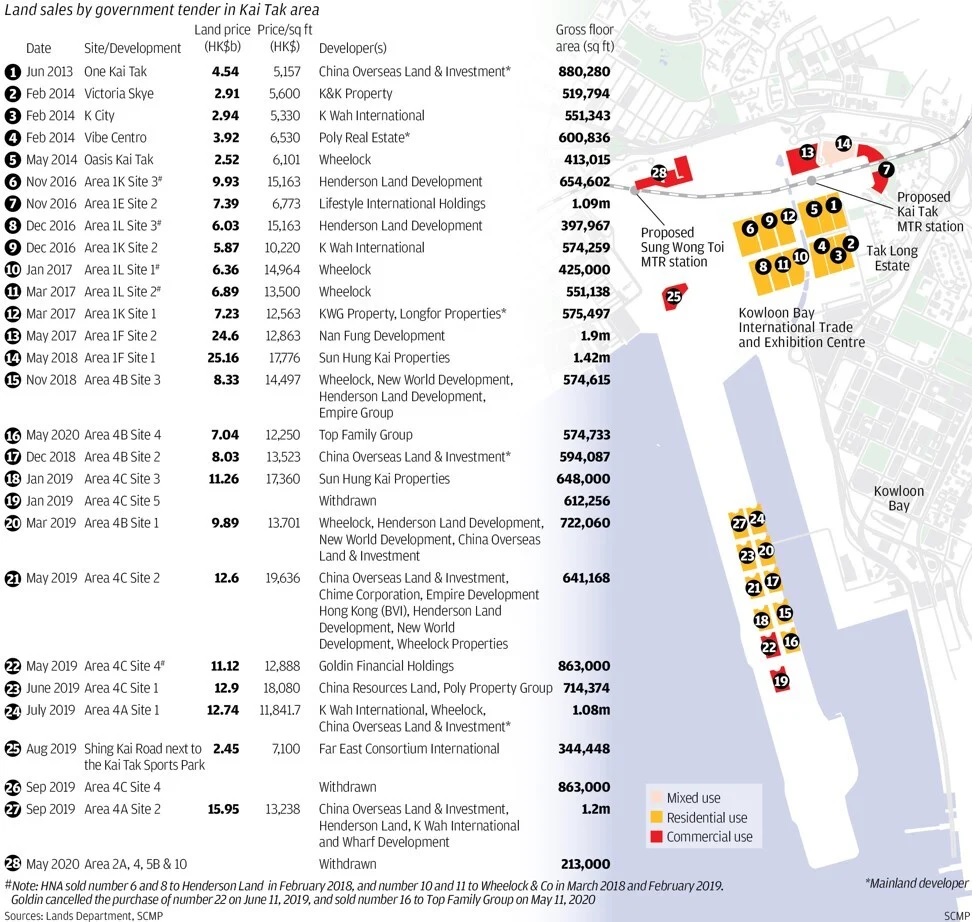

Hong Kong’s government can turn its ‘rotten luck’ on Kai Tak land sales into a windfall for building homes, analysts say

Hong Kong can end a string of “rotten luck” in its recent public land tenders involving the former international airport site in Kai Tak by converting them into residential use to ease the city’s chronic housing shortage, analysts said.

The conversion could help the government reach its annual land-supply targets while boosting its coffers, according to surveyor. The idea is overdue as other facilities in the area, such as the Sports Park, are springing up fast, real estate consultancy said.

The government has failed to find buyers in three commercial sites on the east side of Kowloon Bay for various reasons, crimping its revenues and ability to increase public housing. The stretch coincided with anti-government street protests and the coronavirus outbreak that sent the city’s economy into a recession.

“Selling land needs right timing and the government has had rotten luck in finding buyers for commercial sites in a poor economic climate,” a surveyor said. “The land conversion idea can help support its land-supply targets.”

Financial Secretary Paul Chan Mo-po broached the idea on May 14, a day after the government withdrew Site 4, Site 5(B) and Site 10 in Area 2A as bids came below its undisclosed reserve price. Four parties including Sun Hung Kai Properties and CK Asset Holdings had expressed interest in the first tender of the new financial year.

The government would consider converting the Kai Tak commercial sites for residential purposes, Chan said at a public event, without specifying any particular plot. The Civil Engineering and Development Department is conducting a technical feasibility, he added, without elaborating.

The May 13 tender was the third failed sale since Hong Kong carved up the former airport site into redevelopment parcels. The plot known as Area 4C Site 5 was withdrawn in January 2019, while Area 4C Site 4 failed to sell in a September retender exercise.

The three failed tenders have cost the government at least HK$21.2 billion in missed revenues based on estimates by three property surveyors. Covering a total area of 430,100 square feet (39,957 square metres), they can potentially add 4,000 new homes to the existing housing stock.

“The proposed change to residential will certainly receive general support from Hongkongers, given that the government has struggled to ease housing shortage,” surveyor said.

The former airport site has contributed its fair share to the city’s treasury since at least June 2013. In the just-concluded year to March 31, it contributed to a record haul of HK$110.07 billion from land sales, including other record-setting tenders. It could have been higher had Goldin Financial paid up, instead of walking away from its winning bid,

The last flight out of Kai Tak airport took place in 1998, a year after the handover to China, with the operations relocated to the reclaimed site on Chek Lap Kok island.

In a 2011-12 policy address, the government unveiled its vision of turning an area comprising Kai Tak, Kowloon Bay and Kwun Tong into the city's second core business district, to complement the bustling Central district and ease rocketing property prices.

The plan development for Kai Tak covers 328 hectares of land to accommodate 134,000 residents in 49,900 housing units. Five per cent of the site allocated for commercial use, 13 per cent for residential and as much as 30 per cent for open space.

Much still needs to be done after almost a decade.

The government had failed to meet its land supply targets in two of the past five years. In the financial year just ended on March 31, it provided land bank sufficient for building 12,190 flats, or 9 per cent below its aim. The government has set an average 18,800 units as its annual target from 2019 to 2023.

The cumulative shortfall in public housing, totalling 23,300 units since 2013, is equivalent to about two Taikoo Shing Estates on Hong Kong Island, according to report published by local think tank Our Hong Kong Foundation in April.

Property developers have been reluctant to place big bets given the large investment outlay and long gestation period, surveyor said. Converting them into residential use is “a better option” and could generate a windfall to the city’s coffers, the surveyor added.

Residential plots in Kai Tak can fetch up to HK$11,000 per sq ft, almost double their valuation as commercial sites, Lam estimated.

“The [Kai Tak] site cannot wait any more,” the surveyor said. “The Sports Park nearby is going to launch very soon. It makes no sense to let such a big site nearby sit empty when the park makes its grand debut.”

(South China Morning Post)

Cheung Kong wins starter-home site for $4.95b

A site on Anderson Road in Kwun Tong, where at least 1,000 starter home units shall be developed, has been awarded to CK Asset (1113) for HK$4.95 billion, or HK$4,546 per buildable square foot, at the lower end of market valuation.

CK Asset said it is pleased that the group won the bid and it hopes to contribute to the SAR's housing supply through such development projects. Surveyors previously valued the site between HK$4.6 billion and HK$7.1 billion, or HK$4,200 to HK$6,500 per buildable sq ft.

The price shows developers are bearish on the market, a surveyor said.

The site with development limitations earlier only received nine bids, including ones from China Overseas Land & Investment (0688), Sino Land (0083) and Wheelock Properties.

All residential units to be built should range from 250 sq ft to 500 sq ft in saleable area, among which 20 percent shall be studio units, 25 percent shall be one-bedroom units and 55 percent shall be two-bedroom units.

After the developer obtains the occupation permit, the government will randomly select no less than 1,000 starter home units, including 200 studio units, 250 one-bedroom units and 550 two-bedroom units.

The developer is required to offer these starter home units for sale at 80 percent of market price to eligible applicants.

In 2018, Chinachem won another plot of residential land at Anderson Road for HK$3.11 billion, in which the Buildings Department allowed four residential buildings to be built on the site.

Elsewhere, CHFT Advisory and Appraisal valued the residential site on Praya Road in Ap Lei Chau at HK$1.18 billion to HK$1.22 billion, or HK$12,400 to HK$13,000 per buildable sq ft.

Meanwhile, a 242-sq-ft flat at Amoy Gardens changed hands for HK$5.12 million, or HK$21,190 per sq ft, hitting a new high at the estate, according to property agency.

In the primary market, Sun Hung Kai Properties (0016) released 123 flats in the third price list of Wetland Seasons Park Phase 2 in Tin Shui Wai, at an average price of HK$12,639 per sq ft after discounts. The developer will launch 200 flats for sale on Saturday.

And Vanke Property (Hong Kong) will tomorrow open show flats of The Campton, which offers 467 units.

In other news, the one-month Hong Kong Interbank Offered Rate, which is linked to the mortgage rate, slid for seven days in a row, down by 2.45 basis points to 0.59101 percent.

(The Standard)

港島核心區優質乙廈交投量將轉活

本港肺炎疫情反覆不定,即使疫情受控,經濟活動復甦需時,拖累寫字樓租買表現,近月港島多區甲廈空置率按月上升,買賣價及租金走勢仍待觀察;而隨着核心區投資價值看高一綫,個別優質乙級商廈近期備受名人垂青,趁低吸納作長遠投資。在名人效應下,預料港島核心區優質乙級商廈買賣交投量將會轉活,特別是全層矜罕樓面更會成為吸納對象。

商廈前景未許樂觀,但本港金融中心根基鞏固,港島核心區寫字樓長遠投資潛力仍然看俏。因此,在逆市下有個別實力投資者趁物業造價下滑及議價空間擴大,成功入市優質單位,預料商廈買賣宗數將會較上月回升。

中全層物業成市場焦點

根據代理統計,4月份港島4大核心區甲級商廈空置率錄得升幅,包括金鐘、銅鑼灣、中環及灣仔,上升幅度約0.1%至1.16%不等,當中最大增長為銅鑼灣區,最新甲廈空置率錄得約8.22%。而中環作為核心中之核心,該區甲廈空置率向來為市場指標,過往多徘徊於1%至3%,惟中環最新甲廈空置率已上漲至約4.54%,按月上升約0.42%,中區甲級商廈亦跟隨大市調整。

整體甲廈空置率上升,市場把焦點轉移至核心區乙級商廈,當中全層物業更成為市場焦點,實力投資者趁低吸納優質單位,近月中環區錄得數宗名人入市個案。例如利國偉家族人士斥資約2.86億元購入中環永安集團大廈16樓全層,面積約11,062平方呎(未核實),成交呎價約25,854元。資料顯示,永安集團大廈向來放盤量少,特別全層樓面更見鳳毛麟角,該物業對上一宗全層成交要追溯至2010年,該成交為23樓全層,可見全層單位罕有度高,加上中區全層逾萬呎放售盤源亦極為罕有,因而吸引買家出手。

料名人投資者趁低入市

此外,亦有名人家族趁低價增持物業,澳門前賭王傅老榕後人傅厚民買入中環安蘭街18號19樓全層,面積約2,448平方呎(未核實),作價約7,375萬元,平均呎價約30,127元。翻查資料,傅厚民於2019年中以約8,200.8萬元購入該廈18樓全層,面積同約2,448平方呎(未核實),成交呎價約33,500元,即最新呎價較其下跌約一成,獲同幢業主趁低加購。

核心區甲級寫字樓買賣價及租金雖見下滑,但由於抗跌能力高,呎價及租金叫價相對較高,因而令近期買賣及租務交投處於膠着狀態,然而地理優勢仍為企業入市重要考慮因素,加上個別優質乙級商廈質素不俗,全層樓面更屬矜罕,最重要是業主叫價相對克制,故在低息環境下容易成為投資者及用家入市首選。筆者相信,香港商業地位具有長遠優勢,核心區寫字樓投資價值仍被看高一綫,預料隨着陸續有更多名人及實力投資者趁低入市,預料優質全層商廈物業將會在短期內受捧。

(經濟日報)

交投聚焦長沙灣 新甲廈料受捧

今年大額買賣交投較多為長沙灣區,隨着商業氣氛轉濃,區內將有全新商廈項目落成,料推出時可獲投資者及用家注視。

受疫情影響,今年大額投資買賣不多,而成交較集中於長沙灣區,如今年1月,長沙灣青山道550至556號恆發工業大廈全幢,以約11億元易手,買家為本地財團。該廈樓高12層,地盤面積約15,837平方呎,現時總樓面面積約156,087平方呎,最多可重建約190,044平方呎樓面,以11億元成交價計,每呎樓面地價料約5,788元,預計新買家將重建成商廈項目。

第一集團 今年購入兩工廈

另外,第一集團近在上月兩度入市購入長沙灣全幢工廈,該集團先斥7.9億元購入,長沙灣道924及926號利洋中心全幢。項目地盤面積約1.2萬平方呎。其後集團以6.4億元購入比鄰長沙灣道916至922號,並指兩地盤合併發展,總地盤面積增至約2.16萬平方呎,若以地積比率12倍計算,預計可重建樓面約26萬平方呎,料總投資金額約28億元,最快於2023年落成。

財團購入工廈日後重建,事實上,本港大型發展商近年積極吸納長沙灣商業地盤,新世界 (00017)更是積極在長沙灣投地,2016年2月,先以約78億元購入瓊林街商貿地,每呎樓面地價約7,808元,同年5月再下一城,斥資逾40億投得近長順街商業地。2017年8月更以29.6748億元投得永康街商貿地,三幅地皮共涉樓面約190萬平方呎,涉資約150億元。

荔枝角道888號料下月推

近日樓市氣氛轉好,發展商即推住宅及工商新盤。消息指,新世界料快推出長沙灣荔枝角道888號甲廈項目,預計呎價約1.3萬元起。物業樓高31層,寫字樓由5至31樓,而地庫設3層停車場。而頂層30及31樓為特色樓層,每層面積20,200至23,600平方呎,每層提供約14個單位,項目料於2022年4月落成。業界人士透露,發展商有望下月推售,市場人士估計呎價約1.3萬元起,按單位面積最細約1,200餘平方呎起計,入場費約1,500萬元,料獲投資者及用家捧場。

(經濟日報)

高銀蝕讓效應區內地價大貶值啟德13幅住宅地跌價逾15%

在疫情影響下,經濟前景未明,而且高銀金融於上周蝕讓啟德住宅地效應,導致區內住宅地價大貶值,以近兩年同區批出13幅住宅地計,地皮即跌價逾15%。

啟德區近年為土地供應重鎮,近兩年來政府已批出共13幅住宅地,惟在社會運動及疫情影響下,進一步打擊本港經濟,而且原先由高銀金融持有的4B區4號地皮,於上周以70.4億沽出,並預期虧蝕逾25億,即時令同區住宅地皮身價大跌。

涉及商業部分跌幅較高

有測量師表示,近期地皮連一連串不利因素影響,加上高銀蝕沽啟德地下,目前區內已批出的13幅住宅地,其最新估值較購入價跌逾15%,最高跌價約26%。

最高跌價約26%

該測量師續指,惟自去年中社會運動開始,整體經濟轉差,不少商業地流標收場,加上疫情影響,進一步打擊本已陷入衰退的本地經濟,樓市亦急速逆轉,該區地皮前景亦令人擔憂,當中涉及商業部分的地皮,其身價跌幅較高,如1F區1號地,最新樓面地價估值約13600元,較2年前中標的每呎樓面約17776元,跌約24.1%。

另一測量師指出,本港整體經濟大環境轉差,近期亦有地皮以低價批出,加上該區商業地流標,為區內增加不明朗因素,因而導致整區地價下跌。

(星島日報)

Sentiment brightens as luxury homes move on

More luxury homes have been sold, including two units in Dukes Place at Jardine's Lookout for HK$438 million, a unit at Trafalgar Court for HK$90 million and a house in Kowloon by China Overseas Land & Investment (0688) for HK$153 million as market sentiment brightens.

Dukes Place is jointly developed by CSI Properties (0497) subsidiary Couture Homes Properties, Asia Standard International and Grosvenor Asia Pacific.

A total of 980 primary home units have been sold this month with a recovery in the property market, the largest number in a month since the Covid-19 outbreak. However, the would-be buyers of 12 new flats have forfeited their deposits in May.

Chevalier International (0025) has named its new project at Tai Kok Tsui, jointly developed with the Urban Renewal Authority, as Sablier.

The project offers 144 home units, more than 60 percent of them single-room flats.

Wing Tai Properties (0369) has released the fourth price list of its Oma by the Sea in Tuen Mun, offering 108 units at an average price of HK$13,416 per square foot after discount.

In the secondary market, the owner of a 1,510-sq-ft duplex apartment at Starcrest in Wan Chai lost more than HK$10 million after selling it for HK$54 million.

The one-month Hibor, meanwhile, dropped by 2.89 basis points to 0.61554, the lowest in more than two-and-a-half years.

In the shop rentals market, Milan Station (1150) rented out a shop on Wellington Street with a 20 percent higher rent. Oriental Watch (0389) continued to rent a shop in Hysan Plaza.

Ten percent of respondents believe it is a good time to buy property, the highest in nine years, while 57 percent expect home prices to fall in the next 12 months, a sharp increase of 15 percentage points before the Covid-19 pandemic, says Citi Hong Kong.

Property prices are expected to fall between 7.5 percent and 10 percent this year, but the impact will be slightly less than what was witnessed during the 2003 SARS epidemic.

(The Standard)

商廈驚現頂租放盤潮中環金鐘成重災區疫市下前景未明朗租戶紛提前離場

疫市持續多時,經濟前景未明顯,不少企業經營困難,惟有縮小規模甚至結業,紛放棄所承租的據點,提早離場,令商廈市場驚現頂租放盤潮,核心區中環金鐘成為重災區。

業界人士指出,租戶推出頂租放盤,皆因租約有私人擔保,不能隨意撤走了事,因而找新客頂替。市場上頂租放盤向來不多,惟近期市場湧現頂租放盤,分布單一業權或散業主大廈,且不乏大面積及全層單位。

全港逾100個頂租放盤

當中,中環皇后大道中9號目前有5個頂租盤,全部逾3000方呎,租期長達2023年;美國銀行中心有6個,包括一個全層單位;中環中心更多逾10個,細至2000方呎,大至逾萬呎的半層單位。有代理透露,現時全港商廈共有逾100宗頂租放盤,中環金鐘成為重災區。

過去十個月以來,整體甲廈租金普遍跌幅30%至50%,因此,租客即使幸運地找到有人頂租,都要支付新舊租金差價,代理舉例說,以美國銀行中心一個面積約5500方呎單位為例,新月租(32萬,每呎60元)與舊月租(52萬,每呎95元),月差20萬,若果於2021年4月約滿,期間10個月租金差價涉200萬。

舊租客支付差價

舊租客可「一筆過」或逐月繳付差價。「不過,既然做不下去,未必有能力一次過賠償,通常逐月支付,亦有業主視乎情況,以折扣價收取賠償額。」代理續說。

代理說,生意人都懂計算,有裝修的租盤向來受捧,尤其疫市下開業的更加實際,因此,頂租放盤吸引力在於裝修,放盤叫租貼近舊有租金,或低約10%,惟最後都以市價租出。他又說,商廈裝修簡單,不像鋪位投入生財工具,舊租客沒有「頂手費」可收。

另一代理表示,近期政府推工資補貼為企業舒困,惟一些公司面對全球嚴峻環境,加上示威及疫市後遺症,導致經營困難因而放頂租。

(星島日報)

泛海六全層逾三萬呎PUREYOGA推頂租

消息人士透露,中環泛海中心的大手租客,瑜伽公司PURE YOGA將其承租的6全層樓面,推出放頂租。

上址為皇后大道中59號至65號泛海大廈15、17、20、21、22及23樓,共6全層樓面,共涉逾3萬呎,由PURE INTERNATIONAL (HONG KONG)LIMITED承租。記者現場所見,上述部分樓層為寫字樓,部分放置雜物,至於該廈2樓則為瑜伽學校。本報向該廈大業主查詢,泛海集團執行董事關堡林回應,該數層屬租客後勤部門,他們有意遷工廈節省成本,至於位處低層樓面的學校,則繼續租下去。本報亦向PURE YOGA查詢,惟直至截稿時未獲回覆。

八年前進駐

有代理透露,PURE YOGA大約於2012年進駐該廈,至今八年,上址目前最新平均呎租逾45元。

業內人士指,租客推頂租,首先要取得業主同意,試過有租客多番努力下,找到人頂租,業主不放行,最後不成功。他又形容,只有一些較有人情味的業主,才容許租客頂租,部分大業主企硬,不容許頂租。

(星島日報)

New homes hit the market as nano flats feel the heat

A property agency recorded 19 secondary transactions at ten major housing estates over the past weekend, down by 13.6 percent week-on-week, as developers continued to launch new home sales in the primary market, while rents of nano flats came under downward pressure.

Laguna City in Kwun Tong and Metro City in Tseung Kwan O recorded no secondary transactions at all.

In Fanling, a 520-sq-ft flat at Fanling Centre changed hands for HK$7.18 million, or HK$13,808 per sq ft, after HK$20,000 was cut from the asking price.

In the primary market, Sun Hung Kai Properties (0016) released 70 flats in the second price list of Wetland Seasons Park Phase 2 in Tin Shui Wai, at an average price of HK$11,779 per sq ft after discounts, 3.6 percent higher than the first price list.

The first two batches of the project have been oversubscribed 8.5 times with around 2,000 checks received for 210 units.

Meanwhile, around 2,000 prospective buyers for Aquila‧ Square Mile in Tai Kok Tsui, visited the project's show flats located in Central, between Friday and yesterday.

And in Yuen Long, Road King Infrastructure (1098) sold 11 flats at Crescent Green over the past three days.

Property agency expects the number of primary transactions to hit 2,000 this month.

But there were also two cases of forfeited deposits of around HK$220,000 and HK$300,000 after purchases of two flats at Emerald Bay in Tuen Mun were canceled.

The HK$220,000 forfeiture involved the would-be purchase of a 229-sq-ft studio flat at Emerald Bay Phase 1, which was priced at HK$4.37 million. The HK$300,000 forfeiture related to a 372-sq-ft flat at Emerald Bay Phase 2 that the purchaser had agreed to buy this month for HK$5.95 million.

In the rentals market, rents of micro flats came under downward pressure. A 166-sq-ft studio at AVA 55 in Kowloon City was rented for only HK$8,000 a month, or HK$48 per sq ft.

And in Pak Shek Kok, a 248-sq-ft studio flat at Solaria was let for only HK$8,900 last month, or HK$36 per sq ft, after HK$2,100 was cut from the asking price. The rental yield was only 2.1 percent per annum, as the owner purchased the unit for HK$5.15 million in 2018.

(The Standard)

Hong Kong’s homebuyers shun property sales for the fourth weekend in a row as they await better deals amid a glut of options

Hong Kong’s property sales flopped for the fourth straight weekend, as homebuyers turned their backs on unsold projects to wait for better discounts, amid a real estate slump in the city’s worst economic contraction in decades.