受疫情打击,甲厦市场沦为「重灾区」,租金持续下滑。消息指,尖沙嘴星光行低层单位以每呎约22元租出,较旧租金跌约23%,低市价逾一成,并创该厦过去一年以来新低。

低市价逾一成

市场消息指出,尖沙嘴星光行低层27C室,建筑面积434方呎,以每呎约22.5元租出,月租约9765元;据地产代理指出,上址旧租金为每呎29.5元,惟该租户于去年12月迁出,故最新租金下跌约23.7%。

代理亦指出,上址租金明显较市价为低,以该厦市场每呎租金约25元计,上述租金低市价约12%;据本港一间代理行资料显示,该甲厦近期频录承租,最新承租个案为该厦高层29室,面积约452方呎,于本月以每呎28元租出,月租约12656元。若该厦呎租跌穿每呎22元水平,需追溯至去年2月,当时该厦低层48室,面积约398方呎,以每呎约20元租出,月租约8000元。

据业内人士指出,儘管甲厦空置率逐步改善,惟整体租金表现仍备受压力,近期,部分业主希望在农历新年前将单位租用,加上新一波疫情急升温,议价空间逐步扩阔,故近期甲厦租金均见折让。

另外,金鐘区内甲厦亦录承租个案,消息指,统一中心高层C01室,面积3856方呎,以每呎约46.7元租出,月租约18万。

(星岛日报)

更多星光行写字楼出租楼盘资讯请参阅:星光行写字楼出租

更多尖沙咀区甲级写字楼出租楼盘资讯请参阅:尖沙咀区甲级写字楼出租

更多统一中心写字楼出租楼盘资讯请参阅:统一中心写字楼出租

更多金鐘区甲级写字楼出租楼盘资讯请参阅:金鐘区甲级写字楼出租

由信和及帝国集团合作发展的黄竹坑 Landmark South 总楼面逾25.6万方呎,首批租户于今年第3季进驻,项目意向呎租约30元。

今年第二季竣工

信和集团及帝国集团昨日宣布,旗下首个位于黄竹坑甲厦项目 Landmark South,楼高31层,总楼面256957方呎,将于今年第二季落成,项目已开始招租,意向呎租约30元,该项目包括甲级办公室、零售及餐饮等用途,办公室面积约218222方呎,单位面积介乎1497至14005方呎,零售铺位面积则介乎11823方呎至38735方呎。另外,该项目8楼设有9000方呎空中花园,同时设有4100方呎室内绿化空间。

同时,该项目获香港艺术发展局进驻,设立其永久办事处,以营运面积约5000方呎的全新艺术展览空间、一个艺术资讯中心及约28间艺术工作室。

获香港艺术发展局进驻

信和集团资产管理董事蔡碧林表示,Landmark South 与集团区内住宅项目产生协同效应,巩固集团在港岛南的多元物业投资组合。

帝国集团执行董事姚志伟称,随着港铁港岛南线通车后,黄竹坑人流不断增加,区内发展日见成熟,料疫情回稳后优质商厦需求有力反弹。

(星岛日报)

更多Landmark South写字楼出租楼盘资讯请参阅:Landmark South写字楼出租

更多黄竹坑区甲级写字楼出租楼盘资讯请参阅:黄竹坑区甲级写字楼出租

金鐘海富中心 港铁上盖配套齐

海富中心位于金鐘核心地标之一,位处港铁站上盖配套成熟,日后东铁綫通车后金鐘更属交通中枢,前景理想。

海富中心位于港铁金鐘站上盖。是一幢分散业权的商业大厦,是金鐘区内甲级写字楼指标,目前物业可提供出租及出售,相比之下该物业的成交不算太活跃。

海富中心在1980年落成,楼龄约42年,是由两幢甲级商业大厦组成,分别为一座及二座,楼高共22层,每层面积约10,627平方呎,单位面积由数百平方呎起,单位景观主要望向城市景及部分海景。该物业有不少行业进驻,例如领事馆、金融及律师楼等企业。

交通配套方面,该物业在港铁金鐘站A出口上盖,由该物业步行至A出口约2至3分鐘路程,加上第2季东铁綫将延伸至金鐘,届时往返其他地区更方便,金鐘势成中枢。同时,附近巴士站亦提供不同巴士路綫来往各区,有利商客。

餐饮配套方面,位于大堂的下层设有美食广场,为商客提供商务餐饮,同时可步行至统一中心及太古广场,该商场设有大量餐饮选择,相信可以满足商务餐饮的要求。

高层5568呎 1.5亿元成交

近期,金鐘海富中心成交较为平静,其中在2020年10月,涉及一座高层01室,面积5,568平方呎,以逾1.5亿元成交,平均呎价2.85万元;另一宗成交为于2019年1月,涉及高层B02室,面积3,061平方呎,以1.09亿元成交,平均呎价3.56万元;另一宗1期于2018年11月,涉及单位为中低层04室,面积6,452平方呎,以2.3亿元成交,平均呎价3.56万元。

(经济日报)

更多海富中心写字楼出售楼盘资讯请参阅:海富中心写字楼出售

更多统一中心写字楼出售楼盘资讯请参阅:统一中心写字楼出售

更多金鐘区甲级写字楼出售楼盘资讯请参阅:金鐘区甲级写字楼出售

更多海富中心写字楼出租楼盘资讯请参阅:海富中心写字楼出租

更多统一中心写字楼出租楼盘资讯请参阅:统一中心写字楼出租

更多太古广场写字楼出租楼盘资讯请参阅:太古广场写字楼出租

更多金鐘区甲级写字楼出租楼盘资讯请参阅:金鐘区甲级写字楼出租

低层1058呎 意向价3491万

中环区一带的写字楼一直备受投资者欢迎。新近有业主因应市况变化,放售金鐘海富中心二座低层单位,意向价约3,491万元,将以交吉形式出售,自用投资皆宜。

呎价3.3万 附精緻装修

代理表示,今次放售单位位于金鐘夏愨道18号海富中心二座6楼08室,面积约1,058平方呎,意向价约3,491万元,折合呎价约33,000元。谢立生表示,物业以交吉形式出售,单位附有精緻写字楼装修,方便準买家节省时间及成本。此外,物业本身佔尽地理优势,交通四通八达,而单位间隔灵活,可吸引不同企业进驻,租务情况理想;现时该物业市值呎租约40至45元。

该代理续称,金鐘写字楼供应向来紧絀,大多业主具实力且惜售,翻查资料,2021年至今金鐘指标甲厦仅录得9宗买卖个案;另外,该厦对上一宗相类似单位面积的成交个案亦需追溯至2018年中,为低层06室,面积约901平方呎,成交呎价约31,076元。

该代理表示,随着政府展开金鐘廊重建发展计划,金鐘一带商业核心区地位将进一步稳固,料将吸引更多跨国及中资企业进驻。加上沙中綫即将通车,金鐘站作为主要中转站,周边物业价值会大大提高。该代理相信,今番放售单位为区内知名指标商厦,质素上乘,甚具竞争力,料会获用家及投资者洽询。

(经济日报)

更多海富中心写字楼出售楼盘资讯请参阅:海富中心写字楼出售

更多金鐘区甲级写字楼出售楼盘资讯请参阅:金鐘区甲级写字楼出售

指标甲厦售价窄幅向上 按月升0.1%

上月商厦市场气氛稍为回暖。有代理行发表的报告指出,指标甲厦售价窄幅向上,按月上升0.1%,按年累升1.7%,甲厦租金按月微升0.2%。

该报告指出,上月分散业权甲厦售价按月微升0.1%,分散业权乙厦售价则维持不变。12月较为瞩目之大手写字楼买卖为上环中远大厦10楼全层写字楼,面积约19,745平方呎,作价约4.2亿元易手,呎价约21,270元,是次出售物业录得亏损约2,620万元。

租金方面,分散业权甲厦乙厦租金上月分别按月升0.2%及升1.4%。上月较为瞩目的租务成交为铜锣湾利园一期高层单位,面积约14,737平方呎,呎租约80元。

整体甲厦空置率 高位徘徊

空置率方面,虽然整体甲厦空置率仍然在高位徘徊,但上月空置率出现轻微缓和,当中湾仔/铜锣湾及上环的表现最好,湾仔/铜锣湾空置率连续5个月回落,该区的空置率更由11月份的9.4%下降至12月份的8.4%。而上环的指标甲厦空置率亦由11月份的8.7%下降至12月份的7.8%,连续两个月回落。

该行代理表示,今年预料多个写字楼一手项目将会继续推出,有望带动写字楼成交,当中位于荃湾的沙咀道1号项目以及宏基资本 (02288) 旗下的黄竹坑宏基汇亦有机会在年内推出,期望有助刺激写字楼买卖成交数字。

该代理又指,2022至2023年甲级写字楼供应将达高峰,今年甲厦落成量将超过500万呎 (建筑面积),而通关前景未明朗,即使一旦通关,预料初期亦会设限额,相信整体市场气氛仍然持观望态度,短期写字楼租务市场或会继续受压。

(经济日报)

更多中远大厦写字楼出售楼盘资讯请参阅:中远大厦写字楼出售

更多上环区甲级写字楼出售楼盘资讯请参阅:上环区甲级写字楼出售

更多利园写字楼出租楼盘资讯请参阅:利园写字楼出租

更多铜锣湾区甲级写字楼出租楼盘资讯请参阅:铜锣湾区甲级写字楼出租

信和结志街申建商厦被拒 城规会︰改作写字楼偏离规划原意

本港房屋土地供不应求,由信和持有中环结志街36号住宅用地,早年向城规会申请改划为写字楼用途发展被城规会否决后,发展商随即提出上诉、再度闯关,城规会上诉委员团最新公布,在重新检视相关方案后,决定驳回其申请,认为用作写字楼发展,将会偏离原先作住宅的规划原意,并加剧住宅地皮供应短缺。

信和近年一直争取就结志街36号住地用地、改划作商业项目发展,发展商过去多次就项目提出发展商业项目,早于2018年被都会规划小组委员会拒绝其申请,其后更于2019年初再被城规会否决,发展商随即提出上述,城规会上诉委员会在重新检视相关方案后,决定驳回其申请,意味上述项目被否决。

曾两度驳回申请

城规会上诉委员公布,已于近日驳回上述,并公开判词;据文件显示,上诉委员团认为,是次上诉的用地计画用作写字楼发展,必然会偏离「住宅 (甲类)」的规划原意,而且城规会拒绝批出规划许可的理由之一,即批出该许可会为在同一个地区「住宅 (甲类)」的类似申请开创不良先例,而且该类申请的将加剧住宅用地的供应短缺。

开先例将加剧住宅短缺

另外,据差估署香港物业报告所指,2020年上环丙级写字楼的需求下降1.7万多方呎,空置率升至7.5%;申请人亦未有充分理据证明或说服城规会区内有强烈增加写字楼需求,亦未能证明该地盘不利于住宅发展;故此驳回其申请;换言之,上述项目由住宅改划商厦项目发展正式被否决。本报昨向信和查询有关事宜,唯截稿前未有回覆。

据城规会文件显示,上述结志街36号项目,毗邻信和与市建局合作发展的私楼ONE CENTRAL PLACE;地盘面积约948方呎,现划作「住宅 (甲类) 9」地带用途,早于2018年向城规会申请改划为拟议办公室、商店及服务行业及食肆发展。发展商计画地盘以地积比15倍重建,拟议兴建一幢楼高不多于21层高的小型商厦,当中地下3层作商铺食肆,其餘楼层为写字楼,涉及可建总楼面约14225方呎。

资料显示,上述项目早于2018年申请被拒绝后,发展商提出覆核申请,并于2019年被规划署反对申请。

(星岛日报)

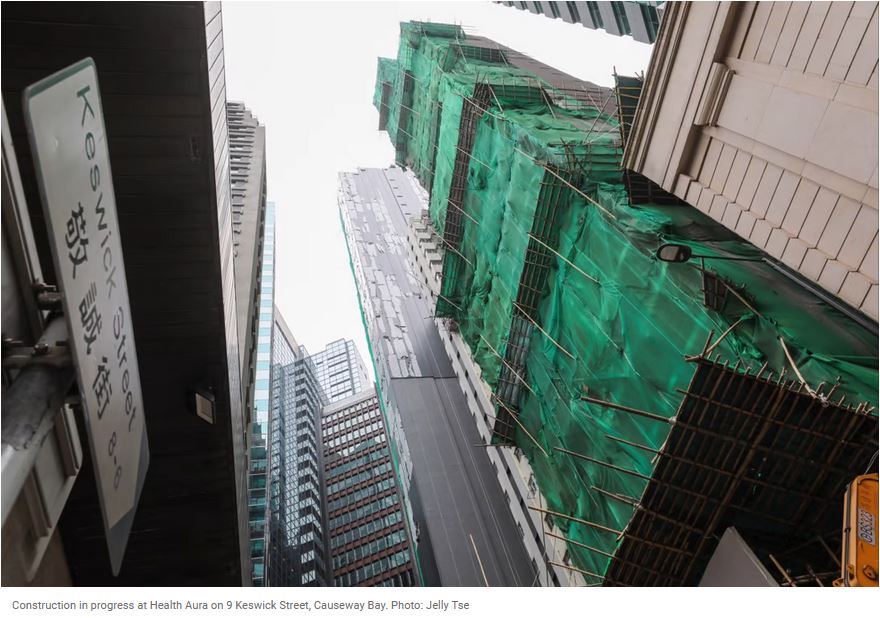

Hong Kong developer H Development seeks medical services providers to lease its purpose-built tower in Causeway Bay

H Development Holdings has invested HK$600 million (US$77 million) in Health Aura at 9 Keswick Street in Causeway Bay.

The tower has been built in accordance with medical specifications, with space dedicated for MRI centre.

H Development Holdings is seeking to lease a purpose-built tower, the first of its kind in Causeway Bay, as the privately owned property firm believes the city has the potential to become a medical tourism destination for the Greater Bay Area.

The company has invested HK$600 million (US$77 million) in Health Aura on Keswick Street, which has a gross floor area of 30,000 square feet. The redeveloped property, which is about a five-minute walk from St Paul’s Hospital, will be available for lease soon.

The tower has been built in accordance with medical specifications all the way down to its sewage systems. The ground floor is specifically designed for a Magnetic Resonance Imaging (MRI) centre based on guidelines from medical-equipment maker Siemens Imaging Systems.

“We hope to lease the whole building to one medical group,” chairman Eric Ng said. “The location is perfect to meet the demand of visitors from the Greater Bay Area who seek medical care in Hong Kong.”

The company has a portfolio worth HK$20 billion in Hong Kong, comprising five completed commercial buildings and another three under construction. Five of the eight buildings are located in Causeway Bay, including the recently completed 25-storey grade A commercial tower, HDH Centre, on Irving Street.

Analysts said demand for wellness and health care services from locals and mainland visitors, especially routine check-ups and screenings for cancer, are likely to grow in the coming years due to an increasingly greying population. Figures from Hong Kong government show that the share of city’s population aged 65 or above will increase from 19 per cent in 2020, to 31 per cent in 2039, and 34 per cent in 2049.

A property agency firm forecasts that medical centres will require of one million sq ft of commercial space from 2019 to 2022.

“Hong Kong’s tourism will transform to health care over the next several years from purely shopping as shoppers gradually shift to online shopping,” agent said.

“Operators of high-end medical group will opt for bigger spaces,” the agent said, adding Health Aura’s 30,000 sq ft space should be sought after.

The agent said that a growing number of landlords were increasingly offering commercial space to medical tenants.

In Tsim Sha Tsui, Henderson Land Development’s H Zentre, opposite Sheraton Hotel, has purpose-built systems and facilities for medical service providers. The tower has a mix of wellness and retail services providers.

“We will offer long lease terms to medical tenants who invest heavily in their clinics,” said Thomas Wu, chief executive of H Development.

A five-year fixed term plus the option of another five years will allow tenants to maximise the use of expensive equipment, he said, adding that the normal market practice is for landlords to offer a fixed-term lease of two years with an option for another two.

H Development is optimistic about Hong Kong’s office and retail market, noting that the government’s long-term, multitrillion-dollar infrastructure development plans, such as the Northern Metropolis and Lantau Tomorrow Vision, will create the city’s next housing and business hubs.

“It will create ample job opportunities bringing more people to Hong Kong,” said Wu.

“With more Chinese companies seeking to list in Hong Kong means more demand for office space. The next 10 years will be a golden era for Hong Kong.”

(South China Morning Post)

For more information of Office for Lease in HDH Centre please visit: Office for Lease in HDH Centre

For more information of Grade A Office for Lease in Causeway Bay please visit: Grade A Office for Lease in Causeway Bay

For more information of Office for Lease in H Zentre please visit: Office for Lease in H Zentre

For more information of Grade A Office for Lease in Tsim Sha Tsui please visit: Grade A Office for Lease in Tsim Sha Tsui

Hong Kong market will be unkind to old mass housing estates as prices slide in early weeks of 2022

Large developments built more than 20 years ago in Kowloon and Hong Kong Island are likely to experience bigger declines

Covid-19 infections and emigration have been cited as reasons for caution in the market outlook this year

Prices at large decades-old housing estates in Hong Kong are likely to fall further after owners signalled their willingness to compromise on their expectations amid a worsening wave of Covid-19 infections and concerns about higher interest rates.

A property agency’s index tracking prices in mass housing estates has retreated 3.4 per cent since it peaked on August 8 last year, according to compiler a property agency’s data from January 16. The reading is set to weaken through the Lunar New Year next month, a company official said.

Hong Kong recorded 140 new cases of Covid-19 infections on Sunday, the worst outbreak in 18 months, after scores of residents at a housing estate were ordered to undergo tests last week amid a lockdown. The Federal Reserve has signalled three rate increases this year, spooking investors especially in Hong Kong, which adopts policy in lockstep with the US central bank.

“Correction will definitely sustain,” a property agent said. “It has not really reflected the [Omicron variant] landing in Hong Kong, which has caused a lot of trouble now.”

Large developments built more than 20 years ago in Kowloon and Hong Kong Island are likely to experience bigger declines as investors, who tend to be more sensitive to interest-rate changes, occupy a higher proportion of housing estates than those in New Territories, the agent added.

South Horizons in Southern district suffered the most, having lost 7.6 per cent in value to HK$17,296 per sq ft between August 8 and December 26, according to the agency’s data. Taikoo Shing in Quarry Bay is the next biggest loser with a 6.5 per cent drop to HK$19,917 per sq ft.

Kai Tak and Ap Lei Chau are among the districts with the highest proportion of listings offering price cuts, according to another property agency’s information, including smaller units of less than 431 sq ft. This has “driven the number of deals up significantly” despite the pandemic, another agent said.

“Many owners are willing to reduce prices to push transactions forward,” agent said. “Some sellers who are eager to cash out may even offer discounts of 5 per cent or more” to entice buyers, the agent added.

The price actions in the early days of 2022 underscores some jitters about the outlook for the local market. Analysts at Morgan Stanley and UBS have predicted softer conditions this year, partly due to emigration. JPMorgan stands on the opposite side with forecast for a gain in 2022.

To be sure, houses in New Territories also offer compelling opportunities for bargain seekers. Almost 17 per cent of properties in Shatin offer price cuts, among the 30,00o-odd online listings maintained by the property agency.

Prices at Kingswood Villas in Tin Shui Wai, among major housing estates, has weakened also more than 5 per cent since early August. A flat measuring 540 sq ft changed hands for HK$5.16 million last week. At HK$9,556 per sq ft, the price was 21 per cent below the original asking price in mid-2021.

The Caribbean Coast in Tung Chung saw 14 transactions in the first 21 days this month, compared with only three deals in the same period last month, according to another property agency.

(South China Morning Post)