外资代理行:0+3可带动租务 租金全年跌5%

疫情持续下,甲楼空置情况恶化,有外资代理行指,甲厦最新空置楼面再上升至1,190万平方呎,属历史最多,而空置率为14.1%,已逼近历史最高位仅差0.3个百分点,东九龙空置更高见2成,该行料「0+3」后可带动租务,惟因新供应多,租金全年仍跌5%,空置率年尾创新高。

据该行最新数字,今年第3季新增180万平方呎甲厦新供应,同时间吸纳情况不算理想,故空置楼面达1,190万平方呎,创历史新高,而空置率上升2个百分点至14.1%,而东九龙区空置率更高见2成。

东九龙空置率高见2成

该行代理认为,相信不论检疫措施0+3及日后可能再放宽至「0+0」,可带动商务活动,令甲厦租务增加,惟目前空置楼面多,要吸纳尚要一段时间,再加上中港通关尚未有时间表,料全年商厦租金跌5%。

该代理指,空置率最高纪录为2004年,涉14.4%,代理相信按此走势,今年空置率将创新高,因今明两年供应多,料明年空置率更升至约15.6%。

投资市场方面,该行另一代理指,第3季因美国加息步伐加快,令大额物业投资市场淡静,涉及7,700万元的大额买卖仅录20宗,宗数按季跌一半。

后市上,代理认为以现时商业借贷成本已达3.6%,投资成本提高,外资基金及本地买家均转为观望,相信第4季大手买卖较为淡静,但该代理认为因物业价格已作调整,故相信仍有财团等趁低吸纳的机会。若0+0措施实行,他预计因酒店入住率改善,投资前景相对较佳。

(经济日报)

桥头围商业项目 打造天水围版apm

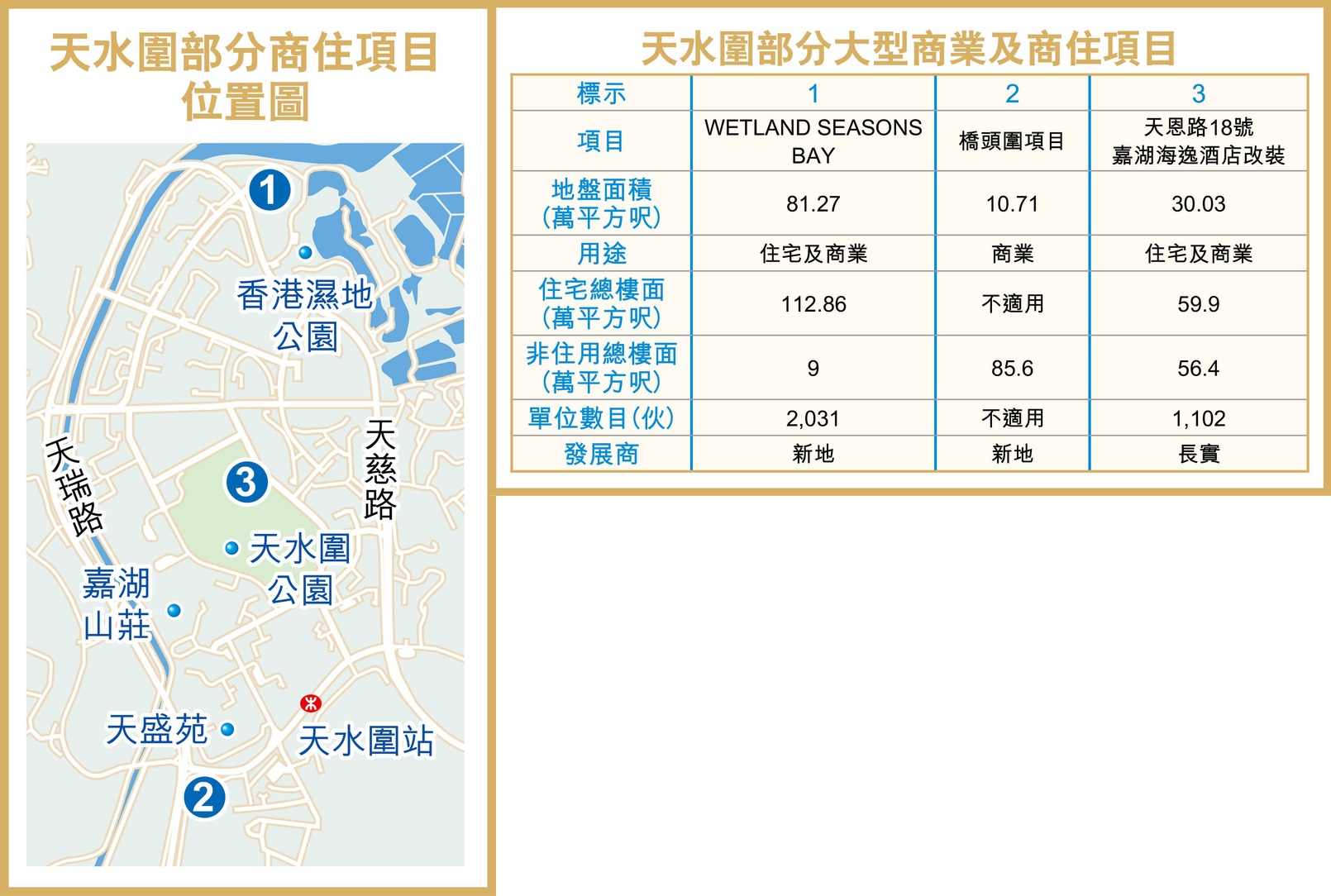

在「北部都会区」策略推动之下,洪水桥/厦村新发展区将会兴建港深西部铁路来往前海,预计将带动比邻的天水围商业及住宅发展,而天水围最新有大型商业项目获屋宇署批出建筑图则,涉及总楼面逾85万平方呎,势成「天水围版」的观塘创纪之城5期 apm项目。

「北部都会区」重点发展香港新界北一带的用地,佔地约3万公顷。在港深两地的商业活动交流,政府将会落实于洪水桥/厦村新发展区兴建港深西部铁路连接前海,料位处旁边的天水围的商业活动亦将会受惠。

3项目增151万呎商业楼面

政府早在90年代将天水围发展为新市镇,原为大片鱼塘的天水围随即大变天,并吸引不少发展商在区内「插旗」,发展大型屋苑。虽然该区以住宅发展为主,但区内不乏商业项目,现时该区合共有3个较新或将落成的大型商业及商住项目,共提供约151万平方呎的商业楼面。

当中较瞩目为新地 (00016) 持有的天水围桥头围项目,用地位于洪天路与屏厦路交界,邻近港铁天水围站,项目于今年7月获屋宇署批出建筑图则,获准兴建1幢28层高 (另设3层地库) 的商厦,总楼面面积约85.62万平方呎。

事实上,新地于去年以约19.74亿元为上述项目补地价,当时每呎楼面补价约2,305元,料为新界最大宗商业项目补地价个案之一。新地过往曾就地皮申请发展为住宅,惟于2016年向城规会申请改作发展为办公室、商店及服务行业、食肆等综合商业用途,当中零售商场楼面佔约50万平方呎,办公室则佔约35.6万平方呎的楼面,并已于2017年获会方批准相关申请。

嘉湖海逸酒店改装 减8成住宅

另外,鑑于疫情重创酒店业,长实 (01113) 持有的天水围嘉湖海逸酒店,今年再度向城规会提交新方案,由重建变成改装方案,将会改装为2幢不多于24层高 (另设2层地库) 的分层住宅,提供约1,102伙。至于现时的酒店地下及1楼,将改作商业用途,现有平台的商业用途 (置富嘉湖第一及二期) 则会保留。改装后的项目总楼面约116.3万平方呎,其中住宅总楼面佔约59.9万平方呎,非住用总楼面约56.4万平方呎。

长实于2019年已曾就上述项目向城规会申请重建为2幢53层高的综合商住项目,总楼面逾200万平方呎,料提供约5,000伙住宅,平均面积约300平方呎。相比之下,住宅伙数大减近8成。

(经济日报)

更多创纪之城写字楼出租楼盘资讯请参阅:创纪之城写字楼出租

更多观塘区甲级写字楼出租楼盘资讯请参阅:观塘区甲级写字楼出租

外资代理行:商厦租金按季跌0.4%至3.4%

有外资代理行指出,今年第3季写字楼租金进一步下跌,跌幅介乎0.4%至3.4%,整体空置率10.2%,涉约650万方呎,九龙东为4.4%,空置楼面190万方呎,中环130万方呎,空置率8.3%,部分地区空置率接近或稍高于09年金融海啸时水平。

中环呎租跌至102.5元

该行指出,长沙湾、葵涌及荃湾跌幅最小,幅度0.4%,港岛南3.4%跌幅最大,中环呎租跌至102.5元,较2019年高位跌33%,整体较高位跌约30%。

中资租赁规模低于2018年水平,较活跃的中资主要是私募基金及资产管理、证券、银行、房地产及保险行业,偏好核心商务区,以中环为例,中资租户佔25%,上环高达35%,与此同时,本季陆续出现来自其他行业租赁,包括ESG相关行业、金融科技、加密货币及NFT等。

数据显示,香港租金高于第二位东京,最近部分企业由港迁移新加坡,令新加坡核心甲厦整体租金按季微升0.3%,当地超级甲厦租金升幅更高,达0.9%。

该行代理表示,部分有意搬迁租客,考虑装修成本及还原费用,部分业主愿意提供更长免租期甚至补贴装修。

(星岛日报)

新地上诉观塘工厦强拍令驳回 伯恩光学持逾97%业权可进行拍卖

由伯恩光学创办人杨建文併购的观塘业发工业大厦第一期,今年4月获土地审裁处颁下强制售卖令,其后持有该厦2个单位的新地提出上诉申请,最新遭土地审裁处拒绝批出上诉许可。该项目为早于1978年落成的15层高工厦,至今楼龄约44年,今年4月曾获该处批出强拍底价为23.49亿,若以强拍底价作计算,每方呎楼面呎价约9788元。若顺利统一业权,将与毗邻工厦合併发展。

是次上诉的业主为Pawling Limited持有8楼C及D室两个单位,据新地年报显示,Pawling Limited为新地主要附属公司之一,并持有该公司100%权益。

上述项目位于「其他指定用途」註明「商贸」地带,容许作部分「工业」的用途,据判词显示,上诉人认为申请地点应视为位处工业地带,若在「工业」用地申请强拍,必须集齐90%的业权,认为80%强拍门槛并不适用于该座工厦,因此不应批出该强制售卖令。

新地仅持有2单位

据强拍条例,地段上每个单位各佔该地段不可分割份数的10%以上;地段上所有楼宇的楼龄均达50年或以上;及地段并非坐落于工业地带,而地段上的所有大厦均为楼龄达30年或以上的工业大厦。

「破坏其重建计画」

根据判词伯恩光学总裁杨建文口供指,新地刻意破坏其重建计画。而法庭指,上诉人未能就上诉提供合理观点,因此拒绝批出上述许可。

业发工业大厦第1期位于开源道77号,邻近观塘鱷鱼恤中心及创纪之城5期 apm等商厦,该项目为早于1978年落成的15层高工厦,至今楼龄约44年,该项目地盘面积约2万方呎,土地用途为商贸地带,若地积比约12倍重建发展,涉及可建总楼面约24万方呎;今年4月曾获该处批出强拍令,底价为23.49亿,若以强拍底价计算,每方呎楼面呎价约9788元。

获批建39层高商厦

值得留意的是,杨建文或有关人士早于2017年12月透过强拍途径以底价约16.216亿、统一毗邻开源道75号业发工业大厦2期。而该两幢工厦连同毗邻的年运工业大厦已于去年9月曾向城规会申请合併上述项目并放宽两成地积比率限制发展,重建为一幢楼高39层的商厦,涉及总楼面约72万方呎,而城规会于今年5月已批准该申请,规划许可有效期至2026年5月20日。

强拍底价23.49亿

据城规会文件显示,上址地盘面积约5万方呎,申请放宽地积比率约20%发展,由12倍增加至14.4倍,重建为1幢楼高39层 (包括各1层的平台花园、防火层及空中花园,另有5层地库) 的商业大厦,其中地库1楼至10楼属零售餐饮用途,楼上则属于办公室用途,涉及总楼面约72万方呎。

另外,该项目亦提供合共311个车位,值得留意的是,项目平面图显示于部分楼层预留位置兴建行人天桥连接毗邻的商厦。

(星岛日报)

更多鱷鱼恤中心写字楼出租楼盘资讯请参阅:鱷鱼恤中心写字楼出租

更多创纪之城写字楼出租楼盘资讯请参阅:创纪之城写字楼出租

更多观塘区甲级写字楼出租楼盘资讯请参阅:观塘区甲级写字楼出租

Evergrande crisis: creditors seek to drum up demand for Hong Kong trophy headquarters with prospect of rebuilding it bigger

The cost of knocking down and rebuilding the tower in Wan Chai could add HK$3 billion to the HK$7 billion and HK$9 billion for the land estimated by agents

Once a crown jewel of Chinese tycoon Hui Ka-yan’s property empire, China Evergrande Centre was recently taken over by the receivers from Alvarez & Marsal

The Hong Kong headquarters of troubled China Evergrande Group, recently put up for sale by receivers, is hoping to woo buyers with the prospect of building a higher tower on the spot overlooking the iconic Victoria Harbour.

“If the new buyer chooses to rebuild the tower, the new building could stretch 135 metres high from the current 98 metres, or about 33-storeys with more sea-view floors,” property agent said, the sole agent mandated by the receivers of the property.

The cost of knocking down and rebuilding China Evergrande Centre in Wan Chai could add HK$3 billion (US$380 million) to the price range of between HK$7 billion and HK$9 billion for the land estimated by the agents, according to the agent.

That means an estimated investment in the range of HK$10 billion to HK$12 billion, or HK$28,950 to HK$34,740 per square foot.

That is in line with the HK$31,000 per sq ft Henderson Land Development paid for the iconic New Central Harbourfront commercial site 3 last year.

“A possible strategy would be for potential buyers to invest in the plot of land for the long term, rather than focusing on the 3-5 years of yield return of the office tower, which is definitely not very high at this moment due to the interest hikes,” the agent said.

The agency invited bids for the 27-storey China Evergrande Centre on Gloucester Road on September 25. The tender will close at noon on October 31.

“So far we have received some warm reactions from interested parties and we believe that the property could be successfully snapped up,” the agent said.

Once a crown jewel of Chinese tycoon Hui Ka-yan’s property empire, China Evergrande Centre was recently taken over by the receivers Tiffany Wong and Kitty Yeung, directors in Hong Kong at global restructuring and management advisory firm Alvarez & Marsal. They were appointed by creditors in September.

The tower is pledged as collateral for a HK$7.6 billion loan from lenders led by China Citic Bank International, the Hong Kong subsidiary of Chinese state-owned China Citic Bank Corp, Ming Pao, a Chinese-language newspaper, reported in August.

In other words, the sale will not directly offer any relief to Evergrande’s dire liquidity.

“If the final price tag cannot cover the loan, theoretically the creditors can still go after the Chinese developer,” a surveyor said.

“It is not an easy deal, to be honest. The creditors would hope to have a clean exit, with the proceeds to cover the loans at least, but the Hong Kong office market has been hit hard in the souring micro-environment.”

The city’s economy shrank 1.4 per cent in the second quarter of this year, following a 3.9 per cent contraction in the first three-month period.

Average rents in the city’s office space will fall by as much as 5 per cent this year and by another 5 to 10 per cent next year, according to another agency.

The current downturn in Hong Kong’s office property market has been described by the agency as its “longest and deepest”.

China Evergrande Centre, built in 1985, has a gross floor area of about 345,423 sq ft (32,000 square metres). It includes a lobby, shops, office floors each with a typical area area of 12,000 to 14,000 sq ft, plus 55 parking spaces.

Evergrande paid US$1.6 billion, or a then-record HK$36,187 per square foot to acquire the asset then known as Mass Mutual Tower, from developer Chinese Estates Holdings in 2015.

“We will see more such distressed property sales of assets that have not yet entered forced-sale procedures, as their owners choose to cash in with huge discounts to ease their liquidity problems in the near future,” the surveyor predicted.

“Local Hong Kong wealthy investors and families are interested in such assets because they are cheap.”

(South China Morning Post)

For more information of Office for Lease at China Evergrande Centre please visit: Office for Lease at China Evergrande Centre

For more information of Grade A Office for Lease in Wan Chai please visit: Grade A Office for Lease in Wan Chai

Hong Kong developers lobby government to end cooling measures, protect homeowners from negative equity amid price slump

The Real Estate Developers Association is lobbying the government to lift stamp duties imposed as a cooling measure when the market was much hotter

The number of homes valued below their mortgage loan amount remains small, and analysts do not expect a massive increase soon

Hong Kong property developers and agents are lobbying the government to scrap legacy stamp duties to avoid pushing homeowners into negative equity amid slumping home prices, a clarion call that is being dismissed by analysts.

The city’s 1.4 million private property owners could face negative equity – when a home loan exceeds the market value of the property – if home prices fall further, said Stewart Leung, executive committee chairman of the Real Estate Developers Association (Reda), which represents the city’s biggest developers.

If cooling measures are not relaxed, and prices keep declining, banks will ask mortgage holders to repay part of their loans, Leung, who is also chairman of Wheelock Properties, told the Post in a call on Tuesday.

“It will mess up the market,” he said. “Even if home prices do not rise, do not let them fall.”

The government has implemented cooling measures for more than a decade to reduce short-term speculation and lessen non-local and investment demand.

“The government must scrap the cooling measures,” Leung said. “Otherwise, it will affect the 1.4 million households.”

Leung’s call came as a market index compiled by a property agency, has fallen by more than 10 per cent from a market peak in August 2021, returning to its level in February 2019.

Hong Kong home prices could plummet by 30 per cent by the end of 2023 as sharply increasing interest rates continue to pressure affordability and repel investors from the market, according to Goldman Sachs.

Analysts do not expect a rapid increase in the number of owners facing negative equity.

“Based on the current market conditions, I think there is no room to completely remove all the stamp duties currently in place, as we have not seen the residential market drastically collapse,” a property agent said.

Hong Kong saw 55 cases of residential mortgage loans in negative equity in the three months ended June 30, according to Hong Kong Monetary Authority (HKMA) data, down from 104 in the three months ended March 31. The aggregate value of these cases stood at HK$300 million (US$38.2 million), versus HK$610 million in the comparative period.

A massive number of cases “should not appear so fast”, a mortgage broker said. “Chances will be greater for those who bought in the last two years. Unless the market falls sharply again, and buyers use high loan-to-value ratios, it should be relatively safe.”

Hong Kong’s Financial Secretary Paul Chan underscored the sanguine outlook. Speaking on September 22 after the US Federal Reserve raised its key rate, he said he did not think Hong Kong’s property market slump posed a risk to the city’s financial system.

“I don’t think there would be a risk of sharp adjustment in the property market. But obviously, given the dampened sentiment, you can tell from the recent figures that the transaction volume has come down, and prices [have] been adjusted a little,” he said, according to a transcript posted on the government’s website. “We will continue to monitor the situation, but we don’t believe there will be a risk to the financial system.”

Negative equity peaked at more than 105,000 households in 2003 after the outbreak of severe acute respiratory syndrome (Sars) sent already struggling home prices spiralling down, according to HKMA figures.

“Many owners would rather change hands at a loss to cash out,” a property agent said. “Quite a few buyers who have entered the market with mortgages at a high loan-to-value ratio in recent years have fallen into a crisis of negative equity.”

For example, Cullinan West in western Kowloon saw a flat change hands at HK$32.5 million recently, for a loss of HK$10.49 million, according to another local agency.

This year’s overall number of property transactions is expected to be around 64,000, the lowest in 32 years, an agent said.

The sluggish transaction volume proves that the property market has entered an “ice age”, and that the cooling measures launched earlier for the hot property market are out of date, the agent said.

(South China Morning Post)