金鐘力宝中心呎价1.33万易手 重返14年前水平 投资者承接

经济不景,核心区甲厦造价纷下挫,重返10多年前水平,金鐘力宝中心一个单位,建筑面积1505方呎,以约2001万易手,平均每呎1.33万,重返14年前水平,新买家为投资者,料回报逾4厘。

市场消息透露,金鐘力宝中心二座中低层05室,建筑面积约1505方呎,以2000万易手,平均呎价1.33万,该单位望中银及山景,以交吉形式沽售,以市值呎租约45元计算,料回报约4厘,原业主于2012年11月以2739.1万购入单位,自用12年,帐面亏损738.1万,幅度约27%。

自用12年亏损738万

上述同类型单位于2017年至2019年商厦市况高峰期,呎价普遍由2.4万至逾3万,最新造价回落40%至逾50%。力宝中心二座1304室,建筑面积1090方呎,于2017年4月以每呎24214元易手,同厦803室,建筑面积4219方呎,于2018年8月以每呎33366元售。

资深投资者罗守辉旗下TOYOMALL沽售上环信德中心招商局大厦一个单位,该厦902室,建筑面积1158方呎,以1838万易手,平均呎价15872元。

TOYOMALL 1838万沽信德

原业主于2005年以590万购入单位,持货19年帐面获利1248万,物业升值2.1倍。

该厦高层及低层单位呎价差距甚大,去年5月,该厦9楼12室及13室,建筑面积2114方呎,以3900万售出,平均呎价18448元,去年9月,该厦高层以每呎逾3万易手,招商局能源运输股份以7.78亿元购入信德中心招商局大厦28楼全层自用,建筑面积25395方呎,平均呎价30636元,亦是信德中心分层最大金额成交。

(星岛日报)

更多力宝中心写字楼出售楼盘资讯请参阅:力宝中心写字楼出售

更多金鐘区甲级写字楼出售楼盘资讯请参阅:金鐘区甲级写字楼出售

更多信德中心写字楼出售楼盘资讯请参阅:信德中心写字楼出售

更多上环区甲级写字楼出售楼盘资讯请参阅:上环区甲级写字楼出售

甲厦租金持续受压 外资代理行:今年暂累跌3%

有外资代理行发布最新的香港每月物业市场报告指,港岛区整体甲厦租金继续下跌,截至今年8月按年跌6.5%,年初至今累跌3%。

经济欠佳,楼市低迷,对律师行和股票市场带来很大影响,本地律师行,尤其专门从事产权转让、首次公开募股 (IPO) 和本地证券公司律师行,缩减业务规模,业主则以优惠及弹性条款吸客。

新对冲基金带动需求

儘管面对挑战,新对冲基金带动需求,目标为面积5000方呎以下写字楼,该行预期全年写字楼租金跌3%至5%。

九龙区写字楼租赁放缓,尤其欧洲公司推迟租赁决定,导致写字楼租赁下跌,半零售租户内仍回升,中国工商银行 (ICBC) 将写字楼搬迁及扩充红磡海滨广场一座的16.5万方呎写字楼,包括一个食堂。随着ICBC搬迁,对九龙东写字楼业主带来压力,区内租金受压。

红磡海滨广场16.5万租出

该行指出,鉴于本地和全球经济现况,预计年底前市场面临不确定性,预期九龙东租金因中国工商银行退出观塘,所引起的涟漪效应而下跌3%至5%。

港人北上成风,零售市场持续收缩。今年7月,本港零售销货总额按年跌11.8%至291亿,连续第四个月下跌,凸显市场信心持续疲弱。

(星岛日报)

更多海滨广场写字楼出租楼盘资讯请参阅:海滨广场写字楼出租

更多红磡区甲级写字楼出租楼盘资讯请参阅:红磡区甲级写字楼出租

金鐘海富中心每呎放租28元

有本港代理表示,金鐘海富中心一座低层单位放租,建筑面积约2667方呎,意向呎租约28元,月租约7.47万。该厦提供中央冷气,拥有多个房间设计,供不同部门员工办公,单位亦设来去水供应茶水间,该厦租户包括国际企业,政府组织及外国领事馆等,适合金融、会计律师楼等行业。

胡忠大厦高层每月14.8万放租

该代理又称,湾仔皇后大道东213号胡忠大厦高层单位,建筑面积约4622方呎,意向呎租约32元,月租约14.8万,该厦为湾仔地标商厦,提供中央冷气,设云石大堂,是次放盘单位位处单边,望山景,间隔方正,提供豪华装修,设有多间会议室及独立电话室,更罕有提供设来去水供应茶水间。该厦设有12部电梯,设有车场方便各租户。

(星岛日报)

更多海富中心写字楼出租楼盘资讯请参阅:海富中心写字楼出租

更多金鐘区甲级写字楼出租楼盘资讯请参阅:金鐘区甲级写字楼出租

更多胡忠大厦写字楼出租楼盘资讯请参阅:胡忠大厦写字楼出租

更多湾仔区甲级写字楼出租楼盘资讯请参阅:湾仔区甲级写字楼出租

观塘万兆丰中心 呎价7600逾1年低

商厦买卖造价持续下滑,观塘海滨道133号万兆丰中心有中层户以逾一年低位的呎价易手。资料显示,观塘万兆丰中心16楼A室,建筑面积约3722方呎,成交价2828.72万元,呎价约7600元,创该厦逾一年呎价新低,买家为内地背景企业。

上述单位原业主为保良局前副主席林文灿或有关人士,于2012年9月斥资4467.6万元入市万兆丰中心16楼A及L室,建筑面积合共约5840方呎,呎价约7650元。是次只沽售其中一个单位,但成交呎价较12年前低约0.7%。

同厦较高层的26楼B1室,建筑面积约2258方呎,上月以2370.9万元沽出,呎价约10500元。原业主2011年8月以1704.79万元买入,账面赚666.11万元或39.1%。

「针织大王」家族再沽上环商厦

另外,「针织大王」罗定邦家族的罗氏集团拆售上环德辅道西1号写字楼,获单一买家购入9楼及10楼两层,每层建筑面积约1088方呎,每层成交价674.56万元,合共总值1349.12万元,呎价约6200元。

(信报)

更多万兆丰中心写字楼出售楼盘资讯请参阅:万兆丰中心写字楼出售

更多观塘区甲级写字楼出售楼盘资讯请参阅:观塘区甲级写字楼出售

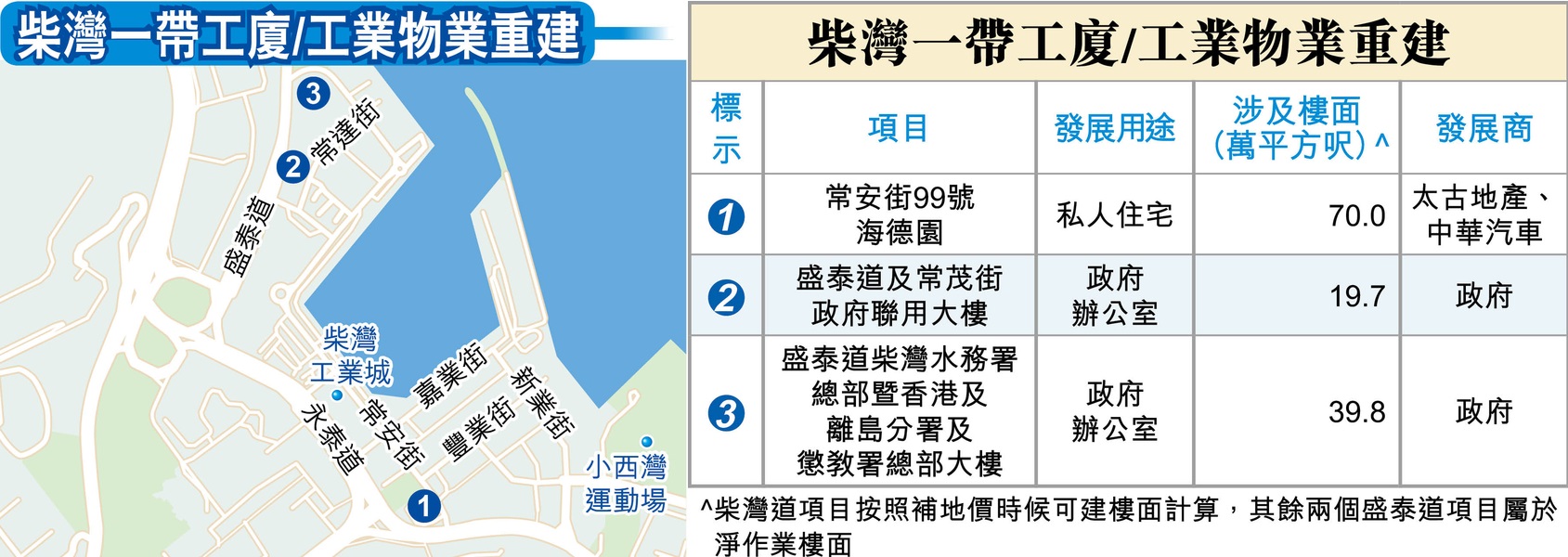

太古柴湾海德园 中巴车厂变亳宅

柴湾区大型新盘供应罕有,太古地产 (01972) 及中华汽车 (00026) 旗下海德园,前身为中巴车厂重建,涉及3幢住宅大厦,将会提供约850伙。

柴湾区内设有两个工业区,分别位于是邻近港铁柴湾站的利眾街工业区,以及围绕着柴湾货物装卸湾、柴湾工业城一带的工业区。当中柴湾码头以北大多数属于政府办公室及设施、教育机构等设施,而南面规划多为「工业」用途,普遍属于分层工厦,不少用作办公室等后勤用途。

70万呎楼面 3幢涉850户

至于海德园则位于柴湾道及常安街,属于「综合发展区」规划用途地带,并不位于工业区内,前身为中巴柴湾道车厂,早于1977年落成,曾为中巴主要车厂及办公室,但随着中巴的专营权结束,中巴便部署重建成大型商住项目,而太古地产成为合作伙伴。

项目佔地约10.2万平方呎,太古地产则在2021年公布,以约45.4亿元为该项目补地价,以可建楼面约70万平方呎计算,每平方呎补地价约6,539元,将会兴建3幢住宅大楼,并将提供一个有盖公共交通交滙处,以及比邻约4万平方呎的公共空间供社区人士使用。

在住宅部分,海德园提供850个单位,户型由1房至4房不等,以2房及3房单位为主,实用面积介乎约500至1,100平方呎,目前正进行上盖工程,以及待批出预售同意书。项目将分期数落成,首张入伙纸预计于2025年取得。

码头以北 增建2政府大楼

至于柴湾码头北面部分现时较多政府及公用设施,包括两个正在兴建的政府大厦,合共涉及约59.5万平方呎的净作业楼面,其中盛泰道及常茂街交界的政府联用大楼,将会作为运输署及路政署办公室、运输署指定驾驶学校暨考试中心以及公眾停车场等用途,涉及19.7万平方呎。

另一个规模更大的盛泰道项目,则将会作为水务署总部暨香港及离岛分署及惩教署总部的联用大楼府办公室,将採用双塔式兴建,楼高15层,包括在3层平台上兴建12层高的办公室,净作业楼面约39.8万平方呎。随着区内不少政府大楼陆续落成,预计亦会带动区内住宅的租赁需求。

柴湾安全货仓2单位1亿沽

柴湾区内工厦有市有价,英皇国际 (00163) 今年5月曾公布,以约1亿元出售柴湾安全货仓工业大厦2个单位,以总面积约3.6万平方呎计算,呎价约2,758元。

沽出的单位为柴湾嘉业街56号安全货仓工业大厦11楼A及B室,总面积约36,255平方呎,英皇原本持有作投资用途,今年5月曾公布沽售,每平方呎均价约2,758元。

发达中心千呎户 5年贬值逾2成

另外,资深投资者罗守辉或有关人士持有柴湾常安街77号发达中心16楼C室,面积约1,882平方呎,则在今年中以约688万元沽出,平均呎价约3,656元,买家为宗教团体中华基督教会小西湾堂。罗守辉于2019年8月以约880万元购入上址,持货近5年转手帐面蚀约192万元,楼价贬值22%。

据一间本港代理行早前发表的报告则指,反映指标工厦售价走势的售价指数8月报327点,按月下跌约0.6%,其中柴湾区工厦平均呎价约4,608元,按月下跌0.7%,而租金方面平均呎租约14.7元,按月下跌0.9%。

(经济日报)

New flats flood market as developers vie for buyers

Developers continued to launch new flats on the market and entice buyers with discounts following a reduction of interest rates in the city last month.

The secondary market, meanwhile, remained pressured by the new projects.

Uptown East in Kowloon Bay, developed by Wong Sun Hing Group, launched 89 new flats with the cheapest priced at HK$5.05 million after discounts.

The fourth price list offers a range of one- to three-bedroom types in sizes of 336 to 774 square feet.

The average price is HK$16,317 per sq ft after discounts, 4 percent higher than the last price list released half a year ago.

Meanwhile, Emperor International's (0163) One Jardine's Lookout will put 20 new flats on sale this Friday, with the cheapest priced as low as HK$3.6 million after discounts.

Eighteen of these flats will be sold under the price list and two will be sold by tender.

Vice-chairman Alex Yeung Ching-loong said 14 open-plan flats at another project - Central 8 in the Mid-levels - will also be sold by tender on the same day.

In Kai Tak, Cullinan Sky had received around 10,000 checks for 304 flats as of Monday, making them 31 times oversubscribed.

Cullinan Sky is a mega project being developed by Sun Hung Kai Properties (0016) , whose first batch was launched at prices last seen in 2017 in the area.

In other news, Wheelock Properties has raked in HK$15.07 billion so far this year from the sale of 1,388 new homes, surpassing its performance over the same period last year.

The company's Lohas Park phase 12 in Tseung Kwan O has sold 833 flats since the launch of sales for a total of HK$5.24 billion.

And its Koko Hills phase 3 in Kwun Tong has sold 20 flats worth a total of HK$176 million in just a month after being put on sale.

In the secondary market, a two-bedroom 401-sq-ft flat at Bedford Gardens in North Point was sold at HK$3.8 million, a level last seen nearly 10 years ago at the development, according to a property agency.

The flat had a HK$4.2 million price tag but the seller finally settled for 10 percent less than their asking price.

Also on Hong Kong Island, a 516-sq-ft unit in Nan Fung Sun Chuen in Quarry Bay was sold for HK$4.78 million, HK$320,000 less than the HK$5.1 million that the seller had paid for a decade ago.

(The Standard)

长江集团中心二期呎租失守百元 私募博裕每月92万进驻中环

长实 (01113) 旗下位于中环夏慤道10号的全新超甲级商厦长江集团中心二期录得租赁成交,私募基金博裕资本 (Boyu Capital) 承租该厦低层半层楼面,涉及月租约92万元,呎租低于100元,只为约95元。

市场消息指出,长江集团中心二期11楼西座1至2室,建筑面积约9661方呎,获博裕资本承租,月租约92万元,呎租约95元,料为该厦首宗呎租低于100元的租赁成交。

长江集团中心二期楼高41层,总建筑面积达55万方呎,当中有32层为写字楼,标準楼层建筑面积约17254方呎,已于今年落成入伙。租户除可租用全层外,物业亦分为东、西两座,每座各有两个办公室单位,方便需要较少楼面的企业租用,全部单位俱享维港海景。据代理表示,由于11楼属物业较低层单位,故放租叫价亦只为每方呎110元,最终略减13.6%达成租赁成交。

原租金鐘太古广场 乘机扩充

博裕资本现时办公室位于金鐘太古广场二座中低层约3000方呎单位。资料显示,太古广场二座目前中低层单位市值呎租约95至105元,与长江集团中心二期呎租相近。是次该公司搬迁至新落成超甲级商厦,并趁租金回落,扩充租用楼面。

长江集团中心二期为和记大厦的重建项目,今年5月份竣工,近期租赁交投明显加快。市场消息透露,该厦近半年已促成3至4宗租务成交,租客普遍为租用半层的企业。

根据资料,长江集团中心二期的租户,不乏同区或邻近金鐘的企业作升级之用。例如首批租户之一内地企业联合能源,便是把原位于金鐘太古广场的总部迁至长江集团中心二期,租用39楼西座1至2室,建筑面积约8627方呎。新写字楼面积扩大近两倍,涉及月租约95万元,呎租约110元。

恒地拟留The Henderson十七楼自用

至于医疗投资基金滙桥资本 (Ally Bridge) 原先租用中环告罗士打大厦高层单位作为办公室,现已转租长江集团中心二期39楼东座2室,建筑面积约3367方呎,月租约37万元,呎租约110元,新旧办公室面积相若,但同区搬迁可提升写字楼质素及享有更佳景观。

恒地 (00012) 旗下同区美利道2号旗舰商业项目The Henderson亦已入伙,出租情况理想,全层待租楼面不多。据悉该厦17楼全层,租用面积约12923方呎,已预留给发展商相关公司自用。

有外资代理行发布最新的香港每月物业市场报告中指出,8月香港写字楼租赁市场依然缺乏动力,港岛区整体甲级写字楼租金续挫,年初至今已下跌3%,预期今年全年将下滑3%至5%。不过,近期市场上出现不少对冲基金,带动面积约5000方呎写字楼单位的需求。

(信报)

更多长江集团中心二期写字楼出租楼盘资讯请参阅:长江集团中心二期写字楼出租

更多The Henderson写字楼出租楼盘资讯请参阅:The Henderson 写字楼出租

更多置地广场写字楼出租楼盘资讯请参阅:置地广场写字楼出租

更多太古广场写字楼出租楼盘资讯请参阅:太古广场写字楼出租

更多金鐘区甲级写字楼出租楼盘资讯请参阅:金鐘区甲级写字楼出租

冠忠巴士7591万 购永得利广场单位

用家加快入市购工商物业自用,冠忠巴士 (00306) 以7,591万元,购葵涌永得利广场单位作自用。

冠忠巴士公布,购入葵涌永得利广场2座22楼,涉资约7,590.72万元。永得利广场2座22楼属工业或办公物业,总楼面面积约2.37万平方呎,按此计算呎价为3,202元。冠忠巴士表示,现时租用物业作为其香港办公室,公司董事拟将该物业用作集团于香港的主要营业办公室,集团可进一步节省办公室租金成本、行政成本以及办公室搬迁开支。

翻查资料,该项目早年曾由外资基金持有,2012年大鸿辉伙拍资本策略 (00497) 等,以5.5亿元购入多层,而是次22楼涉及约9,725万元。如今持货12年沽出,帐面蚀约2,134万元。

(经济日报)

尖沙咀加威中心 享地利合半零售

尖沙咀加威中心位于区内心臟地段,大厦以医美行业为主题,交通便利有助商户经营。

加威中心位于尖沙咀加连威老道头段,邻近弥敦道,亦即尖沙咀传统消费地段,而大厦正对The One商场,可说是尖沙咀主要街道之一。由港铁尖沙咀站出口,步行仅数分鐘便可到达,而弥敦道亦是巴士站聚集之处,交通极为便利。

配套上,物业地下现为人气茶餐厅,邻近诺士佛臺酒吧街、附近的厚福街,均有大量餐厅选择,上班人士亦可前往The One、K11 Art Mall等大型商场。

大厦早于1973年落成,属乙级商厦,保养上尚算不差,外形、地下入口、大堂等未有残旧感觉。项目提供两部升降机,通往17层写字楼,因楼层不算多,故仍可疏导人流。

每层逾3千呎 间隔灵活

单位每层面积逾3,300平方呎,间隔四正亦灵活,据了解每层可分间数单位,面积由400餘平方呎起,适合小型公司。而景观上,主要望向尖中一带楼景,个别高层单位较为开扬。

用户方面,目前大厦不少涉及医疗、美容行业,及健身室,故具半零售成分,附近交通配套完善非常重要。另外,极高层两层楼面,目前由打印机品牌使用作办公室。

买卖方面,大厦向来甚少成交,对上一宗为2021年,物业702室,面积约503平方呎,以675万元易手,呎价约13,419元。

至于租务上,即使大厦楼层不多,租务亦相对较理想,去年至今录10宗租务,去年尾大厦中层D至E,面积约1,111平方呎,成交呎租约30元。今年4月,物业10楼C01室,面积约1,000平方呎,以每呎约30元租出。至于5月份703室,面积约973平方呎,成交呎租约32元。

高层全层放盘 叫价3900万

加威中心全层放盘缺,现业主放售高层全层单位,叫价3,900万元。

另外,单位同时放租,意向月租为8.2万元,意向呎租约26元。

备美容所装修 呎价12436

有代理表示,有业主放售尖沙咀加威中心14楼全层,面积约3,136平方呎,意向价约3,900万元,呎价约12,436元。

据悉,该厦一向极少放售盘,而是次放售单位更属高层,景观开扬。此外,单位上手用户为美容行业,现仍提供美容所装修,包括分间多个房间及美容床等,可即时使用,故单位质素十分理想。

同区乙厦方面,上月尖沙咀金马商业大厦录得成交,涉及低层全层,面积约2,489平方呎,以约2,338万元成交,呎价约9,393元。

(经济日报)湾仔会展广场办公大楼 银主低价1.35亿沽

呎价1.5万返13年前 蔡志忠「捞底」入市

近月多幢指标甲厦造价创逾10年低位,吸引投资者捞底入市,早前湾仔会展广场办公大楼银主盘,以1.35亿沽出,呎价1.5万元重返13年前水平,据悉买家为资深投资者蔡志忠或有关人士。

湾仔会展广场办公大楼近期录得一宗低价成交,涉及物业33楼7及9室,建筑面积约9,000平方呎,属该厦罕有全海景单位,以1.35亿元易手,呎价约1.5万元,按此成交呎价计,重回2011年水平。

市场人士透露,是次买家为资深投资者蔡志忠,相信见是次甲厦呎价大幅回调后,趁低价入市。他于2017年,曾伙拍多名投资者购入中环中心75%业权,其后他于2018年拆售22楼全层,并于2019年沽清,获利约5亿元。

翻查资料,是次涉及会展广场办公大楼单位,曾由中资机构持有,2023年中物业获中资财团斥约3亿元购入,惟最终取消交易,单位重新放售,市况亦转差,单位沦为银主盘,如今重新沽出。

事实上,近期港岛多幢传统指标甲厦,相继录低价成交,如金鐘力宝中心二座中低层5室,面积约1,505平方呎,以2,000万元易手,平均呎价1.33万,属逾10年呎价新低。原业主于2012年以2,739.1万购入单位,帐面亏损739.1万,幅度约27%。

观塘万兆丰中心 呎价低见7600

东九龙方面,甲厦仍录低价成交,消息称,观塘万兆丰中心中层A室,面积约3,722平方呎,以约2,828万元成交,呎价约7,600元,属近年呎价新低。

有外资代理行代理表示,有业主出售深水埗福荣街131号及福华街146/152号部分商业物业,包括部分位置于地下、1楼、2楼及3楼,总实用面积约17,789平方呎,市场人士估值约2.3亿元。据悉,该物业由邓成波家族持有,早年以约2.7亿元购入。

(经济日报)

更多会展广场办公大楼写字楼出售楼盘资讯请参阅:会展广场办公大楼写字楼出售

更多湾仔区甲级写字楼出售楼盘资讯请参阅:湾仔区甲级写字楼出售

更多中环中心写字楼出售楼盘资讯请参阅:中环中心写字楼出售

更多中环区甲级写字楼出售楼盘资讯请参阅:中环区甲级写字楼出售

更多力宝中心写字楼出售楼盘资讯请参阅:力宝中心写字楼出售

更多金鐘区甲级写字楼出售楼盘资讯请参阅:金鐘区甲级写字楼出售

更多万兆丰中心写字楼出售楼盘资讯请参阅:万兆丰中心写字楼出售

更多观塘区甲级写字楼出售楼盘资讯请参阅:观塘区甲级写字楼出售

北角渣华道321号全幢标售 市值料10亿

业主委託外资代理行以公开招标形式出售北角渣华道321号 (前称柯达大厦1期) 全幢,截标日期为2024年12月5日 (星期四) 中午12时正。

业权统一 新买家可享命名权

该行代理表示,渣华道321号与旁边的柯达大厦2期发展商同为新鸿基物业,属同一个地段,惟2期整座早前已经分拆出售,所以渣华道321号的统一业权实属罕有,以放售物业现有地积比率面积约153,985平方呎,参考附近成交,物业市值料约10亿元,平均呎价约6,500元。

渣华道321号地契以999年期批地,业主亦在早期以永久豁免书获准可用作写字楼及商业用途,适合各行各业。

业主于2000年购入,据悉买入价约1.4亿元,现持有24年来罕有公开招标放售。物业规格质素之高,为港岛区罕见,可塑性非常大,是次业主放售,意向价已较高峰期大幅回落,而买家购入全幢即可享大厦命名权及设置大型广告牌,非常适合医疗机构、教育机构、宗教团体、政府机构、后勤部门等用家,预期将吸引不少机构用家及长綫投资者出价洽购。

上址位处北角渣华道及健康东街交界,距离港铁鰂鱼涌站约5分鐘步程,邻近甲级商厦包括英皇道633号、英皇道625号「Foyer」及K11 ATELIER King's Road。

物业于1985年落成,楼高13层,地库车库提供27个车位,特定楼层楼底约6.8米高,设有独立出入口、大堂及停车场。

(经济日报)

更多Foyer写字楼出租楼盘资讯请参阅:Foyer 写字楼出租

更多K11 Atelier King's Road写字楼出租楼盘资讯请参阅:K11 Atelier King's Road 写字楼出租

更多鰂鱼涌区甲级写字楼出租楼盘资讯请参阅:鰂鱼涌区甲级写字楼出租

更多英皇道633号写字楼出租楼盘资讯请参阅:英皇道633号写字楼出租

更多北角区甲级写字楼出租楼盘资讯请参阅:北角区甲级写字楼出租

骆克駅全幢意向价6亿

由林子峰等持有的铜锣湾骆克道L'HART骆克駅全幢商厦放售,意向价6亿,呎价18359元。其于2017年以9.65亿买入,叫价较买入价低3.65亿或近40%。

有外资代理行代理表示,铜锣湾骆克道487至489号银座式大厦,地盘面积约2182方呎,总建筑面积约32681方呎。物业以「现状」及连约出售,意向价6亿,呎价18359元。

投资者林子峰等持有

大厦目前主要由饮食及美容承租,出租率超过75%,预计月租达150万,回报约3厘。资料显示,林子峰于2017年7月以9.65亿向镇科集团购入骆克駅,于2018年曾叫价13亿放售,现持货7年叫价回落7亿或54%,而且较买入价低3.65亿,蚀幅达37.8%。

(星岛日报)

深水埗黄金大厦基座放售

深水埗黄金大厦基座放售,有外资代理行代理表示,深水埗福荣街131号及福华街146至152号黄金大厦部分商业物业放售,物业戏院部分、礼堂天台 (包括地下、一楼、二楼及三楼部分位置),总实用面积约17789方呎,项目市值由2.3亿至2.5亿。

市值逾2.3亿

该代理又说,当中一楼礼堂楼底特高,达9.1米,区内极罕有,适合作戏院、教育、宗教及演讲场地等;部分位置于地下及1楼现时为商铺。黄金大厦位于深水埗一线零售地段,门面面向福荣街及桂林街大单边。步行至港铁深水埗站仅需约1分鐘,区内为著名电脑、电子用品及饮食热点,大厦外墙两边均设有大型户外广告位置。

(星岛日报)

Home prices 'to rise as sentiment improves'

Developers in Hong Kong may pull back on discounts or even raise prices for new homes as market sentiment improves amid interest rate cuts, says CK Asset's (1113) chief sales manager William Kwok Tze-wai.

Kwok made the prediction while announcing a 10 percent price increase in the price of flats at Blue Coast II, its new project in Wong Chuk Hang.

The rate cuts have boosted the confidence of home hunters and investors and led to increased transactions, and it is believed that Hong Kong property prices have bottomed out, he said.

Meanwhile, New World Development (0017) is said to have paid a land premium as low as HK$2.2 billion - less than HK$2,000 per square foot - for its project in Fanling North New Development Area.

The news comes after Adrian Cheng Chi-kong, the third-generation scion of the firm's founding family, stepped down as NWD chief executive last week, handing over the job to chief operating officer Eric Ma Siu-cheung.

It is the second land premium payment case in the second phase of the new development area.

The Lands Department set the premium at HK$2,600 per sq ft - 30 percent below the standard amount - in November last year for six due projects with developers including Chinachem Group and Henderson Land (0012).

In the primary market, Chinachem and the Urban Renewal Authority announced a new project named Echo House in Cheung Sha Wan.

The project, comprising 198 flats, is expected to launch sales this month.

In Kowloon, The Pavilia Forest, jointly developed by NWD and Far East Consortium (0035), sold 14 flats in two days for a total of HK$90 million, including a unit priced at HK$12.15 million.

In the secondary market, a three-bedroom, 677-sq-ft flat in Wetland Seasons Park in Tin Shui Wai was sold at HK$6.7 million, HK$680,000 less than the asking price of HK$7.38 million.

A property agent expects the number of deals to increase by 19 percent to 10,000 in the fourth quarter, thanks to interest rate cuts.

The agent also predicts 2,000 transactions in the primary home market this month, with sales volume and turnover in the first three quarters both surpassing last year's total and reaching a three-year high.

(The Standard)减息周期啟动 大手买卖增

上月中美国正式减息,香港亦跟随,而本港大手物业买卖亦相继落实,预计近期股市畅旺下,投资物业成交进一步上升。

近期工商物业连环录大手成交,电商龙头之一京东 (09618) 旗下京东产发,刚落实购入沙田利丰中心全幢,物业位于石门安平街2号,市场消息指,购入价约18亿元,以全幢总楼面约48.73万平方呎计,呎价约3,694元。

利丰中心全幢 18亿沽

京东产发日前公布属于利丰中心的买家,指出对于在香港购入新的物流设施感到高兴,将继续在香港扩展业务。

京东产发属于电商京东旗下的投资及资产管理公司,在世界各地购入不少物流中心,市场估计上述购入利丰中心有机会部分作自用,配合在香港扩充网购业务。至于物业原由M&G英卓房地产投资持有,是次为今年罕有全幢工厦成交,并为今年至今最大宗工厦买卖。

星展银行 购中环中心全层

另外,早前「磁带大王」陈秉志持有的中环皇后大道中99号中环中心66楼及75楼两层全层楼面,获新加坡星展银行斥资逾14亿元洽购至尾声,当中66楼的成交率先曝光,作价约为7亿元。资料显示,中环中心66楼全层,面积约26,967平方呎,呎价约25,958元。

长实 (01113) 2017年底以天价约402亿元售出中环中心75%权益,涉及总楼面面积约122.27万平方呎,平均呎价约32,878元;以最新66楼成交呎价计,较财团购入平均呎价低超过21%。据悉,星展银行本身亦自用中环中心地铺及多层写字楼,若连同最新购入两层,现持物业8层全层写字楼。

至于新世界 (00017) 续沽甲厦,据悉,长沙湾荔枝角道888号南商金融创新中心53个单位,由投资者约7.6亿元承接,该批单位分布于23、25、26及27楼,面积约合共57,623平方呎,平均呎价逾1.3万元。该批单位交吉易手,面积介乎424至2,561平方呎,据了解买家为投资者,现以每呎35元招租。

另外,市场亦录银主沽货,涉及观塘骆驼漆中心全幢,为一幢楼高7层之商厦,总面积约85,116平方呎,据悉以约4亿元沽出。翻查资料,邓成波家族早于2014年以约10.8亿元买入上述骆驼漆中心全幢,并曾在2017年放售,当时意向价高达约28.8亿元。物业早前已被银主接管,沦为银主盘。

分析指,上月初市场预计美国即将减息,而憧憬投资成本下降,投资者已开始部署收购物业,如今减息正式啟动,有助财团加快落实入市。此外,近期股市急升,令投资气氛进一步向好,预计第四季大额买卖明显加快。

(经济日报)

更多中环中心写字楼出售楼盘资讯请参阅:中环中心写字楼出售

更多中环区甲级写字楼出售楼盘资讯请参阅:中环区甲级写字楼出售

更多南商金融创新中心写字楼出售楼盘资讯请参阅:南商金融创新中心写字楼出售

更多长沙湾区甲级写字楼出售楼盘资讯请参阅:长沙湾区甲级写字楼出售

Flat prices increased as sales decline

Developers in Hong Kong put their flats up for sale and raised prices in response to a decline in September sales.

The Hong Kong Land Registry announced 2,848 sale and purchase agreements of residential building units in September, down 22.1 percent monthly and 0.5 percent yearly.

Star Properties cut the discounts for the remaining units at After The Rain in Yuen Long by up to 3 percent, joining local developers in pushing home prices up from an eight-year low.

Last week, Sun Hung Kai Properties (0016) raised the average price of the second batch of 122 units at Cullinan Sky in Kai Tak by 6.5 percent to HK$20,939 per square foot after discounts, as most units in this batch "enjoy views of Kai Tak Plaza."

Blue Coast II in Wong Chuk Hang, developed by CK Asset (1113) and MTR Corp (0066), uploaded its prospectus, involving 558 units, indicating a potential price hike of 10 percent.

However, on Wednesday, SHKP placed 77 more units at phase 3B of Novo Land in Tuen Mun for sale. The average price was HK$3.10 million to HK$6.75 million after discounts, 2 percent cheaper than the previous batch.

The project sold 697 flats, over 90 percent, with all one-bedroom units sold out. The company also put 58 more flats at The Yoho Hub II in Yuen Long in the market with a average price of HK$14,698 per sq ft after discounts.

In other news, the Rating and Valuation Department's private property price index stood at 292.1 in August, down 1.7 percent month-on-month and 13.3 percent year-on-year.

(The Standard)

Hong Kong property deals slump to 7-month low, but things are looking up for October

Sales of new and lived-in homes, offices, shops, car parks and industrial spaces dropped 18.7 per cent to 3,843 units in September

Property deals in Hong Kong fell to a seven-month low in September as homebuyers and investors stayed on the sidelines awaiting the start of a policy easing cycle, analysts said.

But now that the cycle has commenced – with rate cuts from the US Federal Reserve and the Hong Kong Monetary Authority (HKMA) – property deals are likely to pick up.

“Major developers have been preparing to launch projects to capture the pent up demand following the interest rate cut,” an agent said. “At the current high inventory level, developers are still likely to prioritise competitive pricing where we foresee primary sales transactions to rebound in coming months.”

Sales of new and lived-in homes, offices, shops, car parks and industrial spaces dropped 18.7 per cent to 3,843 units in September, from 4,729 in August, according to data from the Land Registry. It is the lowest tally since February, when restrictions on property buying were still in place.

Total sales value fell by about a fifth to HK$27.7 billion (US$3.57 billion) from HK$34.3 billion in August, also the lowest point since February. And home sales fell 22 per cent to 2,848 units in September from a month earlier.

Two weeks ago, the Fed cut its benchmark interest rate by a half point and the HKMA followed suit. Hong Kong’s de facto central bank adjusts its policy based on what the Fed does to keep the local currency’s peg to the US dollar. Those moves paved the way for Hong Kong’s commercial banks to trim their rates, which is expected to translate into savings for borrowers who tie their loans to prime rates.

For example, on a HK$5 million loan over 30 years priced at prime minus 1.75 per cent, a reduction lowers the mortgage rate to 3.875 per cent, meaning the monthly payment drops by HK$720 to HK$23,512, according to a local mortgage broker.

Secondary market transactions are also likely to pick up with lower interest rates, the agent added.

Another agent said things are looking up for October, given the lower-rate environment and policy help from Beijing.

“With the dual benefits of interest rate cuts and support measures from mainland China, it is anticipated that overall property transactions will bottom out in September, followed by a significant rebound in October,” the agent said.

The agent also said preliminary expectations suggest that property transactions in October could exceed 5,000, representing a month-on-month increase of nearly 50 per cent.

Hong Kong’s first rate cut in four years has provided some optimism to the property market already. The first two new projects launched following the rate reduction saw strong sales over the weekend. Emperor International sold all 85 units that it made available at the One Jardine's Lookout development in Happy Valley, while Sun Hung Kai Properties (SHKP) sold 112 units or 93 per cent of the flats it listed at The Yoho Hub II in Yuen Long on the first day of sales on Saturday.

This weekend, SHKP is selling another 300 units at the Cullinan Sky in Kai Tak, while Lai Sun Development will offer 98 units at The Parkland in Yuen Long.

The first price list for the Lai Sun project, which covered 50 of the 98 units, indicated that they would be sold at a 10-year low. The first batch was priced at an average of HK$9,278 per square foot, 5.3 per cent lower than the average of HK$9,807 per square foot for the initial batch at The Parkhill, which was launched in 2015 by New World Development.

(South China Morning Post)工商铺买卖价量微跌 本港代理行:上月录209宗

9月份迎来美国联储局4年以来首次降息,加上内地政府接连推措施振市,股票市场高涨,带动投资物业市场。有本港代理行代理表示,9月份工商铺买卖价量均微跌,共录约209宗成交,较上月跌约9宗,减幅约4%;金额共录约55.6亿,按月微跌约8.5%,按年增加约25.7%。工商铺逾亿大额成交宗数佔9宗,较8月份的5宗为多,增幅约80%。

铺位及写字楼跑赢大市

该代理指,9月份写字楼交投气氛趋热,录约34宗成交,按月及按年分别增约30.7%及约41.6%,月内录至少4宗逾亿成交,9月份商铺买卖录约52宗,按月增约15.5%,金额录约10.07亿,按月增约15.7%,价量齐升。投资者张实来以约2亿购入尖沙咀弥敦道86号地下D1、D2、E及F铺。

该代理续指,工厦买卖录约123宗,按月减约16.3%,金额升至约23.81亿,按月大增近四成,其中由邓成波家族持有观塘兴业街1号骆驼漆中心全幢,以约4.08亿易手,新买家伯恩光学杨建文相关人士。

尖沙咀铺2亿成交瞩目

该代理分析,9月份工商铺交投增多,可见投资者信心逐步恢復,加上近日内地宣布一系列「政策组合拳」大力刺激经济,配合减息效应,带旺股市持续上扬,预测本月工商铺买卖有所回升。

(星岛日报)

本港代理行:首三季工商铺交投按年跌20%

工商铺註册数字维持平稳,有本港代理行综合土地註册处资料显示,9月份工商铺註册量共录265宗,按月微升约0.8%,金额则录43.67亿,按月增约29%。总结今年首三季,工商铺共录2448宗註册,按年跌约19.9%,金额330.54亿,按年跌约5.6%。该行认为,中美两国央行放宽货币政策,有利投资市场发展。

今年暂录2448宗註册

9月份录7宗逾亿元註册,包括投资者再以约7.63亿购入长沙湾南商金融创新中心四层物业多个单位。北角英皇道250号北角城中心地下和1楼多个铺位,尖沙咀弥敦道86至88A号安乐大厦地下4个铺位,分别以3.1亿2亿成交。中资投资者以1.02亿购入红磡卫安中心4楼全层。

上月录7宗逾亿元买卖

9月份工商铺宗数录265宗,按月微升约0.8%,金额录43.67亿,按月增约290%。三板块註册宗数个别发展,商厦及商铺板块註册宗数9月分别录59宗及76宗,按月分别增约31.1%及33.3%。工厦最新仅录130宗,按月减约19.3%。价值500万或以下物业录最多註册是,9月份152宗,按月增约8.6%,其次500万至1000万物业新录43宗登记,按月增约30%。

该行代理表示,据市场推算,9月份人行减息降準及降低房贷利率,将为市场释放至少一万亿人民币,措施令中港股重新估值,由谷底大幅反弹。为保持房地产市场稳定,内地政府将北上广深等一线城市限购令废除,有助改善市场气氛。此外,减息刺激工商铺市场,随著工商铺累积一定跌幅,投资者及实力用家重临。

(星岛日报)

更多南商金融创新中心写字楼出售楼盘资讯请参阅:南商金融创新中心写字楼出售

更多长沙湾区甲级写字楼出售楼盘资讯请参阅:长沙湾区甲级写字楼出售

更多北角城中心写字楼出售楼盘资讯请参阅:北角城中心写字楼出售

更多北角区甲级写字楼出售楼盘资讯请参阅:北角区甲级写字楼出售

澳洲单车服饰品牌首度攻港 中环设旗舰店业界料月租逾30万

品牌时装纷大手租铺设据点,最新为澳洲单车服饰品牌MAAP,在港开设首间旗舰店,落位中环砵甸乍街地铺,面积约2061方呎,业界料月租介乎30万至40万。

再有服装店攻港,有外资代理行指,澳洲单车服饰品牌MAAP承租中环万宜大厦一个地铺,作为在港首间旗舰店。该铺面向砵甸乍街,面积约 2061方呎,透过体验式消费售卖单车服饰。店内设陈列室展示一系列单车产品、比赛装备、训练服饰、非自行车服装及其他配件,顾客可作即时体验之餘,并即场选购心仪产品。

该行强调未能透露铺租,不过市场人士表示,砵甸乍街地铺市值呎租介乎150元至200元,推算该铺月租30万至40万,旧租客Mother Court售卖母婴服饰及相关用品,在此经营约4年。

料平均呎租逾150元

该行另一代理表示,MAAP来港设立旗舰店,展现对香港及亚洲市场的信心,及对提升单车体验的承诺,落位中环,有利提高品牌对本地和海外人士的接触面,更与健康和可持续生活方式产生共鸣。

以体验式消费吸客

其中MAAP自家设计的Café概念,配合万宜大厦商场18米高中庭及透光天窗,给予顾客独特体验。该厦距离港铁中环及香港站步程约5分鐘。

MAAP 联合创办人Oliver Cousins 表示,集团坚定发展『单车围绕生活』(Life Around Bikes, LaB) 概念,在世界各地建构所属社区文化,香港旗舰店展现对单车生活的热情,并将社区与现实世界接轨。每个新的LaB门店,提供独特顾客体验。

(星岛日报)

更多万宜大厦写字楼出租楼盘资讯请参阅:万宜大厦写字楼出租

更多中环区甲级写字楼出租楼盘资讯请参阅:中环区甲级写字楼出租

Office, shop deals soar 31pc

Hong Kong's office and shop transactions rose by nearly 31 percent in September over the previous month.

But overall, the number of industrial and commercial deals declined by 4.1 percent.

A property agent said there were 209 transactions worth a total of HK$5.56 billion last month, down 8.5 percent over the previous month and 25.7 percent from a year ago.

There were nine large-value deals exceeding HK$100 million compared to five in August.

There were 34 office deals including at least four worth over HK$100 million each and 52 shop transactions, together worth HK$1.01 billion and up by 15.7 percent month-on-month.

While the number of industrial deals fell by 16 percent to 123, their total value rose by nearly 40 percent to HK$2.38 billion.

The agent said the significant increase in transactions showed confidence was returning to the market, which has been boosted by China's stimulus blitz. The agent expects better sales this month, including an increase in large-value transactions.

In other news, Australian cycling apparel brand MAAP opened its first flagship store in Hong Kong yesterday.

The store, located on the ground floor of Man Yee Arcade in Central, occupies an area of 2,061 square feet.

(The Standard)

Property has hit bottom, says Leung

Hong Kong's property market has bottomed out and is expected to rebound by 5 to 10 percent by the year-end, chairman of the Real Estate Developers Association Stewart Leung Chi-kin said yesterday, as the weekend was marked by an increase in transactions.

Leung said the stock market frenzy would buoy sentiment in both primary and secondary property markets.

Speaking on a radio program, Leung predicted that new property projects "will definitely be offered at higher prices" in the future.

He said there would also be a chance for local second-hand home prices to rise in early next year after dropping roughly 30 percent in the past three years.

In the primary market, Lai Sun Development (0488) launched the sale of the first batch of 98 flats at its Yuen Long development The Parkland yesterday.

The cheapest unit in the batch costs HK$2.43 million.

Order-taking closed for the batch on Saturday, which was oversubscribed 7.7 times with 853 checks received.

As of 4.50pm yesterday, 94 flats were sold.

This came as all 204 flats at Cullinan Sky marked for sale were sold out on the first day on Saturday, minting over HK$1.5 billion for the developer, Sun Hung Kai Properties (0016). The Kai Tak project was oversubscribed by almost 142 times with 29,161 checks received.

The developer followed the Cullinan Sky sale with a third price list offering 120 flats priced from HK$4.82 million to HK$14.12 million after discounts.

Meanwhile, 29 flats at another Kai Tak project - The Pavilia Forest - were sold over the weekend after 17 flats were sold on Friday, with one homebuyer snapping up five two-bedroom flats for HK$38 million.

The project has raked in over HK$400 million by selling 64 units within a week this month, and minted nearly HK$2.7 billion in total by selling 397 homes so far to rank first in the Kai Tak district.

In the secondary sector, 11 deals were struck at 10 blue-chip estates over the first weekend, one more than a week earlier and the second weekend recording double-digit transactions.

A property agent predicted the number of deals in the primary market would rise to 2,300 this month and the secondary market to 3,300.

Another property agent suggested that the government should allow citizens to use their mandatory provident fund to pay the down-payment for home mortgages and introduce a stamp duty holiday originally implemented in the UK, which would ease the tax burden on homebuyers.

(The Standard)

力宝中心呎售12406 创近14年新低

市场消息指,金鐘甲级商厦力宝中心二座低层单位,面积2,199平方呎,近日以2,728万元沽出,呎价低见12,406元,属于2010年之后、近14年新低价。据悉,原业主在2018年3月以8,280万元购入,持货至今6年,帐面劲蚀5,552万元,贬值高达67%。

有外资代理行发表9月份香港写字楼租赁市场报告指出,截至第二季度,写字楼空置率达到14.8%,创下历史新高,亦超越过往低迷时期的水平,如沙士及2009年的全球金融危机,特别是核心商业区,如中环的空置率,激增220万平方呎。

料今年写字楼租金降10%

该行指主要原因为经济表现疲弱而导致的需求减少、租客喜好转变及高息环境。多种因素导致各区写字楼空置楼面合共达到1,060万平方呎,又料空置率将于2027年升至17%。租金自2019年高峰以来下降40%,反映行业需应对著经济持续的不确定性,及正经历重大的转型与调整。该行亦料今年写字楼租金预测将下降5%至10%。

另外,中环德己立街38至44号好利商业大厦低层地下A号铺,位于兰桂坊地段,由接管人透过莱坊放售,该铺面积3,228平方呎,曾经由酒吧租用。该铺曾经在今年初由持货多年的长情业主放售,当时市值2.5亿元,但近日被接管后,估计现时市值约1.3亿元,贬值近5成。

(经济日报)

更多力宝中心写字楼出售楼盘资讯请参阅:力宝中心写字楼出售

更多金鐘区甲级写字楼出售楼盘资讯请参阅:金鐘区甲级写字楼出售

写字楼空置率14.8%新高

本港写字楼空置率高企,有外资代理行最新发表的香港写字楼租赁市场报告,截至今年9月,全港各区写字楼空置楼面合共1060万方呎,空置率达14.8%的历史新高。

报告指出,香港写字楼市场目前正面临前所未有的挑战,空置率超越过往低迷时期,如2003年沙士的12.5%及2009年全球金融危机的9.2%空置率。中环核心商业区最新空置楼面高达219.4万方呎,空置率约10.9%。空置情况严重,由多种因素造成,包括经济表现疲弱而导致的需求减少、租客喜好转变及高息的影响。

市场竞争激烈,业主须大幅降低租金,导致租金自2019年高峰挫40%。核心与非核心区的租金差距收窄,一些金融机构将其非核心业务重新迁回核心商业区内。该行预期,今年写字楼租金料下降5%至10%。该行代理表示,据2011至2019年平均每年130万方呎的净吸纳量计,写字楼空置率预计在2027年达17%。

(信报)

Hong Kong developer Lai Sun’s Yuen Long project a sell-out as buyers regain confidence

Buyers flock to Lai Sun’s The Parkland in Yuen Long, snapping up nearly all units amid rate cuts and stock market gains, boosting market confidence

Hong Kong developer Lai Sun Development saw robust sales for its new residential project in the New Territories priced at a 10-year low, as buyers made the most of the recent rate cut and strong stock market performance.

Almost all 98 units on offer at The Parkland, located at 266 Tai Kei Leng in Yuen Long, were sold as of 5pm on Sunday. Most of the buyers were first-time buyers, according to agents.

Units in The Parkland range from 265 sq ft to 488 sq ft, with the first batch including 80 one-bedroom and 18 two-bedroom flats. The discounted selling price ranges from HK$2.43 million (US$313,000) to HK$4.63 million, or HK$8,614 to HK$10,663 per square foot. All 80 one-bedroom units are priced under HK$3 million.

The cheapest flat is a 282 sq ft one-bedroom unit priced at HK$2.43 million. It nearly matches the least expensive unit in Domus, developed by Paliburg Holdings in New Territories’ Hung Shui Kiu area in 2015, at HK$2.39 million.

The developer is now planning to launch a tender for special units next week, and the prices will continue to be competitive, according to Lai Sun’s senior vice-president Julian Poon Yui-man.

With the recent reduction in interest rates and the recovery in the city’s stock market, the property market sentiment is gradually improving, and market confidence will also slowly recover. Both property prices and transactions could experience a rebound soon, Poon told local media.

Recent home sales across Hong Kong have been strong because of improved market conditions. On Saturday, Hong Kong’s largest developer, Sun Hung Kai Properties, saw homebuyers snap up its latest residential project in Kai Tak after selling out more than 90 per cent of the units at The Yoho Hub II in Yuen Long the previous week.

Similarly, Emperor International sold all 85 units at One Jardine's Lookout in Happy Valley last weekend.

The sentiment improved recently after the Federal Reserve started the rate-easing cycle. The US central bank cut its benchmark interest rate by 50 basis points last month, with the Hong Kong Monetary Authority following suit. The cuts have paved the way for the city’s commercial banks to trim their rates, which is expected to translate into savings for borrowers who tie their loans to prime rates.

Developers have accelerated the pace of property sales after the interest-rate cut. The market is expected to record around 2,000 transactions in October, a seven-month high.

(South China Morning Post)

Homebuyers flock to Sun Hung Kai’s Cullinan Sky project in Kai Tak amid interest rate cut

As of 7pm, homebuyers snapped up 204 flats out of the 300 units on offer at Cullinan Sky Phase 1

Sun Hung Kai Properties (SHKP), Hong Kong’s largest developer by market capitalisation, on Saturday saw homebuyers flock to its latest residential project in Kai Tak, the city’s former airport, on the back of the recent interest-rate cut and stock market rally.

As of 7pm, the developer had sold 204 flats out of the 300 units on offer at Cullinan Sky Phase 1, according to agents. Under this project’s sales programme, the 204 units were snapped up based on their price list, while 96 were up for tenders. The units up for tenders have not yet been awarded.

“The new interest rate cut cycle and the surging stock market in Hong Kong have accelerated homebuyers’ desire to enter the market,” a property agent said on Saturday.

Among the homebuyers who flocked to the sales centre of Cullinan Sky at the International Commerce Centre in West Kowloon, around 40 per cent were from mainland China, according to the agent. The agent said young buyers accounted for about 50 to 60 per cent of those who made inquiries on Saturday.

Ahead of this weekend’s sale, the Cullinan Sky project already attracted around 29,161 prospective buyers who had put down a deposit.

SHKP priced the first batch of units on offer at Cullinan Sky Phase 1 at HK$19,668 (US$2,533) per square foot on average, about 20 per cent lower than the stock in new projects in the same area, according to a local property agency.

The discounted pricing by SHKP reflects the obstacles still faced by the city’s property market, such as an excess inventory of homes and a weak economy.

The 204 units up for sale include two-bedroom flats, which measure from 236 sq ft to 559 sq ft. The price after discount has been set between HK$4.74 million and HK$12.28 million, or HK$17,015 to HK$24,284 per sq ft. The batch by price list is valued at more than HK$1.7 billion.

Meanwhile, the 96 units up for tenders are bigger flats with three to four bedrooms. These range from 854 sq ft to 3,936 sq ft.

SHKP acquired the plot in Kai Tak in 2018 for HK$25.1 billion, the most expensive development site in Hong Kong at the time.

Beijing’s latest stimulus package has benefited the Hong Kong stock market, which has seen a flow of fresh funds, and is expected to also push up the local property market, according to another property agent.

The Hang Seng Index rose 23 per cent in the past two weeks, restoring more than US$3 trillion in market value to Chinese stocks in Hong Kong, Shanghai, Shenzhen and New York, according to Bloomberg data.

Rising rents in Hong Kong is also seen as a positive factor for the local property market, the agent said. The rental home index in July was six points shy of the peak in August 2019, setting the stage for more investors to buy in the property market for potential returns.

“It is expected that the property market sentiment will continue to improve,” the agent said. “This month, the number of first-hand transactions could reach 2,500, a seven-month high, while property prices are expected to stop falling and rebound by 3 to 5 per cent in the fourth quarter.”

(South China Morning Post)

For more information of Office for Lease at International Commerce Centre please visit: Office for Lease at International Commerce Centre

For more information of Grade A Office for Lease in Tsim Sha Tsui please visit: Grade A Office for Lease in Tsim Sha Tsui

今年甲厦租金暂录跌幅4.7% 外资代理行:供过于求情况持续

有外资代理行指出,甲级写字楼供过于求,空置率高企,令租金连续21季下降,今年迄今跌幅达到4.7%,过去5个季度甲厦录净吸纳量,令空置率略为下跌0.1百分点,然而,整体空置率仍录16.8%。

该行表示,2024年第三季甲厦租赁按季跌16%至99.3万方呎,年初至今租赁量达360万方呎,佔2023年全年总量89%,不过,需求仍疲弱,本季只有7%交易面积超过1万方呎,为自2013年第三季以来最低佔比。空置率过剩,令租金连续21季下降,按季跌2.6%,较上一季1.6%跌幅更大,今年迄今暂录跌幅达到4.7%。

整体空置率16.8%

由于供过于求,大中环地区租金较上季跌2.8%,负净吸纳量令九龙整体租金按季跌4.7%,较2024年第二季的跌幅2.2%更快,亦为自2020年第三季以来的最大跌幅。

该行代理表示,儘管办公室租户对成本谨慎,但自2023年以来,租赁势头持续改善,部分内地企业决定搬迁,惟整体新建和扩张需求仍有限。若中国和香港经济持续復甦,较低利率和中国货币宽鬆政策,有助推动办公空间需求增加。该行预计,随着市场对2025年经济前景更加清晰,租赁活动更加活跃。不过,高空置率和新增供应可能在短期内继续推动租金下降。

租金连续21季下降

该行另一代理表示,商业地产交易量从今年第2季低基数按季上升,投资需求仍疲软,零售及工业租赁活动平稳。期待已久减息,加上中国宽鬆货币政策,向市场发出了正面的信号,今年第3季度营商信心有所改善。

该行另一代理表示,国际时尚品牌对铺位需求出现新增长,核心铺租较2019年高峰低约35%,港元潜在疲软将有利游客消费,相信零售需求将在未来几季继续改善。

该行另一代理表示,本季度工业租赁势头减弱,今年迄今63%租赁由物流公司带动,随着全球息口开始下降,有利全球贸易,中国经济持续復甦,有利物流业。

该行另一代理表示,减息周期开始后,市场对大额交易兴趣增加,加上价格下跌,吸引用家及投资者入市。

甲厦需求仍疲弱,本季只有7%交易面积超过1万方呎,为自2013年第三季以来最低佔比。

(星岛日报)

中环中心全层料每月113万租出

中环中心录大手承租,由世茂集团创办人许荣茂相关人士持有的该厦32楼全层,由资产管理公司承租,料月租逾113万。

中环中心32楼,建筑面积约25204方呎,由万方管理(香港)有限公司承租,租期由2024年10月至2028年3月,为期41个月,市场人士估计,月租约113万,平均呎租45元,该全层于2019年至2021年间,由Unicorn Bay Hong Kong Invl Ltd承租,月租逾220万,平均呎租87元,最新租金减幅48%,该单位由2021年至早前,则一直作示范单位用途。

资产管理公司进驻

同由许荣茂相关人士持有的中环中心56楼全层,其中1室于今年7月租出,建筑面积2161方呎,以每月13万租出,呎租约60元,租约为期3年,租客为北京银行股份有限公司,是一间总部位于北京的商业银行,在2017年《银行家》杂誌发布的全球银行品牌500强排行榜中,排名第62位。

业内人士指,由于今番租出为全层单位,加上属低层,故呎租较56楼廉宜。

(星岛日报)

更多中环中心写字楼出租楼盘资讯请参阅:中环中心写字楼出租

更多中环区甲级写字楼出租楼盘资讯请参阅:中环区甲级写字楼出租

港岛指标甲厦 连录低价成交

近1个月港岛主要指标甲厦,相继录低价成交,相信因空置率高加上租金回调,价格亦跟随调整。

港岛商业区由上环至湾仔,共有数幢可供买卖的指标甲厦,上半年交投淡静,下半年陆续出现交投,价格上更明显向下。如湾仔会展广场办公大楼近期录得1宗低价成交,涉及物业33楼7及9室,面积约9,000平方呎,属该厦罕有全海景单位,以约1.35亿元易手,呎价约1.5万元,按此成交呎价计,重回2011年水平。

蔡志忠1.35亿 购会展广场办公大楼银主盘

买家为资深投资者蔡志忠,他指甲厦呎价大幅回调后,而会展广场办公大楼邻近政府总部,临海而建,而区内优质甲厦林立,如中环广场、新鸿基中心、鹰君中心、华润大厦等,均没有拆售,而可供出售的会展广场办公大楼高层全海景属市场罕有,决定入市。事实上,蔡志忠于2017年,曾伙拍多名投资者购入中环中心75%业权,其后他于2018年拆售22楼全层,并于2019年沽清,获利约5亿元。

翻查资料,是次涉及会展广场办公大楼单位,曾由中资机构持有,2023年中物业获中资财团斥约3亿元购入,惟最终取消交易,单位重新放售,市况亦转差,单位沦为银主盘,如今重新沽出,价格1年间下跌55%。

金鐘力宝中心 呎价低见1.24万

金鐘最具指标甲厦为力宝中心,近期更一连录2宗低价成交,涉及2座中低层5室,面积约1,505平方呎,以约2,000万元易手,平均呎价约1.33万元,一度创逾10年呎价新低。原业主于2012年以约2,739.1万元购入单位,帐面亏损约739.1万元,幅度约27%。相隔数日后,该厦再录买卖,日前力宝中心二座低层11至12号室,面积约2,199平方呎,最新连租约以约2,728万元易手、呎价约1.24万元。据悉,上述单位月租约9.34万元,租期至明年5月,新买家享租金回报约4.1厘;资料显示,上述原业主2018年3月以约8,280万元购入,持货逾6年,帐面蚀5,552万元或67%。

上环区方面,指标甲厦定为信德中心,近期资深投资者罗守辉售上环信德中心招商局大厦902室,面积约1,158平方呎,涉及约1,838万元,平均呎价15,872元。原业主早于2005年以约590万购入单位,持货19年帐面获利约1,248万元,物业升值2.1倍。

分析指,近年甲厦空置率一直上升,租金跌势持续,而在高息环境下,个别业主希望沽货减磅,因租金未止跌下,唯有大幅降价放盘,导致低价成交相继出现。由于甲厦价格已高位下跌6成以上,渐现用家及投资早承接,预计港岛区甲厦交投量有望上升,价格续在低位徘徊。

(经济日报)

更多会展广场办公大楼写字楼出售楼盘资讯请参阅:会展广场办公大楼写字楼出售

更多湾仔区甲级写字楼出售楼盘资讯请参阅:湾仔区甲级写字楼出售

更多会展广场办公大楼写字楼出租楼盘资讯请参阅:会展广场办公大楼写字楼出租

更多中环广场写字楼出租楼盘资讯请参阅:中环广场写字楼出租

更多新鸿基中心写字楼出租楼盘资讯请参阅:新鸿基中心写字楼出租

更多鹰君中心写字楼出租楼盘资讯请参阅:鹰君中心写字楼出租

更多华润大厦写字楼出租楼盘资讯请参阅:华润大厦写字楼出租

更多湾仔区甲级写字楼出租楼盘资讯请参阅:湾仔区甲级写字楼出租

更多中环中心写字楼出售楼盘资讯请参阅:中环中心写字楼出售

更多中环区甲级写字楼出售楼盘资讯请参阅:中环区甲级写字楼出售

更多力宝中心写字楼出售楼盘资讯请参阅:力宝中心写字楼出售

更多金鐘区甲级写字楼出售楼盘资讯请参阅:金鐘区甲级写字楼出售

更多信德中心写字楼出售楼盘资讯请参阅:信德中心写字楼出售

更多上环区甲级写字楼出售楼盘资讯请参阅:上环区甲级写字楼出售

观塘海滨道商业气氛转浓,而宏基资本大厦单位享全邮轮码头景观,极为舒适。

海滨道近年相继有甲厦项目落成,包括大业主持有的海滨汇、绿景NEO大厦等,以及可供出售项目包括宏基资本大厦、万兆丰中心、丝宝国际大厦等,整体甲厦楼面增加,亦有外资、内企租用单位,整体商业气氛理想。

宏基资本大厦于交通上,由牛头角港铁站步行至该厦需时5分鐘,而观塘道亦有多条巴士綫,物业拥停车场,为自驾人士提供选择。

其他配套上,海滨道商铺不算多,上班人士可前往观塘一带,有多个大型商场,商铺数目充足,而The Millennity商场部分日后全面开业,可望有更多餐厅选择。

物业旁有观塘海滨长廊,全长逾1公里,北至顺业街以南,南至骏业街的观塘公眾码头,上班人士可在中午或放工后,到海滨长廊散步或做运动。

分层楼面每层逾1.1万呎

宏基资本大厦于2013年落成,大堂楼底高,空间感十足,加上大堂门口採全玻璃设计,可引入室外光綫,开扬光猛。另有提供座椅,供到访人士休息。

大厦提供5部升降机,通往22层写字楼。分层楼面每层面积约1.1万至1.2万平方呎,部分可分为两个单位使用,单位楼高约3.8米,配上落地玻璃,採光度极佳,可享开扬的邮轮码头景致,极为舒适。另一边则望向牛头角一带的都市景致,亦相当开扬。

用户方面,较知名包括有内企信义玻璃 (00868),使用物业高层全层,另亦有政府部门使用该厦楼面。

租务上,物业今年仅录一宗租务成交,涉及低层单位,面积约951平方呎,以约2万元租出,呎租约21元。

最顶两层放售 意向价1.8亿

宏基资本大厦最顶两层单位,现首度进行放售,意向价约1.8亿元,平均呎价约7,480元。

每层12029呎 呎价7480元

有外资代理行代理表示,有业主出售观塘海滨道135号宏基资本大厦顶楼两层27及28楼连8个私家车位。物业每层面积各约12,029平方呎,总建筑面积约24,058平方呎,现以部分交吉及部分连租约出售,而业主意向价约1.8亿元,平均呎价约7,480元。

据了解,是次放售的楼层为宏基资本大厦的最顶两层,为该厦发展商宏基资本(02288) 早年重建后作总部自用至今,故属首度公开放售,非常罕有。物业除享有180度维港及邮轮码头海景外,间隔亦方正实用。

近期同区同类型单位买卖上,2024年7月,联合出版集团以1.33亿元买入观塘俊汇中心28及29楼连天台,呎价约6,287元。另观塘敬业街云讯广场一层半楼面,获四洲集团 (00374) 以逾2.05亿购入作总部,成该厦首宗成交,呎价逾8,200元。

(经济日报)

更多宏基资本大厦写字楼出售楼盘资讯请参阅:宏基资本大厦写字楼出售

更多万兆丰中心写字楼出售楼盘资讯请参阅:万兆丰中心写字楼出售

更多丝宝国际大厦写字楼出售楼盘资讯请参阅:丝宝国际大厦写字楼出售

更多俊汇中心写字楼出售楼盘资讯请参阅:俊汇中心写字楼出售

更多云讯广场写字楼出售楼盘资讯请参阅:云讯广场写字楼出售

更多观塘区甲级写字楼出售楼盘资讯请参阅:观塘区甲级写字楼出售

更多宏基资本大厦写字楼出租楼盘资讯请参阅:宏基资本大厦写字楼出租

更多海滨汇写字楼出租楼盘资讯请参阅:海滨汇写字楼出租

更多绿景NEO大厦写字楼出租楼盘资讯请参阅:绿景NEO大厦写字楼出租

更多万兆丰中心写字楼出租楼盘资讯请参阅:万兆丰中心写字楼出租

更多丝宝国际大厦写字楼出租楼盘资讯请参阅:丝宝国际大厦写字楼出租

更多The Millennity写字楼出租楼盘资讯请参阅:The Millennity写字楼出租

更多观塘区甲级写字楼出租楼盘资讯请参阅:观塘区甲级写字楼出租

Hong Kong commercial property prices to keep falling on supply glut worries, according to an international property agency

In the third quarter, commercial real estate investment volume rose 22.6 per cent quarter on quarter to US$1.28 billion, the agency said

Hong Kong’s commercial property market has seen an improvement in investment sentiment thanks to lower rates and a rebound in Chinese stocks, but prices will keep falling because of worries about a supply glut, an international property agency said.

“We are seeing increased interest in big-ticket deals in the market following the start of the rate cut, coupled with deeper price discounts, [and] end users and long-term investors are gaining confidence to enter into buying positions,” an agent said.

“Further rate cuts and monetary easing in the mainland China economy will possibly translate into a stock market rally and improve investment market sentiment in the few months ahead,” the agent said.

In the third quarter, commercial real estate (CRE) investment volume rose 22.6 per cent quarter on quarter to HK$9.97 billion (US$1.28 billion), the report said. Financially stressed assets accounted for HK$5.5 billion in investment volume, or 55 per cent of the quarter’s total, as pressure continued to mount on sellers to fulfil their loan covenants.

The agency said in the third quarter, there were only 25 CRE transactions worth more than HK$77 million and most deals were smaller.

“Most deals were smaller sized, with 15 transactions involving a lump sum of less than HK$300 million,” it said.

The agent said CRE mortgage rates stood at around 6 per cent in the third quarter, down from 7 per cent in the year-earlier period. But yields for property investments stayed below 4 per cent.

Last month, the Hong Kong Monetary Authority (HKMA) joined the US Federal Reserve in cutting its benchmark rate by a half point, kicking off a highly awaited cycle of easing. The HKMA had not cut its rate in four years. The city’s de facto central bank adjusts its own policy based on what the Fed does to keep the local currency’s peg to the US dollar.

After that, Hong Kong’s commercial banks trimmed their rates by a quarter point for the first time in nearly five years, which translates into savings for borrowers whose loans are tied to prime rates.

“We have seen Asia-Pacific regional fund outflows to Japan and Australia from Hong Kong as Japan has low interest rates and investment yields in Australia were as high as 5 to 6 per cent,” the agent said. “But as the interest rate cut cycle began, some funds invested in Singapore are backing Hong Kong.”

Transaction volume is likely to improve more in the fourth quarter and into 2025, the agency said. Capital values, however, will take longer to improve as a supply overhang in some property sectors and a negative carry will prevent a sharp jump in prices.

For the office market, rents will continue to drop in the short term due to high vacancy rates and new supply.

Gross leasing volume fell 16 per cent quarter on quarter to 993,000 square feet in the third quarter. Leasing requirements remained small with just 7 per cent of deals this quarter exceeding 10,000 sq ft, the smallest since the same quarter in 2013.

“The vacancy overhang ensured rents declined for the 21 consecutive quarters, bringing the year-to-date decline to 4.7 per cent,” another agent said.

Kowloon East saw the biggest decline in rents, falling 4.7 per cent quarter on quarter. Rents in Greater Central fell 2.8 per cent due to vacancy pressures and new supplies.

Rents for grade A offices across all areas are expected to fall by about 5 to 10 per cent this year, the agency said.

“This quarter saw selective mainland Chinese firms making decisions to relocate, but overall, new and expansion demand remains limited,” the agent said, adding that it is expected that leasing activities to become more active as the market gets greater clarity on the economic outlook in 2025.

(South China Morning Post)

New home sales set to double: Wheelock

The number of transactions in the primary market could double to 1,500 to 2,000 in October from a month ago, according to Wheelock Properties'managing director Ricky Wong Kwong-yiu.

Wong also predicted home prices would advance slightly this quarter due to increased confidence in the market, saying Wheelock would speed up the pace to put more new projects on the market.

Wheelock and MTRC (0066) will put up 158 units of Park Seasons at Lohas for sale this Friday. Prices start from HK$4.53 million, or HK$14,059 per square foot.

Hong Kong saw 919 private residential units completed in August, down 42.8 percent from the previous month, according to data from the Rating and Valuation Department.

For the first eight months, a total of 9,622 private residential units were completed, accounting for only 43.2 percent of the government's target of 22,267 units for the whole year.

Market watchers warned earlier this year that a high inventory of new flats was a major factor keeping home prices under pressure.

The production included 5,610 newly finished flats or 58.3 percent in the New Territories, followed by 3,607 new homes or 37.5 percent in Kowloon in the first eight months. Hong Kong Island came last, with only 405 units built up to August 31.

Chinachem Group launched a new project, Echo House, yesterday. The project in Cheung Sha Wan offers 198 units with home style from one-bedroom flats to three-bedroom units. Sales brochure will be released this week.

In other news about the commercial property market, an international property agency said the rents of offices in Hong Kong have dropped for 21 quarters in a row as of the third quarter this year, mainly due to high vacancy rate that has risen to 16.8 percent.

The agency predicts the market may need seven to eight years to destock vacant offices and the rents could drop more than 5 percent in 2024 year-on-year, although the rental demand could revive with a bullish economic outlook for the rest of the year.

During the July-to-August quarter, the vacancy rate of retail stores in Causeway Bay, Tsim Sha Tsui, Mong Kok and Central remained unchanged at 6.8 percent compared to the second quarter, although the rents rose by 1 percent quarter-on-quarter.

The agency believes that consumption demands in the local retail market will continue to recover in the coming quarters, amid potential further rate cuts and policy easing, possible weakening of the Hong Kong dollar to benefit retail sales and continued recovery of China's economy.

The firm predicted the rents of retail stores in four core areas could record up to 5 percent year-on-year increase in 2024.

(The Standard)九龙湾企业广场一期中层意向价2010万

美联储啟动减息步伐,料资金将回流本港,有利资产及工商铺市场。有本港代理表示,九龙湾常悦道9号企业广场一期2座中层08至09室,建筑面积约4042方呎,意向价约2010万,平均呎价约4973元,以现状及交吉形式出售。

叫价较3年前低20%

该代理表示,美国减息后,资金回流中港股市,有利营商气氛,商厦市场因此受惠。资料显示,企业广场一期2座及3座7楼全层,于2021年曾以约1.6亿成交,呎价约6200元。上述物业叫价较3年前低20%,该单位设全写字楼装修,间隔实用。

该代理补充,该厦为九龙东指标商厦,邻近德福广场及MegaBox等大型购物商场,附近亦设有多条巴士及小巴专线前往全港各区。

(星岛日报)

更多企业广场写字楼出售楼盘资讯请参阅:企业广场写字楼出售

更多九龙湾区甲级写字楼出售楼盘资讯请参阅:九龙湾区甲级写字楼出售

何超凤前夫放售赤柱洋房 估值5.9亿

呎价约8万 物业前身邓丽君故居

传统豪宅地段独立屋罕有,现业主放售赤柱佳美道全新落成独立屋,楼高4层,市值约5.9亿元,呎价约8万元。翻查资料,该物业前身曾为邓丽君故居。

有代理行表示,有业主放售赤柱佳美道18号,该物业为已落成独立屋。项目的实用面积达7,295平方呎,花园及庭园分别为2,453平方呎及381平方呎。

项目楼高4层连地库;地下为大型客厅及饭厅、1楼及2楼每层均设套房设计的一间主人房及两间睡房;较为特别的是2楼主睡房建有大型露台,外望开扬南区海景。其他建筑设施包括独立升降机、天台、游泳池、花园及双车位停车库等等。

该代理指,若参照市场最新成交呎价,项目市值约5.9亿元,呎价约8万元。

翻查资料,佳美道18号曾为邓丽君的在港寓所,兴建于1953年。据悉,邓丽君于1988年以700万元购入,居住至1995年逝世。故居外墙为绿色,半圆型的露台成为别墅的主要外观,并设有工作及宴会的空间、练歌室。

山顶道28号 10亿洽购至尾声

邓丽君于1995年逝世后,故居及相关遗物交由邓丽君文教基金会保管,其家属一度计划将其故居改建为邓丽君纪念馆,让歌迷缅怀偶像昔日风采,但计划因附近一带均为住宅,怕影响民居而告吹,最后决定招标放售。经三度招标后,2004年由何鸿燊女儿何超凤及夫婿何志坚,以3,180万元购入,其后进行重建。两人于2016年离婚,现由何志坚放售物业。

近月传统豪宅地段连环录大额买卖,包括由老牌何氏家族持有山顶种植道46号豪宅项目,7月以11亿元全数沽出4幢洋房,平均呎价约64,759元,新买家为伯恩光学创办人杨建文。至于同由何氏家族持有旗下山顶道28号独立屋,近日获10亿元洽购至尾声,有望短期易手,独立屋佔地面积约1.67万平方呎,实用面积约8,910平方呎,呎价逾10万元。

(经济日报)

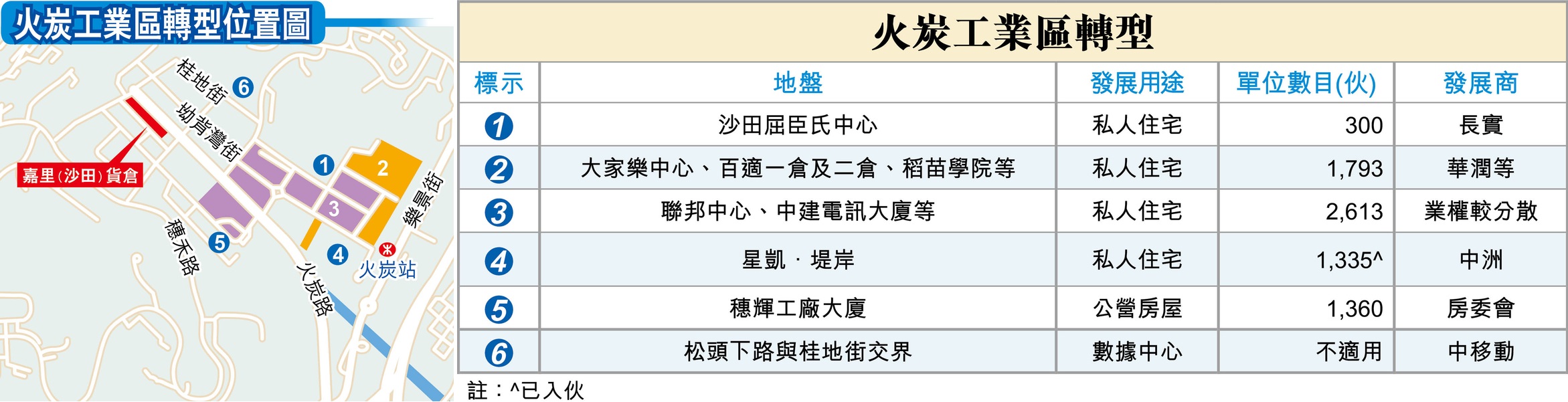

工厦转住宅 火炭料增建逾4700伙

有发展商看準旧工业区的工厦,并部署重建,当中长实 (01113) 于2021年就火炭旧工业区部分工厦向城规会申请重建约4,706伙,规模近半个沙田第一城,属区内最大规模的改划。

料新增公私营单位逾6000户

据资料显示,火炭工业区佔地约30公顷,区内共有约45幢工厦,以楼龄较旧的工厦为主,平均楼龄逾30年以上,一半楼龄介乎约15至30年。观乎该区重建项目,粗略统计,预测日后会新增至少逾6,000伙公私营房屋供应。

区内近8成工厦属于分散业权,虽这会增加重建的困难,但有发展商亦看中区内工厦的发展前景而拟大举申请重建,其中长实于2021年就火炭工业区东部20幢工厦,向城规会申请由「工业」用途改划为「住宅 (戊类)」等用途,以重建大型屋苑,提供约4,706伙,料属区内最大规模的重建项目。

分3期发展 最快2026年落成

据当时的申请文件,项目将会分3期发展,共涉24幢住宅,当中第1期是长实旗下的沙田屈臣氏中心,提供约300伙,预料2026年落成。而第2期则涉邻近港铁火炭站的多幢工厦,包括大家乐中心、华润旗下沙田冷仓一仓、二仓、百适一仓、二仓,及稻苗学院等,提供约1,793伙,料于2028年落成。第3期涉中建电讯大厦及峯达工业大厦等共13幢工厦,提供约2,613伙,但因前述的工厦现时的业权相当分散,普遍欠单一大业主主导重建,预期短期内难以落实重建。

另外,华润物流近年亦积极扩大区内势力,属区内大地主之一,旗下在区内持有的工厦已增至5幢,包括于2022年5月以约23.3亿元,向嘉里购入的山尾街36至42号嘉里 (沙田) 货仓、百适一仓、百适二仓、沙田冷仓 (一仓) 及沙田冷仓 (二仓)。沙田冷仓 (一仓) 及百适一仓早年曾向城规会申请重建为酒店及商场,提供约858间客房,但方案当年未获会方批准。

事实上,有新盘亦已经由前工厦完成重建,并已入伙,包括前身为火炭惠康仓的新盘星凯‧堤岸。项目原由爪哇控股 (00251) 持有,其后中洲置业于2015年底以约11.2亿元向爪哇购入地皮,并于2017年完成补地价程序,补地价金额涉约35.8亿元,每平方呎楼面地价约3,580元。

除了私人重建,邻近星凯‧堤岸的房委会旗下火炭穗辉工厂大厦亦已开始清拆,将以最高地积比率6.7倍,发展2幢住宅,提供约1,360伙公营房屋,初步预计在2031年落成。

(经济日报)

New homes continue to flood the market

More residential properties have been put on the market in Hong Kong including a luxury house owned by the late superstar Teresa Teng Li-Chun.

The house on Carmel Road in Stanley - which was once owned by the Taiwanese singer and actress - was put on the market for HK$590 million, according to property agency.

Cullinan Sky in Kai Tak, developed by Sun Hung Kai Properties (0016), launched the fourth price list yesterday offering 107 flats, with prices ranging from HK$4.79 million to HK$12.56 million after discounts.

The developer will roll out 238 flats for its second round of sales on Saturday, and will stop taking checks on Thursday.

The 107 homes span from studio to two-bedroom units, with areas of 236 to 559 square feet. They are priced between HK$18,945 and HK$26,784 per sq ft after discounts.

Earlier, all of the 204 homes in the first round of sales were sold in a day last Saturday. The first batch of flats in the 906-unit development was priced 20 percent lower than nearby new projects.

The Pavilia Forest in Kai Tak, co-developed by New World Development (0017) and Far East Consortium (0035) sold 12 units yesterday with one homebuyer snapping up seven flats for HK$37 million.

The Pavilia Forest II will put 31 more units on the market with the discounts of up to 16 percent.

The Yoho Hub II in Yuen Long, also developed by SHKP will launch 52 units on the third round of sales next Monday. The price after discounts range from HK$6.69 million to HK$14.03 million.

Blue Coast II in Wong Chuk Hang, co-developed by CK Asset (1113) and MTRC (0066) will launch its first price list today, to offer at least 112 units, mostly will be two-and-three bedroom units.

The completed development Manor Hill in Tseung Kwan O, developed by Kowloon Development Company (0034), will put 13 flats on sale this Saturday, with prices ranging from HK$5.62 million to HK$5.65 million after discounts. The project has recorded 51 transactions in this month, raking in more than HK$280 million.

And The Parkland in Yuen Long, developed by Lai Sun Development (0488), launched the third price list with 14 units yesterday. The prices range from HK$2.84 million to HK$7 million after discounts.

The agency predicted the price of residential properties will drop by up to 5 percent in this year, even though the transaction volume could surge by more than 15 percent year-on-year, benefiting from upbeat signs in the stock market.

(The Standard)尖东好时中心1297万易手 持货19年升值15%

向来以用家主导的尖东商厦好时中心,近日录一宗成交,市场消息透露,该厦低层04室,建筑面积约2162方呎 以每呎6000元易手,涉货约1297.2万。

原业主,早于2005年12月以1124.2万购入,持货19年,帐面仅获利173万,物业升值15%。

较高峰期回落6成

好时中心对上1宗买卖于今年2月录得,该厦4楼12室,建筑面积1393方呎,以820万易手,平均呎价5887元。

近期该厦成交呎价则较高峰期回落约6成,该厦于2018年1月商厦高峰期,每方呎高逾1.5万,单位为9楼3室,建筑面积约1293方呎,以2020万易手,平均呎价15623元。

原业主早于2005年4月,以700万购入物业,持货19年帐面获利1320万,期内物业升值1.9倍。

荃湾国际企业中心每呎4300元沽

工厦新盘造价亦较高峰期回落,市场消息透露,第一集团沽售荃湾国际企业中心二期21楼全层,建筑面积约8359方呎,以每呎约4300元易手,涉资3594万。

该厦于2021年1月推售时,成交呎价曾高达7800元,最新造价较高峰期跌45%。

(星岛日报)

更多好时中心写字楼出售楼盘资讯请参阅:好时中心写字楼出售

更多尖沙咀区甲级写字楼出售楼盘资讯请参阅:尖沙咀区甲级写字楼出售

更多国际企业中心二期写字楼出售楼盘资讯请参阅:国际企业中心二期写字楼出售

更多荃湾区甲级写字楼出售楼盘资讯请参阅:荃湾区甲级写字楼出售

教会连环沽港岛区两物业 中环大昌每呎1.8万赤柱静修院作价4.26亿

港岛区2项物业成交,中环乙厦大昌大厦全层以6670万易手,呎价1.8万,赤柱舂磡角静修院作价4.26亿,卖方为THE BISHOP OF THE ROMAN CATHOLIC CHURCH IN HONG KONG。

市场消息透露,根据土地註册处资料,THE BISHOP OF THE ROMAN CATHOLIC CHURCH IN HONG KONG持有的2项物业,在上月13日转手,买方为THE MOTHER SUPERIOR OF THE SOEURS DE SAINT PAUL DE CHARTRES (HONG KONG),虽然两者皆为教会,惟买方过往曾大手购入旧楼豪宅,今番未知该2宗属真正买卖或内部转让,本报昨日联络该2间教会,惟直至截稿时尚未联络得上。

大昌全层64年间升66倍

中环干诺道中15至18号大昌大厦17楼以6670万易手,代理指,该全层建筑面积3700方呎,平均呎价1.8万,买家THE MOTHER SUPERIOR OF THE SOEURS DE SAINT PAUL DE CHARTRES (HONG KONG),原业主THE BISHOP OF THE ROMAN CATHOLIC CHURCH IN HONG KONG早于1960年12月以99万承接单位,持货64年帐面获利6580万,物业升值66倍。

赤柱舂磡角道43号全幢亦以4.26亿易手,根据差估署资料,上址为天主教静修院私人宿舍及教堂,未有面积资料提供。根据天主教静修院网页介绍,该静修院有客厅、饭堂、小圣堂,会议室等,另合共设46个单人房。

静修院内设46个单人房

上述2项物业买方为THE MOTHER SUPERIOR OF THE SOEURS DE SAINT PAUL DE CHARTRES (HONG KONG),亦曾于2015年以3.9亿购入九龙城露明道8号全幢豪宅旧楼。

近年最瞩目教会购物业,要数北角新光戏院铺址,去年11月由The Island Evangelical Community Church (Island ECC) 以7.5亿承接,将作为自用,该物业为北角英皇道侨辉大厦全幢约77.41%业权 (即新光戏院现址)。

(星岛日报)

CK Asset rules out sharp rebound in home prices

CK Asset (1113) believes Hong Kong's property market has bottomed out but prices will not rebound sharply.

The prediction came as the developer rolled out the first price list for Blue Coast II in Wong Chuk Hang, offering 128 flats at prices that are 2 percent lower than projects in the same district.

The flats have an average price of HK$21,526 per square foot after discounts, while the first batch of Blue Coast, launched in March was priced at an average of HK$21,968 per sq ft after discounts.

CKA will put more new flats on the market and predicted prices may recover by 3 percent in two months although they will still be lower as home prices have fallen by around 7 percent so far in 2024.

The first price list for Blue Coast II includes 78 two-bedroom and 50 three-bedroom flats with areas between 485 sq ft and 781 sq ft. They are priced between HK$9.21 million to HK$18.82 million after discounts.

Meanwhile, The Parkland in Yuen Long, developed by Lai Sun Development (0488), launched its third price list yesterday, offering 14 flats. The units will be put on the market on Sunday, with prices ranging from HK$2.84 million to HK$7 million after discounts.

Echo House in Cheung Sha Wan, developed by Urban Renewal Authority and Chinachem released a sales brochure yesterday and will launch a first price list as early as next week, offering at least 50 units.

Koko Rosso and Koko Mare in Lam Tin, developed by Wheelock Properties, collectively rolled out eight two-bedroom flats with sea views by tender yesterday.

And High Park I in Yuen Long, developed by Asia Standard (0129) will roll out 30 new units on Saturday, with the cheapest priced at HK$3.69 million after discounts.

(The Standard)商厦频现低价成交 本港代理行:售价按月跌6.8%

有本港代理行发表的商厦报告指9月指标甲厦售价按月跌约6.8%。由于上月有数宗甲厦物业低价成交,令上环、金鐘及湾仔平均甲厦售价大跌,拖累整体表现。

上环信德中心招商局大厦有单位以呎价约1.58万成交,金鐘力宝中心二座单位以呎价约1.31万易手。湾仔会展广场办公大楼33楼多个单位以1.35亿成交,呎价约1.5万,上述三宗呎价重返2010至14年水平。

现多宗「跳价」成交

该行代理表示,不少甲厦业主「以价换量」,今年首三季指标甲厦售价累跌近20%,成交录77宗,超过2022年及2023年全年水平,上月甲厦出现多宗「跳价」成交。联储局减息后,买家趁低吸纳优质商厦,湾仔会展广场办公大楼33楼物业买家为资深投资者蔡志忠,预料短期内低价成交陆续有来。

造价重返10多年前水平

市传伯恩光学杨建文以4.1亿购入观塘东九龙银行中心 (前称骆驼漆大厦),与邓成波家族在2014年买入价比,贬值约60%,四洲集团以2.05亿购入同区云讯广场两层多个单位。

(星岛日报)

更多信德中心写字楼出售楼盘资讯请参阅:信德中心写字楼出售

更多上环区甲级写字楼出售楼盘资讯请参阅:上环区甲级写字楼出售

更多力宝中心写字楼出售楼盘资讯请参阅:力宝中心写字楼出售

更多金鐘区甲级写字楼出售楼盘资讯请参阅:金鐘区甲级写字楼出售

更多会展广场办公大楼写字楼出售楼盘资讯请参阅:会展广场办公大楼写字楼出售

更多湾仔区甲级写字楼出售楼盘资讯请参阅:湾仔区甲级写字楼出售

更多云讯广场写字楼出售楼盘资讯请参阅:云讯广场写字楼出售

更多观塘区甲级写字楼出售楼盘资讯请参阅:观塘区甲级写字楼出售

外资代理行:甲厦租金全年料跌6%至8%

有外资代理行指,现时企业以成本控制及升级搬迁为主,甲厦业主灵活吸客,预期全年租金跌幅6至8%。

该行代理表示,甲厦本季录达32.41万方呎正吸纳量,连续四个季度正吸纳量,季内不少逾万呎大租务,使待租率下调至19.3%,两年以来首次回落。

本季正吸纳量32.4万呎

今年首三个季度共录约98万方呎净吸纳量,第三季新租赁面积录83万方呎。以尖沙咀、中区及九龙东佔比最高,分别佔本季新租赁面积23%、19%及19%,银行及金融业 (38%) 佔比最高,其次为消费品及制造业 (18%) 及专业服务业及房地产 (16%)。

节省成本及升级搬迁主导

由于季内未有新写字楼落成,整体待租率下调至19.3%水平,是2022年第一季度以来首度下跌。整体甲厦租金跌幅于第三季度加快,按季跌2.4%,年初至今跌4.3%。企业以成本控制及升级搬迁为主,业主採取灵活租赁方案吸客,租金回软,预期全年租金跌6至8%。

展望后市,减息周期启动,内地宏观经济政策刺激中港股票市场,再加上首三季香港首次公开招股 (IPO) 市场重返全球第4位,有助金融市场復甦,对甲厦需求起支持作用。

(星岛日报)

铜锣湾罗素街地铺月租40万 深圳大疆创新进驻 售卖无人机及航拍器材

铜锣湾罗素街一个地铺以每月40万租出,租客为来自深圳、全球知名的无人机生产及研发商大疆创新,平均呎租约279元,较两年前疫情期间反弹33%。

罗素街59至61号丽园大厦地下B5号铺,建筑面积1433方呎,市场消息透露,租客大疆创新,是一家以生产、研发民用无人机、航拍器材、摄影等光学系统为主的科技公司。

大疆创新2006年成立,总部设于深圳,目前据点遍及全球,包括美国、德国、荷兰、日本及澳洲等地,属全球无人机及航拍产品的一哥。

市场更有此说法,大疆无人机在美国市佔率逾50%,由于找不到性价比接近的产品,中美贸易战中迟迟未被禁。不过,上月9日, 美国眾议院投票通过法案,禁止该集团向美国出口及销售新款无人机。

呎租279元反弹33%

知情人士表示, 2016年首度来港设置旗舰店,选址铜锣湾谢斐道Tower 535三层高复式巨铺,面积逾1万方呎。惟2021年疫情时撤出,去年8月回归,伙拍相机技术领导者哈苏进驻尖沙嘴The ONE对面的栢丽大道G19及G20号铺。事隔逾一年,选址罗素街地铺,彰显对后市的信心,惟未知是否伙拍哈苏或其他伙伴。

上述罗素街铺旧租客为首饰店,2022年8月签下3年约,月租30万,早前提早近一年退租。业主就铺位叫价每月60万,最终成交租金比首饰店高10万或33.3%。

2016年曾开设万呎旗舰店

该铺曾由长情租客溥仪眼镜租用逾10年,2015年续租时月租高达250万创下记录。不过,该品牌在2020年6月底约满迁出,离场前月租减至130万。

随后疫情期间,该铺以短租为主,包括家品店及口罩店,直至2022年才有长租户承租,最新租金较疫情时上升,惟比较9年前高位则大跌84%。

(星岛日报)

更多Tower 535写字楼出租楼盘资讯请参阅:Tower 535 写字楼出租

更多铜锣湾区甲级写字楼出租楼盘资讯请参阅:铜锣湾区甲级写字楼出租

Two major developers are hiking prices

Sun Hung Kai Properties (0016) has raised prices for its new projects and CK Asset (1113) is set to follow suit as they anticipate more supportive measures in the upcoming policy address on Wednesday and from Beijing.

Both the major developers have been recording overwhelming sales.

CK Asset is considering raising prices for new projects as it expects the policy address and Beijing's package will activate the economy.

Real Estate Developers Association chairman Stewart Leung Chi-kin had earlier called on the government to allow a third of the HK$30 million investment required in the new capital investment entrant scheme to be used by investors to purchase industrial and commercial or residential properties, if they so desired.

Sun Hung Kai Properties released the fifth price list of the Cullinan Sky in Kai Tak yesterday, offering 149 units, after selling out 238 units on Saturday.

The flats range from one-to three-bedroom and open-plan units, from 236 to 692 square feet, with prices between HK$5.1 million and HK$18.9 million after discounts.

SHKP deputy managing director Victor Lui Ting said SHKP will "not stop launching new flats" due to the accelerated recovery of the property market in the fourth quarter.

Blue Coast II in Wong Chuk Hang, co-developed by CK Asset and MTRC (0066), rolled out a second price list of 108 units for sale on Saturday, with an average discounted price of HK$21,876 per sq ft, 1.6 percent higher than the first price list. The project has received over 4,000 checks in three days, making the flats nearly 16 times oversubscribed.

Lai Sun Development Company's (0488) The Parkland in Yuen Long sold eight out of 14 units in the second round of sales on Sunday.

The 14 units in sizes ranging from 265 to 494 sq ft, were priced from HK$2.84 million after discounts.

The Pavilia Forest at the old Kai Tak airport runway, co-developed by New World Development (0017) and Far East Consortium International (0035), announced nine transactions yesterday, with 107 deals worth HK$670 million recorded this month.

Emperor International's (0163) One Jardine's Lookout in Happy Valley sold a four-bedroom flat for HK$29.14 million by tender, the highest since the project was put on the market.

In the secondary market, the city's 10 major housing estates recorded nine deals over the weekend, 18 percent less than the previous week.

A property agent said the decrease is due to homeowners asking for higher prices and a rebounded primary market facing new projects.

(The Standard)深圳微眾银行攻港 中环设总部

中资机构来港开拓业务,中环交易广场三座全层,以每呎约100元租出,新租客为深圳微眾银行,来港设立总部。

租交易广场全层 呎租100元

市场消息指,中环交易广场三座录得全层租务成交,涉及中高层全层,面积约1.1万平方呎,成交呎租料约100元。交易广场3期为中环超甲级商厦之一,而租务高峰期时,呎租曾达约150至160元,现时已回调逾3成。

消息称,新租客为内地金融机构微眾银行 (WeBank)。据了解,该企业总部设于深圳,由腾讯 (00700)、百业源和立业等企业发起设立,于2014年正式开业,为内地首家由民营企业出资建立的商业银行。

据悉集团业务主要服务个人消费者和小微企业,提供高效和差异化的金融服务,而微眾银行无实体营业网点或柜台。

事实上,较早前本港投资推广署,亦有欢迎深圳前海微眾银行股份有限公司 (微眾银行) 在香港设立其科技公司总部,并计划在港投资高达1.5亿美元和创造高技能科技职位,表示微眾银行是在深圳成立的全球领先数字银行。

据悉,该集团设于香港的科技公司总部将作为研发活动的基地,为全球市场提供商业化科技解决方案。

业界:股市旺 吸内企设总部

中资机会稍加快在港扩充,如早前九龙站环球贸易广场 (ICC) 录得全层租务,涉及物业69楼全层,面积约3.5万平方呎,以每呎约70元租出。新租客为内地金融机构远东宏信,原已租用该厦1.8万平方呎楼面,现因应业务而进行扩充。市场人士预计,随着近期股市强劲,加上内地新措施等,将带动本港金融市场向好,料吸引更多内地企业来港设立总部,带动甲厦租务。

(经济日报)

更多交易广场写字楼出租楼盘资讯请参阅:交易广场写字楼出租

更多中环区甲级写字楼出租楼盘资讯请参阅:中环区甲级写字楼出租

更多环球贸易广场写字楼出租楼盘资讯请参阅:环球贸易广场写字楼出租

更多尖沙咀区甲级写字楼出租楼盘资讯请参阅:尖沙咀区甲级写字楼出租

Sun Hung Kai’s Cullinan Sky sees another weekend of brisk sales on rate cut and stock rally

Quantitative easing and a slew of economic stimulus measures from Beijing have increased buyer confidence, agents say

Hong Kong homebuyers on Saturday flocked to a second round of sales at Sun Hung Kai Properties’ Cullinan Sky Phase 1, a residential project in Kai Tak, as interest rate cuts and improved stock market performances boost sentiment in the real estate sector.

As of 8pm, Sun Hung Kai, Hong Kong’s largest developer by market capitalisation, sold 232 flats out of 238 on offer, according to property agents. The apartments ranged from studios to two-bedroom units, with saleable areas ranging from 236 to 655 square feet.

The discounted prices range from HK$4.786 million to HK$14.12 million (US$615,900 to US$1.1817 million), or HK$18,188 to HK$26,784 per sq ft.

Buyers are drawn by the project’s prime location and competitive pricing, according to a property agent. The buildings are directly connected to the Kai Tak MTR station and the nearby AIRSIDE shopping centre.

Last week, Sun Hung Kai sold all of the first batch of units on offer at the same project. Many clients who failed to buy last time returned on Saturday, accounting for around 80 per cent of those who made inquiries, the agent said.

Ahead of the weekend, the project already attracted around 38,100 prospective buyers who had put down a deposit.

Quantitative easing, coupled with a slew of economic stimulus measures from Beijing, have increased buyer confidence, according to another property agent.

Among the buyers who piled into the sales centre of Cullinan Sky at the International Commerce Centre in West Kowloon, about 40 per cent were mainlanders, the agent said. Around 60 per cent came from Kowloon, and the rest from Hong Kong Island and the New Territories.

Investors made up around 40 per cent of the buyers, according to an agency. One group splashed around HK$22 million to scoop up three apartments, including a studio, a one-bedroom and a two-bedroom unit.

Investor sentiment in the property market improved recently after the Federal Reserve started easing interest rates. The US central bank cut its benchmark interest rate by 50 basis points last month, with the Hong Kong Monetary Authority following suit. The cuts have paved the way for the city’s commercial banks to trim their rates, which is expected to translate into savings for borrowers who tie their loans to prime rates.

Developers have accelerated the pace of property sales after the interest-rate cut. The market is expected to record over 2,000 transactions of new flats in October, a seven-month high.

Still, Hong Kong’s stock market been volatile recently, with the benchmark Hang Seng Index (HSI) slumping more than 9 per cent on Tuesday as investors took profits, after rallying more than 20 per cent since the US interest rate and China’s announcement of a package of stimulus measures to reboot the economy. The HSI ended the week down over 3 per cent.

The stock market uncertainty adds to the obstacles still faced by the city’s real estate sector, such as an excess inventory of homes and a fragile economy.

(South China Morning Post)

For more information of Office for Lease at AIRSIDE please visit: Office for Lease at AIRSIDE

For more information of Grade A Office for Lease in Kai Tak please visit: Grade A Office for Lease in Kai Tak

For more information of Office for Lease at International Commerce Centre please visit: Office for Lease at International Commerce Centre

For more information of Grade A Office for Lease in Tsim Sha Tsui please visit: Grade A Office for Lease in Tsim Sha Tsui

恒生中心2.6万呎租出 港铁公司进驻

九龙湾恒生中心全层楼面,面积约2.6万方呎,由港铁公司承租,业界人士预期月租约近60万,平均每呎23元。

市场消息表示,九龙湾德福广场恒生中心11楼全层,每层面积2.6万方呎,由港铁公司承租,预期呎租约23元,月租接近60万,港铁总部亦毗邻该项目,即德福广场港铁总部大楼,是次租用恒生中心,料作为扩充用途。

料平均呎租23元

市场消息指,恒生中心楼高15层,1995年恒生银行以约10.9亿购入该厦10层楼面,一直作自用,直至疫情期间,银行纷採在家工作安排,减省办公室楼面,恒生银行亦不例外,把其中多层自用楼面放租。

近年东九龙连录大手租务,包括资本策略牵头的九龙湾啟汇 (Harbourside HQ),获医院管理局租用2层半楼面,涉及达9万方呎,成为东九龙暂录最大宗的甲厦租赁成交。

月租料约60万

有代理表示,火炭黄竹洋街5至7号富昌中心G楼单位放售,建筑面积约4351方呎,意向价约2959万,平均每方呎约6800元。

上述单位楼底高约26呎10吋,楼面负重为500磅,单位内设独立冷气,现连装修出售。大厦设2部载货升降机,备有货台,可入40呎货柜。

(星岛日报)

更多啟汇写字楼出租楼盘资讯请参阅:啟汇写字楼出租

更多九龙湾区甲级写字楼出租楼盘资讯请参阅:九龙湾区甲级写字楼出租

骆克駅位处消费旺段 合餐饮业

铜锣湾银座式商厦林立,而骆克駅正对港铁站出口,加上罕有个别楼层可作复式铺,甚适合餐饮使用。

骆克駅位于铜锣湾骆克道,正对铜锣湾广场一期,亦邻近崇光百货,可算是铜锣湾传统消费地段,人流本身颇畅旺。

区内或同地段亦有不少银座式商厦,而骆克駅最大优势,是正对港铁站出口,而轩尼诗道及告士打道亦有多条巴士綫及电车站,交通极方便,有利商户经营。其他配套上,同地段本身亦有商场、商店等,整体气氛理想。

大厦于2008年落成,楼高26层,质素仍然甚新,地下设有一个铺位,面积约1,967平方呎,于零售高峰时,曾以每月120万元租予鐘錶店喜运佳,现铺位由烧烤店租用。地下入口楼底高,并设有租户广告板,可作各商户宣传之效,而大厦提供两部升降机通往各层,疏导人流上仍尚可。

提供多组复式单位

物业以楼上铺用途,地盘面积约2,182平方呎,总楼面约32,681平方呎,每层面积约1,267平方呎,以商铺使用来说不算大,项目最大特色之一,是提供多组复式单位,合共9组涉及18层楼面,而每组复式单位,均内置楼梯,打通后面积达2,500平方呎,适合餐厅使用,其中一组复式单位,涉及27及28楼,属项目顶层连天台,故更为适合天台餐厅。景观方面,绝大部分单位望向骆克道楼景。

租户方面,现时主要商户为餐厅,包括多间日式餐厅,亦有美容店等。据悉,目前大厦出租率约8成,呎租约40元。

项目早年由镇科集团发展,2017年以约9.65亿元,沽出骆克道487至489号骆克駅银座式商厦全幢,呎价约2.9万元,由「小巴大王」马亚木等投资者承接,作收租之用多年。

银座商厦全幢放售 估值8亿

铜锣湾银座式全幢商厦具投资价值,现业主放售骆克駅全幢,市值约8亿元。

全数租出 月收租可达150万

有外资代理行代理表示,铜锣湾骆克道487至489号骆克駅全幢现正放售,总建筑面积约32,681平方呎,以「现状」形式及连租约出售。

物业楼层高度约为3.3米,承重则为5千帕,目前主要由饮食及美容商铺承租。据悉,物业市值约8亿元。

现时大厦仍有数层待租,包括1及2楼,每层面积较大,涉逾2,000平方呎,楼底亦较高,适合多个行业。

另高层复式楼层,面积合共逾2,500平方呎,亦正在招租,呎租约40元。预计整项物业全数租出,每月租金收入约150万元。

同区租务上,附近铜锣湾广场二期中高层06室,面积约1,030平方呎,近日以每平方呎约38元租出。

(经济日报)

更多铜锣湾广场一期写字楼出租楼盘资讯请参阅:铜锣湾广场一期写字楼出租

更多铜锣湾广场二期写字楼出租楼盘资讯请参阅:铜锣湾广场二期写字楼出租

更多铜锣湾区甲级写字楼出租楼盘资讯请参阅:铜锣湾区甲级写字楼出租

般咸道全幢商住楼意向价2亿

西半山般咸道35号全幢商住楼放售,佔地面积约1648方呎,全幢面积约6545方呎,意向价约2亿。

有外资代理行说服小业主齐集100%业权放售,物业适宜活化作服务式住宅或其他用途,料回报逾3厘,公开邀约及招标截止日期12月18日。

属二级历史建筑

该行代理表示,该物业为「上居下铺」商住楼,楼高共4层,连地库每层佔约1115方呎至1600方呎,物业为新古典主义建筑设计,建筑体现罗马及希腊设计元素。物业位处于正街自动扶梯连接系统旁,距港铁西营盘站仅2分鐘步程。他又说,物业拥999年地契,是香港仅存欧式战前建筑,属于二级历史建筑。

(星岛日报)

CK Asset's (1113) Blue Coast II in Wong Chuk Hang unveiled a third price list offering 60 flats at an average of HK$22,404 per square foot after discounts, 2.4 percent higher than the second price list.

The flats include 23 two-bedroom and 37 three-bedroom units, with prices ranging from HK$9.4 million to HK$18.72 million after discounts.

CKA chief sales manager William Kwok Tze-wai expects prices will increase by 5 to 10 percent on future price lists.

The project attracted 35,000 visitors in three days and had received about 5,000 checks for 296 flats as of yesterday, making them nearly 16 times oversubscribed.

The first round of sales is expected to start this weekend.

Also, in Wong Chuk Hang, Southland sold two four-bedroom flats yesterday for a total of HK$90 million at prices of HK$39,571 per sq ft and HK$34,975 per sq ft respectively.

The project from Road King (1098) has raked in HK$15 billion from the sale of 729 flats - over 91 percent of the 800 units in the project.

In North Point, Sun Hung Kai Properties' (0016) Victoria Harbour II sold a three-bedroom flat and a feature flat worth a total of HK$87.3 million yesterday at HK$38,595 per sq ft and HK$57,365 per sq ft, respectively.

In Yuen Long, The Yoho Hub II put 52 flats on the market yesterday, including 20 two-bedroom and 32 three-bedroom units priced between HK$6.69 million and HK$14.03 million after discounts. The project from SHKP had sold over 600 flats as of Sunday.

In Mong Kok, Gateway Square Mile developed by Henderson Land (0012) will put 10 flats on sale this Friday.

They include six one-bedroom and four two-bedroom units, with sizes ranging from 260 to 353 sq ft and prices between HK$18,375 per sq ft to HK$22,371 per sq ft after discounts.

The project has sold 86 flats worth a total of nearly HK$500 million so far.

In Tseung Kwan O, Nan Fung Group's LP10 in Lohas Park sold two four-bedroom flats with sea views by tender yesterday for a total of HK$62.6 million.

The two flats were priced at HK$20,907 per sq ft and HK$20,250 per sq ft, respectively.

The project has sold 826 units out of a total of 893 flats so far.

(The Standard)The Henderson逾8900呎楼面租出

恒基旗下中环The Henderson再录承租,该厦中低层一个单位,面积逾8900方呎,以月租约98万租出。

市场消息透露,该厦2602室,面积约8916方呎,料以每呎110元租出,涉及月租约98万,惟未知租客类型。该厦接连获国际企业承租,包括艺术及奢侈品拍卖行佳士得亚太区总部、国际投资公司凯雷及瑞士高级制錶爱彼品牌等。

料呎租110元

The Henderson租客包括金卫医疗集团,以月租约96万租用建筑面积逾8000方呎单位,呎租约120元;内地大型汽车制造商华晨集团,以每月近79.2万承租中高层,建筑面积约6600方呎,呎租约120元。大手租客包括佳士得租用4层,涉约5万方呎,凯雷租用约2万方呎楼面。

(星岛日报)

更多The Henderson写字楼出租楼盘资讯请参阅:The Henderson 写字楼出租

更多中环区甲级写字楼出租楼盘资讯请参阅:中环区甲级写字楼出租

铜锣湾4层复式铺叫租48万

铜锣湾骆克道485号地下、一至三楼复式巨铺,翠华茶餐厅旧址,意向月租48万,较高峰期大幅回落约67%。

2017年月租达146万

有本港代理表示,铜锣湾骆克道485号地下及一至三楼招租,面积共约6500方呎,意向月租约48万,平均呎租约74元,与旧租客每月约55万相比,跌幅约12%。物业配备400A三相电以及食物电梯直通各层,提供生财工具及饮食大牌。

物业自2000年,由「阿一鲍鱼」创办人杨贯一开设的富临饭店租用长达约13年,其后翠华餐厅2014年抢租,签10年长约,首5年月租122万,随后5年于2017年升至146.4万,租约至2023年12月底,不过,翠华早于2020年2月起停业并纳空租。

(星岛日报)

运动品牌撤出骆驼漆 巨铺减价10%放租

近年零售市况每况愈下,商铺门店逐渐结业,结业潮甚至蔓延至「价廉物美」的工厦区,两大运动品牌「Adidas Outlet」及「Nike Outlet」,先后撤出观塘工厦地铺。

观塘骆驼漆大厦两大Outlet「Nike Outlet」及「Adidas Outlet」,向来是市民购买波鞋及运动服装的好去处,店铺先后在9月及10月撤出观塘骆驼漆大厦。

意向月租11万

骆驼漆大厦地铺向来是人气运动品牌热点,多间地铺以「Outlet」招徠,吸引顾客前来寻找平价波鞋。其中骆驼漆大厦1座地下的「Nike Factory Store Outlet」,在9月正式撤出观塘骆驼漆大厦1座B3号铺。

该店早在2009年开始承租骆驼漆大厦1座地下B3铺,面积约3171方呎,至今开业超过15年,业主于9月底重新招租,月租叫价11万。

Adidas Outlet同期撤出

继Nike退租后,另一承租骆驼漆大厦2座地下B2铺多年的运动品牌「Adidas Factory Outlet」,近日同样结业撤出大厦,该铺面积约2543方呎。

市场消息指,该店搬迁至九龙湾重新开业营运。恒富体育集团亦于7月时宣布,全新PUMA专门店已进驻骆驼漆大厦地铺。

(星岛日报)

茶饮店退租潮 柠濛濛弃铜锣湾店

近年不少内地茶饮品牌攻港,惟「水土不服」问题持续发生,市场消息透露,「LMM柠濛濛手打香水柠檬茶」设于铜锣湾广场一期地下的旗舰店连续几天「拉闸」(没有开业)。代理透露,租客想退租,大业主近日叫价6万元重新招租。

原6万元租 业主重新招租

据了解,该铺为铜锣湾广场一期地下8号铺,面积约400平方呎,原本由保险公司承租,去年8、9月间租予柠濛濛,每月月租约6万元,租期原本至2026年10月,惟该店开业不足1年便退租。

资料显示,柠濛濛旗下旺角登打士街分店今年6月结业,天后站分店则于7月结业,若连上述铜锣湾广场一期分店计,短期内连续3间分店结业。

有报道引述,LMM柠濛濛在小红书专页发文指出,在香港开设茶饮店与内地的相差甚大,包括租金、註册餐饮牌照费用、水电费用、人工成本等,更指香港开店成本,分分鐘高逾3,000万元。

其次,另一个内地品牌于旺角的分店早前亦提早退租,该铺为旺角豉油街50号富达大厦地下6号铺,面积约530平方呎,本年5月以月租约12万元租出,新租客为内地柠季手打柠檬茶。开业不足半年,据了解近日该租客已迁出,店外贴上代理招租广告。代理指,业主现以每月约13.2万放租,较旧租高约1成,

该品牌在开业装修时,店外贴上广告宣称在内地获评为美团、抖音TOP5茶饮店。据悉,目前品牌在港仍有其他分店,包括大埔新达广场等。

(经济日报)

更多铜锣湾广场一期写字楼出租楼盘资讯请参阅:铜锣湾广场一期写字楼出租

更多铜锣湾区甲级写字楼出租楼盘资讯请参阅:铜锣湾区甲级写字楼出租

邓成波家族9200万 蚀沽庙街物业

邓成波家族沽货,旗下油麻地庙街全幢商住物业,以9,200万易手,蚀逾5,000万元离场。

消息指,油麻地庙街41、41A、43号全幢及45号地下及4楼,合共以约9,200万元沽出。涉及物业位于油麻地庙街头段及永星里交界,正对庙街食街传统旺段,现为10层高住宅大厦,设升降机,总实用面积约15,000平方呎,住宅部分现为学生宿舍营运商全幢租用,租约至2026年,涉及月租约41.3万元,以9,200万元成交价计,呎价约6,133元,回报率至少逾5.4厘。

呎价6133元 租金回报5.4厘

据悉,该批物业由邓成波家族持有,波叔早于2015年展开收购,两年间合共以1.47亿元购入,当时估计家族收集业权日后重建。本年8月,该家族委託代理行放售,叫价约1.2亿元,如今降价23%沽货。持货约7年沽出物业,蚀5,500万元离场,幅度达37%。

另有本港代理表示,铜锣湾骆克道485号地下及1至3楼现正招租,该物业面积共约6,500平方呎,意向月租约48万元,平均呎租约74元,与旧租客茶餐厅每月约55万元租金相比,跌幅约12%。

(经济日报)

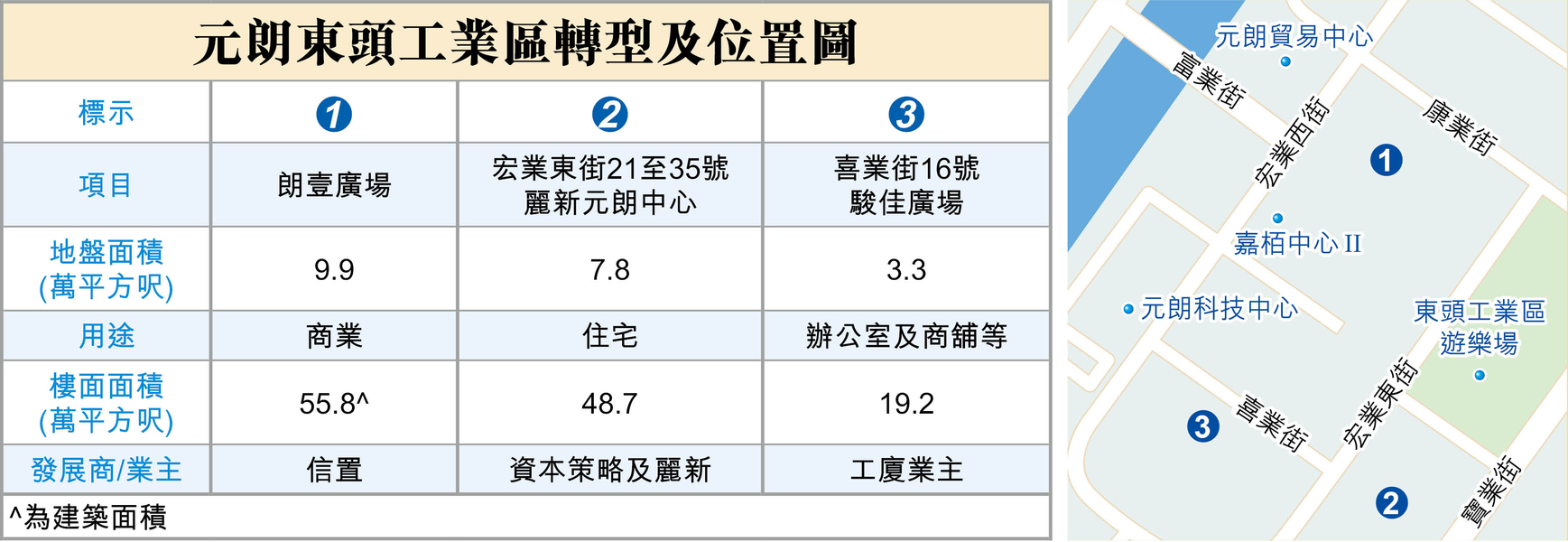

朗壹广场 东头区最大商业项目

近年元朗东头工业区转型成为住宅及商贸区,除了信置 (00083) 旗下大型商业项目朗壹广场落成,提供约55.8万平方呎楼面外,资本策略 (00497) 及丽新发展 (00488) 部署重建区内工厦成住宅项目,涉及逾千伙。

元朗东头工业区佔地约75万平方呎,位于港铁朗屏站朗业路以北,属于规划署约10年前建议改划的7个工业区之一,近年已经陆续有工厦展开重建成为住宅,包括尚豪庭、映御、雨后、朗屏8号及居屋宏富苑等多个住宅项目。

楼面56万呎集零售写字楼一身

至于现时区内规模最大的商业项目,则属于信置旗下朗壹广场 (ONE NORTH),该项目前身为宏业西街与康业街交界商贸地,由发展商于2015年以约16.9亿元投得,现时已经兴建成基座商场以及两幢写字楼,总楼面约55.8万平方呎,并于2022年落成,属于同区最新及最大商业项目。

朗壹广场由基座3层高的零售商场,以及基座以上2幢楼高14层的写字楼组成,零售餐饮面积则涉约11.3万平方呎,而写字楼部分每层楼面约1.7万平方呎,净天花楼底高度约3.1米,总写字楼楼面约44.5万平方呎,另外亦有2万平方呎的休憩园林。

丽新元朗中心批增建逾2成单位

另外,同区由资本策略及丽新发展持有的丽新元朗中心,位于元朗宏业东街21至35号,现时为9层高工厦,于1986年落成、楼龄38年,发展商近年曾经提出多个不同重建计划,包括在2019年曾拟重建成1幢16层高商厦,而在去年亦获城规会批准重建成2幢住宅大楼。

根据发展方案,项目将会重建成2座29层高住宅大楼,及1座3层高的商铺等非住用设施,其中住宅部分将会提供约1,019个单位,平均单位面积约461平方呎,总楼面涉约48.7万平方呎,相较2021年的旧方案,单位数目增加191伙,增幅约23%。

另外,同区工厦业主持有的喜业街骏佳广场,则曾经申请以地积比率5.75倍重建,以重建成1幢10层高商厦,总楼面约19.2万平方呎,其中逾半或约10万平方呎作为停车场,其餘写字楼及零售分别佔7万及2.2万平方呎。

喜业工厦呎价 跑赢大市

据EPRC经济地产库资料显示,元朗区过去1年录得约12宗工厦成交,平均呎价介乎约3,000至4,000餘元,其中喜业工厂大厦于8月中录得一宗成交,呎价约4,185元。

元朗工厦年内12宗成交

喜业工厂大厦位于喜业街2至6号,楼龄约37年,据EPRC经济地产库资料显示,该厦交投不算活跃,8月录得1宗成交,涉及2楼一个单位,面积约1,596平方呎,以约668万元沽出,平均呎价约4,185元,相较原业主于2021年年中以约574.6万元购入,持货约3年时间,转手帐面赚约93.4万元,期内升值16%,跑赢大市。

至于交投比较活跃则是富华工业大厦及嘉华工业大厦,前者在过去一年录得6宗成交,后者亦录得4宗成交,其中位于喜业街,楼龄约39年的富华工业大厦,在7月中录得1楼3个单位以合计980万元沽出,该批单位合计面积约3,467平方呎,以此计算,平均呎价约2,827元。原业主于2000年以约75万元购入该批单位,至今持货24年,现转手帐面赚905万元,期内单位升值逾12倍。

(经济日报)

更多朗壹广场写字楼出租楼盘资讯请参阅:朗壹广场写字楼出租

更多元朗区甲级写字楼出租楼盘资讯请参阅:元朗区甲级写字楼出租

琼林街83号「PORTAS」铺位获雪糕店3.2万承租

有代理行表示,长沙湾琼林街83号「PORTAS」一个铺位物业租出,物业实用面积约592方呎,以月租约3.2万元租出,呎租约54元,新租客经营雪糕店。

该行指出,「PORTAS」位于九龙西核心地带,徒步即可到达港铁荔枝角站,属区内罕有双子塔地标甲厦;发展商推出招租至今一直广受欢迎,其中商铺部分最受餐饮业青睞,现已获台式及越南餐厅进驻。

(信报)

更多PORTAS写字楼出租楼盘资讯请参阅:PORTAS写字楼出租

更多长沙湾区甲级写字楼出租楼盘资讯请参阅:长沙湾区甲级写字楼出租

Cheung Sha Wan flats priced at eight-year low

Chinachem Group's Echo House in Cheung Sha Wan announced the first price list offering 50 flats at an average price of HK$14,888 per square foot after discounts, an eight-year low for the district.

The rollouts come at a time when both UBS and HSBC Global Research are forecasting home prices in Hong Kong to rise by 5 percent next year.

UBS expects prices to rebound by up to 5 percent next year due to a lower interest rates, limited supply, a rise in population and higher rentals.

HSBC Global Research, too, anticipates a rise of 5 percent next year compared with 2 percent expected before, due to rate cuts and a rebound in retail business.

The Echo House flats are 3.8 percent lower than units in nearby project Park One of Henderson Land's (0012), which launched the first batch of 50 units with a price of HK$15,482 per sq ft in 2016.

In Wong Chuk Hang, CK Asset (1113) announced the sale of 256 flats in Blue Coast II under the price list in the first round of sales on Saturday.

The flats were priced between HK$9.21 million and HK$18.91 million after discounts.

In Kai Tak, Cullinan Sky by Sun Hung Kai Properties (0016) announced the third round of sales offering 248 flats at an average price of HK$22,120 per sq ft after discounts, with prices for some of the units raised by 3 percent.

Also in Kai Tak, The Knightsbridge, co-developed by six developers including Henderson Land (0012), China Overseas (0688) and Chinachem, announced the sale of 55 flats by tender.

In Sheung Wan, Hanison's (0896) Hollywood Hill said it sold 24 flats worth HK$176 million since the developer switched from renting units out to selling them off amid the rate-cut cycle. The flats were priced at HK$18,300 per sq ft on average, 30 percent lower than in 2021.

In addition, the Lands Department received land premiums worth HK$1.89 billion from 22 lease modifications and two land exchanges, instead of 24 land transactions the third quarter, marking a nearly 18 percent quarter-on-quarter decrease.

(The Standard)京东进驻中环怡和大厦签逾三年约

电商龙头京东近期动作多,旗下京东产发早前购入沙田利丰中心全幢,其相关公司亦进驻中环怡和大厦,面积逾3000方呎,业界料呎租逾110元,涉资逾33万。

平均呎租逾110元

市场消息透露,中环怡和大厦36楼14至19号室,由JD. COM INT'L LTD 承租,该单位面积逾3000方呎,料呎租逾110元,租期由今年6月至2027年7月,合共37个月,旧租客为一间律师楼,租期为2020年1月至2027年7月,由于提早撤出,由京东相关公司承租。

京东旗下京东产发早前亦购入石门安平街2号利丰中心全幢物流中心,市场消息指购入价约18亿,以全幢总楼面约48.73万方呎计,平均呎价约3694元,部分单位将作为自用,以配合在香港不断扩充网购业务。至于该厦租客跨国企业Maersk,早前曾一度外出觅租盘,不过,最终京东让其继续承租该厦。

料月租逾33万

该物业原业主为M&G英卓房地产投资持有,该项目为今年至今暂录最大宗工厦买卖。

有代理表示,湾仔轩尼诗道338号北海中心25楼A及B室,总面积约为2460方呎,平均呎价仅约7888元,物业目前由业主自用中,拥有开扬景观,内部精心装修,配套设施状况极佳,将以交吉形式出售。

(星岛日报)

更多怡和大厦写字楼出租楼盘资讯请参阅:怡和大厦写字楼出租

更多中环区甲级写字楼出租楼盘资讯请参阅:中环区甲级写字楼出租

更多北海中心写字楼出售楼盘资讯请参阅:北海中心写字楼出售

更多湾仔区甲级写字楼出售楼盘资讯请参阅:湾仔区甲级写字楼出售

CK Asset ups prices at three projects

CK Asset (1113) announced a 3 percent price hike in 121 flats across three projects.

The projects include El Futuro in Sha Tin, #Lyos in Yuen Long and Grand Jeté Phase I in Tuen Mun.

CKA executive director Justin Chiu Kwok-hung said the decision to raise prices was made before the announcement of the policy address, which he believes will further boost the market through favorable measures.

Meanwhile, Blue Coast II in Wong Chuk Hang, co-developed by CKA and MTR Corporation (0066), said it has received nearly 7,000 checks over six days for 256 flats, making them 26 times oversubscribed.

Also in Wong Chuk Hang, three flats at Southland developed by Road King (1098) were sold for more than HK$93 million yesterday.

The price list of The Pavilia Forest at the old Kai Tak airport runway, co-developed by New World Development (0017) and Far East Consortium International (0035), was also revised, offering seven two-bedroom flats at unit prices of HK$17,634 to HK$20,610 per square foot after a 17 percent discount.

In other news, Henderson Land (0012) is renting out 20 flats at its new projects instead of selling them, amid growing demand for rental accommodation. A total of 14 units at the developer's The Upper South in Aberdeen Island have already been rented.

(The Standard)减息股市向好 推动甲厦买卖

近期受减息及股市反弹等利好因素带动,甲厦录得数宗买卖,业界料可推动成交上升,惟呎价仍会在低位徘徊。

据一间本港代理行每月十大指标甲厦买卖上,9月份录5宗成交。湾仔会展广场办公大楼近期录得1宗低价成交,涉及物业33楼7及9室,面积约9,000平方呎,属该厦罕有全海景单位,以约1.35亿元易手,呎价约1.5万元,按此成交呎价计,重回2011年水平。买家为资深投资者蔡志忠,购入作投资之用。

会展广场办公大楼重售 1年跌价逾5成

是次涉及会展广场办公大楼单位,曾由中资机构持有,2023年中物业获中资财团斥约3亿元购入,惟最终取消交易,单位重新放售,市况亦转差沦为银主盘,如今重新沽出,价格1年间下跌55%。

另金鐘最具指标甲厦为力宝中心,近期更一连录2宗低价成交,涉及2座中低层5室,面积约1,505平方呎,以约2,000万元易手,平均呎价约1.33万元,一度创逾10年呎价新低。原业主于2012年以约2,739.1万元购入单位,帐面亏损约739.1万元。另力宝中心二座低层11至12号室,面积约2,199平方呎,最新连租约以约2,728万元易手、呎价约1.24万元。

据悉,上述单位月租约9.34万元,租期至明年5月,新买家享租金回报约4.1厘。原业主持货逾6年,帐面蚀约5,552万元或67%。

信德中心低层 呎价1.58万沽

上环区方面,指标甲厦定为信德中心,近期资深投资者罗守辉售上环信德中心招商局大厦902室,面积约1,158平方呎,涉及约1,838万元,平均呎价15,872元。原业主早于2005年以约590万元购入单位,持货19年帐面获利约1,248万元,物业升值2.1倍。

该行代理认为,自从减息后,对整体市况气氛已有好转,而近期股市整体向好,亦带动投资市场,有用家及投资者稍加快部署。同时间,由于部分业主仍有沽货压力,愿意大幅降低叫价,即吸引承接。后市上,整体市况气氛改善,加上施政报告中提及放宽按揭等措施,均有利商厦投资,预计成交量有望上升,价格上仍在低位徘徊。他强调,商厦市场全面反弹,仍要经济配合。

(经济日报)

更多会展广场办公大楼写字楼出售楼盘资讯请参阅:会展广场办公大楼写字楼出售

更多湾仔区甲级写字楼出售楼盘资讯请参阅:湾仔区甲级写字楼出售

更多力宝中心写字楼出售楼盘资讯请参阅:力宝中心写字楼出售

更多金鐘区甲级写字楼出售楼盘资讯请参阅:金鐘区甲级写字楼出售

更多信德中心写字楼出售楼盘资讯请参阅:信德中心写字楼出售

更多上环区甲级写字楼出售楼盘资讯请参阅:上环区甲级写字楼出售

工商铺9月买卖266宗 按月微跌

统计指,9月份工商铺买卖录得266宗,按月微跌1.1%。

据土地註册处初步临时数字显示,2024年9月全港共录得266宗工商铺物业买卖登记,较8月份的269宗微跌1.1%或3宗,连跌4个月,惟跌势已见喘稳,预期受减息及内地全面救市带动本港市场气氛回暖下,可令后市逐步回升。9月份三大范畴物业登记量录得2升1跌,当中商厦及店铺双双升逾2成,但佔比最重的工厦却减少17.3%,而拖累整体登记出现微跌。

有代理指出,9月份工厦买卖登记量再度回软,反映资金在观望息口去向未有定案前仍把持不定,上月工厦登记佔比降至只有50.4%,按月跌约9.8个百分点。初步数字显示,9月全月工厦共录得134宗买卖登记,按月挫17.3%,创近6个月新低。至于9月份工厦登记总值为18.23亿元,与8月相若,按月微跌0.92%,但仍为今年内次高水平。

商厦量价齐涨 金额倍升

商厦买卖登记方面,另一代理表示,今年以来表现持续反覆,最新则重上半百宗水平,后市在整体市场气氛回暖下可略为看好。总结9月全月商厦共录得54宗买卖,较8月份的43宗大升25.6%,为工商铺中登记量升幅最大。至于月内商厦登记总值更激增近1.2倍,劲录19.92亿元,创下近5个月最多。

店铺市场同样向好,另一代理指出,店铺买卖在上月结束4连跌,出现逾2成反弹,反映店铺市道初有起色。数据显示,9月份店铺买卖登记录得78宗,按月上升21.9%;不过月内店铺登记总值则跌18.1%,仅得10.60亿元,创7个月低位。展望后市,在内地救市、市场回暖及观察国庆黄金周来港旅客情况,加上本地近期市道渐转旺,相信店铺后市有望转趋乐观。

(经济日报)

上环中远大厦意向呎价1.28万

有代理称,上环皇后大道中183号中远大厦低层01室,建筑面积约2139方呎,意向价约2750万,平均每呎售价约12856元,物业以交吉形式出售。许氏指出,上述单位间隔方正实用,加上中远大厦属上环地标商厦,徒步至港铁上环站A2出口仅约2分鐘。

交吉形式推出

近期指标甲厦售价纷跌至每呎1万多元,其中,力宝中心连录2宗买卖,其中一个「摸顶货」6年间贬值64%,力宝中心二座511至512室,建筑面积约2199方呎,以易手价2860万,平均呎价1.3万,该单位望部分海景,连上市公司租约,月租9.35万,明年5月届满,另加2年生约,料回报3.9厘。

(星岛日报)

更多中远大厦写字楼出售楼盘资讯请参阅:中远大厦写字楼出售

更多上环区甲级写字楼出售楼盘资讯请参阅:上环区甲级写字楼出售

更多力宝中心写字楼出售楼盘资讯请参阅:力宝中心写字楼出售

更多金鐘区甲级写字楼出售楼盘资讯请参阅:金鐘区甲级写字楼出售

本地共享办公室扩充迎「高才通」 进驻中环中心 大手承租2.6万呎单位