信和旗下元朗 ONE NORTH 朗壹广场,其中第1座写字楼楼面已租出逾80%楼面,租客包括港铁公司及卓滙集团等。

港铁承租13.4万方呎

朗壹广场与港铁公司达成租约协议,将分阶段承租合共8层,涉及楼面约13.4万方呎,作为其当区铁路项目工程综合办事处。

卓滙集团承租1.03万呎

另一重要租户为环保及清洁品牌卓滙集团,承租面积达10300方呎。商场零售区由本地攀爬运动品牌香港攀爬乐园,承租地面楼层逾10000方呎的室内攀石场,已于9月开幕,该品牌亦同时在商场中庭营运近10米高攀石设施。

(星岛日报)

更多朗壹广场写字楼出租楼盘资讯请参阅:朗壹广场写字楼出租

更多元朗区甲级写字楼出租楼盘资讯请参阅:元朗区甲级写字楼出租

政府拟推5产业用地 元朗佔3幅

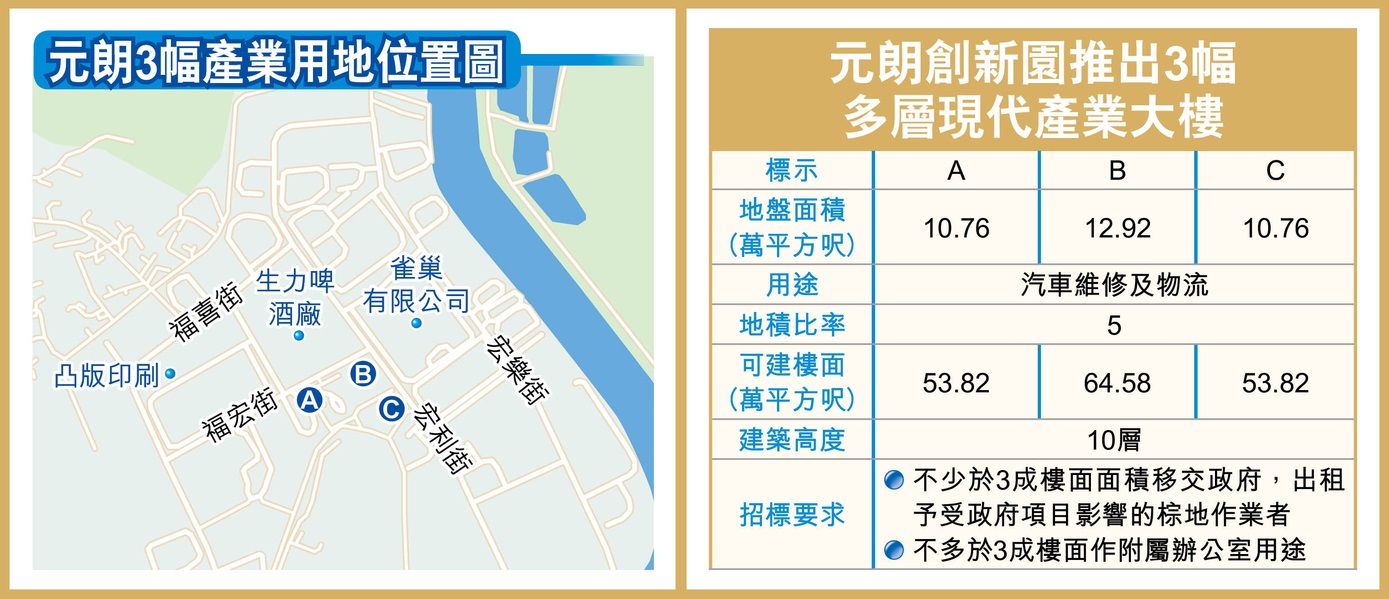

政府计划推出5幅多层产业大楼用地,其中3幅位于元朗横洲创新园,合共提供约172万平方呎楼面,每幅规模约50万至60万平方呎,将会发展汽车维修及物流等用途。

政府选定首批5幅位于元朗创新园及洪水桥/厦村的多层现代产业大楼用地,主要作为物流及汽车销售维修保养用途,最快明年陆续推出招标,将提供约775万平方呎楼面供应,预计2027/28年起陆续落成,其中2幅规模比较巨型的物流地位于洪水桥,其餘3幅元朗创新园的用地规模相对较小。

楼面172万呎 作汽车维修物流

元朗创新园的3幅用地合共提供约172万平方呎楼面,佔首批5幅产业用地的总楼面775万平方呎只有约2成,每幅用地面积约10.76万至12.92万平方呎不等,地积比率划一为5倍,可建楼面约53.82万至64.58万平方呎不等,规模相对较小。

该3幅用地均位于福宏街跟宏利街交界,邻近微电子中心,现址为巴士总站、露天货仓及露天停车场等用途,其中福宏街及宏利街的2幅用地佔地约10.76万平方呎,而属于两面单边交界位置的用地佔地则约12.92万平方呎。

不少于3成楼面 须移交政府

按照政府计划,元朗的3幅用地未来计划作为汽车服务及维修、物流及货柜等产业用途,跟洪水桥的两幅用地主要作物流用途略有所不同。不过该3幅用地同样规定投得项目的发展商、营运商在建成项目之后,须将不少于3成楼面面积移交政府,由政府委任的代理机构管理,出租予受政府项目影响的棕地作业者,目的以有序和具效益方式整合和容纳对本地经济有贡献的棕地作业。

事实上,早前团结香港基金指,参考本港现有不同汽车城的营运模式,认为多层产业大楼所兴建的汽车城以地标式多用途形式营运,提供由展销、维修等纵向服务,并可同时设娱乐、餐饮等多元化消閒,增加市民享有服务体验。同时基金会亦建议,有关用地面积须在2公顷 (21.5万平方呎) 以上,另卖地条款规定不能够拆售,亦要引入不同汽车制造商或代理商。

(经济日报)

外资代理行促撤辣 指楼市处危险期

明年面对多项挑战 估中小楼价跌1成

今年楼价由升转跌,有外资代理行认为,明年楼市仍面对多项挑战,中小型住宅楼价将再跌1成,该行更认为现楼市处危险期,建议政府全面撤辣。

该行表示,高息及外围经济环境欠佳下,买家对入市抱观望态度,导致下半年住宅市场更低迷。截至11月,今年中小型住宅楼价下跌3.1%,重返2017年3月的价格水平。

指按息倘降 楼价难显著反弹

该行负责人表示,政府减辣对楼市没有任何帮助。发展商较以往更积极促销楼盘,提供达双位数的楼价折扣。虽然市场预期美联储从2024年中开始降息,但由于流动性紧缩以及目前定存利率相比于按揭利率较高,本地银行可能不会立即跟进。此外,即使明年按揭利率下降,楼价依然难以显著反弹,预期楼价将持续下跌,中小型住宅楼价于2024年将下跌约1成,重返2016年的水平。该行形容,现时楼市站在危险山坡旁边,香港受环球经济差、地缘政治及高息影响,明年一旦楼价再下跌10%,负资产数目料将升至约3万宗水平,削弱市民消费意慾,继而影响经济。

有见楼价料进一步向下,该行建议政府全面撤辣,带动更多外来资金入市,并为首次置业的年轻人提供无息贷款,以协助晋身买楼阶梯。

写字楼市场方面,该行指,整体甲级写字楼空置率于今年年底升至12.9%,来自内地企业的租赁需求逐渐改善。今年中环的总租赁楼面约有22%涉及内地租户,较去年约6%回升。该行代理预计,今明两年有多幢优质新商厦落成,将带动租务上升,并会集中能配合可持续发展的新商厦,整体甲厦租金明年将下跌5至10%。

(经济日报)

13% Hongkongers think it is a ‘good time’ to buy property, second highest level of optimism on record, Citi survey shows

A Citi Hong Kong survey found that 13 per cent of the respondents think it is the ideal time to buy a home, down from 16 per cent in September 2022

The survey, of 1,100 respondents, also found that fewer residents expect property price increases in the next 12 months

The number of Hongkongers who say it is a “good time” to buy a house fell three percentage points in September from a year ago, according to a study conducted by Citi Hong Kong, but it is the second most optimistic result recorded in the past 11 years.

A Citi Hong Kong survey conducted in September found that 13 per cent of the respondents think it is the ideal time to buy a home, down from 16 per cent a year ago. The survey held via telephone and street interviews with 1,100 people, also found that fewer residents expect increases in the prices of dwellings in the next 12 months. In the survey conducted in 2021, only 4 per cent of respondents thought it was an ideal time to purchase a house.

Only 10 per cent of those interviewed felt that prices would rise, down from 12 per cent a year ago, while the percentage who see prices falling has risen to 57 per cent from 51 per cent.

Citi has been holding the survey since 2010 to assess the state of home ownership in Hong Kong, gauge public sentiment regarding home ownership and track public expectations of future housing price trends.

“While the percentage of respondents considering now a good time to enter the market has remained historically high, many respondents have a wait-and-see attitude towards home ownership,” the report said.

“When asked about the level of property price considered ideal, those respondents interested in home ownership suggested a median price of HK$5 million (US$640,000), way lower than the current median housing price in Hong Kong.”

Based on average prices in the city of homes with sizes ranging from below 40 square metres to units bigger than 160 square metres, a dwelling in the city could cost between HK$4.67 million and HK$59.2 million.

The city’s residential market has struggled with a downturn as lived-in home prices fell by nearly a fifth in October from a peak in September 2021, according to the latest official data.

Meanwhile, new residential launches have also seen developers pricing their flats at close to six-year lows. Sun Hung Kai Properties’ flats at Yoho West, whose sale was launched this month, had an average price tag of HK$10,888 per square foot after discounts, a level not seen since 2017.

A property agent said home prices are unlikely to experience a significant rebound due to the government plans to build 39,100 subsidised sale flats in the next five years, which will dampen demand in the private housing market.

Without support for the downward momentum, negative equities are expected to increase to about 30,000 cases if the home prices drop a further 10 per cent next year, according to the agent who suggested the government should remove all cooling measures and provide interest-free loans to assist the young generation of first-time buyers in getting on the property ladder.

Among those keen on buying a home, the 21 to 29 age group had the highest level of interest, at 21 per cent.

“Among the young respondents, their discontent with their current place of residence is mostly related to their dissatisfaction with the transport network and supporting facilities there,” the study said.

An overwhelming 80 per cent of the young respondents also showed support for easing property curbs, as “56 per cent pointed to the positive effect of lower stamp duties on their desire to purchase a property and the price range of properties available for selection”.

On the other hand, of the respondents who already owned a home, about 90 per cent expressed no interest in selling their properties.

(South China Morning Post)