财团8280万收购摆花街地铺 高市价约50% 每呎8.28万

财团于2020年前就摆花街一幢申请强拍,未获批准,最新购入该旧楼的一个地铺连阁楼,将令收购计画取得突破,该地铺作价8280万,较市价高出约50%,平均每呎8.28万。

上址为中环摆花街11号地铺连入则阁,建筑面积各为约1000方呎,以8280万易手,平均呎价8.28万,铺位阔19呎,深41呎,租客The Candel Company。原业主2001年8月以700万买入铺位,持货逾21年,帐面获利7580万,物业升值逾10倍。

持货21年升值逾10倍

盛滙商铺基金创办人李根兴评论道,上述地铺市值约5000至6000万,月租约11至12万,料回报约2.5厘,因此,收购价高市价50%,不过,较5年前的收购价大跌,毗邻的9、13、15及17号地铺连阁楼,面积相若,早于2018年被收购,作价分别为1.48亿、1.336亿、1.35亿及1.48亿,最新铺位收购价较5年前低逾40%。

上述摆花街9至19号旧楼,市传由新世界相关的财团收购,早于2018年之前涉足该项目,并于2020年5月,就11至17号涉及4个地段的2幢旧楼,合併申请强拍,当时,11号地下及阁楼业主 (即上述成交铺位的业主),对申请提出质疑,反对强拍。

收购价较5年前低40%

去年11月,审裁官作出裁决,由于摆花街11至13号旧楼,与15至17号并无连接楼梯,不应以同一个申请处理,而申请者已拥有15至17号全数业权,并不合强拍条例,因此,申请人只可就餘下的11至13号旧楼,继续申请强拍程序。业内人士指,经历数年来铺市大跌,最终铺主有见收购价高于市价50%,才首肯被收购。

财团五年前收购摆花街旧楼,地铺收购价由逾1.3至1.48亿,其中一个拒绝收购,随着铺市大跌,最新仅以8280万获收购。

(星岛日报)

Sluggish Hong Kong office-rental market shows signs of bottoming out as enquiries pick up, analysts foresee rising rents

Rents are expected to edge up by the end of the year, according to market players

The office vacancy rate stood at 14.4 per cent last year, the highest since 1998

Hong Kong’s depressed office-rental market is showing signs of bottoming out, with agents fielding more leasing enquiries and rents expected to edge up by the end of the year, according to market players.

The reopening of the border with mainland China has resulted in a significant increase in enquiries, according to Hongkong Land, Central’s biggest landlord.

“Leasing has been quite active recently,” an agent said. “Landlords have greater confidence and are panicking less.”

At the beginning of the year, the market was still difficult “since we needed to recoup previous losses in the last three years of the pandemic”, the agent added. “Market sentiment should improve at year’s end.”

In the last three years, overall office rents have sunk 22 per cent, she said, adding that the decline has slowed this year, with rents dipping 0.8 per cent overall as of late March. Rents may edge up about 3 per cent this year, the agent added.

Hong Kong’s overall office vacancy rate stood at 14.4 per cent last year, the highest since 1998, according to the Hong Kong Property Review 2023 published by the Rating and Valuation Department on Friday. In Kowloon East, vacancy rate amounts to as much as 20 per cent, though rents edged up in the fourth quarter, the agent said.

For 2022 as a whole, real gross domestic product (GDP) contracted by 3.5 per cent. Looking ahead, the Hong Kong economy is expected to stage a rebound in 2023, with real GDP forecast to grow by 3.5 to 5.5 per cent, according to the government.

Another agency echoed the agent’s view, finding in a report that the Hong Kong office market saw stronger activity in February as market sentiment improved in tandem with the revival of economic activity, though rents still dipped.

Companies from multiple sectors took advantage of the favourable market for tenants in February to consolidate and upgrade their office space. For example, Canadian pension fund CPPIB leased two floors in Henderson Land’s new and as yet incomplete 36-floor The Henderson, in a consolidation from York House, another agency said.

An unnamed beverage company is also relocating from Exchange Tower in Kowloon Bay to The Henderson, and luxury brand Hermes is relocating its office with an upgrade and consolidation from Chinachem Leighton Plaza to Lee Garden One, the agency added.

Increasing demand for small and medium-sized space continues to favour the co-working sector, fuelling expansion, the consultancy said.

“If you go back over the last three years, we had certain months that were pretty grim,” said Neil Anderson, director and head of office, commercial property at Hongkong Land, which has 4.9 million sq ft of commercial real estate in Central. “It’s fair to say we’re talking single digits. I think there was one month where we had eight introductions in terms of the demand for office space – pretty lacklustre.”

Leasing enquiries then rose to 21 in January, 39 in February and 46 as of March 28, he said last week at an event hosted by the landlord.

“Forty-six is very high,” Anderson said. “We’re not going to be doing deals with every single inquiry – that’s just the nature of the business. But in terms of the level of demand, and how busy we are as a business, that does kind of tell you that things are looking a lot more optimistic and healthy. Transaction volumes will come later.”

Companies from mainland China are also on the market for deals, according to an analyst. Companies including Huawei Technologies and Huatai Financial have leased office space in Central, another agent said.

(South China Morning Post)

For more information of Office for Lease at The Henderson please visit: Office for Lease at The Henderson

For more information of Office for Lease at York House please visit: Office for Lease at York House

For more information of Grade A Office for Lease in Central please visit: Grade A Office for Lease in Central

For more information of Office for Lease at Exchange Tower please visit: Office for Lease at Exchange Tower

For more information of Grade A Office for Lease in Kowloon Bay please visit: Grade A Office for Lease in Kowloon Bay

For more information of Office for Lease in Chinachem Leighton Plaza please visit: Office for Lease in Chinachem Leighton Plaza

For more information of Office for Lease in Lee Garden One please visit: Office for Lease in Lee Garden One

For more information of Grade A Office for Lease in Causeway Bay please visit: Grade A Office for Lease in Causeway Bay

Chinachem, MTR sell 70 per cent of flats at In One project amid improving sentiment

The project’s geographical advantage and location above a MTR station are attractive to many investors, an agent says

Sales this weekend have attracted quite a good response so far: another agent said

Chinachem Properties and the MTR Corp sold 151 – about 70 per cent – of the 210 flats on offer at their latest project, In One, on Sunday, as easing interest rate rises boost sentiment among homebuyers and investors.

The units at In One, phase 1C of the Ho Man Tin station property development, consist of two and three-bedroom units ranging between 423 to 934 sq ft in size. After discounts, they are priced between HK$12.18 million (US$1.64 million) and HK$29.77 million, with a discounted average price per square foot of HK$29,348.

“The project’s geographical advantage and location above a MTR station are also attractive to many investors, who made up 40 per cent of our clients,” an agent said. Young people aged below 40 years accounted for 70 per cent of all buyers.

The average price after discount was higher than the HK$27,083 per square foot offered in previous rounds, but Chinachem said the current round included apartments on higher floors and should not be compared directly. Homebuyers bought all 179 units of phase 1B last Monday.

Three customers bought two flats at In One, with one spending about HK$38 million on a three-bedroom unit and a two-bedroom unit, an agent said.

Homebuyers also snapped up 75 per cent of flats at Wheelock Properties’ Koko Mare in Lam Tin within three hours on Saturday.

“Sales this weekend have attracted quite a good response so far, selling 70 to 80 per cent on first days of sales,” another agent said. “Market activity is still strong in the first-hand market.”

When compared with the previous week, however, the number of first-hand transactions dropped from more than 600 units to around 360 units this weekend, the agent said. “It seems that first-hand demand dried up a bit after the market took up over 2,000 first-hand transactions in March,” the agent said.

Sales of brand new homes might slow down further during the long Easter holiday, with many local buyers travelling, the agent said.

Other recent launches, including Star Properties’ After The Rain project in Yuen Long, Henderson Land’s One Innovale in Fanling and Sun Hung Kai Properties’ Novo Land in Tuen Mun, have also attracted strong interest.

Property demand has surged in Hong Kong amid hopes that the city has reached a peak in terms of interest rate increases. Sales of new and lived-in homes could hit 66,000 units this year, up nearly 50 per cent from last year, according to market observers.

The Hong Kong Monetary Authority last month raised the city’s base rate to a 15-year high of 5.25 per cent, after the US Federal Reserve increased its target rate by a quarter point. However, Hong Kong’s major lenders, including HSBC and Bank of China (Hong Kong), kept their best lending rates unchanged between 5.625 per cent and 5.875 per cent.

A total of 13,161 residential units, comprising 1,958 new homes and 11,203 lived-in units, have been sold in Hong Kong between January 1 and March 22, according to Land Registry data. The transactions were 25 per cent higher compared with the same period a year ago.

The reopening of the border between Hong Kong and mainland China is also boosting confidence among investors, who are snapping up property, as an economic recovery in Hong Kong is also likely to bolster demand for homes in the city.

An agent said the easing banking crisis in US and Europe has also boosted buyer sentiment, as well as a rebound in Hong Kong stocks. These circumstances have led to a boost among middle-class buyers, who are more confident about entering the market.

“Brand-new homes are still very attractive and it is believed that the hot sales seen in March can be maintained,” the agent said.

(South China Morning Post)

255 homes snapped up as weekend sales boom

At least 255 flats were sold from two new projects - In One and Koko Mare - over the weekend while transactions in the secondary market also rebounded.

In One atop the Ho Man Tin MTR station sold 152 units as of 6.30pm yesterday at a discounted average price of HK$28,036 per square foot.

The project is co-developed by Chinachem and MTR Corporation (0066), and a total of 210 flats were put for sale on the price lists yesterday, including 142 two-bedroom and 68 three-bedroom units. The cheapest unit was priced at HK$12.2 million.

Chinachem said that within the first half hour of sales, customers had already picked 50 flats, with the majority of them buying the units for self-occupancy.

During the period, there were five instances where groups of buyers purchased two units each. Of these, three groups opted to buy one 2-bedroom and one 3-bedroom unit each.

The highest transaction amount recorded among these purchases was approximately HK$40 million.

Meanwhile, Wheelock Properties kicked off sales for the first batch of flats at Koko Mare in Lam Tin on Saturday and sold 103 homes within three hours, raking in about HK$860 million from the sales.

The initial batch of apartments included 138 flats which were sold at a discounted average price of HK$18,386 per sq ft.

In Tuen Mun, Emperor International's (0163) Seaside Castle recorded the first deal of the year yesterday when House No 2 at the development sold for more than HK$126 million or HK$30,000 per sq ft.

The house, with a sea view, spans an area of 4,213 sq ft and features four bedrooms as well as a garden measuring 457 sq ft, a rooftop of 884 sq ft, and two private car parking spaces.

The property also includes a lift that provides access to all levels of the house.

In other new home sales, Henderson Land's (0012) One Innovale in Fanling sold four apartments yesterday, cashing in about HK$18.8 million.

A property agency said there will likely be more new projects launching sales this month.

To maintain the high level of sales seen in March for primary properties, developers are expected to continue offering attractive prices.

This is likely to result in the number of transactions reaching 2,500 in April, marking a 29-month high, it said.

Besides, the agency noted that the improved market sentiment boosted sales of second-hand homes as the number of transactions in 10 major housing estates over the weekend rose 67 percent week-on-week to 10.

(The Standard)

写字楼空置率14.4%创24年来新高

去年受第5波疫情打击,加上近年写字楼供应量大增,令到空置量急升。根据差估署最新公布的《香港物业报告2023》初步统计数字,去年本港整体写字楼空置率14.4%,较2021年的12.3%增加2.1个百分点,空置率属1998年录得15.9%之后24年来新高。

期间,甲厦空置率亦由2021年的12.5%,大增2.6个百分点至15.1%,亦是1998年后15.3%后的24年新高。期内整体写字楼总落成量,大增至377.8万方呎,创1995年后的27年新高,其中甲级写字楼录321.8万方呎,为2008年后14年新高,估计落成量大幅增加,导致空置率急升。

甲厦使用量由负转正

有代理表示,商厦由土地规划、卖地至落成,历时长达10年,2012年经济畅旺,政府规划更多商厦地皮,及至大约5年后、2017推出卖地,当年,新世界一举连夺长沙湾3幅商贸地,近年陆续落成。

虽然商厦空置率增加,不过,去年整体使用量录增长,由2021年的负43万方呎,升至净吸纳量20.5万方呎,甲厦使用量亦同时由负转正。

差估署数字预期,今年写字楼整体落成量将下降至约287万方呎,当中甲级佔270万方呎,2024年写字楼整体落成量将进一步降至114万方呎,甲级佔约93.6万方呎。

(星岛日报)

邓成波家族放售市值逾60亿物业

自从「铺王」邓成波2021年5月离世后,其家族陆续大手放售旗下物业,昨日再有一张最新放售物业清单曝光,合共25项物业,分布港九新界,包括有铺位、商住楼、写字楼及车场等,市值合共逾60亿,其中最贵重的一项高达11.2亿。

最贵重一项高达11.2亿

该批物业分布观塘、旺角、尖沙嘴及湾仔,最大宗为观塘兴业街1号骆驼漆中心全幢,市值11.2亿 ,目前月租130万,项目于去年推出时叫价约14亿,最新减价20%,项目总楼面逾10万方呎,位于兴业街交界,距离港铁观塘站2分鐘步程。

邓成波于2014年以10.8亿买入骆驼漆中心,及后进行翻新工程,更曾于2017年商厦高峰期以28.8亿放售。

位于尖沙嘴加拿分道37至39号物业,以6.8亿放售,目前月收59.6万;日前,该家族透过外资代理行放售深水埗钦洲街明辉大厦商住楼,亦在物业清单内,意向价1.8亿。

加拿分道物业意向价6.8亿

近期,该家族最瞩目的买卖为沽售旺角商业中心地下至4楼,作价3.5亿,物业于2017年以3.8亿购入,帐面亏损约3000万。

(星岛日报)

旺角「巨无霸」商业地 中标价高次标34%

新地上月初以47.29亿力压2财团、投得旺角洗衣街「巨无霸」商业地,地政总署昨以不具名方式,公布其餘2份落选标价,出价介乎6.88亿至35.21亿,楼面呎价约451至2310元;而中标价较次标高出约34.3%,可见新地出价进取,以「志在必得价」竞投。

上述用地以每方呎楼面地价约3103元批出,当时地价属低于市场估值下限价约16%。首两标出价已见明显差距,次标出价约35.21亿,与中标价相差约12.08亿或约34.3%,每方呎楼面地价约2310元。

最低每呎出价451元相差5.9倍

同时有财团以「执鸡价」竞投,最低标出价仅约6.88亿,与中标价相差40.41亿,中标价远远拋离其约5.9倍,每方呎楼面地价仅约451元。

上述商业地位处于旺角洗衣街及亚皆老街交界,邻近旺角及旺角东站。地盘面积约12.4万方呎,涉及可建总楼面约152.4万方呎,是近年九龙区罕有商业地新供应。除中标的新地外,其餘入标财团,包括长实,以及鹰君则伙拍信和合组财团。

涉总楼面152万方呎

据卖地章程,中标财团须负责兴建指定政府社会服务设施、长者中心,青少年及幼儿中心,亦要兴建行人天桥通道接驳附近建筑物及公眾停车场等,而政府物业并不计算总楼面内。

(星岛日报)

Tycoon Chen Hongtian blames ‘short-term cash-flow disruption’ for seizure of Hong Kong properties including Peak house

His company, Cheung Kei Group, cites defaults on ‘several big-ticket accounts receivable’ and ‘abnormal obstacles’ for loss of control over assets

Chen Hongtian’s three core properties in Hong Kong are worth about HK$9.8 billion (US$1.25 billion), company says

Chinese tycoon Chen Hongtian’s company has blamed a “short-term cash-flow disruption” after three of his properties in Hong Kong, including a house on The Peak that he bought for HK$2.1 billion (US$268 million) in 2016, were taken over by creditors.

“I hope that the public will further understand the correct information,” Chen told the Post on Friday, breaking his silence over the seizure of three of his assets in the city.

“Chen Hongtian’s three core properties in Hong Kong are worth about HK$9.8 billion, according to recent appraisal reports commissioned by banks,” Cheung Kei Group said in a statement on Friday, published in the official WeChat account of Shenzhen-based Harmony Club, which is chaired by Chen.

“Although the value of some properties has dropped sharply compared to before the pandemic, it should be slightly higher than the HK$5 billion in loans, and the debt ratio is less than 60 per cent.”

The statement came after Chen’s house, a 9,212 sq ft property at 15 Gough Hill Road, was seized this month by receivers appointed by Bank of East Asia (BEA), according to government records.

In February this year, Bank of Communications appointed receivers for his Opus Hong Kong property, which he bought with Chen Yao Li Ni.

Chen lost control of other assets in the city, including commercial buildings Towers A and B of Cheung Kei Center in Hung Hom. They were mortgaged with Hang Seng Bank in May 2019. The bank appointed receivers to take over the buildings this month.

“In the past two months, several big-ticket accounts receivable were defaulted off-the-cuff by the other party,” the statement said. “At the same time, the buyer of a big transaction suddenly defaulted a few days before the completion of the transaction, resulting in a related breach of contract.”

In addition, many “normal business processes” in mainland China have encountered “abnormal obstacles”, the company added. “A series of events caused a short-term cash flow disruption. These problems are likely to be properly resolved in a short period of time.”

The company went on to plead for “understanding and support” from “relevant financial institutions and media” to “support enterprises to tide over difficulty” when “the government hopes to revive economic development”.

Harmony Club is a group of about 150 tycoons, mostly based in Shenzhen, who directly or indirectly control more than 70 listed companies and around 3,000 corporate entities.

The club’s executives include Pony Ma Huateng of technology company Tencent, Wang Chuanfu of electric vehicle company BYD and Wang Wei of SF Express, a delivery services and logistics company.

Meanwhile, agents for a mansion on The Peak linked to Hui Ka-yan, Evergrande’s founder and chairman, failed to find an acceptable bid during the planned timeline of the second half of March.

“The [bids] received for the Black’s Link project have not met the requirements, and we will continue to contact potential buyers for the sale of the mansion,” an agency said, one of the two agencies involved.

Mansion 10B at Black’s Link could be valued at over HK$800 million, given that comparable properties on The Peak are valued at HK$140,000 to HK$150,000 per square foot, a source familiar with the sale process said in early March.

(South China Morning Post)

For more information of Office for Lease at Cheung Kei Center please visit: Office for Lease at Cheung Kei Center

For more information of Grade A Office for Lease in Hung Hom please visit: Grade A Office for Lease in Hung Hom

Hong Kong property: Wheelock sells 75 per cent of flats in first batch of Koko Mare project in Lam Tin

Homebuyers snapped up 103 of 138 flats at Wheelock Properties’ Koko Mare in Lam Tin within three hours on Saturday

Property demand has surged in Hong Kong amid hopes that the city has reached the peak of interest rate increases

Wheelock Properties sold 103, or 75 per cent, of the 138 flats on offer in its latest Lam Tin Project within three hours after sales began on Saturday, as the reopening of Hong Kong’s border with mainland China and other positive developments boost homebuyers’ sentiments.

The units at Koko Mare, phase 3B of the Koko Hills development, consist of one to two-bedroom units ranged between 300 to 400 sq ft. After discounts, they were priced between HK$5,937,000 (US$756,000) to HK$9,931,000, with an average price of HK$17,000 to HK$23,039 per sq ft.

“The sales were strong,” an agent said. “The project received positive responses from homebuyers, especially young people aged below 40, who accounted for 70 per cent of all buyers.”

The enthusiastic response to Koko Hills matches last month’s robust sales of the 160 flats offered in the second batch of its sibling project, Koko Rosso. Buyers snapped up nearly all units within a day.

Other recent launches, including Star Properties’ After The Rain project in Yuen Long, Henderson Land’s One Innovale in Fanling, and Sun Hung Kai Properties’ Novo Land in Tuen Mun, also attracted strong interests.

“The new launches have received good market responses, and home prices in the first quarter have risen 5 to 6 per cent from the fourth quarter last year,” said Ricky Wong, managing director at Wheelock. “I expect that rising trend to extend into this month.”

Most of the units sold today were priced at HK$6 million to HK$9 million, allowing first-home buyers to benefit from the government’s recent move to cut ad valorem stamp duty, Wong added.

Property demand has surged amid expectations that Hong Kong has reached the peak of interest rate increases.

The Hong Kong Monetary Authority last week lifted the city’s base rate to a 15-year high of 5.25 per cent, following the US Federal Reserve increased its target rate by a quarter point to a range of 4.75 per cent to 5 per cent.

But Hong Kong’s major lenders, including HSBC and Bank of China (Hong Kong), kept their best lending rates unchanged at 5.625 per cent, while Standard Chartered kept its prime rates unchanged at 5.875 per cent.

The city may see a 50 per cent jump in home transactions this year, which will be especially encouraging to younger buyers, according to analysts.

“The interest rate is likely to have hit the peak level, which may attract first-time homebuyers and investors to buy properties,” an agent said.

In March, Hong Kong recorded 8,202 home transactions, the highest level in 20 months and up 37.2 per cent compared with February, according to data compiled by a property agency. It was also the third consecutive month that the city saw an increase in home transactions.

“As more projects will be launched in April, we expect Hong Kong to see more than 2,500 new homes sold this month,” the agent said.

An online survey conducted between March 1 to March 7 by 28Hse.com, a Hong Kong-based property information provider, showed that above half of the 3,528 interviewees expected Hong Kong’s home prices to rise in the coming 12 months, while 20 per cent of respondents estimated that prices would drop 10 per cent.

About 37 per cent of the respondents said they were currently very interested in buying a new home, while 22 per cent said they had no such plans.

(South China Morning Post)观塘「细码」甲厦易手 平均呎价1.34万

在起动九龙东推动下,观塘成为第二核心商业区,区内甲厦受捧,其中,观塘道368号波顿科创中心一个单位,以每呎逾1.345万易手。

有代理表示,观塘观塘道368号波顿科创中心单位,面积约654方呎,由用家以880万一手承接,平均呎价约13456元,市值呎租约27元,料回报2.4厘。

料回报2.4厘

该单位拥有特高16呎楼底,内置会议室及地毡,24小时中央冷气,该厦为亿京发展的全新商厦,附近配套完善,附近多家酒店,邻近海滨公园,设有银行、食肆,距离港铁站只需3分鐘步程,附近有多条有巴士綫及小巴站。代理续称,全面通关效应,带动东九龙工厦受关注,观塘区具地利,近年亦有多幢新型商厦落成及入伙。

亿京发展全新商厦

另一代理表示,观塘开源道55号开联工业中心中层,面积约1800方呎,业主意向价1098万放售,平均呎价约6100元,市场呎租18元,料回报率3.5厘。该厦中层单位为清水楼,免装修拆卸成本,曲尺窗,望城市景。大厦于1985年落成,设有停车场及卸货台。

代理称,观塘区渐转型为工商综合区,区内面貌焕然一新,吸引投资潜力备受用家及投资者青睞,加上全面通关效应,带动东九龙工厦物业更受市场关注,买卖市场气氛转活,展望买卖市场交投持续增长。

(星岛日报)

更多波顿科创中心写字楼出售楼盘资讯请参阅:波顿科创中心写字楼出售

更多观塘区甲级写字楼出售楼盘资讯请参阅:观塘区甲级写字楼出售

马亚木连沽两铺套现7400万 爵禄街18年升1.3倍 德辅道西呎价1.41万

近期工商铺买卖趋活跃,投资者趁势沽货,「小巴大王」马亚木单日连沽2个铺位,套现7400万,其中,新蒲岗爵禄街单边铺以5000万易手,持货18年升值1.3倍。

新蒲岗爵禄街16至30号A永乐唐楼地下F、G号铺及1 楼E、F、G、H及L室,铺位位处单边,以5000万易手,平均呎价2.6万,该铺位门阔88呎,地铺租客包括味浓车仔面、B记小食店、华记隆食品、恒峰设计以及安定堂,1楼为住宅,马亚木于2004年以1818.9万购入地下及1楼F及G铺,并以550万购入1楼E室,合共2368.9万,持货逾18年,帐面获利3131.1万,物业升值逾1.32倍。该厦楼高只有6层,于1964年落成,具有重建价值。

单日沽2铺套现7400万

盛滙商铺基金创办人李根兴表示,该巨铺拥有88呎阔,位处民生旺段,租赁有保证,非常抵买,他错失机会。

马亚木亦沽售西环地铺,坚尼地城德辅道西426至428号B号铺,山道4至16号地下12及12B号铺,建筑面积约1700方呎,租客日本城,以2400万易手,平均呎价14118元。

马亚木于2002年12月以1380万买入,持货逾20年,帐面获利1020万,物业升值约74%。

德辅道地铺2400万售

该物业于1971年落成,楼龄51年,铺位门阔约15呎,深约90呎。

马亚木上月亦售出旺角西洋菜南街250至252号地下相连地铺,作价9500万,建筑面积约2200方呎,呎价约4.32万,由茶餐厅等4名租客承租,月租共约26.15万,买家料回报3.3厘,马亚木于2004年10月以5150万买入,持货逾18年,帐面获利4350万,升值84.5%。

小巴大王马亚木沽售2个民生铺位,其中,新蒲岗旧楼巨铺,门阔88呎,由多个民生商户承租。

(星岛日报)

核心区铺位租务加快 商户多元化

核心区铺位租务加快,近日主要租务成交中,除了传统奢侈品外,亦有其他商户扩充,渐见多元化。

通关后核心区铺位租务明显加快,而近期更出现租户种类多元化,如传统核心区一綫街铺,出现医疗商户。在德国、丹麦、中国内地及英国经营眼科矫正诊所的德视佳 (01846) 宣布,租用铜锣湾罗素街2000广场地铺及3楼,作香港首间旗舰店。

资料显示,矫视诊所承租地下及3楼,全店总楼面面积约7,188平方呎,包括地下约2,000平方呎及3楼约5,188平方呎。

德视佳租2000广场作旗舰店

德视佳创始人董事长兼首席执行官约根森 (Jorn Slot Jorgensen) 表示,早在2019年10月已经计划在香港开设分店,但因疫情而被迫搁置计划,直至今年香港全面復常,加上与内地通关,经济开始復甦,故重啟计划,在港设立分店,预计新店将于今年下半年开业。

翻查资料,该铺上手租客为奢侈品牌店Prada,租金高峰期月租高达900万元 (地下至3楼),疫情初期品牌提早迁出,及后业主把铺位分拆招租,其中一层由餐饮承租。据了解,是次医疗中心每月约80万至100万元,较原先租金有明显跌幅。

另外,中环皇后大道中8号地下及1楼,地下面积约4,000平方呎,连同1楼约2,000平方呎,合共约6,000平方呎,以每月约100万元租出。该厦位于皇后大道中头段,比邻都爹利街,附近较多特色餐饮及时装店。

据了解,新租客为一家艺廊,目前租用同区艺廊集中地 H Queen's 楼上全层,如今扩充楼面,而租用地下及1楼,料更方便客人参观及选购艺术品,亦配合都爹利街一带环境。事实上,目前附近的皇后大道中9号地下一铺位,亦由艺廊租用。

重现商机 核心区铺空置减

翻查资料,旅客消费高峰期时,皇后大道中8号地下曾获法国手袋品牌Longchamp租用,作品牌旗舰店,月租料约200万元,其后迁出;

西洋菜南街52至54号地下及1楼,面积约3,200平方呎,获时装品牌National Geographic Apparel以每月约50万元租用。该品牌在港分店主要位处商场,包括尖沙咀海港城、铜锣湾时代广场等;现趁租金便宜,于核心区一綫地段租街铺。上述铺位曾由韩国时装店MLB租用,现月租跌约44%。

分析指,自中港通关后,旅客重返香港,令不少行业有商机。除了传统零售、餐饮后,旅客对其他商品、服务业同样有需求,例如医疗、艺术品等,令传统零售商以外,不同行业亦趁机租铺,故近期核心区新租户种类多元化,亦降低整体铺位空置率。

(经济日报)

更多2000年广场写字楼出租楼盘资讯请参阅:2000广场写字楼出租

更多时代广场写字楼出租楼盘资讯请参阅:时代广场写字楼出租

更多铜锣湾区甲级写字楼出租楼盘资讯请参阅:铜锣湾区甲级写字楼出租

更多皇后大道中8号写字楼出租楼盘资讯请参阅:皇后大道中8号写字楼出租

更多H Queen’s写字楼出租楼盘资讯请参阅:H Queen’s写字楼出租

更多皇后大道中9号写字楼出租楼盘资讯请参阅:皇后大道中9号写字楼出租

更多中环区甲级写字楼出租楼盘资讯请参阅:中环区甲级写字楼出租

中环为香港核心商业区,经济重心之一,商厦林立,商业气息浓厚。位于中环中心地带些利街的 LL Tower,装修新颖雅致,设计别緻而现代,邻近食店,配套齐全,吸引不少商户进驻。

LL Tower 于2018年始落成,楼龄只有5年,整幢大厦以黑色为主导,感觉奢华贵气,大堂设有2部载客电梯,方便疏通人流。物业为一座分散业权的商业大厦,设有可供租售写字楼,大部分为半零售用途。

楼高25层,包括16层办公楼层 (6至23楼) 以及5层零售 (G至3楼),每层标準面积约2,327至2,351平方呎,大部分楼层由本地零售商租用。主要租户包括零售、餐饮等等。

邻近半山扶手电梯

LL Tower 邻近著名半山扶手电梯,起点为皇后大道中,全长200公尺,是世界最长的户外有盖电梯,专为半山区居民而设,方便其来往中环商业区。此外,由王家卫导演的《重庆森林》亦曾在该地取景,王菲及梁朝伟曾在此地甜蜜互动,故亦吸引不少人慕名前来打卡。

LL Tower 交通方面,步行到港铁中环及香港站约需9至15分鐘,附近亦设有巴士及小巴站,尚算便利。

饮食配套方面,物业内设有餐厅及酒吧,亦邻近著名兰桂坊,放工可相约同事朋友饮酒谈心。附近亦设有不少食肆,提供不同国家的美食,满足不同人士的口味。

LL Tower 今年暂未录得成交,去年录得两宗成交,皆为高层全层单位,实用面积均是2,327平方呎,分别以5,119万元及5,468万元成交,呎价分别为22,000元及23,500元。

(经济日报)

更多LL Tower写字楼出租楼盘资讯请参阅:LL Tower写字楼出租

更多中环区甲级写字楼出租楼盘资讯请参阅:中环区甲级写字楼出租

更多LL Tower写字楼出售楼盘资讯请参阅:LL Tower写字楼出售

更多中环区甲级写字楼出售楼盘资讯请参阅:中环区甲级写字楼出售

Developer rolls out Easter promotions

Developers are gearing up for sales over the Easter holidays and rolling out promotions to tempt buyers.

The Grand Victoria series in Cheung Sha Wan will be offering promotions over the Easter break that include coupons for furniture, home appliances, travel and dining for buyers of three-bedroom and four-bedroom units.

Co-developed by Sino Land (0083), Wheelock Properties, K Wah International (0173) and SEA Group (0251), the project has sold 119 flats for HK$2.6 billion, with eight units fetching over HK$50 million each, since its launch at the start of the year.

In Ho Man Tin, In One's Phase 1C sold four homes yesterday, cashing in more than HK$76 million at a discounted price of HK$28,369 to HK$33,522 per square foot. Jointly developed by Chinachem and MTR Corporation (0066), In One is being built atop Ho Man Tin MTR station.

Meanwhile, the Urban Renewal Authority has made acquisition offers of HK$16,022 per sq ft to property owners affected by the Kim Shin Lane/ Fuk Wa Street Development Project in Sham Shui Po. The offer is based on the current price of a seven-year-old building.

In other news, New World Development (0017) has signed a memorandum of understanding with a unit of China Vanke (2202) to jointly develop property technology, marking the first cooperation of its kind between the mainland and Hong Kong developer in the Greater Bay Area.

And latest figures from the Estate Agents Authority show the number of licensed real estate agents in the city rose by 36 month-on-month to 41,074 while the number of branches of property agencies rose by 37 to 7,092.

(The Standard)

Hong Kong property deals likely to dip in April as used home sales lose ground, a property agency said

The number of deals is likely to dip slightly after a three-month rally pushed transactions to a 20-month high in March

The second-hand market will see its market share fall as buyers are drawn to new projects priced competitively by developers, a property agency said

The number of property deals in Hong Kong is likely to dip slightly this month after a three-month rally pushed transactions to a 20-month high in March, according to one of the city’s major agencies.

The number of properties changing hands, including residential, commercial and industrial units as well as parking spaces, came in at 8,612 in March, up 44 per cent month-on-month, according to data from the agency.

“In April, the overall number of property transactions is expected to fall within 5 per cent because of a slowdown of the second-hand market, to about 8,250,” an agent said.

The transaction volume in the second quarter is expected to remain at a high level, Chan said, as developers launch new projects at a clip.

The second-hand market, however, will see its market share fall as buyers are drawn to new projects priced competitively by developers eager to stimulate demand after a difficult period.

The corresponding transaction value in March jumped 57 per cent to a seven-month high of HK$69.19 billion (US$8.81 billion), according to the agency.

Hong Kong’s pre-owned home prices rose 2.22 per cent in February, the most in almost three year, as demand recovered on expectations of slower interest rate increases and an improvement in economic sentiment following the reopening of the city’s borders.

The home price index stood at 345.9, the highest in four months, according to data from the Rating and Valuation Department.

The biggest rebound was for new homes, which saw sales almost triple from 619 in February to 1,736 in March, a 16-month high, according to the agency.

In the three months to March, the overall number of transactions surged 62.1 per cent to 18,997, the highest in three quarters, according to another property agency.

Thanks to the higher transaction volume, the number of mortgages for completed homes climbed by almost a third to a seven-month high of 7,525, according to a mortgage brokerage service provider.

Because of the market downturn last year and the longer time required for new home sales to reach completion, the number of mortgages for homes still under construction fell significantly in the first quarter, according to another mortgage broker. The broker, however, expects the number of mortgages to surge in the second quarter after stamp duties for local first-time buyers were relaxed in February.

While the border reopening after Covid-19 boosted the economy and the housing market, it did not, as expected, bolster demand from people from outside Hong Kong, according to a report on Monday by property services provider Pruden Group.

Pruden attributed this to the extra stamp duties as well as tighter mortgage requirements for non-local buyers and a smaller difference in the mortgage rates between Hong Kong and mainland China.

(South China Morning Post)

金鐘东昌大厦铺放售 估值约6.8亿

近期积极沽货的资深投资者罗守辉,再推出贵重物业放售,涉及金鐘及尖沙咀铺位,合共市值约23.6亿元。

消息指,罗守辉推出物业为金鐘东昌大厦商铺部分放售,涉及物业1及2楼,面积分别为9,641及13,119平方呎,合共约22,760平方呎,铺位曾由健身中心租用,2017年续租时,月租达200万元,较前租金升约11%,现时铺位交吉。该铺其中一个卖点是,比邻今年落成的全新甲厦 The Henderson,整体商业气氛进一步提升,故商铺需求高,物业市值约6.8亿元,呎价约3万元。

尖东广场多层铺 16.8亿放售

至于另一项物业为尖东广场多层商铺。物业属于尖沙咀加连威老道94号明辉中心基座商场,早年由不同商户租用,业主早年把物业提升质素,关闭商场进行质素提升,包括更换升降机,当时翻新费高达1亿元。据了解,物业地库、低层地下、地下、高层地下,以及1至3楼,每层面积由1万至1.4万平方呎,总楼面约90,222平方呎,佔全幢明辉中心的不分割份数60.1%,现以约16.8亿元放售。两项物业现放售,总值约23.6亿元。

(经济日报)

更多东昌大厦写字楼出售楼盘资讯请参阅:东昌大厦写字楼出售

更多金鐘区甲级写字楼出售楼盘资讯请参阅:金鐘区甲级写字楼出售

更多The Henderson写字楼出租楼盘资讯请参阅:The Henderson 写字楼出租

更多中环区甲级写字楼出租楼盘资讯请参阅:中环区甲级写字楼出租

更多明辉中心写字楼出租楼盘资讯请参阅:明辉中心写字楼出租

更多尖沙咀中心写字楼出租楼盘资讯请参阅:尖沙咀中心写字楼出租

更多明辉中心写字楼出售楼盘资讯请参阅:明辉中心写字楼出售

更多尖沙咀区甲级写字楼出售楼盘资讯请参阅:尖沙咀区甲级写字楼出售

工商铺录451宗註册 代理行:创9个月新高

有代理行综合土地註册处资料显示,3月份工商铺註册量,为自2022年6月来最多,共录451宗,按月急升约68.3%,金额录58.33亿,按月升约78.7%。

目前工商铺价格低位徘徊,投资者信心恢復,相信「捞底」增加,各板块上升,商厦表现最好,註册量按月飆升1.5倍至110宗,工厦亦不俗,最新录240宗註册,大升约84.6%。商铺表现平稳,3月录101宗登记,按月升约7.4%。

逾亿註册维持平稳

若按金额划分,3月份註册量升幅最多的为价值逾500万以上至1000万物业,按月激增约1.1倍至101宗,其次为逾1000万至2000万及逾5000万元以上至1亿物业,按月分别急升约86.5%及62.5%,至69宗和13宗登记。逾亿买卖维持有4宗,商厦及铺位各2宗,包括有长沙湾南商金融创新中心27楼9个单位,以及旺角砵兰街450至454号HQ全幢,作价分别为2.41亿及3.5亿,商铺则包括有旺角商业大厦地下至4楼多个铺位及屯门城点基座商场,金额分别3.5亿及4.4亿。

中细价物业主导市场

该行代理表示,由于美国通胀回落幅度缓慢,相信高息环境持续,大手物业保持淡静,对于资金充裕的投资者而言,仍有能力买入中低价物业。 疫市下,工商铺价格大幅回落,目前仍低位徘徊,随着中港通关和香港復常,投资者趁势「捞底」。

(星岛日报)

更多南商金融创新中心写字楼出售楼盘资讯请参阅:南商金融创新中心写字楼出售

更多长沙湾区甲级写字楼出售楼盘资讯请参阅:长沙湾区甲级写字楼出售

官地价跌吸引 财团减慢旧楼收购

强拍申请首季仅2宗 按季少5成

虽然2023年社会已復常,但今年首季仅录2宗强拍申请,按年大幅减半,某程度反映发展商有见地价下跌而减慢旧楼收购步伐。同时,自去年第三季起,有4宗强拍申请于12个月内迅速获批,获批速度有加快的趋势。测量师认为,这反映政府加房屋供应的决心。

土地审裁处于本年首季度合共接获2宗强拍申请,分别于1月及2月份所录得。以区域划分,全数申请均位于港岛区,而且属小型项目,两者地盘面积介乎4,000至近5,000平方呎,现况市值逾2亿元。

若与去年同期相比,强拍申请按年减少2宗,即50%。而去年首季度的申请大部分位于鸭脷洲,并全于2月、即第5波疫情肆虐期间所录得。

业界料今年申请 较去年22宗少

有测量师认为,由于近期地价下跌,发展商从而较倾向购买政府地,而且楼价有反弹迹象,小业主未必容易接受收购价,故首季强拍申请减少,并料今年全年的申请宗数会较去年22宗更少。

除了申请宗数按年大减外,翻查2022年统计数字,由强拍申请日至成功获批强拍计,普遍需时约1至4年,惟由去年8月起至今,共有4宗强拍申请可在1年内 (约7至10个月) 获批强拍,当中万科香港收购的牛头角定富街71至79号项目需时最短,需时仅约7个月。至于今年首季获批的数宗强拍申请中,乐风等收购的鸭脷洲好景街26、28号及平澜街2号旧楼,则需时约9个月,可见近期排期聆讯时间有缩短的趋势。

该测量师又认为,这反映土地审裁处的效率增加,以配合政府提速、提效、提量的房屋政策,加快本港房屋供应量。

(经济日报)

Developers keep rolling out flats at a rapid pace

Wheelock Properties has released the third batch of 48 homes at Koko Mare in Lam Tin with an average discounted price of HK$19,284 per square foot, 1.7 percent higher than the last one.

Half of the units in the batch are with one bedroom while the other half come with two bedrooms. With sizes ranging from 310 sq ft to 500 sq ft, they are priced between HK$5.88 million and HK$9.7 million after discounts, or between HK$17,708 and HK$20,645 per sq ft.

The developer said the arrangement for the second round of sales will be announced soon.

Managing director Ricky Wong Kwong-yiu said Miami Quay I, Wheelock's project with Henderson Land Development (0012), New World Development (0017), and Empire Group in Kai Tak, has sold 49 homes for over HK$480 million and a new price list may be unveiled after Easter.

In Tai Kok Tsui, Chevalier International (0025) will put five more homes at Sablier on the market next Monday, all of which are below HK$6 million.

In Ngau Tau Kok, eight flats at The Aperture will be put up for tender on Saturday, the developer Hang Lung Properties (0101) said. All of them come with three bedrooms and an area of 771 sq ft.

In Pak Shek Kok, Sun Hung Kai Properties (0016) said it may release the sales brochure for University Hill next week at the earliest and the first price list is expected to be unveiled at the end of this month.

The project provides 607 homes from 250 sq ft to 650 sq ft with studio to two-bedroom units accounting for 80 percent of the total.

On the luxury front, a 7,042-sq-ft house at Mount Nicholson on the Peak will be open for tender next Thursday.

It has a 2,715-sq-ft garden, a 1,970-sq-ft yard, and a parking space of 2,088 sq ft.

The project was co-developed by Nan Fung Group and The Wharf (0004), with Wheelock Properties responsible for sales.

Separately, the Lands Department has trimmed the compensation rates for resumed land in the New Territories amid falling property prices.

The compensation for agricultural land resumed for development uses has been cut by 13 percent to HK$1,267 per sq ft from last October, and that for building land to valuation plus HK$2,514 per sq ft.

(The Standard)

Luxury villa at Hong Kong’s The Peak up for tender, could fetch as much as US$122.5 million

The 7,042 sq ft property at 8 Mount Nicholson Road has been developed by Wharf Holdings and Nan Fung Group

Luxury residential market expected to keep up momentum and post even stronger growth in the second quarter, Colliers executive says

A 7,042 sq ft villa at The Peak, Hong Kong’s most exclusive address, is up for tender on April 13, according to Wheelock Properties.

The property in the ultra-exclusive enclave of Mount Nicholson at 8 Mount Nicholson Road has been developed by Wharf Holdings and Nan Fung Group. Wheelock is the sole agent for the sale.

The attempt to sell the four-bedroom unit – expected to fetch as much as HK$961.5 million (US$122.5 million) – comes at a time of marginal improvement in Hong Kong’s luxury property segment on the back of a full reopening of the city’s and mainland China’s borders, the end of strict Covid-19 restrictions and the stabilisation of interest rates.

“The range of the price for the house could be anywhere between HK$86,340 and HK$136,544 per square foot, based on sales last year,” a surveyor said.

Hong Kong’s residential market is seeing a marked improvement, with the number of transactions rising 40.3 per cent month on month to 4,282 in February, according to a property agency, which cited official data. Primary sales supported overall market sentiment, surging 80.4 per cent month on month to 655 deals. The overall home price index also rose by 0.6 per cent in January, according to official data.

The demand for property has surged in Hong Kong amid hopes that the city has reached a peak in terms of interest rate increases.

The Hong Kong Monetary Authority in March raised the city’s base rate to a 15-year high of 5.25 per cent, after the US Federal Reserve increased its target rate by a quarter point to a range of 4.75 per cent to 5 per cent. However, Hong Kong’s major lenders did not follow suit. HSBC and Bank of China (Hong Kong) kept their best lending rates unchanged at 5.625 per cent, while Standard Chartered kept its prime rate unchanged at 5.875 per cent.

The pause in lending rates by the city’s three currency-issuing banks has boosted hopes that homebuying activity will continue to increase in the coming months, as mortgage rates are likely to stabilise. Sales of new and lived-in homes could hit 66,000 units this year, up nearly 50 per cent from 2022, according to market observers.

“Since the full border reopening earlier this year, the Hong Kong luxury residential market has seen signs of recovery across both transactions and leasing,” a property agent said. “Driven by mainland buyers, transactions in the primary market have gained momentum, with transaction prices holding up strongly.

“For example, a few new projects in Kowloon have recorded transaction prices of over HK$50,000 per square foot. The ultra high-end market has also seen improved sentiment, with multiple single-lot houses reaching final stages of negotiations. We expect the luxury residential market to keep up the momentum and post even stronger growth in the second quarter.”

The surveyor on the other hand, pointed to some “sluggishness” in the luxury property market.

Earlier this year, a four-bedroom luxury home in Mount Nicholson resold at an estimated loss of about HK$130 million. The home, in one of the most expensive luxury developments in Hong Kong, set a record for Asia when it sold for HK$519.9 million in 2019. It sold on January 27 to a buyer named “Yu Ye” for HK$390 million, about 25 per cent below the price “Li Jun” paid for it, according to official records.

(South China Morning Post)

同区宏利金融中心 网购公司租3万呎升级

东九龙租务稍增,亦见跨国机构进行扩充。消息称,观塘新甲厦 The Millennity 全层,获跨国金融科技公司租用,呎租约28元,属扩充及升级个案。另观塘宏利金融中心全层3万呎,获网购公司租用作升级。

通关后整体商厦租务改善。消息指,观塘巧明街大型综合商业项目「The Millennity」落成,租务亦加快,项目2座28楼全层,面积约1.26万平方呎,以每平方呎约28元租出。据了解,新租客为金融科技公司Doo Group。该集团于2014年成立,总部设于新加坡,是一家以金融科技为核心的金融服务集团,提供证券、基金等金融产品,以及货币兑换等业务,集团于全球多个国家设办公室。

据悉,该公司原租用九龙湾亿京中心单位,是次租 The Millennity 既可扩充业务,亦可升级至全新甲厦。

The Millennity 首季入伙 租务加快

The Millennity 首季入伙,上月开始有租客迁入,大厦近期租务亦加快,如1座20及21楼全层,每层面积约1.9万平方呎,合共约3.8万平方呎,成交呎租约28元。

新租客为一家本地设计公司,原租用大角咀嘉运大厦办公室,由于业主将重建物业,故需寻找新写字楼作搬迁。

另观塘伟业街宏利金融中心亦录全层租务,涉12楼,面积约3万平方呎,以每平方呎约23元租出。据悉,新租客为网购公司STRAWBERRYNET,主要售卖美粧产品如香水、化粧品等,该公司原租用工厦物业,现转租全层甲厦,属扩充及升级。

据了解,该层楼面原由宏利保险租用,早年集团租用大批楼面,2021年租用同区国际贸易中心(ITT)约14.5万平方呎楼面,并获命名权「宏利广场」,当中不少部门由伟业街宏利金融中心迁入。

另湾仔北海港中心中高层09室,面积约900平方呎,成交呎租约56元。商厦买卖方面,新盘销情不俗,如黄竹坑黄竹坑道23号再录全层成交,涉及低层全层,面积约6,151平方呎,以约6,981万元沽出,呎价约11,350元。

(经济日报)

更多The Millennity写字楼出租楼盘资讯请参阅:The Millennity写字楼出租

更多宏利金融中心写字楼出租楼盘资讯请参阅:宏利金融中心写字楼出租

更多宏利广场写字楼出租楼盘资讯请参阅:宏利广场写字楼出租

更多观塘区甲级写字楼出租楼盘资讯请参阅:观塘区甲级写字楼出租

更多亿京中心写字楼出租楼盘资讯请参阅:亿京中心写字楼出租

更多九龙湾区甲级写字楼出租楼盘资讯请参阅:九龙湾区甲级写字楼出租

更多海港中心写字楼出租楼盘资讯请参阅:海港中心写字楼出租

更多湾仔区甲级写字楼出租楼盘资讯请参阅:湾仔区甲级写字楼出租

湾仔乐基中心 申重建1幢商厦

位于湾仔湾仔道165至171号的乐基中心,最新撤回旧申请,并重新向城规会申请重建1幢商厦,新申请的建筑物高度限制水平较旧申请的减少近1成。

项目附近设有英皇集团中心、集成中心等指标商厦,地盘面积约6,932平方呎,现坐落于「住宅 (甲类)」用地之上。

申请人Top Talent Development Limited最新向会方申请以地积比率约15倍,重建1幢25层高 (另设2层地库) 的商厦,以发展食肆、商店及服务行业、办公室,总楼面约10.4万平方呎。

总楼面面积 较旧申请减30呎

值得一提的是,翻查对上一次申请,申请人拟将建筑物高限由110米 (主水平基準上,下同) 放宽至121米,惟是次申请拟将建筑物高限维持在110米,减幅约9%,而层数则维持25层。同时,总楼面面积亦录轻微减幅,新申请的总楼面较旧申请的少30多平方呎。

申请人指,最新申请符合用地的规划意向,而且湾仔区欠缺足够的休憩用地,并受湾仔道车流的环境滋扰,相比起用地划作的住宅用途,地点更适合发展为商业用途。

此外,项目将会加入不同设计优点,包括沿着湾仔道、交加里楼宇后移,及设阶梯式的建筑设计等。

(经济日报)

更多英皇集团中心写字楼出售楼盘资讯请参阅:英皇集团中心写字楼出售

更多集成中心写字楼出售楼盘资讯请参阅:集成中心写字楼出售

更多湾仔区甲级写字楼出售楼盘资讯请参阅:湾仔区甲级写字楼出售

更多英皇集团中心写字楼出租楼盘资讯请参阅:英皇集团中心写字楼出租

更多集成中心写字楼出租楼盘资讯请参阅:集成中心写字楼出租

更多湾仔区甲级写字楼出租楼盘资讯请参阅:湾仔区甲级写字楼出租

新世界1.88亿沽名铸50个车位

新世界积极拆售非核心一篮子物业,其中与市建局合作发展的尖沙嘴名铸,消息指,该公司上月以1.88亿沽出项目地库停车场,涉及约50个停车位,即每个车位平均成交价376万,据了解,新买家以公司名义购入。

平均每个成交价376万

名铸涉及345伙,项目基座为K11购物艺术馆商场及酒店,地库四层停车场只有59个住客车位,即平均接近6名住户争一个车位,因此地库车位向来渴市。据悉,新世界过往将这批车位作出租用途,高峰期每个车位月租高达逾9000元,现时平均月租约6000元;若以目前租金计算,每个车位的租金回报只有1.91厘。

事实上,新世界近年陆续出售非核心物业,包括去年底以20亿沽出新蒲岗九龙贝尔特酒店、过去半年亦先后沽售商厦及商铺等。

(星岛日报)

西营盘利宏大楼 强拍底价4.65亿

裕景兴业就西营盘干诺道西133至134号利宏大楼,于2019年5月向土地审裁处申请强制拍卖,经过约4年时间,最新获土地审裁处批出强制售卖令,底价定为4.65亿元。

利宏大楼位于干诺道西近东边街,1969年落成,楼龄约54年,属于1幢8层高的商住唐楼,最低层为地铺连阁楼,其以上作住宅用途,设有2条公共楼梯,没有升降机。

裕景兴业一方于2019年提出强拍时,已经持有该厦约85.71%业权,尚餘约5个单位未能成功收购,土地审裁处最终批准以底价4.65亿元拍卖。

资料显示,利宏大楼佔地约2835方呎,具潜力重建为商业楼宇,可建楼面面积约42530方呎。

另外,土地审裁处2021年拒绝山顶道81号至95号豪宅「十间」小业主联合提出的强拍申请,申请一方提出上诉,土地审裁处昨天再颁下判案书,认为上诉没有合理机会取得胜诉,驳回上诉申请。

(信报)

Snow Lake Capital hedge fund quits HK after 12 years

China-focused hedge-fund firm Snow Lake Capital Ltd. has left Hong Kong after 12 years of operating in the city, people familiar with the matter said.

The company shuttered its office in Hong Kong last month, the people said, requesting not to be named because the matter is private. Founder and Chief Executive Officer Sean Ma has relocated to Menlo Park, California for personal reasons. Its chief operating and financial officer is also based in the US city, said one of the people. All members of its Hong Kong-based research team moved to Beijing last month, the person added.

While it’s rare for hedge fund firms to completely shut operations in Hong Kong, more have been diversifying away from the city in recent years. Pandemic-era restrictions and Beijing’s tightening grip over the former British colony are prompting companies to look at options in the US or Singapore.

Hong Kong has been trying to bolster its appeal as a financial hub. It said last month that the city would offer tax concessions for family offices.

Snow Lake’s Hong Kong office is marked as having “ceased business of regulated activities,” according to the Securities and Futures Commission website.

A representative of Snow Lake declined to comment. Snow Lake operated out of New York and Beijing for its first two years. It established a foothold in Hong Kong in early 2011 when it shut the New York office.

A former analyst at Ziff Brothers Investments LLC, Ma set up Snow Lake in 2009 with backing from Zhang Lei, the founder of Hillhouse Capital. The company focuses on long-term stock holdings in technology, consumer, health care, clean energy, real estate and financial industries — most of which are Chinese — according to a US regulatory filing in January.

In 2020, Snow Lake shot to international fame when it emerged as the author of a report released by Muddy Waters that exposed sales inflation at China’s Luckin Coffee Inc., Bloomberg reported at the time, citing people familiar.

In the first 11 years of the firm, Ma steered his Greater China-focused stock hedge fund to gains in all but one year. He added an Asia fund in 2018. The same year, Snow Lake funds were a cornerstone investor in the initial public offering of China Renaissance Holdings Ltd., the Chinese investment bank whose Chairman Bao Fan is now cooperating with authorities in an unspecified investigation. It’s unclear if Snow Lake still holds a stake.

It’s also suffered setbacks. Its activist stake in MGM China Holdings Ltd. backfired, hurt by the Covid pandemic and increased government oversight of casinos. The firm’s investments in Chinese education stocks were also dented in 2021 by Beijing’s crackdown on the sector. It had to shutter the Asia fund after two of its managers quit.

The firm disclosed nearly US$563 million of discretionary assets under management at the end of October in the January US regulatory filing. That compared with about US$2 billion it oversaw between hedge and long-only funds as late as 2021. Hillhouse’s Zhang no longer owns a stake in Snow Lake.

(The Standard)

外资迁出中环 内地城商银行进驻

面对甲级商厦租金昂贵及严控成本的需要,居家工作 (WFH) 及共用空间的办公室模式冒起,外资机构近年逐步压缩位于中环核心区的商厦楼面面积,或弃租一线商厦迁往外区。

跨国企业弃租核心区

毕马威中国香港区中资金融机构主管合伙人方海云表示,WFH与办公室上班的混合模式成为疫后各行业的趋势,不仅银行界,其他相关领域如律师楼、审计业及证券公司等亦朝向这个方向发展,跨国企业由原来租用中环核心区多层楼面,可能调整至「几层缩埋一层」,甚至迁出中环区,办公室亦奉行「拆墙鬆绑」式弹性共用及智能工作空间。

鑑于大型国有银行多数已在中环区自置或租赁旗舰物业,方海云指近年外资退租而腾出的核心商厦空间,如中环国际金融中心 (IFC) 及交易广场等原有办事处,获中资股份制商业银行或城市商业银行、券商等进驻部分楼层,对这些新来港的金融机构来说,落户中环核心区可产生推广招徠的效果。

上月初彭博报道,法国巴黎银行计划把本港大部分员工迁出国际金融中心二期,转移至鰂鱼涌太古坊的办公室,藉此削减成本,以应对后疫情时代的发展。

粤港澳大湾区内城商行之一的东莞银行,前年3月获香港金融管理局授予银行牌照,在本地设立中国註册香港分行后,便承租由日本野村集团弃用的部分国际金融中心二期单位。

目前办公室盘踞国际金融中心一、二期的中资银行香港分行,包括民生、华夏、兴业及国家开发银行等。

(信报)

更多交易广场写字楼出租楼盘资讯请参阅:交易广场写字楼出租

更多国际金融中心写字楼出租楼盘资讯请参阅:国际金融中心写字楼出租

更多中环区甲级写字楼出租楼盘资讯请参阅:中环区甲级写字楼出租

恒生首放租九龙湾总部3层

后疫情时代居家工作 (WFH) 与办公室上班的混合模式成大势所趋,跨国大行缩减租赁中环核心区写字楼面积之际,拥有自置甲级商厦的本地大行亦复检使用空间,若有过剩面积,便放租「开源」。消息透露,本地第三大银行恒生银行 (00011),位于九龙湾的九龙区后勤总部「恒生中心」,10层自置物业廿多年来自用为主,去年底该行完成使用复检后,其中3层楼面已透过地产代理在市场放租,是该行购入上址物业近30年首次作「全层式放租」安排。

市场消息称,该3层放租的写字楼每层面积约26000方呎,涉高、中及低层,即合共达78000方呎,基于保安理由,业主要求每层全层只租予一个租户 (不会拆散出租)。地产界估计,上址呎租介乎23至25元,因九龙东商厦持续供过于求,未来一段时间呎租难望回復至疫情前水平。

不拆租 料年收逾二千万

若以下限呎租估算,3层楼面均成功获承租的话,恒生每月额外租金收入约180万元,年租收入逾2000万元。

近年写字楼市道疲弱,九龙湾的甲级商厦在今年暂只有3宗买卖个案,全为楼龄10年以内的物业,成交呎价由9624至13114元不等。以此推算,紧贴港铁站的恒生中心现市值呎价约10000元,惟恒生中心楼层只放租,无意放售。

对于放租恒生中心部分楼层,恒生银行发言人回覆本报查询时表示,「本行一贯不时会检视、调整旗下物业的组合和用途,以配合业务发展及不断转变的需求。」

据悉,一如其他大型金融机构,过去3年恒生亦受新冠疫情影响,导致办公室使用率大降,疫后WFH及办公室工作混合模式已成市场趋势,目前不计前线分行因工种需要必须回行址上班外,该行员工普遍维持每周WFH一至两天的安排。因应社会復常后办公室面积更有效地运用,该行持续进行复检并研究把过剩的空间放租「开源」,九龙湾恒生中心的评估亦于去年底完成,结论是上址10层自用办公室预计经重整改造 (Restacking) 之后,可以腾出约3至4层楼面作全层放租。

消息说,疫情肆虐期间办公室使用率极低,恒生中心若干楼层一些单位曾临时放租,不过今次「全层式放租」是该行购入上址10层楼面近30年来首次安排。基于租户必须全层承租,故放租存在难度及需时处理,恒生会在放租前进行空间整改,包括把散布各层的过剩空间集中于同一楼层,上址部分工种及员工可能要迁往恒生位于旺角亚皆老街113号的另一商厦运作。

善用过剩面积开源节流

有代理指出,以九龙湾甲级商厦目前市价计,预料恒生中心的呎租水平约为25元以内,鑑于疫情期间商厦需求及市道受影响,加上该区未来数年有不少大型写字楼落成,供过于求情况下,相信呎租难望回復至疫情前逾30元的价码。

恒生银行近两年业绩失色,去年盈利跌27%至101.7亿元,把过剩办公室面积放租务求开源节流,也符合母公司滙控 (00005) 的集团化政策路向。

毕马威中国香港区中资金融机构主管合伙人方海云认为,去年度恒生来自投资物业的租金收入仅2.69亿元,只佔该行总营业收入约0.5%,相信恒生中心部分楼层放租,「新增收益对银行 (贡献) 亦好湿碎」,但此举绝对是正面发展,亦是市场大势所趋,「年轻一代行咗WFH走唔返转头」,僱主为挽留人才,都会配合安排。

(信报)

95年斥10.9亿购十层楼面

毗邻九龙湾「港铁总部大楼」的「恒生中心」,位于九龙湾伟业街33号德福广场二期,楼高15层,属甲级商厦,根据1995年8月的报道,恒生银行(00011) 当年以10.9亿元,向项目发展商港铁 (00066) 与新世界发展 (00017) 购入恒生中心其中10层写字楼连大厦命名权,作为该行的九龙区后勤总部,涉及总楼面面积21.4万方呎,平均呎价5100元。

总楼面超过21万方呎

时任恒生银行董事长利国伟表示,恒生中心交易为继1987年斥资8.4亿元购入中环德辅道中83号作为总行旗舰物业以来,该行最大宗的商厦买卖。

多年来,恒生银行与港铁的合作关係相当密切,前者几乎在每个港铁站内都设有自动柜员机装置。

德福二期商厦项目共有两幢各楼高15层的甲级写字楼,总楼面面积达56.6万方呎,恒生购入其中一幢10层楼面并获冠名为恒生中心,该厦餘下5层楼面及隔邻的港铁总部大楼合共总楼面36万方呎,全部均由港铁保留自用以及作为后勤总部。

事实上,恒生银行本身亦持有若干商厦物业,除了中环总行之外,于港九地区拥有不少历史悠久的地标物业,其中包括位于旺角亚皆老街113号的「恒生113」、旺角弥敦道677号的「恒生旺角大厦」、尖沙咀加拿芬道18号「恒生尖沙咀大厦」,以及湾仔轩尼诗道200号的「恒生湾仔大厦」等。

(信报)

中环新世界大厦录「半零售业」承租 林浩文:获医学美容及潮玩品牌进驻

两地通关后,中环新世界大厦录「半零售业」承租,新世界资产及房地产组合管理总经理林浩文表示,该厦录专业医学美容行业,以及日本潮玩品牌进驻,令该厦出租率升至90%,其中,医学美容由于租用楼面需求比一般公司大,承租能力较强。

儘管未有透露租金,林浩文指出,自从口罩令全面撤销后,半零售行业积极扩充,专业医学美容对甲厦租务需求强劲,中环新世界大厦成为目标,由于放置医美器材,加上部分专业医生驻场,租用楼面需求比一般公司大,承租力较强。

该厦现时专业医美行业租户比例,由疫情前10%增加至现时35%,现时整体出租率逾90%,预计年底升至逾95%水平。

医学美容比例佔35%

至于地铺出租率更高达100%,租金稳步增长,他预计明年上升至疫情前水平。由于对前景乐观,新签租户租约期较长,反映对本港经济前景乐观。

除了医学美容外,日本潮玩品牌BE@RBRICK,近期亦在大厦租用2层楼面,面积逾1.5万方呎,该公司尚举办「BE@RBRICK WORLD WIDE TOUR 3」日本以外首站的世界巡迴展览,展期至5月中。

新世界大厦总出租楼面约48万方呎,现时约有3至4层楼面等租,涉及约4.5万方呎,每层面积约5000至1万方呎,已获多组客洽谈,预计未来数月完成交易。

日本BE@RBRICK承租两全层

他续指,通关后,集团旗下甲厦接获买卖及租务查询,包括内地金融机构及科技企业等,反映企业对本港经济前景乐观,相信推动今年第3及第4季甲厦成交量,加快市场復甦。

(星岛日报)

更多新世界大厦写字楼出租楼盘资讯请参阅:新世界大厦写字楼出租

更多中环区甲级写字楼出租楼盘资讯请参阅:中环区甲级写字楼出租

奢侈品牌租1.4万呎巨铺 疫后最大宗铺位租务

新世界大厦地铺,早前由意大利奢华品牌Brunello Cucinelli旗下生活家品牌Casa Cucinelli进驻,林浩文表示,该店抢闸于去年底全面通关前攻港,开设全亚洲最大型旗舰店,疫后消费模式转变,品牌更注重顾客消费体验,合共承租3层巨铺,面积逾1.4万方呎,店内设有接待室及展示厅等,属疫市后最大宗铺位租务。

市传月租80万

他又表示,该集团亦积极善用系内其他物业空间做不同POP-UP活动,如英皇道 K11 ATELIER King's Road 引入韩国沉浸式艺术馆Arte Museum及与金融机构举办音乐会。

市场消息指,上述Brunello Cucinelli月租约80万,新世界大厦写字楼意向呎租由70至逾80元。

(星岛日报)

更多新世界大厦写字楼出租楼盘资讯请参阅:新世界大厦写字楼出租

更多中环区甲级写字楼出租楼盘资讯请参阅:中环区甲级写字楼出租

更多K11 Atelier King's Road写字楼出租楼盘资讯请参阅:K11 Atelier King's Road 写字楼出租

更多鰂鱼涌区甲级写字楼出租楼盘资讯请参阅:鰂鱼涌区甲级写字楼出租

上月录1894宗工商铺租赁

有代理行资料显示,3月份共录约1894宗工商铺租务个案,总金额约1.25亿,两者对比2月份同样升约20%,呈价量齐升局面,当中宗数更录自2021年8月后单月新高,意味企业愿意承租物业开展或拓展业务。该代理行分析,随着中港澳全面通关,相信以商铺先行,餐饮业作领头羊,全面带动工商铺租赁。

该行代理表示,3月份工商铺租务,对比2月劲升20%,比较2022年3月同期更有约43%升幅,更自2021年8月后新高,反映商户对承租工商铺开业信心回升。3月份租务总金额约1.25亿,按月增约22%,按年急增约53%

代理行:创一年半单月新高

该代理续表示,商铺升幅最大,3月份录约548宗租赁,对比上月多出约52%,按年更上升约一倍,足见商户对零售及餐饮前景看好,纷纷租铺迎接新一波消费力。同时,3月份铺位租务总成交金额6703万,按月多出约75%,与2022年相比同样增加约一倍。

该代理指,工厦宗数居首位,3月共约832宗租务,总金额约2101万,对比2月分别升约12%及11%,按年增约15%及9%。

写字楼由今年1月约313宗,按月增至最新约514宗,对比2月份多出约8%,较去年同期明显改善约57%,3月份写字楼总金额录约3780万。

(星岛日报)

中环永安集团大厦单位放售,有代理表示,中环德辅道中71号永安集团大厦28楼3至7室放售,建筑面积约5912方呎,意向价约1亿5371万,平均每呎约2.6万。

平均呎价约2.6万

有代理表示,该单位交吉出售,市值呎租约45至48元,若以意向价计算,料回报逾2厘,该单位间隔四正,外望交易广场及国际金融中心二期,享部分海景,附设写字楼装修、中央冷气及来去水,永安集团大厦楼高31层,附设10部客梯及1部货梯。

上述业主于2020年以5400万购入,永安集团大厦聚集银行及金融证券机构、保险公司、律师行及医疗集团等,周边甲厦林立。

(星岛日报)

更多永安集团大厦写字楼出租楼盘资讯请参阅:永安集团大厦写字楼出租

更多交易广场写字楼出租楼盘资讯请参阅:交易广场写字楼出租

更多国际金融中心写字楼出租楼盘资讯请参阅:国际金融中心写字楼出租

更多中环区甲级写字楼出租楼盘资讯请参阅:中环区甲级写字楼出租

政府部门租创纪之城3万呎 呎租25元

近月东九龙不少租务成交来自政府机构搬迁,观塘创纪之城一期3万平方呎楼面,获政府机构租用,呎租约25元。据了解,涉及部门为选举事务处,原租用九展因大厦重建需搬迁。

市场消息指,观塘创纪之城一期录得租务成交,涉及约3万平方呎楼面,成交呎租约25元。据了解,新租客为政府部门,料属旗下选举事务处使用。该办事处主力负责选民登记、举办选举等工作,需要一定楼面运作。

原租用九展 搬迁兼扩充

据悉,机构目前其中一办事处,位于九龙湾国际展贸中心,涉及约2万平方呎。由于亿京牵头财团早前收购九展,去年提出的九龙湾重建计划,近期获准放宽高度限制4成,以重建上址成为3幢地标商业楼宇,预计2027年落成,故现有租客料在未来一段时间需迁出。政府部门现于同区租用创纪之城,并有所扩充楼面。

东九龙甲厦楼面多,不少政府部门均使用该区楼面,如去年承租东九龙多个商厦,包括一号九龙、城东誌、企业广场五期等,合共逾11万平方呎,料涉及衞生署、港台等机构使用。可配合「起动九龙东」计划作带头作用,持续进行扩充。

最近市场上大手租务成交,多来自东九龙,如观塘巧明街大型综合商业项目「The Millennity」落成,项目2座28楼全层,面积约1.26万平方呎,以每平方呎约28元租出。新租客为金融科技公司Doo Group。

另其他九龙区租务,旺角新世纪广场第一座17楼,面积约22,175平方呎,以每呎约30餘元租出。新租客为商务中心品牌Regus,本身已租用该厦约7千平方呎楼面,现进行扩充。据了解,是次租出楼面,原由内地共享空间品牌租用。

至于九龙湾国际交易中心中高层01、09至12室,面积约13,089平方呎,以每月约28.8万元租出,成交呎租约22元。

(经济日报)

更多创纪之城写字楼出租楼盘资讯请参阅:创纪之城写字楼出租

更多The Millennity写字楼出租楼盘资讯请参阅:The Millennity写字楼出租

更多城东誌写字楼出租楼盘资讯请参阅:城东誌写字楼出租

更多观塘区甲级写字楼出租楼盘资讯请参阅:观塘区甲级写字楼出租

更多企业广场写字楼出租楼盘资讯请参阅:企业广场写字楼出租

更多国际交易中心写字楼出租楼盘资讯请参阅:国际交易中心写字楼出租

更多一号九龙写字楼出租楼盘资讯请参阅:一号九龙写字楼出租

更多九龙湾区甲级写字楼出租楼盘资讯请参阅:九龙湾区甲级写字楼出租

更多新世纪广场写字楼出租楼盘资讯请参阅:新世纪广场写字楼出租

更多旺角区甲级写字楼出租楼盘资讯请参阅:旺角区甲级写字楼出租

上月工商铺买卖反弹 按月升近7成

中港通关有利投资市场,3月份整体工商铺买卖上升7成,至于后市,业界料高息环境令中细银码物业较受惠。

工商铺註册量反弹,有代理行综合土地註册处资料显示,3月份工商铺註册量是自2022年6月以来最多,共录451宗 (主要反映2月份市况、剔除54宗内部转让个案),按月急升约68.3%,而註册金额则录58.33亿元,按月大升约78.7%。

当中工商铺各板块註册宗数全綫上升,商厦表现最好,註册量按月升1.5倍至110宗;工厦表现亦相当不俗,最新录240宗註册,按月大升约84.6%。商铺板块则表现平稳,3月录得101宗登记,按月上升约7.4%。

金鐘指标商厦 呎价高位挫4成

商厦成交上,3月份核心区指标商厦录买卖成交,包括金鐘远东金融中心2302室,面积约2,282平方呎,以约7,189万元易手,呎价约3.1万元,买家料为用家。按成交呎价计,已较高峰期同类单位下跌约4成。据悉,原业主为投资者,于2016年底以约8,717万元购入单位,如今持货7年沽出,蚀约1,528万元离场,蚀幅约18%。

若按金额划分,3月份註册量升幅最多的为价值逾500万至1,000万元的物业,按月增约1.1倍至101宗,其次为逾1,000万至2,000万元及逾5,000万至1亿元的物业,按月分别急升约86.5%及62.5%至69宗和13宗登记。在逾亿元买卖註册方面,3月维持4宗,其中商厦及铺位物业註册各有2宗,商厦包括有长沙湾南商金融创新中心27楼9个单位,以及旺角砵兰街450至454号HQ全幢,作价分别为2.41亿元及3.5亿元。商铺则包括有旺角商业大厦地下至4楼多个铺位及屯门城点基座商场,成交金额分别为3.5亿元及4.4亿元。

高息环境 中细码物业后市受惠

该行代理表示,受联储局加息影响,不少的债券价格大幅下跌,导致不少存户从持有相关资产的金融机构提款,部分银行更因流动性危机而被接管或併购。不过,随着联储局向银行提供短期贷款,预料欧美的金融市场暂时将会恢復稳定,短期内对本地工商铺市场的影响有限。不过,由于美国整体通胀率回落的幅度缓慢,部分范畴的通胀率仍然居高不下,该代理相信未来的高息环境会持续。大手物业成交将会保持淡静,但对于一些资金充裕的投资者而言,仍有能力买入一些中低价物业,预料这类物业仍会录得可观的交投数字。

(经济日报)

更多远东金融中心写字楼出售楼盘资讯请参阅:远东金融中心写字楼出售

更多金鐘区甲级写字楼出售楼盘资讯请参阅:金鐘区甲级写字楼出售

更多南商金融创新中心写字楼出售楼盘资讯请参阅:南商金融创新中心写字楼出售

更多长沙湾区甲级写字楼出售楼盘资讯请参阅:长沙湾区甲级写字楼出售

Secondary home sales lag amid Easter travel exodus

Hong Kong's property transactions slowed during the four-day Easter break as people traveled to the mainland and overseas.

A total of 19 deals were recorded at 10 major housing estates over the holiday, which was down by 64 percent from the 53 transactions notched up last year, according to a property agency.

The number for the weekend alone, though, rose slightly by 10 percent to 11 deals from a week ago.

A property agent said that with society moving back to normality, many Hongkongers went traveling during the break, which affected property viewing activities, leading to a sink in transactions.

The agent expects the focus to remain on the primary market this month and second-hand sales will be affected.

Another property agency also saw deals at 10 blue-chip estates more than halve to 23 over the long break with the weekend transactions up by 9.1 percent to a five-week high of 12 transactions.

Some homeowners have narrowed the room for a price negotiation or have even raised their asking price given the recent positive sentiment in the market. Yet buyers have not followed the rising prices, leaving the secondary market in a tug-of-war situation for the time being, another agent said.

But the agent believes that home sales will gradually pick up - driven by the release of the purchasing power of the "new Hongkongers" from the mainland - as the economy recovers and the interest rate peaks.

In the new homes market, Wheelock Properties' Koko Mare in Lam Tin has released the fourth price list of 58 units at an average price of HK$19,670 per square foot after discounts, up by 7.3 percent from the first listing.

The batch includes 15 one-bedroom units and 43 two-bedroom units, with the cheapest units costing HK$6.4 million after discounts.

Managing director Ricky Wong Kwong-yiu said the price is in line with that in the first batch given the differences in views and direction. The developer has received over 2,100 checks.

It plans to launch a new round of sales next week.

On the luxury front, Sino Land (0083) and CLP (0002) will put 34 flats at St George's Mansions in Ho Man Tin up for tender starting Friday.

(The Standard)尖沙咀新港中心 低层户租8.3万

整体商厦租务稍增,消息指,尖沙咀新港中心一座低层07室,面积约2,445平方呎,以每月约8.3万元租出,呎租约34元。

另同地段的力宝太阳广场低层单位,面积约2,950平方呎,以每呎约31元租出,涉及月租约9.1万元。

(经济日报)

更多新港中心写字楼出租楼盘资讯请参阅:新港中心写字楼出租

更多力宝太阳广场写字楼出租楼盘资讯请参阅:力宝太阳广场写字楼出租

更多尖沙咀区甲级写字楼出租楼盘资讯请参阅:尖沙咀区甲级写字楼出租

通关后商厦租务看俏 疫后新生态渐现

随着疫情消退、中港通关,本地经济迈向復常,带动工商铺市场投资气氛好转。根据政府统计处中小型企业业务状况调查,中小企业务收益的现时动向指数由去年12月的46.1,弹升6%至2月的49,显示中小企对未来业务情况较去年乐观,整体就业情况持续改善。

踏入经济重啟的新阶段,企业和投资者重拾信心,写字楼市场在2023年恢復交投动力。近期商厦租务交投步伐略见加快,根据一间代理行2月发表的商厦市场报告指出,租务成交量按月攀升53.6%至401宗,相信是企业选择扩充令租赁需求逐渐回升。

其中,内地旅客来港进行医疗美容或专业体检服务的需求渐增,尤其在通关后交投更活跃,其中旺角中心、佐敦香港体检中心的医疗楼层录得数宗医学美容承租个案,反映医疗及美容中心的扩张需求仍然强劲,可望提振传统旅游旺区如尖沙咀、旺角的写字楼租赁需求。

利好因素 带动后市表现

展望中长綫发展,市场人士认为各大零售核心区周边且具楼上铺概念的写字楼更受市场追捧,原因是可满足跨境医疗旅客对私隐度高、环境舒适方便的要求,同时该类型物业仍属低水,预料可以吸引资金流入,预计有质素的商厦物业前景理想,以尖沙咀为例,该区商厦平均呎价介乎10,536元至12,081元,回报率更达2.8%至3.4%。

长綫而言,商业地皮的拍卖情况值得留意,例如今财年即将推3幅位处市区核心地段的地皮,不论是金鐘、湾仔或啟德均极具策略性及发展潜力,料能够吸引本地和内地大型发展商入标。同时,市场憧憬政府一连串「招商引才」相关措施带来正面影响,带动企业落户需求,相信未来会有不同行业的公司持续在港购入或租用写字楼,有利商厦长远发展及成交。

(经济日报)

更多香港体检中心写字楼出租楼盘资讯请参阅:香港体检中心写字楼出租

更多佐敦区甲级写字楼出租楼盘资讯请参阅:佐敦区甲级写字楼出租

湾仔3幢政府大楼 最快2026年可腾出

政府产业署每年覆检未尽其用的政府土地,以腾出作其他发展用途。今年预计将腾出26.8万平方呎的古洞石仔岭花园,配合新界东北发展兴建道路及安老院;而湾仔海旁3幢政府大楼,则预计最快仍要2026年之后才有机会腾出。

石仔岭花园 腾出26.8万呎

根据产业署回覆立法会的资料显示,当局过去3年腾出了合共4幅用地作不同用途,其中前坚尼地城已婚警察宿舍B座,面积2.7万平方呎,将会拨出作为公营房屋发展。

据资料显示,前坚尼地城已婚警察宿舍B座多年来有意重建,早在2002年所有居民均已经迁出,一直空置长达逾10年,按照政府规划该宿舍将联同前香港学堂临时校舍用地,一併重建成约1,200个公营房屋单位。

至于今年会腾出的石仔岭花园,则前身为英军军营,多年来出租予安老院营运,在2020年已经开始清折,估计产业署今年度属于正式交地作发展。

在产业署未来计划腾出的土地之中,最为瞩目为湾仔海旁3座政府大楼,将会发展成贵重商业项目,不过据产业署指,有关政府大楼原有部门的重置计划涉及兴建9个重置项目,其中4个项目已经落成并陆续啟用,餘下5个重置项目正在兴建中,预计将相继于2023至2026年完工。换句话,相信在未来3年内要推出该地皮的机会不大。

(经济日报)

建华集团2年9.35亿 购啟德2商场

6.5亿买啟德1号基座 回报约5厘

地区商场承接力强。较早前,中国海外 (00688) 以6.5亿元,沽出旗下楼盘啟德1号基座商场铺位,买家为建华集团,增持铺位料部分作自用。

资料显示,啟德沐寧街2号及8号,均为啟德1号基座商场,以6.5亿元成交,按物业面积约3.5万平方呎计,呎价逾1.85万元。由两间有限公司登记购入,其中一间的董事为建华集团行政总裁凌伟业。

经营街市的建华集团,亦曾于啟德购铺。2021年集团向合景泰富 (01813) 及龙湖地产 (00960) 购入啟德住宅尚‧珒,基座铺位,涉2.85亿元,连同是次大手入市,2年斥9.35亿元购入啟德商铺。

翻查资料,地段2号地下及1楼,面积约17,360平方呎,地下铺位面积由637平方呎起,租客主要为地产代理,1楼则由酒店租用。同地段8号地下及1楼,面积约17,780平方呎,地下租客包括地产代理、医务所等,1楼为餐厅。现时两商场铺位总月租高见274万元,按6.5亿元成交价计,租金回报率高见约5厘,估计建华将收回部分铺位自用。

旺角花园街铺 1.15亿易手

另资料显示,旺角花园街45至47号地下A号铺,即波鞋街地铺,以1.15亿元成交,以铺位面积约2,000平方呎计算,呎价约5.75万元。铺位原由「波鞋街大王」之称的彭汉釗持有,1986年以303万元购入,上月则以1.15亿元沽出,持货37年帐面大赚37倍或1.1亿元。事实上,比邻铺位,即花园街45至47号地下B号,则在2月份凯施饼店以1.148亿元沽出。

(经济日报)

市况转好 老牌投资者趁机沽货

通关后投资市场持续向好,而业界老牌投资者趁市况转好,纷大手放售物业,希望藉此套现,再作部署。

最近不少资深投资者大手放售铺位,较为积极包括「铺王」邓成波家族,近2年不时大手放售旗下物业,日前再有一张最新放售物业清单曝光,合共25项物业,分布港九新界,包括有铺位、商住楼、写字楼及车场等,市值合共约逾60亿元。

该批物业分布观塘、旺角、尖沙咀及湾仔,价值最高为观塘兴业街1号骆驼漆中心全幢,物业位于开源道及兴业街交界,距离港铁观塘站2分鐘步程。总楼面面积约逾10万平方呎,项目楼高7层,已转作商铺用途,市值约11.2亿元。翻查资料,2017年波叔曾委託测量师行放售,叫价28.8亿元,去年推出时叫价约14亿,已减价一半,按最新叫价计,再减20%。

邓成波家族 放售25项物业

另外,位于尖沙咀加拿分道37至39号物业,以约6.8亿元放售,目前按月收租约59.6万元;另外,家族透过代理行放售深水埗钦洲街明辉大厦商住楼,亦在物业清单内,意向价约1.8亿元。

至于另一资深投资者罗守辉,亦推出2项贵重物业放售,其中位于尖东有尖东广场多层商铺价值最高。物业属于尖沙咀加连威老道94号明辉中心基座商场,位置上,为尖沙咀中部前往尖东必经之路。早年基座商场由不同商户租用,包括银行、餐厅、快餐店等,而业主罗守辉早年关闭商场进行质素提升,最大改动为原本多商场属中空设计,业主决定把楼上多层楼面填平,并放弃部分地库楼面,令楼上每层楼面加大,亦可作独立出租,适合餐厅等使用全层。另外,业主亦更换升降机,提高质素,而个别楼层更享有露台,据悉当时翻新费高达约1亿元。

东昌大厦两层铺 市值约6.8亿

据了解,物业地库、低层地下、地下.高层地下,以及1至3楼,每层面积由1万至1.4万平方呎,总楼面约90,222平方呎,佔全幢明辉中心的不分割份数60.1%,现以约16.8亿元放售。值得一提,经翻新后加装高清玻璃幕墙、大型LED显示屏及四面广告招牌,其外墙极具宣传之效。

另一项罗守辉推出物业为金鐘东昌大厦商铺部分,涉及物业1及2楼,面积分别约9,641及13,119平方呎,合共约22,760平方呎,铺位曾由健身中心租用,现时交吉。铺位一大卖点,是比邻今年落成的全新甲厦 The Henderson,整体商业气氛进一步提升,故商铺需求亦高,物业市值约6.8亿元,呎价约3万元。

分析指,自通关后整体商铺投资气氛明显向好,交投有所增加,而持重货的老牌业主,有见气氛远较去年理想,故即趁机放售物业,希望趁市旺沽货套现资金,留待日后再作部署,故近期见老牌业主推售物业甚积极。

(经济日报)

更多东昌大厦写字楼出售楼盘资讯请参阅:东昌大厦写字楼出售

更多金鐘区甲级写字楼出售楼盘资讯请参阅:金鐘区甲级写字楼出售

更多The Henderson写字楼出租楼盘资讯请参阅:The Henderson 写字楼出租

更多中环区甲级写字楼出租楼盘资讯请参阅:中环区甲级写字楼出租

更多明辉中心写字楼出租楼盘资讯请参阅:明辉中心写字楼出租

更多尖沙咀中心写字楼出租楼盘资讯请参阅:尖沙咀中心写字楼出租

更多明辉中心写字楼出售楼盘资讯请参阅:明辉中心写字楼出售

更多尖沙咀区甲级写字楼出售楼盘资讯请参阅:尖沙咀区甲级写字楼出售

尖沙嘴新港中心单位1.5亿易手 日资公司沽售持货18年升值47%

两地通关后,商厦市况逐步改善,尖沙嘴新港中心录1宗大买卖,一个面积近9400方呎单位,以逾1.5亿易手,平均呎价1.6万,新买家为用家,原业主为日资公司,物业于18年间升值47%。

上址为尖沙嘴新港中心第1座1407至11室,建筑面积约9392方呎,以每呎约1.6万易手,上述单位市值呎租38元,以易手价计算,料回报2.85厘。

不过,市场消息指,新买家为用家,有意购入单位自用,原业主为Rohm Elecronics (Hong Kong) Company Limited,于2005年1月以1.02亿购入上址,持货18年,帐面获利4800万,物业升值47%。

有代理指,上述为高层单位,景观开扬,亦属大厦罕有大型单位放售,成交价属市价水平。

平均呎价1.6万

于2018年市况高峰期,新港中心16楼单位,建筑面积约1947方呎,造价4478.1万,平均呎价2.3万,最新造价较高位回落30%。

近年市场屡录日资公司沽商厦,年前,日本玩具生产商TOMY沽售同区星光行一篮子全海景写字楼单位,12楼07至12室、同层14至16及16A室,建筑面积约9621方呎,属全海景办公室单位,作价逾1.443亿,呎价约1.5万,较2020年初同厦同类单位的呎价约2.1万元,大幅回落近30%。原业主80年代购入该批商厦单位。

中环中心每呎50元租出

由金利丰行政总裁朱李月华持有的中环中心33楼一个单位,涉及3303室,建筑面积约2770方呎,以每呎约50元租出,较该厦多个月前出租的33楼,呎价由32元至38元,显著上升,业内人士指,33楼由大业主持有,平衡整体利益,不会为一宗「租仔」大减价,相反地,39楼由小业主持有,大家心急希望单位快租出。

新港中心罕有大单位买卖,约9392方呎,以1.5亿易手,平均呎价1.6万,较2018年高峰期回落30%。

(星岛日报)

更多新港中心写字楼出售楼盘资讯请参阅:新港中心写字楼出售

更多星光行写字楼出售楼盘资讯请参阅:星光行写字楼出售

更多尖沙咀区甲级写字楼出售楼盘资讯请参阅:尖沙咀区甲级写字楼出售

更多中环中心写字楼出租楼盘资讯请参阅:中环中心写字楼出租

更多中环区甲级写字楼出租楼盘资讯请参阅:中环区甲级写字楼出租

字节跳动扩充 租中环国际金融中心2万呎

呎租料120元 通关带动超甲厦租务

中港通关带动中资企业扩充,中环超甲厦国际金融中心一期2万平方呎楼面,获中资科企巨头字节跳动租用,呎租料约120元,属扩充个案。该层楼面原由瑞士宝盛集团租用,早前集团迁往港岛东。

市场消息指,中环国际金融中心一期录得租务成交,涉及物业中层单位,面积约2万平方呎,以每呎约120元租出,属市价水平。据了解,新租客为中资科技公司字节跳动,近年旗下社交应用程式TikTok更是极受欢迎,属科企巨头。该集团原租用港岛区较细办公室,是次租国际金融中心一期单位,既可整合业务及扩充,并可升级至超甲厦。

翻查资料,该层楼面原由瑞士老牌私人银行宝盛集团租用,该集团原本租用中环国际金融中心一期3层楼面,以及交易广场等楼面,合共逾7万平方呎。2021年,该集团决定预租鰂鱼涌太古坊二座4层楼面作搬迁,可节省租金支出,如今其中一层楼面获中资企业承租,另其餘近两层楼面,仍在待租中。

中石油租友邦金融中心全层

通关后中资机构稍转活跃,消息指,中环超甲厦友邦金融中心 (AIA Central) 全层,面积约1.5万平方呎,以每呎约100元租出,新租客为国企中石油,料今次属扩充业务。

事实上,近期整体超甲厦租务有增,如 The Henderson 录得第3宗预租个案,涉及两层中层楼面,每层面积约1.4万平方呎,合共约2.8万平方呎,成交呎租料逾130元,新租客为加拿大退休金计划投资局 (CPPIB)。据一间外资代理行资料显示,目前中环甲厦空置率为8.9%,而最新一季租金约按季跌约1.5%。

另消息称,中环中心中层03室,面积约2,770平方呎,以每月近14万元租出,呎租约50元。

买卖方面,传统商厦交投亦稍加快。消息指,尖沙咀新港中心第一座高层07至11室,面积约9,392平方呎,1.5亿元成交,呎价约1.6万元。是次成交涉及5单位,部分连租约,平均呎租约35至36元,另两单位交吉。据了解,原业主为一家日资公司,早于2005年购入该层楼面全层。呎价方面,2022年11月,施永青旗下的「施永青基金」,以1,875万元出售新港中心高层单位,当时成交呎价仅1.25万元,现时有所回升。

(经济日报)

更多国际金融中心写字楼出租楼盘资讯请参阅:国际金融中心写字楼出租

更多交易广场写字楼出租楼盘资讯请参阅:交易广场写字楼出租

更多友邦金融中心写字楼出租楼盘资讯请参阅:友邦金融中心写字楼出租

更多The Henderson写字楼出租楼盘资讯请参阅:The Henderson 写字楼出租

更多中环中心写字楼出租楼盘资讯请参阅:中环中心写字楼出租

更多中环区甲级写字楼出租楼盘资讯请参阅:中环区甲级写字楼出租

更多新港中心写字楼出售楼盘资讯请参阅:新港中心写字楼出售

更多尖沙咀区甲级写字楼出售楼盘资讯请参阅:尖沙咀区甲级写字楼出售

更多太古坊写字楼出租楼盘资讯请参阅:太古坊写字楼出租

更多鰂鱼涌区甲级写字楼出租楼盘资讯请参阅:鰂鱼涌区甲级写字楼出租

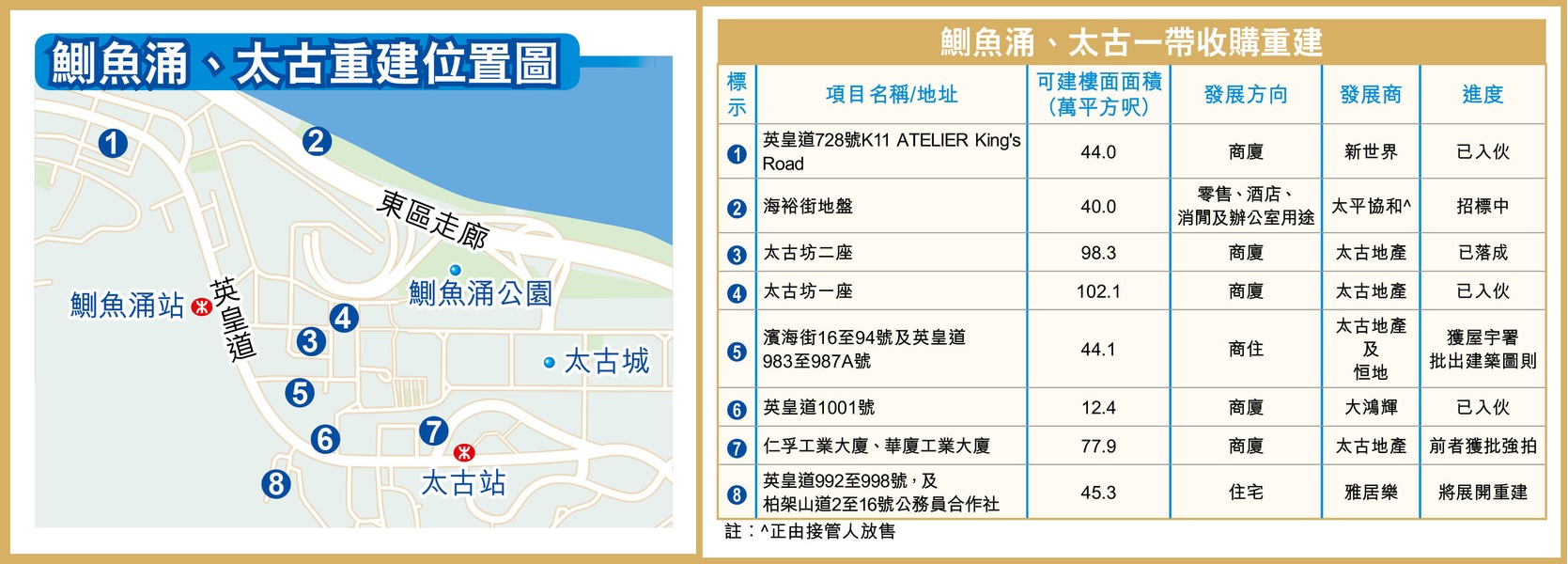

鰂鱼涌、太古一带渐成港岛东的主要商业区,该带的旧楼及工厦具重建价值,初步估计区内的重建项目涉逾464万平方呎商业楼面,而有「区内大地主」之称的太古,依然相当积极拓展区内商业王国,当中已与去年落成的太古坊二座,佔约70万平方呎总楼面,最新预租率过半数。

鰂鱼涌以往属于住宅及工业为主的社区,但随着区内的大地主太古地产 (01972) 陆续将区内厂房、工厦重建成为太古坊的商厦群,渐变成本港第2个商业延伸区,吸引不少大型机构进驻。

太古坊重建耗资150亿

本身已经坐拥区内商业王国太古坊的太古地产,依然积极巩固其地位,发展商早前展开太古坊重建计划,耗资约150亿元,其中太古坊一座已于2018年落成,而太古坊二座则于去年9月落成,现为1座楼高42层的甲级写字楼,总楼面面积逾98.3万平方呎。太古地产近日透露,项目的预租率升至逾56%,现时租户包括瑞士宝盛、东方汇理香港、中信银行 (国际) 等。

仁孚工厦获批强拍 底价逾50亿

同时,太古地产收购逾10年的鰂鱼涌仁孚工业大厦,已在去年初获土地审裁处批出强拍令,底价为约50.526亿元。发展商早于2018年已经就项目及比邻的船坞里8号华厦工业大厦申请强拍。据集团透露,若最终成功投得上述2项目,将计划重建为办公楼及其他商业用途,总楼面约77.9万平方呎。

由于该区加快转型,发展商看準机遇,陆续为收购区内工厦及旧楼。太古及恒地 (00012) 旗下的鰂鱼涌滨海街16至94号及英皇道983至987A号旧楼,亦已在去年3月获屋宇署批建2幢28层高 (另设3层平台及2层地库) 的商住大厦,及设有住户康乐设施,住用总楼面约36.83万平方呎,非住用楼面则涉约7.24万平方呎。

另外,原由太平协和所持有的鰂鱼涌海裕街地盘,于去年中招标放售,可重建的商业楼面涉约40万平方呎。消息指,项目的市值约40亿元,每呎楼面地价约1万元,但日后转作商厦用途时需补地价。项目在2021年3月获通过有关原址换地申请,拟换地后的地盘面积或可达91,838平方呎,经补地价后或可提供建筑面积约40万平方呎楼面,发展为5幢34米至41米 (主水平基準以上) 的建筑物,用作酒店及办公室,并设4.1万平方呎的观景平台。

(经济日报)

更多太古坊写字楼出租楼盘资讯请参阅:太古坊写字楼出租

更多鰂鱼涌区甲级写字楼出租楼盘资讯请参阅:鰂鱼涌区甲级写字楼出租

去年甲厦空置率 创98年后新高

受疫情打击,去年写字楼的空置率进一步攀升。据差估署近日公布的《香港物业报告2023》初步统计数字,2022年写字楼的整体空置率则升至14.4%,按年增2.1个百分点。至于甲级写字楼的空置率则升至15.1%,较2021年的12.5%升2.6个百分点,两者均创下于1998年后,即24年后新高纪录。

疫情拖累 写字楼需求受压

报告亦提及,除中区录8.7%较低空置率外,所有分区的甲级写字楼均录得双位数的空置率,可见甲厦的空置情况颇为严重。

另外,由于受全球利率上升、疫情等利淡因素影响,2022年大部分时间的经济前景变得黯淡,为市场带来不确定性,及导致写字楼需求受压。2022年第4季度甲级写字楼的售价,及租金分别按年下跌4.9%及2.6%。

翻查差估署资料,截至2023年1月,该月的甲级写字楼平均租金最贵的地区属于中区,每平方呎租约94元,其次为上环,每平方呎租约86元,排名第3为湾仔/铜锣湾,每平方呎呎租约60元,紧随其后是北角/鰂鱼涌,每平方呎租约50元。

(经济日报)

外资代理行:商铺租务增 料今年租金升1成

通关后旅客重返,有外资代理行指,商铺租务明显上升,料今年铺租升约10%,而写字楼空置楼面仍多,全年租金料跌约5%。

中港通关后,核心区铺位租务明显上升,该行资料显示,首季核心区铺位租务达45万平方呎,为近十多年来单一季度最高,反映旅客重返,令商户重新租铺,空置率下降0.5个百分点至14.9%,

该行代理表示,零售商现考虑实体店扩张,把握旅客重临的机会,惟奢侈品牌目前大多持观望态度。该代理指核心区街铺租金按季上升1.2%,预计今年将上升5至10%。

写字楼空置多 全年租金跌约5%

写字楼市场方面,该行另一代理指,通关后写字楼租赁在2023年第一季度有所改善,净吸纳量连续第三个季度保持正增长,达到15.9万平方呎,空置率自2018年第四季度以来首次下跌0.2个百分点至15.1%,总空置面积为1,290万平方呎。后市上,该代理指整体商业气氛将改善,惟今年仍有260万平方呎新供应,故料全年空置率仍上升至16%以上,全年写字楼租金仍跌约5%。

(经济日报)

伯恩光学观塘工厦今举行强拍

伯恩光学创办人杨建文併购的观塘业发工业大厦1期,去年获土地审裁处颁下强制售卖令后,最新落实于今日举行公开拍卖,底价为23.49亿。料与毗邻项目重建商厦发展,涉72万方呎。

业发工业大厦1期位于观塘开源道77号,现址1幢15层高工厦,早于1978年落成,至今约45年楼龄。

该旧楼地盘面积约2万方呎,土地用途为商贸地带,若地积比约12倍重建发展,涉及可建总楼面约24万方呎,若以强拍底价计算,每方呎楼面呎价约9788元。

(星岛日报)

PRESALE APPROVALS jump 90pc in march

Three projects with a total of 1,482 homes were granted presale consents last month - an increase of 703 units or 90.2 percent month-on-month, according to the Lands Department.

But the department granted only eight residential presale consents in the first quarter of this year, allowing for the sale of 4,031 units. This marks a decrease of 15.7 percent from the fourth quarter of last year, when 4,784 units were granted presale consents.

The three new developments approved for presales in March include In One phase IC atop the Ho Man Tin MTR Station, a joint venture between Chinachem and MTR Corp (0066) involving 214 units. They have an anticipated completion date of May 5, 2025.

The developers launched the first round of sales earlier this month to promote and sell 210 flats, and by Monday 161 were sold. They accounted for more than 76 percent of the flats available for sale and brought a return of nearly HK$2.85 billion.

The other two projects approved for presales are Twin Victoria by China Overseas (0688), featuring 702 flats, and The Knightsbridge, a collaborative effort between six developers, with 566 flats.

Both projects are at Kai Tak.

Meanwhile, developers of a residential project in Tai Kei Leng, Yuen Long, have applied to increase the building density by over 20 percent to construct 345 flats.

The project is said to be a collaboration between Henderson Land (0012) and New World Development (0017).

It has also been reported that a consortium has purchased an old building at 59-77 Prince Edward Road West in Mong Kok for redevelopment at a price of about HK$11,000 per square foot.

The residential component of the purchase is said to be about HK$591 million.

Elsewhere, St George's Mansions in Ho Man Tin will begin the tender sale of 34 units this Friday. The upscale development has sold 27 flats since its launch in mid-2020, bringing in almost HK$3.3 billion in revenue.

And this Saturday, Wheelock Properties will release the second batch of flats for sale at Koko Mare in Lam Tin. The batch will include a total of 98 flats, with sizes ranging from 310 to 529 sq ft, and discounted prices ranging from HK$5.9 million to HK$11.1 million.

In other news, high street shop rents in Hong Kong are expected to increase by up to 10 percent in 2023 due to the significant return of tourists, while office rents are anticipated to soften further and may drop by up to five percent, according to a property agency.

High street shop rents experienced a quarterly recovery of 1.2 percent in the first quarter, bouncing back from a 3 percent decline in 2022.

(The Standard)「磁带大王」11.6亿放售中环中心涉75楼全层 意向每呎4.8万

两地通关后,投资者见市场气氛改善,大手放售物业,「磁带大王」陈秉志持有的中环中心多层楼面,其中75楼全层推出放售,意向价近11.6亿,平均每呎4.8万,并以全港第5高建筑物作为招徠。

上址为中环中心75楼全层,建筑面积约24121方呎,由于楼面庞大,涉及银码高达11.57亿,昨日有不少住宅部代理,收取由商业部代理发出物业讯息,字眼具创意,指该项目为「晋身跨国企业形象的阶梯」,大厦以高度闻名香港,为香港第5高大厦。

电讯商承租 料回报2厘

至于前4位高楼则全部「非卖品」,分别为西九龙环球贸易广场、中环国际金融中心、湾仔中环广场以及中环中国银行总行中银大厦,并强调「商厦讲求地段、 级数、重建价值及自用罕有性,而非回报率」。

可买卖公司省印花税

而事实上,该75楼全层实用率近80%,租客为中国联通,月租167万,于明年6月30日届满,平均69.23元,市场人士指,租金属市价水平,若以意向价计算,料回报不足2厘。该物业可以买卖公司,省却釐印费,市场人士指,相信日后买家为自用客居多。

过往,「磁带大王」陈秉志连环沽售中环中心,包括25楼全层,涉资逾6.75亿,48楼全层以逾9.8亿沽售,除了全层之外,他亦以约4亿卖出中环中心42楼「中转楼层」的70%业权予金利丰朱李月华。

中环中心于2017年11月以402亿易手,为瞩目世纪大刁,买家还包括世茂许荣茂、金利丰朱李月华、「小巴大王」马亚木、「物流张」张顺宜、投资者蔡志忠及商人卢文端。

「磁带大王」陈秉志11.6亿放售中环中心75楼全层,呎价4.8万,回报料不足2厘。

(星岛日报)

更多中环中心写字楼出售楼盘资讯请参阅:中环中心写字楼出售

更多中环区甲级写字楼出售楼盘资讯请参阅:中环区甲级写字楼出售

更多环球贸易广场写字楼出租楼盘资讯请参阅:环球贸易广场写字楼出租

更多尖沙咀区甲级写字楼出租楼盘资讯请参阅:尖沙咀区甲级写字楼出租

更多国际金融中心写字楼出租楼盘资讯请参阅:国际金融中心写字楼出租

更多中银大厦写字楼出租资讯请参阅:中银大厦写字楼出租

更多中环区甲级写字楼出租楼盘资讯请参阅:中环区甲级写字楼出租

更多中环广场写字楼出租楼盘资讯请参阅:中环广场写字楼出租

更多湾仔区甲级写字楼出租楼盘资讯请参阅:湾仔区甲级写字楼出租

两地通关后甲厦租赁渐改善,中资科技巨企字节跳动扩充楼面,承租中环国际金融中心一期单位,面积约2万呎,业界料呎租约120元。

中资科技公司字节跳动,旗下社交应用程式TikTok极受欢迎,该公司近期亦扩充楼面,承租中环超甲厦国际金融中心一期单位,面积约2万方呎,以整合业务及作为扩充,业界料呎租约120元,属市价水平,月租约240多万。

业界料呎租约120元

该全层旧租客为瑞士老牌私人银行宝盛集团,原本租用中环国际金融中心一期3全层楼面,以及邻近的交易广场单位,合共面积逾7万方呎,一年多前迁至鰂鱼涌太古坊二座,承租4层楼面,以节省租金支出。至于腾空的国际金融中心一期3层楼面,目前由字节跳动率先承租1层,其餘的2层楼面仍然放租中。业内人士表示,疫情期间,作为超甲厦的国际金融中心亦不乏空置,料随着两地通关,未来料加快租出。

(星岛日报)

更多国际金融中心写字楼出租楼盘资讯请参阅:国际金融中心写字楼出租

更多交易广场写字楼出租楼盘资讯请参阅:交易广场写字楼出租

更多中环区甲级写字楼出租楼盘资讯请参阅:中环区甲级写字楼出租

更多太古坊写字楼出租楼盘资讯请参阅:太古坊写字楼出租

更多鰂鱼涌区甲级写字楼出租楼盘资讯请参阅:鰂鱼涌区甲级写字楼出租

甲厦录负吸量24.8万呎 外资代理行:租金按季跌1.5%

有外资代理行指出,第一季甲厦再度录负净吸纳量24.8万方呎,反映企业以节省成本为目标,扩租需求普遍较少,整体待租率攀升至17.1%,租金续见下调压力,按季回落1.5%,与上年同期相比跌7.9%,首季以港岛东和九龙东租金跌幅较明显,按季下调超过2%。

预测全年租金跌2%至4%

该行代理指,过去数周,写字楼查询及看楼活动渐回升,不过,仍需要一段时间才能转化实际租赁成交,通关为市场释出利好讯息,但目前写字楼待租率处高水平,预测全年租金跌2%至4%。

新租赁以银行及金融行业租户 (33.3%) 面积佔比最大,其次专业服务行业 (14.8%) 及医疗美容 (13.5%)。九龙东及中区分别佔比超过30%及20%。展望未来几个月,内地企业潜在需求有助带动写字楼租赁。另外,本年下半年度将有近200万方呎新供应落成,预租面积将为市场带来正吸纳量,维持全年吸纳量预测约在40万方呎水平。

上半年铺租料升3至8%

今年首两个月零售业总销货额总计693亿,由于去年基数较低,按年录17.3%升幅。街铺空置率普遍下跌,旺角空置率按季下降1.8个百分点至10.9%,中环下降1.4个百分点至9.9%,尖沙嘴下降1.2个百分点至15.5%,铜锣湾空置率维持在7.9%。由本地白领和高端旅客支持的中环,租金按季升3.2%,旺角按季升2.8%,铜锣湾则按季升2.4%。

(星岛日报)

外资代理行:料利息次季见顶 大手买卖将趋向活跃

有外资代理行指出,受加息影响,今年首季巿场仅录15宗大手交易 (亿元或以上),总值91亿,按年跌16%,按季跌15%。不过,随着欧美银行危机渐稳定,利率快见顶,大手买卖将在第二季变活跃。

首季仅录15宗大手交易

该行代理表示,零售 (价值2亿内) 和住宅地将吸引投资者,政府发布《有关香港发展家族办公室业务的政策宣言》中措施,中长期推高物业需求和价格。近期,準买家查询量恢復2019年中前60%至70%,包括基金及内地投资者。

该行另一代理表示,今年甲厦落成量可达350万方呎,包括中环2座新供应,空置率偏高,不过,租赁活动增加,今年第一季凈吸收量9.3万方呎,整体甲厦空置率微降至14.7%。

第1季甲厦租金按年跌1.3%

另一代理说,今年第一季整体甲厦租金按年跌1.3%,尖沙嘴空置率按季跌0.4%至12%,今年1月至2月,整体零售业销售额按年增长17.3%,包括珠宝鐘表增62.6%及服装增46.3%,带动铺位市况。

另有代理指,本季仓库空置率为3.3%,按季保持稳定,低空置率租金偏向业主叫价,只略下降0.5%,普通工业租金同期按季增长0.5%。 另一代理料住宅市场表现向好,年内升幅5%至9%。

(星岛日报)

伯恩光学23.49亿夺观塘工厦 与毗邻项目合併重建可建楼面约72万呎

观塘工业区起动,不少财团趁势把旗下工厦改划作商业发展,由伯恩光学杨氏家族併购的观塘业发工业大厦1期,昨日以底价23.49亿投得,成功统一业权发展。料日后该项目将与毗邻的项目合併重建1幢楼高39层的商厦,涉及总楼面约72万方呎。

由伯恩光学创办人杨建文併购的观塘业发工业大厦1期,早于2018年向土地审裁处申请强拍,去年获该处颁下强制售卖令后,昨日举行公开拍卖,结果由手持「3号牌」财团代表,在无竞争对手下,以底价23.49亿投得,成功统一业权发展,结束历时5年的强拍程序。

每呎楼面地价约9788元

业发工业大厦1期位于观塘开源道77号,现址1幢15层高工厦,早于1978年落成,至今约45年楼龄。该旧楼地盘面积约2万方呎,土地用途为商贸地带,以地积比约12倍重建发展,涉及可建总楼面约24万方呎,若以强拍底价计算,每方呎楼面地价约9788元。

值得留意的是,杨建文或有关人士早于2017年12月透过强拍途径以底价约16.216亿、统一毗邻开源道75号业发工业大厦2期,换言之两个项目强拍总金额约39.706亿;事实上,该两幢工厦连同毗邻的年运工业大厦已于去年获城规会批准重建商厦。

已获批重建商厦

据城规会文件显示,项目地盘面积约5万方呎,将重建为1幢楼高39层的商业大厦,其中地库1楼至10楼属零售餐饮用途,楼上则属于办公室用途,涉及总楼面约72万方呎。

有代理指,经济虽已復常,但发展商仍须观望楼市情况,因此併购活动仍未全面復甦。

伯恩光学昨以底价投得观塘业发工业大厦1期,料与毗邻项目合併重建成商厦,总楼面约72万方呎。

(星岛日报)

山顶马己仙峡道屋地50亿易手 持货逾70年 「锡矿大王」陆佑家族沽货

星岛独家本报获悉,山顶超级豪宅地新录大额成交,月前区内1幅贵重地皮罕有放售,令财团趋之若鶩,在两地全面通关不足3个月,山顶随即录大手成交,由陆佑家族持有逾70年的山顶马己仙峡道屋地,刚获财团以50亿购入,造价属有史以来本港屋地第三高,平均楼面呎价逾10万,业内人士称,该项目极具重建价值,料重建成超级洋房。

本报地产组

市场消息透露,由马来西亚「锡矿大王」陆佑家族持有马己仙峡道30至38号豪宅,于今年2月委託测量师行进行放售,项目佔地面积约66650方呎,为山顶区珍罕的大型地皮,意向价50亿至60亿,随即吸引多家财团洽商,最终在不足3个月内,已落实新买家,项目刚以50亿易手,成为瞩目的大手买卖。知情人士续说,该项交易以买卖公司形式易手,新买家得以节省釐印费,项目极具重建价值,重建总楼面约4.8万方呎,以易手价计算,每呎楼面价约10.42万。新买家看中该项目位处山项,私隐度极高,而且享维港全海景,极之吸引。

2月委测量师行进行放售

该项目造价亦属有史以来屋地第三高,多年来,市场录瞩目的屋地成交,包括2018年,华润置地向周寿臣家族后人购入寿山村道39号屋地,作价逾59亿,至今仍是本港历来最贵造价私人屋地,楼面呎价达8.6万,则创南区内新高。

于2015年,「重庆李嘉诚」张松桥向何东后人购入山顶何东花园,作价51亿,至今造价仍然是屋地第3高,佔地12.4万呎的何东花园,重建楼面约6.2万方呎,张松桥随后将之重建2幢超级洋房,每幢约3万方呎,每幢出售价逾30多亿。业内人士预料,马己仙峡道屋地很适合重建大型豪宅,因应超级富豪喜好,预期新买家极大机会将物业,重建为2幢超级洋房,每幢约2.4万方呎,吸引超级富豪进驻,由于传统地皮豪宅供不应求,多年来价格一直保持硬净,近年来,山顶以至南区等传统豪宅,新盘造价屡创新高,未受市况低沉所冲击。

山顶何东花园作价51亿瞩目

市场人士指,陆佑家族持有物业逾70年,并曾于50年代将物业重建,及后大部分单位出租,据说,亦有家族成员曾在此居住,今番沽售料获利可观。

除了私人豪宅地皮外,政府卖地表曾有多幅港岛区地皮以高价批出,最瞩目为九龙仓于2020年12月豪掷120亿投得山顶文辉道2、4、6及8号豪宅地,当时每方呎楼面地价约46272元,至于文辉道9及11号地皮,亦于2021年2月由九龙仓为首财团以72.5亿夺标,以可建楼面约14.5万方呎计,每呎地价50010元。

另外,港岛大坑道135号地皮,由中信泰富于2019年12月以32亿投得,当时每方呎楼面地价约24836元。

爪哇控股去年亦斥资11.881818亿投得浅水湾南湾道豪宅地,当时每方呎楼面地价达62352元,呎价更打破全港卖地史纪录,一举登上呎价最贵地王宝座;其后该公司于同年底引入汉国置业共同发展。

陆佑家族持有的马己仙峡道30至38号,现址为金马伦大厦,由多幢低密度住宅组成。

(星岛日报)

资本中心全层连两车位 银主放售

湾仔资本中心14楼全层连两个车位,现正放售。物业为银主盘,以现状、部分交吉及部分连租约出售。

资本中心位于湾仔告士打道151号,是次出售14楼全层物业,建筑面积约1.45万方呎,实用率约79%,享有维多利亚港海景,以及湾仔运动场开扬景观。物业于1982年落成,但近年大厦大堂及升降机已进行全面翻新。现时大厦大堂装修新簇,设有8部升降机及1部专用载货升降机。连同物业合併出售的车位为资本中心3楼的307及308号车位。

有代理表示,受惠全面通关效应及经济復甦带动,为核心甲级写字楼市场交投带来更正面和乐观的气氛和展望。是次出售的资本中心全层连车位为罕见的投资机遇,加上为银主盘,对于有意于湾仔核心商圈购入甲级商厦楼面的投资者及用家来说实属难得的投资机遇,相信将吸引不少本地及内地买家争相竞投。

(信报)

更多资本中心写字楼出售楼盘资讯请参阅:资本中心写字楼出售

更多湾仔区甲级写字楼出售楼盘资讯请参阅:湾仔区甲级写字楼出售

尖沙咀新甲厦放售 估值25亿

资深投资者吴镇科家族旗下亨利集团持有,尖沙咀堪富利士道1至2A号全新甲厦现正放售,市值约25亿元,其总建筑面积约58,584平方呎,以此计算,呎价约4.3万元。

物业为1座22层高商厦,料于今年第二季落成。有代理称,物业标準楼层面积约3,000平方呎,高层均设有露台及空中花园,可望维港海景及九龙公园景致。

(经济日报)

工商铺疫后攻略 专家看好铺市

中港正式通关,经济復常,商用物业需求上升。业界人士普遍认为,息口走势成为投资市场关键,而加息预计放缓下,现时属投资工商铺良好时机,并以商铺市场最值得睇好。

疫情持续3年,中港持续封关,严重冲击商用物业需求。今年初,中港正式通关,2月更是全面通关,立即带动投资气氛。据一间本地代理行资料显示,3月份整体註册宗数最新报451宗,按月反弹约68.3%,註册金额则录58.33亿元,按月上升约78.7%。当中工商铺各板块註册宗数全綫上升,商厦表现最好,註册量按月升1.5倍至110宗,工厦表现亦相当不俗,最新录240宗註册,按月大升约84.6%。商铺板块则表现平稳,3月录得101宗登记,按月上升约7.4%。

首季工商铺914买卖 升18%

季度买卖上,另一本地代理行资料显示,今年首季工商铺914宗买卖,较去年第四季的772宗,升约18%,涉及金额约217亿元,较过往两季为高,但整体来说仍属偏低水平。

至于较大额的物业买卖市场上,有外资代理行资料统计,2023年第一季度商业地产投资额 (超过7,700万成交) 按年下跌43%至76亿元,为2020年第四季度以来数字最低的季度,全季只有两宗逾10亿元或以上买卖,当中商铺交易佔投资额一半以上,自2020年第四季度以来首次出现。

工商铺市场以投资者作主导,而去年起美国加息,即令工商铺投资减慢。美国联储局于今年第一季度再次加息50个基点,而香港主要银行维持最佳贷款利率不变。1个月期香港银行同业拆息 (HIBOR) 由2022年12月的4.4厘,下降至2023年3月的3.2厘,整体上仍远较2021年为高,成为大额物业投资最大阻力。

投资市场 暂难V形反弹

后市方面,业界人士相信,高息环境仍会影响投资意慾。有代理认为,因处相对高息环境,投资工商铺回报率不足以抵销利息开支,投资市场暂难出现V形反弹,但相信通关后,租务需求向上,带动买卖市场。该代理指,商铺市场已率先反弹,现时买铺投资者憧憬资产价格上升,故此无惧息口。另一代理表示,美国整体通胀率回落的幅度缓慢,部分范畴的通胀率仍然居高不下,相信未来的高息环境会持续。大手物业成交将会保持淡静,但对于一些资金充裕的投资者而言,对中低价物业感兴趣,料中低价物业交投转理想。

投资者方面,资本策略 (00497) 主席钟楚义认为,息口偏高当然会影响工商铺投资,但由于现处加息周期尾声,加上价格已调整,故属入市好时机,并相信不论商铺及商厦,交投料同步向上。宏安地产 (01243) 行政总裁邓灝康认为,写字楼空置率高,相对压力较大,比较看好商铺市场,最近有内地客入市购铺。大手市场上,他指加息后基金暂缓入市,料大额成交量会偏低。

(经济日报)

奢侈品现扩充 旺区铺租可升约1成

通关后核心区商铺租务急增,空置率下降,业界人士相信,年内铺租可以回升。

有外资代理行最新发表的第一季香港零售租赁市场报告指出,核心区铺位租金自2019年第二季开始急跌,其后新冠疫情来袭,铺市进一步受挫,及至今年首季中港通关后,铺租才出现了4年以来的首次明显回升。

受惠旅游相关行业的租赁带动,中环、尖沙咀及旺角的优质商铺租金按季升5%,而铜锣湾则微升0.8%,以致本港整体优质街铺租金在本季增长为3.9%,是自2019年首季以来铺租首度回升。

该行指,首季4大核心商业街的空置率居高不下,广东道有4成街铺仍然待租,罗素街和西洋菜南街的空置率分别为27%及23%;皇后大道中街铺的业主愿意接受不同的新租户进驻,例如药房、中端时装店和饼店等,空置率因而下降至20%。

Swatch Group 百万租中环多层铺

首季租务上,奢侈品开始出现扩充,但个案不算多,不过Swatch Group以约100万元,租用皇后大道中丰乐行多层铺位。至于六福珠宝亦以约60万元,租用罗素街8号地下铺位。

后市上,该行预料,因整体市况受利好因素带动,核心区街铺租金有8%至12%的上调幅度。

(经济日报)

更多丰乐行写字楼出租楼盘资讯请参阅:丰乐行写字楼出租

更多中环区甲级写字楼出租楼盘资讯请参阅:中环区甲级写字楼出租

跨国企业仍审慎 中资成甲厦动力

甲厦空置楼面仍处高位,业界人士认为,由于环球经济隐忧等因素,跨国企业仍相对审慎,预计市况走势关键之一是中资动力。

据一间外资代理行数据,写字楼租赁情绪在2023年第一季度有所改善,总租赁量较上一季的低基数按季增加42%,至110万平方呎。然而,租赁活动主要由一些大型企业的搬迁所主导,实际新需求租务不算多。

净吸纳量连续第三个季度保持正增长,达到15.9万平方呎,当中大部分来自九龙。而港岛区的净吸纳量为负数,企业为了追求高质素的写字楼,搬至非核心区。空置率自2018年第四季度以来首次下跌0.2个百分点至15.1%,而总空置面积为1,290万平方呎,仍处相对高水平。

外资代理行:租金料仍轻微下跌

该行代理指出,今年首季出现正吸纳量,主因新供应尚未计算在内,而今季新供应楼面约260万平方呎,数字绝对不低。

该代理又指,通关后整体商业气氛提升,惟中资成交仅涉约7万平方呎,相信下半年情况会加快。代理分析,在高息环境下,营商环境受到一定挑战,而近期欧美出现银行倒闭及危机,或多或少影响扩充意慾,故下半年甲厦市况,很大程度上视乎中资动力,若中资扩充积极,可带动租金回稳。

后市预测上,该代理料今年因有大型项目落成,空置率料进一步上升至逾16%,租金料仍轻微下跌。

(经济日报)

新落成甲厦成焦点 吸商户预租

甲厦租金仍向下,而今年多个新项目甲厦落成,质素理想兼租金有调整,吸引不少商户预租,成近月焦点。

据一间外资代理行每月商厦租金走势显示,2月全本港整体甲厦租金普遍轻微下跌,如中环整体商厦呎租为104.2元,按月跌1.1%,而边綫区如上环、湾仔等,跌幅不足1%。

中环 The Henderson 录3宗预租

租务焦点落在核心区全新项目预租上,中环 The Henderson 录得第3宗预租个案,涉及两层中层楼面,每层面积约1.4万平方呎,合共约2.8万平方呎,成交呎租料逾130元。据悉,新租客为加拿大退休金计划投资局 (CPPIB),管理环球资产高达3万亿港元,为大型资产管理公司。据悉该机构目前租用同区约克大厦,是次搬迁可把部门整合,亦可提升级数。

今年将落成的 The Henderson 为中环超甲厦焦点项目,物业楼高36层,每层约1.2万至1.5万平方呎,包括地面和5层地库,总楼面面积46.5万平方呎,去年起进行招租,拍卖行佳士得租用4层,涉约5万平方呎,作集团在港首个常设拍卖中心和艺廊。另外,国际投资公司凯雷集团 (Carlyle) 则租用约2万平方呎楼面。

另外,铜锣湾利园一期写字楼录租务成交,涉及物业高层两层,面积约3万平方呎,以每呎逾50元租出。新租客为时装及皮具名牌Hermès,该品牌目前租用同区华懋礼顿广场,预计是次租用利园写字楼,既可升级,亦进行少量扩充,而品牌亦于利园设有分店,故更方便业务运作。

金融科企 租观塘 The Millennity

九龙区方面,租务焦点亦在全新项目,观塘巧明街 The Millennity 今年落成,项目2座28楼全层,面积约1.26万平方呎,以每平方呎约28元租出。据了解,新租客为金融科技公司Doo Group。该集团于2014年成立,总部设于新加坡,是一家以金融科技为核心的金融服务集团,提供证券、基金等金融产品,以及货币兑换等业务。该公司原租用九龙湾亿京中心单位,是次租 The Millennity 既可扩充业务,亦可升级至全新甲厦。The Millennity 首季入伙,上月开始有租客迁入,大厦近期租务亦加快,如1座20及21楼全层,每层面积约1.9万平方呎,合共约3.8万平方呎,成交呎租约28元,新租客为一家本地设计公司。

另观塘伟业街宏利金融中心亦录全层租务,涉12楼,面积约3万平方呎,以每平方呎约23元租出。据悉,新租客为网购公司STRAWBERRYNET,主要售卖美粧产品如香水、化粧品等,该公司原租用工厦物业,现转租全层甲厦,属扩充及升级。

该行指,随着整体市场气氛改善以及经济活动復甦,香港写字楼市场在2月份的表现更趋活跃。写字楼租金下降,租户追求优质写字楼空间的趋势持续,租赁市场转趋乐观。来自多个行业的企业,利用租户主导市场的优势,去整合和提升写字楼空间,料今年情况持续。

(经济日报)

更多The Henderson写字楼出租楼盘资讯请参阅:The Henderson 写字楼出租

更多约克大厦写字楼出租楼盘资讯请参阅:约克大厦写字楼出租

更多中环区甲级写字楼出租楼盘资讯请参阅:中环区甲级写字楼出租

更多利园写字楼出租楼盘资讯请参阅:利园写字楼出租

更多华懋礼顿广场写字楼出租楼盘资讯请参阅:华懋礼顿广场写字楼出租

更多铜锣湾区甲级写字楼出租楼盘资讯请参阅:铜锣湾区甲级写字楼出租

更多The Millennity写字楼出租楼盘资讯请参阅:The Millennity写字楼出租

更多宏利金融中心写字楼出租楼盘资讯请参阅:宏利金融中心写字楼出租

更多观塘区甲级写字楼出租楼盘资讯请参阅:观塘区甲级写字楼出租

更多亿京中心写字楼出租楼盘资讯请参阅:亿京中心写字楼出租

更多九龙湾区甲级写字楼出租楼盘资讯请参阅:九龙湾区甲级写字楼出租

今年甲厦供应仍然充足,除中区两幢甲厦成焦点外,非核心区如观塘、黄竹坑等,均有全新甲厦。

中环为长期供应有限的商业区,而今年却出现两幢全新项目,除了恒地 (00012) The Henderson 外,长实 (01113) 旗下和记大厦重建项目,长江集团中心二期亦于今年落成。项目楼高41层,总建筑面积达55万平方呎,标準办公室楼层建筑面积约17,300平方呎。据悉,楼层採用方正及无中柱式设计,并採取双电梯大堂设计,项目分为东、西两座,方便租户进出夏愨道和琳宝径,并提供185个车位。除全层租户外,每层东、西座的租户分别可拥有企业专属楼层式地址、专属私人电梯大堂及独立出入口。

观塘敬业街41号 拟短期推

非核心区方面,伟华置业亦将有两项目推出,其中黄竹坑Viva Place,今年尾落成,现进行招租,意向呎租约30元起。项目位于香业道及黄竹坑道,楼高27层,总楼面约30万平方呎,每层面积约10,749至11,963平方呎。该厦由伟华置业发展,早年收购项目前身为信诚工业大厦,并以10.08亿元完成补地价。另外,集团亦将观塘敬业街41号云讯广场,属拆售项目,提供29层写字楼,每层面积约1.5万平方呎,最细单位约1,800平方呎起。项目已取得入伙纸,料在短期内推出。

(经济日报)

更多The Henderson写字楼出租楼盘资讯请参阅:The Henderson 写字楼出租

更多长江集团中心二期写字楼出租楼盘资讯请参阅:长江集团中心二期写字楼出租

更多中环区甲级写字楼出租楼盘资讯请参阅:中环区甲级写字楼出租

更多云讯广场写字楼出售楼盘资讯请参阅:云讯广场写字楼出售

更多观塘区甲级写字楼出售楼盘资讯请参阅:观塘区甲级写字楼出售

Hong Kong's commercial property market is regaining momentum with ByteDance moving into One International Finance Centre and a new office tower in Tsim Sha Tsui going on the market for HK$2.5 billion.

ByteDance is shifting to a bigger office at one of Hong Kong's most prestigious locations in Central, a company spokesperson said, taking a major step to expand its presence in the financial hub after a year of cautious global expansion.

The world's most valuable tech startup's lease at One International Finance Centre will cover 20,000 square feet at HK$120 per sq ft or HK$2.4 million per month, local media reported, citing unidentified people in the market.

Elsewhere in Tsim Sha Tsui, a brand new Grade A office building on Humphreys Avenue is up sale for about HK$2.5 billion or HK$43,000 per sq ft, as companies are coming back to the city following the reopening of the border with the mainland in January.

Currently held by Henry Group, the 22-storey building is close to Nathan Road and Tsim Sha Tsui MTR station. It is expected to be completed in the second quarter of this year.

Meanwhile, Biel Crystal won a compulsory auction of the first phase of an industrial building in Kwun Tong for the reserve price of HK$2.35 billion, becoming the sole owner of the property.

A property agency estimates the rents of Grade A buildings will rally 5 percent in Central and Admiralty this year, with a 3 percent rise for the overall market, while another agency forecasts a decline of 4 percent at most this year, citing excessive supply.

In terms of shops, the agency predicts rents will rise 3 to 8 percent yearly in the first half, but still remain below pre-pandemic levels. Savills sees rents for quality stores growing up to 12 percent this year.

(The Standard)

For more information of Office for Lease at International Finance Centre please visit: Office for Lease at International Finance Centre

For more information of Grade A Office for Lease in Central please visit: Grade A Office for Lease in Central

‘Given the current double-digit office vacancy rate and discounted market, tenants have a great opportunity to upgrade or consolidate their office space,’ a property agent says

Transformers-themed restaurant ‘The Ark’ to open this month

Chinese technology company ByteDance, known for its short-video apps TikTok and Douyin, is set to move its multiple offices across Hong Kong into a new space at One International Finance Centre in Central, with the city’s commercial property market offering opportunities to upgrade or consolidate offices.

ByteDance had rented office space at One International Finance Centre, a representative told the Post. According to a person familiar with the matter, the Chinese technology company, which has multiple offices in Hong Kong, including one in Times Square and another space at WeWork in Lee Garden One, was set to move them into the new space.