逾亿买卖暂录34宗 代理:按年跌50%

有代理表示,香港地少人多,仓存需求大,迷你仓及物流行业应运而生,例如,建华集团创立新品牌24 Storage,于过去一年间设12个据点,目标为逾万呎工厦,如屯门建荣工业大厦低层全层,面积达约1万方呎,储存易集团旗下筲箕湾阿公岩村道8号的储存易集团中心开幕,总面积近7万方呎。

总金额近106亿按年跌70%

代理续表示,今年上半年暂录得约34宗逾亿成交,总金额约105.59亿。2022上半年录约68宗及360.85亿,下半年约43宗及267.27亿。对比去年上半年按年跌约50%及70%,明显反映经济环境疲弱,需待政策奏效刺激市道。

统计2023上半年十大工商铺成交,各类别分布平均,工厦及写字楼共佔5宗,其餘为与旅游相关铺位、基座商场及酒店,排名第一为尖沙嘴君怡酒店,以总价约34亿由内地旅游集团公司承接;紧接为观塘的活化商厦项目 KOHO 全幢,成交价约17亿元,市传由收租客购入;第三位则为观塘年运工业大厦强拍,由伯恩光学杨建文以约11.28亿元投得。

君怡酒店34亿承接最瞩目

十大成交排名中,基座商场易手频仍,包括荃湾协和广场商业部分,由亚证地产、联合集团和天安中国联合以约10亿买入,计画作加建改建;另大角嘴海桃湾基座西九汇商场由阳光房地产以约7.48人亿承接。

(星岛日报)

更多KOHO写字楼出租楼盘资讯请参阅:KOHO 写字楼出租

更多观塘区甲级写字楼出租楼盘资讯请参阅:观塘区甲级写字楼出租

铜锣湾谢斐道 Tower 535 录得全层租务成交,涉及物业25楼全层,面积约11,665平方呎,成交月租约70万元,呎租约60元。

据了解,新租客为一家饮食集团,将经营高级中菜。因该厦位于铜锣湾核心地段,兼享全海景,该厦高层楼面,过去亦有餐饮客户租。

(经济日报)

更多Tower 535写字楼出租楼盘资讯请参阅:Tower 535 写字楼出租

更多铜锣湾区甲级写字楼出租楼盘资讯请参阅:铜锣湾区甲级写字楼出租

观塘皇廷广场中层 呎售9151

东九龙甲厦录低价成交,消息指,观塘敬业街皇廷广场中层E室,面积约907平方呎,以约830万元易手,呎价约9,151元,呎价较去年低约1成。

租务方面,消息称,尖东永安广场中层10室,面积约1,689平方呎,以每呎约30元租出。

(经济日报)

更多皇廷广场写字楼出售楼盘资讯请参阅:皇廷广场写字楼出售

更多观塘区甲级写字楼出售楼盘资讯请参阅:观塘区甲级写字楼出售

更多永安广场写字楼出租楼盘资讯请参阅:永安广场写字楼出租

更多尖沙咀区甲级写字楼出租楼盘资讯请参阅:尖沙咀区甲级写字楼出租

New homes dominate weekend sales

Only four deals were recorded at the 10 major housing estates over the weekend as buyers were drawn to the primary market with at least 183 units sold at Henley Park in Kai Tak after sales kicked off on Saturday.

It was a 55.5 percent drop from a week ago and the ninth consecutive week with single-digit sales, according to a property agency.

New projects were very competitive in pricing that second-hand homeowners could not match, resulting in a decline in deals, a property agent said.

Another agent said US interest rates are expected to peak soon, which, together with Hong Kong's plan to fine-tune measures to help buyers purchase homes for self-use, will help boost market sentiment.

In the primary market, Henderson Land Development (0012) raised the price for Henley Park by 1 percent in the latest batch after selling 80 percent of the homes available in the first round of sales of 228 homes over the weekend.

The third batch, which involves 82 flats from 250 to 649 square feet, is priced at an average of HK$22,163 per sq ft after discounts. That compares to HK$22,148 for the second batch and HK$21,088 for the first.

Flats in the third list cost between HK$5.15 million and HK$17.59 million after discount.

The completed project offers 740 flats from 250 to 1,558 sq ft with up to three bedrooms.

(The Standard)

Henderson Land’s Kai Tak flats snapped up by young buyers, with 70 per cent of units sold ahead of interest rate hikes

The Kai Tak flats, on offer for an average price of HK$21,463 (US$2,739) per square foot, were 31 times oversubscribed as of Friday

Home prices in Hong Kong fell 15.6 per cent in 2022, the biggest annual decline since the Asian financial crisis in 1998

Young homebuyers flocked to Henderson Land Development’s new project in Kai Tak on Saturday, snapping up seven out of every 10 units on offer ahead of an expected interest rate hike.

As of 5pm, 160 of the 228 homes at Henley Park found buyers, according to a property agent.

The agent described the situation as a “fairly good sales result” given the weak market conditions at present.

“The project was greeted with heavy subscriptions and the homes can be used for investment purpose too with good returns,” the agent said. “But in the near term, home prices in [Hong Kong] are still facing downward pressure.”

The flats, sold at an average price of HK$21,463 (US$2,739) per square foot, received more than 7,100 pre-orders as of Friday, 31 times oversubscribed.

The price is about 15 per cent cheaper than leftover stock of new homes in the same district, including Henderson’s The Henley, according to another property agent.

The cheapest unit of 250 sq ft had a price tag of HK$5.18 million, while the most expensive flat, offering total space of 649 sq ft, was on offer for HK$17.24 million.

Analysts said the results were in line with expectations as most would-be buyers were still cautious about the market outlook even after Henderson offered big discounts.

Home prices in Hong Kong fell 15.6 per cent in 2022, the biggest annual decline since the Asian financial crisis in 1998, as Covid-19 pandemic curbs dented buying interest, data released by the Rating and Valuation Department showed.

Developers continued to slash prices to woo buyers after new home sales slumped 38 per cent to a three-month low of 942 in May, according to a property agency.

The first agent predicted that new home sales in June may have jumped to 1,500 units because new projects unleashed more properties on the market.

Some developers are even offering dining and travel vouchers to boost sales.

On Friday evening, 20 units at Grand Ming Group’s project The Grands at To Kwa Wan were sold, representing 67 per cent of the total 30 flats on offer, after the developer handed out vouchers worth HK$8,800 for the first six buyers.

In March, Star Properties gave out railway tickets valued at up to HK$11,000 to the first six buyers of its After The Rain project in Yuen Long.

The US central bank is likely to resume its rate hike campaign after a break earlier this month, Federal Reserve Chair Jerome Powell said on Thursday, as a slew of stronger-than-expected US economic data underscored why more monetary tightening is likely needed.

The Hong Kong government is considering marginally relaxing mortgage loan-to-value ratios for some residential property purchases, Financial Secretary Paul Chan Ma-po said on a Commercial Radio programme last Sunday.

Chan cautioned residents against a high-interest rate environment amid market expectations that the US Fed will increase rates once or twice in the second half of this year. Hong Kong interest rates move in lockstep with the US as the local currency is pegged to the US dollar.

On June 22, Bank of East Asia said it expected lenders to raise the prime rate by 25 basis points in July due to rising Hibor, which reached 5.1 per cent on Saturday, the highest level since 2007, and a tight aggregate balance.

Hong Kong’s residential market remains sluggish after a short-lived rebound in the first quarter.

Home prices may end the year unchanged from the start of 2023, Citigroup said last month.

Based on gains recorded in the first quarter, home prices could drop by 7 per cent over the remainder of the year.

(South China Morning Post)力宝中心低层单位意向租金19万

有代理表示,金鐘力宝中心二座低层单位,建筑面积约3960方呎,业主意向租金约19万元,呎租约48元。

该行指出,物业景观开扬,望园景及海景,附写字楼装修,已分间成多个会议室,亦附设电掣插位,免却重新铺设电线麻烦。单位亦设有来去水位,可作茶水间之用。

物业目前已交吉。大厦设有12部载客升降机及1部消防升降机,方便来往各楼层,亦设有停车场及上落客位,方便车辆出入。

(信报)

更多力宝中心写字楼出租楼盘资讯请参阅:力宝中心写字楼出租

更多金鐘区甲级写字楼出租楼盘资讯请参阅:金鐘区甲级写字楼出租

坚尼地城地收6标书 区内地主积极竞投

坚尼地城西寧街与域多利道交界地皮,昨截收6份标书,于邻近持有项目的发展商积极入标,包括持有邻近货仓的招商局置地 (00978),伙信置 (00083) 合资竞投,而持有域多利道60号项目的会德丰地产亦入标角逐。

上述地皮为今个财政年度 (2023年4月至2024年3月) 首幅招标政府用地。

招商局置地信置 合资竞投

本报记者现场所见,鹰君 (00041)、会德丰地产、长实 (01113)、新地 (00016) 、嘉华 (00173) 均以独资身份竞投,信置则伙招商局置地入标。值得留意的是,招商局置地持有邻近地皮的招商局货仓,若成功投得用地,估计日后发展地皮时,弹性会增加,将会发挥协同效应。而有份入标的会德丰地产亦持有邻近的域多利道60号项目。

会德丰地产物业发展高级经理何伟锦称,由于地皮位于港岛,而且集团曾发展邻近的域多利道60号,所以决定入标,出价已考虑市况、长建筑规约期限等因素。嘉华香港地产发展及租务总监尹紫薇指,地皮位于港岛,属少有供应,出价已反映建筑规约期限长的因素。

今年有多幅政府土地以低价售出或流标收场,有测量师认为,今年初楼市气氛稍有起色,但年中开始发展缓慢,估计发展商对今个财政年度第一幅地有可能存在观望态度。同时,这幅地的建筑年期较一般长,料发展商出价有可能趋向保守。

地皮现为巴士总站,面积约24,326平方呎,若以纯住宅计最高可建楼面243,264平方呎。考虑到中标发展商要进行多项相关工程,包括将现有巴士总站进行搬迁重置等,地皮的建筑规约期限长达9年,即发展商需于2032年9月30日或之前建成项目。

地皮估值约9.7亿至23.1亿元,即每呎楼面地价约4,000至9,500元。

(经济日报)

Site in Kennedy Town attracts major players

Six developers - CK Asset (1113), Great Eagle (0041), Sun Hung Kai Properties (0016), Wheelock Properties, K Wah International (0173) as well as a consortium formed by Sino Land (0083) and China Merchants Land (0978) - are vying for a Kennedy Town site.

The Lands Department said yesterday a total of six bids have been received for the plot at the junction of Sai Ning Street and Victoria Road.

The 240-square-foot plot is currently used as the Kennedy Town bus terminal and other facilities. Were the site to be used solely for residential development, the maximum gross floor area permissible would be around 243,300 sq ft. Market estimates of the site range from HK$970 million to HK$2.31 billion, with a land premium of about HK$4,000 to HK$9,500 per sq ft.

Wheelock said that decision to vie for the site on its own was made in view of the plot's prime location on Hong Kong Island and its proximity to the MTR station. In addition, the company also took into consideration its existing project at No 60 Victoria Road that is near the site.

In the primary market, Henderson Land (0012) has received a total of 7,169 checks for the 228 units in the first batch of its Kai Tak project Henley Park, making the batch 30 times oversubscribed. The discounted average price of the available flats is about HK$21,463 per sq ft.

And from July 4, CR Land (Overseas) and Poly Property (0119) will offer for sale by tender 118 flats at Pano Harbour in Kai Tak.

In other news, Jefferies believes the home price rally in the SAR has basically ended after a roughly 7 percent surge in the first half.

(The Standard)渣打71万租太古广场楼面 设私人理财中心 每呎100元为期5年

香港与内地通关后,市场对金融服务需求增加,令核心商业区商厦租赁成交加快。渣打银行刚以每月71万元承租金鐘太古广场一座7098方呎楼面,将开设优先私人理财中心。

据了解,太古广场一座9楼1至4室,租用面积合共7098方呎,每月租金71万元,呎租约100元,新租户为渣打银行,租期为5年。

据悉,渣打银行将在上址开设优先私人理财中心,专为资产管理总值达800万元或以上的高资产净值客户而设。目前渣打银行有3间优先私人理财中心在营运,分别位于中环交易广场富临阁、铜锣湾利园一期及尖沙咀 K11 ATELIER-Victoria Dockside,在租用太古广场写字楼单位后,优先私人理财中心将增至4间。

中信証券同厦扩充

另外,资料显示,欧洲最大资产管理公司东方汇理 (Amundi),原本租用太古广场一座9楼半层接近1.2万方呎单位超过10年,惟该公司已把办事处迁往鰂鱼涌全新甲级商厦太古坊二座,现由渣打银行承接当中逾半楼面。在2018至2019年期间,太古广场同类单位呎租可达150元,即最新呎租较高位下跌逾33%,吸引金融机构伺机租用。

至于上址楼下一层的8楼,近期亦录得租赁成交,为11室,租用面积3342方呎,月租约33.4万元,呎租约100元。据知,新租户为中信証券 (06030) 旗下公司。中信証券旗下相关公司自2000年起租用太古广场一座多层楼面,目前租用超过7万方呎,当中亦在8楼租用约1万方呎,在最新增租面积后扩至逾1.33万方呎,约为该层楼面约2.2万方呎逾六成。

中通快递进驻中环中心56楼

核心区其他商厦近期都录得租赁个案,位于中环皇后大道中99号的中环中心,56楼3室,建筑面积约2772方呎,以每月18万元租出,呎租约65元。市场消息指新租户为中通快递 (02057)。

(信报)

更多太古广场写字楼出租楼盘资讯请参阅:太古广场写字楼出租

更多金鐘区甲级写字楼出租楼盘资讯请参阅:金鐘区甲级写字楼出租

更多交易广场写字楼出租楼盘资讯请参阅:交易广场写字楼出租

更多中环中心写字楼出租楼盘资讯请参阅:中环中心写字楼出租

更多中环区甲级写字楼出租楼盘资讯请参阅:中环区甲级写字楼出租

更多利园写字楼出租楼盘资讯请参阅:利园写字楼出租

更多铜锣湾区甲级写字楼出租楼盘资讯请参阅:铜锣湾区甲级写字楼出租

更多维港文化汇K11办公大楼写字楼出租楼盘资讯请参阅:维港文化汇K11办公大楼写字楼出租

更多尖沙咀区甲级写字楼出租楼盘资讯请参阅:尖沙咀区甲级写字楼出租

更多太古坊写字楼出租楼盘资讯请参阅:太古坊写字楼出租

更多鰂鱼涌区甲级写字楼出租楼盘资讯请参阅:鰂鱼涌区甲级写字楼出租

尖东一带商厦林立,有多幢商厦包括新文华中心、南洋中心及好时中心等,商业气息浓,区内指标甲厦东海商业中心配套齐全,交通便利,吸引不少商户进驻。

东海商业中心位于尖沙咀东加连威老道98号,属区内著名风水名厦,位处尖东核心商业圈,由长实 (01113) 及利兴置业有限公司共同发展,并由著名日本建设公司熊谷组参与兴建,质素上乘。

物业于1982年落成,地下大堂非常宽敞外,亦提供布置甚有质素。设有6部载客电梯,方便疏通人流。物业楼高17层,总楼面面积约30万平方呎,不包括第二层地库、第一层地库及地下,当中有13层为写字楼。景观上,单位前方无大型建筑物遮挡,可远眺海景,感觉开扬。

今年暂录两成交

交通方面,大厦比邻连接红隧行人天桥出入口,步行只需约5分鐘即可达红隧巴士站及红磡站,其中东铁过海段亦已正式通车,因此现时尖东站滙聚多条港铁路綫,往来香港各区相当便利。

从大厦步行至尖沙咀港铁站,亦只需10分鐘,步行约5分鐘到康宏广场巴士总站,多条巴士綫来往港九新界。另大厦设有停车场,方便驾车人士出入。

饮食及生活配套上,物业附近已有酒楼、茶餐厅等,以及尖东知名酒店如HOTEL ICON、九龙香格里拉等,均提供特色餐饮,适合商务午餐。上班人士亦可前往漆咸道南、加连威老道一带,大型商场多,餐厅选择甚多。

此外,该厦向来以用家为主,如迪生创建 (00113) 品牌亦于上址设总部多年,而租客亦大有来头,包括大型企业及领事馆,而华侨永亨银行及滙丰银行亦于上址设有分店。

成交方面,大厦今年暂录得两宗成交,分别为6楼及10楼单位,面积972及817平方呎,成交价900万及960万,呎价9,259元及11,750元。

(经济日报)

更多东海商业中心写字楼出售楼盘资讯请参阅:东海商业中心写字楼出售

更多新文华中心写字楼出售楼盘资讯请参阅:新文华中心写字楼出售

更多南洋中心写字楼出售楼盘资讯请参阅:南洋中心写字楼出售

更多好时中心写字楼出售楼盘资讯请参阅:好时中心写字楼出售

更多康宏广场写字楼出售楼盘资讯请参阅:康宏广场写字楼出售

更多尖沙咀区甲级写字楼出售楼盘资讯请参阅:尖沙咀区甲级写字楼出售

更多东海商业中心写字楼出租楼盘资讯请参阅:东海商业中心写字楼出租

更多新文华中心写字楼出租楼盘资讯请参阅:新文华中心写字楼出租

更多南洋中心写字楼出租楼盘资讯请参阅:南洋中心写字楼出租

更多好时中心写字楼出租楼盘资讯请参阅:好时中心写字楼出租

更多康宏广场写字楼出租楼盘资讯请参阅:康宏广场写字楼出租

更多尖沙咀区甲级写字楼出租楼盘资讯请参阅:尖沙咀区甲级写字楼出租

中层相连户放售 意向价2140万

近期尖东区甲厦表现跑赢大市,租务成交稳步上扬,空置率持续改善,有利区内买卖气氛转好,尖东区今年首季买卖宗数约17宗,较去年第四季约8宗增加逾1倍水平,而总买卖楼面亦增加至约21,728平方呎,升幅较上季增逾1倍。

面积1672呎 每呎叫价12800

有业主趁交投气氛回暖,遂将旗下的尖沙咀东部东海商业中心中层单位推出市场,并委託代理以意向价约2,140万元放售。

代理表示,是次放售物业位于尖沙咀东海商业中心5楼04至05室,面积约1,672平方呎,意向呎价约12,800元,涉资约2,140万元,单位以交吉形式出售,配备基本写字楼装修,间隔方正实用,面向尖东著名地标市政局百周年纪念花园,可享喷水池景观,更可同时远眺维港海景。

(经济日报)

更多东海商业中心写字楼出售楼盘资讯请参阅:东海商业中心写字楼出售

更多尖沙咀区甲级写字楼出售楼盘资讯请参阅:尖沙咀区甲级写字楼出售

空置多 下半年甲厦租售价料仍跌

上半年商厦买卖成交宗数仍不多,业界指空置楼面需时消化,料下半年甲厦租售价仍下跌。

有代理行资料显示,今年上半年暂录约346宗写字楼买卖个案,比2022下半年多出约一成,但与2022上半年相比,仍有约11%差幅。至于金额方面,今年上半年总成交金额约83.43亿元,按年同比上升约10%。该行指,过去两年间单月写字楼买卖宗数大多徘徊于40至80宗水平,对上一次录得超过100宗已要追溯至2021年7月约112宗,可见买家入市信心仍然偏疲弱。

租赁方面,2023上半年共有约2,749宗成交,与2022下半年约2,755宗相若;总金额则录得约2.64亿元。

信德中心招商局大厦 呎价返7年前

呎价方面,今年商厦亦录得个别创新低成交个案,上环信德中心招商局大厦低层相连户,以呎价仅约18,448元易手,该厦对上一次呎价相若的成交要追溯至7年前,以及湾仔富通大厦中高层全层连车位亦录得约7,600万元易手,平均呎价约11,969元,呎价重返大厦2012年水平。

买家上,随着中港通关,写字楼市场中资背景的买家亦见增多,例如有中资公司买入会展广场办公大楼高层一篮子单位,作价约2.55亿元,预计作自用兼扩充楼面用途。租赁方面亦见中资企业承租物业,例如内地知名媒体公司进驻中环国际金融中心一期中层全层,市传月租约200万元;亦有内地能源公司预租长实旗下兴建中的中环长江集团中心二期高层,市传月租约93.5万元。

成交量稳 售价有5%下调空间

有代理认为,写字楼市场前景充满不明朗因素,包括加息周期持续、中美关係未定,加上向来为香港商厦市场重要购买力的国内资金入市步伐放慢,种种原因令企业及投资者持观望态度,导致写字楼租买交投量难以回升。同时,近年市场未间断推出新商厦楼面,令本已消化不及的空置情况雪上加霜。

展望下半年市况,代理指现时不少发展商急谋对策,以高佣及折扣价推售物业,并提供特长成交期及送釐印费等优惠吸引买家,预测下半年写字楼成交量会维持平稳,录得约320宗水平,而因为市场供应过多,买卖价料仍有约5%下调空间。至于租务方面,预测香港对外经济活动增多会利好租务需求,料下半年租赁成交宗数会有约3,000宗,惟同样因为新供应及空置率高企,租金有机会继续下跌约5%。

(经济日报)

更多信德中心写字楼出售楼盘资讯请参阅:信德中心写字楼出售

更多上环区甲级写字楼出售楼盘资讯请参阅:上环区甲级写字楼出售

更多富通大厦写字楼出售楼盘资讯请参阅:富通大厦写字楼出售

更多会展广场办公大楼写字楼出售楼盘资讯请参阅:会展广场办公大楼写字楼出售

更多湾仔区甲级写字楼出售楼盘资讯请参阅:湾仔区甲级写字楼出售

更多国际金融中心写字楼出租楼盘资讯请参阅:国际金融中心写字楼出租

更多长江集团中心二期写字楼出租楼盘资讯请参阅:长江集团中心二期写字楼出租

更多中环区甲级写字楼出租楼盘资讯请参阅:中环区甲级写字楼出租

尖沙咀新港中心 交吉户4300万放售

尖沙咀新港中心单位,现以约4,300万元放售,呎价约1.8万元。

面积2444呎 呎价叫1.8万

有代理表示,尖沙咀广东道30号新港中心二座6楼07室,面积约2,444平方呎,意向价约4,300万餘元,平均呎价约1.8万元,单位以交吉形式出售。

该代理指,项目为矜罕单边单位,可饱览海防道及广东道开扬城市景观,单位同时备有写字楼装修,间隔方正实用,并由长情业主自用逾20年,属投资或自用皆宜之选。代理续指,新港中心目前仅有8个放售盘源,叫价为每平方呎1.7万至2.2万不等。租赁方面,物业出租率长期处于九成,平均呎租更自去年第四季约32元上升至今年首季约37元,最新一宗租赁成交位于9楼09室,成交呎租达约38元。

(经济日报)

更多新港中心写字楼出售楼盘资讯请参阅:新港中心写字楼出售

更多尖沙咀区甲级写字楼出售楼盘资讯请参阅:尖沙咀区甲级写字楼出售

麦卡伦60万租中环铺 全球首家旗舰店

涉兴瑋大厦两层8500呎 近兰桂坊利品酒销售

上半年核心区商铺租务市场转好,个别品牌作出扩充。中环兴瑋大厦两层铺位涉及8,500平方呎,获威士忌品牌麦卡伦 (The Macallan) 以约60万承租,该品牌早前已迁往太古广场新办公室,现更开设全球首间旗舰店,作品酒、销售之用。

物业4层原由adidas租用,迁出后由恒生银行租两层,现由麦卡伦租其餘两层。

消息指,中环录得大楼面商铺租务成交,涉及皇后大道中36号兴瑋大厦2及3楼,每层面积逾4,000平方呎,合共约8,500平方呎,以每月约60万元租出,呎租约70餘元。

据了解,新租客为知名威士忌品牌麦卡伦,其出品威士忌深受爱好者追捧,个别年份出品亦成收藏家至爱。

扩办公室 租太古广场全层

据悉,是次品牌租用两层楼面,将开设全球首间旗舰店,预计既有销售业务,亦可供作品酒活动,而旗舰店位置,正处皇后大道中通往兰桂坊必经之路,故相信日后可吸引中环上班一族及旅客前来。事实上,该幢物业由单一业主持有,包括3D广告荧幕,近日亦有播放麦卡伦广告,极有宣传价值。

麦卡伦之前已作出扩充业务,该英国企业目前租用九龙湾国际交易中心中层单位,面积约1.2万平方呎,市值呎租约20餘元,而早前公司租用金鐘太古广场二座中层全层,面积约2万平方呎,成交呎租约100元,属以往较少九龙区商户升级至中环核心商厦个案。提升办公室级数,再选择在港开设旗舰店,反映品牌对本港及内地市场甚重视。

铺位早年曾由运动服装adidas租用,涉物业地下至3楼,合共4层,2021年迁出后业主重新分拆招租,2021年获恒生银行租用,月租约120万元,若连同是次租用两层,涉及约60万元,租金仍较旧租客下跌一半。不过,业主为物业加装3D广告荧幕,据悉租值亦颇为理想。

外资代理行料零售铺租 温和上升5%

通关后本地消费仍稳定,当中涉及酒类的产品销售不俗,除了麦卡伦外,早前亦有相关行业扩充。百威啤酒原租用铜锣湾时代广场单位作办公室,早前亦预租同区希慎广场逾万平方呎单位,呎租达65元,属同区扩充业务,可见疫情后酒精饮料销情向好,令企业有空间扩充。

市况方面,有外资代理行指出,市场气氛改善,零售租赁市场在6月份重拾势头,特别是优质零售街铺,录得多宗大额租赁个案。该行指,零售街铺业主积极寻找有意打造体验式零售概念的租户,因现今消费者正在寻找新和独特的购物体验。展望后市,认为由于核心地段的空置商铺数量减少,预计今年零售商铺租金将温和上升5%。

(经济日报)

更多兴瑋大厦写字楼出租楼盘资讯请参阅:兴瑋大厦写字楼出租

更多中环区甲级写字楼出租楼盘资讯请参阅:中环区甲级写字楼出租

更多太古广场写字楼出租楼盘资讯请参阅:太古广场写字楼出租

更多金鐘区甲级写字楼出租楼盘资讯请参阅:金鐘区甲级写字楼出租

更多国际交易中心写字楼出租楼盘资讯请参阅:国际交易中心写字楼出租

更多九龙湾区甲级写字楼出租楼盘资讯请参阅:九龙湾区甲级写字楼出租

更多时代广场写字楼出租楼盘资讯请参阅:时代广场写字楼出租

更多希慎广场写字楼出租楼盘资讯请参阅:希慎广场写字楼出租

更多铜锣湾区甲级写字楼出租楼盘资讯请参阅:铜锣湾区甲级写字楼出租

核心区开铺一举多得 提升品牌形象

核心区出现数个国际品牌开旗舰店,疫情后消费者习惯改变,品牌租铺除了售卖货品外,亦增强体验成分,如涉及展览、互动等元素,可提高品牌宣传形象。

据政府最新统计数字显示,本港5月零售业总销货价值的临时估计为345亿元,较去年同月升18.4%;而今年首5个月合计的总销货值临时估计,则按年升21%。可见疫后復常,不论本地及旅客消费明显胜去年,加强零售商重新扩充兴趣,因此上半年,四大核心零售区录得多宗租务,而铺位空置率稍下降。

通关近半年,暂时访港人数未及疫情前,而消费上,似乎以中下价货品为主,故目前扩充零售商,本地药粧店佔大部分,国际品牌新租个案仍偏少。

增体验元素 展览互动吸客

暂时市场录得国际品牌租多层铺位,作旗舰店个案不多,中环佔其中两宗,包括名錶Omega,租用丰乐行多层逾8千平呎铺位,而新近出现威士忌品牌麦卡伦,租用中环兴瑋大厦两层作旗舰店。至于最多人留意的,定为CHANEL租铜锣湾京华中心两层。

以往国际品牌大手租用多层楼面作旗舰店,主要售卖品牌产品,而近年消费者习惯改变,不少转至网上购物,令品牌现时租实体店,不再单一售卖产品。如麦卡伦租用两层,预计部分楼面开放作酒迷品尝试酒,而Omega租用的旗舰店,据悉亦会有部分楼面作展览之用。

此外,消息称CHANEL租用的京华中心,亦有机会加入举办活动、展览等元素。可见品牌租用多层商铺,用途上加入体验成分,既可吸引客群前来实体店,同时可宣传品牌的故事、特色及最新资讯,可建立品牌形象,与消费者保持紧密关係,长远有助销售。

(经济日报)

更多丰乐行写字楼出租楼盘资讯请参阅:丰乐行写字楼出租

更多兴瑋大厦写字楼出租楼盘资讯请参阅:兴瑋大厦写字楼出租

更多中环区甲级写字楼出租楼盘资讯请参阅:中环区甲级写字楼出租

找换店30万租罗素街铺 月租降58%

通关后与旅客相关的商户扩充,铜锣湾一綫地段罗素街铺位,获找换店以约30万元租用,作业务扩充,租金跌58%。原业主持货达60年,租金回报达3750厘。

租金水平较高峰期跌8成

铜锣湾罗素街28号地下铺位租出,维高物业表示,新租客为HONG KONG EXCHANGE找换店,以约30万元租用,现正进行装修。据了解,是次租用铺位面积达800平方呎,比起一般找换店为大,故预计除了基本货币找换及汇款生意外,亦将有其他业务,属扩充性质。

翻查资料,该铺早年曾由化粧品Kiehl's租用,零售高峰期时月租高达140万元,及后品牌曾以70万元续租,惟疫情期间迁出。铺位及后由口罩店作短租,月租约12.5万元。如今换上找换店,租金跌58%,较高峰期更跌近8成。

该铺由一老牌业主持有,早于1964年,以9.8万元购入铺位,其后由家族成员继承,一直持货至今。2021年,业主曾委託代理行放售铺位,叫价3.8亿元,当时未获承接。

持货60年 租金回报3750厘

铜锣湾区今年录数宗找换店新租及续租,如景隆街2号A2号,面积约50平方呎,铺市高峰期2014年找换店曾以26万元租用,呎租达5,200元,及后减租。而最近则以7.8万元续租,呎租达1,560元。比邻的A1号铺,年初亦由找换店以5.2万元租用,面积同样约50平方呎,呎租约1,040元。

(经济日报)

尖沙嘴星光行地铺月租20万 较3年前旧租金减43%港式小食店进驻

位处尖沙嘴核心地段的星光行,近期地铺连录租赁,最新为该厦向梳士巴利道一个铺位,刚以每月20万租出,较3年前减约43%,该宗亦是过去2个月间,该厦地铺录得的第3宗租赁。

市场消息透露,尖沙嘴梳士巴利道3号星光行地下6号地铺,建筑面积658方呎,刚由港式小食店以每月20万承租,签署生约及梗约各2年,平均呎租304元,对上长租客亦是小食店,于2020年2月进驻,月租35万,此水平租金反映疫情前水平,敌不过随后疫情汹汹,该店早于1年多前已提早离场。

该地铺在过去1年多,一直短租散货,直至今年开关后,才开始有準租客洽商,终于成功租出,新租金较旧租金大跌约43%。

平均呎租304元

上述地铺曾由甜品连锁店许留山承租,属于长情租客,早在2001年起进驻上址,于2014年高峰期,月租曾高达110万,呎租1672元,不过于2017年续租时,月租减至60万元,及后许留山于2019年动乱时结业,铺位空置数个月,迎来小食租客。若与高峰期相比较,最新租金最多跌约82%。

过去1年短约形式租出

星光行地铺在经历暴动及疫情后,曾一度吉铺处处,自从两地通关后,屡录大手租赁,该厦地下1及2号铺,实用面积约4260方呎,旧租客屈臣氏,迁出一段时间 (2021年10月迁出),铺位一直丢空,最终于今年5月,由一家售卖名牌手袋的店铺承租,月租接近100万,平均呎租235元,较2019年疫情前月租180万,租金亦大减44%。

另外,该厦地下3、4号及15号地铺,建筑面积约2500方呎,由莎莎以每月65万承租,平均呎租260元,旧租客则为万寧,亦于2021年底撤出,铺位亦一直丢空。

(星岛日报)

更多星光行写字楼出租楼盘资讯请参阅:星光行写字楼出租

更多尖沙咀区甲级写字楼出租楼盘资讯请参阅:尖沙咀区甲级写字楼出租

骏业街活化项目意向价7.3亿

有代理表示,观塘骏业街51号全幢物业,面积约56312方呎,项目为一幢21层高的工厦,现正活化改建作商厦,意向价7.3亿,平均呎价12963元,将以交吉形式出售。该项目适合零售等行业,项目位处东九龙CBD2核心商贸区,毗邻多座甲厦,加上该厦邻近港铁观塘站,高层可望烟花海景,并拥有特色平台,用途多,吸引不同行业,按目前市况而言,该厦市值呎租约30至35元。

平均呎价12963元

该代理续指,本港全面通关后,工商物业交投趋活跃,今次推售物业毗邻开源道73至77号业发工业大厦1、2期,以及巧明街119至121号年运工业大厦,今年4月被正式统一收购,合併发展重建为1幢39层高新地标商厦,相信区内环境变天在即。

(星岛日报)

Hong Kong office rents and rental values expected to decline further amid uncertainties about global, Chinese economies, analysts say

Vacancy levels rose in the first half to 15.7 per cent and will continue to rise as new developments are completed, and rents are expected to edge down by another 1 to 2 per cent, analysts says

Hong Kong office rents could continue to fall in the second half, as some companies might further downsize offices by adopting hot-desk arrangements: Bloomberg Intelligence

Hong Kong’s office rents and rateable values are expected to fall amid high vacancies, new supply, uncertainties around the global economy and downsizing by firms, analysts said.

While senior executives want staff to return to the office – and the Asia-Pacific region continues to lead the United States and Europe in this aspect – flexible working as an option is increasingly popular in Hong Kong, according to a property agency.

“Office leasing momentum has remained slow in recent months on the back of prolonged uncertainties in the global economic outlook,” an agent said.

Vacancy levels rose in the first half of 2023 to 15.7 per cent and will continue to rise as new developments are completed and enter the market, the agent said, adding that rents are expected to edge down by another 1 to 2 per cent in the second half.

The decline in office rents is reflected in rateable values, the annual rental value estimated by the Rating and Valuation Department. Twenty-four out of 33 benchmark office buildings, or 72.7 per cent, last year saw their rateable values fall below 2013 levels, according to another property agency.

The rateable values of Hong Kong’s grade-A office buildings declined by 26.7 per cent between 2019 and last year, the agency said, with the Bank of America Tower reporting the biggest dive of 35.3 per cent.

The agency expected overall rateable values to slide by a further 10 per cent in 2023 “due to the high-vacancy rate of office buildings and the completion of large-scale grade-A high-rise buildings, which cause downward pressure on rents”.

Leasing strategies will continue to be cautious in the short term, according to the first agency report on the Asia-Pacific office markets published in late June.

“Despite the dismantling of pandemic-related restrictions and a return to normal life, economic uncertainty continues to persist amid rising inflation and interest rates, as well as a slower-than-expected recovery in mainland China,” the first agency’s marketing report said.

Occupiers, therefore, are expected to retain a conservative stance towards leasing in the short term, with lease renewals, renegotiations, right sizing and enhancing lease flexibility among choices available to them, according to the report. Occupiers are looking especially closely at more flexible expansion and contraction options as well as break clauses.

Occupiers also intend to explore ways to reduce space by exercising lease expirations and consolidating locations, the report added. Demand from large occupiers looking to sublease space continues to result in elevated levels of shadow space in Australia, Singapore and Hong Kong.

Bloomberg Intelligence echoed the view that Hong Kong office rents could continue to fall in the second half, as some companies might further downsize offices by adopting hot-desk arrangements. This could further depress office rent revenue for landlords.

Financial uncertainties globally could limit demand, particularly from the banking sector, Bloomberg Intelligence said. Major landlords might struggle to fill up their existing office space due to strong competition from a number of new buildings.

And while Hong Kong employees are less hesitant about travelling to work compared with many other gateway markets because of shorter commutes, the agent said flexible working as an option for staff, however, has become increasingly popular, particularly among multinational companies. This also forms part of companies’ ESG policies, which promote flexibility and work-life balance.

Another agency’s report from late June said that rather than making an office-only mandate part of their strategy, companies need to acknowledge the return will require reasons and motivation.

Many Hongkongers could demand higher salaries to offset losing work-from-home flexibility, according to Bloomberg Intelligence. This could also push major companies to continue offering such arrangements to avoid losing talent.

(South China Morning Post)

For more information of Office for Lease at Bank of America Tower please visit: Office for Lease at Bank of America Tower

For more information of Grade A Office for Lease in Admiralty please visit: Grade A Office for Lease in Admiralty

For more information of Grade A Office for Lease in Central please visit: Grade A Office for Lease in Central

More Wong Chuk Hang flats to be rolled out

Phase 4A of La Montagne

in Wong Chuk Hang, jointly developed by Kerry Properties (0683), Sino

Land (0083), Swire Properties (1972), and MTR Corporation (0066), may

unveil the first price list today, providing at least 87 flats, the

developers said.

The price will be set with reference to La Marina

in the same area and other luxury projects in the southern part of Hong

Kong Island, they said, adding that the first batch will be a

"surprise" in pricing and they will adjust the price according to the

market response in subsequent batches.

The first price list is expected to include flats with one to three bedrooms.

In Yuen Long, Asia Standard International (0129)

has released the sales brochure of High Park I and may unveil the first

price list of 125 units this week at the earliest.

The first price list will mainly cover one and

two-bedroom units, the developer said. Showrooms will open to the public

soon and the sales may take place this month, it added.

The project provides 623 units in total, of which, nearly 70 percent are two-bedroom flats.

This came as Henderson Land Development (0012) said the 82 flats in the third batch of Henley Park

in Kai Tak were 84 times oversubscribed after receiving 7,000 checks.

The second round of sales may be launched at the weekend, Henderson

said. It had raised the price by 1 percent in the latest batch which

involves 82 flats from 250 to 649 square feet.

The flats in the third batch are priced at an

average of HK$22,163 per sq ft after discounts. That compares to

HK$22,148 for the second batch and HK$21,088 for the first.

The completed project offers 740 flats from 250 to 1,558 sq ft with up to three bedrooms.

(The Standard)

半岛中心呎价1.15万成交

尖东半岛中心录一宗成交,有代理表示,半岛中心1021至1022室,建筑面积约3204方呎,以每呎11500元易手,涉资约3684.6万,原业主于2012年以约2888万购入,持货11年,帐面获利796.6万,物业升值27.6%,该单位以交吉交易,市值呎租约24元,料回报约2.5厘。

持货11年升值27.6%

据了解,新买家购入物业,需支付相等于楼价4.25%的税项,涉资约157万。

于2018年市况高峰时,半岛中心普遍呎价高达1.3万,最新造价较高位回落约11%,而于2020年疫情肆虐期间,该厦亦录1宗呎价跌穿万元交易,该厦10楼1室,建筑面积1431方呎,以1408万易手,平均呎价9839元。

(星岛日报)

更多半岛中心写字楼出售楼盘资讯请参阅:半岛中心写字楼出售

更多尖沙咀区甲级写字楼出售楼盘资讯请参阅:尖沙咀区甲级写字楼出售

核心区甲厦租务增 太古广场1.2万呎租出

近月核心区甲厦租务有增,消息指,中环中国建设银行大厦全层,获中资机构承租,呎租约100元。另保险公司亦扩充,租用金鐘太古广场1.2万平方呎。

市场消息称,中环甲厦录得全层租务成交,涉及干诺道中3号中国建设银行大厦中低层全层,面积约6,905平方呎,成交呎租约100元。该厦比邻友邦金融中心,单位享全海景兼质素较新,故租金水平理想。据了解,新租客为中资机构。

中环中心呎租约40元

另消息称,金鐘太古广场二座中层单位租出,涉大半层楼面,面积约1.24万平方呎,以每平方呎约100元租出。据悉,新租客为保险公司,作扩充业务之用。

此外,中环中心中层04室,面积约2,460平方呎,以每呎约40元租出。至于湾仔中环广场中高层02室,面积约2,735平方呎,成交呎租约62元。

而铜锣湾方面,指标商厦之一的时代广场录两租务,涉及2座中高层楼12至16室,面积约约4,448平方呎,以每呎约50元租出。至于项目1座中高层12室,面积约908平方呎,成交呎租约50元。

中资除了租写字楼外,亦有购单位自用,消息称,尖东半岛中心高层21至22室,面积约3,204平方呎,以约3,685万元易手,呎价约11,500元,以交吉交易。据悉,买家为内地机构,购入单位自用。原业主于2012年,斥2,883万元购入单位,持货12年转手,获利约802万元,升值约3成。另湾仔乙厦金鐘汇中心低层03室,面积约451平方呎,以705万元成交,呎价约15,632元。

(经济日报)

更多太古广场写字楼出租楼盘资讯请参阅:太古广场写字楼出租

更多金鐘区甲级写字楼出租楼盘资讯请参阅:金鐘区甲级写字楼出租

更多中国建设银行大厦写字楼出租楼盘资讯请参阅:中国建设银行大厦写字楼出租

更多友邦金融中心写字楼出租楼盘资讯请参阅:友邦金融中心写字楼出租

更多中环中心写字楼出租楼盘资讯请参阅:中环中心写字楼出租

更多中环区甲级写字楼出租楼盘资讯请参阅:中环区甲级写字楼出租

更多中环广场写字楼出租楼盘资讯请参阅:中环广场写字楼出租

更多湾仔区甲级写字楼出租楼盘资讯请参阅:湾仔区甲级写字楼出租

更多半岛中心写字楼出售楼盘资讯请参阅:半岛中心写字楼出售

更多尖沙咀区甲级写字楼出售楼盘资讯请参阅:尖沙咀区甲级写字楼出售

更多金鐘汇中心写字楼出售楼盘资讯请参阅:金鐘汇中心写字楼出售

更多湾仔区甲级写字楼出售楼盘资讯请参阅:湾仔区甲级写字楼出售

观塘市中心重建 拟增楼面宽高限

观塘的商厦供应继续增加,为九龙东的重要核心商业区之一,未来观塘有至少4个项目待推,总楼面涉逾500万平方呎,其中以位于市建局观塘市中心第4、5区的重建项目的规模最大。市建局最新计划将项目的总楼面增约2成半至约270万平方呎,并放宽其建筑物高度限制。

去年底已推出招标的市建局观塘市中心第4、5区重建项目,因市场气氛疲弱,于今年1月截标时仅接1份标书,项目最终难逃流标的命运。而局方在今年初亦透露,会研究加入住宅等元素重推,让中标发展商可更灵活调拨发展楼面,以作住宅、办公室、酒店和零售等,从而增加吸引力。

研究加入住宅元素 添叫座力

而据市建局最新向观塘区议会提交文件,当局建议将用地的总楼面面积增加约25%至约270万平方呎,并以总地积比率约12倍发展 (政府、机构或社区设施所涉约18.5万平方呎总楼面将豁免计算在内)。当中住用楼面面积将不多于总楼面面积约45%,餘下的楼面面积将保留作非住宅用途,用以维持观塘市中心所需的零售及商业用途。

另外,当局最新拟将建筑物高度限制,由原先获批方案的285米 (主水平基準上,下同) 提升约26%至360米,将成为九龙区第2高、仅次于484米高的环球贸易广场 (ICC)。整体方案将参考「垂直城市」(Vertical City)的发展理念,兴建1幢商住混合大厦。

观塘行动区已申拨款 改划交通网络

至于区内另一大型重建计划是「观塘行动区」,项目涵盖观塘码头广场宠物公园及比邻巴士总站等用地,政府建议将用地改划为「商业」发展用途,以发展办公室、零售、服务行业及/或食肆用途,并提供公共交通交滙处,及公眾休憩空间,总楼面约93.3万平方呎。发展局去年已向政府申请约6.1亿元拨款,为用地兴建多条新的道路、有盖行人天桥等设施,料获得拨款后,项目在4年内完成工程。

同时,伯恩光学杨建文家族于今年4月已以底价约23.49亿元,成功统一业发工业大厦1期的业权。杨氏家族于2017年亦已以约16.2亿元统一业发工业大厦2期业权,并于2021年已连同比邻的1期地盘,及年运工业大厦向城规会申请一併重建为1幢商厦,而申请亦已获城规会批准。

(经济日报)

更多环球贸易广场写字楼出租楼盘资讯请参阅:环球贸易广场写字楼出租

更多尖沙咀区甲级写字楼出租楼盘资讯请参阅:尖沙咀区甲级写字楼出租

New flats priced 9pc below first phase amid sales slump

New flats at La Montagne in Wong Chuk Hang have been priced on average at HK$27,989 per square foot, which is 9 percent lower than the first phase of the project launched two years ago.

This came as the Land Registry revealed that Hong Kong's home sales slumped by over 25 percent year-on-year last month in both volume and value terms.

The project near Wong Chuk Hang MTR Station is being jointly developed by Kerry Properties (0683), Sino Land (0083), Swire Properties (1972) and MTR Corporation (0066).

The 88 flats in the first price list cost between HK$9.67 million and HK$30.13 million after discounts, and comprise 12 one-bedroom, 60 two-bedroom and 16 three-bed units with areas ranging from 403 to 914 square feet. After discounts, the cheapest one-bedroom is HK$9.67 million, the cheapest two-bedroom is HK$12.82 million, and the cheapest three-bedroom unit is HK$26.78 million.

A property agent estimates that the prices of the first batch at La Montagne are around 15 percent cheaper than other projects in the same area in the primary market.

Calvin Tong, director and general manager, Hong Kong of Kerry Properties, however, said the units in the first list are priced at the market level and prices may go up in subsequent lists.

Sino Land executive director Victor Tin Sio-un believes the market has digested the possibility of two more interest rate hikes by the US and it is now a good time to purchase a home.

And Swire Properties residential director Adrian To said the pricing is attractive.

Phase 4A has a total of 432 apartments featuring one- to three-bedroom flats with areas of 351 to 1,847 sq ft.

Elsewhere in Yau Tong, CK Asset (1113) has named its new project The Coast Line, which provides 886 units in two phases.

CK Asset said the second phase, involving 658 flats, has obtained presale approval and it might launch sales this month.

With new homes flooding into the market recently, CK Asset executive director Justin Chiu Kwok-hung said he did not see any "price war" for new properties and CK does not have much pressure to "destock."

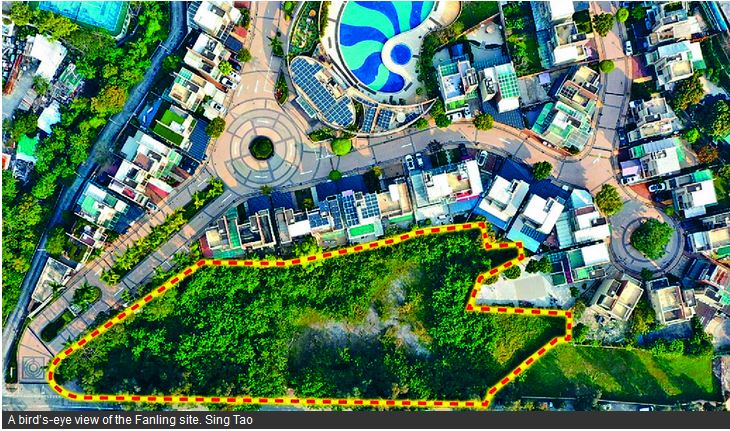

Commenting on the controversial plan to build homes on the golf course in Fanling, Chiu said the number of homes planned on the site would hardly solve the city's housing shortage, but he agreed with the government's policy of constantly looking for land for development and building more public housing in various districts.

Meanwhile, Henderson Land (0012) said Henley Park in Kai Tak sold three flats yesterday, cashing in HK$24.56 million in total.

In other news, Billion Development and Project Management has requested the Town Planning Board to increase the plot ratio for a residential site in Yuen Long to build 1,850 flats, an increase of 37 percent over the previous plan.

(The Standard)

CK Asset dismisses concerns about rising interest rates and oversupply, will launch The Coast Line residential development in Yau Tong

Expected increase in interest rates in the second half of the year ‘is not a big problem’, executive says

Developer will reference other Kowloon East waterfront projects, as well as the city’s actual economic environment when deciding pricing for the project

CK Asset Holdings – the flagship property developer of billionaire Li Ka-shing and his family and one of Hong Kong’s largest builders – will soon launch its The Coast Line residential project in Yau Tong, becoming the latest company to offer a new development in the city’s weakening housing market.

The project at 8 Tung Yuen Street is being developed in two phases and will have 886 flats altogether. A second phase with 658 units has also obtained presale approvals and will be launched within the month.

CK Asset did not disclose prices for The Coast Line, but the developer will reference other Kowloon East waterfront projects, including residential developments around Kai Tak station, as well as the city’s actual economic environment, said Executive Director Justin Chiu Kwok-hung.

The company will focus on “affordability”, Chiu said. “We want to help homebuyers buy houses,” he said.

The Coast Line’s launch comes amid a decline in Hong Kong’s lived-in home prices. Prices of such properties fell in May for the first time this year, as looming interest rate increases cast a long shadow over a market facing a glut of newly built flats. Lived-in homes saw sales plummet 13 per cent to 2,411 in June, which was the weakest month of 2023. Non-residential properties saw a 5 per cent decline in sales to 735 in June from a month ago.

CK Asset is expected to give a discount of around 5 per cent, analysts said.

“We will not see a big price reduction,” said Raymond Cheng, managing director of CGS-CIMB Securities in Hong Kong. “But the developer is likely to adjust [prices to reflect] the decline in the Hong Kong property market over the past year, and it will give some discounts on the newly launched phase to attract homebuyers.”

Hong Kong home prices and volumes saw a strong rebound in the first quarter, but started to slow down in the second three-month period, Ken Yeung, a property analyst with Citi, said in a research note on Tuesday. The bank is more bearish than developers about the second-half home price outlook, as it has seen a quick decline in transaction volumes since April with abundant new supply, on the back of a higher-for-longer interest rate environment.

“We expect home prices to see a 6 per cent correction in the second half of 2023,” Yeung said in the note.

CK Asset’s Chiu is, however, confident about the property market’s outlook. “The economy will continue to improve in the second half of the year, [and] property prices will follow the economy towards a stable development,” he said.

An expected increase in interest rates in the second half of the year “is not a big problem”, Chiu said, adding that more project launches increased the supply of residential property and choices for buyers, which is a sign of a healthy market.

The market has been moving in the right direction, Chiu said, adding that he is looking forward to the long-term healthy development of the property market.

(South China Morning Post)

Hong Kong property market deal flow seen slowing further after transaction volumes fall to a five-month low in June

The number of property transactions in Hong Kong struck a five month low of 4,777 in June, down 10 per cent from May, according to Land Registry data

That trend is unlikely to reverse any time soon as Hong Kong Monetary Authority CEO Eddie Yue Wai-man warned that the cycle of rising interest rates was far from over

Property transaction volumes in Hong Kong fell to a five month low in June after declining by a tenth from a month ago, shaving nearly a quarter from the previous year’s levels as caution prevailed in one of the world’s priciest real estate markets, official data showed on Tuesday.

The number of properties changing hands, including residential, commercial and industrial units and parking spaces, struck a five-month low of 4,777 in June, down 9.6 per cent from May, according to data released by Hong Kong’s Land Registry on Tuesday. Transactions are down 24.1 per cent from June 2022 when 6,290 deals were struck and 44.4 per cent lower than the March level of 8,599, which was a 20-month high at that time.

Deal flow could shrivel for the fourth straight month hitting lows not seen since January, experts say.

“Although the United States and Hong Kong both suspended interest rate hikes in mid-June, the message is that there are still two chances of interest rate rises in the future, which made the markets cautious,” a property agent said. “The overall transaction volume will remain under pressure this month.”

The corresponding value of the deals struck fell 11 per cent month on month to HK$39.67 billion (US$5.07 billion) in June. The decline in transaction value follows the slide in prices of lived-in homes in May, the first fall this year, as rising interest rates soured appetite.

That trend is unlikely to reverse any time soon- Hong Kong Monetary Authority CEO Eddie Yue Wai-man warned in June that the cycle of rising interest rates was far from over despite the de facto central bank hitting the pause button following 10 straight increases in its base rate since March 2022.

Bank of East Asia said it expects commercial lenders to raise their prime rates by 25 basis points in July after rising interbank lending rates, or Hibor, struck their highest levels since 2007 in June.

The agent expects the number of transactions to continue to shrink in July, to about 4,610 property units, down 3.5 per cent on the month. A property agency expects a sharper fall in July with overall property transactions declining to 4,500. These forecasts could make July the slowest month since January. Another agency echoed the view that July’s figure could fall to the lowest since January’s level of around 4,427.

Still, another agency expects deal flow to improve in August when it expects new property launches to pick up. Even though the market for new homes had the best sales performance among all categories in June, the number of deals edged up by only 3.5 per cent to 1,013 as the market watched the impact of interest rate rises.

Lived-in homes saw sales plummet 13 per cent to 2,411 in June, which was the weakest month of 2023. Non-residential properties saw a 5 per cent decline in sales to 735 in June from a month ago.

(South China Morning Post)恒基5.28亿沽啟德 THE HENLEY 商场 出租率近80%中资背景投资者承接

啟德新发展区住宅热卖,零售物业亦受追捧,恒基沽售啟德新盘 THE HENLEY 商场,作价5.28亿,平均呎价约2.02万,买家为中资背景的投资者,该商场出租率近80%。

恒基旗下啟德新盘 THE HENLEY,项目商场上月中以5.28亿易手,该物业由2座2层高商场组成,连3个上落货车位及1个畅通易达车位,11个私家车位及2个电单车位,其中1座楼面17227方呎,2座8905方呎,总楼面约26132方呎,以易手价计算,平均呎价约2.02万。

韩家辉:价格属合理水平

恒基物业代理董事及营业 (二) 部总经理韩家辉对本报证实已售出该商场,价格属合理水平,该商场出租率近80%,项目邻近啟德体育园,买家为内地资金背景的投资者,看好啟德区未来发展,料作长綫收租。

业内人士指,近期啟德区商场连环沽,平均呎价18497元,建华集团于今年4月,斥资6.5亿向中国海外购入啟德1号 (I) 及啟德1号 (II) 两个基座商场及车位。

平均呎价约2.02万

两个商场合共有15个铺位、56个私家车位及电单车位组成,总楼面共约35140方呎,目前月租总收入约282万,租客主要为代理行,另有酒楼、超市、医务所等民生行业,回报率达5.2厘。

「街市大王」之称建华集团,早于2021年12月率先在啟德插旗,斥资近3亿向龙湖地产购入同区尚.珒基座商铺,面积约1.4万呎,呎价逾2万,建华于2年多以来,合共涉资约9.5亿购入区内商场,部分将作为自用。近年啟德区内大型住宅纷落成,2026年亦将提供逾万伙简约公屋,人口不断增加,商场需求大,受用家投资者追捧,对发展商来说,沽售非核心物业,套现资金投入新发展项目。

(星岛日报)

会德丰17.2亿夺坚尼地城住宅地

本财年首幅卖地表地皮、为上周截标的坚尼地城西寧街与域多利道交界住宅地,招标结果昨揭盅。地政总署公布,由会德丰地产以17.2亿力压5个财团得手,以纯住宅计每方呎楼面地价约7071元,属市场估值范围之内,惟呎价较去年11月同区另一幅批出住宅地低出约25.6%。

梁志坚:打造西区地标屋苑

会德丰地产主席梁志坚表示,非常高兴投得上述罕有独特的港岛海景地皮,集团于港岛发展经验丰富,亦曾于同区推出多个高尚住宅项目,十分熟悉该区优势特点,此经验有助集团把新项目打造成下一个西区地标屋苑。

会德丰地产副主席兼常务董事黄光耀认为地价合理,出价已考虑项目发展年期长及牵涉不少其他工程等因素;初步发展中小型单位,主打1至2房户,料可提供约500至600伙,预计4至5年后以楼花方式推售。

地价8个月内下跌25%

该项目当时市场估值约10亿至18亿,每方呎估值约4100至7400元,批出地价属市场估值范围内;除中标的会德丰地产外,其餘入标财团,包括长实、新地、嘉华国际、鹰君,而信和伙拍招商局置地合组财团。

值得留意的是,是次呎价对比去年11月批出的同区另一幅西寧街及域多利道住宅地,当时以逾4.39亿批出,每方呎楼面地价约9500元,可见是次地价约8个月跌价约25.6%;并且是2002年6月北角英皇道632号住宅地 (现已发展为慧云峯) 以1981元批出之后,港岛区卖地表住宅地逾21年来每方呎楼面地价新低纪录。

有测量师说,该地对比去年同区批出住宅地有折让,惟港岛区供应相对比较少,该地亦有不少限制。另一测量师指出,在现时加息环境,发展商起楼成本增加。

发展年期长达9年

该项目地盘面积约2.43万方呎,若作纯住宅发展,涉及可建总楼面约24.32万方呎;若作商住发展,可建总楼面约29.19万方呎。据卖地条款,单位设有限呎条款,住宅单位面积不可少于280方呎,逾百年历史的东华痘局拱形牌坊及基石须搬迁至特定范围内,另须保留2棵古树细叶榕,并且负责兴建临时及全新的公共交通总站和公厕等政府设施;项目的发展期长达9年,较一般项目的6年为长。

(星岛日报)

中环万安2层5700万易手 香港洋务工会持货37年

中环租庇利街12至13号万安大厦2楼及3楼,每层建筑面积约2436方呎,总楼面约4872方呎,以5700万易手,平均呎价11700元,原业主为香港洋务工会,属于长情业主,持物业逾37年,今番获利可观。

基隆街商住楼4000万沽

香港洋务工会附属于工联会,行政会议成员,香港工会联合会会长郑耀棠曾任该会副主席。

深水埗基隆街159号全幢商住楼,佔地面积约934方呎,总楼面约7400方呎,以4000万易手,平均呎价5405元,物业楼高8层,包括地下商铺和7层住宅,与太子港铁站步程约5分鐘,于1963年入伙。

(星岛日报)

Kennedy Town site goes to Wheelock for $1.7b

Wheelock Properties has won a residential site in Kennedy Town for HK$1.72 billion, around HK$7,070 per square foot, in what is believed to be the lowest in 21 years for a site on Hong Kong Island - although it is within market estimates.

The plot, in land lot No 9094 at the junction of Sai Ning Street and Victoria Road, is currently a bus terminal. It has a site area of about 2,260 sq m and will provide a maximum gross floor area of 22,600 sq m for private residential purposes, according to the Lands Department.

The per-sq-ft price for the site was over 25 percent lower than that of the land sold for HK$439.3 million, or HK$9,500 per sq ft, last November. The two sites are less than two hundred meters apart.

Market valuation for the site, the first plot sold so far this fiscal year, ranges from HK$970 million to HK$2.3 billion, or HK$4,000 to HK$9,500 per sq ft.

Wheelock Properties chairman Stewart Leung Chi-kin said he was pleased to have been awarded the site and the developer would turn it into a new landmark estate in the area.

Wheelock has vast experience in property development on Hong Kong Island and is very familiar with the characteristics there, Leung said.

He said the cost is in line with market expectations and the developer made its offer with reference to the current market conditions.

Leung expected the project to take longer to develop as Wheelock will have to relocate the bus terminal before construction. The total investment for the project cost be almost HK$3 billion and will provide 500 to 600 small and medium-sized units, he said.

The other five competitors include Sun Hung Kai Properties (0016), a consortium by Sino Land (0083) and China Merchants Land (0978), CK Asset (0178), K. Wah International (0173) and Great Eagle (0041).

(The Standard)力宝中心高层单位意向租金10.8万

有代理表示,金鐘力宝中心二座高层单位,面积约2700方呎,业主意向租金约10.8万元,呎租约40元。

上述物业装修新净,租客可减省装修开支;物业同时坐拥开扬景观,属大厦的优质单位。

该行指出,力宝中心地下及平台设有零售及餐饮商户,因此吸引著名跨国公司、中资公司、律师事务所等进驻,相信此物业定能吸引用家垂青。

(信报)

更多力宝中心写字楼出租楼盘资讯请参阅:力宝中心写字楼出租

更多金鐘区甲级写字楼出租楼盘资讯请参阅:金鐘区甲级写字楼出租

外资代理行料写字楼租金全年跌7%

有外资代理行代理表示,香港甲级写宇楼租赁活动仍未见明显反弹,在第二季继续录得17.27万方呎负吸纳量,当中以尖沙咀区和中区最为明显。

整体待租率由第一季的17.1%微升至第二季的17.3%,使甲厦租金继续下调,按季回落2.1%,年初至今累跌3.6%。

环球经济情况不稳定,企业扩充步伐审慎,由于下半年将有几个大型写字楼项目陆续落成,而待租率高企的情况亦将为写字楼租金的反弹带来阻力。预计下半年写字楼租金将继续调整,全年或录得5%至7%跌幅,较年初预期跌2%至4%为高。

该行另一代理指,自通关以来,各核心零售区商铺空置率呈下降趋势,最新平均空置率约9%,为3年来低位。至于街铺租金,年初至今各区平均升幅约5% 。

过去数月积极进驻一线街道地铺的多以药妆店和药房为主,内地客的消费模式已改变,令高端零售商和连锁品牌不敢轻举妄动,也未见他们有明确的扩张意欲。而且通关之后,港人出境的人次比来港旅客人数还要多,变相流失部分本地消费力,故对下半年的租金走势持审慎观望态度。

住宅市场方面,高息环境拖慢买家入市步伐,5月及6月住宅买卖宗数减少,第二季住宅物业成交宗数约1.22万宗,较今年第一季下调13%,比上年同期少18%。该行另一代理认为,即使下半年息口见顶,高息环境亦将会维持一段时间。另外,最近股票市场波动、外围经济復甦缓慢等因素均会抑制买家入市情绪,压抑住宅市场交投及楼价表现。

预期下半年发展商将继续积极推盘去货,并以贴近二手市场开价的策略和不同优惠条款吸引买家,而二手市场步伐则相对慢热。预计全年楼价升幅介乎3%至7%,租金料升5%至8%;住宅成交量则按年升10%至15%,达约5万伙左右。

(信报)

晋逸维园酒店4.68亿售 买家嘉华相关人士

「越南朱」朱立基持有的北角晋逸维园精品酒店易手,买家为嘉华国际相关人士,作价4.68亿,平均呎价10808元。嘉华相关人士透过CHARMFIELD PACIFIC LIMITED购入,该公司董事包括吕耀华及尹紫薇,吕氏为嘉华国际执行董事,尹紫薇为嘉华国际香港地产发展及租务总监。

平均每呎10808元

市场消息透露,该项目除了基座铺位外,楼上为住宅契,料发展商重建物业,得以退还昂贵的釐印费;该项目佔地面积约4100方呎,楼高23层,共提供132间房,每个房间作价约355万,总楼面约4.33万方呎,平均呎价10808元。

该物业位于英皇道31至33号及银幕街18及20号,与琉璃街交界3面单边,地下及1楼商铺总面积约9441方呎。

(星岛日报)

Home completions fall, prices ease

Private home completions in May fell by 75 percent from April in a further sign of a slowdown in developer activity in Hong Kong.

Latest data from the Rating and Valuation Department showed the number of completed private homes fell for four months in a row in May.

The reading in May also marked a new low since October 2020.

For the first five months of this year, the total number of completed homes dropped to 7,222 units, 35 percent fewer than a year ago.

The cumulated number is only 36 percent of the estimated 19,953 units for this year, meaning the market may miss the full-year target, according to the department.

Meanwhile, developers put new homes on market at marked down prices in an accelerated pace to reduce stocks.

Yesterday, a total of 125 new flats at High Park I in Yuen Long were priced an average of HK$13,747 per sq ft after discounts, 11 percent lower than a nearby project sold two years ago.

The marked down price list announced by developer Asia Standard International (0129), the first for the Yuen Long project, followed the 9-percent lower pricing for the first batch of units at La Montagne in Wong Chuk Hang.

After discounts, the 125 units at High Park I are being sold for HK$4.41 million to HK$7.06 million.

They include 26 one-bedroom, 96 two-bedroom, two three-bedroom and one with special features, with saleable areas from 326 to 498 sq ft.

Meanwhile, Henderson Land Development (0012) said more flats at Henley Park in Kai Tak may be put up for sale after more than 7,500 checks for the 82 units on the third price list were received.

Elsewhere in Wong Chuk Hang, Phase 4A of La Montagne saw more than 3,000 groups of buyers visit the showrooms and the developers said more batches may be released for sale subject to market responses.

A property agency believes the developers will continue to price their projects at market levels in the second half to attract homebuyers, expecting home prices to rise 3-7 percent for the whole year.

However, Citi Hong Kong believes local property prices could fall 6 percent in the second half to stay flat for the full year.

Mainlanders may render support to the property market, another property agency said.

The agency said the proportion of individual buyers from the mainland rose to 13 percent in the first quarter, marking an 11-year high. It estimated a total of 100,000 talents from mainland China and other regions will come to Hong Kong this year through various schemes.

(The Standard)

A Property agency says Hong Kong home rents and leasing activity expected to rise in second half, even as analysts paint divergent picture for home prices

The leasing market has reported growth since the reopening of the border, a property agent says

Positive outlook for rents and leasing comes amid divergent forecasts for Hong Kong’s property market in the second half of 2023

Hong Kong home rents are expected to continue rising in the second half of 2023 even as the volatility in home prices persists, a property agency said.

The city’s housing market initially witnessed a recovery in prices after the border with mainland China was reopened in February, according to a report released by the agency on Thursday. The prices of lived-in homes have recorded a cumulative increase of 4.9 per cent over the last five months, even after the price index recorded its first decline in May and fell by 0.7 per cent, the report said.

But persistent high interest rates, recent stock market volatility and geopolitical tensions are all weighing on sentiment and are expected to dampen a recovery in residential prices, an agent said.

The leasing market, on the other hand, has reported growth since the reopening of the border, and has also benefited from a pledge made by the Hong Kong government to attract more talent to the city with its Top Talent Pass Scheme, the agent said.

“This is a good sign for the leasing market,” the agent added. “And it has already been partially reflected in the rental index, which has risen by 4 per cent over the last four months.”

The rental index will put in a more stable performance compared to the price index this year, and it will also slightly outperform home prices by one to two percentage points, the agent said.

“The rental index could increase by around 5 to 8 per cent this year,” the agent added.

The agency’s report comes amid a divergence in forecasts for Hong Kong’s property market in the second half of this year, with some analysts predicting a recovery as the city’s economy rebounds from the coronavirus pandemic, and others warning of ongoing and potential headwinds such as further interest rate hikes.

The agency said it expected more price volatility in the second half and forecast that home prices will rise by 3 to 7 per cent this year. Raymond Cheng, managing director of CGS-CIMB Securities, said he expected home prices to rise by an average of 5 per cent, with interest rates likely to peak this year. His views were echoed by another property agent.

Another property agency, on the other hand, has forecast a drop of up to 5 per cent in lived-in home prices for the whole year and said interest rates as a factor will not fade away until early next year. The agency’s forecast followed similar predictions by another agency and Citi.

In a reflection of the sentiment around leasing activity, Sun Hung Kai Properties said on Thursday that it will launch its new flagship rental project, Townplace West Kowloon, in the second half of 2023. The project with a total of 843 units will be tailor-made for young talent moving to Hong Kong following the introduction of the city’s new immigration policy for hiring top talent.

The policy has increased demand for rental options for young professionals dramatically, the developer said in a statement.

(South China Morning Post)远东金融中心意向呎租40元

金鐘为本港核心商业区,商业气氛浓厚,有代理表示,金鐘远东金融中心高层单位,建筑面积约2780方呎,意向租金约11万,呎租约40元。代理表示,物业位处高层,景观开扬,望园景及部分海景,附全新写字楼装修,内有大会议室及基本家具。单位设有2个出入口,其中一个连接后楼梯,可作后门之用,方便搬运办公用品。单位交吉,可即时起租,大厦设有4部客梯及1部货梯。

裕林工中意向价5589万

另有代理表示,葵涌葵乐街2至28号裕林工业中心A座高层全层连天台,建筑面积约15970方呎,意向价5589万,呎价约3500元,现连租约出售,租客食品工场及货仓,月租14.3万,回报逾3厘。

(星岛日报)

更多远东金融中心写字楼出租楼盘资讯请参阅:远东金融中心写字楼出租

更多金鐘区甲级写字楼出租楼盘资讯请参阅:金鐘区甲级写字楼出租

工商铺录308宗买卖 代理行:连跌3个月

有代理行资料显示,6月份共录约308宗工商铺买卖,商铺最差强人意,该行认为,通关后投资者重返市场,惟息口因素导致前景不明朗,致使6月份工商铺买卖价量齐跌。

该行代理表示,6月份市场共录约308宗工商铺成交,按月减约11宗或3%,连跌3个月,金额录约38.24亿,按月跌约7%,创上半年单月新低。6月份欠缺大买卖,仅录个别逾亿成交,共约10亿,宗数及金额对比去年同期分别减约50%及60%,月内最大宗为嘉华国际以约4.68亿向越南富商朱立基购入天后英皇道全幢酒店。

金额录38.24亿按月跌约7%

代理续指,工厦较突出,共录约206宗,佔总成交宗数逾60%,资深铺位投资者余旻修新近以6985万购入葵涌亿万工业中心5楼全层,面积约27940方呎,料回报逾4厘。

商铺于6月份录约66宗成交,较上月75宗跌约10%,金额14.63亿,跌幅约13%,商厦持续低迷,全月仅录约36宗,按月微跌3宗,金额由约8.06亿减少至约7.76亿。 该代理仍看好商铺,主因暑假将至,加上第二轮消费券出场,料为铺市带来推动力。

(星岛日报)

大手工商铺买卖仅录47亿 外资代理行:较上季跌65%

利息急升,工商铺市场备受打击,有外资代理行指出,今年第二季大手工商铺买卖仅录47亿,按季跌65%,创2009年第二季以来最低,由于利息高企,令工商铺市场普遍出现负回报。

该行代理表示,工商铺物业个别发展,写字楼租赁较一年前放缓,零售市场復甦,工业租赁气氛减弱,投资市场因高息而低迷。

创14年来新低

今年次季金额逾7700万的大买卖,按季跌65%至47亿,创2009年第2季度以来最低,上半年总额只有181亿,为2009年上半年以来最低,个人买家主导,机构投资者观望,瞩目交易为沙宣道50至52号涉资5.5亿,啟德 THE HENLEY 的零售商场作价5.28亿。内地客本季投资额19亿,佔总额42%。

该行另一代理表示,今年6月利息高达5.1厘,2007年9月以来最高,令工商铺普遍出现负回报,价格受压。

利息骤升 工商铺录负回报

该行另一代理表示,上半年录负吸纳量27.67万方呎,总空置面积1350万方呎,空置率15.7%历史新高。

整体租金按季跌0.5%,半年跌幅2.2%。中环核心区租金自去年第二季首次稳定,按季升0.1%。

甲厦空置15.7%历史新高

该行另一代理表示,本地消费恢復至2019年水平,入境旅客达到2019年经济下行前水平一半,今年上半年零售租赁达87万方呎,为有记录以来的半年最高水平,餐饮业佔32%新增租赁,预计下半年核心区铺租升3至5%。

该行另一代理表示,物业中心工厦空置低,但需求低迷,租金持平。

今年第2季工商铺物业个别发展,写字楼租赁较一年前放缓,零售市场復甦,工业租赁气氛减弱,投资市场因高息而低迷。

(星岛日报)

甲厦首六月空置率15.7%破顶

面对全球各国经济放缓及持续加息,在眾多不利因素影响下,本港甲级写字楼租赁势头放缓。有外资代理行最新发表2023年上半年香港商业房地产市场报告指出,今年上半年整体甲级写字楼空置率达到15.7%的历史新高,总空置面积增至1350万方呎,该行料全年租金下跌最多5%。

该行代理表示,甲级写字楼租赁气氛减弱,原本之前连续三个季度录得净吸纳量,但到今年第二季度,整体甲级写字楼市场则录得37.89万方呎负吸纳量 (即整体迁出腾空楼面多于新租出楼面)。

核心区铺下半年料涨租5%

由于市场再现负吸纳量,把整体甲级写字楼总空置面积推高至1350万方呎,再创历史新高。今年上半年整体甲级写字楼空置率上升0.4个百分点,达到15.7%,亦创新高。需求疲软导致第二季度整体甲级写字楼租金按季下降0.5%,半年跌幅达2.2%。

该代理认为,由于有更多新落成的甲级写字楼应市,市场将面临多方面压力,预计空置率将进一步上升,今年全年租金将下跌5%以内。

零售市场则逐步復甦,该行另一代理称,今年上半年整体核心区街铺空置率下降3.3个百分点至11.6%,为2020年第一季度以来最低水平。核心区街铺租金上半年增3.1%,预计下半年上涨3%至5%。

(信报)

力宝中心为金鐘指标商厦,现力宝中心二座单位,以每呎48元放租。

有代理表示,有业主出租金鐘力宝中心二座低层单位,物业建筑面积约3,960平方呎,业主意向租金约19万元,每平方呎约48元。

附写字楼装修 即租即用

该代理表示,物业景观开扬,望园景及海景,附写字楼装修,已分间成多个会议室,亦附设电掣插位,免却重新铺设电綫的麻烦。单位亦设有来去水位,可作茶水间之用。单位目前已交吉,租用后仅需搬入简单傢俱即可使用。

租务方面,上月大厦低层单位,面积约2,009平方呎,以8.5万元租出,呎租约42元。另上月尾大厦高层单位,面积约7,052平方呎,成交呎租约46元,月租涉及约32.4万元。

(经济日报)

更多力宝中心写字楼出租楼盘资讯请参阅:力宝中心写字楼出租

更多金鐘区甲级写字楼出租楼盘资讯请参阅:金鐘区甲级写字楼出租

九龙湾亿京中心 可打通变大楼面

九龙湾亿京中心属区内优质商厦之一,两座合共可组成大楼面,维港海景更是非常吸引。

亿京中心位于九龙湾宏光道,而地段属区内核心商业地段,附近为企业广场一期及企业广场二期、企业广场五期 Megabox 等商厦群,对面旧式工厦亦活化成商厦创豪坊,整体观感佳。

交通方面,港铁九龙湾站前往该厦,步行需15分鐘以上,略为不便,而大厦设有接驳巴士前往港铁站。另外,屯马綫两年前通车,由啟德站前往该厦,需时约5至10分鐘。Megabox 商场附近亦有多条巴士綫,可前往港岛及九龙,交通甚为方便。

饮食配套上,大厦地下提供商店不多,附近主要为工业区,物业地下仍有少量餐厅,上班人士可步行至Megaox商场,餐厅选择甚多。其他配套上,大厦附近有零碳公园,环境舒适。

物业由亿京发展,2009年落成,物业楼高35层,地下大堂甚具气派,设有梳化供商务人士使用。门口左面为A座,右面为B座,每座均设多部升降机,疏导人流上非常有效。

共分两座 景观成卖点

大厦共分A、B两座,A座每层面积约1.26万平方呎,另B座每层面积约1.24万平方呎。大厦特色之一,是两座楼面可打通,相连楼面面积达2.5万平方呎。

写字楼层由7楼起,A、B座原则每层间有5伙,全层可提供约10多个单位,分布上,面积较大A室分布于每层两边,面积可达4,000平方呎,其他单位面积由1,000多平方呎起。因呎数上选择多,大型至中小型公司亦适合。单位间隔四正,柱位全位于墙身内,增加灵活性。

景观方面,可谓大厦最大卖点,以A座较佳,因面向啟德维港海景,望向邮轮码头、跑道区住宅项目等,极为舒适,整体而言,大部分单位单边向海,没有大型建筑物阻挡。

买卖方面,物业今年未录成交,对上成交为去年初,B座28楼A室,面积约3,939平方呎,以约4,600万元成交,呎价约11,678元。另A座22楼C室,面积约1,788平方呎,成交价约1,800万元,呎价约10,067元。

(经济日报)

更多亿京中心写字楼出租楼盘资讯请参阅:亿京中心写字楼出租

更多企业广场写字楼出租楼盘资讯请参阅:企业广场写字楼出租

更多九龙湾区甲级写字楼出租楼盘资讯请参阅:九龙湾区甲级写字楼出租

更多亿京中心写字楼出售楼盘资讯请参阅:亿京中心写字楼出售

更多九龙湾区甲级写字楼出售楼盘资讯请参阅:九龙湾区甲级写字楼出售

顶层全层放租 意向呎租20元

九龙湾亿京中心享优质景观,现物业顶层全层单位进行放租,意向呎租约20元。

单位提供装修 设计实用

有代理表示,有业主放租亿京中心全层单位。物业为A座35楼全层,面积约13,851平方呎,意向呎租约20元。单位最大卖点,为物业顶层,享极优质维港景观。

据了解,单位原由一家电子公司自用,单位提供装修,包括已分间多个会议室,非常舒适实用。

租务成交方面,6月份物业A座12楼D室,面积约1,906平方呎,成交呎租约22元。另外,5月份A座29楼B室,面积约2,146平方呎,以每呎约20元租出。

同区租务上,九龙湾富临中心A座中高层E室,面积约5,866平方呎,以每呎约18元租出。另企业广场1期3座中高层05至07室,面积约5,216平方呎,成交呎租约17元。

(经济日报)

更多亿京中心写字楼出租楼盘资讯请参阅:亿京中心写字楼出租

更多富临中心写字楼出租楼盘资讯请参阅:富临中心写字楼出租

更多九龙湾区甲级写字楼出租楼盘资讯请参阅:九龙湾区甲级写字楼出租

工商铺半年1816买卖 涉资359亿

有本港代理行指,2023上半年暂录得约1,816宗工商铺买卖个案,涉及总成交金额约358.77亿元,对比2022下半年约1,790宗及351.21亿元均见增长。市场并以用家作主导,尤其以工商类别最为明显,亦有部分实力企业趁写字楼价格未回升前赶紧吸纳心仪物业。

至于租务市场就以铺位最为突出,在旅游发展及消费券派发刺激下,铺位租务气氛明显活跃。

大额买卖成交方面,今年上半年暂录得约34宗逾亿元成交,涉及总金额约105.59亿元,对比2022上半年约68宗及360.85亿元、以及2022下半年约43宗及267.27亿元都有明显差幅,反映经济环境疲弱影响投资市场表现,需待政策奏效刺激市道。

料下半年市况 危中有机

统计2023上半年10大工商铺物业成交,各类别分布平均,工厦及写字楼共佔5宗,其餘为与旅游相关的铺位、基座商场及酒店。排名第一为尖沙咀君怡酒店,以总价约34亿元由内地旅游集团公司承接;紧接为位于观塘的活化商厦项目 KOHO 全幢,成交价约17亿元,市传由收租客购入;第三位则为观塘年运工业大厦强拍,由伯恩光学杨建文以约11.28亿元投得。

而在10大成交排名中,基座商场较受捧,今年上半年商场项目交投更为炽热,包括荃湾协和广场商业部分,由亚证地产、联合集团和天安中国联合以约10亿元买入,计划作加建改建;另大角咀海桃湾基座西九汇商场由阳光房地产以约7.48亿元承接;近年发展前景备受关注的啟德区啟德一号商场亦以约6亿元售出。

该行代理指,展望2023下半年,一大利好因素为港府得到中央全力支持,鼓励北水南下,预料下半年资金走向会较佳,加上政府集中重振香港经济措施,相信接下来会适度推行利好营商措施,下半年工商铺市况危中有机,保持审慎乐观。预测下半年会继续以商铺市场最为活跃,工厦物业就料会维持优势平稳向上,而写字楼市场就需要待经济进一步好转、中美关係明朗化等因素才可有转势。

(经济日报)

更多KOHO写字楼出租楼盘资讯请参阅:KOHO 写字楼出租

更多观塘区甲级写字楼出租楼盘资讯请参阅:观塘区甲级写字楼出租

天乐广场每呎9725元售 创过去5年新低

商厦市况低迷,湾仔天乐广场全层,建筑面积约3496方呎以3400万易手,平均呎价9725元,造价为5年来新低,原业主持货28年料获利可观。

全层单位3400万易手

市场消息透露,湾仔天乐广场19楼全层,建筑面积约3496方呎,以3400万易手,平均呎价9725元,造价属过去5年以来新低,该厦对上1宗成交于2019年5月录得,该厦30楼全层,建筑面积3496方呎,以4600万易手,平均呎价13158元,若以此比较,最新买卖较对上一宗显著回落,幅度达26%。不过,由于30楼较19楼高,景观开扬,因此,实际幅度较26%为少。

(星岛日报)

更多天乐广场写字楼出售楼盘资讯请参阅:天乐广场写字楼出售

更多湾仔区甲级写字楼出售楼盘资讯请参阅:湾仔区甲级写字楼出售

九龙塘龙圃别墅今强拍 底价9.66亿

由雅居乐 (03383) 收购的九龙塘义本道6号龙圃别墅,于今日 (11日) 下午3时进行强拍,拍卖底价9.66亿元。

龙圃别墅早于1967年落成,比邻毕架山一号,现楼高5层,共提供44个单位,其地盘面积21,640平方呎,假设以地契列明的地积比率约1.8倍重建,总楼面涉约38,952平方呎。以该总楼面计,每呎楼面地价约24,800元。

(经济日报)

CK gets green light for Ma On Shan hotel conversion

CK Asset (1113) said its program to redevelop Horizon Hotels & Suites in Ma On Shan into a 772-unit residential project has received approval from the Buildings Department and that it will proceed with the premium payment.

According to the developer, the redevelopment proposal is for 772 flats, covering a site area of 84,402 square feet and a residential floor area of approximately 484,389 square feet. The premium payment is expected to happen soon.

In early 2020, CK Asset submitted an application to the Town Planning Board to convert more than 70 percent of the floor area of Horizon Suites in Ma On Shan into residential units, while also retaining a portion of the units for hotel use.

However, in December 2020, a revised proposal was submitted that completely abandoned the initial plan for a mixed-use development.

That envisaged the conversion of the entire hotel into a purely residential development, which then offered just 758 units.

Based on the information available from the development proposal then, the project site covered around 86,100 sq ft. The proposed development was intended to have a plot ratio of 6.3, resulting in a total gross floor area of around 542,600 sq ft.

The residential floor area of the project was about 482,900 sq ft.

As per the plan, each floor would house 58 units. Additionally, the non-residential floor space was estimated to be around 59,700 sq ft.

In recent years, the developer has been actively seeking to rebuild residential units within its hotel projects.

Last month, it sought approval to rebuild about 1,665 apartments in its Harbourfront Horizon Suites in Hung Hom.

That came after it sought approval to convert the nearby Harbourview Horizon Suites into a three-tower residential and hotel complex that is expected to provide 1,503 homes and 442 hotel rooms, in effect, reducing the hotel's size by 80 percent.

Its Harbour Plaza Resort City in Tin Shui Wai will also be converted into 1,102 flats.

(The Standard)

Mainlanders fuel surge in property viewings

A property agency said appointments for home viewings at the La Montagne project in Wong Chuk Hang by mainlanders surged, hitting 30, and that it expected the number to surpass 100 in the next one to two weeks.

The agency expects the border reopening to help boost sales of luxury homes priced at HK$10 million or above to 1,500 in the primary market this month.

La Montagne will be the focus, with most of 88 units in the first price list costing more than HK$10 million after discounts. The new project atop the Wong Chuk Hang MTR Station is jointly developed by Kerry Properties (0683), Sino Land (0083), Swire Properties (1972), and MTR Corp (0066).

The easing of mortgage rules will also stimulate home sales, a property agent said.

The agent said home viewing appointments surged 30 percent weekly in both primary and secondary markets over the past weekend,

The Hong Kong Monetary Authority on Friday lifted the maximum loan-to-value ratio for self-use residential properties below HK$15 million to 70 percent, and 60 percent for those that are valued from HK$15 million to HK$30 million.

The agent added that nearly all units in the first price list of La Montagne will benefit from the easing, as only one is priced above HK$30 million.

Morris Lo, sales and marketing director at Kerry Real Estate Agency, said it will study whether to raise prices at La Montagne in coming lists now that mortgage rules have been eased. He said on Friday there was room for an increase in prices.

Lo added that Kerry will put more new homes on the market in the near term, and is likely to start sales as early as this weekend.

In Kai Tak, Henley Park, developed by Henderson Land (0012), received over 8,384 checks for the second batch of 82 units, marking a 101-time oversubscription. Sales of the second batch start today.

Henderson also said the relaxation in mortgage limits has improved sentiment, with its One Innovale project in Fan Ling seeing three deals by tender yesterday, bringing in HK$18.5 million.

Some smaller banks in Hong Kong were said to have increased the cap on interest rates for mortgage plans based on the Hong Kong interbank offered rate to the same as the prime rate, leading to an actual rate of 5.875 percent, and offering no cash rebate.

(The Standard)外资代理行:上半年商厦负吸纳量32.6万

有外资代理行指出,通关后,写字楼总租赁于上半年增加13.8%,恢復至2019年底疫情前73%水平,期内录负吸纳量32.6万方呎,整体空置率由去年底12.2%升至12.6%。

商厦空置率12.6%

中环写字楼租赁需求主要来自资产管理、私人银行及基金,至于商务中心、金融服务、消费品牌及保险业则活跃于湾仔、铜锣湾及港岛东,九龙东吸引专业服务机构及科技租户。整体写字楼租金于上半年回落2.1%,中环写字楼租金下跌2.6%。尖沙嘴租金微升0.3%。

该行代理表示,未来半年,整合及提升写字楼质素租赁支持需求,由于租金较2019年高位回落约30%,业主提供租赁条款更具弹性,新供应推高空置率,不过,预期写字楼租金下半年跌0%至5%。

核心街铺空置率由去年底的16.6%跌至6月底的13.7%,铺租去年跌10.6%,今年上半年回升8.2%。短期而言,餐饮业、药房、大眾时装及生活品牌,以至体验性零售,继续成为市场主导。该行另一代理表示,年底前约400万方呎新零售楼面落成,预期下半年核心街铺及大型商场租金升幅将为5%以内。

该行另一代理表示,上半年成交价5000万以上商用物业,投资总额较去年下半年减1.8%至178亿,商铺佔总额约43.5%。投资者对核心街铺重拾兴趣,价格去年下跌7.6%后回升2.4%。

核心区铺租升幅料5%以内

该行另一代理表示,楼市最坏情况已过去,但復甦之路漫长,未来受5大因素左右,分别是1加息、人才缺失、政府政策、本地经济增长及内地经济復甦步伐。

该行另一代理表示,卖地及补地价收入减少,政府总收入下跌,一些交通基建工程或因而影响竣工。仲量联行香港主席曾焕平表示,港楼市经历自2008年以来最长调整期,并尚未见底。

(星岛日报)

山顶和福道2幢洋房5.6亿易手 前明珠兴业黄坤妻子沽货每呎6.97万市价水平

传统豪宅受追捧,前明珠兴业主席黄坤的妻子沽售山项豪宅,涉及和福道2幢洋房,合共涉资5.6亿,平均呎价逾6.97万,属市价水平。据悉,项目放盘短时间易手,彰显传统豪宅有价有市。

市场消息透露,山顶和福道11号及13号,每幢面积4016方呎,拥有4房 (包3间套房) 及特大花园,早前以每幢意向价3.8亿放售,随即引起多组实力买家洽购,儘管出价未到业主意向,由于业主有心出售,最终每幢减价接近1亿,以逾2.8亿易手,合共涉资5.6亿。

市场消息指,买家为同一名买家或相关人士,并以本地客呼声较高,以买卖公司形式易手。

每幢洋房减价约1亿售

市场消息指,11号洋房由国健实业有限公司持有,于1993年6月以1700万购入;至于13号洋房于1994年由辉进投资有限公司购入,作价4450万,两家公司董事都包括王綺霞,为前明珠兴业主席黄坤的太太。该2洋房购入价合共6150万,持货至今约30年获利可观,帐面高逾4.38亿。

坐拥大花园及泳池

有代理表示,该每幢洋房各自拥有2000方呎花园,内里有泳池,花园设计极具品味,惟由于项目并非望海景,故造价未能突破新高。洋房皆连傢俬出售,内里豪华而且别致。

和福道一向有不少名人业主,包括梁朝伟及刘嘉玲、资深大律师陈志海、名人何添后人何厚鏘、何厚浠兄弟等。于2012年5月,息影国语片女星汪玲沽售和福道7号屋,作价约2亿,建筑面积4527方呎,同样拥有4房 (包3间套房) 及特大花园,呎价约4.42万。

今年以来,山顶不乏大手买卖,最瞩目为马来西亚「锡矿大王」陆佑家族持有逾70年的山顶马己仙峡道30至38号豪宅,于今年4月以50亿易手,造价更创有史以来本港屋地第三高。

(星岛日报)

雅居乐底价9.66亿夺九龙塘旧楼业权

雅居乐併购的九龙塘龙圃别墅,今年3月获土地审裁署批出强拍令,项目原定于5月举行拍卖,惟当时因小业主业权问题而取消;最新于昨日再次举行拍卖会,底价9.66亿,由手持「1号牌」的雅居乐代表,在未有其他竞争无对手下以底价投得,成功统一业权发展。

以可建总楼面约6.49万方呎计,每方呎楼面地价约14880元。

长沙湾公务员楼申强拍

另外,土地审裁处接获今年第4宗申请强拍,由财团併购的长沙湾顺寧道308至314号公务员合作社旧楼,新近获财团申请强拍,以统一业权发展,该财团持有约90%业权,整个项目市场估值约逾1.24亿。

(星岛日报)

柴湾角7项目 重建商厦数据中心

荃湾柴湾角商贸区属于近年转型较快的商业区之一,区内近年有多个较大型重建计划,将提供逾290万平方呎的工商业楼面,规模最大属于嘉民亚洲旗下的中央纱厂重建计划。

柴湾角工业区的范围,东面至大涌道,西面至荃湾西近丽城花园,北面至青山公路近愉景新城,南面至海盛路海旁,包括青山公路 (荃湾段) 中段及沙咀道前段的工厂大厦。

早在上世纪60、70年代「纱厂」、纺织厂林立,被称为「小曼彻斯特」,规划署近年见该区具转型的潜力,故此将整区改划成「其他指定用途 (商贸)」。近年区内至少有7个重建计划正在进行,涉及约291万平方呎工商业楼面,当中不少计划重建成商厦或数据中心。

纱厂重建4大楼 项目出租逾8成

当中嘉民于2014年购入中央纱厂第1至5号厂原址展开重建,重建转型为4座大楼,总面积达160万平方呎,将会作为数据中心用途,当中丈量约份第355约地段第301号A及餘段地盘在今年3月完成2.65亿元补地价,以项目最高可建楼面约145,349平方呎计,每呎楼面地价约1,829元。

目前嘉民荃湾西项目首2座落成大楼已全数租出,其餘2座大楼预计于2024年完工,目前整个项目的预租率达87%,租户均为数据中心及创科企业。

第一集团3地盘 建国际企业中心

除了嘉民亚洲外,另一个活跃区内工厦重建的第一集团,近年购入区内3个重建地盘,打造成国际企业中心1至3期项目。当中从星星地产手上以约9.8亿元购入的柴湾角街11号,由第一集团发展成商厦国际企业中心1期,总楼面面积约15.5万平方呎。

至于柴湾角街73号的国际企业中心2期,则属于新式工厦项目,楼高20层,涉约11.4万平方呎楼面,全层楼面则约6,000平方呎。而大涌道18号工业地盘,第一集团补地价逾9亿元,并发展成20层高商厦国际企业中心3期,属于20层高商厦,每个单位建筑面积介乎900餘至约1,600平方呎不等。

同时,亿京购入前永南货仓大厦,亦在近3年前补地价约14亿元,现时已重建成沙咀道1号商厦环贸广场,楼高23层,写字楼单位面积由约500餘至全层约2.7万平方呎不等。

(经济日报)

环贸广场今年暂录7成交 呎价1万

荃湾近年有不少新工、商业项目推出,其中亿京去年开始拆售的沙咀道1号环贸广场,今年录得7宗成交,最高呎价约1.1万元。

据EPRC经济地产库显示,环贸广场今年以来共录得7宗买卖成交,平均呎价约1万元,涉及以中、小型单位为主,面积介乎约543至2,125平方呎,售价由535至2,141万元不等,每平方呎造价介乎9,108至10,735元,例如今年3月成交的17楼一个单位,面积约563平方呎,以约604.4万元沽出,平均呎价约10,735元。

中小型单位受捧

至于同区第一集团发展的大涌道国际企业中心3期,由推出至今平均呎价约10,672元,其中上月沽出的15楼单位,面积约1,210平方呎,售价约1,403.6万元,平均呎价约11,600元。另外,大家乐 (00341) 首席执行官罗德承等人亦曾经在去年5月斥逾4,200万元购入中层2个单位。

(经济日报)

Low valuations to spur bargain hunts among developers

A "large pool of undervalued assets" in Hong Kong's property market may spur more bargain hunting among majority shareholders as valuations hit a 30-year low, according to JPMorgan Chase.

The SAR's cash-rich property tycoons may take advantage of the cheap valuations to buy assets, conduct buybacks or take out minority shareholders at a time when developers and landlords are on average valued at a 63 percent net asset value discount to the aggregate market capitalization, wrote its analysts, including Cusson Leung, in a note.

"We believe the uniqueness of the Hong Kong property and conglomerates sector is that their majority shareholders will not be shy to grab opportunities from the market downturn," the analysts wrote.

The property sector is trading at a combined market cap of HK$1.1 trillion, while their aggregated net asset value amounted to HK$3 trillion, the investment bank said. That represents a large pool of undervalued assets that majority shareholders can choose from, it added.

Some families may be more active than others in taking advantage of the valuation dislocation, such as Li Ka-shing-backed CK Asset Holdings (1113). Others include Wharf Real Estate Investment (1997), Kerry Properties (0683), Swire Pacific, Swire Properties (1972) and Henderson Land Development (0012).

(The Standard)

Flat prices 'to go up on mortgage easing'

Wheelock Properties anticipates developers will increase the sale of mid-priced units due to the relaxation of mortgage loan measures, while overall home prices in Hong Kong are expected to rise 5-7 percent this year. And Wheelock also plans to sell four new projects.

Its vice chairman, Ricky Wong Kwong-yiu, expects mid-price flats in the HK$10 million to HK$15 million range to be highly sought after, projecting a 20-30 percent increase in transactions for such units in the primary market in the second half compared to the first half.

That came as the developer reported total sales of over HK$11.3 billion in the first half from 814 units. And the four projects it is planning to launch in the second half involve over 1,800 units.

On the other hand, a property agency predicted a 10 percent decline in residential property prices in the second half, saying market conditions do not support a lasting recovery in property prices.

It recommends the government consider doing away with cooling measures, particularly stamp duties, and eliminating stress tests.

In other news, benefiting from the upturn in property transactions, stamp duty revenue in the first half saw a 75.9 percent rebound to around HK$4 billion, compared with HK$2.3 billion in the second half last year. The trend is not expected to be sustained amid sluggish sentiment.

Wang On Properties (1243) has submitted an application to the Town Planning Board, seeking a 20 percent relaxation in the plot ratio for the redevelopment of Yau Tong Industrial Building tower four, with the aim of building 676 residential units.

Another property agency said yesterday Dragon Court in Kowloon, the subject of a compulsory sale order, was acquired by Agile Group (3383) for HK$966 million.

The Lands Tribunal has also got a fourth application for a compulsory sale this year, the latest being 308-314 Shun Ning Road, Cheung Sha Wan at a valuation set at nearly HK$125 million.

A second price list for 45 units at La Montagne in Wong Chuk Hang was launched at prices starting from HK$9.8 million, or HK$24,309 per sellable square foot, after discounts. Kerry Properties (0683), Sino Land (0083), Swire Properties (1972) and MTR Corp (0066) said together with those launched in the first price list, 115 units will be put up for sale on Saturday.

(The Standard)

Hong Kong’s home prices to decline further amid high mortgage rates, glut of new units, lack of mainland buyers a property agency said

The company’s latest forecasts says prices will drop 5 to 10 per cent in the second half, resulting in a total drop of 5 to 8 per cent in 2023

Housing market is having ‘the longest price adjustment since 2008’ and ‘has not found a bottom’, the property agency said

Hong Kong’s floundering residential property market has not yet bottomed out, and the road to recovery will be long and difficult given headwinds including high interest rates, a glut of unsold new units and a lack of buying power from mainland China, according to a property agency.

Factors including a volatile stock market, a challenging external economic environment and a decrease in new births and marriages are also affecting housing demand, the real estate company said in its midyear property market report, released on Tuesday.

“Hong Kong’s housing market is now having the longest price adjustment since 2008, and the market has not found a bottom,” a property agent said.

Home prices fell by 1.2 per cent quarter-on-quarter in the second quarter of 2023, after rebounding by 4 per cent in the first quarter, and have plunged 15.9 per cent from a peak 20 months ago, the agency said.

The company now expects prices to drop 5 to 10 per cent in the second half, resulting in a total drop of 5 to 8 per cent in 2023.

The number of unsold units in completed projects is the highest since 2007, the report added. There are 83,000 housing units available in Hong Kong, with 18,000 in completed projects and the rest under construction. In addition, about 25,000 more units are expected to hit the market in 2023, according to the agency.

“Based on observations from previous cycles, current conditions do not warrant a sustainable home price recovery,” the agent said, adding that given the headwinds surrounding the sector, the current down cycle will be longer than previous troughs.

The world economy is not expected to recover significantly in the next one to two years, Tsang said, nor would China’s relationship with Europe and US improve significantly in the near future.

Hong Kong’s economy grew by 2.7 per cent in the first quarter over a year earlier, ending four consecutive quarters of contraction. The government’s full-year forecast for growth is between 3.5 and 5 per cent.

A recovery in the property market will only begin with a downward trend in interest rates, the agent said.

The Hong Kong Monetary Authority (HKMA) in June paused its rate hikes for the first time since March 2022, keeping the city’s base rate at 5.5 per cent after the Federal Reserve’s move to stagger potential further increases after 10 consecutive hikes.

But the mortgage rate has more than doubled to 3.5 per cent from 1.5 per cent before the rate hike cycle. This means the monthly mortgage payment for a HK$6 million (US$766,640) flat with a 90 per cent loan-to-value ratio spread over 30 years has surged 30.1 per cent to HK$25,461, according to another property agency.

The HKMA on Friday evening eased mortgage rules for the first time since 2009 to make borrowing easier for first-time homebuyers and those who want to upgrade to bigger flats. The move has piqued the interest of potential homebuyers and current owners, but will not make a big difference for the overall property-market outlook, according to brokers and bankers.

The first agency’s home-price forecast echoes those of other analysts. Another agency has predicted a drop of up to 5 per cent in lived-in home prices for the whole year, while Citi expects prices to end the year flat compared with 2022.

In contrast to the for-sale market, the agent said the residential leasing market will gain support from a population inflow from mainland China and the arrival of people recruited under the Top Talent Pass Scheme.

“These [people] may not buy a house immediately, but they will definitely rent one, and this will benefit the leasing market,” the agent said.

Hong Kong has received more than 100,000 applications to various talent schemes so far this year and approved over 60 per cent of them, nearly double the number targeted.

Luxury rental prices will increase up to 5 per cent in the second half, according to the first agency. This aligns with another agency forecast that said the rental price index will increase by around 5 to 8 per cent in 2023.

(South China Morning Post)企业广场三期全层1.8亿放售 正八集团廖伟麟持有

由正八集团主席廖伟麟持有的九龙湾企业广场三期全层放售,市值1.8亿。

有外资代理行代理表示,九龙湾宏照道39号企业广场三期28楼全层海景甲厦,建筑面积约16100方呎,享180度海景,市场估值约1.8亿,呎价约10800元,物业估值呎价低水,该物业同1幢大厦低层8楼,于2018年成交价格2亿 (平均每方呎价12579元),呎价大幅回落超过10%,是次放售物业为28楼全层,属罕有幸运数字的高层单位。企业广场三期位于东九龙,于2004年落成,毗邻MEGABOX、啟德发展区、九龙湾港铁站及多个发展规划项目。

平均呎价1.08万

另一代理表示,长沙湾青山道489至491号香港工业中心B座单位,建筑面积约1731呎,意向价950万放售,平均呎价5488元,市场呎租18.5元,料回报达4厘。该单位为半仓写装修,高层多窗,景观开扬,楼底约10呎多,实用高达80%,内设有独立冷气配备及洗手间,香港工业中心内设4部货梯,2部客梯及车场,车位充裕。大厦位处荔枝角中心点,附近商厦各式食肆临立。

(星岛日报)

更多企业广场写字楼出售楼盘资讯请参阅:企业广场写字楼出售

更多九龙湾区甲级写字楼出售楼盘资讯请参阅:九龙湾区甲级写字楼出售

都会大学4.3亿洽荃湾酒店 邓成波家族放售 房间数目160个

都会大学自从今年2月高调表示计画买酒店,改建学生宿舍,消息透露,该大学锁定首个目标为旭逸酒店.荃湾,项目拥有160个房间,由邓成波家族持有,以约4.3亿洽购,料短时间落实交易。

市场消息透露,自从计画购酒店后,都会大学未能如期在九龙区找到酒店,首个目标转移至新界,为葵涌圳边街15至19号旭逸酒店.荃湾,项目楼高20层,拥有160个房间,总楼面约11.54万方呎,以金额约4.3亿计算,每个房间涉资约269万,呎价4962元,知情人士表示,项目已进入尽职审查阶段,预期短期内落实交易。

每个房间涉资约269万

本报就洽购上述酒店向都会大学查询,发言人回应:「都大正物色合适物业作学生宿舍,以丰富学生的校园生活,提供宿位让更多非本地生及交换生到校就读,增加与本地学生的交流机会,提升大学学习气氛及促进校园国际化。宿舍的选址及筹备工作正在进行中。」

该项目为邓成波家族持有,于2011年3月以1.6亿购入圳边街15至19号万通大厦,为全幢工厦,经过活化后成为酒店。业内人士指,该项目距离都会大学车程约45分鐘,胜在空间够大,价格廉宜,符合大学希望学生有充裕的学动及活动空间。

发言人:物色合适物业作宿舍

都会大学校长林群声今年2月表示,计画今年内购入九龙区酒店,再改建学生宿舍,目标提供300至400个宿位,主要向内地生提供住宿,以及增加学生做交换生机会,由酒店改装的宿舍可以成为学生活动中心,同时让宿生及非宿生举办活动,作为都大学生的聚脚点。

近期酒店买卖畅旺,不少酒店由财团购入后,改为学生宿舍,包括荃湾汀兰居,红磡逸酒店及新蒲岗贝尔特酒店。

(星岛日报)

观塘骏业街51号全幢 意向价7.3亿

政府近年积极推动九龙东,将多个政府部门乔迁往东九龙指标商厦,增强区内人流,亦带动其他相关行业机构迁入九龙东商厦,改善区内商厦吸纳情况。

区内多座工厦活化作商业写字楼用途,物业发展潜力更看高一綫,有业主趁势放售观塘骏业街51号全幢物业,意向价约7.3亿元。

有代理指,独家放售项目为观塘骏业街51号全幢,面积约56,312平方呎,意向价约7.3亿元,将以交吉形式出售,每呎叫价约12,963元。

活化改建可作商厦

项目为楼高21层工业大厦,现正活化改建作1幢可商业用途的商厦,合零售等各行业。而该厦位处东九龙CBD 2核心商贸区,比邻多座甲级大厦,有望带动人流提升区内消费力,加上该厦邻近港铁观塘站,享有贯通全港铁路网络,能配合多元化商业活动,成就无限商机。

市值呎租30至35元

同时,该厦高层单位更备有烟花海景,特色平台,用途弹性大,可吸引不同行业需要。为配合政府活化工厦政策,该物业持续翻新及提升多项设备配套,物业云石大堂,时尚典雅,银座式商厦外形设计,更为企业选址成就独有优势。按目前市况而言,该厦市值租金可望为每平方呎约30至35元。

该代理续指,本港全面通关后,商界交流活动转趋频繁,个别企业亦积极为扩展业务作部署,物色优质物业,而九龙东有较多优质工商厦物业,加上政府积极在区内展开推动经济发展的措施,率先安排更多部门进驻,以吸引更多中小企相关行业进场,带来起动及协同作用。

同时,据资料显示,今次推售物业比邻为开源道73至77号业发工业大厦1、2期,以及巧明街119至121号年运工业大厦,于本年4月已被正式统一收购。合併发展重建为1幢39层高新地标商厦,相信将令区内周遭环境一带变天在即,带动更多商业活动及消费人流,预料是次项目将会获更多投资者洽购。

(经济日报)

Lease price for TST shop takes 80pc hit

A shop space in Tsim Sha Tsui was rented out for HK$400,000 per month, representing an 80 percent decrease from its peak, according a property agency.

Drugstore chain Sakura has leased it for three years, marking its second store opening in a core retail district this year.

The shop, located on the ground floor of Haiphong Mansion at 53-55 Haiphong Road has an area of about 1,200 square feet.

Chow Tai Fook Jewellery previously leased the shop in 2014 for approximately HK$1.8 million a month but vacated it in June 2020 due to the pandemic.

Despite a slower-than-expected recovery affecting the city's investment transaction volume in the first half, another agency expects the resilient retail sector to gain momentum in the second half due to the influx of mainland tourists and firms.

It anticipates an accelerated recovery in the second half, with high street shop rents growing by 8 percent over the full year.

The news came as the first agency’s founder said current trends show more people opting to rent rather than buy, indicating that the relaxation of mortgage rules has not been effective and leading him to expect cooling measures to be lifted in the future.

The agent said the relaxation was driven by government risk aversion to a market collapse and not to help people buy homes.

Swire Properties (1972) said its Eight Star Street in Wan Chai has sold 33 units, bringing in around HK$702 million at an average HK$38,983 per square foot.

Four units are still available at prices, after discounts, of HK$41.93 million to HK$70.68 million.

Its Chai Wan bus depot redevelopment, expected to be sold next year, will provide 850 units in two phases.

Wheelock Properties' Koko Mare in Lam Tin added a sixth price list for 45 flats ranging in size from 310 to 529 sq ft at an average discounted price of HK$19,333 psf, putting the starting price at HK$7.6 million.

CK Asset (1113) is set to release its sales brochure for The Coast Line II in Yau Tong this week, with a possibility of unveiling prices next week. The first batch will be at least 132 units.

(The Standard)

长实波老道「大刁」告吹 基金买家遭杀订20亿

长实 (1113) 去年天价出售中半山波老道豪宅21 BORRETT ROAD一系列住宅连车位,却因买家新加坡基金华瑞资本未有如期付款,令交易告吹,长实亦杀订,没收逾20.76亿元订金,可能是史上最大宗挞订个案。长实执行董事赵国雄对交易告吹认为甚为可惜,早前曾跟买家研究过解决方案,并称将按市况重新安排销售。

赵国雄:曾与买家研解决方案

长实表示,儘管双方就21 BORRETT ROAD交易,已尝试按不损害权益基础,通过讨论解决违约问题,惟未能达成解决方案,因此已根据买卖协议,向买方发出终止通知,致使买卖协议被即时终止。长实称,没收了买方已支付的20.76亿元订金,是次出售事项及卖家贷款将不会进行。

赵国雄表示,在签订买卖合约后,市场不断变化及利率变动,最终未能达成协议,只好执行相关合约条款,认为「甚为可惜」,并称将按市况重新作出销售安排。他补充指,21 BORRETT ROAD豪宅项目位于香港最尊贵的山顶地段,乃一项稀珍的优质资产。

外界对买家基金背景所知不多

长实去年将21 BORRETT ROAD餘下销售项目,以207.66亿元出售予华瑞资本,涉及152个住宅单位、242个住宅车位及31个电单车位,其中住宅的成交呎价为6.2万元,较当时成交价提供折扣。长实更提供贷款,最多103.3亿元或物业七成按揭,协助华瑞资本收购项目。事实上,去年购入波老道物业的新加坡基金,外界对其背景所知不多。

今次有可能是本港史上最大宗挞订个案,每个单位平均杀订1.34亿元。翻查资料,2019年由会德丰负责销售的山顶豪宅Mount Nicholson,亦曾出现买家「褪軚」后,遭没收逾3600万元巨额订金,是2013年《一手住宅物业销售条例》实施后最大金额。

有代理认为,在现时高息环境下,买方财务压力远比开始收购时高,可能因此取消成交,而现时市场整体资金不足,预计部分大额交易在短期内或受到搁置甚至取消。

有测量师认为,今次属个别事件,若买家财政健康,是次挞订也反映买家可能觉得现在价格比先前签约时价格,已调整超过10%,才有这个决定。

21 BORRETT ROAD的地皮早于2011年,由长实以116.5亿元投得,成为当年全港排名第二的百亿地王,每呎楼面地价逾2.67万元。

(星岛日报)

大围生力工厦全幢月租250万 AirTrunk提价50%进驻呎租逾20元

今年以来工厦市场气氛不如去年,买卖大减,然而,数据中心仍然积极扩展中,其中,全球知名的数据中心营运商 AirTrunk,向生力啤酒厂相关人士,承租大围生力工业中心全幢,月租高逾250万,较旧租金提价逾50%,设立香港第2个数据中心。

市场消息透露,AirTrunk 承租大围成运街9至11号生力工业中心全幢,总楼面124860方呎,以每月逾250万租出,平均呎租逾20元,租期逾15年。代理表示,由于数据中心投资额巨大,一般皆签署至少15年租约,而该全幢旧租客包括医疗公司、海味经营商及日资电子公司,呎租介乎13至14元,新租金大升逾50%。

签署逾15年长约

AirTrunk 来自澳洲,是全球知名数据中心,上述为该集团在香港的第2个数据中心,首个于2019年11月,承租青衣立信工业大厦,总楼面约18.7万方呎,月租约420万。

业内人士表示,工业转作数据中心、迷你仓及冻仓,能有较高增值潜力,改装后亦为业主带来更高租金及升值空间,由电子商贸及科技发展所带动,市场数据中心需求持续增加,驱使更多投资者追捧具有潜力转作这些用途的工厦,预期未来3年,此类型工厦仍受追捧。

业主生力啤酒相关人士

数据中心能够提供大量的计算和存储资源,以及高度可靠的服务而受追捧,尤其近年随着数据量急剧增长,许多组织和企业需要管理和存储大量数据,数据中心提供了一个高度安全、可靠和可扩展解决方案。此外,数据中心还能够提供高速互联网连接和优质的网络架构,使得用户能够更快传输数据。

因此,不少基金购入工厦后,纷改作数据中心,以取得高回报,从而进一步推动价格上升。

AirTrunk 积极扩展,继3年前于青衣建立数据中心,最新向生力啤酒厂相关人士,承租大围生力工业中心全幢。

(星岛日报)

代理行:上半年录2173宗工商铺买卖

有代理行表示,今年上半年录2173宗工商铺买卖登记,连跌3个半年度后首现反弹,料在利好因素下,下半年整体工商铺交投将持续上升,登记量看升20%。

该行代理指出,今年上半年工厦登记宗数重登千宗以上,比例最多,共录1208宗,佔整体比率55.6%;商厦及店铺分别录443宗及522宗登记,佔比各约20.4%及24%。

连跌3个半年首现反弹

该代理指,今年下半年整体工商铺买卖持续上升,登记量看升20%,上试2600宗水平;至于金额方面,料商厦出现较大金额升幅,加上工厦及店铺稳步上升配合下,料录约510亿,按半年看涨58%。

预期商厦买卖登记量升幅料最显著,相信随着经济復甦,海内外企业加速回流,需求亦将增加,下半年买卖登记量有望再升35%,料录约600宗;工厦物业表现料续平稳向好,下半年买卖登记有力再升近两成半,达1500宗。

利该行另一代理说,上半年全港共录1208宗工厦登记,金额约141.73亿,较去年下半年分别升28%及22%,按年同期仍跌23%及16%。

该行另一代理表示,疫下港人压抑太久,通关后大举外游,抵消外来消费动力,上半年店铺表现未见突破,截至6月30日止,上半年共录522宗店铺买卖,较去年下半年508宗微升3%,连跌3个半年度后反弹,惟较去年同期仍跌18%;金额录108.57亿,较去年下半年104.29亿增加4%,处低位徘徊。

店铺表现未见突破

观察的13个分区当中,上半年有7区的登记量录得升幅,当中荃湾区升幅最显著,由去年下半年的17宗急升88%,至今年上半年的32宗,而观塘区亦由8宗大升88%至15宗;北角/炮台山区也升了56%至28宗。此外,上半年旺角/油麻地/大角嘴区,以77宗登记蝉联最活跃的观察区,惟按半年轻微回落9宗或10%。

(星岛日报)

湾仔君悦居全幢住宅 财团9亿洽购

核心区全幢物业受投资者注视,湾仔分域街君悦居全幢住宅,获财团9亿洽购。

住宅单位 月租逾1.2万

市场消息称,湾仔骆克道君悦居全幢物业正获洽购,物业位于骆克道42至50号,地盘面积约5,219平方呎,物业楼高15层,地库至2楼为商铺,现租客包括多间餐厅、便利店及健身中心,3楼至15楼为房间,间隔由开放式至两房,涉及114间房。由于物业位于湾仔中心地段,租务甚佳,按资料显示,住宅单位月租约1.2万起。

整幢物业面积约70,529平方呎。市场人士透露,项目近日获财团以9亿元洽购至尾声,有望短期内成交,呎价约1.28万元。

都会大学洽购荃湾旭逸酒店

据了解,项目由本地老牌家族持有,2005年家族以4.5亿元,向罗家宝购入物业,作长綫收租。

全幢住宅及酒店受捧,消息称,邓成波家族旗下荃湾旭逸酒店获洽,物业楼高20层,提供160间客房,总楼面约11.54万平方呎,正获4.3亿元洽购至尾声。据了解,是次洽购为都会大学,料改建学生宿舍。

(经济日报)

置地每年投放1亿美元升级中环物业组合

在中环持有多幢甲厦的置地公司,未来将投放1亿美元升级旗下中环物业组合。而今年怡和集团与置地公司共同庆祝怡和大厦50周年誌庆,并举办一连串庆祝活动。

置地公司行政总裁黄友忠表示,未来集团将继续大力投放资源于怡和大厦及中环物业组合内的其他商厦,以维持置地公司在香港的领导定位。置地公司每年投放高达1亿美元,革新并升级旗下物业,确保怡和大厦符合最新的提升现代化和数码化标準。

黄友忠指出,在质量优先 (Flight to quality) 的趋势下,企业会优先考虑拥有最高级别可持续发展认证、地理位置优越的优质办公室。作为置地中环物业组合的一部分,怡和大厦将持续受惠于这一趋势。

怡和集团行政总裁韦梓强 (John Witt) 表示,怡和大厦作为香港其中一个著名地标,以独特的建筑设计及圆形玻璃窗闻名,引领现代中环发展,同时,一直见证着香港作为国际商业及金融中心的不变地位,未来亦然。

作为怡和大厦50周年庆祝活动的一部分,置地公司将为租户、社区和访客举办公开讲座、展览和导赏团等活动。

怡和大厦于1973年落成,是香港首座摩天大厦,也是置地公司中环生态圈的枢纽。怡和大厦以稳健的设计、当时亚洲最快的电梯及最大的空调冷却系统,以及可尽览维港景观的1748扇标誌性圆形玻璃窗,为区内商厦树立划时代的新标準。时至今日,怡和大厦仍为香港著名地标之一。

(信报)

更多怡和大厦写字楼出租楼盘资讯请参阅:怡和大厦写字楼出租

更多中环区甲级写字楼出租楼盘资讯请参阅:中环区甲级写字楼出租

Li Ka-shing’s CK Asset forfeits deposit as sale of US$2.66 billion Mid-Levels project to Singapore fund falls through

LC Vision Capital 1 failed to make a US$133 million payment, plus accrued interest, on the purchase of 148 units at 21 Borrett Road

CK Asset cited high interest rates as a factor in the collapse of the deal in an exchange filing on Thursday