疫情期间不少公司採灵活办公策略,跨国共享空间营运商IWG集团认为,疫情后灵活办公空间更见普遍,机构亦开始採纳混合模式,市场尚有很大增长空间,并指在家工作不会取代传统办公室。

IWG集团旗下的灵活办公室,包括Spaces、Regus及Signature,主要为共享空间,除了提供流动办公桌外,亦有独立房间,办公桌月租由数千元起。

疫情持续2年,商厦需求受封关冲击,整体甲厦空置率上升。不过,IWG集团香港区域经理Paul MacAndrew指,灵活办公空间需求却有上升,如集团旗下出租率,也有明显增长。他分析,「其实在疫情前,灵活办公概念已渐流行。疫情出现后,即明显加速相关的需求。」

在家工作难取代传统办公室

在去年疫情高峰期,不少公司採在家工作政策,或灵活办公的做法,例如把公司员工分成两队,一半在家工作,另一半返回办公室。今年疫情缓和,Paul指出,机构续使用灵活办公,「疫情后,灵活办公的概念更加流行,例如一间公司,不是所有员工需在总部办公室工作,亦非每星期5日均返公司,准许在家工作。」他认为这是大势所趋,「机构不得不考虑作出变革,因为员工亦喜欢这种模式。」

事实上,早前IWG英国研究指出绝大部分的英国员工(72%),均倾向选择长期灵活工作,多于加薪1成但需长驻办公室,反映疫情为员工对办公室的取态,带来结构转变。此外,三分之二的员工更不会应徵没有提供混合工作模式的职位。

Paul强调,在家工作未能如此代替传统办公室,特别香港背景较为困难,「香港不像外国,家居面积大又有花园,香港居住环境细,难以完全在家工作。相信传统写字楼绝不会被取代,机构始终需要总部,接见客人。不过,租用面积可能会缩细。」

在IWG共享空间内,会员可租用办公桌(Hot Desk),另外亦有独立房间计划等,而所有会员均可享办公室内的设施包括茶水间、会议室等。他指,共享空间正是胜在灵活,「租约可以较短,可节省很多装修费。」

海滨汇佔地逾5万呎 650办公位

IWG集团近两年积极扩充,更于东九龙设首个办公点。集团租用观塘海滨汇楼面,旗下Signature佔地超过50,000平方呎,提供超过650个办公位置及供1至150人使用的私人办公室,开业已数月。Paul指,东九龙前景不错,「东九龙为第二核心商业区,现时交通、餐饮配套等理想,甚有吸引力。」他透露,现时旗下东九龙租用的行业涉及IT、时装、人力资源等,甚为广泛。

至于传统的商业区方面,集团早在去年租用铜锣湾希慎广场,以及尖沙咀港威中心,今年续活跃扩充,于尖沙沮港威大厦为Signature增添1层楼面,新设商务休息厅及多个私人办公室。该中心现佔地3层,提供共75,000呎楼面,为本港最大的Signature空间。另外,集团续强攻铜锣湾区,数月前接手WeWork,租用铜锣湾 Tower 535 的11及12楼,开设Spaces在港的第6个中心,新址总面积达23,400平方呎,计划于下月开业,届时可提供超过300多个办公位置及供1至60人使用的私人办公室。

(经济日报)

更多海滨汇写字楼出租楼盘资讯请参阅:海滨汇写字楼出租

更多观塘区甲级写字楼出租楼盘资讯请参阅:观塘区甲级写字楼出租

更多希慎广场写字楼出租楼盘资讯请参阅:希慎广场写字楼出租

更多Tower 535写字楼出租楼盘资讯请参阅:Tower 535写字楼出租

更多铜锣湾区甲级写字楼出租楼盘资讯请参阅:铜锣湾区甲级写字楼出租

更多港威大厦写字楼出租楼盘资讯请参阅:港威大厦写字楼出租

更多尖沙咀区甲级写字楼出租楼盘资讯请参阅:尖沙咀区甲级写字楼出租

看好经济前景 「甲厦需求总会回来」

疫情冲击甲厦需求,吕干威相信,营商人士对本港及内地经济前景有信心,故甲厦需求总会回来。

疫情期间甲厦需求转弱,租金下跌及空置率上升,希慎为铜锣湾大地主,持有大批甲级商厦。吕干威指,集团旗下商厦整体出租率仍理想,疫情期间波幅不算高。后市上,他认为压力仍有,「毕竟环球经济存不确定因素,机构会採保守态度。不过,我认为大型机构对中国经济长远有信心,故写字楼租务需求总会回来,只是暂时抑制。」供应方面,未来两年踏入甲厦供应高峰,他表示核心商业区供应不多,压力较细。

集团对商业后市甚看好,今年伙华懋以197.8亿夺铜锣湾利园山道商业地王。吕干威指出,「地皮规模大,在铜锣湾商业成熟的地区,能够扩大3成业务,是非常难得,故值得购入。」

迎潮流 与共享空间机构合作

传统写字楼面对另一挑战,就是近年灵活办公室出现。他指,「情况有如当年网购出现,对传统购物商店造成冲犛。现考验各大业主如何调整写字楼这项产品,去适应新需求。」事实上,希慎早前亦与共享空间机构合作,开拓灵活办公市场,正是迎合新潮流,「办公生态改变,不一定要留在公司工作,或有固定办公地方,年轻一代亦喜欢舒适而自由度较高的工作环境,故我们把灵活办公室结合现有写字楼,可增强物业的吸引力。」

(经济日报)

Property market shrugs off rate hike fears

Hong Kong's primary residential market seems not to have been affected by an expected interest rate hike, with new projects booking over one hundred transactions over the weekend.

Another 50 flats at Caine Hill in Sheung Wan are now being offered by Henderson Land Development (0012) after the 50 homes in the first batch were sold within three hours after its launch on Saturday.

The second batch, is priced at HK$29,630 per sq ft after discounts, about 3 percent higher than the first one, and includes 13 studio flats and 37 one-bedroom flats ranging from 190 sq ft to 285 sq ft.

Henderson said 28 of 50 flats worth over HK$209 million in total will hit the market on Thursday.

In Ngau Tau Kok, The Aperture saw at least 42 out of 130 flats available in the second round of sales sold over the weekend with the developer Hang Lung Properties (0101) raking in HK$358 million.

In Tseung Kwan O, Kowloon Development (0034) has booked nearly HK$2.9 billion in revenue after more than 64 transactions at Manor Hill were recorded on Saturday.

The secondary market was quiet, in contrast.

Only nine deals in a property agency’s top ten blue chip estates were logged over the weekend, down by 2 deals or 18.2 percent from last week to a seven-week low.

Agent said that the decline was due to first-hand residential projects snatching a lot of second-hand property customers, coupled with the recent volatility in the stock market and the negative news about mainland developers.

With the new variant of the coronavirus still under control, the agent expects that property transactions would surge significantly once the border between the mainland and the city officially reopen.

Separately, two more homes at The Henley III in Kai Tak were sold for HK$6.08 million and HK$5.95 million, respectively.

(The Standard)

West Kowloon district emerging as new darling of Hong Kong-based multinational tenants

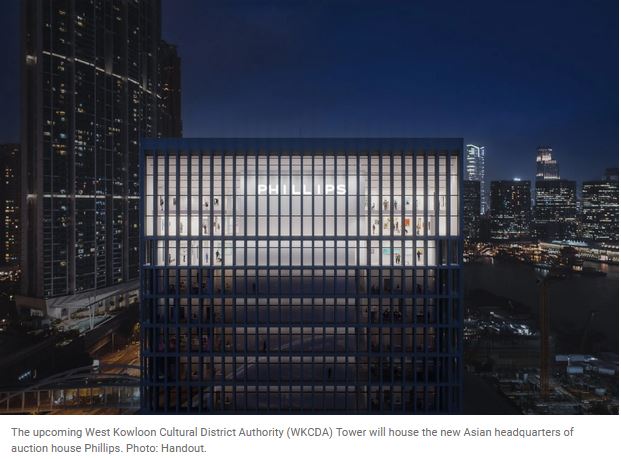

The area is set to see new office buildings open in the next few years, including the West Kowloon Cultural District Authority (WKCDA) Tower

Auction house Phillips has signed a deal to rent the main floors of the WKCDA Tower, next to the M+ art museum

The West Kowloon district is likely to become an important commercial district in Hong Kong in the coming years, as new office space comes onto the market, according to analysts.

“The Kowloon station precinct serves as an extension to the core Tsim Sha Tsui office submarket but currently has only limited amount of office space, so it isn’t seen as a stand-alone office submarket for the time being,” said property agent said.

However, “the future offices and generous open space to be built within the West Kowloon Cultural District Authority (WKCDA) Tower will help strengthen the commercial atmosphere of the area and gradually build up the appeal of the Kowloon station precinct as a preferred office district”, the agent said.

The area is expected to attract financial companies and mainland enterprises upon the completion of the 16-storey WKCDA Tower, as well as a planned twin tower development with 2.6 million sq ft of office space and 603,000 sq ft of retail space atop the Guangzhou-Shenzhen-Hong Kong Express Rail Link (XRL) terminus, set to open between 2025 and 2026, the agent said.

The XRL terminus, the only station in Hong Kong linked to the wider high-speed railway network in China, as well as the Kowloon station, which connects to the Hong Kong International Airport via the Airport Express, are some of West Kowloon’s biggest draws. The XRL’s West Kowloon station is a seven-minute drive from the Tsim Sha Tsui MTR station and a 15-minute ride to Shenzhen.

At the moment, however, the ICC – the tallest building in Hong Kong and home to the outposts of several major Chinese and multinational financial institutions – is the only office block in proximity.

One company that is taking advantage of the rapidly developing area is Russian-owned auction house Phillips. It has signed on to rent a 48,000 sq ft space occupying the main floors of the WKCDA Tower to house its new Asian headquarters, which is eight times bigger than its current space at St. George’s Building, according to Ingrid Hsu, public relations director for Asia at Phillips.

West Kowloon’s transport links and the opening this month of the M+ museum of contemporary art and design are some of the reasons behind Phillips’ decision to relocate to the area.

“Being located at the heart of the West Kowloon Cultural District will allow Phillips to work alongside M+, the Hong Kong Palace Museum and the wider district on complementary programming and events, further enhancing the area as a world-class global destination for arts and culture,” Hsu said.

Cheaper rents in the area compared to on Hong Kong Island are also likely to entice potential tenants. In November, office rents in Tsim Sha Tsui ranged between HK$41 (US$5.25) and HK$94 per square feet, while those on Hong Kong Island cost between HK$56 and HK$152 per square feet, according to another angency.

(South China Morning Post)

For more information of Office for Lease at International Commerce Centre please visit: Office for Lease at International Commerce Centre

For more information of Grade A Office for Lease in Tsim Sha Tsui please visit: Grade A Office for Lease in Tsim Sha Tsui

For more information of Office for Lease at St. George’s Building please visit: Office for Lease at St. George’s Building

For more information of Grade A Office for Lease in Central please visit: Grade A Office for Lease in Central