代理:上月50大甲厦录11宗买卖

疫市下甲厦备受压力,成交量于低位徘徊。据代理行指出,50大甲厦今年8月仅录11宗买卖,属按月横行,惟成交楼面则按月急挫6成,当中传统核心区更录「零成交」,反映市况疲弱。

综合该代理行数据显示,今年8月五十大指标甲厦合共仅录11宗买卖,与7月成交量相若,仍然处于低水平,而按月表现则持平其中,港岛区甲厦只录得1宗买卖,港岛核心区 (包括中环、上环、金鐘、湾仔等) 更未录成交,表现冰封,市场继续由新界及九龙区支撑交投,最新成交面积仅3.09万平方呎,按月下跌约60%,反映上月交投以细单位、细银码物业佔主导。

属按月横行

若以地区划分,八月份的成交量主要集中于九龙及新界,期内分别各佔6宗及4宗,其中沙田京瑞广场合共录3宗买卖,属八月份表现最好的大厦,而尖东新东海商业中心亦录2宗交投。至于港岛区只录1宗,涉及黄竹坑环汇广场。

核心区录「零成交」

该行代理表示,近期股市表现波动,加上中港通关仍然未有进展,写字楼交投步伐转趋缓慢,而物业价值较高的港岛核心区甲厦,交投更因而冰封;反观新界及九龙区写字楼物业由于物业银码较低,呎价相对显得低水,因而仍然受到部分市场人士追捧。

(星岛日报)

更多新东海商业中心写字楼出售楼盘资讯请参阅:新东海商业中心写字楼出售

更多尖沙咀区甲级写字楼出售楼盘资讯请参阅:尖沙咀区甲级写字楼出售

更多环汇广场写字楼出售楼盘资讯请参阅:环汇广场写字楼出售

更多黄竹坑区甲级写字楼出售楼盘资讯请参阅:黄竹坑区甲级写字楼出售

海港中心相连海景户 意向价1.43亿

湾仔海港中心中高层相连海景单位推出市场放售,意向价约1.43亿元,平均呎价约3.68万元。

代理表示,位于湾仔港湾道25号海港中心中高层04至05室,面积约3,886平方呎,意向呎价约3.68万元,涉及总额约1.43亿元,现已交吉。

该代理续指,单位亦正招租中,意向呎租约70元,月租约27.2万元,租客可即享单位豪华装修及怡人景观,属市场上质素上乘的核心区甲级商厦盘源。

业主于今年5月份斥资逾1.03亿元购入项目,有感近月商厦市况渐升温,遂将物业放售。

(经济日报)

更多海港中心写字楼出售楼盘资讯请参阅:海港中心写字楼出售

更多湾仔区甲级写字楼出售楼盘资讯请参阅:湾仔区甲级写字楼出售

騏生商业中心全层5800万沽 持货六年平手离场

受疫情重击,商厦市场阴霾密布。尖沙嘴騏生商业中心中层全层以5800万易手,呎价约1.4万,属市价水平,原业主持货6年平手离场,惟计及印花税等开支,料实蚀约600万离场。

据土地註册处资料显示,尖沙嘴騏生商业中心中层全层于上月中以5800万售出,买家以公司名义滙福控股有限公司 (UNION LUCK GROUP HOLDINGS LIMITED) 登记,註册董事莫诚峰等人,与一名澳门马主同名同姓,原业主于2015年以5800万购入,持货6年平手离场。

料实蚀约600万离场

据代理指出,上址面积4140方呎,以易手价计,呎价约14010元,属市价水平,若计及佣金、印花税等开支,料原业主实蚀约600万离场。

代理行资料显示,该商厦近期成交于今年8月录得,为中层全层,面积4140方呎,以5796万售出,呎价约1.4万;另一成交为中层全层,于今年4月以6250万售出,以面积4140方呎计,呎价约15097元。

此外,同区商厦棉登大厦亦录承接,该商厦低层单位,面积1472方呎,以约1600万售出,呎价约10870元;市场消息指出,旺角信和中心低层03室,面积908方呎,以962.48万售出,呎价约1.06万。

(星岛日报)

更多騏生商业中心写字楼出售楼盘资讯请参阅:騏生商业中心写字楼出售

更多尖沙咀区甲级写字楼出售楼盘资讯请参阅:尖沙咀区甲级写字楼出售

新创建13.7亿购母企长沙湾甲厦

新创建 (00659) 公布,以13.67亿元向母公司新世界发展 (00017)购入长沙湾甲级写字楼楼花荔枝角道888号18楼至21楼共4层,总楼面面积96744方呎,呎价约14130元。每层物业的买方,可以每个停车位不高于150万元的价格购买最多9个停车位的优先认购权,以及享有卖方提供的租务优惠。当中,新创建间接全资附属公司富通保险佔19楼及20楼两层,涉资6.79亿元,总楼面面积47712方呎。

(信报)

更多荔枝角道888号写字楼出售楼盘资讯请参阅:荔枝角道888号写字楼出售

更多长沙湾区甲级写字楼出售楼盘资讯请参阅:长沙湾区甲级写字楼出售

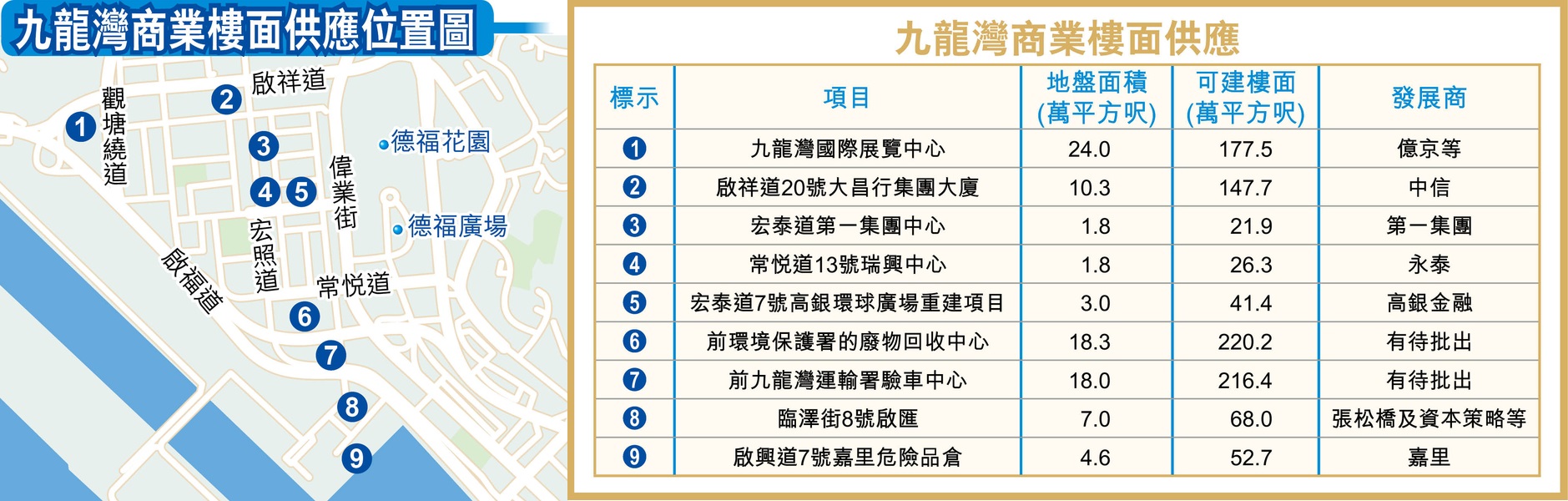

西九商业楼面供应足 达515万呎

西九龙一带将会有不少商业楼面供应,当中新地 (00016) 西九高铁站商业地早前获城规会批准涉及约316.5万平方呎,连同西九文化区的两幅商业及展览用地,将有逾515万平方呎楼面推出。

位于港铁九龙站的西九一带现时以豪宅区为主,比较大规模的商业项目,属于九龙站上盖的环球贸易广场 (ICC),总楼面达282.2万平方呎,不过随着西九高铁站上盖项目批出,连同旁边的西九文化区亦会有不少商业项目支援文化区的财政营运,区内商业气氛将会陆续成形。

高铁站上盖 增9成零售楼面

短中期内最快推出料为新地在2019年,以422亿元投得的西九站上盖商业地王,发展商去年便向城规会提交新构思的规划方案,要求放宽高度限制,以兴建两幢较高的大型商厦。按照规划方案,项目写字楼楼面减少1成至256.2万平方呎,并将商场零售楼面增加9成至约60万平方呎外,还申请放宽高度限制3至4成,以兴建两幢19层至30层高「钻石型」商厦,取代原本3幢商厦。

如果以建筑高度 (主水平基準以上) 计算,由原本114米至159米,修订为101米至148米高,其中在较近擎天半岛的1A座高度由原本159米降低至118米,减少26%,而近漾日居的2B座则由114米减少至101米,减少11%。

新地在2019年11月投得高铁站上盖用地后,同年12月引入大股东郭氏家族,再于去年4月把部分股权售予平保旗下平安人寿,新地将持有该用地写字楼部分50%业权、平安人寿持30%、郭氏家族佔20%,商场部分则由新地全资拥有。

西隧口ACE项目 建展览中心

另外,西九文化区管理局亦陆续推出区内的商业用地,其中位于西隧出口上方的ACE项目,原本在去年已经展开招标,但因为疫情下经济环境转差,故此煞停招标。

项目总楼面约145万平方呎,计划在故宫博物馆的北面兴建一个50万平方呎的展览中心,以及在西隧上方兴建一个U形的酒店及办公室,涉及87.3万平方呎楼面,及7.4万平方呎的零售及餐饮楼面。

同时,西九文化区第31及34号用地,亦在今年6月获屋宇署批出建筑图则,将会建2幢18层高商厦,作为写字楼及零售等用途,涉及楼面约53.43万平方呎,当中最高3层将会相连。

(经济日报)

更多环球贸易广场写字楼出租楼盘资讯请参阅:环球贸易广场写字楼出租

更多尖沙咀区甲级写字楼出租楼盘资讯请参阅:尖沙咀区甲级写字楼出租

强拍申请较去年同期跌六成 首八个月仅九宗 叫价强硬减慢收购

整体楼市气氛急剧升温,楼价出现反弹迹象,连带发展商旧楼併购活动亦大受影响。今年迄今土地审裁处仅接获9宗强拍申请个案,对比去年同期的22宗,大减13宗或59%,更创18年后按年同期新低。有业内人士指出,在楼价稳步上扬的情况下,部分旧楼业主叫价企硬,故影响财团的併购进度。

近期楼市回升,不少业主不愿平价卖楼,更影响发展商收购旧楼进度;据本报统计今年迄今土地审裁处仅接获9宗强拍申请个案,对比去年同期的22宗,按年同期大幅减少13宗,跌幅高达约59%,而今年首8个月强拍申请数字更创2018年同期接获19宗强拍申请后的近4年新低纪录。

事实上,今年迄今9宗强拍申请当中有4宗申请于第1季度录得,其后2季分别各有两宗申请,而今季则暂录1宗申请;若以区域划分,有5宗分别来自九龙区,包括何文田、九龙城、太子、深水埗及佐敦。

另外两宗均来自西营盘,以单一地区计佔最多,餘下来自北角及铜锣湾各有1宗申请。

创18年后同期新低

上述9宗申请强拍的项目规模及估值相对较细,据申请文件显示,市场估值介乎约7885.3万至逾7亿;其中估值金额最低为今年3月、裕泰兴罗氏家族成员罗守弘及相关人士,申请强拍的西营盘皇后大道西381及383号,当时估值约7885.33万。

至于估值金额最高为上月申请强拍的北角马宝道77至87号康乐大厦,当时估值约7.0399亿,申请人为卓越兆业有限公司 (Excellent Group Inc Limited),公司董事包括澳门商人罗盛宗等。

发展规模相对较细

值得留意的是,去年同期的22宗强拍申请,并不乏大型发展商踪影,如恒基、嘉里、新世界及相关人士等,惟今年迄今参与申请旧楼强拍大型发展商仅有恒基,其餘均为中小型财团为主。

有协助财团收购旧楼的人士透露,在本港经济渐復甦及失业率下跌情况下,带动楼价稳步上扬,旧楼业主亦不愿平价卖楼,影响财团的併购进度;加上在疫情影响下,小业主难以举行业主大会,耽误强拍进程,料今年全年仅有12至15宗强拍申请,对比去年全年的35宗、最多减少近66%。

料今年仅12至15宗申请

有测量师认为,併购旧楼面对的较大阻力,往往因楼价回升,不少旧楼业主售意欲较低,部分业主更反价,令财团难以集齐八成或以上业权,以符合达强拍门槛。再者在楼市回升情况下,法庭批出的旧楼强制售卖令底价亦会过高,不排除有财团因而放慢併购步伐,以静待后市发展。

另一测量师指出,近年政府土地供应短缺,吸引不少发展商加入併购旧楼行列,而且市区优质地段的旧楼群,在楼价大升的情况之下,部分业主面对财团收购时往往亦会提高叫价,并不会低价卖楼,拖慢财团收购进度,故影响申请强拍数字。

(星岛日报)

Checks flood in as Henley sales start set

Henderson Land Development (0012) announced the first round of sales of The Henley III in Kai Tak will offer 100 units ahead of the launch of its third price list.

The sale will be on Saturday and will provide 38 studio, 50 one-bedroom, eight two-bedroom and four three-room flats, with sellable areas ranging from 238 sq ft to 778 sq ft.

The discounted prices are between HK$6.25 million and HK$24.99 million.

The project has received 534 checks by 2pm yesterday, meaning a fourfold oversubscription, said Thomas Lam Tat-man, sales executive.

La Marina, on top of Wong Chuk Hang MTR station, will put 200 units on the market the same day. Besides the 188 units in the first two price lists, 12 four-bedroom units will be sold via tender.

Codeveloped by Kerry Properties (0683), Sino Land (0083) and MTR Corp (0066), it was oversubscribed 13 times, bringing in over 2,600 checks by yesterday.

That came as luxury rents rose 1.4 percent in the second quarter after a 16 percent decline from the third quarter of 2019 to the first quarter of 2021, property agent said.

Mid-Levels saw the highest rental growth, 2 percent, among major sub-markets, largely on the back of limited availability. Tenants took advantage of lower rents to upgrade, agent said.

Meanwhile, NWS (0659) will spend HK$1.3 billion buying four properties from parent New World Development (0017). They are office units inside NWD's 888 Lai Chi Kok Road project.

Sino Land (0083) and Tsim Sha Tsui Properties (0247) said their joint venture won the tender for a commercial and residential site in Singapore with a bid price of S$1.028 billion (HK$5.95 billion). The site covers an area of 32,185 square meters, which offers a total gross floor area of 96,555 square meters.

(The Standard)

For more information of Office for Sale at 888 Lai Chi Kok Road please visit: Office for Sale at 888 Lai Chi Kok Road

For more information of Grade A Office for Sale in Cheung Sha Wan please visit: Grade A Office for Sale in Cheung Sha Wan

Security tokens will boost multibillion dollar Asia-Pacific investment property sector, market players say

Property agent expect that the use of security tokens to rise rapidly and boost liquidity

Initial adoption will be from income generating properties and development projects: digital asset exchange HKbitEX

The multibillion dollar Asia-Pacific investment property market could be boosted by the use of security tokens, which could allow individual professional investors to take part in large-scale projects with entry tickets prices possibly as low as HK$1,000 (US$128.41).

These tokens – typically asset-backed digital representations of ownership or other economic rights in an underlying asset – will allow individual professional investors to take part in large-scale projects. They will also let developers and asset owners raise funds without fully disposing of their projects, according to market players.

“While we expect investment property transaction volumes across Asia-Pacific should rebound strongly in 2021, we expect the use of security tokens to rise rapidly and boost liquidity,” property agent said. The volume of such transactions amounted to US$184 billion last year, according to analyst.

Security tokens are tokenised digital securities created through security token offerings (STOs) and are traded using the blockchain distributed ledger technology. For issuers, STOs provide an alternative fundraising channel that offers greater efficiency, lower costs and a broader base of potential investors, according to the first edition of a real estate STO white paper series jointly published by accounting firm Deloitte, digital asset exchange HKbitEX, property agency and law firm Sidley Austin.

For investors, STOs offer access to a new world of previously inaccessible investment opportunities by offering fractionalised interest, secondary market liquidity and information transparency.

Currently, less than 1 per cent of transactions in Asia are leveraging STOs, according to HKbitEX. There have been no use cases in Hong Kong yet.

“We anticipate accelerated growth in STO transactions over the next three years, with real estate financing participants being among the first to embrace [these offerings],” said Gao Han, the founder and CEO of HKbitEX.

AspenCoin, for example, raised US$18 million through an STO in the United States in 2018. These security tokens represented the fractional equity ownership of The St. Regis Aspen Resort, a 179-room luxury hotel in Colorado. The price per token was US$1 with a minimum investment hurdle of US$10,000. The total offering represented an 18.9 per cent non-voting equity stake in the property.

“Initial adoption will be from income generating properties and development projects, as these are straightforward and the values are easy to understand from an investors’ perspective,” said Ken Lo, co-founder and chief strategy officer at HKbitEX.

Investors will be able to exit through a secondary market, as the tokens can be traded easily and efficiently over the counter or on an exchange, according to the white paper series. The general minimum entry ticket could range from HK$1,000 to HK$10,000, said Lo. The exchange is working on getting a license from the Securities and Futures Commission (SFC) for such tokens, which it hopes to acquire over the next two years, he added.

According to the SFC, these security tokens are complex financial products offered to professional investors with a portfolio, including money and securities, of at least HK$8 million or its equivalent in any foreign currency.

STOs will help ease “shortcomings and restraints” in the real estate industry, said Raymond Wong, senior general manager of sales at Henderson Land Development. These shortcomings and restraints include high development costs, high construction costs, high price of investment in properties or homes, and lengthy and complicated procedures, he added.

(South China Morning Post)

DJI’s Causeway Bay store likely to be split into smaller units as landlord may struggle to find tenants for massive space

Phoenix Property has a better chance of finding tenants by splitting the space occupied by DJI across three levels at Tower 535 into multiple units, market observers say

Billionaire Francis Choi Chee Ming’s Early Light Group has still not found tenants for nearly 20,000 sq ft of space in Plaza 2000 vacated by Prada in June 2020

The landlord of a massive space vacated by DJI in Hong Kong’s popular shopping district of Causeway Bay is unlikely to find a single tenant amid the shift in the city’s retail landscape, but dividing it into smaller units can improve its chances several fold, said market observers.

DJI, the world’s largest maker of recreational drones, occupied some 10,318 sq ft spread over three levels at Tower 535 on Jaffe Road, owned by private equity real estate investment group Phoenix Property Investors. Together with two other vacant shops on the ground and first floors, some 18,784 sq ft of space is available for lease.

The first floor has an asking price of HK$150 per square foot (US$19) and HK$50 per square foot for the second floor space, they said.

Some other landlords with similar floor plates in the area once occupied by sole tenants have struggled to find takers despite agreeing to bring down rents sharply and split them into small units to accommodate the needs of different retailers.

“From the latest market sentiment, [the space] will probably take three to four months [to lease] with a reasonable market rental level and flexible layout,” property agent said. The agent added that a smaller floor plate, especially a single-floor format, that can accommodate the different requirements of tenants would make it easier to lease the space.

Phoenix did not reply to an email requesting comment on the plans for the vacant space.

DJI closed its two-storey flagship store on August 16, citing the need to reflect on “the company’s and market’s evolving needs”. It marked one of the more recent withdrawals of retailers in Causeway Bay, which was once the world’s most expensive shopping district with the top average rent, as retail sales in Hong Kong took a beating following the street protests of 2019 and the coronavirus pandemic lockdowns that followed last year. Affordable fashion retailer Forever 21 and lingerie giant

Victoria’s Secret were among the brands that initially abandoned their Causeway Bay locations and then eventually exited the city altogether.

While details of DJI’s lease are not available, spaces on Jaffe Road were leased for HK$212 to HK$422 per sq ft in 2016, the same year the company opened its store, according to information posted on a property agency’s website.

“The Hong Kong retail landscape has changed over the past few years, from retailers targeting prominent locations for big flagship stores to what is now regular sized boutiques,” property agent said.

Causeway Bay, in particular, has seen a shift in retail offerings. Supermarkets, fast fashion and restaurants are taking over spaces from traditional luxury brands in the trendy shopping district. Recently hamburger joint

Five Guys took up 6,700 sq ft on Russell Street that was formerly occupied by cosmetics retailer Sa Sa.

However, 20,000 sq ft at Plaza 2000 next door, formerly occupied by Italian fashion brand Prada, has found no takers despite the generous offer of landlord Early Light Group, owned by billionaire

Francis Choi Chee Ming, to cut rents steeply. The owner’s move to subdivide the space spread over four levels into multiple units has still not borne fruit.

The landlord was willing to lease 5,042 sq ft on the second floor for about HK$61 per sq ft in March, the Post reported.

“Since the border is closed due to Covid-19, both landlords and retailers have realised the importance of maintaining a good balance of local and tourist consumption in their portfolio,” agent said. “Local consumption is the foundation for stable sales, while tourist consumption is the icing on top, especially during economic growth.”

Most market observers expect F&B operators to lease the Tower 535 space as they are driving deals in Causeway, but they are not ruling out other categories such as supermarket operators.

In Causeway Bay, “the F&B sector is still and will be the major leasing momentum,” agent said.

(South China Morning Post)

For more information of Office for Lease at Tower 535 please visit: Office for Lease at Tower 535

For more information of Office for Lease at Plaza 2000 please visit: Office for Lease at Plaza 2000

For more information of Grade A Office for Lease in Causeway Bay please visit: Grade A Office for Lease in Causeway Bay

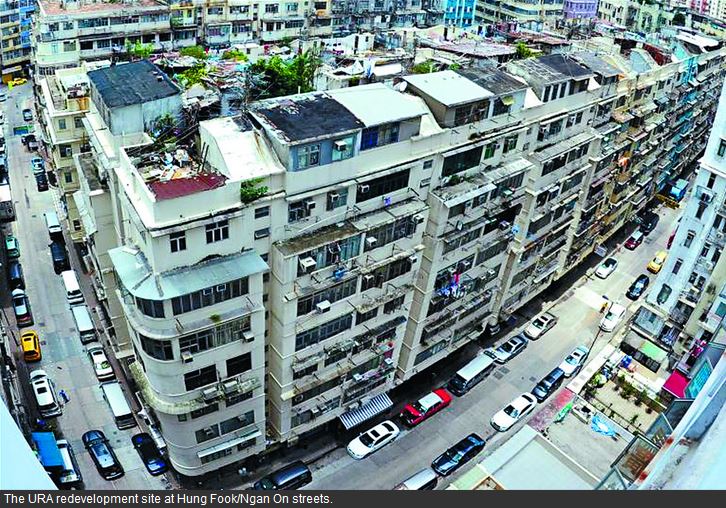

万科申请强拍牛头角旧楼 已收集逾91%业权 市场估值逾3.5亿

近年本港土地供应短缺,不少财团透过併购旧楼增加土储,其中,由万科香港併购的牛头角定富街3幢旧楼,目前向土地审裁处申请强拍,目前已收集逾91%业权,市场对整个项目估值逾3.59亿,料日后重建成商住项目,为今年迄今第10个申请强拍的项目。

政府大力发展东九龙,近年吸引各路发展商于区内旧楼「插旗」,万科香港亦积极拓展东九龙一带版图,该公司併购多年的定富街3幢旧楼,新近向土地审裁处申请强拍,统一业权发展;据土地审裁处文件显示,目前该财团已集齐约91.67%至93.75%业权,目前餘下5个单位并未成功收购,市场对整个项目估值约3.59229251亿。

万科香港回覆本报查询时指出,该公司将扎根本地作长远发展,持续从多渠道增加土地储备,只要通过集团风险审查的项目,除竞投政府地皮外,二手市场地皮和市建局的项目皆都会考虑。

万科︰透过多种渠道增土储

上述旧楼位于定富街45至63号 (单号),现址为3幢楼高6层的商住旧楼,分别为45至47号华发楼、49至51号安贤楼、53至63号定胜楼,地下约有10个商铺,楼上则为住宅楼层,共提供50个住宅单位;上述旧楼早于1971年至1972年之间落成,至今楼龄约50年。

可建楼面6.83万呎

该3幢旧楼群毗邻观塘道休憩处,邻近港铁牛头角站,步行前往约5分鐘,极具重建价值。整个项目地盘面积约7595方呎,若以重建地积比9倍重建发展,可建总楼面约68355方呎。

近年万科香港密密併购旧楼,以增加土地储备,近2年透过强拍途径于深水埗连购2个项目,涉资资超过8.5亿。包括去年底以5.76253亿成功统一海坛街244至256号旧楼业权,该地盘面积约7495方呎,现规划为「住宅 (甲类) 6」地带,可建总楼面约5.7万方呎。

项目楼龄约50年

今年4月更以2.76亿投得医局街227至233号旧楼业权;项目地盘面积约4200方呎,现规划为「住宅 (甲类) 6」地带,若以地积比9倍作重建发展,可建总楼面约3.78万方呎。据了解,上述海坛街及医局街的两个旧楼项目,料提供逾500伙住宅单位,最快明年底分阶段推出市场。

有业内人士指出,近年本港土地供应短缺,不少发展商面对夺地难问题,故吸引财团加入併购旧楼行列,惟经济逐步復甦,加上楼价持续回升,有不少业主不愿平价卖楼,故拖慢发展商的併购进度。

(星岛日报)

北角电气道铺逾1.26亿易手 投资者李耀华今年暂沽两物业

疫情持续转好,带动铺位交投转活,资深投资者率先沽货,由李耀华持有的北角电气道相连铺位以1.268亿成交,持货4年帐面获利4400万;李耀华于今年暂沽两项铺位物业,合共套现逾1.46亿。

市场消息透露,北角电气道254至280号地下C及D铺,合共面积2400方呎,以1.268亿成交,呎价约52908元,该铺现由食肆以28万租用,买家料可享回报约2.6厘。李耀华昨日回应本报,证实沽售该单位,表示对成交价感到满意。

土地註册处资料显示,原业主于2017年分别以4140万购入上述两铺位,合共涉资约8280万,以公司名义吉之岛物业有限公司持有,註册董事包括李耀华等人,持货4年帐面获利4400万,物业期间升值约53%。

每呎价5.29万连约沽

事实上,李耀华近期频频沽货,资料显示,他于今年4月以1980万售出荃湾海坝街卓明大厦地铺,面积429方呎,呎价约4.6万;另外,尖沙嘴栢丽大道D段地下G29号及G30号地铺及1楼15号铺,于去年10月获投资者林子峰以约2.1亿承接,呎价约60519元,持货8年帐面劲蚀2.3亿,故李耀华沽出三个铺位物业,合共套现逾3.56亿。

渣打4680万沽上水新丰路铺

近期,大型银行亦加入沽铺行列,市场消息指出,由渣打银行持有的上水新丰路55至57号绍计楼地下A号铺及入则阁,面积约1964方呎,另设入则阁1736方呎,合共面积约3700方呎,以交吉形式4680万售出,平均呎价约12649元,市传买家为投资者李达成。

据土地註册处资料显示,上述铺位原业主渣打银行 (香港) 有限公司于2005年以1480万购入,持货16年帐面获利3200万,物业期间升值约2.16倍。

此外,市场消息指出,黄大仙环凤街40至44号海鸿大厦地铺,面积950方呎,以约3300万成交,呎价约34736元,该铺由食肆以7.8万承租,料买家享租金回报约2.8厘。

黄大仙连约铺3300万售

据土地註册处资料显示,上址原业主于1990年6月以260.4万购入,持货31年帐面获利3039.6万,物业期间约11.7倍。

(星岛日报)

兴胜创建沽观塘工业中心一篮子单位造价1.29亿

工厦物业有价有市,再录大手成交。

由兴胜创建持有的观塘工业中心一篮子物业,总楼面逾2.1万方呎,作价约1.29亿易手。

涉逾2.1万方呎楼面

据兴胜创建昨日公布指出,以1.29亿售出观塘工业中心一篮子物业,包括该项目3座1楼N-3单位及地下R4、R5及R6号楼梯,4座1楼Q-4单位 (包括其附属天台) 及项目地下55号及56号车位,涉及楼面约21146方呎。

是次买卖支付条款为首笔按金646万,于签署买卖协议时支付,另一笔按金646万需于今年9月27日前支付,餘额约1.16亿于今年11月30日前支付。

该集团通告指,集团对旗下资产进行策略性检讨,以尽量提高股东回报,并指目前市场为释放物业价值良好机会,故沽出物业可令公司重新分配资金至有利日后部署投资机会。

套现部署日后投资

据代理行资料显示,该工厦近期频录成交,其中,1座低层P室,面积1465方呎,上月以740万售出,呎价约5051元;另一成交为一座低层A室,面积2058方呎,亦于上月以864万售出,呎价约4200元。

至于租赁方面,该工厦近期承租个案为3座高层K室,面积2954方呎,于上月以5万租出,呎租约17元。

(星岛日报)

陈俊巖家族1.15亿购中环铺

疫情逐步放缓,带动核心区铺位交投回暖,城中名人亦率先入市。中环德辅道中远东发展大厦地铺早前以1.15亿成交,买家身分终曝光,为「戏院大王」陈俊巖家族成员。

据土地註册处资料显示,中环德辅道中113号远东发展大厦地铺,于上月以1.15亿易手,买家以公司名义CINEMA DEVELOPMENT COMPANY LIMITED登记,註册董事分别为陈荣裕、陈荣美及陈荣民,为「戏院大王」陈俊巖家族成员。原业主于2003年6月以1700万买入,持货18年帐面获利9800万,物业升值逾5.7倍。

据业内人士指出,上述铺位面积约1161方呎,以易手价计算,平均呎价9.9万,物业阔14呎,深约80呎,租客为中国联通,月租22万,料买家享2.3厘回报。

回报率2.3厘

地产界人士表示,该厦楼龄44年,虽然陈旧,但对铺位并没有影响,该铺位对正德辅道中,接近租庇利街,极为罕有,虽然疫市持续多时,不过,中环仍然没有放盘,该铺位目前租金偏低,相信提升至30万,并没有问题。事实上,该铺位于2013年至2017年之间,曾由Bose音响承租,月租高达33万。

(星岛日报)

更多远东发展大厦写字楼出售楼盘资讯请参阅:远东发展大厦写字楼出售

更多中环区甲级写字楼出售楼盘资讯请参阅:中环区甲级写字楼出售

Ex-Swire boss in luxury foray

Keith Kerr, the former chairman of Swire Properties (1972), has gained permission to redevelop a site in Repulse Bay into a super-luxury project.

The 12-story property at 125 Repulse Bay Road, with a gross floor area of 30,894 square feet, was bought by Kerr in December for HK$1.012 billion.

He bought the site through a company named Joyful Colour and plans to turn the building into a super-luxury mansion, mainly composed of duplex units.

Meanwhile, there were a total of 41,208 licensed agents in Hong Kong on August 31, rising by 175 month on month to a record high, data from the Estate Agents Authority shows.

Of these, the number with a salesperson's license reached 22,704, an increase of 49.

Those with an individual estate agent's license, commonly known as "E-license," increased by 126 month on month to 18,504.

The number of agency branches increased by 29 to 7,130.

There has been an upward trend for three consecutive months, showing the active expansion of real estate agencies.

There were a total of 3,903 company licenses as of the end of last month, increasing by 12 compared with the month before.

Separately, the total number of registrations of properties last month, including first-hand private buildings, second-hand residential buildings, first-hand public housing, industrial and commercial stores, pure parking spaces, and others, fell by about 21 percent month on month to a half-year low of 7,862, partly because of the rising property prices, property agency said.

It is worth noting that although the overall registration volume in August hit a six-month low, the total number of registrations in the first eight months reached 68,155, which is about 49.1 percent higher than that of a year ago, and hit a nine-year high, the agency said.

(The Standard)

包浩斯1.26亿沽信和工中 採售后租回回报率近四厘

疫情重创零售市道,连锁时装品牌减磅沽货,包浩斯以售后租回形式,沽出九龙湾信和工商中心一篮子物业,作价1.26亿,买家享租金回报近4厘水平。

连锁时装品牌包浩斯公布,以1.26亿沽出九龙湾啟祥道9号信和工商中心5楼1至40号工场及9号储物室,以及地库P39号车位及L9号货车位,买家为嘉隆 (香港) 有限公司,据公司註册处资料显示,该公司註册董事为周姓人士,交易并以售后租回形式进行,为期3个月,并指该物业将继续用作集团办公室、仓库及停车场,以月租41.6万,料买家享租金回报约3.9厘。

平均呎价3973元

资料显示,包浩斯在2004年2月以1040万购入上述一篮子物业,持货逾17年,帐面获利1.156亿,期间升值逾11倍。据代理指出,上述物业涉及总楼面约31712方呎,以易手价计,呎价约3973元。

据代理资料显示,该厦近期频录成交,其中,该厦高层2室,面积759方呎,于上月以365万售,呎价约4809元。另一宗买卖为低层53室,面积581方呎,于今年7月以303万售出,呎价约5215元。

持货17年获利1.1亿

因疫情重创零售市道,该时装品牌早前亦以短租形式租用市区铺位。资料显示,包浩斯早前以20万短租西洋菜南街38至40号地铺连阁楼,面积各约2040方呎,合共4080方呎,呎租约98元 (不连阁楼),该巨铺旧租为莎莎,于2017年7月以100万进驻,及至今年2月迁出,铺位于丢空1个多月录短租,月租较长租租金减80%。

晶苑罗正达购观塘工厦

另一方面,据土地註册处资料显示,观塘振业工业大厦中层C室,于上月以2760万成交,买家以公司名义凯优有限公司 (BEST WINNER CORPORATION LIMITED) 登记,註册董事为罗正达 (LO, CHING TAT NICHOLE),为晶苑地产发展有限公司董事。

原业主于1987年以275万购入,持货34年升值2485万,物业期间升值约9倍。

(星岛日报)

南丰中心每呎11983元售

商厦市场交投不俗,市场频录承接,荃湾南丰中心低层单位以每方呎11983元售出,属市价水平。

据土地註册处资料显示,荃湾南丰中心低层03室于上月中以725万售出,买家以个人名义登记,为林姓人士,原业主于1994年以229万购入,持货27年帐面获利约496万,期间升值约2.16倍。

据从事商厦买卖的代理指出,上址面积605方呎,呎价约11983元,属市价水平。据代理资料显示,该厦近期频录买卖,其中该厦23楼单位,面积1037方呎,于上月以970万售出,呎价约9354元;该厦另一宗买卖为11楼30室,面积605方呎,于6月以660万售出,呎价约10909元。

半岛中心398万承接

另外,尖沙嘴区内商厦亦频录买卖,消息指,半岛中心低层17室,面积445方呎,以约398万售出,呎价约8944元;同区汉口中心低层24室,面积约1100方呎,以约900万易手,呎价约8182元。

同区商厦亦录租赁成交,市场消息指出,诚信大厦低层,面积约4300方呎,以每方呎约36元租出,月租约15.48万。

(星岛日报)

更多半岛中心写字楼出售楼盘资讯请参阅:半岛中心写字楼出售

更多汉口中心写字楼出售楼盘资讯请参阅:汉口中心写字楼出售

更多尖沙咀区甲级写字楼出售楼盘资讯请参阅:尖沙咀区甲级写字楼出售

佳明3.2亿 购土瓜湾炮仗街旧楼

看好屯马綫 拟建1幢住宅连商铺

受惠港铁屯马綫开通,土瓜湾旧楼更为吸引发展商注视,佳明集团 (01271) 最新收购土瓜湾炮仗街41、43及45号项目,涉资3.2亿元。

项目早于1955年落成,地盘面积3,532平方呎,可建楼面面积约31,330平方呎,以其可建楼面面积计算,每平方呎楼面地价约10,214元。

旧契项目 最快明年推售

佳明集团营业及市务总监顏景凤称,集团计划就项目兴建1幢低层设有商铺的住宅。而项目距离港铁土瓜湾站仅约3分鐘步程,加上区内有多个大型重建项目陆续推出招标,故看好该区潜力。又谓地皮属旧契项目,不受预售楼花同意书的规限,最快明年中推出市场。

曾志伟沽界限街铺 赚2780万

另一方面,恒和珠宝 (00513) 公布,斥资1.835亿元收购何文田界限街164号及164A号物业,其中一个铺位由知名艺人、现为无綫电视高层的曾志伟及其相关人士持有,是次收购带挈曾氏赚2,780万元。

根据文件,上述物业涉及何文田界限街164号地下、1楼、2楼和部分天台,及界限街164A号地下、1楼及2楼。其中,界限街164号地下,所涉的收购价为3,200万元,该单位原由金祐置业有限公司持有,公司董事包括曾宝仪等人,即电视广播有限公司 (00511) 副总经理 (综艺、音乐制作及节目) 曾志伟的女儿。文件亦指,该物业的最终实益拥有人为曾志伟。

翻查土地註册处资料,上述公司早于2002年以420万元买入界限街164号地下,意味目前沽出单位,曾志伟及其女儿等人帐面大赚2,780万元,物业19年间升值约6.6倍。

恒和集团又指,由于物业位于以周边名校闻名的低密度豪宅区,极具发展潜力,可重建为豪华住宅项目,而收购事项符合集团的整体发展策略。

(经济日报)

长沙湾工商新项目多 前景理想

长沙湾近年渐多商业项目落成,渐由传统工业区,转型为工商业混合地段,新式项目增加,地段前景不错。

近年不少财团积极发展长沙湾区,购入工厦发展成商厦,或新式工厦,如本年初长沙湾青山道550至556号恆发工业大厦全幢,以9.65亿元成交,买家为外资基金凯龙瑞。物业楼高12层,地盘面积约15,837平方呎,最多可重建约190,044平方呎楼面,以9.65亿元成交价计,每平方呎楼面地价料约5,078元。买家早前已申请放宽地积比率至14.4倍,并计划兴建1幢27层高的新式工厦,涉及总楼面约22.8万平方呎。

另外,第一集团于区内连环推出工厦项目,该集团近2年连扫区内3幢工厦作重建,分别位于大南西街及长沙湾道,均向城规会申请放宽地积比率,将建新式工厦,涉及逾51万平方呎楼面。其中长沙湾道916至922号工厦,佔地约9,600平方呎,将重建1幢27层高全新工厦,总楼面约12.92万平方呎。另同区长沙湾道924至926号工厦,将重建为27层高工厦,总楼面约17.2万平方呎。

新创建13.67亿购新甲厦多层

至于甲厦方面,近年最积极定为新世界 (00017),先后投得3项商业项目,其中位于荔枝角道888号去年尾发售,至今反应不俗,近日市况转好,成交有所增加,包括日前录5宗散单位买卖,至于最大手为新创建 (00659) 旗下Modern Elite、富通及Tycoon Estate,以13.67亿元向母公司新世界,收购荔枝角道888号楼花商厦,总楼面面积96,744平方呎,呎价约1.41万元。据悉,是次收购的4层楼面中,富通保险佔两层,涉资6.79亿元。

传统甲厦方面,早前VTC职业训练局斥约1.175亿元购入长沙湾亿京广场二期多个单位,涉及楼面约8,164平方呎,平均呎价约14,392元。

西港都会中心 活化项目登场

传统工厦方面,个别业主把物业进行活化,如香港兴业 (00480) 把旗下永康街西港都会中心,由工厦活化成商厦,业主去年进行改装工程,近日完工。项目楼高24层,物业每层面积约5,887平方呎,而业主有见细单位抢手,故把个别楼层分间,单位由1,354至1,664平方呎起,意向呎租约24元。

分析指,由于长沙湾位处传统九龙市区,交通便利,而过往主要为工业项目,随着多路财团于该区发展,近年渐多重建项目,包括新式工厦,以及全新甲厦,令长沙湾区物业质素全面提升,前景不错。由于未来1至2年,仍有多个项目待售,相信区内整体工商物业成交增加。

(经济日报)

更多荔枝角道888号写字楼出售楼盘资讯请参阅:荔枝角道888号写字楼出售

更多亿京广场二期写字楼出售楼盘资讯请参阅:亿京广场二期写字楼出售

更多长沙湾区甲级写字楼出售楼盘资讯请参阅:长沙湾区甲级写字楼出售

Mad rush for flats at Henley III

The first batch of flats at The Henley III in Kai Tak was 7.5 times oversubscribed as of 3 pm yesterday with Henderson Land Development (0012) receiving 850 checks for the 100 units offered on Saturday.

Thomas Lam Tat-man, general manager of the sales department at Henderson Land, said is confident of receiving 1,000 checks before the deadline of 8 pm tonight because of the low price of this batch - there are 83 units with a discounted price of less than HK$10 million - and the developer may launch the second round of sales next week.

The Holborn in Quarry Bay, also developed by Henderson Land Development, uploaded its sales brochure yesterday and will release the price list next week at the earliest.

Located at 1 Shau Kei Wan Road, The Holborn will offer 420 units ranging from studios to three bedrooms, measuring from 200 square feet to 571 square feet, according to its sales brochure.

The first batch of 84 flats will mainly provide studio to one-bedroom units. It plans to open sales at the end of this month and will take reference from the prices of new properties in the same area of Hong Kong Island and projects along the Hong Kong Island railway.

It is expected to open three show flats next week, including a one-bedroom modified demonstration unit, a one-bedroom standard unit, and a two-bedroom standard unit.

Meanwhile, Sun Hung Kai Properties' (0016) Wetland Seasons Bay in Tin Shui Wai has received 5,000 checks for the 300 units offered on Saturday, or at 15.6 times of oversubscription.

Among the 300 units, 285 units will be sold in the form of price list which covers from studio to three-bedroom units with a price increase of 1 percent to 9 percent in some units, and the remaining 15 units through tendering.

Codeveloped by Kerry Properties (0683), Sino Land (0083), and MTR Corporation (0066), La Marina in Wong Chuk Hang was 19 times oversubscribed with 3,750 checks received for the 200 units offered also on Saturday.

(The Standard)

Fivelements to shut Times Square spa amid quibbles over rent, as uncertainties of Hong Kong’s recovery stymies businesses

Fivelements Habitat’s wellness centre on level 13A of Times Square Tower One will cease operating at 6pm on September 30, according to a notice

The wellness centre, measuring 15,000 sq ft, is estimated to cost HK$975,000 in monthly rent

Fivelements Habitat, which provides yoga sessions, spa treatments and plant-based cuisine, is shutting its Times Square wellness centre in Causeway Bay after two years of operation, as it failed to reach an agreement with landlord Wharf Reic on the terms of its lease renewal.

The centre, located on level 13A of Times Square Tower One, will cease operating at 6pm on September 30, ahead of the expiry of its lease in December, according to a notice to customers.

“We were reaching an inflection point where we’re required to commit to a further lease term and we were not able to reach an economically viable agreement with the landlord,” said Jason Washbourne, managing director of Fivelements’ owner Evolution Wellness Hong Kong in an email interview with the South China Morning Post.

Fivelements, which opened in Times Square in July 2019, is the latest business to pull back in Hong Kong, after two years of economic havoc first wreaked by months of street protests, and then by lockdowns to contain the coronavirus outbreak. Now, as Hong Kong’s economy claws its way out of its worst recession on record, local businesses are grappling with how they should price commercial real estate while consumption is yet to fully recover amid tentative foot traffic.

Pedestrian traffic has visibly improved at many shopping centres in Hong Kong, including Wharf’s Times Square and Harbour City, as the first HK$2,000 instalment of the city’s consumption vouchers which took effect last month set off a spending spree at shops and restaurants.

The boom may be fleeting, as spending disappeared as soon as the first vouchers were used up, said the Hong Kong Retail Management Association, which represents more than 9,000 retail outlets that employ half of the city’s retail workforce. Sales in August were still 80 per cent lower than the peak in 2018, and consumption in September may decline further until the second instalment of vouchers is distributed, according to estimates by the guild.

That has translated into uncertainties about where retail rents are headed, as many commercial leases are still bound by contractual terms set at the depth of Hong Kong’s economic slump. Average rent across Hong Kong’s shopping centres fell 10.2 per cent in the second quarter from last year, down 45.2 per cent from the peak in 2018, according to data provided by property agency.

“While retailers have regained confidence, premises with corner and extensive shop frontage, high headroom or with provisions for operating restaurants will see a 5 to 10 per cent increase in rents compared to last year,” agent said.

Landlords and tenants had been caught in a stand-off since last year when the Covid-19 outbreak first reared its head. Nearly 50 brands staged an unprecedented strike in February 2020, closing nearly 200 shops in 14 shopping centres – including Times Square – across Hong Kong to demand rent reductions. Most landlords held out, opting to settle with their tenants on individual cases instead of acceding to across-the-board cuts.

Amid the stand-off, the luxury brand Prada closed its three-storey Russell Street flagship store at Times Square’s doorstep, for which it was paying HK$9 million in monthly rent. As soon as the Milano atelier announced its closure, the landlord offered to slash its rent by 44 per cent, putting a dent into Russell Street’s claim as the world’s most expensive shopping strip.

As the Covid-19 lockdowns wore on and tourists stayed home, luxury retailers exited Causeway Bay in droves. Rolex, Omega and skincare brand Kiehl’s all shut their outlets. The Italian lingerie label La Perla shut its four-floor store, which it rented for HK$7 million a month.

Covid-19 had been particularly challenging for Hong Kong’s beauty and wellness industry, as social distancing measures and lockdowns forced spas, gyms, yoga schools, dance classes and massage centres to shut. Salons and beauty parlours were allowed to reopen in February after shutting for more than 100 days in 2020, leaving the industry out of pocket by an estimated HK$2 billion (US$258 million).

While some businesses have bounced back, others are still struggling to recover their lost revenue as many customers continue to stay home.

“We are saddened that after two years of business disruptions, we have not been able to reach a workable agreement with the landlord,” said Washbourne. “It’s both sad and perhaps ironic that we face these challenges in a city that has been through so much, and where there is so much to be gained at the community level with a brand like Fivelements.”

Wharf Real Estate Investment Company (Wharf Reic), the manager of Times Square, did not respond to requests for comment. Still, Wharf Reic’s chairman and managing director Stephen Ng did note during the company’s interim results briefing last month that rents had faced “downward pressure,” culminating in lower charges on new leases as the lagging effect of the economic slump makes its way to property landlords.

Fivelements operates a retreat in Bali, and a wellness centre in Hong Kong measuring 15,000 sq ft (1,393 square metres). The monthly rent for Times Square’s Tower One ranges from HK$53 to HK$58 per square foot, according to another property agent. The rate was even higher two years ago at HK$60 to HK$65, which would translate to HK$975,000 per month for a business of Fivelements’ size. Washbourne declined to divulge the centre’s rent or say how many customers it has.

Fivelements is “currently seeking alternative space” to continue its business of providing yoga, soundscape and tea meditation in Hong Kong, he said.

“The team is actively pursuing options and we are hopeful that we will find a way to maintain this great community,” Washbourne said.

Some customers are already lamenting the imminent closure.

“It is very unfortunate that the two parties cannot come to an agreement,” said Jocelyn Tam, who practises yoga at Fivelements, adding that the facility was a “calm oasis amid the hustle and hysteria” of Hong Kong.

The company “invested a lot of money decorating and setting up this sanctuary,” she noted, but the government’s restrictions to prevent the spread of Covid-19 have “taken a toll on the membership.”

“It is difficult to maintain or develop good physical and mental habits if there are intermittent interruptions caused by the closure of the premises,” she said.

(South China Morning Post)

For more information of Office for Lease at Time Square please visit: Office for Lease at Time Square

For more information of Grade A Office for Lease in Causeway Bay please visit: Grade A Office for Lease in Causeway Bay

甲厦空置率高 租金有压力

环球疫情令商务活动放缓,写字楼需求减少,本港甲厦空置率创多年新高。

有代理指,近期有个别机构趁租金下跌而落实租务,气氛少许改善,惟该代理认为本港与其他地方尚未通关,需求始终有限,加上空置率偏高,甲厦租金仍有压力。

去年初至今,新冠肺炎困扰全球,而写字楼市场,向来倚靠跨国企业扩充,在封关情况下,环球商业活动叫停,租务大减,而本港写字楼租金亦下跌。

中环呎租跌至100 较高峰减3成

据代理行资料显示,甲厦租务高峰期为2018年,当时商业气氛旺盛,中环甲厦空置率曾低见约1%,而现最新空置率升至6.9%,同时新需求下降,租金亦由高峰期每呎约140元,跌至约100餘元,幅度接近3成。

经过一年多淡静后,近两个月中区租务略有改善,6月份市场录得美资基金公司租用国际金融中心二期作扩充,而近日市场更录得大手租务,涉及国际金融中心一期两全层,连同部分单位,合共约5.3万平方呎租出,成为今年中环超甲厦最大宗租务。据了解,新租客为中资金融机构中金公司,连同集团原租用的7万平方呎续租,合共涉及约12万平方呎,成为该厦最大租户。此外,一家商务中心亦租用中环超甲厦。

通关之后 租金才明显好转

租务活动有改善,该代理分析,主因疫情缓和及租金调整,「很多机构一直有意扩充,只是疫情下,所有部署暂缓,如今香港疫情缓和,机构重啟扩充。与此同时,整体空置楼面增加,因之前有租客迁出中环,腾出楼面,租金由高峰期有跌幅,公司负担能力提高,给予机会一定要在中环扩充,或等机会重返中环的公司。」

该代理指,近月租务成交,主要来自机构搬迁,新需求偏低,并指中资是较活跃及有意扩充,「始终因中美关係紧张,很多内企IPO来港上市,带旺整体租务市场。外资方面,扩充多属基金,传统金融机构,反而略为收缩。」

目前中环空置率,较整体约10%为低,但同属近年新高。后市上,该代理认为未来两年为商厦供应高峰,而中环偏少,对租金冲击相对较低。不过,该代理指要通关,租金才有明显好转机会,估计通关之后,市况会转好,很多机构正等待通关,外地或内地企业来港租写字楼,相信届时需求好转。」租金上,该代理认为空置率偏高,暂时需求不强,租金仍下行,「空置率少许改善,惟租金未必有力上升,目前仅个别大厦,因空置降低,业主有条件企硬不减租,但整体上空置率偏高,估计大部分商厦租金仍有压力。」

(经济日报)

更多国际金融中心写字楼出租楼盘资讯请参阅:国际金融中心写字楼出租

更多中环区甲级写字楼出租楼盘资讯请参阅:中环区甲级写字楼出租

港居住环境空间不足 难效外国在家工作

疫情下衍生在家工作,对传统办公室概念造成冲击。有代理认为,本港居住环境空间不足,难以效法外国般在家工作,能否成新趋势仍有待观察。

租务市场略有改善,其中中资机构租国际金融中心一期楼面,另外国际商务中心品牌TEC,租用中环友邦金融中心全层,并将于11月开幕。

TEC在香港拥有11个办公空间,总面积超过232,000平方呎,其中7个地点设于中环,包括国际金融中心一期以及香港会所大厦分行。

近年流行灵活办公室

今次疫情期间,很多机构因安全理由,推出在家工作,避免增加员工感染病毒机会。推行一段日子后,个别机构更加在家工作列入长期运作模式,直接冲击甲厦需求。该代理则相信,本港与外国情况不同,「外国居住环境阔落一点,在家工作仍很舒适,香港居住环境较狭窄,并非所有家庭可以支持做到在家工作,香港是否可以容易地像外国,公司完全或部分在家工作,仍需时观察,只是因疫情关係暂进行,会否成趋势以后继续仍要观察。」

该代理指,近期反而不少公司减楼面,并非因在家工作,「近年流行灵活办公室,所需的楼面略为减少。事实上,现时一些租客和业主,在商讨续租时,会较弹性处理,让客人或可选择略为减少楼面。」

(经济日报)

更多国际金融中心写字楼出租楼盘资讯请参阅:国际金融中心写字楼出租

更多友邦金融中心写字楼出租楼盘资讯请参阅:友邦金融中心写字楼出租

更多香港会所大厦写字楼出租楼盘资讯请参阅:香港会所大厦写字楼出租

更多中环区甲级写字楼出租楼盘资讯请参阅:中环区甲级写字楼出租

上月录549宗工商铺买卖

今年气氛比去年显著回升,投资者趁势沽货。有代理行资料显示,8月份录约549宗工商铺买卖,涉及总金额约94.48亿,对比7月份分别减少约12%及35%,不过较2020年8月数字明显改善,分别增约60%及36%。

代理:较七月份减少12%

该行代理表示,8月份市场共录得约549宗工商铺买卖成交,对比7月轻微减少约12%,惟较去年同期见明显改善,按年多出约60%。总金额录约94.48亿,按月下跌约35%,对比去年同期见升幅,递增约36%;商铺表现最为平稳,宗数录得154宗,与上月相若。

该代理指出,8月份工商铺成交宗数及金额对比7月份均下跌,主因7月份录多宗大额成交,例如葵涌中央工业大厦全幢、葵涌瑞康工业大厦全幢、粉岭叶氏化工大厦全幢等;商厦就有多个核心区指标商厦全层楼面成交,例如中环中心及统一中心;铺位有油麻地窝打老道40号地下连1楼及2楼成交,反观8月份,逾亿元交易相对减少,因而令按月表现有所回落。

代理认为,工商铺市场已踏入復甦阶段,的确令不少业主,包括资深投资者、发展商、大型集团及老字号店趁势沽货,市场上优质盘源增加。

由于市况转强,不少业主心态亦呈强,在议价空间上已较前收窄,因而加长洽谈买卖过程。

(星岛日报)

更多中环中心写字楼出售楼盘资讯请参阅:中环中心写字楼出售

更多中环区甲级写字楼出售楼盘资讯请参阅:中环区甲级写字楼出售

更多统一中心写字楼出售楼盘资讯请参阅:统一中心写字楼出售

更多金鐘区甲级写字楼出售楼盘资讯请参阅:金鐘区甲级写字楼出售

长沙湾联兴工厦估值6.6亿

市区工厦有价有市,部分业主趁势放售。据代理指出,长沙湾联兴工厂大厦约85%业权放售,市场估值约6.6亿。

据代理指出,该行获业主委託出售长沙湾琼林街109号联兴工厂大厦约85%业权,连同潜在可供出售业权计算可增至约99%,截标日期为今年10月12日中午12时。市场消息指出,该项目放售的85%业权,合共涉逾40名业主。

85%业权放售

代理指出,联兴工厂大厦现为一幢10层高的工业大厦,地盘面积约8800方呎,以地积比率约7.8倍计,可建楼面68676方呎,惟项目正向城规会申请以地积比率14.4倍发展,若申请获批,届时可建楼面达126720方呎,项目市场估值约6.6亿,每呎楼面地价约5200元。

代理表示,政府去年就非住宅物业「撤辣」,加上政府推出以标準金额补地价及活化政策申请增加20%地积比率即将到期,以上种种因素均带动近期工业市场成交炽热。

事实上,该厦近期频录大手买卖,而同区青山道恆发工业大厦早前亦以约9.65亿成交,另同区利洋中心及百丽大厦于去年分别以约7.9亿及约6.4亿售出作重建用途。

(星岛日报)

观塘兆富工厦71%业权放售

自政府宣布起动九龙东后,观塘区内工厦重建活化活动渐趋活跃,观塘伟业街201号兆富工厂大厦地厂、3楼、4楼及5楼连天台放售,面积约3.6万方呎。

代理表示,上述单位佔全幢物业逾71%业权,单边开扬,极具重建价值,地盘面积约10075方呎,上述物业门面特阔,特高楼底,地厂楼底约达19.6米,其他楼层楼底约达10.6米,具空间感。

上述物业邻近新鸿基甲级写字楼 One Harbour Square 及 Two Harbour Square,位处观塘商贸区,邻近宏利金融中心及观塘海滨公园,步行至观塘码头仅约3分鐘,徒步往地标商场apm及港铁观塘站需时约8分鐘。

企业广场三期意向5738万

有代理行表示,九龙湾宏照道39号企业广场三期中高层7至8室,面积约4590方呎,业主意向售价约5738万,呎价约12500元,意向租金约91800元,呎租约20元。

据该代理行资料显示,该厦近期成交为3期25楼1至3号,及5号室,面积8970方呎,以9200万售出,呎价约10256元;至于租赁方面,该项目1期2座高层全层,面积14098方呎,于今年4月以281960元租出,平均呎租约20元。

(星岛日报)

更多企业广场三期写字楼出售楼盘资讯请参阅:企业广场三期写字楼出售

更多九龙湾区甲级写字楼出售楼盘资讯请参阅:九龙湾区甲级写字楼出售

更多One Harbour Square写字楼出租楼盘资讯请参阅:One Harbour Square 写字楼出租

更多Two Harbour Square写字楼出租楼盘资讯请参阅:Two Harbour Square 写字楼出租

更多宏利金融中心写字楼出租楼盘资讯请参阅:宏利金融中心写字楼出租

更多观塘区甲级写字楼出租楼盘资讯请参阅:观塘区甲级写字楼出租

西环华明中心每月400万租出疫市最大宗租赁中资客开设超市食肆

疫下消费气氛薄弱,却凸显民生区抗跌力强,西环华明中心商场连写字楼,由中资客承租,月租高达400万,将经营超市及食肆等基本民生行业,该宗更是疫市最大宗租赁,力压早前珠宝店进驻旺角核心区巨铺。

上址为皇后大道西421号华明中心基座,包括铺位及写字楼,合共约12万方呎,另地库58个车位,市场消息透露,刚获中资客以每月400万承租,平均呎租33元,新租客将大展拳脚,开设超市及食肆等生意。该宗是疫市最大宗租赁,力压早前迪生创建承租弥敦道及西洋菜南街巨铺,月租300万 (建筑面积1.2万方呎)。

租约长达八年

持有华明基座的科达地产主席汤君明,证实物业租出,并表示租期长达8年,包括梗约2年,生约各为3年。对于项目成为疫下大租赁,他笑言:「赛翁失马,焉知非福!」他指出,该项目丢空长达4年,2017年来,当承租上址的建筑师楼,超市及酒楼先后撤走,他不积极找租客,直至近年,当地库车场约满,他更索性将之收回,将整个基座统一放租,结果获中资租客垂青,新租客钟情面积巨大,可打造成为地标消费项目。

打造地标消费商场

他解释说,此期间丢空多时,损失租金收入,惟物业悉数交吉,刚好切合新租客的新用途!该项目于4年前,月收共240万,今番升幅66%;该物业楼龄高 (于1985年落成),不过,实用率亦高达85%,有别于一般新商场只有约60%。

早于2008年初,当西环未有港铁时,科达地产分两阶段购入上述物业,先后以2.1亿及1亿购入一篮子货,合共涉资逾3.1亿,当年该基座物业不起眼,购入价平均每呎不足3000元,现时回报可观。

近年西环发展迅速,港铁开通,区内新盘频落成,近年亦录瞩目商场买卖,恒基旗下西环翰林峰,2019年落成,项目商场部分楼面,先后获香港大学于2018年10月及2020年7月购入,自用作为教学研究用途,合共涉资9.634亿,建筑面积约4.05万方呎,平均呎价2.38万。

(星岛日报)

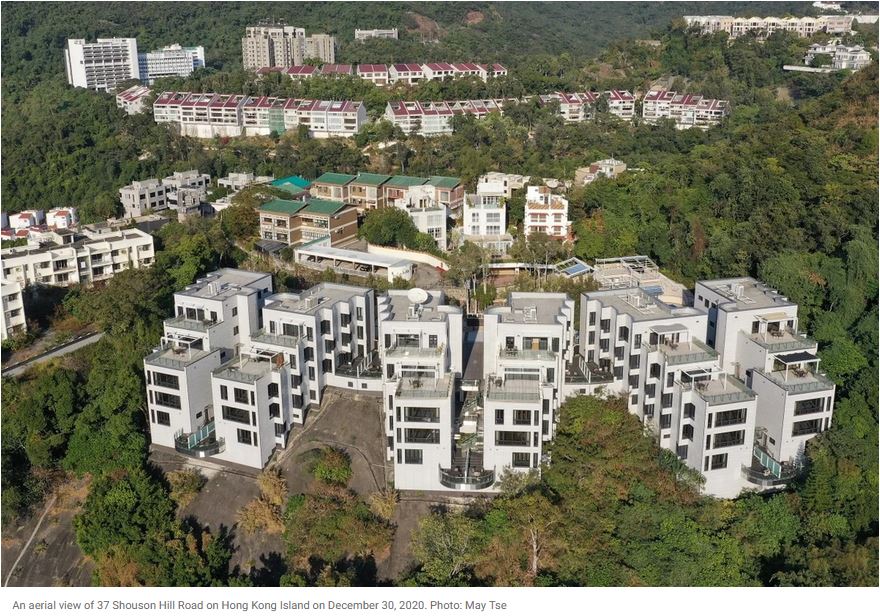

Hong Kong luxury real estate is getting more expensive – again – as residential sales rebound in The Peak and Southside, according to property agencies

Shouson Hill, Deep Water Bay, Repulse Bay, Tai Tam and Stanley are seeing strong demand for apartments with lots of space indoors and out – ideal for pandemic-era WFH

Southside is booming: development around Wong Chuk Hang MTR will produce 5,200 mid- to upper-end flats close to new A-grade commercial space and desirable international schools

Confidence is returning to Hong Kong’s luxury residential market, putting behind it a “considerable slump” that began in the second half of 2019.

New research from property agency shows that activity began to pick up during the second half of 2020, with 20 top-end sales in the prime (homes worth more than HK$100 million) sub-markets of The Peak and Southern district, up 54 per cent year-on-year. Data collected from EPRC shows the surge has carried forward into 2021 with 30 transactions to date, a 500 per cent rise. Over the 12 months from July 2020 to June 2021, these sales realised a total of HK$12.8 billion, more than twice that (115 per cent up) achieved in the year before.

Thirty of these transactions took place in Southern district – Shouson Hill, Deep Water Bay, Repulse Bay, Tai Tam and Stanley – with 20 on The Peak.

Property agent believes that softer pricing, along with the city’s economic recovery, are driving market confidence.

“The purchasing price for luxury residential property has become more attractive, now coming in at HK$80,000 to HK$100,000 per square foot, instead of HK$80,000 to HK$150,000 in 2018,” the agent said.

“Amid growing optimism of Hong Kong’s economic recovery and the pandemic being brought under control, demand will remain healthy. We forecast a gradual price growth of three per cent for the second half of 2021.”

Another property agent said that the market evidence suggests luxury flats have become a more attractive asset type compared to houses.

“Apartments offer more flexibility and require a lower lump sum consideration, comparatively offering more opportunities,” the agent explains. “Mount Nicholson is a prime example – the mixed product offering of both houses and apartments has seen the latter achieve higher unit rates and expedited take-up.”

As for who’s buying, the agency’s data shows that both mainland Chinese and wealthy locals are equally represented.

Another property agent confirms that we are seeing a market rebound led by the Southside.

“I haven’t seen this much confidence in the market in a long time, if ever,” the agent said. “On the rental side, there’s a lack of supply of anything ready to move into, so prices there are on the rise again. Properties that meet a new set of Covid-19 home lifestyle criteria and flats ready for immediate move-in have emerged as crucial features for both buyers and tenants, with no signs of stopping in 2022.”

Though the definition of luxury property was once based solely on price, the agent notes that a shift toward incorporating lifestyle factors, which began in the early 2000s, has been cemented since the pandemic. “Prospective buyers in the HK$100 million-plus market are now demanding more interior space, extra bedrooms and external living areas, all within close proximity to amenities,” the agent said.

Anything that ticks these boxes in the “new normal” is demanding a lot of attention, The agent continues. “Flats with four bedrooms, outdoor areas and enough space for a study, office and family room are first to draw interest. There’s quite a lot of opportunity in the secondary market at the moment, particularly in properties that have outside space for entertaining at home, with views and walking access to restaurants, beaches, hiking and everyday conveniences.”

In addition to Repulse Bay and Stanley, the agent said, previously undervalued Tai Tam, Pok Fu Lam and Red Hill are seeing values rise due to their ability to fulfil these new home lifestyle demands.

“The Southside of Hong Kong continues to appeal to prospective homeowners and investors, demonstrated by South Land’s recent launch in May when flats were snapped up by homebuyers,” the agent said.

“If we hone in on the luxury property market specifically, we’re seeing the same demand, if not higher. A recent example of a sought-after Southside property we brokered was Pine Lodge in Shouson Hill, which drew five bidders and sold within three weeks at 10 per cent above the asking price.”

As prospective buyers in the HK$100 million-plus market tend toward properties with more interior space and in close proximity to outdoor areas, the Southside, with its wide views and easy access to beaches, hiking trails and eateries, continues to appeal to prospective luxury homeowners and investors, the agent believes: “Boasting neighbourhoods like Deep Water Bay, which is renowned as the most affluent residential area in the world, and home to the city’s most exclusive private clubs, the Southside is on the rise, overtaking Central’s Mid-Levels in popularity.”

However, with upcoming projects around Wong Chuk Hang MTR set to deliver about 5,200 mid- to upper-end residential units from 2022 to 2027, there will be opportunities coming onto the market at a range of price points.

The agent said that the former industrial area, now transformed into a trendy hub with “great characteristics”, also appeals for those looking to start families in Hong Kong as the neighbourhood is home to some of the city’s most prestigious international schools.

“To add to the mix, the area has seen an influx of A-grade commercial office spaces – international corporate firms that were previously non-existent are now headquartered in Wong Chuk Hang,” the agent said.

The agent believes that a variety of factors indicate that the Hong Kong luxury residential sector can expect growth to continue into 2022.

“Hong Kong is entering its third decade of low interest rates and monetary policy continues to underpin liquidity and low debt in the market to create favourable conditions,” the agent reasons. “As the Covid-19 situation stabilises, border restrictions are being incrementally relaxed and businesses are once again feeling the confidence to expand as sentiment improves.

“There will be increases across the board. We are forecasting secure capital growth as owners are willing to hold for the next five or 10 years, and so Hong Kong property as a long-term asset class is looking very attractive again.”

The property agency foresees that in the secondary luxury market, tight supply for both outright sales and for leasing will see pressure on prices maintained, with overall growth reaching five per cent year-on-year in 2021, and further gains of up to 10 per cent year-on-year expected in 2022.

Meanwhile, a market review by property agency affirms that luxury residential (defined by the agency as class-E properties with an area of 1,722 sq ft or more) as one of the bright spots of an uneven recovery in real estate.

The agent said that luxury transactions in the first half of this year had approached pre-Covid-19 levels, while luxury capital values further climbed by 3.1 per cent in the second quarter of 2021, after rising 0.8 per cent in the first quarter. This was largely attributed to the improving investment sentiment, fuelled by several primary market transactions struck at record levels amid the better-than-expected economic recovery.

The agent cites sustained end-user demand, substantial liquidity and better-than-expected economic recovery in the city as market drivers.

In the leasing market, the agent expects that the rents of luxury residential will rise 0.5 per cent in the second half of 2021, due to increased demand triggered by the shift to working from home during the pandemic.

(South China Morning Post)

教协1.75亿沽旺角两层会址

有近50年历史的教协早前宣传解散,该会拥有多个贵重物业即时于市场放售。百本医护 (02293) 刚公布,向教协购入旺角好望角大厦8楼和9楼两层,合共作价1.75亿元。

百本医护购入 作医护考核中心

百本医护有意利用上述物业作为主要业务办公室、设立医护人员考核中心及其他业务用途。

百本医护公告披露,好望角大厦8、9楼物业分别作价9,150万及8,350万元。百本医护会分3期支付,合共1,000万的首期按金会昨日签订临时协议后支付;合共750万的额外按金会于9月16日或之前签订正式买卖协议后支付;合共约1.575亿的餘额会于11月11日之前完成落实后支付。

资料显示,教协多年来自置物业营运,包括在旺角、铜锣湾、荃湾三个办事处,当中除了荃湾南丰中心的办事处属于租用外,其餘均属于自置物业,总值约3亿元多。

(经济日报)

荃湾工厦申建商业项目

近期有不少工厦项目申请重建发展,德莱建业去年以3.1亿购入的荃湾理想集团广场,新近向城规会申请放宽地积比及高度限制,以重建成1幢楼高28层的全新商业大厦,涉及总楼面约8.85万方呎。

据城规会文件显示,上述项目位于白田坝街46至48号,目前属「其他指定用途」註明「商贸」地带,申请拟议略为放宽地积比率及建筑物高度限制,以作准许的办公室、商店及服务行业和食肆用途。

申增至总楼面8.85万呎

文件显示,上址地盘面积约7767方呎,申请放宽地积比率约16%发展,由9.832倍增加至11.4倍,而建筑物高度由主水平基準以上100米申请放宽至108.305米,即增加约8%;拟议重建为1幢楼高28层 (包括4层地库) 的商业大厦,涉及总楼面约88545方呎,其中83884方呎为写字楼用途,另有4661方呎为零售楼面。

上述项目预计在2025年6月落成,日后该商厦2楼至3楼为零售楼层,而4楼则为空中花园,其餘楼上6楼至25楼均为写字楼用途;另外,地库首3层为停车场,而最底层是机电设施。

申请人指出,本拟议重建计画完全符合政府的政策目标,活化现有工厦,以应对荃湾区对私人办公室日益增长的需求,亦符合申请地点的土地用途规划意向。资料显示,德莱建业于去年11月斥资3.1亿,向理想集团购入上述项目。

(星岛日报)

Hong Kong’s September home sales head for a record as buyers snap up most of 588 flats offered at three projects

As many as 541 of the 588 apartments on offer at three projects found buyers as at 9:30pm, according to sales agents

As many as 9,800 buyers registered their interest to bid for the 588 flats on offer this weekend, translating to 16 bidders vying for every available unit

Hong Kong’s homebuyers returned to the city’s largest weekend property sales in almost a year, snapping up almost 92 per cent of the flats on offer, as sentiments were lifted by an improving economy and easy financing amid low interest rates.

As many as 541 of the 588 apartments on offer at three projects found buyers as at 9:30pm, according to sales agents. At the former Kai Tak airport in Kowloon, Henderson Land Development sold 68 of 100 flats released in the first batch of The Henley III project. At Wong Chuk Hang at the southern edge of Hong Kong Island,

Kerry Properties sold all 188 flats at La Marina, jointly developed with Sino Land and MTR Corporation. Sun Hung Kai Properties pulled off a hat trick with its Wetland Seasons Bay project in Tin Shui Wai in the north-western corner of the New Territories near Shenzhen, selling all 285 units in open sale in its third round, with another 15 units earmarked for sale via tender. The project had sold out during the two previous consecutive weekends.

“The sales activity was lively and booming this weekend, as Hong Kong’s economy is faring well, which improved the optimism in the property market,” agent said. “With a low-interest rate environment, the purchasing power is very strong.”

As many as 9,800 people registered their interest to bid for the 588 flats on offer this weekend, translating to 16 bidders vying for every available unit.

The strong demand over the weekend offers a clear sign that Hong Kong’s residential property market is heading for a record in September, with the sales of newly completed homes expected to rise by 50 per cent from August to 1,800 units. In the second-hand market, about 5,500 lived-in homes are expected to be transacted, unchanged from last month, agent said.

The Henley III, scheduled for delivery in April 2022, comprises 404 flats in total, ranging from 238 to 778 square feet (73 square metres), from studios to three-bedroom flats. Prices this weekend began at HK$6.25 million, going up to HK$25 million (US$3.2 million). The average price of the first 100 flats released for sale was HK$27,938 per square foot, 5.6 per cent more than the first batch of Phase I released in April.

Kerry Properties’ La Marina was overbought by close to 20 times, with 3,750 bids vying for 188 flats. The project, comprising 600 units, stands atop the Wong Chuk Hang subway station, and is scheduled for completion in August 2023. Prices averaged HK$30,880 per square foot after discounts, starting at HK$10.8 million for the smallest flats. The flats range in sizes from 341 to 921 square feet.

Half of the buyers of La Marina are investors who are holding the property for rent and price appreciation, owing to the project’s convenient location in the south of Hong Kong Island, the agent said.

The project has “very good potential” owing to its proximity to the subway station, said Po. “There has not been such a big project for many years.”

Wetland Seasons Bay, located on the fringe of Hong Kong’s Wetlands Park, is scheduled for completion in June 2022. The project comprises 1,996 apartment units and 10 villas across three phases. Today’s sale, following two sell-out weekends, was priced at HK$13,400 per square foot after discounts.

(South China Morning Post)新银集团中心银主盘1.4亿沽

受疫情打击,商厦市场阴霾密布,市场再现银主盘成交。消息指,湾仔新银集团中心全层银主盘以1.4亿易手,每呎造价约18950元,属低市价水平。

七年间升值6%

市场消息指,湾仔新银集团中心高层全层,为银主物业,面积7388方呎,以1.4亿沽,呎价约18950元。据土地註册处资料显示,上址原业主于2014年以约1.32亿购入,以公司名义永勤有限公司 (YONGQIN LIMITED) 持有,为海外註册公司,以易手价计,物业于7年间升值约800万,升值约6%。

据从事商厦买卖的代理指出,该厦早前23楼全层于上月以1.422亿连一个车位成交,呎价约19247元,惟是次成交属更高楼层,并享高楼底,故认为成交价低市价约5%。

据代理行资料显示,该厦早前频录买卖,其中,该厦5楼3室,面积2015方呎,于2018年8月以4534万售,呎价2.25万;另一宗买卖为低层全层,面积7388方呎,于同年4月以约1.625亿售,呎价约2.2万。

永安广场 2851万售

消息指,尖沙嘴永安广场低层08至09室,面积2318方呎,以约2851万售出,呎价约1.23万;另外,由第一集团发展的长沙湾GCC3环球商贸广场3期低层02至6室,面积7857方呎,以7813.7万易手,呎价约9945元。

(星岛日报)

更多新银集团中心写字楼出售楼盘资讯请参阅:新银集团中心写字楼出售

更多湾仔区甲级写字楼出售楼盘资讯请参阅:湾仔区甲级写字楼出售

更多永安广场写字楼出售楼盘资讯请参阅:永安广场写字楼出售

更多尖沙咀区甲级写字楼出售楼盘资讯请参阅:尖沙咀区甲级写字楼出售

湾仔海港中心相连户叫价1.43亿

湾仔北日后有沙中綫港铁站,海港中心相连海景单位现正放售,意向价约1.43亿元。

意向呎价约3.68万

代理表示,湾仔港湾道25号海港中心中高层04至05室,面积约3,886平方呎,意向呎价约3.68万元,涉及总额约1.43亿元,现已交吉。物业为大单边单位,坐拥环迴优美海景及湾仔球场景致。

物业已备有写字楼装修及间隔,另设有来去水位,方便买家即买即用,自用或投资皆宜。据悉,单位亦正招租中,意向呎租约70元,月租约27.2万元。萧氏补充,业主于今年5月份斥资逾1.03亿元购入项目,有感近月商厦市况升温,遂将物业放售应市。

(经济日报)

更多海港中心写字楼出售楼盘资讯请参阅:海港中心写字楼出售

更多湾仔区甲级写字楼出售楼盘资讯请参阅:湾仔区甲级写字楼出售

上环德辅道中铺意向月租36万 老牌家族朱钧记持有 较旧租减47%

疫情逐步回稳,带动零售市道转活,部分业主趁势放租旗下铺位物业,由老牌家族朱钧记持有的上环德辅道中铺位,以意向租金36万招租,较旧租下跌约47%,适合食肆及金融机构进驻。

据朱钧记发言人表示,上述放租为上环德辅道中268号地下及阁楼物业,总面积约5000方呎,门面阔约42呎,以意向月租36万放租,呎租约72元。

前租客余仁生迁出近两年

该铺早前由余仁生以68万承租,惟受疫情打击下游客量锐减以及经济不稳,余仁生无奈迁出至今近2年,现意向租金较旧租金下跌约47%,最新招租租金甚具竞争力,料吸引大型商户承租进驻。

总面积约5000方呎

该公司发言人续指出,该铺毗邻港铁上环站,交通配套完善,适合大型食肆及金融机构进驻,该铺亦属区内罕有放租大型旺铺。该集团对于后市租金持乐观态度,随着疫情放缓及市民回復正常外出消费,加上未来通关等各种有利因素,相信未来租金及零售生意定必稳步上扬。

另外,该集团正积极考虑在市场吸纳更多优质商厦及铺位,以扩展公司业务及作长綫收途,该公司新近以4亿购入北角英皇道135至145号民眾大厦基座商铺部分,总楼面约32000方呎,呎价属合理水平,回报理想。

平均每呎叫租72元

该物业位于英皇道及油街交界,人流畅旺,可朔性高,将配合公司未来发展,作长綫收租用途。该公司往后将继续积极留意市场,吸纳更多高质素物业。

此外,该集团近期亦正进行另一项重建项目,位于尖沙嘴柯士甸道114至116号,现址为服务式住宅大厦,项目于拆卸后,将兴建一幢甲厦以作出租用途,该地盘面积约5400方呎,总楼面约70000方呎。现该住宅大厦经已拆卸,而新商厦预计于2023年竣工。由于近年该区对甲级商厦需求大增,项目邻近弥敦道及港铁佐敦站,区内五星级酒店及大型商场齐备,交通配套成熟,相信项目落成后,定能为公司带来可观收入及对公司未来发展有正面影响。

(星岛日报)

上月录17宗大额物业买卖 外资基金投资者频出手 尖沙嘴晋逸酒店全幢作价9.8亿

疫情逐步回稳,为投资市场释出正面讯息。八月份市场共录17宗逾亿元大手物业买卖,外资基金频频出手「扫货」,以尖沙嘴晋逸精品酒店全幢以9.8亿易手最瞩目,此外,多个大型财团趁势沽货,包括兴胜创建、宏安地产及邓成波家族等;据业内人士指出,随着本港经济重回正轨,加上低息环境带动,料资金持续流入投资市场,料今年第四季大手成交陆续浮现。

综合市场及土地註册处资料显示,今年8月市场共录约17宗逾亿元大手物业成交,包括工商铺及酒店,合共涉资约55亿,较今年7月的70亿按月回落约两成,惟期间市场仍录多宗瞩目大手成交。有代理评论,受低息环境持续,市场资金充裕等利好因素带动,预计下半年的逾亿大手工商铺买卖承接过去两个月的旺势,对于外资基金近期频大手入市,该代理指,全幢酒店于市场上一直备受实力买家追捧,随疫情回稳,料大手买卖将持续浮现。

土瓜湾全幢酒店3.8亿沽

上月最瞩目的大手成交为尖沙嘴宝勒巷晋逸精品酒店以9.8亿沽出,买家为首度在港投资物业的美资基金,该酒店房间总数约158间,平均房价每个约620万,平均呎价约13687元。消息指,是次成交价较业主早前意向价回落了大约18%,某程度上反映疫情对旅游酒店业之冲击。

上月亦有一宗全幢酒店买卖个案,位于土瓜湾谭公道103至107号全幢酒店,以约3.8亿沽,买家共居空间品牌Weave Living,该品牌在过去四年在港以约25亿累购6个项目,涉及共居项目、服务式住宅及公寓,房间共约99间,平均每个房间造价约383万,呎价约12752元。

统一中心全层5.15亿售

另一方面,多个大型财团均于上月沽货,资料显示,由宏安地产持有的金鐘统一中心30楼全层以5.15亿易手,以面积约20488方呎计,呎价约25135元,物业将以买卖公司形式交易,该全层现时月租约114.7万,租期至2023年,料买家可享租金回报约2.7厘。据了解,买家为许大绚及梁先杰。资料显示,原业主于2016年以5.12亿购入,持货约5年帐面获利约277.5万。

兴胜创建旗下观塘禧年工业大厦全幢亦于上月以6.28亿易手,消息指,上址为大业街1号禧年工业大厦全幢,作价6.28亿,平均呎价9985元,以卖公司形式易手,现时月租96.7万,租约将于2022年2月至2023年7月届满,料新买家享约2厘回报。买家为均辉集团老闆李俊驹,均辉经营空运公司总部设于伟业街,不排除购入物业自用。该厦佔地5780方呎,于1980年落成,现时总楼面62889方呎,包括地下面积约4634方呎,1至3楼每层5662方呎,4至12楼每层4173方呎,13楼为3706方呎,以现址楼面计算,平均呎价约9985元。

(星岛日报)

更多统一中心写字楼出售楼盘资讯请参阅:统一中心写字楼出售

更多金鐘区甲级写字楼出售楼盘资讯请参阅:金鐘区甲级写字楼出售

邓成波家族一亿沽骆驼漆

「铺王」邓成波家族连环沽货,消息指,该家族最新以1亿沽出观塘骆驼漆大厦低层单位,每呎造价约6759元,属市价水平,该家族于过去4个月累售逾30项物业。

市场消息指出,由「铺王」邓成波家族持有的观塘骆驼漆大厦1期低层A至D室,面积约14795方呎,以1亿成交,呎价约6759元。据土地註册处资料显示,上址原业主于2010年以4700万购入,以公司名义空间无限有限公司持有,註册董事为邓展英及黄靄云,该家族持货11年,帐面获利5300万,物业期间升值约1.12倍。

持货11年赚5300万

据从事工厦买卖的代理指出,上述成交价属市价水平。据代理行资料显示,该厦近期频录成交,其中,该厦1期全层于本月以1.1836亿元售出,以面积14795方呎计,呎价约8000元;另一成交为该厦三期中层N室,面积1379方呎,于今年7月以1000万售出,呎价约7250元。

邓成波家族累售逾30项物业

事实上,邓成波家族近期连环沽货,累售逾30项物业,其中,由该家族持有屯门东亚纱厂全幢,以及粉岭勉励龙中心全幢,早前分别以22.4亿及6.95亿易手,买家为华润物流。

该家族近期另一沽出物业为九龙城侯王道26号地铺,面积约1000方呎,以3650万售出,平均呎价约3.65万,现址为髮型屋,邓成波于2018年8月以3500万购入,持货接近3年,帐面获利150万,物业升值约4.2%。

(星岛日报)

元朗工业区转型住宅新区 高地价效应新界西北发展大变天

近期新界西北成市场焦点,长实于上月以逾7.1亿,每方呎楼面地价9112元,高价夺得元朗流业街住宅地后,邻近的东头工业区亦随即起动,不少发展商趁势把旗下的工厦转作住宅,令该区出现大变天,摇身一变成为新晋住宅区。

长实于上月以楼面呎价9112元,高市场估值上限约14%,夺得元朗流业街住宅地,并发展为低密度洋房项目,而毗邻的东头工业区亦受带动,部分工厦亦改作住宅用途。

其中,丽新发展与资本策略旗下的元朗工厦丽新元朗中心,目前已获城规会通过,可重建作住宅用途,料涉800伙,若扣除政府主动更改土地用途,属区内一带,首个转型作住宅的工业项目。

丽新:具条件发展全商住社区

丽新发展高级副总裁潘锐民指出,是次将项目申请重建,主要是近年本港对住宅需求大增,而且该项目邻近铁路站,极具发展潜力,料未来将主打中小型住宅单位。

潘氏认为,近年东头工业区发展加快,附近亦有不少住宅项目正在兴建中,有条件发展成为全商住社区,相信未来会有不少工厦项目申请改建为住宅发展。

此外,由星星地产持有的宏业西街21号,亦由工业地转作住宅,星星地产执行董事陈文辉表示,宏业西街项目本身为工业地皮,当衡量过继续作工业项目,或改建成住宅后,两者可获得的收益差距后,加上本港刚性置业需求持续,最终决定改变用途。

星星地产:改建住宅收益更高

现时该项目将补价重建成商住物业,总楼面逾15万方呎,料提供逾300伙,并主打中小型单位,预计明年推出。

陈氏亦指出,近年政府积极拓展新界西北,本身已看好元朗区未来发展,东头区尤其看高一綫,随着区内不同住宅及商业项目相继落成,认为东头区转型已接近完成,变成一个商住皆宜的区域。

除住宅外,同区亦接连有商业项目落成,除了经已啟用、由星星地产发展的商厦虹方,至于由信和发展的宏业西街项目,亦可望在短期内落成,可建楼面约49.7万方呎,将打造成甲级商厦,而发展商于15年以16.9亿购入该地皮,每方呎楼面地价约3396元。

东头区转型近完成

另外,目前属工厦的喜业街16号骏佳广场,亦已获城规会批准,可重建作商厦,业主早前曾向城规会作申请,提出加密方案,总楼面增加15%至19.2万方呎,将会进一步增加商业楼面,以及公眾停车位。

有测量师指出,本港经济结构转型,对传统工厂大厦需求量减少,而且元朗东头工业区毗邻港铁朗屏站,出入交通便利,加上邻近元朗市中心,商业及交通配套发展成熟,该区近年亦有多个住宅项目相继落成,将会有助促进区内的工厦群转型为住宅发展,相信未来区内将会有不少工厦业主申请转为住宅发展,预料未来东头工业区将会大变天,有力成为新晋住宅区域。

(星岛日报)

工商铺8月成交近116亿 22个月高

8月份大额买卖旺,统计指上月工商铺成交近116亿元,创22个月新高,而工厦市场一枝独秀,由于市场气氛仍向好,9月份投资金额仍理想。

有代理行综合土地註册处资料显示,8月份工商铺註册共录得584宗,按月下跌9.3%,惟8月份整体註册金额按月升18%,录115.65亿元,为自2019年10月以后新高,主要受多宗逾亿元成交所带动。

8月份工商铺各板块註册宗数均继续录按月下跌。工厦註册量最新报338宗,按月减少6.9%。商厦及商铺註册量亦分别按月下跌4.1%及18.8%,最新分别录116及130宗。8月份整体註册宗数为584宗,是近5个月以来首次跌破600宗水平,按月下跌9.3%。不过,整体註册金额则继续录得升幅,主要受多个全幢工厦成交带动。

全幢工厦共4宗 涉资42.86亿

市场焦点涉全幢工厦,合共4宗,涉资共42.86亿,佔总註册金额约37%,包括邓成波家族沽出屯门东亚纱厂工业大厦全幢及粉岭勉励龙中心全幢,分别以约22.43亿元及约6.95亿元。此外,兴胜创建 (00896) 亦连环沽工厦,包括以6.28亿沽出观塘大业街1号禧年工业大厦全幢,以及3亿元售出柴湾美利仓大厦5成业权,由美资基金AEW购入。

买家方面,该行指今年工厦物业同受中外资金追捧,今年以来中外资合共斥141.36亿元入市,属历来首见;买家又以机构投资者为主,今年以来暂录约98.33亿元,佔总买入金额56%,同属历来首见。

除工厦外,分层甲厦亦录大手成交,金鐘统一中心30楼全层以5.15亿易手,以面积约20,488平方呎计,呎价约25,135元,买家可享租金回报约2.7厘。据了解,买家为许大绚及梁先杰。资料显示,业主为宏安地产,于2016年以5.12亿购入,持货5年近平手离场。

该行代理表示,8月份继续录得多幢全幢工厦註册成交,当中不乏邓成波家族所放售,有不少来自中资及本地的买家接货,可见投资者对工厦前景充满信心。

该代理又指,虽然本港疫情连续多月受控,内地疫情亦渐趋稳定,但是中港通关仍未有具体时间表,或会令部分投资者稍微转趋审慎,预计后市交投量会继续徘徊于500至600宗水平。

(经济日报)

更多统一中心写字楼出售楼盘资讯请参阅:统一中心写字楼出售

更多金鐘区甲级写字楼出售楼盘资讯请参阅:金鐘区甲级写字楼出售

老凤祥旺角店月租22万跌9成

核心区整体租务淡静 业主寧放短租

核心区整体租务淡静,业主寧放短租。消息指,旺角亚皆老街铺位,获燕窝店以约22万租用,较旧租客内地金店老凤祥旧租金低近9成。

市场消息指,旺角亚皆老街67至69号地下连阁楼铺位租出,物业地下面积约2,000平方呎,阁楼面积约1,800平方呎,面积合共约3,800平方呎,以每月约22万元租出。消息称,新租客为楼上燕窝庄租用,据悉属短租性质,为期半年。

燕窝店租用 为期半年

该铺位处西洋菜南街与亚皆老街交界,对面为旺角中心,属区内人流畅旺一綫地段。

据悉,该铺曾由内地金店老凤祥租用,品牌于2015年来港扩充,先后于尖沙咀及旺角开店,其中以每月200万,租用上址作分店。品牌今年约满迁出,业主黎永济重新把铺位招租,由于受到疫情下零旅客影响,整体铺租大挫,业主以每月约80万元放长租,暂未获承接,为免铺位长期交吉,现以22万短租形式租出,较对上约200万月租,低近9成。

疫情下商铺空置率仍偏高,代理行资料显示,核心区商铺空置率较去年少许改善,仍属偏高水平。资料显示,8月份旺角区空置率为11.87%,按月回落0.03个百分点,较去年减少0.37个百分点。

现时区内西洋菜南街仍有大量吉铺,亦有不少短租个案。近月服装品牌堡狮龙 (00592) 租西洋菜南街48至50号地下及阁楼,面积共3,600平方呎,月租约25万元,呎租约69元。该铺自今年2月起交吉,原以每月50万元放租,最终降价一半获短租。

近期整体零售略好转,惟旅客尚未重返,核心区旺段铺位吉铺仍多,业主纷减价吸客,如早前尖沙咀栢丽大道一巨铺,获谢瑞麟珠宝以每月约25万租用,较旧租跌84%。

另外,民生区成为商户进驻对象,消息指,西环皇后大道西421号华明中心基座商业部分多层楼面,以每月约400万元承租,为民生区罕有大手成交,涉及面积约4.7万平方呎。据了解,新租客为中资财团,用作开设超市及食肆。

(经济日报)

新地W LUXE重推 速沽逾6成

市况好转,发展商重推商厦新盘餘货,新地 (00016) 旗下石门W LUXE重推,速沽逾6成,入场费约539万元起。

有代理表示,位于石门安耀街5号W LUXE近日推售15个精选单位应市,项目短时间内已售出10伙,佔总数约66%,为发展商带来近6,000万元卖楼收益。项目现时尚有5个单位待售,面积由约406至533平方呎不等,售价由约539万元起,平均呎价由约12,300元起。

尚有5单位待售 539万入场

该代理续称,W LUXE于2020年底落成,为石门区楼龄最新的精品商厦项目,每户设有独立洗手间,物业质素及配套甚有保证,过去曾吸引投资者大手入市,斥资逾1.29亿元买入大厦顶层连天台,成交呎价约19,339元,反映买家肯定W LUXE投资价值。

(经济日报)

长沙湾中国船舶大厦为区内楼龄较新商厦,单位景观开扬,周边配套亦完善。

近年,不少商厦项目在长沙湾落成,商业气氛渐见浓厚。中国船舶大厦位于长沙湾道650号,为长沙湾区内甲级写字楼大厦的指标。

交通上,由港铁荔枝角站步行至该厦,需时约6至10分鐘,附近亦设有不少巴士站,直达港九新界,交通便利。饮食方面,大厦内有数间中式酒楼,邻近亦有不少茶餐厅及食肆。附近较大型商场长沙湾广场以及近年新落成的 D2 PLACE ONE 及 D2 PLACE TWO 商场内亦有大量食肆可供选择。

写字楼单位 设升高台

项目原为长沙湾邮政局及员工宿舍大楼,于2014年被第一集团以10.02亿元投得,发展成写字楼,共提供148个写字楼单位。2017年中国船舶重工集团以2.59亿元购入顶层复式户,并获大厦命名权。

大厦楼龄仅约3年。项目总楼面面积225,000平方呎;地下至2楼为商铺;3楼至18楼为写字楼;19楼至25楼则为复式写字楼。所有写字楼单位设升高地台。同时,大厦4楼为机房;并不设13楼、14楼及24楼。

物业每层面积约1.1万平方呎,最细单位由900餘平方呎起,适合中小型企业。景观上,主要单位望向长沙湾道,面前大厦不多,甚为开扬,而12楼以上可享有海景。

成交方面,大厦今年4月录得2宗买卖成交,其中,高层02室,面积约1,134平方呎,以1,315万元成交,呎价11,596元。另外,高层03室,面积同样是约1,134平方呎,以1,335万成交,呎价11,772元。

租务方面,今年亦录得3宗租务成交,其中,中低层06室,面积约951平方呎,以每月20,922租出,呎租22元,另高层02室,实用面积约1,134平方呎,以每月29,484租出,呎租26元。至于中高层09室,面积约1,037平方呎,以每月26,962租出,呎租26元。

(经济日报)

更多中国船舶大厦写字楼出售楼盘资讯请参阅:中国船舶大厦写字楼出售

更多长沙湾区甲级写字楼出售楼盘资讯请参阅:长沙湾区甲级写字楼出售

更多中国船舶大厦写字楼出租楼盘资讯请参阅:中国船舶大厦写字楼出租

更多长沙湾广场写字楼出租楼盘资讯请参阅:长沙湾广场写字楼出租

更多 D2 PLACE ONE 写字楼出租楼盘资讯请参阅:D2 PLACE ONE 写字楼出租

更多 D2 PLACE TWO 写字楼出租楼盘资讯请参阅:D2 PLACE TWO 写字楼出租

更多长沙湾区甲级写字楼出租楼盘资讯请参阅:长沙湾区甲级写字楼出租

铜锣湾旧楼铺传4亿沽 佔16%业权

市区旧楼具收购价值,楼龄达57年的铜锣湾本德大厦,有一篮子商铺市传以约4亿元售出,整批铺位佔大厦业权逾16%,由大厦大业主老牌电器厂家新玛德孙氏家族购入的呼声甚高。

据悉,铜锣湾波斯富街21至27号本德大厦地下A至D铺,连1及2楼多个铺位,建筑面积约13800方呎,传已售出,作价约4亿元,呎价2.9万元。

买家为新玛德孙氏机会高

上述铺位原业主是被称为「大坑铺王」的周炳权家族,部分铺位早于50年前已购入,土地註册处资料显示,该批铺位去年曾作内部转让,总值3亿元。

资料显示,本德大厦3至15楼住宅部分由新玛德孙氏家族持有,于2008年初以4.98亿元购入,已佔大厦逾81%业权。该家族一直有意增购大厦业权,2018年底斥5500万元多购一个地铺,令业权增至逾82%。是次易手物业约佔该厦16.4%业权,若由孙氏家族囊括,该家族将拥有大厦逾98%业权。

(信报)

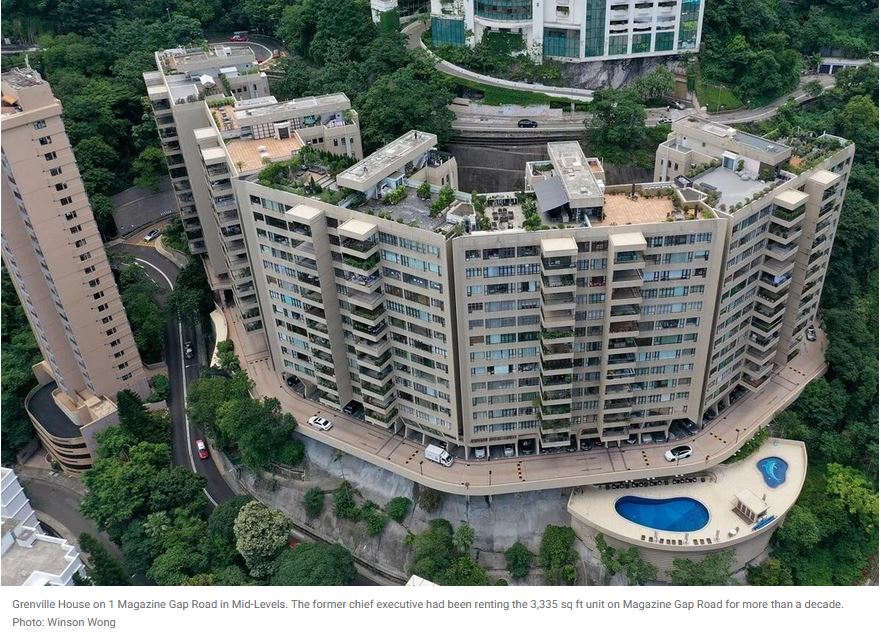

Worst is over for Hong Kong’s luxury home rental sector as local demand fills flats vacated by expats, says SHKP unit

Local tenants have taken advantage of tumbling rents to upgrade to better quality projects amid a dearth of expats, says managing director of Signature Homes

Luxury residential rents increased 1.4 per cent between April and June, the first quarterly rise since the third quarter of 2019, according to property agency

The worst is over for Hong Kong’s high-end home rentals sector, as local demand has gradually filled up the empty flats left behind by expatriates, according to the luxury residential leasing arm of Sun Hung Kai Properties (SHKP).

Luxury home rents have dropped by 16 per cent in the last two years, and local tenants have taken advantage to upgrade to better quality projects.

“The market started to get warmer in the second quarter this year, and rent became stabilised in the summer,” said Derek Sun, managing director of SHKP’s Signature Homes unit, which manages more than 2,000 properties from single houses in the south of Hong Kong to serviced apartments in core business districts. “The worst is behind us and we are more optimistic about the rental market in 2022.”

Luxury residential rents in Hong Kong recorded an increase of 1.4 per cent between April and June, the first quarterly rise since the third quarter of 2019, according to property agency’s market review.

Mid-Levels saw the highest rental growth, of 2 per cent, among the major submarkets, largely on the back of limited availability.

The market was primarily supported by the current pool of residents in Hong Kong, which offset the significant drop in expatriate arrivals, the agency said.

“With the ongoing travel restrictions, expatriate arrivals are expected to remain limited in the short term. However, we still expect to see more leasing enquiries in the third quarter of 2022 as summer is the traditional home search season,” agent said. “With the expectation of border reopening before the year-end, the luxury leasing market is anticipated to improve gradually.”

SHKP’s leasing portfolio has units costing from HK$22,000 (US$2,830) a month for a studio in its Townplace in Soho to HK$650,000 for a single house at 50 Island Road in Deep Water Bay.

In May, a 7,022 square-foot detached house at 73 Mount Kellett Road, owned by an unrelated private entity Giant Expert Investments, was leased for HK$1.6 million a month, or HK$228 per square foot, making it the most expensive in per square foot terms in Hong Kong this year.

Early in 2021, Hong Kong’s embattled serviced apartment operators and landlords slashed their rents and offered sweeteners to boost occupancy rates that had been hit hard by travel restrictions and a sharp decline in relocations because of the pandemic.

“Some of our clients from overseas have postponed their reservation [with us] during the pandemic,” said Sun of Signature Homes.

At the height of Covid-19 last winter, he said rents were cut by about 10 per cent for leases upon renewal, as many cities had imposed travel restrictions that kept expatriates away from Hong Kong.

In the first half of this year, visa approvals from the General Employment Scheme and Mainland Talents and Professionals Scheme plunged by half from the same period of 2020 to 11,128, according to data from the Immigration Department.

“We have started to work with agents to bring in local families to replace corporate tenants [from overseas],” said Sun.

Sun said occupancy rates have rebounded to 80 to 90 per cent as a result of a local marketing push and the refurbishment of existing properties

Signature Homes completed the renovation of Four Seasons Place at Hong Kong Station in Central last year, and refurbishment work at Dynasty Court in Mid-Levels is ongoing.

“The market is receptive to newly renovated properties at a high rent,” said Sun.

As a corporate landlord, SHKP has a full technical team capable of offering immediate maintenance services that individual landlords cannot provide, he said.

(South China Morning Post)

Residential completions slim after 12pc year-on-year drop

The number of private residential completions in Hong Kong recorded in the first seven months dropped by 12 percent year-on-year to 10,058 units, reaching only 55 percent of the government's forecast for the whole year, according to data from the Rating and Valuation Department.

Only 1,097 private residential units were completed in July, down by 6.2 percent from June this year. That number, compared with the peak of 3,679 units in May, plunged more than 70 percent, though it still maintained a level of over 1,000 units per month.

The number of small and medium-sized units completed in class B - saleable area ranging from 431 to 752 square feet - is relatively large with a total of 5,310 units completed in the first seven months, accounting for half of the total completions and 66 percent of the class' annual target.

In terms of region, the supply is still mainly concentrated in the New Territories - with 5,222 units completed in the first seven months - accounting for about half of the total completions, followed by Kowloon's 4,084 units, or 41 percent of the total private residential completions. Only 752 units were completed on Hong Kong Island in the same period.

Meanwhile, Henderson Land Development's (0012) The Holborn in Quarry Bay will release its price list and open showrooms this week at the earliest, said Mark Hahn Ka-fai, general manager of the sales department.

The first batch of 84 flats will mainly provide studios and one-bedroom units. Hahn said the project has a 12,000-sq-ft clubhouse and garden as well as 16 recreational facilities, including a gym and banquet hall.

The Holborn will offer a total of 420 units ranging from studios to three-bedroom units, measuring from 200 sq ft to 571 sq ft.

Separately, there were only two new residential projects that applied for pre-sale consents in August, and none were granted in the month, data from the Lands Department showed.

Only 6,771 units were involved in the pre-sale consent applications in the first eight months of this year, which is a 52.7 percent year-on-year decrease from the 14,314 units offered in the same period last year and a record low in eight years, property agency said.

An analyst of the agency pointed out the number did not mean that developers had slowed down the pace of launches.

In fact, three major property projects were launched on the same day during the past weekend, which shows that developers are still actively promoting the sales. Furthermore, the sale of new flats in the first eight months of this year have exceeded 11,100 units, increasing 26 percent compared to the same period last year.

Aside from the new projects, the current market has accumulated nearly 12,000 units. It is believed that even if new applications decrease year-on-year this year, the firsthand sales volume will still reach the projected level of 18,000 units, the analyst added.

(The Standard)三星50万租华人行地铺 租跌7成

中环租金大幅调整,近期个别商户进行扩充。消息指,华人行地下一铺位,获电子产品三星租用,月租料约50万元,租金较旧租客錶店跌逾7成。另同区H Queen's地下逾3,000平方呎铺位,获运动服lululemon以每月约60万元租用。

市场消息指,中环核心区一綫地段皇后大道中连录租务成交,涉及华人行地下3至5号铺,面积约1,654平方呎,以约50万元租出。该铺正对娱乐行及中建大厦,为区内心臟地段,平日人流畅旺。据了解,该铺目前由口罩店租用,属短租性质,近日正式迁出。

消息指,新租客为三星电子,估计开分店主力售卖手机。翻查资料,该铺早前曾由Swatch Group旗下鐘錶品牌宝珀 (Blancpain) 以每月180万元租用,呎租1,088元。去年中疫情爆发,宝珀关掉在港数分店包括上址,其后铺位交吉一段时间,获口罩店以每月约25万元短租。按最新月租约50万元计,较对上鐘錶店跌约72%。事实上,最近同厦另一铺位,涉及1号铺,面积约1,098平方呎,目前亦由口罩店短租,最近亦获鐘錶店预租,月租料同约50万元。

运动商户扩充 商铺租务稍增

本港疫情缓和下,商铺租务稍增,其中主打本地消费包括运动商户,扩充稍为积极。中环皇后大道中新式商厦H Queen's地下,面积约3,000平方呎,新近获加拿大体育休閒服品牌lululemon租用,月租约60万元,而且该品牌近日已展开装修,预计短期内开业。

该品牌主打的瑜伽服装极受欢迎,生意在疫情下甚理想,故仍有扩充空间。

据了解,该铺原租客为运动服装品牌MLB Korea,成为物业2018年落成时首批租客,月租约80万元,打造成旗舰店,分成上下两层,如今由lululemon顶上。

疫情下核心区零售受冲击,去年多个品牌相继收缩业务,令街道吉铺处处。以中环为例,多个大型品牌去年迁出,商铺空置率曾高见20%。

疫情缓和下,今年区内租务明显改善,单计近半年,先后有American Eagle及恒生银行,租用皇后大道中两大复式旗舰店,而华人行地下两铺位亦先后租出,空置率降低,租金则仍在低位徘徊。

(经济日报)

更多华人行写字楼出租楼盘资讯请参阅:华人行写字楼出租

更多娱乐行写字楼出租楼盘资讯请参阅:娱乐行写字楼出租

更多中建大厦写字楼出租楼盘资讯请参阅:中建大厦写字楼出租

更多中环区甲级写字楼出租楼盘资讯请参阅:中环区甲级写字楼出租

中资财团5.5亿 收集联合道旧楼

地盘共逾万呎 可重建商住项目

中资发展商早前向已故铺王邓成波家族购入九龙城联合道旧楼一篮子物业后,再扩大收购,至今已经以5.5亿元成功收购大部分业权,包括大部分地铺,而住宅单位收购平均呎价亦达1.7万元。

联合道2至16号属于3幢旧楼物业,分别包括联合道2至4号裕联大厦、6至8号,以及10至16号新泰楼,早年邓成波家族成功收购了6至8号地盘全数业权,其餘两个地盘则收购了超过2成业权,并在今年初以4亿元将有关业权出售予一家中资发展商。

代理行:获决定性业权分数

之后该发展商再继续收购,及后再以1.5亿元购入多个地铺及住宅单位。据代理行指,合共以约5.5亿元购入上述地盘决定性业权分数,当中住宅平均收购呎价约1.7万元,每个面积介乎800至1,000平方呎的商铺的成交价则介乎约3,500万至4,000万元不等。

据昨日EPRC经济地产库资料,联合道2至16号早前录得4宗住宅,以及3宗地铺成交,合共涉资约1.4亿元,例如联合道2至4号地下B号铺以4,200万元获收购,新买家为新银投资有限公司,董事为黄洁盈。

据了解,现时发展商已经收购了大部分地铺单位,其中联合道10至16号已经掌握了超过5成业权,而2至4号更持有逾6成业权。整个地盘面积约10,051平方呎,现划为「住宅 (甲类)」用途。整个地段日后可重建为商住项目,并能提供逾90,450呎可建楼面面积。

该行代理表示,项目的买家长远看好邻近豪宅地段的物业前景,并计划继续在香港地产市场进行投资。

(经济日报)

财团连环收购九龙城旧楼 卢华家族申强拍南角道 中资逾5.5亿购联合道

自屯马綫通车后,九龙城旧楼收购活动明显加快,最新资深投资者卢华家族併购的南角道43至45号向土地审裁处申请强拍,以统一业权发展,市场对整个项目估值逾1亿,而同区联合道2至16号旧楼项目,新近亦获中资斥资5.5亿併购逾50%业权。

据土地审裁处文件显示,卢华家族平均持80%业权,目前仅餘下1个地铺及阁楼并未成功收购,市场估值共约2477.025万,而上述整个项目市场估值逾1亿;为土地审裁处今年接获的第11宗强拍申请。

上述申请强拍的项目邻近港铁宋皇臺站,步行前往约2分鐘,出入交通便利,而且南角道向来为九龙城核心地段,周边有不少特色餐厅如泰国菜馆及火锅店等,极具重建价值。

南角道估值逾1亿

现址为1幢楼高5层 (包括阁楼) 商住旧楼,地下为2个商铺,楼上为住宅楼层,涉及6个住宅单位;早于1952年落成入伙,至今楼龄约69年。整个项目地盘面积约2286方呎,若以地积比9倍重建发展,可建总楼面约20574方呎。

卢华家族旗下永成地产投资公司经理蔡仁辉指出,上述旧楼是集团旗下的併购项目,由于上述项目地契受 (One House) 条款所限,日后统一业权后,会先向地政总署进行补地价程序,「鬆绑」后将会发展为AVA系列楼盘之一。

蔡仁辉︰将重建作AVA系列

蔡仁辉认为,自屯马綫全綫通车后,九龙城区发展步伐加快,料未来该区将会有不少旧楼申请强拍发展,不过该区不少旧楼受One House地契「绑死」无法展开重建,冀政府放宽上述限制,藉以加快房屋供应。资料显示,卢华家族相关人士于区内亦有发展项目,包括早年併购的啟德道49至55号 (单号),现已发展为新盘AVA 55,涉及88伙。

另外,该区的旧楼群近期逐步获财团收购,并不乏中资财团身影,继今年6月斥资约4亿购入已故「铺王」邓成波家族持有的联合道一篮子物业的中资财团,该财团最新再斥资5.5亿增持联合道2至16号业权,据指是次增持逾50%业权。

联合道项目可建楼面九万呎

上述联合道2至16号旧楼群,由3幢唐楼组成,涉及73个业权,地下现为商铺用途,楼上则为住宅单位;新近获中资财团斥资5.5亿购入决定性业权,住宅部分平均收购呎价约1.7万;而每个面积介乎800至1000方呎的商铺,成交价介乎约3500万至4000万不等。

该项目整个地盘面积约10051方呎,现划为「住宅 (甲类)」用途,整个地段日后可重建为商住项目,可建总楼面约90450方呎。

代理表示,上述项目毗邻九龙塘传统豪宅区,日后重建为商住物业将享有开扬景观,更能远眺九龙仔公园;新买家为内地投资者,长远看好邻近豪宅地段的物业前景,并计画继续在本港地产市场进行投资计画。

另一代理补充,上址交通便利,并邻近联合道及太子道西交界,位置优越,旺中带静,买家不论重建或稍作翻新改装均能享有不俗的租赁回报及升值前景。

(星岛日报)

沙田石门京瑞广场再录大手成交。该项目地铺以7600万售出,料买家享租金回报约2.8厘。

呎价2.37万

据土地註册处资料显示,由亿京发展的石门京瑞广场地下双号铺位,于上月中以7600万易手,以公司名义啟天投资有限公司 (TREND SKY INVESTMENTS LIMITED) 购入,註册董事为龙姓人士。同时,资料亦显示,上述铺位于今年4月以18万承租,租约期至2024年3月,料买家享租金回报约2.8厘。据业内人士指,上址面积约3205方呎,呎价约2.37万。

回报约2.8厘

沙田石门京瑞广场备受用家及投资者追捧,该项目早前曾录连环沽出13个铺位,成交价由1323万至1.2亿,合共涉资逾4.6亿,当中最大手成交为地下一篮子铺位,合共面积3128方呎,以约1.2亿售,呎价约38363元。

此外,该项目2期地下两单号铺位,面积约1468方呎,以8015万售,呎价约5.45万。

该项目早前亦录名人入市个案。资料显示,日清食品代理商,广大食品有限公司早前购入京瑞广场地下G5及G56铺,作价1.39亿,地下G03号铺作价9100万,广大董事为沉济福、沉济强、梁冠程及梁冠禧,四人是老牌食品进出口及零售批发商有成行办馆管理层或相关人士,当中沉济福为集团执行董事。

G5及G56铺建筑面积约6743方呎,现址食肆陈根记,月租37万,料回报约3.19厘,此外,G03号建筑面积约3223方呎,现址西餐厅SuCasa月租22.6万,租金回报约3厘,呎价分别为2.06万及2.82万。

(星岛日报)

更多京瑞广场写字楼出售楼盘资讯请参阅:京瑞广场写字楼出售

更多石门区甲级写字楼出售楼盘资讯请参阅:石门区甲级写字楼出售

亿京广场相连单位5553万售

疫情持续平稳,带动商厦市场转活,长沙湾亿京广场高层相连单位以5553万易手,呎价约12552元,属市价水平。

据土地註册处资料显示,长沙湾亿京广场高层A及B室,分别于上月以2850万及2703.36万,合共涉资约5553万,买家以公司名义日永有限公司 (日永有限公司) 登记,註册董事为钱姓人士。

据业内人士指出,上址面积约4424方呎,以易手价计,呎价约12252元,属市价水平。

据代理行资料显示,该项目近期频录成交,其中,II期中层F室,面积348方呎,于上月以449万售出,呎价约12902元。

The Hennessy 每呎42元承租

资料显示,该项目早前获职业训练局以6434万连购2伙,料作自用用途,为2期22楼D及E室,分别于今年4月以2829.4万及3605万成交,买家以Vocational Training Council登记,即为职业训练局,原业主分别于2017年11月以2344.8万及2987.6万购入,持货3年多帐面获利约484万及618万。

另一方面,商厦市场亦频录承租个案,消息指,湾仔 The Hennessy 高层单位面积约3506方呎,以每呎42元租出,月租约14.7万,属市价水平。

(星岛日报)

更多亿京广场写字楼出售楼盘资讯请参阅:亿京广场写字楼出售

更多长沙湾区甲级写字楼出售楼盘资讯请参阅:长沙湾区甲级写字楼出售

更多The Hennessy写字楼出租楼盘资讯请参阅:The Hennessy 写字楼出租

更多湾仔区甲级写字楼出租楼盘资讯请参阅:湾仔区甲级写字楼出租

「造船大王」家族3500万沽联合广场铺 持货34年升近三倍 呎价逾3.4万

铺位市场交投回暖,城中名人亦趁势沽货。「造船大王」家族、前港区全国人大代表王敏刚胞姊王敏馨持有的太子联合广场地铺以3500万售出,呎价约3.4万,持货34年赚2620万,升值近3倍。

据土地註册处资料显示,太子联合广场地下单号铺,于上月中以3500万售出,原业主于1987年以880万购入,以公司名义ALFA WHEEL DEVELOPMENT LIMITED持有,註册董事为王敏馨,为外号「造船大王」中华造船厂创办人王华生女儿,持货34年帐面获利2620万,期间升值约2.97倍。据地产代理指出,上述铺位面积1007方呎,呎价约34757元。

市场消息指出,西环卑路乍街22至24A号懋华大厦地下双号铺,面积约1300方呎,以约3300万成交,呎价约25385元,该铺由五金行以每月约4.3万租用,料买家享租金回报约1.6厘。

卑路乍街铺3300万短炒沽

据土地註册处资料显示,铺位原业主于今年6月以2680万购入,以公司名义旺凯有限公司 (WIN SUCCESS CORPORATION LIMITED) 持有,註册董事MAPLE时装老闆麦志刚,持货仅3个月帐面获利约620万,物业期间升值约23%。

三个月升值23%

业内人士指出,上述铺位成交价属市价水平,惟麦志刚早前购入明显较市值为低,并指该铺租金尚有上升空间。

代理指出,原业主为市场资深投资者,甚具买卖眼光,早前以「低水」价购入铺位,随近期疫情持续稳定,带动市场交投气氛转活,故成功短炒获利沽货离场,另外,对于政府于下周啟动「来港易」,料该措可大幅刺激市场消费力,对零售市道带动立竿见影的作用。

书局街铺3650万承接

事实上,麦志刚近期频频入市,资料显示,他于今年5月以以3100万购入湾仔道单号铺位,该铺靠近庄士敦道交界,面积约700方呎,附设700方呎阁楼,呎价约4.42万,市场人士指出,成交价低市价约30%。原业主于1967年以13万购入,及后由遗产继承人于1992年承接,54年升值约3087万或237倍。

另一方面,早前以3650万易手的北角书局街铺位,该买卖以取消交易告终,惟据市场消息指出,该铺新获另一买家以3650万再度承接,以面积900方呎计,呎价约4.05万,该铺由食肆以每月9万租用,料买家享租金回报近3厘水平。

(星岛日报)

浸会医院3400万沽业丰工厦

浸会医院于疫市下连环沽货,新以约3400万沽出葵涌业丰工业大厦一篮子物业,每方呎造价约3683元;该机构于近1年合共沽出6项物业,合共套现约5.5亿。

据土地註册处资料显示,葵涌业丰工业大厦低层A1、A3、B1及B3室,于上月以3400.8万连一车位售出,买家以公司名义弘基市场策略有限公司 (FOUNDATION MARKETING LIMITED) 登记,註册董事为梁姓及陈姓人士,原业主为HONG KONG BAPTIST HOSPITAL,于2004年以375万购入,持货17年帐面获利3025万,期间升值约8倍。

持货17年赚3025万

据从事工厦买卖的代理指出,上述单位总楼面约9233方呎,呎价约3683元,属市价水平。

据代理行资料显示,该工厦近期频录成交,其中,中层8室面积420方呎,于上月以248万售出,呎价约5905元;另B座中层B02室,面积1946方呎,于同月以669万售出,呎价约3438元。

据本报统计显示,浸会医院于近1年共沽售旗下共6项商厦及工厦物业,成交价介乎3128万至1.68亿,合共套现约5.5亿,其中,最大手成交为观塘丝宝国际大厦低层全层,于今年4月连两车位以逾1.68亿售出,呎价约1万;该机构于去年11月亦沽出该厦低层另一个全层楼面,作价约1.59亿,呎价约9500元。

(星岛日报)

Hong Kong bans Pan Sutong from pre-selling Grand Homm flats in Ho Man Tin amid concern over developer’s cash crunch

The Grand Homm project in Ho Man Tin comprises 379 luxury apartments, developed by a unit wholly owned by the Chinese tycoon Pan Sutong

As many as 28 homes priced between HK$26 million and HK$121 million had been sold even while the complex was under construction

Hong Kong’s government has banned the real estate magnate Pan Sutong from selling residential property off the drawing plan until its construction is completed, in an unprecedented exercise of its mandate amid concerns over the developer’s cash crunch.

Grand Homm, a luxury apartment project comprising 379 luxury apartments in seven tower blocks in the Ho Man Tin residential area of Kowloon district, had its presale consent cancelled on August 27, according to Lands Department records on September 6.

As many as 28 homes priced between HK$26 million and up to HK$121 million (US$15.6 million) had been sold even while the complex was under construction by Pan’s wholly owned unit Gold Topmont. The developer postponed its completion date to May 29, 2021 from November 30, 2020, due to the late arrival of construction material in Hong Kong, according to sources familiar with the matter.

The ban, the first exercise of the local authority’s mandate since presale consent was granted in 2013, marked an unprecedented step to deter unfinished residential projects from blighting the cityscape. Derelict homes, a common feature of China’s urban landscape in the 1980s and 1990s, have since been mostly cleaned up as the government raised the minimum capital that developers must have to ensure they are able to complete their work and not put any property buyers out of pocket.

Hong Kong’s Lands Department “cannot keep its eyes closed if there is an obvious breach that is unlikely to be rectified in the near future,” a surveyor said. “I think it’s an individual case, and hopefully there are no other cases in the immediate future. [The government] hasn’t tightened the rules yet.”

Gold Topmont said it would “change the strategy” to sell the project upon its completion and obtaining the Certificate of Compliance from the authorities, according to a statement to the media.

“The company will continue to monitor the progress of the project to ensure that [it] is completed as soon as possible,” the developer said.

Buyers of six of the 28 homes sold have opted to cancel their purchase contracts. One of the cancelled transactions included a duplex unit measuring 2,422 sq ft (225 square metres) that sold for HK$121.1 million, or HK$50,000 per square foot, inclusive of a roof top measuring 817 sq ft.

“Buyers who have bought earlier can choose to continue to complete the agreement or cancel the transaction immediately,” Gold Topmont said “The latter will [receive a] refund of the deposit and interest compensation in accordance with the terms of the sale and purchase agreement.”

This was not the first time Pan has had a bailout. Goldin Properties Holdings, also chaired by Pan, reached a novation agreement in March to transfer its right to develop a separate residential property project in Ho Man Tin to Great Eagle Group of the Lo family, according to MTR Corporation, the city’s subway operator and largest land owner.

The emergence of Great Eagle is the latest twist in the dramatic rise and fall of Pan, whose Hong Kong-listed Goldin made headlines in June 2019 when it forfeited HK$25 million in deposit after walking away from its HK$11.1 billion bid for a harbourfront plot of commercial land at the former Kai Tak airport site. Less than a year later, the developer sold a separate plot of residential land at Kai Tak for a record HK$2.57 billion (US$331 million) loss.

The Ho Man Tin land parcel, which could yield 69,000 square metres (742,716 sq ft) of gross floor area capable of housing as many as 1,000 apartment units, could cost HK$10 billion to develop, according to analysts’ estimates.

Goldin sold 50.1 per cent of the stake in the project to Pan for HK$6 billion in April 2018. Goldin, with HK$7.6 billion in total liabilities as of December 2020, reported HK$993.13 million in interim loss in the second half.

Pan, 57, was estimated to be worth US$27 billion in 2015 by the Bloomberg Billionaires Index. With the shares of Goldin and most of his property portfolio locked up as collateral for loans, the tycoon has fallen out of the list of the world’s 500 wealthiest people.

Goldin Financial received a bailout last year after it sold its second Kai Tak land parcel called Area 4B Site 4 at a discount in exchange for cash and loans. The buyer, a private company incorporated in the British Virgin Islands known as Sino Shield, was believed to be linked to Hong Kong’s most famous business tycoon Li Ka-shing.

On February 9, Pan and his Gold Brilliant unit signed a tentative agreement to transfer their development rights in Ho Man Tin to Great Eagle, chaired by tycoon Lo Ka-shui. Ten days later, CK Asset’s unit Cheung Kong Property (Business Development) filed a writ in the Hong Kong High Court, suing Pan and Gold Brilliant for breaching a September 1, 2020 agreement that granted the right of first refusal to build in Ho Man Tin.

(South China Morning Post)铁路大厦全层1.5亿沽

商厦市场再录大手成交,尖沙嘴铁路大厦高层全层以1.5亿易手,每呎造价约1.37万,高市价约一成,创该厦6年以来呎价新高。

据土地註册处资料显示,尖沙嘴铁路大厦高层全层于上月中以1.5亿易手,买家以公司名义骏颖国际有限公司购入,註册董事为刘毅翔,与建信国际工程有限公司董事名字相同。原业主于2011年以8704万购入,持货10年帐面获利6296万,升值约72%。

每呎13787元创六年新高

据代理指出,上址建筑面积10880方呎,呎价约13787元,呎价较市价高约一成,并创该厦近6年呎价新高。据代理资料显示,该厦近期成交为11楼01至02室,面积4735方呎,于今年4月以5200万售出,呎价约10982元;该厦对上最贵呎价成交为中层全层,面积10880方呎,于2015年9月以1.5558亿售出,呎价约1.43万。

另一方面,据代理行发表的报告指出,受写字楼空置率高企拖累,今年首8个月整体甲厦租金累积升幅仅约2.2%,金鐘于期间录累积跌幅约10.1%,整体空置率达10.1%,中区空置率约8.5%

该行代理表示,近期甲厦租务交投步伐有所加快,主要是受中资机构扩充的需求带动,以及部分企业因节省租金而进行搬迁所致。

(星岛日报)

更多铁路大厦写字楼出售楼盘资讯请参阅:铁路大厦写字楼出售

更多尖沙咀区甲级写字楼出售楼盘资讯请参阅:尖沙咀区甲级写字楼出售

上环全幢商厦2.8亿易手 长情业主沽货 45年升值293倍

疫情持续平稳,带动工商铺交投转活,上环永乐街全幢商厦以约2.8亿易手,平均呎价约2.56万,长情业主持货45年,物业升值约293倍。

市场消息指出,上述为上环永乐街57至59号全幢商厦,总楼面约10917方呎,以约2.8亿易手,呎价约25648元。

平均呎价2.56万

据土地註册处资料显示,原业主早于1976年以95万购入,以公司名义展鹏投资有限公司持有,註册董事为陆姓及刘姓人士,持货45年帐面获利约2.79亿,期间升值约293倍。