外资代理行:商厦空置需时数年消化

本港写字楼市场于第三季呈现復甦势头,吸纳量于两年内首次回復正数,不过,根据外资代理行数据,今年头三季累积整体吸纳量为负74.6万方呎,换言之自年初以来增加了相当于约半幢国际金融中心二期的待租面积。目前市面上有近900万方呎楼面待租,加上约474万方呎新供应于未来两年登场,即使以最乐观情况估计,庞大供应亦需要数年时间消化。因此不论是业主或租户,都应该认清现实,及早为未来的市况做好準备。

该行代理表示,为捕捉将来因租赁需求復甦而迎来的商机,业主可考虑提升资产质素,例如为物业翻新,加装具能源效益的设备,一方面为节省物业开支,另一方面为满足越来愈重视可持续发展的跨国企业的社会责任需要。另外亦可藉着租户更替,重整行业组合及加强与租户的关係管理等。

租客把握议租机会

该代理续说,租户更应把握议租优势,以及市场上大楼面议租机会,为未来几年房地产策略和扩充整合做好预算。长远而言,疫情对租赁需求的不利因素将逐渐消退,重啟跨境经济活动,将为市场重新注入活力,尤其是国内公司来港集资等活动有助带动相关服务业 (法律、银行金融和会计等),需要扩充办公空间。

科技产业带动新需求

行政长官于刚发表的施政报告提到,香港将加强与深圳及大湾区的连繫,加快发展高增值科技产业,代理表示,儘管具体细节仍待公布,方向却相当清晰。

(星岛日报)

更多国际金融中心写字楼出租楼盘资讯请参阅:国际金融中心写字楼出租

更多中环区甲级写字楼出租楼盘资讯请参阅:中环区甲级写字楼出租

上环巨铺呎租70元减6% 大型银行取代证券公司

疫市下民生铺仍受追捧,中国建设银行 (亚洲) 承租上环德辅道中3层高复式巨铺,建筑面积合共7633方呎,月租54万,较多年前证券行旧租仅跌6%,平均呎租70元。

上环德辅道中238号地下、1楼及2楼共3层,为罕有三复式巨铺,过往由两家证券行承租,近期1楼及2楼约满,中国建设银行 (亚洲) (下称建行) 率先承租,建行并一併预期地下,现址证券行要待明年才迁出。

月租合共54万

上述1楼及2楼,旧租客证券行早前迁离,建行率先以每月27万进驻,租期5年,由今年10月1日,直至2026年9月30日,1楼及2楼建筑面积分别约1972及2887方呎,合共4859方呎,平均呎租约56元。

该地下现址光大新鸿基证券,租约明年5月到期,建行亦另以每月27万预租,租期由2023年6月1日至2026年9月30日,以建筑面积约2774方呎计算,平均呎租97元。 换言之,该2组铺位月租共54万,以巨铺总面积约7633方呎计算,平均呎租70元,当梗约届满后,尚有三年生约可续。

先进驻楼上 再预租地下

该3层楼面原本分别出租,地下光大新鸿基证券,于2017年以每月33.5万承租,呎租约121元。于1楼及2楼由另一家证券公司以每月24万租用,建筑面积共4859方呎,呎租约49元,旧月租共约57.5万,新租金下跌6%。

业内人士表示,疫市下,巨型楼上铺仍具需求,若然有租客适合,租金不跌反加,地铺抗跌能力较一般。

建行今年连租三巨铺

德辅道中238号由恒和集团发展,原名恒和中心,2016年落成,楼高26层,为商业用途,恒和于2014年拆售楼花,仅沽3层,随后在该厦入伙后,将餘下业权售予外资基金AEW,作价约11.34亿。

建行今年以来积极租铺,连同最新上环铺位在内,最少承租3间复式巨铺,其中,湾仔庄士敦道183至187号德业大厦地下、地库及1楼,总建筑面积约10113方呎,月租52万,平均呎租约51元。该铺位曾由运动用品店租用,月租高达60万,新租金跌约13%。

永光商厦新租跌82%

铜锣湾轩尼诗道499号永光商业大厦地下、阁楼、1楼及2楼,建筑面积共约8024方呎,月租50万,呎租约62元,旧租客六福珠宝,2015年起租用,月租高达280万,新租金较高峰期急跌82%。

(星岛日报)

更多德辅道中238号写字楼出租楼盘资讯请参阅:德辅道中238号写字楼出租

更多上环区甲级写字楼出租楼盘资讯请参阅:上环区甲级写字楼出租

中环甲厦租金大调整 租务将增

代理:憧憬復甦 不如趁机升级

疫情缓和下,近来甲厦租务活动略转活跃,特别以中环区率先起动。有代理认为,中环甲厦租金经过大幅调整后,吸引机构趁机升级,相信今年至明年租务活动增加,惟空置率高加上新供应多,租金仍有压力。

疫情持续一年多,整体环球商务活动未完全回復,写字楼租务受冲击。本港疫情仍算稳定,令近月租务活动有少许改善。代理行最新发表的市场报告指出,9月份中环写字楼租金按月增长0.6%至每平方呎90.3元,录得连续两个月升幅,并重返90元以上的租金水平,而再对上一次中环录得租金增长,为2019年5月,可见市场逐渐呈现復甦迹象。

中环租金重返90元 跑赢大市

9月整体市场租金按月下跌0.1%,平均呎租约55.7元。可见中环区属跑赢大市。

代理指出,疫情爆发至今,不少外资机构仍在收缩成本,「外资对成本甚为敏感,多间跨国机构,于环球整合业务,特别一些最大型投资银行,租用本港多层写字楼,为减成本,有需要弃租或求顶租,现时全港放顶租楼面,涉及约160万平方呎,数量不低。」

不过,该代理指本港疫情缓和,机构开始重新作出部署,「并非所有机构收缩,其实很多私人银行、资产管理公司、对冲基金等,疫情下生意不错,有扩充空间。机构普遍认为明年市况可望逐步回復,租金既然已有回调,不如趁机升级。」

租金跌3成 「去中环化」放缓

事实上,最近中环录得多宗涉及扩充及办公室升级的成交,如近日一家美资对冲基金公司,承租中环超甲厦遮打大厦近1.5万平方呎楼面,作同区升级及扩充业务。另外,早前瑞银弃租的中环国际金融中心二期全层,获一家中资资产管理公司承租,作为搬迁及升级。

代理分析,「中环平均呎租约89.8元,2019年至今已回调26.8%,从高位跌逾3成,现时租金水平开始合理,吸引机构升级。」代理指,亦因租金回调,中环与其他商业区差距收窄,「去中环化」情况放缓。该代理称,现时中环最顶级商厦百餘元,而呎租40至50元区内亦有选择,中环现租客,若现时续租,定比起3年前较为便宜,解释为何去年租务活动少,毕竟搬迁涉及装修费,续租可节省一笔。

截至9月底,中环区甲级写字楼空置率升至7.8%。代理认为,因现时空置楼面仍不少,加上未来两年踏入供应高峰,租金难免受压,「未来新供应,明年有470万平方呎新供应,2023年则有约340万平方呎,实在需时消化,即使成交量增,按每年平均170万平方呎吸纳,也需数年才可消化。估计今年中环租金跌5至10%,明年空置率仍会上升,租金尚有压力。」

(经济日报)

更多遮打大厦写字楼出租楼盘资讯请参阅:遮打大厦写字楼出租

更多国际金融中心写字楼出租楼盘资讯请参阅:国际金融中心写字楼出租

更多中环区甲级写字楼出租楼盘资讯请参阅:中环区甲级写字楼出租

Demand for new homes remains intense

Hong Kong's primary property market frenzy continued over the weekend despite two consecutive months of falling home prices reflected in government data.

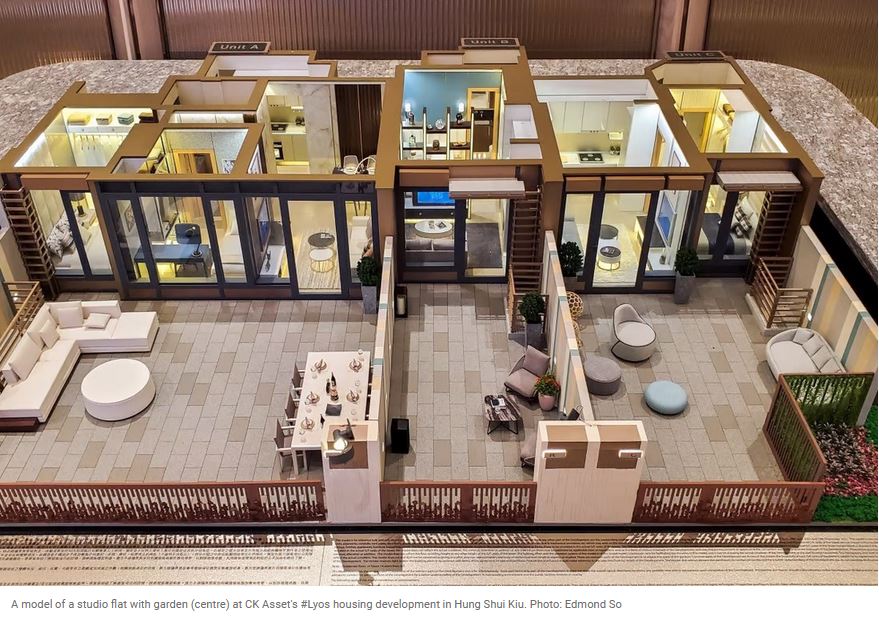

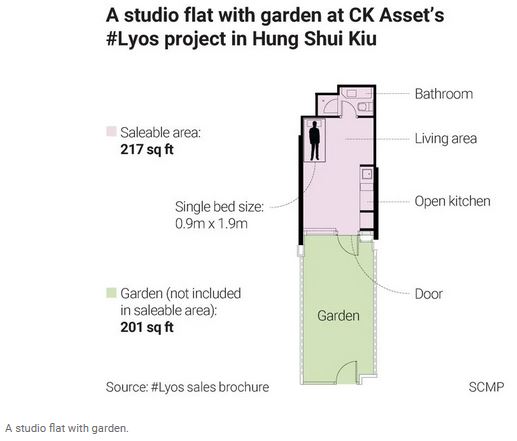

CK Asset (1113) opened a second price list for 62 flats at #Lyos in Yuen Long's Hung Shui Kiu with an average per-square-foot price of HK$15,655 after discounts.

The prices were said by the developer to be roughly the same as for the first batch after taking into account factors such as better views offered.

CK Asset has now received more than 3,000 checks for 150 units and sales are expected to start at the weekend at the earliest.

Elsewhere, Kowloon Development (0034) sold at least 351 out of 438 homes offered in a first round of its Manor Hill project in Tseung Kwan O over the weekend. The developer also said it has struck a deal with the government to exchange a 19,335-square-meter lot at 35 Clear Water Bay Road in Ngau Chi Wan for a New Kowloon lot with a site area of 22,373 sq m.

It is expected to be developed with five residential towers over a retail shopping mall.

Sales are also expected to be launched this month by Sun Hung Kai Properties (0016) at phase two of Wetland Seasons Bay in Tin Shui Wai.

In contrast to the primary market the second-hand sector was sluggish with only nine transactions recorded in a property agency's top 10 housing estates over the weekend, which was down nearly 20 percent on the previous weekend.

The agency also said 150 homes in the estates changed hands in October - a 22-month low that was attributed to the attention going on the first-hand market.

(The Standard)

力宝中心低层呎租49元跌22%

受疫情等因素冲击,核心区甲厦租金弹升乏力,消息指,金鐘力宝中心二座低层单位,于交吉近五个月后,以每呎49元租出,较旧租金下跌逾两成。

市场消息指出,金鐘力宝中心二座低层单位,面积约1151方呎,新以每呎约49元租出,月租约56399元;据地产代理指出,上址对上一手租户于2019年7月以每呎约63元租用,惟单位于今年6月交吉至今,租金亦下跌约22%,惟以现今市道计,上址最新租金已属市价水平。

交吉近五个月

资料显示,该甲厦近期租金备受压力,资料显示,由印尼财团Demonsa家族持有的该甲厦2座中高层1室,建筑面积约1719方呎,以每呎35元租出,月租约6万,此单位望美国银行中心,拥有开扬海景,属于优质单位,租金低市价20%,重返六年前水平。

海富中心中层呎租46元

此外,同区甲厦海富中心亦录承租,消息指,该厦2座中层06室,面积约2064方呎,以每呎约46元租出,属市价水平,月租约94944元。

另一方面,代理表示,尖沙嘴金巴利道25号长利商业大厦17楼全层,面积约4117方呎,以意向价约3500万放售,呎价约8500元,市值呎租约28至30元计,料买家享租金回报约3.9厘。

(星岛日报)

更多力宝中心写字楼出租楼盘资讯请参阅:力宝中心写字楼出租

更多海富中心写字楼出租楼盘资讯请参阅:海富中心写字楼出租

更多美国银行中心写字楼出租楼盘资讯请参阅:美国银行中心写字楼出租

更多金鐘区甲级写字楼出租楼盘资讯请参阅:金鐘区甲级写字楼出租

更多中环区甲级写字楼出租楼盘资讯请参阅:中环区甲级写字楼出租

瑞安中心放售意向价5232万

疫情持续平稳,为市场释出正面讯息,部分业主亦趁势放售旗下物业,其中,湾仔瑞安中心中层单位,以意向价约5232万放售,项目可以买卖公司形式交易,料买家享租金回报逾两厘水平。

料回报逾两厘

有代理表示,湾仔港湾道6至8号瑞安中心12楼09至10室,面积约1804方呎,意向呎价约2.9万,涉及金额约5232万,可以买卖公司形式交易。该代理指,项目以交吉形式出售,单位可望中区商厦景致,附有写字楼全装修,料对买家及投资者均具吸引力。

该代理续称,瑞安中心大部分业权由瑞安及恒隆持有,故市场上可供出售的盘源向来紧絀,是次放售物业属相当矜罕。该代理表示,湾仔北发展前景亮丽,自中环湾仔绕道开通后,已大大改善港岛交通挤塞情况,更缩短中区往返东区的时间,加上港铁沙中綫会展站即将落成,兴建行人园景平台以连接新海滨工程亦进行得如火如荼,湾仔将迎来全新面貌,料将吸引更多跨国及中资企业进驻,核心区商厦的需求预计持续增多,将利好区内写字价造价。谢氏相信,今番放售单位甚具竞争力,而且为大厦罕有放售盘源,料会获用家及投资者踊跃洽购。

望中区商厦景致

据大型代理行资料显示,该商厦近期成交为中层11至18室,面积4250方呎,于2018年3月以1亿售出,呎价约23529元;至于租赁方面,该厦低层01至02室,面积2467方呎,于上月以111015元租出,平均呎租约45元。

(星岛日报)

更多瑞安中心写字楼出租楼盘资讯请参阅:瑞安中心写字楼出租

更多瑞安中心写字楼出售楼盘资讯请参阅:瑞安中心写字楼出售

更多湾仔区甲级写字楼出租楼盘资讯请参阅:湾仔区甲级写字楼出租

更多湾仔区甲级写字楼出售楼盘资讯请参阅:湾仔区甲级写字楼出售

观塘甲厦相连单位易手 用家7100万承接

疫情持续平稳,带动商厦交投转活,市场再录大手成交个案。由亿京发展的观塘道368号高层相连单位以7100万成交,呎价约1.54万,买家购入作业务扩充用途。

由亿京发展的观塘道368号32楼B、C及D室,面积分别为2035方呎、1164方呎及1382方呎,总楼面约4581方呎,获企业以约7100万成交,呎价约15499元,买家购入作业务扩充用途。

平均呎价15499元

该项目早前频录大手成交,资料显示,中国波顿集团早前公布,该公司以约1.56亿购入该项目顶层单位,连同天台部分,面积6869方呎,另天台约1025方呎,呎价约22759元。据公告指,该物业将作为集团于本港的总部,是次买卖将连同项目冠名权,该集团一直于本港租用办公室,购入上述物业可为集团节省租金开支,具潜在资本增值优势。

此外,外号「手套大王」的叶建明及其友人,以4.516亿购入该厦,叶氏购入该厦3层全层特色户,分别为该厦33楼、35楼及36楼全层单位,该项目毗邻港铁牛头角站,受惠屯马綫及快将通车的沙中綫,设有7间商铺及29层写字楼,地库设有3层停车场,提供共140个私家车位和15个电单车位。写字楼单位建筑面积由654至9566方呎,适合不同行业发展,而地面铺位处观塘道。

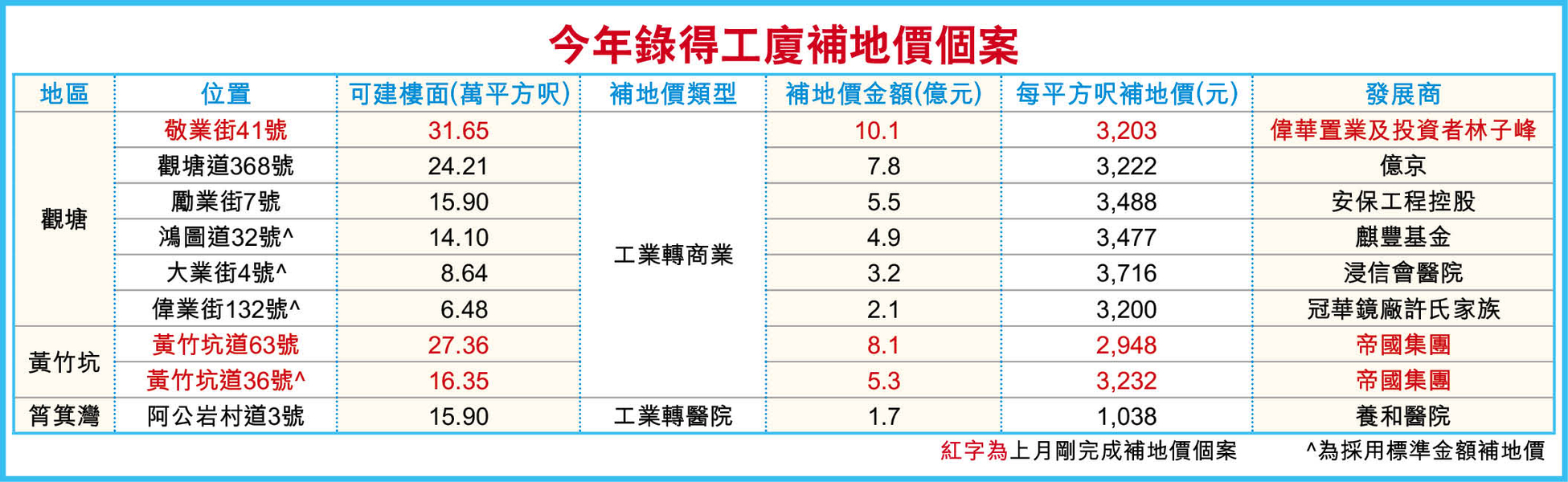

资料显示,该项目前身为英亚工厂大厦,亿京于2017年以13.2亿购入全幢作商厦重建,可建楼面约25万方呎,早前以7.8亿完成补地价。

(星岛日报)

更多观塘道368号写字楼出售楼盘资讯请参阅:观塘道368号写字楼出售

更多观塘区甲级写字楼出售楼盘资讯请参阅:观塘区甲级写字楼出售

尖沙咀长利商业大厦 合中小企

长利商业大厦位处尖沙咀核心地段,邻近各大型商场,而大厦提供数百平方呎细单位,正合中小型公司使用。

长利商业大厦位于尖沙咀区,该大厦属于乙级型的商业大厦,同时属于分散业权的大厦。写字楼单位可提供出租及出售,但近年放租及放售的单位并不多,与同区的商业大厦比较,该大厦的交投量并不活跃。

物业位置处于偏旺地带,交通配套十分齐全,巴士路綫能往返港岛及新界,亦能够步行至天星码头欣赏维港景色,同时设有天星小轮服务往返湾仔及中环,压缩过海时间,此外,港铁尖沙咀及尖东站,由尖沙咀站B1出口步行至8分鐘路程,集合各项交通优势的条件,有助商客以快捷的方式往返各区。

至于配套方面,该厦旁边是美丽华商场及诺士佛臺,该处能提供不同餐饮款式为商客提供良好的餐饮体验,约步行2分鐘便到该处。至于晚上,诺士佛臺一带的酒吧开放,吸引不少顾客光顾进行聚会,让整个地段充满五光十色。

物业在1979年落成,全幢大厦共有16层,设有两部升降机提供让商客往返各楼层,大堂方面属于企理的布局,设有水牌指示,方便商客以最短时间到达目的地,每个楼层的景观都以望市景为主。

每层4000呎 可分间5单位

单位方面,每层面积约4,000平方呎,大致上可分间成最多5个单位,最细单位面积约600平方呎起,故适合中小细公司使用。用户方面,该厦不少楼层由教会佔用,另亦有小型的会计师行、律师楼及教学中心等。

资料显示,长利商业大厦租务情况不俗,新近中层单位面积约1,000平方呎,成交呎租约28元,而于6月一个单位于低层01室,面积约585平方呎,呎租达31元。另今年2月,物业低层2室,面积约1,100平方呎,以约2.53万元租出,呎租约23元。

(经济日报)

商厦9月买卖登记 跌穿百关

有代理表示,股市回落拖累第3季商厦交投回软,期望第四季市况反弹,亦可带动商厦买卖登记渐次回升。

根据土地註册处数据,2021年9月份全港共录91宗商厦买卖登记 (数字主要反映2至4星期前商厦市场实际市况),较8月份的118宗减少23%,除创7个月新低外,亦为期内首度跌穿百宗水平,反映内地整顿产业致令股市大跌带来的影响。

金额跌13% 跌幅相对轻微

虽然9月份登记量挫逾两成,惟金额只跌13%,跌幅相对轻微,当中原因是9月份1亿元或以上商厦登记大增两倍所带动,刺激月内商厦买卖登记金额录约23.67亿元,跌幅相对登记量为少。至于,9月份最瞩目的单一登记项目为荔枝角道888号21楼全层,涉及合约金额逾3.55亿元。

按物业价格划分,在7个价格组别当中,录得6跌1升。在跌幅者中,以5,000万至1亿元以内组别的56%跌幅最剧烈,月内登记量由前月的9宗降至上月4宗;而2,000万至5,000万元以内组别亦挫46%,只录得7宗登记。至于登记量最活跃的是介乎500万至1,000万元以内的组别,月内录得30宗,惟按月亦跌12%,已是相对表现最佳者;至于1亿元或以上的大额登记则成为唯一逆市大升者,月内涨2倍至6宗。

至于以地区划分,在该行观察的11个分区当中,共有6区的登记量按月减少。当中以葵涌区的83%跌幅最惨烈,由前月的6宗挫至上月只有1宗。此外,尖沙咀/佐敦区及上环/中环/金鐘区亦分别只录得8宗及7宗登记,按月各自大跌68%及63%。至于逆市录得升幅最显著者是沙田区,由8月的7宗增至9月的12宗,增幅高达71%;而旺角/油麻地区则为9月份登记量最活跃的观察区,共录20宗登记,按月升54%。

该代理指出,港股在第三季显著回落,加上内地整顿多个行业板块,连带影响本地商厦市道,导致季内买卖登记跌至只有326宗,为本年至今最差的一季。综观10月份截至26日,商厦买卖登记暂时只有约72宗,走势依然缓慢,预料全月登记量维持在80至90宗的低位徘徊;不过后市料在股市回升及施政报告后不明朗因素消除下,最后两个月有望止跌回升,按月重上百宗水平。

(经济日报)

更多荔枝角道888号写字楼出售楼盘资讯请参阅:荔枝角道888号写字楼出售

更多长沙湾区甲级写字楼出售楼盘资讯请参阅:长沙湾区甲级写字楼出售

长沙湾弦雅巨铺意向1.7亿 平均每呎放售价2.8万

疫下民生消费力有增无减,民生区铺位有价有市,租赁及买卖皆稳步上升。长沙湾旺区精品住宅新盘弦雅,地下及1楼巨铺推出放售,面积6068方呎,意向价1.7亿,平均每呎仅约2.8万,该物业同时放租,意向每呎65元。

长沙湾新盘弦雅年内即将落成,该项目地下及1楼共有4间全新铺位放售,包括地铺及复式铺位各2间,建筑面积由1375多呎至1582方呎,门面阔落,内里设有来去水,独立洗手间俱全,适合不同行业,包括近年炙手可热的特色食肆、食材店、健身室以至五花八门的零售及服务行业,可为即将迁入该项目的住客,以至同区内密集的人流,提供生活所需、以及崭新的生活体验。

四个铺位组成 面积6068呎

弦雅属于精品式住宅,对于年轻一代及要求品味生活的优皮士,极具吸引力,该厦地下4个铺位,目前放盘兼同时招租,预期将有4家不同行业,与住客同时间进驻此新居。

此4个铺位合共约6068方呎,对于投资者,极具吸引力,业主意向价1.7亿,以此计算,平均每呎2.8万,代理指,该项目市值呎租65元或以上,新买家预期可收取接近3厘回报。新盘铺位设施簇新,对租客来说,容易打理兼得心应手。

设来去水 独立洗手间

上述铺位还拥有两大优点,铺位四正实用,较坊间一般铺位为实用;超高楼底4.8米,令铺位「高头大马」,事实上,弦雅外形亮丽,成为区内新地标,地铺当然被看高一綫。

上址的1号铺包括地下1582方呎,2号铺地下475方呎,以及另1楼900方呎,兼且拥有同层124方呎的平台露天空间,格外写意,连同平台计算,合共1375方呎,3号铺地下437方呎,另1楼1129方呎,合共1566方呎,4号铺为地下1545方呎。

同时招租意向每呎65元

弦雅位于医局街203号,与港铁南昌站及深水埗站,步行仅约5分鐘,乘搭港铁到柯士甸站、尖东站及西九龙站,分别只有4分鐘、7分鐘及8分鐘;前往中环站及国际机场,需时各为16分鐘及28分鐘;附近更有多条巴士綫来往各区,交通便捷。

(星岛日报)

荃湾立坊巨铺1.42亿易手 投资者持货五个月短炒升值19%

疫情持续平稳,为铺位市场释出正面讯息,市场亦录短炒获利个案。消息指,荃湾立坊巨铺以1.428亿售出,投资者持货仅5个月短炒获利约2280万,物业期间升值19%,买家料享租金回报近4厘。

市场消息指出,荃湾杨屋道118号立坊地铺及基座商场于上月初以约1.428亿售出,项目地铺面积4293方呎,1楼面积约4781方呎,另设平台230方呎,总楼面约9304方呎,呎价约15348元。

帐面获利2280万

据悉,该由现时由地产代理行及连锁便利店及教会承租,以月租收入约47.5万计,料买家享回报近4厘水平。

资料显示,该铺早前由「铺王」邓成波家族持有,早于2019年以约1.3亿购入,于今年5月以1.2亿获另一投资者承接,故当时该家族持货约两年帐面蚀让约1000万,惟该巨铺事隔近5个月后再度易手,该投资者持货仅约5个月帐面获利约2280万,期间升值约19%。

平均呎价15348元

盛滙基金创办人李根兴评论指,上述巨铺位处传统民生区旺段,租金回报近贴近4厘水平,属相当不俗,早前邓成波家族亦以低于市价售出,故该铺被投资者「吼準」趁低吸纳,并随即于市场重新放售,最终成功短炒获利离场。

租金回报近4厘

事实上,铺位市场早前频录投资者短炒获利个案,资料显示,由环亚拍卖董事总经理区蕴聪持有的太子西洋菜南街铺以1100万售出,持货仅2个月帐面获利约350万,该铺由水族馆以2.5万承租,买家料享回报约2.7厘。

曾由邓成波家族持有

此外,由MAPLE时装老闆麦志刚持有的西环卑路乍街22至24A号懋华大厦地下双号铺,面积约1300方呎,早前以约3300万成交,呎价约25385元,持货仅3个月帐面获利约620万,物业升值约23%。

通菜街铺3000万成交

另一方面,市区铺位亦录承接,消息指,旺角通菜街双号地铺,面积约1000方呎,以约3000万易手,呎价约3万,据悉,该铺现时由食肆以约7万元承租,料买家享租金回报约2.8厘。

(星岛日报)

大围村南道巨铺意向4.2亿

疫情持续平稳,为铺市带出正面讯息,部份业主趁势放售旗下物业,有代理指出,大围村南道太安楼巨铺以意向价4.2亿放售,呎价约4.2万,料买家享回报约3厘水平。

平均呎价4.2万

代理指出,有业主现以连租约形式出售大围村南道41至51号太安楼地下B铺连天井及阁楼、地下C铺连天井及阁楼的整笔物业,意向价为4.2亿,以总楼面为9991方呎计,呎价约42038元。

上述物业现时由两家食肆及两家地产代理行承租,以月租收入约105万计,料买家享回报约3厘水平,租约期至2024年届满,上址位处港铁大围站出口,人流畅旺,营商潜力优厚,物业门面阔达65呎,具广告效益。

料回报约三厘

代理称,上述放售物业邻近大围区内大型新盘,加上受未来北部都会区发展策略带动,大围作为新界东龙头重镇,必将受惠于住宅发展及人口增长,故上述放售物业对用家及投资者均具吸引力。

(星岛日报)

屯门三厂厦申重建 涉总楼面63万方呎物流张田氏规模最大 英皇两项目单独发展

屯门区内近期有3幢工厦申请重建为新式工厦,涉及楼面逾63万方呎,当中外号「物流张」张顺宜持有田氏中心第九座最具规模,涉及楼面达41.5万方呎,另外,由英皇国际持有的新安街两幢工厦,拟作单独重建,可建楼面约22.8万方呎。

近年来,屯门工业区变天,最新有3幢旧厂厦申请重建新式工厦,据城规会资料显示,由资深投资者「物流张」张顺宜等人持有的屯门田氏中心第9座 (现址称民生物流中心),拟重建一幢18层 (另设2层地库) 工厦,总楼面面积约41.5万方呎。田氏中心第九座位于屯门洪祥路3B号,佔地约3.64万方呎,城规会文件显示,最新建议把地积比由9.5倍,放宽两成至11.4倍,兴建一幢新工厦,停车场设于部分地面层位置及两层地库,其餘为工作室或仓库等用途,总楼面面积约41.5万方呎。

宽地积比20%重建新式工厦

据市场消息透露,物流张申重建的同时,将该全幢放售,意向价14.8亿,若以重建总楼面计算,楼面呎价3575元,若以现址总楼面约317636方呎计算,平均呎价约4659元,较同区早前易手的东亚纱厂工业大厦,平均呎价4802元为低。物流张接受本报查询,证实该物业放售中。

此外,由英皇国际持有的屯门两幢工厦,分别为新安街13号宝泰工业大厦和15号山龄工业大厦,于去年1月获批合併重建,最新向城规会递交新发展方案,申请将上述两工厦分拆作单独重建,可建总楼面维持22.8万方呎。

据城规会文件显示,两幢工厦地盘面积同为1万方呎,同步申请放宽两成地积比,由9.5倍增加至11.4倍发展,并分别重建为一幢楼高23层 (包括两层地库) 的新式工厦,可建总楼面约113991方呎,即两厦重建后合共可提供约227982方呎工业楼面。

民生物流全幢意向14.8亿

受工厦活化政策带动,鼓励业主将工厦重建或改划,以释放潜在土地供应。据本报统计资料显示,过往数年,屯门区有12宗工厦重建或申请,涉及楼面达213万方呎。

近年区内最大宗成交,为东亚纱厂工业大厦第1期全幢位处河田街2号,由华润物流以22.4亿承接,属今年以来市场上最大宗全幢工厦成交,该全幢楼高15层,总面积约466449方呎,平均每呎4802元。该项目由「铺王波叔」邓成波早于2012年以5亿购入约70%业权,直至2015年统一业权,共涉资近7.8亿,他并向城规会申改装酒店,提供943间房,惟没有成功。

市场消息指,华润物流看中屯门区物流前景,在屯赤隧道通车后,区内前往机场需时不足半小时,有助物流业发展,而且,该厦每层楼面4万呎,属高质素物流仓。目前,逾半幢楼面由一家台湾知名电子公司承租,呎租逾12元,以此计算,现时回报约3厘。由于该厦接近港铁站,步程需时3分鐘,亦有助物流公司更容易聘请员工。

(星岛日报)

快乐蜂呎租75元进驻铜锣湾 新约较高位跌50% 半年斥68万租3铺

新冠肺炎疫情保持稳定,个别行业如食肆重拾扩充步伐。菲律宾连锁快餐店快乐蜂 (Jollibee) 近期乘铺租低迷而积极租铺扩充,不足半年内连环租用3个铺位,月租共约68万元。当中,更首度进驻核心零售区铜锣湾,以每月约20万元租用新基商业中心地铺,租金较高位下跌50%。

据了解,快乐蜂由今年5月开始积极租铺,近月已相继租用铜锣湾、湾仔及元朗3个铺位。其中较瞩目为租用铜锣湾怡和街56至58号新基商业中心地下,建筑面积约2669方呎,快乐蜂以每月20万元租用,呎租仅约75元。此铺邻近维多利亚公园,每逢假日都有大量外籍家庭佣工在附近聚会,料可吸引不少目标客源,而铺位毗连则为另一家美式连锁快餐店麦当劳。

上述新基商业中心的地铺,原由个人护理产品连锁店万寧承租多年,高峰期每月租金曾高达40万元,在去年底约满后结业。铺位丢空多时,一直以约21万元叫价放租,最终放租超过半年后租出,租金较高位大跌20万元或50%。

元朗店月租比旧约减6万

今年5月,快乐蜂在邻区湾仔租用湾仔道138号地下,建筑面积约2130方呎,月租约10万元,呎租47元。快乐蜂在湾仔区轩尼诗道原本有一间分店,但该铺为地库物业,是次在同区增设地铺分店。

据悉,该铺原由食肆承租,月租为18.7万元,租期本身在今年7月才届满,但早于去年3月该食肆已提早结业。由于铺位丢空已超过一年,因此业主愿意接受大幅议价,以每月10万元出租,较旧租大减8.7万元或46.5%。

快乐蜂最新亦首度进驻「大西北」,在元朗租入铺位开新分店,该铺位于元朗大马路50号丰裕轩地下入口连1楼全层,建筑面积约8567方呎,月租约38万元,呎租约44元。

铺位前身由连锁快餐店大快活 (00052) 租用约6年,在今年8月租约期满迁出,最后一份租约月租为44.29万元。最新月租较旧租每月减少6.29万元,跌幅14.2%。

重拾扩充意欲 全港拥13店

快乐蜂过去数年一直处于扩充状态,连同最新租用的3间铺位在内,全港将有13间分店。但该品牌在2019年一度租用大围及葵涌两铺后,或因受疫情打击,去年完全没有新增任何据点。今年疫情转趋稳定,餐厅恢復堂食,加上租金再大幅下降,令快乐蜂重拾扩充意欲。

有外资代理行早前发表报告指出,餐饮业持续带动零售业復甦,餐饮业租金连升两季,其中四大核心区之一的铜锣湾餐饮业铺租在第三季上调2.6%。该行预期,今年最后一季铜锣湾的餐饮业租金增幅有望最多达3%,租金表现可跑赢零售业只有2%以内的涨幅。

(信报)

US firms with HQs in HK plunge to 18-year low

The number of American companies with regional headquarters in Hong Kong has fallen to an 18-year low, while the number of start-ups in the city surged to a new high.

There were 254 American companies with regional hubs in Hong Kong as of June 1, compared with 282 a year earlier, according to new data from the Census and Statistics Department.

That marked a 10 percent drop from the previous year and the lowest number since 2003, when there were 242 American companies based in the city, Bloomberg reported.

At the same time, the number of mainland Chinese firms rose by 5 percent last year to 252. Mainland Chinese and American firm now account for an equal share - 17 percent - of regional headquarters in the city.

US President Joe Biden issued a business advisory in July warning American companies operating in the Asian financial hub of a "new legal landscape" under the national security law that "could adversely affect" their operations.

Two months earlier, more than 40 percent of members surveyed by the American Chamber of Commerce in Hong Kong said they might leave the city, with the new security law topping their list of concerns.

The imposition of the law collided with Hong Kong's strict Covid-containment policies that require citizens to spend as long as 21 days in a hotel quarantine, even if fully vaccinated.

The European Chamber of Commerce has voiced its members' frustration over doing business in an environment that thwarts international travel. The number of French, German and Italian firms headquartered in the city also fell in the year leading up to June 1.

When pressed last month on whether her government would ease pandemic controls, Chief Executive Carrie Lam Cheng Yuet-ngor made her priorities clear.

"Of course, international travel is important, international business is important," she said. "But by comparison the mainland is more important."

Meanwhile, Hong Kong grew the overall number of start-ups by 12 percent to a record high of 3,755 from 2020. A survey by Invest Hong Kong showcased the positive impact across the job market with the number of staff hired by start-ups rebounding by 29 percent year-on-year.

Key factors driving start-ups to set up in the city were accessibility to international or regional markets, business opportunities in the mainland, access to funding, the simple tax system and low tax rate.

(The Standard)

More flats set to hit the market

CK Asset's (1113) #Lyos in Hung Shui Kiu is expected to launch more units today and kick off sales on Saturday.

The developer has uploaded the second price list, offering 62 units, after the project received over 1,000 cheques. The cheapest flat, covering 205 square feet, costs nearly HK$3.96 million.

Meanwhile, Sun Hung Kai Properties (0016) plans to reveal the price list of the second phase of Wetland Seasons Bay in Tin Shui Wai soon and launch sales next weekend, of no less than 78 units.

In secondary sales, a 944-sq-ft four-room flat at the Wings II in Tseung Kwan O sold for HK$18.8 million after the owner slashed the asking price by 10 percent, making the average price HK$19,915 per sq ft.

In the commercial end, a shop of H Cube at No 118 Yeung Uk Road, covering 9,580 sq ft, was sold for HK$142.8 million last month.

This came around four months after the family of Tang Shing-bor - known in Hong Kong as the "Shop King" - sold the property for HK$120 million in July. The sale marked a paper gain of HK$22.8 million in four months, or a 19 percent gain on the investment.

(The Standard)中环皇后大道中九号全层呎租70元 交吉七个月租出重返六年前水平

甲厦租金急跌下,逐渐带动租赁,近期核心区甲厦纷录承租,其中,中环皇后大道中九号低层全层,于丢空逾7个月后,以每呎约70元租出,最新月租约96万,租金重六五年前水平。

上址为皇后大道中九号4楼全层,建筑面积13721方呎,市场消息透露,刚以每呎70元租出,月租约96万,上址旧租客为医疗集团,于2016年沽售物业时,售后租回,当时呎租为70元,签下长约,该医疗集团于今年3月约满迁出单位,业主以每呎75元放租,至今丢空约7个月,最终减幅约6.6%,获新租客进驻,最新租金重返2016年水平。现时业主于2016年以3.7亿购入物业,最新回报约3.1厘水平。

每月租金96万

业内人士指,于2017年及2018年商厦高峰期,皇后大道中九号呎租普遍逾100元,即使于2019年,政治事件引发动乱期间,皇后大道中九号仍能力保100元水平,有代理行资料显示,该厦1个高层单位,建筑面积约2378方呎,于2019年去年11月以每呎100元租出。最新租金较高峰期跌逾30%,比较金鐘及上环甲厦租金普遍高位回落50%,皇后大道中九号抗跌能力较为高,只因单位供应少,而且位处中环市中心,位置上胜一筹。

回报逾三厘

去年4月,该厦录一宗低价承租,皇后大道中九号中低层6室,面积约2269方呎,望新显利大厦楼景,以每呎57.5元租出,根据代理提供资料,该单位于2015年8月以每呎58元租出,去年租金重返2015年水平。

市场消息透露,湾仔新鸿基中心多个单位,面积由2134方呎至11946方呎,近期先后租出,平均呎租50至52元,属市价水平。

另一代理行资料显示,9月份港岛区整体甲厦空置率约10%,接近历来新高水平,按月上升0.21个百分点,按年大增1.83个百分点。核心商业区中以金鐘表现最疲弱,最新空置率按月升0.23个百分点至约9.02%,为核心商业区中最高。该行认为,虽然疫情缓和,但全面通关未有具体措施及日期,商厦缺乏中资及外资支持,预计短期内租售价受压。

(星岛日报)

更多皇后大道中九号写字楼出租楼盘资讯请参阅:皇后大道中九号写字楼出租

更多新显利大厦写字楼出租楼盘资讯请参阅:新显利大厦写字楼出租

更多中环区甲级写字楼出租楼盘资讯请参阅:中环区甲级写字楼出租

更多新鸿基中心写字楼出租楼盘资讯请参阅:新鸿基中心写字楼出租

更多湾仔区甲级写字楼出租楼盘资讯请参阅:湾仔区甲级写字楼出租

上月录482宗工商铺买卖

短期内未有重大利好消息,工商铺交投平稳。有代理行综合土地註册处资料显示,10月份工商铺录482宗买卖,按月微跌6%。受多宗大手成交带动,金额则录79.99亿,按月升3.9%。近日股市波动,中港通关未见明朗化,资金仍充裕,预计后市交投维持约500宗水平。

代理:宗数按月微跌6%

10月份工商铺各板块註册宗数全綫按月下跌,工厦最新报272宗,按月减少0.4%。商厦及商铺分别按月跌10.5%及13.7%,最新分别录85及126宗,整体宗数482宗,是近7个月以来首次跌破500宗水平,按月跌约6%。受大额成交带动,金额按月升约3.9%,录79.99亿。

共录六宗逾亿买卖

若按金额划分,最多为500万或以下物业,共录226宗,按月微跌约0.9%。其次为逾500万以上至1000万物业,共录118宗,按月微跌约4.1%。逾2000万至5000万宗数跌幅最大,按月跌27.6%,共录42宗登记。逾5000万至1亿表现最好,宗数按月跃升92.9%,共录27宗。10月份共录6宗逾亿买卖,按月减5宗,商厦及铺位各佔3宗,其中商厦成交更涉资逾20亿,包括长沙湾荔枝角道888号19至20楼全层及29至31楼全层,分别以约6.79亿及约11.88亿成交,而铺位成交包括以约1.5亿成交的何文田窝打老道84号冠华园地铺。

(星岛日报)

更多荔枝角道888号写字楼出售楼盘资讯请参阅:荔枝角道888号写字楼出售

更多长沙湾区甲级写字楼出售楼盘资讯请参阅:长沙湾区甲级写字楼出售

共享空间品牌IWG 拓第6据点

近年积极扩充的经营共享办公室的IWG集团再拓据点,集团指,将于铜锣湾 Tower 535 开设Spaces在港的第6个中心,新址总面积达2.34万平方呎,计划于2022年1月开放。

是次涉及租用楼层为 Tower 535 的11楼及12楼全层,据了解,该批楼面原由共享空间办公室品牌WeWork租用,该品牌早年大手租用物业8层合共约9万平方呎楼面,早前全数迁出,现由另一品牌顶上租用其中两层。

(经济日报)

更多Tower 535写字楼出租楼盘资讯请参阅:Tower 535 写字楼出租

更多铜锣湾区甲级写字楼出租楼盘资讯请参阅:铜锣湾区甲级写字楼出租

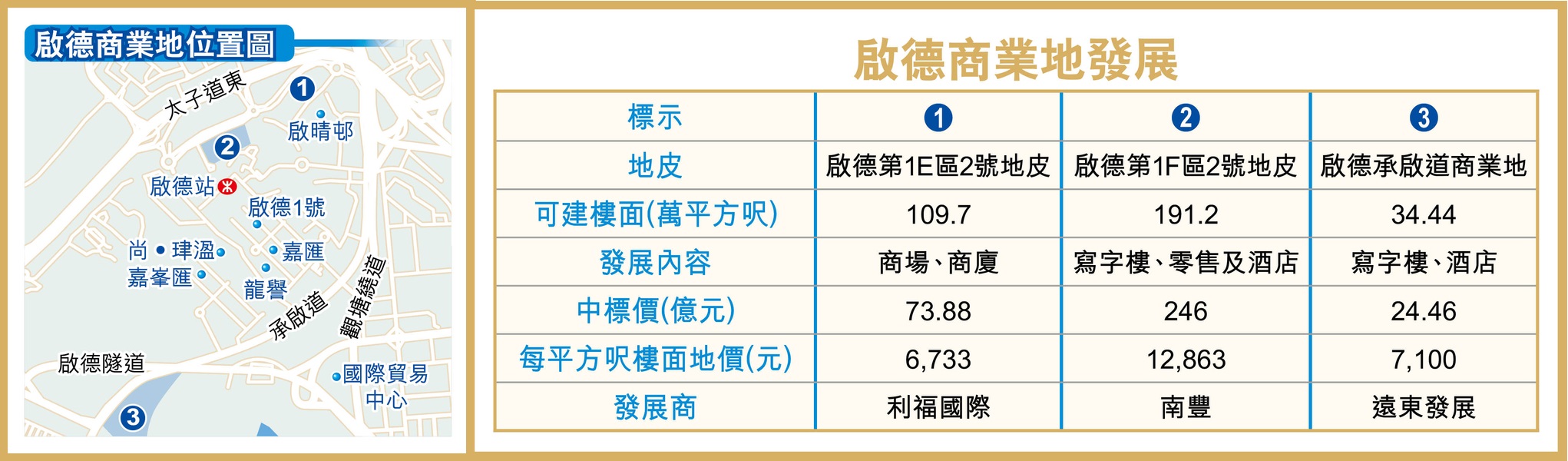

啟德3商业项目 最快明年落成

受惠啟动东九龙计划,加上港铁屯马綫已经全綫通车,区内的住宅及商业发展渐趋成熟,多个商业项目的发展如火如荼。以近年批出的3幅地皮计,可为啟德增加335万平方呎的商业楼面。而该区瞩目的地下购物街,其中一段亦望明年落成。

啟德地下街 备24小时无障碍通道

政府近年大力发展啟德区,而随基建逐渐落成,商业项目发展迅速,其中啟德地下购物街正积极推行。根据规划署及土木工程拓展署向区议会递交的文件显示,按照大纲图,前北面停机坪将会兴建长约1,500米的地下购物街,东段长约400米接驳新蒲岗及港铁啟德站,西段长约1,100米,并由港铁啟德站伸延至宋皇臺站及九龙城。地下购物街的行人走廊将设24小时无障碍通道,并设有出入口方便市民往返新蒲岗、九龙城、啟德站及宋皇臺站。如与日本大阪心斋桥的长堀通 (クリスタ长堀) 地下街相比,长堀通地下街长约730米,意味啟德地下购物街,比大阪的长约1倍。

值得留意的是,拟建的地下购物街有横跨上周最新宣布改划为住宅地的商业地,而鑑于地下购物街会途经不同发展用地,政府会于卖地条款要求发展商兴建、管理及营运发展用地内及邻近的地下购物街。

南丰AIRSIDE 料明年第4季开幕

同时,若计入近年区内批出的3幅商业地,将可为啟德提供逾335万平方呎商业楼面,项目相继在明年陆续落成,当中规模较大、南丰旗下的啟德商业地标项目AIRSIDE,预计明年第四季正式开幕,总投资额达约320亿元。该项目楼高47层,提供逾191万平方呎的多用途商业空间,其中商厦佔约120万平方呎,10至47楼为写字楼,每层面积约3.2万至5.3万平方呎。发展商曾表示,项目的地库至9楼为零售楼层,合共涉及约70万平方呎楼面,当中将预留3成楼面作餐饮,并已获MCL戏院承租,将提供7个影院,涉约1,100个座位。

此外,由利福国际 (01212) 于2016年以约73.88亿元投得的啟德第1E区2号商业地,亦将变身为两幢楼高18至19层的双子塔式商厦,并设4层地库,涉及总楼面逾109万平方呎,当中9成楼面作零售用途,其中1幢亦会发展为大型百货公司崇光 (SOGO) 分店。据公司中期报告表示,上述项目预计于2023年营运。

另外,由远东发展 (00035) 于2019年以约24.46亿元投得的承啟道商业地,将会发展为酒店及写字楼,提供约400个酒店房间,及12层高 (计入地库) 的写字楼及零售商厦,预计于2024年落成。地皮比邻日后啟德体育园主场馆,涉及总楼面约34餘万平方呎。

(经济日报)

西营盘旧楼强拍底价3.7亿

近年港岛区地皮供应罕有,区内旧楼物业频获财团併购,由财团申请强拍的西营盘保德街1至7号旧楼,最新获土地审裁处颁下强制售卖令,底价约3.77亿,对比2019年9月申请强拍时市场估值逾2.37亿,高出1.4亿或59%。

据土地审裁处文件显示,该财团最新持有82.05%业权,餘下4个地铺及3个住宅单位并未成功收购。

可建楼面约2.7万呎

判词中亦提到,基于现有楼宇楼龄较高,目前大厦维修状况不佳,部分混凝土可能已经受损,钢筋亦出现不同程度的锈蚀,而且建筑设计在许多方面已经过时,部分设施未能符合现代安全标準和法定要求,加上翻新成本与维修费用不成比例,再者申请人已採取一切合理步骤取得全部业权,故批出强拍令。

上址现为1幢楼高8层商住旧楼,地下为商铺,楼上为住宅,早于1966年落成入伙,至今楼龄约55年;地盘面积约3005方呎,项目属于999年期的「千年地契」,重建无用途限制,若以地积比约9倍重建,预计可建总楼面约27045方呎。

项目位处保德街及山道交界,属大单边位置,而且邻近港铁香港大学站,步行前往约5分鐘步程,出入便利,极具重建价值。

石塘咀工厦申建商厦

近年不少工厦申请重建发展,其中,西营盘石塘咀德辅道西380号,新近向城规会申请重建为一幢楼高23层的商厦,可建总楼面约22476方呎。

据城规会文件显示,上述项目现时属「住宅 (甲类) 6」地带,拟议办公室及商店及服务行业发展;地盘面积约1498方呎,拟议地积比15倍发展,以重建一幢楼高23层 (包括3层平台) 的商厦,涉及可建总楼面22475方呎。

申请人指,项目属住宅甲类用途地带,而写字楼用途属第二栏,故需作出规划申请,而且上述申请符合规划意向,拟议方案不会引致土地用途不协调问题,亦防止「纳米盘」发展。

(星岛日报)

武夷1.28亿放售土瓜湾商住地盘

近期投资市场表现不俗,有财团趁势放售物业,由武夷集团持有的土瓜湾北帝街一个地盘,佔地2132方呎,意向价1.28亿。

上址为北帝街105至105A号地盘,佔地面积约2132方呎,属甲类地盘,住宅地积比约7.5倍,非住宅约9倍,若以9倍计算,可建总楼面为19188方呎,最高建筑物高度为主水平基準以上100米,以叫价1.28亿计算,平均楼面呎价6671元。

佔地面积2132方呎

代理表示,近年土瓜湾大变天,各大财团于区内大肆发展,有投入市建局项目,亦有收购旧楼,随着项目重建,令旧楼焕然一新,上址地盘适宜发展精品商住楼,地盘所位处的北帝街,附近设施一应俱全。

平均楼面呎价6671元

月前,恒基以81.89亿夺得区内庇利街/荣光街重建项目,每方呎楼面地价约1.14万,项目横跨庇利街、荣光街、环安街等街道,地盘面积约7.97万方呎,可建总楼面约71.75万方呎,预计提供约1150个住宅单位,面积最少约300方呎,一半单位不少于约480方呎,另有约100个车位的公眾停车场。目前,区内尚有市建局鸿福街/银汉街项目招标,鸿福街1至51号 (单数) 及银汉街2至42A号 (双数),地盘面积约49310方呎,可建总楼面约443789方呎,预料可提供约750伙,市场估值约59.9亿至62.1亿,每方呎楼面地价约13500至14000元。

(星岛日报)

新世界12.8亿 购铜锣湾旧楼2成业权

成功收购后业权料逾8成 达强拍门槛

铜锣湾黄金地段具重建价值,获财团高价收购。较早前英记茶庄等标售铜锣湾波斯富街旧楼项目约2成业权,结果获财团以12.8亿元购入,呎价逾10万元。据了解,新买家为新世界 (00017),成功收购后业权料增至逾8成。

铜锣湾波斯富街一綫街旧楼收购战见突破,资料显示,铜锣湾利园山道23、25号 (部分)、波斯富街72号及波斯富街74号(前段)的4间地铺,及16个分布于同厦1至5楼的16个住宅单位,早前透过招标出售,当时估值约18亿元。据土地註册处资料显示,该批单位近日以12.8亿元沽出。据了解,是次涉及楼面合共约1.2万平方呎,当中涉及4地铺,而铺位价值甚高,整批物业收购呎价约10.6万元。

翻查资料,利园山道23号地铺业主为投资者张实来等人,而另一间波斯富街72号地铺则由英记茶庄陈树源、陈根源等持有。

地段重建价值高 掀收购战

位于希慎广场后面跟时代广场之间的利园山道5至27号、波斯富街54至76号,以及罗素街60号的旧楼群,佔地约2万平方呎地盘,可重建成30万平方呎楼面。由于位处铜锣湾最黄金地段,加上面积庞大,重建价值极高,早在2013年获财团「插旗」收购,但同时亦有多批投资者、发展商「落钉」,形成收购战。

据了解,是次项目由新世界或有关人士购入。集团本身已拥有逾6成业权,如今以12.8亿元购入该批单位,取得关键的两成业权后,估计已成功收购逾8成业权,换言之,已达8成强拍门槛,可望加快收购进度。

事实上,现时未获收购的小业主不乏名人、发展商等,包括英皇在2011年以3.8亿元购入波斯富街76号地铺,当时正值自由行旅客高峰期,商铺租售价每年拾级而上,该铺呎价高达63万元,成为当时全港「呎价铺王」。

另外,罗素街60号地下B号铺,面积约1,100平方呎,则由「小巴大王」马亚木持有。由于该地段地铺业主多属实力业主,相信仍有一轮磋商。

(经济日报)

更多希慎广场写字楼出租楼盘资讯请参阅:希慎广场写字楼出租

更多时代广场写字楼出租楼盘资讯请参阅:时代广场写字楼出租

更多铜锣湾区甲级写字楼出租楼盘资讯请参阅:铜锣湾区甲级写字楼出租

德辅道西蚊型地申改建23层商厦

市区可供发展的土地不多,部分划作住宅用途的蚊型地盘,部分发展商寻求改为兴建商业楼宇。有财团近日向城规会申请,在西环德辅道西380号兴建1幢不多于23层的商业楼宇,总楼面面积约2.25万方呎。

地盘狭长 不宜起住宅

该申请由「祥发置业有限公司」提出,涉及德辅道西380号,佔地仅约1498方呎,规划上属「住宅 (甲类) 6」用途,位于私人住宅屋苑维港峰对面,现时是一幢楼高4层的住宅楼宇。城规会文件显示,该公司建议把上址重建为1幢23层商业楼宇,最低的3层平台作为零售等用途,其上则提供写字楼单位,预计2024至2025年落成。

该公司解释,地盘形状狭长,而邻近地段业权分散,在有限预算和时间下难以把德辅道西380号地盘,合併邻近地段发展,若单以该地盘建住宅,估计只能兴建1幢12层住宅楼宇,提供9个平均面积仅145方呎单位,生活环境不理想,加上採光和消防等方面限制等,认为该地盘不适合作住宅发展。

(信报)

The Arles rolls out 272 more flats

The sixth price list of the Arles in Fo Tan was unveiled by Centralcon Properties yesterday, offering 272 flats priced from around HK$5 million.

With sizes ranging from 228 square feet to 850 sq ft, the list includes 10 special units with rooftops, 32 studios, 70 one-bedroom units, 41 two-bedrooms, 74 two-bedrooms with studies, three units of three bedrooms, and 52 three-bedrooms with studies.

The average discounted price is HK$16,432 per sq ft if the maximum discount of 15 percent is applied.

The developer has cashed in about HK$7 billion so far as the project sold around 690 flats in October, which accounted for nearly 80 percent of the total number of flats for sale.

In Kai Tai, Wheelock Properties's Monaco One will open the price list of more than 99 flats, covering from one-room to three-room units in a day, and kick off the sales next week.

The selling prices will be at a similar range as Monaco and Grand Monaco in the same project, as well as the neighboring newly-developed residential properties, said executive director Ricky Wong Kwong-yiu. For reference, the average discounted price for Grand Monaco, which launched in February, is HK$23,795 per sq ft.

In Tseung Kwan O, Manor Hill by Kowloon Development (0034) was set to launch the second round of sales this weekend offering at least 312 flats, after the second sales arrangement was out yesterday.

The developer has sold 80 percent of the 438 flats in the first round, cashing in around HK$2.1 billion.

Over 4,000 checks have been received as of yesterday, said the developer, adding that more studio flats will be offered in the upcoming round of sales since the studios launched the first round was sold out very quickly.

(The Standard)

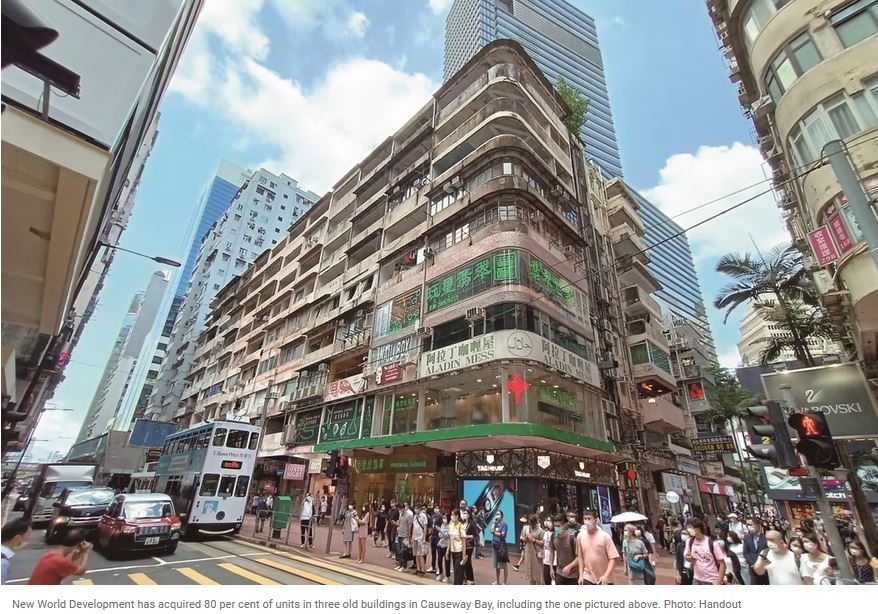

New World Development pays US$164.5 million for 20 per cent stake in three old buildings in prime Hong Kong area

New World Development now owns an 80 per cent stake in three rundown eight-storey buildings in Hong Kong’s prime Causeway Bay area

The price was about 29 per cent lower than the market expectation of HK$1.8 billion

New World Development has acquired a further 20 per cent ownership in three dilapidated buildings in the heart of Causeway Bay for HK$1.28 billion (US$164.5 million), according to people familiar with the matter.

The price was about 29 per cent lower than the market expectation of HK$1.8 billion, analysts said.

The latest acquisition takes New World’s ownership to 80 per cent in the three eight-storey buildings close to Russell Street, once the world’s most expensive retail location.

Under the Land (Compulsory Sale for Redevelopment) Ordinance, developers can force a compulsory auction to buy the remaining stake in a building, if it is over 50 years old and they already own at least 80 per cent.

The four ground-level shops and 16 flats in the buildings at the intersection of Percival Street, Russell Street and Lee Garden Road sold for HK$1.28 billion, Land Search Online records show.

The company must have paid between HK$140,000 to HK$150,000 per square foot for the shops and HK$15,000 per square foot for the flats, property agent said.

“The developer will probably redevelop the site into a commercial property considering the prime location, which could sell for HK$40,000 per square foot,” the agent said.

New World Development declined to comment.

The 20 per cent ownership share in the three buildings comprised 2,500 sq ft of street level shops and 7,000 sq ft of residential space, according to another property agency.

“We are optimistic about Causeway Bay definitely,” agent said. “The overall market demand for such prime property never stops.”

The deal came as overall property transactions in Hong Kong, including residential, commercial and industrial properties, as well as parking spaces, fell to a nine-month low of 6,250 in October, Land Registry data showed on Tuesday. The number of transactions fell 15.5 per cent month on month compared to 7,400 in September. A total of 6,212 deals were concluded in January.

The drop follows a 0.4 per cent decline in the lived-in home price index to 396.3 in September, data from the Rating and Valuation Department showed. It was the steepest fall since October 2020 when it retreated by 0.5 per cent. It was also the second consecutive monthly decline since the index touched a record high of 397.7 in July.

Meanwhile, another property agency said that overall property transactions in the first 10 months stood at the highest level in four years at 81,818 versus 83,815 in the corresponding period in 2017, before the market was hit by the ensuing US-China trade war, social unrest and coronavirus pandemic. The agency said it expects the full-year total to mark a nine-year high at some 95,000.

Another agent said that they expects that deals to rise by some 20 per cent to 7,450 in November on the back of more property launches.

On Saturday, CK Asset will offer 220 flats at #Lyos in Hung Shui Kiu in the New Territories. Sun Hung Kai Properties, meanwhile, priced the first batch of 98 flats at phase two of Wetland Seasons Bay at HK$14,708 per square foot on Tuesday.

“The market response has been quite positive after the release of [chief executive’s] policy address, clearing some uncertainty,” agent said.

(South China Morning Post)

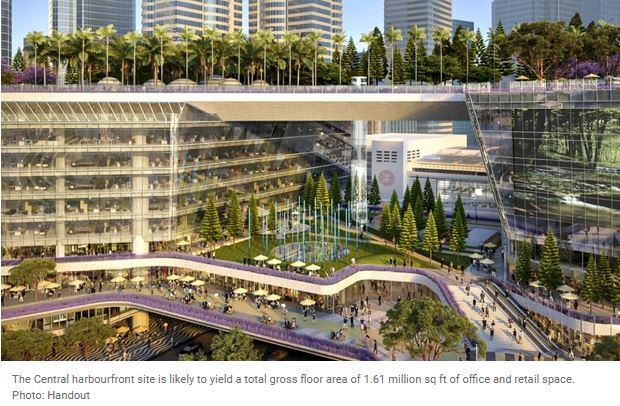

恒地508亿夺中环商地 港历来最贵

中环新海滨商业地由恒地 (00012) 以508亿元独资夺得,成本港最高价新地王,每平方呎楼面地价约3.1万元,总投资额630亿元,将以「桥」为概念打造成地标式商场及商厦,成中区新地标。

李家诚:总投资额630亿 打造世界级地标

被视为超级地王的中环新海滨3号用地,发展局昨日公布,以「双信封制」(因政府重视用地建筑设计,故此要求发展商以独立信封分别提交设计建议书和价格建议书,而非价高者得) 方式批予恒地旗下国基发展有限公司,其在价格建议和非价格建议的得分均是最高,总分共得100分。

恒地标书出价508亿元,将会打破新地 (00016) 在2019年,以422亿元夺得西九高铁站项目纪录,成为全港历来最贵价地皮,属于市场估值范围内。若以项目商业楼面161万平方呎计算,每平方呎楼面地价约3.1万元,虽然低于美利道地王 (现为商厦THE HENDERSON) 的每平方呎5万元。市场人士指,地皮地价合理,为写字楼部分较美利道项目为低。

恒地4年斥740亿 夺中环两地

连同在2017年以232.8亿元投得美利道地皮,恒地在4年内以740亿元连夺两幅中环商业地王,两幅地皮合共总投资额达890亿元。

恒地集团主席李家诚称,将投资630亿元打造项目成为世界级地标建筑、朝气蓬勃海滨长廊及为公眾提供大量日常享用的活动空间,将显著提升恒地在中环国际商务中心地位,连同THE HENDERSON (艺术) 和H CODE (娱乐),组成恒地多维平台,将中环海岸綫转变为标誌性国际枢纽。

发展局则指,政府的愿景是将3号用地打造成香港的崭新地标,一个以人为本、着重可持续发展和城市设计,以及与四周环境融合的典范。

政府接6标书 4份不合格

项目在6月份截标时,接获6份标书,来自恒地、新地 (00016)、长实 (01113)、信置 (00083) 伙拍招商局置地及鹰君 (00041) 财团、港铁 (00066) 伙拍九仓 (00004) 及华懋财团等,但最终有4分标书未能在两部分达到合格要求,故此最终只有两份标书被视为符合要求。

至于恒地的标书被评为「100分」,意思其实不是指标书满分,而是正如政府所指「在价格建议和非价格建议的个别评审中,表现最好的标书会获取满分」。

按照恒地规划,3号用地总数约160万平方呎楼面,零售、餐饮和娱乐空间等用途将会佔94万平方呎,将会较ifc商场 (58万平方呎)更大6成,其核心为一个6层高的水族馆,另外提供约66万平方呎办公室楼面,将分为两期发展,分别在2027及2032年落成。

据代理行最新资料显示,中环甲厦空置率,升至7.8%,为近年新高。租金方面,中环超甲厦呎租,亦由高峰期回调2至3成,目前中环指标超甲厦国际金融中心二期,近日成交呎租约120至140元,而交易广场呎租则约120元。

(经济日报)

更多国际金融中心写字楼出租楼盘资讯请参阅:国际金融中心写字楼出租

更多中环区甲级写字楼出租楼盘资讯请参阅:中环区甲级写字楼出租

顶尖购物商场94万呎规模超IFC

中环民耀街新海滨3号商业地王 (下称新海滨3号地) 刚由恒地 (00012) 以508亿元投得,成为卖地表历来造价最贵的地皮。发展商将兴建3座建筑物,总建筑面积约161.46万方呎,当中有94万方呎为商场楼面,规模较同区主要商场国际金融中心 (IFC) 商场大17.5%。整个项目分两期发展,第一期将于2027年完成。

恒地表示,新海滨3号地王项目势成为中环核心区和海滨的重要接驳,计划发展成一个综合用途地标,该用地分两期发展,第一期预料于2027年落成,包括约27万方呎写字楼楼面、34万方呎零售、餐饮和娱乐空间,以及约900个停车位。

分两期发展 最快2027落成

第二期将于2032年完成,提供约39万方呎写字楼楼面、60万方呎零售空间和连接港铁中环站的地下通道。

项目落成后,将提供94万方呎商场,较邻近的国金中心商场总面积共80万方呎,多出约17.5%楼面。恒地形容,未来该顶尖购物商场集艺术、雕塑、自然、文化和剧场于一身,其核心为一个6层高的水族馆。

除了建筑物楼面面积外,恒地拟创造超过30万方呎的都市公园空间连接中环和海滨长廊的林荫大道、重置天星小轮鐘楼及相关的广场空间,供市民24小时使用。

市场人士指出,现时区内超甲级写字楼如国际金融中心二期 (IFC 2) 的呎租约130至150元,与高峰期相比下跌逾三成;至于国际金融中心商场最新零售铺位呎租介乎400至600元。以此推算,区内商场的铺位呎租,较写字楼呎租高出1倍以上。

超甲厦呎租回升 气氛利好

有代理称,新海滨3号地的地皮剪裁及设计,「相信比较适合做零售,而近海位置可打造特色高档餐饮」。

该代理又说,写字楼市场近期虽然低迷,但已有低位回升跡象,未来粤港澳大湾区的发展大趋势下,中资企业对中环超甲级写字楼的需求只会有增无减。

有测量师提到,今年中环写字楼及商铺租赁市场渐见改善,为发展商增添发展此项目的信心。

今年首7个月,中环甲级写字楼租金回落3.3%,惟已于8月开始连续两个月回升,累积涨0.7%,呎租重返90元以上水平,可见市场逐渐呈现復甦跡象。

(信报)

更多国际金融中心写字楼出租楼盘资讯请参阅:国际金融中心写字楼出租

更多中环区甲级写字楼出租楼盘资讯请参阅:中环区甲级写字楼出租

恒地逾四年中环押注890亿

政府近年先后批出两幅中环核心区瞩目商业地王,均由恒地 (00012) 独资摘下,以该两幅地皮地价连建筑费的总投资额计算,恒地约4年半时间,已于中环押注890亿元。

恒地率先于2017年5月击败8个对手,以232.8亿元中标中环美利道商业地王,按照该地皮的总楼面面积约46.5万方呎计算,楼面呎价高达50064元,至今仍属本港卖地史上楼面呎价最贵的地王。

恒地当时预算该项目总投资额逾260亿元,将兴建优质写字楼连商铺,并于今年7月宣布把项目命名为The Henderson,预告2023年落成,已获拍卖行佳士得预租其中4层。

政府地价收入逾1251亿超标

事隔4年半,恒地昨再以508亿元投得中环新海滨3号地,楼面呎价31463元,虽较The Henderson的楼面呎价低37.2%,但已是本港卖地表商业地的楼面呎价次高。以新海滨3号地的总投资额逾630亿元计算,意味恒地在该两幅中环地皮上的总投资额逾890亿元。

恒地近月抢地意欲积极,今年9月才以81.89亿元中标市区重建局红磡庇利街/荣光街重建项目,预计可兴建约1150个住宅单位。该项目连同刚中标的新海滨3号地,恒地在不足3个月时间,共斥资接近590亿元投地。

另外,新海滨3号地的地价,是政府本财政年度地价收入能否达标的关键,综合地政总署和市场资讯,本财政年度透过官地招标和补地价等的地价收入料超过1251亿元,已超越今年2月《财政预算案》估算的976亿元约28.2%。

(信报)

代理:中环商业地批出 料带动港岛甲厦空置情况改善

中环新海滨3号商业地以天价508亿元由恒地 (0012) 夺标,有代理表示,面对近期经济环境及疫情影响,今次新海滨地皮的中标价相对合理,亦符合市场预期,相信将会利好写字楼长远发展。该代理又指,随著今次中环新海滨地皮公佈中标价,将会带动到港岛区特别是中环及金鐘一带的商厦吸纳情况,加上通关在即的因素推动下,将会加快中资及外资入市步伐,预料短期内港岛甲厦空置情况改善幅度会更大,同时,中标消息对本呈胶著状态的港岛区商厦买卖市场有正面帮助,预料个别洽购中的商厦买卖个案将会加快落实,买卖价亦会稳步上扬。

(明报)

庄士红磡酒店 基金16亿洽购

东铁綫过海段快通车 具潜力改共居

全幢物业续成基金追捧对象,庄士旗下红磡芜湖街逸酒店 (Hotel Sav),获基金出价16亿元洽购,物业总楼面12万呎,提供388房。

市场消息指,红磡全幢酒店获基金洽购,涉及物业为庄士集团旗下逸酒店,位于红磡芜湖街83号,物业前身为庄士红磡广场,属商厦用途,于1996年落成,业主近年把物业改装成酒店,于2015年正式啟用。

呎价1.3万 每间房价约412万

物业楼高25层,地下及1楼为酒店大堂及商铺,5至25楼为客房,每层提供约23间房,房间总数约388间。据悉,未有疫情前,房间每晚房价约750至1,000元,项目总楼而约12.2万平方呎。消息指,近日有财团出价洽购,出价约16亿元,呎价约1.3万元,而每房价值约412万元。

消息指,洽购项目为外资基金,看準项目位于市区,而东铁綫过海段明年有望通车,届时红磡来往港岛区更为方便,除了传统酒店用途外,亦有潜力改装成共居。

疫情下零旅客状态一年多,冲击酒店入住率,令不少酒店出现经营困难,酒店造价亦有所下降,同时间,个别财团趁酒店价格回调,有兴趣购入全幢酒店,日后或更改用途。如油麻地487至489号CASA酒店,去年业主曾把物业放售,叫价约8亿元,而近日项目获财团积极洽购,出价达6.5亿元,预计快将易手。消息称,该财团为一家外资基金,拟购入后发展共居。

另有代理行资料显示,10月份市场共录得约404宗工商铺买卖个案,为自2021年6月起按月呈跌势,数字更为今年度新低,对上一次低成交宗数要数2021年11月,当时工商铺市场仅录得384宗。

(经济日报)

工商铺录404宗成交 代理行:属今年以来新低

工商铺交投气氛比去年改善,不过,由于经济气氛尚未见明朗,近期交投有所放缓。根据代理行统计,10月份工商铺共录约404宗成交,涉及总金额约75.85亿,为今年度按月新低,仅次于去年11月水平。该代理行预测,股票市场波动频仍,投资砖头保值,工商铺受惠多个利好政策,入市成本降低,同时回报相对稳定,料有更多新晋投资者有兴趣。

10月成交金额约75.85亿

该行代理表示,根据资料显示,10月份市场共录约404宗工商铺买卖个案,为自2021年6月起按月呈跌势,数字更为今年度新低,对上一次低成交宗数要数2021年11月,当时市场仅录384宗。同时,10月份工商铺成交宗数对比9月减少约18%,不过较2020年10月持续录增幅,递增约11%。至于金额方面,由于成交宗数下跌,加上月内瞩目大额交易比9月份为少,10月总成交金额录约75.85亿,按月跌约36%,按年同期比较则见升势,金额升约一成。

该代理续表示,10月份工商铺成交宗数下跌,主因9月份有一手项目推出,亿京旗下观塘道368号甲厦项目开售,带动该月整体录约90宗写字楼买卖,到10月份一手项目销情渐放缓,宗数明显下降,月内仅录约46宗买卖。金额下跌则因9月份录多宗大额成交,例如荔枝角道888号3层楼面以约12亿沽出、中环及铜锣湾均录巨铺交易等,令10月份成交金额略见逊色。

(星岛日报)

更多观塘道368号写字楼出售楼盘资讯请参阅:观塘道368号写字楼出售

更多观塘区甲级写字楼出售楼盘资讯请参阅:观塘区甲级写字楼出售

更多荔枝角道888号写字楼出售楼盘资讯请参阅:荔枝角道888号写字楼出售

更多长沙湾区甲级写字楼出售楼盘资讯请参阅:长沙湾区甲级写字楼出售

亿京观塘甲厦每呎1.31万售

亿京拆售中的观塘甲厦,反应不俗,买家有扫入全层单位的投资者,亦有自用用家,有上市公司更斥资购入特色单位自用,连命名权购入。该厦亦不乏千餘万的成交,市场消息透露,观塘道368号录一个细单位成交,涉及为11楼D室,建筑面积940方呎,以每呎约13100元易手,作价1231.4万。

作价逾1231万

该厦对上一宗为一个高层相连单位,以7100万成交,呎价约1.54万,买家购入作业务扩充用途,涉及32楼B、C及D室,面积分别为2035方呎、1164方呎及1382方呎,总楼面约4581方呎,获企业以约7100万成交,呎价约15499元,买家购入作业务扩充用途。

该厦录上市公司购入单位自用,中国波顿集团以约1.56亿购入顶层单位,建筑面积6869方呎,另天台约1025方呎,呎价约22759元,作为总部,将连同项目冠名权。

外号「手套大王」的叶建明及其友人,以4.516亿购入该厦,叶氏购入该厦3层全层特色户,分别为该厦33楼、35楼及36楼全层单位,该项目毗邻港铁牛头角站,受惠屯马綫及快将通车的沙中綫。写字楼单位建筑面积由654至9566方呎。前身为英亚工厂大厦,亿京于2017年以13.2亿购入全幢重建商厦,可建楼面约25万方呎,早前以7.8亿完成补地价。

(星岛日报)

更多观塘道368号写字楼出售楼盘资讯请参阅:观塘道368号写字楼出售

更多观塘区甲级写字楼出售楼盘资讯请参阅:观塘区甲级写字楼出售

深水埗旧楼强拍底价3.27亿

近年市区土地供应罕有,不少财团透过强拍增加土储;由财团申请强拍的深水埗医局街旧楼,最新获土地审裁处颁下强拍令,底价为3.27亿,对比2020年10月申请强拍时市场估值约1.8109亿,高出80.6%。

据土地审裁处文件显示,是次获批强拍令的项目位于医局街134至140号,涉及4座旧楼物业,据判词指出,最新该财团持有医局街134号至138号全数业权,而140号旧楼最新亦持有89.58%业权,整个项目平均持有约94.79%业权,目前仅餘下1个单位并未成功收购,该小业主从未出席审讯,亦无法联繫,属失踪小业主。

已收集约90%业权

根据判词指出,申请人曾委託结构工程师对该旧楼进行结构评估,认为该建筑物已达其设计寿命,加上维修情况欠佳,部分设施未能符合现代安全标準和法定要求,而且维修成本与重建成本不成比例,认为重建发展是合适做法。再者申请人已採取一切合理步骤取得全部业权,故批出强拍令。

上址现为4幢楼高约5层商住物业,地下为商铺,楼上则属住宅;早于1956年落成,至今约65年楼龄。整个项目佔地面积合共约4617方呎,若以住宅重建发展,涉及地积比约7.5倍,可建总楼面约34627方呎;若以商业或商住物业,则以地积比9倍发展,可建总楼面约41553方呎。

上述旧楼由新暉投资发展有限公司于去年提出强拍申请,当年该公司董事为陈承邦、朱威澔、朱威霖以及汇隆控股有限公司执行董事苏宏进。据土地审裁处资料显示,该处今年迄今暂批出19宗强拍令;而强拍申请个案则暂录13宗,对比去年同期的29宗申请,大减16宗,跌幅高达55%。

(星岛日报)

豫港大厦全层意向租金9.8万

有代理表示,湾仔豫港大厦21楼全层,面积约3251方呎,业主意向租金约9.8万元,呎租约30元。

该行指出,上述单位间隔四正实用,外望城市繁华景观,配备具格调的写字楼装潢,即租即用。大厦附设2部客梯及停车场,方便用家出入。

(信报)

更多豫港大厦写字楼出租楼盘资讯请参阅:豫港大厦写字楼出租

更多湾仔区甲级写字楼出租楼盘资讯请参阅:湾仔区甲级写字楼出租

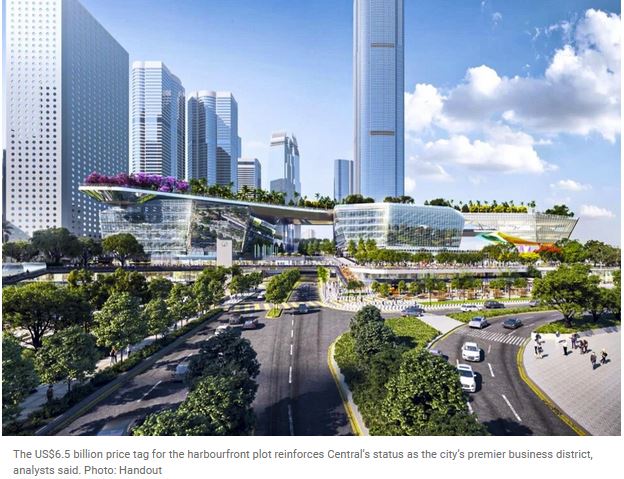

Henderson buys Hong Kong’s ‘land king,’ paying a record US$6.5 billion for harbourfront commercial plot in Central

Henderson Land says it will invest HK$63 billion to develop the site into an iconic landmark and social destination dedicated to the public

The plot was estimated to fetch between HK$37 billion and up to HK$55 billion, according to valuers

Henderson Land Development won the bid for Hong Kong’s most expensive commercial land, combining a sprawling design with a record price tag to beat five contenders in the government’s “two-envelope” tender for the harbourfront plot in Central.

A unit of Henderson will pay the record-setting HK$50.8 billion (US$6.5 billion) for a 50-year land grant of New Central Harbourfront Commercial Site 3, according to a statement by the government. The plot, north of the city’s old General Post Office and next to the International Finance Centre, measures 516,316 square feet (47,967 square metres), and can yield 1.6 million sq ft in gross floor area.

Henderson said in a statement that it will invest HK$63 billion to develop the site to create an iconic landmark and a “social destination dedicated to public enjoyment”.

The winning price, close to the top end of the market’s valuation of between HK$37 billion and HK$55 billion, is the second trophy in four years for Henderson since the developer, controlled by one of Hong Kong’s wealthiest families, paid what was then a record HK$23.28 billion in 2017 for the government’s Murray Road car park to turn it into an office tower.

The successful bid “is based on the idea of a bridge, and aims to curate a world-class iconic landmark in Hong Kong, enhance the connectivity between the hinterland and harbourfront in Central, and create a vast amount of green and public spaces,” a spokesperson for the Development Bureau said. “The development is expected to achieve good integration with the surrounding environment and vitalise the harbourfront area.”

A key feature of the design is its height limit, devoid of any building taller than 50 metres (164 feet) on the plot’s western fringe, with nothing higher than 16 metres to the east.

The constraint was to honour a 1971 agreement granted to Hongkong Land Limited, which paid what was then a record price of HK$258 million to lease a plot for 75 years, where the Jardine House tower now stands. The then British colonial government agreed that no building directly to the north of Jardine House would ever obstruct its views. As a result, the height of the General Post Office building, built in 1976 north of Jardine House, was capped at 120ft (37m).

“We are excited to take part in this world-class development, which will form one of the most important and strategic additions to Hong Kong’s CBD,” said Martin Lee Ka-shing, chairman of Henderson Land. “We are confident that the project will generate favourable financial returns to the company.”

Henderson said that the project will be delivered in two phases, with the first phase due to complete by 2027. Phase one will have 270,000 sq ft of office space and 340,000 sq ft of retail, dining and entertainment spaces. Phase two, targeted for completion in 2032, will have 390,000 sq ft of office space and 600,000 sq ft of retail space.

The price tag of the winning bid works out to HK$31,463 per square foot, 37 per cent cheaper than the commercial plot that Henderson paid for at Murray Road in 2017, according to property agency.

“Office development at such an iconic location will be highly sought after by both big multinational and mainland Chinese corporations,” an agent said.

Henderson plans to erect three buildings on the harbourfront to accentuate Hong Kong’s image as Asia’s World City. The block closest to the harbour will be multifunctional, while the other two will be office buildings.

The focal point of the entire design is the old Star Ferry Clock Tower, which will be reconstructed close to its original position to maintain a visual connection with the harbour and Hong Kong’s maritime heritage, according to the land sale condition.

The “two-envelope” approach to awarding tenders was a way to put a cap on land prices, awarding bids on meritorious designs, as well as the highest price. Henderson’s Pacific Gate Development unit attained the highest marks for its premium and non-premium proposals, according to the government’s Tender Assessment Panel (TAP).

Six bids were received for the site, of which four failed to attain the passing mark for both the premium and non-premium proposals in the two-envelop approach, the government said, without naming those that failed.

The tender attracted Hong Kong’s biggest developers: the most valuable developer Sun Hung Kai Properties, Li Ka-shing’s flagship company CK Asset Holdings, as well as tycoon Peter Woo’s Wharf Real Estate Investment Company. The city’s subway operator MTR Corporation submitted a joint proposal with Chinachem Group, while Robert Ng Chee Siong’s Sino Land partnered with the Lo family’s Great Eagle Holdings and China Merchants Group in a joint bid.

Henderson’s bid reflects the developer’s confidence in the Central business district’s prospects, another agent said.

(South China Morning Post)

For more information of Office for Lease at International Finance Centre please visit: Office for Lease at International Finance Centre

For more information of Grade A Office for Lease in Central please visit: Grade A Office for Lease in Central

Henderson scoops prime Central harbor site for $50.8b

Henderson Land Development has spent HK$50.8 billion to secure site 3 of the New Central Harbourfront with a 50-year land grant following a two-envelope open tender.

The 516,300-square-foot site at Man Yiu Street sits right next to International Finance Centre, which was jointly developed by Henderson, and enjoys a good view of Victoria Harbour.

The sum looks to be the highest-ever selling price for a single site in Hong Kong. It had been valued at between HK$37 billion and HK$56.5 billion.

An official for the Development Bureau said the vision is for site 3 to become a new landmark in Hong Kong.

"The successful tenderer's proposal is based on the idea of a bridge and aims to curate a world-class iconic landmark in Hong Kong, enhance the connectivity between the hinterland and harborfront in Central and create a vast amount of green and public space."

It added: "The successful tenderer proposes to have three buildings with a view to accentuating Hong Kong's image as Asia's World City."

The block closest to the harbor will be multi-functional whereas the other two will be office buildings.

Adequate separation is proposed among the buildings as ventilation corridors and "city windows" to ensure the project will have sufficient natural ventilation and lighting.

The public open space proposed will exceed the minimum of 25,000 square meters as required in the tender document.

What is already known as Horizon Park - a platform at roof level - will connect the three buildings.

The public will be able to enjoy panoramic views of the Central cityscape and Victoria Harbour from there.

The platform, to be fashioned as an urban forest, will also provide a lawn, jogging routes and outdoor space for public use.

The proposal also provides a pedestrian network to link with existing routes in Central, connecting its hinterland areas with the harborfront. There will also be a pedestrian connection with Central MTR Station.

The administration adopted a two-envelope approach in the tender to take both design and premium into consideration, meaning an equal weighting for premium and non-premium proposals was adopted.

A tender assessment panel assessed the tender proposals in accordance with requirements, and Henderson Land's Pacific Gate Development attained the highest marks with its ideas.

The SAR administration had received six tenders. But four of them did not conform with a requirement that a tender must attain a passing mark for both the premium and non-premium proposals in the two-envelope approach.

In other words, two of the tenders - including Henderson's successful one - fulfilled both requirements. That led to one of the two being given a higher total mark and hence awarded the tender.

CK Asset, New World Development and a consortium formed by Sino Land, China Merchants Land and Great Eagle were also among the bidders.

Development Bureau officials will be releasing combined scores, the premium offer and the gist of the design proposals of the second conforming tender after the completion of transaction procedures.

Site 3's 516,300 square feet offer a gross floor area of 1.84 million sq ft and will be mainly used for commercial and retail purposes.

There will also be 228,000 sq ft for government, institutional or community facilities plus a car park.

Netting out areas for public use, the average price is HK$31,462 per sq ft in gross floor area.

This latest winning of a tender by Henderson Land marks its second major investment in Central in 4 years.

The developer submitted the winning tender for a commercial site on Murray Road with a HK$23.2 billion bid in May 2017. That was a record high for Hong Kong at that time.

Given the top gross floor area of around 465,000 square feet, the average price stood at around HK$50,063 - also a high that still stands in the SAR.

That came before Sun Hung Kai Properties purchased the giant commercial site atop the West Kowloon Station for HK$42.2 billion in November 2019, which set the record high before site 3.

The also came with an area of over 643,100 sq ft, or a gross floor area of 3.16 million sq ft.

(The Standard)

For more information of Office for Lease at International Finance Centre please visit: Office for Lease at International Finance Centre

For more information of Grade A Office for Lease in Central please visit: Grade A Office for Lease in Central

Monaco One hits the market with 99 flats

More developers are launching new projects, with one at Kai Tak and another in Kennedy Town.

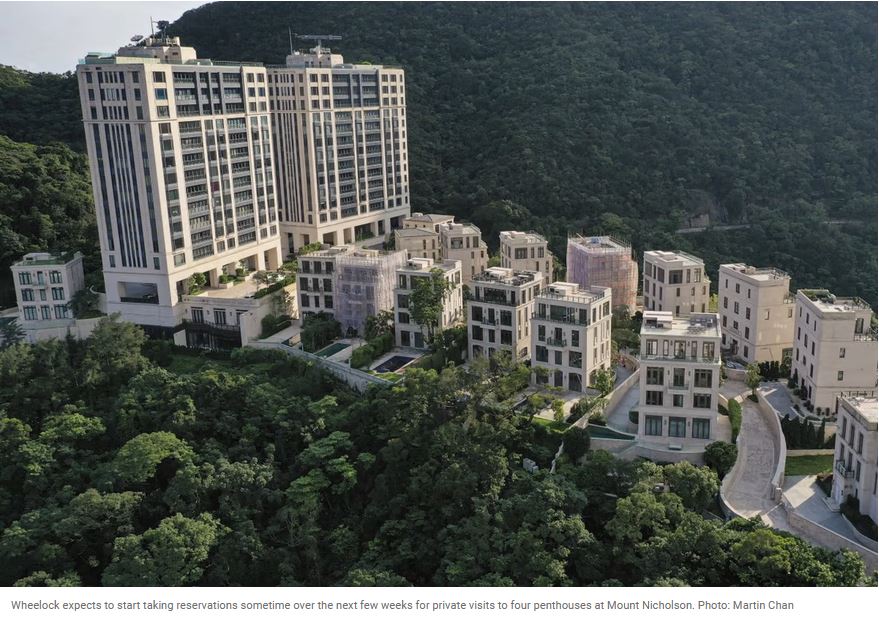

Wheelock opens the first price list of Monaco One in Kai Tak today, offering at least 99 flats with prices starting HK$7 million.

A 1,471-square-foot special unit with four bedrooms may be put in the first round of sales by tender, said managing director Ricky Wong Kwong-yiu. It is expected to break the record of the highest price per square foot at Kai Tak.

Meanwhile, the developer revealed a three-bedroom show flat, replicating a 552-sq-ft unit in the project. The largest three-bedroom in Monaco One is 671 sq ft. All show flats will be open to the public on the weekend, along with registration.

Providing a total of 492 flats with one and two-bedroom flats accounting for 80 percent of the total, the project is targeted at first-time home buyers and nuclear families.

In Kennedy Town, the Kennedy 38, jointly developed by Wheelock, Sun Hung Kai Properties (0016) and Henderson Land Development (0012) will open show flats next week.

Rebuilt from a 46-year-old industrial building, Kennedy 38 has only one block and provides 341 homes, where 30 percent are studios and 60 percent are one-bedrooms.

The selling price of the project will take reference from neighboring new projects, which is around HK$33,000 per square foot, said Victor Lui Ting, the deputy managing director of SHKP.

(The Standard)工商铺9月买卖 险守500宗

有代理表示,股市回吐窒碍工商铺市道,惟预期经第三季连月回调后,第四季可望喘稳回升。

根据代理资料所得,今年9月全港共录得510宗工商铺物业买卖登记 (数字主要反映2至4星期前市场实际状况),较8月的582宗再跌12%,已连跌3个月创近7个月新低,亦为年内次低,反映股市回落对工商铺市道影响不轻;至于该月买卖合约总值录得89.42亿元,按月跌25%,连跌两月,并跌穿百亿元水平。

按工商铺3个物业类别划分,工厦按月登记量已跌穿300宗,但仍为交投最多的类别。9月全月工厦仅录得271宗登记,按月跌19%,佔整体工商铺成交达53.1%。当中买卖登记佔比最多的是介乎200万至500万元以内的细价工厦,期内录得119宗登记,惟按月跌16%。此外,在高价工厦登记减少下,拖累月内工厦买卖金额急跌58%,仅录得30亿元,创了6个月以来最少。

商厦仅91成交 7个月新低

商厦买卖登记量表现最为逊色,终于跌破之前保持了6个月按月均录逾百宗的纪录,反映内地整顿行业及港股下挫而令商厦交投遇冷,9月商厦买卖登记只录得91宗,按月大减23%,为7个月以来新低;当中尤以5,000万至1亿元以内组别跌幅最大,按月挫56%,由8月的9宗减至9月的4宗。至于月内整体商厦买卖登记金额跌幅相对较少,按月跌13%,录23.67亿元,主要靠亿元以上登记增多所支撑。

至于店铺买卖登记量方面,受惠疫情稳定,加上消费券效应及市场报復式消费而令店铺买卖登记量跑赢大市,成为唯一逆市录得升幅的类别。9月店铺共录148宗登记,按月升14%;而升幅主要集中在中高价店铺,如1,000万至2,000万元以内组别按月倍增至35宗,而在大码登记支撑下,买卖登记总额录35.71亿元,按月劲升69%。

代理指出,工商铺整体登记量于9月跌幅扩大,包括受到股市于第三季明显造淡及恒大事件困扰所影响,拖累季内工商铺登记量只有1,738宗,较次季的1,999宗回落13%。至于10月因市场一度观望《施政报告》政策,加上短期通关落空,故料10月登记量仍续维持在相若水平横行,料录约520宗。不过,黄氏相信,踏入第四季中后段,随着股市若能持续回升,恒大事件明朗化及市场对《施政报告》有较正面的解读,工商铺整体后市亦可望逐渐回暖。

(经济日报)

中环地王建40万呎城市绿洲 恒基:重置天星鐘楼及邮政总局

中环新海滨商业地王日前由恒基以五百零八亿破纪录独资投得,该项目除了兴建商场及写字楼外,并着重绿色设计,拥有逾四十万方呎绿化空间,冀打造「城市绿洲」,落成后将重塑中环海滨环境,为该区带来新景象。届时还会重置天星鐘楼,并于该项目中间的一座地下及地库提供邮政总局设施。

中环商业地王设计方案全城关注,恒基主席李家杰、李家诚及一眾管理层,昨日出席网上记者会讲解项目的设计概念。李家杰指出,集团投得的中环地王绿化面积达四点八公顷,并着重绿色设计,将设有大量绿色元素,并建三百米长的天台公园,提供六十个不同项目,包括引入不同高科技设施;并循减碳、能源控制和污水处理等方面加入不同的新科技,冀成为国际指标和新的榜样,同时将贯切集团ESG理念建造项目,即「环境保护 (Environmental)、社会责任 (Social) 与公司管治 (Governance)」,希望为下一代提供更美好环境。

李家杰:绿化面积达4.8公顷

恒基主席李家诚补充,该项目设逾四十多万方呎绿化空间,将会重塑中环海滨环境,希望公眾地方、绿化空间均以高水準设计,并会利用专长回馈社会,为市民带来更多活动空间,营造中环新景象。

他强调,集团对香港充满信心,再者香港是世界金融中心,中环永远是国际金融机构、跨国企业最抢手落户的地点,相信该项目会为集团带来理想的回报。另外,除提供商业楼面外,亦会以崭新概念运用绿色空间,把文化、表演活动等融入购物体验中,并提供休閒、旅游娱乐和表演的场地。

李家诚:重塑海滨环境

据卖地条款,中环邮政总局届时将会拆卸,恒基地产策划 (一) 部总经理余惠伟表示,未来邮政总局设施将设于该项目中间的一座地下及地库;同时亦会重置「天星小轮鐘楼」。据卖地章程显示,中标发展商须负责重建天星小轮鐘楼,并于该鐘楼原址作兴建、管理及维修。

余惠伟指出,希望透过项目建设世界级地标,设计以「桥」为概念,设计会提供大量绿化及公共空间,连接中环与海滨长廊的林荫大道,与海滨产生协同效应,更能使海滨朝气蓬勃;亦加强中环内陆和海滨的连接,同时会提供支援设施,例如提供三百多个公眾停车位等。

邮局将设于地下及地库

从该项目设计概念图可见,由三座建筑物组成,部分位置刻意留中空,作通风廊及都市窗户,而建筑物天台「Horizon Park」相连平台串连起三座建筑物,长约三百米,未来公眾可在平台上眺望中环和维港景色。平台将以植物营造空中森林,同时提供草坪、缓跑径及户外空间予公眾使用。另外,该项目商场集合艺术、雕塑、自然、文化和剧场于一身,其核心为一个六层高的水族馆,预料将会成为新一个瞩目景点。

业内人士指,今次海滨三号地以其中环海边的位置和独特的低密度设计,在设计上亦有考虑周遭商厦的景观,故以低密度发展,同时该项目设计以中空式设计及大规模园林绿化,增加通风及通透效果,营造「城市绿洲」概念,加上全港首个长约三百米的绿化天台,而且未来亦会重置天星鐘楼等,更成为该项目一大卖点,相信未来也能赢得市民的掌声。

(星岛日报)

中环海滨地王 Lead 8王欧阳操刀设计

供大量绿化空间 李家杰:ESG理念打造项目

恒地 (00012) 相隔4年再下一城,重注508亿元夺中环新海滨3号商业地王,项目的设计由Lead 8及王欧阳负责,除兴建300米长的天台公园外,亦会提供大量绿化及公共空间,与海滨产生协同效应。恒基兆业地产集团联席主席李家杰指,将贯彻ESG理念打造项目。

中环新海滨3号商业地王,由Lead 8及王欧阳负责,其中Lead 8于2014年成立,曾负责多个内地地标项目,包括上海徐家汇中心项目,不少为中资龙湖旗下项目,如龙湖重庆公园天街、星湖天街等。本地项目则包括新世界发展的香港国际机场航天城11 SKIES及北角和富薈等。

而王欧阳则设计多个本地地标项目,包括铜锣湾时代广场、香港太古广场第一及二期、朗豪坊、太古坊一座等,并另曾负责观塘市中心、太古坊、香港大学百周年校园等项目。

设300米长天台公园 引文化表演

恒地一眾高层昨日会见传媒,介绍项目详细设计概念及规划特色,而恒基兆业地产集团联席主席李家杰指,项目面积达4.8公顷,将採用「桥」的设计,设大量绿化空间,包括兴建300米长的天台公园,且提供60个不同项目包括不同新科技的设施。集团主要希望从减碳、能源控制、污水处理等方面,建立国际榜样。同时,集团会贯彻ESG理念打造项目,以给予下一代更好环境。

恒基兆业地产集团联席主席李家诚表示,项目设有40多万平方呎的绿化空间,将为市民提供更多活动空间。鑑于香港是世界性金融中心,而中环永远是跨国公司最抢手的选址,相信会为项目带来优良回报。而项目的定位除了包含传统国际品牌外、崭新概念等,未来亦会引入不同的文化表演,以融入购物消閒元素。集团亦对香港充满信心,并会利用专长回馈社会。

重置天星小轮鐘楼+邮政总局

恒地地产策划部总经理余惠伟称,集团希望建设世界地标,其设计会提供大量绿化及公共空间,与海滨产生协同效应,并会供应300多个公眾车位、引入5G网络及礼宾服务等。另外,集团亦会重置天星小轮鐘楼,并在中间地块的地下及地库,重置邮政总局。

至于投资回报方面,目前中环商厦普遍月租每呎约130至190元不等,若以项目的地价及建筑费,即630亿元计,项目回报率约4厘。而以平均呎租160元计,回报达5厘;如以呎190元计,回报则近6厘。

中环新海滨3号商业地王位于怡和大厦对出,地盘面积近52万平方呎,最高可建楼面约161.5万平方呎。

值得留意的是,中标财团另需兴建约23万平方呎的政府设施,包括重置现时的邮政总局等。

(经济日报)

更多时代广场写字楼出租楼盘资讯请参阅:时代广场写字楼出租

更多铜锣湾区甲级写字楼出租楼盘资讯请参阅:铜锣湾区甲级写字楼出租

更多太古广场写字楼出租楼盘资讯请参阅:太古广场写字楼出租

更多金鐘区甲级写字楼出租楼盘资讯请参阅:金鐘区甲级写字楼出租

更多朗豪坊写字楼出租楼盘资讯请参阅:朗豪坊写字楼出租

更多旺角区甲级写字楼出租楼盘资讯请参阅:旺角区甲级写字楼出租

更多太古坊一座写字楼出租楼盘资讯请参阅:太古坊一座写字楼出租

更多鰂鱼涌区甲级写字楼出租楼盘资讯请参阅:鰂鱼涌区甲级写字楼出租

更多怡和大厦写字楼出租楼盘资讯请参阅:怡和大厦写字楼出租

更多中环区甲级写字楼出租楼盘资讯请参阅:中环区甲级写字楼出租

土瓜湾美善同道商住地盘获洽 屯马綫通车带动财团区内觅盘

随着屯马綫通车,令红磡及土瓜湾一带的交通进一步改善,区内物业受捧,土瓜湾美善同道一个商住地盘,由準买家以4.68亿洽购至尾声,楼面呎价11429元,目前正进行尽职审查。

上址为土瓜湾美善同道51至57号商住地盘,市场消息透露,该物业于市场上放售一段日子,获多名买家洽购,其中,一名準买家极具诚意,出价达4.68亿,打动业主割爱,双方就该项目进入细节商谈,準买家亦就物业作尽职审查,预期短期内将落实交易。

涉资约4.68亿洽至尾声

该项目属住宅甲类地段,佔地面积4800方呎,可建总楼面40950方呎,地积比约8.5倍,平均楼面呎价11429元。

楼面呎价11429元

近年,土瓜湾不断有新项目落成,区内变天,其中,美善同道聚集公务员宿舍,地段甚寧静,适合兴建精品住宅,今年2月,裕泰兴就美善同道6至12号补地价,涉资1.8484亿,以住宅楼面36006方呎计算,即每呎5134元。

其中美善同道6及8号,该财团于11年以强拍形式统一业权,作价1亿,总楼面约2.16万方呎计,即每呎楼面达4629元。至于10至12号物业,早年完成统一业权。项目曾获屋宇署批出建筑图则,可兴建1幢30层高的商住楼。

庄士「逸 · 酒店」获洽购

红磡区内亦有大型酒店获洽购,庄士机构公布,集团旗下红磡芜湖街83号「逸 · 酒店」,正与独立第三者进行初步洽谈,可能出售持有该酒店及其牌照之附属公司。

市场消息透露,上述酒店準买家为美资基金aew,洽购该酒店至尾声,全幢总楼面约12万呎,平均呎价1.3万,提供388个房间,平均每个房间作价412万。

该基金趁疫市下酒店业处低潮,拟购入投资,疫情前,该酒店每晚房价约750元至高达1000元,回报可观。aew于2000年成立,近年积极在港购物业,今年中以3亿购入柴湾美利仓大厦50%业权。

準买家美资基金aew

「逸· 酒店」楼高25层,地下及1楼为酒店大堂及商铺,5至25楼为客房,每层约23间房,前身为庄士红磡广场,属商厦用途,于1996年落成,业主近年把物业改装成酒店,于2015年正式啟用。

(星岛日报)

邓成波家族5亿 沽筲箕湾全幢工厦

黑石基金购入 拟改装作迷你仓

邓成波家族续沽货套现,消息指,该家族以约5亿元,沽出筲箕湾精雅印刷集团大厦全幢,持货2年帐面蚀8,000万。据悉,新买家为为黑石基金,今年3度入市,料购入改装迷你仓。

今年工厦市场买卖旺,市场消息指,筲箕湾精雅印刷集团大厦全幢,以约5亿元成交。物业位于阿公岩村道8号,属工厦用途,项目佔地11,666平方呎,现址总楼面69,680平方呎,以5亿元成交价计,呎价约7,175元。原业主曾经在向城规会申请放宽地积比率重建该大厦,以发展1幢26层高酒店,预计可建楼面约16.8万平方呎,以提供约726个酒店房间。以可建楼面计算,每呎楼面地价约2,976元。

持货2年转手 蚀约8000万

项目原由邓成波家族持有,波叔于2019年斥5.8亿元购入工厦,持货2年转手,蚀约8,000万元,贬值14%。该家族近月连环沽货,如今已套现逾110亿元。

消息指,新买家为黑石基金,该基金今年非常活跃,属第3度入市购工厦,早前分别以5.08亿元,购入观塘新传媒集团中心全幢,以及2.83亿元购粉岭叶氏化工大厦,合共涉近13亿元。据了解,该集团购入3项物业后,将加以改装,转成迷你仓用途,可望提高租值。

另近日消息指,一家美资基金正以16亿元,洽购红磡芜湖街「逸•酒店」。庄士机构 (00367) 指,集团可能出售旗下位于红磡芜湖83号的「逸•酒店」,集团现正与一独立第三者,并就集团持有上述酒店及其牌照的附属公司,进行初步洽谈,惟暂未就可能进行之交易订立任何条款或确实协议。

(经济日报)

轩尼诗道锦祥楼 1.99亿易手

土地註册处资料资料显示,铜锣湾轩尼诗道470号锦祥楼 (楼龄50年),刚以约1.99亿元易手。

资料显示,项目属于一幢约5层高旧楼,估计购入重建。据悉,中银香港 (02388) 目前持有轩尼诗道472号,数月前获批重建1幢24层高商厦,总楼面约4.2万平方呎,估计是中银购入合併重建机会甚大。

(经济日报)

Henderson confident of delivering world-class landmark at Central harbourfront, dismisses dividend payment fears

Henderson beat five other rivals for a 50-year land grant for New Central Harbourfront Commercial Site 3 with a record bid of US$6.5 billion

Henderson vice-chairman Colin Lam says they are open to discussions with other parties who would be interested in jointly developing the project

Henderson Land Development said it has deep pockets to develop a prime harbourfront site in Central into an iconic landmark.

The city’s third-largest developer by market value on Wednesday won the bid for a 50-year land grant of New Central Harbourfront Commercial Site 3 for a record HK$50.8 billion (US$6.5 billion), beating five contenders in the government’s “two-envelope” tender.

“We would sign the cheque immediately if we were asked to pay the HK$50.8 billion tomorrow. It is not a problem,” said Colin Lam Ko-yin, vice-chairman of Henderson, said at a briefing on Thursday to discuss the company’s plans for the site. “We do not have any [financial] pressure and [the land purchase] won’t impact our dividend payment.”

Lam said that Henderson was open to discussions with other parties who would be interested in developing the project together.

The company plans to invest HK$63 billion to develop the site to create an iconic landmark and a “social destination dedicated to public enjoyment”. Henderson’s blueprint calls for three buildings on the harbourfront to accentuate Hong Kong’s image as Asia’s World City. The block closest to the harbour will be multifunctional, while the other two will be office buildings. Sizeable green areas and open spaces for the public have also been included in the design.

The focal point of the entire design is the old Star Ferry Clock Tower, which will be reconstructed close to its original position to maintain a visual connection with the harbour and Hong Kong’s maritime heritage, according to the land sale condition.

“My father beamed from ear to ear knowing that we won the project,” said Peter Lee Ka-kit, Henderson’s co-chairman and the elder son of founder Lee Shau-kee.

He added the land would be developed attentively, offering plenty of green space.

Martin Lee Ka-shing, co-chairman and the founder’s younger son, said the site will be developed into a world-class landmark destination. “Henderson Land is rooted in Hong Kong and we are confident of the city and we hope to leverage what we are good at to give back to society,” he said.

According to property agency, the Central Site 3 ranks as the second most expensive land transaction worldwide of all time, after a 861,120 sq ft ( 80,000 sq metre) site in Seoul’s Gangnam district was acquired by a Hyundai Motor-led consortium in 2014 for 10.5 trillion won (US$10 billion).

Market observers said the record price for the prime plot will boost the city’s commercial property market and reinforce Hong Kong’s position as a world class global financial hub.

“It is another instance of a local developer casting a vote of strong confidence about the prospects of Hong Kong, considering the project’s long-dated development cycle,” another property agent said. “The additional office space, while modest in size, will serve well as the Hong Kong financial market continues to widen in breadth and depth.”

Others pointed out that Central will remain the most sought-after district even if the North New Territories, the location of the proposed Northern Metropolis, becomes the focal point of development in Hong Kong.

“Although there are other large-scale developments such as Northern Metropolis and Lantau Tomorrow Vision in the pipeline, it would take 15 to 20 years for these projects to be fully completed and at least another decade for the areas to mature,” agent said.

“Central will remain the financial centre for Hong Kong in the foreseeable future,” the agent added.

(South China Morning Post)

After Henderson Land’s record bid, here are the 5 other most expensive land sales in Hong Kong

Henderson Land’s record bid beat out five contenders in the government’s ‘two-envelope’ tender for the harbourfront plot

Hong Kong – one of the most expensive real estate markets in the world – has consistently set record land sale prices in recent years

Henderson Land Development may have set a record by bidding HK$50.8 billion (US$6.5 billion) for Hong Kong’s most coveted commercial plot in the main business zone of Central, but the city is no stranger to eye-watering land deals.

Henderson Land’s record bid beat out five contenders in the government’s “two-envelope” tender for the harbourfront plot in Central. North of the city’s old General Post Office and next to the International Finance Centre, the plot measures 516,316 sq ft (47,967 square metres), and can yield 1.6 million sq ft in gross floor area.

The bid for Central Site 3 is “an exceptional result considering the complexity of the site, the two-envelope tender and the huge investment sums in terms of the premium and construction costs to follow,” surveyor said. “This is a historic record high lump sum for a single development site in Hong Kong and a mega sum from any investment perspective.”

Before Henderson’s bid, Hong Kong – one of the most expensive real estate markets in the world – has consistently set record land sale prices, with many of the plots forecast to yield around 5 to 6 per cent. Henderson’s Murray Road project is only likely to yield 3 per cent though due to the high price paid, according to a property agent.

After Henderson’s record bid, here are the next five most expensive commercial land bids ever made in Hong Kong, according to information provided by some property consultancies:

1. Sun Hung Kai Properties (SHKP) won with a bid of HK$42.23 billion in November 2019 for a commercial site atop a high speed rail station at West Kowloon with an estimated gross floor area of 3.17 million sq ft. The winning bid of HK$13,345 per square foot was at the low end of a valuation range between HK$13,000 and HK$20,000 per square foot. The project, which can be developed for retail, office or hotel use, is still under construction.

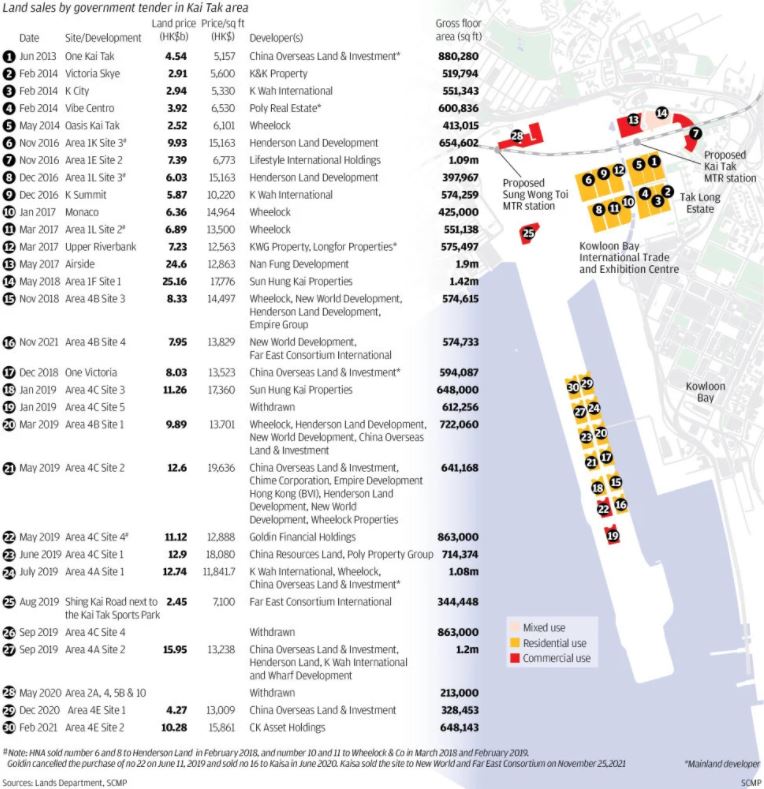

2. SHKP also had a winning bid of HK$25.16 billion for the Kai Tak Area 1F Site 1 in May 2018. With a gross floor area of 1.42 million sq ft, the bid for the site translates into HK$17,776 per square foot. The developer said the total investment cost for the site would be about HK$40 billion, and the project would have 300,000 sq ft allocated for retail spaces, plus an underground shopping street connected to the Kai Tak station on the Tuen Ma line of the MTR.

3. Nan Fung Development’s unit Rich Union won with a bid of HK$24.6 billion for the Kai Tak Area 1F Site 2 in May 2017, with a gross floor area of 1.91 million sq ft. The bid translates into HK$12,863 per square foot. Nan Fung has commenced construction of the AIRSIDE, a mixed-use commercial development on the site. The 47-storey building is touted to be the tallest building in Kai Tak, which is being developed as the city’s second most important business district.

4. Henderson Land bid HK$23.28 billion for the Murray Road Car Park in Central in May 2017. The site can be developed into a commercial building with 465,005 sq ft of total gross floor area, and the bid translates into HK$50,064 per square foot. The property, to be called The Henderson, is designed by the prestigious Zaha Hadid Architects, and the 36-storey building is scheduled to open its doors in 2023.

5. Patchway Holdings (HK), a joint venture by Hysan Development and Chinachem Group, bid HK$19.78 billion for a site on Caroline Hill Road in Causeway Bay in May 2021. With anestimated floor area of 1.1 million sq ft, the successful bid translates into about HK$18,400 per sq ft. The land sale document stipulates that the winning developer must include a health care clinic, a child care centre and a public car park with at least 125 spaces in its development plans.

(South China Morning Post)

For more information of Office for Lease at International Finance Centre please visit: Office for Lease at International Finance Centre

For more information of Grade A Office for Lease in Central please visit: Grade A Office for Lease in Central

Henderson in solid shape to handle Central project

Henderson Land (0012) said it will remain financially sound even after settling the HK$50.8 billion land price for a prime Central Harbourfront site.

Shares of the developer dropped 3 percent yesterday after the announcement of the total investment of HK$63 billion, the biggest outlay ever for a project in Hong Kong.

Its current gearing is only 20 percent as of end-July, and it will only be 30 percent after borrowing for the site, executive director and vice-chairman Colin Lam Ko-yin said yesterday in a virtual meeting.

But he added that Henderson does not rule out collaborating with other interested developers in the three-tower-block project.

The group enjoys stable rental incomes, dividends and revenues from property sales with a strong cash flow, Lam said, and it can settle the land premium in a short time without raising more funds from a share placement. To that end, the developer has no intention to change its dividend policy, Lam said.

The average rental prices for office buildings and shops in the Central stand at HK$130 to HK$190, suggesting a rental yield range of 4 percent to nearly 6 percent for the 516,300-square-foot Site 3, Lam said.

Henderson Land will relocate the General Post Office, reconstruct the Star Ferry Clock Tower and also provide over 300 public parking spaces, said Yu Wai-wai, general manager of project management department at the developer.

Lee Shau-kee, founder of Henderson Land, is very happy about winning the tender, said his son Peter Lee Ka-kit, co-chairman of Henderson Land. It had made him "grin from ear to ear," Peter Lee added.

Peter Lee also said his 93-year-old father is in good health.

The other co-chairman of Henderson, Martin Lee Ka-shing, said the company has confidence in Hong Kong, and the developer will use its expertise to give back to society.

Central district is always the top pick for multinational companies given that Hong Kong is an international financial hub, Martin Lee added, and the project is expected to deliver a good return.

Site 3 occupies a prominent location on the new Central Harbourfront. It is bounded by the Central Piers to its north, Two International Finance Centre to its west, Statue Square to its south, and the Hong Kong Observation Wheel to its east.

(The Standard)

For more information of Office for Lease at International Finance Centre please visit: Office for Lease at International Finance Centre

For more information of Grade A Office for Lease in Central please visit: Grade A Office for Lease in Central

Flats at Monaco One in Kai Tak rolled out

Wheelock Properties unveiled its first price list of Monaco One in Kai Tak, offering 99 flats at an average discounted price of HK$23,365 per square foot.

The price came in at 3 percent higher than the first batch of the sister project Monaco in the same district launched early this year, but 17 percent lower compared to that of Henderson Land Development's (0012) The Henley III in August.

The batch comprises 49 one-bedroom units, 34 two-bedroom units and 16 three-bedroom units with saleable areas ranging from 319 sq ft to 671 sq ft.

The cheapest flat - a 319-sq-ft one-bedroom unit - is priced at HK$7.57 million after discounts, or at HK$23,724 per sq ft.

The prices of future batches may be at least 10 percent higher and the developer will start receiving checks Saturday, managing director Ricky Wong Kwong-yiu said, adding that the sales are expected to launch in mid-November.

This came as data from the Lands Department revealed that eight new residential projects filed an application for pre-sale consent in October, involving 5,378 flats.

Among the new applicants, a project on Hang On Street which is co-developed by the Urban Renewal Authority and Lai Sun Group has been named as Bal Residence.

The project will provide 156 homes upon completion and Lai Sun previously said more than 90 percent of them will be one-bedroom units.

Together with the ones applied in the previous months, 29 projects with 14,662 flats altogether were pending approval as of the end of last month.

The department only granted three pre-sale consents covering 1,221 units in the month, down around 60 percent from 2,966 units in September.

Meanwhile, there were 602 private homes completed in September in the city, up 18.5 percent month-on-month, reversing a three-month downward trend, data from the Rating and Valuation Department showed.

A total of 11,168 private residential units were completed in the first nine months of this year, accounting for 61.3 percent of the government's estimation of 18,228 units.

Class B units, which range from 40 square meters to 69.9 sq m, took up more than half of the built flats, followed by Class A units with salable areas less than 40 sq m which accounted for nearly 30 percent of the total.

(The Standard)

Number of private residential units completed up 18.5pc

Hong Kong saw 602 units of private residential units completed in September, up 18.5 percent month-on-month and twisting a three-month downward trend, the latest data from the Rating and Valuation Department showed.

For the first nine months of the year, a total of 11,168 private residential units were completed, accounting for 61.3 percent of the government's target of 18,228 units for the whole year.

The figure for the first nine months, however, was still down by 18.4 percent when compared to the 13,684 units completed in the same period last year.

(The Standard)新世界4.55亿沽美孚一篮子铺 投资者蔡志忠等承接 料回报约3.7厘

民生铺位受捧,资深投资者蔡志忠伙拍「磁带大王」陈秉志,向新世界购入美孚新邨一蓝子商铺,作价4.55亿,平均呎价5335元,料回报接近3.69厘。

上址为美孚新邨铺位,分布于1至4期,6至8期,位处平台、1楼及2楼铺位,建筑面积由最细的399方呎,由水晶店晶盛源承租,以至最大的铺位,位处4期1楼,现址为草之道滚球训练学院,建筑面积约32257方呎,总面积约85284方呎,新世界原本叫价5.5亿,减价9500万,减价约17%,以4.55亿易手,平均呎价为5335元。

伙拍「磁带大王」陈秉志购入

蔡志忠接受本报查询时指,该批铺位月收140万,平均每呎约16元,属偏低水平,上述商铺合共由24个租客承租,包括有上市连锁家品店、物理治疗专科中心、大型健身中心、医务所、幼稚园、草地滚球场以及餐厅等等,以成交价计算,回报约3.69厘。

平均呎价5335元

有市场人士表示,上述一篮子商铺呎价仅5000多元,铺位平过住宅,预期蔡志忠及陈秉志一如既往,拆售物业。蔡志忠过往曾拆售中环中心全层、沙田石门商场等等。不过,他回应指,暂时未有拆售计画。

蔡志忠续说,该批篮子大业主新世界一手持货,持货至今逾半世纪,亦只有老牌业主才肯割爱,呎价便宜,可遇不可求。近期中外资金及地产基金追捧香港物业,他看好民生商铺前景,美孚新邨属中产屋苑,消费力强。该屋苑逾1.3万伙,居住人口近4万人,全港第二大屋苑,人口比欧洲小国摩纳哥多。

美孚新邨对上一宗巨额铺位买卖,为荔湾道10至16号万事达广场地下N50A号1至11铺号及1楼15至17号铺位,于去年6月3亿成交,买家为詹氏老牌家族,其中,詹耀良有「手套大王」之称,地铺面积约3300方呎,1楼约14000方呎,总面积约17300方呎,平均呎价17341元,租客包括酒楼等民生行业,回报逾4厘。

(星岛日报)

更多中环中心写字楼出售楼盘资讯请参阅:中环中心写字楼出售

更多中环区甲级写字楼出售楼盘资讯请参阅:中环区甲级写字楼出售

土瓜湾商住地盘意向1.28亿

武夷集团持有的土瓜湾北帝街一个地盘,佔地2132方呎,意向价1.28亿。

上址为北帝街105至105A号,代理表示,上址佔地面积约2132方呎,属甲类地盘,住宅地积比约7.5倍,非住宅约9倍,若以9倍计算,可建总楼面为19188方呎,最高建筑物高度为主水平基準以上100米,以叫价1.28亿计算,平均楼面呎价6671元。

楼面呎价6671元

该代理续说,近年土瓜湾大变天,各大财团于区内扩展,购入市建局项或收购旧楼,随着项目重建,令旧楼焕然一新,上址地盘适宜发展精品商住楼,地盘所位处的北帝街,附近设施一应俱全。

早前,恒基以81.89亿夺得区内庇利街/荣光街重建项目,每方呎楼面地价约1.14万,项目横跨庇利街、荣光街、环安街等街道,地盘面积约7.97万方呎,可建总楼面约71.75万方呎,预计提供约1150个住宅单位,面积最少约300方呎,一半单位不少于约480方呎,另有约100个车位的公眾停车场。目前,区内尚有市建局鸿福街/银汉街项目招标,鸿福街1至51号 (单数) 及银汉街2至42A号 (双数),地盘面积约49310方呎,可建总楼面约443789方呎,预料可提供约750伙,市场估值约59.9亿至62.1亿,楼面呎价约13500至14000元。

(星岛日报)

320 new flats snapped up over weekend

Hongkongers' enthusiasm for new homes continued over the weekend with more than 320 flats sold across three projects, squeezing purchasing power for the second-hand market.

An investor splashed out nearly HK$100 million to buy eight flats on the same floor at The Arles in Fo Tan yesterday, which means they will pay 15 percent stamp duty of roughly HK$15 million for the flats totaling 4,239 square feet.

The project, developed by Centralcon Properties, sold at least 50 of 272 flats for the latest batch of sales, as of 1 pm yesterday.

Meanwhile, CK Asset (1113) sold all the 200 flats of #Lyos in Yuen Long's Hung Shui Kui offered in the first three price lists on Saturday, cashing in HK$1.05 billion.

The fourth price list providing 90 units at an average discounted price of HK$15,817 was unveiled by the developer and the sales will be launched on Wednesday. Ranging from 202 sq ft to 482 sq ft, the prices of the new batch are from HK$3.53 million to HK$7.77 million after discounts, which are 2 to 3 percent higher than the previous one.

In Tseung Kwan O, Manor Hill by Kowloon Development (0034) recorded at least 70 transactions over the weekend, accounting for 22 percent of the 312 units offered in the batch.

In Kai Tak, Wheelock Properties received at least 1,500 checks for Monaco One, an oversubscription of 14 times for the first batch of 99 flats. Sales are expected to kick off on the weekend and a new batch with 5 to 10 percent increases in prices may be launched prior to that.

The second phase of Wetland Seasons Bay in Tin Shui Wai will open the first round of sales tomorrow, offering 136 flats, the developer Sun Hung Kai Properties (0016) said.

The second-hand market, however, was listless with only three homes changing hands in a property agency's top 10 housing estates over the weekend, down nearly 70 percent from a week ago. The number of zero-transaction real estates also rose from five to seven and no deals were reported in the three housing estates in New Territories.

In the commercial market, New World Development (0017) sold a group of shops at Mei Foo Sun Chuen for HK$455 million to veteran property investors Choi Chi-chung and tape tycoon David Chan Ping-chi after cutting the asking price by 20 percent.

(The Standard)

Hong Kong buyers bet on housing market to pick up as investor pays HK$100 million for whole floor at Centralcon’s The Arles project

While news about the border reopening is boosting demand, price-sensitive buyers refrained from snapping up more expensive units at The Arles over the weekend

As many as 116 flats of the 272 total units on offer at The Arles on Sunday were sold by developer Centralcon Properties

Hong Kong buyers are betting on an uptick in the city’s housing market amid plans to reopen the border with mainland China by February next year, according to analysts, as results of home sales on Sunday were mixed.

As many as 116 flats, or 42.6 per cent, of the 272 total units on offer at The Arles – a project by local developer Centralcon Properties that is located near the Fo Tan subway station in the eastern New Territories – were sold on Sunday, according to agents. The flats that were snapped up were each sold at a 15 per cent discount, priced at around HK$20,905 (US$2,686) per square foot.

Sales of the project have been “reasonable” on the back of news about the border reopening, agent said.

An individual spent HK$100 million on Sunday to buy the whole floor – representing a total of 8 units – at one of The Arles’ buildings, according to Centralcon Properties. Buyers of units with an area of 4,239 square feet will need to pay around 15 per cent tax.

The agent indicated, however, that price-sensitive buyers refrained from snapping up the more expensive units in the development. The prices of flats at The Arles range from HK$8 million to HK$100 million.

The results of Sunday’s sales for The Arles come a day after CK Asset Holdings recorded brisk business at its #Lyos project in Hung Shui Kiu. On Saturday, the firm sold all 200 flats offered in the first batch of sales for its #Lyos development.

The successful launch at Hung Shui Kiu shows how Hong Kong’s residential property bull run has gained momentum in recent months after a brief stumble last year, as the city’s economic recovery and low interest rates bolstered sentiments.

Still, The Arles is a crucial test on whether that momentum can be maintained this month. When fully completed in March 2023, The Arles will comprise 1,335 flats measuring between 228 and 947 square feet.

“The units are small and close to the subway station, which are quite attractive to some young people,” another said.

The third round of sales at The Arles is expected to be valued between HK$5 million and $21.8 million, with prices per sq ft ranging from HK$16,423 to HK$26,251. The Arles has posted two favourable sales rounds, selling about 47 per cent of units on offer in the second round and 82 per cent in the first round.

“Since the stock market has recently been less volatile, the overall sentiment towards the property market is pretty good,” agent said. The agent indicated that more buyers are entering the market after Hong Kong Chief Executive Carrie Lam Cheng Yuet-ngor’s policy address last month.

The government unveiled its plan for a “Northern Metropolis”, close to the southern border of mainland China, where 2.5 million people may live within 20 years. The scheme, repackaged and expanded from an existing new town plan, is seen as a major strategic change for development. It will move the centre away from Hong Kong Island to the north, integrating the city into Beijing’s latest national development plan

The metropolis will include existing new towns in Tin Shui Wai, Yuen Long, Fanling and Sheung Shui and their neighbouring rural areas, as well as six new development areas under planning or construction.

The agent predicted a 2 per cent gain in housing prices this month and in December, as well as new home sales of 25,000 units and around 4,000 unit sales in the secondary market in November.

(South China Morning Post)东涌配电站流标 港铁拒接纳5标书

拆解3原因:发展周期长 补地价及分红比例高

港铁 (00066) 东涌牵引配电站项目上周截标,昨宣布拒绝接纳5份标书,项目「流标」收场,将重新招标,为近7年再有港铁项目标流。入标财团拆解流标3大原因,包括:发展周期长、补地价金额加上港铁要求地价分红过高,强调并非看淡后市。

对本年度供应 政府指影响微

政府发言人指,截至本年第3季,2021/22年度的私人房屋用地供应约1.37万伙,已超过全年供应目标1.29万伙。东涌牵引配电站发展项目未能如期推出,对本年度的私人房屋土地总供应影响不大;而政府会继续加快造地建屋的步伐,预期在本年第四季度仍会有不同来源的用地推出,为市场提供稳定及持续的土地供应。

东涌牵引配电站位于文东路及喜东街交界,住宅楼面上限约94万平方呎,预计提供约1,400至1,800伙。项目上周四共接获5份标书,包括长实 (01113) 、新地 (00016) 、恒地 (00012) 、华懋及信置 (00083) ;但港铁最终宣布,决定不接纳任何有关该项目的标书文件,并会于适时重新招标,属于自2014年天水围天荣站后再度有铁路项目流标。

将再招标 发展商非看淡楼市

据其中一间有入标的大型发展商称,相信流标有多方面原因,其中项目建筑工程有一定难度,下方是电力设施,地底亦有东涌綫隧道经过,所以发展周期长达7年半,增加了发展成本及风险。与此同时,项目的补地价水平亦较高,见不到有建筑成本上的扣减,所以发展商出价不会太过进取,最终港铁不愿让步亦只有流标收场。

另一间财团亦称,流标绝对不是发展商看淡楼市前景的讯号,因为对比近期推出的住宅地不少都以高价批出,认为今次流标只是个别情况,并认为政府要求的补地价金额亦算合理,关键是港铁要求的地价及分红比例等过高,并称若果之后重新招标,需要在招标条款上有所修订才有机会顺利批出。

不过,有测量师估计,主要原因是项目补地价偏高,高出比较市场预期逾10至20%,令投资回报降低,因此令发展商对入标价有保留。而另一测量师则指,项目补地价金额水平太高,计及向港铁支付的分红,发展商难以合理利润发展。以东涌东环及昇薈为例,两个项目每平方呎售价大约1.3万至1.6万元。

据资料显示,项目的补地价金额约47.65亿元,每呎补地价约5,072元,另发展商须支付不少于2.5亿元入场费,以及不少于15%分红,但截标前市场对地盘估值只是介乎42.3亿至75.2亿元,每呎楼面地价约4,500至8,000元,部分测量师认为补地价水平太高,故此有「流标」风险。

(经济日报)

中银1.99亿购铜锣湾旧楼

疫情持续平稳,带动工商铺交投转活,市场再录大手成交。消息指,铜锣湾轩尼诗道全幢商住物业,以1.99亿易手,买家为中国银行 (香港),项目料与毗邻地盘作合併发展。

呎价3.4万易手

综合市场消息指出,轩尼诗道470号于上月底以1.99亿易手,买家为中国银行 (香港) 有限公司,以项目总楼面约5800方呎计,平均呎价约34310元。据悉,项目楼龄约50年,楼高5层,地下为铺位,楼上则为住宅。

资料显示,中国银行 (香港) 亦持有同区轩尼诗道472号,并于今年3月获屋宇署批重建一幢24层高商厦,可建楼面约4.2万方呎;据业内人士指出,中国银行 (香港) 将上述两地盘作合併发展,地盘面积约3500方呎,可建楼面约5.25万方呎。

柴湾工业城980万成交

另一方面,工厦市场亦频录成交,消息指,柴湾工业城2座中层3室,面积约1508方呎,以980万承接,呎价约6498元;另外,观塘华成工商中心亦录买卖,消息指,该厦中层13室,面积约1354方呎,以970万易手,呎价约7163元。

(星岛日报)

MTR rejects all five bids for plot at Tung Chung, Lantau Island, as developers recoil at huge sum needed to build

The companies that submitted bids were among Hong Kong’s largest developers, namely CK Asset Holdings, Sun Hung Kai Properties, Henderson Land Development, Sino Land and the Chinachem Group

Given the costly investment required for the parcel atop MTR’s Tung Chung traction substation, the fact the bids fell short was unsurprising, say analysts

The MTR Corporation has rejected all five bids for a large residential site in Tung Chung on Lantau Island after the plot elicited a cool response from Hong Kong’s developers.

“[MTR] has decided not to accept any of the tender submissions [and] will retender the project in due course,” the rail operator said in a statement. MTR declined to give a further comment.

Given the costly investment required for the parcel, located atop MTR’s Tung Chung traction substation, the fact the bids fell short was unsurprising, according to analysts. With a gross floor area of 929,364 square feet (10,000 square metres), the plot can accommodate between 1,400 and 1,800 flats and would require an estimated investment of HK$11.3 billion (US$1.45 billion) to develop.

The companies that submitted bids were among Hong Kong’s largest property developers, namely CK Asset Holdings, Sun Hung Kai Properties, Henderson Land Development, Sino Land and the Chinachem Group.

“The main reason for the unsuccessful tendering of the Tung Chung Power Distribution Station project would likely be the high land premium of over HK$5,000 per square foot, which is about 10 to 20 per cent higher than market expectations. This might lower the developer’s investment return, and thus affect [their bids],” a surveyor said.

The plot on Lantau Island, where the city’s Disneyland resort and airport are located, received five bids when the tender closed last week. That was far fewer than the 35 expressions of interest the rail operator received in the preceding weeks.

The expressions of interest included ones from mainland China-based home builders such as Vanke China, Kaisa Group Holdings and China Overseas Land & Investment.

Since then, many mainland developers have had to contend with a tightening credit squeeze as Beijing cracks down on risky borrowing.

Kaisa, for example, is selling assets to raise capital for liabilities including a missed payment on a wealth product and US$11 billion of dollar bonds, as it faces a hectoring by Shenzhen’s government. The trading of its shares was halted in Hong Kong.

The developer has put 18 property projects in Shenzhen on the auction block, with a combined value estimated at 81.82 billion yuan (US$12.8 billion), according to a catalogue seen by the Post.

The Tung Chung plot, which is about a 10-minute drive from the existing Tung Chung subway station, could be worth between HK$5.6 billion and HK$7.3 billion, including a HK$4.8 billion land premium payable to the government.

The estimated value translates to HK$6,000 to HK$7,800 per square foot, according to property agencty. After adding in construction costs, the total investment for the site could go as high as HK$12,200 per sq ft.

With flats in the district selling recently for between HK$13,000 and HK$16,000 per sq ft, developers probably found it difficult to justify the investment required, according to a surveyor.