纪惠集团6.9亿 购中环中心全层

投资气氛略转好,「小巴大王」马亚木以约6.93亿元,沽出中环中心中低层全层,呎价约2.7万元,属今年该厦呎价新低,料仅获利微利离场,买家为纪惠集团。

市场消息指,中环中心录得全层成交,涉及物业26楼全层,面积约2.5万平方呎,以约6.93亿元成交,呎价约2.7万元。据了解,单位目前部分楼面租出。按成交呎价计,为该厦今年新低。

该厦今年曾录全层楼面成交,涉及「磁带大王」陈秉志以8.7亿元,沽出物业38楼全层,呎价约3.4万元。由于是次沽出26楼,属物业中低层,不及中高层海景单位优质,造价较低。

另外,陈秉志上月推出中环中心39楼最后5伙拆售全数沽出,呎价约3.3餘万元,业主提供优惠,每个单位回赠1,000万元,变相减价逾1成。按是次每呎2.7万元计,为该厦今年新低。

纪惠共持有3层楼面收租

原业主为马亚木,他伙拍多名投资者,于2017年向长实 (01113) 购入中环中心,而马亚木持有当中13层楼面,如今以每呎2.7万元沽出全层,料仅获微利离场。

据了解,买家为纪惠集团,而购入单位同时,物业已获新租客预租,呎租约60元,回报率约2.7厘。事实上,纪惠集团已数度购入中环中心,先在2018年,以约7.62亿元购入向卢文端购入19楼全层,呎价约3.1万元,并于2019年1月,以7.3691亿元购入28楼全层,面积约24,980平方呎,呎价2.95万元,是次第3度入市,目前集团已持有3层中环中心楼面,作长綫收租用途。

(经济日报)

更多中环中心写字楼出售楼盘资讯请参阅:中环中心写字楼出售

更多中环区甲级写字楼出售楼盘资讯请参阅:中环区甲级写字楼出售

近月工商铺市况明显转活,新近有业主趁势放售观塘万兆丰中心中高层,意向约3465万,準买家更可获配售一个车位,叫价约210万。

代理表示,观塘海滨道133号万兆丰中心中高层C室,面积约2475方呎,意向呎价约1.4万,总金额约3465万,物业由业主自用,将交吉出售。

该代理指,该单位享全海景,将连写字楼装修出售,买家即买即用,单位现时市值呎租约25至28元。準买家亦可同时洽购万兆丰中心一个车位,售价约210万。

(星岛日报)

更多万兆丰中心写字楼出售楼盘资讯请参阅:万兆丰中心写字楼出售

更多观塘区甲级写字楼出售楼盘资讯请参阅:观塘区甲级写字楼出售

甲厦交投按年弹升1.8倍 代理:上半年录96宗

工商铺去年底撤辣,加上疫情对市场影响减退,资金寻出路,带动写字楼交投急弹。代理数据显示,今年上半年五十大指标甲厦合共录96宗买卖,按年大幅反弹约1.8倍。

代理表示,本港疫情影响逐渐减退,在新晋投资者入市带动下,加上去年低基数效应,写字楼交投按年大幅反弹,但现时与高位比较仍然有一段距离。不过,近日政府表示有意先行局部恢復通关,若稍后政策落实细节,相信对写字楼市场有正面影响,预计今年全年甲厦买卖仍会表现不俗。

疫情减退资金寻出路

代理数据显示,今年上半年五十大甲厦共录96宗买卖,相对去年同期的34宗,按年急弹逾1.8倍,期内成交面积约37.1万呎,按年亦上升接近1.5倍。至于2019年同期共录得90宗买卖,显示今年上半年的指标甲厦买卖,已经超过2019年中政治运动爆发前夕的水平。

然而,若与2018年同期,即中美贸易战刚爆发时的134宗,以及2017年商厦大牛市时的191宗比较,最新成交量分别仅及当年的约七成及五成左右。

中环中心半年录八成交

若按地区划分,上半年录最多成交的为九龙区,期内合共录60宗买卖,港岛及新界区分别各录20宗及16宗。上半年交投较活跃的大厦,包括中环中心 (8宗)、尖东新文华中心 (8宗)、观塘寧晋中心 (6宗) 及葵涌新都会广场 (6宗),但期内仍有多座大厦未录得买卖,包括中环环球大厦及金鐘海富中心等港岛核心区指标甲厦。

若单计6月份,五十大甲厦共录得18宗买卖,是连续6个月企稳双位数的水平,涉及面积约4.39万方呎,与5月份的15宗及4.51万方呎相若。另外,6月份共有38座大厦录零成交,较5月份的37座略为上升。

(星岛日报)

更多中环中心写字楼出售楼盘资讯请参阅:中环中心写字楼出售

更多环球大厦写字楼出售楼盘资讯请参阅:环球大厦写字楼出售

更多中环区甲级写字楼出售楼盘资讯请参阅:中环区甲级写字楼出售

更多新文华中心写字楼出售楼盘资讯请参阅:新文华中心写字楼出售

更多尖沙咀区甲级写字楼出售楼盘资讯请参阅:尖沙咀区甲级写字楼出售

更多寧晋中心写字楼出售楼盘资讯请参阅:寧晋中心写字楼出售

更多观塘区甲级写字楼出售楼盘资讯请参阅:观塘区甲级写字楼出售

更多海富中心写字楼出售楼盘资讯请参阅:海富中心写字楼出售

更多金鐘区甲级写字楼出售楼盘资讯请参阅:金鐘区甲级写字楼出售

丰泰地产2.6亿 放售湾仔商地盘

市区地盘罕有,丰泰地产放售湾仔庄士敦道商业地盘,市值约2.6亿元。

代理表示,获委託放售湾仔庄士敦道189号,地盘属于两面单边,前临庄士敦道及谭臣道,地盘面积1,466平方呎,可作银座式商厦、写字楼或酒店等。现物业连地铺楼高6层,总楼面面积约9,637平方呎。物业已获屋宇处批准图则,可重建为一幢22层高的银座式大厦,楼面面积达21,990平方呎。物业市值约2.6亿元,每呎楼面地价约1.2万元。

(经济日报)

元朗地掀中小财团争夺

政府积极推地,其中,元朗住宅地将于新一季推出,据业内人士指出,市场估值约3.6亿至4.25亿,每呎楼面地价约5500至6500元,由于发展规模较小,料掀中小财团争夺。

地盘面积16万方呎

元朗流业街与涌业路交通,地盘面积163699方呎,可建楼面约65480方呎。莱坊执行董事及估价及諮询部主管林浩文指出,近期投地市场气氛不俗,对市场释出正面作用,该幅住宅地虽靠近工业区,惟区内近年发展迅速,于土地仍供不应求下,料各大发展商将积极竞投,市场估值约3.9亿至4.2亿,每呎楼面地价约6000至6500元。

有测量师表示,该地皮靠近工业区,加上景观亦欠理想,而且地皮剪裁亦较复杂,料每呎楼面地价约5500元,估值约3.6亿,项目规模及投资金额较小,故对中小型发展商具吸引力。

市场估值3.6亿

代理表示,项目位置上邻近港铁元朗站,属低密度发展,规模较小,由于投资额及风险较低,故预期该地皮亦会获不少发展商追捧,包括中小型发展商,以每呎楼面地价约5500元计算,估值约3.6亿。

另一测量师表示,地皮位置较为偏远市中心,交通较为不便,料地皮有机会发展成低密度住宅,地皮银码不大。

(星岛日报)

北环綫3中途站曝光 沿途8盘料受惠

合共涉9万伙 包括新地多个项目

港铁 (00066) 最近提交造价620亿元的北环綫环评概要,走綫三个中途站位置曝光,周边预计有8个项目将会受惠,涉及9万伙,包括新地 (00016) 旗下多个私人项目。

全长10.7公里的北环綫,属于《铁路发展策略2014》建议的7个铁路方案之一,由现有屯门马綫锦上路站接驳至东铁綫落马洲支綫新增的古洞站,形成一个环形铁路,政府在去年底拍板由港铁负责详细规划及设计。

港铁近日向环諮会提交北环綫的环评研究概要,据文件指,北环綫总站为锦上路站跟古洞站,总站之间设凹头、牛潭尾及新田三个中途站,并公开了三个中途站的确实位置。

在粗略统计,在该3个中途站旁边至少有8个公营或私营发展项目,合共涉及9万个住宅供应。除了政府早前透露物色到的90公顷土地,涉及7万伙之外,还有至少5个私人项目,合共约2万伙。

Park YOHO近凹头站 呎价看升

当中凹头站将位于沙埔发展区附近,亦即是新地旗下Park YOHO,项目2016年开始推售,目前实用呎价约1.3万至1.8万元左右,相信日后在凹头站开通之后将会受惠于铁路发展。

至于新地亦在周边成功收购了大批农地储备,当中位于Park YOHO东面的长春新村项目,将会提供3,891伙;而沙埔项目第二期亦会提供约1,154伙。除了住宅外,新地在邻近的荣基村一带亦持有一个总楼面约60万平方呎的商业项目。

新田站位处落马洲发展枢纽

同时,新田站的石湖围一带,新地亦跟置地拥有一个大型项目,早前申请兴建多达1.1万伙的大型屋苑,第一期将会提供约1,900伙,其餘则有待政府新界北研究后落实。

新田站将会在政府主导规划的「新田/落马洲发展枢纽」的市中心附近,而该发展区则会提供约3.1万个住宅供应,以及创科园区。

锦綉花园邻近的牛潭尾站则会位于横平山南路附近,周边除了政府物色发展的棕地群外,九建 (00034) 等亦拥有一个「综合发展区」项目,将会兴建逾150幢低密度住宅,涉及约201伙。

北环綫将分两阶段落实,第一期会在2023年动工增设古洞站,而第二阶段锦上路站至古洞站之间的主綫则会在2025年动工,并在2034年落成。

值得注意的是,港铁在环评概要内提及,会对锦上路站以北的西铁补偿湿地、沙埔沼泽、石湖围水耕农地等生态敏感地区可能造成影响。

(经济日报)

民生铺消费稳呎价低 投资者垂青

最近民生区屡录商铺买卖,更有投资者大手购入民生商场,由于民生区消费稳健,加上铺位呎价较低,令长綫投资者感兴趣。

近期邓成波家族频频放售物业,个别大楼面铺位获承接。家族旗下葵涌安荫及荃湾石围角商场,两项目合共以约13亿元沽出。两物业均为民生区商场,葵涌安荫商场楼高两层,地下设有街市,总楼面约40,889平方呎;租客包括洗衣店、便利店等民生商户,出租率约77%,每月租金收入约218.4万元。

另一项物业为石围角商场,亦包括街市,总楼面约13.2万平方呎,现由超市、麦当劳快餐店等租用,出租率约79%,每月租金收入约314.5万元。值得一提,两项物业均设有停车场,分别提供355及578个车位,共涉933个。

林子峰:为物业翻新 提升质素

据悉,两项物业均获「磁带大王」陈秉志、资深投资者林子峰等,以约13亿元承接。林子峰表示,是次购入商场楼面大,呎价仅约5,000餘元,相当便宜,此外,项目出租率暂约8成,回报率已达5厘,加上未有任何翻新工作,故日后全数租出,租金收入尚有提升空间,项目亦连同数百车位,故投资价值高,他指日后将为物业进行翻新以提升质素。

翻查资料,陈秉志及林子峰过往多年,先后多次向领展购入商场,包括大埔运头塘商场、将军澳翠林商场等,合共涉及10多个商场,如今再增购相关物业。过去林子峰购入的商场,多进行车位拆售,如2014年以3.18亿元向领展购入屯门兆麟苑商场及车位,于2015年拆售,全数449个车位短时间内沽清,套现约3.42亿元,已高于整项物业购入价。

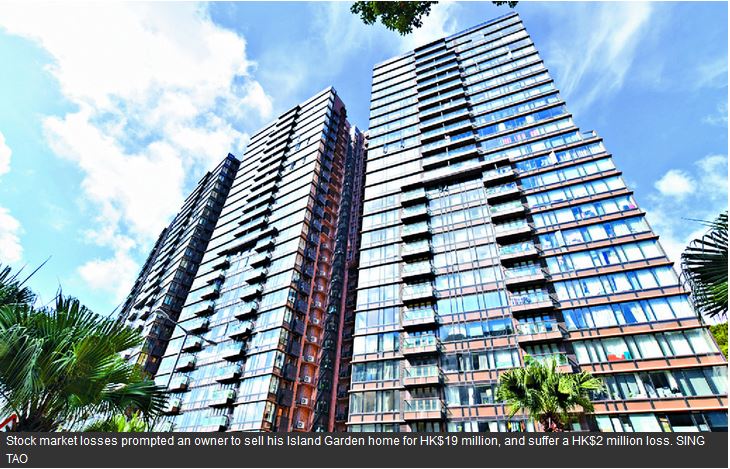

鰂鱼涌银行铺 1.05亿沽

除此之外,民生区亦录单一铺位成交,如邓成波家族以约1.05亿元,沽出鰂鱼涌英皇道1065号C铺,面积约3,325平方呎,呎价约3.16万元。该铺位处民生区兼属大楼面,物业由银行租用,月租约30万元,新买家享约3.4厘租金回报。铺王邓成波于10年前,以约4,200万元购入,持货10年转手,如今家族帐面赚约6,300万元离场,升值约1.5倍。

分析指,疫情下民生区铺位租客多为日常所需商户包括超级市场、便利店、餐厅及家品店等,疫情下生意没受冲击,个别生意更转好,故租金收入非常稳定。由于经济渐復甦,失业率亦有改善,民生消费料持续稳定,故追求稳健回报的投资者,仍追捧民生铺位。

(经济日报)

5月工厦351买卖 近两年次高

工厦交投转理想,资料显示,5月工厦录3511宗买卖,为近两年次高月份。

代理表示,工厦交投一季比一季畅旺,自去年次季以来,已连升4季,料第二季可持续上升并重越千宗水平。根据代理资料所得,2021年5月份全港共录得351宗工厦物业买卖登记 (数字主要反映2至4星期前工厦市场实际市况),较4月份的382宗减少8%,为连升两月后轻微回落,但仍为近24个月次高水平。5月份工厦登记总值录得约32.68亿元,按月跌39%,主因4月有较大额的全幢登记拉高基数所致。

观塘兆富工厦地下 1.8亿沽

按物业价格组别作分析,在7个价格组别的工厦买卖登记当中,5月份录得3跌3升1持平;当中1,000万至2,000万元以内的组别所录的26%跌幅最显著,登记量由4月的43宗,降至5月的32宗;其次,500万至1,000万元以内组别亦跌25%,至88宗登记,反映中细价工厦登记略有回落。至于中高价工厦则逆市录得升幅,其中银码介乎5,000万至1亿元以内的组别,录6宗,按月大增2倍,而1亿元或以上者则持平在4宗。此外,上月10大贵重工厦登记个案中,以观塘兆富工厂大厦地下全层的1.8亿元登记最瞩目,其次为柴湾王子工业大厦7楼、11至13楼全层连天台及车位的逾1.27亿元登记。

该行定期观察的10个主要工业区作分析,共录得5区上升及5区下跌的情况;当中以新蒲岗区的跌幅最大,区内5月份买卖登记共7宗,较4月的12宗减少42%。至于沙田区亦录40%的跌幅,月内登记32宗。另外,葵涌区续为登记量最多的观察区,月内录70宗登记,按月微减1宗。值得注意的是柴湾区月内逆市大升1.5倍至20宗。

代理指出,5月下旬工厦交投再次加快,其后表现亦见稳定,且不乏大银码成交,故料落入6月份的登记量值将再次回升,料可录得介乎380至400宗左右;按此推算,次季工厦买卖登记量肯定可以破千宗,达至逾1,100宗水平,按季料升25%,并且将连升5季,重返2019年次季后的新高。展望第3季,随着陆续有一手工厦料开始拆售,将可带动整体市场气氛,第3季工厦市道可续看俏。

(经济日报)

Property deals soar to 24-year high at $468b

Local property transactions surged 74.2 percent year-on-year to HK$468.71 billion in the first half as of June 29, hitting a 24-year high, according to property agency.

The transactions included residential properties in the primary and secondary market, commercial properties and car-parking spaces, and the number of transactions jumped 52.1 percent to 49,795 in the first half as of June 29, a more-than-eight-year high, it said.

In the primary market, 8,087 deals of private residential flats were recorded during the period, up 25.2 percent year-on-year, with the total consideration rising 57.8 percent to HK$111.51 billion.

In the secondary market, the number of transactions increased 48.1 percent to 32,737 during the period, with the total consideration up by 62.8 percent to HK$280.06 billion.

In the commercial market, an property agency recorded 96 transactions at 50 Grade A office buildings in the first half, up by 182.35 percent year-on-year.

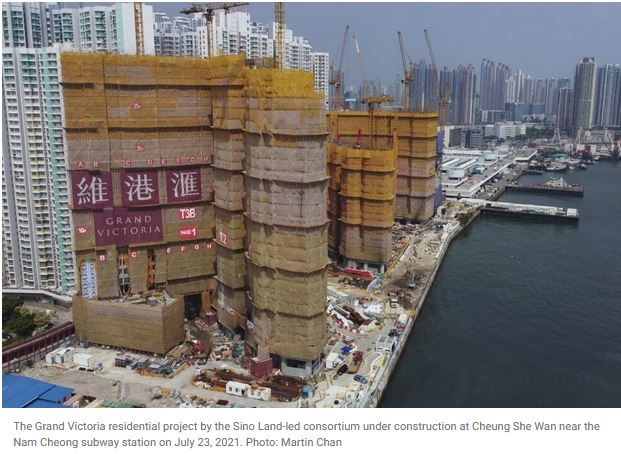

Separately, three flats at Grand Victoria were sold for about HK$44.71 million in total. The property in Cheung Sha Wan is being developed by Wheelock Properties, Sino Land (0083), K Wah International (0173), Shimao (0813) and SEA Holdings (0251).

(The Standard)

Hong Kong government departments take advantage of falling rents to lease more office space in Kowloon

The Transport Department recently signed a lease in Kowloon, while the Lands Department is looking additional office space, according to property agency

With more companies starting to expand amid an improving economy, the city’s grade A office market recorded its first net absorption since July 2019, another agency said

The Hong Kong government is taking advantage of the drop in office rents to seek additional space for some departments, joining private companies looking to expand amid an improving economy.

The Transport Department recently signed a lease for a huge office space in Kowloon, while the Lands Department is in talks with landlords to take up additional office space, according to property agency.

In May, office rents in Kowloon East fell 9.3 per cent year on year to HK$26.9 per square foot per month, while in Central they dropped 12.9 per cent to HK$111.8 per square foot compared to a year ago, the latest data from property agency showed.

“They are mainly looking for space in Kowloon where rents are about a quarter of those on Hong Kong Island,” agent said.

The Transport Department recently leased 27,000 sq ft at Skyline Tower in Kowloon Bay, a core part of Hong Kong’s plan to transform Kowloon East into the city’s second core business district, at about HK$22 per square foot, while the Lands Department is looking for additional space close to its Cheung Sha Wan offices, the agent said.

In the past year, the Government Property Agency, which rents and allocates office space to various departments among other activities, has leased 100,000 sq ft at Skyline Tower to accommodate the back up offices of the Social Welfare Department, Immigration Department, Drainage Services Department and Audit Commission.

“The government’s move indicates rents in Kowloon East have dropped substantially,” said another agent.

Overall grade A office rents in Hong Kong have fallen about 27 per cent from the peak in June 2019, when they started their downward spiral amid the anti-government protests followed by the Covid-19 pandemic, according to the property agency. Local and multinational firms opted for downsizing or implemented work-from-home arrangements to contain costs amid tougher operating conditions.

The agent said that the rate of decline in rents has narrowed since early this year, and expects overall rents to fall by five to 10 per cent this year, compared to the 18.9 per cent plunge in 2020.

For the first five months this year, office rents have declined 4.1 per cent, ageny said. With more companies starting to expand, the property consultancy said the city’s grade A office market recorded its first net absorption since July 2019.

“We have helped several China-backed securities firms and asset management companies in Central take up more space,” the agent said.

Companies that have recently leased office space include the food delivery company Foodpanda, which leased two floors with a gross floor area of 39,000 sq ft at Times Square in Causeway Bay in June.

BitMEX, which operates a cryptocurrency derivatives exchange out of the priciest office tower in Hong Kong, is exploring the possibility of leasing additional space equivalent to half a floor at Cheung Kong Center from CK Asset Holdings.

The three-year lease of BitMEX’s 20,000 sq ft of space on the 45th floor of the tower, costing about US$600,000 per month, expires later this year.

With business confidence building up in Hong Kong in recent months, companies have started reassessing their real estate needs, agent said.

“We believe that the worst period for the office leasing market has passed and rental fall will moderate in the second half of the year for most core markets,” the agent said.

(South China Morning Post)

For more information of Office for Lease at Cheung Kong Center please visit: Office for Lease at Cheung Kong Center

For more information of Grade A Office for Lease in Central please visit: Grade A Office for Lease in Central

For more information of Office for Lease at Skyline Tower please visit: Office for Lease at Skyline Tower

For more information of Grade A Office for Lease in Kowloon Bay please visit: Grade A Office for Lease in Kowloon Bay

For more information of Office for Lease at Times Square please visit: Office for Lease at Times Square

For more information of Grade A Office for Lease in Causeway Bay please visit: Grade A Office for Lease in Causeway Bay

Hong Kong’s real estate deals jump to 24-year high in first half buoyed by upbeat economic sentiment

Real estate deals amounted to HK$468.71 billion from January to June, the most since HK$483.6 billion in the first half of 1997, property agency data shows

Secondary housing tops the volume, accounting for nearly 60 per cent of the turnover this year

Hong Kong’s real estate market is gathering steam. Total transactions in Hong Kong’s property sector surged to a 24-year high in the first half, led by a bounce in residential assets, as investors piled into the market amid the economic recovery.

The overall volume, including homes, commercial and industrial properties and car parking spaces, rose to HK$468.71 billion (US$60.4 billion) in the first six months, the most since HK$483.6 billion in the first half of 1997, according to data compiled by property agency. It represented a 74.2 per cent jump from the same period last year, when the Covid-19 pandemic coupled with the recession dampened investor sentiment.

Secondary housing topped the list, accounting for HK$280.06 billion or nearly 60 per cent of the turnover.

“Even under the haze of the pandemic, the property market has rebounded, with the number and value of transactions rising, of which the second-hand housing market has become the main driving force,” analyst said.

The prices of lived-in homes extended a five-month rally in May and were at their highest since July 2019, according to Rating and Valuation Department data. They were also within 0.8 per cent of a historic high recorded in May 2019, before anti-government protests kicked off in the city. Some analysts have predicted that Hong Kong’s secondary home prices could rise by 5 to 10 per cent this year.

Offices saw the fastest growth in transactions, rising nearly fivefold to HK$22.58 billion in the first half compared to HK$4.52 billion a year earlier. One of the biggest transactions was the HK$10.5 billion sale of Kowloon Bay International Trade and Exhibition Centre in June, data from another property agency showed.

The office market is showing signs of recovery and will rally once the border is reopened as funds from mainland China will return, agent said.

The commercial and industrial property segment saw first-half deals increase 136 per cent to 3,623, the most since the second half of 2018 before the outbreaks of social unrest and coronavirus pandemic saw investors retreat to the sidelines, according to the agency. Transactions in the second half are expected to rise by another 25 per cent from the first half to 4,500, it estimated.

“The bottom in the industrial and commercial property market has ended, and the market is slowly entering an upward trend,” the agent said.

Separately, a real estate unit of asset manager Schroders Capital and real estate investment firm BentallGreenOak said that they have acquired an industrial property and car parking spaces at Cable TV Tower and One Midtown from Wharf Development.

Located in Tsuen Wan, the premises comprise about 568,200 sq ft of industrial space and 122 car parking spaces.

The companies paid HK$2.6 billion for the assets, according to sources. A Schroders spokesman, however, declined to confirm the price.

“In anticipation of a gradual recovery in trade and economic activities, this deal represents a strategic investment and a good opportunity to capitalise on Hong Kong’s international importance as a trading and logistics centre,” said Andrew Moore, head of Schroders Capital Real Estate Asia Pacific.

(South China Morning Post)

For more information of Office for Lease at KITEC please visit: Office for Lease at KITEC

For more information of Grade A Office for Lease in Kowloon Bay please visit: Grade A Office for Lease in Kowloon Bay力宝中心中层 市价8.8万租出

消息指,金鐘甲厦力宝中心录得租务成交,涉及物业一座中层01室,面积约2,100平方呎,以约8.8万元租出,呎租约42元,属市价水平。

另外,中环两商厦亦录租务成交,包括盘谷银行大厦低层全层,面积约3,343平方呎,成交呎租约41元。另外,英皇商业中心中层全层面积约2,680平方呎,以每呎约42元租出。

(经济日报)

更多力宝中心写字楼出租楼盘资讯请参阅:力宝中心写字楼出租

更多金鐘区甲级写字楼出租楼盘资讯请参阅:金鐘区甲级写字楼出租

更多英皇集团中心写字楼出租楼盘资讯请参阅:英皇集团中心写字楼出租

更多中环区甲级写字楼出租楼盘资讯请参阅:中环区甲级写字楼出租

施罗德26亿购荃湾一篮子物业

本报早前率先披露,荃湾有线电视大厦一篮子物业买卖,买家身分终曝光。施罗德资本房地产与BentallGreenOak于昨天公布双方已透过其投资管理机构旗下房地产基金,完成向九仓收购荃湾有线电视大楼及One Midtown的工业物业及停车位,作价26亿。项目均位于荃湾的中心地段,当中的工业物业楼面约56.82万方呎,并提供122个停车位。

(星岛日报)

湾仔豫港大厦12车位2440万拍出

有拍卖行昨日举行拍卖,现场售出其中两个项目,当中最瞩目为有买家以2440万连扫湾仔豫港大厦12个车位。该拍卖行发言人表示,豫港大厦12个车位,属银主盘,以开拍价2440万一口价拍出,每个车位月租约4000至5000元,租金回报约2.4至3厘。至于深井丽都花园双号车位,同属银主盘,开拍价99万,获3组客竞投,拍至122万成交,属市价。另北角城市金库单号铺位,124方呎,连至2023年4月底的租约,月租2500元,以56万售出,亦属市价。

(星岛日报)

更多豫港大厦写字楼出售楼盘资讯请参阅:豫港大厦写字楼出售

更多湾仔区甲级写字楼出售楼盘资讯请参阅:湾仔区甲级写字楼出售

永泰26亿夺古洞地 楼面呎价高见9209

粉岭古洞段住宅地由永泰地产 (00369) 以26.168亿元高价夺得,每平方呎楼面地价约9,209元,创粉岭、上水区次高,亦较比邻用地8年升8成。永泰指看好新界北一带发展,市场预料日后开售呎价逾2万元。

永泰地产地产投资及发展部董事总经理吴家煒称,集团非常高兴投得该地皮,地皮位置优越。而随着政府近年大力推动的大湾区蓝图、落马洲河套发展及规划中的北环綫铁路,相信区内基建及生活配套更趋完善,并特别看好新界北一带发展。集团亦认为楼市将继续平稳发展,并会持续从不同渠道增加土地储备作长远发展。

早于2017年,铺王梁绍鸿旗下大鸿辉以1.3亿元投得上水「蚊型」地,每平方呎楼面地价1.4万元,贵绝新界北区。是次永泰投得粉岭古洞段住宅地,属区内次高。

比邻的粉岭高尔夫球场旁地皮,即现时恒地 (00012) 旗下高尔夫‧御苑,于2013年底以28.88亿元批出。该地皮佔地约15.4万平方呎,地积比率约3.6倍,可建楼面达55.5万平方呎,当时每平方呎呎楼面地价约5,200元。相比之下,是次批出的地皮楼面地价约9,209元呎,意味相隔近8年,地皮大幅升值约77%。

看好新界北 推售呎价料2.2万

地皮于上周五截标,接获17份标书,入标发展商包括会德丰地产、新地 (00016)、恒地、佳兆业 (01638) 等。地皮邻近高尔夫‧御苑,不属于古洞北新发展区范围内,地盘面积约4.7万平方呎,最高可建楼面约28.4万平方呎,地皮估值14.5亿至19.9亿元,每呎楼面地价约5,100至7,000元,永泰投地价较市场估值上限高逾3成。

而是次以高价夺地的永泰,对上一次成功投得官地要追溯到2016年中,当时以9.82亿元投得屯门青山公路大欖段住宅地。

有测量师认为,是次发展商出价相当进取,成交呎价接近市区地价,而且与该区现楼呎价差距不算大,反映发展商十分看好该区发展,预计落成后呎价达2.2万元。

(经济日报)

赌王两千金 近6千万扫Mount Nicholson 6车位

山顶聂歌信山道Mount Nicholson早前拆售车位,造价近1,200万元创全球新高纪录。买家全属城中一綫富豪家族,其中赌王何鸿燊与四太两位千金,何超欣及何超盈便斥近6,000万元购入6个车位。

土地註册处资料显示,Mount Nicholson单日录得10宗车位成交登记,30至36号6个相连车位,以每个990万元售出,登记买家为赌王四太梁安琪两名千金何超欣、何超盈,即是说何家以约5,940万元购入6个车位。

资料显示,2016年赌王四太梁安琪,以12.9亿元买入Mount Nicholson 4个住宅单位,送给两名90后女儿何超欣及何超盈,当时四太便指送楼希望让女儿学习投资。

德永佳潘氏 约4486万购4车位

另外,屋苑一个双号车位亦以991.1万元沽出,买家为苏树辉 (SO SHU FAI),与澳博控股公司行政总裁及执行董事名字相同。

土地註册处资料显示,Mount Nicholson车位至今共录得34宗註册登记,成交价介乎950万至1,188.8万元,当中出手最豪算是德永佳执行董事潘浩德,以每个1,188.8万元连购3个,目前属全球最贵车位。其家族成员再以920万购入1车位,即潘氏家族共以约4,486万购入4车位,平均每个车位造价1,121.5万元。

(经济日报)

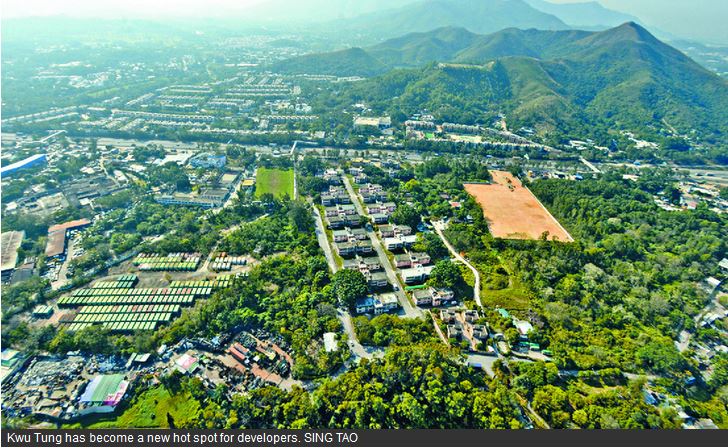

Wing Tai wins Kwu Tung residential site at $2.6b

Wing Tai Properties (0369) has won the tender for a 4,400-square-meter residential site in Kwu Tung, Fanling, for over HK$2.6 billion, higher than market estimates of HK$1.7 billion to HK$2.2 billion.

Kenneth Ng Kar-wai, the developer's executive director, said the group is pleased to secure a good location for the project, as the site is only a 10-minute walk to Sheung Shui Station and is close to the Fanling Golf Course.

The winning bid showed that the developer has confidence in the future of the district's luxury market, property agent said. The agent said that he expected total investment on the project to reach HK$3.5 billion to HK$3.8 billion, adding that the average selling price may be at least HK$25,000 per square foot upon completion.

The site, Lot No. 4076 in Demarcation District No. 91 at the junction of Fan Kam Road and Castle Peak Road in Kwu Tung came with an average price of HK$9,208 per square foot and a maximum gross floor area of 26,400 sq m.

In the primary market, New World Development (0017) sold a four-room flat in the third phase of The Pavilia Farm atop Tai Wai Station at over HK$45,000 per sq ft, a record high for apartments in the New Territories. The unit, covering 1,695 sq ft, sold at HK$76.50 million via tender, or HK$45,133 per sq ft. Chief executive Adrian Cheng Chi-kong said the developer has cashed out over HK$37.3 billion at The Pavilia Farm.

Wheelock Properties, meanwhile, sold 1,050 units in the first half, receiving HK$18.2 billion, while Sino Land (0083) sold 817 units worth HK$11.1 billion.

In the secondary market, Laguna City in Lam Tin recorded 22 transactions in June, up 38 percent compared to May. A 517 sq ft flat in Laguna City sold for HK$7.8 million after the price was reduced by HK$180,000.

In comparison, transactions at Kingswood Villas in Tin Tsui Wai fell 55 percent month-on-month to 31, as room for price reductions narrowed.

This came as Tseung Kwan O saw 466 secondary deals last month, up 8 percent month-on-month, according to a local property broker.

(The Standard)工商铺回勇 铺价下半年看升15%

疫情冲击去年工商铺市场,随着疫情缓和,上半年投资市场反弹,资料显示,整体工商铺买卖上半年按年升1.4倍,至于大手买卖金额达324亿,按年升1倍。业界人士普遍均认为市场资金多,下半年续向好,特别商铺市场反弹力最高。

环球疫情对商业活动造成巨大冲击,影响工商铺物业投资,而今年上半年则出现反弹。据代理数字显示,上半年工商铺共录3,623宗成交,较去年同期的1,531宗,升约1.4倍,较去年下半年亦升约3成,而去年同期金额亦由255.5亿元,大幅升至今年上半年的722.83亿元。

至于大额物业投资市场方面,另一代理数据显示,2018年投资市场高峰期,全年大额成交 (约7,800万元以上物业买卖) 共涉约1,430亿元,而受疫情影响,去年全年数字仅528亿元,仅约高峰期三分一。今年上半年买卖金额约为342亿元,按去年同期的136亿元,升逾1倍,当中还未计算即将成交的大额物业包括九展逾百亿元买卖,相信下半年金额进一步上升。

近期工商铺买卖转畅旺,其中邓成波家族近个多月加快沽货步伐,多项物业包括铺位、商场及全幢工厦均先后获本地财团、中资机构等承接,共涉逾70亿元,反映工商铺市况远较去年理想。

对于市况回勇,另一代理认为,疫情今年缓和,令投资气氛大幅改善,加上目前市场资金非常充裕,利息亦低,配合经济復甦,投资市场全面睇好。

代理:资金足利息低 利投资市场

在工商铺中,该代理看好商铺市场反弹力度最大,售价料有15%升幅。至于另一代理认为,下半年整体工商铺市场均向好,当中最看好商铺市场,预计买卖会畅旺,特别民生区消费稳定,交投量续上升。代理指,铺价去年大幅调整后,今年上半年已回升,预计下半年铺价续有10至15%升幅。

投资者方面,纪惠集团行政总裁汤文亮认为,去年铺租大幅调整后,今年势必反弹,只要恢復通关,铺租可回升2至3成,故商铺有投资价值。至于太子珠宝鐘錶主席邓鉅明则认为,即使香港及澳门或有机会通关,相信数量仅属限度,消费不会一下子重返,起码待明年中零售才明显復甦。

投资市场上,最近商铺成交有增,汤文亮认为,因价格便宜,但整体零售实未配合。若要投资,民生区消费理想,若有4厘回报胜在稳定,但不能期望大幅升值。

(经济日报)

邓成波家族葵涌工厦 约9亿洽至尾声

邓成波家族近期频频沽货,旗下葵涌中央工业大厦,获财团以约9亿元洽购至尾声,若落实将蚀1.8亿元离场。

消息指,由邓成波家族持有的葵涌中央工业大厦正获洽购,物业位于葵涌打砖坪街57至61号,总楼面约27.6万平方呎,消息指项目获财团9亿元洽购,呎价约3,260元,有望短期易手。

若落实交易 须蚀1.8亿

翻查资料,2018年兴胜创建伙拍招商局资本,以7.2亿元购入该厦,其后于2019年以10.8亿元转售给铺王邓成波。由于波叔早年主力发展酒店,故购入物业后即申请重建成酒店,拟建成一幢31层高酒店,提供1,196个房间,地积比率约11.4倍,总楼面面积不多于27.6万平方呎。如今若以9亿元售出,持货两年将蚀约1.8亿元离场。

(经济日报)

邓成波家族频沽货油麻地铺三亿易手

邓成波家族连环沽货,最新以3亿售出油麻地窝打老道宝翠大楼地铺,作价3亿,呎价约1.5万,持货12年帐面获利1.88亿。

总楼面1.99万呎

据代理指出,由邓成波家族持有的油麻地窝打老道40号宝翠大楼1楼及2楼及地铺,作价3亿,以总楼面约19983方呎计,呎价约15013元,买家为本地投资者。

据悉,该铺现时由护老院及健身中心以约107万承租,料买家可享租金回报约4.2厘。

根据土地註册处资料,邓成波家族2009年以6223.8万购入1楼及2楼,并于2016年以5000万购入地铺及阁楼,以是次易手价计,持货12年帐面获利约1.88亿,物业期间升值约1.7倍。

12年升值1.7倍

该代理称,上述物业位处市区核心地段,交通配套不俗,对安老院舍经营来说选址理想,其客源及租务回报稳定,故吸引投资者青睞。

(星岛日报)

正八连环沽嘉峰臺地铺平均每呎8850元六年升值40%

正八集团主席廖伟麟近年锁定中短綫买卖,大手购入商厦、商场等物业,然后伺机拆售,最新连环沽售嘉峰臺3个地铺,平均每呎约8850元,持货6年,物业升值40%,新买家收取逾3厘回报。廖氏表示,民生地段及商场铺位,有消费力支持,投资回报稳定。

廖伟麟表示,于2015年购入的嘉峰臺商场,陆续拆售,最新将地下1个近5000方呎大铺,拆售3个铺位,并旋即沽售2个,每个不足1000万,由投资者承接,该2个铺位分别由代理行承租,租赁稳定,新买家可享回报逾3厘。

廖伟麟:民生商场获垂青

据了解,牛池湾嘉峰臺地下5号铺,建筑面积4965方呎,兼且可租予3名租客,拆细后5A、5B及5C铺,其中,5A号及5B铺分别以950万及978万易手,平均每方呎约8850元,新买家分别可收取3.15厘及3.5厘回报。新成交价对比该商场集团于2015年6月购入价,于近6年间,整体约有40%升幅。

上月,他亦沽出该商场地下3号铺,作价2418万连租约成交,租客为一家茶餐厅,月租约7.15万,新买家料可享回报约3.5厘。

料买家享逾三厘回报

目前,该商场最后一个铺位,为5C号铺,建筑面积约2785方呎,适合乾湿货及零售行业,亦有準买家洽商,有望于短期内沽出。

2006年至今,廖伟麟做过逾200宗买卖,近年代表作包括2018年11月以2.3亿沽售海富中心单位,呎价35647元,创该厦历史新高,记录保留至今,物业购入价1.84亿,持货半年轻鬆获利4600万。他表示,2018年商厦高位时,买家勇猛乐观,他大手沽货,成为市场上最大卖家。

他入货短炒,从不急于出货,只会伺机出货,3年前以1.95亿购入荃湾有线电视大厦30楼全层,平均呎价5000多元,近日趁市好拆售,部分单位呎价高达6600元。

15年来做200宗买卖

廖伟麟母亲廖汤慧靄旗下纪惠集团,坐拥逾400亿资产,包括持货数十年收租的豪宅及甲厦。而他则于2015年创立正八集团,专攻中短綫买卖,公司名字纪念其父亲。

(星岛日报)

更多海富中心写字楼出售楼盘资讯请参阅:海富中心写字楼出售

更多金鐘区甲级写字楼出售楼盘资讯请参阅:金鐘区甲级写字楼出售

One Victoria in hot demand amid boom

China Overseas Land and Investment (0688) has released 106 flats in the fourth price list of One Victoria at an average price of HK$26,814 per square foot after a maximum 13.5 percent discount is applied, 16.7 percent higher than the first price list.

The developer collected HK$4.14 billion after selling 370 flats of 400 flats on offer at the Kai Tak project on Saturday.

The new price list offers units ranging from 330 to 766 sq ft, with the discounted price ranging from HK$23,204 to HK$28,748 per sq ft.

Meanwhile, Henderson Land Development (0012) sold 10 units at The Henley I in Kai Tak over the weekend including a 298-sq-ft featured unit with a 17-sq-ft balcony which sold for HK$8.38 million, or HK$28,108 per sq ft.

In the secondary market, property agency recorded 22 transactions at 10 blue-chip housing estates over the weekend, rising 46.7 percent from a week ago.

The figure has also maintained a double-digit level for 20 consecutive weekends.

Seven transactions were recorded in Kingswood Villas, a six-fold increase from last weekend.

Transactions were also recorded in seven other housing estates, while the number of zero-deal estates narrowed to two, namely Tai Koo Shing and Kornhill.

Property agent said that both primary and secondary transactions were booming.

The Agent added that 460 transactions were made in the primary market in the first three days of July, mainly from new projects in Kai Tak.

In the commercial market, Tang Shing-bor's family sold an 18,800-sq-ft shop in Jade Mansion at Yau Ma Tei for HK$300 million.

Property agent said that the first and second floors and ground shops of Jade Mansion were purchased at the price of about HK$1.59 million per sq ft by a local investor.

The Tang family bought the first and second floors for HK$ 62.24 million in 2009, and purchased ground shops and lofts for HK$50 million in 2016.

A book profit of HK$188 million was made after the sale.

(The Standard)马亚木13亿沽中环中心两全层持货三年升10%每呎2.52万及2.77万

近期工商铺买卖趋热,连跑输大市的甲厦亦起动,「小巴大王」马亚木沽售中环中心两全层单位,涉资共约13.23亿,平均每呎2.52万及2.77万,持货三年间升值约10%,分别由一家老牌家族,以及纪惠集团承接。

市场消息指,中环中心20楼及26楼全层,早于市场放售一段日子,直至近期频获洽购,最终该两全层分别以6.3亿及6.93亿易手,以建筑面积24980方呎计算,平均呎价分别为2.52万及2.77万。由于位处中低层,呎价为今年该厦呎价新低。其中,该厦20楼新买家为本港一家老牌家族,有机会购入该厦自用,26楼全层则由纪惠集团承接。

低层买家为老牌家族

中环中心世纪大刁,该厦75%业权2017年11月以402亿易手,买家中国国储能源化工集团佔55%权益,港方组合佔45%,有「小巴大王」马亚木、「磁带大王」陈秉志、「物流张」张顺宜、蔡志忠及商人卢文端。

随后,大股东中国国储因资金问题放弃购入,股权作重整,不但引入世茂房地产主席许荣茂及金利丰主席朱李月华两人,马亚木亦由本来由8层增加至13层,市场消息指,由于马亚木购入的比预期多,上述20楼及26楼早于2019年放售,惟遇上政治事件及疫情,最终封盘,直至近期市况改善,代理亦大力催谷。市场消息指,当时该两全层购入呎价分别约2.3万及2.5万,持货逾3年,帐面获利约10%。

纪惠第三度购入该厦

该厦26楼买家纪惠集团,为第三度购入中环中心,率先于2018年向卢文端购入19楼全层,作价约7.62亿,呎价约3.1万,并于2019年1月以7.3691亿购入28楼全层,面积约24980方呎,呎价2.95万,是次为第三度入市,现时集团持有中环中心3层楼面,作长綫收租用途。

「磁带大王」陈秉志于早前以8.7亿沽售38楼全层,呎价约3.4万,由于20楼及26楼属于中低层,未能作比较。

陈秉志上月推出中环中心39楼最后5伙拆售,悉数沽出,呎价约3.3万,业主提供每个单位回赠1000万,变相减价逾10%。

(星岛日报)

更多中环中心写字楼出售楼盘资讯请参阅:中环中心写字楼出售

更多中环区甲级写字楼出售楼盘资讯请参阅:中环区甲级写字楼出售

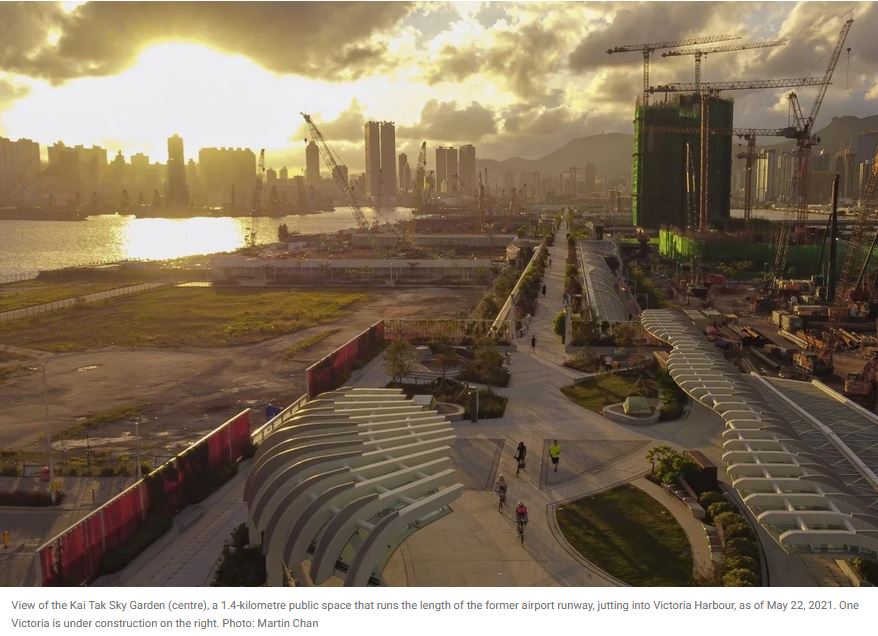

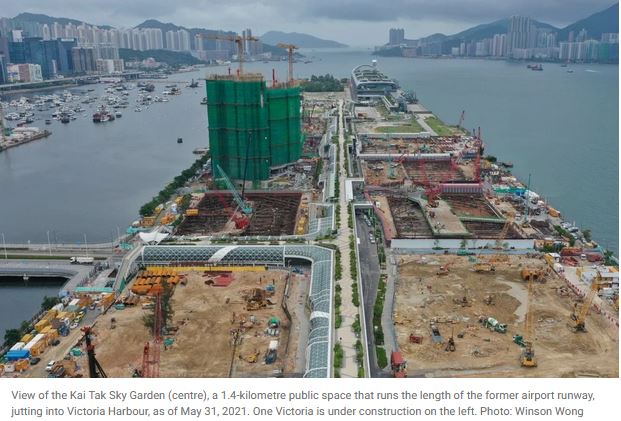

Hong Kong’s homebuyers pile into Kai Tak’s first harbourfront flats after a tepid start, betting on property bull market to continue

China Overseas Land sold 364 flats, or 91 per cent of the first batch of 400 units on offer, at One Victoria in Kai Tak on Saturday

The development is priced for more than 10 per cent lower than nearby The Henley unveiled by Henderson Land in May

Hong Kong’s homebuyers snapped up the first harbourfront flats built on Hong Kong’s former airport runway in Kai Tak despite a slow start, as generous discounts lured investors to double down on their bets of the continuing property bull market.

China Overseas Land and Investment sold 364 flats, or 91 per cent of the first batch of 400 units on offer at the One Victoria project in Kai Tak on Saturday, according to real-estate agents.

The first batch on offer was priced at an average of HK$22,977 per square foot, about 13 per cent cheaper than Henderson Land Development’s The Henley project in the same area, 70 per cent sold as of May, helped by its location closer to the Kai Tak subway station.

One Victoria is priced about 5 per cent lower than second-hand property in the Kai Tak area, and is 15 per cent cheaper than the leftover property from new projects in the neighbourhood, which could attract buyers who are looking for upsides in their investments, property agent said. The sales campaign will last until 11pm, giving agents more time to find buyers and close deals, the agent said.

The weekend’s sales got off to a slow start, with fewer than half being sold in the first few hours. The current batch of the One Victoria flats range from 329 square feet to 643 square feet, with prices starting from HK$6.56 million (US$844,700) after discounts. The whole project will comprise a total of 1,059 apartments when it is completed around March 2023.

The sale result came amid a boom on the city’s housing market, the world’s costliest, as cheap money unleashed by global central banks prompts investors to seek investments that can preserve values.

One Victoria is about a 45-minute walk from the Kai Tak Station. It is also likely to be surrounded by construction sites.

With the opening of the Tuen Ma Line, which connects the West Rail Line and the Tuen Ma Line Phase 1 and includes the Kai Tak Station, the Kai Tak district will “officially enter the harvest season” and mature in terms of community development, another property agent said. As the first waterfront project on the runway, One Victoria will offer good views, the agent added.

Hong Kong’s economy has been rebounding, snapping several quarters of recession caused by the social unrest and the coronavirus pandemic.

First-quarter growth accelerated to 7.9 per cent, the most in 11 years, while new home sales increased at the fastest pace in two years.

Hong Kong’s residential property transactions surged by about 35 per cent in the first half, the highest level since the second half of 2012, to more than 38,500 deals, according to a property agency. Transaction volumes also jumped by about half to about HK$366 billion, the highest level since the first half of 1997.

An increase in housing supply has so far failed to cool down the fervour. New home supply is expected to increase 14 per cent from a year ago to 36,919 units in 2021, according to another property agency.

(South China Morning Post)甲厦880万呎空置新高 租金看跌5%

疫情下,甲厦新需求急挫,以致全港甲厦空置楼面增至880万平方呎,创历史新高,而空置率升至10.8%。代理认为,下半年租务活动仍以搬迁为主,新需求要视乎通关,料今年下半年租金跌约5%。

环球疫情对甲厦租务影响甚大,新需求减少,加上个别国际机构弃租,空置楼面增加。数据显示,甲厦空置楼面由去年尾的800万平方呎,增至今年首季约840万平方呎,最新统计更升至880万平方呎,打破1999年纪录,成为历来甲厦最多空置楼面。

湾仔铜锣湾空置率高见11%

空置率方面,第二季甲厦空置率为10.8%,按季升0.5个百分点,而2004年为历来空置率最高,约14.8%。第二季中区空置率升幅放缓至7.3%,惟个别地区加快,如湾仔及铜锣湾区,空置率11.1%,为历来最高。

代理认为,今年上半年甲厦租务情况有所改善,惟以搬迁为主,加上个别银行弃租楼面,故负吸纳情况持续,空置未有改善。

该代理指,由于目前尚未通关,甲厦租务新需求仍疲弱,相信要待通关后,海外及内地机构再展开新租务。后市方面,该代理指明年尚有300万平方呎楼面新供应,需时消化,料负吸纳情况持续,估计下半年租金跌约5%,而调整期仍长。

相比之下,商铺租务市场有所改善,第二季整体街铺空置率跌至15.4%,为2020年第二季以来的最低水平。租赁需求轻微回升,有助街铺租金按季上升1.2%,为2018年第二季以来的首次上涨,亦是自2013年第四季以来最强劲的季度增长。

商户纷开业 铺租可望升5%

代理认为,无疑通关对零售推动甚大,惟目前本地消费非常稳定,租金亦跌至2004年水平,吸引不少商户开业,料下半年租务续改善,租金可望升约5%。

投资市场方面,2021年上半年商业物业投资额推高至347亿元,佔去年全年总额528亿元的66%,市场亦录得多宗全幢工厦、商厦成交。该行另一代理预计,下半年投资市场仍向好,比较睇好民生区商场及酒店,具有投资价值。

(经济日报)

更多湾仔区甲级写字楼出租楼盘资讯请参阅:湾仔区甲级写字楼出租

更多铜锣湾区甲级写字楼出租楼盘资讯请参阅:铜锣湾区甲级写字楼出租

商厦5月127买卖 连升3月

商厦买卖转平稳,5月份市场录得127宗商厦买卖,按月微升。

代理表示,今年以来商厦买卖登记连续两季均突破300宗以上,料上半年合共可录逾680宗,将较去年同期的258宗激增逾1.6倍。根据土地註册处数据,2021年5月份全港共录127宗商厦买卖登记 (数字主要反映2至4星期前商厦市场实际市况),较4月份的125宗再升2%,连升3个月,已明显摆脱2019年下半年社会运动爆发及疫情以来长期按月不足百宗的超低迷市况。

不过,5月份未能做到量值齐升,因为在1亿元或以上的大银码商厦交投大减下,拖累5月份商厦买卖登记金额大幅回落,只录约17.95亿元,按月急挫66%,登记金额在连升两月后稍作回气。至于,5月份最瞩目的单一登记项目为中环皇后大道中九号30楼3005室,涉及合约金额1.26亿元;其次为九龙湾企业广场一期3座7楼全层,涉及登记金额达8,084.2万元。

按物业价格划分,在7个价格组别当中,录得4升两跌一持平。在升幅者中,以5,000万至1亿元以内组别的33%升幅最显著,月内登记量由前月的3宗升至上月4宗;其次,2,000万至5,000万元以内组别亦升29%,录得18宗登记;至于登记量最活跃的是介乎200万至1,000万元以内的两个组别,月内同告录得34宗,按月表现相对平稳;惟1亿元或以上的大额登记则急降88%至只得1宗。

商厦下半年 有望稳中向好

至于以地区划分,在该行观察的11个分区当中,共有3区的登记量按月有所上升。当中以铜锣湾及西营盘区的1倍升幅最显著,前者由前月只有3宗增至上月的6宗,后者则由1宗增至2宗。此外,旺角及尖沙咀区分别录得21宗及17宗登记,前者按月升31%,后者则持平,并各自成为5月份登记量最活跃的观察区首名及次名。

代理指出,商厦买卖登记量连月高企在逾百宗水平,预料6月份仍可保持,届时次季登记量料录约360宗,将连升5季,并创自2019年第3季以来的8季新高,亦将印证商厦买卖登记量已重返疫情及社会运动爆发前的高水平。代理相信,只要疫情不再恶化,相信第3季以至下半年,商厦买卖登记量将可维持稳中向好的格局。

(经济日报)

更多皇后大道中九号写字楼出售楼盘资讯请参阅:皇后大道中九号写字楼出售

更多中环区甲级写字楼出售楼盘资讯请参阅:中环区甲级写字楼出售

更多企业广场写字楼出售楼盘资讯请参阅:企业广场写字楼出售

更多九龙湾区甲级写字楼出售楼盘资讯请参阅:九龙湾区甲级写字楼出售

中环远东发展大厦低层单位,现以每平方呎约1.29万元放售。

低层单位连约 1535万叫售

代理表示,有业主放售中环德辅道中113至125A号远东发展大厦6楼04室,单位连租约,面积约1,190平方呎,业主意向售价为每平方呎约12,900元,售价约1,535万元。

该代理指,单位现时由律师楼租客承租,每月租金收入约2.8万元,回报率约2.1厘,属合理水平。单位间隔实用,配置全写字楼装修,用户可享开扬城市景观。大厦设有云石大堂,设计时尚,附设4部载客电梯,方便用户出入,适合各机构进驻。

大厦租售纪录上,上月大厦录1宗成交,涉及高层2室,面积约1,200平方呎,以约1,790万元成交,呎价约14,917元。租务方面,6月大厦中层全层,面积约6,686平方呎,呎租约35元。

(经济日报)

更多远东发展大厦写字楼出售楼盘资讯请参阅:远东发展大厦写字楼出售

更多中环区甲级写字楼出售楼盘资讯请参阅:中环区甲级写字楼出售

中环庄士大厦 享地利合中小企

庄士大厦位于中环干诺道中,位于中环核心商业地带,正对国际金融中心和交易广场,亦邻近有盖天桥连接各幢超甲级商厦如国际金融中心及交易广场,佔尽地利优势,适合中小型企业进驻中环。

大厦于1973年落成,至今楼龄约48年,是单幢的乙级商厦,由发展商庄士中国投资 (00298) 统一管理。写字楼单位只供出租而不作出售,放租单位面积由400呎至3,000呎,与同区其他商厦比较,庄士大厦的过去租务成交不是非常活跃。

单幢乙厦 写字楼只租不售

大厦总面积约55,367平方呎,分为商铺及写字楼用途,只设有干诺道中入口。物业地下为零售商铺设有麦当劳,而其他楼层主要为医疗诊所、律师事务所等。大厦广告位置甚多,值得一提该大厦户外广告招牌位置突出,侧向于干诺道中、面向香港交易所及交易广场,不论途人及驾车人士在行人天桥及干诺道中,能一览无遗,达到宣传推广之效,因此非常适合公开招股公司及金融机构。

交通配套上,庄士大厦位于交通枢纽地带,只需步行3至5分鐘到达地铁站,如香港站C出口及中环站A出口,坐拥铁路綫优势,交通方便。大厦周边亦附设有各巴士、小巴路綫及电车供选择,来往港九新界各地更见便捷。

大厦邻近多间五星级豪华酒店,如四季酒店,文华东方酒店和置地文华东方酒店,及品牌旗舰店和大型购物商场,即国际金融中心ifc及置地广场。而且比邻协成行中心、永安集团大厦、德辅道中33号及交易广场等甲级商业大厦,同时亦可步行到达兰桂坊。

饮食配套上大厦地铺为快餐店,而附近亦有大家乐、谭仔米綫、元气及吉野家等,上班一族亦可到附近德辅道中、毕打街一带有多间茶餐厅可供选择,或可步行至邻近大型商场,如国际金融中心ifc等,食肆林立。

每层2321呎 多为一梯一伙

干诺道中一带商厦林立,庄士大厦绝对是中环心臟地段。在配套方面,大厦于去年重新装修大堂及门面,气派非凡,备有3部电梯,让繁忙时段可分流客人,方便上落。大厦每层面积约2,321平方呎,大多以一梯一伙为设计,楼层设独立厕所。

单位间隔方正实用,适合中小型企业使用,相当实用。景观外望干诺道中一带,可望向交易广场及国际金融中心ifc,亦有单位享海景观,惟整体景观开扬舒适。在去年重新装修后,吸引不同种类的医疗租客进驻,如专科门诊、物理治疗及牙科等。

(经济日报)

更多庄士大厦写字楼出租楼盘资讯请参阅:庄士大厦写字楼出租

更多国际金融中心写字楼出租楼盘资讯请参阅:国际金融中心写字楼出租

更多交易广场写字楼出租楼盘资讯请参阅:交易广场写字楼出租

更多置地广场写字楼出租楼盘资讯请参阅:置地广场写字楼出租

更多协成行中心写字楼出租楼盘资讯请参阅:协成行中心写字楼出租

更多永安集团大厦写字楼出租楼盘资讯请参阅:永安集团大厦写字楼出租

更多德辅道中33号写字楼出租楼盘资讯请参阅:德辅道中33号写字楼出租

更多中环区甲级写字楼出租楼盘资讯请参阅:中环区甲级写字楼出租

丰泰放售湾仔地盘 市值2.6亿

港岛市区地盘具重建价值,丰泰地产放售湾仔庄士敦道商业地盘,可重建为银座式式商厦,市值约2.6亿元。

可重建银座式大厦

代理表示,湾仔庄士敦道189号现正放售,地盘属于两面单边,前临庄士敦道及谭臣道,地盘面积1,466平方呎,可作银座式商厦、写字楼或酒店等。现物业连地铺楼高6层,总楼面面积约9,637平方呎。物业已获屋宇署批准图则,可重建为一幢22层高的银座式大厦,楼面面积达21,990平方呎。物业市值约2.6亿元,每呎楼面地价约1.2万元。

附近全幢物业成交上,去年湾仔皇后大道东72号全幢,以约2.53亿元成交。项目原为一幢10层高商住大厦,每月租金约33万元。

新买家将重建项目,地盘面积约2,014平方呎,若重建成商住大厦,可重建楼面约19,737平方呎,按2.53亿元成交价计,每呎楼面地价约1.28万元。

(经济日报)

财团看好后市 大额成交创年半高

近期邓成波家族频频放售物业,而目前投资市场转好,该家族推出银码较大的商场及工厦,即获财团承接,反映财团看好后市。

上半年整体市况转好,代理资料显示,大额成交表现理想,今年上半年市场暂约65宗逾亿元工商铺买卖,比2020年上、下半年约31宗及47宗分别增加约1倍及38%,同时亦为2019下半年后年半新高数字。

邓成波家族大银码放盘 屡获承接

最近市场成交转多一个原因,为邓成波家族加快推售物业。近一星期家族更推出银码较大的工厦及商场,更屡获承接。工厦方面,家族旗下多个全幢工厦获留意,其中粉岭勉励龙中心以及屯门东亚纱厂工业大厦,获中资财团购入。

粉岭安乐门街35至37号勉励龙中心,地盘面积约6万平方呎,现楼高5层,总楼面约152,773平方呎,以约7亿元沽出,呎价约4,600元。翻查资料,2014年邓成波5.15亿元购入。另一幢物业为屯门河田街2号东亚纱厂工业大厦,邓波早于2012年以5亿元购入项目约7成楼面,至2015年统一业权,共斥约7.8亿元;物业地盘佔地约7.2万平方呎,划为「其他指定用途」註明「商贸」地带,楼高15层。项目以17亿元沽出,呎价3,648元,两项物业获一家中资物流中心购入,涉约24亿元。

另外,近日家族持有葵涌中央工业大厦正获洽购,物业位于葵涌打砖坪街57至61号,总楼面约27.6万平方呎,消息指项目获财团9亿元洽购,呎价约3,260元,有望短时间内易手。

安荫石围角商场 约13亿沽

此外,家族持有的民生区商场,亦获财团大手购入,涉及葵涌安荫及荃湾石围角商场,两项目合共以约13亿元沽出。两物业均为民生区商场,葵涌安荫商场楼高两层,总楼面约40,781平方呎;出租率约77%,每月租金收入约218.4万元。另一项物业为石围角商场,亦包括街市,总楼面约13.2万平方呎,出租率约79%,每月租金收入约314.5万元。两项物业均设有停车场,分别提供355及578个车位,共涉933个。

两项物业均获「磁带大王」陈秉志、资深投资者林子峰等,以约13亿元承接。

分析指,疫情缓和,投资气氛转好,正值邓成波家族积极放售物业,不少属优质工厦、商场,可作增值及收租,故获财团承接。后市上,由于该家族仍在放售大量物业,而市场上不少投资者看好后市,加快入市步伐,料短时间内整体物业交投量上升,当中不乏大额成交。

(经济日报)

加连威老道旧楼 强拍底价19.26亿

重建过程一波三折的尖沙咀加连威老道65至73号,早前顺利获土地审裁处批出强拍令后,现定于本月底、7月27日进行公开拍卖,底价约19.26亿元。

该加连威老道65至73号 (单号) 旧楼,由已故铺王邓成波家族展开收购,原本在去年6月已经获法院出强拍令,但当时遇上有一名小业主向高等法院反对,并批出暂缓令,最终法庭在今年6月作出裁决,拒绝该名小业主的上诉申请,令到强拍能够继续进行。

按照地盘面积约10,840平方呎,规划为「商业」用途,若以地积比率12倍发展,可建楼面约13万平方呎,以底价19.262亿元计算,每呎楼面地价约1.48万元。

(经济日报)

佐敦官涌街旧楼 罕有3.8亿放售

市区地盘罕有,有投资者李栢景持有的佐敦官涌街52至56号全幢旧楼,最新以3.8亿元放售,若果顺利沽出,以可建楼面面积约26,100平方呎计算,每呎楼面地价约为1.46万元。

该项目现以「私人协商」形式放售。

目前为一座12层高的混合式住宅大楼,现有楼面面积约17,804平方呎,地下到二楼已经获城规会批准改为酒店用途,上层为住宅,全幢物业共提供76个单位。

据资料显示,该旧楼最初由香港小轮持有,在2012年7月就获投资者李栢景以1.55亿元购入。

(经济日报)

自去年底政府为工商铺「减辣」,带动市况回升,随疫苗接种,经济环境有望復甦,部分业主趁势放售,观塘万兆丰中心高层海景单位,以意向价约3465万放售。

代理表示,上述观塘海滨道133号万兆丰中心中高层C室,面积约2475方呎,意向呎价约1.4万,涉及总金额约3465万;物业现由业主自用,将以交吉形式出售。单位享有全海景景观,将会连写字楼装修出售,买家可即买即用,节省时间及部分装修支出,属近期市场上极受用家欢迎的单位类型。

代理补充,单位现时市值呎租约25至28元。準买家亦可同时洽购万兆丰中心1个车位,售价约210万,不但可作自用,亦可考虑出租及作中长綫投资。翻查资料,万兆丰中心向来受用家追捧,该厦最近获社福机构购入作自用,为大厦低层F室,面积约4065方呎,成交价约4065万。

(星岛日报)

更多万兆丰中心写字楼出售楼盘资讯请参阅:万兆丰中心写字楼出售

更多观塘区甲级写字楼出售楼盘资讯请参阅:观塘区甲级写字楼出售

九龙塘住宅掀财团角逐

政府积极推地,九龙塘广播道住宅地将于新一季推出。据业内人士指出,该地皮位处传统豪宅地段,近年来亦缺乏同类供应,料掀中大型财团积极竞投,市场估值约14.3亿至17.8亿,每呎楼面地价约2万至2.5万。

可建楼面约7.2万呎

九龙塘广播道79号住宅地,地盘面积23864方呎,可建楼面71591方呎。有测量师表示,该住宅地皮位处九龙塘传统地段,已多年以来没有政府用地供应,料对发展商具一定吸引力,惟地皮背靠龙翔道,故日后落成后会受一定噪音滋扰,因市区土地供应买少见少,料各大发展商将积极竞投,估值约14.3亿,每呎楼面地价约2万。

另一测量师称,地皮位处传统豪宅地段,对发展商甚具吸引力,估值约15.7亿至17.8亿,每呎楼面地价约2.2万至2.5万。

(星岛日报)

Office and retail rental markets stabilizing

Office and retail rental markets have shown initial signs of stabilization in the second quarter this year, a realtor said.

While office leasing activity is on the rise, the average availability rate is expected to remain at a similar level of 14.4 percent throughout 2021, property agent said.

Leasing activity was most active in the finance and insurance sectors.

Overall office rental value fell at a milder pace in the second quarter this year, resulting in an average drop of 1.4 percent quarter-on-quarter in all districts. A 3.3 percent drop was seen in the first half.

Office rents in greater Tsim Sha Tsui and Kowloon East have dropped by 3.5 percent and 2.3 percent quarter-on-quarter respectively, the highest two among all sub-markets.

Property agent said that the office rental value is still under pressure as most occupiers remain cost-conscious, availability of office space for lease is high, and the economy is still in its early stages of recovery.

As for the retail market, food and beverage, and health and wellness are outperforming other sectors.

Another agent said that the impact of the pandemic has resulted in pent-up demand for relaxation and lifestyle adventures.

There is high demand for fine-dining as an alternative, prompting the F&B sector, especially high-end authentic and specialty luxury dining, to lease better retail spaces.

(The Standard)

Sha Tin luxury beckons as market recovers

Far East Consortium International (0035) revealed the sales brochure of its luxury project Mount Arcadia in Sha Tin.

The project provides 62 flats, measuring between 1,018 square feet and 1,548 sq ft, four houses measuring 2,814 sq ft to 3,448 sq ft, and 68 car parking spaces.

The developer said last month that it intended to sell the flats by tender.

Meanwhile, the real estate market recovery will likely be most pronounced in the office and retail sectors, where mainland Chinese companies and tourists account for a meaningful share of leasing and consumption demand, respectively, property agent said.

In the Grade A office market, overall vacancy climbed 0.5 percentage points in the second quarter this year to 10.8 percent. Total vacant space totalled 8.8 million sq ft, a new record high, the company said.

Overall rents continued to contract, albeit at a slower rate, falling 2.1 percent quarter-on-quarter in the second quarter in 2021.

In the retail market, high-street shop vacancy fell to 15.4 percent in the second quarter this year, the lowest since the second quarter in 2020. The slight pickup in demand helped high-street shop rents increase by 1.2 percent quarter-on-quarter, the first gain witnessed since the second quarter in 2018, and the strongest quarterly growth since the fourth quarter in 2013, it said.

Separately, the number of Hong Kong property transactions went up by 4.6 percent month-on-month to 9,381 in June, data from the Land Registry showed.

The total consideration of property sale and purchase agreements rose 5.7 percent month-on-month to HK$92.6 billion.

(The Standard)

Hong Kong’s second-quarter residential land tenders set to fuel bidding war amid supply squeeze

Only two small parcels will be up for grabs in the quarter starting July 1 as land supply constraint persists

Other corporation, agencies to supplement bigger plots to help meet city’s target of 5,400 flats in the current quarter

Hong Kong’s failure to provide sufficient land for private housing is expected to keep competition alive among small and medium-sized developers in this quarter’s land-sale programme, just as the city’s property market is turning rosy again.

The government will offer two parcels of land for public tender in the July-to-September quarter, enough to provide only 200 flats in an under-supplied housing market. The plots at Kowloon Tong and Yuen Long could see keen bidding, with one analyst raising his valuation of the former piece by 36 per cent amid bullish sentiment.

The widespread vaccination programme, positive market atmosphere and the brisk sales in the market “will enhance confidence and desire to invest” among developers, a surveyor said. “The response to land bidding will be enthusiastic.”

The land sales come as the city’s economy emerged from its worst recession on record with a 7.9 per cent expansion in the first quarter while retail sales rebounded. Prices of lived-in homes have rallied this year to within 0.8 per cent of the record-high in May 2019, with some analysts predicting a 5 to 10 per cent jump for 2021.

The 200 flats from the tenders represent only 4 per cent of the total supply of 5,400 units targeted in the quarter, and is less than the average number of flats in one building block within the Kingswood Villas project in Tin Shui Wai. The other 96 per cent of land supply will be provided by MTR Corporation, the Urban Renewal Authority (URA) and private developers.

A surveyor raised its valuation of the plot in Kowloon Tong at 79 Broadcast Drive by 36.6 per cent, to about HK$1.07 billion (US$137.7 million) or HK$15,000 per square foot, citing the scarcity factor and improving market sentiment.

That parcel can accommodate up to 180 units and is likely to be favoured by many developers, especially among small and medium-sized players, according to another surveyor.

The other plot in Yuen Long – at the junction of Lau Yip Street and Chung Yip Road and about 13 minutes’ walk from the Long Ping Station – can only accommodate 20 to 30 villas. Its size is certain to attract small to medium-sized developers based on a low estimated valuation of HK$390 million, surveyor said.

Recent heated competition in small land tenders underpins that observation. For instance, the residential parcel in Fanling that Wing Tai Properties won on June 30 attracted as many as 17 bids.

The tight supply conditions in Hong Kong are unlikely to ease until the later years of this decade when more land from new townships becomes available, said Ryan Ip, head of land and housing research at local think tank Our Hong Kong Foundation. New Territories and Lantau island reclamation project are key in planning the next generation of new towns, he added.

“We hope [the government] will increase its efforts to increase its residential land to stabilise future supply,” analyst said.

Apart from the government tenders in the current quarter, the URA project in To Kwa Wan will be the focus because of its size, according to Midland Surveyors. The project near Bailey Street and Wing Kwong Street will provide 1,150 flats and has attracted the interest of 36 potential bidders.

“Due to the large scale of the project, which is rare in recent years, and benefiting from the traffic advantage of the Tuen Ma Line, the project is likely to be favoured by developers,” surveyor said. “It is likely to be a parcel worth nearly HK$10 billion, attracting large-scale developers and consortiums.”

MTR Corp’s Tung Chung project, at the traction substation next to the Caribbean Coast development, can accommodate some 1,600 flats. It is about 20 minutes’ walk from the Tung Chung railway station.

(South China Morning Post)

湾仔政府大楼重建曝光 地皮估值达逾500亿

湾仔北告士打道3幢政府大楼重建方案曝光,可建楼面达249.4万平方呎,将会建成甲级商厦、酒店及会展设施,地皮市值料高达逾500亿元。

湾仔北重建地盘面积166,239平方呎,地积比率15倍,即可建楼面约249.4万平方呎,估计楼高达52层,包括最低10层为92.6万平方呎的会议及展览楼面,而中间的27层则作为甲级商厦,总楼面达97万平方呎。

至于项目最高15层则作为酒店用途,涉及57万平方呎楼面,将会提供500间客房。由于地皮佔据湾仔黄金地段地段,市场估计,地皮估值将逾500亿元,每呎楼面地价逾2万元。

另外,为增加与会展中心的协同效应,湾仔北重建项目将包括兴建一段横跨港湾道的架空连接通道,接驳会展中心一期,另外,项目亦将会兴建多条新的行人连接道及改善现有行人网路设施。

新世界西贡项目 申改建972伙

此外,新世界 (00017) 伙同泛海 (00129) 等持有的西贡沙下综合发展项目,再次在城规会闯关,最新提出兴建16幢分层单位将提供972伙,较3年前旧方案增加26%。

该项目位于大网仔路跟惠民路交界,属于「综合发展区」用途,地盘面积约63.8万平方呎,发展商曾经在2007年、2018年两度提交规划方案,但未能获城规会同意,今次则再提新申请。

根据新方案,地积比率1.5倍,略高于2018年方案的1.467倍,可建楼面约95.7万平方呎,将会兴建15幢4至10层高的分层住宅,将会提供972伙,平均面积980平方呎,较旧方案的1,216平方呎减少19%。

(经济日报)

黄竹坑9项目 主攻写字楼商场

黄竹坑正在由传统工业区转型成为住宅及商业区,除了近期区内住宅新盘销情炽热,区内商业重建步伐亦如火如荼,区内至少有9个发展项目,合共提供逾214万平方呎商业楼面。

The Southside 区内规模最大

黄竹坑过往轻工业为主,黄竹坑道一带多属于传统的多层工厂大厦,但由于邻近海洋公园,曾经吸引不少发展商将工厦申请重建成酒店用途,但近年兴建商厦的趋势逐步取代原有的旅游业发展。目前区内9个发展项目,合共提供逾214万平方呎的商业楼面供应,集中以办公室及大型商场为主。

区内其中一个规模最大的商业项目,属于港铁 (00066) 黄竹坑站上盖港岛南岸项目的商场部分「The Southside」。港岛南岸前身为公屋黄竹坑邨,在2009年清拆后,便用作港铁南港岛綫车厂,同时作为黄竹坑站上盖以及物业发展。总单位数目达5,400伙的黄竹坑站上盖项目,命名为港岛南岸,分6期发展,分别批出予多间不同发展商,其中第1期晋环早前已经开售,销情炽热,而嘉里 (00683) 、信置 (00083) 等发展的第2期早前亦已命名为扬海。

为配合住宅发展的社区需求,黄竹坑站上盖第3期设有一个可建楼面约50.59万平方呎的大型商场,发展商长实 (01113) 在商场建成后须交还给港铁。按照港铁早前公布,商场预计2023年落成,设有5层商铺楼层,有约150间商户,提供约235个停车场车位,计划引入不同类型的商户,包括娱乐及大型综合超市等。

帝国集团佔总供应逾4成

除了大型商场外,黄竹坑区内有不少商业项目发展,其中已故商人郭湘炳创办的帝国集团,亦透过独资及合资拥有3个商业项目,涉及约72.3万平方呎楼面,佔区内未来楼面供应逾4成,逐步建立商业王国。

当中位于业勤街商贸地,属于帝国集团伙拍信置,斥约25.3亿元投得,将会发展甲级商厦Landmark South,集办公室、零售、餐饮、艺术与创意社区于一身,配合近年黄竹坑蜕变发展。该物业楼高28层,总楼面面积约28.5万平方呎,预计将在2022年落成。

而帝国集团亦在区内先后收购天丰工业大厦及仁孚香港仔车厂两幢工厦作重建,当中以约17亿元购入84%业权的天丰工业大厦,发展商及后成功收购餘下业权,预计重建后可提供27.4万平方呎楼面;至于仁孚香港仔车厂项目,可建楼面约16.4万平方呎。

(经济日报)

更多Landmark South写字楼出租楼盘资讯请参阅:Landmark South写字楼出租

更多黄竹坑区甲级写字楼出租楼盘资讯请参阅:黄竹坑区甲级写字楼出租

万国数据斥9亿 购葵涌工厦

较早前,邓成波家族以9亿元,沽出葵涌中央工业大厦,消息指,新买家为万国数据,购入后将重建成数据中心。物业总楼面约27.6万平方呎,呎价约3,261元。

万国数据近年积极在港发展,3年间先后3度购入葵涌工厦,包括美罗工业大厦以及蓝田街2至16号地盘,全部重建成数据中心。原业主为邓成波家族,于2019年以10.8亿元购入物业,持货两年转手蚀1.8亿元。

(经济日报)

蔡志忠1亿沽OK Mall铺 呎售8551元

资深投资者蔡志忠积极沽货,刚以约1亿元沽出石门京瑞广场一楼OK Mall 102A01铺位,铺位面积11,695平方呎,呎价约8,551元,目前铺位市值租金每月约30万元,预期买家可获3.6厘回报。

资料显示,蔡志忠等人于2015年以4.95亿元购入上述京瑞广场二期一楼全层,面积约60,000呎,后来入则改装成为OK Mall商场,分间成188个铺位拆售,当时成功售出186个铺位,套现约8.5亿元,而连同近日再沽出最后两间铺位,合共套现约10.3亿元,扣除当年买入价,帐面获利约5.35亿元。

蔡志忠3个月内连沽3个铺位,套现合共套现约2.48亿元。他称并非看淡后市,而是「化零为整」,为换货作準备,目前正在洽谈大型物业。

(经济日报)

更多京瑞广场写字楼出售楼盘资讯请参阅:京瑞广场写字楼出售

更多石门区甲级写字楼出售楼盘资讯请参阅:石门区甲级写字楼出售

仲齐大厦月底强拍 底价1.95亿

英皇国际 (00163) 所收购的筲箕湾南安街67至71号仲齐大厦,将于7月28日(周三)上午11时,委託仲量联行进行强拍,底价为1.95亿元。

该厦现划为「住宅 (甲类) 2」用途,地盘面积约3,000平方呎。大厦于1964年落成,现为1幢楼高8层的商住物业,地下设3个商铺,1至7楼为住宅,并共用两条公用楼梯。

(经济日报)

金朝阳二亿购南华冷房43%

旧式工厦具重建潜力,金朝阳 (00878) 斥资2亿元购入葵涌南华冷房大厦一篮子物业,涉及大厦约43%业权。

根据土地註册处资料,葵涌华星街13至17号南华冷房大厦地下、1楼全层、2楼B室连4个车位,总建筑面积共22513方呎,于5月20日由腾翠有限公司以2亿元购入,呎价约8884元。腾翠有限公司董事包括金朝阳主席傅金珠及执行董事陈慧苓。

据悉,上述一批物业佔大厦约43%业权,原业主分别于1970年及1982年购入,总成本约342.5万元,如今账面大赚约1.97亿元,升值57.4倍。

最快下月统一全幢业权

金朝阳早于2019年斥约1.18亿元购入该厦2楼A室及3楼全层,大厦餘下的地库、低层地下及平台部分业权原由资深投资者「铺王」邓成波家族拥有,金朝阳今年4月以1.35亿元提出收购,有关交易将在下月完成,意味金朝阳最快下月统一大厦业权。

此外,土地註册处资料显示,蛋挞王创办人庄任明及蛋挞王董事总经理庄裕坤,透过叄拾投资有限公司以6500万元买入火炭坳背湾街34至36号丰盛工业中心B座14楼全层连两个车位,建筑面积约21620方呎,呎价约3006元。

(信报)

Property deals surge 76pc to $474b in first half

The number of property transactions rose 53.7 percent to 50,336 in the first half from a year ago, while total property sales shot up 76.4 percent year-on-year to HK$474.44 billion, data from Hong Kong's Land Registry showed.

However, the latest report from property agency showed that Hong Kong posted only 2.2 percent annual growth in home prices, although global prices are rising at their fastest rate since 2007 and 43 out of the 15 tracked cities are registering annual price growth above 10 percent.

Meanwhile, China Overseas Land and Investment (0688) is launching 286 units in One Victoria in Kai Tak on Saturday after selling 95 percent of 400 units last weekend.

The mainland developer released the fifth price list yesterday, involving 148 units ranging from 332 to 766 square feet, at an average price of HK$28,103 per sq ft.

HKR International (0480) will also launch five houses in IL PICCO at Discovery Bay to sell by tender on Saturday.

Three 2,023 sq-ft houses and two 2,171 sq-ft houses will be on sale.

Since the beginning of this year, IL PICCO has sold 3 houses and cashed about HK$160 million.

As for the office market, another agency revealed that initial signs of stabilization were shown in the second quarter this year.

The firm commented that while office leasing activity is on the rise, the average availability rate is expected to remain at a similar level of 14.4 percent throughout 2021. Leasing activity was most active in the finance and insurance sectors.

A 3.3 percent decline in the overall office rental value was seen in the first half of the year, which a similar range fall may also see in the second half.

(The Standard)

美国银行中心呎租50元 低市价一成

受疫情等因素打击,甲厦市场租金持续受压。消息指,中环美国银行中心高层单位,于交吉9个月后,以每方呎50元租出,低市价10%。

市场消息指出,中环美国银行中心高层07室,面积约1023方呎,月租51150元,平均呎租50元,低市价10%。

据土地註册处资料显示,上址业主于2018年以5500万购入,註册董事分别为欧姓及周姓人士,以最新租金计,租金回报仅约1.1厘。

地产代理指出,上述单位位处高层,并坐享海景,属优质单位,以现今市道计,市值租金约55至60元,故最新租金低市价约一成,该单位早前由物业管理及投资公司租用,惟于去年10月撤出交吉至今,早前曾以每方呎60元放租,惟受疫情等因素影响,市场问盘洽租反应平平,议幅亦逐步扩阔。

该甲厦现时约有28伙放租盘,入场呎租由45元起。美国银行中心为本港知名甲厦之一,据代理资料显示,该甲厦高层单位于2018年11月以每呎115元租出,若以最新租金计,该厦呎租于约3年间大幅回落逾五成。

(星岛日报)

更多美国银行中心写字楼出租楼盘资讯请参阅:美国银行中心写字楼出租

更多中环区甲级写字楼出租楼盘资讯请参阅:中环区甲级写字楼出租

更多金鐘区甲级写字楼出租楼盘资讯请参阅:金鐘区甲级写字楼出租

工商铺买卖下半年料3900宗

代理表示,工商铺市场已逐步转为牛市,相信下半年工商铺整体买卖可达3,900宗,全年成交量有望达7,600宗,全年升幅达1倍。

代理:上半年3712宗

有代理统计,今年上半年工商铺合共录得3,712宗买卖,按年上升1.6倍,成交金额约711.6亿元,按年升2.2倍。代理表示,随着疫情转好,量化宽鬆持续带动资金流入市场,加上通关在即,下半年工商铺市场会逐步向好。

写字楼方面,50大甲级工厦成交量上半年录97宗成交,按年升逾1.8倍,售价上半年累升3.8%,预计下半年升幅约5%。代理表示,租务市场受制于高空置率,预计下半年租金保持平稳,全年升幅预计5%内。

商铺则于上半年录972宗成交,按年升134.8%。受疫情影响,游客大幅减少,代理表示,现时多个核心区商铺空置率均近1成半,该代理预计第三季整体商铺空置率仍有10至15%,但相信元朗和旺角等民生区復甦会比较快,整体商铺空置率约5%。该代理展望,5,000元消费券能带刺激消费,带动更多铺位租务,减少核心区空置率。

至于工厦上半年录得1,997宗成交,按年升1.7倍,上半年售价累升3.4%,租金则微跌0.8%。代理预计下半年工厦成交量和成交价均会上升。

(经济日报)

观塘万兆丰中心海景户 意向价3465万

疫情缓和下,工商铺市况明显转活,买家入市步伐加快之餘,业主亦乐于放售优质单位,如属观塘区知名临海甲厦万兆丰中心,中高层海景单位,现以每平方呎约1.4万元放售,準买家更可获配售一个车位,叫价约210万元。

準买家可获配售车位

代理指,放售为观塘海滨道133号万兆丰中心中高层C室,面积约2,475平方呎,现以意向价约3,465万元放售,平均呎价约14,000元,物业现由业主自用,将以交吉形式出售。单位楼层高,享有全海景观,并连同写字楼装修出售,买家可节省时间及部份装修支出,可即买即用,属近期市场上极受用家欢迎的单位类型。参考单位现时市值呎租介乎25至28元,新买家若将单位出租,回报亦甚为稳定。另外,準买家亦可同时洽购万兆丰中心一个车位,售价约210万元,不仅可作自用,亦同考将其出租及作中长綫投资,甚具弹性。

临海甲厦 市场追捧

仅10年楼龄的万兆丰中心,属区内临海新贵商厦,物业坐落于观塘海滨道上,而近年区内优质商厦亦集中于海滨道一带,足见其位置上甚为超越。而项目周边交通配套成熟,邻近港铁牛头角站及观塘码头,交通便利。

该代理续指,万兆丰中心为观塘区内知名临海甲厦,大厦每层海景单位仅有6个,为A至F室,其中,A及F室为大单位,面积约3,000餘平方呎起,而B至E室为中小户型,面积约2,000餘平方呎。而据资料显示,万兆丰中心向来为用家追捧,该厦最近获社福机构购入作自用,为大厦低层F室,面积约4,065平方呎,以约4,065万元成交,平均呎价约1万元;而与是次放售单位相若的成交,可参考中层C室,面积约2,475平方呎,去年10月以每平方呎约12,727元易手,相比之下,现正放售的单位位处更高层,景观亦更为开扬,而且连装修出售,加上可配售车位,竞争力大为提升。代理预计,放售的单位各方面质素优胜,加上现时工商铺物业入市成本降低,自置物业可免却加租及租务条款等烦恼,料用家会积极物色心仪单位,而坐拥海景优势的万兆丰中心可望洽购反应理想。

(经济日报)

更多万兆丰中心写字楼出售楼盘资讯请参阅:万兆丰中心写字楼出售

更多观塘区甲级写字楼出售楼盘资讯请参阅:观塘区甲级写字楼出售

邓成波妻 1.1亿沽南昌街地盘

已故「铺王」邓成波家族接连沽出旗下物业,根据土地註册处资料,由邓氏妻子叶少萍持有的深水埗南昌街165号地盘,佔地1,753平方呎,以地积比率9倍计,可建楼面约15,777平方呎,地盘近日以1.1亿元沽出,楼面呎价约6,972元。该地盘目前为一间商铺,而该铺为邓成波儿子邓耀邦旗下的零售连锁店「民生Daily Manson」。

新买家为WINFIELD LIMITED,公司董事为陈圣泽即恒和珠宝集团有限公司创办人。而叶少萍于2016年7月以6,600万元购入上址,持货5年,目前转手帐面获利4,400万元,物业升值约67%。

(经济日报)

厂商会大厦19楼 呎造2.4万低顶峰两成

中环乙级商厦厂商会大厦录近两年首宗买卖,一个中层全层单位以7700万元易手,呎价约2.4万元,较高位下跌近两成。

市场消息指出,干诺道中64至66号厂商会大厦19楼全层,建筑面积约3200方呎,以7700万元成交,呎价约24063元。单位连律师事务所租约易手,月租约11.9万元,租金回报约1.85厘。

原业主为EARLYBIRD ASSETS LIMITED,公司董事包括高级女装内衣生产商高华集团首席执行官刘敏姿等,单位于1995年10月以2290万元购入,持货约26年,账面获利5410万元,升值2.4倍。

该厦对上一宗成交于2019年5月录得,面积相同的24楼全层以9600万元成交,呎价高达30000元,即逾两年呎价下挫19.8%。

恒和陈圣泽1.1亿买深水埗物业

此外,资深投资者「铺王」邓成波家族早前以1.1亿元售出的深水埗南昌街165至167号物业,土地註册处资料显示,新买家为WINFIELD LIMITED,公司董事为恒和集团 (00513) 创办人陈圣泽。

(信报)

更多厂商会大厦写字楼出售楼盘资讯请参阅:厂商会大厦写字楼出售

更多中环区甲级写字楼出售楼盘资讯请参阅:中环区甲级写字楼出售

理想集团6.5亿 放售两地盘

市况好吸引财团放盘,第一太平戴维斯表示,获理想集团委託,放售九龙塘豪宅地盘及观塘工厦地盘,市值约6.5亿元。

其中九龙塘喇沙利道48A及50号屋地,48A号地盘面积约3,996平方呎,50号地盘面积约5,507平方呎,可建约17,000呎平方呎之大宅,连一层地下车房,物业市值约4.4亿元。另一项物业为观塘大业街25号高良工业大厦88.89%业权,物业地盘面积约4,165平方呎,可重建成近6万平方呎楼面,市值约2.1亿元。

(经济日报)

威灵顿街铺呎租118元跌35%重返九年前水平

儘管疫情稍回稳,惟核心区铺位租金跌势未止。市场消息指,中环威灵顿街地铺于交吉约1年半后,获零售商以每月约9万承租,取代时装店进驻,呎租约118.4元,租金下跌约35%,并重回9年前水平;据业内人士指,中港两地尚未通关,零售市道依然疲弱,料部分核心区铺位租金持续调整。

市场消息指,上述为威灵顿街39号地铺,面积约760方呎,于交吉约1年半后,新获零售商以约9万承租,呎租约118.4元,该铺早前由时装店以14万租用,故租金下跌约35%,租金亦重回9年前水平。

据土地註册处资料显示,上址业主于2011年以400万购入,以最新租金计,租金回报亦不俗。

代理指出,儘管受疫情放缓带动,近期铺位交投回升,惟不代表市况一片向好,事实上,现今零售市道依然疲弱,核心区铺位租金仍备受压力,其中,中环区铺位空置率持续偏高,中港两地至今尚未通关,受内地旅客绝迹影响,料铺位租金持续调整。

零售商取代时装店进驻

据代理行资料显示,该街道早前亦录租金下调个案,为威灵顿街42号至50号地铺,面积1613方呎,以每月27万获食肆承租,呎租约167元,该铺早前由电讯公司以38万承租,租金下跌约29%。

另外,该街道近期瞩目租务、为由协成行持有的威灵顿街17至19号香港工商大厦地下及地库,面积约4000方呎,市传以约45万获谭仔米綫承租,较旧租低约四成。

大围「挞订铺」4150万成交

另一方面,铺位市场亦录承接,市场消息指出,大围田心街20至30号云叠花园地下10号及19A号铺,面积1500呎,以4150万成交,呎价约2.76万,该铺由便利店以9.3万承租,料买家享租金回报约2.68厘。资料显示,该铺于今年3月曾以4300万售出,惟买卖最终取消交易,是次再度售出,成交价较早前低约150万,幅度约3.5%。

据土地註册处资料显示,上址原业主于1999年以1050万购入,以公司名义GOODFINE PROPERTIES LIMITED持有,註册董事为刘姓及李姓等人士,持货21年帐面获利3100万,升值约2.95倍。

据业内人士指出,受疫情影响,令便利店营运受益,推动该类铺位售价「水涨船高」,并指上述铺位地段人流量并不高,最新成交价属高市价水平。

(星岛日报)

古洞北住宅地掀财团争夺粉岭地高价效应估值调高两成每呎八千

政府锐意发展新界东北,古洞北新发展区成为市场「新宠」,继区内首幅地皮、与及粉岭住宅地相继以天价成交,楼面呎价接连破顶下,将于本月底截标的古洞第24区地,顿成市场焦点,多家发展商均表态具兴趣及研究入标。业内人士指,将吸引各路大中小型财团群起竞逐,部分更将以高价争夺,故将估值调高达两成,市值约34亿至39亿,每方呎约7000至8000元。

在觅地困难下,政府为求增加供应,近年大力拓展新界东北,而古洞北将成为新市镇,无论基建以及交通配套均日渐改善,包括兴建港铁北环綫古洞站,而区内的24区用地,接近未来古洞站,更成市场焦点。

会德丰:正研究入标价

会德丰地产主席梁志坚称,集团对地皮感兴趣,目前正研究入标金额及发展方式,由于地皮邻近未来落成的古洞站,位置不俗、交通方便,看好粉岭及古洞区发展潜力,预计6至7年后区内配套将会成形。

资本策略执行董事方文彬表示,集团一向钟情北区地皮,是次亦会积极考虑入标,欣赏其位置邻近古洞站,未来与落马洲仅一站之隔,深圳亦只一河之隔,区内商业配套陆续落成,将对区内楼价起正面作用,地皮适合兴建2至3房为主单位,提供予小家庭,而集田团年前开始发展的区内项目,亦料于第3季推出。

资本策略:积极考虑入标

佳明营业及市务总监顏景凤表示,古洞24区地皮剪裁方正,同时邻近规划中的港铁北环綫古洞站,具可塑性及发展潜力,相信发展商会参考毗邻之25区地皮成交价作指标,该集团亦会积极研究再决定是否入标。

该地地盘面积约82064方呎,地积比率约6倍,可建约49.2万方呎,市场估计每方呎约7000至8000元,地皮估值34亿至39亿。

佳明:近港铁站具可塑性

有测量师指出,地皮接近未来铁路站,但位置上较古洞25区地皮远,惟仍属区内「龙头」地,地价估算在25区地皮开标后调升25%,粉岭粉锦公路地开标后再升15%,料楼面呎价约7000至7300元,估值34亿至36亿,预期有约10个发展商入标。

另一测量师指,是次地皮与古洞25区地皮毗邻,位置均属优质,亦有商业元素,古洞25区地皮呎价逾7000元,上次粉岭住宅地呎价达9000元,原来估计楼面呎价约6500元,已因市况调升至8000元,将来落成后呎价需15000至18000元。

测量师表示,是次地皮规模不太大,可以吸引各类型发展商,部分会以合组财团形式入标,料有逾10个发展商入标。

本月23日截标

自古洞区内首幅地皮批出后已调高估值约两成,预料楼面地价约7000元,估值约34亿,未来落成400至600方呎单位为主,这地皮的成交价对古洞往后的地价有参考作用。

(星岛日报)

More flats at Koko Hills set to hit market

Developers applied for pre-sale consent for three residential projects involving 838 flats last month, of which 836 are from Koko Hills in Cha Kwo Ling, according to the data from the Lands Department.

Koko Hills phase 3A will offer 392 units and phase 3B will offer 444 units. A site in South Lantau Road, Cheung Sha, will offer two units.

As of the end of June, 23 applications for residential pre-sale consent were being processed, involving 12,639 units. Two residential pre-consents for 1,171 units were approved in June, of which 1,059 are from One Victoria in Kai Tak. A site in King Sau Lane, Tuen Mun, will offer 112 units.

In the second quarter, six residential projects received pre-sale consent, involving 3,486 units. The Henley in Kai Tak, offering, 301 units and South Land in Wong Chuk Hang, offering, 800 units will be completed next year.

The number of completed private residential units in May surged 97 percent to 3,679 units, a six-month high, from 1,863 in April.

The total number of completed units in the first five months was 7,791, more than 40 percent higher than the annual target of 18,000.

Commercial transactions rose 1.6 times year-on-year to 3,712 in the first half, with turnover rising 2.2 times to HK$71.16 billion, property agent said.

(The Standard)

机构转租 东九龙商厦成焦点

近期整体甲厦租务略加快,集中在企业搬迁活动,而东九龙新式甲厦更成为市场焦点。

据代理每月租金走势显示,整体甲厦租金于5月跌势明显放缓,多区租金按月未有变化,而中环整体呎租约111.8元,按月无起跌,而港岛区仅湾仔及港岛东下跌,惟按月跌幅约0.1%及0.3%。整体来说,若与年初相比,租金下跌速度大幅放缓。

观塘海滨汇 保险集团大手洽租

租务方面,5月整体租务集中在东九龙,以观塘海滨道海滨汇为例,录得大手洽租个案,如物业6楼全层,以及7楼部分楼面,面积合共达9万平方呎,呎租约25元,较高峰呎租约33元,下跌逾2成。消息透露,洽租的企业为医疗保险集团保柏,该集团目前租用鰂鱼涌太古坊柏克大厦,另集团亦于九龙湾宏天广场租用楼面,是次大手洽租海滨汇楼面,可整合业务,但节省租金不算多,惟海滨汇属全新海景甲厦,质素有所提升。

至于其他租务成交,包括9楼一单位,面积约2万平方呎,获英国超市Sainsbury's租用,属同区搬迁兼缩减业务,另同层约3.6万平方呎楼面,以每平方呎约26元租出,租客为新传媒集团。据悉,该集团原使用观塘鸿图道82号新传媒集团中心,物业由英皇持有。今年4月英皇以以5.08亿元沽出物业,总楼面面积约8.95万平方呎,呎价约5,676元,由外资黑石基金购入,并打算把物业转作迷你仓业务,故新传媒集团需寻找新办公室。

除此之外,东九龙另一幢租务较旺为观塘国际贸易中心,物业低层全层,面积约3.6万平方呎,以每平方呎约30元租出。据悉,新租客为Farfetch网购平台,公司原租用黄竹坑物业,如今整合业务加上提升写字楼级数,搬至观塘区。

中资公司 顶手租国金1期楼面

核心区方面租务不多,个别外资早前弃租楼面,获新租客承接,如中环国际金融中心一期中层1万平方呎楼面,原由外资机构租用,早前提出弃租,并由中资中金公司顶租,呎租120元,租金跌约3成。

分析指,目前环球疫情未完全解决,尚未通关,甲厦新租务需求疲弱,令整体甲厦吸纳情况未如理想。近期录得租务成交,多属机构搬迁。未来一两个月本港与欧美通关似乎进展不多,相信新需求仍偏弱。

(经济日报)

更多海滨汇写字楼出租楼盘资讯请参阅:海滨汇写字楼出租

更多国际贸易中心写字楼出租楼盘资讯请参阅:国际贸易中心写字楼出租

更多观塘区甲级写字楼出租楼盘资讯请参阅:观塘区甲级写字楼出租

更多柏克大厦写字楼出租楼盘资讯请参阅:柏克大厦写字楼出租

更多鰂鱼涌区甲级写字楼出租楼盘资讯请参阅:鰂鱼涌区甲级写字楼出租

更多宏天广场写字楼出租楼盘资讯请参阅:宏天广场写字楼出租

更多九龙湾区甲级写字楼出租楼盘资讯请参阅:九龙湾区甲级写字楼出租

更多国际金融中心写字楼出租楼盘资讯请参阅:国际金融中心写字楼出租

更多中环区甲级写字楼出租楼盘资讯请参阅:中环区甲级写字楼出租

中环中心连录全层成交 涉资13亿

甲厦买卖因市况转好稍为加快,最近投资者马亚木以约13亿元,沽出两层中环中心全层楼面。

市场消息指,中环中心录得全层成交,涉及物业26楼全层,面积约2.5万平方呎,以约6.93亿元成交,呎价约2.77万元。据悉,新买家为纪惠集团,购入作长綫收租。该集团近3年,先后3度入市,如今持有中环中心3层全层单位。

该厦今年曾录全层楼面成交,涉及「磁带大王」陈秉志以8.7亿元,沽出物业38楼全层,呎价约3.4万元。由于是次沽出26楼,属物业中低层,不及中高层海景单位优质,造价较低。

马亚木持13层 现减持

原业主为马亚木,他伙拍多名投资者,于2017年向长实 (01113) 购入中环中心,而马亚木持有当中13层楼面,如今以每呎2.7万元沽出全层,料仅获微利离场。

据了解,马亚木同时沽出20楼全层,面积约24,593平方呎,以约6.15亿元沽出,呎价约2.5万元,料为近2年新低。

(经济日报)

更多中环中心写字楼出售楼盘资讯请参阅:中环中心写字楼出售

更多中环区甲级写字楼出售楼盘资讯请参阅:中环区甲级写字楼出售

工商铺上月663买卖 价量齐升

多个利好消息持续刺激工商铺市况,带动交投量稳步上扬。根据代理统计,6月共录得约663宗工商铺买卖成交;而受惠月内九龙湾国际展贸中心全幢以约105亿元售出,令整月总成交金额录得约255.54亿元,对比5月分别增加约9%及1.45倍。

代理表示,根据该代理行资料显示,6月市场共录得约663宗工商铺买卖成交,比5月回升约9%,较去年6月更大幅增加约1.18倍。至于金额方面,由于月内九龙湾国际展贸中心全幢以约105亿元易手,带动6月总成交金额跃升至约255.54亿元,按月及按年分别多出1.45倍及3.55倍。若扣除该宗大额成交的话,全月总成交金额有约150.54亿元,对比上月亦录约44%增幅。

铺位买卖金额升1倍

该代理称,按3个范畴分析的话,以商铺市场表现最好,6月铺位成交宗数约186宗,对比5月约161宗上升约16%,金额则录得约67.24亿元,按月升幅约94%。当中成交宗数更为2018年5月后单月新高记录,反映投资者对入市铺位意慾持续上升。其次为商厦市场,6月共录得约99宗写字楼买卖个案,对比5月约73宗升36%;而总成交金额扣除九龙湾国际展贸中心约105亿元全幢成交后,全月金额亦有约23.88亿元,按月升幅约7成。至于工商物业走势就相对平稳,价量均与5月水平相若。

该代理认为,工商铺市场低潮期结束,3个类别均现曙光。当中以铺位物业最为活跃,疫苗接种令防疫措施有所放宽、消费券又将提升本地消费力,期待已久的屯马綫现已通车,令九龙城及土瓜湾一带铺位备受注目,多个因素带动铺位买卖成交量。至于写字楼物业沉寂一段时间,最近大额成交都接连出现,最受瞩目的当然要数九龙湾国际展贸中心全幢交易,另外中区指标甲厦中环中心买卖都逐渐活跃起来,证明市场承接力强,中长綫看好写字楼物业前景。而工厦就一直有活化政策支持,又不乏中细额入市选择,迎合各类型买家的需求,购买力向来稳定。工商铺3个类别都迎来好消息,预测下半年交投量表现会更为出色。

(经济日报)

更多九龙湾国际展贸中心写字楼出租楼盘资讯请参阅:九龙湾国际展贸中心写字楼出租

更多九龙湾区甲级写字楼出租楼盘资讯请参阅:九龙湾区甲级写字楼出租

更多中环中心写字楼出售楼盘资讯请参阅:中环中心写字楼出售

更多中环区甲级写字楼出售楼盘资讯请参阅:中环区甲级写字楼出售

深水埗旧楼今强拍

市区地皮供应量有限,吸引财团积极併购市区旧楼,其中,由恒基收购的深水埗耀东街旧楼,将于今日作强拍,底价为5.24亿。

底价5.24亿

深水埗耀东街9至14号旧楼,将于今日作强拍,项目地盘面积7725方呎,现为3幢4层高商住物业,地下为铺位,1至3楼为住宅,楼龄逾60年,而恒基持有约87.5%的业权,底价为5.24亿,相较19年市场估值逾1.79亿,高出约1.9倍。

是次强拍的旧楼,属恒基巴域街、耀东街及南昌街收购项目的一部分,发展商多年前已经有收购计画,料会整合发展,全个项目佔地面积逾4万方呎,最高可建总楼面约40万方呎,料将联同收购项目的其餘部分一併发展,预期仍需时进行收购,预计兴建中、小型住宅单位为主。

(星岛日报)

旺角弥敦道地铺1.1亿易手

近期核心区铺市升温,投资者追捧,市场消息指,有「金行街」旺角弥敦道旺段,其中一个地铺以1.1亿易手,平均呎价9.17万,物业于32年升值6.5倍。

市场消息透露,上址为旺角弥敦道旺段一个双号A铺,建筑面积1200方呎,以1.1亿易手,平均呎价9.17万,现址珠宝店月租28万,新买家料回报3.05厘,市传买家为俊文珠宝创办人陈俊文。上址原业主于1988年以1450万购入铺位,持货32年,物业升值6.5倍。

平均呎价9.17万

近期弥敦道铺成为市场焦点,不但有买卖,更有瞩目租赁,月租300万疫后最大宗,迪生创建于5月承租弥敦道一个巨铺,总面积约2万方呎,月租逾300万,该铺位还贯通西洋南街,现址为周大福及屈臣氏。

周大福则承租同一街道另一个铺位,面积约2200方呎,月租约19万。

市传珠宝商陈俊文承接

迪生创建承租弥敦道636号银行中心广场地下之G01至03号,06至19号铺及其公共区域一部分,以及1楼之17号铺,以月租逾300.36万,较旧租跌45%,平均每呎150元,重返沙士时水平,签下为期6年长约。除了基本月租外,另加「额外营业额租金」,即俗称「分成」。

业内人士指,上述属区内最旺位置,人流较铜锣湾罗素街及尖沙嘴广东道还要多,以现时呎租150元,为重返沙士时的低水平。该业内人士又说,虽然该铺位巨型,惟相信在铺市高峰期,呎租高逾1000多元,现时较高峰期大幅回落。

周大福则承租弥敦道683至685号美美大厦地铺,建筑面积约2200方呎,月租19万,旧租客为谢瑞麟。

(星岛日报)

揭三大美资汉堡租铺策略 攻核心区逾3000呎巨铺 月租25万至70万

贵价汉堡包动輒卖半百至逾百元,依然雄霸市场,美资汉堡亦有趁淡市及疫市下扩张,抢租核心区铺,吼準面积至少3000方呎,甚至近万呎的巨铺,月租由25万至70万不等,平均呎租少于100元。

美资汉堡成为疫市租铺生力军,她们主攻面积逾3000呎铺位,月租由25万至70万不等,当中并以3000至6000多呎、月租40万至50多万最受捧。根据本报统计,市场上巨头、「五兄弟」之称的FIVE GUYS,现时承租6个据点,面积由3000呎至9681方呎不等,月租由25万至70万,月租支出共290万;另一巨头SHAKE SHACK (下称SS) 亦承租6个据点,面积由3000呎至5900方呎不等,月租由25万至60万,旗下6个据点每月支出共280万。

两巨头各拥六个据点

售卖贵价汉堡包的过江龙,近年攻港,最先到来的是SHAKE SHACK (下称SS),早于2018年春季落户中环国际金融中心商场,开设首家分店,连续数月大排长龙,人龙不乏内地客,接着,有「五兄弟」之称的FIVE GUYS (下称FG),亦在湾仔庄士敦道60号地铺开店,同样长龙不断。

代理透露,儘管两家过江龙尝了甜头,惟2018年至2019年6月之前,铺市畅旺,食肆要觅核心区巨铺,始终不易,惟2019年6月以后,由政治事件引发动乱愈演愈烈,汉堡亦起劲租铺,SS早于2019年底之前扩张至5家分店,除了中环国金、金鐘太古广场,铜锣湾时代广场,并向九龙进发,分别在尖沙嘴海港城及九龙站圆方开店,并于2020年4月,疫市下进驻沙田新城市广场。

新竞争者加入 平租中环铺

FIVE GUYS亦不示弱,在动乱时,分别进驻中环万年大厦,北角新落成商厦港汇东、尖沙嘴 K11 Musea,其中该集团于2019年10月,开设中环第三家分店,最惹瞩目,面积近万呎 (建筑面积9681方呎),月租70万,打造全港最大汉堡店,当时业界指租金平,较HMV旧租100万减幅30%。

随之而来疫市,铺租低度未算低,新竞争者Aussie Grill by Outback (下称AG) 加入市场,并以40万承租中环核心旺段娱乐行巨铺,建筑面积逾5000方呎,叫好兼叫坐。日前本报记者巡视中环店,见FS近万呎的据点,中午一时有70多位堂食顾客,AG同一时段却有90多位堂食客。

疫市下,汉堡店反应不比从前,有代理透露,AG虽然租得好据点,不过,始终时势不同,开业时遇上「健身群组」爆发,不像SS及FG年前有大排长龙场面。经营AG的为OUTBACK STEAKHOUSE,该集团商业总监曹玉萍则说,随着疫市改善,近月生意渐稳定,未来锁定在铜锣湾、湾仔、尖沙嘴及旺角开店。

AG曹玉萍:打好基础一步步来

她续说,不过,集团租铺开店策略并不急进,只是一步步来,最重要找到心议据点,打好基础。「做好一件事,比完成一件事来得重要」,就像集团旗下的OUTBACK STEAKHOUSE,90年代来港,一直稳步拓展,现时生意十分稳定。

FIVEGUYS:锁定进军香港

她看好市场,麦当劳雄踞大眾化市场,来港30多年,坐拥300多家分店,惟当顾客想吃出一些变化,吃得更好,这就是『升级版』市场所在。

本报就租铺策略分别向SHAKE SHACK及FIVE GUYS查询,SHAKE SHACK表示不作回应,FIVE GUYS则表示,近期承租罗素街铺位,为此感兴奋,锁定进军香港!

(星岛日报)

更多国际金融中心写字楼出租楼盘资讯请参阅:国际金融中心写字楼出租

更多娱乐行写字楼出租楼盘资讯请参阅:娱乐行写字楼出租

更多万年大厦写字楼出租楼盘资讯请参阅:万年大厦写字楼出租

更多中环区甲级写字楼出租楼盘资讯请参阅:中环区甲级写字楼出租

更多港汇东写字楼出租楼盘资讯请参阅:港汇东写字楼出租

更多北角区甲级写字楼出租楼盘资讯请参阅:北角区甲级写字楼出租

Home buying frenzy spills over into Hong Kong’s lived-in, subsidised Home Ownership Scheme flats

Transactions involving such flats amounted to US$2.3 billion in the first half of this year, the highest since records began in the second half of 1995.

Strong sentiment and rising property prices are driving the brisk turnover of second-hand HOS flats, real estate agent said.

Hong Kong’s home buying fever has spilled over into the subsidised housing market as turnover and average prices rise to new highs amid a recovery in the city’s coronavirus pandemic-battered economy.

Transactions involving lived-in Home Ownership Scheme (HOS) flats in the first half of this year amounted to HK$17.6 billion (US$2.3 billion), the highest since records began in the second half of 1995 and up 36.4 per cent from the same period last year, according to property agency. The total number of deals in this period, at 3,262, was also the highest since 3,296 transactions in the second half of 2014.

“The housing market sentiment is improving, property prices are rising and user demand is strong – [all of this is] driving the brisk turnover of second-hand HOS flats,” property agent said.

The frenzy came as the city’s economy emerged from its worst recession on record and clocked a 7.9 per cent expansion in the first quarter. The overall prices of lived-in homes have rallied this year to within 0.8 per cent of a record high set in May 2019, with some analysts predicting a 5 per cent to 10 per cent jump for 2021.

The Hong Kong government’s subsidised HOS flats can be sold to buyers eligible for the scheme without paying a premium. If sold in the secondary market to buyers not eligible for the scheme, the sellers must pay a premium set by the government. Most sellers can net a gain even after paying the premium because of the high discounts originally offered by the government.

Such flats sold for HK$5.41 million on average during the first half, their highest average price since records began in 1996, according to data from another property agency. They have also risen 47.7 per cent since HK$3.66 million in 2016, when this rally started.

“With the rebound in home prices, and the significant year-on-year increase in the number of transactions of second-hand HOS flats at a higher price range, the average price of second-hand HOS flat transactions so far this year has risen to a new high,” agent said.

For instance, a 592 sq ft flat at Kornhill Garden in Tai Koo changed hands for a record HK$10.88 million in May, breaking the record of HK$10.68 million set by a similar flat in the same estate in May 2020.

“The pandemic stabilised [locally], the economy improved and a new batch of [buyers eligible to apply for HOS flats] entered the [secondary] market,” agent said. “The number of transactions in the second half may rise over 20 per cent to test the 4,000 level. The average price is likely to rise a further 7 per cent to 8 per cent.”

(South China Morning Post)美国银行中心低层每呎52元承租

儘管近期商厦市场仍低迷,空置率为2003年以来高水平,不过,在疫情逐渐受控情况下,商厦租赁有改善,美国银行中心一个中低层单位,以每方呎52元租出,较去年低位反弹逾20%。

较低位反弹逾20%

上述为美国银行中心中低层12室,建筑面积732方呎,以每方呎约52元租出,月租约3.8万。代理指,此租金水平反映市场气氛,较去年市况低迷时反弹逾20%;该厦近日另一宗租赁,为一个高层单位,面积约1023方呎,以每方呎约50元租出,月租5.1万,代理指出,单位属高层优质单位,成交呎租低市价10%。上址业主于2018年以5500万购入,故最新回报率仅约1.1厘。

该甲厦现时有约28个放租,入场呎租由45元起。美国银行中心属指标甲厦,业权分散,该厦高层单位于2018年11月以每方呎115元租出,惟去年租金大跌,优质单位呎租低至40元,去年8月,该厦29楼2室,建筑面积约1998方呎,以每方呎约40元租出,为该厦近10年呎租新低;该厦34楼5室,去年2月以每方呎42元租出。

(星岛日报)

更多美国银行中心写字楼出租楼盘资讯请参阅:美国银行中心写字楼出租

更多金鐘区甲级写字楼出租楼盘资讯请参阅:金鐘区甲级写字楼出租

更多中环区甲级写字楼出租楼盘资讯请参阅:中环区甲级写字楼出租

嘉宝商厦呎价1.6万易手

位处中环苏豪区的嘉宝商业大厦,向来受用家欢迎,该厦刚录1宗成交,1个中高层单位以2088万易手,平均呎价约1.6万,物业于22年间升值近10倍。

中环砵典乍街37号至43号嘉宝商业大厦中高层1室,建筑面积1305方呎,以每方呎1.6万成交,涉资2088万,原业主于1999年3月以190万购入,持货约22年,帐面获利1898万,物业升值近10倍。

22年升值10倍

有代理指,上述原业主早年曾自用单位,近年则作出租用途。根据土地註册处资料显示,上述单位于2018年2月以每月3.5万承租,若以最新易手价计算,料回报率逾2厘。

嘉宝商业大厦交投不多,对上一宗为去年3月,9楼4室,建筑面积640方呎,以930万易手,平均呎价约14531元。再对上一宗为2018年12月录得,为15楼2室,建筑面积约1120方呎,以1850万易手,平均呎价约16518元。

代理续说,以最新单位成交呎价,成交价重返2018年高位水平,嘉宝商业大厦向来放盘少,受用家追捧,价格向来企得硬净。

(星岛日报)

铜锣湾渣甸街铺减租24%平均每呎136元租出

核心区铺租持续下滑,铜锣湾渣甸街地铺,于交吉逾9个月后,以6.8万租出,平均呎租约136元,租金下挫24%,重返5年前水平。

市场消息指出,上述为铜锣湾渣甸街61至63号地铺,面积约500方呎,新近以6.8万租出,平均呎租约136元,据悉,该铺早前由眼镜零售店以9万租用,故租金下跌约24%。据业内人士指出,该铺早于去年8月已交吉,期间曾以12万放租,惟受疫情等因素冲击,市场洽租情况淡静,议幅亦逐步扩阔,最新租出租金重返5年前水平。

月租6.8万 重返五年前

据土地註册处资料显示,上址业主于1986年以121.7万购入,并以联名形式持有,以最新租金计算,回报率相当不俗。

盛滙商铺基金创办人李根兴指出,上述铺位位处地段并非一綫地段,属于民生消费,故租金跌幅较大市为低。

交吉逾九个月

据大型代理行资料显示,该街道近期频录减租个案,61至63号另一个地铺,面积约700方呎,早前获面包店以9.8万承租,平均呎租约140元,该铺早前由药房以18万租用,故租金下跌约46%;另外,该街道单号地铺,面积约900方呎,以25万获食肆续租,呎租约277.8元,租金下跌逾一成。

此外,该街道54号富盛商业大厦地下单号铺,面积约1000方呎,获食肆以19万承租,呎租约190元,该铺早前由另一食肆以25万租用,租金下跌约24%。

(星岛日报)

New home sales hotter than July

Hong Kong property developers sold nearly 800 new homes in the first 10 days of July, though second-hand transactions declined as sellers raised their asking prices.

China Overseas Land and Investment (0688) launched second-round sales for its One Victoria project at Kai Tak on Saturday and sold 118 out of the 286 flats offered in one day, continuing the success of its first-round sale.

The 286 flats are offered at a discounted average price of HK$27,165 per square foot, a 12 percent increase compared to the average price of HK$24,240 per sq ft for the first batch.

The developer received around 2,800 checks for the 286 flats, making the batch was nearly nine times oversubscribed, and chalked up sales of around 500 flats within nine days, cashing out HK$5.7 billion.

Meanwhile, CK Asset (1113) said it has sold all 1,422 flats at Sea to Sky in Lohas Park, cashing out around HK$16.3 billion, following the launch of the project a year ago.

Most of the flats at the tower are large three-bedroom units and cost around HK$11.5 million, with an average price of around HK$18,000 per sq ft.

Still in the primary market, Wheelock Properties and Sino Land (0083) sold 11 flats at Grand Victoria phase one in West Kowloon yesterday for HK$182 million.

The developers have launched 143 flats at the project, including 34 units which will be sold by tender.

And Henderson Land Development (0012) sold 20 flats at Skypoint Royale in Tuen Mun for more than HK$105 million.

In the secondary market, property agency recorded 18 transactions at 10 blue-chip housing estates over the weekend, down 18.2 percent week-on-week.

Property agent said that as the pandemic in Hong Kong continues to ease, first-and second-hand transactions are booming with 770 deals recorded in the primary market as of Saturday this month.

With the market picking up, the agent said that many sellers are setting more aggressive prices and this led to a fall in the number of secondary deals. But the agent still held a positive outlook for "stable development" in July.

(The Standard)邓成波家族尖区地盘3.85亿获洽

「铺王」邓成波家族近日连环沽货,消息指,尖沙嘴嘉兰围地盘,获买家以约3.85亿洽至尾声,若最终落实成交,每呎楼面地价约8750元。

可重建作商厦

消息指,邓成波家族持有嘉兰围3号地盘,获买家以约3.85亿洽购至尾声,其地盘面积3660方呎,预计可重建作商厦,可建楼面约4.4万方呎,以最新洽购价计,每呎楼面地价约8750元。

每呎楼面约8750元

事实上,邓成波家族近期频频沽货,该家族早前以1.1亿沽出深水埗南昌街165号地盘,买家为恒和珠宝集团主席陈圣泽,项目地盘面积1753方呎,以地积比率9倍计,可建楼面约15777方呎,每呎楼面地价约6972元,于16年以6600万购入,持货5年帐面获利4400万,期间物业升值67%。

另外,该家族早前以3亿售出油麻地窝打老道宝翠大楼地铺,作价3亿,呎价约1.5万,持货12年帐面获利1.88亿。同时,该家族早前亦以蚀让价沽货,为葵涌打砖坪街57至61号中央工业大厦全幢,佔地约2.43万方呎,总建筑面积约17万方呎,成交价9亿,平均呎价约5294元,持货仅两年帐面蚀1.8亿,贬值16.7%。

该家族早前亦售出油麻地窝打老道宝翠大楼1楼及2楼及地铺,作价约3亿,以总楼面约19983方呎计,呎价约15013元,买家为本地投资者。

据悉,该铺现时由护老院及健身中心以约107万承租,料买家可享租金回报约4.2厘。

(星岛日报)

恒地底价5.24亿夺石硤尾旧楼

发展商积极併购市区旧楼,周五 (9日) 有两个旧楼併购项目出现新进展,其中恒地 (00012) 循强制拍卖以底价5.24亿元统一石硤尾耀东街9至14号旧楼业权,将连同毗邻的旧楼分期发展。宏安地产 (01243) 于2019年申请强拍的黄大仙鸣凤街旧楼,同日也获土地审裁处批出强制售卖令,底价8.05亿元。

耀东街旧楼于周五早上进行拍卖,结果手持1号牌的恒地执行董事黄浩明,在没有对手的情况下以底价5.24亿元投得。该项目佔地约7725方呎,位于石硤尾街与南昌街之间,现为6幢1952年落成的4层高唐楼,楼龄约69年,地面层为商铺。

恒地年报显示,前述地盘属于恒地旗下耀东街、南昌街、巴域街和石硤尾街一带的大型重建项目的一部分,黄浩明透露,随着购入前述耀东街旧楼,已统一整个重建项目的业权,总地盘面积约4.6万方呎,预计可建楼面面积逾40万方呎,将主力兴建中小型住宅单位;该地盘计划分期重建,其中有部分范围现时借出作社会房屋用途,会在收回土地后才发展。

宏安黄大仙项目准强拍

另外,宏安地产于2019年向土地审裁处申请强拍的黄大仙鸣凤街26至48号旧楼,于周五获土地审裁处批准以底价8.05亿元强拍。该项目由3个地段组成,包括26至32A号乾丰大厦、34及36号凤凰楼,以及38至46号旧楼,总地盘面积约9630方呎,现有楼宇高6至8层,1962至1965年落成,楼龄约56至59年。

宏安地产于申请强拍时,持有上址约80.6%业权,及后进一步收购小业主的物业,业权遂增加至约83.5%。该地盘大纲图划为「住宅 (甲类) 1」用途,可建楼面面积约8.67万方呎。

(信报)

New World’s compensation to Pavilia flat buyers may slash valuations and cut the bank loans available to mortgage borrowers

More than half of the buyers chose a cash payment method, in which the purchase is fully settled within 180 days of the contract

The remaining 417 buyers, making up 48.9 per cent of the purchase, chose to pay only when construction is completed, according to data by mortgage broker

New World Development’s decision this week to compensate owners of the flats it plans to demolish at The Pavilia Farm apartment complex could slash the valuation of the property and reduce the amount of bank loans available to mortgage borrowers.

Slightly more than half of the customers who bought the 852 apartments at The Pavilia Farm III chose a so-called cash payment method, in which the purchase is fully settled within 180 days of the contract. The remaining 417 buyers, making up 48.9 per cent of the purchase, chose to pay only when construction is completed, according to data by mortgage broker.

The two payment options make a difference in how New World compensates customers who signed the contracts for blocks 1 and 8, the two towers out of the seven-block project earmarked for demolition due to defects. Cash payment customers will receive a compensation of up to 7.6 per cent of their property’s value, while buyers who opted for the stage payment plan will get HK$380,000, New World said on Wednesday.

“Banks may deduct the compensation from the loan amount, so buyers who already have the mortgage may need to make up the difference in the first instalment,” agent said.

Banks may revalue their mortgages when the flats are delivered to buyers, now delayed for nine months until March 2024 for blocks 1 and 8. Any decline in the valuation will lead to a corresponding reduction in the mortgage loan available, the agent said. Still, the chance of this happening is slim, because the apartments at The Pavilia Farm III, which start from HK$6.76 million and go up to HK$24 million (US$3.1 million), are low enough that any adjustment would not affect the mortgage by much, the agent said.

The Pavilia Farm comprises 3,090 apartments in seven tower blocks, to be built in three phases. The entire project is scheduled for completion in 2023.

The developer decided to demolish and rebuild blocks 1 and 8 in Tai Wai, after finding that the concrete walls in the podium of the two towers failed to “meet the requirements of the approved design” found during concrete strength tests.

The construction quality and structural safety of the remaining 2,198 units in the five towers of phases I and II comply with all relevant Hong Kong regulations, a New World spokeswoman said on Thursday.

More than 10 of the 57 floors in the two towers were built before the defects were found on June 18, by which time 846 of the total 892 flats in the third phase had already been sold, the developer said.

Banks are likely to be cooperative and flexible, as the compensation had been announced and arranged in a transparent manner, and New World is trustworthy as a developer, mortgage broker said. Some banks have said that the case will be processed as usual according to procedures and timetables, the mortgage broker added.

(South China Morning Post)

Hongkongers continue their beeline for One Victoria flats in Kai Tak as cheap funds, economic growth lure buyers into market

China Overseas Land and Investment (COLI) sold 118 apartments, or a third of the 286 units on offer at One Victoria by 9pm

The launch was oversubscribed by nine times, receiving 2,800 bids for the 286 flats on offer

Hong Kong’s homebuyers continued making their beeline for the first waterfront flats built on the city’s former airport runway, as low-cost mortgages combined with signs of an economic recovery and easing Covid-19 outbreaks to lure them back into the property market.

China Overseas Land and Investment (COLI) sold 118 apartments, or 41 per cent of the 286 units on offer at One Victoria as of 9pm, sales agents said. The project, built on a strip of land that protrudes into Victoria Harbour, is about 45 minutes walk from MTR Corporation’s Kai Tak subway station. The distance – considered far by Hong Kong standards – did little to deter buyers.

“Kai Tak will be a key area for development, so its sophisticated planning and high quality of property in the area attract investors,” property agent said, the agent also estimated that 40 per cent of customers are buying One Victoria as a “long-term investment”.

The One Victoria project comprises 1,059 flats of different sizes, all scheduled for delivery at the end of March in 2023.

The launch, the second weekend of sales, was oversubscribed nine times, receiving 2,800 bids for the 286 flats on offer. Last weekend, COLI sold 91 per cent of the flats on offer.

The current batch on offer featured units with one to three bedrooms, measuring between 332 square feet and up to 766 square feet 766 sq ft (72 square metres). Prices started from HK$8 million, going up to HK$23.6 million (US$3 million), or HK$28,103 per square foot on average after discounts, almost 22 per cent more than the launch price on June 22.

China’s central bank announced a cut in the nation’s reserve requirement ratio (RRR) on Friday, a much-anticipated move that released about 1 trillion yuan (US$154.3 billion) into the monetary system for commercial banks to lend to businesses and factories to bolster the post-coronavirus economic recovery.

Hong Kong’s monetary policy is run in lockstep with the US Federal Reserve to maintain the city’s currency peg with the US dollar. The world’s most powerful central bank is expected to keep rates at current low levels until 2023.

The continuous flow of financial liquidity will boost Hong Kong’s residential property market, helping owner-occupiers afford new homes through low mortgage rates, while spurring investors to park their capital in fixed assets that generate higher returns.

“Residential property will continue to serve as a tool for [investors] to hedge against inflation,” property agent said.

The market could get another leg up when Hong Kong’s northern border with mainland China reopens, which would open the doors for tourists, business travellers and investors to re-enter the city.

The Hong Kong economy is also seeing signs of recovery amid the government’s efforts in boosting retail sales with HK$36 billion vouchers for citizens. Housing prices are expected to further rise as the local residential land supply will shrink to the lowest level in a decade. Total housing supply could top 7,050 units this financial year, bringing the total to about 55 per cent of the target of 12,900 apartments.

Hong Kong’s housing prices may increase to a record this month, with sales of new homes expected to increase by 20 per cent to 18,000 units from last year, the agent said.

“If the peak of housing prices doesn’t come in July, it will be in August due to various positive factors,” the agent said. “Housing prices in many countries around the world have risen in the past two years during the easier monetary policy, but Hong Kong had lagged behind. Once the border with the mainland reopens, new capital from the mainland will support the Hong Kong market.”

(South China Morning Post)

代理表示,中环云咸商业中心高层全层放租,面积合共约3480方呎,业主意向租金约11.5万元,呎租约33元。

该代理指出,上述单位间隔四正实用,拥开扬山景,每层均设有独立洗手间,私隐度高,用户可承租其中一个单位或全层承租,极具弹性。

大厦设有3部载客电梯及附设停车场,徒步前往中环港铁站仅需约6分鐘,附近亦设有多条巴士及小巴专线前往港九各区,交通极为方便。

(信报)

更多云咸商业中心写字楼出租楼盘资讯请参阅:云咸商业中心写字楼出租

更多中环区甲级写字楼出租楼盘资讯请参阅:中环区甲级写字楼出租

New World carried on selling flats at The Pavilia Farm III after concrete defects were found, as engineers didn’t deem them serious

The developer enjoyed two lively sales weekends after the defects were found in two blocks later earmarked for demolition

Some buyers struck a forgiving tone, saying New World had acted properly and would learn from the experience

New World Development kept selling flats at The Pavilia Farm III – including two tower blocks earmarked this week for demolition – on June 20 and 27, days after defects were found, because engineers did not consider them serious enough to warrant drastic action.

The sale on June 20 was a success, with the developer selling 169 of the 173 flats on offer for a total haul of about HK$2.7 billion (US$347.57 million) in one day. The biggest customer forked out HK$54 million for three flats, while a unit at Tower 1A sold at HK$29,037 per square foot, a price record for Phase III.

A week later New World ratcheted up another bumper weekend, selling 79 of 85 flats at The Pavilia Farm III, in Tai Wai, even after a 24 per cent price increase from a month earlier.

“As the test result was preliminary, maybe the [developer] wanted to double confirm” before taking drastic action, said CGS-CIMB Securities’ managing director Raymond Cheng, adding that the sales outcome would not have been affected by much even if the test results had been known. “Of course it’s not ideal and very good, but it’s not intentional.”

Days later, on July 3, New World’s contractor reported that the concrete strength in sections of the wall base in two of the seven tower blocks in the project’s latest phase failed to meet design standards. It was another five days before the developer took the unprecedented step of announcing its plan to tear down and rebuild the affected towers, and compensate customers for delaying their delivery by nine months.

The two weeks that New World took to announce its course of action was acceptable to James Mak, who paid HK$23.4 million for a four-bedroom unit at The Pavilia Farm III measuring 998 square feet.