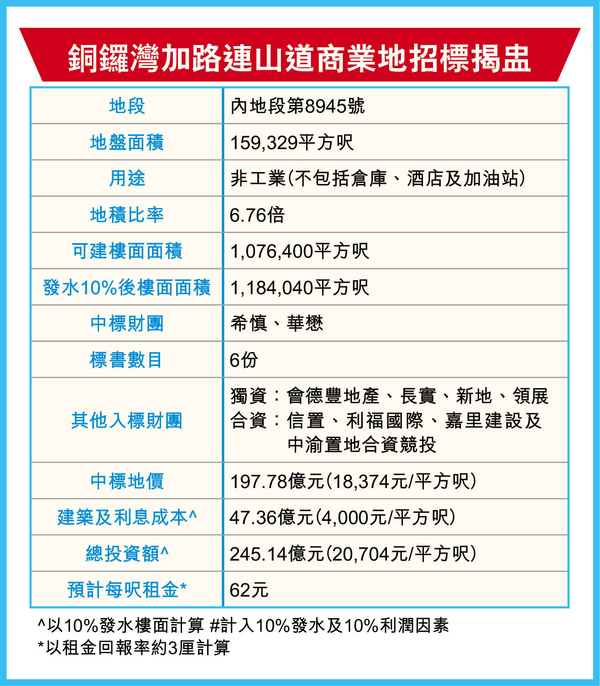

位处铜锣湾加路连山道的百亿商业地王中标财团揭盅,由区内大地主希慎兴业(00014) 伙华懋,以197.78亿元夺得,每呎楼面地价逾1.8万元,高于市场估值上限约15%,反映发展商无惧疫情对商厦市场的冲击。

疫情打击商业市道,近1年政府推出的多幅商业地均流标收场,而是次推出的铜锣湾加路连山道商业地王终顺利售出。地政总署昨日公布,地皮由大热门希慎伙拍华懋,以197.78亿元投得,每呎楼面地价约18,374元,较市场估值上限高约15%,可见是次中标发展商出价不算保守,且胜于市场预期。

希慎出资6成 华懋占4成

以中标金额计,该地皮属本港历来第4贵的商业地,最贵的商业地王,属于西九高铁站商业地,地价约422.3亿元,其次是启德第1F区2号商业地皮,成交价246亿元,紧随其后则为中环美利道商业地,当时中标价232.8亿元。

希慎属铜锣湾大地主之一,近百年前已扎根铜锣湾,并集中发展商业项目。目前该集团在区内拥有多个商业项目,包括利舞台广场、利园一至六期及希慎广场等。按照卖地章程,中标财团需要兴建行人天桥,接驳同系利园商场,相信可再大大增加项目之间的协同效应。

根据希慎最新发出的通告,集团将会出资118.67亿元,并将会持有合资公司的60%,亦即是华懋占有其余40%,而合营伙伴应按其各自于投标公司的股权比例出资。

希慎兴业主席利蕴莲称,项目是一项战略性的长期投资,将有助于提升集团的资产组合,并指可在核心地段发展大型商业项目的机会难得。同时,项目将为利园区的未来发展及营运产生协同效应,及可为集团增加稳定的租金收益。

无惧疫情冲击 呎租料达62元

华懋集团执行董事兼行政总裁蔡宏兴表示,除了提供商店及写字楼楼面,项目更附设社区设施及公众休憩空间,可为社会创造共享价值,贯彻集团宗旨。

据卖地章程,项目不能拆售。而铜锣湾一带有不少商厦,惟其租金差异颇大,综合市场资料,去年初至今,区内商厦呎租维持于28至100元水平。假设项目落成后的租金回报率约3厘,初步估计项目日后呎租可达约62元,租金颇为理想。

代理预计,是次卖地结果反映「面粉价贵过面包价」。若计入建筑费及利息开支等,项目的总发展成本高达约260至280亿元,每呎约2.4万至2.6万元,甚至高于金钟甲厦,并料项目落成后呎租逾70元。

代理称,是次中标价反映发展商对后市信心十足,又指成交价对6月截标的中环海滨商业地的地价具参考价值。

▲ 位处铜锣湾加路连山道的百亿商业地王,由区内大地主希慎兴业伙华懋以197.78亿元夺得。 (资料图片)

(经济日报)

更多利园写字楼出租楼盘资讯请参阅:利园写字楼出租

更多希慎广场写字楼出租楼盘资讯请参阅:希慎广场写字楼出租

更多铜锣湾区甲级写字楼出租楼盘资讯请参阅:铜锣湾区甲级写字楼出租

前翠华中环旗舰店 谭仔45万租2层疫市扩充涉4千呎 租金平约4成

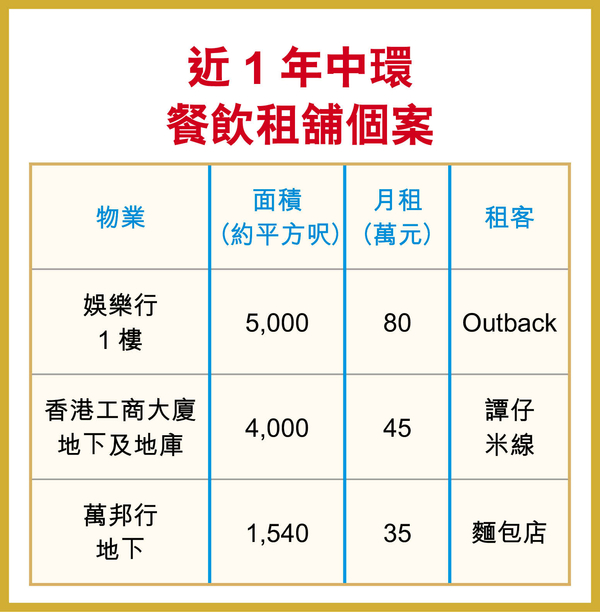

餐饮续租铺,翠华位于中环威灵顿街旗舰店交吉一年后,其中两层获谭仔米线以约45万元租用,较旧租低约4成。

中环威灵顿街17至19号香港工商大厦地下及地库,面积约4,000平方呎,以每月约45万元租出。该铺邻近兰柱坊,属餐饮集中地段。

消息称,新租客为谭仔云南米线,该品牌在疫情期间扩充不断,去年亦于中环开店,租用中环华商会所大厦3层,涉及约8,514平方呎,其中用餐区占2层,可提供逾200餐座,亦是现时谭仔所有分店中最大一间分店。如今见租金回调,即于同区扩充。

8160呎铺 高峰期月租达230万

翻查资料,该铺曾由翠华茶餐厅租用,翠华在1998年9月底起租用威灵顿街铺,其后更扩大铺位至地库、地下、阁楼及1楼的旗舰店,整个铺位建筑面积合共8,160平方呎,是翠华在香港最大的分店。

租金方面,高峰期该铺月租曾高见230万元,其后租金随大市回落,4年前翠华以约130万元续租,已经较高峰期少近一半,并在2019年短暂续租,但疫情影响下旅客绝迹,生意未如理想,而翠华去年中决定不续租并迁出,结束22年历史。如今业主重新招租,并把其中两层租出,新租金较旧租平约4成。

疫情下租金明显回落,零售商相对保守,而餐饮则趁机扩充。过去一年,中区不少铺位获餐饮品牌进驻,如中环万邦行地下铺位面积约1,540平方呎,去年获面包店以每月约35万元租用,租金较高峰期跌约7成。同地段的H QUEEN'S地下,近日亦获本地甜品及饼店预租,即将开业。

▲ 翠华去年中决定不续租中环威灵顿街旗舰店铺位并迁出,业主把其中两层租予谭仔米线。 (资料图片)

(经济日报)

更多万邦行写字楼出租楼盘资讯请参阅:万邦行写字楼出租

更多中环区甲级写字楼出租楼盘资讯请参阅:中环区甲级写字楼出租

观塘开联工中逾万呎地厂 开价1.38亿

起动九龙东以来,观塘区商易发展乘势加快,而疫情渐趋平稳下,工商铺市场交投亦重回正轨,大额成交纷见,同时吸引业主伺机割爱换货,而现放售的观塘开联工业中心地厂单位,业主以约1.38亿元连租约放盘。

食堂承租回报逾3.6厘

代理指,观塘开源道55号开联工业中心A座地下6C至6D室,面积约11,000平方呎,现以意向价约1.38亿元放售,平均呎价约12,545元,单位业主为资深投资者罗珠雄,见近期市况转旺,将单位叫价由原本约1亿元,提价放售。

放售为地厂单位,现由食堂承租,月租约30万元,按意向价计,新买家可享约2.6厘租金回报,利润吸引,极其适合购入作长线收租投资之用。而物业坐落于区内核心地段——开源道之上,为观塘区主要工商厦地段,人流旺盛,为物业确保稳定客源,加上地厂本身供应有限,而且地厂处于人流必经之地,更为项目增值不少。

罕有大单位 处核心地段

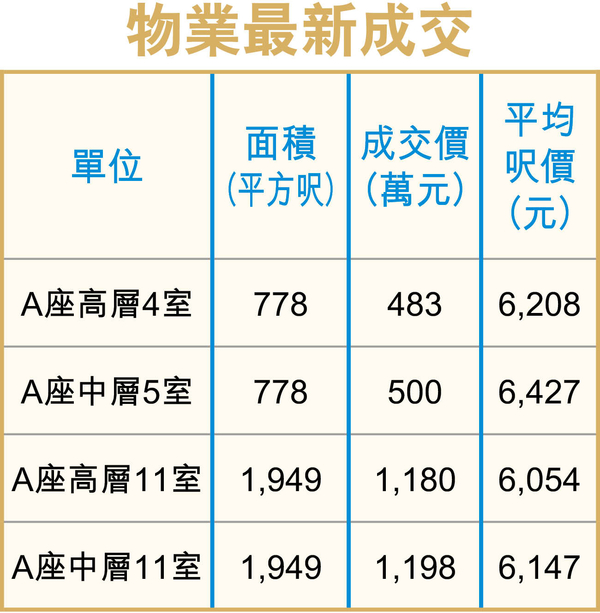

据资料显示,仅仅开源道两旁的工厦,过去一年以来已录得逾30宗成交,而开联工业中心A座占15宗,反映出该厦的受欢迎程度,惟成交的单位以分层户,并以面积于2,000平方呎以下的细单位居多,平均呎价约5,800余元,市场最新录得中层5室,面积仅778平方呎,成交价约500万元,平均呎价6,427元,另高层11室,面积约1,949平方呎,以每平方呎约6,054元易手,造价约1,180万元。

代理指,观塘作为香港第二核心商业区,区内物业投资价值备受肯定,而地厂单位碍于其数量有限,而面积逾万平方呎的大型地厂更为罕有,因而成为投资上佳之选。而据资料显示,观塘区对上一宗逾万平方呎地厂买卖成交,已需追溯至2019年9月,为鸿图道33号王氏大厦地下单位,面积约11,000平方呎,当时以约1.8亿元沽出,平均呎价约1.64万元,相比现正放售的开联工业大厦A座地厂,面积与王子大厦相若,惟单位可即享合理的租金回报,料可获投资者踊跃洽购。

▲ 开联工业中心A座地厂每呎售1.25万(代理提供)

(经济日报)

更多观塘区甲级写字楼出售楼盘资讯请参阅:观塘区甲级写字楼出售

Hysan,

Chinachem’s HK$19.8 billion bid wins first plot of land in Causeway Bay

to be auctioned by Hong Kong government since 1997

The

price is much higher than expected and shows developers’ confidence in

the outlook for Hong Kong’s office market, analysts said

A

joint venture set up by the two developers won the plot on Caroline

Hill Road for HK$18,400 per square foot, the Lands Department said on

Wednesday

A joint bid by Hysan

Development and Chinachem Group has won the first commercial site to be

offered by the government in Causeway Bay for 24 years, for HK$19.778

billion (US$2.55 billion).

The price is much higher

than expected, analysts said, showing developers’ confidence in the

outlook for Hong Kong’s office market as the city tries to get back on

track from a deep recession.

Patchway Holdings (HK), a

joint venture set up by Hysan and Chinachem’s Chime Corporation won the

plot on Caroline Hill Road for about HK$18,400 per square foot, the

Lands Department said on Wednesday. Hysan already owns the Lee Gardens luxury shopping centre in Causeway Bay.

The price tag for the new

parcel of land is 15 per cent above market estimates that ranged

between HK$11 billion and HK$17.2 billion.

“The project significantly expands the scale of the Lee Gardens portfolio

and reinforces Hysan’s leading position in Causeway Bay ... The company

believes Hong Kong will remain a major international city and benefit

from China’s strong economic momentum,” said Irene Lee Yun-lien, who

chairs Hysan Development, in a filing to the Hong Kong stock exchange on

Wednesday evening.

Hysan Development, the

biggest landlord in the city’s famous Causeway Bay shopping district,

holds a 60 per cent stake in the joint venture and will pay HK$11.867

billion for the land, while Chime Corporation controls the remaining 40

per cent. The winning bid was enough to see off competition that

included Hong Kong’s two biggest developers, Sun Hung Kai Properties and

CK Asset Holdings.

“Such a high winning

price shows that the developers are strongly confident in the commercial

property market in the area,” surveyor said.

Hong Kong’s economy

rebounded with stronger than expected growth of 7.8 per cent in the

first quarter of 2021, the fastest in 11 year after a historic low a

year ago when coronavirus pandemic took hold, according to data from the

Census and Statistics Department.

The site, opposite the iconic Lee Garden Three, can yield a million square feet of gross floor area.

It

is the first commercial plot to be tendered by the government in

Causeway Bay since 1997, according to the surveyor expects that the

total investment for the office and retail project could reach HK$28

billion.

“This is a rare

large-scale commercial project in the heart of the city. We are excited

to have this opportunity to partner with Hysan, the most experienced

developer in the district, to develop this project,” said Chinachem

Group’s chief executive Donald Choi. “The project will have synergy with

Hysan’s other Lee Gardens developments and the long-term prospects are encouraging.”

The potential value of

the project will be enhanced by a proposed system of covered walkways

joining it to Causeway Bay MTR station, Hysan said in the filing.

Currently, Hysan

Development’s portfolio of retail, office and residential investment

properties covers a total gross floor area of 4.5 million square feet,

including Lee Gardens, which hosts Hermes and Chanel as well as Goldman Sachs as its office tenant.

The company said the

project will boost the area of its commercial projects by 27 per cent

and is expected to be completed by the end of 2026 or beginning of 2027.

Hong Kong’s office and

retail property segments remain hobbled by an uncertain global economic

outlook amid the coronavirus pandemic that could hurt demand as

companies surrender office space and introduce flexible work

arrangements to cut costs.

The Wan Chai-Causeway Bay

area saw office rents tumble 25 per cent in April from a peak in June

2019, while in Central they fell 30 per cent in the same period,

according to property agent.

The retail property

segment in the city also slumped in 2020, with rental values of prime

shopping streets in Causeway Bay falling between 40 per cent and 50 per

cent, according to property agency.

Sino Land bid for the

parcel on Caroline Hill Road as part of a consortium that included

Lifestyle International Holdings, Kerry Properties and CC Land Holdings.

Offers also came from Sun

Hung Kai Properties (SHKP), CK Asset Holdings, Wheelock Properties and

Link Reit, Asia’s largest real estate investment trust.

(South China Morning Post)

For more information of Office for Lease at Lee Garden please visit: Office for Lease at Lee Garden

For more information of Grade A Office for Lease in Causeway Bay please visit: Grade A Office for Lease in Causeway Bay