儘管疫情持续平稳,惟核心区甲厦租金仍弹升乏力,消息指,金鐘力宝中心中层单位于交吉近一年半后,以每呎约36元租出,较旧租金急挫约45%,低市价约15%。

交吉近一年半后租出

市场消息指出,金鐘力宝中心二座中层08室,面积1318方呎,以每呎约36元租出,月租约47448元。

据从事甲厦租赁的代理指出,上址旧租金约每呎66元,惟于自去年2月交吉至今,故租金急挫约45%。有代理评论指,上述租金低市价约15%。

事实上,该甲厦近期租金持续偏软,频频录低市价承租,资料显示,该甲厦一座高层01室,于交吉近5个月后,以每呎49元承租,月租约12万,较旧租金跌约14%,较市价低约一成,反映儘管疫情持续平稳,惟核心区甲厦租金仍弹升乏力。

代理资料显示,该甲厦近期成交为该厦一座高层全层,面积14385方呎,于本月以719250元租出,平均呎租约50元。

此外,中环远东发展大厦亦录承租个案,消息指,该厦高层05至06室,面积约2512方呎,以每呎约34元租出,月租约85408元;上环南和行大厦低层04室,面积约1832方呎,以每呎23元租出,月租约42136元。

(星岛日报)

更多力宝中心写字楼出租楼盘资讯请参阅:力宝中心写字楼出租

更多金鐘区甲级写字楼出租楼盘资讯请参阅:金鐘区甲级写字楼出租

更多远东发展大厦写字楼出租楼盘资讯请参阅:远东发展大厦写字楼出租

更多中环区甲级写字楼出租楼盘资讯请参阅:中环区甲级写字楼出租

更多南和行大厦写字楼出租楼盘资讯请参阅:南和行大厦写字楼出租

更多上环区甲级写字楼出租楼盘资讯请参阅:上环区甲级写字楼出租

工商铺买卖暂录1657宗

有代理行资料显示,截至本月27日,今年第三季市场共录约1657宗工商铺买卖,总成交金额约341.49亿,分别按季下跌约19%及33%,惟成交量已超越去年全年水平,预第四季交投稳定。

该行代理表示,今年第三季暂录约1657宗工商铺成交,涉及总金额约341.49亿;对比上一季宗数减少约19%,金额则下跌约33%,即使扣除上季的九龙湾国际展贸中心全幢成交,金额仍然递减约15%。虽然按季表现欠佳,但全年首3季计算,2021年工商铺交投量按年价量齐升,今年截至9月27日总共录约5414宗工商铺买卖个案,总成交金额约1123.32亿,对比2020年分别多出约26%及45%。

代理:较第二季跌约19%

该代理续表示,大手成交表现方面,季内共录38宗逾亿元成交个案,涉及总金额约121.98亿;宗数按季减约两成,金额则较第2季递减约33%。2021年度十大工商铺买卖成交排名榜中,佔4宗于第三季出现,可见季内大额交投表现理想。

另一方面,该行另一代理表示,观塘开源道62号骆驼漆大厦第1座1楼全层,面积约14795方呎,以连租约形式易手,成交价约1亿,呎价约6759元。据土地註册处资料显示,上址买家GOODRAY DEVELOPMENT LIMITED,註册董事为资深投资者庄道济。

(星岛日报)

太古柴湾项目补价逾45.4亿 每呎地价约6542元 可建住宅达800伙

政府全力觅地以增加供应之际,连带发展商亦加快补地价进度;太古地产和中华汽车持有的柴湾前中华巴士车厂用地,发展进程具突破,最新与政府达成换地协议,补地价超过45.4亿,每方呎楼面地价约6542元,是近4年来最大宗私人补价个案;太古地产发言人指出,将会兴建3幢住宅大楼,提供约800伙,以协助缓解本港住宅短缺问题。

近期有不少发展商透过改划土地发展,以增房屋供应,太古股份及太古地产昨发出公告指出,太古地产和中华汽车组成的合资公司,就一幅柴湾土地与政府达成换地协议,补地价金额为45.4021亿;资料显示,该金额是4年来最大宗私人补地价个案,以总楼面约69.4万方呎计,每方呎约6542元。

近四年最大宗补价个案

是次换地要约涉及的交回地段及重批地段均位于柴湾道 (前为中华巴士车厂) 的地皮范围内,将交回位于柴湾道391号用地予政府,总地盘面积约10.24万方呎,该地主要限作工业用途。

重新批出的地段将为柴湾内地段第178号,即前中华巴士车厂及毗邻土地,批准用途为非工业用途 (不包括办公室、货仓、酒店及加油站),总地盘面积约9.69万方呎,可建总楼面约69.4万方呎,重批地段的租期为50年。

太古佔八成权益 可建69.4万呎

太古地产发言人指出,该公司与中华汽车组成合资公司,计画于重批地段发展的项目,总楼面约69.4万方呎,预计兴建包括3座住宅大楼,预料项目落成后将为市场提供约800个住宅单位,以协助缓解本港住宅短缺问题,并指该公司将继续支持政府解决本港房屋问题。

除上述住宅单位外,亦有零售空间,同时该项目亦将提供一个有盖公共交通交汇处,以及毗邻约4.3万方呎的公共空间供社区人士使用。

另外,该公告亦指出,换地符合太古地产继续发展优质住宅物业的主要策略,并预期可提升长远的股东回报。而各公司的董事认为换地乃属其日常业务中所订立,且换地的条款是按一般商业条款所商议订立,属公平合理并符合其利益及其股东的整体利益。

太古:协助缓解住宅短缺问题

据公告显示,太古地产及中华汽车各自的全资附属公司,前者太古地产持有合资公司80%权益,后者则持有20%权益,而补地价金额将按其于合资公司的持股量按比例提供,太古地产将以内部资源提供其应付的80%补地价部分,涉及逾36.32亿。

资料显示,年初迄今有不少瞩目补地价项目批出,包括年初中国恒大持有的和生围低密度住宅项目,涉及近42亿完成补地价程序,每方呎楼面地价约4703元;涉及金额最多的补地价个案,对上一宗为2017年时,新地以逾158亿补价西贡14乡项目。

(星岛日报)

港岛大型住宅供应珍罕

港岛住宅供应向来短缺,而大型项目更是罕有。细数港岛未来潜在供应,主要为黄竹坑站港岛南岸3至6期,共提供约3800伙。是次柴湾项目共建达800伙,更为近年港岛东罕有的大型供应。

港岛南岸尚餘4期未推,料继续成为市场焦点。由长实及港铁合作发展的港岛南岸第3期,位于黄竹坑站西北面,住宅楼面近100万方呎,料建4座住宅大厦,预计提供1100至1200伙住宅单位,规模将较第1及2期庞大,佔整个项目发展面积约35%。另外,第4期由嘉里、信和、太古合作发展,位于黄竹坑站南面,住宅楼面约63.8万方呎。项目于今年3月获批建筑图则,将建2座35层高住宅大厦,另连3层平台,合共提供约800伙分层住宅,间隔料以2、3房为主。由于受限量及限呎条款限制,单位实用面积均不少于280方呎。

港岛南岸尚餘四期供应

至于第5期项目则于今年1月底由新世界、帝国、资本策略及丽新合作投得。项目可建楼面约63.6万方呎,提供约1050伙,平均单位面积约605方呎,市场估计以高档中型单位为主,落成后每方呎可售逾3.8万元。第6期则由会德丰地产于今年4月夺得,发展商指,项目将以2房及3房的中型单位为主,计画3年后推售。项目楼面约50.4万方呎,料建750伙,市场估计落成单位每方呎可售约3万元以上。

此外,龙光及合景泰富旗下鸭脷洲利南道66号上月初获批预售,消息指项目楼书及示范单位接近完成,有望短期内命名,随即推出市场。项目提供295伙,主打4房大户,料2022年3月落成。

(星岛日报)

罗素街铺王 口罩店10万进驻

鐘錶店突结业 黎永滔86万招长租

核心区一綫街吉铺仍多,黎永滔持有罗素街铺位,原由鐘錶店租用,去年以60万续租,近日突结业迁出,业主现短租予口罩店,月租料约10万元。该铺高峰期月租高达216万,短租租金下跌95%,现业主以86万 (长租) 招租。

铜锣湾罗素街59号地下G铺,面积约700平方呎,近日获口罩店短租,现正装修中,料在短期内开业,估计月租约10万元。

2012年呎租全港最贵 现跌6成

该铺由资深投资者黎永滔持有,原租客为鐘錶品牌Daniel Wellington,2017年以约100万元租用铺位,去年受疫情影响,核心区铺位商户生意下跌,罗素街多个租客约满迁出,而该鐘錶品牌仍在疫市下,去年以逾60万元续租铺位3年,租金下跌约4成。不过,品牌于本月中突结业,提早迁出。据了解,业主以短租形式租予口罩店同时,并以每月约86万元放长租。翻查资料,该铺曾为罗素街铺王,2012年零售高峰期时,周生生曾以216万租铺,呎租逾3,000元,为全港最贵呎租铺位。若以86万招长租计,租金较高峰期已跌约6成。

铺位买卖方面,消息指,湾仔湾仔道77至83号地下铺位,面积约1,214平方呎,以约5,900万元成交,呎价约4.85万元。铺位现由家品店以每月11.8万元租用,回报率约2.4厘。另长沙湾青山道381号铺位,以约2,800万元成交,铺位面积约1,050平方呎,由地产代理行以每月7.1万元租用,回报率约3厘。

(经济日报)

恒和珠宝陈圣泽 1.3亿扫京瑞广场2两地铺

商铺交投好转,其中石门安群街京瑞广场近日频频录得交易个案。

恒和珠宝集团有限公司创办人陈圣泽亦趁势买入京瑞广场二期两个相连地铺,为地铺G18及G19,合共斥资约1.29亿元。

土地註册处资料显示,京瑞广场二期地铺G18及G19,分别以5,208万元及7,668.4万元成交,其中地铺G18新买家显示为鹰冠投资有限公司,公司董事为陈圣泽,为恒和珠宝集团有限公司创办人;G18铺位以5,208万元成交,实用面积923平方呎,呎价约56,424.7元。至于地铺G19,新买家则显示为利钻有限公司,公司董事同样为陈圣泽,以7,668.4万元成交,实用面积1,251平方呎,呎价约61,298元。

另公司名义 1.1亿购南昌街地盘

陈圣泽近期频频入市,包括近月亦曾以公司名义,向已故「铺王」邓成波的妻子叶少萍,购入位于深水埗南昌街165号地盘,涉资约1.1亿元。

(经济日报)

更多京瑞广场写字楼出售楼盘资讯请参阅:京瑞广场写字楼出售

更多石门区甲级写字楼出售楼盘资讯请参阅:石门区甲级写字楼出售

Swire turns bus terminal into housing

Swire Pacific (0019) and Swire Properties (1972) will turn an old Chai Wan bus terminal, with a land premium of HK$4.54 billion, that was situated for residential development to the government.

In yesterday's announcement, the developer announced their surrender of the lot at No.391 Chai Wan Road, measuring 102,420 square feet, in exchange for a regranted 9,000 square meter site from the government.

A joint venture company formed between Swire Properties and China Motor Bus Company has accepted the government's land exchange offer to develop a site in Chai Wan.

The joint venture company is 80 percent owned by Swire Properties and 20 percent owned by CMB. To that end, Swire Properties will fund its 80 percent share of the land premium with its internal resources.

Both the surrendered and regranted sites in the land exchange are located within a plot of land that is the former CMB bus depot at Chai Wan Road. The joint venture company plans to develop the regranted site into a development comprising three residential towers and retail space, with an aggregate gross floor area of approximately 694,000 sq ft.

The development will also provide a covered public transport terminus. Furthermore, there will be a public open space of about 43,000 sq ft adjacent to the regranted site for the community's use.

Upon project completion, the development will provide around 800 units to the market, which will help address the city's housing shortage.

The total gross floor area of the regranted project shall not exceed 64,500 sq m. Of which, the total gross floor area for private residential purposes shall not exceed 64,314 sq m and that for non-industrial purposes is limited to 186 sq m, according to an exchange filing.

The land exchange is in line with Swire Properties' key strategies to continue with its high-quality residential property activities, and is expected to enhance long-term shareholder returns, said the filing.

The company also said in another statement that it will continue to support the government's efforts in addressing the housing issue in Hong Kong.

(The Standard)

Inside looks set for Koko Reserve

Show flats for Koko Reserve, the second stage of the Koko Hills project in Lam Tin, are being opened by Wheelock Properties on Saturday.

The first batch of flats including at least 30 three-bedroom and four-bedroom homes will have saleable areas from more than 700 square feet.

They will be launched within days in the form of tenders, said managing director Ricky Wong Kwong-yiu.

The project consists of 82 homes with saleable areas ranging from 504 to 1992 sq ft.

Also up for immediate action is The Arles in Fo Tan, with property agency releasing a sales brochure yesterday. A price list could be seen as soon as today. The project provides 1,335 homes, ranging from studios to three-bedroom flats with saleable areas from 228 to 2001 sq ft.

Meanwhile, Lohas Park's phase 10 in Tseung Kwan O was 2.7 times oversubscribed after Nan Fung Group received 650 checks for 176 homes being launched tomorrow.

This second round of sales includes 75 two-bedroom flats, 85 three-bedroom flats and 16 four-bedroom flats.

Saleable areas range from 634 to 1,205 sq ft, with prices starting at around HK$9.5 million.

(The Standard)

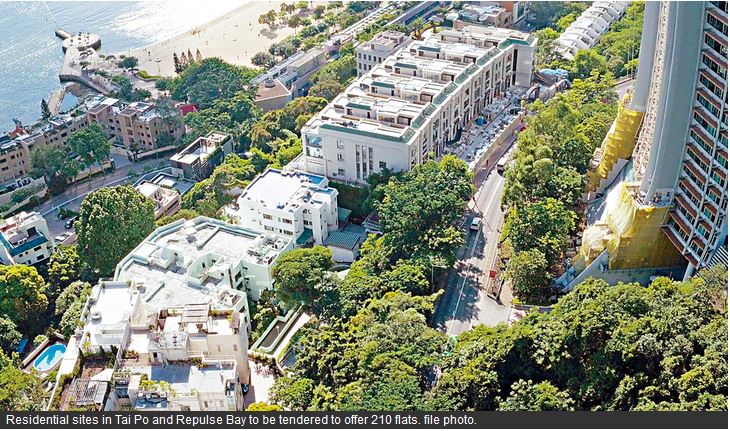

Residential sites in Tai Po and Repulse Bay to be tendered to offer 210 flats

Hong Kong government plans to launch two residential sites via tender, involving 210 flats, from October to December.

The two lands are located in Tai Po and Repulse Bay respectively, Secretary for Development Michael Wong Wai-lun said.

Also, Urban Renewal Authority's Hung Fook Street / Ngan Hon Street Development Scheme in To Kwa Wan will accommodate around 750 households.

The quarterly private units supply is expected to be around 7,110 for the upcoming quarter, the highest in recent years, said Wong.

(The Standard)

Hong Kong keeps third-quarter land supply steady as focus shifts to Carrie Lam’s October 6 plan to ease city’s housing shortage

The city’s government will release two sites capable of accommodating 210 flats for sale in the fiscal third quarter starting on October 1

The city’s total housing land supply could beat a government target by 30 per cent to top 17,000 units in the financial year ending in March 2022

Hong Kong’s government will keep its fiscal third-quarter land sale plan the same as three months earlier, as it focuses the spotlight on the final policy address by Chief Executive Carrie Lam Cheng Yuet-ngor on October 6, when she is due to deliver a widely expected blueprint to boost land supply and alleviate the city’s housing shortage.

The government, which typically releases land from its reserves for developers to build homes, plans to sell a residential plot in Tai Po, and a parcel on South Bay Road in Repulse Bay, enough to build about 210 flats during the three months starting in October, keeping the programme unchanged from the last quarter, according to the Secretary for Development Michael Wong.

“Looking ahead, the government will continue to increase land supply through a multipronged approach to meet the housing, economic and social development needs of our community,” Wong said during a briefing on Wednesday.

Lam’s final address will set out the policy priorities of her final year as the chief executive overseeing the world’s least affordable major urban centre, a dubious honour held for more than a decade according to various surveys.

Hong Kong’s housing supply is augmented by developers, who build private housing for buyers with the budget and preference. The city’s total land supply for housing could beat a government target by 30 per cent to top 17,000 units in the financial year ending in March 2022, Wong said. In this year’s first three fiscal quarters, total supply surpassed the target by 10 per cent to top 14,430 homes.

The Urban Renewal Authority (URA) and private developers are expected to provide a total of 7,110 flats in the three months from October. Some 750 flats in To Kwa Wan will be supplied by the URA and 6,150 by private developers.

“There are 12 private projects to be ready for this quarter, [which] indicates that the government has accelerated the process of lease modification to increase land supply,” property agency said. “But it is hard to rely on private developers to meet the shortfall as they probably release the projects according to market conditions. Builders are unlikely to release these units in one go,” the agent said.

The agent believes that the home prices would continue to grow as Hong Kong’s shortage of new private flats is a long-term problem.

“Private housing shortage will be more serious four years from now as the government runs out of land resources,” the agent said.

Hong Kong’s housing shortage, a chronic problem that has been blamed for a slew of problems from high business costs to the public grievances that drove hundreds of thousands of residents to march during anti-government protests in 2019. The problem has raised red flags among Chinese officials overseeing the city’s affairs, with some of them telling Hong Kong’s developers to use their resources and influence to champion state interests, according to a Reuters report.

For now, reports of arm-twisting by Beijing officials have been denied, according to the Real Estate Developers Association (Rea), the powerful interest group representing the city’s builders and developers. The association did stress that members including Sun Hung Kai Properties, Henderson Land Development and CK Asset Holdings were continuing to support the Hong Kong government in boosting housing supply and improving living standards.

Lived-in home prices in Hong Kong retreated for the first time this year in August from an all-time high, after a slump in the equity market weakened buying sentiment.

Prices declined 0.15 per cent to 397.1 in August, according to a Rating and Valuation Department index. It revised the July reading to 397.7 from 396.3. The previous record of 396.9 was set in May 2019.

(South China Morning Post)