今日公布的财政预算案中指出,本港经济今年将明显反弹,本地生产总值增长将达到3.5%至5.5%,有外资代理行代理指,经济復常将可带动房地产行业各物业的需求,预料整体租赁及交投活动将于今年显著復苏。政府预计2024至2027年间每年经济增长达3.7%,反映本港经济復苏将维持一段长时间,亦令未来3至4年对商业房地产的需求持续,可望加强投资者对本港中期前景的信心。

该代理又指,下年度卖地计划中有3幅商业用地,提供约215.28万方呎楼面,由于写字楼市场供应充足,预计发展商对商业用地的兴趣有限。另下年度亦推出3幅工业用地,涉185.99万方呎楼面,有鑑于工业物业空置率偏低,料能吸引财团参与,而政府未来可考虑推出更多工业用地,以满足市场需求。

(明报)

粉岭工厦提价5%放售 全幢最新意向价3亿

近日工商铺市场气氛渐好转,有业主提价放售物业,粉岭安乐门街26号全幢工厦,早前以2.8亿放售,最新提价2000万,以3亿放售,加幅逾5%。

有代理表示,粉岭安乐门街26号全幢,总建筑面积约6.5万方呎,业主最新修改定价至3亿,呎价约4615元,楼高7层,落成于2010年,设玻璃幕墙,车场提供22个车位及3个货车位。粉岭安乐村工业区佔地约351.1万方呎,聚集数据中心及物流中心,大部分物业属单一业权。

丰树放售两项物流中心

新加坡丰树基金放售2项工厦物流中心,石门伟达中心逾半业权,楼高22层,总楼面约96万方呎,丰树持有约50.9万方呎,物业1996年落成,现以逾25亿放售,呎价约5000元。还有,粉岭业和街4至8号丰树粉岭物流中心,以约6.9亿放售,呎价约5000元,地盘面积约27588方呎,楼高5层,总楼面约13.7万方呎,2物业市值近32亿。

(星岛日报)

旺角百亿商业地王 估值降逾4成

测量师:发展限制多 流标风险高

规划逾10年、前身为旺角水务署及食环署办事处的商业地,属区内罕有商业地供应,由于地皮规模庞大,总楼面高达约152.4万平方呎,加上比邻旺角东站,有条件挑战百亿地王之列,地皮将于明日 (24日) 截标,惟有业测量师认为,流标风险高,更将估值大幅调低逾4成。

有测量师料,地皮最大缺点是有很多发展限制,包括要保留近亚皆老街的3棵榕树,变相不能在榕树周边兴建任何建筑。同时,中标发展商日后要兴建天桥接驳旺角道行人天桥及黑布街、亦要提供公共运输交滙处、及比邻项目的休憩用地等。

另外,地盘中间包括旺角道及快富街分别需要预留两个建筑物间距,令到空气更流通,视觉更宽阔,预计这会增加日后商场设计的困难,变相不能兴建大型商场,故减低项目地价,并估计日后用作商场的楼面只佔约2成,楼上则为商厦。

地皮比邻新地 (00016) 旗下新世纪广场、帝京酒店,而且近期新地有竞投其他商业项目,所以他认为是次他们入标的机会很大,料项目最终接获2至3份标书。

估值调低 约93亿至98亿

不过,观乎过去1个多月,连续有3幅地皮流标,其涉总投资额均偏高。他指,由于地皮的投资额大,涉逾200亿元,加上近期发展商竞投商业项目的意慾不太高,料是次发展商出价不会高。与此同时,该测量师认为政府会否调低底价视乎政府政策,但近期政府亦推出简约公屋等,意味当局不需在地皮价钱低迷时推地,反而有其他选择,因此地皮的流标风险依然高。

测量师又指,考虑到写字楼成交量已经下跌了4成,而且加息,及建筑成本增加,因此最新将地皮估值调低至约93亿至98亿元,每平方呎楼面地价约6,102至6,430元,较地皮去年2月被纳入卖地表时估值约160亿至183亿元,大幅下挫逾4成。以目前计算,项目落成后商厦呎租料约42元,日后或再有上升空间。

(经济日报)

Budget 2023-24: Hong Kong records lowest land sale revenue since 2016, prompting conservative projection for coming financial year

Government estimates it will generate HK$85 billion from land premium income, including sales of 18 sites in coming financial year

Finance minister Paul Chan says conservative projection takes ‘reference from market situation’ and past performance of government’s land sale programme

Hong Kong has offered up a conservative estimate for its land revenue over the coming financial year after recording its lowest income from such sales in the past seven years.

Authorities planned to put 12 residential plots, as well as three commercial and three industrial sites on the market this year, partly contributing to a forecast HK$85 billion (US$10.8 billion) in land premium income, Financial Secretary Paul Chan Mo-po announced on Wednesday.

The estimate is less than the HK$120 billion forecast for 2022-23 from land revenue, which included the sale of 13 residential sites and four commercial plots.

“From previous experiences, land revenue drops when the property price goes down. The property price went down some 15 per cent last year but it was still at a high level. The property market has become more stable lately,” Chan said during his budget press conference.

“We have taken reference from the market situation and the land sale programme and tuned down the land revenue a bit.”

But the sum for the coming financial year is closer to the revised estimate of HK$71.1 billion for the current one, marking the lowest sales figure in the past seven years.

The revised estimate accounted for only 60 per cent of the initial HK$120 billion forecast for 2022-23.

“It is mainly due to the lower-than-expected transaction prices of some land lots and the cancellation of some land sales,” Chan said.

Only 12 sites were sold out of the 17 offered up in last year’s land sale programme.

The government last April rejected tenders for a residential plot at Castle Peak Road in Tuen Mun and again last month for a site at Cape Road, Stanley, as the premium offers did not meet the official reserve price.

Two of the city’s major builders, the MTR Corporation and Urban Renewal Authority, also each withdrew from a tender earlier this year, with both railway property development and the revamping of built-up areas previously contributing to the government’s land revenue.

A government source emphasised that it “won’t sell land cheaply”, adding a press conference on Thursday would reveal more details about the land sale programme, including the locations up for grabs.

Some 20,550 private flats are expected to be built under this year’s programme, surpassing the government’s estimate for annual demand of 12,900 units.

During the budget announcement, the government also said it intended for 72,000 private homes to be built over the next five years of the scheme. Around 60 per cent of land would be supplied from new development areas, including Fanling North, Kwu Tung North, Hung Shui Kiu, Yuen Long South and Tung Chung, it added.

A surveyor said the land revenue forecast for the upcoming financial year was relatively “conservative”.

“As the value of commercial plots may not be as high as expected, while the residential market has started to show some stable signs, I think it is appropriate to set a rather conservative estimate,” the surveyor said.

The surveyor explained that land set aside for commercial use under the programme could struggle to fetch the government’s expected price tag, given similar sites were widely available on the current market.

Authorities could also offer more incentives for the private to bid on its residential plots, such as excusing developers from building care homes for the elderly or performing slope maintenance at sites.

Another surveyor said it was difficult to predict whether these residential plots could be sold.

Successful sales depended on whether the government offered accurate valuations for the plots based on the market conditions, in addition to whether there were fresh incentives to attract bidders, the surveyor explained.

(South China Morning Post)

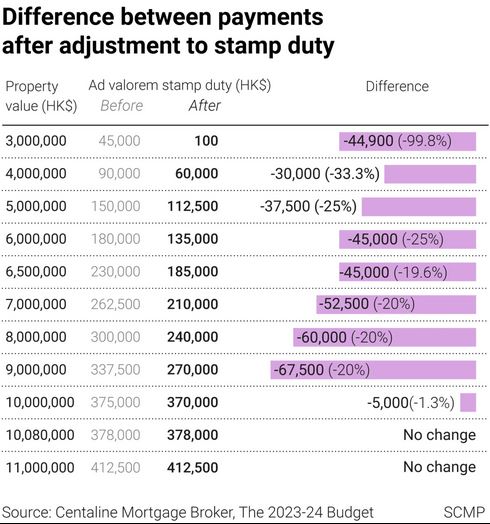

Hong Kong gives first-home buyers a leg-up with trims to ad valorem stamp duty

Adjustments aimed at ‘easing the burden on ordinary families of purchasing their first residential properties’, Paul Chan says

Measure effective immediately, will benefit 37,000 buyers and cost the government around HK$1.9 billion a year

Hong Kong’s government will adjust a decade-old stamp duty on mass-market homes to help the city’s first-home buyers get on the property ladder, as it looks to make housing more affordable in the world’s most unaffordable housing market.

“Last year, more than 90 per cent of buyers of residential properties were first-time buyers,” Finance Secretary Paul Chan Mo-po said in his budget announcement on Wednesday. “Having considered that no adjustments have been made to the value bands of the ad valorem stamp duty payable for the sale and purchase or transfer of residential and non‑residential properties since 2010, I have decided to make adjustments in this regard, with a view to easing the burden on ordinary families of purchasing their first residential properties, particularly small and medium residential unit.”

The ad valorem stamp duty will now be HK$100 (US$12.8) for homes worth up to HK$3 million, instead of HK$2 million previously, among other cuts. The changes apply to homes worth HK$10 million or below, with the difference up to HK$67,500 for properties worth HK$9 million ones, according to a property agency.

“We expect this should help reduce the burden of buyers of private properties priced at about HK$4 million to HK$6 million, which is the prevailing price for many first private homes,” said Raymond Cheng, managing director of CGS-CIMB Securities.

Wednesday’s relaxation comes after the city’s home prices fell 15.6 per cent in 2022, their biggest drop in 24 years. While the number of residential property transactions plunged by almost 40 per cent to a low of about 45,000 deals, the non-residential property market also went quiet.

The adjustments announced on Wednesday shall take effect immediately, Chan said, adding that it is anticipated that this measure will benefit 37,000 buyers and cost the government around HK$1.9 billion a year. Chan, however, said there was no plan to further relax housing market restrictions.

The measure will help relieve the burden of families that are buying their first homes or swapping for a new one, an agent said. This will boost transactions of small and medium residential units, he said, adding that homes worth less HK$10 million will be more sought after.

A majority of first-time property buyers will benefit from this change, which will most likely attract genuine users looking to acquire their first property, said Polly Wan, tax partner at Deloitte China. “Reducing the stamp duty can relieve some of the financial burden of first-time property buyers,” she said.

The adjustment was “definitely a surprise” and suggest the government listened to the industry’s opinions, another agent said.

But the impact might be limited, others said. “Although the government has made minor adjustments to the ad valorem stamp duty, it is expected to have little impact on the market and will not significantly push buyers to enter the market,” agent said.

The government should completely abolish the outdated special stamp duty and use the Buyer’s Stamp Duty to attract talent to the city, the agent said. The city should take a “tax exemption first, tax recovery later” approach so that the market can resume its due circulation and increase housing supply.

“The measure will not lead to a significant increase in housing demand in the residential market,” agent said. The agent estimated that for a property worth HK$9 million, homebuyers could save up to HK$67,500 after the adjusted stamp duty.

“I believe potential homebuyers will not make a buying decision because of tens of thousands of Hong Kong dollars in stamp duty. Luxury units worth over HK$10 million are not affected by the adjustment so there won’t be an impact on this segment,” the agent added.

The latest relaxation follows a slew of easing measures introduced over the past few years. For instance, in his first policy address in October 2022, Hong Kong leader John Lee Ka-chiu announced the refund of an extra stamp duty that non-locals paid when buying Hong Kong residential property. Eligible non-local buyers can claim the refund after they remain in the city for seven years and obtain permanent residence.

Non-locals pay the Buyer Stamp Duty and an ad valorem stamp duty, two taxes of 15 per cent, on property purchases. Under the new policy, non-locals can get a refund of the taxes and pay a lower ad valorem rate ranging from HK$100 to 4.25 per cent of the property value.

In the budget announced in February last year, the mortgage amounts available were raised to help buyers, with the loan-to-value ratio of 80 per cent increased to a maximum of HK$12 million from HK$10 million. First-home buyers who qualify for the higher 90 per cent mortgages can now borrow up to HK$10 million from the previous HK$8 million.

In November 2020, the Double Ad Valorem Stamp Duty, introduced in February 2013 to curb speculation, was scrapped for non-residential property after prices dropped and transactions slowed during the coronavirus pandemic and Hong Kong’s worst economic recession on record. Its maximum rate dropped back from 8.5 per cent to 4.25 per cent.

“Any adjustment will have a positive effect on weakening market sentiment,” said Donald Choi, CEO of Chinachem Group. The removal of these measures will also not lead to any market speculation, given the city’s slowing economy, he added.

“The proposed changes to the first homebuyer stamp duty is minute,” an agent said. “It reduces the stamp duty liability by 0.75 per cent of purchase price for homes under HK$9 million,” the agent added.

“This is at best a gesture to demonstrate the government is responding, but it will have near zero impact on reviving the market.”

Since the Hong Kong economy has just started to recover, it is understandable that the government may need more time to carefully assess the domestic property market trend before making any adjustments to its “hard measures”, said Paul Ho, financial services tax leader for Hong Kong at EY.

“The adjustment will reduce the burden for first-time homebuyers and small-to-medium size properties, whereas the ‘hard measures’ are really targeted at speculators to manage the demand side.”

(South China Morning Post)