今日公布的財政預算案中指出,本港經濟今年將明顯反彈,本地生產總值增長將達到3.5%至5.5%,有外資代理行代理指,經濟復常將可帶動房地產行業各物業的需求,預料整體租賃及交投活動將於今年顯著復蘇。政府預計2024至2027年間每年經濟增長達3.7%,反映本港經濟復蘇將維持一段長時間,亦令未來3至4年對商業房地產的需求持續,可望加強投資者對本港中期前景的信心。

該代理又指,下年度賣地計劃中有3幅商業用地,提供約215.28萬方呎樓面,由於寫字樓市場供應充足,預計發展商對商業用地的興趣有限。另下年度亦推出3幅工業用地,涉185.99萬方呎樓面,有鑑於工業物業空置率偏低,料能吸引財團參與,而政府未來可考慮推出更多工業用地,以滿足市場需求。

(明報)

粉嶺工廈提價5%放售 全幢最新意向價3億

近日工商鋪市場氣氛漸好轉,有業主提價放售物業,粉嶺安樂門街26號全幢工廈,早前以2.8億放售,最新提價2000萬,以3億放售,加幅逾5%。

有代理表示,粉嶺安樂門街26號全幢,總建築面積約6.5萬方呎,業主最新修改定價至3億,呎價約4615元,樓高7層,落成於2010年,設玻璃幕牆,車場提供22個車位及3個貨車位。粉嶺安樂村工業區佔地約351.1萬方呎,聚集數據中心及物流中心,大部分物業屬單一業權。

豐樹放售兩項物流中心

新加坡豐樹基金放售2項工廈物流中心,石門偉達中心逾半業權,樓高22層,總樓面約96萬方呎,豐樹持有約50.9萬方呎,物業1996年落成,現以逾25億放售,呎價約5000元。還有,粉嶺業和街4至8號豐樹粉嶺物流中心,以約6.9億放售,呎價約5000元,地盤面積約27588方呎,樓高5層,總樓面約13.7萬方呎,2物業市值近32億。

(星島日報)

旺角百億商業地王 估值降逾4成

測量師:發展限制多 流標風險高

規劃逾10年、前身為旺角水務署及食環署辦事處的商業地,屬區內罕有商業地供應,由於地皮規模龐大,總樓面高達約152.4萬平方呎,加上比鄰旺角東站,有條件挑戰百億地王之列,地皮將於明日 (24日) 截標,惟有業測量師認為,流標風險高,更將估值大幅調低逾4成。

有測量師料,地皮最大缺點是有很多發展限制,包括要保留近亞皆老街的3棵榕樹,變相不能在榕樹周邊興建任何建築。同時,中標發展商日後要興建天橋接駁旺角道行人天橋及黑布街、亦要提供公共運輸交滙處、及比鄰項目的休憩用地等。

另外,地盤中間包括旺角道及快富街分別需要預留兩個建築物間距,令到空氣更流通,視覺更寬闊,預計這會增加日後商場設計的困難,變相不能興建大型商場,故減低項目地價,並估計日後用作商場的樓面只佔約2成,樓上則為商廈。

地皮比鄰新地 (00016) 旗下新世紀廣場、帝京酒店,而且近期新地有競投其他商業項目,所以他認為是次他們入標的機會很大,料項目最終接獲2至3份標書。

估值調低 約93億至98億

不過,觀乎過去1個多月,連續有3幅地皮流標,其涉總投資額均偏高。他指,由於地皮的投資額大,涉逾200億元,加上近期發展商競投商業項目的意慾不太高,料是次發展商出價不會高。與此同時,該測量師認為政府會否調低底價視乎政府政策,但近期政府亦推出簡約公屋等,意味當局不需在地皮價錢低迷時推地,反而有其他選擇,因此地皮的流標風險依然高。

測量師又指,考慮到寫字樓成交量已經下跌了4成,而且加息,及建築成本增加,因此最新將地皮估值調低至約93億至98億元,每平方呎樓面地價約6,102至6,430元,較地皮去年2月被納入賣地表時估值約160億至183億元,大幅下挫逾4成。以目前計算,項目落成後商廈呎租料約42元,日後或再有上升空間。

(經濟日報)

Budget 2023-24: Hong Kong records lowest land sale revenue since 2016, prompting conservative projection for coming financial year

Government estimates it will generate HK$85 billion from land premium income, including sales of 18 sites in coming financial year

Finance minister Paul Chan says conservative projection takes ‘reference from market situation’ and past performance of government’s land sale programme

Hong Kong has offered up a conservative estimate for its land revenue over the coming financial year after recording its lowest income from such sales in the past seven years.

Authorities planned to put 12 residential plots, as well as three commercial and three industrial sites on the market this year, partly contributing to a forecast HK$85 billion (US$10.8 billion) in land premium income, Financial Secretary Paul Chan Mo-po announced on Wednesday.

The estimate is less than the HK$120 billion forecast for 2022-23 from land revenue, which included the sale of 13 residential sites and four commercial plots.

“From previous experiences, land revenue drops when the property price goes down. The property price went down some 15 per cent last year but it was still at a high level. The property market has become more stable lately,” Chan said during his budget press conference.

“We have taken reference from the market situation and the land sale programme and tuned down the land revenue a bit.”

But the sum for the coming financial year is closer to the revised estimate of HK$71.1 billion for the current one, marking the lowest sales figure in the past seven years.

The revised estimate accounted for only 60 per cent of the initial HK$120 billion forecast for 2022-23.

“It is mainly due to the lower-than-expected transaction prices of some land lots and the cancellation of some land sales,” Chan said.

Only 12 sites were sold out of the 17 offered up in last year’s land sale programme.

The government last April rejected tenders for a residential plot at Castle Peak Road in Tuen Mun and again last month for a site at Cape Road, Stanley, as the premium offers did not meet the official reserve price.

Two of the city’s major builders, the MTR Corporation and Urban Renewal Authority, also each withdrew from a tender earlier this year, with both railway property development and the revamping of built-up areas previously contributing to the government’s land revenue.

A government source emphasised that it “won’t sell land cheaply”, adding a press conference on Thursday would reveal more details about the land sale programme, including the locations up for grabs.

Some 20,550 private flats are expected to be built under this year’s programme, surpassing the government’s estimate for annual demand of 12,900 units.

During the budget announcement, the government also said it intended for 72,000 private homes to be built over the next five years of the scheme. Around 60 per cent of land would be supplied from new development areas, including Fanling North, Kwu Tung North, Hung Shui Kiu, Yuen Long South and Tung Chung, it added.

A surveyor said the land revenue forecast for the upcoming financial year was relatively “conservative”.

“As the value of commercial plots may not be as high as expected, while the residential market has started to show some stable signs, I think it is appropriate to set a rather conservative estimate,” the surveyor said.

The surveyor explained that land set aside for commercial use under the programme could struggle to fetch the government’s expected price tag, given similar sites were widely available on the current market.

Authorities could also offer more incentives for the private to bid on its residential plots, such as excusing developers from building care homes for the elderly or performing slope maintenance at sites.

Another surveyor said it was difficult to predict whether these residential plots could be sold.

Successful sales depended on whether the government offered accurate valuations for the plots based on the market conditions, in addition to whether there were fresh incentives to attract bidders, the surveyor explained.

(South China Morning Post)

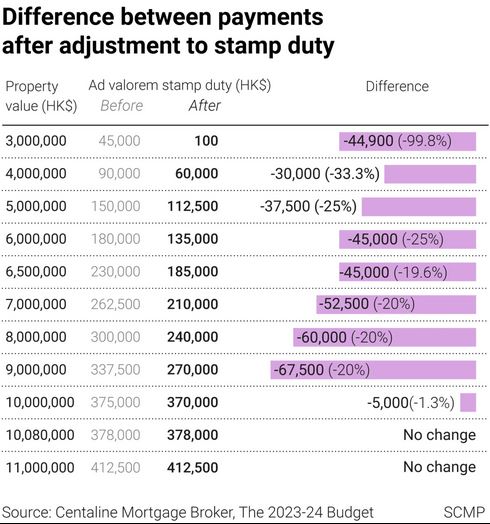

Hong Kong gives first-home buyers a leg-up with trims to ad valorem stamp duty

Adjustments aimed at ‘easing the burden on ordinary families of purchasing their first residential properties’, Paul Chan says

Measure effective immediately, will benefit 37,000 buyers and cost the government around HK$1.9 billion a year

Hong Kong’s government will adjust a decade-old stamp duty on mass-market homes to help the city’s first-home buyers get on the property ladder, as it looks to make housing more affordable in the world’s most unaffordable housing market.

“Last year, more than 90 per cent of buyers of residential properties were first-time buyers,” Finance Secretary Paul Chan Mo-po said in his budget announcement on Wednesday. “Having considered that no adjustments have been made to the value bands of the ad valorem stamp duty payable for the sale and purchase or transfer of residential and non‑residential properties since 2010, I have decided to make adjustments in this regard, with a view to easing the burden on ordinary families of purchasing their first residential properties, particularly small and medium residential unit.”

The ad valorem stamp duty will now be HK$100 (US$12.8) for homes worth up to HK$3 million, instead of HK$2 million previously, among other cuts. The changes apply to homes worth HK$10 million or below, with the difference up to HK$67,500 for properties worth HK$9 million ones, according to a property agency.

“We expect this should help reduce the burden of buyers of private properties priced at about HK$4 million to HK$6 million, which is the prevailing price for many first private homes,” said Raymond Cheng, managing director of CGS-CIMB Securities.

Wednesday’s relaxation comes after the city’s home prices fell 15.6 per cent in 2022, their biggest drop in 24 years. While the number of residential property transactions plunged by almost 40 per cent to a low of about 45,000 deals, the non-residential property market also went quiet.

The adjustments announced on Wednesday shall take effect immediately, Chan said, adding that it is anticipated that this measure will benefit 37,000 buyers and cost the government around HK$1.9 billion a year. Chan, however, said there was no plan to further relax housing market restrictions.

The measure will help relieve the burden of families that are buying their first homes or swapping for a new one, an agent said. This will boost transactions of small and medium residential units, he said, adding that homes worth less HK$10 million will be more sought after.

A majority of first-time property buyers will benefit from this change, which will most likely attract genuine users looking to acquire their first property, said Polly Wan, tax partner at Deloitte China. “Reducing the stamp duty can relieve some of the financial burden of first-time property buyers,” she said.

The adjustment was “definitely a surprise” and suggest the government listened to the industry’s opinions, another agent said.

But the impact might be limited, others said. “Although the government has made minor adjustments to the ad valorem stamp duty, it is expected to have little impact on the market and will not significantly push buyers to enter the market,” agent said.

The government should completely abolish the outdated special stamp duty and use the Buyer’s Stamp Duty to attract talent to the city, the agent said. The city should take a “tax exemption first, tax recovery later” approach so that the market can resume its due circulation and increase housing supply.

“The measure will not lead to a significant increase in housing demand in the residential market,” agent said. The agent estimated that for a property worth HK$9 million, homebuyers could save up to HK$67,500 after the adjusted stamp duty.

“I believe potential homebuyers will not make a buying decision because of tens of thousands of Hong Kong dollars in stamp duty. Luxury units worth over HK$10 million are not affected by the adjustment so there won’t be an impact on this segment,” the agent added.

The latest relaxation follows a slew of easing measures introduced over the past few years. For instance, in his first policy address in October 2022, Hong Kong leader John Lee Ka-chiu announced the refund of an extra stamp duty that non-locals paid when buying Hong Kong residential property. Eligible non-local buyers can claim the refund after they remain in the city for seven years and obtain permanent residence.

Non-locals pay the Buyer Stamp Duty and an ad valorem stamp duty, two taxes of 15 per cent, on property purchases. Under the new policy, non-locals can get a refund of the taxes and pay a lower ad valorem rate ranging from HK$100 to 4.25 per cent of the property value.

In the budget announced in February last year, the mortgage amounts available were raised to help buyers, with the loan-to-value ratio of 80 per cent increased to a maximum of HK$12 million from HK$10 million. First-home buyers who qualify for the higher 90 per cent mortgages can now borrow up to HK$10 million from the previous HK$8 million.

In November 2020, the Double Ad Valorem Stamp Duty, introduced in February 2013 to curb speculation, was scrapped for non-residential property after prices dropped and transactions slowed during the coronavirus pandemic and Hong Kong’s worst economic recession on record. Its maximum rate dropped back from 8.5 per cent to 4.25 per cent.

“Any adjustment will have a positive effect on weakening market sentiment,” said Donald Choi, CEO of Chinachem Group. The removal of these measures will also not lead to any market speculation, given the city’s slowing economy, he added.

“The proposed changes to the first homebuyer stamp duty is minute,” an agent said. “It reduces the stamp duty liability by 0.75 per cent of purchase price for homes under HK$9 million,” the agent added.

“This is at best a gesture to demonstrate the government is responding, but it will have near zero impact on reviving the market.”

Since the Hong Kong economy has just started to recover, it is understandable that the government may need more time to carefully assess the domestic property market trend before making any adjustments to its “hard measures”, said Paul Ho, financial services tax leader for Hong Kong at EY.

“The adjustment will reduce the burden for first-time homebuyers and small-to-medium size properties, whereas the ‘hard measures’ are really targeted at speculators to manage the demand side.”

(South China Morning Post)