市建局土瓜湾项目 邀33财团入标

观塘凯滙之后市建局最大型项目土瓜湾庇利街/荣光街项目,昨日起邀请33间发展商入标,将于下月23日截标,商场部分将由发展商跟市建局共同持有10年,地皮市场最高估值逾百亿元。

庇利街项目地盘面积7.97万平方呎,可建楼面71.7万平方呎,属于继观塘凯滙之后,市建局近年推出最大型的项目,除了近60万平方呎的住宅楼面外,还设有约12万平方呎的商业楼面。

据市场消息透露,发展商须竞投一笔过前期费用,以价高者得,而住宅部分卖楼收益超过148亿元后须与市建局分红,首2.5亿元分红为20%,其后每上升2.5亿元,递增10%,最高分红比例50%。以住宅部分可建楼面近60万平方呎计算,即日后每呎逾2.48万元开始须分红。

项目估值79亿至108亿

同时,项目所设有的12万平方呎商业楼面,首10年将会由发展商与市建局共同持有,租金收入由发展商佔7成、市建局佔3成,发展商跟市建局可以购入对方部分业权,或者再延长合约多5年,到15年后公开招标出售,并由七三比分红。

项目亦再设单位面积下限,不计露台、工作平台等,最少实用面积300平方呎起。发展商按发展协议中列明有关九龙城土瓜湾小区发展的「总体设计要求」作为兴建新发展项目的蓝本,与比邻的市建局重建项目产生协同效应,以达致整个小区的重整及规划更完整及一体化。综合市场资讯,估值约79亿至108亿元,每呎楼面地价约1.1万至1.5万元。

(经济日报)

市建庇利街邀33财团入标 竞投限一笔过出价 卖楼148亿须分红

市区重建局 (下称市建局) 近7年最大型的重建项目、红磡庇利街/荣光街重建计划 (下称庇利街项目) 6月下旬招收意向书后,经过约1个月时间,正式于周五 (23日) 开始招标,8月23日截标。消息人士透露,日后住宅部分的收入达148亿元,中标财团须按机制向市建局分红,以该项目住宅楼面上限约59.79万方呎计算,即平均呎价约2.47万元便触发分红机制,而发展商须支付一笔过出价竞投该项目,将成为胜负关键。

平均呎价2.47万即触发机制

佔地约7.97万方呎的庇利街项目,毗邻庇利街、环安街、荣光街和马头围道等,邻近私人住宅屋苑环海.东岸,上月吸引36家发展商提交意向书。市建局周五公布,邀请其中33家发展商及财团入标,8月23日截标,该局辖下的招标遴选小组将评审所收到的标书,并向市建局董事会提交建议,再由董事会作最终决定。

庇利街项目属市建局透过小区模式推展红磡和土瓜湾一带重建项目中首个推出的地盘,可建楼面面积约71.75万方呎,其中住宅楼面面积约59.79万方呎。市建局初步构思可提供约1150伙,并设有接近12万方呎商业楼面,以及提供约100个车位的公眾停车场。

要求发展商共持零售部分10年

据了解,一如其他招标项目,市建局要求发展商就庇利街项目自行建议一口入场费,住宅部分的卖楼收入若达148亿元,便要与市建局分红,首2.5亿元的比例为20%,其后分红比例以每2.5亿元为一组递增;当收入达155.5亿元以上,分红一律为50%。

至于非住宅部分,消息指出,市建局要求与发展商共同持有零售部分10年,并会视情况或再延长5年;公眾停车场部分,发展商则可随时要求市建局推出整个发售。至于由发展商和市建局共同持有期间,非住宅部分的租金等扣除成本后,收益将由发展商和市建局「七三」瓜分。

市建局行政总监韦志成上月在网誌中指出,整个红磡和土瓜湾一带的小区由8个重建项目组成,总地盘面积逾30.14万方呎,计划分3至4期推出招标,而庇利街项目作为第一期项目,「将肩负起贯彻落实小区总体规划的重任」。

市建局表明,要求发展商根据「总体设计要求」作为兴建庇利街项目的蓝本,与毗邻其他市建局重建项目产生协同效应,以达致整个小区的重整及规划更完整及一体化。

市建局指出,总体设计要求包括加强区内外的连接性,例如连接港铁土瓜湾站等、步行街两旁的配置和绿化设计须配合全区「小街小铺」的设计特色,建筑物须后移以改善通风,亦要应用智能化的楼宇与设施管理元素等。

地皮估值最高达129亿

综合业界估算,庇利街项目市值约93.27亿至129.14亿元。有测量师指出,参考同区的半新楼现时成交呎价动輒2.5万元或以上,估计庇利街项目的地皮市值约107.62亿至129.14亿元,每方呎楼面地价约1.5万至1.8万元。该测量师认为,随着港铁沙中线项目陆续通车,红磡和土瓜湾一带交通渐方便,即使庇利街项目商业部分有共同持有等要求,相信对发展商的入标意欲影响不大,料该地皮可吸引本地发展商入标。

(信报)

城规批三工厦重建申请

受惠于工厦活化政策,市场频录工厦密密申请重建发展。城规会于昨日批出三宗工厦重建申请,分别位于长沙湾、葵涌及荃湾,当中长沙湾恆发工业大厦,将放宽两成地积比率至14.4倍发展,重建为1幢27层高新式工厦,总楼面约228054方呎。

恆发工厦获放宽地积比

据城规会文件显示,长沙湾青山道550至556号,现时为恆发工业大厦,项目地盘面积约15837方呎,早前提出放宽两成地积比率至14.4倍发展,重建为1幢27层高新式工厦,总楼面逾22.8万方呎。

此外,葵涌大连排道45至51号金星工业大厦,项目佔地面积约23563方呎,将重建为1幢29层高全新工厦,计画将地积比率增加至11.4倍发展,包括2层地库及1层防火层,总楼面约26.8万方呎。

另一方面,荃湾半山街18至20号庆丰印染厂,则要求重建作数据中心用途,该项目地盘佔地面积约25000方呎,以地积比率11.4倍发展,拟兴建为1幢20层高的数据中心,总楼面约28.5万方呎。

(星岛日报)

Hong Kong’s real estate buyers give the cold shoulder to leftover flats as they reserve their fire power for new launches

Investors bought 30 of the combined 191 flats on offer at four projects in two locations, representing 16 per cent of the total on offer this weekend

Buying interest may return next month when Sun Hung Kai Properties puts its Wetland Seasons Bay in Tin Shui Wai on the market, agents say

Hong Kong’s real estate buyers mostly ignored a weekend sale of leftover apartments at four residential projects, as they await newer offerings to come on to the market.

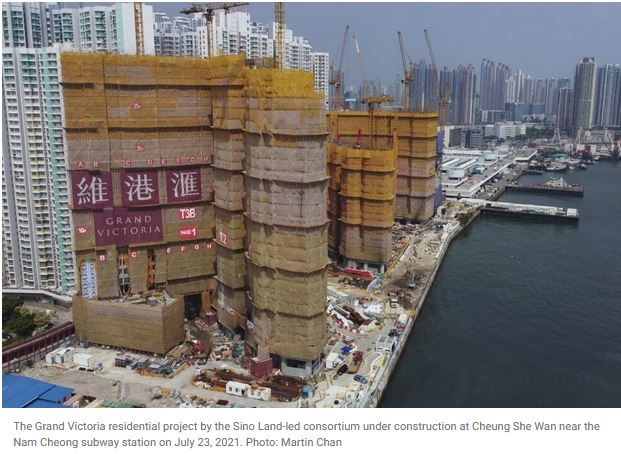

Investors bought 30 of the combined 191 flats on offer at Seaside Sonata and Grand Victoria III in Cheung Sha Wan, as well as Aquila. Square Mile and Cetus. Square Mile in Tai Kok Tsui, representing 16 per cent of the total on offer this weekend.

“These homes have been on the market for some time, and are more expensive than their launch prices,” agent said. “These units will continue to be available, so [buyers feel] there is no rush to sign up today, and will take longer to come to their decisions.”

The tepid response to the leftover flats marked a momentary breather in Hong Kong’s galloping residential property market, fuelled by low-interest mortgages amid signs of a recovering economy.

The weekend’s sales were not helped by the fact that only one of every 15 apartments on sale were priced less than HK$20,000 per square foot, with the majority priced between HK$25,000 and HK$29,000 per square foot.

Grand Victoria III, built by a consortium led by Sino Land and located about 20 minutes walk from the Nam Cheong subway station, was on offer at a price point that’s 10 per cent higher than the previous sale in March, or HK$27,060 per square foot after discounts.

During the sale four months ago, the consortium sold 89 per cent of the 227 units on offer. Today, only six of the 83 units on offer were sold.

CK Asset Holdings’ Seaside Sonata project, located 10 minutes walk from Nam Cheong station, generated the best response, selling 19 flats out of 83 units on offer at prices ranging from HK$8.5 million to HK$19.8 million, or between HK$16,675 and HK$25,345 per square foot. Only four flats out of the lot on offer were priced below HK$10 million, with a 488-square foot unit on the ninth floor being offered at HK$8.5 million after discounts.

At Tai Kok Tsui, near Mong Kok on the Kowloon peninsula, Henderson Land Development was offering to sell small flats at Aquila. Square Mile and Cetus. Square Mile for between HK$5.3 million and HK$11.6 million for units between 193 square feet and up to 413 square feet. The developer managed to find buyers for five flats out of 25 units on sale.

The market is awaiting the launch of new projects, and active buying may resume when Sun Hung Kai Properties (SHKP) launches its Wetland Seasons Bay project in Tin Shui Wai next month, with 1,996 flats on offer.

“If it debuts at an attractive price, it will attract strong interest from prospective buyers again,” the agent said.

Hong Kong’s second-hand home prices dipped by 0.5 per cent to 186.89 in the week ending July 18, according to property agency’s market index, which tracks transactions in 100 housing estates across the city. The current price level is 1.9 per cent off the June 2019 peak of 190.48.

“Home prices will move up and down within a narrow range until they reach a breakthrough point,” agent said

(South China Morning Post)

Plot of land in rural Kwu Tung draws strong response from Hong Kong developers betting on future housing demand, transport links

The parcel of land in the rural northern New Territories could fetch up to HK$3.9 billion (US$500 million), or HK$8,000 per square foot, surveyors estimate

Twelve bids were submitted for the site in Hong Kong’s sparsely populated northern New Territories as developers vie for the city’s limited land supply

A medium-sized residential site in one of the least developed areas of Hong Kong has generated a strong response from developers vying to get their hands on some of the limited land available in the world’s most expensive property market.

Twelve bids were submitted for the site – called Area 24 – in the Kwu Tung area of Hong Kong’s northern New Territories before the tender closed on Friday at noon. The developers are betting on future housing demand in the sparsely populated area once transport links have been completed in a few years’ time.

Located next to a plot won by Sun Hung Kai Properties in April, it is the third parcel of land to be offered for government tender in Kwu Tung in as many months.

“Fierce competition for land is unavoidable as the government is unable to provide sufficient land for private housing,” property agent said.

The companies bidding included some of the city’s biggest developers such as Sun Hung Kai Properties (SHKP), Henderson Land Development and CK Asset Holdings. A joint venture between Chinachem Group and Hysan Development, and a joint bid by Far East Consortium and Tai Hung Fai Enterprise also threw their hats into the ring.

SHKP has already developed two low-rise residential developments close to Area 24. They are the 26-year-old Europa Garden made up of 63 houses, and Valais, comprising 330 houses, which was completed in 2009.

With a gross floor area of 492,388 square feet, surveyors estimated the plot could fetch HK$3.3 billion (US$420 million) to HK$3.9 billion, or HK$6,500 to HK$8,000 per square foot.

“Currently the site is inaccessible until the Kwu Tung Station is opened in 2027, but the area will undergo big changes in the next decade,” surveyor said.

The surveyor expects the site could handle 800 homes and a shopping complex to serve future residents.

The MTR Corporation secured approval in December to plan and design the HK$62 billion Northern Link rail project. The 10.7 kilometre railway will include Kwu Tung Station, serving the transport needs of the Kwu Tung North New Development Area which, when finished, will accommodate almost 120,000 people and create 33,000 jobs.

“Land in the area is sought-after as builders bet that the future improvement of transportation will create housing demand,” another surveyor said, who has the most bullish forecast of HK$3.9 billion, or HK$8,000 per sq ft.

The Northern link will connect the Tuen Ma line and the Lok Ma Chau Spur branch of the East Rail line. It should also serve as a connection to the border checkpoint to mainland China for passengers to and from the western part of the New Territories

In April, SHKP outbid nine rivals to win the parcel known as Area 25, Kwu Tung, for a jaw-dropping HK$8.61 billion, some 40 per cent higher than the market valuation.

With a gross floor area of 1.19 million square feet, that worked out at around HK$7,184 per sq ft, which should translate to as much as HK$20,000 per sq ft for completed homes after factoring in profit margins.

SHKP’s winning bid was just 4.9 per cent above the HK$8.21 billion second-highest offer, according to a Lands Department announcement on May 26.

In June, Wing Tai Properties won the second residential site in Kwu Tung for HK$2.62 billion, or HK$9,208 per sq ft.

The surveyor said that plot, at the junction of Fan Kam Road and Castle Peak Road, is in a more developed area of Kwu Tung. It is about a 10-minute walk to Sheung Shui Station, and close to a golf course in Fanling.

“Kwu Tung North is less developed and has no public transport at the moment,” the surveyor said.

(South China Morning Post)