估高盛等基金实蚀逾6亿 近年商厦最大宗

商厦价格近年大幅回调,市场录大额蚀让。消息指,由高盛等基金持有的上环88WL全幢商厦,获本地财团以约7.5亿元承接,呎价仅逾8,300元。基金多年前以近10亿购入地盘,未计建筑费已蚀约2亿,估计最终蚀逾6亿离场,为近年涉及商厦最大宗蚀让个案。

大厦楼高24层 出租率近半

市场人士指,由高盛、凯龙瑞等基金放售逾1年的上环全新商厦88WL,近日获数个财团争夺,包括用家及投资者,最终获本地财团以约7.5亿元承接。

大厦楼高24层,于去年落成,贸素相当不俗。每层面积约3,988至4,253平方呎,业主把大厦提供两类楼面,7至10楼每层面积约4,253平方呎,连同近200平方呎露台,适合作餐厅、半零售用途如健身室等。于物业高层楼面,则作传统商业用途,每层可分间成6单位,面积由数百平方呎起。据了解,现时大厦出租率近半,平均呎租逾40元。

凯龙瑞基金早年购入永乐街3旧楼地盘,共涉9.62亿元,其后引入基金投资进行重建,去年落成。惟自疫情后,商厦租售价出现大幅回调,而基金早于去年中曾放售物业,叫价13.5亿元,未获承接,半年后再委託测量师行放售,降价至9亿,如今再降价至7.5亿元沽出,以总楼面约90,199平方呎计,呎价约8,314元。未计建筑费已蚀约2亿元,若连同起楼成本,估计蚀5亿至6亿离场,为近年商厦最大手蚀让。

凯龙瑞基金早年主力投资商厦,而高息加上租金下跌,面对不少压力,如早年投资湾仔谢斐道303号全幢商厦KONNECT,以及比邻的告士打道160号海外信託银行大厦41个车位,今年初遭债权人接管。债权人率先更拆售海外信託银行大厦的车位,当中15个车位以约1,875万元沽,平均每个车位作价约125万元。

此外,商厦空置情况有恶化趋势,根据差估署《香港物业报告2024》,去年私人写字楼空置量多达2,110万平方呎楼面,当中甲级商厦去年空置量达1,482万平方呎,按年再多108万平方呎,空置率达到16%,按年上升0.9个百分点,创历史新高。

(经济日报)

更多88WL写字楼出租楼盘资讯请参阅:88WL写字楼出租

更多上环区甲级写字楼出租楼盘资讯请参阅:上环区甲级写字楼出租

更多海外信託银行大厦写字楼出售楼盘资讯请参阅:海外信託银行大厦写字楼出售

更多湾仔区甲级写字楼出售楼盘资讯请参阅:湾仔区甲级写字楼出售

超甲厦地标项目今年落成 预租加快

多个大型甲厦项目今年落成,个别更属「地标」超甲厦,预租个案开始增加。

今年多项甲厦落成,当中更有地标项目,包括新地 (00016) 在2019年以约422亿元投得西九高铁站上盖的商业地王,项目日前举行平整仪式。高铁西九龙总站发展项目为两幢双塔式办公楼,提供约260万平方呎甲厦楼面,基座设有约60万平方呎零售楼面;项目亦提供逾10万平方呎休憩用地,当中设有开放予公眾的观景台。

瑞银加码 租高铁站项目46万呎

瑞银在2022年宣布预租西九项目9层楼面、共约25万平方呎,最新瑞银宣布租用整幢14层写字楼,涉及约46万平方呎楼面,大幅增加8成,租约为10年。项目预计2025年底竣工,2026年起开始入伙,瑞银属于第1个租户。瑞银方面指,现时集团租用香港5个办公室物业,而租用新写字楼后,所有员工可以齐集同一座大厦。

新地主席兼董事总经理郭炳联称,瑞银集团决定租用约46万呎写字楼,证明对香港作为一个金融中心、财富中心和资产管理中心,投下信心一票。

长江集团中心二期 中资客租半层

至于中环亦有两幢大厦今年落成,预租有所加快,其中长实 (01113) 旗下和记大厦重建项目长江集团中心二期,录得半层楼面租务,涉及物业中高层,面积约8,500平方呎,以每平方呎约90餘元租出。消息称,新租客为一家中资金融机构,原租用湾仔鹰君中心全层,面积约1.5万平方呎,是次该机构属缩减楼面,但同时可提升级数。

长江集团中心二期今年落成,项目楼高41层,总面积约达55万平方呎,标準办公室楼层面积约17,300平方呎,项目分为东、西两座。据了解,该厦暂时获数宗预租。

另恒地 (00012) 中环全新甲厦The Henderson亦刚完工,大厦录得新租务成交,涉及物业中高层,一个面积约6,600平方呎单位,成交呎租约120元。新租客为华晨汽车集团,原租用中环超甲厦遮打大厦中层。是次搬迁作出少许楼面上扩充,并稍为升级至全新超甲厦。

The Henderson总楼面约46.5万平方呎,较早前恒地公布业绩时表示,大厦出租率已逾5成。对上一宗全层租务,涉及瑞士高级制錶品牌爱彼承租全层,作为其AP House及香港办公室之用,该租务为佳士得拍卖行、金融机构凯雷后,再多一个国际品牌进驻。

(经济日报)

更多长江集团中心二期写字楼出租楼盘资讯请参阅:长江集团中心二期写字楼出租

更多The Henderson写字楼出租楼盘资讯请参阅:The Henderson 写字楼出租

更多遮打大厦写字楼出租楼盘资讯请参阅:遮打大厦写字楼出租

更多中环区甲级写字楼出租楼盘资讯请参阅:中环区甲级写字楼出租

更多鹰君中心写字楼出租楼盘资讯请参阅:鹰君中心写字楼出租

更多湾仔区甲级写字楼出租楼盘资讯请参阅:湾仔区甲级写字楼出租

甲厦空置率16% 创新高

近年甲厦供应高峰,导致空置率展创新高,资料显示,最新甲厦空置率高见16%,为有纪录以来新高。

商厦总空置楼面 逾2千万呎

据差估署《香港物业报告2024》初步统计数字显示,去年私人写字楼空置量多达2,110万平方呎楼面,空置率高达14.9%,其中甲级商厦空置量亦达1,482万平方呎,空置率更达16%,按年急增近1个百分点,创历史新高纪录,差过97金融风暴及03年沙士时期。

去年私人写字楼落成量约171万平方呎,按年已经大减55%,惟同年的整体使用量只有44万平方呎,其中乙级及丙级商厦更录得负使用量,导致去年底的写字楼空置率升至14.9%,按年增加0.5个百分点,属于有纪录新高,涉及楼面多达2,110万平方呎。

当中甲级商厦去年空置量达1,482万平方呎,按年再多108万平方呎或8%,空置率达到16%,按年上升0.9百分点,相较1998年金融风暴后的15.3%,以及2003年沙士后的13.7%还要高。

(经济日报)

上环信德中心 指标甲厦配套完善

上环为本港传统商业区之一,商厦林立,信德中心为该区指标甲厦,交通方便,配套完善,景观开扬,受到不少商户青睞。

信德中心位于上环干诺道中200号,底层基座设有9层高的商场。物业楼高40层,写字楼楼层由9楼起,电梯大堂共分两段,中低层9至24楼位于大厦地下,而高层单位设于商场,共设有16部载客电梯,方便疏通人流。实用率方面,东翼实用率普遍仅为7成,相对西翼实用率逾8成稍低。

大厦总楼面面积约38万平方呎,每层楼面面积约2.5万平方呎,最多可分间成18个单位,单位面积由约1,000平方呎起。物业临海而建,故大部分单位均可享有开扬海景。当中2至5号单位,更面向正维港烟花景。另外,01、16至18号单位,均享有海景。至于其他单位,望向上环商厦及中半山楼景,景观开扬。

9层商场 提供大量食肆

交通方面,物业位处港铁上环站上盖,门口亦设有巴士站,提供多条路綫,直达港九新界,东翼位置对出的天桥,可连接至中环国际金融中心商场,交通便利。此外,物业基座为港澳码头,方便来往澳门及内地珠海。

饮食配套亦十分完善,物业基座为9层高的商场,有大量餐厅食肆可供选择,包括酒楼、快餐店、茶餐厅等,可满足不同上班族的需要。

近年物业最大手成交,为信德集团 (00242) 向新世界 (00017) 购入信德中心商场部分楼面,涉及可出租面积214,486平方呎,以及写字楼面积13,827平方呎楼面,连同85个车位,涉资达23.6亿元。

信德中心租户以大型上市公司及各国领事馆为主,大厦近日接连录得成交,其中西座1610室以4,464万元成交,呎价31,000元。

(经济日报)

更多信德中心写字楼出租楼盘资讯请参阅:信德中心写字楼出租

更多上环区甲级写字楼出租楼盘资讯请参阅:上环区甲级写字楼出租

更多国际金融中心写字楼出租楼盘资讯请参阅:国际金融中心写字楼出租

更多中环区甲级写字楼出租楼盘资讯请参阅:中环区甲级写字楼出租

中上环核心区向来受商户欢迎,有本港代理行代理表示,有业主放售上环信德中心招商局大厦 (东翼) 中层12至16室,建筑面积约6,223平方呎,意向价约1.15亿元放售,呎价约18,500元。

装修齐备 间隔方正

单位以交吉形式放售,装修齐备,间隔方正,且享有高实用率,单位景观开扬海,享广阔维港海景。

该代理指出,大厦位处交通枢纽,上环港铁站上盖,比邻港澳码头及巴士总站,亦设有行人天桥连接国际金融中心等区内主要商厦,享有交通优势。大厦基座商场亦提供大型中式食肆、银行、餐饮、会所及停车场等配套,一应俱全。

(经济日报)

更多信德中心写字楼出售楼盘资讯请参阅:信德中心写字楼出售

更多上环区甲级写字楼出售楼盘资讯请参阅:上环区甲级写字楼出售

更多国际金融中心写字楼出租楼盘资讯请参阅:国际金融中心写字楼出租

更多中环区甲级写字楼出租楼盘资讯请参阅:中环区甲级写字楼出租

Buyer interest soars for Wong Chuk hang homes

CK Asset (1113) has collected more than 12,000 checks for Blue Coast, its new project atop Wong Chuk Hang MTR station, making the 248 flats in the first two price lists over 47 times oversubscribed.

The developer will roll out a third price list shortly to meet market demand, said Justin Chiu Kwok-hung, CK Asset's executive director, adding that the firm may hike prices for future batches based on the market's response.

Chiu said there's a 70 percent chance that property prices in the city will rise this year.

Meanwhile, Wheelock Properties said it sold nearly 800 flats in the first quarter, cashing in nearly HK$8.7 billion. It sold 762 of them in the month after the government removed all the housing curbs, raking in over HK$7.3 billion.

The highlight during the quarter would be Seasons Place, its new project in Lohas Park, which has conducted two rounds of sales and sold 542 flats, accounting for nearly 85 percent of the total revenue for the quarter.

Meanwhile, deals on the secondary market slowed over the four-day Easter break as people traveled to the mainland and overseas.

A total of 15 deals were recorded at 10 major housing estates over the holiday, which was down by 21 percent from the 19 transactions notched up during the same period last year, according to a local property agency.

Among them, Taikoo Shing in Quarry Bay and Laguna City in Kwun Tong recorded no transactions, the agency said.

The number for the weekend alone also fell by 42 percent to 11 from a week ago, the lowest since the withdrawal of all stamp duties a little over a month ago, according to the agency.

An agent from the agency said that many Hongkongers went overseas or headed north to mainland cities during the break and this, coupled with fierce competition in the first-hand markets, hit second-hand deals.

Another local property agency recorded 21 transactions at 10 blue-chip estates during the four-day holiday, similar to the 22 transactions last year.

For the weekend alone, it saw the number of transactions fall 24 percent to 16 from the previous week.

(The Standard)上环88WL全幢商厦7.5亿易手 建滔相关人士承接料回报逾5厘

商厦录大手成交,由高盛等基金持有的上环88WL全幢商厦以7.5亿易手,买家为建滔集团相关人士,平均呎价约8315元,原业主为高盛、凯龙瑞等基金,多年前以近10亿购入地盘,连同建筑费,估计蚀逾5亿离场。

高盛、凯龙瑞等基金放售逾1年的上环全新全幢商厦88WL,早前将意向价由13.9亿调低至9亿,物业陆续获投资者及用家洽购,近期建滔集团相关人士积极出价,最终以约7.5亿承接该全幢,以总楼面约90199方呎计算,平均呎价8315元,该厦去年新落成,现时出租率约50%,平均呎租约40元,料回报逾5厘。新买家购入物业,并非买卖公司,需要支付相等于楼价4.25%的釐印费。

高盛凯龙瑞沽售

该厦楼高24层,每层面积约3988至4253方呎,大厦吸纳两种类型租客,7至10楼每层面积约4253方呎,连同近200方呎露台,作为餐厅及健身室等半零售用途,高层楼面景观开扬,用作传统写字楼用途,每层分间6单位,面积由数百方呎起。

该项目由凯龙瑞基金于早年购入永乐街3幢旧楼,涉资9.62亿,随后引入基金投资者合作,大厦于去年落成,正值商厦市场吹淡风,空置率新高,租售价大跌之际,基金去年中放售物业叫价13.5亿,及至半年后委託测量师行放售,降价至9亿,最新再减价至7.5亿沽售,未计建筑费蚀约2亿,若计及起楼成本,蚀让5亿至6亿离场,为近年商厦最大手蚀让。

蚀让逾5亿离场

凯龙瑞基金主力投资商厦,近年高息加上商厦租售价下跌,面对压力,曾由该基金持有的湾仔谢斐道303号全幢商厦KONNECT,以及毗邻的告士打道160号海外信託银行大厦41个车位,今年初遭债权人接管,债权人率先更拆售海外信託银行大厦的车位,15个车位以约1875万沽,平均每个作价约125万。

现时,商厦供过于求,空置率上升,差估署《香港物业报告2024》显示,去年私人写字楼空置量多达2110万方呎楼面,甲厦去年空置量达1482万方呎,按年再增加108万方呎,空置率高达16%,按年升0.9个百分点,创历史新高。

(星岛日报)

更多88WL写字楼出租楼盘资讯请参阅:88WL写字楼出租

更多上环区甲级写字楼出租楼盘资讯请参阅:上环区甲级写字楼出租

更多海外信託银行大厦写字楼出售楼盘资讯请参阅:海外信託银行大厦写字楼出售

更多湾仔区甲级写字楼出售楼盘资讯请参阅:湾仔区甲级写字楼出售

外资代理行:商厦租金受压 今年料下跌7%至9%

有外资代理行报告指,在环球经济前景不明朗情况下,香港整体营商气氛保持审慎,相信成本控制仍是大多数企业的首要任务。2023年全年整体净吸纳量录负25.83万方呎,直至2023年底,整体待租率被推高至18.8%,此数字亦计及滙丰中心第1座。

去年底待租率18.8%

2023年共有123.68万呎新增写字楼供应入市,相比2022年的286.86万方呎跌57%。这些新落成甲厦集中在非核心商圈,其中两个项目位于九龙东,另有一个项目坐落九龙西。该行预计,2024年供应量将增加至174.16万方呎。

该行预料,2024年香港写字楼市场表现或维持疲弱,在待租面积高企下,未来12个月写字楼租金继续受压,预期2024年全年调整幅度介乎7%至9%。然而,这些新增供应将能为有意升级搬迁的企业提供更多优质选择,尤其是积极寻求搬迁至符合环境、社会和治理 (ESG) 要求的商厦的企业。

报告显示,截至去年第4季,大中华区21个主要城市核心商圈甲厦存量达约7.34亿方呎,净吸纳量年录约1741万方呎,较2022年有所提升,台北核心区去年底空置率较低,约8.3%。二线城市中,苏州核心商圈去年底空置率最低,为16.5%。

(星岛日报)

九龙湾4商业项目重建 九展最大

九龙湾属于起动九龙东、第二个核心商业区 (CBD2) 主要部分,目前区内有4个商业重建项目,预计将提供逾320万平方呎商业楼面供应,最大规模属于亿京等重建九龙湾国际展贸中心。

九龙湾前身属于工业区,但过去10年逐步转型成为商贸区,并与啟德、观塘组成起动九龙东、作为第二个CBD2。区内工厦业权相对集中,不少大型工厦由单一业主持有,故此要展开重建转型难度较低。

增建逾320万呎楼面

根据资料显示,九龙湾区内近年有6个重建项目批出,其中4个重建成商业项目,涉及323万平方呎商业楼面,另外由九龙仓 (00004) 旗下啟兴道九龙货仓,发展商于2022年底亦以约20.9亿元完成补地价,将由目前的工业用途转作商住项目,将会提供约1,782伙。

至于重建成商业的项目之中,则以亿京等组成的财团在2021年中以约105亿元,向合和实业买入九龙湾国际展贸中心,并计划展开重建,属于九龙湾区内规模最大重建项目之一。该项目将会重建成将建4幢16层高商业物业,另设3层地库及3层基座,总楼面共176.78万平方呎,料重建的投资额高达200亿元。

另外,永泰 (00369) 旗下常悦道13号瑞兴中心,近年亦获批准放宽地积比率至14.4倍重建,将会重建1幢30层高的商厦 (包括4层地库),提供约26.3万平方呎楼面。而由中渝置地 (01224) 主席张松桥等持有的临泽街8号啟汇,虽然曾经在2020年年中获批建筑图则可以重建2幢28层高商业大楼,涉及楼面约68万平方呎,不过去年医管局承租该商厦约10层楼面,估计发展商短期内未必会落实有关重建计划。

除了发展商展开重建外,政府亦将区内废物回收中心、验车中心等搬出,以组合成「九龙湾行动区」以兴建大型商业、零售及文化项目,涉及总楼面面积逾430万平方呎,其中伟业街的前运输署验车中心,可建楼面达216万平方呎,将会在大型商场基座上兴建办公室、酒店及零售、餐厅等综合用途。

不过,由于近年商厦市场出现供过于求,九龙东商厦空置率上升,市场相信政府短期内未必会推出有关商业用地招标。

(经济日报)

更多啟汇写字楼出租楼盘资讯请参阅:啟汇写字楼出租

更多九龙湾区甲级写字楼出租楼盘资讯请参阅:九龙湾区甲级写字楼出租

新落成商厦 吸企业租用

九龙湾新落成商厦吸引市场注意,其中第一集团旗下九龙湾宏照道23号第一集团中心近年落成,早前以约18万元租出地下铺位予内地电动车代理商。

第一集团中心地铺 月租18万

第一集团中心原为工厦物业,由第一集团持有,早年透过补地价重建成商厦,近期落成,为区内全新的甲级写字楼项目,楼高21层,设有3层地库停车场、5个商铺及81个写字楼单位。

据指,早前录得首宗租赁成交,涉及广汽埃安新能源汽车代理商租用地下1号铺作本港首个展销厅。该铺位面积约2,777平方呎,楼层高度约6米,每月租金约18万元,平均呎租约65元。

据悉,目前项目尚餘一个地铺招租,面积约2,382平方呎,每呎叫租约65元,月租叫价逾15万元。写字楼方面,该集团亦推出19至21楼全层楼面招租,面积约14,488平方呎,意向呎租28元。另外,早前有欧洲綫上零售商以呎租26元租用九龙湾商厦一号九龙高层,面积近7,000平方呎单位,月租约18餘万元,作为集团总部。

(经济日报)

更多第一集团中心写字楼出租楼盘资讯请参阅:第一集团中心写字楼出租

更多一号九龙写字楼出租楼盘资讯请参阅:一号九龙写字楼出租

更多九龙湾区甲级写字楼出租楼盘资讯请参阅:九龙湾区甲级写字楼出租

Two local property agencies forecast property sales hitting 10-month high in March

‘Market sentiment improved rapidly and transaction volumes increased’ last month after Hong Kong scrapped its property cooling measures in February: property agency

Two agencies forecast that sales could breach 9,000 deals mark in April

Hong Kong property sales are expected to hit a 10-month high in March following the removal of all of the city’s property cooling measures, two leading property agencies said.

Two Hong Kong’s largest real estate agencies, said the total number of transactions could have breached the 5,000 deals mark last month, the highest level since May last year, when sales of new and second-hand homes, parking spots, shops, offices and industrial units reached 5,284 deals. Official sales data is set to be released this week.

A total of 3,189 property transactions worth about HK$22.6 billion (US$2.9 billion) were recorded in February, government data shows. Sales in March are tipped to amount to about HK$37.3 billion, the highest level since June’s HK$39.7 billion worth of deals.

“After the government withdrew the property curbs, the property market sentiment improved rapidly and transaction volumes increased,” an agent said.

Among the measures scrapped by Financial Secretary Paul Chan Mo-po in his budget speech on February 28 were the Buyer’s Stamp Duty that targeted non-permanent residents and a New Residential Stamp Duty for second-time purchasers. Homeowners were also no longer required to pay a Special Stamp Duty if they sold their homes within two years.

The decade-old measures were scrapped to boost a struggling property market.

Mortgage financing was also eased. The Hong Kong Monetary Authority currently allows homes valued at less than HK$30 million to be eligible for 70 per cent mortgage financing, compared with the previous cap of 60 per cent for flats valued between HK$15 million and HK$30 million.

One of the agency said new home sales could have hit 1,488 units valued at HK$13.72 billion in March, more than four times the 357 units sold in February and more than double their value of HK$5.63 billion. As for secondary homes, they might have improved by 23.2 per cent and 21.9 per cent to 2,290 units valued at HK$15.63 billion, respectively.

The agency has estimated that a total of 5,010 deals were completed in March, while another agency has forecast that 5,004 property transactions took place. And this improved performance is likely to continue, with property sales forecast to reach 9,300 units in April, a 33-month high, according to the first agency.

Another property agency, has forecast that 9,160 property transactions will be recorded in April.

“With developers actively launching new projects and late-stage projects throughout March, the registration of property transactions will have been fully reflected starting mid-March, so we expect more sales in April,” an agent said.

The likes of CK Asset Holdings, Wheelock Properties, New World Development and Henderson Land Development are among just the Hong Kong developers that have launched new home sales in March.

However, given that interest rates remain at more than a two-decade high, an international property agency still believes that a short-term rebound in property prices is unlikely.

“I am pretty sure the property transactions this year will be impressive because developers are keen to dispose of their unsold stock and they’re offering attractive deals, but this means that in the secondary market, homeowners will have to sell at an even bigger discount and not many are willing to do that,” another agent said.

Historical analysis suggests that home price stabilisation will require monthly secondary residential transaction volumes to stand firmly above 3,500 units, the agency said.

(South China Morning Post)上月工商铺交投仅录203宗 业界:撤辣后未明显受惠

楼市全面撤辣后,工商铺未明显受惠,资金重注投向住宅,今年3月份工商铺录203宗成交,较2月份传统农历年淡季,升幅亦仅12%。近期工商铺减价蔚成风气,商厦铺位更录大幅蚀让成交。

有本港代理行代理表示,楼市在全面撤辣后,住宅好「威水」,交投量节节上升,由于多年受辣招所困,一旦鬆绑,资金倾向重注住宅,工商铺市场观望,买卖淡静,亦皆因政府年前已为工商铺鬆绑撤辣,釐印费向来低于住宅,故今番楼市全面撤辣,不但未惠及工商铺,甚至将资金由工商铺拉扯向住宅。

宗数仅较2月升12%

该代理举例说,撤辣前,代理一窝蜂在工商铺新盘「跑数」,现时则全部都在跟进住宅,令工商铺市场独憔悴。有见市况淡静,部分有心沽货的投资者,惟有大幅减价,力求成功售出物业。

根据该行资料显示,今年3月工商铺共录203宗成交,较2月份的181宗,增幅约12%,不过,由于2月份为传统农历年淡季,不能直接作比较;若对比去年3月402宗,减幅更高达50%。

高盛、凯龙瑞等基金旗下上环全新全幢商厦88WL,去年意向价13.9亿,近期以约7.5亿易手,平均呎价仅8315元,项目前身为永乐街3幢旧楼,早年购入价9.62亿,大厦于去年落成,若计及起楼成本,蚀让5亿至6亿离场,为近年商厦最大手蚀让。

商厦铺位录大幅蚀让

另外,投资者刘军沽售海防道32至33A宝丰大厦地下D铺作价1.3亿,持货6年贬值57%。盛滙商铺基金创办人李根兴表示,随着住宅兴旺,投资者套现了不少资金,相信「下一轮」旺场将会输到工商铺,资金亦会逐渐流向工商铺。

该行另一代理则表示,3月份工商铺范畴当中,工厦交投相对表现佳,3月份录130宗,较2月份的110宗上升18%。不过,整体金额下跌,只有7.78亿,较2月份减少30.5%。

(星岛日报)

更多88WL写字楼出租楼盘资讯请参阅:88WL写字楼出租

更多上环区甲级写字楼出租楼盘资讯请参阅:上环区甲级写字楼出租

佐敦复式巨铺1.45亿放售

资深投资者、有「太子邓」之称的太子珠宝鐘錶主席及行政总裁邓鉅明,有意减持投资物业,委託代理放售佐敦多层复式铺位,意向价1.45亿元。

有本港代理行代理表示,佐敦道39至39A号根德大厦地下2号铺及1楼至2楼,现推出放售,地下建筑面积约1700方呎,1楼及2楼建筑面积分别约2800及2200方呎,合共总建筑面积约6700方呎,意向售价约1.45亿元,意向呎价约2.16万元。

上址位处佐敦道及炮台街单边,邻近庙街,现分间成多个铺位出租。资料显示,邓鉅明于2010年7月,向「铺王」邓成波家族购入上述复式铺位,当时作价5700万元,目前叫价较购入价高出8800万元或1.5倍。

铺位录蚀让买卖,消息指出,西营盘第二街88号怡丰阁地下6号铺,建筑面积约300方呎,铺位面向常丰里,有指以500万元成交,呎价约1.67万元。铺位由装修设计公司租用,月租1.2万元,买家可享2.9厘租金回报。

资料显示,原业主于2015年4月以1268万元入市,持货9年,账面大幅亏损768万元,劲蚀60.6%离场。

此外,新蒲岗大有街2至4号旺景工业大厦5楼H室,建筑面积2424方呎,以668万元售出,呎价约2756元。原业主为一家本地酱油厂,于2020年12月斥资943万元购入,账面蚀275万元或29.2%。

(信报)

Blue Coast to kick off sales as buyers clamor for new homes

New homes in Hong Kong continued to remain in demand following the removal of all stamp duties a little over a month ago, with CK Asset (1113) collecting 24,000 checks for its Blue Coast project at The Southside in Wong Chuk Hang.

Wheelock Properties and Henderson Land (0012) meanwhile revealed they had notched up home sales worth HK$9.1 billion and HK$8.3 billion respectively so far this year.

The 24,000 checks received for Blue Coast near Wong Chuk Hang MTR station made the first batch of 442 flats nearly 56 times oversubscribed.

The developer will launch sales for the first batch tomorrow and may hike prices by as much as 10 percent for some flats on future price lists.

CK Asset's chief sales manager William Kwok Tze-wai said that even if the prices are hiked by 5 to 10 percent, the company would still be at the losing end.

Prices for the first list for 138 units were HK$21,968 per square foot on average after discounts, the lowest among all completed projects in the neighborhood, while prices for third price list were up to 1.7 percent higher than the first list.

Kwok said demand was dominated by local buyers, with mainlanders accounted for about 30 percent of interested buyers.

The four-bedroom flats on higher floors may be put up for sale by tender in the second round of sales.

Meanwhile, Henderson Land and Wheelock Properties have fared very well in the primary market for first quarter of the year.

Henderson Land has earned more than HK$8.3 billion this year and ranks first in terms of deals with 1,227 transactions.

Wheelock Properties meanwhile achieved the most revenue with sales of nearly HK$9.1 billion from 815 transactions.

In other news, The Knightsbridge in Kai Tak, developed by Henderson Land (0012) and other five companies, has sold 19 flats and raked in HK$760 million since the removal of all property curbs on February 28.

And Wetland Seasons Bay phase 3 in Tin Shui Wai has put another batch of 52 flats on the market, with the cheapest priced at HK$3.9 million.

(The Standard)马会预租航天城1.3万呎楼面

香港赛马会预租新世界旗下机场航天城11 SKIES楼面,设立投注站,根据马会提交区议会文件披露,在11 SKIES的M楼层预留一个面积13283方呎的铺位,作为新投注处的选址,并增添餐饮、消閒及数码化投注设施,希望藉此向旅客推广本地赛马文化的窗口,将在2025年运作。

根据马会网页显示,现时马会在全港拥有逾80间投注站,在离岛区分别有东涌逸东邨、梅窝及长洲3个投注站。

马会指出,该铺位以旅客及机场过境人士为主要目标顾客群,并介绍已有近140年历史的赛马娱乐文化;同时提供模拟赛马体验及餐饮服务。马会形容:「马照跑、舞照跳」是香港社会繁荣稳定的重要标誌,也象徵成功贯彻落实「一国两制」方针。

2025年投入运作

11 SKIES总楼面达380万方呎,将设有全港最大室内游乐空间,包括艺术博物馆ARTE MUSEUM,以及4D动感飞行影院等等。

添餐饮消閒等设施

泛海国际等相关人士旗下中环泛海大厦基座近2万呎巨铺,获瑞士高档护肤品牌La Prairie短租作期间限定店,为时1星期,市场人士料租金约12万。

皇后大道中59至65号泛海大厦地铺及1楼,位于砵甸户街交界,总楼面约19075方呎,由瑞士高档护肤品牌La Prairie短租约一星期,市场人士料租金12万,该铺位正在营运,铺位外墙已换上蓝色主调,据La Prairie网站资料,上述期间限定店于3月30日至4月7日营运。

上述铺位于2013年由英国时装品牌TOPSHOP承租,作为攻港的首间店铺,月租高达300万,及后在2017年续约时,月租降至约150万,2020年8月份,TOPSHOP宣布结业撤出香港,该旗舰店在2020年10月因租约期满结业。

(星岛日报)

更多泛海大厦写字楼出租楼盘资讯请参阅:泛海大厦写字楼出租

更多中环区甲级写字楼出租楼盘资讯请参阅:中环区甲级写字楼出租首季工商铺录681宗註册 本港代理行:较去年同期减30%

今年首季工商铺承接上年年底弱势。有本港代理行综合土地註册处资料显示,首季工商铺共录681宗註册,按年减约30.4%,金额录105.63亿,按年跌约14.1%。该行认为经济尚未完全恢復,相信中短期内,工商铺市难以重返疫情前的表现。

市况难以重返疫情前

今年首季工商铺三板块宗数全线下跌,工厦录352宗註册,按年减约29.2%。商厦及商铺分别录142宗及187宗註册,按年跌约29.7%及33%。

三板块宗数全线下跌

该行代理料工商铺交投见底。日本央行3月决定加息,为07年来首次,经济仍疲弱,料保持宽鬆货币政策。短期而言日本退出负利率政策对国际市场影响有限。

(星岛日报)

Secondary home sales take a beating amid new launches

Secondary home sales in Hong Kong fell into the single digits for the first time since all property curbs were removed six weeks ago, as prospective buyers continued to flock to new projects.

The 10 major housing estates recorded only nine deals, below double digits for the first time since February 28, when all stamp duties were scrapped, according to a local property agency.

The number of deals fell by 18.2 percent over the previous weekend.

Three estates reported zero deals, including Kornhill in Quarry Bay, South Horizons in Ap Lei Chau and Whampoa Garden in Whampoa

An agent said buyers were attracted to the new projects priced at market levels.

Meanwhile, some 75 estates around the MTR stations witnessed 483 second-hand deals last month, up by 22 percent from a month ago, another local property agency reported.

Seven of the most actively traded 10 estates tracked by the agency reported price increases in March with South Horizons, in the south of the Hong Kong Island, seeing the largest increase in the average price per square foot of 7.1 percent to HK$13,725 from a month ago.

Prices at Whampoa Garden in Hung Hom dropped by 6.2 percent monthly to HK$12,150 per sq ft on average.

In the primary market, Wheelock Properties plans to launch Park Seasons - Phase 12B of Lohas Park - as early as this month to offer 685 units, intensifying the race for new home buyers. As the biggest phase in Lohas Park, Park Seasons's one- and two-bedroom flats range from 314 to 537 sq ft.

Executive director Ricky Wong Kwong-yiu said prices will be released in this week and all flats will be priced below HK$10 million. The developer plans to increase prices by up to 10 percent from the last phase.

Phase 12A of Lohas Park, Seasons Place, was launched last month and has raked in around HK$3.47 billion from the sale of 548 flats.

CK Asset (1113), meanwhile, has put 88 more flats at Blue Coast near Wong Chuk Hang MTR station up for sale and raised the average price by 3 percent to HK$23,233 per sq ft after discounts. The new batch of flats range from 454 sq ft to 1,267 sq ft, featuring two to four bedrooms.

It gained nearly HK$7.5 billion by selling 96 percent of 422 units at Blue Coast in the first round of sales on Saturday, and the three-bedroom flats were the first to sell out. The developer said it will keep increasing the prices of flats in future lists.

Executive director Justin Chiu Kwok-hung said sales are going faster than expected.

The primary market recorded 4,895 deals in the first quarter, over 110 percent higher than the previous three-month period and the highest after the second quarter of 2019, according to the Sales of First-hand Residential Properties e-platform.

(The Standard)

业主大幅减价 逾亿元买卖增

工商铺市况仍一般,而个别业主急于套现,愿大幅降价放售物业,即吸引投资者承接,令大手买卖个案增。

近期业主减价沽货个案增,而最大手成交为高盛、凯龙瑞等基金放售逾1年的上环全新商厦88WL,近日获数个财团争夺,包括用家及投资者,最终获本地财团以约7.5亿元承接。

大厦楼高24层,于去年落成,质素相当不俗。每层面积约3,988至4,253平方呎,可作传统商业用途及半零售成分,每层可分间成6单位,面积由数百平方呎起。据了解,现时大厦出租率近半,平均呎租逾40元。

基金沽上环全幢 料蚀至少6亿

凯龙瑞基金早年购入永乐街3旧楼地盘,共涉约9.62亿元,其后引入基金投资进行重建,去年落成。惟自疫情后,商厦租售价出现大幅回调,而基金早于去年中曾放售物业,叫价约13.5亿元,未获承接,半年后再委託测量师行放售,降价至约9亿元,如今再降价至约7.5亿元沽出,以总楼面约90,199平方呎计,呎价约8,315元。

未计建筑费已蚀约2亿元,若连同起楼成本,保守蚀至少6亿元离场,为近年商厦最大手蚀让。市场人士指,新买家为建滔集团或有关人士。该集团早年亦有投资上环商厦,2010年以约6.6亿元向南丰购入上环苏杭街69号「The Chelsea」全幢商厦,其后于2019年商厦高峰期,以约19亿元售予基金,相信是次有见价格大幅回调,以低价入市作长綫投资。

湾仔全幢商住 1.68亿沽

另消息指,邓成波家族以约1.68亿元,沽出湾仔轩尼诗道168至170号焕然楼全幢商住大厦,总楼面面积约2.24万平方呎,呎价仅约7,500元。该物业地盘面积约1,915平方呎,现时为一幢14层高商住大楼,地下至阁楼为商铺,1楼至12楼为住宅。邓成波于2016年以约3.03亿元购入,早年曾以约4亿元放售,其后该家族减价3成至约2.8亿元,如今大幅减价至约1.68亿元沽出,持货8年劲蚀约1.35亿元,幅度达45%。

商铺方面,尖沙咀海防道32至33A宝丰大厦地下D铺连阁楼,以约1.3亿元成交。铺位现由时装店承租,月租约25万元,目前回报率2.3厘。由于地段为海防道旺段,相信新买家看好旅客陆续重返,铺位租金日后将回升,故趁低价购入。

翻查资料,投资者刘军于2017年6月以约3亿元购入该铺,早前曾以约3.5亿元放售铺位,其后多番减价,最终大幅降至约1.3亿元沽出。持货接近7年,帐面蚀让约1.7亿元,物业贬值约57%。

分析指,高息环境下投资气氛仍一般,个别业主因有沽货压力,近期减价幅度明显。同时间,投资者见物业价格已较高峰期回调4至5成,便开始趁低吸纳,令近期大额成交稍增。

(经济日报)

更多88WL写字楼出租楼盘资讯请参阅:88WL写字楼出租

更多The Chelsea写字楼出租楼盘资讯请参阅:The Chelsea 写字楼出租

更多上环区甲级写字楼出租楼盘资讯请参阅:上环区甲级写字楼出租

中环一号广场 近苏豪区合半零售

中环摆花街一号广场邻近苏豪区,加上每层面积不算大,最适合半零售商户使用。

中环一号广场位于摆花街1号,处中环摆花街及威灵顿街交界,从位置上看属中环半山地段,略偏离中环核心商业区地段。不过,该厦位处地段邻近苏豪区一带,附近既有酒吧、特色餐厅,亦有大馆等建筑物,因此整体观感甚佳,非常适合餐厅、半零售商户落户,或有特色办公室。

交通方面,从港铁站出口,经半山扶手电梯步行至该厦,需时10分鐘左右,附近亦有数条巴士綫可到达该厦。大厦地下有上落客停车处,交通上不及同区核心段商厦便利。饮食配套上,大厦位处中环餐饮段的正中心,邻近兰桂坊,有大量特色餐厅及酒吧选择。

另外,附近亦有新商业项目,如摆花街9至19号新世界 (00017) 地盘正在施工中,拟建一幢22层及另有1层低层地下的商业大厦,总楼面面积约65,706平方呎。另外,资本策略 (00497) 发展的中环威灵顿街92号即将落成,去年德林控股 (01709) 公布,投资近3亿元购买该厦最高5层,亦获得该物业的冠名权,将命名为「德林大厦」(DL Tower),以5层总楼面约1.16万平方呎计,呎价约2.53万元。

每层约4005呎 实用率7成

物业于1993年落成,地下多层为铺位,现由餐厅租用。大厦用户主要为半零售成分,除了中式餐厅外,亦有美容、艺廊、鐘錶维修店等,门口设有灯厢展示各公司楼层。大厦提供3部升降机,通往各楼层。

写字楼为4至20楼,设计上採用玻璃幕墙,观感不俗。物业每层楼面约4,005平方呎,实用率约7成,楼底高2.7米。因楼面不算大,非常适合半零售商户使用全层,另每层楼面最多可分间成4个单位,面积由500餘平方呎起,中细公司亦合使用。景观上,附近大厦林立,因此以楼景为主,中高楼层景观较为开扬。

买卖方面,该厦放盘不算多,对上一宗成交已为2022年,物业5楼全层,面积约4,005平方呎,成交价6,375万元,呎价约15,918元。原业主2011年4月以4,165.2万元购入,持货11年,帐面获利2,209.8万元。

(经济日报)

更多一号广场写字楼出售楼盘资讯请参阅:一号广场写字楼出售

更多德林大厦写字楼出售楼盘资讯请参阅:德林大厦写字楼出售

更多中环区甲级写字楼出售楼盘资讯请参阅:中环区甲级写字楼出售

葵涌新都会广场呎价8300元售 持货19年升值1.4倍

新都会广场为葵涌区内指标甲厦,该厦近期录今年以来第3宗买卖,该厦2座高层一个单位,以1199.35万易手,物业于19年间升值1.4倍。

上址为新都会广场第2座4312室,建筑面积约1445方呎,以每呎8300元易手,涉资1199.35万,原业主于2005年4月以496万购入,持货19年帐面获利703.35万,物业升值1.4倍。

成交价1199万

该厦对上1宗成交为第2座极高层01室,单位属银主盘,建筑面积约3131方呎,以约2192万沽出,平均呎价约7000元,该单位业主于1992年,以约1268万购入,惟沦为银主盘,若以购入价计算,物业于32年间仅升值73%。

新都会广场拥有2座甲厦,基座为大型商场,商场设行人天桥接驳葵芳港铁站,步程仅需3至5分鐘,该厦亦连接葵涌广场商场,专售价廉物美的时装潮流产品,商场内食肆聚集,该广场由新地发展,物业于1993年落成,设有2座商厦项目,1座由大业主持有收租,另2座业权分散,已卖散的2座商厦,楼高46层,写字楼层7楼起,全层面积约1.6万方呎,每层设有约12个单位,室内间隔灵活,室内开则呈八角形,部分单位设两边窗,景观开扬,另部分单位长方形间隔。

(星岛日报)

更多新都会广场写字楼出售楼盘资讯请参阅:新都会广场写字楼出售

更多葵涌区甲级写字楼出售楼盘资讯请参阅:葵涌区甲级写字楼出售

Applications for presale consent hit two-year high

Developers applied for presale consent for five residential projects involving 4,904 flats last month - a more than two-year high - while only one home was completed in February, the lowest monthly figure in three-and-a-half years, separate official data showed.

Data from the Lands Department yesterday revealed that the number of units involved in March applications surged 187 percent from February, the highest since January 2022.

Among the projects that have applied for presale consent, a notable one would be CK Asset's (1113) project at Anderson Road in Kwun Tong.

The developer acquired the site for HK$4.95 billion in May 2020.

The project will offer a total of 2,926 flats and is expected to be completed by the end of September 2026.

Meanwhile, figures from the Rating and Valuation Department yesterday showed that the number of private home completions stood at one in February. That compares with 3,593 units completed in January.

The combined completion of 3,594 units for the first two months is 16.1 percent of the full-year target of 22,300 units.

Elsewhere, Wheelock Properties is expected to release the first price list for Park Seasons, Phase 12B of Lohas Park, in Tseung Kwan O this week, which will offer at least 138 flats.

Executive director Ricky Wong Kwong-yiu said the prices may have room for a 5 to 10 percent increase compared to Seasons Place, Phase 12A of Lohas Park, adding that the starting price, however, could be lower due to the smaller size of the units at Park Seasons.

This came as CK Asset's Blue Coast atop Wong Chuk Hang MTR Station may start the second round of sales this weekend.

The 88 flats on the fourth price list were oversubscribed over 44 times after receiving more than 4,000 checks.

Separately, CSI Properties (0497) has named its Nathan Road project Topside Residence, involving 259 units, with the smallest one covering 232 square feet.

The sale may start as early as this month.

(The Standard)丽新系14亿 售中环友邦金融中心业权

丽新国际 (00191) 联同系内丽新发展 (00488) 宣布,以近14.22亿元出售中环友邦金融中心餘下10%权益予友邦保险 (01299) ,丽新发展将套现所得,用于偿还贷款及一般营运资金。友邦保险将完全拥有友邦金融中心全部权益。

中环友邦金融中心地盘原址为富丽华酒店,该酒店业权是于1997年由丽展投得,当时作价69亿元,其后适逢亚洲金融风暴,丽展分段将该物业斩件出售。物业楼高38层,提供总面积约42.9万平方呎。据通告指,预期丽国及丽展分别录得近1.55亿元帐面亏损。

(经济日报)

更多友邦金融中心写字楼出租楼盘资讯请参阅:友邦金融中心写字楼出租

更多中环区甲级写字楼出租楼盘资讯请参阅:中环区甲级写字楼出租

甲厦空置率16.7%创历史新高 外资代理行:首季丢空楼面达1470万方呎

甲厦供过于求,今年首季新增供应面积达92.52万方呎,导致整体空置率再创历史新高,达1470万方呎,空置率16.7%,租金按季跌1.2%;不过,本季吸纳量高达61.2万方呎,为2018年第三季以来最高水平。

有外资代理行指,今年首季新落成的甲厦项目,预租进展缓慢,整体空置楼面达1470万方呎,空置率创历史新高,即16.7%,供应过剩导致租金按季跌1.2%,连续第20季下降。

租金连续第20季下跌

不过,市场吸纳量改善,租赁按季增35%,达130万方呎,净吸纳量达61.2万方呎,自2018年第3季以来最高,除中环外,大多数核心区均录净吸纳量,港岛东7.16万方呎,2022年第4季以来首次增长。东九地标甲厦AIRSIDE录数宗大租赁,带动区内净吸纳量23.33万方呎。

该行代理表示,近三分一新租赁由银行金融业推动,政府机构亦是好租客,展望未来,企业继续控制成本,供应增加,预计空置升租金受压。

去年全年零售业销货额增长16.2%,1月较去年同期升0.9%,2月份升1.9%,为连续15个月上升,租赁需求导致空置率按季跌2.5个百分点至6.6%,为2019年第四季以来最低。4核心区空置率均个位数,2018年第二季以来首次出现。

核心区铺空置率录个位数

中环空置率跌幅最大,下降5.3个百分点至6.6%,尖沙咀及旺角空置率分别降2.9及2.3个百分点,至5.8%和7.4%。铜锣湾空置率维持不变,空置率下降导致核心区街铺租按季升2.7%,2022年第3季以来最大增幅。

该行另一代理表示,选择减少,首季租赁势头减弱,部分食肆缩小规模,核心区铺租升2.7%,为2022年第3季度以来最大按季增幅。该行另一代理表示,仓库空置率上升0.2个百分点至5.6%,租户缩规模,仓租按季跌1.1%,自2020年第4季首录跌幅。

(星岛日报)

更多AIRSIDE写字楼出租楼盘资讯请参阅:AIRSIDE写字楼出租

更多啟德区甲级写字楼出租楼盘资讯请参阅:啟德区甲级写字楼出租

代理行:工商铺611宗买卖按季跌11%

有本港代理行资料显示,第一季市场共录约611宗工商铺买卖,总金额约187.83亿元,按季分别跌约11%及7%,季度成交量更较过去20年逆境时期更淡静,创有纪录以来最低交投量。

宗数有纪录以来新低

今年第一季工商铺市况欠佳,发展商及投资者积极出货,议价空间扩大,有见减息周期将至,预测第2季工商铺量升价跌,料交投量约750宗,金额约145亿元,租售价维持现水平,或最多跌幅约5%。

该行代理表示,今季工商铺成交宗数为有纪录以来新低,对比2003年沙士、2008年金融海啸、2013年工商铺加辣,至近年动乱及疫情期间表现更差。疫情期间的季度最低成交量曾录约660宗,今季比其进一步减约7%。

该代理表示,北上消费成风,餐饮业受拖累,加上政府拟落实推行垃圾徵费,加重餐饮及零售业营运成本,令本身经营困难的店铺倍添压力,有机会出现新一轮结业潮。

料食肆现新结业潮

该行另一代理表示,首季录约131宗铺位成交,历来最低,宗数跌势自2022年第3季起,对比去年第4季约173宗跌约24%,按年同期大跌逾40%,金额受愉景新城商场以约40.20亿易手所带动,录约71.90亿元,按季增约30%,若扣除该大额交易,按季减约23%。

该行另一代理表示,首季共录约122宗写字楼成交,较第4季约128宗为低,按年约35%跌幅,自2023年第1季后连续4季下跌,连续7个季度宗数低于200宗。金额共约85.71亿元,若扣除中环盈置大厦,季内金额仅录约21亿,为2022年第3季后新低。

该行另一代理表示,首季共录约358宗工厦成交,按季轻微跌约7%,总金额约30.22亿,按季跌约35%,量稳价跌。

(星岛日报)

更多盈置大厦写字楼出租楼盘资讯请参阅:盈置大厦写字楼出租

更多中环区甲级写字楼出租楼盘资讯请参阅:中环区甲级写字楼出租

红磡商住大厦放售 估值逾3亿

有外资代理行代理表示,获接管人委託,标售红磡新柳街3号「Incredible Residences」及马头围道96号1楼至11楼连天台 (住宅部分),截标日期为2024年5月31日 (星期五) 中午12时。

Incredible Residences于2020年完工,楼高25层,总建筑面积约23,878平方呎。该商住大厦提供5个商铺和61个住宅单位,物业市值逾3亿元。至于马头围道96号住宅部分,市值约5,000万元,合共约3.5亿元

据了解,两项物业原由海外投资者持有,去年曾推出标售,未获承接,年初更被银行接管。

(经济日报)

旧楼有价 汉口大厦获批作商住用

尖沙咀的商业用地供应相对罕有,而且贵为核心商业区之一,区内旧楼价值高,因此一般而言,发展商透过收购旧楼以增加在区内的土地储备。据本报粗略统计,该区重建步伐积极,现时至少有9个重建项目正在进行,涉约112万平方呎楼面,当中由新世界 (00017) 或相关人士持有的汉口大厦,于今年初获批建商住项目。

9项目重建 增建112万呎楼面

根据统计,区内现时至少9个重建项目正在进行,涉及楼面约112万平方呎,其中有8个属于旧楼收购重建项目,其中由新世界或相关人士持有的汉口大厦,于年初获城规会批准重建1幢28层高的商住大厦,项目拟以地积比率约12倍重建,将提供110伙分层住宅、办公室、及商店,总楼面涉约138,791平方呎。

项目于去年3月进行强拍,并由新世界或相关人士成功以底价约21.34亿元统一物业业权,以重建后的总楼面计算,每呎楼面地价约1.5万元。

香檳大厦改建 料扩展恒地版图

至于另一龙头发展商亦积极在区内扩大其商业王国,由恒地 (00012) 收购多年的香檳大厦B座亦已在今年初完成强拍程序。项目于今年1月以底价约17.28亿元,成功由发展商统一业权。据发展商最新中期报告指,项目重建后的总楼面涉约14.7万平方呎。

值得留意的是,恒地积极扩展区内的版图,同系的美丽华商场及酒店正正位于香檳大厦旁边,预计若香檳大厦B座成功重建后,将会产生协同效应,并将有望扩展其原有逾200万平方呎楼面的商业王国。

事实上,各发展商积极收购区内旧楼,区内近年最大型的商业项目属于由海员俱乐部与帝国集团合作的前海员之家,日后会重建为1座40层高酒店,总楼面约34.7万平方呎,由发展商营运的酒店楼面涉约30万平方呎,另约5万平方呎楼面需预留给海员俱乐部作教堂及会所。

同时,乐风集团等于2022年亦就尖沙咀汉口道35至37号恕园大楼申请强拍,当时项目的现况市值逾6.3亿元,但因发展商最后成功收购项目全数业权,所以不需循强拍途径统一其业权。其后,项目于去年已获屋宇署批出建筑图则,并获准重建1幢21层高商厦,涉及总楼面约11.53万平方呎。

(经济日报)

Debt-saddled Lai Sun Development sells stake in insurer AIA Group’s Hong Kong headquarters

A wholly-owned unit of the developer has sold its equity stake in the AIA Central skyscraper for HK$1.42 billion (US$180 million) in a bid to boost its liquidity

Lai Sun Development was saddled with total liabilities of more than HK$34.69 billion for the six months ended January 31, according to its interim results

A wholly-owned unit of Lai Sun Development Company, a Hong Kong property firm, has sold its equity stake in the AIA Central skyscraper for HK$1.42 billion (US$180 million) in a bid to boost its liquidity.

The move comes just a few weeks after the developer disposed of its interest in an industrial building in the city as it tries to overturn a mountain of debt.

Lai Sun said it has signed an agreement to sell its unit Peakflow Profits’ shareholdings in Bayshore Development, the owner of AIA Central, to Grand Design Development, which is a subsidiary of insurance giant AIA Group.

The 38-storey office tower at 1 Connaught Road Central has served as the regional headquarters of Asia’s biggest insurer since 2005.

Peakflow Profits is a wholly-owned subsidiary of Lai Sun Development and an indirect, non-wholly-owned unit of Lai Sun Garment (International), according to an exchange filing.

AIA Group will hold the remaining equity stake in Bayshore Development after the disposal.

The proceeds of the sale will go towards repayment of bank loans and general working capital for Lai Sun Development, the companies said in a statement.

Lai Sun Development was saddled with total liabilities of more than HK$34.69 billion for the six months ended January 31, according to its interim results.

Each of the Lai Sun units is expected to record a loss of about HK$154.6 million on the disposal, according to the filing to the Hong Kong stock exchange.

“The disposal enables the vendor to realise the value of the property investment, thereby enhancing the cash flow and financial position of the LSG Group and the LSD Group as a whole,” the companies said, adding that the deal is “prudent” while the terms and conditions of the sale are “fair and reasonable”.

In mid-March, Lai Sun Development sold some of its property assets in the Wyler Centre Phase II, an industrial building in Kwai Chung, including the 20th floor and its parking spaces on the second floor, for HK$80 million – an estimated loss of HK$6 million.

The company said in a filing on March 15 that the sale represented its “commitment to its noncore asset disposal plan” aimed at enabling it to reallocate more financial resources to capital structure enhancement.

(South China Morning Post)

For more information of Office for Lease at AIA Central please visit: Office for Lease at AIA Central

For more information of Grade A Office for Lease in Central please visit: Grade A Office for Lease in Central

Luxury home deals soar in first quarter

Luxury home deals on The Peak and in the Southern District jumped 1.4 times to 22 in the first three months of 2024 over the previous quarter, and the turnover soared over 13 times to HK$3.4 billion, a local property agency said.

Among them, there were six deals worth more than HK$100 million, versus none in the fourth quarter of last year. Three new luxury homes were sold in the first quarter worth HK$1.27 billion, and 19 deals were reported in the secondary market for a total of HK$2.14 billion, the agency said.

A house was sold for HK$333.55 million at Mount Pokfulam yesterday, a project co-developed by Wang On Properties (1243) and Kam Wah Property.

And a 1,290-square-foot unit with a roof top at The Avenue 2 in Wachai was rented out for HK$115,000 per month by an expat.

Meanwhile, the mass residential market continued to remain active. New projects raised prices and reduced discounts after drawing buyers from the secondary market, which recorded more losses.

CK Asset (1113) revealed its the fifth price list, putting up 96 units at Blue Coast in Wong Chuk Hang for sale. The average price after discounts was raised by 4 percent to HK$25,307 per square foot.

The fourth price list had an average price of HK$24,289 per sq ft after discounts. CK Asset has increased prices four times since the initial price list, which hit a five-year low with an average of HK$ 21,968 per sq ft.

CK Asset executive director Justin Chiu Kwok-hung said that all flats for the phase 3B of Blue Coast have been put up for sale. The company plans to release the phase 3C in the middle of this year, hoping that selling prices will stay ahead of costs to ensure no more losses.

The average cost per sq ft for Blue Coast is HK$28,000.

A total of 413 units have been sold so far, around 98 percent of flats in the first round of sales. The developers have raked in HK$7.6 billion with an average transaction price of HK$24,000 per sq ft.

In other news, OnMantin atop Ho Man Tin MTR station, which was jointly developed by Great Eagle (0041) and MTR Corp (0066), may be launched as early as this month. The project comprises five towers with 990 homes and is estimated to be completed in March 2025.

Star Properties has put up 57 flats for sale at After The Rain in Yuen Long, carrying an average price of HK$13,992 per sq ft after discounts.

K&K Property put up 10 flats for sale at One Stanley, located at 128 Wong Ma Kok Road, for tender yesterday.

And Henderson Land (0012) has adjusted its price lists for Square Mile in Tai Kok Tsui to reduce discounts that were offered during the Spring Festival.

In other news, a two-bedroom flat in Euston Court in Hong Kong Island saw a HK$1.4 million loss when it was sold for HK$8 million. The seller had bought the unit for HK$9.4 million in March 2023, which depreciated roughly 15 percent in a year.

(The Standard)上环新纪元甲厦呎价1.2万售 较高峰期跌逾50%连约回报4厘

甲厦市场吹淡风,有投资者趁势吸纳,上环皇后大道中181号新纪元广场一个面积逾1万方呎单位,以1.23亿易手,平均呎价12103元,较高峰期下跌逾50%,买家为内地投资者,料回报4厘。

市场消息透露,上址为皇后大道中181号新纪元广场8楼03、05及07室,建筑面积约10163方呎,以易手价1.23亿计算,呎价约1.2万水平。

内地投资者1.23亿购

据悉,由内地商人吸纳,看中目前甲厦价格大跌,趁机吸纳作为投资用途,目前该单位市值呎租约40元,料回报约4厘。

原业主为万途洋行,于2009年11月以1.344237亿购入,持货逾14年,帐面获利1442.37万,物业升值10.7%。

建筑面积10163方呎

该厦于2018年高峰期,呎价普遍逾2.5万,高座的中远大厦更有个别单位呎价突破4万,儘管上述为低层单位,质素未比得上景观开扬的高层户,不过,对比高峰期,该单位售价亦至少跌逾50%。

大道东商住楼市值5亿

2018年4月,新纪元广场高座中远大厦30楼01及13室,以1.25亿易手,建筑面积3079方呎,呎价40597元,创该厦呎价新高,当时亦刷新上环商厦新高纪录。

有外资代理行表示,湾仔皇后大道东98号至108号 (104号3楼除外) 推出放售,现时市值约5亿,较2020年放售时市值约8.5亿低40%。该物业为4幢旧唐楼,佔地面积约4870方呎。该行代理表示,皇后大道东属湾仔区黄金地段,物业距离港铁湾仔站仅6分鐘步程。

(星岛日报)

更多皇后大道中181号写字楼出售楼盘资讯请参阅:皇后大道中181号写字楼出售

更多中远大厦写字楼出售楼盘资讯请参阅:中远大厦写字楼出售

更多上环区甲级写字楼出售楼盘资讯请参阅:上环区甲级写字楼出售

新世界1.15亿沽西贡傲瀧商场

新世界续沽售非核心物业,旗下位处西贡的傲瀧商场及52个车位,以1.15亿易手,平均呎价5347元,新买家料回报逾4厘。

平均呎价5347元

上述为傲瀧商场,建筑面积21506方呎,连同52个车位,其中商场地下及1楼由餐厅及家品店承租,租约至2026年1月,月租17.42万,2楼及3楼由建身中心承租,租约至2026年8月,月租18万,月租收入合共35.42万,另车位尚未出租,料每个车位市值月租逾2000元,月收约10.4万,月租合共45.82万,料回报逾4.7厘。

市场消息指,新买家以富贵星有限公司名义购入物业,公司董事黄关林,与上市公司申洲国际执行董事兼总经理同名同姓,相信为同一人。

申洲国际经营织布、染整、印绣花、裁剪与缝制各类纺织产品,包括睡衣、休閒衣服,全球员工逾9万人,主要市场包括内地、日本及欧美市场。

连同52个车位

近期新世界频沽售非核心物业,最瞩目为荃湾愉景新城商场连车位,作价40.2亿,成2017年以来本港最大单一商场交易,呎价约8600元,连同设有1000个车位的停车场,预计今年4月完成交易。

料回报逾4.7厘

新世界于今年1月,亦沽河内道等一篮子铺位,作约2亿,该批铺位租客以小本经营为主,以食肆佔大比数,其他有银器店及裁缝等,在2012年后铺市大起飞年代,这些铺位大部分加租幅度轻微,商户经营稳定。

在经历铺市大起落后,去年新世界将该篮子铺位合共8个铺位,推出市场放售,由于该一篮子铺位,为买家提供逾4厘回报,最终在今年1月淡市下成功出货,铺位以逾2亿易手,铺位全部录蚀让,幅度30%至40%。

(星岛日报)

东瀛游广场全层放售 呎价10年低

发展局于去年就观塘市中心第四及第五区巨无霸商业项目建议採用「垂直城市」的发展概念,容许作住宅、商业、办公室及酒店等混合发展,为日后观塘商贸区增添多元化商业色彩,区内发展前景更见亮丽,有业主趁势放售区内优质商厦东瀛游广场高层全层物业,以呎价创10年低价作招徠,意向呎价仅需约6,500元。

叫价克制 意向呎价6499元

有代理表示,招标项目位于观塘鸿图道83号东瀛游广场23楼全层,面积约12,029平方呎,意向价约7,818万元,呎价约6,499元,截标日期为2024年4月19日 (星期五)。

该单位将以现状及连租约形式出售,每月总租金收入共约23.8万元,料新买家可享租金回报约3.7厘。单位坐拥开扬景观,可远眺鲤鱼门海景,内笼亦配备基本写字楼装修及间隔。而考虑到用家需要,业主亦可与现有租客协商,提供弹性予新买家可以全层交吉形式购入单位。

租金回报3.7厘 可交吉购入

该代理补充,由于业主希望重组投资组合,考虑到市场需要,故定价相当克制,全层单位意向呎价创区内近10年新低。翻查资料显示,该厦最近一宗同类型全层楼面成交要追溯至2020年10月,售出之楼层为35楼,单位面积约10,875平方呎,成交价约9,787.5万元,平均呎价约9,000元,而按此成交价计算,与招标单位呎价差距约28%。

该代理续指,政府多年来致力于塑造东九龙为优质的写字楼枢纽,近年积极牵头将个别办事处总部迁至该区,此外,在疫情后办公模式改变及商厦租金回调的影响下,亦令不少企业转租东九龙的优质商厦,因而吸引不少投资者入市该区物业作长綫投资。

据资料显示,今年首季 (截至3月12日) 观塘区已录得约16宗商厦买卖成交,较上一季仅约3宗大增约4.3倍,亦创自2022年首季后新高,反映投资者倾向看好区内商厦呎价值博率高。另一方面,区内租赁情况亦渐入佳境,2月份录得约43宗租赁成交,按月大幅增加约53%,租金方面亦稳步上升,平均呎租亦由1月份的约22元上升至2月份的约24元。庄氏认为,随着观塘区商贸区发展完善,加上新兴「垂直城市」等发展概念,区内商业气氛会愈趋浓厚,东瀛游广场的呎租及呎价料将持续上升,预料中长綫投资者会趁早吸纳区内项目。

(经济日报)

更多东瀛游广场写字楼出售楼盘资讯请参阅:东瀛游广场写字楼出售

更多观塘区甲级写字楼出售楼盘资讯请参阅:观塘区甲级写字楼出售

有代理表示,长沙湾荔枝角道888号南商金融创新中心,获买家购入3个高层单位,建筑面积合共约5232方呎,总成交金额8430万元,呎价约16112元。

该行指出,近年发展商积极在九龙西布局,甲级商圈已逐渐形成,吸引不少大型租户争相进驻,高质的甲厦更备受高增值产业青睞,升值潜力无限。

(信报)

更多南商金融创新中心写字楼出售楼盘资讯请参阅:南商金融创新中心写字楼出售

更多长沙湾区甲级写字楼出售楼盘资讯请参阅:长沙湾区甲级写字楼出售

写字楼买卖 首季跌至122宗

有本港代理行统计指,首季写字楼买卖宗数微跌。

据该代理行最新数字,2024年第一季市场共录得约122宗写字楼买卖成交,较对上一季约128宗为低,按年对比则续有约35%跌幅,自2023年第一季后连续4个季度录得跌幅,更为连续第7个季度之买卖成交宗数低于200宗。

买卖总成交金额方面则受惠于个别大手全幢商厦易手所支持,全季共有约85.71亿元,若扣除中环盈置大厦全幢交易,季内成交金额仅录得约21亿元,为2022年第三季后新低。按月表现方面,3月份买卖宗数仅录得32宗,为自2023年以来按月第二新低。租赁市场走势继续寻底,第一季共录得约1,188宗租务个案,成交金额录得约1.18亿元,按季计分别下跌约9%及20%,而较按年同期亦减少约12%及14%,反映市场对写字楼租务需求持续下滑。

指标商厦整体表现疲弱,港九指标商厦于第一季共录得9宗买卖成交,当中香港指标商厦仅录得1宗,比对去年同期的9宗急跌,而今年首季港九指标商厦租务宗数则为126宗,当中首季港岛指标商厦租务成交宗数为80宗,较去年第四季高出12%,但长期未能突破100宗水平,而九龙指标商厦于第一季仅录得46宗租务成交,较去年第四季下调近30%,为2022年第三季后再度跌穿50宗。

港岛甲厦空置率12.56%

写字楼空置率持续高企,港岛区甲厦整体空置率录得约12.56%,其中一綫核心区如金鐘的最新甲厦空置率为9.02%,中环录得11.92%。九龙区方面,整体甲厦空置率录得约14.19%,其中以东九龙情况最为严峻,观塘区为14.18%,九龙湾更高达21.84%。

该行代理分析,商厦市场自2019年来一直处于低潮期,虽然疫情已消退,但环球经济市道仍然疲弱,香港亚洲金融中心地位受压,加上企业暂缓扩展业务步伐,种种因素令写字楼租卖需求递减。同时,面对经济严峻市况加剧,以及本港踏入商厦新供应高峰期,单是今年计,据差餉物业估价署资料显示,2024年预测新写字楼供应逾168万平方呎,市场消化速度远远赶不上新供应,商厦市况雪上加霜。

展望第二季写字楼租务成交量会略为平稳,预测第二季租务交投会见平稳,料会有1,350宗水平,租金则平稳发展,个别地区料继续有约5%下跌空间。买卖方面则维持于约120宗水平,但呎价就同样预测会继续下调,幅度约5%。

(经济日报)

更多盈置大厦写字楼出租楼盘资讯请参阅:盈置大厦写字楼出租

更多中环区甲级写字楼出租楼盘资讯请参阅:中环区甲级写字楼出租

高息持续 首季大手成交淡静

统计指,去年尾息口持续高企至今年,令今年首季大手买卖进一步淡静,合共仅涉约132亿元。

据一间外资代理行最新统计,2024年第一季度商业地产投资额 (成交金额超过7,700万元,不包括纯土地或相关交易) 按季微跌5.5%,至132亿港元。

该行分析,投资势头放缓部分,因美联储决定在2024年第一季维持利率不变。一个月期香港银行同业拆息 (HIBOR) 从2023年12月的5.6%降至今年3月份的4.8%,而香港最优惠贷款利率则维持不变。

两宗大手买卖 佔投资额逾8成

首季仅录得13宗大手交易,其中两宗重大交易佔总投资额的84%,包括新世界(00017) 以约40.2亿元沽出荃湾愉景新城商场予同区大地主华懋,属于2017年后最大宗单一商用物业成交纪录,D•PARK原本由新世界及香港兴业 (00480) 合作发展,各佔一半权益,属于愉景新城屋苑的基座商场,1997年落成,2010年新世界斥资约13.78亿元向香港兴业购入餘下一半权益。若果以商场及停车场一半权益作价约13.78亿元计算,相当于当时整个商场市值约27.56亿元,现时新世界以约40.2亿元出售整个商场,物业持货14年升值46%。物业总楼面逾60万平方呎,连同逾千个车位。

另一宗大手买卖,为投资者「越南朱」朱立基以作价约64亿元,沽出中环商厦盈置大厦,新买家为台湾跨国软件公司「趋势科技」创办人兼董事长张明正的相关人士,属于近年台湾资金于本港楼市最大的单一投资。盈置大厦前身为恒生大厦,1962年落成,全幢楼面约264,622平方呎,早于2006年由摩根士丹利以约22.58亿元承接,其后翻新大厦,而朱立基则于2009年9月以约36亿元购入盈置大厦。

外资代理行看好全幢住宅租赁市场

该行代理表示,政府在2月份撤除所有辣招,及放宽商业物业的按揭成数上限,为投资者提供了更友善的环境。然而,在持续高利率的情况下,负利差仍然为投资者的一大障碍。首季度投资需求尚未出现明显復甦,但整体投资额较对上一季仍保持韧性。

后市上,该代理指写字楼和仓库物业的价格调整已经放缓,而零售物业的价格调整正在上升。若果下半年有进一步减息的跡象,预计投资势头将逐步加速。范畴上,他较看好住宅租赁市场,包括全幢住宅改装成学生宿舍、服务式住宅等。

(经济日报)

更多盈置大厦写字楼出租楼盘资讯请参阅:盈置大厦写字楼出租

更多中环区甲级写字楼出租楼盘资讯请参阅:中环区甲级写字楼出租

新世界 (00017) 旗下长沙湾商厦南商金融创新中心再录成交,高层两伙以4,230万沽出,据悉买家为内地上市公司高层。

据指新沽出的两伙属于高层A1及B12室,分别面积为1,964及790平方呎,以合共4,230万元易手,呎价约1.5万元。

近日南商金融创新中心销情加快,另外3间高层单位日前以8,430万元沽出,面积合共约5,232平方呎,呎价约16,112元。

(经济日报)

更多南商金融创新中心写字楼出售楼盘资讯请参阅:南商金融创新中心写字楼出售

更多长沙湾区甲级写字楼出售楼盘资讯请参阅:长沙湾区甲级写字楼出售

名錶店40万租中环铺 较旧租升3成

新世界大厦1700呎铺位 呎租约235元

通关后核心区铺位租务明显加快,新世界大厦地下铺位,获名錶店以每月约40万元租用,较旧租升约3成。另有量师行预计,旅客重返可望带动今年核心区铺位租金升约1成。

中环再录商铺租务成交,皇后大道中新世界大厦地下铺位租出,涉及面积约1,700平方呎,获瑞士名錶品牌Franck Muller租用,现时铺外已掛起广告牌,预告快将开业。该品牌本港一直设有专门店,包括尖沙咀海港城、铜锣湾时代广场等。

市场人士估计,是次月租涉约40万元,呎租约235元,由于地段为中环核心区一綫地段,故租金尚算理想。翻查资料,该铺于2021年,即疫情封关期间,获珠宝品牌APM Monaco租用,由于当时受疫情影响,核心区铺位空置率高,估计当时月租不足30万元。按最新月租计,新租金较旧租升约3成。

太平行 7179呎铺 60万承租

事实上,除了商店扩充外,该品牌亦有购入商厦。去年尾,Franck Muller以逾6,300万元,向新世界 (0017) 入长沙湾全新甲厦南商金融创新中心高层3伙,平均呎价约1.5万元,作集团自用。

随着旅客重返,核心区铺位租务持续向好。是次租出的新世界大厦地下铺位,比邻的皇后大道中20号太平行地下A铺及地库,合共面积约7,179平方呎,原已交吉多年,近日获体育品牌以每月约60万元承租,呎租约84元。租户为连锁运动用品店。

一綫街铺首季租金 升1.8%

另该行布最新的2024年市场季度报告指,今年首季整体一綫街铺租金按季上升1.8%,入境游客显著增长,推动尖沙咀区的商铺租金按季上升2.6%,表现较其他地区理想。该行代理称,虽然港人外游或会对餐饮业造成影响,但珠宝及健身行业前景仍然乐观。

该代理预计,市场对核心区一綫街铺的需求,特别是月租介乎50万至100万元的店铺,将在未来两个季度持续畅旺,料全年一綫街铺租金升最多1成。另外,整体甲级写字楼租金按季下跌2.5%,该行另一代理表示,业主会提供租金优惠,以吸引及挽留租户,因写字楼租金则持续面对不利因素,预计其租金年内录跌幅。

(经济日报)

更多新世界大厦写字楼出租楼盘资讯请参阅:新世界大厦写字楼出租

更多太平行写字楼出租楼盘资讯请参阅:太平行写字楼出租

更多中环区甲级写字楼出租楼盘资讯请参阅:中环区甲级写字楼出租

更多时代广场写字楼出租楼盘资讯请参阅:时代广场写字楼出租

更多铜锣湾区甲级写字楼出租楼盘资讯请参阅:铜锣湾区甲级写字楼出租

更多南商金融创新中心写字楼出售楼盘资讯请参阅:南商金融创新中心写字楼出售

更多长沙湾区甲级写字楼出售楼盘资讯请参阅:长沙湾区甲级写字楼出售

黄竹坑伟华汇甲厦2.4万呎租出

黄竹坑新落成的地标甲厦伟华汇,录2全层楼面租出,合共2.4万方呎,租客为中环金融机构以及同区的科技公司。

有外资代理行表示,伟华置业旗下港岛南黄竹坑伟华汇今年1月获得入伙纸,该厦早前已录2全层楼面预租,18楼及28楼全层,每层约1.2万方呎,共涉2.4万方呎,租客包括来自中环的金融机构,以及同区一间科技公司,各自承租1层全层楼面,该两间租客皆承租跟原址相若的楼面,港岛南甲厦租金较核心区实惠,吸引租客纷迁入,同区租客亦钟情该区甲厦,皆因得以提升办公室的质素。

代理续说,伟华汇正推出招租,平均呎租28至36元,目前尚有多间大型金融、保险机构等洽租该厦,更有大手洽租逾10万方呎。租客至少需承租半层楼面,涉及逾5000多呎。

金融机构及科技公司进驻

伟华置业执行董事蔡敬业表示,该厦投资额40亿,将作为长线收租,尽管区内商厦新供应多,伟华汇属于区内较罕有提供全层逾万呎大楼面,加上大厦质素高,对物业竞争力有信心。该厦亦提供特色楼层,包括1楼及2楼设有平台及绿化空间,26楼及天台设有空中花园,为租户提供理想的休憩场所,更可作为企业活动。

伟华汇楼高27层,地下3层为车场,全幢总建筑面积约30万方呎,标準楼层1.2万方呎,楼底净高度达2.9米。该厦距离黄竹坑站步程约3分鐘,仅两站可直达金鐘站。大厦位于香叶道,前身为信诚工业大厦,由伟华置业併购及重建发展。

(星岛日报)

更多伟华汇写字楼出租楼盘资讯请参阅:伟华汇写字楼出租

更多黄竹坑区甲级写字楼出租楼盘资讯请参阅:黄竹坑区甲级写字楼出租

LV重返铜锣湾罗素街 承租时代广场万呎铺

尽管零售市况表现一般,奢侈品消费不復当年勇,不过,近年来,部分珠宝金行及奢侈品牌把握淡市在核心区落户,法国龙头奢侈品牌路易威登 (LOUIS VUITTON,下称LV),最新重返铜锣湾时代广场承租一个复式铺,租期逾5年。

LV于2021年3月,宣布关闭时代广场分店,相隔三年,最新重返时代广场,租用该商场一个复式铺位作为旗舰店,租约期超过5年,为近年罕有国际名牌扩充租务个案。

LV最新租用复式铺位,位处商场中庭楼层,约1.2万方呎,在此建立港岛区旗舰店,预计最快在圣诞节前开业,惟上述铺位租金不详,地产界人士估计租约期长达5年,计及上述最新租务,时代广场出租率逾90%。

面积约1.2万方呎

LV早于2013年铺市高峰期租用时代广场,铺位面积约1万方呎,市传最后一份租约月租高达500万,随着近年2019年中后的动乱,2020年初的疫情,该品牌在2021年3月正式宣布关闭时代广场分店,不过,相隔3年后,最新重返商场,地产界人士表示,虽然难于估计最新租金,惟相信较高峰期大跌,目前,罗素街地铺租金较高峰期普遍跌70%,相信商场亦录一定跌幅,由于商场由大业主持有,幅度不及地铺,惟估计至少30%或以上。

(星岛日报)

更多时代广场写字楼出租楼盘资讯请参阅:时代广场写字楼出租

更多铜锣湾区甲级写字楼出租楼盘资讯请参阅:铜锣湾区甲级写字楼出租

Wheelock Properties has unveiled its first price list for Park Seasons, phase 12B of Lohas Park, offering 138 flats, with the cheapest priced at HK$4.54 million after discounts.

It is the second residential project that Wheelock Properties has launched in less than a month after housing curbs were removed in last February.

Seasons Place, launched in mid-March, has sold over 84 percent of its units over three weeks.

The first batch for Park Seasons will cost between HK$4.54 million and HK$7.34 million after discounts, with apartment sizes ranging from 322 to 496 square feet.

The average price for the 138 flats is HK$14,488 sq ft after discounts. Although this is 2.1 percent higher than that of the first price list for Seasons Place a month ago, it is still nearly 9 percent cheaper than Phase 10 of Lohas Park, which launched three years earlier.

Wheelock Properties executive director Ricky Wong Kwong-yiu expects the first price list to meet market demand, with over 80 percent of homes priced below HK$7 million.

Show flats and subscriptions will be available starting Saturday, with sales potentially starting next weekend at the earliest.

Elsewhere, CK Asset (1113) said its second batch for Blue Coast in Aberdeen has been 70 times oversubscribed after receiving more than 13,000 cheques in five days for its 184 flats.

In Ho Man Tin, Onmantin, jointly developed by Great Eagle (0041) and MTR Corporation (0066), may launch next week. The project offering 990 units has received over 3,000 inquiries, said Great Eagle.

In other news, Hong Kong actress Jennifer Tse Ting-ting reportedly purchased a flat at The Aster in Happy Valley for HK$17.1 million.

(The Standard)商业活动加快 商厦需求改善

伟华置业蔡敬业:甲厦有质素 有竞争力

甲厦空置率创历史新高,业主推出新项目招租面对激烈竞争。伟华置业执行董事蔡敬业认为,今年整体商业活动已加快,料商厦需求会改善,而甲厦项目最重要是具有质素,便有竞争力。

伟华集团一直把黄竹坑视作基地,总部设置于区内多年,并一直有意发展地产项目。早年集团收购同区工厦,集齐业权后重建甲厦「伟华汇」。物业楼高27层,提供总建筑面积约30万平方呎,每层楼面面积约1.2万平方呎,今年初正式落成。项目近日招租,并已录得两宗预租。

冀政府支持更多企业来港

今年甲厦供应多同时,本身空置率亦高企。据一间外资代理行最新数字,甲厦空置率维持在12.9%,整体甲级写字楼市场在2月录得负14,600平方呎净吸纳量。

对于商厦租务需求疲弱,蔡敬业认为整体经济一般,「不只香港、内地,全球去年经济一般。由于地缘政治,或令外资在港投资减少,中资公司亦因内地经济本身一般,扩充较慢。」后市上,他则认为较去年乐观,主因集团包装生意今年增长强劲,「去年生意乏增长,而今年却较去年大增1倍,而我们客人主要为欧美公司,似乎反映整体经济亦有好转迹象。」他指所接触的外资公司,政治考虑等属非常次要,「他们最重要看商机,而普遍认为香港仍是营商好地方。」

蔡敬业又指,疫情后香港商业往来活动已加快,希望政府可以支持更多企业来港做生意,而只要香港有充足人才,外资便感兴趣来港投资。他亦提到,旗下伟华汇近期获不少企业前来睇楼,「其实企业搬迁亦要开支,因涉及一笔装修费,若没打算长綫发展,根本不会打算搬至一个质素更新的写字楼。」

减息讯号现 市况会向好

下半年市况转看乐观,他谓政府为住宅市场撤辣,可推动本地经济,「楼市是香港人主要财富,楼价升,市民资金稳定,对其他投资定有帮助。」至于息口上,银行界普遍预计今年第三季减息,他坦言只能被动去等,期望要真正减息讯号出现,市况便进一步向好。

是次伟华汇投资高达40亿元,属于集团旗舰商厦,但同时面对市场上多个甲厦项目推出。他指甲厦楼面多,确实需要时间消化,长远来说关键是大厦质素。同区新项目亦不少,他认为大厦具自家优势,「黄竹坑多活化项目,并以分间细单位为主,大楼面而具甲厦标準却不多,伟华汇每层楼面逾万呎,更有竞争力。」他谓在招租初期,会有少许优惠吸引企业搬迁,叫价上亦不会偏离市场价。

另外,集团位于观塘敬业街云讯广场项目,去年已落成,属拆售项目。他指因应目前市况,不能急于推出,「若仅拆售一两层,可能会失去潜在全幢準买家。」

(经济日报)

更多伟华汇写字楼出租楼盘资讯请参阅:伟华汇写字楼出租

更多黄竹坑区甲级写字楼出租楼盘资讯请参阅:黄竹坑区甲级写字楼出租

更多云讯广场写字楼出售楼盘资讯请参阅:云讯广场写字楼出售

更多观塘区甲级写字楼出售楼盘资讯请参阅:观塘区甲级写字楼出售

中环核心区巨铺连录抢租 奢侈品零售食肆等进驻租金稳步向上

今年以来,核心区铺位租赁势头强劲,中环区尤其突出,区内巨铺连录抢租。过去半年至少录7宗瞩目个案,租客多元化,除了传统的奢侈品牌外,食肆带来新意念新体验,还有健身中心进驻核心地段巨铺。

今年以来,中环区频录奢侈品店进驻。近日,新世界大厦1个约1700方呎地铺,获瑞士名錶品牌Franck Muller租用,每月租金约40万,较2021年旧租升30%,该铺将于今年6月开业。早前,同厦另一个巨铺,建筑面积约10000方呎,由星展银行以每月180万承租,月租180元。

Franck Muller每月40万租铺

中环中建大厦3至6号地铺,铺面向毕打街,旧租客OMEGA迁出,随即由同厦长情租客「补上」。溥仪眼镜在铺市火红年代,付租能力未及奢侈品,一直承租中建大厦内铺,近期一见街铺有空置,趁势扩张。巨铺面积约2497方呎,月租逾70万,平均呎租约280元,较OMEGA疫市前月租约87万跌约20%。

中建大厦名店林立,该厦地库面积约1.9万方呎,由连锁健身中心承租,落实进军中环核心地段,月租约190万,平均呎租约100元,旧租客德国男装服饰品牌名店HUGO BOSS,在此设立旗舰店近10年。

根据一间外资代理行资料显示,今年首季,核心区租赁需求扩张,导致空置率按季下降2.5个百分点至6.6%,为2019年第四季以来的最低水平。中环空置率跌幅最大,下降5.3个百分点至6.6%。四个核心区空置率均录得个位数,为2018年第二季以来首次出现。

溥仪眼镜70万租铺扩张

该行代理表示,本港过去几季度租赁活动活跃,四个核心区街铺空置率降至个位数。由于空置商铺选择减少,今年第一季租赁势头减弱。虽然部分餐饮商缩小规模,本季仍出现许多新餐厅。核心区街铺租金上升2.7%,为2022年第3季度以来最大按季增幅。

区内空置率跌至6.6%

另一代理表示,中环租赁理想,该区为本港核心商业区,疫后吸引鐘錶珠宝、大型连锁店及银行进驻。而且,租客更趋多元化,健身中心亦进驻核心地段,租用大面积楼面,有食肆将新概念带入中环,去年有航空公司租用铺位作为体验店等,市场百花齐放。

(星岛日报)

更多新世界大厦写字楼出租楼盘资讯请参阅:新世界大厦写字楼出租

更多中建大厦写字楼出租楼盘资讯请参阅:中建大厦写字楼出租

更多中环区甲级写字楼出租楼盘资讯请参阅:中环区甲级写字楼出租

Geopolitical fears fail to deter homebuyers

Home hunters in Hong Kong remained undeterred by geopolitical risks, with new projects raising prices after drawing thousands of buyers, but the frenzy for new flats continued to exert pressure on the secondary market.

Ten major housing estates tracked by a local property agency recorded just nine transactions last weekend, unchanged from a week ago.

Half of them saw no transactions at all.

An agent said around 200 flats were sold on the primary market over the weekend, and customers were attracted by low prices at a project in Hong Kong Island.

Besides, several good flats in the secondary markets were already sold in the past month after property curbs were removed, and prices were under pressure due to lower demand.

Another local property agency also recorded nine deals in the 10 estates it tracked last weekend.

It is the first time the number fell to single digits after the budget was unveiled in February, and the lowest in seven weeks.

In the primary market, CK Asset (1113) increased prices for nine flats at Blue Coast in Wong Chuk Hang, after transactions for two flats in Tower 2B were canceled.

The prices for the two flats rose by 10 percent to HK$21 million for the 813-square-foot unit and HK$20.48 million for the 746-sq-ft flat.

Prices for the other seven flats in Tower 2B were hiked by 2 percent.

Park Seasons, the phase 12B of Lohas Park, saw its 138 flats nearly 13 times oversubscribed after collecting over 2,000 checks.

Ricky Wong Kwong-yiu, executive director of Wheelock Properties, said the sales plan for the new batch will be finalized by tomorrow at the earliest, and the first round of sales may be launched on Saturday.

The prices will be slightly adjusted.

The 138 flats range from 322 sq ft to 496 sq ft and are priced from HK$5.16 million to HK$8.34 million with an average price of HK$14,488 per sq ft after discounts.

Seasons Place, the phase 12A of Lohas Park sold seven flats last Saturday. Around 87 percent of units in the project have been sold, raking in nearly HK$3.6 billion. The average price after discount of the first bunch of flats in Seasons Place was HK$14,188 per sq ft, HK$300 cheaper than Park Seasons.

(The Standard)甲厦价大幅回调 吸引投资者入市

甲厦呎价持续回调,与高峰期已有巨大跌幅,渐吸引投资者留意,趁低吸纳作长綫投资。

有本港代理行发表的商厦市场报告指出,首季商厦註册宗数仅录142宗,按年下跌约29.7%,而註册金额则录14.15亿元,按年下跌约60.1%。售价方面,首季乙厦售价跑赢甲厦,分散业权乙厦售价首季上升约2.2%,但甲厦售价则下跌约4.8%。

成交上,上环指标甲厦皇后大道中181号新纪元广场低座8楼半层楼面买卖,成交价逾1.23亿元,物业建筑面积约10,163平方呎,呎价约1.21万元。据悉,单位现由滙丰银行租用,呎租约46元。据称买家是次购入物业作长綫收租用途。

优品360高层 1.2亿购新纪元半层

翻查资料,该层楼面早年由澳洲基金持有,该基金拆售全幢商厦,2009年获本地财团大南制衣以约1.34亿元购入全层,期后该厂家售出部分单位,连同是次出售单位,估计获利约5,800万元。据悉,新买家为优品360执行董事许志群或有关人士,料购入作投资用途。

呎价方面,2016年物业中高层全层,面积约15,451平方呎,以约3.09亿元易手,呎价高见近2万元。其后整体商厦价格回落,按现时成交呎价约1.2万元计,较高峰期跌4成。

另一宗焦点买卖,为高盛、凯龙瑞等基金放售逾1年的上环全新商厦88WL,近日获数个财团争夺,包括用家及投资者,最终获本地财团以约7.5亿元承接。

建滔集团 7.5亿承接88WL

凯龙瑞基金早年购入永乐街3旧楼地盘,共涉约9.62亿元,其后引入基金投资进行重建,基金早于去年中曾放售物业,叫价约13.5亿元,未获承接,半年后再委託测量师行放售,降价至约9亿元,如今再降价至约7.5亿元沽出,以总楼面约90,199平方呎计,呎价约8,315元。未计建筑费已蚀约2亿元,若连同起楼成本,保守蚀至少约6亿元离场,为近年商厦最大手蚀让。市场人士指,新买家为建滔集团或有关人士。该集团早年亦有投资上环商厦,2010年以约6.6亿元向南丰购入上环苏杭街69号全幢商厦,其后于2019年商厦高峰期,以约19亿元售予基金。

该行指,首季甲厦市场出现「价跌量升」的情况,今年第一季共录得29宗指标甲厦成交,是自2023年第二季以来最多,反映由于部分甲厦业主为吸引买家承接物业,所以决定降低物业的叫价,令近期甲厦的交投增加。

(经济日报)

更多皇后大道中181号写字楼出售楼盘资讯请参阅:皇后大道中181号写字楼出售

更多上环区甲级写字楼出售楼盘资讯请参阅:上环区甲级写字楼出售

更多88WL写字楼出租楼盘资讯请参阅:88WL写字楼出租

更多上环区甲级写字楼出租楼盘资讯请参阅:上环区甲级写字楼出租

首季乙厦售价升2.2% 本港代理行:跑赢整体大市

有本港代理行发表的商厦市场报告指,首季商厦註册宗数仅录142宗,按年跌约29.7%,金额录14.15亿,按年跌约60.1%。首季乙厦售价跑赢甲厦,分散业权乙厦售价在首季升约2.2%,甲厦售价则跌约4.8%。

金额14.15亿按年跌60%

该行代理相信,乙厦过往数年累积较大跌幅,入场门槛低,首季甲厦「价跌量升」,今年第一季共录29宗成交,2023年第二季以来最多,反映部分甲厦业主为吸引买家降低叫价,令近期甲厦交投增加。

上月,一间上市公司以约8430万购入长沙湾南商金融创新中心多个高层单位。铜锣湾广旅集团大厦中层全层以约3480万成交,呎价约10774元,呎价较高峰期回落近三成。

新商厦录大额租务

多个新商厦录大额租务,一间德国超市以月租约185.5万租用啟德AIRSIDE 1层楼面,该超市原本租用九龙站环球贸易广场 (ICC) 中低层3层楼面,预料该超市迁出后,相关楼面或以月租约600万租予金管局。在中环区,一间中资汽车生产商以月租约79.2万租用The Henderson的商厦楼面。

地政总署最近调低部分新界新发展区及市区补地价金额水平,工业地转商厦或现代工业用途补价将下调20%。此举收窄土地拥有人及政府就地皮定价差距。

(星岛日报)

更多南商金融创新中心写字楼出售楼盘资讯请参阅:南商金融创新中心写字楼出售

更多长沙湾区甲级写字楼出售楼盘资讯请参阅:长沙湾区甲级写字楼出售

更多广旅集团大厦写字楼出售楼盘资讯请参阅:广旅集团大厦写字楼出售

更多铜锣湾区甲级写字楼出售楼盘资讯请参阅:铜锣湾区甲级写字楼出售

更多AIRSIDE写字楼出租楼盘资讯请参阅:AIRSIDE写字楼出租

更多啟德区甲级写字楼出租楼盘资讯请参阅:啟德区甲级写字楼出租

更多环球贸易广场写字楼出租楼盘资讯请参阅:环球贸易广场写字楼出租

更多尖沙咀区甲级写字楼出租楼盘资讯请参阅:尖沙咀区甲级写字楼出租

更多The Henderson写字楼出租楼盘资讯请参阅:The Henderson 写字楼出租

更多中环区甲级写字楼出租楼盘资讯请参阅:中环区甲级写字楼出租

首季8宗逾亿买卖 按年挫5成

据一间外资代理行统计,首季仅录8宗逾亿元大手买卖,按年跌半。

外资代理行料全年达500亿成交

该行指,2024年第一季度,整体投资市场仅录得8宗逾亿元大手买卖,交易总额为56亿元,按年分别下跌53%及41%。交易主要涉及回报率逾4%至5%的资产,其中社区购物中心及街铺因租金收入稳定和具吸引力,在2024年第一季度的交易中佔了一半。

该行代理指出,视乎美国潜在减息及股市復甦带来的影响,投资情绪将逐步转趋正面,不良资产仍备受追捧。楼市撤辣亦将有利于住宅物业销售,继而推动住宅地皮需求上升。内地学生及专才涌港,亦将带动住屋需求。整体而言,该代理预计,今年投资金额将达500亿元,按年上升约34%。

(经济日报)

黎永滔荃中商铺 2.2亿获洽至尾声

个别资深投资者加快沽货,消息指,黎永滔旗下荃湾中心商铺,获2.2亿元洽购至尾声料快易手,若最终成交,持货6年蚀5,500万元。

市场消息指,荃景围86号荃湾中心商场2期11至14座基座铺位,总建筑面积44,035平方呎,获财团出价2.2亿元洽购,贴近业主意向价。

早年2.75亿购入 作收租

该批铺位位于屋苑基座,目前主要由3租客承租,其中护老院佔近3万平方呎,另有幼稚园及设计公司,每月租金收入约130万元。若接2.2亿元洽购价计,呎价近5,000元,回报率达7厘。

翻查资料,物业曾由项目发展商新地 (00016) 持有收租达36年,2018年资深投资者黎永滔以2.75亿元购入,作收租之用。若最终以2.2亿元沽货,将蚀5,500万元,幅度达两成。事实上,黎永滔近期加快推售铺位,包括放售铜锣湾景隆街全幢。

另消息指,旺角花园街3至5号地下铺位,面积约1,306平方呎,以5,300万元成交,呎价约4万元。铺位现由餐厅租用,月租约16万元,回报率约3.6厘。原业主于2005年以3,800万元买入,持货19年转手,获利约1,500万元,升幅近4成。

(经济日报)

伟华汇优质设计 黄竹坑新地标

黄竹坑伟华汇外形美观,而物业大堂质素、景观均非常优质,属区内新地标项目。

交通上,黄竹坑新落成商厦多,而伟华汇位处的香业道,属连接港铁黄竹坑站出口的地段,只需步行5至10分鐘,比起同区不少新商厦较为方便。而由黄竹坑站前往金鐘站仅约10分鐘车程,故前往各区亦极便利,另黄竹坑道亦有多条巴士綫来往港九。另值得一提,大厦既设有停车场,而地下亦设有盖位供汽车上落客。

饮食配套不足是过往黄竹坑区最大问题,而随着黄竹坑站商场THE SOUTHSIDE去年开幕,提供大量餐厅及零售商店,解决多年来区内食肆不足之问题。

外形上,伟华汇的建筑理念深受竹子坚韧不拔的特性所啟发,于是将其精粹融入设计细节当中。竹节长度灵活多变,亦配合黄竹坑的主题,外形美观。

地下大堂楼底甚高亦阔落,极具气派。据悉,项目属同区新甲厦中,较少升降机大堂设于地下,较为便利。

伟华汇楼高27层,地下3层为停车场,提供总建筑面积约300,000平方呎,物业分为低层 (1至15楼) 及高层 (17至30楼) 两区,分别设有两个升降机大堂,有效疏导人流,而大堂设有入闸机,保安严密。

每层约1.2万呎 同区罕有

分层每层楼面面积约12,000平方呎,为同区较少提供逾万平方呎楼面,间隔非常四正,实用率逾8成,楼底净高度达到2.9米,空间感十足。景观方面,高层单位享有少许海景,极为开扬,而中低层单位望向园林,同样舒适。

伟华汇设有特色楼层,于1楼及2楼设有平台及绿化空间,16楼及天台均设有空中花园,为租户提供理想的休憩场所,更可作企业活动。

项目今年初正式入伙,已获绿建环评 (BEAM Plus) 暂定金级认证、WELL健康建筑标準预先认证,并将申请成为WELL Certified™健康建筑标準「金级」认证。

该厦前身为信诚工业大厦,伟华集团早于2013年展开收购,直至2020年获批重建,连同收购及建筑,总投资额达40亿元。

(经济日报)

更多伟华汇写字楼出租楼盘资讯请参阅:伟华汇写字楼出租

更多黄竹坑区甲级写字楼出租楼盘资讯请参阅:黄竹坑区甲级写字楼出租

Residential rebound running out of steam

Hong Kong's residential market is losing momentum following a short rebound after the removal of housing curbs, warns JP Morgan.

It said home prices in the secondary market fell 1.5 percent last week, the biggest week-on-week drop in eight months.

The US investment bank also highlighted CK Asset's (1113) Blue Coast in Wong Chuk Hang, which sold less than 75 percent of the flats in the second round of sales, as evidence that the rebound was fading.

It said the developer's attempt to raise prices moderately and weakened expectations for the US Federal Reserve to cut interest rates, all pointed to a slowdown.

The impact on prices in the primary market would be more apparent if developers compete with price cuts as they try to lower inventories, it added.

Meanwhile, Morgan Stanley predicts a significant drop in profits for developers with large inventories, referring to CKA's below-cost sales of Blue Coast flats.

The weaker-than-expected recovery in the property market has also affected developers' appetite for new projects. In the first quarter, the total land premiums slumped 97 percent from a year ago to HK$437 million.

In other market news, Dynasty Court at the Mid-Levels, developed by Sun Hung Kai Properties (0016), sold five flats for around HK$275 million, according to local media reports.

And two connected houses on No 56 Repulse Bay Road have been put up for sale with an estimated market value of HK$360 million or HK$67,830 per square foot, according to a lead agent.

(The Standard)观塘骆驼漆大厦地厂1.5亿易手 邓成波家族沽售持货14年贬值逾59%

邓成波家族持续沽货,观塘开源道骆驼漆大厦地厂,建筑面积约3816方呎,以1.5亿易手,持货14年贬值高逾59%,新买家为伯恩光学始创人杨建文,料回报4.8厘。

上址为观塘开源道62号骆驼漆大厦1座A1及A2号地厂,建筑面积约3816方呎,以易手价1.5亿计算,平均呎价3.93万,该家族于2010年以每呎4.6万购入该2个地厂,涉资约1.76亿,及后再于2015及2016年间以1.9亿为该地厂补价,成本价约3.66亿,持货约14年,今番帐面蚀让约2.16亿,物业贬值约59%。

投资者杨建文承接

据了解,上述连租约易手,目前月租60万,以易手价计算,回报约4.8厘,新买家为伯恩光学始创人杨建文。

业内人士分析道,该地厂之所以劲蚀,皆因该地铺已补价作商业用途,与地铺并没有分别,近年铺位租金从高峰期急跌70%至80%,价格亦随之下跌,因此上址跌价59%,属合理水平。

买家杨建文就上述物业收取高回报,目前不少旺区铺位易手,回报约3厘,上址高达4.8厘。杨建文近年大手购入观塘物业,除了收购开源道业发工业大厦1期、2期及年运工业大厦,并透过强拍统一业权,上述3个工厦佔地约5万方呎,将合併重建楼高39层甲厦,总楼面约72万方呎,发展为一幢楼高200米的地标甲厦。

连约回报4.8厘

此外,他亦购入观塘商厦,包括寧晋中心多个单位,还有,他的目标还包括观塘万年工业大厦,收购至少逾45.7%业权,坐落巧明街116至118号,楼高13层,距离港铁观塘站出口仅5分鐘步程,邻近创纪之城5期 - 东亚银行中心及鱷鱼恤中心等,佔据有利位置。

杨建文为伯恩光学始创人,有「手机屏幕大王」之称,他活跃于地产界,并一直重锤观塘区。

(星岛日报)

更多寧晋中心写字楼出售楼盘资讯请参阅:寧晋中心写字楼出售

更多观塘区甲级写字楼出售楼盘资讯请参阅:观塘区甲级写字楼出售

更多创纪之城写字楼出租楼盘资讯请参阅:创纪之城写字楼出租

更多鱷鱼恤中心写字楼出租楼盘资讯请参阅:鱷鱼恤中心写字楼出租

更多观塘区甲级写字楼出租楼盘资讯请参阅:观塘区甲级写字楼出租

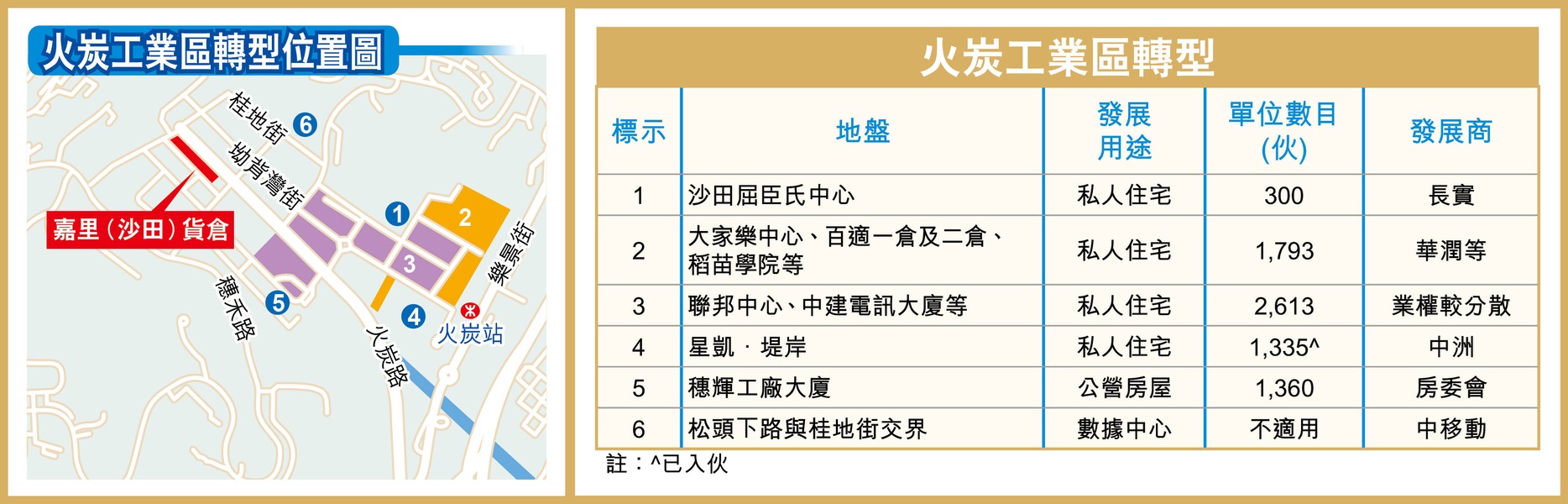

火炭转型 发展公私型楼新建区

火炭由以往旧工业区逐步转型为住宅,当中最大规模的改划,属于2021年长实 (01113) 递交的住宅重建申请,涉及约4,706伙。观乎该区重建项目,初步预计将会新增至少逾6,000伙公私营房屋。

火炭工业区佔地约30公顷,区内共有约45幢工厦,平均楼龄逾30年以上,一半楼龄介乎约15至30年。而有发展商早前已经看中区内潜力,前身为火炭惠康仓的新盘星凯‧堤岸,目前已经入伙。项目原由爪哇控股 (00251) 持有,其后中洲置业于2015年底以约11.2亿元向爪哇控股买入地皮,并于2017年完成补地价程序,补地价金额约35.8亿元,每平方呎楼面地价约3,580元。

大规模重建 首期最快后年落成

虽然区内近8成工厦属于分散业权,会增加重建的困难,但有发展商亦看中区内工厦的发展前景,大规模为区内工厦申请重建,其中最大规模的为长实于2021年递交的申请,发展商就火炭工业区东部20幢工厦,向城规会申请由「工业」用途改划为「住宅 (戊类)」等用途,以重建大型屋苑,提供约4,706伙。据当时的申请文件,项目将会分3期发展,合共涉及24幢住宅,当中第1期是长实旗下的沙田屈臣氏中心,提供约300伙,预料2026年落成。而第2期则涉邻近港铁火炭站的多幢工厦,包括大家乐中心、华润旗下沙田冷仓一仓、二仓、百适一仓、二仓,及稻苗学院等,提供约1,793伙,初步估计于2028年落成。

项目第3期则涉中建电讯大厦及峯达工业大厦等共13幢工厦,提供约2,613伙,但因前述的工厦现时的业权相当分散,普遍欠单一大业主主导重建,预期短期内难以落实重建。

华润系持5工厦 成区内大地主

另外,华润物流近年密密买入香港的工厦,积极扩大区内势力。华润物流于2022年5月以约23.3亿元,向嘉里购入位于火炭工业区内山尾街36至42号嘉里 (沙田) 货仓,以总楼面面积约404,374平方呎计,平均呎价约5,762元。如若计入百适一仓、百适二仓、沙田冷仓 (一仓) 及沙田冷仓 (二仓),华润系内持有的火炭工厦增加至5幢,属区内大地主之一。华润创业早年曾就沙田冷仓 (一仓) 及百适一仓向城规会申请重建为酒店及商场,提供约858间客房,惟方案当年未获会方批准。

(经济日报)

New projects continue to be launched in Hong Kong but that's not deterred Wheelock Properties from raising prices for the second batch of flats at Park Seasons in Lohas Park by 3.8 percent.

The 78 flats in the second list are priced at HK$15,039 a square foot after discounts. The developer will launch sales of 168 flats this Saturday at an average price of HK$14,632 per sq ft after discounts.

Ricky Wong Kwong-yiu, the executive director for Wheelock Properties, said the new batch is being offered at the original price to maintain the project's attractiveness, but exclude factors such as higher floor levels.

Meanwhile, Blue Coast at The Southside sold a four-bedroom flat by tender for more than HK$37.19 million.

In Ho Man Tin, Onmantin, jointly developed by Great Eagle (0041) and MTR Corporation (0066), will release its first price list of at least 155 flats today. Show flats for phase IIA and phase IIB have been opened to tempt buyers.

The developers plan to launch sales for phase IIB first this month.

Topside Residence developed by CSI Properties (0497) in Jordan is also expected to release its first price list this week.

(The Standard)亿京3265万 沽观塘万泰利广场单位

亿京续减价推售旗下甲厦餘货,刚以约3,265万元,沽出观塘万泰利广场单位,呎价较高峰期大跌4成。

呎价9448 较高峰跌4成

资料显示,观塘创业街万泰利广场录得成交,涉及29楼E至F室,面积合共约3,456平方呎,以约3,265万元沽出,呎价约9,448元,单位原属一手发展商餘货。

翻查资料,2019年该厦全层单位,面积约12,042平方呎,以2.16亿元沽出,呎价约16,741元。如今最新成交价,较高峰期跌4成。事实上,亿京近期推售旗下一手甲厦项目餘货,包括观塘电讯一代广场、九龙湾恩浩国际中心、新蒲岗万迪广场等,呎价一律大减3至4成。

另东九龙商厦租务上,九龙湾亿京中心A座中高层D室,面积约2,173平方呎,以每呎约17元租出。

(经济日报)

更多万泰利广场写字楼出售楼盘资讯请参阅:万泰利广场写字楼出售

更多电讯一代广场写字楼出售楼盘资讯请参阅:电讯一代广场写字楼出售

更多观塘区甲级写字楼出售楼盘资讯请参阅:观塘区甲级写字楼出售

更多恩浩国际中心写字楼出售楼盘资讯请参阅:恩浩国际中心写字楼出售

更多九龙湾区甲级写字楼出售楼盘资讯请参阅:九龙湾区甲级写字楼出售

更多亿京中心写字楼出租楼盘资讯请参阅:亿京中心写字楼出租

更多九龙湾区甲级写字楼出租楼盘资讯请参阅:九龙湾区甲级写字楼出租

国际品牌进驻旺区 中环铺40万租出

意时装店落户百佳大厦 较疫情前降租3成

核心区一綫地段续有国际品牌进驻,中环皇后大道中地铺,获意大利时装品牌Falconeri以月40万租用。铺位地下及1楼原由Charles and Keith租用,租金较疫情前下跌约3成。

中环皇后大道中再录国际品牌租务,涉及百佳大厦地下铺位,面积约1,700平方呎,获意大利时装品牌Falconeri租用,品牌近日亦已掛起广告板,预告快将开业。

资料显示,Falconeri主打羊绒衣服,创立于2000年,生产綫一直在意大利,初期以男士产品为主,渐渐发展女性系列,令品牌更全面,更属四季合穿。2019年该品牌于铜锣湾恩平道开设专门店,现转战中环一綫地段开业。

据了解,是次月租涉约40万元,呎租约235元。翻查资料,物业地下及1楼,由鞋店Charles and Keith以80万租用,品牌去年尾迁出,业主重新分拆招租,现先租出地下,1楼仍在招租中。按现时租金计,较疫情前仍跌约3成。

外资代理行:核心区空置率 降至6.6%

据一间外资代理行统计,随着商铺租务增加,令核心区空置率按季下降2.5个百分点至6.6%,为2019年第四季以来最低水平。四个核心区空置率均录得个位数,中环空置率跌幅最大,下降5.3个百分点至6.6%。

事实上,皇后大道中在近两个月,已先后录3宗涉及国际品牌零售商租用,如皇后大道中新世界大厦地下铺位租出,涉及面积约1,700平方呎,获瑞士名錶品牌Franck Muller租用,月租约40万元。

另皇后大道中20号太平行地下A铺及地库,合共面积约7,179平方呎,原已交吉多年,近日获体育品牌Nike以每月约60万元承租,呎租约84元。据悉,目前皇后大道中大型铺位已全数获租,仅皇后大道中59至65号泛海大厦地铺及1楼,亦即前TOPSHOP时装租用的复式铺,近年一直只作品牌作期间限定店,包括上月瑞士护肤品牌La Prairie短租。

(经济日报)

更多百佳大厦写字楼出租楼盘资讯请参阅:百佳大厦写字楼出租

更多新世界大厦写字楼出租楼盘资讯请参阅:新世界大厦写字楼出租

更多太平行写字楼出租楼盘资讯请参阅:太平行写字楼出租

更多泛海大厦写字楼出租楼盘资讯请参阅:泛海大厦写字楼出租

更多中环区甲级写字楼出租楼盘资讯请参阅:中环区甲级写字楼出租

铜锣湾希云大厦「流拍」收场 底价24.25亿金朝阳未有出价承拍

本港经济復甦步伐不似预期,连带旧楼併购市场亦受影响,由金朝阳併购约17年的铜锣湾希云大厦,昨举行公开拍卖,底价为24.25亿,惟该财团并未有出价承拍,以流拍收场;金朝阳指,考虑香港现时经济状况,及房地产价值可能继续向下调整后,决定不在拍卖中作出投标。

上述项目今年2月已获土地审裁处批出强拍令,昨在仲量联行举行拍卖会,惟拍卖官多次重复叫价后,却迟迟未有人承价,最终该项目流拍收场,为《土地 (为重新发展而强制售卖) 条例》1999年实施以来第4宗流拍个案。

金朝阳昨发出公告指,公司经审慎考虑香港现时经济状况及房地产市场,尤其是房地产价值可能继续向下调整后,最终决定不在拍卖中作出投标。而且根据估值报告,希云大厦于重建后市值约21亿,低于底价24.25亿。

金朝阳:重建后市值21亿低底价

该公告续指,现正寻求其法律顾问意见,探索及评估公司下一步就该地段拥有权可能採取不同方案,包括与各註册拥有人联络及订立私人协议,以购买餘下单位;或向土地审裁处申请延长举行另一次拍卖时间,并申请下调底价以与该地段当前市值一致。

可建总楼面19.7万呎

希云大厦早于1959年落成,至今约65年楼龄,现为1幢楼高11层商住综合用途楼宇,地下高层及地下商铺为非住宅用途,1楼至10楼为住宅用途。该地现为「其他指定用途(混合用途)」,地盘约13150方呎,若重建作商业项目,以地积比率15倍计算,可建总楼面约19.7万方呎;若发展为住宅项目,以地积比率9倍计算,可建总楼面约11.8万方呎。

资料显示,金朝阳曾于2022年8月以32.09亿售出希云大厦,买家徐意为一间中资发展商相关人士,其后于去年取消交易,金朝阳除没收买方逾3.2亿初始按金之外,买方同时需要支付和解金及额外费用,涉及金额合共逾3.64亿。

(星岛日报)

佐敦官涌街巨铺1.488亿易手 凯莉山学校旧址信兴相关人士承接

近期商厦铺位买卖趋活跃,兴胜创建以1.488亿沽售佐敦官涌街巨铺,该项目为凯莉山学校旧址,最新成交呎价12127元,买家为信兴集团相关人士。

佐敦官涌街38号The Austine PLACE地下及1楼,建筑面积约12270方呎 (包括地下面积约4,880方呎),业主兴胜创建去年9月以意向价2.2亿放售,最终减价7120万,以1.488亿易手,平均呎价12127元。

平均呎价12127元

该物业于2014落成,曾由凯莉山学校承租多年,随着该学校停运,巨铺亦一直空置。

兴胜创建预期,出售事项产生所得款项约1.488亿,其中约9000万元,将用作偿还以该物业作抵押之银行贷款,而所得款项餘额,在扣除相关费用及开支后,将用作一般营运资金。儘管该铺位经代理放售时,建筑面积逾1.227万呎,据悉实用面积7856方呎。

物业于2014落成

市场消息透露,该巨铺买家透过Amazing Grace Kowloon Limited购入物业,该公司董事蒙倩儿,为信兴集团创办人蒙民伟长女,市传购入该物业将作为慈善用途,惟有关说法未获证实,本报昨日致电信兴集团,直至截稿时仍未能联络得上。

信兴集团相关人士亦于2021年出手,购入尖沙咀商厦新东海商业中心16楼共5个单位,作价8131.85万,当时透过SHUN HING REALIFE COMPANY LIMITED购入物业,公司董事包括蒙倩儿及蒙德扬,蒙德扬为蒙民伟儿子。原业主为日资建筑公司前田建设 (MAEDA CORPORATION),该公司在1991年以3552.75万购入上述写字楼单位,帐面获利约4579万,升值约1.29倍。

(经济日报)

更多东海商业中心写字楼出售楼盘资讯请参阅:东海商业中心写字楼出售

更多尖沙咀区甲级写字楼出售楼盘资讯请参阅:尖沙咀区甲级写字楼出售

New Ho Man Tin flats priced at eight-year low

Onmantin, jointly developed by Great Eagle (0041) and MTR Corporation (0066) in Ho Man Tin, has revealed the first price list, offering 115 flats with an average price of HK$19,988 per square foot, the lowest in eight years in the district.

The flats range from 388 sq ft to 774 sq ft and the cheapest is a one-bedroom flat priced at HK$6.89 million.

"The price level reflects the developers' desire to reduce inventories," a property agent said.

In the district, the luxury project St George's Mansions, developed by Sino Land (0083) and CLP, sold a four-bedroom flat for HK$85.48 million yesterday.

Meanwhile, Wheelock Properties said its property sales have exceeded HK$10 billion in less than four months this year, achieving the full-year target early.

The developer has sold 867 flats, cashing in HK$10.04 billion, including 568 flats at the Seasons Place in Tseung Kwan O.

While Hong Kong developers continue selling new projects at relatively low prices, they remain cautious about the land redevelopment projects.

The compulsory sale of Haven Court in Causeway Bay at a reserve price of HK$2.43 billion was canceled as it failed to receive any bids yesterday, marking the fourth unsuccessful compulsory sale this year.

Developer Soundwill (0878) filed for this compulsory sale in 2019, holding 84.04 percent ownership at that time. Completed in 1959, Haven Court occupies an area of about 13,150 sq ft and is an 11-story composite building, with a total of 44 shops and 125 flats.

(The Standard)The Henderson逾8000呎租出 医疗集团进驻平均每呎120元

中环地标甲厦The Henderson新录一宗租务,一个逾8000方呎单位,以每呎约120元租出,新租客为医疗集团,于同区升级搬迁至全新甲厦。

上址为甲厦The Henderson 15楼2至3室,建筑面积逾8000方呎,由金卫医疗集团进驻,市场人士透露,月租约96万,平均呎租120元,该集团本身承租中银大厦48楼,全层面积约7287方呎,现时中银大厦原址全层以每呎110元放租。业内人士表示,金卫医疗属升级搬迁,迁至设施新颖的环保商厦,并稍为扩大楼面。

每月租金约96万

金卫医疗集团是一间主要从事医疗业务的香港投资控股公司,集团通过四大分部运营, 医疗设备开发、生产及销售医疗设备,医院管理分部在中国提供医院卫生管理服务及营运医院。

The Henderson近期连录承租,包括内地大型汽车制造商华晨集团,以每月近79.2万承租中高层,建筑面积约6600方呎,呎租近120元,该集团港办公室设于遮打大厦中层,是次搬迁少许扩充,并升级至全新甲厦。

同区升级搬迁主导

The Henderson大手租客包括加拿大退休金计划投资局 (CPPIB),由同区约克大厦搬至The Henderson。拍卖行佳士得租用4层,涉约5万方呎,作为集团在港首个常设拍卖中心和艺廊。国际投资公司凯雷集团 (Carlyle)租用约2万方呎楼面。

有本港代理表示,今年第一季度,儘管新增供应推高空置率,整体市场表现比过往活跃,政府机构、银行及保险公司频作大手租赁,新供应为租户提供更多新选择。至于中环区,仍以升级搬迁为主,租户追求崭新甲厦,钟情新设施及环保标準,儘管整体租赁趋活跃,由于供应多,空置率仍然攀新高,预期今年内租金表现未见惊喜。

The Henderson楼高36层,每层约1.2万至1.5万方呎,总楼面46.5万方呎。

(星岛日报)

更多The Henderson写字楼出租楼盘资讯请参阅:The Henderson 写字楼出租

更多中银大厦写字楼出租资讯请参阅:中银大厦写字楼出租

更多遮打大厦写字楼出租楼盘资讯请参阅:遮打大厦写字楼出租

更多约克大厦写字楼出租楼盘资讯请参阅:约克大厦写字楼出租

更多中环区甲级写字楼出租楼盘资讯请参阅:中环区甲级写字楼出租

旺角建摩厦规划署不反对 新地「巨无霸」商业地总楼面逾152万呎

旺角未来再有新摩厦供应,由新地发展的旺角「巨无霸」商业地,早前向城规会递交新发展蓝图,申请放宽高限,以建摩天商厦等,打造旺角Green Heart,涉及可建总楼面约152.42万方呎。最新获规划署不反对,城规会将于今日举行会议审理,料会「开绿灯」通过。

规划署指,上述项目增建行人天桥等设施,有助提高项目与周边的连接性;而车辆出入安排及改善工程,运输署及路政署等相关部门并未有提出任何负面意见,但建议提交详细交通管理计划,以便运输署进行监察。另外,项目设有不少社福施设,申请人就其布局及设计属可接受。故该署不反对有关申请,城规会将于今日举行会议审理。

城规今审议料通过

据文件显示,项目申建3幢建筑物,靠近亚皆老街位置,兴建1幢楼高56层 (另设6层地库) 主大楼、即商厦,主水平基準以上320米;邻近港九潮州公会中学位置,则兴建7层 (另设6层地库) 政府、机构或设施附属大楼,另会有1幢2层高构筑物用作承托通往黑布街行人天桥,可建总楼面约152.42万方呎,料于2030年落成。

项目申建3幢建筑物

为配合最新发展方案,建议把用作兴建附属大楼位置高限,由40米放宽至46米,即增加6米或约15%,以容纳升降机槽等设施,并提供无障碍通道连接天台公眾休憩用地;同时申请放宽整个项目中央位置建筑物间距限制,以提供一条小型社区天桥,连接附属大楼和发展项目其他部分等。

该项目日后将提供约120万方呎写字楼楼面,约20万方呎商场楼面。附属大楼提供社区设施,包括长者日间护理中心、长者邻舍中心、精神健康综合社区中心、社区会堂及综合青少年服务中心,涉及约5万方呎;同时提供逾10万方呎的公眾休憩用地。

据卖地条款,项目须保育3棵榕树,故在设计上作出改动,政府原方案是地盘之下为5层地库,认为设计不利于榕树保育及生长,为保育3棵榕树,于是在设计上作出改动,建议避开榕树底部不作挖掘,加深其他位置建地库,故最新增加1层地库至6层,以作为公共交通交汇处、跨境巴士设施,以及多层停车场,届时将提供约1000个车位。

新地曾指,项目总投资额逾100亿,以打造九龙全新地标。上述地皮是新地于去年3月以47.29亿投得,当时每呎楼面地价约3103元。

(星岛日报)

Shop king's family takes $24m hit in TST sale

The family of Hong Kong's late "shop king" Tang Shing-bor sold a shop in Tsim Sha Tsui for HK$32.5 million, suffering a paper loss of over HK$24 million after holding it for nearly 14 years.

The 890-square-foot ground floor shop on 43 Granville Road saw the selling price come in at HK$36,500 per sq ft.

Tang's family bought the shop in June 2010 for HK$56.8 million. This would mean the property depreciated by about 43 percent in value over the years.

In the primary market, Topside Residences in Jordan, redeveloped by CSI Properties (0497), is expected to roll out its first price list early next week.

The project provides a total of 259 flats, of which 137 are two-bedroom flats. The show flats will also be opened next week.

In Pak Shek Kok, Sun Hung Kai Properties (0016) raised the prices of nine flats in phase 2 of St Martin by 0.5 percent to 9.3 percent. Phase 2 offers 640 flats in total.

(The Standard)

Hong Kong’s buoyant home sales to fight gravity of continued high interest rates as cut hopes dwindle, analysts say

Property agents have raised sales forecasts for the year amid project launches at discounted prices, but lack of a rate cut could pare those estimates

Developers are likely to continue pricing projects low to keep their transaction volumes up, an analyst says

Dwindling hopes for an interest-rate cut this year could put a damper on surging Hong Kong home sales, according to analysts.

As of Tuesday, 5,109 new homes have been sold in Hong Kong in 2024, roughly half of the full-year total in both 2022 and 2023, according to data compiled by a local property agency.

As developers rush to put new projects on sale at discounted prices to take advantage of the suddenly buoyant buying sentiment, property agents have raised their 2024 sales forecasts. The agency, for example, now expects 18,000 new homes to sell this year, up from a previous estimate of 14,000.

However, interest rates, which remain at their highest level since 2007, could spoil the party, analysts said after a speech on Tuesday by US Federal Reserve chairman Jerome Powell tempered hopes of an imminent rate cut. Economists now expect any rate reduction to be delayed until at least September and possibly next year.

Should the rate cut not materialise at all this year, buyers may hesitate to purchase homes, an agent said.

“On the demand side, buyers may hesitate, while developers are still likely to price their projects well below the prices of second-hand units if they want to keep their transaction volumes higher,” the agent said.

Still, a lack of rate cuts may trim the top off of potential sales, according to Raymond Cheng, managing director of CGS International Securities.

“If we see decreasing interest rates, we forecast a 40 per cent annual increase in new home sales to 15,000 to 16,000 this year,” he said. “But without rate cuts, we are likely to see about a 30 per cent increase in new home transactions, to a range of 14,000 to 15,000 units.”

On the other hand, another agent, believes the current attractive pricing will still lure potential buyers to the market.

“Despite the high interest rates, end-user homebuyers can take advantage of the lower price levels,” the agent said. “Meanwhile, investors can now cover their mortgage payments with rental income, as the residential rental market has improved by 8 per cent year on year. Additionally, the influx of newcomers to the city is creating a new group of potential buyers, further stimulating demand.”

“Rate cuts have been widely expected and factored in by buyers in the first few months of the year,” another agent said. “However, the consensus was for rates to be cut only moderately by 50 to 75 basis points this year anyway, hence any delay is expected to mainly affect market sentiment.”

Keen to clear an estimated 20,000 unsold units, developers have been pricing new project launches at multi-year lows. On Wednesday, for example, Great Eagle Holdings priced the first 115 units of its new residential project called Onmantin in Ho Man Tin at an average price of HK$19,988 (US$2,556) per square foot after discounts.

That is the lowest in the same neighbourhood since Kerry Properties launched its Mantin Heights development at HK$19,000 in 2016, agents said. The price is also about 25 per cent below the In One Above project launched by Chinachem Group in May last year.

A lack of rate cuts this year will not affect all buyers equally, said CGS’ Cheng. Up to 40 per cent of current homebuyers are from mainland China and are not as sensitive to rate changes as local buyers tend to be, he said.

“There will be some impact on those who are buying for investment purposes and the local people who are price-sensitive,” he said. “If the US Fed keeps delaying the rate cuts, price-sensitive homebuyers are likely to delay their purchases.”

Hong Kong home sales picked up this year following two of their worst years since 1996 after the government removed all property cooling measures on March 1. These decade-old property curbs included the Buyer’s Stamp Duty designed to target non-permanent residents, the New Residential Stamp Duty for second-time purchasers and the Special Stamp Duty aimed at homeowners that resell their properties within two years.

The Hong Kong Monetary Authority has also taken action to encourage home sales. Homes valued at less than HK$30 million are now eligible for 70 per cent mortgage financing, compared with the previous rule that granted only 60 per cent financing for flats valued between HK$15 million and HK$30 million.

(South China Morning Post)新世界永康街83号商厦 700万入场

新世界 (00017) 续推工商项目,旗下长沙湾永康街83号商厦短期展开发售,料先推2层,入场费约700餘万元起,呎价约1.1万元起。

先拆售2层低层 共36伙

市场消息称,新世界旗下长沙湾永康街83号即将推出,项目大厦楼高28层,另设4层地库停车场,地下至1楼为入口大堂及商铺,5楼至31楼为写字楼用途,项目2楼为平台花园,供绿化休憩空间。分层全层面积约19,216平方呎,每层可分间18个独立单位,单位面积由约545至1,626平方呎,项目近日已开始入伙。

代理透露,发展商料先推出项目2层低层拆售,每层提供18伙,合共36伙。定价方面,预计呎价约1.1万元起,预计入场费约700万元起。

新世界发展早于2017年投得长沙湾3幅商业用地,包括荔枝角道888号项目、琼林街项目及永康街项目,总可建楼面面积接近200万平方呎。

(经济日报)

更多永康街83号写字楼出售楼盘资讯请参阅:永康街83号写字楼出售

更多长沙湾区甲级写字楼出售楼盘资讯请参阅:长沙湾区甲级写字楼出售

旺角朗豪坊巨铺月租200万 面积1.5万呎运动用品店提价10%续约

核心区旺角录一宗瞩目续租个案。位处朗豪坊最当眼地铺,面向砵兰街、亚皆老街及上海街。巨铺面积约1.5万呎,获运动用品店续租,较旧租提价约10%。该店并大肆装修,不惜投入资源为未来拓展铺路。

上址为朗豪坊地铺,三面单边,对出为一个供人休憩的广场,对正红绿灯,日夜人流聚集。巨铺面积约1.5万方呎,由运动品牌adidas承租,早前约满,该铺去向为市场所关注。因疫情后零售市况表现一般,铜锣湾等不少巨铺都因应淡市拆细出租,惟承租该巨铺的adidas最终选择续租。

三面单边对绿灯位

市场消息指,是次续租较旧租提价约10%,月租约200万,平均每呎约133元。该运动用品店并投入巨资装修,显示其看好前景。现场所见,该铺已围上木板,预告该店将于今年7月份以全新姿态面世。

adidas于2017年进驻该巨铺。当时,国际时装品牌H&M已承租该铺10年,虽然铺市已回落,但相对现时来说仍然十分畅旺,当年月租料约550万,呎租约367元,与H&M租金相若,除了基本租金外,并有营业额分成计算。

市场人士表示,随着后来疫情肆虐,该铺于市况最低潮时月租约100多万,至于今番续租,较旧租金约180万提价约10%。

平均呎租133元

朗豪坊附近一带为旺角区一线地段,近年连录大手承租,包括松本清承租雅兰中心地铺及1楼部分,总面积约6000方呎,开设品牌在港的第六间分店,市传月租高达100万,呎租料约125元。

至于在该地段,旺角砵兰街244号远东旺角银行大厦基座旺角文华商场,亦有巨铺于近年拆售租出。

(星岛日报)

更多朗豪坊写字楼出租楼盘资讯请参阅:朗豪坊写字楼出租

更多雅兰中心写字楼出租楼盘资讯请参阅:雅兰中心写字楼出租

更多旺角区甲级写字楼出租楼盘资讯请参阅:旺角区甲级写字楼出租

Developers bite at secondary sales

Ten major housing estates saw just eight deals, the least in about eight months amid pressure from more launches by developers and rainstorms.

The estates, tracked by a local, saw only eight deals last weekend, down by 11.1 percent, the third consecutive weekend that transaction volumes have hit single digits and reaching a new low in nearly eight weeks.

Estates that saw no transactions at all narrowed to four: Kornhill in Quarry Bay, South Horizons in Ap Lei Chau, Metro City in Tseung Kwan O and City One Shatin.

An agent said affordable second-hand housing options are becoming scarce, and buyers are reluctant to pay higher prices, further tilting them toward the primary market.

New properties continued to dominate this month, with most units being priced conservatively and offering diverse options, leading to sustained pressure on the secondary market, the agent said.

Wheelock Properties' Park Seasons, phase 12B of Lohas Park, sold 126 of 168 units, or 75 percent, on Saturday in the first round of sales, a modest show compared to nearby Seasons Place's selloff of all 368 units offered as part of its first round in one day last month.

The 168 units range from 322 to 496 square feet and are priced from HK$4.54 million to HK$7.7 million, with prices averaging HK$14,632 per sq ft after discounts.

Chairman Stewart Leung Chi-kin said Wheelock Properties is also gearing up to launch other projects to meet demand.

Latest plans for a Wan Chai project will be announced as soon as next month.

Onmantin atop Ho Man Tin MTR station, developed by Great Eagle (0041) and MTR Corp (0066), got more than 2,500 checks for 203 units, an oversubscription of about 12 times.

The project yesterday put up 84 apartments for sale by tender on Thursday.

Henderson Land Development (0012) will sell 18 units at The Quinn Square Mile in Mong Kok tomorrow, after being given occupation permits last week. Prices of some units have risen by up to 4 percent.

(The Standard)

新世界 (00017) 旗下长沙湾南商金融创新中心近期接连录得成交,最新以4,220万元沽出高层两伙,平均呎价约1.53万元。

涉及的两伙位于高层A1及B12室,面积分别为1,964及790平方呎,合计面积约2,754平方呎,获大手客以,4220万元购入。

事实上,南商金融创新中心近期交投加快,早前有国内资金资金购入该厦两伙作价逾4,000万元。

(经济日报)

更多南商金融创新中心写字楼出售楼盘资讯请参阅:南商金融创新中心写字楼出售

更多长沙湾区甲级写字楼出售楼盘资讯请参阅:长沙湾区甲级写字楼出售

Hong Kong’s homebuyers set aside high-rate concerns as they snap up Wheelock’s Park Seasons flats after discounts

Wheelock Properties sold 126 flats, or three-quarters of the 168 units on offer at its Park Seasons project at the Lohas Park as of 3pm, according to the developer

The sale comprised 1-bedroom and 2-bedroom flats measuring between 322 and 496 square feet, priced at HK$14,632 per square foot on average after discounts

Hong Kong’s homebuyers turned out for the latest weekend launch of new residential property, as the developer’s discounts assuaged concerns that interest rates could remain high for a longer period.

Wheelock Properties sold 126 flats, or three-quarters of the 168 units on offer at its Park Seasons project at the Lohas Park in Tseung Kwan O, according to the developer.

The sale comprised one-bedroom and two-bedroom flats measuring between 322 and 496 square feet (46 square meters), priced at between HK$4.54 million and up to HK$7.70 million (US$983,200), or HK$14,632 per square foot on average after discounts.

About 4,000 people had put down deposits to bid for the flats, or about 24 buyers for every available unit. The buoyant response underscored how Hong Kong’s property buyers had adapted to the high interest-rate environment, a property agent said

“Even if the US Federal Reserve does not cut interest rates, as long as developers maintain attractive prices, transactions should remain strong in May and June,” the agent said.

Hong Kong’s de facto central bank has been conducting its monetary policy in lockstep with the Fed to preserve the city’s currency peg to the US dollar, in place since 1983. The peg means that Hong Kong must keep rates high if the Fed maintains a high cost of funding.

That prospect may stretch into September, from the earlier expectation of a cut in June, after Fed Chairman Jerome Powell struck a hawkish tone this week on US inflation, saying that it could take “longer than expected” to get inflation back on target.

Some analysts have expressed concern that buyers may hesitate to purchase homes should the rate cut not materialise this year. Local and price-sensitive homebuyers could be the most impacted.

That did not deter homebuyers at Lohas Park. The project was jointly developed by Wheelock and Hong Kong’s subway operator MTR Corporation. The project’s 1,985 flats come in three phases, named 12A to 12C. Park Seasons (12B), on sale this weekend, comprises 685 flats.

The developer has already sold 570 flats in the first phase of its Lohas Park project, or 88 per cent of Seasons Place since launching it a month ago. That translated into about HK$3.64 billion of sales revenue.

The local government anticipated the high-rate environment, and preemptively removed some decade-long purchasing curbs to stimulate demand, especially from buyers with genuine need to own, the agent said.

The removal of curbs on March 1 rekindled property deals this year, after two of the worst years for transactions since 1996. As many as 18,000 new homes may find buyers this year, according to a forecast by another local property agency, 28 per cent more than the previous estimate of 14,000 flats.

(South China Morning Post) 中环盈置大厦全幢标售 叫价70亿

呎价2.64万 台资去年64亿向「越南朱」购入

中环全幢商厦罕有放盘,早前台资机构向投资者朱立基购入中环盈置大厦全幢商厦,业主随即委託测量师行标售物业,叫价约70亿元,呎价约2.64万元。

市场消息指,一家外资测量师行,接获业主委託,放售盈置大厦全幢。盈置大厦位于德辅道中77号,1962年落成,全幢楼面264,622平方呎,目前出租率逾8成,包括地下及1楼复式铺位,面积约6,000平方呎,去年获国际大型航空公司阿联酋航空 (Emirates) 以约55万元租用,开设首间体验店,料短期内开幕。

地下及1楼复式铺 租55万

至于楼上写字楼部分,租客主要为金融机构。项目最大卖点,是位处中环传统最核心地段,适合企业购入作总部,并获大厦命名权,于中环仍十分罕有。据了解,业主叫价约70亿元,呎价2.64万元。

物业前身为恒生大厦,早于2006年由摩根士丹利以22.58亿元承接,彻底打造翻新大厦,而「越南朱」朱立基于2009年9月以约36亿购入。去年尾,朱立基全綫沽售本港物业,并以作价64亿元把大厦沽出,新买家为台湾跨国软件公司「趋势科技」创办人兼董事长张明正的相关人士,属于近年台湾资金于本港楼市最大的单一投资。

越南女首富张美兰早前因贪污、挪用资金等被起诉,日前裁定罪名成立,于越南判处死刑,张美兰与丈夫朱立基曾经在香港拥有百亿物业。

(经济日报)

更多盈置大厦写字楼出租楼盘资讯请参阅:盈置大厦写字楼出租

更多中环区甲级写字楼出租楼盘资讯请参阅:中环区甲级写字楼出租

长沙湾永康街83号近月落成,项目设计甚时尚,附近配套亦齐全。

项目位处永康街及汝州西街交界,由港铁荔枝角站出口,步行至该厦仅5分鐘,而附近的永康街、青山道及长沙湾道,均有多条巴士及小巴綫,交通四通八达。另物业地库设有4层大型停车场,可提供约182个私家车车位,停车场入口位于永街康,并设有时租及月租,方便用户。

饮食方面,荔枝角道一带的工厦及商厦地下,均有不少餐厅。同区较大型商场为长沙湾广场、D2 PLACE ONE 及 D2 PLACE TWO,餐厅种类较多。