受疫情等因素打擊,核心區甲廈租金備受壓力。消息指,中環美國銀行中心高層單位,獲律師行以每呎約48元續租兩年,較舊租金下跌約18%,屬貼市價水平,業主享租金回報逾6厘水平;據業內人士分析指,疫市下甲廈租賃需求持續萎縮,加上市場正值供應高峰期,料整體租金持續受壓。

涉及面積3778方呎

核心區甲廈罕現減價續租個案。市場消息指出,中環夏愨道12號美國銀行中心高層1至2號室,建築面積3778方呎,以48元獲律師行續租,月租約181344元,為期兩年,上址舊租金為每呎59元,故最新租金較舊租金下跌約18%。

單位望海景兼對正電梯

據代理指,上址最新租金屬市價水平,該單位高層望海景,對正電梯位,屬該廈優質單位,1至2室已打通多年,屬該廈較罕有相連單位供應,早於2009年以約3249.08萬購入作長綫收租用途,料回報約6.69厘,上址於高峰期呎租高達約70元,故續租租金較高峰期回落逾3成,反映甲廈租金受壓。

有代理指,受疫情打擊、加上市場正值供應高峰期,令核心區甲廈租金持續受壓,能否復甦取決於能否順利通關。不過,政府早前宣布放寬入境檢疫安排,縮短抵港人士酒店檢疫期及推行「紅黃碼」,無疑是邁向全面恢復通關好開始,為寫字樓市場帶來曙光。

(星島日報)

更多美國銀行中心寫字樓出租樓盤資訊請參閱:美國銀行中心寫字樓出租

更多金鐘區甲級寫字樓出租樓盤資訊請參閱:金鐘區甲級寫字樓出租

更多中環區甲級寫字樓出租樓盤資訊請參閱:中環區甲級寫字樓出租

疫市下甲廈再錄大手承租個案。市場消息指,九龍站環球貿易廣場高層樓面,佔地逾4.7萬方呎,獲中資金融機構中金公司以每呎約75元承租。

市場消息透露,九龍環球貿易廣場 55樓4B至7室、及56全層,合共建築面積約47491方呎,新獲中資金融機構中金公司承租,平均呎租約75元,月租約356.18萬,屬疫市下甲廈較大手承租個案。業內人士指出,上址早前由德意志銀行租用,惟於去年棄租撤出。

涉及樓面約4.7萬呎

金鐘區內亦錄甲廈承租個案,消息指,太古廣場二座低層14至15室,建築面積約1624方呎,以每呎約120元租出,月租約194880元;此外,尖沙嘴康宏廣場高層4室,建築面積約2750呎,以每呎約35元租出,月租約96250元。

太古廣場每呎120元租出

至於買賣方面,黃竹坑 W50 新錄連環成交,市場消息指出,該廈高層2室,建築面積約575方呎,以約800萬售出,每呎造價約13913元,該廈另一成交為高層1室,建築面積約580方呎,亦約以800萬售出,呎價約13793元。

旺角好景商業中心高層5室,建築面積161方呎,以197萬售出,呎價12236元。

(星島日報)

更多環球貿易廣場寫字樓出租樓盤資訊請參閱:環球貿易廣場寫字樓出租

更多康宏廣場寫字樓出租樓盤資訊請參閱:康宏廣場寫字樓出租

更多尖沙咀區甲級寫字樓出租樓盤資訊請參閱:尖沙咀區甲級寫字樓出租

更多太古廣場寫字樓出租樓盤資訊請參閱:太古廣場寫字樓出租

更多金鐘區甲級寫字樓出租樓盤資訊請參閱:金鐘區甲級寫字樓出租

更多W50寫字樓出售樓盤資訊請參閱:W50 寫字樓出售

更多黃竹坑區甲級寫字樓出售樓盤資訊請參閱:黃竹坑區甲級寫字樓出售

疫情封關下,中資機構成本港商廈市場的租賃主力。眾安在綫 (06060) 旗下虛擬銀行眾安銀行 (ZA Bank) 承租上環無限極廣場高層全層樓面,月租約58萬元,料作擴充。

每呎55元 較舊約挫19%

市場消息指出,眾安銀行落實租用無限極廣場 28樓全層,建築面積約10603方呎,成交月租約58萬元,呎租約55元。

眾安銀行於2019年3月底成為首批獲金管局發出虛擬銀行牌照的3間營運商之一,亦是最早面世的虛銀。資料顯示,眾安銀行的本港辦事處位於薄扶林數碼港,是次租用主要商業區商廈,料作擴充用途。資料顯示,上述28樓全層舊租約2020年簽訂,當時月租約72萬元,每呎68元,最新呎租比兩年前下跌19.1%。

中金每月375萬租環球貿易廣場

不少中資機構相繼擴充,內地投資銀行中金公司 (03908) 承租尖沙咀九龍站環球貿易廣場 (International Commerce Centre, ICC) 55樓半層及56樓全層,總租用面積達5萬方呎,月租約375萬元,呎租約75元。該批單位原由德意志銀行租用,去年租約期滿已遷出,料租金較高峰期下跌25%。

此外,中環皇后大道中99號中環中心 55樓10室,建築面積2487方呎,以每月17.4萬元獲原租戶續約,呎租約70元。租戶原在2019年以22.4萬元租用上址,呎租約90元,現租金較3年前低22.2%。

(信報)

更多無限極廣場寫字樓出租樓盤資訊請參閱:無限極廣場寫字樓出租

更多上環區甲級寫字樓出租樓盤資訊請參閱:上環區甲級寫字樓出租

更多環球貿易廣場寫字樓出租樓盤資訊請參閱:環球貿易廣場寫字樓出租

更多尖沙咀區甲級寫字樓出租樓盤資訊請參閱:尖沙咀區甲級寫字樓出租

更多中環中心寫字樓出租樓盤資訊請參閱:中環中心寫字樓出租

更多中環區甲級寫字樓出租樓盤資訊請參閱:中環區甲級寫字樓出租

羅珠雄觀塘工廈地廠1.5億獲洽

受疫情及加息等因素打擊,有資深投資者放售旗下物業。由羅珠雄持有的觀塘開聯工業中心地廠,獲準買家以1.5億洽購。

資深投資者羅珠雄昨日向本報表示,旗下觀塘開源道55號開聯工業中心地廠,建築面積約1.1萬方呎,近期獲數名準買家洽購,作價約1.5億,呎價約13636元。據代理指,上述地廠現時由食堂以15萬租用,料回報約1.2厘。

據悉,羅珠雄於2018年以買賣公司形式購入上址,作價約9500萬,若最終以上述洽購價售出,持貨4年帳面獲利約5500萬,物業期間升值約57%。

另一方面,由其士與市建局合作的旺角傲寓,項目地鋪及一樓商鋪以「私人協商」形式放售,意向價約兩億。該項目位於大角嘴福澤街8號,於去年入伙,該物業共有兩層,包括傲寓地下及一樓其中一部分的商鋪連一樓私人戶外平台空間,設有兩條內部樓梯及一部電梯,面積逾8000方呎。

傲寓基座鋪位意向2億

有代理表示,大角嘴正進行多項大型收購項目,財團積極擴展版圖,隨着多個高端精品住宅項目落成,刺激民生鋪需求,吸納時尚餐廳等商鋪進駐,帶動區內人流。

(星島日報)

屋署6月批20圖則 恒地佔兩項目

梅艷芳故居壽臣山恒安閣 獲批重建

屋宇署今年6月批出20份建築圖則,恒地 (00012) 有兩個項目獲批,包括大埔舊墟直街美新里3號項目,最新獲批建1幢21層高的商住項目連住宅康樂設施,總樓面涉約4.85萬平方呎,其中住宅樓面佔約4.14萬平方呎。

上述項目於去年9月曾獲署方批准興建1幢樓高17層的商住大廈,當時的總樓面約4.32萬平方呎,即最新獲批方案的總樓面較舊方案高出逾5,000平方呎左右,並加入住客康樂設施。

同時,恒地旗下大角咀萬安街16至30號項目,亦獲署方批建1幢22層高 (另設3層平台) 的商住項目連住客康樂設施,涉及總樓面約5.78萬平方呎。

另已故天后梅艷芳故居壽臣山恒安閣,亦最新獲批重建1座樓高3層的分層住宅,總樓面約5.77萬平方呎。事實上,新地 (00016) 郭氏家族於2013年以1.47億元(呎價約36,127元)購入梅艷芳故居後,已正式統一整幢恒安閣的業權,完成當年長達6年的收購。

佳明粉嶺戲院地 建17層商住樓

而山頂種植道44號項目獲批重建1座3層高 (另設1層停車場) 的獨立屋,住宅總樓面約7,852平方呎。

至於在2020年由陳卓林家族成員陳思遠以4.51億元投得的大埔大埔公路--大埔滘段 (大埔市地段第241號) 住宅地,亦獲批建6座3至4層高的洋房、2座8至9層高的分層住宅 (全另設1層地庫) 連住客康樂設施,總樓面約9.5萬平方呎。

佳兆業資本 (00936) 早於2020年以8,590萬元投得的上海街445號蚊型地,獲批興建1座18層高 (建於3層平台之上) 的商住項目,總樓面約1.28萬平方呎。此外,佳明集團 (01271) 旗下粉嶺聯發街1號前粉嶺戲院地盤,獲批重建1座17層高 (另設2層地庫) 的商住項目連住宅康樂設施,總樓面約3.6萬平方呎。

另外,屋宇署該月批出4個過渡性房屋項目,其中規模最大的是將軍澳寶邑路項目,最新獲批興建2座4層高過渡性房屋,總樓面約10.7萬平方呎。

(經濟日報)

銅鑼灣商業區南延 10項目待發展

銅鑼灣近年有不少收購重建,當中禮頓道128至138號希雲大廈日前獲收購後,有機會重建成為商業項目,聯同加路連山道項目,進一步將銅鑼灣商業區向南面伸延。

粗略估算,目前銅鑼灣區內至少有10個商業項目,合共提供逾285萬平方呎樓面,除了加路連山道商業地外,其餘9個均屬舊樓或者酒店項目重建,大部分更由舊樓併購而成。

現時銅鑼灣商業區由北面的告士打道開始,去到南面的利園山區,電車路軒尼詩道兩旁更為繁華的零售區域,近10多年焦點開始轉移至南面,當中機電工程署總部遷出後,騰出了加路連山道大型商業地,造就銅鑼灣向南面擴展的契機。

加路連山地 增希慎利園山版圖

作為商業用地的加路連山道用地,於去年5月由希慎興業 (00014) 夥華懋以約197.78億元投得,將會興建3座16至24層高 (另設5層地庫) 的商廈,基座屬於商場、社區設施及停車場,總樓面約109.8萬平方呎。擁有利園山多幢商廈收租的希慎,在區內經營多年,早在去年初已經獲准在區內興建5條天橋及有蓋行人路貫穿旗下利園山的商業王國,包括上述的加路連山道地盤。

與此同時,位於禮頓道、加路連山道及希雲道交界的多幢舊樓,多年來亦獲財團收購,日前位於禮頓道128至138號、希雲街2至30號希雲大廈,經金朝陽 (00878) 收購後,便公布以約32.09億元沽出。該項目屬於兩面單邊地盤,鄰近以住宅、學校及醫院等社區設施為主,但隨着加路連山道商業地落成後,銅鑼灣商業版圖將進一步南擴,連帶動禮頓道一帶商業潛力。

希雲大廈佔地約1.32萬平方呎,屬於「其他指定 (混合用途)」用途,可以住宅或商業,又或者申請作混合兩者發展,若果以商業地積比率最高15倍計算,可建樓面約19.8萬平方呎,每呎樓面地價約1.62萬元。據金朝陽指,新買方為United Endeavor,徐意為最終實益擁有人,但未有交代其背景。市場有傳新買家具中資背景。

另外,利園山道5至27號、波斯富街54至76號,以及羅素街60號的舊樓群,近年由新世界 (00017) 所收購,目前正在申請強拍以統一業權,佔地約2萬平方呎,現時已經屬於「商業」規劃用途,若果以最高地積比率15倍發展,可建樓面將達30萬平方呎,預計將會較適合作銀座式商廈,或者基座為商場、樓上為寫字樓的綜合式商廈發展。

(經濟日報)

3,000 homes get go signal

The Buildings Department yesterday reported that it had approved 20 sets of building plans in June involving more than 3,000 small and medium-sized flats.

Of the approved plans, 16 were for apartment and apartment/commercial developments, with six on Hong Kong Island, three in Kowloon and 11 in the New Territories.

Consent was given for work to start on 16 building projects among the 20 plans, which when completed will provide 131,448 square meters of gross floor area for domestic use involving 3,094 homes plus 62,679 sq m of gross floor area for non-domestic use.

The largest of these is a residential project in the Tai Po Road-Tai Po Kau area, which is intended to be for multi-level flats and limited-height blocks of homes with a total floor area of around 95,090 square feet.

Two eight- and nine-floor buildings, five three-story blocks and a four-floor family dwelling with a basement are envisaged for the project.

And the building where the late Hong Kong singer and actress Anita Mui Yim-fong's home is located, Henredon Court at Shouson Hill, has been approved for redevelopment into a three-floor residential building involving a total floor area of 57,700 sq ft.

Sun Hung Kai Properties (0016) has meanwhile received 12,887 checks for its first round of sales at Novo Land's phase 1B, making the batch more than 70 times oversubscribed.

And Henderson Land (0012) announced it will be selling 32 units at The Henley I in East Kai Tak on Saturday, with the lowest price at HK$24,747 per sq ft.

Elsewhere, a luxury harbor-view five-room home at 21 Borrett Road in Mid-Levels has been rented at about HK$230,000 per month while a harbor-view duplex at Marinella in Aberdeen has gone for rental at HK$45,000 monthly.

Meanwhile, the mortgage-related one-month Hong Kong Interbank offered rate rose to 1.87446 percent, the highest since March 2020.

(The Standard)

URA’s Kwun Tong town centre redevelopment tender likely to draw muted response amid bleak economic outlook, analysts say

Only three to four bids can be expected from top developers because of the ‘large and long-term investment’, a surveyor said

Market observers expect the site to fetch between HK$18 billion and HK$20 billion, compared with earlier estimates of as much as HK$26 billion

The upcoming tender for the last phase of Kwun Tong town centre’s mega redevelopment will test the market’s resilience amid a weakening economy and high office vacancy rates in the area, market observers say.

The Kwun Tong Town Centre Project, which aims to turn the old district into a “small Taikoo Shing”, is the Urban Renewal Authority’s largest redevelopment project to date. The entire project occupies a site area of more than 500,000 sq ft spread over five plots and has been undertaken in phases since 2007. Taikoo Shing is Swire Group’s development in Quarry Bay, which includes flats, offices, a hotel and shopping centre.

Following the withdrawal of tenders for three commercial sites in the nearby Kai Tak Development area in 2019 and 2020, property consultants said they do not expect the Kwun Tong tender to draw many bids.

Only three to four bids can be expected from top developers because of the “large and long-term investment”, a surveyor said. “The market is no longer normal since the outbreak of Covid-19.”

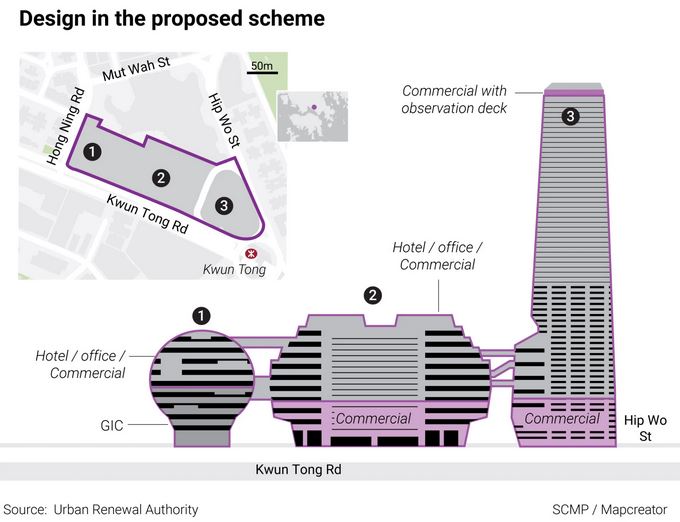

Last week, the URA asked developers and consortiums to formally show their interest in undertaking the Kwun Tong Town Centre Development Areas 4 and 5 Project. The deadline for submitting expressions of interest is September 7.

The current project covers an area of 25,595 square metres (275,502 sq ft). Upon completion, it will provide a maximum total gross floor area of 201,220 square metres.

The development proposal includes an egg-shaped building, a 60-storey commercial tower and a smaller building, according to the URA’s application to the Town Planning Board in July. The project will also include community facilities and a large open space.

The surveyor said that they have expected that Sun Hung Kai Properties (SHKP), which owns the APM shopping centre in Kwun Tong, and CK Asset Holdings to go it alone, while Henderson Land Development could be part of a consortium.

SHKP and Henderson declined to comment. CK Asset and Sino Land did not reply to requests for comment.

Sino Land was involved in the previous phases of the redevelopment, which included the Park Metropolitan residential project completed in 2014 and the Grand Central project in 2020.

The surveyor cuts the valuation for the site by nearly 20 per cent to HK$20 billion (US$2.5 billion), or HK$9,500 per square foot, saying “developers are conservative at the moment”. He previously estimated the plot to fetch between HK$22.7 billion and HK$26 billion.

The outlook for the Hong Kong’s economy does not look too bright. Last week, the government revised its full-year growth forecast from 1 to 2 per cent growth to between 0.5 per cent growth and 0.5 per cent contraction amid a worsening external trade environment. The revised estimates came after the gross domestic product shrank by 1.3 per cent year on year in the second quarter and 3.9 per cent in the first quarter.

This was preceded by a rate increase by the Hong Kong Monetary Authority (HKMA), which raised borrowing costs to 2.75 per cent, the highest since 2019. The HKMA’s chief executive Eddie Yue Wai-man warned of more interest rate increases in the coming months.

Another surveyor said “only the top-notch local developers would consider such a huge commercial project”.

The current vacancy rate of commercial buildings in East Kowloon, at 14 to 15 per cent, is the highest in Hong Kong, the surveyor said. More projects are still to be launched, the surveyor added.

The surveyor estimates that the site to fetch HK$8,500 per square foot, which translates to HK$18.4 billion.

The URA has initiated a pilot arrangement of “floating planning parameters” for the tender, taking “into consideration the uncertainties brought by the ongoing pandemic and the latest market circumstances”.

Under the arrangement, the total gross floor area will remain unchanged, while giving flexibility to the successful developer or consortium to determine the actual gross floor area within specified ranges for offices, hotels and other commercial uses for the commercial portion.

Another stipulation calls for a minimum of 65,000 square metres of commercial gross floor area to be sited at lower levels of the development to maintain its character of a “town centre”. The project is tentatively slated for completion in phases from 2028 to 2032.

The surveyor said that the URA introduced the floating parameter arrangement as it expects the project to carry certain risks given the backdrop of rising interest rates. The weakening economy is an added concern.

“The changes are due to the uncertainty surrounding the hotel and retail sectors. That is [why] the URA is leaving it to the developer whether to include a hotel in the new development,” the surveyor said. “Similarly, the developer could also decide to reduce the floor area allocated to the retail portion and [include] more office space.”

(South China Morning Post)