新蒲崗ArtisanLab頻錄大手洽租 新世界林浩文:力吸新派工業

新世界資產及房地產組合管理總經理林浩文指出,集團旗下新蒲崗重建工廈Artisan Lab意向呎租約18元,目標租戶以新派工業、工作坊及文化創作等行業,現時獲大手租洽租4萬方呎樓面,佔地約5全層,並料兩項目於一年內可租出逾9成樓面,每年租金收入約4000萬。

林浩文指出,新蒲崗近年發展迅速,區內文青氣息日趨濃厚之外,商貿活動亦與日俱增,見證區內迅速「變天」,有見及此,集團旗下於區內六合街兩大項目Artisan Hub及Artisan Lab,分別為工廈活化及工廈重建項目,鄰近鑽石山站,因兩項目具協同效應,整體招租部署以Artisan Hub引入主題餐廳及24小時健身中心等商戶,以增加社區人流量,繼而帶動兩項目的出租率及租金水平。

他續指出,位處六合街21號Artisan Lab,屬工廈重建項目,近期落成已頻獲多家公司洽租,全層面積由5000多方呎至8000多方呎,傾向出租予優質全層商戶,若樓面較大的樓面,有機會分拆至兩至3個工作室放租,面積由1000多呎起,項目現階段正進行租戶整合、希望引入優質商戶為項目帶出品牌效應,主攻租戶類型包括新派工業、文青藝術設計及創作媒體等商戶。

平均呎租約18元

林浩文指出,Artisan Lab設逾3000方呎的共享空間,樓底高約兩米多至4米,屬市場罕有供應,項目意向呎租約18元,與區內呎租若,故對同區商戶甚具吸引力,承租進駐作「升級」用途;他亦指出,該項目新錄設計建公司承租約8000方呎樓面,同時亦獲一組大手租客洽租4萬方呎樓面,佔地約5全層,反映項目質素備受肯定,並料Artisan Hub及Artisan Lab兩項目於一年內可租出逾9成樓面,每年租金收入約4000萬。

料每年收租4000萬

Artisan Lab,項目樓高22層,總建築面積逾12萬方呎,分間單位建築面積約1391至3576方呎,全層樓面則達8323方呎,部分樓層設有特色平台,至於位處六合街9號的Artisan Hub,屬工廈活化項目,總樓面約6.5萬方呎。

另一方面,林浩文亦指出,長沙灣荔枝角道888號南商金融創新中心約40%買家購入作收租用途,新世界會協助部分業主收租,於7月份合共租出約6萬方呎樓面,呎租約23至28元。

(星島日報)

更多南商金融創新中心寫字樓出租樓盤資訊請參閱:南商金融創新中心寫字樓出租

更多南商金融創新中心寫字樓出售樓盤資訊請參閱:南商金融創新中心寫字樓出售

更多長沙灣區甲級寫字樓出租樓盤資訊請參閱:長沙灣區甲級寫字樓出租

更多長沙灣區甲級寫字樓出售樓盤資訊請參閱:長沙灣區甲級寫字樓出售

企業廣場高層海景單位叫價2977萬

有代理表示,九龍灣企業廣場三期高層海景單位,建築面積約2290方呎,業主意向價2977萬元,呎價約1.3萬元,交吉放售。

該代理指出,單位配以寫字樓裝修,設有2房,擁開揚海景,即買即用。企業廣場三期設有大型停車場,可供租客使用,毗鄰國際交易中心、MEGABOX、Manhattan Place 等甲級寫字樓,而距離九龍灣港鐵站約8分鐘步程,亦有多條巴士線及小巴線來往各區,交通便利。

(信報)

更多企業廣場寫字樓出售樓盤資訊請參閱:企業廣場寫字樓出售

更多國際交易中心寫字樓出售樓盤資訊請參閱:國際交易中心寫字樓出售

更多九龍灣區甲級寫字樓出售樓盤資訊請參閱:九龍灣區甲級寫字樓出售

更多企業廣場寫字樓出租樓盤資訊請參閱:企業廣場寫字樓出租

更多國際交易中心寫字樓出租樓盤資訊請參閱:國際交易中心寫字樓出租

更多Manhattan Place寫字樓出租樓盤資訊請參閱:Manhattan Place 寫字樓出租

更多九龍灣區甲級寫字樓出租樓盤資訊請參閱:九龍灣區甲級寫字樓出租

Homes in New Territories sell like hot cakes

Hong Kong homebuyers continued to flock to new developments in the New Territories with One Innovale in Fanling receiving at least 1,200 checks after Novo Land in Tuen Mun sold out the first batch of 336 flats.

Henderson Land (0012) received at least 1,200 checks for the 123 flats released in the first price list for One Innovale - Archway - the first phase of One Innovale - making the batch 12 times oversubscribed. The list includes 16 studio, 96 one-bedroom, 8 two-bedroom and 3 three-bedroom units with an average price of HK$14,168 per square foot after discounts.

Thomas Lam Tat-man, general manager of sales department, Henderson Land, said most of the subscriptions were for the one-bed units. He said a second batch may be released as early as today, and there may be a modest increase in prices.

Sales are expected to start this coming weekend, he added.

One Innovale will offer a total of 603 flats when completed.

Meanwhile, Sun Hung Kai Properties (0016) said all 336 flats in the first round of sales for phase 1A at Novo Land were sold over the weekend despite a looming increase in the capped rate for Hong Kong interbank offered rate-based mortgage plan.

SHKP general manager of sales and marketing Andy Chan said that 123 flats in the third list - including 64 studios, 13 one-bedroom, 22 two-bedroom and 24 three-bedroom units - were priced at HK$3.28 million to HK$9.33 million or HK$13,255 to HK$15,427 per sq ft after discounts.

The fourth price list of 168 flats has now been released at an average price of HK$14,385 per sq ft after discounts, a slight increase over the third list's average price of HK$14,052 per sq ft after discounts.

Meanwhile, seven secondary sales were recorded across the top 10 housing estates in the last weekend of July, down 46 percent from the previous weekend and back to the single-digit level, according to Midland Realty. There were a total of nine deals across the top 15 estates, down 35.7 percent week-on-week, it added.

An property agency said that second hand sales were affected by the release of new projects,with the impact of rate hikes and a cautious attitude among buyers.

(The Standard)日資財團近3億放售2物業

今年以來大手物業買賣暢旺,日資西松建設趁勢放售兩物業,市值近3億,其中,粉嶺一幅倉地市值1.75億,平均每呎2000元。

粉嶺貨倉地1.75億放售

有外資代理行代理表示,該露天貯物地盤位於粉嶺坪輋,可由坪輋路及五洲路直達,距離打鼓嶺鄉村中心政府大樓,大約5分鐘步行距離,屬該區罕有交通便利的露天貯物地盤。

該代理續說,該地盤面積約87481方呎,地契為農地,城規用途為露天貯物,業主自用多年,存放建築機械,及部分出租,租客用來存放建築材料,該倉地已平整,具地政處豁免書,可合法搭建有尺寸限制的建築物,以供存放建築機械及材料。

該代理分析道,該地皮目前只有不足2000方呎搭建上蓋,根據契約,可有一半面積搭建上蓋,建築費用每呎約300元,市值呎租9至10元,令回報大為提高,適合用家自用或投資收租,更因鄰近北部都會區發展策略中的坪輋 / 打鼓嶺新發展區,長遠極具升值潛力。

星光行 10單位市值1.16億

另一放售物業為尖沙嘴星光行 5樓多個單位,506至512室及524至526室,部分單位更坐擁全海景觀,全部10個單位將交吉放售,總建築面積約8339方呎,屬近年少有大面積相連單位放盤,市值1.16億,平均每呎13910元。

該代理表示,星光行屬九龍傳統寫字樓,年中不乏放盤及成交,屬尖西指標核心辦公樓,兩項物業市值共近3億。

(星島日報)

更多星光行寫字樓出售樓盤資訊請參閱:星光行寫字樓出售

更多尖沙咀區甲級寫字樓出售樓盤資訊請參閱:尖沙咀區甲級寫字樓出售

財團申強拍金星工業大廈

土地供應短缺,財團加快併購舊樓步伐,土地審裁處最新「一口氣」接獲兩宗強拍申請,最矚目為財收購的葵涌金星工業大廈,向土地審裁處申請強拍,以統一業權發展,市場估值逾5.65億。事實上,連同上述兩個項目,今年來土地審裁處合共接獲16宗強拍申請,已追平去年全年的數字。

項目估值逾5.65億

文件顯示,目前該財團持有上址85.71%業權,餘下兩項物業及車位並未成功收購,涉及14.29%業權均由同一名業主持有,該批物業市場估值約1.0442億,市場對整個項目估值5.6571億。上址現為一幢7層高工廈,早於1972年落成,至今樓齡約50年,地盤面積約23570方呎。資料顯示,該工廈早前獲城規會批准重建為一幢樓高20層的數據中心,涉及總樓面約26.86萬方呎。

另外,樂風集團夥拍由博領資產管理及石壁投資併購的佐敦南京街19至21號舊樓,最新亦向該處申請強拍,目前該財團持有逾93.75%業權,現僅餘下地下一個物業並未成功收購,市場估值3018.1867萬,市場對整個項目估值1.08981467億。上址現為一幢8層高商住舊樓,地下為商鋪,樓上為住宅樓層,該舊樓早於1962年落成入伙,至今樓齡約60年。

該項目位於佐敦商業地段,毗鄰港鐵佐敦站約2分鐘步程,極具重建價值。

資料顯示,樂風集團等去年斥資7.5億,收購南京街11號至21號舊樓大部分業權,地盤面積擴展至約7250方呎,該地段現時劃入商業用途,若以最高地積比率12倍計算,涉及可建總樓面約8.7萬方呎。

(星島日報)

中環亞洲大廈頂層 意向價3500萬放售

中環特色單位罕有,現亞洲大廈頂層全層連天台放售,意向價約3,500萬元。

有代理表示,中環干諾道中33號亞洲大廈15樓全層連天台及上層天台,全層面積約893平方呎,意向價約3,500萬元,平均呎價約39,194元,以交吉形式交易。

連基本裝修 備獨立洗手間

該代理指,物業由業主自用多年,因有意移民故忍痛割愛,上述物業位於大廈頂層,可眺望維港景觀,連基本寫字樓裝修及備有獨立洗手間。

該代理補充,中環區商廈不足1,000呎全層的單位甚為罕有,獨立全層用途廣泛且私隱度高,加上物業專享外牆廣告權,面向人來人往的干諾道中,極具宣傳效益。物業大堂華麗,盡顯氣派,備受用家歡迎,出租率高;預計現時市值呎租約40元。

(經濟日報)

大鴻輝1.8億 購中環全幢舊樓

大鴻輝以1.8億元,購入中環荷李活道全幢舊樓。

涉及物業為中環荷李活道26號及28號的永寧大廈,該商住大廈於1958年落成,樓高6層,實用面積約為7,828平方呎。物業包括地下的兩間商舖,1樓、2樓、3樓的6個寫字樓單位,以及4樓和5樓共4個住宅單位,該地皮現劃為「住宅 (甲類)」用途。以1.8億元成交價計,呎價約2.3萬元。據悉,項目由大鴻輝購入。

(經濟日報)

新蒲崗兩工商項目 擁新式配套

新世界 (00017) 旗下新蒲崗兩工商項目近日入伙並進行招租,區內交通配套大為改善,加上物業具特色,有一定吸引力。

新世界近日推出兩項目招租,分別為Artisan Lab及Artisan Hub,同位於新蒲崗六合街。隨着去年港鐵屯馬綫通車,而鑽石山站出口步行至新蒲崗工商業區僅數分鐘,交通配套比以往完善。

Artisan Lab設靈活活動空間

其中Artisan Lab位於六合街21號,是區內罕有透過重建發展的全新工廈。項目樓高22層,總面積逾12萬平方呎,分間單位面積約1,391至3,576平方呎,全層樓面則達8,323平方呎,空間感十足,部分樓層更設有特色平台。

據了解,項目擁不少新式配套,是以往工廈項目極少出現,包括1樓逾830平方呎活動空間,間隔靈活,設開放模式及閉門模式,適合租戶舉辦活動或內部培訓工作坊。另外天台則設有約2,200平方呎綠化園林Artisan Oasis。

Artisan Lab正招租,已獲多間公司洽租,市場反應理想,其中人氣文青烘焙工房「享樂烘焙」因項目的地理優勢及新式建築設計,已承租5樓全層逾8,000平方呎樓面擴充業務。據了解,目前多層樓面亦洽租中,業主意向呎租約18元。

Artisan Hub保留建築歷史特色

另外,同地段9號Artisan Hub原為工廈,業主把物業活化成商廈。建築上保留了悠久的歷史特色,如外牆遮陽篷、水磨地板,同時加入創新設計及色彩,外形甚特別。

物業樓高11層,1至5樓為商用樓層,6至11樓屬寫字樓用途,全層面積由5,564至6,889平方呎。項目地下至5樓屬零售樓層,個別樓層適合飲食用途,中至高層適合瑜伽、健身室、辦公室及共享工作室等行業。用戶上,現時寫字樓租客包括創意產業ACOO、活動策劃公司Milton Exhibits及時裝Eleven Group Limited。租務方面,近日1樓獲健身室承租,2樓則獲空手道精英運動員李振豪成立的「Be Smove Karate Fitness」租用。據悉,項目意向呎租約16至18元。

新世界表示,兩項目處同地段,但定位不同,Artisan Lab屬全新工廈,適合文創、工作坊等使用;而Artisan Hub因屬商廈,故可作傳統寫字樓使用。兩項目若全數租出,每年租金收入可達4,000萬元。

(經濟日報)

荃灣新甲廈IEC3 特設多個特色戶

荃灣商業氣氛提升,而國際企業中心3期 (IEC3) 屬全新項目,物業景觀開揚,兼提供多個特色單位,質素於同區甚突出。

國際企業中心3期位於荃灣大涌道,該地段為傳統工業區,而近年漸出現新式商廈及工廈重建項目。物業對面為南豐紗廠,近年甚受年輕人歡迎,亦為地段注入活力。

位置上,由荃灣港鐵站出口,穿過愉景新城商場前往該廈,需時10分鐘以上,略為偏離港鐵站,而大廈其他配套算充足,大涌道及青山公路有多條巴士綫可前往港九新界,而大廈設有停車場,提供113個車位,故整體交通網絡尚算不俗。

飲食及生活配套上,由於附近主要為舊式工廈,餐廳選擇不算多,上班人士可前往愉景新城,商場內餐飲較多,或可選步行10分鐘至荃灣中心一帶。

159個寫字樓單位

大廈位處單邊,外形上不俗,而項目地下4間商舖,已全面營業,提供完善餐飲及零售服務,而地下電梯大堂旁設有咖啡室。物業樓高20層,2樓至22樓為寫字樓,共設159個寫字樓單位。

每層樓面大致上分為9個單位,1至3號單位面向大涌道,而4至7號室面向白田壩街。景觀上,以3號單位最理想,因面前高樓不多,可望非常開揚荃灣景觀,遠眺如心廣場,非常開揚舒適。

大廈另一賣點,是提供多組特色單位,物業2樓7、8及9號單位,提供特大花園平台,面積由683至2,183平方呎,另12樓3至5號單位,亦設有平台,面積由89至119平方呎,而20、21樓亦設平台單位,至於22樓3單位,則內置樓梯連同天台,項目提供10多組特色單位,適合用家及投資者。

資料顯示,第一集團於2018年初,以6億元購入荃灣大涌道18至20號地盤,地盤面積約1.8萬平方呎,可建樓面約17.27萬平方呎,每平方呎樓面地價3,474元,每層面積約1.2萬平方呎。其後集團透過補地價,為項目轉成甲廈用途,涉及金額逾9.2億元,以可建樓面約17.27萬平方呎計,每平方呎樓面補地價5,334元,當時創全港工廈轉寫字樓每呎補地價新高。

(經濟日報)

多個單位推售 1200萬入場

荃灣新甲廈質素不錯,現第一集團推售國際企業中心3期多個單位,入場費約1,200萬元起。

據第一集團表示,國際企業中心3期現進行發售,單位呎價約1.04萬元起,入場費約1,200萬元起。項目全數屬分間單位,適合中小型企業使用。

近日錄成交 呎價約1.07萬

買賣方面,近日該廈錄成交,涉及單位為3樓07至09室,建築面積約由1,065至1,791平方呎,平均呎價約1.06萬至1.07萬元,3個單位共約4,247平方呎,總成交金額約4,520萬元。據了解,買家為用家。

另外,本年5月,項目獲買家以4,201.68萬元購入19樓2及3室,以及2個電車車位和2個電單車位,上述單位面積共3,504平方呎,平均呎價約1.2萬元。資料顯示,登記買家為Ellensburg Limited,該公司董事為大家樂 (00341) 首席執行官羅德承。

據了解,目前第一集團於同區亦有國際企業中心1期甲廈項目在推售中,物業位於柴灣角街,料於年底正式入伙。

(經濟日報)

For Hong Kong’s Office Market, Border Reopening Holds Key to Unlocking Demand

“Increased space availability and the more attractive rental level in Hong Kong’s office market have created opportunities for occupiers to move into newer, greener buildings at a lower cost, but a broader rebound in demand will take root once the border with mainland China reopens”, a property agent says.

The Asian financial hub’s Grade A office rental rates fell 1.7 percent year-to-date as of June 2022, according to an agency’s office market research report. The agency predicts a 2-3 percent drop in rents for the full year, with a second-half recovery to be led by core CBD districts as the fifth wave of COVID-19 subsides.

All else remaining equal, the agent sees occupiers gravitating to newer buildings at the expense of Hong Kong’s aging office stock — unless owners take the initiative to make improvements to their decades-old properties.

“Most of the occupiers in the office sector are still looking for a cost-efficient real estate strategy,” the agent says. “Some of the large multinational corporations would look for offices with strong green credentials because they may need to comply with certain such certifications now or potentially in the future. As such, a flight-to-quality is really a strong recurring theme that we’re seeing on the ground nowadays.”

Emerging New Sectors Delivers Boost

The agency’s research shows that during the first half of 2022, office rents fell 1.6 percent year-to-date in Greater Central and 2.7 percent in Prime Central. Across the harbour, rents dipped by a milder 0.5 percent in Kowloon East and edged up 0.3 percent in Greater Tsimshatsui during the period.

Among the occupiers moving in Tsimshatsui was BKYO, a locally based fintech firm, leasing 23,400 square feet gross (2,174 square metres) of space at The Gateway Tower 5 in the second quarter. The agent says the move wasn’t surprising given the Hong Kong government’s strategy to support for tech-led sectors under the city’s development plan.

“The government is keen to push the new economy,” the agent says. “This is a long-term initiative in which Hong Kong would like to boost fintech, start-ups, medical science, innovation and technology (I&T), and other such related new businesses. This trend is set to stimulate new streams of demand from sectors like co-working space operators, TMT and healthcare to support Hong Kong’s office market going forward.”

COVID Optimism

Looking beyond offices, the agent anticipates that Hong Kong’s retail sector is bottoming out as lockdown measures start to ease. The agency’s report forecasts food and beverage rents to rise by 1 to 5 percent in the second half of the year, with some high street rents likely to reach 3 to 5 percent growth.

“We are expecting the social distancing policy to relax in the second half of this year,” the agent says, “this coupled with the next round of the Consumption Voucher program soon to be issued in August, and provided that there are no recurrences of extreme waves of COVID in the city, this could drive some momentum leading to greater stability and recovery in the retail market.”

On the investment side, demand for industrial properties is tipped to remain strong after global fund managers fuelled a rush of acquisitions in the first half. An emerging factor in this industrial demand is the opportunity for converting existing buildings into data centres, which was illustrated most recently with Angelo Gordon’s plan to transform a building in Tuen Mun into a 20-megawatt data centre facility.

With border restrictions having the potential to ease and business confidence returning, The agency sees opportunities for more fund manager activity in the city during the coming months.

“We see PE funds with dry powder poised to deploy,” the agent says. “Some of them may have hesitated or their activities were frustrated because of COVID in the first half of 2022, they now seem set to become increasingly active in the second half and into 2023. We expect industrial properties, hotels, and development sites will continue to gain traction among investors.”

(Mingtiandi)

For more information of Office for Lease at The Gateway please visit: Office for Lease at The Gateway

For more information of Grade A Office for Lease in Tsim Sha Tsui please visit: Grade A Office for Lease in Tsim Sha Tsui

太古坊二座錄大手洽租最新預租率近50%

太古地產公布,旗下鰂魚涌太古坊二座預租率接近50%,繼早前獲瑞士寶盛私人銀行承租4層樓面,涉近10萬方呎,該項目亦新錄承租個案,進駐租戶包括東方匯理香港、德國化工業巨頭巴斯夫集團及波士頓顧問集團等,此外,該項目早前錄大型銀行承租逾15萬方呎樓面,佔可租用樓面近20%,成為項目主要租戶;據業內人士指出,上述呎租約50元,涉及月租約750萬,為近年港島區最大手租務成交。

新錄東方匯理及巴斯夫承租

太古地產辦公樓業務董事Don Taylor表示,太古坊二座即將迎來多個新租戶,令原本已發展蓬勃的太古坊社區更添活力,實在令人期待。

在疫情持續不斷的情況下,企業工作模式亦改變,租戶在考慮辦公室選址時,比以往更着重員工的身心健康和工作效率。

樓高42層 料年底落成

瑞士寶盛大中華區私人銀行主管及香港分行行長戚志雄表示,集團視大中華為主要市場,本港更是發展重心,期待以太古坊二座作為擴展業務的重要基地。

太古坊二座預期於今年年底前落成,項目樓高42層,總樓面達100萬方呎,至於項目太古坊一座早於2018年9月竣工,前身為常盛大廈,是太古投資150億的太古坊重建計畫中,首幢落成的辦公樓,樓高48層,總樓面約100萬方呎。

(星島日報)

更多太古坊寫字樓出租樓盤資訊請參閱:太古坊寫字樓出租

更多鰂魚涌區甲級寫字樓出租樓盤資訊請參閱:鰂魚涌區甲級寫字樓出租

商廈物業有價有市,再錄大手成交。新世界旗下長沙灣南商金融創新中心新錄連環3宗成交,涉資近1億元,其中,該項目獲一組大手投資客以約6000萬連購兩伙,呎價約1.6萬。

投資客6000萬連購2伙

上述售出3伙均位於高層,屬海景戶,飽覽昂船州大橋全景,建築面積約1700至2200方呎,成交價介乎2700萬至逾3100萬,其中兩伙由一名投資者斥資近6000萬連環購入,呎價高近1.6萬。

該項目位處長沙灣荔枝角道888號,鄰近港鐵荔枝角站,至今已售出逾7成半樓面,套現逾65億,買家包括金融機構、高等院校、上市公司及其他專業服務機構。

據發展商早前指出,該商廈項目約40%買家購入作收租用途,新世界會協助部分業主收租,於今年7月份合共租出約6萬方呎樓面,呎租約23至28元;該項目約241個私人停車位早前於市場上放售,定價介乎200萬至220萬。

新世界近年在長沙灣區打造「甲廈商圈」,區內亦涉及項目為瓊林街及永康街項目,最快明年第四季竣工,分別提供樓面約120萬及42萬方呎,3商廈項目合共提供樓面達220萬方呎,逾5成樓面將作長綫收租用途。

(星島日報)

更多南商金融創新中心寫字樓出租樓盤資訊請參閱:南商金融創新中心寫字樓出租

更多南商金融創新中心寫字樓出售樓盤資訊請參閱:南商金融創新中心寫字樓出售

更多長沙灣區甲級寫字樓出租樓盤資訊請參閱:長沙灣區甲級寫字樓出租

更多長沙灣區甲級寫字樓出售樓盤資訊請參閱:長沙灣區甲級寫字樓出售

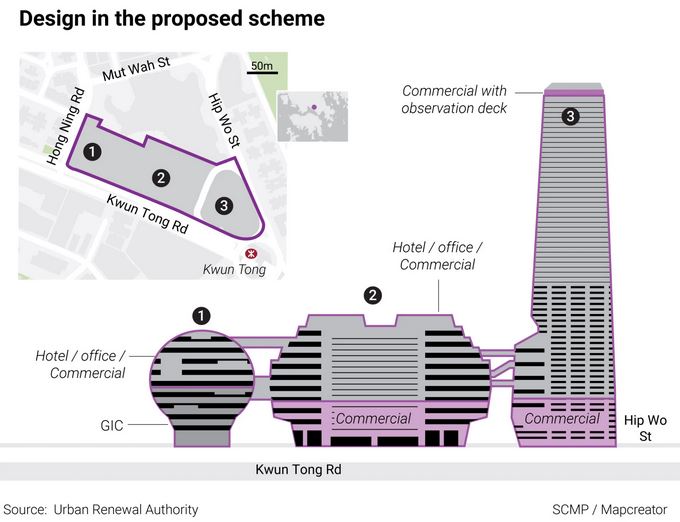

市建觀塘項目放寬商業限制 可剔除酒店發展增重建彈性

疫情及封關措施影響下,旅遊及酒店業大受打擊,連商業項目亦需要調整策略推出;市建局觀塘市中心重建計畫第4和第5發展區,最新向城規會提交修訂申請,調整酒店、寫字樓及商業零售組合比例,增加項目發展彈性,容許中標發展商視乎需要「變陣」,包括可放棄興建酒店等,惟整個項目可建總樓面維持約216.59萬方呎不變。業界指,整體商業氣氛不景氣,不排除有流標風險。

據城規會文件顯示,上述觀塘市中心主地盤第4及第5發展區項目位於新盤凱滙對出,毗鄰港鐵觀塘站,地盤面積約26.5萬方呎,包括約26.25萬方呎政府土地。興建2幢樓高13至64層、另有5層地庫的綜合商業大樓,可建總樓面約216.59萬方呎;商業用途分布相當有彈性。

最大修訂為酒店部分由指定興建約34萬方呎,修訂為不設樓面面積下限至最多34.44萬方呎,意味中標財團可選擇不興建酒店或最多提供400間酒店客房。

發展商:增項目吸引力

其次,寫字樓部分由列明須興建約70萬方呎樓面,最新修訂為70.89萬方呎至137.37萬方呎。最後商業用途樓面 (商店及服務行業、食肆、娛樂場所及教育機構),零售部分由原來指定須興建約100萬方呎樓面,最新修訂為69.97萬方呎至102萬方呎。另項目亦設有約7.08萬方呎政府、機構或社區設施樓面,及提供約2.18萬方呎的公共交通交匯處。

市建局指,因應2019至2020年度有3幅位於啟德的商業用地「流標」、加上疫情導致不穩定的酒店需求,以及去年底向發展商收集到不同的意見後,在可建總樓面不變下,調整發展參數增加彈性,容許未來中標發展商因應市場需求,適度調整准許的商業發展樓面作不同業務用途。而中標發展商日後可為三類非住宅業務,即為酒店、寫字樓及商業樓面提供可調整的彈性。

可建總樓面逾216萬呎不變

為保持項目位處策略性位置的「市中心」特色及形象,不論未來發展組合如何調整,該項目的下層保留不少於69.97萬方呎的商業樓面面積。

有發展商表示,修訂項目條款可增加吸引力,如可自行決定是否發展酒店。

另外,寫字樓及零售樓面亦有調整,增加彈性。有測量師說,在疫情影響下通關無期,旅遊及酒店業大受打擊,早前的規劃限制較多發展商未必有興趣,而是次改動容許中標發展商對各組合自行作出發展,增加項目彈性必定對標價有正面作用,惟近年商業地頻流標收場,而且整體商業氣氛不景氣,區內未來仍有不少商業項目供應,認為該項目仍有流標風險。

另一測量師表示,放寬項目發展限制,容許不同樓面作出調配可以增加項目吸引力,惟九龍東未來仍有不少寫字樓樓面新供應,在整體商業氣氛呆滯下,需要時間吸納,而且區內早前曾有不少同類項目流標收場,認為項目仍有流標風險。

(星島日報)

凱龍瑞基金4.3億購葵涌工廈 鄧成波家族沽貨 涉永昇90%業權

疫市持續不斷,加上中美衝突升溫,財團投資工廈熱情未減,鄧成波家族收購多年的葵涌永昇工業大廈約90%業權,剛以4.3億易手,買家為凱龍瑞基金。該項目早於年前申請強拍,尚餘七個單位未收購。

永昇工業大廈佔地逾2萬方呎,可塑性高,加上項目年前申請強拍,有望於不久的將來統一業權,自從鄧成波家族推出放售以來,頻獲財團洽購,消息人士透露,凱龍瑞基金已落實購入該廈約90%業權,作價4.3億,以地積比9.5倍計算 (未計可申請放售),可建總樓面約20.9萬方呎,今番易手涉及90%業權,計算樓面呎價約2286元。市場人士則指,新買家看中工廈發展前景,由於項目佔地龐大,可重建發展數據中心,應市場需求。

餘下7個單位未收購

本報昨日就上述消息分別向鄧成波家族及凱龍瑞基金作查詢,惟兩者均沒有作出回應。

葵涌永昇工業大廈位於永基路26至30號,佔地面積約2.2萬方呎,樓高約11層,於1979年落成,樓齡約43年,鄧成波家族早於2011年斥資約1.4億,購入該廈約80%業權,及後不斷收購,集齊90%業權,目前餘下7個物業未購入,當中包括2個車位,早於2020年10月申請強拍,當時全幢估值逾3.86億。今番沽售物業,料獲利可觀。

早於年前申請強拍

至於該項目買家凱龍瑞基金,近年活躍於市場,凱龍瑞基金除了入貨外,亦有出貨,早前推灣仔軒尼詩道全新商廈「333 Hennessy」現樓發售,並錄分層單位及全層成交,呎價約1.78萬至1.98萬,該廈樓高23層,地下至10樓為商鋪用途,11至23樓為商業用途。項目設計新穎,樓層設有廚房,會議室,適合作私人會所,非一般的傳統寫字樓用途。

基金旗下尖沙嘴金馬倫道項目亦有新進展,早前獲醫思健康 (2138) 認購30%股權,總額不多於2.75億,主要用作醫療中心及其他臨牀用途。

該基金近年併購尖沙嘴金馬倫道舊樓,集合業權,將發展銀座式商廈,總投資額約20億元。

2018年,該基金斥資13.5億向鄧成波購入灣仔謝斐道王子酒店,樓面約8.6萬方呎,其後斥資1億翻新,由酒店改商廈用途,易名為「凱聯」,並打造成提供辦公室及餐飲一站式主題商廈,現時出租率逾80%,呎租約40餘元,大廈內有餐廳、商務中心及會所等。

(星島日報)

更多 333 Hennessy 寫字樓出售樓盤資訊請參閱:333 Hennessy 寫字樓出售

更多灣仔區甲級寫字樓出售樓盤資訊請參閱:灣仔區甲級寫字樓出售

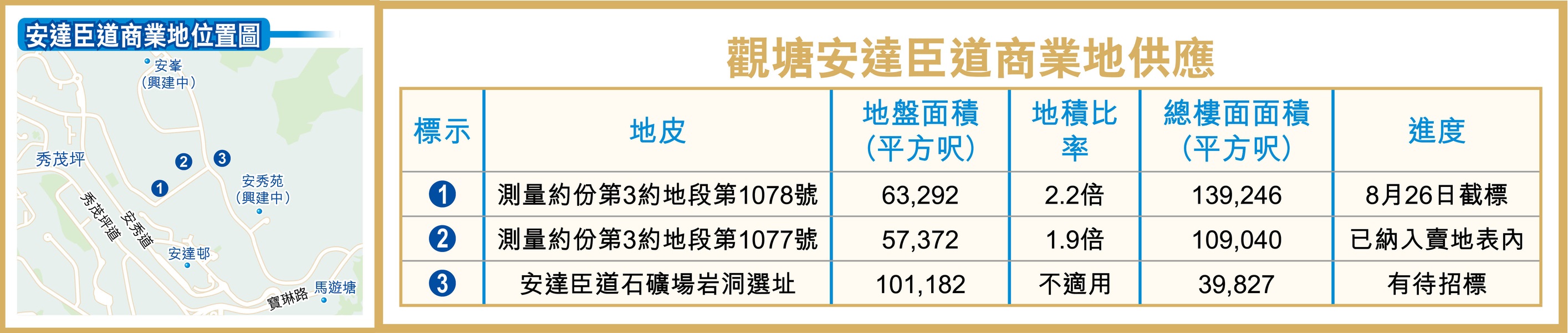

安達臣道石礦場首幅商業地 月底截標

前觀塘安達臣道石礦場屬於近年新發展社區,區內3幅商業地,提供近30萬平方呎商業樓面,其中1幅今季率先推出,可建樓面13.9萬平方呎,由於位置較偏離市區,相信將會發展成民生商場。

3地增29萬呎商業樓面

前安達臣道石礦場數年前關閉後,在修復之後重新發展成為住宅社區,隨着區內屋苑陸續落成入伙,居民移入將會對零售、餐飲以及社區設施需求增加。當年政府規劃期間,除了房委會安排在區內的3幅公營房屋用地內,提供共約1.83萬平方呎的零售設施外,亦安排了區內有3幅商業地以及2個岩洞發展選址,合共提供約28.8萬平方呎商業樓面。

當中最早推出為測量約份第3約地段第1078號用地,位於北南兩個住宅區中間,將與規劃中的室內運動場館組成文娛核心區,亦會成為安達臣道社區西面的進出口、經安健道接駁至秀茂坪的住宅區。

地皮佔地約6.3萬平方呎,規劃為商業用途,可建樓面約13.9萬平方呎,已經在7月29日開始招標,並將於8月26日截標。市場預計,該幅商業地皮估值約5.5億至8.5億元,每呎樓面地價約4,000至6,100元。

由於地皮規模屬於中小型,大約相當於一般住宅項目的基座商場,再加上位處較隔涉的民生區,預計較適合打造成為民生商場,提供一般餐飲、超市、民生商品滿足區內居民需求。項目投資額預計大約10億元,租金收入較為穩定,適合中長綫投資。

2地合併 減低流標風險

除了上述商業地外,地政總署亦將區內2幅商業地「打包」組成測量約份第3約地段第1077號商業地,並且納入賣地表內。該幅地皮由安禧街及安健道2幅相距甚遠的地皮組成,由於安禧街一端的商業地佔地只不足1萬平方呎,可建樓面更只有約4,844平方呎,吸引力低,獨立推出恐怕會「流標」收場,故此結合安健道另一幅規模相對較大的商業地「打包」推出,合併成的商業地佔地亦只有5.7萬平方呎,可建樓面不足11萬平方呎,仍然只是小型的商業項目。

商業地以外,安達臣道石礦場將會研究發展岩洞,成為商業設施,包括在岩壁上將規劃出兩個商業設施,合共提供近4萬平方呎商業樓面,可以作為咖啡廳、餐廳、紀念精品店、零售商店,以至酒窖、水療設施等商業設施。

(經濟日報)

長沙灣三相連全幢物業放售 市值2.3億

有業主放售位於長沙灣元州街三相連全幢物業,預計市價約2.3億元。該批物業涉及全幢業權100%。

有代理行表示,長沙灣元州街409至413號全幢,總地盤面積約3342.5方呎,預計整個項目市值約2.3億元。新買家可短期作收租用途,項目現時單是地舖的每月租金收入約13.43萬元,而其毗鄰面積及配套相若的地舖近期剛告續租,每月租金收入提升至約6萬元。

同時,物業投資方向靈活,除了可靜候區內大規模的收購重建發展外,新買家亦可考慮自行將項目重建成一座樓高26層的商住物業,地庫可作停車場,地下可作商舖及大廈入口,樓上則可作發展住宅,共提供約92個實用面積約400餘方呎的單位。

(信報)

Residential transactions dive 51pc

Hong Kong's Land Registry received only 3,671 sales and purchase agreements of residential units last month, down by 23.9 percent from June and 51.9 percent less than a year ago.

The value of the transactions for residential units also dropped to HK$33.9 billion, 25 percent less from June and 56.9 percent less year-on-year.

In addition, the number of all contracts also slid 20.6 percent monthly to 4,997 in July, 49.8 percent less than one year ago. The value of all agreement in July decreased to HK$41.9 billion, 21.9 percent less from June and 55.4 percent less than one year ago.

However, new flats have had warm welcome. Sun Hung Kai Properties (0016) has put the fifth price list for phase 1A of Novo Land in Tuen Mun on sale, offering another 168 flats at roughly the same price as the previous ones, after the first round sold out.

A total of 336 units as well as 12 units with special features go sale this Saturday, priced from HK$12,996 to HK$16,289 after discounts.

Elsewhere, the 246 homes on offer at One Innovale - Archway in Fanling were more than 11 times oversubscribed after receiving over 3,000 checks, the developer Henderson Land Development (0012) said.

Henderson plans to release 72 more flats this weekend, priced at HK$13,698 to HK$16,502 per sq ft after discounts.

(The Standard)

外資代理行:甲廈租金微跌 下半年升幅溫和

有外資代理行統計,上半年本港甲廈租金僅微跌,該行認為下半年核心區可帶動整體市況,租金料溫和增長。

據該行每月商廈租金走勢報告,7月份絕大部分商業區波幅不大,升跌均在1%之內,反映整體租金甚平穩。該行指,上半年港島區甲廈微跌0.7%,核心區如中環及金鐘更錄升幅,分別達114.7元及73.9元。

國際金融中心二期 連錄租務

報告亦提到,除了寫字樓物業之間為了留住現有租戶的激烈競爭外,業主和共享辦公空間營運商的競爭也很激烈。業主現更願意提供靈活的租賃條款,並為租戶提供設備齊全的辦公空間。隨着租金下調,更多租戶正在重新考慮傳統的辦公室選擇。因租金回調,部分商戶進行升級,如一家加拿大投資機構,原租用商務中心,現轉租國際金融中心二期約4,500平方呎單位。

國際金融中心二期近期錄數宗租務,其中高層11至16室,建築面積約8,733平方呎,成交呎租約150元。物業屬極高層,景觀甚佳,新租客為投資機構。另外,該廈約2.75萬平方呎樓面,獲美資投資銀行富瑞金融集團 (Jefferies) 租用,該公司原租用同區長江集團中心,趁租金下跌轉租國際金融中心二期。據悉,有關樓面原由野村證券租用,集團早前棄租。此外,另一家美資機構景順投資 (Invesco),租用怡和大廈約3.1萬平方呎樓面,機構原租用同區花園道3號,亦屬辦公室升級。

該行預計,核心商業區的寫字樓需求將持續增加並支持整體租賃市場,推動寫字樓租金將在2022年下半年錄得溫和增長。

九龍續租個案多

至於九龍區方面,近日租務以搬遷為主,包括一家船務公司,原租用觀塘 Two Harbour Square 商廈,現轉租尖沙咀港威大廈約2.3萬平方呎樓面。

該行指,從近期的租戶搬遷來看,市場對靈活辦公空間的需求不斷增長,租戶尋求升級或優化寫字樓仍然是九龍區寫字樓租賃市場的主要趨勢。除了追求寫字樓的質量外,九龍區租賃市場內租戶間對優質辦公室的競爭,很大程度上受到租戶續約的支持。7月份九龍區錄得了一些重要的租戶續約個案。

展望未來,在市場不確定的情況下,預計租賃需求將繼續萎縮。在通關之前,相信租戶在未來3至6個月內將保持謹慎,寫字樓租金將維持平穩。

(經濟日報)

更多長江集團中心寫字樓出租樓盤資訊請參閱:長江集團中心寫字樓出租

更多國際金融中心寫字樓出租樓盤資訊請參閱:國際金融中心寫字樓出租

更多怡和大廈寫字樓出租樓盤資訊請參閱:怡和大廈寫字樓出租

更多花園道3號寫字樓出租樓盤資訊請參閱:花園道3號寫字樓出租

更多中環區甲級寫字樓出租樓盤資訊請參閱:中環區甲級寫字樓出租

更多Two Harbour Square寫字樓出租樓盤資訊請參閱:Two Harbour Square 寫字樓出租

更多觀塘區甲級寫字樓出租樓盤資訊請參閱:觀塘區甲級寫字樓出租

更多港威大廈寫字樓出租樓盤資訊請參閱:港威大廈寫字樓出租

更多尖沙咀區甲級寫字樓出租樓盤資訊請參閱:尖沙咀區甲級寫字樓出租

瑞士寶盛租太古坊二座 涉10萬呎

港島東太古坊二座今年落成,據悉目前出租率近5成,而瑞士寶盛租用其中4層,涉10萬平方呎樓面。

太古坊二座預期於今年年底前落成,為太古地產 (01972) 投資150億元的太古坊重建計劃中最新亮點。太古坊二座樓高42層,總樓面面積達100萬平方呎。早前瑞士財富管理公司瑞士寶盛承租4層辦公樓面,面積合共近10萬平方呎,太古坊二座陸續迎來新租戶,其中包括全球最大資產管理公司之一東方匯理香港、國際化工公司巴斯夫集團,及旗艦管理顧問波士頓顧問公司。

另外,一家銀行確認租用太古坊二座總樓面面積逾15萬平方呎辦公空間,佔大廈的可租用樓面面積近20%,成為太古坊二座的主要租戶,亦是近年港島區最大租務之一。據悉,目前項目預租率接近5成。

總樓面百萬呎 預租近5成

瑞士寶盛大中華區私人銀行主管及香港分行行長戚志雄表示,視大中華地區為主要市場,其中香港更是發展重心,故期待以太古坊二座作為擴展區內業務的重要基地。

(經濟日報)

更多太古坊寫字樓出租樓盤資訊請參閱:太古坊寫字樓出租

更多鰂魚涌區甲級寫字樓出租樓盤資訊請參閱:鰂魚涌區甲級寫字樓出租

遠展12.4億 低價奪市建局西營盤地

樓面呎價13085 發展商:入標已計加息因素

遠東發展 (00035) 以12.4億元投得市建局西營盤崇慶里 / 桂香街發展項目,每呎樓面地價約13,085元,屬於市場預期下限。發展商指,港島地皮供應罕有,長遠看好區內發展前景。

遠東發展地產總裁方文昌回覆本報查詢時指出,集團十分高興投得上述項目,因為用地位處港島市區,屬於罕有供應,而且地點優越,鄰近港鐵西營盤站兩個出口,交通便利,加上西營盤屬於發展成熟的社區,配套充足,因此集團看好項目的發展前景,並初步預計發展中小型單位。

擬發展中小單位

另外,問及加息對樓市影響。方文昌指,當時入標已經計入加息、項目設計條款等因素,又預計未來本港的加息幅度緩慢,而且市區剛性需求強勁,故對項目發展有信心。

項目於上月已共接獲9份標書,多家大型發展商均派代表到場入標,包括會德豐、新地 (00016) 、新世界 (00017) 、信置 (00083) 等。截標前市場對項目估值介乎約12.8億至16.1億元,每呎樓面地價1.35萬至1.7萬元。

參考EPRC經濟地產庫資料,鄰近上述項目之近半年平均成交實用呎價,半新盤薈臻的呎價約22,934元,而藝里坊‧1號則約31,372元。

有測量師表示,是次中標價合理,而且該區近年新盤售價約2.8萬至3萬多元左右,估計該區住宅項目的承接力不俗。

項目旁邊是崇慶里兒童遊樂場,佔地約1.16萬平方呎,總樓面約9.48萬平方呎,預計將建成商住項目,提供約165伙私人住宅。中標發展商需要按照發展協議中列明的標準與品質、可持續發展及智能系統要求,以發展新項目。

(經濟日報)

上月工商鋪註冊錄366宗

受疫情及加息等利淡因素「夾擊」,工商鋪觀望氣氛籠罩。有代理行綜合土地註冊處資料顯示,工商鋪市場於上月錄註冊量366宗 (主要反映6月份市況),按月下跌約29.6%,註冊金額則錄58.94億,按月微升約5.9%。

今年7月工商鋪各板塊註冊宗數全綫下跌,工廈及商金註冊量分別按月降約34.4%及28.6%,最新分別錄187及100宗,商廈註冊量則按月跌約16.8%,最新報79宗,連升三個月後再次回落。7月份整體註冊宗數最新報366宗,數字再度跌至今年低位,按月挫約29.6%。7月份整體註冊金額錄58.94億元,按月微升約5.9%。

註冊金額按月微升5.9%

7月逾1億物業註冊宗數錄4宗,按月減少1宗,當中工廈及鋪位物業註冊各佔兩宗,工廈包括元朗宏業東街8號晉美工業大廈全幢及葵涌貨櫃碼頭路51至63號葵順工業中心10樓全層,分別以約2.6億及1.195億成交,而鋪位物業登記則包括以13.6億成交的大埔曉運路10號運頭塘邨全幢商場。

該行代理表示,雖然市場一直對通關充滿期待,但現時通關時間表仍然未知,令市場觀望氣氛濃厚,使上月工商鋪註冊宗數大幅回落。

(星島日報)

Far East wins Sai Ying Pun URA race for $1.24b

Far East Consortium (0035) has won a Urban Renewal Authority residential project in Sai Ying Pun for HK$1.24 billion.

The project to redevelop Sung Hing Lane and Kwai Heung Street went to Mega Source Global, a fully owned subsidiary of FEC.

The project covers a site area of 1,077 square meters and will provide a total gross floor area of about 8,804 sq m.

After redevelopment the site will offer about 165 homes.

The average floor area price is HK$13,085 per square foot. That compares to an earlier market valuation of HK$13,500 to HK$17,000 per sq ft.

The authority also expects the renewal project to connect with a nearby children's playground and to improve pedestrian access between Des Voeux Road West and Kwai Heung Street.

Additionally, the renewal authority requires the developer to comply with environmentally sustainable and smart provisions to help create a sustainable living environment.

Far East Consortium's chief of property Raymond Fong remarked that land on Hong Kong Island is in short supply.

He noted the site is convenient for transportation by being close to two exits of Sai Ying Pun MTR station. And with Sai Ying Pun being a well developed community, Far East is positive about the project.

The project attracted nine bidders including Sun Hung Kai Properties (0016), New World Development (0017) and CK Asset (1113).

(The Standard)

Two more projects to enter red hot market

Two projects in Sai Kung and Ho Man Tin offering altogether 1,154 units will join the red hot primary property market, as three big projects go on sale this weekend.

The Lands Department received two applications for presale consent in July: Phase 1 of Shap Sze Heung in Sai Kung with 773 flats developed by Sun Hung Kai Properties (0016) and the Grand Homm in Ho Man Tin with 381 flats.

The authority also approved presales for two projects: Phase 1 of Park Peninsula in Kai Tak, developed by Wheelock Properties and several other developers, will have 1,017 flats while the One Innovale-Archway developed by Henderson Land Development (0012) will offer 603 flats in Fanling.

The first batch of 318 flats at One Innovale-Archway to be sold on Saturday, was 21 times oversubscribed with over 7,000 cheques by 8 pm yesterday, according to Henderson Land's general manager of the first sales department Thomas Lam Tat-man.

Meanwhile in Tuen Mun, Grand Jeté kickstarts the hot market with 80 flats for sale today, and Sun Hung Kai Properties' Novo Land follows tomorrow after receiving more than 13,000 cheques for the 336 flats on offer.

According to Rating and Valuation Department, 1,200 flats were completed in the first half of 2022, an 18-year high.

Moreover, 1,700 nano flats will be completed this year, nearly triple that of 2021, while the relaxation on the mortgage insurance programme and interest rate hikes will put pressure on prices, a property agency said.

(The Standard)

金鐘力寶中心呎租45元跌15%

受疫情等因素衝擊,核心區甲廈租金急下滑。金鐘力寶中心中層單位,於交吉半年後,以每呎45元租出,較舊租金下跌約15%。

交吉半年始租出

市場消息透露,金鐘力寶中心一座中層6室,建築面積約2100方呎,新以每呎約45元租出,月租約9.45萬,據悉,上址舊租金為每呎約53元,惟租戶於今年2月租約屆滿遷出,業主亦將單位重新放租,故最新租金較舊租金下跌約15%,屬貼市水平。

事實上,該甲廈於疫市下租金備受壓力,資料顯示,該廈二座高層相連單位,於上月以每呎約49元租出,較舊租金急挫逾3成;據業內人士指出,力寶中心於疫市租金跌幅「最傷」,主要因為該甲廈早已賣散業權,各小業主於租務市場上可謂「各自為政」,為免單位丟空,業主願減租吸客。

至於買賣方面,該甲廈近期較矚目成交為二座高層2室,屬多按物業,建築面積1341方呎,於上月以3710萬售出。地產代理指出,2016年起業主曾3次向多家財務公司承造按揭,現時成交價屬市價水平,買家為中資企業。

據了解,原業主早於1996年斥資2120萬,一併購入上述單位及毗鄰3室,計入上月以2970萬售出的3室,以及是次以3710萬售出的2室,合共套現6680萬,持貨26年帳面獲利4560萬。

(星島日報)

更多力寶中心寫字樓出租樓盤資訊請參閱:力寶中心寫字樓出租

更多金鐘區甲級寫字樓出租樓盤資訊請參閱:金鐘區甲級寫字樓出租

更多力寶中心寫字樓出售樓盤資訊請參閱:力寶中心寫字樓出售

更多金鐘區甲級寫字樓出售樓盤資訊請參閱:金鐘區甲級寫字樓出售

疫市下商廈物業仍備受追捧,再錄大手成交。上環東協商業大廈低層全層易手,作價7800萬,呎價約1.6萬,低市價約5%。

上環德輔道中244至248號東協商業大廈7樓全層以7800萬售出,以建築面積約4870方呎計,呎價約1.6萬,原業主於1988年以841.3萬購入,持貨34年帳面獲利6985.7萬,期間升值逾8倍。

據地產代理指出,上址早前於市場以1.1億放售,惟受疫情及美國聯儲局連番加息影響,市場洽購問盤淡靜,令業主議幅逐步擴闊,成交價低市價約5%,上址現時由會計師行以17.5萬租用,料買家享租金回報約2.7厘。

美國銀行中心低層意向4998萬

有代理表示,金鐘夏愨道美國銀行中心 6樓10至11室,建築面積1428方呎,意向價4998萬,呎價3.5萬,該物業以交吉形式出售,亦以每呎47元招租。

此外,另一代理稱,中環皇后大道中79至83號萬興商業大廈低層A室,建築面積約850方呎,業主意向售價約1870萬,呎價約2.2萬。

(星島日報)

更多東協商業大廈寫字樓出售樓盤資訊請參閱:東協商業大廈寫字樓出售

更多上環區甲級寫字樓出售樓盤資訊請參閱:上環區甲級寫字樓出售

更多美國銀行中心寫字樓出租樓盤資訊請參閱:美國銀行中心寫字樓出租

更多美國銀行中心寫字樓出售樓盤資訊請參閱:美國銀行中心寫字樓出售

更多金鐘區甲級寫字樓出租樓盤資訊請參閱:金鐘區甲級寫字樓出租

更多金鐘區甲級寫字樓出售樓盤資訊請參閱:金鐘區甲級寫字樓出售

恒基大坑項目申強拍底價逾5.8億

市區可供發展地皮有限,不少財團變陣併購舊樓申請強拍,藉此增加土地儲備。其中,恒基收購多年的大坑新村街項目,上月獲土地審裁處頒下強制售賣令之後,落實於本月25拍賣,底價為5.887億。

根據早前土地審裁處文件顯示,恒基早於2020年申請強拍新村街23及24號舊樓,但公司於今年5月中旬,向土地審裁處建議將已持有的新村街鄰近舊樓,一併納入是次強拍範圍,令整個強拍範圍擴展至新村街17至25號。

料重建後樓面逾4萬方呎

負責是次拍賣的代理指,上址由5幢5至7層高唐樓組成,其中17及17A號地下為商鋪,1至5樓為住宅單位;18及19號地下為商鋪,1至4樓為住宅單位;21及22號地下為商鋪,閣樓為儲存倉,1至5樓為住宅單位;23及24號地下為商鋪,1至5樓為住宅單位;25號地下為商鋪,1至5樓連天台為住宅單位。

資料顯示,新村街23及24號舊樓地盤面積約845方呎,連同新加入強拍的舊樓,合併後整項目為新村街17至25號,地盤面積擴展約4497方呎。根據銅鑼灣分區計畫大綱核准圖,該地皮現劃為「住宅 (甲類) 1」用途,預計未來重建後總樓面約40473方呎,若以強拍底價計算,每方呎地價約14545元。

恒基持有新村街23號全數業權,新村街24號餘下一地鋪未能收購,曾於20年至22年間三度向小業主收購遭拒,其後21年8月及今年5月出價提高至1809萬,惟仍未能打動小業主。

(星島日報)

保柏香港租海濱滙6.6萬方呎樓面

醫療保險公司保柏香港,租用九龍灣海濱滙 2座兩層樓面,涉約6.6萬方呎。而保柏香港總部原在鰂魚涌柏克大廈,早前已遷往海濱滙 2座6樓。

保柏香港表示,新總部位於海濱滙 2座兩層樓面,樓面6.6萬方呎,辦公室內設有樓梯連接兩樓層,將容納超過960名辦公室員工。

保柏亞太區行政總裁Hisham El-Ansary表示,集團正發展成一家綜合的健康和保健公司,海濱滙的總部將辦公室支援員工集中到同一地點,是實現這發展目標的關鍵一步。

保柏香港旗下3個業務,包括在港醫療保險 (保柏亞洲有限公司)、國際醫療保險 (保柏環球) 和醫療保健服務 (卓健醫療),將全部遷往海濱滙,將可增強協同效益並推動保柏的轉型發展。

據了解,海濱滙最近樓面呎租26元至30元。

(信報)

更多海濱匯寫字樓出租樓盤資訊請參閱:海濱匯寫字樓出租

更多觀塘區甲級寫字樓出租樓盤資訊請參閱:觀塘區甲級寫字樓出租

更多柏克大廈寫字樓出租樓盤資訊請參閱:柏克大廈寫字樓出租

更多鰂魚涌區甲級寫字樓出租樓盤資訊請參閱:鰂魚涌區甲級寫字樓出租

美國銀行中心低層相連戶 意向價4998萬

中區商廈屬本港行政及商業核心要塞而屢受企業注目,恒基新近剛宣布旗下地標式甲廈 The Henderson 獲國際投資公司凱雷預租約2萬平方呎樓面,作為該集團亞太區總部,意味着跨國企業對香港金融中心地位投下信心一票。

新近有業主看準市況,交吉形式放售金鐘美國銀行中心低層相連戶,意向價約4,998萬元。

備醫務裝修間隔 合相關行業

有代理表示,位處金鐘夏愨道12號的美國銀行中心 6樓10至11室,總建築面積約1,428平方呎,意向價約4,998萬元,每呎叫價35,000元。物業將以交吉形式出售,單位享開揚城市景觀,而且附有醫務裝修間隔,合相關行業進駐,可即買即用,節省裝修成本及時間。

同步放租 每呎叫租47元

該代理補充,物業為區內知名指標甲廈,交通四通八達,質素上乘,甚具競爭力,向來深受企業歡迎;另外,單位同時以每平方呎約47元招租。而據資料顯示,2022年上半年香港區指標甲廈僅錄得8宗買賣個案;同時,美國銀行中心相連戶放售盤源緊絀,對上一宗成交亦已需要追溯至2021年尾,成交為11樓08至09室,面積約1,410平方呎,成交呎價約37,000元。

金鐘廊重建 起協同效應

該代理續稱,近年受疫情反覆及環球經濟不景氣所影響,寫字樓市場觀望氣氛濃厚,而隨着東鐵綫過海段通車後,令中區交通網絡更趨完善,加上政府展開金鐘廊重建發展計劃及比鄰夏愨道10號長江集團中心二期快將落成,在協同效應下,該廈升值潛力將被看高一綫。至於,現時甲級商廈造價跟隨大市走勢而有所調整,令以往一盤難求的指標商廈議價空間擴大,料可為個別實力投資者及用家締造入市良機,而是次出售單位質素上乘,在現時放售盤源中叫價亦最為相宜,相信會吸引企業或用家加快落戶,藉此提升品牌形象。

(經濟日報)

更多The Henderson寫字樓出租樓盤資訊請參閱:The Henderson 寫字樓出租

更多長江集團中心二期寫字樓出租樓盤資訊請參閱:長江集團中心二期寫字樓出租

更多中環區甲級寫字樓出租樓盤資訊請參閱:中環區甲級寫字樓出租

更多美國銀行中心寫字樓出租樓盤資訊請參閱:美國銀行中心寫字樓出租

更多美國銀行中心寫字樓出售樓盤資訊請參閱:美國銀行中心寫字樓出售

更多金鐘區甲級寫字樓出租樓盤資訊請參閱:金鐘區甲級寫字樓出租

更多金鐘區甲級寫字樓出售樓盤資訊請參閱:金鐘區甲級寫字樓出售

中資減在港投地 首7月入標數僅佔4%

業界:市場競爭減 料未來地價較平穩

受內房危機影響,中資減少在港投地,今年首7個月政府4次招標住宅官地,僅得兩個中資財團入標,佔比僅4%,相較去年1成比例有所減少。分析預計,市場競爭減少,未來地價將會較平穩。

據本報統計,連同年初流標的屯門青山公路「限呎地」,政府今年至今共推出4幅住宅官地招標,合共接獲46份標書,平均每幅地接獲11份標書,最多是由太古地產 (01972) 以19.6億元奪得的灣仔皇后大道地皮,共有21份標書。

今年4官地招標 僅兩間中資入標

在所接獲的46份標書之中,中國海外 (00688) 及中信泰富兩間中資財團分別就灣仔地皮提交標書,佔入標總數僅4%;相較之下,去年全年政府推出8幅住宅官地,共接獲90份標書,連同合資財團計算,至少有9份涉及中資財團、比例10%明顯減少。而且今年入標的兩間中資財團均屬國企,跟去年既有國企亦有民企有所不同。

若對比2020年,當年全年推出10幅地皮,共接獲136份標書,當中便有至少18份涉及中資財團,比率達13%。相較之下,近兩年在內房危機影響下,中資財團在港投地的活躍程度大減。

中資財團減少入標,投得地皮次數亦相應減少。2020年所批出的10幅官地便有至少4幅由中資財團奪得,比率高達4成;但去年只有中渝置地 (01224) 主席張松橋聯同九龍倉 (00004) 等聯手投得山頂文輝道地王。而今年成功批出的3幅地皮,更全由港資及外資財團奪得。

內地資金鏈添壓 投地活躍度降

有代理指出,中資投地活躍程度減少,跟內地資金鏈壓力有關,特別是香港項目的回本期長,在現時情況下未必太受內地發展商歡迎,相信這個因素不會在短期內能夠消除,政府賣地相信由本地財團為主。

至於中資搶地潮減退對於地價影響,該代理指,競爭減少相信地價亦不會爭得那麼貴,特別過往一段時間中資積極投地,有時候投地價錢相當進取,刺激市民預期地價貴、樓價將會更貴,形成一個循環,在現時情況下相信地價走勢將會較為平穩。

(經濟日報)

Office occupancies fall

Swire Properties (1972) saw the occupancy rate in its Hong Kong office portfolio fall a percentage point to 96 percent as of the end of June compared to the end of last year.

Pacific Place's office occupancy rate fell by one percentage point to 97 percent with a negative rental reversion of 18 percentage points in the first half.

And Taikoo Place, whose office occupancy rate also slid one percentage point to 96 percent, saw the negative rental reversion of 3 percentage points.

It said the negative reversions recorded for the two office towers were due to rentals being concluded three years on from the previous peak of the market.

The occupancy rate for Taikoo Hui Offices in the mainland slipped by a percentage point to 94 percent while that for One Indigo rose 2 percentage points to 95 percent.

In its Hong Kong retail portfolio, the occupancy rate for three malls remained unchanged, though their retail sales dipped. While sales for Cityplaza fell 4.9 percent, that of Citygate Outlets and The Mall, Pacific Place fell 1.8 percent and 1.6 percent respectively.

(The Standard)

For more information of Office for Lease at Pacific Place please visit: Office for Lease at Pacific Place

For more information of Grade A Office for Lease in Admiralty please visit: Grade A Office for Lease in Admiralty

For more information of Office for Lease at Taikoo Place please visit: Office for Lease at Taikoo Place

For more information of Grade A Office for Lease in Quarry Bay please visit: Grade A Office for Lease in Quarry Bay

Huge demand for flats at Fanling

Henderson Land (0012) said it has received 4,500 cheques for One Innovale-Archway in Fan Ling, which will kick off sales this weekend, when other two major projects in Tuen Mun also go on sale.

The 318 flats at One Innovale-Archway which go on sale this Saturday were more than 13 times oversubscribed as of 6 pm yesterday.

Henderson Land's general manager of the first sales department Thomas Lam Tat-man said the one-room flats with a cloakroom, from 272 to 329 square feet, had received the most inquiries from potential buyers as the cloakroom could be transformed into a space for other purposes.

Meanwhile, Sun Hung Kai Properties (0016) said there are an increasing number of customers interested in three-bedroom flats at phase 1A of Novo Land, which has received 10,000 cheques ahead of the second round of sales of 348 flats this weekend.

The three-bedroom units are expected to be sold out this weekend because flats priced within HK$10 million are in low supply and buyers can opt for a 90 percent mortgage, SHKP's real estate agency general manager Andy Chan Hon-lun said.

Also this week, Grand Jeté in Tuen Mun will put 80 flats up for sale on Friday. Developed by Sun Hung Kai Properties and CK Asset (1113), the project will offer 75 flats priced from HK$11,996 to HK$17,261 per sq ft and the other five with rooftops for sale by tender.

(The Standard) 工商鋪錄337宗買賣按月跌24%

據一間代理行統計,7月份工商鋪表現疲弱,市場僅錄約337宗成交,按月跌幅約24%,為今年度按月新低。

代理行:金額48億按月跌39%

該行認為,經濟及政治局勢持續不明朗,短期內工商鋪持續淡靜,當中寫字樓表現看淡。該行代理表示,根據資料顯示,7月份工商鋪僅錄約337宗成交,為過去7個月新低,與6月份約444宗比較,則下調約24%,而與去年同期比較亦下跌約46%。

7月份金額錄約48億,較上月約79.11億跌約39%,去年同期約147.09億比較,跌幅達67%。

同時,在工商鋪範疇中,以商廈表現最差,僅錄約44宗買賣,與6月相比下降約23%,為今年度第二新低,涉及金額約4.01億,較6月約10.02億,急跌近60%,跌幅較整體工商鋪為高,反映寫字樓買賣最受影響。

該代理續指,投資者入市心態亦變得更謹慎。7月份工廈市場共錄約193宗買賣,對比6月急跌約33%,按年亦遞減約49%,7月份工廈成交金額15.91億,按月跌48%,較去年7月大跌72%。

(星島日報)

希慎廣場 2層地庫拆細引進餐飲等服務行業

本報早前率先披露,承租銅鑼灣希慎廣場地庫及地鋪兩全層的免稅店,落實減租樓面,希慎計畫因應疫市重組租客,不排除拆細招租,事件有最新進展,免稅店已落實放棄租用B1全層地庫,希慎打算為兩全層地庫,重新規劃及招租,引入食肆及有關的服務行業吸客。

疫市下零售吹淡風,核心區商場亦轉變策略,近日,希慎廣場租客紛收到業主希慎的通知信件,表示隨着希慎廣場開幕10年,集團計畫在今年第三季,為該廈增添更多元素,為租客及顧客提供更佳環境,其中兩層在該廈地庫,將會引入食肆及服務性行業等,日後,希慎將集合高端零售、餐飲、體驗式服務消費,務求給大家耳目一新的感覺。

希慎知會商戶:增添新元素

據市場消息透露,免稅店棄租該廈B1全層,連同早前超市棄租的B2全層,涉及樓面逾2萬呎,該兩全層將重新打造,作整體規劃,然後,引入食肆及體驗式服務行業,務求集飲食與娛樂於一身,在經濟欠佳市況下,找到更好的出路。

超市遷出 免稅店減租樓面

免稅店作為希慎廣場首批租客,早於2012年開幕時進駐,大手承租地鋪及B1地庫全層,地庫約1萬多呎,地鋪1.8萬方呎,最新放棄地庫,只承租地鋪。

該廣場B2地庫,租客超級市場Market Place早前撤出,承租同區京華中心地庫,面積約7000方呎,月租60萬。

(星島日報)

更多希慎廣場寫字樓出租樓盤資訊請參閱:希慎廣場寫字樓出租

更多銅鑼灣區甲級寫字樓出租樓盤資訊請參閱:銅鑼灣區甲級寫字樓出租

灣仔北海中心地鋪1.2億易手 投資者麥志剛沽貨 12年升值1倍

疫市下市場仍錄大手買賣,灣仔軒尼詩道北海中心一個地鋪,建築面積約2600方呎,以1.2億易手,平均呎價4.6萬,買家為住宅投資者,新近轉投鋪市。原業主為MAPLE時裝老闆、資深投資者麥志剛,持貨12年,物業升值一倍。

疫下鋪市不寂靜,屢錄矚目成交,繼早前尖沙嘴栢麗購物大道鋪位易手,資深投資者麥志剛沽售持有自用多年的灣仔北海中心地下巨鋪,並以售後租回形式,在此繼續經營旗下時裝店。

灣仔軒尼詩道338號北海中心地下D號鋪,剛以1.2億易手,該鋪位建築面積約2600方呎,平均呎價4.6萬,現址由麥志剛旗下的連鎖時裝MAPLE FASHION使用多年,將售後租回3年,月租由26萬至30萬,買家為新晉投資者,過往鍾情買住宅,今番首度進軍鋪市,回報介乎2.6厘至3厘。

平均呎價4.6萬

據了解,該宗買賣以公司易手形式進行,新買家不用支付物業釐印費,原業主麥志剛早於2010年8月以6000萬購入該鋪,作價6000萬,今番沽貨,帳面獲利6000萬,物業升值一倍。

市場人士指,經營連鎖時裝店的麥志剛,對鋪市觸覺敏銳,近年成為疫市贏家,先後買賣鋪位,令市場側目,曾是製衣商人的他,後來拓展零售連鎖店MAPLE FASHION,該盤生意走大眾化路綫,進駐核心二綫區及民生旺段。

買家為新晉投資者

早於去年,麥氏買賣西環卑路乍街22至24A號懋華大廈地下雙號鋪,面積約1300方呎,作價約3300萬,呎價約25385元,持貨3個月帳面獲利約620萬,物業升值約23%。市場消息透露,今年以來,他愈戰愈勇涉足大買賣。

公司買賣省稅項

北海中心屬於灣仔名廈,尤其寫字樓受捧,但凡短炒寫字樓的知名投資者,皆涉足該廈,包括早年的資深投資者黎汝遠,以及近年熱衷於中短綫買賣的正八集團主席廖偉麟,均大舉在此購入寫字樓;至於該廈鋪位業主皆為長揸,該地段位處灣仔及銅鑼灣港鐵站之間,屬於灣仔民生地段,隨着港鐵會展站開通,帶來更多人流,市場人士指,港鐵新路綫均在疫市下開通,未見為市場帶來巨大反應,若將來通關後,經濟恢復,正面因素將會逐漸呈現。

(星島日報)

更多北海中心寫字樓出售樓盤資訊請參閱:北海中心寫字樓出售

更多灣仔區甲級寫字樓出售樓盤資訊請參閱:灣仔區甲級寫字樓出售

Prices ease up as home sales boom

Henderson Land (0012) has released a fourth price list for One Innovale-Archway in Fan Ling, which offers more than 180 units and will kick off sales on Wednesday, after selling all units in the first batch on Saturday.

The fourth list, released on Saturday, showed a 1.5 percent rise in price to an average of HK$14,842 per sellable square foot.

Henderson Land also said the price lists will be for 182 units while another three will be sold by tender this Wednesday.

Before the release, all 317 units of phase one of One Innovale had sold out by 4.45pm on Saturday, bringing in over HK$1.5 billion, according to the general manager of the first sales department, Thomas Lam Tat-man.

Of the units sold in the previous price list, the highest-priced was a three-bedroom unit with 609 square feet of sellable area, which sold for HK$8.89 million.

Sun Hung Kai Properties (0016) also unveiled its sixth price list for its phase 1A of Novo Land in Tuen Mun on Saturday, providing 87 flats with an average of HK$14,398 per square foot.

It plans to also start the sale of the rest of the 140 units in phase 1A of Novo Land on Wednesday, including one unit to be sold by tender.

On Saturday, SHKP also sold out all 336 units in phase 1A of Novo Land on its price list, said Andy Chan Hon-lun, its real estate agency general manager.

Also, Villa Lucca, a low-density luxury residential project in Tai Po, has received visits from more than 500 groups of potential buyers.

The project, jointly developed by Hysan Development (0014) and HKR International (0480), might come to market in form of a tender this month amid confidence in sales among developers.

Secondary-market sales have not been affected by primary ones, with a property agency saying 10 major housing estates saw 10 deals in the first weekend of August, three more than the previous weekend.

An agent said that the stable transaction numbers were the result of price reductions by some homeowners amid the rate rises and Sino-US tensions.

However, deals in 10 major blue-chip estates last month fell 38.8 percent to 232 from June, reaching a record low after 124 cases in September 2019.

July turnover also fell 37.5 percent to HK$1.22 billion, marking a 30-month new low.

Another agent expects that deals in the secondary market to decrease further as buyers become more cautious amid interest rates rises.

(The Standard)

土瓜灣舊樓強拍 底價逾12億 恒基黃浩明:重建作商住項目

近年恒基併購土瓜灣一帶舊樓群,並且陸續踏入收成期,最新土瓜灣道68A至70C號獲土地審裁處頒下強制售賣令,底價為12.134億。發展商表示,日後將與毗鄰項目合併重建為商住項目,主打中小型單位。

據土地審裁處文件顯示,上述舊樓為一幢樓高9層商住項目,地下為商鋪,樓上為住宅。恒基自2018年申請強拍時持有約86.243%業權,到今年6月審訊時增持至94.709%業權,當時餘下8個單位並未成功收購,其中有兩名小業主從未出席審訊,同時無法聯繫。

或分兩個項目發展

根據判詞指出,申請人曾委託結構工程師對該舊樓進行結構評估,認為建築物已達其設計壽命,加上維修情況欠佳,部分設施未能符合現代安全標準與法定要求,而且維修成本與重建成本不成比例,故重建發展是合適做法。再者,申請人已採取一切合理步驟取得全部業權,故批出強拍令。

恒基執行董事黃浩明回覆查詢時表示,連同是次獲批強拍的項目,集團在上述地段合共有4個發展項目。雖然4幅屬相連地皮,但因整體業權有待統一,故整體規劃上,或分為兩個項目進行發展,現時尚在研究中,預計日後將重建為商住項目,主力提供中小型單位。

該幢舊樓早於1960年落成入伙,樓齡至今約62年,項目鄰近港鐵土瓜灣站,故具有重建價值。該項目地盤面積約1.2萬方呎,若重建作商住物業,以最高9倍地積比率計算,涉及可建樓面約10.4萬方呎,如以底價12.134億計算,每方呎樓面地價約1.17萬。

主力提供中小型單位

資料顯示,恒基於土瓜灣道、下鄉道及落山道一帶有4個收購項目,已完成併購的有3個,分別為落山道58至70號、美華街1至9號及下鄉道18至20號,若撇除上述已成功併購及是次獲批強拍令的項目,該公司於毗鄰仍有1個項目待批強拍令,意味整個重建區版圖已接近完成。該公司年報顯示,上述4個項目合併後總地盤面積4.25萬方呎,料重建後自佔商住總樓面約37.44萬方呎。

近年恒基密密併購舊樓發展,連同上述項目,今年來已有3個項目獲批強拍令,當中大坑新村街17至25號舊樓物業,將於本月25日舉行公開拍賣,底價為5.887億。

(星島日報)

Amid largest property sale in two years, Hongkongers snap up bargain flats in New Territories

With 666 flats for sale on Saturday, Hong Kong saw the most units for sale in a single weekend in two years

Henderson Land launched 318 units at One Innovale-Archway while SHKP had 348 units available at Novo Land 1A, with flats starting at around HK$3 million

The first weekend of August recorded the largest weekend property sale in Hong Kong in two years, with 666 units split between two projects hitting the market on Saturday, marking the most units for sale in a single drop since 814 units went on sale in September 2020.

Henderson Land launched 318 units at One Innovale-Archway, in Fanling, selling 102 of the units within the first two hours. Just one unit was left by 5pm, according to property agents. The 310 sq ft one-bedroom flats sold out first, according to Thomas Lam, general manager of Henderson’s sales department.

The units sold at an average price of HK$14,168 per square foot, about 5 to 10 per cent lower than units going for sale in a nearby area. Unit sizes ranged from 209 sq ft to 609 sq ft, meaning flats started at about HK$2.96 million.

“Both projects will have good results as developers adopt lower prices to draw sales amid rising interest rates,” a property agent said.

Most buyers were in their 20s and 30s and many reside in the New Territories, according to another property agent.

One Innovale-Archway is the phase 1 development of 603 units set to be completed in March 2023. The whole project will be developed in three phases, with a total of 1,600 units.

Interest in One Innovale-Archway was red hot, with a total of 7,802 registrations recorded on Friday, or nearly 25 buyers for every unit available.

The Novo Land 1A development in Tuen Mun, from Sun Hung Kai Properties (SHKP), was the second project to hit the market on Saturday.

SHKP listed 348 units, and a third had been sold by midday, according to property agents. By the end of the day, 336 had been sold, according to property agents.

Last weekend, Novo Land sold out all 336 units on offer in the first-batch release.

The project sold at a discounted price of HK$12,838 per square foot. Flats started at about HK$3.36 million, putting the smallest flats at about 262 sq ft. It received 18,506 registrations prior to the sale, or 55 buyers for every unit available.

If both projects sell out, it is estimated that nearly 700 new units in Hong Kong will be transacted in the first week of August, with 1,500 first-hand transactions for the whole month, according to the agent.

The US Federal Reserve raised interest rates by 75 basis points for a second time in July to curb rising inflation. Soon after, the Hong Kong Monetary Authority (HKMA) raised its base lending rate, the borrowing cost charged to commercial lenders.

This has led to speculation that the city’s major commercial banks, including HSBC and Bank of China Hong Kong, will soon increase their prime rate for the first time in four years.

Tense US-China relations, coupled with the impact of interest rate hikes, have left money sitting on the sidelines, but bargains currently on the market will stimulate an overall trading rebound, the agent said.

(south China Morning Post)湯臣1.93億購海富中心全層銀主盤 甲廈每呎造價1.81萬 低市價20%

受疫情及加息等因素打擊,甲廈售價備受壓力,金鐘海富中心全層銀主盤以1.93億易手,買家為湯臣集團,每呎造價約1.81萬,低市價約20%,並創該甲廈過去8年來新低。

據湯臣集團公布,該集團以1.93億購入金鐘海富中心二座 13樓全層,並指該收購屬集團策略長期投資,公司相信本港將繼續作為主要國際城市,並受益於政府有利的大灣區政策及中國強勁的經濟增長,預期收購事項將提升該集團物業投資組合,產生穩定的經常租金收入,並進一步加強集團於本港長遠發展,公司於適當時候可能將該物業用作為本港總部。

重返8年前水平

市場人士指出,上址為銀主盤,建築面積約10627方呎計,每呎造價約18161元,低市價約20%,創該廈過去八年呎價新低,原業主早於2004年以6800萬購入,惟及後淪為銀主盤,物業於18年間升值約1.25億,期間升值幅度約1.8倍。

有代理則表示,以上述海富中心造價每呎1.81萬,低市價約20%,市值每呎2.2至2.3萬水平。

該廈最高呎價曾高逾3.5萬,於2018年錄得,最新成交較高位跌逾48%,正反應疫市下經濟疫弱。

事實上,該甲廈早前亦錄銀主盤買賣,資料顯示,該廈二座17樓8室,建築面積約1875方呎,於今年4月以4780萬售出,呎價2.54萬。原業主2001年以821.25萬購入,惟及後淪為銀主盤,物業於21年間升值約3958.75萬,期間升值約4.8倍。

18年升值1.8倍

據代理行資料顯示,該甲廈自2020年以來共錄4宗買賣,呎價均高逾2.5萬,若該廈呎價貼近1.8萬水平,需追溯至2014年9月,為海富中心二座低層7室,建築面積1136方呎,當時以1850萬售出,每呎造價約16285元,故該甲廈最新成交呎價創過去8年以來新低水平。

海富中心二座最高成交呎價於2018年6月錄得,金鐘海富中心二座一個低層單位,面積約1436方呎,以每呎30500元成交,為該廈呎價首度突破3萬。至於一座最高成交呎價於2018年11月錄得,正八集團主席廖偉麟沽售海富中心一座 11樓04室,面積約6452方呎,作價2.3億,平均呎價35647元,屬該廈新高,該單位為短炒,於半年間升值25%。

(星島日報)

更多海富中心寫字樓出售樓盤資訊請參閱:海富中心寫字樓出售

更多金鐘區甲級寫字樓出售樓盤資訊請參閱:金鐘區甲級寫字樓出售

馬亞木2600萬沽旺角車場 持貨27年升值2.46倍

受疫情及加息等利淡因素「夾擊」,鋪位市場觀望氣氛籠罩,資深投資者率先沽貨。市場消息指,由外號「小巴大王」馬亞木持有的旺角華富園20個車位,剛以約2600萬易手,平均每車位售價約130萬,持貨27年,帳面獲利1850萬,期間升值約2.46倍。

平均每個車位130萬

據市場消息透露,旺角豉油街110號華富園地下20個車位以約2600萬成交,平均每車位售價約130萬。據悉,上述一籃子車位由資深投資者、外號「小巴大王」馬亞木持有,早於1995年以750萬購入,故持貨27年帳面獲利約1850萬,物業期間升值約2.46倍。

本報昨日就上述消息向馬亞木兒子馬僑生作出查詢,惟於截稿前未獲回覆。

疫市下接連大手沽物業

事實上,馬亞木於上月初以1.081億沽出同區奶路臣街2L至2M號樂園大廈地下2B,3至7號鋪,買家為市建局,該鋪位處地士道街大單邊,該地段屬於街市地段,鋪位建築面積約是4500方呎,為單邊巨鋪,成交價1.081億,物業樓齡64年,現時租客為超市U Select,月租約22.5萬,以收購價計算,回報為2.5厘。該鋪位門闊15呎,鋪內闊46呎,深96呎。

(星島日報)

商廈半年438買賣跌26% 金額挫56%

有代理表示,在疫情及股市大跌的雙重打擊下,首季商廈交投不斷向下尋底,猶幸在次季有資金趁低吸納,加上疫情轉穩,配合有新項目推出而帶動商廈買賣登記顯著反彈,重上接近百宗的相對高水平。

今年上半年,商廈物業買賣登記共錄438宗,較去年下半年的593宗大跌26%;金額方面,上半年共錄得193.77億元,較去年下半年的441.49億元急挫56%,量及值跌幅均為3大範疇之最;若按年同期比較,更各挫38%及35%。

以價格類別劃分,上半年7個價格組別的商廈買賣登記量錄得6跌1升,跌幅介乎10%至44%不等。其中以銀碼介乎500萬至1,000萬元以內組別的商廈買賣登記量跌幅最急劇,期內僅錄98宗,較去年下半年的174宗急挫44%,反映疫情影響波及經濟、股市的後遺症。

細價商廈 上半年買賣最旺

此外,上半年買賣登記最旺者為銀碼介乎200萬至500萬元以內的細價商廈,期內共錄127宗登記,但按半年亦下跌28%;至於逆市錄得唯一升幅的1億元或以上大碼類別上半年共錄36宗,主要受惠期內錄得全幢商廈的疑似內部轉讓但分拆成多宗分層登記所致,未必反映高價商廈交投明顯轉旺的情況。

從該行長期觀察的11個地區分析,大部分 (10區) 登記量在上半年錄得跌幅,當中以葵涌區的跌勢最急,期內只錄得2宗,較去年下半年的15宗急挫87%;其次沙田區也大跌81%,至8宗登記。至於逆市錄得升幅的唯一地區是灣仔/銅鑼灣區,上半年升了5%,共錄68宗登記,主因期內有新項目應市所帶動。此外,傳統核心地段的上環/中環 / 金鐘區及尖沙咀 / 佐敦區雙雙同錄得74宗登記,分別按半年減少13%及微跌3%,惟攜手成為期內登記量最活躍的觀察區;至於灣仔 / 銅鑼灣區及旺角 / 油麻地區也雙雙錄得68宗,同居於次位。

對於下半年的走勢,該代理指出,疫情對商廈的影響依然存在,近期美國息口調升幅度及節奏高且快,導致買家入市更加審慎,本地跟隨加息陰霾下恐令成交下滑。此外,新商廈落成量逾300萬平方呎,將令空置率持續高企,而大額成交因為投資者審慎觀望亦令成交金額趨跌。該代理預期,下半年商廈買賣登記量料輕微萎縮,下試420宗水平,按半年料微跌4%;至於登記金額則料因大額交投減少而顯著回落逾兩成,下試150億元左右。

(經濟日報)

中環美國銀行中心 低層相連戶5千萬放售

美國銀行中心為中環呎價指標之一,現物業低層相連戶,以近5,000萬元放售,意向呎價約3.5萬元。

有代理表示,位處金鐘夏慤道12號美國銀行中心 6樓10至11室,總建築面積約1,428平方呎,意向價約4,998萬元,折合呎價約35,000元。該代理指,物業以交吉形式出售,單位享開揚城市景觀且附有醫務裝修間隔,合相關行業進駐,可即買即用,節省裝修成本及時間。

同時放租 每呎約47元

該代理補充,物業為區內知名指標甲廈,交通四通八達,質素上乘,甚具競爭力,向來深受企業歡迎;單位同時以每平方呎約47元招租。

該代理續稱,近年受疫情反覆及環球經濟不景氣所影響,寫字樓市場觀望氣氛濃厚。翻查資料,2022年上半年香港區指標甲廈僅錄得8宗買賣個案;同時,美國銀行中心相連戶放售盤源緊絀,對上一宗成交亦已需要追溯至2021年尾,該成交單位為11樓08至09室,面積約1,410平方呎,成交呎價約37,000元。

(經濟日報)

更多美國銀行中心寫字樓出售樓盤資訊請參閱:美國銀行中心寫字樓出售

更多金鐘區甲級寫字樓出售樓盤資訊請參閱:金鐘區甲級寫字樓出售

灣仔德士古大廈位處單邊,享有兩邊開揚景觀,而樓面適合中小型公司使用。

德士古大廈位處灣仔,同地段乙廈甚多,德士古大廈其中一大特別之處,是物業位處灣仔兩大主要幹道,莊士敦道及軒尼詩道交界,享單邊優勢,外觀不錯。交通上,鄰近港鐵灣仔及會展站,步程分別僅約6分鐘及9分鐘,附近亦有巴士,的士站和電車。

飲食配套上,物業對面為英皇集團中心,大廈基座為商場,有餐廳及酒樓,而軒尼詩道食店林立,附近亦有酒店,可作商務午餐。

大廈地下為油站,正門入口位於軒尼詩道,物業提供兩部升降機前往各層,略嫌地下及分層大堂較為狹窄。

樓上樓層面積約2220呎

項目樓高21層,基座3層面積較大,達4,000餘平方呎,而樓上樓層面積約2,220平方呎,因面積不算大,適合中小型公司使用。間隔上,單位略為柱位多。

景觀方面,因位處單邊,是灣仔核心地段中,景觀較開揚的乙廈,不論望向軒尼詩道及莊士敦道的樓景,不會有侷促感覺,高層景觀更佳。

用戶上,大廈業戶多元化,有會計師、宗教團體等。

買賣及租務上,該廈買賣較少,對上一宗大手買賣,為2014年,德士古大廈9至12樓全層,物業總面積約8,880平方呎,成交價7,200萬元,呎價約8,000元。該廈對上一宗買賣,為去年8月,物業16樓全層,面積約2,220平方呎,以約2,800萬元成交,呎價約12,613元。

租務上,今年該廈未錄租務,去年則錄多宗,年初物業中層,面積約2,200平方呎,以約5.28萬元租出,呎租約24元。對上一宗租務為去年12月,物業高層單位,面積約2,200平方呎,以約5.6萬元租出,呎租約25元。

(經濟日報)

更多德士古大廈寫字樓出租樓盤資訊請參閱:德士古大廈寫字樓出租

更多英皇集團中心寫字樓出租樓盤資訊請參閱:英皇集團中心寫字樓出租

更多灣仔區甲級寫字樓出租樓盤資訊請參閱:灣仔區甲級寫字樓出租

更多德士古大廈寫字樓出售樓盤資訊請參閱:德士古大廈寫字樓出售

更多英皇集團中心寫字樓出售樓盤資訊請參閱:英皇集團中心寫字樓出售

更多灣仔區甲級寫字樓出售樓盤資訊請參閱:灣仔區甲級寫字樓出售

2樓全層放售 呎價叫1.08萬

德士古大廈放盤不多,現物業2樓全層,以每呎約1.08萬元放售。

面積4200呎 叫價4536萬

有代理表示,灣仔軒尼詩道258號德士古大廈 2樓全層放售,總面積約4,200平方呎,業主現叫價為每平方呎約10,800元,涉及金額約4,536萬元。

據知,業主原本意向呎價約13,800元,最近下調呎價叫價約兩成至約10,800元。該代理指,單位屬極罕有全層特大單邊位置,位置優越,物業將以交吉形式出售。另外,項目亦在招租中,意向呎租約30元,月租約12.6萬元。

同區乙廈買賣方面,筆克大廈高層全層,面積約2,575平方呎,以約3,879萬元成交,呎價約1.5萬元。另外,附近謝斐道商廈新盤 Novo Jaffe 早前開售,反應甚佳,近日19樓全層,面積約2,243平方呎,以約4,298萬元成交,呎價約1.91萬元。

(經濟日報)

更多德士古大廈寫字樓出售樓盤資訊請參閱:德士古大廈寫字樓出售

更多筆克大廈寫字樓出售資訊請參閱:筆克大廈寫字樓出售

更多 Novo Jaffe 寫字樓出售樓盤資訊請參閱:Novo Jaffe 寫字樓出售

更多灣仔區甲級寫字樓出售樓盤資訊請參閱:灣仔區甲級寫字樓出售

Mad rush for Henderson homes at Fanling

Henderson Land Development (0012) has received more than 8,000 checks for 185 units at One Innovale-Archway in Fan Ling, making the batch nearly 43 times oversubscribed yesterday.

The second-round sales of 185 flats start tomorrow including 182 units to be sold at fixed prices.

Three other garden units will be open for bids.

Thomas Lam Tat-man, a general manager of sales at Henderson Land, said the earlier first round of sales saw 317 flats sold for a total of HK$1.52 billion.

The average price of the flats in the first round was HK$4.78 million with a HK$14,537 average price per square foot.

The remaining 101 flats in the project will be launched next week in the third round of sales.

Lam said it is possible to deliver the flats in October, judging by construction progress, and the presale consent for phase 2 of the project is expected to be approved in August.

Meanwhile, Sun Hung Kai Properties (0016) received at least 15,331 checks for the third-round sales of 140 units at Novo Land, making the batch 109 times oversubscribed.

This came as SHKP and CK Asset (1113) launched the sixth price list of Grand Jeté in Tuen Mun yesterday. The list includes 47 flats with an average price of HK$15,138 per sq ft after a 15 percent discount.

Meanwhile, Chinachem and MTR Corporation (0066) named their jointly developed project in Ho Man Tin as In One. The project will be divided into three phases, with the first phase providing 447 flats.

In other news, the one-month Hong Kong interbank offered rate, a benchmark used for pricing mortgages, rose for the fourth consecutive day to 1.50804 percent yesterday, the highest in two-and-a-half years.

(The Standard)中環中心呎租37元低10% 創12年來新低 回報僅1.24厘

疫市下核心區甲廈租金急下滑,曾由資深投資者蔡志忠拆售的中環中心 22樓,其一個單位交吉逾3年後,以每呎約37元租出,低市價約10%,回報低見1.24厘,創該廈過去12年以來呎租新低;業內人士指,疫情走勢反覆,加上甲廈市場正處供應高峰期,令甲廈租金持續受壓。

市場消息透露,中環中心 22樓11室,建築面積約3184方呎,新以每呎約37元租出,月租約117808元,業主於2019年5月向蔡志忠購入,因當時正值市場高峰期,購入價高達約1.13億購入,每呎造價3.58萬,若以最新租金計,租金回報僅約1.24厘。

交吉逾3年始租出

據代理行資料顯示,該甲廈近期頻錄承租個案,平均呎租介乎43元至85元,故每呎37元實屬偏低水平,若該甲廈較相近租金需追溯至2010年9月,當時該廈低層2號室,建築面積約1730方呎,以每呎約35元租出,故呎租37元,創該甲廈12年以來新低水平。

涉及面積約3184方呎

據地產代理指出,受疫情等因素影響,令甲廈租務需求急速放緩,加上現時市場正處供應高峰期,交吉樓面持續湧現,對商戶而言,寫字樓實在不愁租,令部份業主議幅持續擴闊,上址業主購入單位後,當時曾以每呎約70元放租,由於上址位處低層,以樓景為主、加上樓面大且沒有間隔,故長期以來市場問盤洽租疲弱,最終減價至每呎約37元租出。

較早前意向租金折讓近50%,以市值呎租約40餘元計,低市價約10%,並預測租約中有機會附帶免租期等優惠條款。

事實上,該樓層早前亦錄減價承租個案,資料顯示,中環中心 22樓3室,建築面積1651方呎,於上月以每呎約43元租出,月租約70993元,上址上一手租約於2019年5月以每呎約65元租出,今年5月屆滿,故交吉僅一個月即再度租出,租金急挫約33%。

據一外資代理行早前指出,今年第二季甲廈空置樓面達980萬方呎,創歷來新高水平,最新空置率報11.9%,因市場正處供應高峰期,預測明年底甲廈空置率有機會上升至14%,料屆時空置率將「見頂」。

(星島日報)

更多中環中心寫字樓出租樓盤資訊請參閱:中環中心寫字樓出租

更多中環區甲級寫字樓出租樓盤資訊請參閱:中環區甲級寫字樓出租

億京沽售非核心物業 京瑞廣場 4450萬易手

近年活躍於市場的億京,趁疫市連環吸納全幢商廈及工廈,同時,積極沽售旗下非核心物業,沙田京瑞廣場二期 3個相連地鋪,建築面積約2079方呎,以4450萬易手,新買家料回報約3.24厘。

上址為京瑞廣場二期地下G22, G31及G32號鋪,建築面積約2079方呎,以4450萬易手,平均呎價2.14萬,租客南記春卷粉麵,月租12萬,新買家回報約3.24厘,該廈樓齡6年,由億京發展,並於多年前以出售樓花形式賣樓。

利得街鋪31年升50倍

大角嘴利得街44至54號地下G號鋪,建築面積約600方呎,成交約2300萬,平均呎價3.83萬,原業主於1991年3月以45萬買入,持貨31年,帳面獲利2255萬,物業升值逾50倍。

土瓜灣美景街30至44號安福大廈地下8號鋪,建築面積約450方呎,門闊約35呎,以約1250萬易手,該鋪位擁有三名租客,洗車房、收樓辦事處及地產代理,原業主於2011年9月以490萬買入,持貨11年,帳面獲利約760萬,物業升值1.65倍。

衙前圍道鋪3480萬沽

九龍城衙前圍道45至45C號興發樓地下D (衙前圍道45B) 號鋪,建築面積約600方呎,加上天井位約42方呎,成交價約3480萬,平均呎價5.8萬 (未計天井),該鋪位門闊近15呎,租客鴻福堂,月租6.65萬,租期至2024年3月,回報約2.29厘。該廈樓齡56年,原業主於1999年5月以630萬買入,持貨23年,帳面獲利2850萬,物業升值4.52倍。

(星島日報)

更多京瑞廣場寫字樓出售樓盤資訊請參閱:京瑞廣場寫字樓出售

更多石門區甲級寫字樓出售樓盤資訊請參閱:石門區甲級寫字樓出售

觀塘「巨無霸」商業項目突招意向 市建局馬不停蹄推地 估值約259億

市建局馬不停蹄推出發展項目,於昨日土瓜灣住宅項目截收意向書後,突公布就觀塘市中心重建計畫第4和第5發展區商業項目,於今日起招收意向書;該項目早前向城規會申請調整酒店、寫字樓及商業零售組合比例增加彈性,包括可放棄興建酒店、商業樓面最多102萬方呎等,以打造區內新地標。

觀塘市中心項目是市建局歷來規模最大的單一重建項目,以五個區域進行分階段發展,該項目為最後一個發展區域,地盤面積為27.56萬方呎,可建總樓面約216.59萬方呎。並於下月7日截收意向書。

可建總樓面逾216萬呎

市建局指,該項目將興建一個地標式、綜合政府設施及商業發展的建築群,不但增加觀塘核心地段的民生和經濟活力,亦為市中心營造社區節點和連接周邊的門戶,作為九龍東新地標。項目亦將提供政府、機構或社區設施樓面。

採浮動規劃參數招標

為應對持續的疫情及最新的市場情況,市建局在該項目標書將試行「浮動規劃參數安排」,容許成功取得本項目的發展商及財團,在總樓面保持不變前提下,靈活調撥在指定範圍內商業樓面面積作辦公、酒店和其他商業用途;當中,商業樓面不可少於69.966萬方呎並需設於項目的低層樓層,以保持本項目位處觀塘區策略性位置的「市中心」特色。

有測量師說,日前政府放寬入境隔離政策令人鼓舞,商業氣氛未見有起色,相信大型商業項目短期內推出招標,市場反應趨向保守及審慎,不排除有流標風險,估算整項目落成後可達約460億。綜合市場估值,上述項目估值介乎約184.1億至259.9億,每呎樓面地價由8500至12000元。

另一測量師表示,九龍東商廈供應量多,目前空置率高達14%至15%,為全港最高,而且下半年仍有約300萬方呎甲級寫字樓新供應;相信該局或預計項目有機會流標,故推出彈性安排;惟在目前市況下不排除有流標風險。

業界:具流標風險

該項目早前向城規會提交修訂申請,當中酒店部分不設樓面下限至最多34.44萬方呎,意味中標財團可選擇不興建酒店或最多提供400間酒店客房。而寫字樓部分則修訂為70.89萬至137.37萬方呎,最後商業用途樓面,則修訂為69.97萬方呎至102萬方呎。若規劃獲批准,該局會據「浮動規劃參數安排」推出招標。

(星島日報)

土瓜灣「小區模式」截收31份意向

市建局於土瓜灣第四個以「小區模式」發展的榮光街/崇安街發展項目,昨日截收31份意向書,除大型發展商之外,亦吸引多家中小型發展商參與,數量符合預期。

市建局表示,董事會設立的遴選小組,將會按照訂定的入圍準則,就發展商及財團的項目發展經驗和財政能力,從接獲的意向書中,挑選符合資格的發展商及財團,並根據董事會已批准的主要招標條款,邀請入圍的發展商及財團提交合作發展標書。

根據現場所見及綜合市場消息,多家本地大型和中型發展商均有遞交意向書,包括長實、新地、恒基、信和、會德豐地產、華懋、資本策略、泛海國際、鷹君、建灝地產、帝國集團、遠東發展、英皇國際、中國海外、招商局置地等。

英皇國際物業經理蔡宏基表示,加息對出價有一定影響,集團將採審慎樂觀態度,但依然有待招標文件公布後再作決定。

英皇蔡宏基:加息影響出價

業界指出,項目意向書數目符合預期,發展規模適中,預料大中小型發展商會入標,市場充斥不明朗因素,料財團出價審慎及保守。綜合市場估值約30.6億至33.4億,每方呎樓面地價約1.1萬至1.2萬。

該項目上址地盤面積約3.1萬方呎,可建總樓面約27.86萬方呎,發展規模是目前已推出項目中最細。

(星島日報)

海富中心低層戶意向價2700萬

有代理行表示,金鐘海富中心二座低層08室,面積約1058方呎,業主意向售價約2700萬元,呎價約2.55萬元;業主指上述售價仍可有一定幅度的折讓空間。

該行指出,是次放售單位間隔四正實用,景觀開揚,採光度高,外望公園景,配備全新寫字樓裝修,買家可即買即用。物業設有8部客用電梯和1部貨用電梯,方便用戶出入。

(信報)

更多海富中心寫字樓出售樓盤資訊請參閱:海富中心寫字樓出售

更多金鐘區甲級寫字樓出售樓盤資訊請參閱:金鐘區甲級寫字樓出售

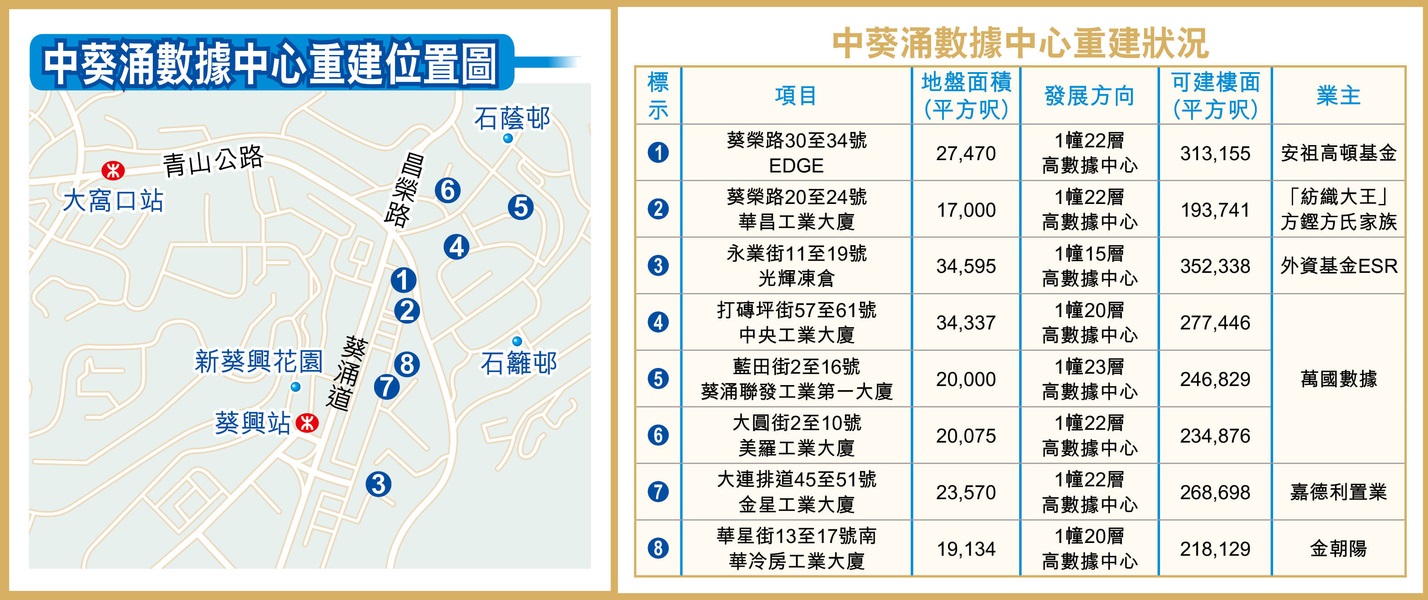

逾半申建數據中心 葵涌勢成供應重鎮

踏入5G年代,數據中心需求增加,發展商或財團紛紛積極為舊工廈申請重建或改裝,而中葵涌現有至少15宗相關申請,總樓面面積高逾390萬平方呎,當中至少一半屬於重建為數據中心的相關個案,估計葵涌勢成數據中心未來的供應重鎮之一。

中葵涌8項目 改劃發展用途

位於葵涌道以東的工業區,近年相繼有不少工廈重建或者改裝申請,單計中葵涌一帶,現已錄至少8宗的重建或改建為數據中心的申請,涉及約211萬平方呎樓面,其中有工廈最新向城規會遞交強拍申請,料會發展為數據中心。

金星工廈已批放寬地積及高限

上述的強拍申請涉及葵涌大連排道45至51號的金星工業大廈,該項目最新向土地審裁處遞交強拍申請,其現況市值逾5.65億元。文件顯示,項目地盤面積約23,570平方呎,早於1972年入伙,現為1幢樓高7層工廈,申請人已經集齊85.71%業權。申請人去年已經向城規會,申請放寬項目地積比率及建築物高度限制分別至11.4倍及主水平基準上129.35米,以發展為1幢22層高 (包括2層地庫) 的數據中心,並已獲會方批准,重建後項目總樓面約26.87萬平方呎。

同時,該帶早前亦接連有外資基金及發展商撤回新式工廈重建方案,並「變陣」發展數據中心,其中金朝陽 (00878) 去年10月就葵涌南華冷房工業大廈,向城規會申請改劃為新式工廈,惟今年中擬「轉軚」以地積比率11.4倍,發展1幢20層高的數據中心,總樓面約21.8萬平方呎。

另外,外資基金安祖高頓早於2015年以約7.8億元購入葵榮路30至34號「EDGE」後,已將其活化為商廈。而基金於去年9月曾向城規會申請重建成新式工廈,惟集團年初確定撤回該方案,並向會方申請以地積比率11.4倍,發展1幢22層高的數據中心,總樓面約31.3萬平方呎。

事實上,區內的工廈重建活躍。有消息透露,鄧成波家族近期以約4.33億元沽出葵涌永基路26至30號永昇工業大廈約9成業權,而接貨為凱龍瑞基金。該廈佔地約2.2萬平方呎,現為「工業」用途,地積比率上限為9.5倍,重建樓面面積約20.9萬平方呎,初步估計基金購入及集齊餘下業權後,將重建為工廈。上述工廈位於永基路26至30號,於1979年落成,樓齡約41年,屬於1幢樓高約12層的工業樓宇。

(經濟日報)

外資基金購物流地 作投資

疫情顛覆全球生態,市場對於物流業的需求大增,有見及此,政府近期推出物流用地,並已於上月批出予外資基金。

ESR以逾52億承接

葵涌西南部為發展多年的葵涌貨櫃碼頭,是亞洲主要轉運港,配套成熟,而政府早前已經物色該帶的一幅物流用地,以招標出售。該幅物流用地位於葵涌8號貨櫃碼頭旁,已於上月中以約52.57億元批出予外資基金ESR,每平方呎樓面地價約3,539元,成交價合乎市場預期。業界普遍估計,投得項目的ESR購入地皮後將作投資用,總投資額料逾100億元。

上述地盤面積約為59.5萬平方呎,指定作物流服務及公眾停車場用途,最高樓面總面積約149萬平方呎,以發展多層現代物流設施及公眾停車場。事實上,葵涌對上一幅推出的政府物流地,已經於2008年4月批出,當時由新創建 (00659) 以約6.48億元投得,每平方呎樓面地價僅933元。於14年間,物流用地的地價上升約2.8倍。

(經濟日報)

Interest high for URA's To Kwa Wan project

The Urban Renewal Authority said it has received a total of 31 expressions of interest from developers for the Wing Kwong Street and Sung On Street Development project in To Kwa Wan and will start receiving EOIs for a project in Kwun Tong today.

The market valuations of the To Kwa Wan project range from HK$2.65 billion to HK$3.62 billion, or about HK$9,500 to HK$13,000 per square foot.

Upon completion, the project will cover a total gross floor area of 25,884 square meters, providing about 560 flats.

Furthermore, the URA will invite interested developers to submit EOIs for the development of the Kwun Tong Town Centre Development Areas 4 & 5 Project today.

The project, which covers a site area of 25,595 sq m, will provide a maximum total gross floor area of 201,220 sq m upon completion.

In other news, Henderson Land Development (0012) has received more than 9,110 checks for One Innovale-Archway in Fan Ling, making the batch 48 times oversubscribed until yesterday.

Sun Hung Kai Properties (0016) will sell the last 140 units at Novo Land today, including 139 units to be sold on price lists and one via tender.

CK Asset (1113) sold the last house at 90 Repulse Bay Road yesterday, which has an area of 5,347 sq ft, with lifts, five bedrooms, a 367 sq ft garden, for over HK$401 million, or about HK$75,000 per sq ft.

In other news, Wheelock Properties has sold 466 flats worth HK$7.6 billion in the first half.

(The Standard)

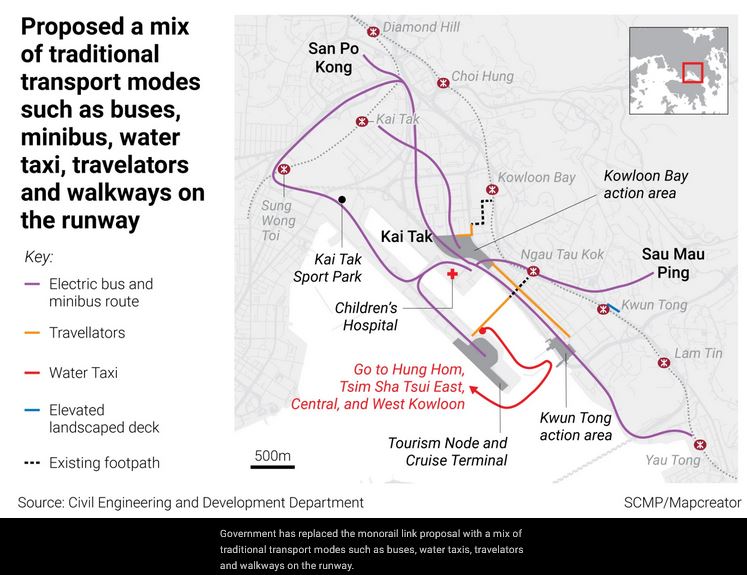

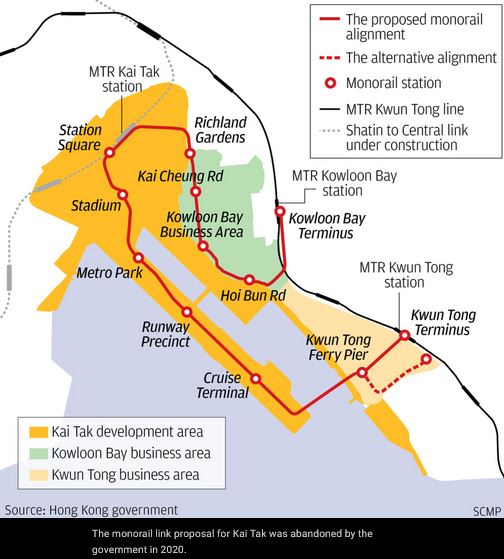

Developers at Kai Tak runway site urge government to improve transport links as sale of new projects looms

Nine developers who own land on the former runway site last month formed a non-profit company to lobby the government on transport

Launch prices have been pressured after the government dropped its plan to build a monorail link at the site in 2020

Developers will face challenges in marketing new flats built on the runway site of Hong Kong’s former international airport as the area’s transport links and infrastructure remain limited, two years after the government scrapped a proposed HK$12 billion (US$1.53 billion) monorail link there, analysts say.

Nine developers who own land on the former runway site last month formed a non-profit company, Kai Tak Runway Private Development Company (KTRPD), to liaise with the government on improving the area’s accessibility. New projects are either slated for presale soon or are due for delivery as early as next year, so the matter is pressing.

“Today, the general impression is it’s inconvenient, with lots of people still unfamiliar with the new transport facilities there,” said Ricky Wong, managing director of Wheelock Properties, which is involved in a consortium that will kick off a sale at Miami Quay at the site soon.

The Miami Quay development will be the second residential project to be put on sale at the former runway. One Victoria development was launched in June 2021 and is scheduled for delivery as early as March 2023.

The non-profit company consists of Chinachem Group, China Overseas Land & Investment, Empire Group Holdings, Far East Consortium International, Henderson Land Development, K Wah International, New World Development, Sun Hung Kai Properties and Wheelock Properties.

The government sold 11 residential plots for a total HK$115.4 billion on the runway at the old airport site, before dropping the idea of building a monorail link in December 2020. The abandoned monorail plan involved linking Kowloon Bay station with the massive Kai Tak Development area, continuing on to Kwun Tong.

However, the plan was dropped after a detailed feasibility study found that it was unworkable. The government replaced it with a mix of traditional transport options, such as buses, minibuses, water taxis, travelators and walkways.

“We are also in discussions with the government to offer shuttle bus services to connect property projects to the nearest MTR station individually. This will reduce the government’s burden,” said Wheelock’s Wong, adding that the area will be transformed once all units are finished and transport links improved.

Connectivity is a major factor in determining the launch price of new projects as most buyers are prepared to pay a premium for a home that is convenient, said property consultants.

“The transportation facilities connecting the runway to the nearest MTR station are not the best now,” agent said. “But the unobstructed sea view could dilute the discount.”

The agent said that new flats to be built on the former runway may price at between HK$25,000 to HK$26,000 per square foot without the monorail link, about 15 per cent down from the HK$30,000 per sq ft expected if the monorail link had been built.

The agent noted that selling prices at The Grand Mayfair I project above Kam Sheung Road MTR station were more than 30 per cent higher than those at Novo Land, which is over 20 minutes walking distance from Siu Hong Station. The average launch prices for the Grand Mayfair were HK$17,608 per sq ft in April, while Novo Land’s were HK$13,188 per sq ft.

Property agent said that the supply of close to 10,000 new flats over the next three years on the old runway site, coupled with deepening economic headwinds could add to pricing pressures. Meanwhile, there are still around 1,500 units currently still for sale in the wider Kai Tak area, according to Dataelements.

“Builders [at Kai Tak] are unlikely to price aggressively,” property agent said.

(South China Morning Post)長江集團中心二期 明年落成快招租

樓高41層共55萬呎 呎租料達超甲廈水平

中環新甲廈項目向來罕有供應,而長實 (01113) 旗下夏愨道和記大廈重建項目於明年落成,項目正式命名為長江集團中心二期 (Cheung Kong Center II),提供約55萬平方呎,料快將進行招租。集團指,項目位處中環核心地段,坐擁270度維港海景,視野廣闊;為香港近年罕有的全海景甲級寫字樓項目,預計於2023年落成。

物業樓高41層,總建築面積達55萬平方呎,集團指,將承襲長江集團中心標誌性的玻璃幕牆外貌和方正設計,為租戶提供靈活多變的實用空間。項目交通便捷,亦提供185個車位。長實集團主席李澤鉅日前表示,長江集團中心二期有望今年稍後時間招租。

提供185個車位

項目前身的和記大廈,於1974年落成,樓高23層,總樓面面積約50萬平方呎。2018年,長實落實重建計劃,並於2019年展開。事實上,當時和記大廈因設備相對舊,呎租較同區為低,如今進行重建,相信呎租可達同區超甲廈最高水平,料成指標之一。

中環新供應向來極少,明年則有兩項目出現,恒地 (00012) 旗下 The Henderson,提供約46.5萬平方呎樓面,該廈暫獲兩宗預租,包括佳士得承租共4層寫字樓,合共約5萬平方呎樓面,作為集團在港首個常設拍賣中心和藝廊,另近日該廈獲金融機構凱雷租用2萬平方呎樓面,市場人士估計呎租約130至140元。

(經濟日報)

更多長江集團中心二期寫字樓出租樓盤資訊請參閱:長江集團中心二期寫字樓出租

更多長江集團中心寫字樓出租樓盤資訊請參閱:長江集團中心寫字樓出租

更多The Henderson寫字樓出租樓盤資訊請參閱:The Henderson 寫字樓出租

更多中環區甲級寫字樓出租樓盤資訊請參閱:中環區甲級寫字樓出租

代理行:50甲廈上月交投跌逾5成

受疫情及加息等因素打擊,甲廈市場交投備受壓力。據一間本地代理行發表的市場報告指出,商廈成交量連升3個月後再次回落,而五十大甲廈上月僅錄5宗買賣,較6月份的11宗挫逾5成。

租金按月跌1.6%

該行代理表示,商廈市場能否復甦,主要取決於能否順利通關,惟新政府上場一個月以來仍未公布與內地通關詳情,令投資者繼續持觀望態度。不過,政府近日宣布放寬入境檢疫安排,包括縮短抵港人士酒店檢疫期及推行「紅黃碼」,無疑是邁向全面恢復通關的好開始,相信可加強投資者對通關的信心,亦重新吸引海外投資者來港,為寫字樓市場帶來曙光。

此外,寫字樓租金走勢持續向下,甲廈租金按月跌1.6%,今年以來累挫4.7%。整體甲廈售價亦錄得輕微跌幅,按月回落0.1%,今年以來累積跌2.3%。空置率方面,甲廈空置率維持高企,7月份的整體甲廈空置率錄9.8%,與6月份數字相若。當中尖沙嘴區空置率雖然不是所有分區中最高,但有持續上升的趨勢,最新升至8.6%,創2020年6月有記錄以來新高。

空置率新報9.8%

近期矚目租務為恒基旗下中環 The Henderson 獲國際投資公司凱雷承租約兩萬方呎樓面,呎租約120元,月租約240萬,為上月最大宗的租務成交個案;此外,金源米業以1.59億購入灣仔新盤 Novo Jaffe 三層樓面,並獲大廈命名權及廣告位,而其中頂層單位呎價高見2.5萬,為項目呎價新高。

(星島日報)

更多The Henderson寫字樓出租樓盤資訊請參閱:The Henderson 寫字樓出租

更多中環區甲級寫字樓出租樓盤資訊請參閱:中環區甲級寫字樓出租

更多 Novo Jaffe 寫字樓出售樓盤資訊請參閱:Novo Jaffe 寫字樓出售

更多灣仔區甲級寫字樓出售樓盤資訊請參閱:灣仔區甲級寫字樓出售

大鴻輝1.2億沽中環南華大廈全層 每呎造價2.91萬 創該廈呎價新高

近年轉型當發展商的大鴻輝,於疫市下頻沽售非核心物業,最新售出中環南華大廈中層全層,作價1.2億連租約易手,每呎造價約2.91萬,創該廈歷來呎價新高,買家享租金回報約兩厘水平;大鴻輝於今年以來連沽3項物業,套現約2.07億。

核心區商廈於疫市下罕錄大手買賣。大鴻輝業主席梁紹鴻指,售出中環雲咸街1號南華大廈 7樓全層,建築面積約4113方呎,以約1.2億連租約易手,平均呎價約29175元,他形容上述造價屬「疫市理想價」,亦以早前購入中環荷李活道全幢商住樓「大刁」相比,直言以1.8億買全幢、隨即以1.2億沽全層,足以反映投資老手本色。

梁紹鴻:屬疫市理想價

梁紹鴻亦為現今商廈市場「把脈」,他指出,中港兩地至今尚未通關,料整體市況仍然受壓,惟政府早前宣布將入境檢疫期縮減至「3+4」,反映當局有意逐步放寬相關措施,料通關指日可待,預測於今年11月有機會落實,屆時商廈市場將逐步回暖,故他對後市仍感樂觀。

連約回報2厘

據市場消息指出,梁紹鴻早於2007年以約2254.74萬購入,持貨15年帳面獲利9745.2萬,物業期間升值約4.3倍。上址現時由教育學院以每呎約49元租用,月租約201537元,以易手價計,料買家享租金回報約兩厘水平。

同時,市場消息盛傳,買家為上海商業總會,為同廈1至3樓業主,購入作自用用途,惟截稿前未能進一步證實。

據業內人士指出,上述呎價創該商廈歷來呎價新高水平,甚至比得上區內指標甲廈皇后大道中9號,實在令市場嘩然!

今年暫沽3物業套現逾2億

據代理行資料顯示,皇后大道中9號最近期成交為14樓3室,建築面積3290方呎,於今年6月以9500萬售出,呎價約28875元,故實在較是次買賣呎價略低;至於南華大廈近期買賣較疏落,對上一宗成交為該廈1007室,於2014年底以1527萬售出,以建築面積約736方呎計,呎價約20747元。

事實上,大鴻輝於今年以來頻頻沽貨,據本報統計資料顯示,大鴻輝分別於今年4月及5月,分別以5000萬及3700萬售出筲箕灣道兩鋪位,合共涉資8700萬,故計及上述南華大廈成交,大鴻輝於今年連沽旗下3項物業,套現約2.07億。

(星島日報)

更多南華大廈寫字樓出售樓盤資訊請參閱:南華大廈寫字樓出售

更多皇后大道中9號寫字樓出售樓盤資訊請參閱:皇后大道中9號寫字樓出售

更多中環區甲級寫字樓出售樓盤資訊請參閱:中環區甲級寫字樓出售

荃灣甲廈「沙咀道1號」 億京短期推

億京旗下荃灣「沙咀道1號」甲廈項目料月內推出,據代理流傳價單,每層樓面分間成20多伙,入場費約600餘萬元起,呎價約1萬餘元起。

億京早年購入沙咀道工廈項目,並重建成甲廈沙咀道1號,該廈料年內入伙。市場人士透露,發展商方面部署短期推售。

流傳價單 呎價逾萬元

據代理流傳價單,料先推出5至7樓、15至17樓6層樓面,而每層樓面分間成1至27號單位 (不設4、13、14及24號室),合共23單位,面積由543平方呎起,至約2,000餘平方呎。入場單位為5樓23號室,面積約543平方呎,定價約608萬元,呎價約1.12萬元,而同層單位,呎價約1萬餘元起,而最終定價,需由發展商進一步落實。

翻查資料,億京在2017年以約21.6億元購入的荃灣永南貨倉大廈全幢,呎價約4,350元。2020年集團以14.15億元補地價「工轉商」,每呎補地價約2,841元,物業位於荃灣青山公路503至515號及沙咀道1至9號,比鄰愉景新城,重建樓面約49.8萬平方呎。

同區新盤買賣方面,第一集團旗下荃灣大涌道18號國際企業中心3期近日錄成交,涉及3樓7至9室,總樓面約4,247平方呎,以4,520萬元售出,平均呎價約1.06萬。

(經濟日報)

大業街33號兩層招租 每呎叫租17元起

觀塘近年受惠於「起動東九龍」及活化工廈2.0等政策,發展一日千里,隨着不少工廈轉型作商廈後,傳統工業樓面供應因而遞減,尤其大樓面供應更見矜罕,個別行業如物流及倉儲行業對工廈需求殷切,因而帶動工廈租務市場有穩定增長,新近觀塘大業街33號兩層全層樓面招租,意向月租約23.97萬元起。

可一併或分開招租

有代理表示,位於觀塘大業街33號2樓及3樓正進行招租,面積分別約14,100平方呎及約14,500平方呎,意向呎租同約17元,可一併或分開出租,涉及月租約23.97萬元起。

備專用升降機 方便上落貨

大業街33號備有專用升降機,方便大型貨物上、落貨,需時甚短;停車場亦提供充足車位及卸貨台,對物流行業極具吸引力,另有獨立保安及更亭,安全及私隱度高。

據代理行成交顯示,觀塘區內工廈租務交投活躍,而成交又集中於中、小型單位身上,面積於2,000平方呎以下者最為市場受落,相比逾萬平方呎大單位,由於供應少,反而更為罕矜,參考市場近期面積較大的工廈租務成交,其中,鴻圖道78號高層單位,面積約6,510平方呎,月租約14.3萬元,平均呎租約22元,另外,觀塘工業中心第3座高層單位,面積約2,157平方呎,月租達3.35萬元,平均呎租16元。

該代理續稱,現代物流業發展獲政府大力支持,新近外資基金ESR以約52億元奪得葵涌貨櫃碼頭旁物流地皮,反映業界對工業相關行業的地皮需求殷切。再者,疫情下零售業發展出現新常態,網上銷售的營運模式令庫存的需要大為提高,因此推動倉儲及物流空間需求上升。而今番招租物業為東九龍區罕有大樓面單位,其配套設施適合各行各業承租,大廈外觀配以特色搶眼壁畫,相當亮麗。同時,該廈地理位置優勝,交通四通八達,對比區內相類似盤源,其叫價更見相宜,目前三湘九龍灣貨運中心其意向呎租大多都達每平方呎約24元,突顯是次招租不論質素或意向價亦相當吸引,料洽租反應會見熱烈。

(經濟日報)

更多鴻圖道78號寫字樓出租樓盤資訊請參閱:鴻圖道78號寫字樓出租

更多觀塘區甲級寫字樓出租樓盤資訊請參閱:觀塘區甲級寫字樓出租

石門新都廣場全層 叫價1.48億

沙田石門區由傳統工業區,轉型為新式商貿區,加上有鐵路貫通下,受歡迎程度大增,而新近有業主放盤新都廣場中層全層單位,連裝修,交吉,意向呎價不足8,000元。

近2萬呎交吉售

有代理表示,承業主委託放售石門安耀街2號新都廣場中層全層單位,面積約19,139平方呎,以交吉形式放售,意向價約1.48億元,每平方呎叫價約7,733元。放售為全層大面積單位,備多窗,擁開揚景觀,眺望山景,內籠同時備有寫字樓裝修,以市場上同類質素單位動輒每呎叫價逾萬元,此單位屬低水及極具投資價值。

新都廣場位於石門中心位置,坐擁港鐵屯門綫優勢,而大廈設有多層停車場,可提供158個私家車位,而周邊商舖林立,中外南北風味食肆一應俱全,配套齊全。而據EPRC經濟地產庫資料顯示,今年以來新都廣場暫錄4宗成交,市場最新錄高層20室,面積約922平方呎,成交價約737.6萬元,平均呎價約8,000元。

該代理指,傳統核心商業區的呎價屢創新高,政府積極開拓二綫商業區,而石門鄰近多個大型屋苑,加上在屯馬綫及東鐵過海綫的帶動下,大大加強與新界及九龍區的聯繫,為該區帶來大量流動人口及消費力,有利石門轉型為新興商貿區。此外,政府正積極就工業用地進行檢討,規劃署建議把沙田小瀝源約80.5萬平方呎的工業地改劃為住宅,料石門將受周邊帶動,升值潛力有增無減,吸引大量資金流入;再者新都廣場租金價格水平合理,空置率低及承租能力強,預料新買家購入後,回報率將會相當理想。

(經濟日報)

更多新都廣場寫字樓出售樓盤資訊請參閱:新都廣場寫字樓出售

更多石門區甲級寫字樓出售樓盤資訊請參閱:石門區甲級寫字樓出售

Super new Hutch House named

CK Asset (1113) said the redevelopment of the 1970s-era Hutchison House has been officially named Cheung Kong Center II and is expected to be completed next year.

The project, which started in 2019, will transform the building into a super Grade A office with sea views of Victoria Harbour.

The new 41-story tower will have a total floor area of 550,000 square feet, in addition to 185 car parking spaces.

The company expects the offices in the rebuilt tower to attract global companies, as the project is adjacent to the buildings of many international financial institutions like BOC Hong Kong (2388) and the Hongkong and Shanghai Banking Corporation.

(The Standard)

For more information of Office for Lease at Cheung Kong Center II please visit: Office for Lease at Cheung Kong Center II

For more information of Grade A Office for Lease in Central please visit: Grade A Office for Lease in Central

Flat buying frenzy in New Territories

Sun Hung Kai Properties (0016) and Henderson Land Development (0012) together sold more than 320 flats at their projects in the New Territories yesterday as more units rolled out on the market.

SHKP began to sell the last 140 flats at phase 1A of Novo Land in Tuen Mun yesterday including 139 on price lists and one via tender and by 7pm only the tender flat remained.

Meanwhile, Henderson Land's second round of sales of 185 flats at One Innovale-Archway in Fan Ling - including 182 on price lists and three via tender - were sold out with one of the tender units fetching HK$12 million, a new high for the project.

A client has spent HK$15 million to purchase three flats with cloakrooms while a long-term investor spent HK$13.5 million to buy two units with two bedrooms and cloakrooms at One Innovale-Archway.

According to an agency, up to 30 percent of its customers are buying into One Innovale-Archway as an investment, and the rental rate for these units is expected to reach HK$45 per square foot with a yield of about 3 percent annually. The remaining 70 percent are buyers who bought flats for living. Most of them are young and optimistic about the development of the Fan Ling area.

Meanwhile, SHKP uploaded the sales brochure for phase 1B of Novo Land involving 800 flats.

Phase 1B consists of three residential blocks of 26, 22 and 26 floors and the flats range in size from 220 to 1,464 square feet.

Located at Siu Hong Area 54, Novo Land consists of six phases which will provide 4,585 flats in total.

Also in the primary market, Villa Lucca, the project that is jointly developed by Hysan Development (0014) and HKR International (0480) in Lo Fai Road, Tai Po, yesterday released the first round sales arrangement for 59 units to be invited for tender from August 18, after the unveiling show flats for prospective buyers.

(The Standard)

Prices of homes near Hong Kong’s MTR stations, normally resilient, are falling as property slump deepens

The secondary housing market is sinking further as interest rate rises and a wave of emigration take a toll on demand

As many as 34 housing estates near railway stations have seen their prices fall between January and July, according to a property agency

Hong Kong’s secondary housing market is sinking further into the gloom as interest rate rises, competition from cheap new developments and a wave of emigration take a toll on demand, according to analysts.

A property agency expects its index which is a gauge of lived-in home prices, to fall as much as 1.9 per cent to 174 by mid-September.

It sank to 177.43 in the week ended July 31, back down at the level seen in March as the fifth wave of the coronavirus raged.

“Under the influence of interest rate hikes and emigration, the second-hand market has been seeing losses in transactions, and buyers have delayed their decisions to enter the market,” agent said.

Even developments close to railways, which tend to be more resilient, are not immune. As many as 34 such housing estates have seen their prices fall between January and July this year, according to the agency, which tracked 56 projects close to MTR stations.

“Transactions in the secondary market have shrunk significantly recently, mainly due to the inevitable interest rate hikes in Hong Kong and the developers’ frequent launches of new properties at low prices,” another agent said.

“Even the most popular properties along the railway lines have experienced declines in both price and transaction volume.”

Financial Secretary Paul Chan mo-po recently told the Post that commercial banks in the city will have no choice but to raise their prime rates, but are not likely to do so at the scale and pace of the Federal Reserve.

Tung Chung Crescent, by Tung Chung MTR station, experienced the biggest drop in prices this year, a decline of 21 per cent from January to HK$10,599 (US$1,350) per square foot in July. This was followed by Ultima, a project close to Ho Man Tin Station, and The Victoria Towers near Austin station, where prices sank 18 per cent and 13 per cent respectively.

Across the 56 developments with proximity to stations, there were only 319 second-hand deals last month, a 19-month low and a long way off the 870 transactions in the same period last year. The number of railway projects that saw no transactions during the month increased to three.

Homeowners across the board are suffering bigger losses when selling their flats. For example, Harbour Glory in North Point saw a flat measuring 1,595 square feet change hands last week at HK$52.5 million, a loss of HK$6 million, according to the agency.

A unit measuring 832 square feet at Fleur Pavilia in North Point went for HK$20 million, a loss of HK$2.36 million last week, according to another agency.

“The continuous correction in home prices has attracted buyers to hunt for bargains,” another agent said.

Valuations of lived-in homes also remained weak, according to the a valuation index which is a weekly gauge that tracks major banks’ valuations of used units in 133 housing estates compiled by a property agency.

It has recovered for the last two weeks after sinking to just 15.2 points, the lowest since March, in the week ended July 17. An index below 40 indicates a bearish view of the market and a downward trend in home prices, while one above 60 points indicates a bullish trajectory.

For instance, the value of a flat measuring 548 square feet at Kingswood Villas’ Locwood Court fell 4.9 per cent in one month to HK$5.85 million in early August, the lowest since February 2021, according to an online valuation by HSBC.

(South China Morning Post)中環荊威廣場全層1.1億連約沽 每呎2.5萬 高市價10% 租金回報1.8厘

疫市下核心區商廈交投仍然活躍,市場再錄逾億元大買賣,消息指,中環荊威廣場高層全層以1.1億連租約易手,每呎造價約2.5萬,高市價約10%,租金回報約1.8厘,原業主持貨15年帳面獲利6339萬,物業期間升值約1.36倍。

核心區商廈於疫市下頻錄大手買賣,市場消息透露,中環威靈頓街1號荊威廣場高層全層以約1.1億成交,以建築面積4397方呎計,呎價約25017元;據業內人士指出,上述成交價屬理想價,較市價稍高約10%,原業主於2007年底以約4660.82萬購入,以易手價計,持貨15年帳面獲利約6339.18萬,物業期間升值約1.36倍。

持貨15年升值1.36倍

據地產代理指出,上址以連租約易手,以市值呎租約37元計,月租收入約16.2萬,料買家享租金回報約1.8厘,儘管成交價較市價略高,惟因上址屬該商廈唯一全層放盤,加上位處高層,坐享開揚景致,故吸引買家以進取價購入,料作自用用途,此外,該乙廈現今僅餘兩伙放售盤,當中為較低樓層的全層單位,以每呎2.5萬放售,另一放售盤為低層單位,以每呎約2.4萬放售。

位處高層享開揚景致

據代理行資料顯示,該乙廈於近期成交較疏落,對上一宗成交為該廈9樓1至2室,建築面積1699方呎,於2020年5月以3200萬售出,呎價約18835元。

至於該廈另一成交為21樓全層,建築面4397方呎,於2019年1月以約1.18億售出,呎價約2.7萬。

該行代理表示,儘管受疫情及美國聯儲局連番大幅加息等利淡因素影響,商廈市場觀望氣氛籠罩,惟現今市場資金充仍充裕,中環亦為本港傳統商業核心區,為各大企業及商家「兵家必爭之地」,故即使以較進取價錢於區內「插旗」,於長綫而言仍然是物有所值,帶動市場於疫市下頻錄大手買賣。

事實上,中環區內頻錄大手商廈買賣,大鴻輝日前以1.2億沽出中環南華大廈中層全層,每呎造價約2.91萬,創該廈歷來呎價新高,買家為上海商業總會。

(星島日報)

更多荊威廣場寫字樓出售樓盤資訊請參閱:荊威廣場寫字樓出售

更多南華大廈寫字樓出售樓盤資訊請參閱:南華大廈寫字樓出售

更多中環區甲級寫字樓出售樓盤資訊請參閱:中環區甲級寫字樓出售

旭輝6.74億售炮台山項目60%予大股東

旭輝控股以總代價6.74億,出售旗下持有北角炮台山英皇道101號及111號項目的合營公司60%股權及銷售貸款,買家為大股東林中、林偉及林峰。

上述合營公司名為「旭輝地產202006」,是旭輝控股與宏安地產於2020年成立,各佔60%及40%權益,並於2020年斥資18.8億,收購英皇道101號及111號地段全數權益。該地段總佔地面積約12695方呎,計畫重建為商住項目,預計2026年完成。

擬重建為商住項目

另外,宏安地產牽頭發展的薄扶林道86A至86D號住宅項目,宏安行政總裁鄧灝康回覆查詢時表示,最近與地政總署達成補地價協議,涉及金額約6535萬,又透露項目總投資額約15億,部署明年第三季以現樓方式推售。

據了解,是次補價涉及放寬部分上蓋面積要求,並涉及樓面面積或地積比率的改動。該項目地盤面積約2.85萬方呎,2020年初已獲屋宇署批出建築圖則,並展開上蓋建築工程,將建7幢洋房,以可建總樓面約2.84萬方呎計,每方呎樓面補地價約2300元。

(星島日報)

工商舖交投放緩 筍盤獲吸納

受多項因素影響,近日工商舖買賣稍為放緩,而市場出現個別筍盤,即獲投資者吸納。

據一間代理行資料顯示,7月份工商舖買賣僅錄得337宗成交,為過去7個月新低,與6月份444宗比較,則下調24%,而與去年同期比較亦下跌46%。7月份成交金額則錄得約48億元,較前月約79.11億元下跌39%,而與去年同期約147.09億元比較,跌幅達67%。在工商舖3個範疇中,以商廈表現最差,僅錄得44宗買賣成交,與6月相比下降了23%,為今年度第2新低,而涉及金額約4.01億元,較6月約10.02億元急跌近6成,跌幅較整體工商舖為高,反映寫字樓市場買賣交投最受影響。

海富中心銀主盤 1.93億易手

整體買賣淡靜,而個別業主大幅降價即獲承接。如港島甲廈金鐘海富中心早前有銀主盤出現,涉及2座13樓全層,面積約10,627平方呎,去年9月份淪為銀主盤,由接管人推出放售,當時每呎叫價高達2.9萬元。該層樓面新近以以1.93億元易手,呎價約18,161元,創該廈近5年來的呎價新低紀錄。原業主偉俊集團控股股東林清渠等,早於2004年10月以6,800萬元購入,18年帳面升值1.83倍。追溯對上1次成交,為海富中心一座低層03A室,面積2,625平方呎,2017年以近4,525萬元易手,呎價約1.7萬元。在2017、2018年高峰期呎價曾達3萬元。

新買家為湯臣集團,指出收購屬策略性長期投資,預期收購將提升物業投資組合,產生穩定經常性租金收入,又指適當時候可能將該物業用作為香港之總部。

另一幢指標甲廈皇后大道中9號亦錄低價成交,內房佳源集團 (02768) 以約9,500萬元沽中環皇后大道中9號細單位,涉及中層03室,面積3,290平方呎,呎價28,875元,屬低市價15%成交。佳源國際早於2013年以香港佳源集團有限公司名義,斥資約9,360萬元買入上址,持貨約9年,現轉手帳面獲利約140萬元,但若連代理佣金、釐印費 (約398萬元) 等費用計算,估計原業主實蝕近450萬元離場。

商舖方面,核心區地段錄低價成交,尖沙咀彌敦道111至181號栢麗購物大道D段地下7號舖連1樓,地舖面積651平方呎,1樓面積1,382平方呎,總樓面2,033平方呎,早前以約1.8億元放售,據悉最終僅以約為6,300萬元易手,低市價約4成,該舖現時由金行承租。

栢麗購物大道舖 低市價4成沽

分析指,由於預計息口即將上升,加上尚未完全通關,令投資市場表現仍一般,個別業主睇淡後市,願大幅降價放售物業。同時間,市場資金仍多,不少投資者一直部署入市,只待業主大幅減價,當個別物業明顯低市價1至2成放盤出現,即吸引投資者入市,反映市場資金仍充裕,日後若仍有「筍盤」出現,便容易獲吸納。

(經濟日報)

更多海富中心寫字樓出售樓盤資訊請參閱:海富中心寫字樓出售

更多金鐘區甲級寫字樓出售樓盤資訊請參閱:金鐘區甲級寫字樓出售

更多皇后大道中9號寫字樓出售樓盤資訊請參閱:皇后大道中9號寫字樓出售

更多中環區甲級寫字樓出售樓盤資訊請參閱:中環區甲級寫字樓出售

Admiralty Office Floor Sells at Five-Year Low Price in Slow Hong Kong Market

Hong Kong-listed developer Tomson Group is acquiring an office floor in Admiralty for HK$193 million ($25 million), clinching the asset at a unit price of HK$18,161 per square foot which is reportedly the lowest in five years amid muted market activity.

Known for its Tomson Riviera project in Shanghai’s Pudong district, Tomson said in a filing to the local bourse on Sunday that its tender for the 13th floor of the Admiralty Centre Tower II had been accepted, allowing it to pick up the 10,627 square foot (987 square metre) asset from receivers acting on behalf of electronic parts trader Wai Chun Group Holdings.

The floor in the 22-storey building atop the Admiralty MTR interchange had first been put on the market for a price equivalent to HK$29,000 per square foot late last year, before slashing the price for the grade A office asset to HK$20,000 early in 2022, according to a report by local financial daily HKET.

The Admiralty Centre Tower II floor has now found a buyer at 37 percent below its asking price from less than one year ago as average prices for grade A offices in Hong Kong have dropped by 31.1 percent from the market’s peak at the end-2018, according to a property agency. Office rents in Central are now 28.3 percent below their market peak in 2019, the agency said.

Prices Fall 49% Since 2019

The office floor sold at a price at the low end of market expectation as investors tend to offer lower bids for properties being sold by receivers and with Admiralty’s office investment market muted for the past year, according to an agent.

Smaller units in the 1980 vintage tower at 18 Harcourt Road have sold for higher prices this year with an 1,875 square foot office on the 17th floor finding a buyer at HK$25,493 per square foot in May, according to data compiled by another agency.

When compared to prices prior to Hong Kong’s social unrest in 2019 Hong Kong and the start of the coronavirus pandemic in 2020, the price for this latest deal was 49 percent less than the HK$29,924 per square foot fetched for a floor in the same building in April 2017, based on separate data from another local agency.

Admiralty Action

For Shanghai-based Thomson, which sources most of its profit from development of properties in mainland China and Macau, the strata office is an income-earning investment which could provide a future Hong Kong home for its business.

“It is expected that the acquisition will enhance the property investment portfolio of the group, generate stable recurring rental income and further strengthen the long-term development of the group in Hong Kong,” Tomson said. “The property may be used as the company’s headquarter in Hong Kong at an opportune time.”

The property generated HK$3.9 million in rental income last year, which was down 10 percent from the HK$4.35 million produced in 2020.

Just prior to conclusion of the tender, Wai Chun signed a three-year agreement to lease half of the floor, or 5,313.5 square feet at a monthly rate of HK$238,000, excluding other fees and charges. The agreement, which covers 1 November through 31 October 2025, also includes two car parking space leases for HK$5,000 per month.

Based on the HKEX filing, the strata office floor is currently held by Wai Chun’s lender, Industrial Bank Co Hong Kong Branch, for a December 2018 mortgage, with the trading firm having purchased the office floor in October 2004 for about HK$68 million.

Moving Closer to Future HQ

Tomson, which is currently based in the Wing On Centre tower in Sheung Wan, had announced late last month that it had leased a new office on the 17th floor of the Far East Finance Centre at 16 Harcourt Road, which is just a few steps from Admiralty Centre Tower II.

Its Admiralty acquisition adds to a series of discounted strata office deals in Hong Kong over the past year, including a HK$95 million purchase last month by an executive director of Cheung & Sons of unit at 9 Queen's Road Central from distressed mainland developer Jiayuan International Group.

Discounted prices and lease rates make Hong Kong’s office market attractive for investors looking to upgrade their workspace, an agent said, who expects the market to rebound during the remaining months of this year with the city’s core business district being a focus of activity.

“We have witnessed a sign of recovery from the downturn in the office market, and believe the positive net absorption will continue to improve in the second half of the year,” agent said. “Central will be the focus of market activities in the remaining part of the year.”

(Mingtiandi)

For more information of Office for Sale at Admiralty Centre please visit: Office for Sale at Admiralty Centre

For more information of Grade A Office for Sale in Admiralty please visit: Grade A Office for Sale in Admiralty

For more information of Office for Lease at Far East Finance Centre please visit: Office for Lease at Far East Finance Centre

For more information of Grade A Office for Lease in Admiralty please visit: Grade A Office for Lease in Admiralty

For more information of Office for Lease at Wing On Centre please visit: Office for Lease at Wing On Centre

For more information of Grade A Office for Lease in Sheung Wan please visit: Grade A Office for Lease in Sheung Wan

For more information of Office for Sale at 9 Queen’s Road Central please visit: Office for Sale at 9 Queen’s Road Central