樓面呎價4546元較兩年前私樓地低60%安達臣道首置地49億批出長實力壓八財團奪標

在疫情仍未受控及經濟下行陰影下,於上周五截標的觀塘安達臣道首置盤地皮,在昨日開標,由長實以四十九億五千一百萬元勇奪,擊退其餘八家財團,每方呎樓面地價四千五百多元,符合市場預期,惟比對○八年初同區批出的私樓地皮,每呎地價達一萬二千元,跌幅逾六成。

本報地產組

安達臣道首置盤地皮為港人上車盤先導項目,亦為首個作混合式發展項目,該項目於上周五截標,當時吸引九家財團入標,主要為本地藍籌發展商之爭。地政總署昨日公布,由長實以四十九億五千一百萬奪地,樓面呎價約四千五百四十六元,力壓其餘八家財團得手,而其餘入標發展商分別為會德豐地產、華懋、信和、嘉華、佳明、中國海外、另外恒基、遠展及帝國集團則合資。

近兩年來首奪大型項目

長實執行董事吳佳慶回應查詢時指,集團對投得安達臣道地皮感欣喜,冀透過有關發展項目為香港房屋供應作出貢獻。

是次亦打破該公司接近兩年來未有投得地皮的悶局,該集團於一八年八月取得黃竹坑站三期「巨無霸」商住項目;而以政府地皮計,對上則為一六年九月、以十九億五千三百萬奪得九肚麗坪路地皮。

吳佳慶:冀對房屋供應作貢獻

該地盤佔地約二十一萬七千方呎,可建樓面約一百零九萬方呎,為第二個「港人首置上車盤」先導項目,受不同的限呎及條款「捆綁」,並反映在地價上。區內對上一幅私人土地為一八年初、華懋以逾三十一億一千萬奪得,樓面呎價約一萬二千元,比較是次地價兩年間低逾六成;此後,政府將安達臣區內六幅私樓地皮撥作公營房屋,另一幅則為是次招標的首置地,令區內發展規模大變天,並以公營房屋主導。業內人士指,是次出價符合市場預期,惟現樓形式推售,無法預售樓花,對日後開售的時間表有所約束,及增加風險。

有測量師認為,中標價屬合理,且該區以公營房屋為主導,及以現樓形式推售,加上同一樓盤的私營公營比例對地價很有大影響,認為發展商出價已經考慮上述因素;另外,指該首置單位加私樓的混合發展模式對日後有指標作用。

業界:地價具指標作用

另一測量師表示,中標價已反映政府亦有因應市場最新情況,以及地皮本身的發展模式而調整底價,屬隨行就市。另外,賣地條款複雜,首置單位數量亦多,地區配套不足、投資額大等因素都影響出價。指該地皮有指標作用,亦了解發展商對發展首置盤的反應正面。相信政府會在未來一些合適的地皮如東北發展區出售上加入相關「首置」條款,以私人發展商的力量去加快公共房屋的興建。估計落成後每呎可售約一萬五千元起。

(星島日報)

疫情影響 灣仔乙廈呎租低見20元

受到疫情所影響,商廈租金亦明顯下跌,當中灣仔乙級商廈新銀集團中心早前有低層單位,呎租低見20元,比起東九龍的工廈活化項目租金更低。

新銀集團中心呎租 十年新低

位於告士打道的新銀集團中心一個低層單位,以呎租僅20元租出,為該廈過去10年來最低呎租個案。相較之下,現時觀塘區由工廈改裝而成的商廈呎租不少達20元左右。上址業主早於2011年以2,468萬元購入,現租金回報約2.9厘。據悉,該廈對上一宗最低呎租租務成交,同為上述單位,於2009年12月以呎租20元租出。

另外,同區樂基中心業主新近收回9至12樓4層樓面,改裝成為全新辦公室及多用途空間,翻新後再分間成每層11伙的多用途辦公室出租,單位面積由289至578平方呎,呎租約36元起,即月租由10,404元起。

由於樓層前身為酒店,故業主保留單位內去水位等設計,大部分單位均設有24小時熱水淋浴間及洗手間,方便租戶工作,單位亦可按租戶要求提供辦公室家具,方便租戶即租即用。而項目目標租戶亦多元化,由工作坊、樓上商店及美容等亦見合適。

(經濟日報)

舊樓重建增 灣仔添186萬呎商用樓面

近年灣仔區有不少重建項目,發展商將收購得來的舊樓重建成商廈,爭取更高地積比率,區內6發展項目,預計可為該區帶來約186.2萬平方呎新商用樓面。

合和中心2期 建綜合商業大型項目

灣仔位於中環金鐘核心商業區,以及銅鑼灣的零售旺區中間,過往區內住宅、商業混雜發展,謝斐道以北比較多商業大廈,而灣仔道以南則屬住宅段,不過近年由於核心區商業土地供應不足,區內舊樓重建成商廈的趨勢有所蔓延。

目前區內共有6個重建項目,合共提供約186.2萬平方呎新商用樓面,包括區內兩大地主太古地產 (01972) 及合和均積極在區內擴展版圖。當中合和以皇后大道東的合和中心為根據地,向周邊進行收購重建,而規劃逾30年的合和中心2期項目亦已展開,將會興建成酒店、辦公室及零售的綜合商業大型項目,可建樓面約109.4萬平方呎。而比鄰的皇后大道東153至167號項目,將會興建1幢小型銀座式商廈,以配合合和中心1期及2期的發展,估計項目最快於2021至2022年分別落成。

至於太古則由早年購入前域多利兵房的用地,興建成金鐘太古廣場的旗艦項目之後,亦向灣仔區擴大版圖,包括在永豐街、星街一帶收購,並重建成太古廣場3期。

太古重建項目 料2023年落成

近年太古的收購版圖進一步擴大,就皇后大道東的寶華大廈、比鄰晏頓街2至12號及蘭杜街1至11號舊樓集齊業權後,並展開重建。項目佔地約1.44萬平方呎,預計將重建成1幢28層高商廈,樓面涉約21.8萬平方呎,預計2023年落成。同系於星街小區也有部署,其中永豐街21至31號舊樓完成收購,將會興建一幢商住樓宇,預計明年可推售樓花。

另外,友邦保險 (01299) 亦將位於司徒拔道1號的總部友邦大廈,重建成1幢18層高連4層地庫的商廈,樓面涉約25.5萬平方呎,預計重建後會保留為集團自用,估計需時約4年。

至於鄰近港鐵灣仔站的軒尼詩道及駱克道一帶不少舊樓物業林立,新地 (00016)則就天樂里附近的祥樂大樓統一全數業權,將計劃重建作寫字樓發展,涉及可建樓面約13.1萬平方呎。

(經濟日報)

土瓜灣舊樓 中資財團申強拍

梁朝偉擁1舖位 估值839萬較購入跌4成

近年財團活躍收購舊樓,連影帝梁朝偉亦遇上收購強拍,其在2013年以1,500萬元購入的土瓜灣地舖,遭中資龐源集團申請強拍,最新該舖市值估值只有839萬元,較購入價大跌4成。

上述提及的舖位位於新柳街2A號,梁朝偉在2013年年底以1,500萬元購入。舖位所在的高山道26號、新柳街2A及2B號舊樓,去年底開始獲龐源集團收購,近期購入至逾83%業權後,向土地審裁處申請強制拍賣餘下的3間舖位。

根據財團提交的測量師報告指,梁朝偉所持有的新柳街2A號舖,最新市值只有839萬元,比起7年前的購入價1,500萬元低44%,而旁邊的新柳街2B號、高山道26號舖位就分別市值998萬及1,096萬元。據測量師報告指,估值考慮到疫情、舖位面積、舖面寬度等因素而下調估值。

不過,由於估值報告只是反映物業現時市值,法庭會考慮其重建價值,按照過往情況,最終拍賣底價大多為市值1倍以上,故此梁朝偉最終亦未必需要蝕讓。

恒地加快旺角舊樓收購

另外,旺角利奧坊•曦岸近期推售,發展商恒地 (00012)亦加快同區的舊樓收購,就大角咀道177至191號申請進行強拍,將會作為利奧坊第7期項目。該批舊樓樓齡63年,市值約3.9億元,已收購8至9成業權,可建樓面約8.1萬呎,估計可提供約200多伙,據知已經規劃作為利奧坊第7期。

此外,中資財團亦強拍深水埗醫局街227至233號單號舊樓,估值約1.6億元;裕泰興家族羅守弘旗下的文化村,則就油麻地廟街181及183號申請強拍,樓齡57年,估值約6,191萬元。

(經濟日報)

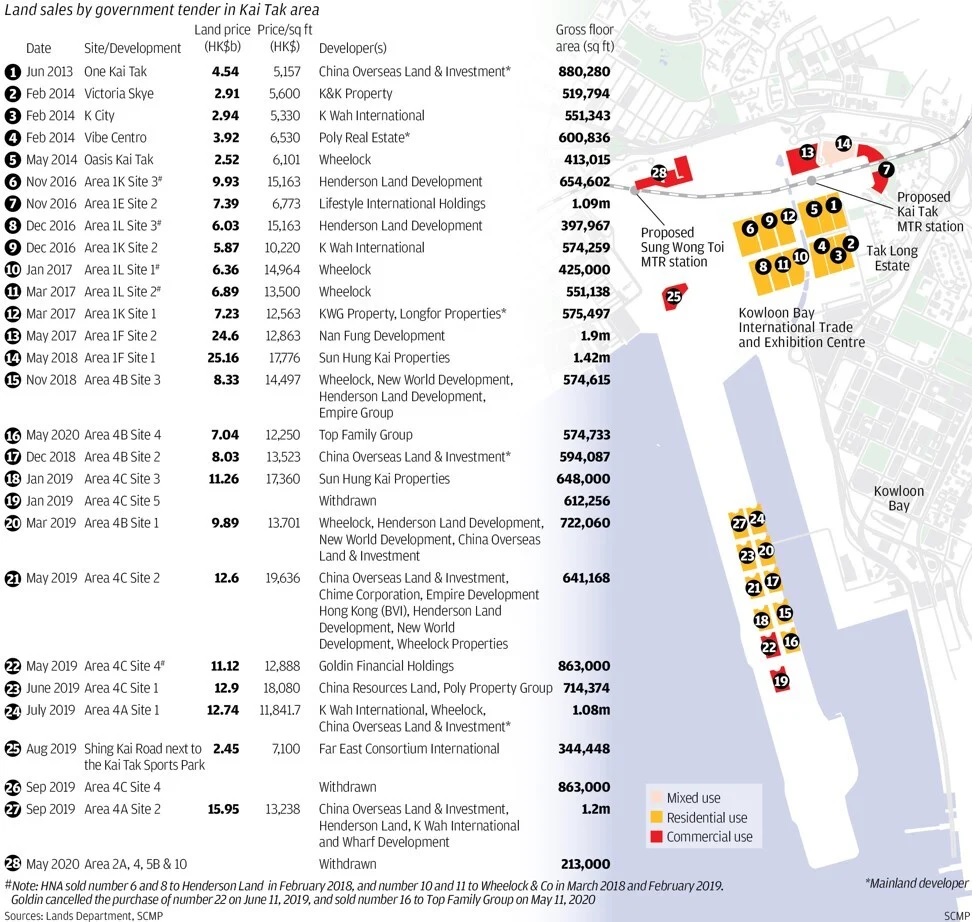

Hong Kong’s government can turn its ‘rotten luck’ on Kai Tak land sales into a windfall for building homes, analysts say

Hong Kong can end a string of “rotten luck” in its recent public land tenders involving the former international airport site in Kai Tak by converting them into residential use to ease the city’s chronic housing shortage, analysts said.

The conversion could help the government reach its annual land-supply targets while boosting its coffers, according to surveyor. The idea is overdue as other facilities in the area, such as the Sports Park, are springing up fast, real estate consultancy said.

The government has failed to find buyers in three commercial sites on the east side of Kowloon Bay for various reasons, crimping its revenues and ability to increase public housing. The stretch coincided with anti-government street protests and the coronavirus outbreak that sent the city’s economy into a recession.

“Selling land needs right timing and the government has had rotten luck in finding buyers for commercial sites in a poor economic climate,” a surveyor said. “The land conversion idea can help support its land-supply targets.”

Financial Secretary Paul Chan Mo-po broached the idea on May 14, a day after the government withdrew Site 4, Site 5(B) and Site 10 in Area 2A as bids came below its undisclosed reserve price. Four parties including Sun Hung Kai Properties and CK Asset Holdings had expressed interest in the first tender of the new financial year.

The government would consider converting the Kai Tak commercial sites for residential purposes, Chan said at a public event, without specifying any particular plot. The Civil Engineering and Development Department is conducting a technical feasibility, he added, without elaborating.

The May 13 tender was the third failed sale since Hong Kong carved up the former airport site into redevelopment parcels. The plot known as Area 4C Site 5 was withdrawn in January 2019, while Area 4C Site 4 failed to sell in a September retender exercise.

The three failed tenders have cost the government at least HK$21.2 billion in missed revenues based on estimates by three property surveyors. Covering a total area of 430,100 square feet (39,957 square metres), they can potentially add 4,000 new homes to the existing housing stock.

“The proposed change to residential will certainly receive general support from Hongkongers, given that the government has struggled to ease housing shortage,” surveyor said.

The former airport site has contributed its fair share to the city’s treasury since at least June 2013. In the just-concluded year to March 31, it contributed to a record haul of HK$110.07 billion from land sales, including other record-setting tenders. It could have been higher had Goldin Financial paid up, instead of walking away from its winning bid,

The last flight out of Kai Tak airport took place in 1998, a year after the handover to China, with the operations relocated to the reclaimed site on Chek Lap Kok island.

In a 2011-12 policy address, the government unveiled its vision of turning an area comprising Kai Tak, Kowloon Bay and Kwun Tong into the city's second core business district, to complement the bustling Central district and ease rocketing property prices.

The plan development for Kai Tak covers 328 hectares of land to accommodate 134,000 residents in 49,900 housing units. Five per cent of the site allocated for commercial use, 13 per cent for residential and as much as 30 per cent for open space.

Much still needs to be done after almost a decade.

The government had failed to meet its land supply targets in two of the past five years. In the financial year just ended on March 31, it provided land bank sufficient for building 12,190 flats, or 9 per cent below its aim. The government has set an average 18,800 units as its annual target from 2019 to 2023.

The cumulative shortfall in public housing, totalling 23,300 units since 2013, is equivalent to about two Taikoo Shing Estates on Hong Kong Island, according to report published by local think tank Our Hong Kong Foundation in April.

Property developers have been reluctant to place big bets given the large investment outlay and long gestation period, surveyor said. Converting them into residential use is “a better option” and could generate a windfall to the city’s coffers, the surveyor added.

Residential plots in Kai Tak can fetch up to HK$11,000 per sq ft, almost double their valuation as commercial sites, Lam estimated.

“The [Kai Tak] site cannot wait any more,” the surveyor said. “The Sports Park nearby is going to launch very soon. It makes no sense to let such a big site nearby sit empty when the park makes its grand debut.”

(South China Morning Post)

Cheung Kong wins starter-home site for $4.95b

A site on Anderson Road in Kwun Tong, where at least 1,000 starter home units shall be developed, has been awarded to CK Asset (1113) for HK$4.95 billion, or HK$4,546 per buildable square foot, at the lower end of market valuation.

CK Asset said it is pleased that the group won the bid and it hopes to contribute to the SAR's housing supply through such development projects. Surveyors previously valued the site between HK$4.6 billion and HK$7.1 billion, or HK$4,200 to HK$6,500 per buildable sq ft.

The price shows developers are bearish on the market, a surveyor said.

The site with development limitations earlier only received nine bids, including ones from China Overseas Land & Investment (0688), Sino Land (0083) and Wheelock Properties.

All residential units to be built should range from 250 sq ft to 500 sq ft in saleable area, among which 20 percent shall be studio units, 25 percent shall be one-bedroom units and 55 percent shall be two-bedroom units.

After the developer obtains the occupation permit, the government will randomly select no less than 1,000 starter home units, including 200 studio units, 250 one-bedroom units and 550 two-bedroom units.

The developer is required to offer these starter home units for sale at 80 percent of market price to eligible applicants.

In 2018, Chinachem won another plot of residential land at Anderson Road for HK$3.11 billion, in which the Buildings Department allowed four residential buildings to be built on the site.

Elsewhere, CHFT Advisory and Appraisal valued the residential site on Praya Road in Ap Lei Chau at HK$1.18 billion to HK$1.22 billion, or HK$12,400 to HK$13,000 per buildable sq ft.

Meanwhile, a 242-sq-ft flat at Amoy Gardens changed hands for HK$5.12 million, or HK$21,190 per sq ft, hitting a new high at the estate, according to property agency.

In the primary market, Sun Hung Kai Properties (0016) released 123 flats in the third price list of Wetland Seasons Park Phase 2 in Tin Shui Wai, at an average price of HK$12,639 per sq ft after discounts. The developer will launch 200 flats for sale on Saturday.

And Vanke Property (Hong Kong) will tomorrow open show flats of The Campton, which offers 467 units.

In other news, the one-month Hong Kong Interbank Offered Rate, which is linked to the mortgage rate, slid for seven days in a row, down by 2.45 basis points to 0.59101 percent.

(The Standard)