萬科5.76億統一深水埗舊樓每呎樓面地價約一萬

市區地皮供應有限,舊樓項目頻獲財團出手購入,其中,萬科香港以底價5.76億統一深水埗海壇街244至256號舊樓,以可建樓面約5.7萬方呎計,每呎樓面地價約1萬。

深水埗海壇街244至256號舊樓,於昨日進行強拍,由萬科於無對手下,以底價逾5.76億統一業權,項目地盤面積7495方呎,坐落位置現規劃為「住宅 (甲類)」, 可建樓面接近5.7萬方呎,每呎樓面地價約1萬。

可建樓面近5.7萬呎

項目為4幢6層高唐樓,其中1幢住宅海壇街244號,樓齡約63年;246至256號則包括3幢住宅,樓齡約64年。項目位於深水埗海壇街,欽州街與九江街之間,項目自2018年底獲財團申請強拍,並於今年10月底獲土地審裁處批出強拍令,經估算後將拍賣底價定於約5.76億,並令重建工程於6年內完成。

海壇街244號設有兩道公用樓梯,物業於1957年獲批入伙紙,允許全幢為住宅用途。

位處海壇街244至256號

另外根據核准建築圖則,其餘6幢大廈分為三組,每組同設兩道公用樓梯,於1955年獲批入伙紙,允許上層作住宅,地下作非住宅用途。

有測量師表示,今年錄35宗強拍,與去年相若,由於收購過程需時,宗數為合理水平,預料未來每年維持30至40宗左右。

該測量師指今年特別的是多了小型發展商及內房參與強拍重建,而隨着更多新晉發展商留意到舊區重建商機,近年深水埗、黃大仙、紅磡,以至西半山區,都出現不少強拍申請,對該區樓價有正面影響。今年市道一般,令更多小業主願意出售舊樓,而在目前樓價相對較低的環境,小業主可以購入同區較新的住宅物業,證明條例逐漸成熟,有助市區重建。

今年錄35宗強拍

該測量師補充,個別業主賠償金額未必與重建值成正比,隨市況波動分成亦會改變,「餅大咗亦多咗人分」。當中住宅區影響較小,但商業區如尖沙嘴和中環,今年分成則比去年差。另外,萬科分開多次強拍地皮附近物業是條例所允許,也有不少個案採用同樣做法,因為發展商收購時未必能一次過收購整個地盤,而分開強拍未必影響業主所獲賠償。

除了上述項目外,萬科近年都積極收購深水埗長沙灣一帶項目,除了去年發售的新盤The Campton外,早前亦就毗鄰的醫局街221至233號進行收購,可建住宅樓面約6.5萬方呎。

(星島日報)

更多尖沙咀區甲級寫字樓出租樓盤資訊請參閱:尖沙咀區甲級寫字樓出租

更多中環區甲級寫字樓出租樓盤資訊請參閱:中環區甲級寫字樓出租

灣仔地鋪每呎110元跌26%位處軒尼詩道租金重返六年前

受疫情衝擊,鋪位市場首當其衝,市區租金持續下滑。灣仔軒尼詩道地鋪於交吉半年後,獲外賣店以11萬承租,平均呎租110元,取代零食店進駐,租金下跌26%,亦重回六年前水平。

市區鋪位再錄減租個案。代理表示,上述為灣仔軒尼詩道78號地鋪,面積約1000方呎,獲外賣住家飯租客以每月約11萬承租,呎租約110元。代理指出,舊租戶為零食店,舊租金約15萬,遷出後交吉近半年,最新租金下跌約26%,亦重回約6年前水平。

每月租金11萬

據土地註冊處資料顯示,上述鋪位業主於2011年5月以5280萬購入,以公司名義忠帆國際有限公司 (LOYALSAILINTERNATIONALLIMITED),註冊董事為黃姓人士,以最新租金計,料享租金回報約2.5厘。

代理指出,受去年反修例事件萌起發酵,加上今年新冠肺炎疫情肆虐,令核心區鋪位租金急速下滑,軒尼詩道亦不能獨善其身,鋪位商戶更產生明顯變化,因遊客近絕迹,該街道現今商戶以民生食肆為主導,同時,亦因租金大幅回落,帶動租賃交投已漸見支持。

外賣店取代零食店

事實上,受市場淡風吹襲,該街道早前亦錄鋪位蝕讓成交,資料顯示,由訊匯金融集團創辦人之一謝兆凱及相關人士持有的灣仔軒尼詩道地鋪,於本月初以4000萬沽出,持貨9年帳面蝕讓150萬,該鋪面積1300方呎計,呎價約30769元,低市價約10%,買家為投資者,購入作長綫收租用途,該鋪由燒味店以每月約11萬承租,租期至2022年,料買家租金回報約3.3厘。

另外,該街道近期亦錄減租個案,資料顯示,灣仔軒尼詩道288號英皇中心地下單號鋪,面積520方呎,以6.8萬租出,呎租約130.8元,該鋪早前由連鎖食肆以10萬承租,租金急挫32%。

(星島日報)

更多灣仔區甲級寫字樓出租樓盤資訊請參閱:灣仔區甲級寫字樓出租

更多灣仔區甲級寫字樓出售樓盤資訊請參閱:灣仔區甲級寫字樓出售

羅守輝8790萬售葵涌工廈 涉三層1.9萬呎樓面

新冠疫情持續嚴峻,繼續有資深投資者沽貨。土地註冊處資料顯示,由老牌發展商裕泰興「太子爺」、尖東廣場有限公司執行董事羅守輝相關人士持有、葵涌美和工業大廈的三層樓面,面積合共19314方呎,上月以合共8790萬元售出,呎價4551元。資料顯示,羅守輝等早前先後購入該廈多層樓面。

(明報)

黃竹坑工廈W50高層戶720萬售 業主料蝕212萬

新式工廈屢次錄得蝕讓成交,土地註冊處資料顯示,港島南區黃竹坑W50高層09室,面積約630方呎,本月中以720萬元售出,呎價約1.14萬元;原業主於2014年以約860萬元購入單位,持貨6年,帳面蝕約140萬元或16%,惟若連同各項使費在內,估計實蝕約212萬元離場,實際蝕幅達25%。

(明報)

更多黃竹坑區甲級寫字樓出售樓盤資訊請參閱:黃竹坑區甲級寫字樓出售

又一村高槐路5號 3.3億「賣殼」易手

豪宅續錄得大額成交,市場消息指,九龍塘又一村高槐路5號項目以公司股權轉讓方式售出,作價約3.3億元,較市場估值低35%。

樓面1.4萬呎 造價低估值35%

資料顯示,屋地佔地面積8,767平方呎,獲批建樓面約14,418平方呎,每平方呎樓面地價約2.29萬元。物業早前曾委託一家測量師行招標,當時市場估值約5.1億元,以此計算,今次成交價較市場估值大幅低35%。原業主於2009年以1.164億元購入物業,今次轉售物業帳面獲利約2.14億元。

葡萄園洋房減價400萬

另外,市場消息指,元朗葡萄園貝翠大道一幢單號屋,實用面積2,806平方呎,開價約4,600萬元,亦減價400萬以4,200萬元沽出,實用面積呎價14,968元。原業主於2007年以2,804.25萬元購入單位,持貨13年,帳面賺約1,396萬元。

市場消息指,跑馬地禮頓山剛售出1座低層A室,實用面積1,087平方呎,連一車位以約4,230萬元易手,實用面積呎價38,914元。原業主於2010年以2,850萬元購入單位,持貨10年,帳面賺1,380萬元,賺幅約48%。

(經濟日報)

尖沙咀一綫街舖同步放租 月租40萬起

核心區商舖租金調整,誘使具實力租客重投市場物色心儀店舖,而尖沙咀現有兩個一綫零售街舖放盤,其中廣東道臨街舖,減租30萬元放租,另,彌敦道地舖連1樓以40萬元放租。

租金可按營業額遞進承租

代理指,現正放租的兩個尖沙咀一綫零售街舖,其中,一個位處廣東道68至80號地下3A號舖,與海港城僅一馬路之隔,前臨為廣東道名牌商店,該舖面積約1,500平方呎,月租叫價由約90萬元,減至最新約60萬元,減幅約33%,每平方呎租金叫價約400元,單位並已交吉。業主深明受疫情影響下,零售及旅遊業大受打壓,故租金方面可接受遞進形式承租,即首年可商議以較相宜的租金進駐,其後每年按營業額狀況再遞增,讓租客更有財務彈性。而據資料顯示,該舖位舊租客經營化粧品店,並已租用物業多年。陸氏預期,隨着愛馬仕旗艦店開幕,將可刺激租客信心,帶動廣東道一帶零售氣氛。

地下連1樓 租值較高位回落5成

至於,另一個放租的零售街舖,坐落於彌敦道54至64B號地下5號舖連1樓,地舖面積約1,000平方呎,1樓面積約400平方呎,合共約1,400平方呎,意向月租約40萬元,平均呎租叫價為286元,業主同樣亦接受以租金遞進形式承租,而舖址將於12月底交吉,上址前租客為韓國化粧品牌,高峰期時月租曾達約80萬元。

代理稱,經過約一年舖市調整期,核心區黃金地段舖租都已大幅下降,租金下調無疑成為商戶租舖誘因,例如奢侈品牌愛馬仕亦全新進駐廣東道名牌商店街,更為今年罕有逆市大型擴充個案,為舖市帶來新動力。雖然近期第4波疫情來襲,個別行業營業受限制,對舖市甚有影響,但同時業主心態上亦因而放軟,反而成為議價良機,預料具實力租客乘此段時間洽詢心儀的舖位。至於是次兩個放租舖位均位處一綫旅遊零售消費地段,過往租金高企令不少行業無奈止步,惟最近因應市況,租金已顯著調整,預計對租客吸引力上漲,洽租反應將會不俗。

(經濟日報)

更多尖沙咀區甲級寫字樓出租樓盤資訊請參閱:尖沙咀區甲級寫字樓出租

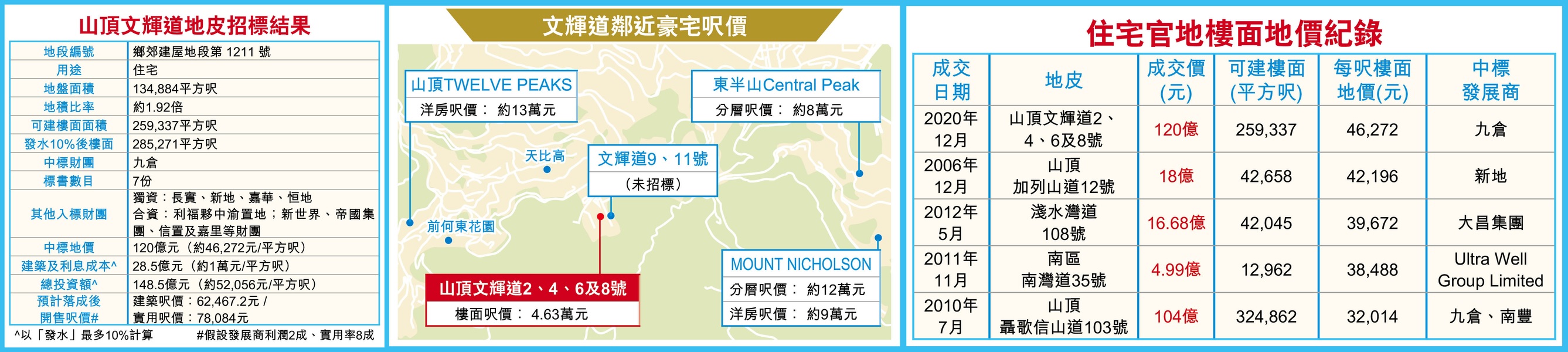

九倉疫市120億高價 奪文輝道地王

樓面呎價4.63萬 全港住宅官地新高

地政總署公布,九倉 (00004) 以120億元投得山頂文輝道地皮,每呎樓面地價4.63萬元,貴絕全港住宅官地呎價,業界認為是次造價具指標性,預計日後賣10萬元一呎以上。

疫情無阻發展商競投豪宅地,上周五截標的山頂文輝道2、4、6及8號地皮,於昨天公布結果,由九倉旗下的Novel Bliss Limited投得,批租期為50年,該公司為出價最高的投標者。項目地盤面積約13.5萬平方呎,以地積比率約1.92倍計算,最高可建樓面約259,337平方呎,每呎地價46,272元。較2006年新地 (00016) 投得的山頂加列山道12號 (現已發展成TWELVE PEAKS) 高,當時每呎樓面地價42,196元,今次高約1成。

市場對用地估值介乎78億至109億元,每呎樓面地價由3萬至4.2萬元不等,故今次中標價較市場估值上限再高約1成。

吳天海:山頂土儲增至逾50萬呎

九倉主席兼常務董事吳天海稱,九倉是擁有最多山頂私人物業的業主之一,集團累積多年的實戰經驗,深諳及更能迎合山頂買家及住戶對理想居停的嚴格要求,是次購入文輝道地皮令集團在區內土地儲備倍增至逾50萬平方呎,而項目將由會德豐地產負責發展及銷售,可望複製MOUNT NICHOLSON的銷售佳績。

資料顯示,文輝道地皮曾在2018年推出招標,當時地皮並未「一拆二」拆細推出,疑因投資額過大而流標收場。而今次以一拆二推出,最終接獲7份標書,較2018年推出時所接獲的5份,多出兩份。入標的其他發展商包括長實 (01113) 、新地、嘉華 (00173) 、恒地 (00012) ,另外合資競投的財團亦包括利福 (01212) 夥拍中渝置地 (01224) ,還有嘉里 (00683) 、信置 (00083) 、帝國、新世界 (00017) 財團。

賣地章程顯示,發展商可申請契約修訂,與項目餘下的三成地盤共用使用康樂設施及泊車位等,協助兩幅地皮協同發展,故市場估計文輝道9及11號,中標的九倉亦會爭取競投,但該地皮暫未推出市場招標。

測量師:造價理想 具指標性

測量師指,項目成交價十分理想,並對項目呎價創下住宅地新高感到驚喜。測量師認為,是次的成交價具指標性,而且反映發展商對未來幾年豪宅後市有信心,又相信疫情及目前的經濟環境對發展商投豪宅地及豪宅市道影響輕微。測量師亦稱,因山頂未來數年沒有超級豪宅供應,加上發展商在山頂擁有其他超級豪宅如MOUNT NICHOLSON,具發展區內豪宅經驗,所以他們投入大量金額投資地皮。

另一測量師亦認為,是次地皮成交價較預期理想,反映取消一手空置稅及拆細地皮的因素,預計該地皮未來落成後每平方呎可賣10萬元。

(經濟日報)

Wharf (Holdings) pays US$1.5 billion for Peak plot, sets record for most expensive residential site sold by government tender

Wharf’s winning bid was higher than a market valuation of between HK$7.78 billion and HK$11.15 billion

Winning bid reflects developer’s confidence in market outlook for super luxury housing, surveyor says

A subsidiary of Wharf (Holdings) has agreed to pay a higher-than-expected HK$12 billion (US$1.5 billion) to become the owner of the first residential land parcel to be sold since 2010 in Hong Kong’s most exclusive housing enclave.

At HK$46,272 per square foot, the sale has also set a record for Hong Kong’s most expensive residential site sold by government tender in terms of square footage. Back in 2006, Sun Hung Kai Properties splashed out HK$1.8 billion, or HK$42,196 per square foot, for the site of luxury project Twelve Peaks at 12 Mount Kellett Road.

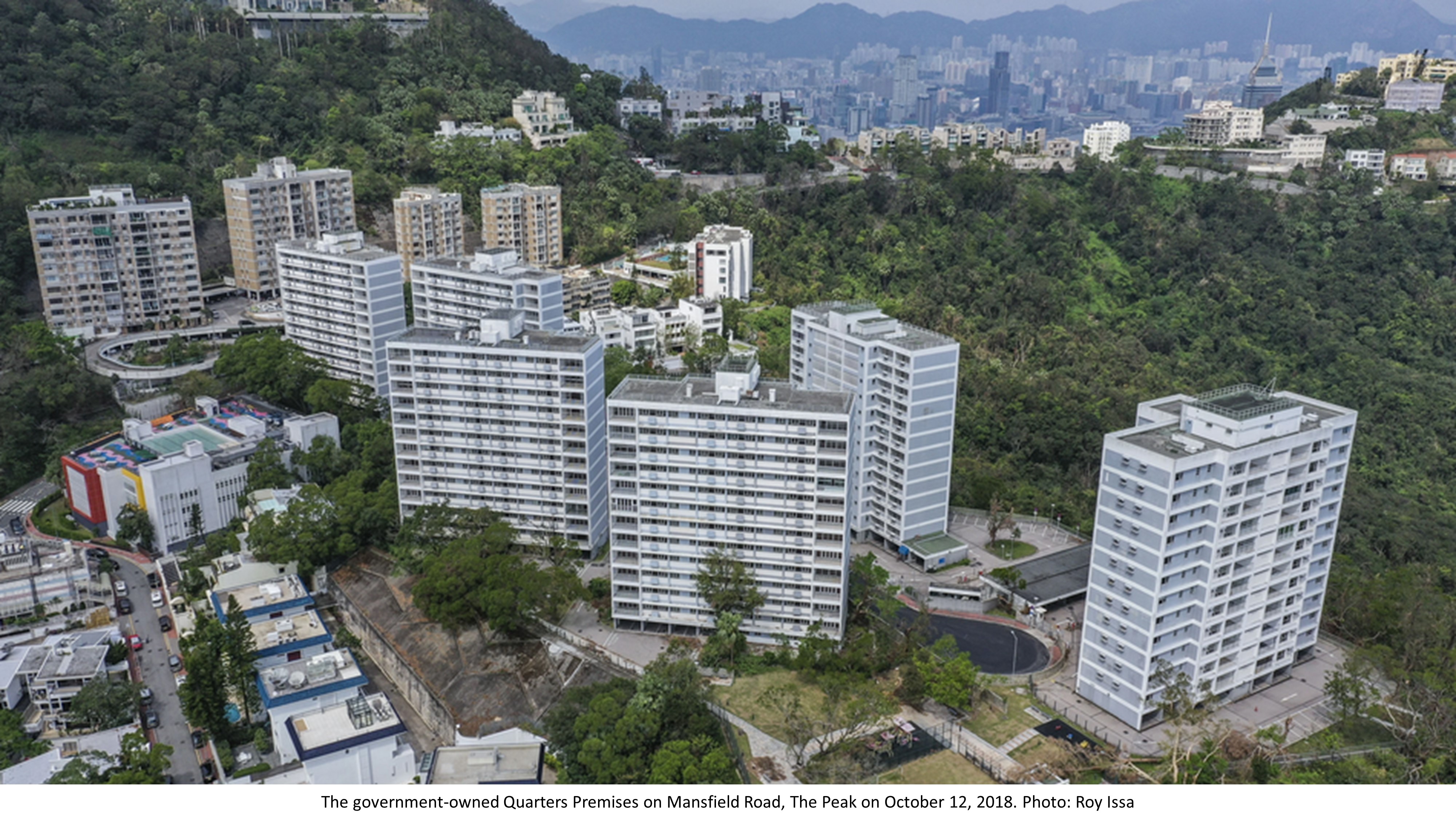

The plot at 2,4,6 and 8 Mansfield Road on The Peak, the site of the former Quarters Premises, where some of Hong Kong’s civil servants were housed, measures 134,884 sq ft and can yield up to 259,337 sq ft of gross floor area.

The successful tender, which follows the sale of the smallest parcel at the beginning of December on the former runway of the old Kai Tak Airport site, shows that the division of large land parcels into bite-size plots was effective in encouraging bids, as Hong Kong’s property market grapples the city’s worst recession in decades.

The winning bid was higher than a market valuation of between HK$7.78 billion and HK$11.15 billion. Wharf Development is a wholly-owned unit of The Wharf (Holdings), a developer controlled by the family of Hong Kong billionaire Peter Woo Kwong-ching.

“The winning bid was better than expected, reflecting the developer’s confidence in the market outlook for super luxury housing, especially on The Peak,” a surveyor said.

Wharf has sufficient experience of the luxury housing market on The Peak, where other projects are also on sale, which could create synergies, so it was reasonable for the developer to bid higher, the surveyor said. This transaction will have a positive effect on land and home prices on The Peak, the surveyor added.

“The group is one of the largest private property owners on The Peak, and has many years of experience meeting the ultra high expectations of buyers and residents for these super luxury properties,” Stephen Ng, chairman and managing director of The Wharf (Holdings) said.

Wednesday’s deal doubles Wharf’s land bank at The Peak to more than 500,000 sq ft, Ng said. As with other projects in Wharf’s portfolio, the Mansfield Road project will be managed, developed and marketed by Wheelock Properties.

The surveyor estimated that the project’s total development cost could be about HK$15 billion to HK$16 billion, and expected it to sell for HK$90,000 per square foot.

In October 2018, the government failed to sell a bigger plot with a much higher valuation at the same site. It then divided the plot into two pieces, one of which was sold on Wednesday. It is about 70 per cent of the bigger parcel of land in size. The government also changed the sales conditions after the sale flopped in 2018 to give developers more flexibility in terms of usage.

Developers were allowed to apply for lease modifications and share recreational facilities and parking spaces with the parcel of land on the remaining 30 per cent of the original site in the future, creating potential synergies in the development of the two sites.

Tenders for “smaller sites can reduce investment costs for developers and attract more of them to participate”, another surveyor said. The surveyor estimated that the plots could bring in about HK$10.4 billion in sales.

The surveyor called on the government to offer the other site – the reaming 30 per cent of the original site – on Mansfield Road “as soon as possible”. Because of the Wharf transaction, the price of the smaller site could be between HK$45,000 and HK$47,000 per square foot, he estimated.

Wednesday’s sale also boosted the proceeds from land sales for the current financial year to about HK$55 billion for the government, the surveyor said.

The average prices of lived-in homes are likely to drop further after October’s surprise decline, as a worsening coronavirus outbreak saps confidence and raises concerns about the prospects of a speedy recovery.

The city’s overall economy continues to be sluggish after Hong Kong was hit by a fourth wave of the pandemic. Border restrictions have greatly reduced transactions in the luxury housing market. Moreover, the government announced earlier that it would shelve a vacancy tax bill to relieve pressure on developers amid concerns that luxury properties will take a long time to be absorbed by the market.

Hang Lung Properties bought the United States Consulate’s former staff quarters at 37 Shouson Hill Road on The Peak in September for a lower than expected HK$2.57 billion, or about HK$54,137 per square foot. Another house at 28 Barker Road, on The Peak, measuring 4,270 sq ft sold for HK$530 million this month, at a loss of HK$12 million.

The tender for the Mansfield Road parcel attracted the Who’s Who of Hong Kong’s biggest developers, such as Sun Hung Kai Properties, CK Asset Holdings, Henderson Land Development, K Wah International, a consortium of Kerry Properties, Sino Land, Empire Development Hong Kong (BVI), New World Development and Beaumont Hill, as well as a consortium of Lifestyle International Holdings Limited and C C Land Holdings.

The parcel is likely to be developed into a mixture of villas and luxury flats, surveyor said. Mount Nicholson, the last land parcel sold by tender on The Peak, has been developed into the most expensive residential enclave in Asia over the past decade, with an unidentified buyer paying HK$500 million for a 4,266 sq ft flat in 2017.

(South China Morning Post)

Sales of shops remain a challenging business

The commercial property market has been recording more deals since Hong Kong abolished the double stamp duty on commercial property transactions, yet what appear to be loss-producing sales continue.

In Sai Wan, a 731-square-foot street shop space at 20 Clarence Terrace changed hands for HK$9.8 million, or HK$13,406 per square foot.

The seller, who purchased the premises three years ago for HK$11.72 million, will thus make a loss of HK$1.92 million, excluding other fees.

New World Development (0017) has collected HK$1.3 billion after selling 74 units at its Grade A commercial building at 888 Lai Chi Kok Road in Cheung Sha Wan.

New World earlier released its price list for 888 Lai Chi Kok Road.

The average per square foot price in the second round of 44 units released to the market was HK$13,275, with the cost of each unit ranging from HK$7.34 million to HK$33.73 million.

Also in the district, Bridgeway Prime Shop Fund Management bought a 1,900 sf street shop at 195 Castle Peak Road for HK$18.1 million, or HK$9,526 psf.

The vendor will make a gain of HK$5.3 million excluding other fees after holding the property for nine years.

In Sham Shui Po, Vanke Holdings (Hong Kong) acquired a building at 244-256 Hai Tan Street for HK$576 million through a compulsory sale on Wednesday. The property is a group of six-storey tenement buildings. The site area is about 7,495 square feet.

In Central, the Hong Kong Sheng Kung Hui church bought a 1,000 sf unit at Glenealy Tower for HK$27 million, or HK$27,000 psf. The seller will make a gain of HK$25.6 million excluding other fees after holding the property for 32 years.

Meanwhile, K&K Property acquired two commercial projects in London for 180 million (HK$1.87 billion).

(The Standard)

For more information of Office for Sale in 888 Lai Chi Kok Road please visit: Office for Sale in 888 Lai Chi Kok Road

For more information of Grade A Office for Sale in Cheung Sha Wan please visit: Grade A Office for Sale in Cheung Sha Wan

For more information of Grade A Office for Sale in Central please visit: Grade A Office for Sale in Central