疫情持续缓和,带动甲厦市场回稳。据代理指出,上月指标甲厦售价按月微升0.2%,租金亦上升约0.8%,整体空置率新报约10%,按月下跌约0.3%。

据该代理行最新发表报告指出,上月甲厦售价按月微升0.2%,港岛核心区,包括中环、上环、金鐘及湾仔等表现持平,而尖沙嘴区表现最好,按月上升2.3%,东九龙及葵涌区则分别按月升0.1%及0.3%。

整体空置率约10%

租金方面,分散业权甲厦及乙厦租金,上月按月分别升0.8%及跌0.9%。当中较为瞩目的,为运动服装品牌Nike由九龙湾迁往观塘国际贸易中心,租用约5.4万呎楼面,呎租约32元。中环国际金融中心二期全层亦获一家中资资产管理公司承租,公司原租用湾仔 One Hennessy,现扩充增至中环国际金融中心二期全层约2.5万平方呎楼面,呎租约130元。

儘管甲厦空置率按月跌0.3%,惟空置率仍然高企,截至10月底为止,本港整体甲厦空置率为10%,当中空置率最高的地区为东九龙,最新空置高见15.5%,至于湾仔/铜锣湾也达9.5%,上环亦升至9.4%。

代理表示,政府最新公布的《施政报告》,提出兴建佔地3万公顷的「北部都会区」,预计落成后可提供65万个工作职位,配合与内地更频繁的经济连繫,写字楼需求定必上升,有利未来商厦市场。

代理:车位买卖按月升45%

代理表示,据土地註册处资料显示,10月录759宗纯车位註册,较9月的521宗增加约45.7%。鑑于签署买卖合约至递交到土地註册处註册登记需时,10月註册个案一般主要反映9月市况。

(星岛日报)

更多国际贸易中心写字楼出租楼盘资讯请参阅:国际贸易中心写字楼出租

更多观塘区甲级写字楼出租楼盘资讯请参阅:观塘区甲级写字楼出租

更多One Hennessy写字楼出租楼盘资讯请参阅:One Hennessy 写字楼出租

更多湾仔区甲级写字楼出租楼盘资讯请参阅:湾仔区甲级写字楼出租

更多国际金融中心写字楼出租楼盘资讯请参阅:国际金融中心写字楼出租

更多中环区甲级写字楼出租楼盘资讯请参阅:中环区甲级写字楼出租

上环巨铺放租逾半年 金融机构每月80万进驻

疫市下巨铺不乏捧场客,继近期中国建设银行 (亚洲) 承租上环德辅道中逾7000方呎铺,同街道另一个巨铺,面积逾1.3万方呎,放盘逾半年后,觅得长租客,由金融机构以每月逾80万进驻,平均呎租58元,较旧租跌28%。业内人士指,短时间内巨铺接连租出,足见银行及金融等行业趁疫市扩张。

平均呎租58元减28%

上环德辅道中134至136号中银保险大厦地库,地下及1楼,地库建筑面积4693方呎,地下4586方呎,1楼4622方呎,合共约13901方呎,属罕有巨铺,由金融机构以每月逾80万租出,较三年前旧租金每月112.5万,下跌28%。

上手租客于2018年7月签约,月租112.5万,今年4月约满,旧租客迁出后,巨铺地下短租予缸瓦佬,同时以每月120万放盘,最终减价30多万,减幅28%成功租出。

同一街道巨铺接连租出

上环德辅道中238号地下、1楼及2楼共三层复式巨铺,近期亦由银行承租,建筑面积合共7633方呎,月租54万,较旧租客证券行跌6%,平均呎租70元。

德辅道中238号巨铺,过往由两家证券行承租,近期1楼及2楼约满,中国建设银行 (亚洲) (下称建行) 率先以每月27万进驻,租期5年,由今年10月1日,直至2026年9月30日,1楼及2楼建筑面积分别约1972及2887方呎。该地铺现址光大新鸿基证券,明年5月约万,建行另以每月27万预租,租期由2023年6月1日至2026年9月30日,建筑面积约2774方呎。两组铺位梗约届满后,有三年生约可续。

(星岛日报)

更多德辅道中238号写字楼出租楼盘资讯请参阅:德辅道中238号写字楼出租

更多上环区甲级写字楼出租楼盘资讯请参阅:上环区甲级写字楼出租

尖沙嘴弥敦道铺呎租100元减75% 楼上侯君刚:短约为期半年

继早前承租旺角亚皆老街老凤祥旧址,楼上有限公司 (前称楼上燕窝庄) 再下一城,承租尖沙嘴弥敦道地铺,月租约15万,平均呎租约100元,较旧租金跌75%,该公司创办人侯君刚表示,趁核心区铺租平连环开店,力吸本地客生意。

疫市下核心铺租大跌,民生行业趁势「摄位」,吼準黄金地段进驻,上址为弥敦道80号金鑾大厦地下A铺,建筑面积约1500方呎,刚由楼上有限公司短租,市场消息透露,每月租金约15万,平均呎租约100元,比较旧租客周大福去年6月迁出时,最后月租约60万,租金大跌75%。

趁铺租跌连环开店

楼上有限公司创办人侯君刚接受本报查询时回应,详细租金不方便透露,基本租约为期半年,半年之后,业主可提前两个月通知交铺。他续说,核心区铺租较旺市时作大幅度折让,吸引他们连环开店,力吸本地客生意。

早前,该公司亦承租亚皆老街老凤祥旧址「铺王」,侯君刚续说,近期市民增加消费,每月生意额都有改善,不过,租赁主动权在业主一方,即使想再租长些时间,相信通关后,业主很快找到心水租客,他惟有见步行步。他续说,早前购入的上水新发街与龙琛路交界铺位,现时亦暂作为自用,此外,并在元朗大马路觅得新据点开铺。

续租主动权在业主一方

事实上,楼上所吼準的旺角及尖沙嘴铺位,过往皆由珠宝店承租。弥敦道80号金鑾大厦地下A铺,珠宝金行周大福曾承租多年,高峰时月租达110万,直至年前减至60万,并于去年6月完约迁出,随后铺位曾短租予包浩斯,月租15万。

上水新发街地铺暂作自用

楼上有限公司于今年8月,承租百年老店「老凤祥」铺址,月租约30万,较旧租跌约80%,上址为旺角亚皆老街67至69号地铺连阁楼,位处西洋菜南街大单边,合共面积3800方呎,短期每月30万,为期3个月起,平均呎租约78.9元。该铺位处旺角一綫地段,老凤祥金行于2015年以每月约200万承租,及后铺市高位回落,老凤祥于2018年以150万续租,故现时短租租金,较旧租大跌约80%。

(星岛日报)

荷李活道彩鸿酒店 8.5亿洽至尾声

物业提供148房间 较高峰期减价逾3成

疫情持续令旅游业困扰,酒店价格回调吸引财团留意。中环荷李活道一幢酒店,获财团8.5亿洽购至尾声快易手,物业提供148间房。现时项目由基金持有,早年以逾8亿购入,高峰期以13亿放盘,减价逾3成。

市场消息指,中环荷李活道彩鸿酒店 (Travelodge Central Hollywood Road) 正获财团洽购,据悉,该物业由基金持有,现获财团出价约8.5亿元,据悉有望短期内成交。

去年曾放售 叫价约13亿

该物业位于荷李活道,物业总楼面面积约5.87万平方呎,楼高约24层,提供148个房间,定位介乎3至4星,于2017年开业。该酒店早年每晚房价造至约800元,惟疫情下旅客数字大跌,整体酒店入住率极低,按网页显示,目前房价跌至每晚约400元。

消息指,业主去年曾放售酒店,叫价约13亿元,惟市况转差未获承接,若最终物业以8.5亿元易手,减价逾3成,而平均每间房价值约574万元。

翻查资料,该酒店过去多年曾数度易手,项目前称丽珀酒店,由远东发展 (00035) 持有,及后转售给帝盛集团,易名为晋逸好莱坞精品酒店,并于2011年以5.15亿元,转售给新加坡基金Alpha。2017年,基金伙拍酒店集团以约8.3亿元购入。若最终以8.5亿元沽出,转手帐面获利约2,000万元。

今年全幢物业买卖旺,而疫情冲击酒店,令价格回落,近期渐吸引财团留意,市场陆续出现全幢酒店快将易手个案。最大手为庄士 (00367) 旗下红磡芜湖街逸‧酒店 (Hotel Sav),获美资基金出价16亿元洽购,物业总楼面12万呎,提供388房。呎价约1.3万元,而每房价值约412万元。另外,油麻地弥敦道Casa酒店全幢,获6.5亿元洽购至尾声,项目提供162间房。消息称,该财团为一家外资基金,拟购入后发展共居。

(经济日报)

外资入市踊跃 倾向防守性高物业

代理:工厦回报佳可增值 成功跑出

今年投资市场明显反弹,有代理分析,在疫情缓和下,投资气氛改善,吸引外资基金踊跃入市,并指出基金倾向投资防守性高物业,而工厦回报可观亦可增值,因此成功跑出。

据代理资料显示,今年逾亿元非住宅物业成交,暂录564.4亿元,较去年全年434亿元,已高出3成。当中工厦买卖极为畅旺,涉及212.95亿元交投,较去年全年76.1亿元,高出1.8倍,值得留意,数字还未计算日前怡和以逾58亿元,沽出红磡及柴湾两项工厦物业。

多个因素向好 投资市场低位弹

该代理分析,各方面因素均向好,令投资市场从低位反弹,「社会事件及去年疫情,不论本地投资者及外资基金开始审慎,累积一定购买力。经过两年,非住宅物业价格回落,资金仍寻找出路。」

该代理指,即使美国联储局已公布逐步减买债,过往两年累积资金仍非常多,「外资基金已集资,他们部署上,投资亚洲比例提高,毕竟亚洲在疫情上较稳定。既然资金多,银纸贬值而物业升值,故把资金续投放在物业上。」

除基本因素外,该代理认为政府措施,有利商业活动回復,「如推出消费券,带动零售及餐饮生意,商铺租务即转好。另外,去年尾减印花税,以及宽按揭,所有措施均能刺激交投。」

论到今年投资市场焦点,工厦肯定独领风骚,连同其他大额买卖,并主要吸引机构投资者留意,数据显示,今年大额买卖宗数中,机构投资者包括基金佔33.6%,若以买卖金额计涉及361.1亿元计,佔整体成交金额的64%,换言之,是今年投资市场主力买家。事实上,近日红磡及柴湾两工厦项目,以逾58亿元易手,买家正为领展 (00823) ,购入工厦作收租。

物流仓冻仓 疫下受惠行业

工厦吸引基金投资者,该代理分析因集合多项有利条件于一身,「机构投资者在疫情下需要投资防守性物业,工厦包括数据中心、物流仓、冻仓等,均是疫情下受惠行业,需求上升,加上工厦租金回报理想,吸引基金入市。相比之下,写字楼空置率上升而租金下跌,商铺未通关难有作为,故基金拣工厦作投资,较容易获批核。」

另外,工厦变化亦高,该代理指政府政策扶持下,包括标準金额补地价、重建工厦增2成楼面等,均推动财团入市重建。在疫情下,工厦更可改装作新用途迎合需求,如今年黑石基金甚活跃,已落实购入观塘及粉岭工厦,并积极洽购筲箕湾工厦,有意把3幢物业,改装成迷你仓,「也是疫下,在家工作的伸延,因住屋空间有限,故迷你仓作储物需求更高。」

(经济日报)

甲厦商铺 明年可追落后

对于明年走势,有代理预计,甲厦及商铺有力追落后,而该代理相信疫情不会令写字楼需求下降,故长綫仍具投资价值。

今年工厦一枝独秀,该代理相信在中短綫上,仍会受财团追捧,惟明年可能放缓,「可供买卖的盘源渐减少,而价格亦在回升,回报率渐下降,基金或会追捧其他物业。」

地区商场成投资之选

首先,该代理预计明年下半年起,整体商铺及甲厦均有力追落后,其中商铺以屋苑基座,或地区商场将成投资之选,「其实疫情下,市民消费习惯有变,如今他们未必要到传统核心区消费,地区商场反而受惠于疫情,租务理想,故有一定投资价值。」另外,该代理分析基金开始与本地发展商合作,研究住宅项目。

另一项较受冲击的物业定为甲厦,今年大手甲厦交投淡静。事实上,数项负面因素困扰甲厦市场,包括封关下租金回调、未来两年供应高峰等,不过,该代理认为,商厦传统是投资者最爱之一,明年中也有力反弹,「写字楼始终是投资者、基金最喜欢,因为容易管理,楼面本身够大易计数,只要价格下跌,便渐有承接力。」

该代理提到,甲厦吸纳量自2019年后连录两年负数,直至第三季录得7万呎正吸纳,为两年来首次转正数,正反映商厦租务改善。该代理分析,疫情下甲厦需求只是暂放缓,未见出现结构转变,「不只香港,甚至亚洲国家,实际上不易实行在家工作。即使公司推出灵活办公,也不一定减少租用楼面,近期更见机构开始重新扩充。」香港金融地位稳,长远商厦需求仍在,「毕竟香港是大湾区中主打金融业,未来很多机构感兴趣来港开业,商厦需求会提升。」

(经济日报)

代理:东九商圈渐成形 近10年商厦呎价升两成

特区政府推出「起动九龙东」长达近10年,目标是要将啟德、九龙湾及观塘一带打造为香港新一代商务区,以配合香港经济转型;有代理指出,整个起动九龙东计划算非常成功,不少大型企业和高端客户均已落户东九龙,虽然整体社区配套、交通等仍具改善空间,但东九龙商圈发展已渐趋成熟,近10年来,区内商厦呎价已上升逾两成。

香港经济活动频繁,带动市场对写字楼需求不断增加,传统核心商业区的写字楼更是供不应求,港府提出「起动九龙东」计划,正可紓缓有关问题。

写字楼楼面增至1480万呎 佔全港23%

据代理行的统计资料显示,2012年第三季、即近10年前,东九龙写字楼楼面只约900万方呎,佔当时全港整体商业楼面的5127万方呎约18%。至于现在,东九龙写字楼楼面已增加至约1480万方呎 (不包括活化工厦的商业楼面),期内增加约580万方呎或64%。

若以全港整体商业楼面计,目前东九商业楼面佔全港商业楼面约6457万方呎的22.9%,存量佔比仅次于中区的24%,反映东九龙商务发展区已成形。

代理分折指,过去东九龙的租户以制造业、消费品租户佔多,随着东九龙发展渐见成熟,过去几乎不见踪影于东九龙的专业服务、房地产业务,已陆续进驻东九龙,租户佔比约12%,连同保险业的租户,两类租户佔东九租户41%,反映高端租户开始接受东九龙。

区内地标商厦现成交呎价约9300元

事实上,东九龙商厦售价亦随着区域发展而上升,该代理称,2012年东九龙地标商厦平均成交呎价约7700元,2018年旺市时呎价曾突破1.3万元,及后因为2019年社会运动、2020年新冠疫情而回落,至现时每呎成交价约9300元,但近10年间仍然上升约21%。

不过,商厦租金因供应增加而受压,实用面积呎租由近10年前的34.1元,下降15%至28.9元。另外,对近日规划署及土木工程署就啟德5幅商业地,提交改划文件,拟由商业转作住宅用途,该代理表示支持有关改划。

支持啟德5幅商业地改划作住宅

该代理分析指,商业区处处讲求方便,最重要是交通四通八达,然而跑道区远离铁路站,交通运输配套亦未完全清晰,「如同孤岛一样」,较难打做成一个完善商圈;此外,跑道区地皮以住宅地佔多,住宅、写字楼所需要的社区配套有别,反之,将地皮改划作住宅,可令跑道区发展更加归一。

(明报)

1,275 homes snapped up over 13 days

Hong Kong's home-buying frenzy continued in November with a total of 1,275 primary transactions recorded in the first 13 days of the month.

Wheelock Properties launched first-round sales for its Monaco One project in Kai Tak on Saturday and sold out all the 341 flats which were offered at a discounted price of HK$24,359 per square foot, raking in HK$3.55 billion.

Ricky Wong Kwong-yiu, the managing director of Wheelock Properties, said a new price list would be released soon, and prices could rise by around 10 percent.

Meanwhile, Sun Hung Kai Properties (0016) said it had sold all 164 flats at Wetland Seasons Bay phase two in Tin Shui Wai on Saturday.

Together with the first round, SHKP has sold over 300 flats, cashing out HK$2 billion. Following the success of its phase two sale, the developer plans to sell 384 flats at Wetland Seasons Bay phase three in the first quarter of next year.

In the secondary market, a property agency recorded 12 transactions at 10 blue-chip housing estates over the weekend, down 9.1 percent week-on-week, after recording double-digit deals for the previous four weeks.

Of the estates, there were no deals recorded at Whampoa Garden in Hung Hom, Kornhill in Quarry Bay and Metro City in Tseung Kwan O.

Property agent said that first-hand transactions are booming, with more than 500 deals recorded over the weekend as the pandemic in Hong Kong continues to ease. Comparatively, second-hand transactions were stagnant.

But the agent believes that the secondary market will pick up, with hopes rising over the resumption of normal travel between Hong Kong and the mainland.

(The Standard)

How tiny can a Hong Kong ‘nano flat’ be? Let’s squeeze in a garden and charge them more

Cramped living ‘a point of pain’ in Hong Kong, but developers add frills to nano flat trend.

Buyers pay more to snap up tiny ground floor flats with gardens in New Territories project.

As new homes in Hong Kong shrink despite costing more, private developers are adding gimmicks to sell their smallest flats. The latest feature: a tiny patch of garden.

More of these shoebox homes, usually just 200 to 300 sq ft in size, have been built in recent years, even in low-density residential areas in the New Territories.

The public sector has also joined in, building more tiny homes referred to as nano flats.

The trend has persisted even though the government has acknowledged that cramped living space is a “pain point for society”. It is considering setting a minimum size for homes built by the private sector and has pledged to increase living space in public housing in the long term, beyond 2030.

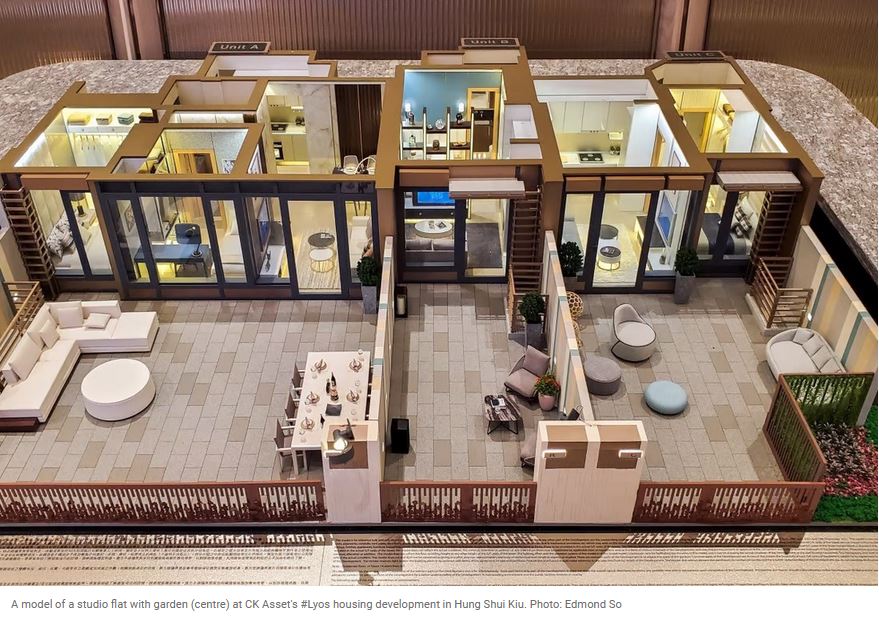

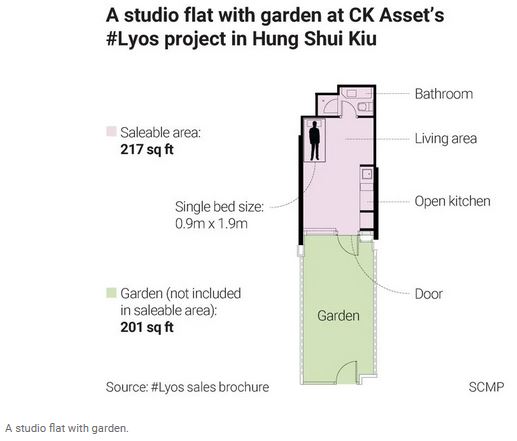

At #Lyos, a project in Hung Shui Kiu in the New Territories developed by CK Asset Holdings, 58 ground-floor flats – mostly studios and one-bedroom units – come with a garden, which is not included in the saleable area of homes.

The nano flats have private gardens of between 53 and 295 sq ft.

The development is the first new project in northern Hong Kong to come to the market since city leader Carrie Lam Cheng Yuet-ngor unveiled the ambitious Northern Metropolis blueprint in her policy address last month.

Of the 341 flats in #Lyos, 184 range in size from 202 to 292 sq ft. The project will be completed in 2023.

All 40 of the ground floor nano flats that came with gardens were snapped up within a day when they opened for sale in two batches earlier this month.

A property agent at the project’s sales office in Hung Hom told a Post reporter posing as a prospective buyer that it was rare for studio or one-bedroom flats to have a garden.

“When you live in the city with lots of high-rise buildings, you are boxed in by four walls and sometimes it feels like you’re in a jail cell,” he said. “It’s nice to have a space to call your own so you can step outside for fresh air, have a cup of coffee and relax. I don’t think you’ll be able to plant trees, but you can definitely grow some plants if you want.”

Most of the flats with gardens sold at a higher price per square foot.

For example, a 217 sq ft studio with a 201 sq ft garden cost about HK$4.7 million (US$603,000), or HK$21,645 per sq ft, whereas the 206 sq ft unit one level up cost HK$4.14 million or HK$20,073 per square foot.

Nano flats often are 200 to 300 sq ft, but can be even smaller. Many do not have an enclosed kitchen or bedroom, or a window in the bathroom.

Some industry observers say Hong Kong’s skyrocketing property prices and tightened mortgage measures led to developers building tiny flats, as most buyers could not afford anything bigger.

Francis Lam Ka-fai, chairman of the Institute of Surveyors’ housing policy panel, said the #Lyos developer included gardens to lure buyers to small ground-floor flats, which were usually not popular.

“Lots of people don’t like to live on the ground floor, because others can look in,” he said. “The garden gives the occupant extra space and offers more privacy.”

An architect, who declined to be named, noted that the developer could have used the garden space as a common area for all residents.

“Instead, it cleverly put those spaces with the flats to sell them more expensively,” he said.

The Post has contacted CK Asset for comment on whether it plans to build more nano flats with gardens.

Private developers have built 10,900 nano flats smaller than 260 sq ft over the past decade, according to Liber Research Community, a civic group that focuses on housing and land issues. It found that nano flats made up 10 per cent of the new homes last year.

In another recent project, the Met. Azure by Wang On Properties in Tsing Yi has 320 nano flats between 181 and 257 sq ft, some of which have balconies. In a 203 sq ft flat – the smallest with the feature – the balcony takes up 22 sq ft of the saleable area.

At Manor Hill by Kowloon Development in Tseung Kwan O, studios and one-bedroom flats ranging from 203 to 300 sq ft make up about 90 per cent of the 1,556 homes in two towers.

With flats between 203 and 428 sq ft going for an average of HK$20,921 per square foot, it is the most expensive new launch at Lohas Park, Hong Kong’s largest private housing project.

The developer said the clubhouse and garden, which covered 49,000 sq ft, provided facilities “comparable to five-star hotels”, giving residents a “staycation-like” experience.

But living in shoebox homes can take a psychological toll. A study published last year and covering different kinds of housing found that living density had a significant impact on Hongkongers’ anxiety and stress levels.

Chan Siu-ming, who led the study and is now assistant professor of social and behavioural sciences at City University, said a garden was no compensation for cramped space.

“This type of nano flat just pushes residents to lower their expectations of living,” he said.

He added that having a balcony would be better for mental health but said there was also a trade-off: “Most residents, if possible, will ‘choose’ a bigger indoor space … because in reality, those balconies are not really ‘extra’. Residents need to pay more or sacrifice indoor space.”

Hong Kong has been ranked the world’s most unaffordable housing market for the 11th year in a row, and it would take 20.7 years on average for a family to afford a home in the city, according to the annual Demographia International Housing Affordability study.

Development minister Michael Wong Wai-lun recently said the government was considering introducing a minimum size for new private flats. He said he would take a leaf from the Urban Renewal Authority, which once required its projects to have flats of no less than 260 sq ft. The authority upgraded that minimum to 300 sq ft in 2018.

The government has also said it aimed to increase sizes of public housing by 10 or 20 per cent in the long run.

However, the size of subsidised Home Ownership Scheme flats has shrunk over the years, with flats as small as 278 sq ft appearing in the programme for the first time in 2018.

There were 622 homes below 320 sq ft in 2018, or 14 per cent of the batch sold in that year. Flats smaller than that made up 22 per cent and 15 per cent, respectively, in 2019 and 2020.

Between 2014 and 2017, the smallest home was 368.1 sq ft.

Anthony Chiu Kwok-wai, executive director of the Federation of Public Housing Estates, described the trend as the “nanoisation” of public housing and urged authorities not to sacrifice living space in their haste to build more flats.

(South China Morning Post)