Hong Kong's home-buying frenzy

continued in November with a total of 1,275 primary transactions

recorded in the first 13 days of the month.

Wheelock Properties launched first-round sales for its Monaco One

project in Kai Tak on Saturday and sold out all the 341 flats which

were offered at a discounted price of HK$24,359 per square foot, raking

in HK$3.55 billion.

Ricky

Wong Kwong-yiu, the managing director of Wheelock Properties, said a

new price list would be released soon, and prices could rise by around

10 percent.

Meanwhile, Sun Hung Kai Properties (0016) said it had sold all 164 flats at Wetland Seasons Bay phase two in Tin Shui Wai on Saturday.

Together

with the first round, SHKP has sold over 300 flats, cashing out HK$2

billion. Following the success of its phase two sale, the developer

plans to sell 384 flats at Wetland Seasons Bay phase three in the first quarter of next year.

In

the secondary market, a property agency recorded 12 transactions at 10

blue-chip housing estates over the weekend, down 9.1 percent

week-on-week, after recording double-digit deals for the previous four

weeks.

Of the estates,

there were no deals recorded at Whampoa Garden in Hung Hom, Kornhill in

Quarry Bay and Metro City in Tseung Kwan O.

Property

agent said that first-hand transactions are booming, with more than 500

deals recorded over the weekend as the pandemic in Hong Kong continues

to ease. Comparatively, second-hand transactions were stagnant.

But

the agent believes that the secondary market will pick up, with hopes

rising over the resumption of normal travel between Hong Kong and the

mainland.

(The Standard)

How tiny can a Hong Kong ‘nano flat’ be? Let’s squeeze in a garden and charge them more

Cramped living ‘a point of pain’ in Hong Kong, but developers add frills to nano flat trend.

Buyers pay more to snap up tiny ground floor flats with gardens in New Territories project.

As new homes in Hong Kong

shrink despite costing more, private developers are adding gimmicks to

sell their smallest flats. The latest feature: a tiny patch of garden.

More

of these shoebox homes, usually just 200 to 300 sq ft in size, have

been built in recent years, even in low-density residential areas in the

New Territories.

The public sector has also joined in, building more tiny homes referred to as nano flats.

The

trend has persisted even though the government has acknowledged that

cramped living space is a “pain point for society”. It is considering

setting a minimum size for homes built by the private sector and has

pledged to increase living space in public housing in the long term,

beyond 2030.

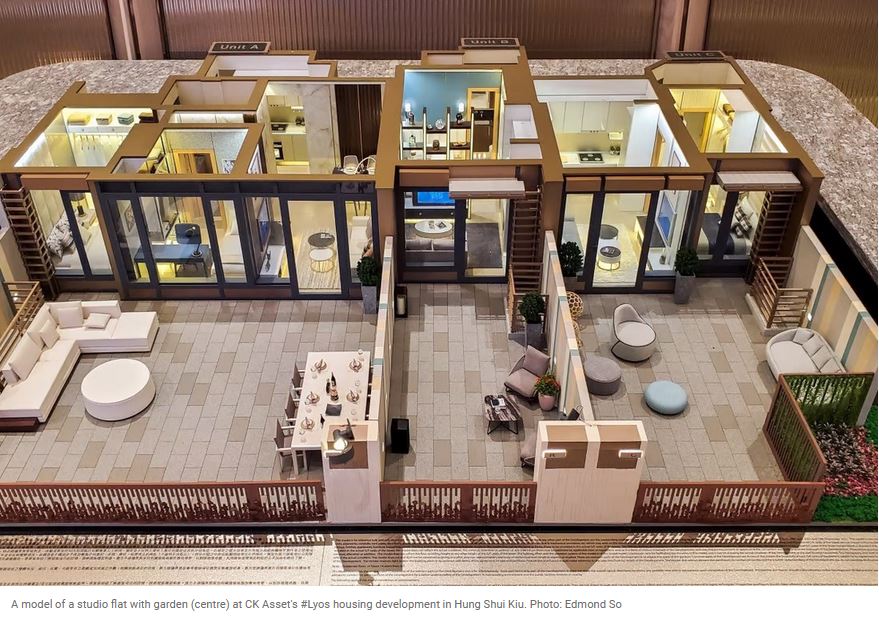

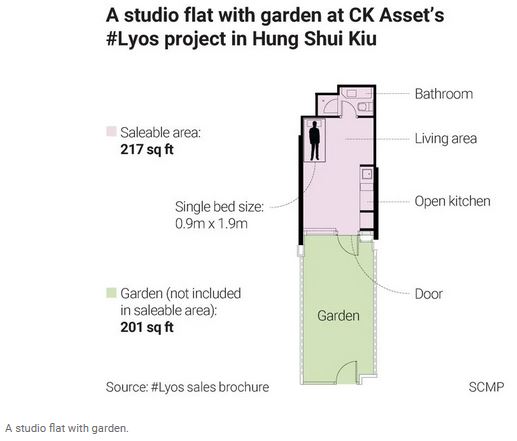

At #Lyos,

a project in Hung Shui Kiu in the New Territories developed by CK Asset

Holdings, 58 ground-floor flats – mostly studios and one-bedroom units –

come with a garden, which is not included in the saleable area of

homes.

The nano flats have private gardens of between 53 and 295 sq ft.

The

development is the first new project in northern Hong Kong to come to

the market since city leader Carrie Lam Cheng Yuet-ngor unveiled the

ambitious Northern Metropolis blueprint in her policy address last

month.

Of the 341 flats in #Lyos, 184 range in size from 202 to 292 sq ft. The project will be completed in 2023.

All

40 of the ground floor nano flats that came with gardens were snapped

up within a day when they opened for sale in two batches earlier this

month.

A property agent at the project’s sales office in Hung Hom told a Post reporter posing as a prospective buyer that it was rare for studio or one-bedroom flats to have a garden.

“When

you live in the city with lots of high-rise buildings, you are boxed in

by four walls and sometimes it feels like you’re in a jail cell,” he

said. “It’s nice to have a space to call your own so you can step

outside for fresh air, have a cup of coffee and relax. I don’t think

you’ll be able to plant trees, but you can definitely grow some plants

if you want.”

Most of the flats with gardens sold at a higher price per square foot.

For

example, a 217 sq ft studio with a 201 sq ft garden cost about HK$4.7

million (US$603,000), or HK$21,645 per sq ft, whereas the 206 sq ft unit

one level up cost HK$4.14 million or HK$20,073 per square foot.

Nano

flats often are 200 to 300 sq ft, but can be even smaller. Many do not

have an enclosed kitchen or bedroom, or a window in the bathroom.

Some

industry observers say Hong Kong’s skyrocketing property prices and

tightened mortgage measures led to developers building tiny flats, as

most buyers could not afford anything bigger.

Francis Lam Ka-fai, chairman of the Institute of Surveyors’ housing policy panel, said the #Lyos developer included gardens to lure buyers to small ground-floor flats, which were usually not popular.

“Lots

of people don’t like to live on the ground floor, because others can

look in,” he said. “The garden gives the occupant extra space and offers

more privacy.”

An

architect, who declined to be named, noted that the developer could

have used the garden space as a common area for all residents.

“Instead, it cleverly put those spaces with the flats to sell them more expensively,” he said.

The Post has contacted CK Asset for comment on whether it plans to build more nano flats with gardens.

Private

developers have built 10,900 nano flats smaller than 260 sq ft over the

past decade, according to Liber Research Community, a civic group that

focuses on housing and land issues. It found that nano flats made up 10

per cent of the new homes last year.

In

another recent project, the Met. Azure by Wang On Properties in Tsing

Yi has 320 nano flats between 181 and 257 sq ft, some of which have

balconies. In a 203 sq ft flat – the smallest with the feature – the

balcony takes up 22 sq ft of the saleable area.

At Manor Hill

by Kowloon Development in Tseung Kwan O, studios and one-bedroom flats

ranging from 203 to 300 sq ft make up about 90 per cent of the 1,556

homes in two towers.

With

flats between 203 and 428 sq ft going for an average of HK$20,921 per

square foot, it is the most expensive new launch at Lohas Park, Hong

Kong’s largest private housing project.

The

developer said the clubhouse and garden, which covered 49,000 sq ft,

provided facilities “comparable to five-star hotels”, giving residents a

“staycation-like” experience.

But

living in shoebox homes can take a psychological toll. A study

published last year and covering different kinds of housing found that

living density had a significant impact on Hongkongers’ anxiety and

stress levels.

Chan

Siu-ming, who led the study and is now assistant professor of social

and behavioural sciences at City University, said a garden was no

compensation for cramped space.

“This type of nano flat just pushes residents to lower their expectations of living,” he said.

He

added that having a balcony would be better for mental health but said

there was also a trade-off: “Most residents, if possible, will ‘choose’ a

bigger indoor space … because in reality, those balconies are not

really ‘extra’. Residents need to pay more or sacrifice indoor space.”

Hong

Kong has been ranked the world’s most unaffordable housing market for

the 11th year in a row, and it would take 20.7 years on average for a

family to afford a home in the city, according to the annual Demographia

International Housing Affordability study.

Development

minister Michael Wong Wai-lun recently said the government was

considering introducing a minimum size for new private flats. He said he

would take a leaf from the Urban Renewal Authority, which once required

its projects to have flats of no less than 260 sq ft. The authority

upgraded that minimum to 300 sq ft in 2018.

The government has also said it aimed to increase sizes of public housing by 10 or 20 per cent in the long run.

However,

the size of subsidised Home Ownership Scheme flats has shrunk over the

years, with flats as small as 278 sq ft appearing in the programme for

the first time in 2018.

There

were 622 homes below 320 sq ft in 2018, or 14 per cent of the batch

sold in that year. Flats smaller than that made up 22 per cent and 15

per cent, respectively, in 2019 and 2020.

Between 2014 and 2017, the smallest home was 368.1 sq ft.

Anthony

Chiu Kwok-wai, executive director of the Federation of Public Housing

Estates, described the trend as the “nanoisation” of public housing and

urged authorities not to sacrifice living space in their haste to build

more flats.

(South China Morning Post)

代理:甲廈租金按月微升0.8% 售價微升0.2%

疫情持續緩和,帶動甲廈市場回穩。據代理指出,上月指標甲廈售價按月微升0.2%,租金亦上升約0.8%,整體空置率新報約10%,按月下跌約0.3%。

據該代理行最新發表報告指出,上月甲廈售價按月微升0.2%,港島核心區,包括中環、上環、金鐘及灣仔等表現持平,而尖沙嘴區表現最好,按月上升2.3%,東九龍及葵涌區則分別按月升0.1%及0.3%。

整體空置率約10%

租金方面,分散業權甲廈及乙廈租金,上月按月分別升0.8%及跌0.9%。當中較為矚目的,為運動服裝品牌Nike由九龍灣遷往觀塘國際貿易中心,租用約5.4萬呎樓面,呎租約32元。中環國際金融中心二期全層亦獲一家中資資產管理公司承租,公司原租用灣仔 One Hennessy,現擴充增至中環國際金融中心二期全層約2.5萬平方呎樓面,呎租約130元。

儘管甲廈空置率按月跌0.3%,惟空置率仍然高企,截至10月底為止,本港整體甲廈空置率為10%,當中空置率最高的地區為東九龍,最新空置高見15.5%,至於灣仔/銅鑼灣也達9.5%,上環亦升至9.4%。

代理表示,政府最新公布的《施政報告》,提出興建佔地3萬公頃的「北部都會區」,預計落成後可提供65萬個工作職位,配合與內地更頻繁的經濟連繫,寫字樓需求定必上升,有利未來商廈市場。

代理:車位買賣按月升45%

代理表示,據土地註冊處資料顯示,10月錄759宗純車位註冊,較9月的521宗增加約45.7%。鑑於簽署買賣合約至遞交到土地註冊處註冊登記需時,10月註冊個案一般主要反映9月市況。

(星島日報)

更多國際貿易中心寫字樓出租樓盤資訊請參閱:國際貿易中心寫字樓出租

更多觀塘區甲級寫字樓出租樓盤資訊請參閱:觀塘區甲級寫字樓出租

更多One Hennessy寫字樓出租樓盤資訊請參閱:One Hennessy 寫字樓出租

更多灣仔區甲級寫字樓出租樓盤資訊請參閱:灣仔區甲級寫字樓出租

更多國際金融中心寫字樓出租樓盤資訊請參閱:國際金融中心寫字樓出租

更多中環區甲級寫字樓出租樓盤資訊請參閱:中環區甲級寫字樓出租

上環巨鋪放租逾半年 金融機構每月80萬進駐

疫市下巨鋪不乏捧場客,繼近期中國建設銀行 (亞洲) 承租上環德輔道中逾7000方呎鋪,同街道另一個巨鋪,面積逾1.3萬方呎,放盤逾半年後,覓得長租客,由金融機構以每月逾80萬進駐,平均呎租58元,較舊租跌28%。業內人士指,短時間內巨鋪接連租出,足見銀行及金融等行業趁疫市擴張。

平均呎租58元減28%

上環德輔道中134至136號中銀保險大廈地庫,地下及1樓,地庫建築面積4693方呎,地下4586方呎,1樓4622方呎,合共約13901方呎,屬罕有巨鋪,由金融機構以每月逾80萬租出,較三年前舊租金每月112.5萬,下跌28%。

上手租客於2018年7月簽約,月租112.5萬,今年4月約滿,舊租客遷出後,巨鋪地下短租予缸瓦佬,同時以每月120萬放盤,最終減價30多萬,減幅28%成功租出。

同一街道巨鋪接連租出

上環德輔道中238號地下、1樓及2樓共三層複式巨鋪,近期亦由銀行承租,建築面積合共7633方呎,月租54萬,較舊租客證券行跌6%,平均呎租70元。

德輔道中238號巨鋪,過往由兩家證券行承租,近期1樓及2樓約滿,中國建設銀行 (亞洲)

(下稱建行)

率先以每月27萬進駐,租期5年,由今年10月1日,直至2026年9月30日,1樓及2樓建築面積分別約1972及2887方呎。該地鋪現址光大新鴻基證券,明年5月約萬,建行另以每月27萬預租,租期由2023年6月1日至2026年9月30日,建築面積約2774方呎。兩組鋪位梗約屆滿後,有三年生約可續。

(星島日報)

更多德輔道中238號寫字樓出租樓盤資訊請參閱:德輔道中238號寫字樓出租

更多上環區甲級寫字樓出租樓盤資訊請參閱:上環區甲級寫字樓出租

尖沙嘴彌敦道鋪呎租100元減75% 樓上侯君剛:短約為期半年

繼早前承租旺角亞皆老街老鳳祥舊址,樓上有限公司 (前稱樓上燕窩莊) 再下一城,承租尖沙嘴彌敦道地鋪,月租約15萬,平均呎租約100元,較舊租金跌75%,該公司創辦人侯君剛表示,趁核心區鋪租平連環開店,力吸本地客生意。

疫市下核心鋪租大跌,民生行業趁勢「攝位」,吼準黃金地段進駐,上址為彌敦道80號金鑾大廈地下A鋪,建築面積約1500方呎,剛由樓上有限公司短租,市場消息透露,每月租金約15萬,平均呎租約100元,比較舊租客周大福去年6月遷出時,最後月租約60萬,租金大跌75%。

趁鋪租跌連環開店

樓上有限公司創辦人侯君剛接受本報查詢時回應,詳細租金不方便透露,基本租約為期半年,半年之後,業主可提前兩個月通知交鋪。他續說,核心區鋪租較旺市時作大幅度折讓,吸引他們連環開店,力吸本地客生意。

早前,該公司亦承租亞皆老街老鳳祥舊址「鋪王」,侯君剛續說,近期市民增加消費,每月生意額都有改善,不過,租賃主動權在業主一方,即使想再租長些時間,相信通關後,業主很快找到心水租客,他惟有見步行步。他續說,早前購入的上水新發街與龍琛路交界鋪位,現時亦暫作為自用,此外,並在元朗大馬路覓得新據點開鋪。

續租主動權在業主一方

事實上,樓上所吼準的旺角及尖沙嘴鋪位,過往皆由珠寶店承租。彌敦道80號金鑾大廈地下A鋪,珠寶金行周大福曾承租多年,高峰時月租達110萬,直至年前減至60萬,並於去年6月完約遷出,隨後鋪位曾短租予包浩斯,月租15萬。

上水新發街地鋪暫作自用

樓上有限公司於今年8月,承租百年老店「老鳳祥」鋪址,月租約30萬,較舊租跌約80%,上址為旺角亞皆老街67至69號地鋪連閣樓,位處西洋菜南街大單邊,合共面積3800方呎,短期每月30萬,為期3個月起,平均呎租約78.9元。該鋪位處旺角一綫地段,老鳳祥金行於2015年以每月約200萬承租,及後鋪市高位回落,老鳳祥於2018年以150萬續租,故現時短租租金,較舊租大跌約80%。

(星島日報)

荷李活道彩鴻酒店 8.5億洽至尾聲

物業提供148房間 較高峰期減價逾3成

疫情持續令旅遊業困擾,酒店價格回調吸引財團留意。中環荷李活道一幢酒店,獲財團8.5億洽購至尾聲快易手,物業提供148間房。現時項目由基金持有,早年以逾8億購入,高峰期以13億放盤,減價逾3成。

市場消息指,中環荷李活道彩鴻酒店 (Travelodge Central Hollywood Road) 正獲財團洽購,據悉,該物業由基金持有,現獲財團出價約8.5億元,據悉有望短期內成交。

去年曾放售 叫價約13億

該物業位於荷李活道,物業總樓面面積約5.87萬平方呎,樓高約24層,提供148個房間,定位介乎3至4星,於2017年開業。該酒店早年每晚房價造至約800元,惟疫情下旅客數字大跌,整體酒店入住率極低,按網頁顯示,目前房價跌至每晚約400元。

消息指,業主去年曾放售酒店,叫價約13億元,惟市況轉差未獲承接,若最終物業以8.5億元易手,減價逾3成,而平均每間房價值約574萬元。

翻查資料,該酒店過去多年曾數度易手,項目前稱麗珀酒店,由遠東發展 (00035) 持有,及後轉售給帝盛集團,易名為晉逸好萊塢精品酒店,並於2011年以5.15億元,轉售給新加坡基金Alpha。2017年,基金夥拍酒店集團以約8.3億元購入。若最終以8.5億元沽出,轉手帳面獲利約2,000萬元。

今年全幢物業買賣旺,而疫情衝擊酒店,令價格回落,近期漸吸引財團留意,市場陸續出現全幢酒店快將易手個案。最大手為莊士 (00367) 旗下紅磡蕪湖街逸‧酒店 (Hotel Sav),獲美資基金出價16億元洽購,物業總樓面12萬呎,提供388房。呎價約1.3萬元,而每房價值約412萬元。另外,油麻地彌敦道Casa酒店全幢,獲6.5億元洽購至尾聲,項目提供162間房。消息稱,該財團為一家外資基金,擬購入後發展共居。

(經濟日報)

外資入市踴躍 傾向防守性高物業

代理:工廈回報佳可增值 成功跑出

今年投資市場明顯反彈,有代理分析,在疫情緩和下,投資氣氛改善,吸引外資基金踴躍入市,並指出基金傾向投資防守性高物業,而工廈回報可觀亦可增值,因此成功跑出。

據代理資料顯示,今年逾億元非住宅物業成交,暫錄564.4億元,較去年全年434億元,已高出3成。當中工廈買賣極為暢旺,涉及212.95億元交投,較去年全年76.1億元,高出1.8倍,值得留意,數字還未計算日前怡和以逾58億元,沽出紅磡及柴灣兩項工廈物業。

多個因素向好 投資市場低位彈

該代理分析,各方面因素均向好,令投資市場從低位反彈,「社會事件及去年疫情,不論本地投資者及外資基金開始審慎,累積一定購買力。經過兩年,非住宅物業價格回落,資金仍尋找出路。」

該代理指,即使美國聯儲局已公布逐步減買債,過往兩年累積資金仍非常多,「外資基金已集資,他們部署上,投資亞洲比例提高,畢竟亞洲在疫情上較穩定。既然資金多,銀紙貶值而物業升值,故把資金續投放在物業上。」

除基本因素外,該代理認為政府措施,有利商業活動回復,「如推出消費券,帶動零售及餐飲生意,商舖租務即轉好。另外,去年尾減印花稅,以及寬按揭,所有措施均能刺激交投。」

論到今年投資市場焦點,工廈肯定獨領風騷,連同其他大額買賣,並主要吸引機構投資者留意,數據顯示,今年大額買賣宗數中,機構投資者包括基金佔33.6%,若以買賣金額計涉及361.1億元計,佔整體成交金額的64%,換言之,是今年投資市場主力買家。事實上,近日紅磡及柴灣兩工廈項目,以逾58億元易手,買家正為領展 (00823) ,購入工廈作收租。

物流倉凍倉 疫下受惠行業

工廈吸引基金投資者,該代理分析因集合多項有利條件於一身,「機構投資者在疫情下需要投資防守性物業,工廈包括數據中心、物流倉、凍倉等,均是疫情下受惠行業,需求上升,加上工廈租金回報理想,吸引基金入市。相比之下,寫字樓空置率上升而租金下跌,商舖未通關難有作為,故基金揀工廈作投資,較容易獲批核。」

另外,工廈變化亦高,該代理指政府政策扶持下,包括標準金額補地價、重建工廈增2成樓面等,均推動財團入市重建。在疫情下,工廈更可改裝作新用途迎合需求,如今年黑石基金甚活躍,已落實購入觀塘及粉嶺工廈,並積極洽購筲箕灣工廈,有意把3幢物業,改裝成迷你倉,「也是疫下,在家工作的伸延,因住屋空間有限,故迷你倉作儲物需求更高。」

(經濟日報)

甲廈商舖 明年可追落後

對於明年走勢,有代理預計,甲廈及商舖有力追落後,而該代理相信疫情不會令寫字樓需求下降,故長綫仍具投資價值。

今年工廈一枝獨秀,該代理相信在中短綫上,仍會受財團追捧,惟明年可能放緩,「可供買賣的盤源漸減少,而價格亦在回升,回報率漸下降,基金或會追捧其他物業。」

地區商場成投資之選

首先,該代理預計明年下半年起,整體商舖及甲廈均有力追落後,其中商舖以屋苑基座,或地區商場將成投資之選,「其實疫情下,市民消費習慣有變,如今他們未必要到傳統核心區消費,地區商場反而受惠於疫情,租務理想,故有一定投資價值。」另外,該代理分析基金開始與本地發展商合作,研究住宅項目。

另一項較受衝擊的物業定為甲廈,今年大手甲廈交投淡靜。事實上,數項負面因素困擾甲廈市場,包括封關下租金回調、未來兩年供應高峰等,不過,該代理認為,商廈傳統是投資者最愛之一,明年中也有力反彈,「寫字樓始終是投資者、基金最喜歡,因為容易管理,樓面本身夠大易計數,只要價格下跌,便漸有承接力。」

該代理提到,甲廈吸納量自2019年後連錄兩年負數,直至第三季錄得7萬呎正吸納,為兩年來首次轉正數,正反映商廈租務改善。該代理分析,疫情下甲廈需求只是暫放緩,未見出現結構轉變,「不只香港,甚至亞洲國家,實際上不易實行在家工作。即使公司推出靈活辦公,也不一定減少租用樓面,近期更見機構開始重新擴充。」香港金融地位穩,長遠商廈需求仍在,「畢竟香港是大灣區中主打金融業,未來很多機構感興趣來港開業,商廈需求會提升。」

(經濟日報)

代理:東九商圈漸成形 近10年商廈呎價升兩成

特區政府推出「起動九龍東」長達近10年,目標是要將啟德、九龍灣及觀塘一帶打造為香港新一代商務區,以配合香港經濟轉型;有代理指出,整個起動九龍東計劃算非常成功,不少大型企業和高端客戶均已落戶東九龍,雖然整體社區配套、交通等仍具改善空間,但東九龍商圈發展已漸趨成熟,近10年來,區內商廈呎價已上升逾兩成。

香港經濟活動頻繁,帶動市場對寫字樓需求不斷增加,傳統核心商業區的寫字樓更是供不應求,港府提出「起動九龍東」計劃,正可紓緩有關問題。

寫字樓樓面增至1480萬呎 佔全港23%

據代理行的統計資料顯示,2012年第三季、即近10年前,東九龍寫字樓樓面只約900萬方呎,佔當時全港整體商業樓面的5127萬方呎約18%。至於現在,東九龍寫字樓樓面已增加至約1480萬方呎 (不包括活化工廈的商業樓面),期內增加約580萬方呎或64%。

若以全港整體商業樓面計,目前東九商業樓面佔全港商業樓面約6457萬方呎的22.9%,存量佔比僅次於中區的24%,反映東九龍商務發展區已成形。

代理分折指,過去東九龍的租戶以製造業、消費品租戶佔多,隨着東九龍發展漸見成熟,過去幾乎不見蹤影於東九龍的專業服務、房地產業務,已陸續進駐東九龍,租戶佔比約12%,連同保險業的租戶,兩類租戶佔東九租戶41%,反映高端租戶開始接受東九龍。

區內地標商廈現成交呎價約9300元

事實上,東九龍商廈售價亦隨着區域發展而上升,該代理稱,2012年東九龍地標商廈平均成交呎價約7700元,2018年旺市時呎價曾突破1.3萬元,及後因為2019年社會運動、2020年新冠疫情而回落,至現時每呎成交價約9300元,但近10年間仍然上升約21%。

不過,商廈租金因供應增加而受壓,實用面積呎租由近10年前的34.1元,下降15%至28.9元。另外,對近日規劃署及土木工程署就啟德5幅商業地,提交改劃文件,擬由商業轉作住宅用途,該代理表示支持有關改劃。

支持啟德5幅商業地改劃作住宅

該代理分析指,商業區處處講求方便,最重要是交通四通八達,然而跑道區遠離鐵路站,交通運輸配套亦未完全清晰,「如同孤島一樣」,較難打做成一個完善商圈;此外,跑道區地皮以住宅地佔多,住宅、寫字樓所需要的社區配套有別,反之,將地皮改劃作住宅,可令跑道區發展更加歸一。

(明報)