金鐘力宝中心每呎40元租出 交吉三个月租金较一年前跌12%

近期甲厦频录大手买卖,优质盘低价卖出成为趋势,租赁市场情况亦类似,由纪惠持有的金鐘力宝中心单位,一口气连环租出2个单位,其中一个单位交吉3个月,以平均呎租40元,租金较一年前跌12.5%,显示市场有需求,但供应充裕,租金暂仍缺乏向上的动力。

力宝中心二座33楼2至3室,建筑面积约4525方呎,以每月18.1万租出,平均呎租40元,租客Lincoln Chambers Limited,租期由2024年6月至2027年5月,该单位去年6月曾以每呎45元租出,月租约20.36万,不料,新租客只承租短短4个月,10月份将单位放顶租,直至今年2月业主收回单位,交吉3个月后,最终觅得新租客,新租金较一年前减12.5%。

月租18万签约3年

再上手租客于2018年1月进驻,月租27.15万,平均呎租60元,租客于2020年12月疫市期间撤出。业内人士指,长实于2017年11月沽售中环中心后,商厦市场踏入高峰期,直至2019年中前,租售价稳步上升,当时亦是市道高峰期,最新租金较高峰期跌33%,重返2009年水平。

另一单位为力宝中心一座34楼3室,建筑面积3350方呎,以每月约12.73万租出,平均呎租38元,租期由2024年5月至2027年5月,上手租客于2022年4月承租,直至今年4月迁出,当时呎租55元,月租18.43万,最新租金较2年前减31%。

高峰期呎租60元

根据纪录,该单位亦于2013年4月,月租为16.2万,平均呎租48元,租期至2016年4月。2013年为铺市高峰期,惟并非商厦高峰期。

有代理评论指,甲厦虽然供应多,惟近期不论核心区或非核心区都持续租出,令空置率维持,未有恶化,不少甲厦租客搬迁,都以成本作为搬迁首要目的,亦有中环大业主旗下甲厦租客,搬往金鐘或黄竹坑。

再上手租客于2018年1月,月租27.15万,平均呎租60元,时为商厦市况高峰期。

(星岛日报)

更多力宝中心写字楼出租楼盘资讯请参阅:力宝中心写字楼出租

更多金鐘区甲级写字楼出租楼盘资讯请参阅:金鐘区甲级写字楼出租

更多中环中心写字楼出售楼盘资讯请参阅:中环中心写字楼出售

更多中环区甲级写字楼出售楼盘资讯请参阅:中环区甲级写字楼出售

美国银行中心28楼呎租45元 较6年高位挫51%

核心区商厦租金较高位大幅回落,中环美国银行中心一个中高层单位,以每月约12.2万元租出,呎租约45元,租金较6年前最高位大跌逾51%。

据了解,中环美国银行中心28楼5至6室,建筑面积约2715方呎,最新以约12.2万元租出,呎租约45元。

大发地产驻港旧营业点

上述单位曾是内房大发地产 (06111) 的香港主要营业地点,于2018年中时承租,当年月租曾高达25万元,呎租曾约92.1元,之后两度续租,租金俱向下,2020年续租一年,获减租至20.4万元,呎租约75.1元,减幅18.5%;2021年再度减租26.9%,月租为14.9万元,呎租约54.9元,当时续租两年。据悉,大发地产在2023年租约届满后便迁出,有关单位放租近一年后才能成功租出,但最新租金较6年前高位大幅下滑51.1%。

另外,美国银行中心29楼2室,建筑面积约1998方呎,获租客承租,月租约9万元,呎租约45元。资料显示,有关单位在2011年中时,曾以每月10.9万元租出,呎租约54.6元,即目前最新租金,较13年前还要低17.6%。

(信报)

更多美国银行中心写字楼出租楼盘资讯请参阅:美国银行中心写字楼出租

更多中环区甲级写字楼出租楼盘资讯请参阅:中环区甲级写字楼出租

海富中心中层4千呎 呎租27元

消息指,金鐘海富中心录得租务成交,涉及物业一座中层1705室,面积约4,028平方呎,以每呎约27元租出,略低于市场水平。

另同区统一中心高层6B及C1至2室,面积合共约12,684平方呎,成交呎租约40元。

(经济日报)

更多海富中心写字楼出租楼盘资讯请参阅:海富中心写字楼出租

更多统一中心写字楼出租楼盘资讯请参阅:统一中心写字楼出租

更多金鐘区甲级写字楼出租楼盘资讯请参阅:金鐘区甲级写字楼出租

观塘临海甲厦以蚀让价放售,海滨道181号One Harbour Square顶层特色单位,意向价约2.1亿,较2015年买入价约2.7亿,折让约6000万或约22%。

较2015年折让约22%

有代理表示,One Harbour Square的28楼全层连车位,总建筑面积约17153方呎,以交吉形式出售,单位除室内写字楼面积外,更享有约802方呎平台,以及私人天台约3112方呎。

今次物业意向价约2.1亿,较业主于2015年以约2.7亿向发展商买入时折让逾22%。业主同时考虑出租,意向呎租为25元,月租约42.88万。

(星岛日报)

更多One Harbour Square写字楼出售楼盘资讯请参阅:One Harbour Square写字楼出售

更多观塘区甲级写字楼出售楼盘资讯请参阅:观塘区甲级写字楼出售

甲厦连录大交易 外资代理行:造价重返14年前

有外资代理行最新发表的投资市场报告指,早前美国银行中心2全层单位分别以2.5亿、2.6亿成交,平均呎价1.8万,与一年前同一幢大厦细单位成交,每呎3.1万相比,价格大跌30%,重返14年前水平,即2010年水平。

过去14年,股市与甲厦价格之间走势的历史相关性高达0.67,股市反弹近20%,未来3个月内令写字楼价格短期反弹。2024年第一季,整幢商业投资市场总额下滑,交易总值84亿,按季跌59%,同比跌57%。

基金处撤资状态

荃湾愉景新城商场以40.2亿成交,传闻回报高达6%。然而,其他回报相近成交,都涉大幅折让。上环88WL以远低于收购价及发展成本售予本地投资者,导致卖方和银行都蒙受重大损失。

投资者和投资基金积极购入全幢商厦,两者正处于撤资状态。2023年底和2024年初,用家和国有企业支撑全幢商厦买卖。在疫情之前,用家和其他买家仅佔市场的4%,但2023年已经增至22%。

展望未来,美国年内减息可能性下降,资金成本短期内仍较高,全球股市反弹、本地企业盈利向好及中国政策进一步支援中港经济,股市持续反弹,将间接支援交易量反弹。预测2024年甲级写字楼价格将下跌10%,核心街铺价格将下跌5%。

(星岛日报)

更多美国银行中心写字楼出售楼盘资讯请参阅:美国银行中心写字楼出售

更多中环区甲级写字楼出售楼盘资讯请参阅:中环区甲级写字楼出售

更多88WL写字楼出租楼盘资讯请参阅:88WL写字楼出租

更多上环区甲级写字楼出租楼盘资讯请参阅:上环区甲级写字楼出租

Henderson to quit Hung Shui Kiu development

Henderson Land (0012) is expected to receive HK$3.9 billion from the government in compensation for a Hung Shui Kiu site that recovered by the authority - a sign that the developer may have quit the development.

This comes as major developers remain cautious about the Northern Metropolis project amid concerns over high infrastructure development costs and land premiums.

It was announced last Thursday that the government would resume about 176 hectares of land for the Phase II development of the Hung Shui Kiu/Ha Tsuen New Development project and eligible residents will be compensated.

Henderson said that of the 6.67 million sq ft of land reserve it has in Hung Shui Kiu, 3.5 million sq ft will be resumed by the government. The amount of compensation is estimated to be HK$3.9 billion in accordance with the compensation rate of HK$1,114 per sq ft set out in the gazette notice.

In relation to the Kwu Tung North/Fanling North New Development Areas in April, Henderson is also expected to get about HK$1.86 billion for the 1.45 million sq ft of land under the company.

As a result of the compensation for the Hung Shui Kiu site, Henderson stands to book a pretax profit of HK$3.1 billion for the current financial year through December.

The Hung Shui Kiu project is planned to provide about 9.7 million sq ft of non-residential gross floor area as part of the Northern Metropolis in line with China's 14th Five-Year Plan.

Land exchange applications in relation to these sites closed at the end of April with the Lands Department saying a total of nine applications have been received.

Speaking on condition of anonymity last month, a major developer called on the government to amend the plan, saying a high office vacancy rate in Hong Kong has made the government plan outdated. It then proposed 40 percent of the floor space be allocated to provide 8,000 residential units.

It also said it may be forced not to join the project if the government adhered to its plan.

The Development Bureau countered that developers should eye long-term growth.

Amid an environment of high interest rates and weak housing demands, local developers have shown a lack of appetite for new sites while working to reduce their new home inventories.

According to a property agency, the secondary market remained weak on the weekend, recording only six deals at the 10 blue-chip estates - a slump of 40 percent week on week.

The agency blamed the weather and few low-priced units being available for the secondary market weakness.

Another property agency recorded seven transactions in its 10 major estates over the same period.

(The Standard)上月整体楼宇买卖录约7346宗回落25%

全面「撤辣」后购买力迅速被消耗,加上发展商开始减慢推盘步伐,上月送交土地註册处登记的楼宇买卖合约,连升两个月之后首度回落。综合各大物业代理统计显示,今年5月整体楼宇买卖合约登记录得7346宗,按月下跌逾25%。

有代理行数据显示,上月整体楼宇买卖合约登记 (包括住宅、车位及工商铺物业) 录约7346宗,较4月的9880宗,按月减少2534宗或约分别下跌25.6%。儘管数字回落,但仍为去年3月录8599宗之后,近14个月次高,反映4月期间楼市交投持续活跃。

期内,一手私人住宅录约1956宗买卖登记,较4月录得3624宗,按月大减46%,但为连续三个月企稳1000宗以上,并且是2021年7月录2032宗之后,接近34个月次高。今年首5个月累计,一手私人住宅录约8424宗买卖登记,已达去年全年10682宗的78.9%。

一手稳企千宗以上水平

二手私人住宅方面,上月录得3349宗买卖,较4月4605宗,按月下跌27.3%,但为2023年3月录4485宗之后,接近14个月次高。其中,荔枝角美孚新邨录约36宗、鰂鱼涌太古城录约35宗、天水围嘉湖山庄录约30宗及沙田第一城录约22宗。

另一代理行数据则显示,5月全港共录约7375宗楼宇买卖合约登记,较4月录得9880宗,按月减少2505宗或逾25%,但依然为近14个月以来次高水平。其中一手私人住宅买卖宗数回落至1893宗,按月大减47%;二手市场则因为新盘抢去不少客源,加上放盘减价幅度未能吸引买家垂青,上月录3153宗买卖登记,按月减28%。

有代理表示,市场购买力迅速被大量消耗,二手市道明显放缓,同时发展商开始减慢新盘推售步伐、本港银行逐步收紧按揭,相信6月登记量继续回软。

另有代理指出,全面「撤辣」亢奋期过后,楼市交投正在进行整固,冀后市走势转趋平稳,一手及二手住宅买卖将处互补状态。

(星岛日报)

中环美国银行中心 中层单位1.1亿放售

中环美国银行中心为指标甲厦,现有业主以约1.1亿放售中层单位。

面积4397呎 呎价约2.5万

有代理表示,是次放售单位位于美国银行中心16楼13至18室,面积达约4,397平方呎,以呎价约2.5万元放售,涉资约1.1亿元,物业坐拥维港海景及遮打花园景色,大门正对升降机口。单位亦配备来去水位,物业将以现状交吉形式出售。

该代称,近期多个港岛区指标商厦录得买卖成交,显示市场活跃,投资气氛浓厚,也反映商厦市场正开始走出疫后的低迷期。

中环区最近录得的3宗大额买卖成交,包括美国银行中心23楼全层连3个车位,成交价约2.5亿元,以及同厦30楼全层连4个车位,作价约2.6亿元获承接,而另一宗为皇后大道中9号29楼全层,以约3.1亿元易手,平均呎价约2.25万元,创近13年新低。

(经济日报)

更多美国银行中心写字楼出售楼盘资讯请参阅:美国银行中心写字楼出售

更多皇后大道中9号写字楼出售楼盘资讯请参阅:皇后大道中9号写字楼出售

更多中环区甲级写字楼出售楼盘资讯请参阅:中环区甲级写字楼出售

商厦租务代理 聚焦新甲厦

整体商厦租务市场新需求不算多,由于新甲厦相继落成,业主当然要抢客,吸引租客搬迁。

最近啟德AIRSIDE连环录租务,单计今年已录逾30万平方呎楼面租务成交。商厦新楼面多,各代理近期积极搵客,搬迁至新甲厦作升级,故新甲厦成为各代理搵生意的焦点。

(经济日报)

更多AIRSIDE写字楼出租楼盘资讯请参阅:AIRSIDE写字楼出租

更多啟德区甲级写字楼出租楼盘资讯请参阅:啟德区甲级写字楼出租

尖沙咀「亚士厘21」 打造医疗商厦

尖沙咀全新商厦「亚士厘21」(21 ASHLEY),以医疗作主题,项目在设计及配套上,均度身订做作医疗用途。

亚士厘21位于尖沙咀亚士厘道,交通上,由尖沙咀港铁站步行至该厦仅5分鐘,而地段亦邻近繁忙的弥敦道,交通非常便利。饮食配套上,亚士厘道属传统饮食地段,现时除了地铺有酒吧、冰室等餐厅租户外,亦有银座式饮食为主题商厦,上班人士亦可前往海港城,餐厅种类应有尽有。

项目由建灝地产发展,物业拥楼底极高的地下大堂,加上设有艺术摆设,非常有气派。大堂亦设有多个广告位,租户日后可作宣传之用。

物业楼高21层,总楼面面积逾10万平方呎,提供全层及分间单位出租,分别有约778、1,944及2,730平方呎的分间单位,而全层面积约5,461至8,064平方呎。

由于大厦早已部署作医疗用途,建筑设计具备各种有利于医疗之配套设施,专为各类型综合诊所、专科医务中心、医学美容中心及日间手术中心而设。个别楼层设有特高楼底 (层与层之间高度达5米) 以及特大地台承重 (达7.5kPa)。

设后备电力 升降机可放病床

此外,为配合诊所及医疗中心日常运作,每个楼层均提供稳定及充裕的电力供应,亦有后备电力可提供于单位内使用。同时,每层均预留额外通风位置供客户装配符合医疗级别及手术室要求的通风及换风系统,安全衞生。此外,每部升降机的设计,亦刚好可安放病床。

景观上,大厦一面望向维港海景,非常舒适,另一面则望尖沙咀楼景,同样开扬。

其他配套方面,业主于其中一层,设有一个多用途会议室,可作演讲厅等之用。另一间房则摆放座椅及枱,可供大厦租户的医疗人员用餐及休息,甚有心思。

该物业地盘原由资本策略持有,2019年资本策略 (00497) 标售亚士厘道21至27号地盘,最终以17.6亿元易手,由建灝地产承接。该物业地盘面积约8,107平方呎,获批兴建一座商业大厦,总地积比率面积约为97,284平方呎,按成交价计,每呎楼面地价约1.8万元。

项目由建灝地产发展,物业拥楼底极高的地下大堂,加上设有艺术摆设,非常有气派。大堂亦设有多个广告位,租户日后可作宣传之用。

(经济日报)

更多亚士厘21写字楼出租楼盘资讯请参阅:亚士厘21写字楼出租

更多尖沙咀区甲级写字楼出租楼盘资讯请参阅:尖沙咀区甲级写字楼出租

多层单位招租 意向呎租45元起

尖沙咀「亚士厘21」以医疗作主题,现多层单位招租,意向呎租约45元。

个别楼层 可作特色餐饮

亚士厘21获医疗相关客户垂青,项目早前落实一宗承租协议,新租户为大型医学影像检验中心,承租最大面积的2楼全层,楼面面积约8,064平方呎。新租户特意选址于亚士厘21作其业务发展。

有外资代理行代理表示,现时不少医疗中心设有磁力共振扫描器,及电脑断层扫描器等大型医疗机器,无论是对商厦的负重力、楼底高低及货�𨋢均有较高的要求,亦因为要配置这些机器,大厦的供电、通风等配套均需要配合。因此针对医疗中心为租户的商厦,其装备要有别于普通商厦,故亚士厘21有一定优势。

该代理指,亚士厘21现多层楼面进行招租,呎租约45元起。除了医疗作主题外,意向租客亦包括其他行业包括健身中心等,亦有个别楼层可作特色餐饮。

(经济日报)

更多亚士厘21写字楼出租楼盘资讯请参阅:亚士厘21写字楼出租

更多尖沙咀区甲级写字楼出租楼盘资讯请参阅:尖沙咀区甲级写字楼出租

商业买卖4月166宗 按季增4成

有外资代理行最新发表的2024年5月投资市场报告指出,恒指一个月内反弹超过3,000点,彻底扭转投资市场情绪,散售市场成交于4月不断增加,许多资金充裕的用户和投资者纷纷进入房地产行业寻找价格优惠的物业。

在散售市场中,许多卖家愿意接受市场定价,从而调整了叫价,因此成交量不断增加,今年4月共录得166宗商业交易,按季增加43%,接年增加5%。

最近一些值得关注的交易包括美国银行中心两个楼层以2.5亿及2.6亿元成交,平均呎价为18,000元。与1年前同一幢大厦的小型单位成交,每呎31,000元相比,价格大幅下跌42%,重返14年前的水平。

在过去14年,恒指与甲级写字楼价格走势之间的历史相关性高达0.67,股市反弹近20%,可能会在未来3个月内促使写字楼价格出现短期反弹,但近期股市反弹的持续性将决定写字楼价格在今年剩餘时间内的走势。

预测甲厦价今年跌10%

今年第一季,整幢商业地产投资市场交易总额出现下滑。物业交易总值为84亿元,按季度下降59%,同比下降57%。位于荃湾的愉景新城以40.2亿元成交,另上环的商业物业88WL以远低于收购价及发展成本的售价售予本地投资者,导致参与的卖方和银行蒙受重大损失。

展望未来,该行指,投资市场仍将受到多重因素的影响。由于美国在今年餘下时间减息的可能性下降,资金成本在短期内可能仍然较高,但在全球股市反弹、本地企业盈利向好以及中国政策进一步支援中港经济的支持下,股市持续反弹将间接地支援交易量进一步反弹。而由于大多数潜在买家都会讨价还价性质,定价可能仍然受到抑制。该行预测2024年甲级写字楼价格将下跌10%,核心街铺价格将下跌5%。

该行另一代理表示,近期股市反弹重振了投资市场情绪,用家甚至投资者都热衷于在散售市场中寻找价格优惠的资产。

不过,目前投资市场只剩下用家和国有企业,全幢商厦买卖仍需时復甦。

(经济日报)

更多美国银行中心写字楼出售楼盘资讯请参阅:美国银行中心写字楼出售

更多中环区甲级写字楼出售楼盘资讯请参阅:中环区甲级写字楼出售

更多88WL写字楼出租楼盘资讯请参阅:88WL写字楼出租

更多上环区甲级写字楼出租楼盘资讯请参阅:上环区甲级写字楼出租

Henderson 'committed to Northern Metropolis'

Henderson Land Development (0012) says it will continue to develop its remaining 3 million square feet of land in Hung Shui Kiu although over a half is set to be resumed by the government.

Speaking at the developer's annual general meeting yesterday, chairman Martin Lee Ka-shing said there are a lot of opportunities in the Northern Metropolis - which includes the Hung Shui Kiu/Ha Tsuen New Development project - and Henderson will not slow down developments on farmlands.

Henderson is expected to receive HK$3.9 billion from the government in compensation for its 3.5 million sq ft of land to be recovered for the second phase of the Hung Shui Kiu/Ha Tsuen New Development, fueling speculation that the developer may quit the project. The area to be resumed by the government amounts to 53 percent of Henderson's 6.57 million sq ft land reserves in the district.

Lee said no arrangement has been made about paying land premiums for the involved sites.

On the local residential market, Lee expressed confidence that home prices would stabilize in the second half as the US Federal Reserve is expected to start cutting interest rates.

He predicted the office market will remain sluggish amid reports that The Henderson in Central, a landmark commercial building under renovation, achieved an occupancy rate of only 60 percent in May.

Replying to questions about the mainland's real estate market, another chairman, Peter Lee Ka-kit, said it will take time for the central government's stimuli to have an impact.

In respect of Henderson's new project The Haddon in Hung Hom, the company has received 240 checks from potential buyers for the 92 flats due to be sold in the first price list, making the batch 1.6 times oversubscribed.

(The Standard)

For more information of Office for Lease at The Henderson please visit: Office for Lease at The Henderson

For more information of Grade A Office for Lease in Central please visit: Grade A Office for Lease in Central

Net-zero offices in Hong Kong, Asia face supply crunch by 2030 as 87% of occupiers need them to hit carbon targets: property consultancy

Supply will not satisfy the demand from occupiers aiming for 100 per cent green-certified portfolios by 2030, research says

The mismatch will drive strong competition for such facilities in the next six years as well, a property consultancy says

Companies striving to meet ambitious decarbonisation targets across Asia-Pacific may crash straight into a shortage of environmentally certified office space by 2030, according to a forecast by a real estate consultancy.

The supply of so-called net-zero carbon (NZC) office space will fall short of demand, as 87 per cent of real estate occupiers in Asia-Pacific are targeting 100 per cent green-certified portfolios by 2030, the consultancy said. The mismatch will drive strong competition for such facilities in the next six years as well, the company said.

The company defines an NZC building as “all-electric, highly rated, energy-efficient and powered by renewable energy”.

“One of the major challenges is the limited supply of green-[certified] buildings,” a consultant said in a statement on Monday, adding that the shortage in the city will be particularly acute.

“The supply may not be able to meet the increasing demand in the long term. Even including the projects in the pipeline, the majority of buildings in Hong Kong will not [be] green certified.”

However, retrofitting existing buildings can deliver environmental performance on par with, or even exceeding, that of newly constructed buildings, the consultant said.

Only 4 per cent of occupiers boast portfolios that are 100 per cent green certified currently, according to the consultancy’s survey of 243 senior commercial real estate decision-makers in Asia-Pacific in November. The research covered eight geographies, with two-thirds of respondents belonging to multinational corporations.

“Today, leasing office space in green certified buildings is no longer a differentiator but a minimum criterion for most occupiers in Asia-Pacific,” another consultant said in a statement.

Seventy-four per cent of occupiers across Asia-Pacific expect half their energy needs to be met by renewables in the future, compared with 9 per cent now, according to the consultancy.

The transition to renewable energy is a critical step for the real estate industry to redefine and transform buildings from passive energy consumers to active contributors through on-site renewable energy generation, the consultancy said.

While developers typically focus on the embodied carbon footprint of building construction – the greenhouse-gas emissions associated with the manufacturing, transport and installation of materials – the impact of fit-outs is often overlooked.

Currently, 65 per cent of occupiers cite investments required for office fit-outs as one of their greatest sustainability challenges, according to consultancy’s survey.

Building fit-outs contribute around one-third of emissions, as the average office has changes made to its interior at least 20 times in its life cycle, according to the consultancy. The lack of focus on fit-out emissions stems from a traditional separation between teams responsible for building development and interior fit-out, the consultancy said.

“Breaking established silos is key to transitioning towards zero waste in the design phase through to procurement and strip-out, to support the reduction of emissions associated with waste and material use,” the consultant said.

Hong Kong is expected to see a 68 per cent supply deficit of top-quality sustainable workplaces up to 2028, according to the consultancy’s Sustainable Offices City Index in October.

“In Hong Kong, office tenants, particularly Hong Kong-listed enterprises, are currently placing a significantly greater emphasis [than in the past] on ESG features when making real estate decisions,” another consultant said in a report last month.

“While Hong Kong aims to achieve carbon neutrality by 2050, multinational corporations are expected to adhere to the standards established by their global headquarters, potentially as early as 2027 to 2030,” the consultant said.

(South China Morning Post)

Hong Kong is Asia’s busiest ‘super-prime’ housing market as removal of property curbs boosts demand: property agency report

With 132 transactions in the year to March, Hong Kong beat Singapore, which recorded 88 deals in the ‘super-prime’ residential market

Demand was supported by a drop in prices in the last few years and the recent scrapping of cooling measures

Hong Kong was Asia’s busiest market for homes valued at US$10 million and above in the year to March, according to a property agency’s report.

“Demand in Hong Kong is mainly coming from Hong Kong buyers or from mainland Chinese purchasers,” an agent said in an email interview after the release of the report on Monday. “The uptick reflects a feeling in the market that pricing has adjusted down in the prime and super-prime markets over the past 18 months.

“There is also an ongoing issue with low supply volumes of best-in-class stock, which is supporting prices.”

Hampered by a sluggish economy and high interest rates, Hong Kong’s residential market was down by as much as 24 per cent in February this year from its peak in September 2021, according to an official index tracking the prices of lived-in homes.

As of April, prices had clawed back some losses, narrowing the gap to 22.5 per cent, data from the Rating and Valuation Department showed.

Among the luxury homes sold in Hong Kong this year was a mansion at The Peak. Bought by a mainland Chinese buyer linked to the founder of Mindray Bio-Medical Electronics in January, the property at 25-26 A&B Lugard Road was snapped up for HK$838 million (US$107 million), according to another property agency.

The removal of all the city’s property cooling measures at the end of February is also boosting transactions in the luxury homes market, the agent added.

“The recent moves to reduce transaction taxes in the housing market have also aided confidence across the market,” the agent said. “Hong Kong remains a critical business centre and wealth hub in Asia and the recent volumes of super-prime sales is likely to be sustained into the medium term.”

Singapore is in a completely different phase of its cycle, with the government cooling home prices with punitive levies. Measures announced by the city state last year included a 60 per cent tax on residential purchases by foreign buyers.

(South China Morning Post)星对冲基金扩充 租中环置地广场-公爵大厦

个别外资机构于中环扩充写字楼,中环置地广场-公爵大厦单位,获新加坡基金公司租用作扩充。

外电报道指,新加坡对冲基金公司Dymon Asia Capital,租用中环置地广场-公爵大厦单位,将可容纳超过70名员工,是目前公司在盈置大厦办公室可容纳人数的两倍。

涉8833呎楼面 呎租约90

翻查资料,该基金原租用中环盈置大厦17楼一个单位,而预计新近租置地广场-公爵大厦高层1及05至10室,面积约8,833平方呎,估计呎租约90元。公爵大厦位处中环最核心位置,故是次属升级及扩充。

有代理表示,有业主放售湾仔摩理臣山道70至74号凯利商业大厦19楼全层,面积约3,014平方呎,另连约300平方呎的空中花园。业主原叫价每呎约12,616元,现以呎价约7,962元放售,意向价约2,400万元。该代理指,单位享马场景。

该单位由资深投资者罗守辉持有,他于2017年以2,428万元购入单位,持货7年,现以蚀让价放售物业。

(经济日报)

更多置地广场写字楼出租楼盘资讯请参阅:置地广场写字楼出租

更多盈置大厦写字楼出租楼盘资讯请参阅:盈置大厦写字楼出租

更多中环区甲级写字楼出租楼盘资讯请参阅:中环区甲级写字楼出租

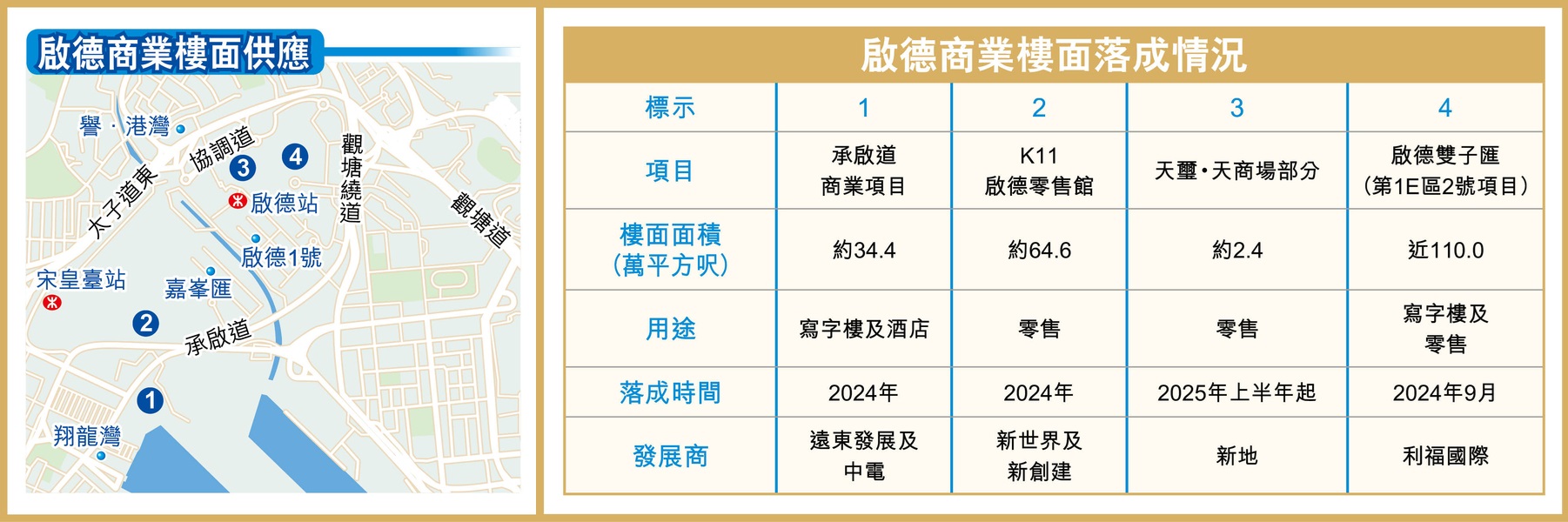

3商业项目 年内进驻啟德

啟德配套日渐成熟,陆续有商业项目落成,继南丰旗下大型商业项目AIRSIDE于去年落成后,预计今年再有3个商业项目落成,共涉近210万平方呎楼面。

啟德第二个核心商业区 (CBD 2) 为定位,区内商业楼面供应多达逾2,000万平方呎,当中去年及今年属于商业项目落成高峰期,接近约400万平方呎商业楼面落成,估计今年再有3个商业项目落成,共涉近210万平方呎楼面,当中以啟德双子汇项目的规模最大,亦将有知名大型日式百货进驻。

双子汇投资额145亿 料9月落成

啟德双子汇前身为第1E区2号用地,于2016年由利福国际击败其餘7间财团,以约74亿元 (每呎楼面地价约6,733元) 投得,将会发展为2幢楼高18至19层高的双子塔式商厦,预计于今年9月落成,总楼面约110万平方呎,总投资额高达145亿元。

项目分2幢发展,其中利福旗下日式百货公司崇光SOGO进驻Tower I,而Tower II拟提供国际奢侈品、美粧、时尚服饰以至生活消閒等商品及服务。

K11啟德零售馆 设逾200间商铺

另外,作为啟德重要基建之一的啟德体育园之主要设施,亦预计今年年底落成。园内的K11啟德零售馆亦会推出,由新世界 (00017) 营运,主建筑共3座,每座最多有5层,佔地约70万平方呎,涉逾200间商店,提供零售及餐饮服务。

而由远东发展 (00035) 投得的啟德承啟道商业项目亦预料在今年落成,项目将发展为1幢办公室及1幢酒店,总楼面约34.4万平方呎,当中约17.4万平方呎的写字楼部分已在2021年12月售予中电 (00002) ,作价约33.8亿元,每呎约19,400餘元,将成为中电的新总部。

新地 (00016) 旗下新盘「天璽‧天」的基座还将设有一个零售商场,面积约2.4万平方呎,预计在2025年起分阶段落成。

纵观啟德区尚有不少商业地待推,涉及商业楼面近980万平方呎。

值得一提是,政府早前曾提出将啟德5幅商业地改划为住宅地,但最终只有3幅获成功改划,其餘两幅位于跑道区的商业地 (4C区4号及4C区5号地盘) 则会保留作商业用途,当中4C区4号用地已纳入今个财政年度的卖地表中,总楼面约86万平方呎。

(经济日报)

更多AIRSIDE写字楼出租楼盘资讯请参阅:AIRSIDE写字楼出租

更多啟德区甲级写字楼出租楼盘资讯请参阅:啟德区甲级写字楼出租

去年落成的啟德商厦AIRSIDE接连录得租务成交,属于近期市场租务表现较理想的甲级商厦项目。

友邦保险租18万呎楼面

据市场消息透露,友邦保险 (01299) 最新租用啟德AIRSIDE 5层楼面,共涉约18万平方呎,呎租约30元,如以租用面积计算,属于今年最大手租务成交。

事实上,近期AIRSIDE接连录租务交投,月前其29及30楼全层,共约7.6万平方呎楼面,获新加坡华侨银行承租,预计呎租约35元。而德国超市集团及保诚保险亦承租其写字楼楼面。

根据一间本港代理行发表的最新商厦市场报告,4月东九龙指标甲厦的平均呎租约22元,按月下跌0.3%,至于售价方面,平均呎价约9,325元,按月亦微跌1.3%。该区空置率在该月达到17.6%水平,为各区最高。

(经济日报)

更多AIRSIDE写字楼出租楼盘资讯请参阅:AIRSIDE写字楼出租

更多啟德区甲级写字楼出租楼盘资讯请参阅:啟德区甲级写字楼出租

HK urban flats now priced at less than $4m

One can afford to buy a home in an urban area in Hong Kong for less than HK$4 million now, as the city's home prices are still almost 30 percent lower after peaking three years ago.

The Highline in Kennedy Town has just unveiled its first price list of 50 units, with the cheapest at HK$3.89 million.

The project is developed by Right Honour Investments under the Shanghai Commercial Bank.

The average price after discounts stands at HK$21,380 per square foot, the lowest in the district in eight years and about 18 percent lower than the recent average of around HK$26,000 in the West Island, an agency said.

The 50 units are comprised of 40 studios, six one-bedroom and four two-bedroom units, with sizes ranging from 211 to 524 sq ft.

The Highline plans to offer a total of 173 units in a 30-story tower, including 90 studios, 50 one-bedroom, 14 two-bedroom and 19 three-bedroom flats.

Its show hall will be open to the public today and subscriptions will start on Friday, an agent said.

In Cheung Sha Wan, The Vim has priced its seven high-rise flats in its sixth price list at a low of HK$3.41 million after discounts. The cheapest unit is a 201-sq-ft studio costing HK$17,003 per sq ft.

The sizes of these seven units vary from 199 to 289 sq ft, with an average price of HK$16,656 per square foot.

The Vim is jointly developed by Carrianna Group (0126) and Choice Holdings.

It comes as the city's private home prices have lost 28 percent from its peak in September 2021, though it rebounded 2 percent in the past three months after the removal of housing curbs in late February.

Henderson Land Development (0012) said The Haddon, its redevelopment project in Hung Hom, has received 272 cheques as of yesterday for 92 units in its first price list, around twice oversubscribed.

Henderson plans to start the first round of sales by the end of this week or the middle of next week.

In other news, the value of registered residential property sales jumped 45 percent year-on-year to HK$53.4 billion despite a 31 percent fall month-on-month, data from the Land Registry showed.

The number of contracts amounted to 5,546, 38.5 percent higher than one year ago but 35 percent lower than one month earlier.

(The Standard)

Hong Kong property deals fall by a quarter as exuberance over scrapping of cooling measures fades

Some 7,361 homes, car parks, shops, office and industrial units changed hands in May, down by 25. 5 per cent from April

From a year ago, both the number and value of property transactions in May were still higher by about 40 per cent

Hong Kong’s property sales fell by a quarter in May, the latest official data shows, as analysts said the initial exuberance over the lifting of property cooling measures had started to wear off.

Some 7,361 new and lived-in homes, car parks, shops, office and industrial units changed hands in May, down by 25.5 per cent from April, according to Land Registry data released on Tuesday. The total value of property sales plunged 25.8 per cent to HK$62.28 billion (US$7.9 billion).

From a year ago, both the number and value of property transactions were still higher by about 40 per cent.

Sales of residential units plummeted 35.1 per cent to 5,546 in May, but were up by 38.54 per cent from a year earlier.

The boost that stemmed from the scrapping of property curbs at the beginning of March appeared to be tapering off.

In March and April, property deals rose on a monthly basis. In particular, the April sales – the highest since July 2021 when 9,957 units were sold – were roughly double the number in March, which marked the first full month of a restriction-free property market.

The prices of Hong Kong’s secondary homes have so far largely reflected the new-found optimism, increasing by an aggregate 2 per cent since February, official data shows.

“Overall trading has returned to a more rational state, but it is expected to remain better than the sluggish market conditions before the withdrawal of the cooling measures,” another agent said.

“It is expected that the overall property transaction registration volume in June will only fall by about 3 per cent month on month, and will maintain the level of 7,000 units.”

With more than 7,000 new homes sold in the three months since the property restrictions were relaxed, it was natural for the market to “take a breath”, another agent said.

In May, fewer units were launched compared to April, the agent added.

“Developers mainly pushed their old inventory for sale during the month,” the agent said. “With several new projects in the pipeline awaiting launch, we expect developers to adjust their pricing strategy as buyers are mainly attracted by discounts and incentives.”

The agent expects property deals to decline further in June.

Another property agency which sells luxury lived-in homes, demand had picked up in recent weeks.

“Most of the demand is coming from Hong Kong and mainland Chinese buyers,” another agent said. “I think this is because sellers are becoming more realistic and are willing to cut about 15 per cent from their original asking price.”

Although interest rates remain at a near 23-year high in Hong Kong, many potential buyers believe a rate cut is likely to come in the first half of 2025.

“The vendors are recognising that there is not likely to be a significant increase in prices because both the mainland China and Hong Kong economies are still sluggish,” the agent said.

(South China Morning Post)中环云咸商业中心全层5300万售 投资者沽货 13年升值24%

商厦市场吹淡风,投资者沽货锁定利润,用家趁势承接,中环云咸商业中心一个全层单位,以5300万易手,平均呎价15230元,物业于13年间升值24%。

中环云咸商业中心26楼全层,建筑面积3480方呎,连CP3层C11号车位,以5300万易手,平均呎价15230元,原业主为投资者,于2011年9月以4273.4万购入单位,一直作为收租,是次沽货帐面获利1026.6万,物业于13年间升值24%。市场消息透露,买方main life corp ltd,目前自用区内云咸街46至48号云明行9楼及16楼全层,每层2100方呎,合共4200方呎,今番购入单位作为扩充营业。

平均呎价1.52万

云咸商业中心于商厦高峰期,该厦18楼全层,于2018年10月9146万易手,平均呎价高达26282元,最新造价较高峰期跌43%。商厦造价向来随经济波幅大,该厦21楼单位,建筑面积3480方呎,于2001年以785万易手,该厦于2003年则未有买卖。

云咸商业中心位于云咸街40至44号,楼高31层,总楼面约10万方呎,拥有25层办公室,6至30楼,地下为商铺,拥有5层停车场,大厦配备3部客用电梯,用家包括资产管理和专业服务行业主导。

造价较2018年跌43%

目前商厦供应多,租金持续数年,价格亦作调整,用家则趁势吸纳自用。据一间外资代理行最新一份商厦报告,去年底至今,商厦市场以用家主导,包括证监会购港岛东中心多层,李寧 (02331) 购港汇东全幢等,用家把握价格大幅调整承接办公室自用,以免长年交租。有见造价由高位回落逾50%,有个别投资者抱「捞底」心态入市。从收租角度,毕竟目前空置楼面多,在高息环境下,商厦回报率不吸引,投资者寄望日后反弹。

(星岛日报)

更多云咸商业中心写字楼出售楼盘资讯请参阅:云咸商业中心写字楼出售

更多云明行写字楼出售楼盘资讯请参阅:云明行写字楼出售

更多中环区甲级写字楼出售楼盘资讯请参阅:中环区甲级写字楼出售

更多港岛东中心写字楼出租楼盘资讯请参阅:港岛东中心写字楼出租

更多鰂鱼涌区甲级写字楼出租楼盘资讯请参阅:鰂鱼涌区甲级写字楼出租

更多港汇东写字楼出租楼盘资讯请参阅:港汇东写字楼出租

更多北角区甲级写字楼出租楼盘资讯请参阅:北角区甲级写字楼出租

代理行:上月工商铺买卖突破300宗

5月份工商铺註册量突破300宗,自2023年8月以来首次,有本港代理行综合土地註册处资料显示,5月份工商铺註册量共录350宗,按月增约17.4%,金额录43.62亿,按月增约41%。

创9个月新高

该行认为,政府撤辣后,发展商低价推售住宅,资金集中一手,不过,「以价换量」趋势将延伸至工商铺市场。

5月份整体註册宗数录350宗,按月增约17.4%,金额录43.62亿,按月升约41%,工商铺三板块註册宗数分别176宗、75宗以及99宗,按月增加约18.9%、15.4%及16.5%。

若按金额划分,录最多註册的银码是价值500万或以下物业,最新192宗,按月增约22.3%,其次为500万以上至1000万物业,最新录78宗登记,按月增约52.9%。介乎2000万以上至5000万物业註册持续增加,5月30宗,按月增约20%。

然而,价值1000万以上至2000万物业按月减约35.1%,最新录37宗,是唯一录减少银码类别。

上环88WL全幢瞩目

5月份录4宗银码逾亿註册,其中商厦及商铺板块皆录2宗,上环88WL全幢及金鐘美国银行中心 30楼全层连车位,分别以7亿及2.6亿成交,呎价约7761元及18732元,远低于市价水平。

至于商铺方面,有投资者以2亿购入荃湾荃景围86号荃湾中心商场2期多个铺位。信兴集团相关人士以约1.49亿买入佐敦官涌街38号The Austine PLACE地下及1楼多个铺位。

(星岛日报)

更多美国银行中心写字楼出售楼盘资讯请参阅:美国银行中心写字楼出售

更多中环区甲级写字楼出售楼盘资讯请参阅:中环区甲级写字楼出售

更多88WL写字楼出租楼盘资讯请参阅:88WL写字楼出租

更多上环区甲级写字楼出租楼盘资讯请参阅:上环区甲级写字楼出租

Prices slashed for Tuen Mun flats

CK Asset (1113) has slashed prices for 28 flats at phase 1 of the Grand Jeté in Tuen Mun -- 23 of which are being relaunched for sale -- by as much as 28 percent.

The prices of these 28 flats have been reduced by 11 to 28 percent, leading to an average price of HK$12,176 per square foot after the discounts. The largest cut is for a one-bedroom apartment, with its price slashed from HK$5.4 million to HK$3.9 million.

Sales of the batch start on Sunday.

The project's phase 1, jointly developed by CKA and Sun Hung Kai Properties (0016), has allowed buyers to move in. However, buyers for 23 units broke off agreements and gave up deposits involving HK$12 million in total, local media reported. The 23 flats have now been put up for sale again as part of this phase 1 batch.

Elsewhere in Kai Tak, New World Development (0017) and Far East Consortium International (0035) plan to launch phase 1 of The Pavilia Forest as early as this quarter, offering 291 flats.

Also in Kai Tak, 108 units of KT Marina will be launched with an average price of HK$21,713 per sq ft after discounts. The project is jointly developed by K Wah International (0173), Wheelock Properties and China Overseas Land & Investment (0688).

In other news, Hong Kong recorded 36 transactions on homes worth at least US$10 million (HK$78 million) in the first quarter this year, according to an international property agency’s global super-prime intelligence report, more than double the 15 deals in the previous quarter. Annually, the city had 132 of these deals for the 12 months ending in March, remaining the top-ranking super-prime residential market in Asia.

(The Standard)新甲厦租务旺 跨国企业追捧

近月商厦租务成交,主要出现于新甲厦上,不少跨国企业趁机承租,作办公室升级。

据一间外资代理行每月商厦租金统计,港岛区整体甲级写字楼平均租金回落至每平方呎64.2元,按年下跌5.2%。港岛区整体空置率在4月份达到12.6%新高,港岛区大部分市场的写字楼租金下跌,其中中环甲级写字楼的租金跌幅最显著,按年下跌9.1%。

港岛租务成交 集中5千呎以下

该行指,香港写字楼市场录得不少内地企业的查询和新需求。一般而言,写字楼面积5,000平方呎以下,拥有海景及装修的中小型优质写字楼,最受内地租户追捧,在市场上较具竞争力和吸引力。

其中一幢新预租个案,落在全新甲厦上,涉及一家金融机构,租用中环长江集团中心二期单位,涉及约8,650平方呎。

九龙租金按月跌1.7%

至于九龙区写字楼市况上,莱坊指,4月份九龙区平均月租按月下跌1.7%至每平方呎约22.8元,连续第3个月下跌。交易以平均面积为3,000平方呎或以下的细交易为主。九龙东的写字楼租赁活动较为活跃,4月份的交易以搬迁个案为主。

据悉,近月九龙区商厦租务,主要来自啟德AIRSIDE上,最新消息指,啟德AIRSIDE录得大手洽租个案,涉及物业31至36楼 (项目不设34楼),合共5层,每层面积约3.5万平方呎,合共约18万平方呎,若成交落实,以租用面积计算,为今年暂时最大手甲厦租务个案。

消息指,是次洽租为友邦保险,预计租用全新甲厦,有助提升品牌形象,并由其他使用办公室单位的部门迁入。近期租务焦点,落在啟德AIRSIDE上,今年连获多间机构承租,包括华侨银行、保诚保险以及德国超市品牌等,连同是次友邦租用多层,合共已租出逾30万平方呎楼面,连同南丰自用多层,令该厦出租率大幅提升。

后市上,该行认为,由于市场缺乏新需求,预计香港区甲级写字楼短期内的空置率将维持高位,2024全年租金将持平至下跌3%。至于九龙区方面,该行认为,尽管市场气氛疲弱,一些值得注意的新租赁交易支持上月的写字楼市场,由于市场不确定性可能持续存在,预计租户将保持谨慎态度。相信能提供节省成本的资本支出补贴,和租金有竞争力的写字楼物业,可以在具挑战性的环境中脱颖而出,预计九龙区写字楼市场在短期内,仍将面临供过于求和需求疲弱的挑战。

(经济日报)

更多长江集团中心二期写字楼出租楼盘资讯请参阅:长江集团中心二期写字楼出租

更多中环区甲级写字楼出租楼盘资讯请参阅:中环区甲级写字楼出租

更多AIRSIDE写字楼出租楼盘资讯请参阅:AIRSIDE写字楼出租

更多啟德区甲级写字楼出租楼盘资讯请参阅:啟德区甲级写字楼出租

Home completions dive 54pc in April

Private home completions in Hong Kong slumped by 54.8 percent to 624 in April from 1,381 units month ago, data from The Rating and Valuation Department showed.

And a presale application made by CK Asset (1113) for its project at Anderson Road in Kwun Tong was rejected by The Lands Department as it was considered premature.

For the first four months, a total of 5,599 private flats were completed in the city, accounting for 25.1 percent of the government's target of 22,267 units for the whole year.

The four-month figure, however, was still down by 21.5 percent when compared to the 7,136 units completed in the same period last year.

Among them, smaller flats continued to see the largest number of completions. The number of flats with an area less than 40 square meters saw 2,948 completions in the first four months, taking up 52.7 percent of the total number of units completed, according to the official data.

This was followed by 2,039 flats completed during the same period with area between 40 and 69.9 sq m, accounting for 36.4 percent of the total.

In the primary market, phase 3B of Sun Hung Kai Properties' (0016) Novo Land in Tuen Mun is expected to release the first price list next week. The phase offers 769 flats in total, with areas ranging from 232 to 1,390 sq ft.

In Kennedy Town, The Highline will put more flats on the market as early as Saturday after revealing its first price list on Tuesday, which provides 50 units with the cheapest at HK$3.89 million.

The project is developed by Right Honour Investments under the Shanghai Commercial Bank.

In Hung Hom, Henderson Land Development's (0012) The Haddon is expected to launch sales next week after collecting 300 checks over the first batch of 92 flats.

(The Standard)上月录286宗工商铺买卖 代理行:按月微跌5.5%

5月份共录约286宗工商铺成交,较4月份微跌5.5%,有本港代理行代理表示,上月录约286宗工商铺买卖,对比2023年同期减少约10%,金额共录约40.41亿,按月减约27.5%,按年相若。

金额40.41亿按月减27.5%

该代理续表示,商铺共录约80宗买卖,较上月约68宗增多约17.7%,按年对比约6.7%增幅,现时大部分业主愿意割价,令整体铺价对比去年大幅下调,吸引投资者低吸。观察今年度按月商铺买卖,由2月份约39宗,升至最新80宗水平,累计升幅约1.05倍。当中悦兴地产罗守耀太太邓嘉玲近日低吸中环域多利皇后街14号地铺连阁楼,成交价约3500万,较铺位原叫价约5800万折让近40%,现租客财务公司月租约10餘万,料回报约3.4厘。

业主割价 买家低吸

该代理指出,5月份共录商厦约42宗成交,按月升约1宗,按年升约3宗。中环皇后大道中9号29楼全层,以约3.1亿售,呎价约2.25万,呎价较6年前高峰期跌约60%,工厦成交月内录约164宗,按月跌约15.5%,金额大跌约41.8%,该代理相信,投资气氛多集中商厦及商铺,故影响买家入市工厦意欲,投资工厦多选择细价物业,故价量齐跌。

该代理分析,环球投资情绪近月明显转变,港股上月更一度突破19000点水平,升至逾九个月高位,标普维持香港评级展望为稳定,本港经济将持续稳步復甦、预料物业市场趋稳定。

(星岛日报)

中环中央广场 坐落苏豪区合用家

中环中央广场位于云咸街,因位处半山景观开扬,附近环境亦非常舒适。

中环中央广场坐落于云咸街60号,亦即半山地段,并非住宅商业心臟,由港铁站步行至该厦,需时10至15分鐘,附近巴士站不多,而大厦设有停车场。此外,业主亦提供15分鐘一班的接驳车,来往物业及历山大厦,方便上班人士。

餐饮方面,物业位处特色餐饮聚集的苏豪区,餐厅甚多,物业邻近「大馆」,亦有少量优质餐厅。上班人士亦可到兰桂坊、皇后大道中等消遣,选择充足。

大厦其中一特色,是横跨两个地段,设亚毕诺道及云咸街两个入口。云咸街地下约2万平方呎的零售商铺,租户包括知名酒吧及会所Dragon-I、韩式餐厅等。

两个入口有户外扶手电梯连接,附花园、坐椅等,整体感觉舒适。亚毕诺道入口大堂较为宽敞,而升降机非常充足,可疏导人流。相比起人流非常繁忙的传统地段,中央广场提供较为舒适感觉。

处半山 享360度开扬景色

中央广场于2001年落成,楼高33层,其中甲级写字楼楼面佔25层,提供27万平方呎办公室,每层面积11,725平方呎,可分间成5个单位,面积由1,400平方呎至起,适合不同行业使用。景观为该厦卖点之一,因有地势高的优势,物业单位可享开扬360度景色,包半山楼景,礼宾府景观,极高层单位享海景。

大厦现由信和集团及南华(中国)持有,用户群集中为证券及基金公司,亦有半零售行业包括瑜伽中心等。楼面由两大业主持有,故一向极少买卖成交。

租务方面,今年大厦录得数宗租务,4月份中层单位,面积约1,397平方呎,以约5.6万元租出,呎租约40元。另29楼2A及2B室,面积约2,870平方呎,以每月11.7万元租出,呎租约41元。

(经济日报)

更多中央广场写字楼出租楼盘资讯请参阅:中央广场写字楼出租

更多历山大厦写字楼出租楼盘资讯请参阅:历山大厦写字楼出租

更多中环区甲级写字楼出租楼盘资讯请参阅:中环区甲级写字楼出租

单位招租 意向呎租42元起

据了解,现时中央广场出租率逾8成,大厦租户方面,现时较知名用户为澳门博彩集团新濠国际 (00200),佔用大厦极高层两层楼面;另知名家电品牌Dyson,亦进驻物业11楼。其他商户主要为金融相关包括资产管理、基金公司等。

信和集团指,现时大厦部分单位进行招租,例如2803至06室,面积约7,304平方呎,意向呎租约42元,另29楼3C至05室,面积约2,911平方呎,以及32楼5B及6号室,面积约2,096平方呎,同样以每呎约42元招租。个别单位保留前租客装修,可即租即用。

(经济日报)

更多中央广场写字楼出租楼盘资讯请参阅:中央广场写字楼出租

更多中环区甲级写字楼出租楼盘资讯请参阅:中环区甲级写字楼出租

尖东新文华中心高层放租每呎20元

尖东新文华中心为区内指标商厦,现物业高层单位,以每呎约20元放租。

面积3712呎 月租7.4万

有本港代理行代理表示,有业主出租尖东科学馆道14号新文华中心B座高层18至20室,物业建筑面积约3,712平方呎,意向呎租约20元,以此计算每月租金约7.4万元。单位享开扬景观,装修齐备,可即租即用。

该代理表示,新文华中心为尖沙咀甲级商厦,设有中央冷气、1部载货电梯、停车场等设备。大厦设有5部载客电梯。大厦亦设有基座商场,满足租户及访客购物需求。

资料显示,物业上月录一宗买卖,涉及新文华中心B座低层19C室,面积约487平方呎,以约540万元成交,呎价约1.1万元。

(经济日报)

更多新文华中心写字楼出租楼盘资讯请参阅:新文华中心写字楼出租

更多尖沙咀区甲级写字楼出租楼盘资讯请参阅:尖沙咀区甲级写字楼出租

更多新文华中心写字楼出售楼盘资讯请参阅:新文华中心写字楼出售

更多尖沙咀区甲级写字楼出售楼盘资讯请参阅:尖沙咀区甲级写字楼出售

Secondary home sales perk up as new launches take a breather

Secondary sales at Hong Kong's 10 major housing estates rose to a six-week high over the weekend, with no new projects to tempt homebuyers away.

The 10 blue-chip estates recorded 11 transactions over the first two days of the three-day Dragon Boat Festival, up by 57 percent from a week ago and back to double-digit figures, according to data from a local property agency.

Another property agenct also posted 10 deals at the 10 major estates during the weekend, up by 43 percent from a week earlier.

An agent said there were no new projects for sale over the weekend, and this resulted in more deals in the second-hand market.

However, many prospective buyers are hoping that the US will now start cutting interest rates earlier than expected, following rate cuts in Canada and Europe, and the number of second-hand deals are likely to remain low as they adopt a wait-and-see approach, the agent said.

Another agent also believes that the focus will remain on the primary market as more new projects are rolled out in the near future to meet demand.

The agent added that the second-hand homes market will remain volatile.

In the primary market, Henderson Land Development's (0012) The Haddon in Hung Hom collected 450 checks as of 7.30pm yesterday, making the 63 flats in the batch more than six times oversubscribed.

In Yuen Long, After The Rain developed by Star Properties, is expected to hike prices, with over 80 percent of the flats already sold.

Elsewhere, phase 1 of the Grand Jeté in Tuen Mun sold seven out of 28 flats on Sunday after the developer CK Asset (1113) slashed their prices by as much as 28 percent.

(The Standard)

恒地 (00012) 中环甲厦The Henderson入伙,恒基兆业地产集团主席李家诚表示,欢迎首批租户进驻,非常高兴项目啟用。项目将融合艺术、创新和可持续发展元素,为未来甲级智能办公室引领新指标,同时印证集团对香港发展的信心。

项目获国际顶尖企业相继承租,包括艺术及奢侈品拍卖行佳士得之亚太区总部、国际投资公司凯雷及瑞士高级制錶品牌爱彼等。发展商指出,进一步将扎哈.哈迪德建筑事务所 (Zaha Hadid Architects) 的设计概念由大厦延伸至室外公共空间,打造全亚洲首个扎哈.哈迪德雕塑公园。

项目3楼办公大堂,亦引入知名当代艺术家杰夫.昆斯 (JEFF KOONS) 的《气球天鹅 (红色)》艺术作品,是首次于亚洲展出的气球天鹅,将艺术建筑美学延伸至室内。至于位于39楼顶层宴会厅为全港最高的全玻璃天幕宴会厅,将于稍后提供尊贵服务。

(经济日报)

更多The Henderson写字楼出租楼盘资讯请参阅:The Henderson 写字楼出租

更多中环区甲级写字楼出租楼盘资讯请参阅:中环区甲级写字楼出租

大鸿辉8亿放售荃湾工中一篮子物业

由大鸿辉兴业持有的荃湾工业中心一篮子工厦放售,意向价8亿,平均呎价3593元,较一年前减价27%。

上址为德士古道220-248号荃湾工业中心2楼至5楼全层,以及22楼05及07单位,单位面积最细为约2388方呎,总楼面共222630方呎不等,以意向价计算,平均每呎3593元,为区内高规格工厦,适合自置作厂房或货仓用途。

较前减价3亿放盘

该物业包括2楼至5楼全层单位,每层楼面约54425方呎,楼底约4.57米、承重15kPa,拥有3部专用货车立,可满足高流动性物流业务,同时人货分隔,节省时间及提高效率。值得留意是,大厦为此4层楼面特设一个专用火牛房,合共提供7500Amp三相电,适合用电量高用家。22楼05及07单位分别2542及2388方呎,景观开扬,该篮子物业配备5个私家车位,2个货车位及1个货柜车位。

荃湾工业中心于1980年落成,属区内高规格工厦物业,大厦设有云石大堂、4部载客电梯及14部载货电梯,另有停车场及卸货台,车位充裕,兼可容纳40呎长货柜,方便上落客。荃湾工业中心邻近西铁荃湾西站,毗邻葵涌货柜码头,经3号干线往返机场及全港各处,皆为方便。

平均每呎3593元

有外资代理行代理表示,工厦长期供不应求,空置率长期保持单位数字,是次放售楼面视乎买家需要,可分层或打包购入,建筑面积由约2388至222630方呎不等。当中约16万方呎大租客将于年内完约离场,适合企业自置。市场资料显示,该批工厦曾于去年2月推出放售,当时叫价11亿,时隔一年再度放盘,物业价格调低3亿,幅度约27%。

(星岛日报)

New Novo Land flats 15pc cheaper than a year ago

Sun Hung Kai Properties (0016) unveiled the first price list for phase 3B of Novo Land in Tuen Mun yesterday, offering 154 flats about 15 percent cheaper on average than a year ago.

The flats cost an average of HK$11,598 per square foot after discounts, 14.7 percent lower compared to prices in phase 2A, which was launched in May last year.

They are also cheaper than the four batches of the project launched in the past two years.

SHKP deputy managing director Victor Lui Ting expects the flats to be popular among homebuyers, as they have been priced at market levels.

The 154 flats cost between HK$2.98 million and HK$6.34 million after discounts of as much as 15 percent and comprise 10 studios, 10 one-bedroom, 114 two-bedroom and 20 three-bedroom units, with sizes ranging from 252 to 543 sq ft.

After discounts, the cheapest studio is priced at HK$2.98 million, or HK$11,856 per sq ft. The one-bedroom costs HK$3.66 million, or HK$12,068 per sq ft, or more. The prices of two- and three-bedroom units start from HK$4.81 million and HK$6.08 million respectively.

SHKP also offers a wide range of mortgage loan options, including a leveraged plan that allows buyers to borrow up to 125 percent of the price of the new flat, if they already own an existing property.

Andy Chan Hon-lun, general manager of sales and marketing at Sun Hung Kai Real Estate Agency, said that show flats will open today and subscriptions will start next week.

Phase 3B offers 769 flats, with two-bedroom flats accounting for 47 percent of the total.

Elsewhere in Jordan, CSI Properties (0497) released the fourth price list of Topside Residences, involving 26 flats.

The latest batch, covering one-bedroom and two-bedroom apartments, costs between HK$5.29 million and HK$9.85 million after discounts of as high as 15 percent. Their sizes vary from 269 to 416 sq ft.

CSI executive director Barry Ho Lok-fai also said that 27 units will be put for sale on Saturday. The project has sold 124 flats since the launch at the end of April.

Remaining cautious about the market, CSI priced the first batch of the redevelopment project in a densely populated urban area at an average of HK$19,388 per sq ft, which is 19 percent cheaper than a nearby project launched four years ago.

In other news, Henderson Land Development (0012) started the first round of sales of The Haddon in Hung Hom yesterday, involving 63 flats in price lists and five special homes by tender.

(The Standard)中环永安集团大厦全层月租58万减17% 平均每呎36元 医务中心续约3年

商厦供过于求,空置率高企,导致租金持续下滑,甚至低于疫情期间水平。中环传统商厦永安集团大厦14楼全层,由医务中心以每月58.2万续租3年,平均呎租36.5元,较3年前减租近17%。

上址为德辅道中71号的永安集团大厦14楼全层,建筑面积15946方呎,以每月58.2万续租,租期由2024年9月至2027年8月,租客为一间极具规模的医务中心,于2021年9月以每月70万承租,新租金减16.8%。

3年前月租70万

该10楼全层建筑面积15946方呎,于2019年1月时月租114.2万,呎租71.6元,随后2022年1月以105万续租,平均呎租65.8元,减幅约8%。之后再于2023年11月,月租减至99.4万,呎租62.3元,再跌约5%。

业内人士表示,2021年虽然疫情肆虐,惟当时市场憧憬通关后一番新景象,目前经济低迷,商厦供过于求,根据莱坊资料显示,截至2024年5月,中环写字楼租金由年初至今跌3.4%。

代理行:甲厦租金按月跌0.5%

有代理行发表的商厦市场报告指,截至5月份,分散业权甲厦售价及租金分别按月跌约2.5%及0.5%,售价今年以来累跌约8.8%,中环及金鐘跌幅较大,按月分别跌约3.5%及7.5%至27933元及20607元,业主大幅减价沽货。

近期有不少企业进驻一手商厦,华侨银行以每月约266万租用啟德AIRSIDE 2层楼面,5月录日资物流公司及零售品牌进驻琼林街83号商厦「PORTAS」。

该行代理表示,东九龙及长沙湾等非传统核心区商厦租金水平较低,吸引企业用作后勤基地甚至总部,不过,传统核心区仍具吸引力,受实力用家追捧。

目前商厦供过于求,另一代理行资料显示,截至5月份,中环写字楼租金由年初至今跌3.4%。

(星岛日报)

更多永安集团大厦写字楼出租楼盘资讯请参阅:永安集团大厦写字楼出租

更多中环区甲级写字楼出租楼盘资讯请参阅:中环区甲级写字楼出租

更多AIRSIDE写字楼出租楼盘资讯请参阅:AIRSIDE写字楼出租

更多啟德区甲级写字楼出租楼盘资讯请参阅:啟德区甲级写字楼出租

更多PORTAS写字楼出租楼盘资讯请参阅:PORTAS写字楼出租

更多长沙湾区甲级写字楼出租楼盘资讯请参阅:长沙湾区甲级写字楼出租

由世茂集团主席许荣茂持有的中环中心31楼全层,意向价约5.72亿,月租约112万,呎价仅约2.3万,远低于近年该厦平均呎价水平。

意向价5.72亿

有代理表示,中环皇后大道中99号中环中心31楼全层,建筑面积约24858方呎,以现状及交吉出售,意向呎价2.3万,涉资约5.72亿;而项目意向月租约112万,呎租约45元。该层楼底高达3.725米,望维港景及山景,设基本装修,更附大面积共享工作空间、体育娱乐室、茶水间和会议室等设施。

该代理指出,中环中心近期录全层单位,以每方呎约2.8万沽出,是次意向价格折让近20%。

(星岛日报)

更多中环中心写字楼出售楼盘资讯请参阅:中环中心写字楼出售

更多中环区甲级写字楼出售楼盘资讯请参阅:中环区甲级写字楼出售

下半年工商铺投资部署 专家教路

高息持续令工商铺投资者仍淡静,业界人士普遍认为,投资市场息口属关健因素。若息口回落,下半年投资市场将转好,而随着近期业主降价幅度明显,料下半年工商铺成交可反弹,当中商铺投资较值得留意。

据一间本港代理行统计,2023年工商铺全年成交3,238宗,按年跌两成之餘,更为有纪录以来新低。踏入2024年,交投仍未有起色,以商厦为例,每月成交徘徊在31至42宗之间,按年仍跌约2至3成,若比起2018年投资高峰期时每月逾百宗买卖,更是大跌6至7成。

相比之下,上月投资市场稍为反弹,5月份工商铺註册量共录350宗 (主要反映4月份市况),按月增加约17.4%,而註册金额则录43.6亿元,按月增加约41%。

近一个月,市场录得数宗具指标的买卖,包括中环美国银行中心两层,以及中环皇后大道中9号全层成交,3层写字楼合共涉逾8亿元。值得留意是两幢指标商厦呎价,分别重回12及14年前,较高峰期价格跌幅达6成。此外,多位资深投资者加快沽货,包括尖沙咀铺位、柯士甸道全幢物业等,均录大幅蚀让。

对于下半年走势,该行代理认为,近期工商铺出现价跌量升,因市场放盘仍多,发展商及投资者均以减价促销套现为主。对投资者来说,高息下对物业回报率大幅提高,至少4厘以上才开始有吸引力,再加上银行令业主降价吸客更明显。

市场放盘仍多 续价跌量升

该代理分析,由于减价幅度大,渐达吸引水平,故交投少许反弹。该代理预计下半年工商铺呈现价跌量升。下半年睇好核心区商铺,认为只要零售市况好转,租金反弹力度最高,带动投资价值。另港岛甲厦价回调甚高,而核心区甲厦始终最受用家及投资者欢迎,亦值得留意。

至于另一本港代理行代理指出,发展商不论住宅及工商铺,均以低价开盘,带动成交量回升,相信下半年持续,故工商铺价或仍有压力,交投将回升。该代理分析,投资市场关键仍睇利息,直接决定银行借贷取态,只要利息开始回落,整体市况将转好。投资上,该代理最睇好供应量最少的商铺,另外因工厦银码细,合投资移民计划,亦会受捧。

倘年尾减息 工商铺将好转

此外,资深投资者对下半半市况普遍审慎,资本策略 (00497) 主席钟楚义指,投资市场关键始终是息口,如果年尾有减息,工商铺均会有好转,另一关键是内地经济表现,若有改善亦会带动旅客来港消费及投资。他认为铺租已见底企稳,工商铺中表现料较佳。

另一项较多投资者及基金留意为全幢住宅租赁项目,包括共居、学生宿舍等。在本港经营9个共居项目,Weave Living投资总监彭德仁指,旗下项目去年租金亦有5%以上升幅,出租率长期理想,反映住宅租赁项目防守力最强。他预计,今年因住宅租金仍会上升,故相关项目值得留意,惟他认为目前利息高企,寻找基金合作上较往年困难,故要遇上优质项目才有望扩充。

(经济日报)

更多美国银行中心写字楼出售楼盘资讯请参阅:美国银行中心写字楼出售

更多皇后大道中9号写字楼出售楼盘资讯请参阅:皇后大道中9号写字楼出售

更多中环区甲级写字楼出售楼盘资讯请参阅:中环区甲级写字楼出售

甲厦供应增 今年租金看跌1成

甲厦租金受高供应冲击,预计今年租金续跌近1成,同时间因新甲厦设备佳,将成搬迁及升级之选。

据一间外资代理行数字,2018年为商厦租务高峰期,中环空置率曾低见约1.5%,区内平均呎租约122元,而整体市场空置率低见约4.5%。其后疫情爆发,封关下租务需求急挫,空置率开始上升。即使去年初通关,营商环境仍受多项因素冲击,加上遇上供应高峰,空置率高见13%,中环空置率亦达10.7%,租金亦从高位下跌34%。

新甲厦设备新 吸引客户搬迁

后市上,该行代理分析,租金走势看供应及需求,现时整体需求仍疲弱,中资机构亦少有扩充,再加上新落成甲厦仍多,故料空置率进一步上升。该代理指,今年整体甲厦租金仍暂跌约3.8%,而中环租金今年暂跌6.3%。

年内大手甲厦租务成交,焦点尽在新甲厦上,以去年入伙的啟德AIRSIDE为例,已先后获德国超市集团、保诚保险及华侨银行租用,涉及共约20万平方呎,最近该厦更获大型保险集团洽租5层,若最终落实,该厦出租率进一步提高。另今年新甲厦项目,包括中环The Henderson、长江集团中心二期,另长沙湾琼林街83号「PORTAS」,亦属大型项目。

该代理预料,下半年租务较上半年多,因中环优质甲厦租金,从高峰期下跌逾3成,对不少企业来说,此时正是迁入核心区的机会。同时间,新甲厦设备新,亦吸引客户搬迁,故预计租务洽商较上半年活跃。

(经济日报)

更多AIRSIDE写字楼出租楼盘资讯请参阅:AIRSIDE写字楼出租

更多啟德区甲级写字楼出租楼盘资讯请参阅:啟德区甲级写字楼出租

更多The Henderson写字楼出租楼盘资讯请参阅:The Henderson 写字楼出租

更多长江集团中心二期写字楼出租楼盘资讯请参阅:长江集团中心二期写字楼出租

更多中环区甲级写字楼出租楼盘资讯请参阅:中环区甲级写字楼出租

更多PORTAS写字楼出租楼盘资讯请参阅:PORTAS写字楼出租

更多长沙湾区甲级写字楼出租楼盘资讯请参阅:长沙湾区甲级写字楼出租

租客重视环保元素 商厦供需失衡

近年亚太区不少企业租用写字楼时,均相当重视物业的低碳排放及绿色认证等元素。有外资代理行认为,相关策略将导致可持续建筑的供需显著失衡,预计在2030年之前,租户争夺低碳办公空间的竞争将会渐加剧。

87%租户追求绿色认证

该行调查发现,亚太区有多达87%的受访租户期望,及至2030年,名下所有物业组合中的建筑物均需取得绿色认证,惟目前获相关认证的物业仅佔4%。当中印度、马来西亚及泰国更有超过95%的租户以此为目标,决心尤为坚定。

报告亦指,74%的亚太区受访租户预期,可再生能源将满足一半能源需求,而目前可再生能源需求仅得9%。该行认为,过渡至可再生能源乃关键一步,透过现场产生可再生能源,将建筑物由被动的能源消耗者,转化为主动的能源供应者。

更多企业採纳能源审计

与此同时,多达65%受访租户认为,写字楼的装修费乃最大的可持续挑战之一,全因建筑装修过程的碳排放量佔总排放量约三分之一。在一般写字楼都会在整个生命周期之中,至少进行20次装修,加上建筑开发及内部装修均由不同团队负责,令市场对装修碳排放的关注不足。

该行代理表示,绿色认证建筑空间已成为基本租赁要求。现时愈来愈多企业採纳能源审计、可持续装修及绿色租赁等可持续策略,预计未来租户将进一步提升标準,例如要求建筑性能及可持续数据超越绿色建筑认证,以确保其资产与企业净零碳排放目标相符。

该行另一代理补充,租户需就房地产价值进行深思熟虑的规划,并与业主、投资者及技术合作伙伴等持份者紧密合作,以应对日趋激烈的可持续资产竞争。

(经济日报)

旺角SOYO雋薈基座市值2亿放售

旺角新盘雋薈去年入伙,项目基座放售,有外资代理行代理表示,旺角豉油街63号「SOYO雋薈」商业部分,总楼面约6899方呎,市值2亿,呎价约2.9万。

连户外及电视广告位

该代理续说,物业坐落黑布街与豉油街交界,楼高2层,地下约3749方呎,1楼约3150方呎,总建筑面积6899方呎,位处单边,门面阔度约94呎,设2块大型户外广告牌及1块外墙电视广告位。

区内豉油街25至31号4号铺,建筑面积约400方呎,于2022年以6500万成交,呎价约16.25万。豉油街50号富达大厦7号铺,建筑面积约414方呎,2021年以5750万易手,呎价13.89万。

(星岛日报)

星星地产放售 一篮子工商单位

早前由发展商星星地产进行活化的商厦项目虹方,现正推售一篮子单位及车位,当中4个连租约单位意向价约1,146万元起,由同为该集团持有的观塘电讯一代广场,中层全层亦以意向价约1.2亿元放售。

虹方8单位 可租可售

有本港代理行代理表示,推售的虹方一篮子餘货单位,位于元朗宏业南街22号,包括8个单位,其中7个连租约,面积由约1,367至3,042平方呎不等,当中9楼01室为特色户,面积约1,367平方呎,附有86平方呎露台、另设洗手间及浴室,意向价约1,146万元,平均呎价约8,383元。目前每月租金约4.5万元,新买家可享回报高达4.7厘,适合购入作长綫收租用途;而另1个交吉单位为10楼01室,面积约2,422平方呎,均属特色户,设有露台约1,173平方呎,现时同时进行招租及放售,意向呎价约11,800元,意向呎租约33元起。预料整个餘货项目成功售出,可套现约1.4亿元。另,同时虹方亦趁势推售一篮子车位,是次出售21个车位皆分布于1楼,叫价由25万至150万元不等。

该代理续称,虹方全幢共提供129伙,出租率超过9成,发展商定价亦见克制合理。资料显示,今年4月该厦低层05室易手,面积约2,460平方呎,成交呎价约8,041元。同时,由于虹方属活化工厦类别,获地政总署容许的发展用途甚多,包括教育机构、资讯科技及电讯业、展览、训练中心、宗教机构、私人会所等,因此该厦租户亦见多元化。

另,星星地产亦趁势推售其持有的观塘电讯一代广场中层全层放售,意向价约1.2亿元。该行另一代理指,现正放售的楼层位于11楼全层,全层面积约13,162平方呎,意向价约1.2亿元。该全层楼面由7个单位组成,现已全层打通交吉,属商铺用途,为该楼层提供更大的发展空间。

物业另设约861平方呎平台,属同厦矜罕,适合不同投资者及用家需要。

电讯一代广场位于观塘成业街10号,比邻凯滙、创纪之城商场及东广场等核心住宅及购物中心,且步行3分鐘可达港铁观塘站,交通便利。该厦楼高31层,地下至1楼为商铺用途,2至8楼为停车场,10至19楼为商铺,20至35楼为写字楼用途。

电讯一代广场近期屡获买家追捧,先后录得多宗成交,包括中层D02室,面积约936平方呎,以约820万元易手,呎价约8,761元;而低层三相连单位,涉及总面积约10,635平方呎,以约1.1亿元易手,呎价约1万元。

(经济日报)

更多电讯一代广场写字楼出售楼盘资讯请参阅:电讯一代广场写字楼出售

更多观塘区甲级写字楼出售楼盘资讯请参阅:观塘区甲级写字楼出售

更多创纪之城写字楼出租楼盘资讯请参阅:创纪之城写字楼出租

更多观塘区甲级写字楼出租楼盘资讯请参阅:观塘区甲级写字楼出租

Baptist Hospital gearing for major redevelopment

Hong Kong Baptist Hospital in Kowloon Tong has proposed a redevelopment project to expand the gross floor area of three blocks by 1.65 times.

The involved buildings are Block A, B and C with a total floor area of 245,800 square feet.

The hospital said it has submitted the proposal to the Town Planning Board, aiming to update the infrastructure of the buildings that is over 50 years old.

The three blocks will be demolished and redeveloped in-situ in phases and integrated into a composite building with a gross floor area of 652,900 sq ft. The number of beds is expected to increase by 19 percent to 700 and operating theaters by 23 percent to 16.

The redevelopment is anticipated to start next year and complete by 2033.

During the construction, Block D and E in Kowloon Tong will be utilized instead.

Moreover, the hospital has been accumulating properties to prepare for the redevelopment for over 10 years, which is estimated to involve over HK$250 million.

Last month, the hospital bought four shops at the adjacent Franki Centre at HK$36 million, or about HK$11,730 per square foot.

Meanwhile, the Real Estate Developers Association of Hong Kong's chair Stewart Leung Chi-kin called on the administration not to "distort market operations with administrative measures again," though he welcomed the momentum of the market after the removal of the housing curbs in late February. He said the property industry will continue to offer advice to the administration on macroeconomic, land and housing policies. He believes that with the improvement in government revenue, resources will be allocated to improve people's livelihoods and welfare and increase housing supply.

On the island, Wang On Properties (1243) plans to launch three projects to offer a total of 440 units.

However, a property agency forecasts home prices to fall as much as 5 percent this year, but DBS believes it would be flat in the second half.

Owned by Shimao (0813) chairman Hui Wing-mau, the 31st floor of The Center in Central has been put for sale for HK$572 million, or HK$23,000 per sq ft, 23 percent cheaper than in November 2023.

(The Standard)

For more information of Office for Sale in The Center please visit: Office for Sale in The Center

For more information of Grade A Office for Sale in Central please visit: Grade A Office for Sale in Central

Hong Kong property: The Highline’s discount pricing helps sell over 50% of the units

The developer Right Honour Investments sold 43 of the 78 units available in the first batch on Wednesday.

Sales at a new residential project on Hong Kong Island petered out after starting briskly despite the developer pricing the flats 20 per cent cheaper than a property launched in the same neighbourhood three years ago.

Right Honour Investments, the developers of The Highline, eventually sold 43 of the 78 units available in the first batch on Wednesday, according to a property agency, the project’s sole agent. A total of 306 buyers had preregistered for the flats.

The units comprised studios, and one and two-bedroom flats, with areas ranging from 211 to 524 sq ft. They were priced from HK$3.88 million (US$497,000) to HK$14.68 million, or HK$18,405 to HK$28,021 per square foot.

The average price was HK$22,719.

The developer, a unit of Shanghai Commercial Bank, surprised the market by pricing the project some 18 per cent lower than the prevailing rate of about HK$26,000 per square foot in the area, according to the property agency.

It was also more than 20 per cent lower than the first batch of flats in Kennedy 38 launched in November 2021, according to the property agency.

Two of the three units that were put up for tender were also sold, according to a property agent.

The Highline has attracted a larger proportion of investors than many other new developments, the agent said, estimating it to be about 50 per cent. The agent expects rents for the flat to be HK$50 per square foot, giving a rental return of about 4 per cent.

Since the removal of the property cooling measures in late February, mainland Chinese homebuyers have become active in Hong Kong’s property market, the agent added, noting that they accounted for 40 per cent of the prospective buyers for new flats.

The upbeat sales at The Highline were in stark contrast to The Haddon launched on Tuesday. Henderson Land only managed to sell 13 of the 63 units in the 453-unit project in Hung Hom, according to a property agent.

The agent said transactions in both the primary and secondary residential markets have slowed down, with prospective buyers returning to a wait-and-see mode as the interest rate outlook remains unclear.

The Hong Kong Monetary Authority will announce its rate decision on Thursday morning, after the US Federal Reserve’s decision on Wednesday night Hong Kong time. Although no rate change is expected at the meeting, more traders expect the Fed to cut rates twice in the remainder of 2024, according to CME Group.

In the primary market, transactions jumped significantly after the government removed the property curbs. A total of 4,141 new residential units were sold in March, compared with 262 in February, according to data provider Dataelements, which tracks new residential properties in Hong Kong. The number dropped by more than 50 per cent to 1,880 units in April and slid a further 32 per cent to 1,273 in May.

Secondary-market transactions have also slowed, from 5,350 in March to 4,500 in April. Analysts expect the number to drop further to 3,000 in May.

(South China Morning Post)湾仔越秀大厦每呎1.35万成交 较高峰期回落20%

湾仔骆克道越秀大厦录1宗成交,17楼全层单位以6330万易手,平均呎价13485元,较高期回落近20%。

17楼全层6330万售

近期甲厦频录成交,造价较高峰期动輒跌60%,乙厦表现相对稳定,尤其是位处核心商厦区的乙厦,价格较硬净,湾仔骆克道160至174号越秀大厦17楼全层1至3室,建筑面积分别1798、1122及1774方呎,合共4694方呎,以6330万易手,平均呎价13485元。

2019年4月,该厦5楼1室,建筑面积978方呎,以1633万易手,平均呎价16697元,为该厦呎价历史新高,最新造价较高峰期回落近20%。

高峰期每呎16697元

越秀大厦于1985年落成,楼龄39年,发展商为越秀地产,物业位处区内核心,邻近多幢商厦如兆安中心、台山商会大厦、金威商业大厦等,租客方面以金融、法律及投资等行业为主。

(星岛日报)

更多越秀大厦写字楼出售楼盘资讯请参阅:越秀大厦写字楼出售

更多湾仔区甲级写字楼出售楼盘资讯请参阅:湾仔区甲级写字楼出售

更多兆安中心写字楼出租楼盘资讯请参阅:兆安中心写字楼出租

更多湾仔区甲级写字楼出租楼盘资讯请参阅:湾仔区甲级写字楼出租

指标甲厦低价成交 业主扩大议幅

近期本港指标甲厦先后出现3宗全层买卖,价格出现急挫。业界指低价成交令业主议价空间扩阔,惟幅度仍不算高,料交投仍偏少。

据中原十大指标甲厦买卖统计,指标甲厦近月连录全层成交,包括中环皇后大道中9号29楼全层单位,面积约13,769平方呎,以约3.1亿元沽出,呎价约22,500元,创12年新低。市场人士透露,新买家为本地商人陈志明。翻查资料,是次购入皇后大道中9号全层,相信有见甲厦呎价已大幅调整,具有投资价值,并日后可把楼面作集团自用。据悉,目前集团租用尖沙咀海港城商厦作办公室单位。

皇后大道中9号呎价 6年跌6成

中环可供出售的甲厦不多,而皇后大道中9号因属罕有拆售项目,加上大厦位处传统核心地段,一直是本港甲厦价格指标。2018年甲厦投资高峰期时,物业34楼顶层,获永伦集团以约5.1亿元购入,呎价约6万元,创下本地甲厦呎价新高。按最新楼层同属极高层的29楼成交价计,呎价在6年间下跌逾6成。

美国银行中心成交呎价低至1.8万

另外,美国银行中心连录2宗买卖,23楼全层银主盘,以约2.5亿元成交,买家为金澳科技 (湖北) 化工有限公司董事长舒心及相关人士,业务涉及代理个人护理用品,成交呎价约1.8万元,料购入自用。另德祥地产 (00199) 以约2.6亿元,沽出同厦30楼全层,呎价约1.9万元,买家为信和集团或有关人士。2019年美国银行中心呎价曾高见约53,800元,最新成交价亦从高位下跌逾6成。

有代理表示,甲厦一连录得3层成交,造价亦甚低,令持货多年并放盘的甲厦业主,近期愿扩阔议价空间,同时亦渐有準买家开始重新留意甲厦市场。不过,该代理指核心区甲厦的业主普遍具实力,降价幅度不会太高。如最近美国银行中心成交呎价约1.8万元,成交出现后,市场尚未有业主愿降价至每呎1.8万元放盘。此外,该代理指近期银行对工商铺按揭取态审慎,影响甲厦买卖成交,故预计短期内甲厦买卖仍较少。

(经济日报)

更多皇后大道中9号写字楼出售楼盘资讯请参阅:皇后大道中9号写字楼出售

更多美国银行中心写字楼出售楼盘资讯请参阅:美国银行中心写字楼出售

更多中环区甲级写字楼出售楼盘资讯请参阅:中环区甲级写字楼出售

沙田利丰中心全幢15亿将易手 属高端物流中心 平均每呎3073元

近期工商铺市况低迷,準买家趁势置业,由基金持有的沙田石门利和利丰中心全幢,物业属高端物流中心,获準买家以约15亿洽购至尾声,料短期内易手,平均呎价3073元,準买家将作为自用。

沙田石门安平街2号利和利丰中心全幢,总楼面488072方呎,获準买家以约15亿洽沟至尾声,平均呎价3078元,物业将于短期内易手,知情人士指,準买家为用家,有见市况淡静,刚好有合适物业放售,趁势购入自用。

基金20年前2.68亿购入

据了解该利和利丰中心全幢业主为La Salle Investment Management Inc. 旗下客户筹组的基金,早于2004年4月,以约近2.685亿向利丰集团购入该全幢,当年呎价仅540元,其时租客签下14年长约,租期直至2028年,皆因物业属高端物流中心,市场上难于找到同类型物业。随着物业获买家垂青,洽购价较当年购入价高12.315亿,物业料升值逾4.5倍。

租客洽租永得利

市场消息透露,该全幢由单一租客Maersk承租,为跨国企业集团,有见物业即将由用家承接,Maersk目前正积极洽租区内的永得利中心3期楼面,预备为搬迁作好準备,惟永得利中心3期目前出租率高,能够提供的楼面亦只有约18万方呎。

近年来,不少工厦用家趁势自置物业,去年12月,黑石基金 (Blackstone) 伙拍储存易迷你仓,斥资5.6亿元购入荃大涌道22号湾合福工业大厦,楼高17层,佔地约1.47万方呎,总楼面约近14万方呎,呎价约4009元。原业主于2016年以4.5亿购入,持货7年升值约1.1亿或24%。

去年9月,慈善机构救世军斥资1.22亿承接,向金朝阳购入葵涌同珍工业大厦地下至3楼一篮子物业,建筑面积合共约37081方呎,平均呎价3290元,救世军向来使用同珍工业大厦上述部分楼面作为办事处,由租客晋身业主。

去年11月,柴湾丰业街5号华盛中心地厂,由一间汽车维修商承租,购入单位自用,建筑面积约9562方呎,连地下1号及2号两个货车位,作价7550万,平均呎价7896元。原业主于1999年以1120万购入,持货24年帐面获利6430万,物业升值5.74倍。

(星岛日报)九龙新甲厦楼面大质优 吸企业

外资代理行:大手租务胜港岛

甲厦大手租务集中于九龙区,有外资代理行代理指,九龙新项目楼面大兼质素高,大手租务势高港岛1倍,惟租金仍会有调整。

据该行统计市场上1万平方呎以上的甲厦租务,发现九龙区暂录约30宗,总涉约70万平方呎,而港岛区暂仅约40万平方呎。该代理指,九龙区现时仍有约多宗大手租务洽商至尾声,面积合共涉及约50万平方呎,若2至3个月内落实,首三季便有约120万平方呎成交,预计高出同期港岛区约1倍。

机构洽租5连层 港岛难供应

该代理分析,九龙区新甲厦多,并拥有多优势,吸引租客搬迁,「九龙区租金较便宜,适合大机构搬迁节省成本。新甲厦质素高,如啟德AIRSIDE、琼林街83号「PORTAS」,提供每层3万平方呎以上大楼面,港岛区少有大型地盘。」

近月啟德AIRSIDE,先后获华侨银行、德国超市等租用,据悉大型保险机构,正洽租该厦5层约18万平方呎楼面,「据悉是次洽租5个连层,港岛区实在难有相关新供应,反映九龙新甲厦优势所在。」此外,华侨银行所租用该厦逾7万平方呎楼面,便从中环、上环等多个办公点,整合在一起,故九龙新甲厦吸引企业前来。此外,琼林街83号「PORTAS」近日租务亦增,获物流公司、日本行李品牌租用,「不少公司原租用长沙湾工厦,现同区搬迁作升级,亦是新甲厦的卖点。」

市场未畅旺 整体租金料跌

新需求上,该代理指除了保险业外,亦有财富管理正在寻找扩充,但整体而言不多,而新成立公司,需求多在1万平方呎楼面以下,对整体租务市场来说佔比不高。该行资料显示,4月份租金跌幅较3月份略为收窄,整体市场租金按月下跌0.4%,「暂时今年商厦正吸纳量仅约60万平方呎,可见对租务市场仍未畅旺,故今年租金仍下跌。」

该代理认为,外资扩充力度弱,其一是环球经济状态一般,减成本属很多跨国企业的全球性策略,因此香港办公室亦要减规模,再加上地缘政治等,令新需求疲弱。反而疫情期间在家工作兴起,并非香港商厦空置率高的主因,「復常一年多,在家工作的策略也改变,员工已重返公司上班,写字楼需求没有因此而下跌。」

市场供应多需求较弱,业主会以不同方法吸引搬迁,例如个别单位或保留上手租客的装修,「对很多企业来说,装修成本高,是决定会否搬迁的重要因素。」在竞争激烈下,新大厦拥ESG概念,会被优先考虑,「反观15至20年楼龄的物业,一旦流失客户后,不易短期内有客人填补。」

(经济日报)

更多AIRSIDE写字楼出租楼盘资讯请参阅:AIRSIDE写字楼出租

更多啟德区甲级写字楼出租楼盘资讯请参阅:啟德区甲级写字楼出租

更多PORTAS写字楼出租楼盘资讯请参阅:PORTAS写字楼出租

更多长沙湾区甲级写字楼出租楼盘资讯请参阅:长沙湾区甲级写字楼出租

投资者罗守辉2200万沽乙厦 蚀近228万

资深投资者罗守辉续沽货,消息指,他以约2,200万元沽出湾仔乙厦特色单位,7年蚀228万元或近1成离场。

消息指,湾仔摩理臣山道70至74号凯利商业大厦19楼全层,面积约3,014平方呎,另连约300平方呎的空中花园,以约2,200万元成交,呎价约7,299元。享马场景,甚为优质。

2017年购特色单位 贬9%

该单位由资深投资者罗守辉持有,他于2017年以2,428万元购入单位,早前以约3,800万元放售单位,上月大幅降价至2,400万蚀放,如今以2,200万元沽出。持货7年转手,蚀228万元离场,贬值约9%。

另同区乙厦买卖方面,消息称,浙江兴业大厦中高层B室,面积约1,071平方呎,以约1,050万元沽出,呎价约9,804元。

商厦租务上,金鐘力宝中心二座低层5B室,面积约2,450平方呎,成交呎租约30元。另尖东康宏广场中高层16室,面积约3,329平方呎,以每呎约23元租出。

(经济日报)

更多浙江兴业大厦写字楼出租楼盘资讯请参阅:浙江兴业大厦写字楼出租

更多湾仔区甲级写字楼出租楼盘资讯请参阅:湾仔区甲级写字楼出租

更多力宝中心写字楼出租楼盘资讯请参阅:力宝中心写字楼出租

更多金鐘区甲级写字楼出租楼盘资讯请参阅:金鐘区甲级写字楼出租

更多康宏广场写字楼出租楼盘资讯请参阅:康宏广场写字楼出租

更多尖沙咀区甲级写字楼出租楼盘资讯请参阅:尖沙咀区甲级写字楼出租

Secondhand home deals remain in the doldrums

Hong Kong's 10 major housing estates reported just five deals over the weekend, a new low in four weeks, as the secondary market remained squeezed by a series of new projects.

The number was 50 percent down from a week ago, data from the a property agency showed.

An agent said buyers stayed away amid weekend rainstorms and uncertainties surrounding the US Federal Reserve's expected interest rate cuts.

The agent also said low-priced new homes attracted buyers away from the secondary market.

Another agency's 10 blue chip estates recorded seven deals, down by 36.4 percent week-on-week.

The 10 major housing estates tracked by another property agecny also slumped by 50 percent week-to-week to only four sales. Besides inclement weather and rate cut uncertainties, another agent said sales also took a back seat as Hongkongers were out celebrating Father's Day yesterday.

Some homeowners reduced prices and even suffered losses to force through a sale.

A flat at Grande Monaco in Kai Tak sold for HK$8.6 million after the asking price was slashed by HK$2.2 million, with the seller, who bought the unit for HK$11.1 million in 2021, losing HK$2.5 million on the deal.

In Ma On Shan, a two-bedroom flat at Mountain Shore sold for HK$6.08 million, handing the seller a paper loss of HK$970,000 over three years, according to another property agency.

The primary market, however, remained active.

Sun Hung Kai Properties' (0016) Novo Land phase 3B in Tuen Mun received over 2,000 cheques as of Saturday for 154 flats in its price list, making them 12 times oversubscribed.

SHKP also unveiled its second price list offering 80 more flats, with the cheapest priced at HK$3.05 million after discounts.

The developer said it will start the first round of sales this weekend and may release more flats before then.

Emperor International (0163) sold a flat at Central 8 in Mid-Levels for HK$5.17 million.

The Highline, a new project in Kennedy Town, sold 44 flats in three days to cash in more than HK$333 million.

The project is developed by Right Honour Investments under the Shanghai Commercial Bank.

And CSI Properties' (0497) Topside Residences in Jordan had 11 out of 27 flats booked as of Saturday.

(The Standard)

长沙湾环球商贸广场二期易手 2全层作价1.3亿

第一集团旗下的长沙湾环球商贸广场二期录大手买卖,市场消息透露,该厦28及29楼全层,建筑面积各约7747及6779方呎,合共14526方呎,以每呎9000元易手,涉资1.3亿。据了解,买家以用家呼声高,发展商则提供一定折扣,幅度相等于售价10%,在扣除回赠后,呎价约8000餘元,涉资只有约1.18亿。

平均呎价9000元

长沙湾道926号环球商贸广场二期 (GCC2),以及918号环球商贸广场一期 (GCC1),今年以来接连录成交,其中,环球商贸广场一期的中层1及2号单位,建筑面积共约3003方呎,以3541.5万售,平均呎价约11793元。

(星岛日报)

更多环球商贸广场一期写字楼出售楼盘资讯请参阅:环球商贸广场一期写字楼出售

更多环球商贸广场二期写字楼出售楼盘资讯请参阅:环球商贸广场二期写字楼出售

更多长沙湾区甲级写字楼出售楼盘资讯请参阅:长沙湾区甲级写字楼出售

湾仔资本中心巨铺月租100万 较旧租金减20%电动车品牌进驻

近年电动车品牌积极插旗,资本策略旗下湾仔资本中心巨铺,建筑面积约1.4万方呎,由比亚迪旗下品牌腾势Denza承租,作为香港旗舰店,月租100万,为今年以来暂录最大宗铺位租务。

上址为湾仔告士打道151号资本中心地铺,多年来一直由保时捷承租,近年月租120万,早前迁走,铺位随即录新租客承租,新租客「腾势DENZA」月租100万,平均呎租71元,较旧租金减20%,新租客将于今年第3季登场。

比亚迪旗下腾势Denza进驻

资本策略执行董事何乐辉表示,受惠汽车市场结构性机遇,集团与和谐汽车合作,善用旗下资本中心巨铺的空间,该铺拥有临街展示的优势,落地玻璃窗设计引进自然光,设计以现代化风格为主调,最适宜打造新能源车旗舰展销厅,日后将设有旗舰车展厅、情景展示区、新车交付区、洽谈室及客户休閒厅等。

「腾势DENZA」来头不少,为中国新能源汽车龙头「比亚迪BYD」及德国汽车巨头「奔驰」,合作打造的电动车品牌,定位「智慧、安全、新豪华,让用户体验真诚相伴感受」,旗下D9型号全年销售逾11万架,成为国产2023年MPV全年销售第一位。

上手租客保时捷月租120万

该铺位旧租客保时捷,早于2010年进驻该巨铺,并于2022年4月决定扩大规模,预租湾仔皇后大道东153至167号毗邻合和中心兴建中的新商厦基座3层高巨铺,涉及2万方呎,月租200万,平均呎租100元,梗约加续租约长达10年。由于2年前属预租,近期迁出前,巨铺亦由腾势Denza落实承租。

湾仔告士打道聚集商厦,大厦地铺楼底高,面积大,特色「高头大马」,该街道因而聚集汽车陈列室,成为街道特色。

(星岛日报)

更多资本中心写字楼出租楼盘资讯请参阅:资本中心写字楼出租

更多合和中心写字楼出租楼盘资讯请参阅:合和中心写字楼出租

更多湾仔区甲级写字楼出租楼盘资讯请参阅:湾仔区甲级写字楼出租

九展拟改商住 86%公眾意见支持

城规收535份仅1成反对 业界:财团或仿效

属于区内地标的九龙湾国际展贸中心,重建计划近日变阵,由原先获批建纯商业,改为大型商住项目,提供近2,000伙住宅,有关改变惹起公眾关注。而城规会在本月初截收公眾意见,并暂接获共535份,当中高达约86%属于支持意见,仅有约1成反对。有业内人士预计,不排除日后有更多发展商或财团仿效。

城规会于本月7日已经就上述改划申请截收意见,合共接获535份意见 (截至17日),主要由个别人士提交,当中大部分属于赞成意见,共涉458份,佔整体约86%,当中60份为反对意见,佔约11%,其餘17份或约3%则为中立意见或仅为计划提出意见。

翻查上述的意见,公眾表示赞成新重建计划的主因是方案可增加区内住宅供应,更有效利用土地,满足不断增长的房屋需求,而且九展附近已经设有过盛工商项目,近年已经出现供过于求的状况,最新计划可以增加人才入住九龙湾,并可与邻近的啟德住宅群产生协同效应。

反对者质疑 无良好接驳网络

至于反对原因则包括拟建住宅未有良好的接驳网络,距离最近港铁站要至少15分鐘步程,届时居民只可依赖私家车出入,为九龙湾交通带来负面影响,加上用地属于「其他指定 (工业展览馆及商业发展)」用途,因此发展住宅不符合规划意向,亦不可配合九龙湾商贸区的发展。

有关注保育人士Mary Mulvihill亦强烈反对,原因包括九展原先的独有定位不该被取代,而且本港亦缺乏类似大型设施,又指重建后的住宅只会是啟德住宅群的复制品等。

业界:发展商厦资金回笼慢

剩餘属中立或提出建议的意见则建议政府可以增加表演展览场地、加强区内交通接驳,亦直言拟建住宅的高度过高,与周边环境不符合等。

有测量师称,由于商厦空置率高企,而且发展商厦的资金回笼慢,所以发展商变阵亦可理解,估计日后会有更多发展商仿效,但不排除届时市场或会面临住宅饱和的情况。

为不少人集体回忆的九展,由亿京伙同资本策略 (00497) 组成的财团,于2021年斥105亿元购入,其后发展商曾向城规会申请重建商业及工业展览馆,并在去年已获会方批准,但近日发展商变阵,减少总楼面及地积比率,并加入住宅元素,新方案将会重建6幢住宅,1幢商厦及1幢混合用途大楼,日后提供1,881伙。

(经济日报)

尖东永安广场 全海景最吸引

尖东商厦多,而永安广场最大优势当然是全维港海景,非常舒适。

尖东为传统商业区,有多幢商厦包括有康宏广场、新文华中心、南洋中心及东海商业中心等,而永安广场优势之一,是物业正对尖东港铁站出口,另经过港铁站地下行人隧道,亦可前往尖沙咀各主要地段,十分方便。除了港铁外,大厦旁为巴士总站,亦可前往漆咸道南一带,来往港九新界巴士綫更多。

邻近多间星级酒店

饮食及生活配套上,物业邻近尖东海傍,大厦地下至尖沙咀中心一带,均设有特色餐厅及酒吧,而尖东一带亦有多间星级酒店包括比邻的香格里拉、hotel Icon及千禧新世界酒店等,适合商务午餐。另一面则可以前往K11 MUSEA商场,亦有近年成焦点的香港瑰丽酒店,特色餐厅充足。另外,上班人士亦可在公餘时间前往尖东海傍散步,配套一流。

永安广场于1981年落成,楼高12层,地下至3楼为商铺,包括永安百货佔用地下及地库多年,惟1楼商户较少。物业4楼至12楼为写字楼单位,写字楼楼面面积近2.2万平方呎。物业共设有6部客用升降机,非常充足。

最细单位约千呎起

大厦设计呈「L」形,单位内笼四正,每层可分间出15个单位,最细单位面积由1,000多平方呎起,适合中小型用家,而每层走廊非常阔落。

物业最大优势是处临海地段,单位拥全落地玻璃,面向尖东海傍单位,可望无遮挡海景。另一边单位望向漆咸道南一带楼景及公园景,同样舒适。

买卖方面,向来该厦买卖不算活跃,2017年商厦高峰期时,呎价曾突破2万元。今年大厦未有任何成交,对上一宗为去年6月,物业202至03室,面积约3.715平方呎,以约6,800万元成交,呎价约1.8万元。

低层优质户放租 意向每呎45

尖东全海景单位现进行放租,意向每呎约45元。

有代理表示,有业主放租尖东永安广场504室,面积约1,351平方呎,意向月租约6万元,呎租约45元。单位最大卖点是享有全海景,加上单位保留上手装修,质素甚佳。

租务方面,4月份物业601室,面积2,340平方呎,以每呎约40元租出。另上月805室,面积约1,800平方呎,成交呎租约40元。

上月一宗租务 成交呎租约40

同区市况上,尖东康宏广场近日录一宗租务,涉及中高层16室,面积约3,329平方呎,成交呎租约23元。

(经济日报)

更多永安广场写字楼出租楼盘资讯请参阅:永安广场写字楼出租

更多康宏广场写字楼出租楼盘资讯请参阅:康宏广场写字楼出租

更多新文华中心写字楼出租楼盘资讯请参阅:新文华中心写字楼出租

更多南洋中心写字楼出租楼盘资讯请参阅:南洋中心写字楼出租

更多东海商业中心写字楼出租楼盘资讯请参阅:东海商业中心写字楼出租

更多尖沙咀中心写字楼出租楼盘资讯请参阅:尖沙咀中心写字楼出租

更多尖沙咀区甲级写字楼出租楼盘资讯请参阅:尖沙咀区甲级写字楼出租

更多永安广场写字楼出售楼盘资讯请参阅:永安广场写字楼出售

更多尖沙咀区甲级写字楼出售楼盘资讯请参阅:尖沙咀区甲级写字楼出售

甲厦差餉租值连跌4年 高位回调33%

有本港代理指出,选取34个顶级及甲级指标写字楼的差餉租值统计,2023年整体写字楼的租值按年跌2.1%,跌幅收窄,但连跌4年,显示经济环境疲弱及空置率高企,写字楼租务市况持续下调。当中,顶级写字楼按年跌2.4%,甲级写字楼跌1.6%。

在8个顶级指标写字楼中,2023年的租值有5个跌3个升。以长江集团中心的租值跌幅最显著,按年跌10.9%,以致比2019年高位下跌超过3成,达33.4%。太古广场1期及2期2023年租值分别按年跌10.0%及8.6%,较2019年高位跌29.0%及29.3%。因为同区有The Henderson及长江集团中心二期等全新落成写字楼影响所致。

(经济日报)

更多长江集团中心写字楼出租楼盘资讯请参阅:长江集团中心写字楼出租

更多The Henderson写字楼出租楼盘资讯请参阅:The Henderson 写字楼出租

更多长江集团中心二期写字楼出租楼盘资讯请参阅:长江集团中心二期写字楼出租

更多中环区甲级写字楼出租楼盘资讯请参阅:中环区甲级写字楼出租

更多太古广场写字楼出租楼盘资讯请参阅:太古广场写字楼出租

更多金鐘区甲级写字楼出租楼盘资讯请参阅:金鐘区甲级写字楼出租

全新甲厦租务回温?

甲厦租务市场大手成交,几乎全集中于全新甲厦,因租金便宜兼设备最新,吸引企业搬迁。反观次一级商厦,竞争力上更加输蚀。

据一间外资代理行最新数字,随着写字楼租赁市场温和改善,4月底整体市场空置率下跌至13%。湾仔/铜锣湾和九龙东的甲级写字楼空置率分别下跌0.2和0.3个百分点,而中环和港岛东的空置率分别微升0.1和0.3个百分点。

租金方面,4月份写字楼租金跌幅较3月份略为收窄,整体市场租金按月下跌0.4%,而3月份则下跌0.7%。中环租金仅下跌0.2%。

啟德AIRSIDE 租务畅旺

初步观察上半年,数幢全新甲厦成租务焦点,啟德AIRSIDE成交甚畅旺,先后有华侨银行、保诚保险及德国超市租用逾20万平方呎楼面;而近日更有消息指,友邦保险洽租该厦18万平方呎楼面,若落实单计该厦已租用逾30万平方呎,肯定为今年交投最旺商厦。另外,位于长沙湾的琼林街83号「PORTAS」有数层楼面租出,亦有多个单位正获洽租。

整体甲厦租务市场新需求动力不足,因环球经济及地缘政治等因素,公司在港成立新办公室的个案不算多,扩充业务的外资亦未回復理想水平。同时间,近两年为甲厦供应高峰期,遇上需求疲弱,导致空置率高企,估计现时有约1,400万平方呎楼面待租。

业主持有大批商厦楼面待租,面对新需求弱,便要吸引现有市场客户搬迁。新商厦拥有的优势,就是设备最新,而在讲求ESG年代,跨国企业要搬迁甲厦,必把ESG元素列入挑选的指标。此外,九龙区的新甲厦提供全层楼面逾3万至4万平方呎,正适合机构整合业务。

跨企承租 考虑ESG元素

据了解,早前AIRSIDE吸纳银行进驻,便是该集团在港的业务分布中环、上环等多区,租用两全层正好可整合各部门。而最关键因素,是业主明白到市场竞争大,叫价上不会进取,甚至以平价吸客。对企业来说,可以低租金租用,一方面搬迁可节省成本,亦提升办公室级数,因此纷纷迁入新甲厦,相信下半年新甲厦仍是焦点。

上周中环The Henderson亦迎来首批租户进驻,发展商恒基兆业地产集团主席李家诚都特别提到项目是融合艺术、创新和可持续发展元素,为未来甲级智能办公室引领新指标。可见ESG元素亦是跨国企业承租的考虑因素,据悉该商厦租户包括艺术及奢侈品拍卖行佳士得的亚太区总部、国际投资公司凯雷及瑞士高级制錶品牌爱彼等。

相比之下,稍为旧式的商厦,当流失租客后,新需求始终较少,除非进一步降低租金,要重新招揽客户不容易。当然业主亦可以选择,此时为物业进行翻新,提高质素重吸客人,但当中涉及一笔投资金额,市况欠佳下会有犹豫,这批物业可说处两难状况。

(经济日报)

更多AIRSIDE写字楼出租楼盘资讯请参阅:AIRSIDE写字楼出租

更多啟德区甲级写字楼出租楼盘资讯请参阅:啟德区甲级写字楼出租

更多PORTAS写字楼出租楼盘资讯请参阅:PORTAS写字楼出租

更多长沙湾区甲级写字楼出租楼盘资讯请参阅:长沙湾区甲级写字楼出租

更多The Henderson写字楼出租楼盘资讯请参阅:The Henderson 写字楼出租

更多中环区甲级写字楼出租楼盘资讯请参阅:中环区甲级写字楼出租

Cheung Kong Center's rental values plunge 33pc in 5 years

Hong Kong's tycoons are seeing their skyscrapers lose rental values by as much as a third, amid the worst commercial property market slump in more than a decade.

Billionaire Li Ka-shing's Cheung Kong Center led the decline among major offices in the city with a 33 percent drop in rental values in the five years through 2023, according to a local property agency.

New buildings including The Henderson dented rents for existing ones, the agency said.

The plunge in rental income underscores the pain in Hong Kong's commercial market. A weak economy and the retreat of multinational companies have weighed on the sector in the past few years. The city's vacancy rate was at a historic high of 16.7 percent in the first quarter, according to another property agency.

The government assesses the annual rental value of each building to charge landlords a property tax called rates, which are set at 5 percent of the estimated rental value.

Cheung Kong Center, owned by CK Asset (1113) had been about a quarter empty for the past year while a new second-phase building has only managed to rent out about 10 percent of space, people familiar said in May. The Henderson, owned by Henderson Land Development (0012), still had about 40 percent of space vacant as of May.

CK Asset's chairman Victor Li Tzar-kuoi recently acknowledged that new demand for offices wasn't high in the short term, but that he was confident in the future of Cheung Kong Center II.

Adding to the competition, there will be an additional 709,000 square feet (65,868 square meters) of office supply - the size of about nine soccer fields - completed between the second and fourth quarter of the year, according to the property agency.

Apart from the increase in supply, the city's office market has been hurt by international banks' cost-cutting efforts and the slower-than-expected return of mainland Chinese companies.

A lack of investment banking deals has prompted some financial firms to shrink office space. Hong Kong's proceeds from initial public offerings in the first quarter were the lowest since 2009, continuing a dismal run since last year when the city lagged behind Mumbai.

(The Standard)

For more information of Office for Lease at Cheung Kong Center please visit: Office for Lease at Cheung Kong Center

For more information of Office for Lease at The Henderson please visit: Office for Lease at The Henderson

For more information of Office for Lease at Cheung Kong Center II please visit: Office for Lease at Cheung Kong Center II

For more information of Grade A Office for Lease in Central please visit: Grade A Office for Lease in Central

Terra flats to go on sale

Sales of flats at Terra in Ho Man Tin start this Friday, with the first 20 units being sold by tender.

Located on Prince Edward Road West, the development is owned by a renowned local family and comprises an 18-story tower offering 45 two- to four-bedroom flats with areas of 680 to 2,296 square feet.

The flats up for sale are mainly two-bedroom and three-bedroom units of 680 to 1,166 sq ft. Among them are four special units with external podiums from 60 to over 200 sq ft. The tenders close on July 5.

Meanwhile, a 942-sq-ft three-bed flat at OMA by the Sea in Tuen Mun developed by Wing Tai Properties (0369) sold for HK$13.25 million while a 388-sq-ft two-bedroom unit at Vanke Hong Kong's VAU Residence in Ho Man Tin sold for HK$8.21 million.

And in Sha Tin, four flats at St Michel, developed by Sun Hung Kai Properties (0016), were sold by tender for HK$72.19 million in total.

(The Standard)长沙湾环球商贸广场易手 全层单位作价5771万

第一集团旗下长沙湾环球商贸广场近录买卖,最新为1期18楼全层,建筑面积约6412方呎,以每呎9000元易手,涉资5771万;该项2期28楼及29楼全层,建筑面积各约7747方呎及6779方呎,合共14526方呎,日前亦以每呎9000元易手,涉资1.3亿。据了解,近期买家以用家主导,发展商则提供一定折扣,幅度相等于售价10%,在扣除回赠后,呎价约8000餘元。

买家以用家主导

长沙湾道918号环球商贸广场一期 (GCC1),以及926号环球商贸广场二期 (GCC2),今年以来接录成交,其中,环球商贸广场一期的中层1及2号单位,建筑面积共约3003方呎,早前以3541.5万售,平均呎价约11793元。

该2幢物业坐落长沙湾道,大厦设停车场,其中2期共提供47个私家车位及17个货车位,步行约1分鐘即达港铁荔枝角站。两幢物业标準楼层楼底高度约4.5米,单位间隔适合不同用家需求,亦提供连平台特色单位,享有极尽开扬景观,远望昂船洲大桥,同区罕有,加上发展商提供高质交楼标準,包括玻璃大门连密码锁、金属假天花连及升高地台等,新买家可即买即用及节省不少成本。

(星岛日报)

更多环球商贸广场一期写字楼出售楼盘资讯请参阅:环球商贸广场一期写字楼出售

更多环球商贸广场二期写字楼出售楼盘资讯请参阅:环球商贸广场二期写字楼出售

更多长沙湾区甲级写字楼出售楼盘资讯请参阅:长沙湾区甲级写字楼出售

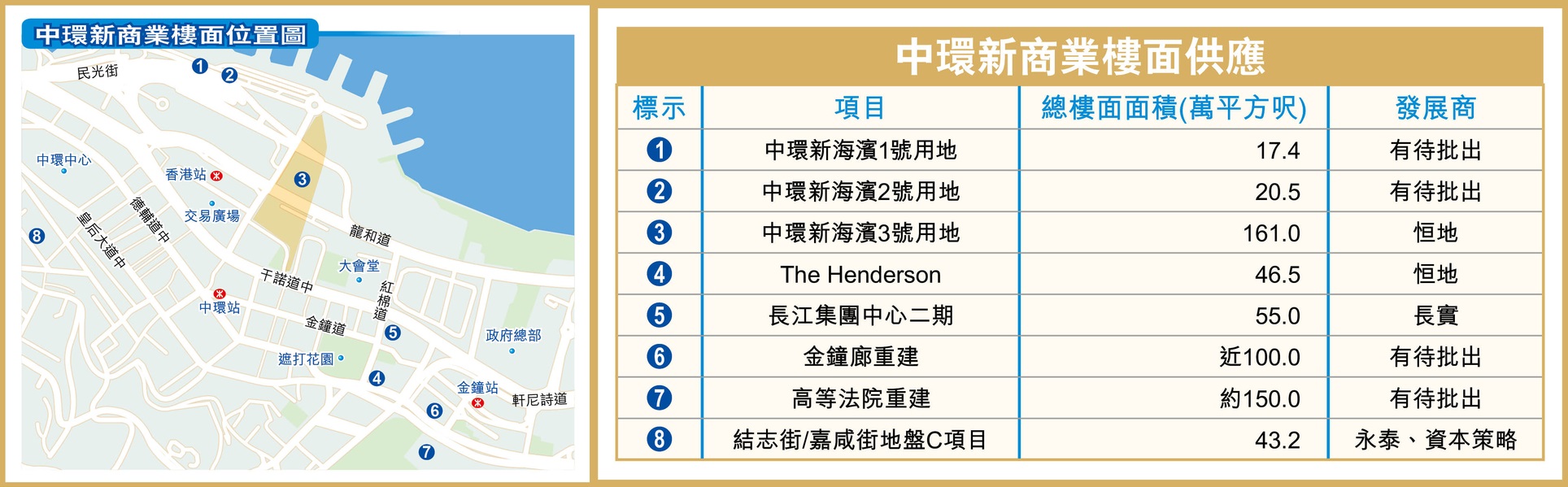

中环增逾300万呎楼面 恒地佔最多

过去数年,政府持续释出中环的商业地供应,计入近期及未来即将落成的商业项目,中环一带新增的商业楼面将逾300万平方呎。

中环及金鐘一带商业地供应罕有,但近年政府持续推出商业项目,及透过迁搬区内政府设施,以释放中环的商业地,增加区内新增商业楼面。如单计区内4个于近期及即将落成的商业重建项目,已合共涉及约305.7万平方呎商业楼面供应,当中以恒地 (00012) 势力最大。

海滨3号地 分2期发展

前身为美利道停车场大厦,由恒地于2017年中以约232.8亿元投得项目,已重建为The Henderson。项目最新已入伙,并获首批租户进驻,现为36层高甲级商厦,总楼面面积约46.5万平方呎。

另外,同系的大型海滨商业地则料于未来数年落成。恒地于2021年以约508亿元、每平方呎楼面地价约31,463元投得中环新海滨3号用地,为本港历来总价最贵地王。而发展商于2022年已经向城规会申请发展3座楼高6至10层的建筑,以用作综合办公室、商业及零售发展等用途,总楼面面积高达约161万平方呎,方案亦已于去年获城规会批准申请。据发展商最新中期报告,项目计划分2期发展,分别料于2026年第4季及2032年第4季落成。

至于邻近的长实 (01113) 旗下长江集团中心二期,则料今年落成。项目原为和记大厦,重建后楼高为41层,总楼面面积约55万平方呎,标準楼层面积约1.73万平方呎。

嘉咸街地 料2025年底竣工

而由永泰 (00369)、资本策略 (00497) 及市建局合作的中环嘉咸街地盘C,亦将重建为甲级商厦、酒店及零售的项目,涉及总楼面面积约43.2万平方呎,预计于2025年底竣工。

该带未来亦有4幅商业用地待推,当中中环新海滨1及2号用地有待推出,而位于金鐘的金鐘廊重建项目,曾纳入上个财政年度 (2023年4月至2024年3月) 的卖地表内,惟最终未有推出。项目位于港铁金鐘站上盖,佔地约9.6万平方呎,总楼面涉近100万平方呎,于2014年已获规划署展开重建规划研究,政府在去年初公布推出时,用地估值高达225亿元。

此外,金鐘未来潜在的大型商业用地供应,亦涵盖高等法院重建项目,总楼面面积亦达约150万平方呎。

长江集团中心二期 暂租出1成

踏入后疫情时代,商厦市场生态有变,商厦空置率亦随之攀升。预计今年落成的中环长江集团中心二期,据悉出租率仅约10%。

商厦业主减价求售

近期有指截至今年3月,长江集团中心二期的出租率仅为10%。而其后长实(01113) 主席李泽鉅出席股东会时直言,市场短期对写字楼的新需求量不大,不过,长远而言,集团对长江集团中心二期前景有信心,因为中环优质全海景写字楼的供应不多。

事实上,参考本港一间代理行最新发表的商厦市场报告,5月份甲级商厦空置率持续高企,在各分区中,东九龙空置率最高,达到17.5%,其次为中环,录10.3%,紧随其后的是金鐘,达8.8%。

报告又指,中环区及金鐘区在5月份所录的平均呎价跌幅亦较大,按月分别下跌约3.5%及7.5%,至每平方呎27,933元及20,607元,现象反映陆续有商厦业主减价求售,如早前德祥地产以约2.6亿元将金鐘美国银行中心30楼全层出售,呎价仅约1.8万元;观澜湖集团亦以约3.1亿元出售中环皇后大道中9号29楼全层,呎价约2.2万元,较高峰期呎价5.5万元比,呎价大跌约6成。

(经济日报)

更多The Henderson写字楼出租楼盘资讯请参阅:The Henderson 写字楼出租

更多长江集团中心二期写字楼出租楼盘资讯请参阅:长江集团中心二期写字楼出租

更多中环区甲级写字楼出租楼盘资讯请参阅:中环区甲级写字楼出租

更多美国银行中心写字楼出售楼盘资讯请参阅:美国银行中心写字楼出售

更多皇后大道中9号写字楼出售楼盘资讯请参阅:皇后大道中9号写字楼出售

更多中环区甲级写字楼出售楼盘资讯请参阅:中环区甲级写字楼出售

内地品牌纷遇困 连锁烤肉店疑欠租

尖东店开业不足1年 铺位45万重新招租

再有内地餐饮品牌来港经营出问题,面临撤走。消息指,尖东新文华中心地铺,去年获内地连锁烤肉店以30万租用,惟经营不足一年传出欠租多月,业主以45万重新把铺位放租。

尖东新文华中心地下A至C铺,面积约4,260平方呎,去年获内地连锁烤肉店「西塔老太太」于4月份租用,月租料约30万元,作为攻港首店,并于去年9月开业。该铺正对尖东喷水池,附近为尖沙咀中心、东海商业中心等商厦,属区内较理想地段的铺位。

据消息人士指,该店营业仅数月,年初已出现欠租情况,近期业主有见情况未有改善,把铺位重新放租,叫租每月约45万元,高约5成。

由于未获新租客承接,故该烤肉店仍营业中,业主亦考虑把铺位放顶手,因铺位装修仍甚新,让其他有意经营餐饮商户顶上。

西塔老太太去年30万租

西塔老太太为内地人气烤肉店,主打「东北泥炉烤肉」,其牛肉排、猪肉亦相当受欢迎,价钱相宜。内地多个城市包括深圳多个大型商场内设有分店,近一年北上消费港人甚多,故对品牌亦有认识。

去年中铺位装修时,门外贴上品牌招纸,写上品牌为「内地排队王」。据悉,在港分店近期不时推优势套餐,如2人午市烤肉餐,定价为199元。

翻查资料,是次铺位早年曾由茶餐厅租用逾10年,租金高峰期达55万元,疫情期间月租降至约45万元,其后烤肉店以约30万元租用,租金跌约3成。

去年通关后,市场上出现一阵内地餐饮品牌攻港热潮,不论饮品、火锅、串烧店等,相继租用本港核心零售区铺位。不过,近期热潮稍为放缓,更有个别品牌开业不久便撤出。

如主打湘西菜的「萝卜向南」去年12月以月租25万租下旺角登打士广场地铺,今年2月才开业,仅4个月就结束营业,该铺业主最近2重新招租。该地铺面积约1,745平方呎,叫租25万元。

(经济日报)

更多新文华中心写字楼出租楼盘资讯请参阅:新文华中心写字楼出租

更多尖沙咀中心写字楼出租楼盘资讯请参阅:尖沙咀中心写字楼出租

更多东海商业中心写字楼出租楼盘资讯请参阅:东海商业中心写字楼出租

更多尖沙咀区甲级写字楼出租楼盘资讯请参阅:尖沙咀区甲级写字楼出租

Food brands make early Mong Kok exit

Chinese food and beverage brands are moving out of their Mong Kok stores before their lease expires, highlighting the challenges they face when expanding into the city.

LMM Hand Crushed Lemon Tea closed its ground floor store in Hang Lung Mansion last week, though its lease runs until April 2025, according to reports.

It had rented the 300-square-foot shop for HK$70,000 a month in the middle of last year, but the store did not fare well and LMM even tried to transfer the lease to other tenants in January at an asking price of HK$50,000 per month.

Following LMM's exit, the landlord has put the store up for lease again at the same rent of HK$70,000.

Commercial property agents say Mong Kok is saturated with food and beverage restaurants, with tenants moving in and moving out frequently amid fierce market competition.

Radish Southward, a fast food brand featuring spicy Jiangxi cuisine, quietly closed its store in Dundas Square, just four months after it entered Hong Kong.

The brand had rented the 1,745-sq-ft store for HK$250,000 a month until December 2026, and the store's landlord is now seeking a new tenant.

These shutdowns are in sharp contrast to the exuberance early this year, when several mainland food and beverage brands including Mixue BingCheng spread their wings into Hong Kong.

Retailers in Hong Kong have been hard hit amid an economic downturn and an exodus of Hong Kong spenders across the border.

(The Standard)

160 Novo Land flats to go on sale

Sun Hung Kai Properties (0016) said it will launch sales of 160 flats at phase 3B of Novo Land in Tuen Mun on Saturday, while unveiling a third price list for 80 flats.

The developer was expecting to collect over 4,000 checks for the 160 flats yesterday after receiving 3,500 checks on Monday, making them more than 20 times oversubscribed.

The new list provides 32 one-bedroom, 26 two-bedroom and 22 three-bedroom flats, at an average price of HK$12,206 per square foot after discounts.

In Sai Ying Pun, Des Voeux W Residence developed by Tai Hung Fai Enterprise is expected to roll out its first price list tomorrow.

In other news, authorities said the sale of flats at Terra in Ho Man Tin may have violated a rule that requires projects to provide sales arrangements three days before the sale, and it would look into the case.

Terra had earlier announced it would launch the tender sale on Thursday morning after uploading related arrangements on Monday afternoon. It rescheduled the date of the sale to Friday later.

(The Standard)观塘泓傲甲厦全层4717万成交 麒丰资本沽货 每呎8800元

房地产基金麒丰资本旗下观塘全新甲厦泓傲刚落成,项目首录成交,该厦高层全层,以每呎约8800元易手,涉资约4717万,交易包括大厦命名权及其中一个广告位,售价低于发展成本价,幅度约27%。

上述为观塘鸿图道32号泓傲32楼全层,建筑面积约5360方呎,连同大厦命名权及外墙广告,以4717万易手,平均每呎8800元,有区内代理透露,该项目首宗买卖以远低于成本价格售,幅度近30%,买家持有同区创业街15号万泰利广场单位自用,购入该项目,既可自用亦有投资性质。

成本价每呎1.2万

麒丰资本创办合伙人暨投资总监洪英伟接受本报查询时回应,该项目开售正好遇上市况不景气,售价只好因应市场作调节,以吸引买家,不过,集团有计划沽售部分单位,餘下转卖为租,待市况復甦时才推售。他直言,该宗成交每呎8800元,该项目每呎成本价逾1.2万,成交呎价较成本价低逾26%,而且,单位连大厦命名权、以及外墙一个面积2000多呎的广告位易手 (该厦共有7个广告位,每个面积相若)。洪氏又说,该32楼全层买家属本地买家,经营国际企业,惟详情不便透露。

该地盘前身为荣兴利工业大厦,由麒丰资本于2018年开始收购,涉资约6.3亿,并于2021年9月以4.867亿完成补价重建甲厦,每呎补地价约3300元,尚未计算费用及利息,该项目地盘面积9808方呎,地积比14.4倍,总楼面约14.12万方呎,重建后楼高35层高,包括4层地库及1层空中花园。

发展商:蚀卖皆因市况不景

麒丰资本由莎莎太子爷郭浩泉及多名「80后」富二代组成,包括洪英伟,除了上述发展项目,尚发展新蒲岗新式工厦东傲,沽货逾70%,目前持有30%收租。

(星岛日报)

更多泓傲写字楼出售楼盘资讯请参阅:泓傲写字楼出售

更多万泰利广场写字楼出售楼盘资讯请参阅:万泰利广场写字楼出售

更多观塘区甲级写字楼出售楼盘资讯请参阅:观塘区甲级写字楼出售

租金较高峰期低4成 配合扩充业务兼升级

个别中资机构有所扩充,中环国际金融中心一期半层约1万平方呎楼面,获内地资源企业租用,呎租约100元,租金较高峰期平近4成,是次租务属整合业务兼升级。

市场消息称,中环指标甲厦录得逾万平方呎成交,涉及国际金融中心一期中层半层楼面,约1.1万平方呎,以每平方呎约100元租出。据了解,该租客为一家内地资源企业,在港亦有租用其他商厦楼面,包括铜锣湾信和广场等,如今租用国际金融中心一期逾万平方呎,既有扩充业务,亦可作升级。

中环国际金融中心一期近年亦有中资机构承租楼面个案,如2021年,该厦5.3万平方呎楼面,获内地金融机构中金公司租用,呎租料约130元。近两三年,甲厦空置率持续上升,令租金下跌,如今成交呎租约100元,已较3年前再跌约2成,而较高峰期,更有逾3至4成跌幅。

太古广场六座全层 呎租45

虽然整体商厦租务气氛仍淡静,但仍有个别机构扩充,如较早前新加坡对冲基金公司Dymon Asia Capital,租用中环置地广场-公爵大厦单位,逾8,000平方呎单位,属扩充业务个案。

近期市场屡录租客趁机升级个案,市场消息指,湾仔全新商厦,太古广场六座录成交,涉及23楼全层,面积约7,640平方呎,成交呎租约45元。

据了解,新租客为跨国企业邓白氏 (Dun & Bradstreet),属一家企业资讯及金融分析公司,总部设于美国。

据悉,该机构原租用观塘创纪之城商厦,是次租太古广场六座作升级。太古广场六座早于2022年开始预柤,现租客包括苏富比拍卖行,租用4层楼面,总楼面涉近3万平方呎。

至于东九龙商厦租金便宜,亦吸引租客搬迁,消息指,观塘Two Harbour Square高层全层,面积约2.6万平方呎,以每呎约20元租出。据了解,新租客为一家建筑公司,原租用北角港运城商厦,搬迁可节省租金开支。

另消息指,湾仔会展广场办公大楼中低层03室,面积约1,200平方呎,以每呎约40元租出。

(经济日报)

更多国际金融中心写字楼出租楼盘资讯请参阅:国际金融中心写字楼出租

更多置地广场写字楼出租楼盘资讯请参阅:置地广场写字楼出租

更多中环区甲级写字楼出租楼盘资讯请参阅:中环区甲级写字楼出租

更多信和广场写字楼出租楼盘资讯请参阅:信和广场写字楼出租

更多铜锣湾区甲级写字楼出租楼盘资讯请参阅:铜锣湾区甲级写字楼出租

更多太古广场写字楼出租楼盘资讯请参阅:太古广场写字楼出租

更多会展广场办公大楼写字楼出租楼盘资讯请参阅:会展广场办公大楼写字楼出租

更多湾仔区甲级写字楼出租楼盘资讯请参阅:湾仔区甲级写字楼出租

更多创纪之城写字楼出租楼盘资讯请参阅:创纪之城写字楼出租

更多Two Harbour Square写字楼出租楼盘资讯请参阅:Two Harbour Square 写字楼出租

更多观塘区甲级写字楼出租楼盘资讯请参阅:观塘区甲级写字楼出租

发展商沽非核心区物业,资料显示,万科以8,380万元,沽出旗下长沙湾新盘The Campton停车场全层。

The Campton停车场位于项目1楼,涉及共70个私家车位及7个电单车位,以成交价8,380万元计,平均每个私家车价约120万元。据悉,发展商规定买家日后只可全层形式转让,不能进行拆售。

(经济日报)

The Uppland set to kick off sales of 140 flats

Early Light International's The Uppland in Tuen Mun, Gold Coast Bay Phase 1, plans to offer at least 140 units in the first batch.

Founded by "King of Toys" Francis Choi Chee-ming, the developer said 65 percent of units at Phase 1 Gold Coast Bay share a sea view, according to the prospectus uploaded yesterday.

The project will offer 692 units in phase 1, with 254 open-style units, 154 one-bedroom, 180 two-bedroom, 35 three-bedroom, and 69 special units. They range from 182 square feet to 767 sq ft in size.

The property's managing director, Raymond Lee Ping-yu, believes that with diverse layouts, it can cater to various buyers.

The smallest units are located in Block 5A, 5th Floor, Unit K, and Block 5B, 7th Floor, Unit K, with a saleable area of 182 sq ft. They are open-style, each with a terrace of 149 sq ft and 155 sq ft, respectively.

The largest units are Units C in Block 5A, with saleable areas of 767 sq ft, configured with three-bedrooms.

The flat on the 26th floor also includes a 622 sq ft rooftop, accessible via a communal staircase.

The new project's coastal location is a key selling point, offering residents a two-minute walk to the beach, Lee said.

About 70 percent of the units have sea views, primarily the south-facing apartments, Lee added.

Sales and marketing manager, Leo Koo Kam-po, said pricing would be announced shortly, and show flats will be available for viewing.

The project is scheduled to start construction in November 2025.

It came as Continental Holdings (0513) unveiled the first price list of Amber Place in Cheung Sha Wan, offering 30 units starting from HK$4.9 million after discounts.

The units range from one-bedroom to two-bedroom flats, with saleable area ranging between 262 sq ft to 462 sq ft. The average selling price ranges from HK$17,108 to HK$23,356 per square foot.

Sales will begin on Saturday, with prices similar to those of new projects nearby.