疫市下大額物業受捧,市場即將有一宗矚目的全幢甲廈放盤,位處九龍灣啟祥道高銀金融國際中心,接管人已委託大型代理行,即將推出標售,全幢物業市值約100億,料吸引投資財團及實力用家角逐。

九龍地標甲廈高銀金融國際中心,早前雖曾獲準買家承接,惟未有如期成交。市場消息透露,該全幢甲廈即將推出標售,樓高28層,總樓面約85.2萬方呎,樓齡約6年,疫情雖持續多時,惟市場上資金尋找出路,料該項目吸引投資財團角逐。

由於項目屬全幢業權,擁有命名權,料有機會吸引實力用家垂青,過去多年來,東九龍屢錄全幢商廈成交,買家包括國內地產商,亦有外資金融機構承接。

高銀金融國際中心位於啟祥道17號,樓高28層,佔地約7.1萬方呎,總樓面約85.2萬方呎,屬地標甲廈項目,價值不菲。根據代理行資料,近月區內指標甲廈成交,包括新落成富臨中心呎價介乎1.4萬至逾1.5萬水平。

料吸投資者及用家

其中,富臨中心B座19樓C至D室,建築面積約3113方呎,以每呎15197元售出,涉資4731萬;而有一定樓齡的億京中心,其中B座28樓A室,建築面積約3939方呎,以每呎11678元成交。

多年來,區內亦屢錄大手成交,其中,億京為首財團,於去年6月向合和實業購入九龍灣國際展貿中心,涉資約105億,並將投資逾180億建地標甲廈;區內地王紀錄,包括南豐於2017年5月底,以逾246億擊敗11間中港財團奪啟德商業地,樓面呎價12,863元。

該幅啟德1F區2號地,鄰近未來沙中綫啟德站,可建樓面達191萬方呎,預計地皮日後約三分一樓面的高層單位可望維港景。

同區甲廈呎價1.5萬

高銀金融國際中心由高銀金融於2011年,以約34億投得啟祥道商業地,並於2016年落成大廈,作為自用及出租。

惟項目於2020年9月,遭接管人宣布放售,意向價120億,及後,項目錄買家FONG Tim擬以143億購入項目,不過,最終未成事。因此,今番再度推出標售。市場人士指,該廈超豪華,擁有中環「FEEL」,大部分以全層形式出租。

(星島日報)

更多高銀金融國際中心出租樓盤資訊請參閱:高銀金融國際中心出租

更多富臨中心寫字樓出租樓盤資訊請參閱:富臨中心寫字樓出租

更多億京中心寫字樓出租樓盤資訊請參閱:億京中心寫字樓出租

更多九龍灣國際展貿中心寫字樓出租樓盤資訊請參閱:九龍灣國際展貿中心寫字樓出租

更多九龍灣區甲級寫字樓出租樓盤資訊請參閱:九龍灣區甲級寫字樓出租

更多富臨中心寫字樓出售樓盤資訊請參閱:富臨中心寫字樓出售

更多億京中心寫字樓出售樓盤資訊請參閱:億京中心寫字樓出售

更多九龍灣區甲級寫字樓出售樓盤資訊請參閱:九龍灣區甲級寫字樓出售

羅氏觀塘道項目補價9億

地政總署資料顯示,羅氏集團旗下觀塘道350號項目,以近9億完成補地價,平均每方呎樓面補價約3256元。

地政總署昨日公布今年4月補地價數據,包括工廈「標準金額」補地價先導計畫推出後的補地價個案,為觀塘道350號項目,以8.9922億完成補地價程序,按可建總樓面27.62萬方呎計,平均每方呎樓面補價約3256元。

上述項目前身為麥士威工業大廈,羅氏集團早於2017年以13.9億購入,該項目獲城規會批准重建,地盤面積逾1.9萬方呎,以地積比率14.4倍發展,將重建成一幢樓高33層,包括4層地庫、1層空中花園/隔火層的商廈,可建總樓面約27.6萬方呎。

平均每呎樓面約3256元

在「北都」計畫驅動下,發展商全力開拓新界區住宅地。由新地持有的元朗米埔錦壆路一幅住宅,上月以2.68億完成補地價,每方呎樓面補價約1927元。該項目曾於2013年獲批71幢洋房,去年9月向城規會提交新發展方案,令單位總伙數增加約42.5倍至3090個住宅單位。

文件顯示,新方案由「住宅 (丁類)」地帶改劃為「住宅 (丙類) 1」地帶,以地積比率2倍發展,擬興建10幢分層住宅及4幢洋房,樓高3至23層,共提3090個住宅單位,當中住宅樓面涉及141.42萬方呎;另有3.54萬方呎非住用樓面,以提供6幢樓高1至3層樓宇,作零售及安老院舍等施設之用,提供100個牀位。

另外,尖沙嘴梳士巴利道18號香港瑰麗酒店,部分商業項目,以3094萬完成補地價程序。

(星島日報)

羅素街鋪王18萬短租 食品店簽署半年約

銅鑼灣羅素街再錄短租,其中位處波斯富街的單邊「鋪王」,獲樓上有限公司承租,每月18萬,為期半年,平均呎租僅129元。

羅素街59號地下B1至B3號鋪,位處波斯富街交界,屬單邊鋪王,建築面積約1408方呎,首飾店Swarovski於今年3月遷出,鋪位交吉短短2個月即租出,消息人士透露,疫市持續下,業主見租客具實力,樂於減價,月租18萬全包,平均呎租僅129元,樓上有限公司簽下半年約,半年後視乎市況續約。

平均呎租129元

該鋪於高峰期,曾由英皇鐘錶珠寶租用,月租高見250萬,其後Swarovski於2015年以150萬承租,近年月租約80萬,雖然最新租約為短約,不能與長租直接比較,不過,比較Swarovski租金,新租金跌幅77%,若與高峰期250萬比較,更跌足92%。

比舊租金跌幅77%

近期,核心區鋪位以民生行業主導,樓上有限公司連環承租黃金地段鋪位,均簽下半年租約,包括亞皆老街老鳳祥舊址單邊鋪王,月租約30萬,該鋪位高峰期月租高逾200萬。彌敦道80號金鑾大廈地下A鋪,建築面積約1500方呎,最新月租約15萬,平均呎租約100,舊租客周大福,年前遷出時月租約60萬。

(星島日報)

力寶中心中高層 意向呎租44元

東鐵綫過海段通車,金鐘商業氣氛更濃,現區內力寶中心單位放租,意向每呎近44元。

面積2282呎 月租叫10萬

有代理表示,獲委託放租金鐘力寶中心一座中高層單位,面積約2,282平方呎,業主意向月租約10萬元,折合平均呎租43.8元。馮氏指出,單位間隔方正,實用率約7成,雙邊向窗光猛開揚,外望金鐘至花園道一帶的城市景觀和山景。單位內備有簡約寫字樓裝修,即租即用,適合公司及跨國企業用作集團總部之選。

物業近日錄一宗租務,涉及力寶中心一座中層04室,面積約2,085平方呎,成交呎租約43元。

(經濟日報)

更多力寶中心寫字樓出租樓盤資訊請參閱:力寶中心寫字樓出租

更多金鐘區甲級寫字樓出租樓盤資訊請參閱:金鐘區甲級寫字樓出租

觀塘寧晉中心 享地利適合半零售

觀塘新式商廈多,位於成業街的寧晉中心最大賣點是鄰近港鐵站,非常方便,細單位亦多,正合半零售行業。

東九龍觀塘新商廈林立,而個別較偏離主要街道,略為不便。成業街7號寧晉中心最大優勢,是位處觀塘最繁忙的開源道及成業街,由港鐵站步行至該廈僅5分鐘,極為方便,而大廈附近的觀塘道巴士綫多,前往九龍各區及港島東甚快。

其他配套上,寧晉中心基座地下至2樓為商場,內設有多間食肆及商舖,加上位於觀塘廣場旁,更利吸納消費客源。另外,由該廈前往觀塘地標商場apm僅數分鐘,有更多餐廳、商店,一應俱全。

柱位隱藏 四正實用

物業於2010年落成,區內第一代散業權商廈,大堂設於3樓,地下有扶手電梯直上,大堂鋪雲石地磚,提供6部客用升降機。大堂內設有大幅波浪形玻璃幕牆,配上高樓底空間感足。

大廈樓高36層,寫字樓層由11樓起,每層樓面約1.77萬平方呎。物業每層間有由A至H室,提供8個單位,原則以B、C、F、G室最接近樓層大堂位置。單位主要望觀塘樓景。大廈開則呈正方形,柱位隱藏於牆身,故分間單位柱位不明顯且四正,甚為實用。

細單位適合中小型機構使用,寧晉中心最細單位由900餘平方呎起,加上鄰近港鐵站,物業不少用戶屬半零售成分,包括有健身中心租用全層,另外一些教育機構、教會等使用細單位。

買賣方面,該廈今年未有買賣,去年中,物業12H室,面積約2,714平方呎,以約2,800萬元成交,呎價約1萬餘元,對上一宗買賣為去年7月,物業32A室,面積約8,887平方呎,以約1.03億元易手,呎價11,567元。

(經濟日報)

更多寧晉中心寫字樓出售樓盤資訊請參閱:寧晉中心寫字樓出售

更多觀塘區甲級寫字樓出售樓盤資訊請參閱:觀塘區甲級寫字樓出售

中高層戶放租 每呎叫24元

觀塘寧晉中心適合多個行業使用,現物業中高層單位放租,意向每呎約24元。

提供裝修 月租約6.5萬

有代理指出,有業主放租觀塘寧晉中心20樓H室,面積約2,714平方呎,意向月租約6.5萬元,每呎意向約24元。單位位處中高層並提供裝修,望向觀塘裕民坊一帶,甚為開揚。

租務方面,該廈今年租務算活躍,由於物業合半零售用途,呎租多在20餘元以上,較為硬淨。錄得近10宗租務,3月份物業26樓D室,面積約2,780平方呎,成交呎租約25元,另同廈30樓H室,面積約2,712平方呎,成交呎租約27元。對上一宗成交為高層D室,面積約2,777平方呎,成交呎租約20元。

同區租務方面,萬兆豐中心中高層單位,面積約1,567平方呎,以每呎約20元租出,另東瀛遊廣場中層C室,面積約1,897平方呎,成交呎租約20元。

(經濟日報)

更多寧晉中心寫字樓出租樓盤資訊請參閱:寧晉中心寫字樓出租

更多萬兆豐中心寫字樓出租樓盤資訊請參閱:萬兆豐中心寫字樓出租

更多東瀛遊廣場寫字樓出租樓盤資訊請參閱:東瀛遊廣場寫字樓出租

更多觀塘區甲級寫字樓出租樓盤資訊請參閱:觀塘區甲級寫字樓出租

酒店成投資焦點 共居品牌作改裝

投資氣氛明顯轉好,近期市場連環錄得大額酒店成交,成投資焦點,當中以共居品牌成主要買家,購入進行改裝。

第二季大額買賣氣氛轉理想,除了工廈外,酒店為另一項投資焦點,更連環錄大手成交。華大酒店 (00201)、順豪物業投資、順豪控股近日公布,以約14.2億元收購荃灣汀蘭居,該物業在2021年12月15日的估值為24.6億元。物業樓高16層,佔地面積約216,314平方呎,共有435間客房,以上述收購價計,即平均每間房價值約326萬元。該物業曾分別作酒店及服務式住宅用途,業主亦曾把部分空間改裝成共居空間。

物業原由鄧成波家族持有,波叔於2017年以16.8億元購入物業,兩年前曾放售,當時叫價高見約23億元,一直未獲承接,現降至14.2億元沽出,較兩年前降價近4成,如今5年蝕2.6億元離場。

同時間,華大酒店亦指,以9億元沽出西環皇后大道西338至346號華麗都會酒店全幢物業。酒店樓高32層,於2015年落成,地盤面積約4,928平方呎,地下為大堂,1樓為停車場,7至32樓為酒店房間,提供214間房,總樓面約6萬平方呎。據了解,酒店暫作隔離檢疫用途,現時每晚房價約600元。以9億元成交價計,平均呎價約1.5萬元。

財團看好本地租務市場

據了解,新買家為共居品牌WEAVE LIVING,該集團指,將與另一基金安祖高頓 (Angelo Gordon) 合作投資華麗都會酒店項目。事實上,WEAVE LIVING近期表現非常積極,4月才以13.75億元購入九龍珀麗酒店,物業位於大角咀道86號,於2011年落成及開業,地盤面積約9,090平方呎,總樓面約11萬平方呎。項目樓高27層,提供435間房,以13.75億元成交價計,每間房價值約316萬元。WEAVE LIVING表示,將進行全面翻新,包括為部分房間重新布局,將物業打造成時尚、配套完備、靈活租期的現代住宿空間。

今年最大手酒店買賣,則為AEW基金以16.51億元購入紅磡「逸.酒店」(Hotel Sav),物業總樓面合共約12.21萬平方呎,設有388間客房。據了解,買家將改裝,日後或主打學生宿舍之用。

分析指,投資氣氛稍轉好,惟整體商業氣氛仍一般,需時回復。在多項物業中,以住宅市場表現最穩定,包括住宅租務需求仍強勁,財團看好本地住宅租務市場,購入酒店後改裝成共居空間、宿舍,主要客群為本地租客,比起傳統酒店靠遊客入住,收入相對穩定,預計相關市場尚有發展空間,令酒店買賣上升。

(經濟日報)

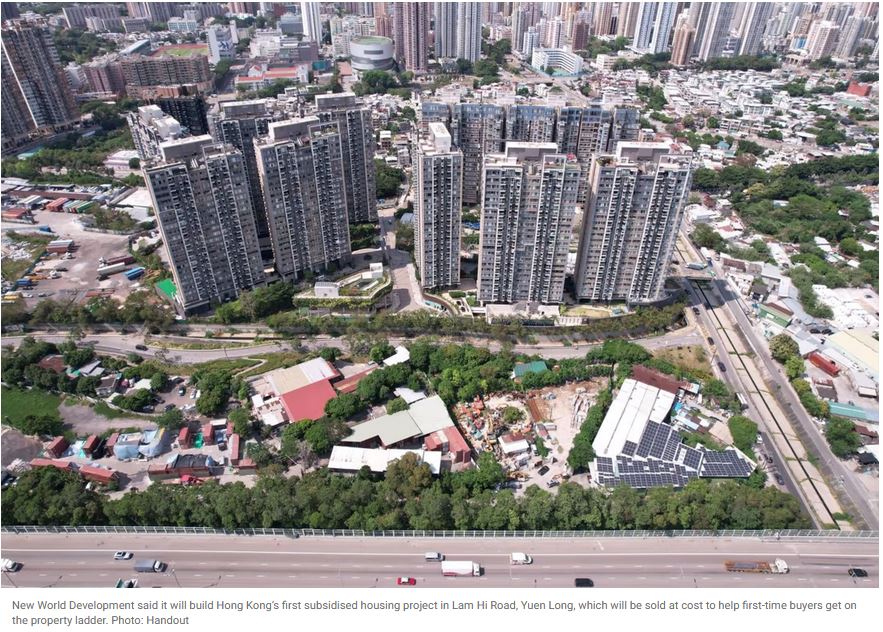

New World’s affordable housing project aimed at getting first-time buyers in Hong Kong on property ladder

A proposal has been submitted to the Town Planning Board to build about 300 flats, with sizes ranging from 300 sq ft to 400 sq ft in Lam Hi Road, Yuen Long

The project, which is still awaiting government approval, will be sold at cost to buyers who fulfil the eligibility criteria

New World Development plans to build Hong Kong’s first subsidised housing project that will be sold at cost to help young first-time buyers get on the property ladder in the world’s most expensive city to own a home.

New World Build for Good, the developer’s social enterprise unit, earlier this month submitted a proposal to the Town Planning Board to build about 300 flats, with sizes ranging from 300 square feet to 400 square feet, on a 30,300 sq ft site in Lam Hi Road, Yuen Long, according to an announcement on Monday.

It expects construction to start next year if everything goes according to plan, with the project likely to be completed as early as 2027.

“My vision is to start a new era in Hong Kong, by improving people’s housing issues and enabling the next generation to achieve the milestone of home ownership,” said Adrian Cheng, CEO of NWD and chairman of New World Build for Good. “We hope to refresh Hong Kong’s housing model and provide truly affordable homes for those in need.”

The site is about 10 minutes by bus from Yuen Long MTR station.

A NWD spokeswoman said the units will be sold at cost. “We will not make any profit from this project,” she said, without disclosing further details.

In December 2021, the developer said it was planning a project aimed at those living in subdivided flats and second-generation public housing renters.

The eligibility criteria for buyers of the flats in the project includes meeting the maximum income and total assets requirements of Hong Kong’s Home Ownership Scheme (HOS), which are set at HK$33,000 (US$4,230) and HK$925,000, respectively, for individuals, and HK$66,000 and HK$1.85 million for a household of two or more members.

A 300 sq ft flat will cost as low as HK$2.7 million, or HK$9,000 per sq ft, which is based on the discounted land premium under the current HOS scheme plus construction cost.

Buyers will only be required to pay a down payment of HK$135,000, 5 per cent of the unit’s price.

The developer also proposed an innovative home loan scheme to alleviate the financial burden of the targeted buyers. Purchasers only require to pay 50 per cent of the flat’s cost when the flat is due for delivery, while the remaining 50 per cent can be paid 10 years after the occupation in one go or in instalments.

The proposed home financing scheme has received positive response from banks and the Hong Kong Monetary Authority, according to the statement issued by New World Build for Good.

“Young families are increasingly finding it difficult to get on the property ladder, and the waiting time for public housing is getting longer,” said the statement.

The average waiting time for a public housing flat in Hong Kong has increased to 6.1 years, the longest since 1998, according to official figures released last Thursday.

Chief Executive-elect John Lee Ka-chiu has proposed an advance allocation scheme under which flats at selected public housing estates could be offered to families on the waiting list before infrastructure and transport facilities are completed. Lee said he hoped to make the projects available a year earlier than expected.

An NWD spokeswoman said the subsidised housing project would occupy half of the site, and the remaining area would continue to be used as an open space for the public and warehouse for storing art.

“NWD has no plan to build a private residential project on the other half of the plot,” she said.

(South China Morning Post)

Hong Kong developers’ rural land conversion in New Territories gathers pace, expect to push for lower land premium due to softening market

Sun Hung Kai Properties pays HK$268 million (US$34 million) to convert farmland in Yuen Long into a residential project

Developers with large holdings in the northern New Territories are likely to negotiate for a lower land premium, analysts say

Hong Kong developers are speeding up the conversion of farmland in the northern New Territories for residential use, with industry observers pointing out that companies are likely to push for lower land premiums due to the softening housing market.

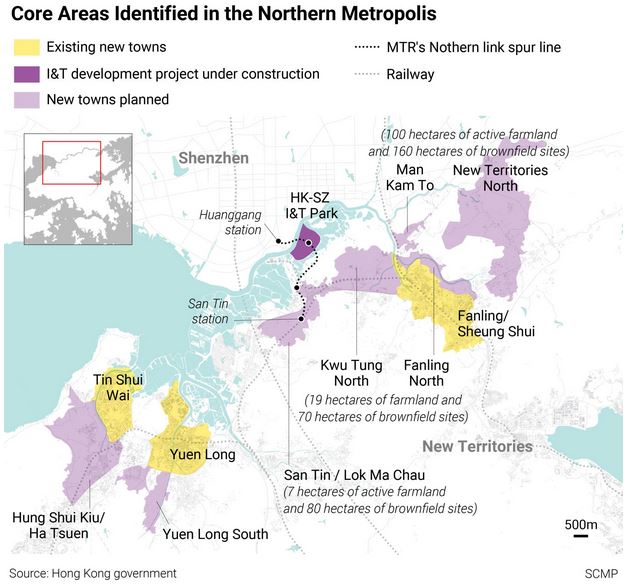

Sun Hung Kai Properties, Hong Kong’s largest developer by market value, last week agreed to pay HK$268 million (US$34 million) to convert farmland in Yuen Long so that it can build a 71-villa project.

Seven land-premium transactions, including that of SHKP, totalling HK$3.3 billion have taken place in Yuen Long, Lands Department records show. The seven plots will provide a total gross floor area of 890,000 square feet.

Land premium is the fee that developers pay the government when a modification or change in land use results in a higher land value.

While there is no fixed fee charged for the land conversion premium, the government arrives at the value by taking into account recent transaction prices in both the housing market as well as the land sales market.

“Both housing and land markets actually indicate a declining trend in recent months because of the volatility in the stock market, increase in the unemployment rate and expectations of an interest-rate rise,” a property agent said.

“This puts developers in a relatively strong position to argue for a lower land premium level,” the agent said.

Hong Kong developers have recently turned conservative in bidding for government land following a decline in home prices, which have retreated 4 per cent from their peak last September. Last month, the government withdrew the sale of a 1.3 million sq ft site in Tai Lam in the northern New Territories, which would have yielded an estimated 2,020 homes, after all tender bids came in below the reserve price.

Surveyors had estimated the site, Hong Kong’s first plot earmarked for residential flats with a minimum area of 280 square feet, to fetch between HK$7.1 billion and HK$9 billion, or HK$5,500 to HK$6,900 per square foot in the tender.

“The strategy of many developers, particularly the bigger ones, is to retop their land banks by converting agricultural land into residential use in addition to the government land sales,” the agent said.

The government’s land sale programme for the current financial year ending March 2023 covers 13 residential sites, which will be able to provide 8,000 flats, according to Secretary for Development Michael Wong Wai-lun.

While the government’s projected supply of new flats is up from 6,000 in the last financial year, the supplies are under 10,000 for the fifth consecutive year.

With the northern New Territories the focus of future development in Hong Kong, “developers with large holdings in the area will become more active in negotiating land premiums”, a surveyor said.

Last October, Chief Executive Carrie Lam Cheng Yuet-ngor proposed to develop the Northern Metropolis, which includes the northern New Territories, into a booming economic and residential hub for 2.5 million people over the next 20 years. The plans involves construction of up to 926,000 flats, including the existing 390 000 homes in Yuen Long and North districts, to accommodate the residents.

Currently, about 100 million sq ft of rural land is owned by various developers, according to a property agency.

“Now they see an opportunity to turn the land into residential development sites through the land premium settlement scheme,” agent said.

(South China Morning Post)