隨疫情持續平穩,帶動甲廈租賃交投轉活,消息指,由外號「小巴大王」馬亞木持有的中環中心高層單位,於交吉半年後,以每呎約80元租出,屬市價水平。

「小巴大王」馬亞木持有

有代理表示,上述為「小巴大王」馬亞木持有的中環中心高層07至08室,面積約4712方呎,以月租約37.696萬租出,平均呎租約80元,屬市價水平,該單位早前曾交吉近半年,該單位外望開揚海景,屬優質單位;他亦指出,隨近期疫情持續穩定,帶動甲廈租賃市況回暖,空置率已見改善。

信和工中地廠意向5.5億

資料顯示,馬亞木於今年7月以6.93億沽出該甲廈26樓全層,以面積2.5萬方呎計,呎價約27720元,買家為紀惠集團。

另有代理表示,九龍灣信和工商中心地下5個相連單位及地庫4個貨車位,建築面積合共約40423方呎,以意向價為5.5億放售,呎價約13606元,該地相連地廠現時月租收入約86萬,料買家享租金回報約1.87厘。

信和工商中心位處九龍灣啟祥道9號,交通配套不俗,加上單位樓底特高,空間感十足,適合不同行業進駐。

(星島日報)

更多中環中心寫字樓出租樓盤資訊請參閱:中環中心寫字樓出租

更多中環區甲級寫字樓出租樓盤資訊請參閱:中環區甲級寫字樓出租

FinTech公司擴充 租中環交易廣場全層

呎租約120元 較高峰期回落兩成

中環超甲廈租務稍為改善,金融科技 (FinTech) 公司租用中環交易廣場三座全層1萬平方呎樓面,呎租約120元,較高峰回落兩成。該金融科技公司屬本港企業,原租用數碼港細辦公室,如今擴充兼升級。

中環交易廣場三座錄得全層租務,涉及物業14樓全層,總樓面面積約為10,150平方呎,獲金融科技公司租用。消息指,成交呎租約120元,按該廈高峰期平均呎租達160元計,呎租回調約兩成。

原租用數碼港 現拓至萬呎樓面

據悉,新租客為數字資產金融服務公司HashKey Group。該公司成立於香港,在新加坡與東京亦設有辦公室。業務方面,主要為機構、家族辦公室、組合型基金、對冲基金和其他專業投資者制定投資策略和技術解決方案。此外,集團於日本亦有虛擬貨幣業務。香港辦公室方面,集團原租用數碼港較細辦公室,因業務擴充,現租用中環甲廈全層,並提升寫字樓級數。

據悉,HashKey是首家進駐置地中環物業組合的數字資產金融服務公司。置地公司商廈業務部董事及主管安德燊 (Neil Anderson) 指,是次租務體現金融行業機構相信中環核心生態圈,有利於促進業務增長與人才發展。據了解,以租用面積計算,銀行、資產管理及其他金融服務機構,於置地整體寫字樓租戶中佔約42%。

中環超甲廈租金跌幅 明顯收窄

據代理行對商廈租金進行的統計,目前中環超甲廈租金每呎約127.9元,按年跌約11.8%,惟按月跌幅約1%,明顯有所收窄,而中環整體呎租約109.1元,按月跌約1%。

事實上,隨着本港疫情緩和,甲廈租務市場稍改善,淡靜一段時間的中環超甲廈租務最近有所增加,最大宗為中環國際金融中心一期兩全層樓面,連同部分單位,合共約5.3萬平方呎租出,呎租料約130元,為今年中環超甲廈最大宗租務。

新租客為中資金融機構中金公司,作擴充業務,連同續租合共約12萬平方呎,成為該廈最大租戶。此外,國際金融中心二期全層2.6萬平方呎,亦獲美資對冲基金Citadel租用作擴充。

(經濟日報)

更多交易廣場寫字樓出租樓盤資訊請參閱:交易廣場寫字樓出租

更多國際金融中心寫字樓出租樓盤資訊請參閱:國際金融中心寫字樓出租

更多中環區甲級寫字樓出租樓盤資訊請參閱:中環區甲級寫字樓出租

環匯廣場全層1.45億易手

整體樓市交投不俗,城中名人亦加入沽貨行列,市場再錄大手成交。由遠東集團創辦人邱德根 (已故) 的媳婦蘇健恩持有的黃竹坑環匯廣場高層全層單位,以1.45億連兩車位成交,持貨8年帳面獲利5858.4萬,物業期間升值約68%。

邱德根媳婦沽貨

據土地註冊處資料顯示,黃竹坑環匯廣場 23樓全層,於上月底以1.45億連兩車位成交,買家以公司名義ACE MERCHANT GROUP LIMITED登記,註冊董事為梁姓人士,原業主為NEW CONTINENT DEVELOPMENT LIMITED,註冊董事為蘇健恩 (SO KIN YAN NATALIE),為遠東集團創辦人邱德根 (已故) 的媳婦、邱達根妻子,於2013年4月以8641.6萬購入,持貨8年帳面獲利5858.4萬,物業期間升值約68%。

三度向銀行承做按揭

資料亦顯示,原業主於購入單位後曾三度向銀行承做按揭;據業內人士指出,上址樓面約9820方呎,以易手價計,呎價約14766元。

據大型代理行資料顯示,黃竹坑環匯廣場對上一宗成交於2019年1月錄得,為該項目高層全層,面積9736方呎,以1.8億售出,呎價約18488元;至於租賃方面,該項目高層6室,面積2397方呎,於今年7月以59925元租出,平均呎租約25元。

(星島日報)

更多環匯廣場寫字樓出售樓盤資訊請參閱:環匯廣場寫字樓出售

更多黃竹坑區甲級寫字樓出售樓盤資訊請參閱:黃竹坑區甲級寫字樓出售

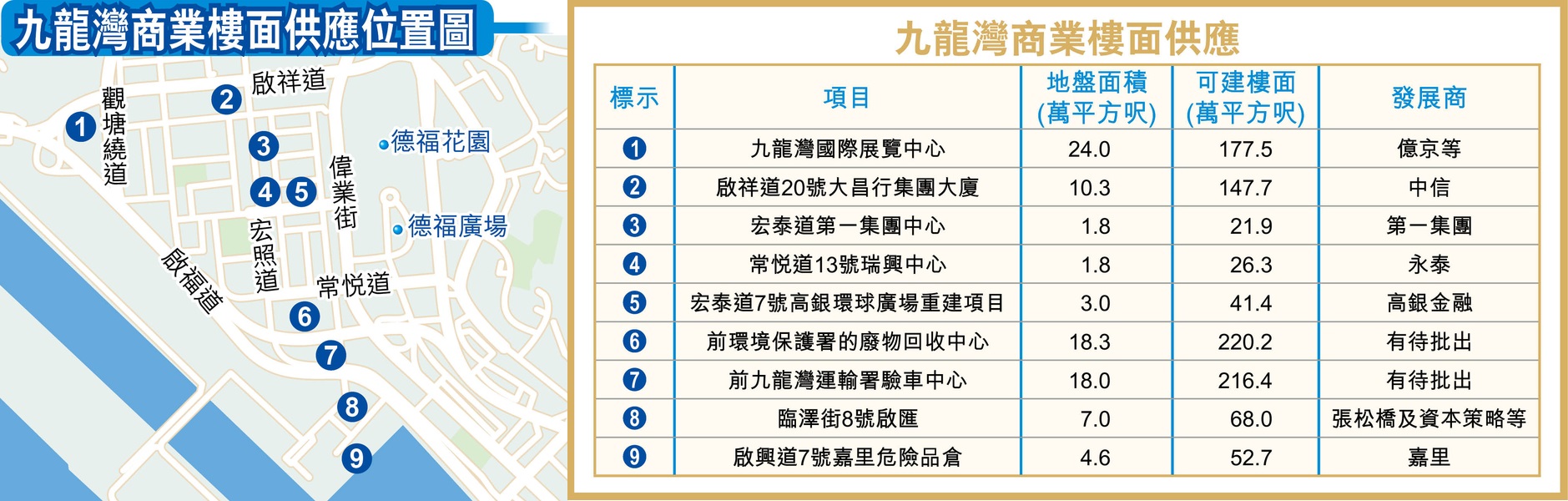

九龍灣添兩商地 商業樓面增至972萬呎

政府推動九龍灣行動區發展,釋出兩幅大型商業用地,提供逾436萬平方呎樓面供應,連同區內其他重建項目,九龍灣未來新增商業樓面供應多達972萬平方呎,接近5幢國際金融中心二期規模。

政府目前在九龍灣跟觀塘之間設有多個大型的政府設施,當局多年來想搬遷重置,以騰出土地打造成為「九龍灣行動區」,作為大型的商業、零售及文化中心,除了兩幅商業用地已經在過去幾年批出,分別建成海濱滙及富臨中心外,其餘仍有兩幅「巨無霸」商業地有待批出。

前廢物回收中心 集零售商廈一身

該兩幅大型商業地合共提供約436.6萬平方呎樓面,相較5年前舊方案增加1成約39.4萬平方呎,每幅可建樓面均超過210萬平方呎,並將會以賣地形式出售。當中位於常悅道的第2號用地,前身為環保署的九龍灣廢物回收中心,地盤面積1.7公頃,將以地積比率12倍發展,將會提供約220萬平方呎樓面,設6層基座作為零售及餐飲等用途,涉及樓面59.3萬平方呎,上蓋再興建3幢商廈,辦公室樓面155.5萬平方呎。

前驗車中心 總樓面216萬呎

至於另一幅在觀塘繞道與偉業街之的第4號用地,前身為運輸署的驗車中心,將重建作為辦公室、酒店及零售、餐廳等綜合用途,總樓面達216萬平方呎。

除了大型商業地供應之外,億京所合組的財團早前以約105億元向合和收購的九龍灣國際展貿中心,樓高14層,現為集會議、展覽、商場、寫字樓的綜合式物業。億京早前表示,集團計劃將項目建成區內的甲級地標式商廈,地盤面積約23.98萬平方呎,總樓面面積約177.5萬平方呎,為了避免補地價程序,計劃維持原有的地積比率,涉及投資額約200億元,成為區內最大型重建項目之一。

另外,由中信股份 (00267) 持有的啟祥道20號大昌行集團大廈,早前亦獲城規會批准,在多層基座上面興建兩幢32層高的商廈,總樓面達147.75萬平方呎。

至於鄰近九龍灣行動區的商廈啟匯,樓齡約10年,去年獲批出建築圖則,並將重建為商廈,涉約68萬平方呎總樓面,項目於2018年由「重慶李嘉誠」張松橋及資本策略 (00497) 等斥約80億元購入。

(經濟日報)

更多海濱匯寫字樓出租樓盤資訊請參閱:海濱匯寫字樓出租

更多觀塘區甲級寫字樓出租樓盤資訊請參閱:觀塘區甲級寫字樓出租

更多富臨中心寫字樓出租樓盤資訊請參閱:富臨中心寫字樓出租

更多九龍灣國際展貿中心寫字樓出租樓盤資訊請參閱:九龍灣國際展貿中心寫字樓出租

更多啟匯寫字樓出租樓盤資訊請參閱:啟匯寫字樓出租

更多九龍灣區甲級寫字樓出租樓盤資訊請參閱:九龍灣區甲級寫字樓出租

更多富臨中心寫字樓出售樓盤資訊請參閱:富臨中心寫字樓出售

更多九龍灣區甲級寫字樓出售樓盤資訊請參閱:九龍灣區甲級寫字樓出售

聯僑廣場申建商廈

由聯僑企業創辦人黃保欣家族持有的觀塘聯僑廣場,新近向城規會申請放寬兩成地積比,以重建為1幢樓高29層商廈,涉及總樓面約16.2萬方呎。

據城規會文件顯示,聯僑廣場位於觀塘勵業街11號,鄰近港鐵牛頭角站,目前屬「其他指定用途」註明「商貿」地帶,新近申請放寬地積比率建築物高度限制,以作准許的辦公室用途。

申放寬地積比至14.4倍

文件顯示,上址地盤面積約11250方呎,申請放寬地積比率約20%發展,由12倍增加至14.4倍,而建築物高度由主水平基準以上100米申請放寬至125.9米,即增加約25.9%;擬議重建為1幢樓高29層 (包括1層空中花園及3層地庫)的商業大廈,涉及總樓面約16.2萬方呎。

資料顯示,該廈前身為工業大廈,早在10年便透過「工廈活化政策1.0」獲准由工廈免補地價改裝成為商廈。

申請人指出,是次改劃符合規劃意向,成為毗鄰港鐵牛頭角站優越位置,作辦公室發展的良好例子,以推動觀塘商貿區一帶實現「起動九龍東」的願景,推動九龍東成為香港第二個核心商業區。另外,亦改善建築物的街道行人環境,全面改善行人路的暢達度、連繫度及舒適程度。

(星島日報)

恒基2.7億統一大角嘴舊樓 每呎樓面地價9357元 連同毗鄰地合併發展

近年市區地皮罕有,不少財團透過強拍舊樓增加土儲,其中,恒基以底價2.7億,統一大角嘴萬安街舊樓業權,每呎樓面地價9357元,將連同毗鄰地盤合併發展,將重建為「利奧坊」系列新盤。

大角嘴萬安街24至30號舊樓,於昨日進行強拍,底價2.7億,由手持「8號牌」的恒基代表,在無競爭對手下以底價投得,成功統一業權發展。該項目由2019年4月申請強拍、直至昨天完成拍賣,耗時約2年時間。

可建樓面逾2.8萬呎

而是次強拍的萬安街項目,位於大角嘴萬安街東面,在萬安街與福利街交界,現址為4幢6層高的商住物業,地下為商鋪,樓上則為住宅單位,地盤面積約3206方呎,現規劃為「住宅 (甲類)」用途,若以可建總樓面28854方呎計,每方呎樓面地價約9357元。而該舊樓早於58年落成,至今樓齡約63年。

另外,恒基已持有萬安街16至22號舊樓全數業權,料將與上述項目整合發展,地盤面積擴展至6418方呎,可建總樓面約57762方呎;預料將會重建成「利奧坊」系列樓盤之一。

據恒基年報顯示,該公司於大角嘴嘉善街、角祥街、博文街、萬安街及大角嘴道一帶有多個收購項目,總地盤面積約3.18萬方呎,若以地積比9倍作重建發展,可建總樓面約28.6萬方呎。

重建成「利奧坊」系列

據統計,連同上述項目為今年以來第15宗 (撇除流拍個案) 循強拍統一業權的項目,涉及總金額約114.81億;最矚目為恒基今年迄今、成功以強拍形式統一5個項目佔最多。

油塘灣項目補價作上訴

有代理稱,近年大角嘴區內的舊樓強拍和收購活躍,除是次拍賣的萬安街地段外,附近的大角嘴道、嘉善街及博文街等的舊樓亦獲發展商收購重建,將陸續為區內帶來更多住宅供應。同時,隨着西九龍的交通基建逐步完善,預計區內其他的社區配套亦會持續提升,西九龍一帶的住宅市場前景將更為看俏。

另外,市場消息指出,由恒基牽頭發展的油塘灣大型綜合發展,早於去年12月獲地政總署批出補價金額,惟發展商未有接納,並已提出上訴;據了解,最新新一份補地價金額亦已於今年6月批出,據指,發展商已提出上訴,現階段仍待上訴結果。

資料顯示,該項目早於2017年7月已獲批出建築圖則,並細分兩期發展,共建30幢分層住宅,總樓面約408.8萬方呎,涉及約6200個單位。

(星島日報)

觀塘高良工廈全幢1.9億售理想集團持有66.6%業權

工廈物業有價有市,市場再錄全幢成交,由理想集團牽頭標售的觀塘高良工業大廈,全幢以1.9億易手,佔地面積達4165方呎,具重建價值,平均樓面呎價3167元。該集團過去10多年逐步收購該廈,直至近年持66.6%業權,聯同小業主沽貨。

觀塘高良工業大廈全幢以1.9億易手,其中,理想集團持有地下、3樓及5至8樓,合共66.6%業權,以逾1.2892億成交,該集團分別於2006年至2017年期間分段購入,購入價介乎224萬至2190萬,合共涉資約5827萬,持貨多年帳面獲利7065.2萬,物業期間升值約1.21倍。

具重建價值

該工廈餘下業主持有單位亦告易手,包括該廈1樓、2樓及4樓,據土地註冊處資料顯示,該項目2樓於上月中以約2119.6萬沽出,原業主於2002年以40萬購入,以個人名義持有,持貨19年帳面獲利2079.6萬,物期間升值約52倍。

該項目1樓及4樓,亦於同日分別以2119.6萬及1868.5萬售出上述三樓面成交價合計約6107.7萬,買家以公司名義瑞翹有限公司 (SKY DRAGON LIMITED) 登記,註冊董事張兆榮。

平均樓面呎價3167元

該全幢早前透過外資測師行放售,意向價為2.1億,若作重建用途,項目樓高9層,地契用途為工業/貨倉,總樓面為33537方呎,項目位處觀塘大業街25號,早於1970年入伙,地盤面積達4165方呎,項項目早前向城規會申請的規劃用途為其他指定用途 (商貿),項目若作重建,樓面面積料可增近1倍至接近6萬方呎,以易手價計,每呎地價約3167元。

據大型代理行資顯示,該廈近期成交為高層全層,面積3650方呎,於2017年4月以1578萬售出,呎價約4323元;至於租賃方面,該廈低層全層,面積5200方呎,於2016年1月以5.2萬租出,平均呎租約10元。

該廈另一宗租賃為高良工業大廈低層A室,面積2800方呎,於2016年1月以2.8萬租出,呎租約10元。

(星島日報)

金國汽車5.5億 放售九龍灣地廠

九龍灣工廈物業近期成交略增,現金國汽車等放售信和工商中心地廠,意向價約5.5億元。

代理表示,九龍灣信和工商中心地下5個相連單位及地庫4個貨車位現正放售,建築面積合共約40,423平方呎,現出售意向價為5.5億元。該代理指,目前物業地下由汽車維修中心等租用,每月租金收入約86萬元。

據了解,項目由金國汽車等持有,早年購入作自用及收租用途。

(經濟日報)

董建華「租轉買」 1.6億購前「特首府」

嘉慧園C座呎價47976 比鄰現居單位

豪宅交投氣氛向好,有名人買入位於中半山的豪宅。土地註冊處資料顯示,中半山嘉慧園C座2樓,實用面積3,335平方呎,近日連1個車位以1.6億元成交,呎價約47,976元,新買家是前特首董建華。

本報就此向董建華查詢,董透過公關回覆表示,他於8月購入該單位。而他仍擔任特首時,該單位曾獲政府承租,以供其居住。在他卸任特首後,他繼續租入該單位作私人居所,惟近月他得知原業主願意出售該單位,於是決定購入單位,作自住之用。事實上,上述單位於去年曾以約2億元 (連租約) 放售,當時呎價近6萬元,意味是次成交價較當時放盤價低2成。

值得一提的是,董建華初上任時,沒有入住禮賓府,因而選擇留居嘉慧園D座2樓單位。不過,由於單位面積較細,故政府以市場租值12萬元,租用比鄰的C座2樓單位,並將其打通予董建華居住。D座2樓目前由廣兆企業有限公司持有,公司董事包括董建華妻子董趙洪娉及其子董立新。

邱達根妻1.45億 沽環匯廣場高層

另外,土地註冊處資料顯示,黃竹坑環匯廣場高層,建築面積9,820平方呎,近日連兩個車位以1.45億元沽出,呎價約14,766元。據市場消息透露,目前該廈12樓以上的全層單位正以每呎約1.8萬至2萬元放售,可見單位的成交價較放售價低至少約18%。

而沽出單位的原業主為NEW CONTINENT DEVELOPMENT LIMITED,公司董事為蘇健恩,與已故遠東集團創辦人邱德根兒子邱達根之妻子姓名相同,預計為同一人。

值得留意的是,上述公司於2013年以8,641.6萬元買入上址,並曾於2016年及2020年向兩間銀行承造按揭。該公司持貨逾8年,目前轉手帳面獲利5,858.4萬元,物業升值約68%。

(經濟日報)

更多環匯廣場寫字樓出售樓盤資訊請參閱:環匯廣場寫字樓出售

更多黃竹坑區甲級寫字樓出售樓盤資訊請參閱:黃竹坑區甲級寫字樓出售

Companies find falling rents in Central hard to resist as they lap up office space in Hong Kong’s main business district

Rents in Central have fallen by 26.4 per cent from their peak in the second quarter of 2019, providing an incentive for some firms to return to the main business district

Property agency expects that grade A office rents in Hong Kong to fall by as much as 10 per cent this year before rising by up to 5 per cent next year

An increasing number of companies are taking advantage of sharply lower rents and locking in leases in sought-after towers in Central, Hong Kong’s most desirable office address.

HashKey Group, a pan-Asian global digital asset financial services group, is moving its headquarters to Three Exchange Square, in Connaught Place, from Pok Fu Lam, taking up the entire 14th floor, or 10,105 sq ft, from September 16, landlord Hongkong Land announced on Wednesday.

“Our new offices at Three Exchange Square will be our global headquarters and our largest office,” said HashKey, which was founded in Hong Kong and has offices in Singapore and Tokyo.

The new headquarters is 50 per cent bigger than HashKey’s 6,773 sq ft current base in Cyberport, which it plans to retain for its technology and support teams.

Rents in Central, the city’s main business district, have fallen by 26.4 per cent from their peak in the second quarter of 2019, and this is providing an incentive for some firms to return, said real estate consultants, who added that Hong Kong remains a top choice for international companies setting up headquarters.

“Flow of capital, rule of law, low tax rates, talent, stock exchange and the prospect of further significant growth for Hong Kong as a part of the Greater Bay Area will continue to see the city thrive as a place of business,” property agent said.

The agency expects that grade A office rents across the city to fall by as much as 10 per cent this year before rising by up to 5 per cent next year, while another agency expects that office rents on Hong Kong Island to increase by as much as 3 per cent in 2022.

The normal lease period in Hong Kong for offices is three years at fixed terms with an option to renew for another three years.

In July, auctioneer Christie’s signed a 10-year lease to take up 50,000 sq ft spread over four floors at The Henderson in Central, which is to be completed in 2023. The building, which is coming up on the site of the former Murray Road multistorey car park, is being developed by Henderson Land Development.

China International Capital Corporation (CICC) and S&P Global have also signed office lease deals in Central.

CICC, the country’s largest investment bank, rented another 53,000 sq ft of space in One IFC in the second quarter, while the rating agency recently moved into Three Exchange Square from its current location at the ICC in West Kowloon.

“Financial institutions are still a major driving force for Hong Kong’s grade A office, both by size as well as by rental amount,” another property agent said.

Banking, finance and insurance firms occupy 39 per cent of grade A office space, the most among all sectors, in the CBD, which includes Central and Admiralty, according to another property agency.

“We believe they will remain the future demand drivers backed by different cross-border new financial initiatives, including the Stock Connect, Bond Connect and Wealth Management Connect,” agent said.

Hongkong Land said financial firms accounted for 42 per cent of its tenants as of June 30.

“HashKey’s decision to move to Central … exemplifies a growing ‘flight to quality’ as financial markets participants in particular see the benefits of being part of a core Central ecosystem that supports their business and talent development goals,” said Neil Anderson, director of Hongkong Land.

(South China Morning Post)

For more information of Office for Lease at Exchange Square please visit: Office for Lease at Exchange Square

For more information of Office for Lease at International Finance Centre please visit: Office for Lease at International Finance Centre

For more information of Grade A Office for Lease in Central please visit: Grade A Office for Lease in Central

For more information of Office for Lease at International Commerce Centre please visit: Office for Lease at International Commerce Centre

For more information of Grade A Office for Lease in Tsim Sha Tsui please visit: Grade A Office for Lease in Tsim Sha Tsui

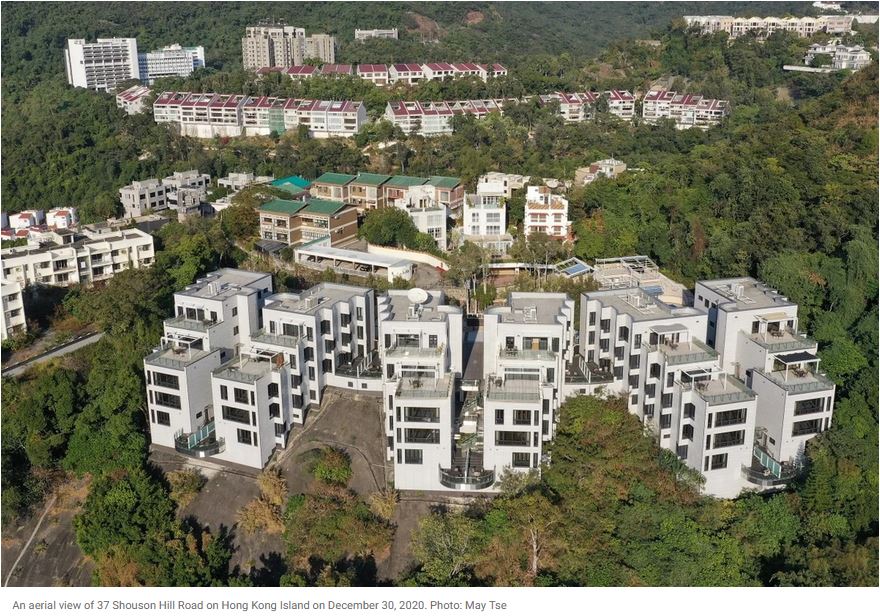

Hang Lung to start construction on Shouson Hill Road ultra luxury project, where US consulate villas stood, by year-end

Hang Lung Properties, led by billionaire Ronnie Chan, paid HK$2.56 billion (US$330 million) for the plot at 37 Shouson Hill Road

The ultra luxury project will only have five to six houses, each measuring 10,000 sq ft, with sweeping views of Deep Water Bay, says CEO Weber Lo

Hang Lung Properties plans to start construction by the end of this year on one of Hong Kong’s most luxurious projects on the former site of US consulate residences on Shouson Hill Road.

Last September, the Hong Kong-listed developer, led by billionaire Ronnie Chan Chi-chung, picked up the parcel at 37 Shouson Hill Road on which six multistorey villas stood for HK$2.56 billion (US$330 million), or HK$54,138 per square foot.

“We won’t squeeze too many flats on the site, which is quite small; instead we would like to have some five to six ultra luxury big houses, each measuring 10,000 sq ft, to match the one of a kind location,” said chief executive Weber Lo Wai-pak.

The site offers breathtaking views of Deep Water Bay and is accessible via a private driveway from Shouson Hill Road.

“It will be very rare,” surveyor said. The surveyor added that he expects the completed houses to fetch at least HK$100,000 per square foot or HK$1 billion.

That would make it among Hong Kong’s most expensive homes, with prices similar to those on The Peak, the city’s most exclusive address. A house on 15 Gough Hill Road fetched HK$2.1 billion in 2016, while a year earlier Alibaba Group Holding’s founder Jack Ma is believed to have paid HK$1.5 billion for a house on 22 Barker Road. Alibaba owns the Post.

“There are a ton of interested buyers who have approached us even before we’ve finalised our design. If we put the project on the market today, they would be gone already,” Lo said. “We’d like to deliver a great product to fetch a higher price.”

Hong Kong’s property market is set to benefit from the deepening integration between Hong Kong and the Greater Bay Area, which is expected to boost the city’s economy, after it took a beating from the anti-government protests in 2019 and was further compounded by the Covid-19 pandemic.

Last Friday, the much-awaited Wealth Management Connect kicked off, a move that will enhance the city’s reputation as a leading financial hub. This was preceded by Beijing’s announcement on September 6 to boost cross-border collaboration between Hong Kong and the neighbouring mainland Chinese cities through the Qianhai and Hengqin economic zones.

“With the Greater Bay Area moving further, we will see more deep-pocketed buyers from the mainland, such as entrepreneurs and senior professionals, coming to Hong Kong,” said Lo.

He added that the national security law and electoral reforms have resulted in a more stable business environment. As a result investors who were on the sidelines are likely to jump into the market pushing demand for high-end residential homes in the city.

Hang Lung Properties, one of the city’s biggest retail landlords and owner of the popular Fashion Walk shopping centre in Causeway Bay, is extremely bullish on the company’s mainland retail portfolio.

“At this moment, we see more opportunities in the mainland in terms of retail properties,” said Lo.

He noted that while retail sales in the city rose 2.9 per cent year on year in July, they will not match the level seen before the anti-government protests when thousands of mainlanders visited Hong Kong every day.

The company, which launched its 10th mainland shopping centre in Wuhan in March, saw rental income of 43 million yuan (US$6.7 million) in the first three months of opening. It expects to open a commercial complex in Hangzhou in 2024 comprising a high-end shopping centre, office towers and a hotel operated by Mandarin Oriental overlooking the iconic West Lake.

“We are hoping to offer a premium social space to the rising middle class in the country where they can feel exclusive and interact with families and friends,” said Lo.

(South China Morning Post)

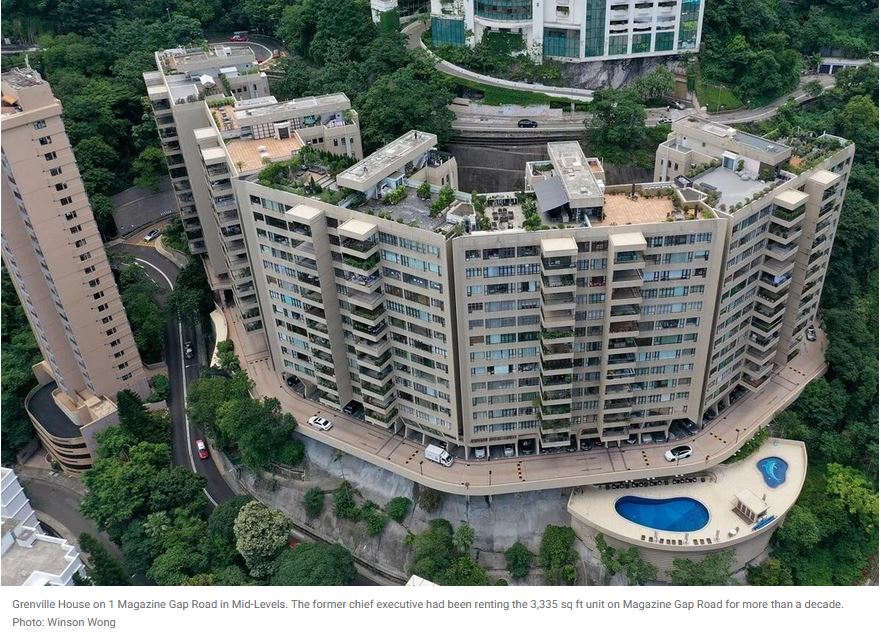

Tung Chee-hwa, ex-Hong Kong chief executive, becomes first-time homeowner at 84 with purchase of US$20.6 million luxury home

Tung paid a stamp duty of 4.25 per cent which indicates he was a first time homebuyer

Former chief executive comes from wealthy Hong Kong shipping family

Tung Chee-hwa, Hong Kong’s first postcolonial chief executive from 1997 to 2005, bought a luxury home at Grenville House in Hong Kong’s posh Mid-Levels district for HK$160 million (US$20.6 million) last month, according to Land Registry records.

Tung bought the unit in his own name, paying a stamp duty of 4.25 per cent, or HK$6.8 million, which indicates that the former chief executive was a first time homebuyer.

“Tung bought the C2 unit of Grenville House in August this year. The government had rented the same unit during his stint as chief executive,” his spokesperson said on Tuesday. “After resigning as chief executive, he continued to rent the unit for his own use. He learnt in recent months that the vendor had intentions to sell his property, leading to his decision to purchase the unit at Grenville House,” the spokesperson added.

Homebuyers have to pay a flat stamp duty of 15 per cent of the property price in Hong Kong. For first time buyers, the duty rates are lower and are calculated based on the property price. The highest rate is 4.25 per cent – the tier that Tung’s unit falls under – for properties priced more than HK$21.7 million.

If he had bought the home under a company name, Tung would have been required to pay a stamp duty of 15 per cent, or HK$24 million. By buying it in his own name, he has saved Hk$17.2 million.

The 84-year-old had been renting the 3,335 sq ft unit on Magazine Gap Road for more than a decade. Its price translates to HK$47,976 per square foot. The property comes with a car park.

Tung’s father was the head of a wealthy shipping family in Hong Kong. He founded the Orient Overseas Container Line, which was sold to China’s state-owned shipping line Cosco in 2018. His younger brother, Tung Chee-chen, was in 2009 ranked by Forbes as the 23rd wealthiest man in Hong Kong with a fortune worth US$900 million. A year earlier, in January, Tung and his family were ranked by Forbes as the 16th wealthiest in Hong Kong, with a total value of US$3 billion.

When Tung took office in 1997, he did not live in Government House, a two-storey building that was the official residence and office for 25 of Hong Kong’s 28 governors. Declassified records from Britain’s National Archives reveal that HE was concerned about the feng shui at Government House, referring to the traditional Chinese practice of arranging the layout of living spaces to create perceived balance with the natural world.

Instead, Tung stayed in his family home, Unit D2 of Grenville House. The government had to rent the unit next to his flat, paying a monthly nominal fee of HK$1 for Tung’s flat and HK$120,000 for the adjacent one.

Both units were renovated for HK$6 million to accommodate a larger living and entertainment space, including an office for Tung. The government also forked out almost HK$800,000 as compensation to move out the existing tenant at that time.

The vendor, Nam Mui (Kin Kee) Company, bought unit C2 for HK$3.9 million in 1982.

Tung has been a member of the board of directors of this newspaper’s owner, Alibaba Group Holding, since September 2014, when the company made its US$25 billion initial public offering in New York.

(South China Morning Post)

La Marina on track for third race for homes

La Marina atop Wong Chuk Hang station will launch a third round of sales on Saturday, including all 133 units on its fifth price list plus two relaunched units that were canceled before.

The discounted average per-sq-ft price of units on the list is HK$36,590, with the flats ranging from one- to four-bedroom units.

That came as Wetland Seasons Bay in Tin Shui Wai saw three buyers forfeit deposits in the third round of sales, totaling as much as HK$459,065.

Henderson Land Development (0012) revealed its second price list for The Holborn in Quarry Bay, offering 68 flats with a minimum investment of HK5.8 million after discounts.

The list includes 43 one-bedroom and 25 studio units, with sellable areas of 220 to 260 sq ft.

The project has received over 600 checks for the 88 units in the first price list, which is equivalent to an oversubscription of 5.8 times.

A general sales manager, Mark Hahn Ka-fai, said the sales arrangement will be announced as soon as today and the project is expected to open sales next Sunday.

Henderson's other project The Henley III in Kai Tak is 13 times oversubscribed, receiving 1,136 checks for 81 units in its latest batch, said Thomas Lam Tat-man, the other general sales manager.

The sales arrangement will be announced shortly, and sales are expected to be around the Mid-Autumn Festival, Lam added.

This came as it acquired the last Man On Street addresses for HK$270 million in a public auction yesterday.

The total site area is about 3,206 square feet and the buildings are about 63 years old.

(The Standard)