馬亞木13億沽中環中心兩全層持貨三年升10%每呎2.52萬及2.77萬

近期工商鋪買賣趨熱,連跑輸大市的甲廈亦起動,「小巴大王」馬亞木沽售中環中心兩全層單位,涉資共約13.23億,平均每呎2.52萬及2.77萬,持貨三年間升值約10%,分別由一家老牌家族,以及紀惠集團承接。

市場消息指,中環中心20樓及26樓全層,早於市場放售一段日子,直至近期頻獲洽購,最終該兩全層分別以6.3億及6.93億易手,以建築面積24980方呎計算,平均呎價分別為2.52萬及2.77萬。由於位處中低層,呎價為今年該廈呎價新低。其中,該廈20樓新買家為本港一家老牌家族,有機會購入該廈自用,26樓全層則由紀惠集團承接。

低層買家為老牌家族

中環中心世紀大刁,該廈75%業權2017年11月以402億易手,買家中國國儲能源化工集團佔55%權益,港方組合佔45%,有「小巴大王」馬亞木、「磁帶大王」陳秉志、「物流張」張順宜、蔡志忠及商人盧文端。

隨後,大股東中國國儲因資金問題放棄購入,股權作重整,不但引入世茂房地產主席許榮茂及金利豐主席朱李月華兩人,馬亞木亦由本來由8層增加至13層,市場消息指,由於馬亞木購入的比預期多,上述20樓及26樓早於2019年放售,惟遇上政治事件及疫情,最終封盤,直至近期市況改善,代理亦大力催谷。市場消息指,當時該兩全層購入呎價分別約2.3萬及2.5萬,持貨逾3年,帳面獲利約10%。

紀惠第三度購入該廈

該廈26樓買家紀惠集團,為第三度購入中環中心,率先於2018年向盧文端購入19樓全層,作價約7.62億,呎價約3.1萬,並於2019年1月以7.3691億購入28樓全層,面積約24980方呎,呎價2.95萬,是次為第三度入市,現時集團持有中環中心3層樓面,作長綫收租用途。

「磁帶大王」陳秉志於早前以8.7億沽售38樓全層,呎價約3.4萬,由於20樓及26樓屬於中低層,未能作比較。

陳秉志上月推出中環中心39樓最後5伙拆售,悉數沽出,呎價約3.3萬,業主提供每個單位回贈1000萬,變相減價逾10%。

(星島日報)

更多中環中心寫字樓出售樓盤資訊請參閱:中環中心寫字樓出售

更多中環區甲級寫字樓出售樓盤資訊請參閱:中環區甲級寫字樓出售

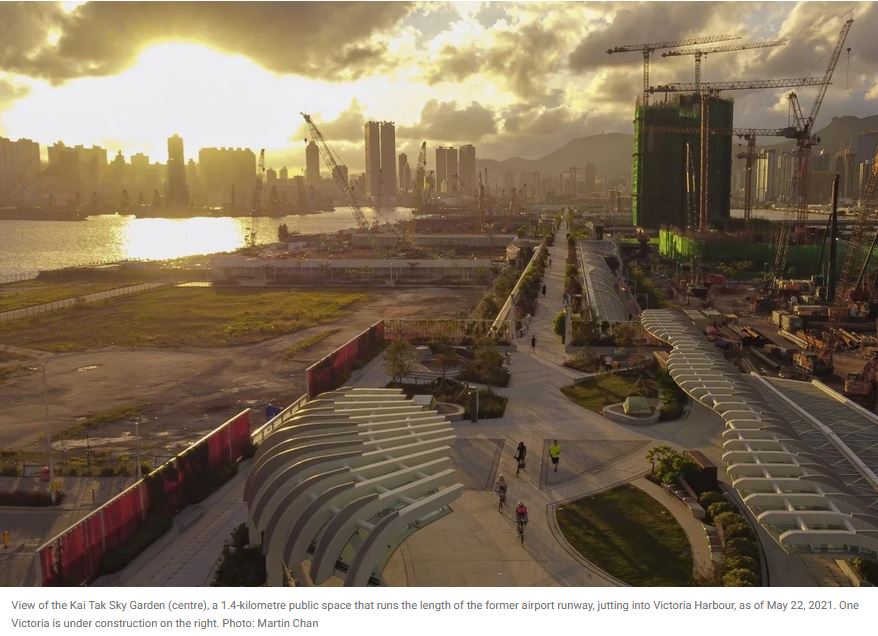

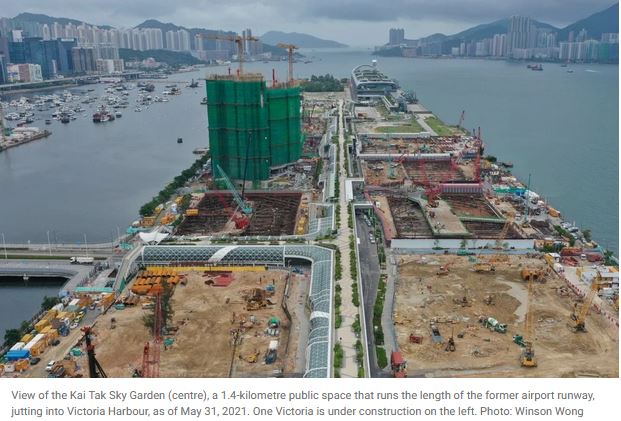

Hong Kong’s homebuyers pile into Kai Tak’s first harbourfront flats after a tepid start, betting on property bull market to continue

China Overseas Land sold 364 flats, or 91 per cent of the first batch of 400 units on offer, at One Victoria in Kai Tak on Saturday

The development is priced for more than 10 per cent lower than nearby The Henley unveiled by Henderson Land in May

Hong Kong’s homebuyers snapped up the first harbourfront flats built on Hong Kong’s former airport runway in Kai Tak despite a slow start, as generous discounts lured investors to double down on their bets of the continuing property bull market.

China Overseas Land and Investment sold 364 flats, or 91 per cent of the first batch of 400 units on offer at the One Victoria project in Kai Tak on Saturday, according to real-estate agents.

The first batch on offer was priced at an average of HK$22,977 per square foot, about 13 per cent cheaper than Henderson Land Development’s The Henley project in the same area, 70 per cent sold as of May, helped by its location closer to the Kai Tak subway station.

One Victoria is priced about 5 per cent lower than second-hand property in the Kai Tak area, and is 15 per cent cheaper than the leftover property from new projects in the neighbourhood, which could attract buyers who are looking for upsides in their investments, property agent said. The sales campaign will last until 11pm, giving agents more time to find buyers and close deals, the agent said.

The weekend’s sales got off to a slow start, with fewer than half being sold in the first few hours. The current batch of the One Victoria flats range from 329 square feet to 643 square feet, with prices starting from HK$6.56 million (US$844,700) after discounts. The whole project will comprise a total of 1,059 apartments when it is completed around March 2023.

The sale result came amid a boom on the city’s housing market, the world’s costliest, as cheap money unleashed by global central banks prompts investors to seek investments that can preserve values.

One Victoria is about a 45-minute walk from the Kai Tak Station. It is also likely to be surrounded by construction sites.

With the opening of the Tuen Ma Line, which connects the West Rail Line and the Tuen Ma Line Phase 1 and includes the Kai Tak Station, the Kai Tak district will “officially enter the harvest season” and mature in terms of community development, another property agent said. As the first waterfront project on the runway, One Victoria will offer good views, the agent added.

Hong Kong’s economy has been rebounding, snapping several quarters of recession caused by the social unrest and the coronavirus pandemic.

First-quarter growth accelerated to 7.9 per cent, the most in 11 years, while new home sales increased at the fastest pace in two years.

Hong Kong’s residential property transactions surged by about 35 per cent in the first half, the highest level since the second half of 2012, to more than 38,500 deals, according to a property agency. Transaction volumes also jumped by about half to about HK$366 billion, the highest level since the first half of 1997.

An increase in housing supply has so far failed to cool down the fervour. New home supply is expected to increase 14 per cent from a year ago to 36,919 units in 2021, according to another property agency.

(South China Morning Post)