上環88WL全幢7.5億沽 呎價僅8300

估高盛等基金實蝕逾6億 近年商廈最大宗

商廈價格近年大幅回調,市場錄大額蝕讓。消息指,由高盛等基金持有的上環88WL全幢商廈,獲本地財團以約7.5億元承接,呎價僅逾8,300元。基金多年前以近10億購入地盤,未計建築費已蝕約2億,估計最終蝕逾6億離場,為近年涉及商廈最大宗蝕讓個案。

大廈樓高24層 出租率近半

市場人士指,由高盛、凱龍瑞等基金放售逾1年的上環全新商廈88WL,近日獲數個財團爭奪,包括用家及投資者,最終獲本地財團以約7.5億元承接。

大廈樓高24層,於去年落成,貿素相當不俗。每層面積約3,988至4,253平方呎,業主把大廈提供兩類樓面,7至10樓每層面積約4,253平方呎,連同近200平方呎露台,適合作餐廳、半零售用途如健身室等。於物業高層樓面,則作傳統商業用途,每層可分間成6單位,面積由數百平方呎起。據了解,現時大廈出租率近半,平均呎租逾40元。

凱龍瑞基金早年購入永樂街3舊樓地盤,共涉9.62億元,其後引入基金投資進行重建,去年落成。惟自疫情後,商廈租售價出現大幅回調,而基金早於去年中曾放售物業,叫價13.5億元,未獲承接,半年後再委託測量師行放售,降價至9億,如今再降價至7.5億元沽出,以總樓面約90,199平方呎計,呎價約8,314元。未計建築費已蝕約2億元,若連同起樓成本,估計蝕5億至6億離場,為近年商廈最大手蝕讓。

凱龍瑞基金早年主力投資商廈,而高息加上租金下跌,面對不少壓力,如早年投資灣仔謝斐道303號全幢商廈KONNECT,以及比鄰的告士打道160號海外信託銀行大廈41個車位,今年初遭債權人接管。債權人率先更拆售海外信託銀行大廈的車位,當中15個車位以約1,875萬元沽,平均每個車位作價約125萬元。

此外,商廈空置情況有惡化趨勢,根據差估署《香港物業報告2024》,去年私人寫字樓空置量多達2,110萬平方呎樓面,當中甲級商廈去年空置量達1,482萬平方呎,按年再多108萬平方呎,空置率達到16%,按年上升0.9個百分點,創歷史新高。

(經濟日報)

更多88WL寫字樓出租樓盤資訊請參閱:88WL寫字樓出租

更多上環區甲級寫字樓出租樓盤資訊請參閱:上環區甲級寫字樓出租

更多海外信託銀行大廈寫字樓出售樓盤資訊請參閱:海外信託銀行大廈寫字樓出售

更多灣仔區甲級寫字樓出售樓盤資訊請參閱:灣仔區甲級寫字樓出售

超甲廈地標項目今年落成 預租加快

多個大型甲廈項目今年落成,個別更屬「地標」超甲廈,預租個案開始增加。

今年多項甲廈落成,當中更有地標項目,包括新地 (00016) 在2019年以約422億元投得西九高鐵站上蓋的商業地王,項目日前舉行平整儀式。高鐵西九龍總站發展項目為兩幢雙塔式辦公樓,提供約260萬平方呎甲廈樓面,基座設有約60萬平方呎零售樓面;項目亦提供逾10萬平方呎休憩用地,當中設有開放予公眾的觀景台。

瑞銀加碼 租高鐵站項目46萬呎

瑞銀在2022年宣布預租西九項目9層樓面、共約25萬平方呎,最新瑞銀宣布租用整幢14層寫字樓,涉及約46萬平方呎樓面,大幅增加8成,租約為10年。項目預計2025年底竣工,2026年起開始入伙,瑞銀屬於第1個租戶。瑞銀方面指,現時集團租用香港5個辦公室物業,而租用新寫字樓後,所有員工可以齊集同一座大廈。

新地主席兼董事總經理郭炳聯稱,瑞銀集團決定租用約46萬呎寫字樓,證明對香港作為一個金融中心、財富中心和資產管理中心,投下信心一票。

長江集團中心二期 中資客租半層

至於中環亦有兩幢大廈今年落成,預租有所加快,其中長實 (01113) 旗下和記大廈重建項目長江集團中心二期,錄得半層樓面租務,涉及物業中高層,面積約8,500平方呎,以每平方呎約90餘元租出。消息稱,新租客為一家中資金融機構,原租用灣仔鷹君中心全層,面積約1.5萬平方呎,是次該機構屬縮減樓面,但同時可提升級數。

長江集團中心二期今年落成,項目樓高41層,總面積約達55萬平方呎,標準辦公室樓層面積約17,300平方呎,項目分為東、西兩座。據了解,該廈暫時獲數宗預租。

另恒地 (00012) 中環全新甲廈The Henderson亦剛完工,大廈錄得新租務成交,涉及物業中高層,一個面積約6,600平方呎單位,成交呎租約120元。新租客為華晨汽車集團,原租用中環超甲廈遮打大廈中層。是次搬遷作出少許樓面上擴充,並稍為升級至全新超甲廈。

The Henderson總樓面約46.5萬平方呎,較早前恒地公布業績時表示,大廈出租率已逾5成。對上一宗全層租務,涉及瑞士高級製錶品牌愛彼承租全層,作為其AP House及香港辦公室之用,該租務為佳士得拍賣行、金融機構凱雷後,再多一個國際品牌進駐。

(經濟日報)

更多長江集團中心二期寫字樓出租樓盤資訊請參閱:長江集團中心二期寫字樓出租

更多The Henderson寫字樓出租樓盤資訊請參閱:The Henderson 寫字樓出租

更多遮打大廈寫字樓出租樓盤資訊請參閱:遮打大廈寫字樓出租

更多中環區甲級寫字樓出租樓盤資訊請參閱:中環區甲級寫字樓出租

更多鷹君中心寫字樓出租樓盤資訊請參閱:鷹君中心寫字樓出租

更多灣仔區甲級寫字樓出租樓盤資訊請參閱:灣仔區甲級寫字樓出租

甲廈空置率16% 創新高

近年甲廈供應高峰,導致空置率展創新高,資料顯示,最新甲廈空置率高見16%,為有紀錄以來新高。

商廈總空置樓面 逾2千萬呎

據差估署《香港物業報告2024》初步統計數字顯示,去年私人寫字樓空置量多達2,110萬平方呎樓面,空置率高達14.9%,其中甲級商廈空置量亦達1,482萬平方呎,空置率更達16%,按年急增近1個百分點,創歷史新高紀錄,差過97金融風暴及03年沙士時期。

去年私人寫字樓落成量約171萬平方呎,按年已經大減55%,惟同年的整體使用量只有44萬平方呎,其中乙級及丙級商廈更錄得負使用量,導致去年底的寫字樓空置率升至14.9%,按年增加0.5個百分點,屬於有紀錄新高,涉及樓面多達2,110萬平方呎。

當中甲級商廈去年空置量達1,482萬平方呎,按年再多108萬平方呎或8%,空置率達到16%,按年上升0.9百分點,相較1998年金融風暴後的15.3%,以及2003年沙士後的13.7%還要高。

(經濟日報)

上環信德中心 指標甲廈配套完善

上環為本港傳統商業區之一,商廈林立,信德中心為該區指標甲廈,交通方便,配套完善,景觀開揚,受到不少商戶青睞。

信德中心位於上環干諾道中200號,底層基座設有9層高的商場。物業樓高40層,寫字樓樓層由9樓起,電梯大堂共分兩段,中低層9至24樓位於大廈地下,而高層單位設於商場,共設有16部載客電梯,方便疏通人流。實用率方面,東翼實用率普遍僅為7成,相對西翼實用率逾8成稍低。

大廈總樓面面積約38萬平方呎,每層樓面面積約2.5萬平方呎,最多可分間成18個單位,單位面積由約1,000平方呎起。物業臨海而建,故大部分單位均可享有開揚海景。當中2至5號單位,更面向正維港煙花景。另外,01、16至18號單位,均享有海景。至於其他單位,望向上環商廈及中半山樓景,景觀開揚。

9層商場 提供大量食肆

交通方面,物業位處港鐵上環站上蓋,門口亦設有巴士站,提供多條路綫,直達港九新界,東翼位置對出的天橋,可連接至中環國際金融中心商場,交通便利。此外,物業基座為港澳碼頭,方便來往澳門及內地珠海。

飲食配套亦十分完善,物業基座為9層高的商場,有大量餐廳食肆可供選擇,包括酒樓、快餐店、茶餐廳等,可滿足不同上班族的需要。

近年物業最大手成交,為信德集團 (00242) 向新世界 (00017) 購入信德中心商場部分樓面,涉及可出租面積214,486平方呎,以及寫字樓面積13,827平方呎樓面,連同85個車位,涉資達23.6億元。

信德中心租戶以大型上市公司及各國領事館為主,大廈近日接連錄得成交,其中西座1610室以4,464萬元成交,呎價31,000元。

(經濟日報)

更多信德中心寫字樓出租樓盤資訊請參閱:信德中心寫字樓出租

更多上環區甲級寫字樓出租樓盤資訊請參閱:上環區甲級寫字樓出租

更多國際金融中心寫字樓出租樓盤資訊請參閱:國際金融中心寫字樓出租

更多中環區甲級寫字樓出租樓盤資訊請參閱:中環區甲級寫字樓出租

中上環核心區向來受商戶歡迎,有本港代理行代理表示,有業主放售上環信德中心招商局大廈 (東翼) 中層12至16室,建築面積約6,223平方呎,意向價約1.15億元放售,呎價約18,500元。

裝修齊備 間隔方正

單位以交吉形式放售,裝修齊備,間隔方正,且享有高實用率,單位景觀開揚海,享廣闊維港海景。

該代理指出,大廈位處交通樞紐,上環港鐵站上蓋,比鄰港澳碼頭及巴士總站,亦設有行人天橋連接國際金融中心等區內主要商廈,享有交通優勢。大廈基座商場亦提供大型中式食肆、銀行、餐飲、會所及停車場等配套,一應俱全。

(經濟日報)

更多信德中心寫字樓出售樓盤資訊請參閱:信德中心寫字樓出售

更多上環區甲級寫字樓出售樓盤資訊請參閱:上環區甲級寫字樓出售

更多國際金融中心寫字樓出租樓盤資訊請參閱:國際金融中心寫字樓出租

更多中環區甲級寫字樓出租樓盤資訊請參閱:中環區甲級寫字樓出租

Buyer interest soars for Wong Chuk hang homes

CK Asset (1113) has collected more than 12,000 checks for Blue Coast, its new project atop Wong Chuk Hang MTR station, making the 248 flats in the first two price lists over 47 times oversubscribed.

The developer will roll out a third price list shortly to meet market demand, said Justin Chiu Kwok-hung, CK Asset's executive director, adding that the firm may hike prices for future batches based on the market's response.

Chiu said there's a 70 percent chance that property prices in the city will rise this year.

Meanwhile, Wheelock Properties said it sold nearly 800 flats in the first quarter, cashing in nearly HK$8.7 billion. It sold 762 of them in the month after the government removed all the housing curbs, raking in over HK$7.3 billion.

The highlight during the quarter would be Seasons Place, its new project in Lohas Park, which has conducted two rounds of sales and sold 542 flats, accounting for nearly 85 percent of the total revenue for the quarter.

Meanwhile, deals on the secondary market slowed over the four-day Easter break as people traveled to the mainland and overseas.

A total of 15 deals were recorded at 10 major housing estates over the holiday, which was down by 21 percent from the 19 transactions notched up during the same period last year, according to a local property agency.

Among them, Taikoo Shing in Quarry Bay and Laguna City in Kwun Tong recorded no transactions, the agency said.

The number for the weekend alone also fell by 42 percent to 11 from a week ago, the lowest since the withdrawal of all stamp duties a little over a month ago, according to the agency.

An agent from the agency said that many Hongkongers went overseas or headed north to mainland cities during the break and this, coupled with fierce competition in the first-hand markets, hit second-hand deals.

Another local property agency recorded 21 transactions at 10 blue-chip estates during the four-day holiday, similar to the 22 transactions last year.

For the weekend alone, it saw the number of transactions fall 24 percent to 16 from the previous week.

(The Standard)上環88WL全幢商廈7.5億易手 建滔相關人士承接料回報逾5厘

商廈錄大手成交,由高盛等基金持有的上環88WL全幢商廈以7.5億易手,買家為建滔集團相關人士,平均呎價約8315元,原業主為高盛、凱龍瑞等基金,多年前以近10億購入地盤,連同建築費,估計蝕逾5億離場。

高盛、凱龍瑞等基金放售逾1年的上環全新全幢商廈88WL,早前將意向價由13.9億調低至9億,物業陸續獲投資者及用家洽購,近期建滔集團相關人士積極出價,最終以約7.5億承接該全幢,以總樓面約90199方呎計算,平均呎價8315元,該廈去年新落成,現時出租率約50%,平均呎租約40元,料回報逾5厘。新買家購入物業,並非買賣公司,需要支付相等於樓價4.25%的釐印費。

高盛凱龍瑞沽售

該廈樓高24層,每層面積約3988至4253方呎,大廈吸納兩種類型租客,7至10樓每層面積約4253方呎,連同近200方呎露台,作為餐廳及健身室等半零售用途,高層樓面景觀開揚,用作傳統寫字樓用途,每層分間6單位,面積由數百方呎起。

該項目由凱龍瑞基金於早年購入永樂街3幢舊樓,涉資9.62億,隨後引入基金投資者合作,大廈於去年落成,正值商廈市場吹淡風,空置率新高,租售價大跌之際,基金去年中放售物業叫價13.5億,及至半年後委託測量師行放售,降價至9億,最新再減價至7.5億沽售,未計建築費蝕約2億,若計及起樓成本,蝕讓5億至6億離場,為近年商廈最大手蝕讓。

蝕讓逾5億離場

凱龍瑞基金主力投資商廈,近年高息加上商廈租售價下跌,面對壓力,曾由該基金持有的灣仔謝斐道303號全幢商廈KONNECT,以及毗鄰的告士打道160號海外信託銀行大廈41個車位,今年初遭債權人接管,債權人率先更拆售海外信託銀行大廈的車位,15個車位以約1875萬沽,平均每個作價約125萬。

現時,商廈供過於求,空置率上升,差估署《香港物業報告2024》顯示,去年私人寫字樓空置量多達2110萬方呎樓面,甲廈去年空置量達1482萬方呎,按年再增加108萬方呎,空置率高達16%,按年升0.9個百分點,創歷史新高。

(星島日報)

更多88WL寫字樓出租樓盤資訊請參閱:88WL寫字樓出租

更多上環區甲級寫字樓出租樓盤資訊請參閱:上環區甲級寫字樓出租

更多海外信託銀行大廈寫字樓出售樓盤資訊請參閱:海外信託銀行大廈寫字樓出售

更多灣仔區甲級寫字樓出售樓盤資訊請參閱:灣仔區甲級寫字樓出售

外資代理行:商廈租金受壓 今年料下跌7%至9%

有外資代理行報告指,在環球經濟前景不明朗情況下,香港整體營商氣氛保持審慎,相信成本控制仍是大多數企業的首要任務。2023年全年整體淨吸納量錄負25.83萬方呎,直至2023年底,整體待租率被推高至18.8%,此數字亦計及滙豐中心第1座。

去年底待租率18.8%

2023年共有123.68萬呎新增寫字樓供應入市,相比2022年的286.86萬方呎跌57%。這些新落成甲廈集中在非核心商圈,其中兩個項目位於九龍東,另有一個項目坐落九龍西。該行預計,2024年供應量將增加至174.16萬方呎。

該行預料,2024年香港寫字樓市場表現或維持疲弱,在待租面積高企下,未來12個月寫字樓租金繼續受壓,預期2024年全年調整幅度介乎7%至9%。然而,這些新增供應將能為有意升級搬遷的企業提供更多優質選擇,尤其是積極尋求搬遷至符合環境、社會和治理 (ESG) 要求的商廈的企業。

報告顯示,截至去年第4季,大中華區21個主要城市核心商圈甲廈存量達約7.34億方呎,淨吸納量年錄約1741萬方呎,較2022年有所提升,台北核心區去年底空置率較低,約8.3%。二線城市中,蘇州核心商圈去年底空置率最低,為16.5%。

(星島日報)

九龍灣4商業項目重建 九展最大

九龍灣屬於起動九龍東、第二個核心商業區 (CBD2) 主要部分,目前區內有4個商業重建項目,預計將提供逾320萬平方呎商業樓面供應,最大規模屬於億京等重建九龍灣國際展貿中心。

九龍灣前身屬於工業區,但過去10年逐步轉型成為商貿區,並與啟德、觀塘組成起動九龍東、作為第二個CBD2。區內工廈業權相對集中,不少大型工廈由單一業主持有,故此要展開重建轉型難度較低。

增建逾320萬呎樓面

根據資料顯示,九龍灣區內近年有6個重建項目批出,其中4個重建成商業項目,涉及323萬平方呎商業樓面,另外由九龍倉 (00004) 旗下啟興道九龍貨倉,發展商於2022年底亦以約20.9億元完成補地價,將由目前的工業用途轉作商住項目,將會提供約1,782伙。

至於重建成商業的項目之中,則以億京等組成的財團在2021年中以約105億元,向合和實業買入九龍灣國際展貿中心,並計劃展開重建,屬於九龍灣區內規模最大重建項目之一。該項目將會重建成將建4幢16層高商業物業,另設3層地庫及3層基座,總樓面共176.78萬平方呎,料重建的投資額高達200億元。

另外,永泰 (00369) 旗下常悅道13號瑞興中心,近年亦獲批准放寬地積比率至14.4倍重建,將會重建1幢30層高的商廈 (包括4層地庫),提供約26.3萬平方呎樓面。而由中渝置地 (01224) 主席張松橋等持有的臨澤街8號啟匯,雖然曾經在2020年年中獲批建築圖則可以重建2幢28層高商業大樓,涉及樓面約68萬平方呎,不過去年醫管局承租該商廈約10層樓面,估計發展商短期內未必會落實有關重建計劃。

除了發展商展開重建外,政府亦將區內廢物回收中心、驗車中心等搬出,以組合成「九龍灣行動區」以興建大型商業、零售及文化項目,涉及總樓面面積逾430萬平方呎,其中偉業街的前運輸署驗車中心,可建樓面達216萬平方呎,將會在大型商場基座上興建辦公室、酒店及零售、餐廳等綜合用途。

不過,由於近年商廈市場出現供過於求,九龍東商廈空置率上升,市場相信政府短期內未必會推出有關商業用地招標。

(經濟日報)

更多啟匯寫字樓出租樓盤資訊請參閱:啟匯寫字樓出租

更多九龍灣區甲級寫字樓出租樓盤資訊請參閱:九龍灣區甲級寫字樓出租

新落成商廈 吸企業租用

九龍灣新落成商廈吸引市場注意,其中第一集團旗下九龍灣宏照道23號第一集團中心近年落成,早前以約18萬元租出地下舖位予內地電動車代理商。

第一集團中心地舖 月租18萬

第一集團中心原為工廈物業,由第一集團持有,早年透過補地價重建成商廈,近期落成,為區內全新的甲級寫字樓項目,樓高21層,設有3層地庫停車場、5個商舖及81個寫字樓單位。

據指,早前錄得首宗租賃成交,涉及廣汽埃安新能源汽車代理商租用地下1號舖作本港首個展銷廳。該舖位面積約2,777平方呎,樓層高度約6米,每月租金約18萬元,平均呎租約65元。

據悉,目前項目尚餘一個地舖招租,面積約2,382平方呎,每呎叫租約65元,月租叫價逾15萬元。寫字樓方面,該集團亦推出19至21樓全層樓面招租,面積約14,488平方呎,意向呎租28元。另外,早前有歐洲綫上零售商以呎租26元租用九龍灣商廈一號九龍高層,面積近7,000平方呎單位,月租約18餘萬元,作為集團總部。

(經濟日報)

更多第一集團中心寫字樓出租樓盤資訊請參閱:第一集團中心寫字樓出租

更多一號九龍寫字樓出租樓盤資訊請參閱:一號九龍寫字樓出租

更多九龍灣區甲級寫字樓出租樓盤資訊請參閱:九龍灣區甲級寫字樓出租

Two local property agencies forecast property sales hitting 10-month high in March

‘Market sentiment improved rapidly and transaction volumes increased’ last month after Hong Kong scrapped its property cooling measures in February: property agency

Two agencies forecast that sales could breach 9,000 deals mark in April

Hong Kong property sales are expected to hit a 10-month high in March following the removal of all of the city’s property cooling measures, two leading property agencies said.

Two Hong Kong’s largest real estate agencies, said the total number of transactions could have breached the 5,000 deals mark last month, the highest level since May last year, when sales of new and second-hand homes, parking spots, shops, offices and industrial units reached 5,284 deals. Official sales data is set to be released this week.

A total of 3,189 property transactions worth about HK$22.6 billion (US$2.9 billion) were recorded in February, government data shows. Sales in March are tipped to amount to about HK$37.3 billion, the highest level since June’s HK$39.7 billion worth of deals.

“After the government withdrew the property curbs, the property market sentiment improved rapidly and transaction volumes increased,” an agent said.

Among the measures scrapped by Financial Secretary Paul Chan Mo-po in his budget speech on February 28 were the Buyer’s Stamp Duty that targeted non-permanent residents and a New Residential Stamp Duty for second-time purchasers. Homeowners were also no longer required to pay a Special Stamp Duty if they sold their homes within two years.

The decade-old measures were scrapped to boost a struggling property market.

Mortgage financing was also eased. The Hong Kong Monetary Authority currently allows homes valued at less than HK$30 million to be eligible for 70 per cent mortgage financing, compared with the previous cap of 60 per cent for flats valued between HK$15 million and HK$30 million.

One of the agency said new home sales could have hit 1,488 units valued at HK$13.72 billion in March, more than four times the 357 units sold in February and more than double their value of HK$5.63 billion. As for secondary homes, they might have improved by 23.2 per cent and 21.9 per cent to 2,290 units valued at HK$15.63 billion, respectively.

The agency has estimated that a total of 5,010 deals were completed in March, while another agency has forecast that 5,004 property transactions took place. And this improved performance is likely to continue, with property sales forecast to reach 9,300 units in April, a 33-month high, according to the first agency.

Another property agency, has forecast that 9,160 property transactions will be recorded in April.

“With developers actively launching new projects and late-stage projects throughout March, the registration of property transactions will have been fully reflected starting mid-March, so we expect more sales in April,” an agent said.

The likes of CK Asset Holdings, Wheelock Properties, New World Development and Henderson Land Development are among just the Hong Kong developers that have launched new home sales in March.

However, given that interest rates remain at more than a two-decade high, an international property agency still believes that a short-term rebound in property prices is unlikely.

“I am pretty sure the property transactions this year will be impressive because developers are keen to dispose of their unsold stock and they’re offering attractive deals, but this means that in the secondary market, homeowners will have to sell at an even bigger discount and not many are willing to do that,” another agent said.

Historical analysis suggests that home price stabilisation will require monthly secondary residential transaction volumes to stand firmly above 3,500 units, the agency said.

(South China Morning Post)上月工商舖交投僅錄203宗 業界:撤辣後未明顯受惠

樓市全面撤辣後,工商舖未明顯受惠,資金重注投向住宅,今年3月份工商舖錄203宗成交,較2月份傳統農曆年淡季,升幅亦僅12%。近期工商舖減價蔚成風氣,商廈舖位更錄大幅蝕讓成交。

有本港代理行代理表示,樓市在全面撤辣後,住宅好「威水」,交投量節節上升,由於多年受辣招所困,一旦鬆綁,資金傾向重注住宅,工商舖市場觀望,買賣淡靜,亦皆因政府年前已為工商舖鬆綁撤辣,釐印費向來低於住宅,故今番樓市全面撤辣,不但未惠及工商舖,甚至將資金由工商舖拉扯向住宅。

宗數僅較2月升12%

該代理舉例說,撤辣前,代理一窩蜂在工商舖新盤「跑數」,現時則全部都在跟進住宅,令工商舖市場獨憔悴。有見市況淡靜,部分有心沽貨的投資者,惟有大幅減價,力求成功售出物業。

根據該行資料顯示,今年3月工商舖共錄203宗成交,較2月份的181宗,增幅約12%,不過,由於2月份為傳統農曆年淡季,不能直接作比較;若對比去年3月402宗,減幅更高達50%。

高盛、凱龍瑞等基金旗下上環全新全幢商廈88WL,去年意向價13.9億,近期以約7.5億易手,平均呎價僅8315元,項目前身為永樂街3幢舊樓,早年購入價9.62億,大廈於去年落成,若計及起樓成本,蝕讓5億至6億離場,為近年商廈最大手蝕讓。

商廈舖位錄大幅蝕讓

另外,投資者劉軍沽售海防道32至33A寶豐大廈地下D舖作價1.3億,持貨6年貶值57%。盛滙商舖基金創辦人李根興表示,隨着住宅興旺,投資者套現了不少資金,相信「下一輪」旺場將會輸到工商舖,資金亦會逐漸流向工商舖。

該行另一代理則表示,3月份工商舖範疇當中,工廈交投相對表現佳,3月份錄130宗,較2月份的110宗上升18%。不過,整體金額下跌,只有7.78億,較2月份減少30.5%。

(星島日報)

更多88WL寫字樓出租樓盤資訊請參閱:88WL寫字樓出租

更多上環區甲級寫字樓出租樓盤資訊請參閱:上環區甲級寫字樓出租

佐敦複式巨舖1.45億放售

資深投資者、有「太子鄧」之稱的太子珠寶鐘錶主席及行政總裁鄧鉅明,有意減持投資物業,委託代理放售佐敦多層複式舖位,意向價1.45億元。

有本港代理行代理表示,佐敦道39至39A號根德大廈地下2號舖及1樓至2樓,現推出放售,地下建築面積約1700方呎,1樓及2樓建築面積分別約2800及2200方呎,合共總建築面積約6700方呎,意向售價約1.45億元,意向呎價約2.16萬元。

上址位處佐敦道及炮台街單邊,鄰近廟街,現分間成多個舖位出租。資料顯示,鄧鉅明於2010年7月,向「舖王」鄧成波家族購入上述複式舖位,當時作價5700萬元,目前叫價較購入價高出8800萬元或1.5倍。

舖位錄蝕讓買賣,消息指出,西營盤第二街88號怡豐閣地下6號舖,建築面積約300方呎,舖位面向常豐里,有指以500萬元成交,呎價約1.67萬元。舖位由裝修設計公司租用,月租1.2萬元,買家可享2.9厘租金回報。

資料顯示,原業主於2015年4月以1268萬元入市,持貨9年,賬面大幅虧損768萬元,勁蝕60.6%離場。

此外,新蒲崗大有街2至4號旺景工業大廈5樓H室,建築面積2424方呎,以668萬元售出,呎價約2756元。原業主為一家本地醬油廠,於2020年12月斥資943萬元購入,賬面蝕275萬元或29.2%。

(信報)

Blue Coast to kick off sales as buyers clamor for new homes

New homes in Hong Kong continued to remain in demand following the removal of all stamp duties a little over a month ago, with CK Asset (1113) collecting 24,000 checks for its Blue Coast project at The Southside in Wong Chuk Hang.

Wheelock Properties and Henderson Land (0012) meanwhile revealed they had notched up home sales worth HK$9.1 billion and HK$8.3 billion respectively so far this year.

The 24,000 checks received for Blue Coast near Wong Chuk Hang MTR station made the first batch of 442 flats nearly 56 times oversubscribed.

The developer will launch sales for the first batch tomorrow and may hike prices by as much as 10 percent for some flats on future price lists.

CK Asset's chief sales manager William Kwok Tze-wai said that even if the prices are hiked by 5 to 10 percent, the company would still be at the losing end.

Prices for the first list for 138 units were HK$21,968 per square foot on average after discounts, the lowest among all completed projects in the neighborhood, while prices for third price list were up to 1.7 percent higher than the first list.

Kwok said demand was dominated by local buyers, with mainlanders accounted for about 30 percent of interested buyers.

The four-bedroom flats on higher floors may be put up for sale by tender in the second round of sales.

Meanwhile, Henderson Land and Wheelock Properties have fared very well in the primary market for first quarter of the year.

Henderson Land has earned more than HK$8.3 billion this year and ranks first in terms of deals with 1,227 transactions.

Wheelock Properties meanwhile achieved the most revenue with sales of nearly HK$9.1 billion from 815 transactions.

In other news, The Knightsbridge in Kai Tak, developed by Henderson Land (0012) and other five companies, has sold 19 flats and raked in HK$760 million since the removal of all property curbs on February 28.

And Wetland Seasons Bay phase 3 in Tin Shui Wai has put another batch of 52 flats on the market, with the cheapest priced at HK$3.9 million.

(The Standard)馬會預租航天城1.3萬呎樓面

香港賽馬會預租新世界旗下機場航天城11 SKIES樓面,設立投注站,根據馬會提交區議會文件披露,在11 SKIES的M樓層預留一個面積13283方呎的舖位,作為新投注處的選址,並增添餐飲、消閒及數碼化投注設施,希望藉此向旅客推廣本地賽馬文化的窗口,將在2025年運作。

根據馬會網頁顯示,現時馬會在全港擁有逾80間投注站,在離島區分別有東涌逸東邨、梅窩及長洲3個投注站。

馬會指出,該舖位以旅客及機場過境人士為主要目標顧客群,並介紹已有近140年歷史的賽馬娛樂文化;同時提供模擬賽馬體驗及餐飲服務。馬會形容:「馬照跑、舞照跳」是香港社會繁榮穩定的重要標誌,也象徵成功貫徹落實「一國兩制」方針。

2025年投入運作

11 SKIES總樓面達380萬方呎,將設有全港最大室內遊樂空間,包括藝術博物館ARTE MUSEUM,以及4D動感飛行影院等等。

添餐飲消閒等設施

泛海國際等相關人士旗下中環泛海大廈基座近2萬呎巨舖,獲瑞士高檔護膚品牌La Prairie短租作期間限定店,為時1星期,市場人士料租金約12萬。

皇后大道中59至65號泛海大廈地舖及1樓,位於砵甸戶街交界,總樓面約19075方呎,由瑞士高檔護膚品牌La Prairie短租約一星期,市場人士料租金12萬,該舖位正在營運,舖位外牆已換上藍色主調,據La Prairie網站資料,上述期間限定店於3月30日至4月7日營運。

上述舖位於2013年由英國時裝品牌TOPSHOP承租,作為攻港的首間店舖,月租高達300萬,及後在2017年續約時,月租降至約150萬,2020年8月份,TOPSHOP宣布結業撤出香港,該旗艦店在2020年10月因租約期滿結業。

(星島日報)

更多泛海大廈寫字樓出租樓盤資訊請參閱:泛海大廈寫字樓出租

更多中環區甲級寫字樓出租樓盤資訊請參閱:中環區甲級寫字樓出租首季工商舖錄681宗註冊 本港代理行:較去年同期減30%

今年首季工商舖承接上年年底弱勢。有本港代理行綜合土地註冊處資料顯示,首季工商舖共錄681宗註冊,按年減約30.4%,金額錄105.63億,按年跌約14.1%。該行認為經濟尚未完全恢復,相信中短期內,工商舖市難以重返疫情前的表現。

市況難以重返疫情前

今年首季工商舖三板塊宗數全線下跌,工廈錄352宗註冊,按年減約29.2%。商廈及商舖分別錄142宗及187宗註冊,按年跌約29.7%及33%。

三板塊宗數全線下跌

該行代理料工商舖交投見底。日本央行3月決定加息,為07年來首次,經濟仍疲弱,料保持寬鬆貨幣政策。短期而言日本退出負利率政策對國際市場影響有限。

(星島日報)

Secondary home sales take a beating amid new launches

Secondary home sales in Hong Kong fell into the single digits for the first time since all property curbs were removed six weeks ago, as prospective buyers continued to flock to new projects.

The 10 major housing estates recorded only nine deals, below double digits for the first time since February 28, when all stamp duties were scrapped, according to a local property agency.

The number of deals fell by 18.2 percent over the previous weekend.

Three estates reported zero deals, including Kornhill in Quarry Bay, South Horizons in Ap Lei Chau and Whampoa Garden in Whampoa

An agent said buyers were attracted to the new projects priced at market levels.

Meanwhile, some 75 estates around the MTR stations witnessed 483 second-hand deals last month, up by 22 percent from a month ago, another local property agency reported.

Seven of the most actively traded 10 estates tracked by the agency reported price increases in March with South Horizons, in the south of the Hong Kong Island, seeing the largest increase in the average price per square foot of 7.1 percent to HK$13,725 from a month ago.

Prices at Whampoa Garden in Hung Hom dropped by 6.2 percent monthly to HK$12,150 per sq ft on average.

In the primary market, Wheelock Properties plans to launch Park Seasons - Phase 12B of Lohas Park - as early as this month to offer 685 units, intensifying the race for new home buyers. As the biggest phase in Lohas Park, Park Seasons's one- and two-bedroom flats range from 314 to 537 sq ft.

Executive director Ricky Wong Kwong-yiu said prices will be released in this week and all flats will be priced below HK$10 million. The developer plans to increase prices by up to 10 percent from the last phase.

Phase 12A of Lohas Park, Seasons Place, was launched last month and has raked in around HK$3.47 billion from the sale of 548 flats.

CK Asset (1113), meanwhile, has put 88 more flats at Blue Coast near Wong Chuk Hang MTR station up for sale and raised the average price by 3 percent to HK$23,233 per sq ft after discounts. The new batch of flats range from 454 sq ft to 1,267 sq ft, featuring two to four bedrooms.

It gained nearly HK$7.5 billion by selling 96 percent of 422 units at Blue Coast in the first round of sales on Saturday, and the three-bedroom flats were the first to sell out. The developer said it will keep increasing the prices of flats in future lists.

Executive director Justin Chiu Kwok-hung said sales are going faster than expected.

The primary market recorded 4,895 deals in the first quarter, over 110 percent higher than the previous three-month period and the highest after the second quarter of 2019, according to the Sales of First-hand Residential Properties e-platform.

(The Standard)

業主大幅減價 逾億元買賣增

工商舖市況仍一般,而個別業主急於套現,願大幅降價放售物業,即吸引投資者承接,令大手買賣個案增。

近期業主減價沽貨個案增,而最大手成交為高盛、凱龍瑞等基金放售逾1年的上環全新商廈88WL,近日獲數個財團爭奪,包括用家及投資者,最終獲本地財團以約7.5億元承接。

大廈樓高24層,於去年落成,質素相當不俗。每層面積約3,988至4,253平方呎,可作傳統商業用途及半零售成分,每層可分間成6單位,面積由數百平方呎起。據了解,現時大廈出租率近半,平均呎租逾40元。

基金沽上環全幢 料蝕至少6億

凱龍瑞基金早年購入永樂街3舊樓地盤,共涉約9.62億元,其後引入基金投資進行重建,去年落成。惟自疫情後,商廈租售價出現大幅回調,而基金早於去年中曾放售物業,叫價約13.5億元,未獲承接,半年後再委託測量師行放售,降價至約9億元,如今再降價至約7.5億元沽出,以總樓面約90,199平方呎計,呎價約8,315元。

未計建築費已蝕約2億元,若連同起樓成本,保守蝕至少6億元離場,為近年商廈最大手蝕讓。市場人士指,新買家為建滔集團或有關人士。該集團早年亦有投資上環商廈,2010年以約6.6億元向南豐購入上環蘇杭街69號「The Chelsea」全幢商廈,其後於2019年商廈高峰期,以約19億元售予基金,相信是次有見價格大幅回調,以低價入市作長綫投資。

灣仔全幢商住 1.68億沽

另消息指,鄧成波家族以約1.68億元,沽出灣仔軒尼詩道168至170號煥然樓全幢商住大廈,總樓面面積約2.24萬平方呎,呎價僅約7,500元。該物業地盤面積約1,915平方呎,現時為一幢14層高商住大樓,地下至閣樓為商舖,1樓至12樓為住宅。鄧成波於2016年以約3.03億元購入,早年曾以約4億元放售,其後該家族減價3成至約2.8億元,如今大幅減價至約1.68億元沽出,持貨8年勁蝕約1.35億元,幅度達45%。

商舖方面,尖沙咀海防道32至33A寶豐大廈地下D舖連閣樓,以約1.3億元成交。舖位現由時裝店承租,月租約25萬元,目前回報率2.3厘。由於地段為海防道旺段,相信新買家看好旅客陸續重返,舖位租金日後將回升,故趁低價購入。

翻查資料,投資者劉軍於2017年6月以約3億元購入該舖,早前曾以約3.5億元放售舖位,其後多番減價,最終大幅降至約1.3億元沽出。持貨接近7年,帳面蝕讓約1.7億元,物業貶值約57%。

分析指,高息環境下投資氣氛仍一般,個別業主因有沽貨壓力,近期減價幅度明顯。同時間,投資者見物業價格已較高峰期回調4至5成,便開始趁低吸納,令近期大額成交稍增。

(經濟日報)

更多88WL寫字樓出租樓盤資訊請參閱:88WL寫字樓出租

更多The Chelsea寫字樓出租樓盤資訊請參閱:The Chelsea 寫字樓出租

更多上環區甲級寫字樓出租樓盤資訊請參閱:上環區甲級寫字樓出租

中環一號廣場 近蘇豪區合半零售

中環擺花街一號廣場鄰近蘇豪區,加上每層面積不算大,最適合半零售商戶使用。

中環一號廣場位於擺花街1號,處中環擺花街及威靈頓街交界,從位置上看屬中環半山地段,略偏離中環核心商業區地段。不過,該廈位處地段鄰近蘇豪區一帶,附近既有酒吧、特色餐廳,亦有大館等建築物,因此整體觀感甚佳,非常適合餐廳、半零售商戶落戶,或有特色辦公室。

交通方面,從港鐵站出口,經半山扶手電梯步行至該廈,需時10分鐘左右,附近亦有數條巴士綫可到達該廈。大廈地下有上落客停車處,交通上不及同區核心段商廈便利。飲食配套上,大廈位處中環餐飲段的正中心,鄰近蘭桂坊,有大量特色餐廳及酒吧選擇。

另外,附近亦有新商業項目,如擺花街9至19號新世界 (00017) 地盤正在施工中,擬建一幢22層及另有1層低層地下的商業大廈,總樓面面積約65,706平方呎。另外,資本策略 (00497) 發展的中環威靈頓街92號即將落成,去年德林控股 (01709) 公布,投資近3億元購買該廈最高5層,亦獲得該物業的冠名權,將命名為「德林大廈」(DL Tower),以5層總樓面約1.16萬平方呎計,呎價約2.53萬元。

每層約4005呎 實用率7成

物業於1993年落成,地下多層為舖位,現由餐廳租用。大廈用戶主要為半零售成分,除了中式餐廳外,亦有美容、藝廊、鐘錶維修店等,門口設有燈廂展示各公司樓層。大廈提供3部升降機,通往各樓層。

寫字樓為4至20樓,設計上採用玻璃幕牆,觀感不俗。物業每層樓面約4,005平方呎,實用率約7成,樓底高2.7米。因樓面不算大,非常適合半零售商戶使用全層,另每層樓面最多可分間成4個單位,面積由500餘平方呎起,中細公司亦合使用。景觀上,附近大廈林立,因此以樓景為主,中高樓層景觀較為開揚。

買賣方面,該廈放盤不算多,對上一宗成交已為2022年,物業5樓全層,面積約4,005平方呎,成交價6,375萬元,呎價約15,918元。原業主2011年4月以4,165.2萬元購入,持貨11年,帳面獲利2,209.8萬元。

(經濟日報)

更多一號廣場寫字樓出售樓盤資訊請參閱:一號廣場寫字樓出售

更多德林大廈寫字樓出售樓盤資訊請參閱:德林大廈寫字樓出售

更多中環區甲級寫字樓出售樓盤資訊請參閱:中環區甲級寫字樓出售

葵涌新都會廣場呎價8300元售 持貨19年升值1.4倍

新都會廣場為葵涌區內指標甲廈,該廈近期錄今年以來第3宗買賣,該廈2座高層一個單位,以1199.35萬易手,物業於19年間升值1.4倍。

上址為新都會廣場第2座4312室,建築面積約1445方呎,以每呎8300元易手,涉資1199.35萬,原業主於2005年4月以496萬購入,持貨19年帳面獲利703.35萬,物業升值1.4倍。

成交價1199萬

該廈對上1宗成交為第2座極高層01室,單位屬銀主盤,建築面積約3131方呎,以約2192萬沽出,平均呎價約7000元,該單位業主於1992年,以約1268萬購入,惟淪為銀主盤,若以購入價計算,物業於32年間僅升值73%。

新都會廣場擁有2座甲廈,基座為大型商場,商場設行人天橋接駁葵芳港鐵站,步程僅需3至5分鐘,該廈亦連接葵涌廣場商場,專售價廉物美的時裝潮流產品,商場內食肆聚集,該廣場由新地發展,物業於1993年落成,設有2座商廈項目,1座由大業主持有收租,另2座業權分散,已賣散的2座商廈,樓高46層,寫字樓層7樓起,全層面積約1.6萬方呎,每層設有約12個單位,室內間隔靈活,室內開則呈八角形,部分單位設兩邊窗,景觀開揚,另部分單位長方形間隔。

(星島日報)

更多新都會廣場寫字樓出售樓盤資訊請參閱:新都會廣場寫字樓出售

更多葵涌區甲級寫字樓出售樓盤資訊請參閱:葵涌區甲級寫字樓出售

Applications for presale consent hit two-year high

Developers applied for presale consent for five residential projects involving 4,904 flats last month - a more than two-year high - while only one home was completed in February, the lowest monthly figure in three-and-a-half years, separate official data showed.

Data from the Lands Department yesterday revealed that the number of units involved in March applications surged 187 percent from February, the highest since January 2022.

Among the projects that have applied for presale consent, a notable one would be CK Asset's (1113) project at Anderson Road in Kwun Tong.

The developer acquired the site for HK$4.95 billion in May 2020.

The project will offer a total of 2,926 flats and is expected to be completed by the end of September 2026.

Meanwhile, figures from the Rating and Valuation Department yesterday showed that the number of private home completions stood at one in February. That compares with 3,593 units completed in January.

The combined completion of 3,594 units for the first two months is 16.1 percent of the full-year target of 22,300 units.

Elsewhere, Wheelock Properties is expected to release the first price list for Park Seasons, Phase 12B of Lohas Park, in Tseung Kwan O this week, which will offer at least 138 flats.

Executive director Ricky Wong Kwong-yiu said the prices may have room for a 5 to 10 percent increase compared to Seasons Place, Phase 12A of Lohas Park, adding that the starting price, however, could be lower due to the smaller size of the units at Park Seasons.

This came as CK Asset's Blue Coast atop Wong Chuk Hang MTR Station may start the second round of sales this weekend.

The 88 flats on the fourth price list were oversubscribed over 44 times after receiving more than 4,000 checks.

Separately, CSI Properties (0497) has named its Nathan Road project Topside Residence, involving 259 units, with the smallest one covering 232 square feet.

The sale may start as early as this month.

(The Standard)麗新系14億 售中環友邦金融中心業權

麗新國際 (00191) 聯同系內麗新發展 (00488) 宣布,以近14.22億元出售中環友邦金融中心餘下10%權益予友邦保險 (01299) ,麗新發展將套現所得,用於償還貸款及一般營運資金。友邦保險將完全擁有友邦金融中心全部權益。

中環友邦金融中心地盤原址為富麗華酒店,該酒店業權是於1997年由麗展投得,當時作價69億元,其後適逢亞洲金融風暴,麗展分段將該物業斬件出售。物業樓高38層,提供總面積約42.9萬平方呎。據通告指,預期麗國及麗展分別錄得近1.55億元帳面虧損。

(經濟日報)

更多友邦金融中心寫字樓出租樓盤資訊請參閱:友邦金融中心寫字樓出租

更多中環區甲級寫字樓出租樓盤資訊請參閱:中環區甲級寫字樓出租

甲廈空置率16.7%創歷史新高 外資代理行:首季丟空樓面達1470萬方呎

甲廈供過於求,今年首季新增供應面積達92.52萬方呎,導致整體空置率再創歷史新高,達1470萬方呎,空置率16.7%,租金按季跌1.2%;不過,本季吸納量高達61.2萬方呎,為2018年第三季以來最高水平。

有外資代理行指,今年首季新落成的甲廈項目,預租進展緩慢,整體空置樓面達1470萬方呎,空置率創歷史新高,即16.7%,供應過剩導致租金按季跌1.2%,連續第20季下降。

租金連續第20季下跌

不過,市場吸納量改善,租賃按季增35%,達130萬方呎,淨吸納量達61.2萬方呎,自2018年第3季以來最高,除中環外,大多數核心區均錄淨吸納量,港島東7.16萬方呎,2022年第4季以來首次增長。東九地標甲廈AIRSIDE錄數宗大租賃,帶動區內淨吸納量23.33萬方呎。

該行代理表示,近三分一新租賃由銀行金融業推動,政府機構亦是好租客,展望未來,企業繼續控制成本,供應增加,預計空置升租金受壓。

去年全年零售業銷貨額增長16.2%,1月較去年同期升0.9%,2月份升1.9%,為連續15個月上升,租賃需求導致空置率按季跌2.5個百分點至6.6%,為2019年第四季以來最低。4核心區空置率均個位數,2018年第二季以來首次出現。

核心區舖空置率錄個位數

中環空置率跌幅最大,下降5.3個百分點至6.6%,尖沙咀及旺角空置率分別降2.9及2.3個百分點,至5.8%和7.4%。銅鑼灣空置率維持不變,空置率下降導致核心區街舖租按季升2.7%,2022年第3季以來最大增幅。

該行另一代理表示,選擇減少,首季租賃勢頭減弱,部分食肆縮小規模,核心區舖租升2.7%,為2022年第3季度以來最大按季增幅。該行另一代理表示,倉庫空置率上升0.2個百分點至5.6%,租戶縮規模,倉租按季跌1.1%,自2020年第4季首錄跌幅。

(星島日報)

更多AIRSIDE寫字樓出租樓盤資訊請參閱:AIRSIDE寫字樓出租

更多啟德區甲級寫字樓出租樓盤資訊請參閱:啟德區甲級寫字樓出租

代理行:工商舖611宗買賣按季跌11%

有本港代理行資料顯示,第一季市場共錄約611宗工商舖買賣,總金額約187.83億元,按季分別跌約11%及7%,季度成交量更較過去20年逆境時期更淡靜,創有紀錄以來最低交投量。

宗數有紀錄以來新低

今年第一季工商舖市況欠佳,發展商及投資者積極出貨,議價空間擴大,有見減息周期將至,預測第2季工商舖量升價跌,料交投量約750宗,金額約145億元,租售價維持現水平,或最多跌幅約5%。

該行代理表示,今季工商舖成交宗數為有紀錄以來新低,對比2003年沙士、2008年金融海嘯、2013年工商舖加辣,至近年動亂及疫情期間表現更差。疫情期間的季度最低成交量曾錄約660宗,今季比其進一步減約7%。

該代理表示,北上消費成風,餐飲業受拖累,加上政府擬落實推行垃圾徵費,加重餐飲及零售業營運成本,令本身經營困難的店舖倍添壓力,有機會出現新一輪結業潮。

料食肆現新結業潮

該行另一代理表示,首季錄約131宗舖位成交,歷來最低,宗數跌勢自2022年第3季起,對比去年第4季約173宗跌約24%,按年同期大跌逾40%,金額受愉景新城商場以約40.20億易手所帶動,錄約71.90億元,按季增約30%,若扣除該大額交易,按季減約23%。

該行另一代理表示,首季共錄約122宗寫字樓成交,較第4季約128宗為低,按年約35%跌幅,自2023年第1季後連續4季下跌,連續7個季度宗數低於200宗。金額共約85.71億元,若扣除中環盈置大廈,季內金額僅錄約21億,為2022年第3季後新低。

該行另一代理表示,首季共錄約358宗工廈成交,按季輕微跌約7%,總金額約30.22億,按季跌約35%,量穩價跌。

(星島日報)

更多盈置大廈寫字樓出租樓盤資訊請參閱:盈置大廈寫字樓出租

更多中環區甲級寫字樓出租樓盤資訊請參閱:中環區甲級寫字樓出租

紅磡商住大廈放售 估值逾3億

有外資代理行代理表示,獲接管人委託,標售紅磡新柳街3號「Incredible Residences」及馬頭圍道96號1樓至11樓連天台 (住宅部分),截標日期為2024年5月31日 (星期五) 中午12時。

Incredible Residences於2020年完工,樓高25層,總建築面積約23,878平方呎。該商住大廈提供5個商舖和61個住宅單位,物業市值逾3億元。至於馬頭圍道96號住宅部分,市值約5,000萬元,合共約3.5億元

據了解,兩項物業原由海外投資者持有,去年曾推出標售,未獲承接,年初更被銀行接管。

(經濟日報)

舊樓有價 漢口大廈獲批作商住用

尖沙咀的商業用地供應相對罕有,而且貴為核心商業區之一,區內舊樓價值高,因此一般而言,發展商透過收購舊樓以增加在區內的土地儲備。據本報粗略統計,該區重建步伐積極,現時至少有9個重建項目正在進行,涉約112萬平方呎樓面,當中由新世界 (00017) 或相關人士持有的漢口大廈,於今年初獲批建商住項目。

9項目重建 增建112萬呎樓面

根據統計,區內現時至少9個重建項目正在進行,涉及樓面約112萬平方呎,其中有8個屬於舊樓收購重建項目,其中由新世界或相關人士持有的漢口大廈,於年初獲城規會批准重建1幢28層高的商住大廈,項目擬以地積比率約12倍重建,將提供110伙分層住宅、辦公室、及商店,總樓面涉約138,791平方呎。

項目於去年3月進行強拍,並由新世界或相關人士成功以底價約21.34億元統一物業業權,以重建後的總樓面計算,每呎樓面地價約1.5萬元。

香檳大廈改建 料擴展恒地版圖

至於另一龍頭發展商亦積極在區內擴大其商業王國,由恒地 (00012) 收購多年的香檳大廈B座亦已在今年初完成強拍程序。項目於今年1月以底價約17.28億元,成功由發展商統一業權。據發展商最新中期報告指,項目重建後的總樓面涉約14.7萬平方呎。

值得留意的是,恒地積極擴展區內的版圖,同系的美麗華商場及酒店正正位於香檳大廈旁邊,預計若香檳大廈B座成功重建後,將會產生協同效應,並將有望擴展其原有逾200萬平方呎樓面的商業王國。

事實上,各發展商積極收購區內舊樓,區內近年最大型的商業項目屬於由海員俱樂部與帝國集團合作的前海員之家,日後會重建為1座40層高酒店,總樓面約34.7萬平方呎,由發展商營運的酒店樓面涉約30萬平方呎,另約5萬平方呎樓面需預留給海員俱樂部作教堂及會所。

同時,樂風集團等於2022年亦就尖沙咀漢口道35至37號恕園大樓申請強拍,當時項目的現況市值逾6.3億元,但因發展商最後成功收購項目全數業權,所以不需循強拍途徑統一其業權。其後,項目於去年已獲屋宇署批出建築圖則,並獲准重建1幢21層高商廈,涉及總樓面約11.53萬平方呎。

(經濟日報)

Debt-saddled Lai Sun Development sells stake in insurer AIA Group’s Hong Kong headquarters

A wholly-owned unit of the developer has sold its equity stake in the AIA Central skyscraper for HK$1.42 billion (US$180 million) in a bid to boost its liquidity

Lai Sun Development was saddled with total liabilities of more than HK$34.69 billion for the six months ended January 31, according to its interim results

A wholly-owned unit of Lai Sun Development Company, a Hong Kong property firm, has sold its equity stake in the AIA Central skyscraper for HK$1.42 billion (US$180 million) in a bid to boost its liquidity.

The move comes just a few weeks after the developer disposed of its interest in an industrial building in the city as it tries to overturn a mountain of debt.

Lai Sun said it has signed an agreement to sell its unit Peakflow Profits’ shareholdings in Bayshore Development, the owner of AIA Central, to Grand Design Development, which is a subsidiary of insurance giant AIA Group.

The 38-storey office tower at 1 Connaught Road Central has served as the regional headquarters of Asia’s biggest insurer since 2005.

Peakflow Profits is a wholly-owned subsidiary of Lai Sun Development and an indirect, non-wholly-owned unit of Lai Sun Garment (International), according to an exchange filing.

AIA Group will hold the remaining equity stake in Bayshore Development after the disposal.

The proceeds of the sale will go towards repayment of bank loans and general working capital for Lai Sun Development, the companies said in a statement.

Lai Sun Development was saddled with total liabilities of more than HK$34.69 billion for the six months ended January 31, according to its interim results.

Each of the Lai Sun units is expected to record a loss of about HK$154.6 million on the disposal, according to the filing to the Hong Kong stock exchange.

“The disposal enables the vendor to realise the value of the property investment, thereby enhancing the cash flow and financial position of the LSG Group and the LSD Group as a whole,” the companies said, adding that the deal is “prudent” while the terms and conditions of the sale are “fair and reasonable”.

In mid-March, Lai Sun Development sold some of its property assets in the Wyler Centre Phase II, an industrial building in Kwai Chung, including the 20th floor and its parking spaces on the second floor, for HK$80 million – an estimated loss of HK$6 million.

The company said in a filing on March 15 that the sale represented its “commitment to its noncore asset disposal plan” aimed at enabling it to reallocate more financial resources to capital structure enhancement.

(South China Morning Post)

For more information of Office for Lease at AIA Central please visit: Office for Lease at AIA Central

For more information of Grade A Office for Lease in Central please visit: Grade A Office for Lease in Central

Luxury home deals soar in first quarter

Luxury home deals on The Peak and in the Southern District jumped 1.4 times to 22 in the first three months of 2024 over the previous quarter, and the turnover soared over 13 times to HK$3.4 billion, a local property agency said.

Among them, there were six deals worth more than HK$100 million, versus none in the fourth quarter of last year. Three new luxury homes were sold in the first quarter worth HK$1.27 billion, and 19 deals were reported in the secondary market for a total of HK$2.14 billion, the agency said.

A house was sold for HK$333.55 million at Mount Pokfulam yesterday, a project co-developed by Wang On Properties (1243) and Kam Wah Property.

And a 1,290-square-foot unit with a roof top at The Avenue 2 in Wachai was rented out for HK$115,000 per month by an expat.

Meanwhile, the mass residential market continued to remain active. New projects raised prices and reduced discounts after drawing buyers from the secondary market, which recorded more losses.

CK Asset (1113) revealed its the fifth price list, putting up 96 units at Blue Coast in Wong Chuk Hang for sale. The average price after discounts was raised by 4 percent to HK$25,307 per square foot.

The fourth price list had an average price of HK$24,289 per sq ft after discounts. CK Asset has increased prices four times since the initial price list, which hit a five-year low with an average of HK$ 21,968 per sq ft.

CK Asset executive director Justin Chiu Kwok-hung said that all flats for the phase 3B of Blue Coast have been put up for sale. The company plans to release the phase 3C in the middle of this year, hoping that selling prices will stay ahead of costs to ensure no more losses.

The average cost per sq ft for Blue Coast is HK$28,000.

A total of 413 units have been sold so far, around 98 percent of flats in the first round of sales. The developers have raked in HK$7.6 billion with an average transaction price of HK$24,000 per sq ft.

In other news, OnMantin atop Ho Man Tin MTR station, which was jointly developed by Great Eagle (0041) and MTR Corp (0066), may be launched as early as this month. The project comprises five towers with 990 homes and is estimated to be completed in March 2025.

Star Properties has put up 57 flats for sale at After The Rain in Yuen Long, carrying an average price of HK$13,992 per sq ft after discounts.

K&K Property put up 10 flats for sale at One Stanley, located at 128 Wong Ma Kok Road, for tender yesterday.

And Henderson Land (0012) has adjusted its price lists for Square Mile in Tai Kok Tsui to reduce discounts that were offered during the Spring Festival.

In other news, a two-bedroom flat in Euston Court in Hong Kong Island saw a HK$1.4 million loss when it was sold for HK$8 million. The seller had bought the unit for HK$9.4 million in March 2023, which depreciated roughly 15 percent in a year.

(The Standard)上環新紀元甲廈呎價1.2萬售 較高峰期跌逾50%連約回報4厘

甲廈市場吹淡風,有投資者趁勢吸納,上環皇后大道中181號新紀元廣場一個面積逾1萬方呎單位,以1.23億易手,平均呎價12103元,較高峰期下跌逾50%,買家為內地投資者,料回報4厘。

市場消息透露,上址為皇后大道中181號新紀元廣場8樓03、05及07室,建築面積約10163方呎,以易手價1.23億計算,呎價約1.2萬水平。

內地投資者1.23億購

據悉,由內地商人吸納,看中目前甲廈價格大跌,趁機吸納作為投資用途,目前該單位市值呎租約40元,料回報約4厘。

原業主為萬途洋行,於2009年11月以1.344237億購入,持貨逾14年,帳面獲利1442.37萬,物業升值10.7%。

建築面積10163方呎

該廈於2018年高峰期,呎價普遍逾2.5萬,高座的中遠大廈更有個別單位呎價突破4萬,儘管上述為低層單位,質素未比得上景觀開揚的高層戶,不過,對比高峰期,該單位售價亦至少跌逾50%。

大道東商住樓市值5億

2018年4月,新紀元廣場高座中遠大廈30樓01及13室,以1.25億易手,建築面積3079方呎,呎價40597元,創該廈呎價新高,當時亦刷新上環商廈新高紀錄。

有外資代理行表示,灣仔皇后大道東98號至108號 (104號3樓除外) 推出放售,現時市值約5億,較2020年放售時市值約8.5億低40%。該物業為4幢舊唐樓,佔地面積約4870方呎。該行代理表示,皇后大道東屬灣仔區黃金地段,物業距離港鐵灣仔站僅6分鐘步程。

(星島日報)

更多皇后大道中181號寫字樓出售樓盤資訊請參閱:皇后大道中181號寫字樓出售

更多中遠大廈寫字樓出售樓盤資訊請參閱:中遠大廈寫字樓出售

更多上環區甲級寫字樓出售樓盤資訊請參閱:上環區甲級寫字樓出售

新世界1.15億沽西貢傲瀧商場

新世界續沽售非核心物業,旗下位處西貢的傲瀧商場及52個車位,以1.15億易手,平均呎價5347元,新買家料回報逾4厘。

平均呎價5347元

上述為傲瀧商場,建築面積21506方呎,連同52個車位,其中商場地下及1樓由餐廳及家品店承租,租約至2026年1月,月租17.42萬,2樓及3樓由建身中心承租,租約至2026年8月,月租18萬,月租收入合共35.42萬,另車位尚未出租,料每個車位市值月租逾2000元,月收約10.4萬,月租合共45.82萬,料回報逾4.7厘。

市場消息指,新買家以富貴星有限公司名義購入物業,公司董事黃關林,與上市公司申洲國際執行董事兼總經理同名同姓,相信為同一人。

申洲國際經營織布、染整、印繡花、裁剪與縫製各類紡織產品,包括睡衣、休閒衣服,全球員工逾9萬人,主要市場包括內地、日本及歐美市場。

連同52個車位

近期新世界頻沽售非核心物業,最矚目為荃灣愉景新城商場連車位,作價40.2億,成2017年以來本港最大單一商場交易,呎價約8600元,連同設有1000個車位的停車場,預計今年4月完成交易。

料回報逾4.7厘

新世界於今年1月,亦沽河內道等一籃子舖位,作約2億,該批舖位租客以小本經營為主,以食肆佔大比數,其他有銀器店及裁縫等,在2012年後舖市大起飛年代,這些舖位大部分加租幅度輕微,商戶經營穩定。

在經歷舖市大起落後,去年新世界將該籃子舖位合共8個舖位,推出市場放售,由於該一籃子舖位,為買家提供逾4厘回報,最終在今年1月淡市下成功出貨,舖位以逾2億易手,舖位全部錄蝕讓,幅度30%至40%。

(星島日報)

東瀛遊廣場全層放售 呎價10年低

發展局於去年就觀塘市中心第四及第五區巨無霸商業項目建議採用「垂直城市」的發展概念,容許作住宅、商業、辦公室及酒店等混合發展,為日後觀塘商貿區增添多元化商業色彩,區內發展前景更見亮麗,有業主趁勢放售區內優質商廈東瀛遊廣場高層全層物業,以呎價創10年低價作招徠,意向呎價僅需約6,500元。

叫價克制 意向呎價6499元

有代理表示,招標項目位於觀塘鴻圖道83號東瀛遊廣場23樓全層,面積約12,029平方呎,意向價約7,818萬元,呎價約6,499元,截標日期為2024年4月19日 (星期五)。

該單位將以現狀及連租約形式出售,每月總租金收入共約23.8萬元,料新買家可享租金回報約3.7厘。單位坐擁開揚景觀,可遠眺鯉魚門海景,內籠亦配備基本寫字樓裝修及間隔。而考慮到用家需要,業主亦可與現有租客協商,提供彈性予新買家可以全層交吉形式購入單位。

租金回報3.7厘 可交吉購入

該代理補充,由於業主希望重組投資組合,考慮到市場需要,故定價相當克制,全層單位意向呎價創區內近10年新低。翻查資料顯示,該廈最近一宗同類型全層樓面成交要追溯至2020年10月,售出之樓層為35樓,單位面積約10,875平方呎,成交價約9,787.5萬元,平均呎價約9,000元,而按此成交價計算,與招標單位呎價差距約28%。

該代理續指,政府多年來致力於塑造東九龍為優質的寫字樓樞紐,近年積極牽頭將個別辦事處總部遷至該區,此外,在疫情後辦公模式改變及商廈租金回調的影響下,亦令不少企業轉租東九龍的優質商廈,因而吸引不少投資者入市該區物業作長綫投資。

據資料顯示,今年首季 (截至3月12日) 觀塘區已錄得約16宗商廈買賣成交,較上一季僅約3宗大增約4.3倍,亦創自2022年首季後新高,反映投資者傾向看好區內商廈呎價值博率高。另一方面,區內租賃情況亦漸入佳境,2月份錄得約43宗租賃成交,按月大幅增加約53%,租金方面亦穩步上升,平均呎租亦由1月份的約22元上升至2月份的約24元。莊氏認為,隨着觀塘區商貿區發展完善,加上新興「垂直城市」等發展概念,區內商業氣氛會愈趨濃厚,東瀛遊廣場的呎租及呎價料將持續上升,預料中長綫投資者會趁早吸納區內項目。

(經濟日報)

更多東瀛遊廣場寫字樓出售樓盤資訊請參閱:東瀛遊廣場寫字樓出售

更多觀塘區甲級寫字樓出售樓盤資訊請參閱:觀塘區甲級寫字樓出售

有代理表示,長沙灣荔枝角道888號南商金融創新中心,獲買家購入3個高層單位,建築面積合共約5232方呎,總成交金額8430萬元,呎價約16112元。

該行指出,近年發展商積極在九龍西布局,甲級商圈已逐漸形成,吸引不少大型租戶爭相進駐,高質的甲廈更備受高增值產業青睞,升值潛力無限。

(信報)

更多南商金融創新中心寫字樓出售樓盤資訊請參閱:南商金融創新中心寫字樓出售

更多長沙灣區甲級寫字樓出售樓盤資訊請參閱:長沙灣區甲級寫字樓出售寫字樓買賣 首季跌至122宗

有本港代理行統計指,首季寫字樓買賣宗數微跌。

據該代理行最新數字,2024年第一季市場共錄得約122宗寫字樓買賣成交,較對上一季約128宗為低,按年對比則續有約35%跌幅,自2023年第一季後連續4個季度錄得跌幅,更為連續第7個季度之買賣成交宗數低於200宗。

買賣總成交金額方面則受惠於個別大手全幢商廈易手所支持,全季共有約85.71億元,若扣除中環盈置大廈全幢交易,季內成交金額僅錄得約21億元,為2022年第三季後新低。按月表現方面,3月份買賣宗數僅錄得32宗,為自2023年以來按月第二新低。租賃市場走勢繼續尋底,第一季共錄得約1,188宗租務個案,成交金額錄得約1.18億元,按季計分別下跌約9%及20%,而較按年同期亦減少約12%及14%,反映市場對寫字樓租務需求持續下滑。

指標商廈整體表現疲弱,港九指標商廈於第一季共錄得9宗買賣成交,當中香港指標商廈僅錄得1宗,比對去年同期的9宗急跌,而今年首季港九指標商廈租務宗數則為126宗,當中首季港島指標商廈租務成交宗數為80宗,較去年第四季高出12%,但長期未能突破100宗水平,而九龍指標商廈於第一季僅錄得46宗租務成交,較去年第四季下調近30%,為2022年第三季後再度跌穿50宗。

港島甲廈空置率12.56%

寫字樓空置率持續高企,港島區甲廈整體空置率錄得約12.56%,其中一綫核心區如金鐘的最新甲廈空置率為9.02%,中環錄得11.92%。九龍區方面,整體甲廈空置率錄得約14.19%,其中以東九龍情況最為嚴峻,觀塘區為14.18%,九龍灣更高達21.84%。

該行代理分析,商廈市場自2019年來一直處於低潮期,雖然疫情已消退,但環球經濟市道仍然疲弱,香港亞洲金融中心地位受壓,加上企業暫緩擴展業務步伐,種種因素令寫字樓租賣需求遞減。同時,面對經濟嚴峻市況加劇,以及本港踏入商廈新供應高峰期,單是今年計,據差餉物業估價署資料顯示,2024年預測新寫字樓供應逾168萬平方呎,市場消化速度遠遠趕不上新供應,商廈市況雪上加霜。

展望第二季寫字樓租務成交量會略為平穩,預測第二季租務交投會見平穩,料會有1,350宗水平,租金則平穩發展,個別地區料繼續有約5%下跌空間。買賣方面則維持於約120宗水平,但呎價就同樣預測會繼續下調,幅度約5%。

(經濟日報)

更多盈置大廈寫字樓出租樓盤資訊請參閱:盈置大廈寫字樓出租

更多中環區甲級寫字樓出租樓盤資訊請參閱:中環區甲級寫字樓出租

高息持續 首季大手成交淡靜

統計指,去年尾息口持續高企至今年,令今年首季大手買賣進一步淡靜,合共僅涉約132億元。

據一間外資代理行最新統計,2024年第一季度商業地產投資額 (成交金額超過7,700萬元,不包括純土地或相關交易) 按季微跌5.5%,至132億港元。

該行分析,投資勢頭放緩部分,因美聯儲決定在2024年第一季維持利率不變。一個月期香港銀行同業拆息 (HIBOR) 從2023年12月的5.6%降至今年3月份的4.8%,而香港最優惠貸款利率則維持不變。

兩宗大手買賣 佔投資額逾8成

首季僅錄得13宗大手交易,其中兩宗重大交易佔總投資額的84%,包括新世界(00017) 以約40.2億元沽出荃灣愉景新城商場予同區大地主華懋,屬於2017年後最大宗單一商用物業成交紀錄,D•PARK原本由新世界及香港興業 (00480) 合作發展,各佔一半權益,屬於愉景新城屋苑的基座商場,1997年落成,2010年新世界斥資約13.78億元向香港興業購入餘下一半權益。若果以商場及停車場一半權益作價約13.78億元計算,相當於當時整個商場市值約27.56億元,現時新世界以約40.2億元出售整個商場,物業持貨14年升值46%。物業總樓面逾60萬平方呎,連同逾千個車位。

另一宗大手買賣,為投資者「越南朱」朱立基以作價約64億元,沽出中環商廈盈置大廈,新買家為台灣跨國軟件公司「趨勢科技」創辦人兼董事長張明正的相關人士,屬於近年台灣資金於本港樓市最大的單一投資。盈置大廈前身為恒生大廈,1962年落成,全幢樓面約264,622平方呎,早於2006年由摩根士丹利以約22.58億元承接,其後翻新大廈,而朱立基則於2009年9月以約36億元購入盈置大廈。

外資代理行看好全幢住宅租賃市場

該行代理表示,政府在2月份撤除所有辣招,及放寬商業物業的按揭成數上限,為投資者提供了更友善的環境。然而,在持續高利率的情況下,負利差仍然為投資者的一大障礙。首季度投資需求尚未出現明顯復甦,但整體投資額較對上一季仍保持韌性。

後市上,該代理指寫字樓和倉庫物業的價格調整已經放緩,而零售物業的價格調整正在上升。若果下半年有進一步減息的跡象,預計投資勢頭將逐步加速。範疇上,他較看好住宅租賃市場,包括全幢住宅改裝成學生宿舍、服務式住宅等。

(經濟日報)

更多盈置大廈寫字樓出租樓盤資訊請參閱:盈置大廈寫字樓出租

更多中環區甲級寫字樓出租樓盤資訊請參閱:中環區甲級寫字樓出租

新世界 (00017) 旗下長沙灣商廈南商金融創新中心再錄成交,高層兩伙以4,230萬沽出,據悉買家為內地上市公司高層。

據指新沽出的兩伙屬於高層A1及B12室,分別面積為1,964及790平方呎,以合共4,230萬元易手,呎價約1.5萬元。

近日南商金融創新中心銷情加快,另外3間高層單位日前以8,430萬元沽出,面積合共約5,232平方呎,呎價約16,112元。

(經濟日報)

更多南商金融創新中心寫字樓出售樓盤資訊請參閱:南商金融創新中心寫字樓出售

更多長沙灣區甲級寫字樓出售樓盤資訊請參閱:長沙灣區甲級寫字樓出售

名錶店40萬租中環舖 較舊租升3成

新世界大廈1700呎舖位 呎租約235元

通關後核心區舖位租務明顯加快,新世界大廈地下舖位,獲名錶店以每月約40萬元租用,較舊租升約3成。另有量師行預計,旅客重返可望帶動今年核心區舖位租金升約1成。

中環再錄商舖租務成交,皇后大道中新世界大廈地下舖位租出,涉及面積約1,700平方呎,獲瑞士名錶品牌Franck Muller租用,現時舖外已掛起廣告牌,預告快將開業。該品牌本港一直設有專門店,包括尖沙咀海港城、銅鑼灣時代廣場等。

市場人士估計,是次月租涉約40萬元,呎租約235元,由於地段為中環核心區一綫地段,故租金尚算理想。翻查資料,該舖於2021年,即疫情封關期間,獲珠寶品牌APM Monaco租用,由於當時受疫情影響,核心區舖位空置率高,估計當時月租不足30萬元。按最新月租計,新租金較舊租升約3成。

太平行 7179呎舖 60萬承租

事實上,除了商店擴充外,該品牌亦有購入商廈。去年尾,Franck Muller以逾6,300萬元,向新世界 (0017) 入長沙灣全新甲廈南商金融創新中心高層3伙,平均呎價約1.5萬元,作集團自用。

隨着旅客重返,核心區舖位租務持續向好。是次租出的新世界大廈地下舖位,比鄰的皇后大道中20號太平行地下A舖及地庫,合共面積約7,179平方呎,原已交吉多年,近日獲體育品牌以每月約60萬元承租,呎租約84元。租戶為連鎖運動用品店。

一綫街舖首季租金 升1.8%

另該行布最新的2024年市場季度報告指,今年首季整體一綫街舖租金按季上升1.8%,入境遊客顯著增長,推動尖沙咀區的商舖租金按季上升2.6%,表現較其他地區理想。該行代理稱,雖然港人外遊或會對餐飲業造成影響,但珠寶及健身行業前景仍然樂觀。

該代理預計,市場對核心區一綫街舖的需求,特別是月租介乎50萬至100萬元的店舖,將在未來兩個季度持續暢旺,料全年一綫街舖租金升最多1成。另外,整體甲級寫字樓租金按季下跌2.5%,該行另一代理表示,業主會提供租金優惠,以吸引及挽留租戶,因寫字樓租金則持續面對不利因素,預計其租金年內錄跌幅。

(經濟日報)

更多新世界大廈寫字樓出租樓盤資訊請參閱:新世界大廈寫字樓出租

更多太平行寫字樓出租樓盤資訊請參閱:太平行寫字樓出租

更多中環區甲級寫字樓出租樓盤資訊請參閱:中環區甲級寫字樓出租

更多時代廣場寫字樓出租樓盤資訊請參閱:時代廣場寫字樓出租

更多銅鑼灣區甲級寫字樓出租樓盤資訊請參閱:銅鑼灣區甲級寫字樓出租

更多南商金融創新中心寫字樓出售樓盤資訊請參閱:南商金融創新中心寫字樓出售

更多長沙灣區甲級寫字樓出售樓盤資訊請參閱:長沙灣區甲級寫字樓出售

黃竹坑偉華匯甲廈2.4萬呎租出

黃竹坑新落成的地標甲廈偉華匯,錄2全層樓面租出,合共2.4萬方呎,租客為中環金融機構以及同區的科技公司。

有外資代理行表示,偉華置業旗下港島南黃竹坑偉華匯今年1月獲得入伙紙,該廈早前已錄2全層樓面預租,18樓及28樓全層,每層約1.2萬方呎,共涉2.4萬方呎,租客包括來自中環的金融機構,以及同區一間科技公司,各自承租1層全層樓面,該兩間租客皆承租跟原址相若的樓面,港島南甲廈租金較核心區實惠,吸引租客紛遷入,同區租客亦鍾情該區甲廈,皆因得以提升辦公室的質素。

代理續說,偉華匯正推出招租,平均呎租28至36元,目前尚有多間大型金融、保險機構等洽租該廈,更有大手洽租逾10萬方呎。租客至少需承租半層樓面,涉及逾5000多呎。

金融機構及科技公司進駐

偉華置業執行董事蔡敬業表示,該廈投資額40億,將作為長線收租,盡管區內商廈新供應多,偉華匯屬於區內較罕有提供全層逾萬呎大樓面,加上大廈質素高,對物業競爭力有信心。該廈亦提供特色樓層,包括1樓及2樓設有平台及綠化空間,26樓及天台設有空中花園,為租戶提供理想的休憩場所,更可作為企業活動。

偉華匯樓高27層,地下3層為車場,全幢總建築面積約30萬方呎,標準樓層1.2萬方呎,樓底淨高度達2.9米。該廈距離黃竹坑站步程約3分鐘,僅兩站可直達金鐘站。大廈位於香葉道,前身為信誠工業大廈,由偉華置業併購及重建發展。

(星島日報)

更多偉華匯寫字樓出租樓盤資訊請參閱:偉華匯寫字樓出租

更多黃竹坑區甲級寫字樓出租樓盤資訊請參閱:黃竹坑區甲級寫字樓出租

LV重返銅鑼灣羅素街 承租時代廣場萬呎舖

盡管零售市況表現一般,奢侈品消費不復當年勇,不過,近年來,部分珠寶金行及奢侈品牌把握淡市在核心區落戶,法國龍頭奢侈品牌路易威登 (LOUIS VUITTON,下稱LV),最新重返銅鑼灣時代廣場承租一個複式舖,租期逾5年。

LV於2021年3月,宣布關閉時代廣場分店,相隔三年,最新重返時代廣場,租用該商場一個複式舖位作為旗艦店,租約期超過5年,為近年罕有國際名牌擴充租務個案。

LV最新租用複式舖位,位處商場中庭樓層,約1.2萬方呎,在此建立港島區旗艦店,預計最快在聖誕節前開業,惟上述舖位租金不詳,地產界人士估計租約期長達5年,計及上述最新租務,時代廣場出租率逾90%。

面積約1.2萬方呎

LV早於2013年舖市高峰期租用時代廣場,舖位面積約1萬方呎,市傳最後一份租約月租高達500萬,隨着近年2019年中後的動亂,2020年初的疫情,該品牌在2021年3月正式宣布關閉時代廣場分店,不過,相隔3年後,最新重返商場,地產界人士表示,雖然難於估計最新租金,惟相信較高峰期大跌,目前,羅素街地舖租金較高峰期普遍跌70%,相信商場亦錄一定跌幅,由於商場由大業主持有,幅度不及地舖,惟估計至少30%或以上。

(星島日報)

更多時代廣場寫字樓出租樓盤資訊請參閱:時代廣場寫字樓出租

更多銅鑼灣區甲級寫字樓出租樓盤資訊請參閱:銅鑼灣區甲級寫字樓出租

Wheelock Properties has unveiled its first price list for Park Seasons, phase 12B of Lohas Park, offering 138 flats, with the cheapest priced at HK$4.54 million after discounts.

It is the second residential project that Wheelock Properties has launched in less than a month after housing curbs were removed in last February.

Seasons Place, launched in mid-March, has sold over 84 percent of its units over three weeks.

The first batch for Park Seasons will cost between HK$4.54 million and HK$7.34 million after discounts, with apartment sizes ranging from 322 to 496 square feet.

The average price for the 138 flats is HK$14,488 sq ft after discounts. Although this is 2.1 percent higher than that of the first price list for Seasons Place a month ago, it is still nearly 9 percent cheaper than Phase 10 of Lohas Park, which launched three years earlier.

Wheelock Properties executive director Ricky Wong Kwong-yiu expects the first price list to meet market demand, with over 80 percent of homes priced below HK$7 million.

Show flats and subscriptions will be available starting Saturday, with sales potentially starting next weekend at the earliest.

Elsewhere, CK Asset (1113) said its second batch for Blue Coast in Aberdeen has been 70 times oversubscribed after receiving more than 13,000 cheques in five days for its 184 flats.

In Ho Man Tin, Onmantin, jointly developed by Great Eagle (0041) and MTR Corporation (0066), may launch next week. The project offering 990 units has received over 3,000 inquiries, said Great Eagle.

In other news, Hong Kong actress Jennifer Tse Ting-ting reportedly purchased a flat at The Aster in Happy Valley for HK$17.1 million.

(The Standard)商業活動加快 商廈需求改善

偉華置業蔡敬業:甲廈有質素 有競爭力

甲廈空置率創歷史新高,業主推出新項目招租面對激烈競爭。偉華置業執行董事蔡敬業認為,今年整體商業活動已加快,料商廈需求會改善,而甲廈項目最重要是具有質素,便有競爭力。

偉華集團一直把黃竹坑視作基地,總部設置於區內多年,並一直有意發展地產項目。早年集團收購同區工廈,集齊業權後重建甲廈「偉華匯」。物業樓高27層,提供總建築面積約30萬平方呎,每層樓面面積約1.2萬平方呎,今年初正式落成。項目近日招租,並已錄得兩宗預租。

冀政府支持更多企業來港

今年甲廈供應多同時,本身空置率亦高企。據一間外資代理行最新數字,甲廈空置率維持在12.9%,整體甲級寫字樓市場在2月錄得負14,600平方呎淨吸納量。

對於商廈租務需求疲弱,蔡敬業認為整體經濟一般,「不只香港、內地,全球去年經濟一般。由於地緣政治,或令外資在港投資減少,中資公司亦因內地經濟本身一般,擴充較慢。」後市上,他則認為較去年樂觀,主因集團包裝生意今年增長強勁,「去年生意乏增長,而今年卻較去年大增1倍,而我們客人主要為歐美公司,似乎反映整體經濟亦有好轉迹象。」他指所接觸的外資公司,政治考慮等屬非常次要,「他們最重要看商機,而普遍認為香港仍是營商好地方。」

蔡敬業又指,疫情後香港商業往來活動已加快,希望政府可以支持更多企業來港做生意,而只要香港有充足人才,外資便感興趣來港投資。他亦提到,旗下偉華匯近期獲不少企業前來睇樓,「其實企業搬遷亦要開支,因涉及一筆裝修費,若沒打算長綫發展,根本不會打算搬至一個質素更新的寫字樓。」

減息訊號現 市況會向好

下半年市況轉看樂觀,他謂政府為住宅市場撤辣,可推動本地經濟,「樓市是香港人主要財富,樓價升,市民資金穩定,對其他投資定有幫助。」至於息口上,銀行界普遍預計今年第三季減息,他坦言只能被動去等,期望要真正減息訊號出現,市況便進一步向好。

是次偉華匯投資高達40億元,屬於集團旗艦商廈,但同時面對市場上多個甲廈項目推出。他指甲廈樓面多,確實需要時間消化,長遠來說關鍵是大廈質素。同區新項目亦不少,他認為大廈具自家優勢,「黃竹坑多活化項目,並以分間細單位為主,大樓面而具甲廈標準卻不多,偉華匯每層樓面逾萬呎,更有競爭力。」他謂在招租初期,會有少許優惠吸引企業搬遷,叫價上亦不會偏離市場價。

另外,集團位於觀塘敬業街雲訊廣場項目,去年已落成,屬拆售項目。他指因應目前市況,不能急於推出,「若僅拆售一兩層,可能會失去潛在全幢準買家。」

(經濟日報)

更多偉華匯寫字樓出租樓盤資訊請參閱:偉華匯寫字樓出租

更多黃竹坑區甲級寫字樓出租樓盤資訊請參閱:黃竹坑區甲級寫字樓出租

更多雲訊廣場寫字樓出售樓盤資訊請參閱:雲訊廣場寫字樓出售

更多觀塘區甲級寫字樓出售樓盤資訊請參閱:觀塘區甲級寫字樓出售

中環核心區巨舖連錄搶租 奢侈品零售食肆等進駐租金穩步向上

今年以來,核心區舖位租賃勢頭強勁,中環區尤其突出,區內巨舖連錄搶租。過去半年至少錄7宗矚目個案,租客多元化,除了傳統的奢侈品牌外,食肆帶來新意念新體驗,還有健身中心進駐核心地段巨舖。

今年以來,中環區頻錄奢侈品店進駐。近日,新世界大廈1個約1700方呎地舖,獲瑞士名錶品牌Franck Muller租用,每月租金約40萬,較2021年舊租升30%,該舖將於今年6月開業。早前,同廈另一個巨舖,建築面積約10000方呎,由星展銀行以每月180萬承租,月租180元。

Franck Muller每月40萬租舖

中環中建大廈3至6號地舖,舖面向畢打街,舊租客OMEGA遷出,隨即由同廈長情租客「補上」。溥儀眼鏡在舖市火紅年代,付租能力未及奢侈品,一直承租中建大廈內舖,近期一見街舖有空置,趁勢擴張。巨舖面積約2497方呎,月租逾70萬,平均呎租約280元,較OMEGA疫市前月租約87萬跌約20%。

中建大廈名店林立,該廈地庫面積約1.9萬方呎,由連鎖健身中心承租,落實進軍中環核心地段,月租約190萬,平均呎租約100元,舊租客德國男裝服飾品牌名店HUGO BOSS,在此設立旗艦店近10年。

根據一間外資代理行資料顯示,今年首季,核心區租賃需求擴張,導致空置率按季下降2.5個百分點至6.6%,為2019年第四季以來的最低水平。中環空置率跌幅最大,下降5.3個百分點至6.6%。四個核心區空置率均錄得個位數,為2018年第二季以來首次出現。

溥儀眼鏡70萬租舖擴張

該行代理表示,本港過去幾季度租賃活動活躍,四個核心區街舖空置率降至個位數。由於空置商舖選擇減少,今年第一季租賃勢頭減弱。雖然部分餐飲商縮小規模,本季仍出現許多新餐廳。核心區街舖租金上升2.7%,為2022年第3季度以來最大按季增幅。

區內空置率跌至6.6%

另一代理表示,中環租賃理想,該區為本港核心商業區,疫後吸引鐘錶珠寶、大型連鎖店及銀行進駐。而且,租客更趨多元化,健身中心亦進駐核心地段,租用大面積樓面,有食肆將新概念帶入中環,去年有航空公司租用舖位作為體驗店等,市場百花齊放。

(星島日報)

更多新世界大廈寫字樓出租樓盤資訊請參閱:新世界大廈寫字樓出租

更多中建大廈寫字樓出租樓盤資訊請參閱:中建大廈寫字樓出租

更多中環區甲級寫字樓出租樓盤資訊請參閱:中環區甲級寫字樓出租

Geopolitical fears fail to deter homebuyers

Home hunters in Hong Kong remained undeterred by geopolitical risks, with new projects raising prices after drawing thousands of buyers, but the frenzy for new flats continued to exert pressure on the secondary market.

Ten major housing estates tracked by a local property agency recorded just nine transactions last weekend, unchanged from a week ago.

Half of them saw no transactions at all.

An agent said around 200 flats were sold on the primary market over the weekend, and customers were attracted by low prices at a project in Hong Kong Island.

Besides, several good flats in the secondary markets were already sold in the past month after property curbs were removed, and prices were under pressure due to lower demand.

Another local property agency also recorded nine deals in the 10 estates it tracked last weekend.

It is the first time the number fell to single digits after the budget was unveiled in February, and the lowest in seven weeks.

In the primary market, CK Asset (1113) increased prices for nine flats at Blue Coast in Wong Chuk Hang, after transactions for two flats in Tower 2B were canceled.

The prices for the two flats rose by 10 percent to HK$21 million for the 813-square-foot unit and HK$20.48 million for the 746-sq-ft flat.

Prices for the other seven flats in Tower 2B were hiked by 2 percent.

Park Seasons, the phase 12B of Lohas Park, saw its 138 flats nearly 13 times oversubscribed after collecting over 2,000 checks.

Ricky Wong Kwong-yiu, executive director of Wheelock Properties, said the sales plan for the new batch will be finalized by tomorrow at the earliest, and the first round of sales may be launched on Saturday.

The prices will be slightly adjusted.

The 138 flats range from 322 sq ft to 496 sq ft and are priced from HK$5.16 million to HK$8.34 million with an average price of HK$14,488 per sq ft after discounts.

Seasons Place, the phase 12A of Lohas Park sold seven flats last Saturday. Around 87 percent of units in the project have been sold, raking in nearly HK$3.6 billion. The average price after discount of the first bunch of flats in Seasons Place was HK$14,188 per sq ft, HK$300 cheaper than Park Seasons.

(The Standard)甲廈價大幅回調 吸引投資者入市

甲廈呎價持續回調,與高峰期已有巨大跌幅,漸吸引投資者留意,趁低吸納作長綫投資。

有本港代理行發表的商廈市場報告指出,首季商廈註冊宗數僅錄142宗,按年下跌約29.7%,而註冊金額則錄14.15億元,按年下跌約60.1%。售價方面,首季乙廈售價跑贏甲廈,分散業權乙廈售價首季上升約2.2%,但甲廈售價則下跌約4.8%。

成交上,上環指標甲廈皇后大道中181號新紀元廣場低座8樓半層樓面買賣,成交價逾1.23億元,物業建築面積約10,163平方呎,呎價約1.21萬元。據悉,單位現由滙豐銀行租用,呎租約46元。據稱買家是次購入物業作長綫收租用途。

優品360高層 1.2億購新紀元半層

翻查資料,該層樓面早年由澳洲基金持有,該基金拆售全幢商廈,2009年獲本地財團大南製衣以約1.34億元購入全層,期後該廠家售出部分單位,連同是次出售單位,估計獲利約5,800萬元。據悉,新買家為優品360執行董事許志群或有關人士,料購入作投資用途。

呎價方面,2016年物業中高層全層,面積約15,451平方呎,以約3.09億元易手,呎價高見近2萬元。其後整體商廈價格回落,按現時成交呎價約1.2萬元計,較高峰期跌4成。

另一宗焦點買賣,為高盛、凱龍瑞等基金放售逾1年的上環全新商廈88WL,近日獲數個財團爭奪,包括用家及投資者,最終獲本地財團以約7.5億元承接。

建滔集團 7.5億承接88WL

凱龍瑞基金早年購入永樂街3舊樓地盤,共涉約9.62億元,其後引入基金投資進行重建,基金早於去年中曾放售物業,叫價約13.5億元,未獲承接,半年後再委託測量師行放售,降價至約9億元,如今再降價至約7.5億元沽出,以總樓面約90,199平方呎計,呎價約8,315元。未計建築費已蝕約2億元,若連同起樓成本,保守蝕至少約6億元離場,為近年商廈最大手蝕讓。市場人士指,新買家為建滔集團或有關人士。該集團早年亦有投資上環商廈,2010年以約6.6億元向南豐購入上環蘇杭街69號全幢商廈,其後於2019年商廈高峰期,以約19億元售予基金。

該行指,首季甲廈市場出現「價跌量升」的情況,今年第一季共錄得29宗指標甲廈成交,是自2023年第二季以來最多,反映由於部分甲廈業主為吸引買家承接物業,所以決定降低物業的叫價,令近期甲廈的交投增加。

(經濟日報)

更多皇后大道中181號寫字樓出售樓盤資訊請參閱:皇后大道中181號寫字樓出售

更多上環區甲級寫字樓出售樓盤資訊請參閱:上環區甲級寫字樓出售

更多88WL寫字樓出租樓盤資訊請參閱:88WL寫字樓出租

更多上環區甲級寫字樓出租樓盤資訊請參閱:上環區甲級寫字樓出租

首季乙廈售價升2.2% 本港代理行:跑贏整體大市

有本港代理行發表的商廈市場報告指,首季商廈註冊宗數僅錄142宗,按年跌約29.7%,金額錄14.15億,按年跌約60.1%。首季乙廈售價跑贏甲廈,分散業權乙廈售價在首季升約2.2%,甲廈售價則跌約4.8%。

金額14.15億按年跌60%

該行代理相信,乙廈過往數年累積較大跌幅,入場門檻低,首季甲廈「價跌量升」,今年第一季共錄29宗成交,2023年第二季以來最多,反映部分甲廈業主為吸引買家降低叫價,令近期甲廈交投增加。

上月,一間上市公司以約8430萬購入長沙灣南商金融創新中心多個高層單位。銅鑼灣廣旅集團大廈中層全層以約3480萬成交,呎價約10774元,呎價較高峰期回落近三成。

新商廈錄大額租務

多個新商廈錄大額租務,一間德國超市以月租約185.5萬租用啟德AIRSIDE 1層樓面,該超市原本租用九龍站環球貿易廣場 (ICC) 中低層3層樓面,預料該超市遷出後,相關樓面或以月租約600萬租予金管局。在中環區,一間中資汽車生產商以月租約79.2萬租用The Henderson的商廈樓面。

地政總署最近調低部分新界新發展區及市區補地價金額水平,工業地轉商廈或現代工業用途補價將下調20%。此舉收窄土地擁有人及政府就地皮定價差距。

(星島日報)

更多南商金融創新中心寫字樓出售樓盤資訊請參閱:南商金融創新中心寫字樓出售

更多長沙灣區甲級寫字樓出售樓盤資訊請參閱:長沙灣區甲級寫字樓出售

更多廣旅集團大廈寫字樓出售樓盤資訊請參閱:廣旅集團大廈寫字樓出售

更多銅鑼灣區甲級寫字樓出售樓盤資訊請參閱:銅鑼灣區甲級寫字樓出售

更多AIRSIDE寫字樓出租樓盤資訊請參閱:AIRSIDE寫字樓出租

更多啟德區甲級寫字樓出租樓盤資訊請參閱:啟德區甲級寫字樓出租

更多環球貿易廣場寫字樓出租樓盤資訊請參閱:環球貿易廣場寫字樓出租

更多尖沙咀區甲級寫字樓出租樓盤資訊請參閱:尖沙咀區甲級寫字樓出租

更多The Henderson寫字樓出租樓盤資訊請參閱:The Henderson 寫字樓出租

更多中環區甲級寫字樓出租樓盤資訊請參閱:中環區甲級寫字樓出租

首季8宗逾億買賣 按年挫5成

據一間外資代理行統計,首季僅錄8宗逾億元大手買賣,按年跌半。

外資代理行料全年達500億成交

該行指,2024年第一季度,整體投資市場僅錄得8宗逾億元大手買賣,交易總額為56億元,按年分別下跌53%及41%。交易主要涉及回報率逾4%至5%的資產,其中社區購物中心及街舖因租金收入穩定和具吸引力,在2024年第一季度的交易中佔了一半。

該行代理指出,視乎美國潛在減息及股市復甦帶來的影響,投資情緒將逐步轉趨正面,不良資產仍備受追捧。樓市撤辣亦將有利於住宅物業銷售,繼而推動住宅地皮需求上升。內地學生及專才湧港,亦將帶動住屋需求。整體而言,該代理預計,今年投資金額將達500億元,按年上升約34%。

(經濟日報)

黎永滔荃中商舖 2.2億獲洽至尾聲

個別資深投資者加快沽貨,消息指,黎永滔旗下荃灣中心商舖,獲2.2億元洽購至尾聲料快易手,若最終成交,持貨6年蝕5,500萬元。

市場消息指,荃景圍86號荃灣中心商場2期11至14座基座舖位,總建築面積44,035平方呎,獲財團出價2.2億元洽購,貼近業主意向價。

早年2.75億購入 作收租

該批舖位位於屋苑基座,目前主要由3租客承租,其中護老院佔近3萬平方呎,另有幼稚園及設計公司,每月租金收入約130萬元。若接2.2億元洽購價計,呎價近5,000元,回報率達7厘。

翻查資料,物業曾由項目發展商新地 (00016) 持有收租達36年,2018年資深投資者黎永滔以2.75億元購入,作收租之用。若最終以2.2億元沽貨,將蝕5,500萬元,幅度達兩成。事實上,黎永滔近期加快推售舖位,包括放售銅鑼灣景隆街全幢。

另消息指,旺角花園街3至5號地下舖位,面積約1,306平方呎,以5,300萬元成交,呎價約4萬元。舖位現由餐廳租用,月租約16萬元,回報率約3.6厘。原業主於2005年以3,800萬元買入,持貨19年轉手,獲利約1,500萬元,升幅近4成。

(經濟日報)

偉華匯優質設計 黃竹坑新地標

黃竹坑偉華匯外形美觀,而物業大堂質素、景觀均非常優質,屬區內新地標項目。

交通上,黃竹坑新落成商廈多,而偉華匯位處的香業道,屬連接港鐵黃竹坑站出口的地段,只需步行5至10分鐘,比起同區不少新商廈較為方便。而由黃竹坑站前往金鐘站僅約10分鐘車程,故前往各區亦極便利,另黃竹坑道亦有多條巴士綫來往港九。另值得一提,大廈既設有停車場,而地下亦設有蓋位供汽車上落客。

飲食配套不足是過往黃竹坑區最大問題,而隨着黃竹坑站商場THE SOUTHSIDE去年開幕,提供大量餐廳及零售商店,解決多年來區內食肆不足之問題。

外形上,偉華匯的建築理念深受竹子堅韌不拔的特性所啟發,於是將其精粹融入設計細節當中。竹節長度靈活多變,亦配合黃竹坑的主題,外形美觀。

地下大堂樓底甚高亦闊落,極具氣派。據悉,項目屬同區新甲廈中,較少升降機大堂設於地下,較為便利。

偉華匯樓高27層,地下3層為停車場,提供總建築面積約300,000平方呎,物業分為低層 (1至15樓) 及高層 (17至30樓) 兩區,分別設有兩個升降機大堂,有效疏導人流,而大堂設有入閘機,保安嚴密。

每層約1.2萬呎 同區罕有

分層每層樓面面積約12,000平方呎,為同區較少提供逾萬平方呎樓面,間隔非常四正,實用率逾8成,樓底淨高度達到2.9米,空間感十足。景觀方面,高層單位享有少許海景,極為開揚,而中低層單位望向園林,同樣舒適。

偉華匯設有特色樓層,於1樓及2樓設有平台及綠化空間,16樓及天台均設有空中花園,為租戶提供理想的休憩場所,更可作企業活動。

項目今年初正式入伙,已獲綠建環評 (BEAM Plus) 暫定金級認證、WELL健康建築標準預先認證,並將申請成為WELL Certified™健康建築標準「金級」認證。

該廈前身為信誠工業大廈,偉華集團早於2013年展開收購,直至2020年獲批重建,連同收購及建築,總投資額達40億元。

(經濟日報)

更多偉華匯寫字樓出租樓盤資訊請參閱:偉華匯寫字樓出租

更多黃竹坑區甲級寫字樓出租樓盤資訊請參閱:黃竹坑區甲級寫字樓出租

Residential rebound running out of steam

Hong Kong's residential market is losing momentum following a short rebound after the removal of housing curbs, warns JP Morgan.

It said home prices in the secondary market fell 1.5 percent last week, the biggest week-on-week drop in eight months.

The US investment bank also highlighted CK Asset's (1113) Blue Coast in Wong Chuk Hang, which sold less than 75 percent of the flats in the second round of sales, as evidence that the rebound was fading.

It said the developer's attempt to raise prices moderately and weakened expectations for the US Federal Reserve to cut interest rates, all pointed to a slowdown.

The impact on prices in the primary market would be more apparent if developers compete with price cuts as they try to lower inventories, it added.

Meanwhile, Morgan Stanley predicts a significant drop in profits for developers with large inventories, referring to CKA's below-cost sales of Blue Coast flats.

The weaker-than-expected recovery in the property market has also affected developers' appetite for new projects. In the first quarter, the total land premiums slumped 97 percent from a year ago to HK$437 million.

In other market news, Dynasty Court at the Mid-Levels, developed by Sun Hung Kai Properties (0016), sold five flats for around HK$275 million, according to local media reports.

And two connected houses on No 56 Repulse Bay Road have been put up for sale with an estimated market value of HK$360 million or HK$67,830 per square foot, according to a lead agent.

(The Standard)觀塘駱駝漆大廈地廠1.5億易手 鄧成波家族沽售持貨14年貶值逾59%

鄧成波家族持續沽貨,觀塘開源道駱駝漆大廈地廠,建築面積約3816方呎,以1.5億易手,持貨14年貶值高逾59%,新買家為伯恩光學始創人楊建文,料回報4.8厘。

上址為觀塘開源道62號駱駝漆大廈1座A1及A2號地廠,建築面積約3816方呎,以易手價1.5億計算,平均呎價3.93萬,該家族於2010年以每呎4.6萬購入該2個地廠,涉資約1.76億,及後再於2015及2016年間以1.9億為該地廠補價,成本價約3.66億,持貨約14年,今番帳面蝕讓約2.16億,物業貶值約59%。

投資者楊建文承接

據了解,上述連租約易手,目前月租60萬,以易手價計算,回報約4.8厘,新買家為伯恩光學始創人楊建文。

業內人士分析道,該地廠之所以勁蝕,皆因該地舖已補價作商業用途,與地舖並沒有分別,近年舖位租金從高峰期急跌70%至80%,價格亦隨之下跌,因此上址跌價59%,屬合理水平。

買家楊建文就上述物業收取高回報,目前不少旺區舖位易手,回報約3厘,上址高達4.8厘。楊建文近年大手購入觀塘物業,除了收購開源道業發工業大廈1期、2期及年運工業大廈,並透過強拍統一業權,上述3個工廈佔地約5萬方呎,將合併重建樓高39層甲廈,總樓面約72萬方呎,發展為一幢樓高200米的地標甲廈。

連約回報4.8厘

此外,他亦購入觀塘商廈,包括寧晉中心多個單位,還有,他的目標還包括觀塘萬年工業大廈,收購至少逾45.7%業權,坐落巧明街116至118號,樓高13層,距離港鐵觀塘站出口僅5分鐘步程,鄰近創紀之城5期 - 東亞銀行中心及鱷魚恤中心等,佔據有利位置。

楊建文為伯恩光學始創人,有「手機屏幕大王」之稱,他活躍於地產界,並一直重錘觀塘區。

(星島日報)

更多寧晉中心寫字樓出售樓盤資訊請參閱:寧晉中心寫字樓出售

更多觀塘區甲級寫字樓出售樓盤資訊請參閱:觀塘區甲級寫字樓出售

更多創紀之城寫字樓出租樓盤資訊請參閱:創紀之城寫字樓出租

更多鱷魚恤中心寫字樓出租樓盤資訊請參閱:鱷魚恤中心寫字樓出租

更多觀塘區甲級寫字樓出租樓盤資訊請參閱:觀塘區甲級寫字樓出租

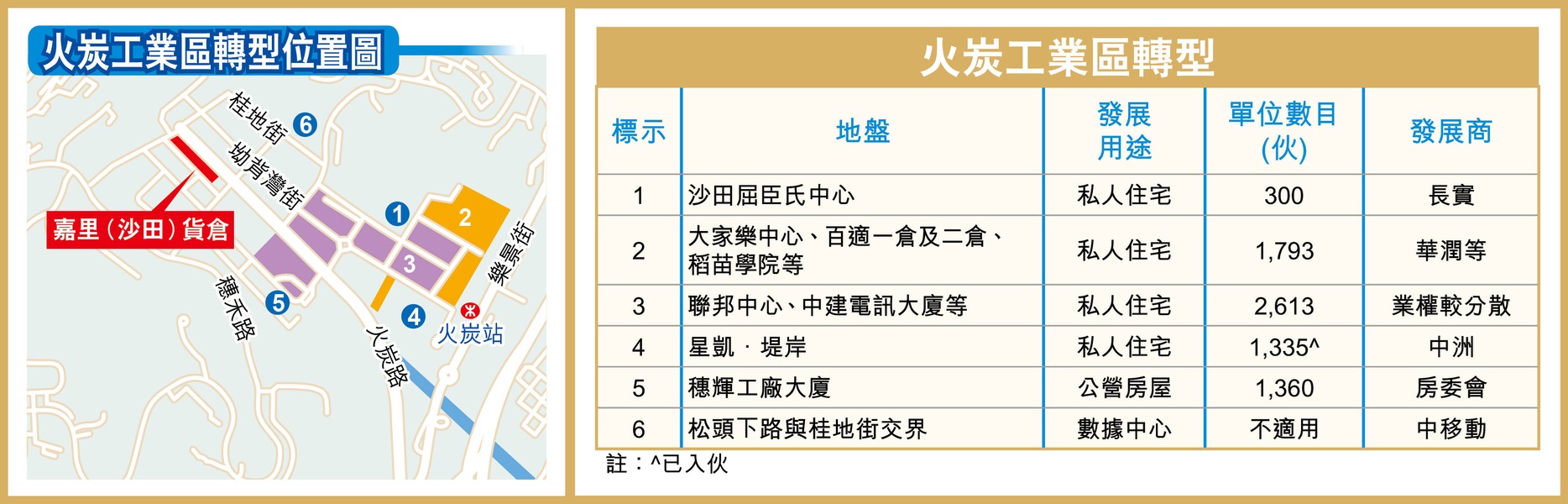

火炭轉型 發展公私型樓新建區

火炭由以往舊工業區逐步轉型為住宅,當中最大規模的改劃,屬於2021年長實 (01113) 遞交的住宅重建申請,涉及約4,706伙。觀乎該區重建項目,初步預計將會新增至少逾6,000伙公私營房屋。

火炭工業區佔地約30公頃,區內共有約45幢工廈,平均樓齡逾30年以上,一半樓齡介乎約15至30年。而有發展商早前已經看中區內潛力,前身為火炭惠康倉的新盤星凱‧堤岸,目前已經入伙。項目原由爪哇控股 (00251) 持有,其後中洲置業於2015年底以約11.2億元向爪哇控股買入地皮,並於2017年完成補地價程序,補地價金額約35.8億元,每平方呎樓面地價約3,580元。

大規模重建 首期最快後年落成

雖然區內近8成工廈屬於分散業權,會增加重建的困難,但有發展商亦看中區內工廈的發展前景,大規模為區內工廈申請重建,其中最大規模的為長實於2021年遞交的申請,發展商就火炭工業區東部20幢工廈,向城規會申請由「工業」用途改劃為「住宅 (戊類)」等用途,以重建大型屋苑,提供約4,706伙。據當時的申請文件,項目將會分3期發展,合共涉及24幢住宅,當中第1期是長實旗下的沙田屈臣氏中心,提供約300伙,預料2026年落成。而第2期則涉鄰近港鐵火炭站的多幢工廈,包括大家樂中心、華潤旗下沙田冷倉一倉、二倉、百適一倉、二倉,及稻苗學院等,提供約1,793伙,初步估計於2028年落成。

項目第3期則涉中建電訊大廈及峯達工業大廈等共13幢工廈,提供約2,613伙,但因前述的工廈現時的業權相當分散,普遍欠單一大業主主導重建,預期短期內難以落實重建。

華潤系持5工廈 成區內大地主

另外,華潤物流近年密密買入香港的工廈,積極擴大區內勢力。華潤物流於2022年5月以約23.3億元,向嘉里購入位於火炭工業區內山尾街36至42號嘉里 (沙田) 貨倉,以總樓面面積約404,374平方呎計,平均呎價約5,762元。如若計入百適一倉、百適二倉、沙田冷倉 (一倉) 及沙田冷倉 (二倉),華潤系內持有的火炭工廈增加至5幢,屬區內大地主之一。華潤創業早年曾就沙田冷倉 (一倉) 及百適一倉向城規會申請重建為酒店及商場,提供約858間客房,惟方案當年未獲會方批准。

(經濟日報)

New projects continue to be launched in Hong Kong but that's not deterred Wheelock Properties from raising prices for the second batch of flats at Park Seasons in Lohas Park by 3.8 percent.

The 78 flats in the second list are priced at HK$15,039 a square foot after discounts. The developer will launch sales of 168 flats this Saturday at an average price of HK$14,632 per sq ft after discounts.

Ricky Wong Kwong-yiu, the executive director for Wheelock Properties, said the new batch is being offered at the original price to maintain the project's attractiveness, but exclude factors such as higher floor levels.

Meanwhile, Blue Coast at The Southside sold a four-bedroom flat by tender for more than HK$37.19 million.

In Ho Man Tin, Onmantin, jointly developed by Great Eagle (0041) and MTR Corporation (0066), will release its first price list of at least 155 flats today. Show flats for phase IIA and phase IIB have been opened to tempt buyers.

The developers plan to launch sales for phase IIB first this month.

Topside Residence developed by CSI Properties (0497) in Jordan is also expected to release its first price list this week.

(The Standard)億京3265萬 沽觀塘萬泰利廣場單位

億京續減價推售旗下甲廈餘貨,剛以約3,265萬元,沽出觀塘萬泰利廣場單位,呎價較高峰期大跌4成。

呎價9448 較高峰跌4成

資料顯示,觀塘創業街萬泰利廣場錄得成交,涉及29樓E至F室,面積合共約3,456平方呎,以約3,265萬元沽出,呎價約9,448元,單位原屬一手發展商餘貨。

翻查資料,2019年該廈全層單位,面積約12,042平方呎,以2.16億元沽出,呎價約16,741元。如今最新成交價,較高峰期跌4成。事實上,億京近期推售旗下一手甲廈項目餘貨,包括觀塘電訊一代廣場、九龍灣恩浩國際中心、新蒲崗萬迪廣場等,呎價一律大減3至4成。

另東九龍商廈租務上,九龍灣億京中心A座中高層D室,面積約2,173平方呎,以每呎約17元租出。

(經濟日報)

更多萬泰利廣場寫字樓出售樓盤資訊請參閱:萬泰利廣場寫字樓出售

更多電訊一代廣場寫字樓出售樓盤資訊請參閱:電訊一代廣場寫字樓出售

更多觀塘區甲級寫字樓出售樓盤資訊請參閱:觀塘區甲級寫字樓出售

更多恩浩國際中心寫字樓出售樓盤資訊請參閱:恩浩國際中心寫字樓出售

更多九龍灣區甲級寫字樓出售樓盤資訊請參閱:九龍灣區甲級寫字樓出售

更多億京中心寫字樓出租樓盤資訊請參閱:億京中心寫字樓出租

更多九龍灣區甲級寫字樓出租樓盤資訊請參閱:九龍灣區甲級寫字樓出租

國際品牌進駐旺區 中環舖40萬租出

意時裝店落戶百佳大廈 較疫情前降租3成

核心區一綫地段續有國際品牌進駐,中環皇后大道中地舖,獲意大利時裝品牌Falconeri以月40萬租用。舖位地下及1樓原由Charles and Keith租用,租金較疫情前下跌約3成。

中環皇后大道中再錄國際品牌租務,涉及百佳大廈地下舖位,面積約1,700平方呎,獲意大利時裝品牌Falconeri租用,品牌近日亦已掛起廣告板,預告快將開業。

資料顯示,Falconeri主打羊絨衣服,創立於2000年,生產綫一直在意大利,初期以男士產品為主,漸漸發展女性系列,令品牌更全面,更屬四季合穿。2019年該品牌於銅鑼灣恩平道開設專門店,現轉戰中環一綫地段開業。

據了解,是次月租涉約40萬元,呎租約235元。翻查資料,物業地下及1樓,由鞋店Charles and Keith以80萬租用,品牌去年尾遷出,業主重新分拆招租,現先租出地下,1樓仍在招租中。按現時租金計,較疫情前仍跌約3成。

外資代理行:核心區空置率 降至6.6%

據一間外資代理行統計,隨着商舖租務增加,令核心區空置率按季下降2.5個百分點至6.6%,為2019年第四季以來最低水平。四個核心區空置率均錄得個位數,中環空置率跌幅最大,下降5.3個百分點至6.6%。

事實上,皇后大道中在近兩個月,已先後錄3宗涉及國際品牌零售商租用,如皇后大道中新世界大廈地下舖位租出,涉及面積約1,700平方呎,獲瑞士名錶品牌Franck Muller租用,月租約40萬元。

另皇后大道中20號太平行地下A舖及地庫,合共面積約7,179平方呎,原已交吉多年,近日獲體育品牌Nike以每月約60萬元承租,呎租約84元。據悉,目前皇后大道中大型舖位已全數獲租,僅皇后大道中59至65號泛海大廈地舖及1樓,亦即前TOPSHOP時裝租用的複式舖,近年一直只作品牌作期間限定店,包括上月瑞士護膚品牌La Prairie短租。

(經濟日報)

更多百佳大廈寫字樓出租樓盤資訊請參閱:百佳大廈寫字樓出租

更多新世界大廈寫字樓出租樓盤資訊請參閱:新世界大廈寫字樓出租

更多太平行寫字樓出租樓盤資訊請參閱:太平行寫字樓出租

更多泛海大廈寫字樓出租樓盤資訊請參閱:泛海大廈寫字樓出租

更多中環區甲級寫字樓出租樓盤資訊請參閱:中環區甲級寫字樓出租

銅鑼灣希雲大廈「流拍」收場 底價24.25億金朝陽未有出價承拍

本港經濟復甦步伐不似預期,連帶舊樓併購市場亦受影響,由金朝陽併購約17年的銅鑼灣希雲大廈,昨舉行公開拍賣,底價為24.25億,惟該財團並未有出價承拍,以流拍收場;金朝陽指,考慮香港現時經濟狀況,及房地產價值可能繼續向下調整後,決定不在拍賣中作出投標。

上述項目今年2月已獲土地審裁處批出強拍令,昨在仲量聯行舉行拍賣會,惟拍賣官多次重複叫價後,卻遲遲未有人承價,最終該項目流拍收場,為《土地 (為重新發展而強制售賣) 條例》1999年實施以來第4宗流拍個案。

金朝陽昨發出公告指,公司經審慎考慮香港現時經濟狀況及房地產市場,尤其是房地產價值可能繼續向下調整後,最終決定不在拍賣中作出投標。而且根據估值報告,希雲大廈於重建後市值約21億,低於底價24.25億。

金朝陽:重建後市值21億低底價

該公告續指,現正尋求其法律顧問意見,探索及評估公司下一步就該地段擁有權可能採取不同方案,包括與各註冊擁有人聯絡及訂立私人協議,以購買餘下單位;或向土地審裁處申請延長舉行另一次拍賣時間,並申請下調底價以與該地段當前市值一致。

可建總樓面19.7萬呎

希雲大廈早於1959年落成,至今約65年樓齡,現為1幢樓高11層商住綜合用途樓宇,地下高層及地下商舖為非住宅用途,1樓至10樓為住宅用途。該地現為「其他指定用途(混合用途)」,地盤約13150方呎,若重建作商業項目,以地積比率15倍計算,可建總樓面約19.7萬方呎;若發展為住宅項目,以地積比率9倍計算,可建總樓面約11.8萬方呎。

資料顯示,金朝陽曾於2022年8月以32.09億售出希雲大廈,買家徐意為一間中資發展商相關人士,其後於去年取消交易,金朝陽除沒收買方逾3.2億初始按金之外,買方同時需要支付和解金及額外費用,涉及金額合共逾3.64億。

(星島日報)

佐敦官涌街巨舖1.488億易手 凱莉山學校舊址信興相關人士承接

近期商廈舖位買賣趨活躍,興勝創建以1.488億沽售佐敦官涌街巨舖,該項目為凱莉山學校舊址,最新成交呎價12127元,買家為信興集團相關人士。

佐敦官涌街38號The Austine PLACE地下及1樓,建築面積約12270方呎 (包括地下面積約4,880方呎),業主興勝創建去年9月以意向價2.2億放售,最終減價7120萬,以1.488億易手,平均呎價12127元。

平均呎價12127元

該物業於2014落成,曾由凱莉山學校承租多年,隨着該學校停運,巨舖亦一直空置。

興勝創建預期,出售事項產生所得款項約1.488億,其中約9000萬元,將用作償還以該物業作抵押之銀行貸款,而所得款項餘額,在扣除相關費用及開支後,將用作一般營運資金。儘管該舖位經代理放售時,建築面積逾1.227萬呎,據悉實用面積7856方呎。

物業於2014落成

市場消息透露,該巨舖買家透過Amazing Grace Kowloon Limited購入物業,該公司董事蒙倩兒,為信興集團創辦人蒙民偉長女,市傳購入該物業將作為慈善用途,惟有關說法未獲證實,本報昨日致電信興集團,直至截稿時仍未能聯絡得上。

信興集團相關人士亦於2021年出手,購入尖沙咀商廈新東海商業中心16樓共5個單位,作價8131.85萬,當時透過SHUN HING REALIFE COMPANY LIMITED購入物業,公司董事包括蒙倩兒及蒙德揚,蒙德揚為蒙民偉兒子。原業主為日資建築公司前田建設 (MAEDA CORPORATION),該公司在1991年以3552.75萬購入上述寫字樓單位,帳面獲利約4579萬,升值約1.29倍。

(經濟日報)

更多東海商業中心寫字樓出售樓盤資訊請參閱:東海商業中心寫字樓出售

更多尖沙咀區甲級寫字樓出售樓盤資訊請參閱:尖沙咀區甲級寫字樓出售

New Ho Man Tin flats priced at eight-year low

Onmantin, jointly developed by Great Eagle (0041) and MTR Corporation (0066) in Ho Man Tin, has revealed the first price list, offering 115 flats with an average price of HK$19,988 per square foot, the lowest in eight years in the district.

The flats range from 388 sq ft to 774 sq ft and the cheapest is a one-bedroom flat priced at HK$6.89 million.

"The price level reflects the developers' desire to reduce inventories," a property agent said.

In the district, the luxury project St George's Mansions, developed by Sino Land (0083) and CLP, sold a four-bedroom flat for HK$85.48 million yesterday.

Meanwhile, Wheelock Properties said its property sales have exceeded HK$10 billion in less than four months this year, achieving the full-year target early.

The developer has sold 867 flats, cashing in HK$10.04 billion, including 568 flats at the Seasons Place in Tseung Kwan O.

While Hong Kong developers continue selling new projects at relatively low prices, they remain cautious about the land redevelopment projects.

The compulsory sale of Haven Court in Causeway Bay at a reserve price of HK$2.43 billion was canceled as it failed to receive any bids yesterday, marking the fourth unsuccessful compulsory sale this year.

Developer Soundwill (0878) filed for this compulsory sale in 2019, holding 84.04 percent ownership at that time. Completed in 1959, Haven Court occupies an area of about 13,150 sq ft and is an 11-story composite building, with a total of 44 shops and 125 flats.

(The Standard)The Henderson逾8000呎租出 醫療集團進駐平均每呎120元

中環地標甲廈The Henderson新錄一宗租務,一個逾8000方呎單位,以每呎約120元租出,新租客為醫療集團,於同區升級搬遷至全新甲廈。

上址為甲廈The Henderson 15樓2至3室,建築面積逾8000方呎,由金衛醫療集團進駐,市場人士透露,月租約96萬,平均呎租120元,該集團本身承租中銀大廈48樓,全層面積約7287方呎,現時中銀大廈原址全層以每呎110元放租。業內人士表示,金衛醫療屬升級搬遷,遷至設施新穎的環保商廈,並稍為擴大樓面。

每月租金約96萬

金衛醫療集團是一間主要從事醫療業務的香港投資控股公司,集團通過四大分部運營, 醫療設備開發、生產及銷售醫療設備,醫院管理分部在中國提供醫院衛生管理服務及營運醫院。

The Henderson近期連錄承租,包括內地大型汽車製造商華晨集團,以每月近79.2萬承租中高層,建築面積約6600方呎,呎租近120元,該集團港辦公室設於遮打大廈中層,是次搬遷少許擴充,並升級至全新甲廈。

同區升級搬遷主導

The Henderson大手租客包括加拿大退休金計劃投資局 (CPPIB),由同區約克大廈搬至The Henderson。拍賣行佳士得租用4層,涉約5萬方呎,作為集團在港首個常設拍賣中心和藝廊。國際投資公司凱雷集團 (Carlyle)租用約2萬方呎樓面。

有本港代理表示,今年第一季度,儘管新增供應推高空置率,整體市場表現比過往活躍,政府機構、銀行及保險公司頻作大手租賃,新供應為租戶提供更多新選擇。至於中環區,仍以升級搬遷為主,租戶追求嶄新甲廈,鍾情新設施及環保標準,儘管整體租賃趨活躍,由於供應多,空置率仍然攀新高,預期今年內租金表現未見驚喜。

The Henderson樓高36層,每層約1.2萬至1.5萬方呎,總樓面46.5萬方呎。

(星島日報)

更多The Henderson寫字樓出租樓盤資訊請參閱:The Henderson 寫字樓出租

更多中銀大廈寫字樓出租資訊請參閱:中銀大廈寫字樓出租

更多遮打大廈寫字樓出租樓盤資訊請參閱:遮打大廈寫字樓出租

更多約克大廈寫字樓出租樓盤資訊請參閱:約克大廈寫字樓出租

更多中環區甲級寫字樓出租樓盤資訊請參閱:中環區甲級寫字樓出租

旺角建摩廈規劃署不反對 新地「巨無霸」商業地總樓面逾152萬呎

旺角未來再有新摩廈供應,由新地發展的旺角「巨無霸」商業地,早前向城規會遞交新發展藍圖,申請放寬高限,以建摩天商廈等,打造旺角Green Heart,涉及可建總樓面約152.42萬方呎。最新獲規劃署不反對,城規會將於今日舉行會議審理,料會「開綠燈」通過。

規劃署指,上述項目增建行人天橋等設施,有助提高項目與周邊的連接性;而車輛出入安排及改善工程,運輸署及路政署等相關部門並未有提出任何負面意見,但建議提交詳細交通管理計劃,以便運輸署進行監察。另外,項目設有不少社福施設,申請人就其布局及設計屬可接受。故該署不反對有關申請,城規會將於今日舉行會議審理。

城規今審議料通過

據文件顯示,項目申建3幢建築物,靠近亞皆老街位置,興建1幢樓高56層 (另設6層地庫) 主大樓、即商廈,主水平基準以上320米;鄰近港九潮州公會中學位置,則興建7層 (另設6層地庫) 政府、機構或設施附屬大樓,另會有1幢2層高構築物用作承托通往黑布街行人天橋,可建總樓面約152.42萬方呎,料於2030年落成。

項目申建3幢建築物

為配合最新發展方案,建議把用作興建附屬大樓位置高限,由40米放寬至46米,即增加6米或約15%,以容納升降機槽等設施,並提供無障礙通道連接天台公眾休憩用地;同時申請放寬整個項目中央位置建築物間距限制,以提供一條小型社區天橋,連接附屬大樓和發展項目其他部分等。

該項目日後將提供約120萬方呎寫字樓樓面,約20萬方呎商場樓面。附屬大樓提供社區設施,包括長者日間護理中心、長者鄰舍中心、精神健康綜合社區中心、社區會堂及綜合青少年服務中心,涉及約5萬方呎;同時提供逾10萬方呎的公眾休憩用地。

據賣地條款,項目須保育3棵榕樹,故在設計上作出改動,政府原方案是地盤之下為5層地庫,認為設計不利於榕樹保育及生長,為保育3棵榕樹,於是在設計上作出改動,建議避開榕樹底部不作挖掘,加深其他位置建地庫,故最新增加1層地庫至6層,以作為公共交通交匯處、跨境巴士設施,以及多層停車場,屆時將提供約1000個車位。

新地曾指,項目總投資額逾100億,以打造九龍全新地標。上述地皮是新地於去年3月以47.29億投得,當時每呎樓面地價約3103元。

(星島日報)

Shop king's family takes $24m hit in TST sale

The family of Hong Kong's late "shop king" Tang Shing-bor sold a shop in Tsim Sha Tsui for HK$32.5 million, suffering a paper loss of over HK$24 million after holding it for nearly 14 years.

The 890-square-foot ground floor shop on 43 Granville Road saw the selling price come in at HK$36,500 per sq ft.

Tang's family bought the shop in June 2010 for HK$56.8 million. This would mean the property depreciated by about 43 percent in value over the years.

In the primary market, Topside Residences in Jordan, redeveloped by CSI Properties (0497), is expected to roll out its first price list early next week.

The project provides a total of 259 flats, of which 137 are two-bedroom flats. The show flats will also be opened next week.

In Pak Shek Kok, Sun Hung Kai Properties (0016) raised the prices of nine flats in phase 2 of St Martin by 0.5 percent to 9.3 percent. Phase 2 offers 640 flats in total.

(The Standard)

Hong Kong’s buoyant home sales to fight gravity of continued high interest rates as cut hopes dwindle, analysts say

Property agents have raised sales forecasts for the year amid project launches at discounted prices, but lack of a rate cut could pare those estimates

Developers are likely to continue pricing projects low to keep their transaction volumes up, an analyst says

Dwindling hopes for an interest-rate cut this year could put a damper on surging Hong Kong home sales, according to analysts.

As of Tuesday, 5,109 new homes have been sold in Hong Kong in 2024, roughly half of the full-year total in both 2022 and 2023, according to data compiled by a local property agency.

As developers rush to put new projects on sale at discounted prices to take advantage of the suddenly buoyant buying sentiment, property agents have raised their 2024 sales forecasts. The agency, for example, now expects 18,000 new homes to sell this year, up from a previous estimate of 14,000.

However, interest rates, which remain at their highest level since 2007, could spoil the party, analysts said after a speech on Tuesday by US Federal Reserve chairman Jerome Powell tempered hopes of an imminent rate cut. Economists now expect any rate reduction to be delayed until at least September and possibly next year.

Should the rate cut not materialise at all this year, buyers may hesitate to purchase homes, an agent said.

“On the demand side, buyers may hesitate, while developers are still likely to price their projects well below the prices of second-hand units if they want to keep their transaction volumes higher,” the agent said.

Still, a lack of rate cuts may trim the top off of potential sales, according to Raymond Cheng, managing director of CGS International Securities.

“If we see decreasing interest rates, we forecast a 40 per cent annual increase in new home sales to 15,000 to 16,000 this year,” he said. “But without rate cuts, we are likely to see about a 30 per cent increase in new home transactions, to a range of 14,000 to 15,000 units.”

On the other hand, another agent, believes the current attractive pricing will still lure potential buyers to the market.

“Despite the high interest rates, end-user homebuyers can take advantage of the lower price levels,” the agent said. “Meanwhile, investors can now cover their mortgage payments with rental income, as the residential rental market has improved by 8 per cent year on year. Additionally, the influx of newcomers to the city is creating a new group of potential buyers, further stimulating demand.”

“Rate cuts have been widely expected and factored in by buyers in the first few months of the year,” another agent said. “However, the consensus was for rates to be cut only moderately by 50 to 75 basis points this year anyway, hence any delay is expected to mainly affect market sentiment.”

Keen to clear an estimated 20,000 unsold units, developers have been pricing new project launches at multi-year lows. On Wednesday, for example, Great Eagle Holdings priced the first 115 units of its new residential project called Onmantin in Ho Man Tin at an average price of HK$19,988 (US$2,556) per square foot after discounts.

That is the lowest in the same neighbourhood since Kerry Properties launched its Mantin Heights development at HK$19,000 in 2016, agents said. The price is also about 25 per cent below the In One Above project launched by Chinachem Group in May last year.

A lack of rate cuts this year will not affect all buyers equally, said CGS’ Cheng. Up to 40 per cent of current homebuyers are from mainland China and are not as sensitive to rate changes as local buyers tend to be, he said.

“There will be some impact on those who are buying for investment purposes and the local people who are price-sensitive,” he said. “If the US Fed keeps delaying the rate cuts, price-sensitive homebuyers are likely to delay their purchases.”

Hong Kong home sales picked up this year following two of their worst years since 1996 after the government removed all property cooling measures on March 1. These decade-old property curbs included the Buyer’s Stamp Duty designed to target non-permanent residents, the New Residential Stamp Duty for second-time purchasers and the Special Stamp Duty aimed at homeowners that resell their properties within two years.

The Hong Kong Monetary Authority has also taken action to encourage home sales. Homes valued at less than HK$30 million are now eligible for 70 per cent mortgage financing, compared with the previous rule that granted only 60 per cent financing for flats valued between HK$15 million and HK$30 million.

(South China Morning Post)新世界永康街83號商廈 700萬入場

新世界 (00017) 續推工商項目,旗下長沙灣永康街83號商廈短期展開發售,料先推2層,入場費約700餘萬元起,呎價約1.1萬元起。

先拆售2層低層 共36伙

市場消息稱,新世界旗下長沙灣永康街83號即將推出,項目大廈樓高28層,另設4層地庫停車場,地下至1樓為入口大堂及商舖,5樓至31樓為寫字樓用途,項目2樓為平台花園,供綠化休憩空間。分層全層面積約19,216平方呎,每層可分間18個獨立單位,單位面積由約545至1,626平方呎,項目近日已開始入伙。

代理透露,發展商料先推出項目2層低層拆售,每層提供18伙,合共36伙。定價方面,預計呎價約1.1萬元起,預計入場費約700萬元起。

新世界發展早於2017年投得長沙灣3幅商業用地,包括荔枝角道888號項目、瓊林街項目及永康街項目,總可建樓面面積接近200萬平方呎。

(經濟日報)

更多永康街83號寫字樓出售樓盤資訊請參閱:永康街83號寫字樓出售

更多長沙灣區甲級寫字樓出售樓盤資訊請參閱:長沙灣區甲級寫字樓出售

旺角朗豪坊巨舖月租200萬 面積1.5萬呎運動用品店提價10%續約

核心區旺角錄一宗矚目續租個案。位處朗豪坊最當眼地舖,面向砵蘭街、亞皆老街及上海街。巨舖面積約1.5萬呎,獲運動用品店續租,較舊租提價約10%。該店並大肆裝修,不惜投入資源為未來拓展舖路。

上址為朗豪坊地舖,三面單邊,對出為一個供人休憩的廣場,對正紅綠燈,日夜人流聚集。巨舖面積約1.5萬方呎,由運動品牌adidas承租,早前約滿,該舖去向為市場所關注。因疫情後零售市況表現一般,銅鑼灣等不少巨舖都因應淡市拆細出租,惟承租該巨舖的adidas最終選擇續租。

三面單邊對綠燈位

市場消息指,是次續租較舊租提價約10%,月租約200萬,平均每呎約133元。該運動用品店並投入巨資裝修,顯示其看好前景。現場所見,該舖已圍上木板,預告該店將於今年7月份以全新姿態面世。

adidas於2017年進駐該巨舖。當時,國際時裝品牌H&M已承租該舖10年,雖然舖市已回落,但相對現時來說仍然十分暢旺,當年月租料約550萬,呎租約367元,與H&M租金相若,除了基本租金外,並有營業額分成計算。

市場人士表示,隨着後來疫情肆虐,該舖於市況最低潮時月租約100多萬,至於今番續租,較舊租金約180萬提價約10%。

平均呎租133元

朗豪坊附近一帶為旺角區一線地段,近年連錄大手承租,包括松本清承租雅蘭中心地舖及1樓部分,總面積約6000方呎,開設品牌在港的第六間分店,市傳月租高達100萬,呎租料約125元。

至於在該地段,旺角砵蘭街244號遠東旺角銀行大厦基座旺角文華商場,亦有巨舖於近年拆售租出。

(星島日報)

更多朗豪坊寫字樓出租樓盤資訊請參閱:朗豪坊寫字樓出租

更多雅蘭中心寫字樓出租樓盤資訊請參閱:雅蘭中心寫字樓出租

更多旺角區甲級寫字樓出租樓盤資訊請參閱:旺角區甲級寫字樓出租

Developers bite at secondary sales

Ten major housing estates saw just eight deals, the least in about eight months amid pressure from more launches by developers and rainstorms.

The estates, tracked by a local, saw only eight deals last weekend, down by 11.1 percent, the third consecutive weekend that transaction volumes have hit single digits and reaching a new low in nearly eight weeks.

Estates that saw no transactions at all narrowed to four: Kornhill in Quarry Bay, South Horizons in Ap Lei Chau, Metro City in Tseung Kwan O and City One Shatin.

An agent said affordable second-hand housing options are becoming scarce, and buyers are reluctant to pay higher prices, further tilting them toward the primary market.

New properties continued to dominate this month, with most units being priced conservatively and offering diverse options, leading to sustained pressure on the secondary market, the agent said.

Wheelock Properties' Park Seasons, phase 12B of Lohas Park, sold 126 of 168 units, or 75 percent, on Saturday in the first round of sales, a modest show compared to nearby Seasons Place's selloff of all 368 units offered as part of its first round in one day last month.

The 168 units range from 322 to 496 square feet and are priced from HK$4.54 million to HK$7.7 million, with prices averaging HK$14,632 per sq ft after discounts.

Chairman Stewart Leung Chi-kin said Wheelock Properties is also gearing up to launch other projects to meet demand.

Latest plans for a Wan Chai project will be announced as soon as next month.

Onmantin atop Ho Man Tin MTR station, developed by Great Eagle (0041) and MTR Corp (0066), got more than 2,500 checks for 203 units, an oversubscription of about 12 times.

The project yesterday put up 84 apartments for sale by tender on Thursday.

Henderson Land Development (0012) will sell 18 units at The Quinn Square Mile in Mong Kok tomorrow, after being given occupation permits last week. Prices of some units have risen by up to 4 percent.

(The Standard)

新世界 (00017) 旗下長沙灣南商金融創新中心近期接連錄得成交,最新以4,220萬元沽出高層兩伙,平均呎價約1.53萬元。

涉及的兩伙位於高層A1及B12室,面積分別為1,964及790平方呎,合計面積約2,754平方呎,獲大手客以,4220萬元購入。

事實上,南商金融創新中心近期交投加快,早前有國內資金資金購入該廈兩伙作價逾4,000萬元。

(經濟日報)

更多南商金融創新中心寫字樓出售樓盤資訊請參閱:南商金融創新中心寫字樓出售

更多長沙灣區甲級寫字樓出售樓盤資訊請參閱:長沙灣區甲級寫字樓出售

Hong Kong’s homebuyers set aside high-rate concerns as they snap up Wheelock’s Park Seasons flats after discounts

Wheelock Properties sold 126 flats, or three-quarters of the 168 units on offer at its Park Seasons project at the Lohas Park as of 3pm, according to the developer

The sale comprised 1-bedroom and 2-bedroom flats measuring between 322 and 496 square feet, priced at HK$14,632 per square foot on average after discounts

Hong Kong’s homebuyers turned out for the latest weekend launch of new residential property, as the developer’s discounts assuaged concerns that interest rates could remain high for a longer period.

Wheelock Properties sold 126 flats, or three-quarters of the 168 units on offer at its Park Seasons project at the Lohas Park in Tseung Kwan O, according to the developer.

The sale comprised one-bedroom and two-bedroom flats measuring between 322 and 496 square feet (46 square meters), priced at between HK$4.54 million and up to HK$7.70 million (US$983,200), or HK$14,632 per square foot on average after discounts.

About 4,000 people had put down deposits to bid for the flats, or about 24 buyers for every available unit. The buoyant response underscored how Hong Kong’s property buyers had adapted to the high interest-rate environment, a property agent said

“Even if the US Federal Reserve does not cut interest rates, as long as developers maintain attractive prices, transactions should remain strong in May and June,” the agent said.

Hong Kong’s de facto central bank has been conducting its monetary policy in lockstep with the Fed to preserve the city’s currency peg to the US dollar, in place since 1983. The peg means that Hong Kong must keep rates high if the Fed maintains a high cost of funding.

That prospect may stretch into September, from the earlier expectation of a cut in June, after Fed Chairman Jerome Powell struck a hawkish tone this week on US inflation, saying that it could take “longer than expected” to get inflation back on target.

Some analysts have expressed concern that buyers may hesitate to purchase homes should the rate cut not materialise this year. Local and price-sensitive homebuyers could be the most impacted.

That did not deter homebuyers at Lohas Park. The project was jointly developed by Wheelock and Hong Kong’s subway operator MTR Corporation. The project’s 1,985 flats come in three phases, named 12A to 12C. Park Seasons (12B), on sale this weekend, comprises 685 flats.

The developer has already sold 570 flats in the first phase of its Lohas Park project, or 88 per cent of Seasons Place since launching it a month ago. That translated into about HK$3.64 billion of sales revenue.

The local government anticipated the high-rate environment, and preemptively removed some decade-long purchasing curbs to stimulate demand, especially from buyers with genuine need to own, the agent said.

The removal of curbs on March 1 rekindled property deals this year, after two of the worst years for transactions since 1996. As many as 18,000 new homes may find buyers this year, according to a forecast by another local property agency, 28 per cent more than the previous estimate of 14,000 flats.

(South China Morning Post) 中環盈置大廈全幢標售 叫價70億

呎價2.64萬 台資去年64億向「越南朱」購入

中環全幢商廈罕有放盤,早前台資機構向投資者朱立基購入中環盈置大廈全幢商廈,業主隨即委託測量師行標售物業,叫價約70億元,呎價約2.64萬元。

市場消息指,一家外資測量師行,接獲業主委託,放售盈置大廈全幢。盈置大廈位於德輔道中77號,1962年落成,全幢樓面264,622平方呎,目前出租率逾8成,包括地下及1樓複式舖位,面積約6,000平方呎,去年獲國際大型航空公司阿聯酋航空 (Emirates) 以約55萬元租用,開設首間體驗店,料短期內開幕。

地下及1樓複式舖 租55萬

至於樓上寫字樓部分,租客主要為金融機構。項目最大賣點,是位處中環傳統最核心地段,適合企業購入作總部,並獲大廈命名權,於中環仍十分罕有。據了解,業主叫價約70億元,呎價2.64萬元。

物業前身為恒生大廈,早於2006年由摩根士丹利以22.58億元承接,徹底打造翻新大廈,而「越南朱」朱立基於2009年9月以約36億購入。去年尾,朱立基全綫沽售本港物業,並以作價64億元把大廈沽出,新買家為台灣跨國軟件公司「趨勢科技」創辦人兼董事長張明正的相關人士,屬於近年台灣資金於本港樓市最大的單一投資。

越南女首富張美蘭早前因貪污、挪用資金等被起訴,日前裁定罪名成立,於越南判處死刑,張美蘭與丈夫朱立基曾經在香港擁有百億物業。

(經濟日報)

更多盈置大廈寫字樓出租樓盤資訊請參閱:盈置大廈寫字樓出租

更多中環區甲級寫字樓出租樓盤資訊請參閱:中環區甲級寫字樓出租

長沙灣永康街83號近月落成,項目設計甚時尚,附近配套亦齊全。

項目位處永康街及汝州西街交界,由港鐵荔枝角站出口,步行至該廈僅5分鐘,而附近的永康街、青山道及長沙灣道,均有多條巴士及小巴綫,交通四通八達。另物業地庫設有4層大型停車場,可提供約182個私家車車位,停車場入口位於永街康,並設有時租及月租,方便用戶。

飲食方面,荔枝角道一帶的工廈及商廈地下,均有不少餐廳。同區較大型商場為長沙灣廣場、D2 PLACE ONE 及 D2 PLACE TWO,餐廳種類較多。