KT Marina

in Kai Tak is set to launch sales of 218 flats on Saturday, with 212

homes on the list and prices starting at HK$5.75 million after

discounts.

The

residential development is a joint venture involving K Wah International

(0173), Wheelock Properties, and China Overseas Land and Investment

(0688).

The first batch will also take in six three-bedroom flats to be sold through a tender process.

The

project has received over 1,500 checks to date, based on 212 homes for

sale on the price list, which is more than six times oversubscribed.

Subscription registrations close at 1pm on Friday.

Flats

on the price list also include one- to three-bedroom units with areas

ranging from 306 to 586 square feet. Discounted sale prices range from

HK$5.75 million to HK$15.46 million, which corresponds to a price

between HK$17,987 and HK$26,384 per sq ft.

The first price list announced last week for KT Marina

Phase 1 offered 208 flats at a discounted average price of HK$19,798

per sq ft and the second list on Monday offered 118 at a discounted

average price of HK$20,988 per sq ft.

Consequently,

a total of 326 apartments were released between these two price lists.

The entire phase 1 of the project will offer 1,017 homes.

In Tuen Mun, Sun Hung Kai Properties (0016) announced the forthcoming release of the fourth price list for Novo Land phase 2A and intends to initiate sales as early as next week.

The list will include a minimum of 93 flats, featuring studios to three-bedroom flats.

At Lohas Park in Tseung Kwan O, the Villa Garda

III project will commence a new sales round on Friday, presenting 129

homes including 65 newly added units. The project is a collaboration

involving Sino Land (0083), K Wah, China Merchants (0978), and MTR Corp

(0066). They released the third list featuring 65 flats on Monday, with

prices starting from HK$7.38 million after discounts.

In Aberdeen, Emperor International (0163) has sold two special units at SouthSky

for an average price of HK$20,000 per sq ft. Sized 288 and 365 sq ft,

the two units have terraces were offloaded at HK$5.76 million and HK$7.3

million respectively.

Meanwhile,

the mortgage-related one-month Hong Kong interbank offered rate dipped 6

basis points to a nearly two-week low at 4.904 percent.

The

overnight Hibor rose over 13 basis points to 4.529 percent yesterday

after the Hong Kong Monetary Authority injected HK$889 million into the

market through the discount window on Monday - the fourth time in

October.

(The Standard)

Hong Kong, Sydney among Asia-Pacific cities facing ‘unprecedented shortage’ of green office buildings: property agency

Sydney

is expected to face an 84 per cent shortfall of green grade A office

space in the next five years, while Hong Kong is likely to see a 68 per

cent supply deficit

Leasing

office space in green-certified office buildings is becoming a must for

companies striving to achieve their net-zero targets, a property agency

says

Cities

in Asia-Pacific are staring at an “unprecedented shortage” of

sustainable office buildings as companies strive to meet their net zero

targets, according to a property agency.

Office

tenants will be looking beyond green certification and making decisions

based on sustainability metrics, including energy efficiency and green

energy procurement as part of corporate commitments to meeting their net

zero carbon goals, according to the property agency.

“Leasing

office space in green-certified office buildings is becoming

non-negotiable for occupiers, but currently there is very little

correlation between these certifications and a building’s energy

performance,” an agent said.

“Demand

for high-quality, low-carbon workplaces will inevitably grow when lease

expiries approach. Occupiers risk being stuck with limited options if

they fail to plan ahead and re-evaluate the sustainability credentials

of their current premises.”

Cities

in the Asia-Pacific are set to face an undersupply of net zero carbon

buildings over the next five years, according to the agency’s analysis

of lease expiries for top occupiers and supply pipelines for sustainable

office buildings pre-registered for the highest grade of green

certification credentials until 2028.

The

agency defines a net zero carbon building as being “all-electric,

highly rated, energy-efficient and powered by renewable energy”.

Sydney

is expected to face an 84 per cent undersupply of low-carbon office

space up to 2028 despite topping the agency’s Sustainable Offices City

Index ranking. The gauge evaluates 20 cities in Asia-Pacific in terms of

their green-certified grade A office stock, the climate change

vulnerability of buildings, government initiatives to foster

sustainability and factors influencing progress towards green built

environment targets.

Hong

Kong, which ranked 16th on the list, is expected to see a 68 per cent

supply deficit of top-quality sustainable workplaces in the next five

years.

With

77 per cent of the top 100 occupiers in Hong Kong by area leased having

committed to net zero carbon targets, the demand for high-grade,

low-carbon workplaces is expected to peak within the next two years,

outstripping supply more than twofold, according to the agency.

“Only a handful of office buildings in Asia-Pacific match the criteria of a zero-carbon building today,” the agent said.

“The

involvement of governments, coupled with corporate demand and action,

will fuel the momentum and ensure a steady pipeline of net zero

carbon-ready office stock in future.”

Meanwhile,

seven in 10 newly constructed grade A office buildings across the 20

cities in the agency’s Asia-Pacific study were green certified.

The Henderson,

Hong Kong developer Henderson Land’s new grade A office tower in

Central spanning 465,000 sq ft across 36 floors, which is expected to be

completed this year, has received platinum pre-certification in both

the WELL Building Standard and Leadership in Energy and Environmental

Design (LEED) green building rating systems.

Swire Properties’ Two Taikoo Place

in Quarry Bay, completed in September 2022 and covering a gross floor

area of nearly 1 million sq ft across 42 floors, has also received the

same ratings.

The

region must accelerate the rate of retrofitting to meet future

regulations to meet the growing demand for sustainable workplaces,

according to the agency.

With

more than half a billion square feet of grade A office space in the

region built before 2011, the potential for retrofitting in the

Asia-Pacific is substantial, the agency said.

Redeveloping

or upgrading assets to be net zero carbon-ready will serve as the most

efficient solution to bridge the supply-demand gap, the agency added.

(South China Morning Post)

For more information of Office for Lease at The Henderson please visit: Office for Lease at The Henderson

For more information of Grade A Office for Lease in Central please visit: Grade A Office for Lease in Central

For more information of Office for Lease at Two Taikoo Place please visit: Office for Lease at Two Taikoo Place

For more information of Grade A Office for Lease in Quarry Bay please visit: Grade A Office for Lease in Quarry Bay

灣仔海港中心全層 意向價4.5億

有外資代理行代理表示,灣仔北海港中心中層全層,由一本地投資者持有。單位面積約15,929平方呎,約9成實用率,現業主意向價約4.5億元,呎價約28,250元。現單位由一企業租用,租約至明年3月。該代理指,海港中心及旁邊鷹君中心共50層樓面,當中超過5成由發展商一直持有作出租之用。

(經濟日報)

更多海港中心寫字樓出售樓盤資訊請參閱:海港中心寫字樓出售

更多灣仔區甲級寫字樓出售樓盤資訊請參閱:灣仔區甲級寫字樓出售

更多海港中心寫字樓出租樓盤資訊請參閱:海港中心寫字樓出租

更多鷹君中心寫字樓出租樓盤資訊請參閱:鷹君中心寫字樓出租

更多灣仔區甲級寫字樓出租樓盤資訊請參閱:灣仔區甲級寫字樓出租

中環大道中巨舖月租180萬 JOYCE旗艦店舊址 星展銀行進駐

核心區巨舖租金大跌,銀行進駐中環鬧市皇后大道中,新世界大廈一個巨舖,包括地下及地庫面積共逾1萬多呎,由星展銀行承租,鎖定長租期,月租約180萬元,舊租客時裝名店 JOYCE 為長情租客,在此經營旗艦店逾20年,年前遷出後,業主新世界拆細巨舖招租。

上址為中環皇后道中16至18號新世界大廈地下18號地舖連地庫,面積約1.2萬方呎,市場消息透露,由星展銀行進駐,簽下7年長約,直至2030年8月底,其中包括4年梗約及3年續約權,月租約180萬元,平均呎租約150元,上述舊租客為時裝名店

JOYCE Boutique,除了承租上述地庫及地下巨舖,還承租1樓及2樓,面積約2.8萬方呎,在新世界大廈經營逾20年。

簽約4年 另3年續租權

去年9月,該旗艦店搬遷至金鐘太古廣場,業主新世界將巨舖拆細招租,上述1.2萬方呎巨舖意向月租220萬,在尚未找到租客前,該巨舖曾由短租客進駐,將舖位打造得美侖美奐。業內人士表示,最新由銀行進駐,可見在淡市中,租賃市場仍不乏動力,預期最新租金較高峰期跌逾70%。

核心街道連錄銀行承租

JOYCE Boutique 屹立中環逾半世紀,70年代在文華酒店內商場開店,隨後遷往有花店和咖啡店林立的嘉軒廣場、然後,20多年前,承租新世界大廈巨舖,作為旗艦店。隨着核心區舖租大跌,承租能力非比名店的銀行,亦紛進駐核心區,中環皇后大道中36號興瑋大廈地下至3樓巨舖,原先由服裝店承租,2021年遷出後,由業主重新分租,地下至1樓,面積約6500方呎,於2021年亦由恒生銀行以120萬元承租。

(星島日報)

更多新世界大廈寫字樓出租樓盤資訊請參閱:新世界大廈寫字樓出租

多興瑋大廈寫字樓出租樓盤資訊請參閱:興瑋大廈寫字樓出租

更多中環區甲級寫字樓出租樓盤資訊請參閱:中環區甲級寫字樓出租

更多太古廣場寫字樓出租樓盤資訊請參閱:太古廣場寫字樓出租

更多金鐘區甲級寫字樓出租樓盤資訊請參閱:金鐘區甲級寫字樓出租

荃灣海濱廣場意向價9億

鄧成波家族放售荃灣海濱廣場,意向價9億,每方呎約3708元,扣除車位後市值約2億,每方呎約2884元,去年2月以13億放售,今年5月減至12億,該商場位於怡樂街1至9、2至23號及怡康街1至7、2至12號,意向書截止日期2023年12月12日,物業於1990年落成,樓高11層,由地下至8樓,另有2層地庫,總樓面242691方呎,提供155個私家車位及16個貨車位。

鄧成波家族放售

有外資代理行代理表示,海濱廣場逾24萬方呎樓面,樓底特高,買家可改主題式零售、休閒、體驗空間,商場設兩部升降機,可由地庫車場、地下大堂直達6、7及8樓,另設扶手電梯,該物業與海濱花園、海灣花園、環宇海灣及栢傲灣為鄰,四個屋苑合計約9200伙。

(星島日報)

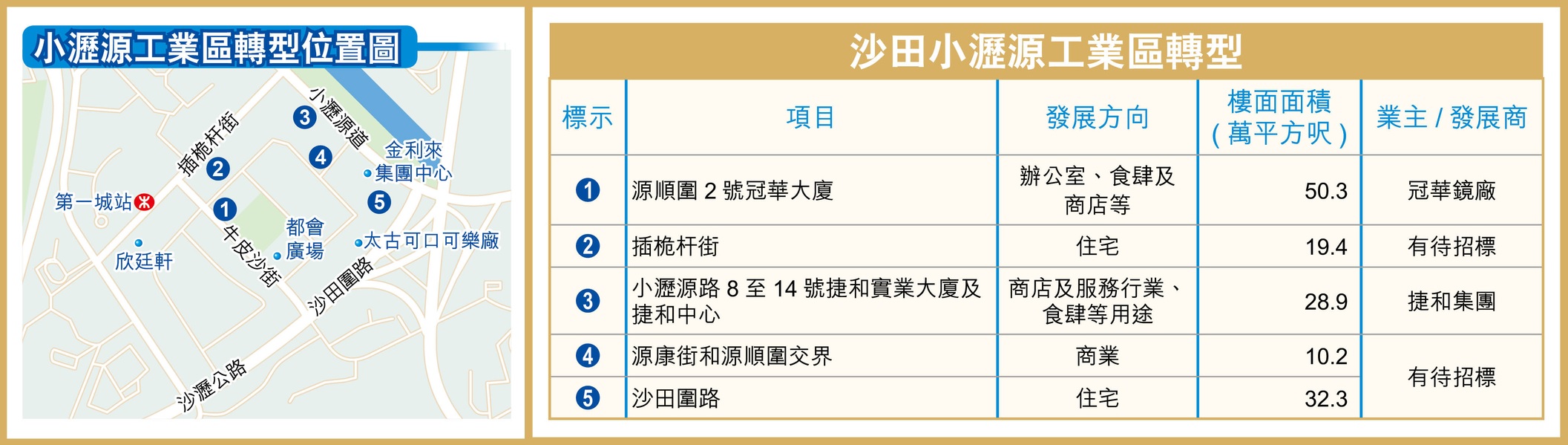

3官地改用途 推動小瀝源轉型

沙田小瀝源工業區轉型,政府除了計劃將該區大規模改劃成為住宅區外,更率先將區內3幅地皮分別改劃成住宅及商業發展,預計可帶來約62萬平方呎樓面供應,帶動區內轉型步伐。

鄰近港鐵第一城站的小瀝源工業區,屬於70年代發展沙田新市鎮時候,為配合社區發展創造就業機會而設,佔地約80.5萬平方呎,目前以貨倉及工廈為主,中間位置則為九巴旗下巴士廠。

政府多年來均想推動小瀝源轉型,早在10年前已經提出改劃成住宅區,不過其後發展不算順利,因巴士廠搬遷有一定挑戰,加上2015年時候社會對工廈有需求,政府一度決定維持該區作為工業地帶。

2休憩地 料增51萬呎住宅樓面

直至2年前完成的新一輪全港工業用地檢討,再次提出將小瀝源工業區改劃成為「住宅 (戊類)」用途。為推動區內其他私人業主加入轉型,政府早前便提出將由政府擁有的3幅休憩用地,以及政府、機構或社區用地,分別改劃成住宅或商業發展。

其中沙田圍路的休憩用地,以及插桅杆街的政府、機構或社區用地,將會改劃成為「住宅 (甲類)」,分別以地積比率5倍及6倍發展,預計可提供約32.3萬平方呎及約19.4萬平方呎的住宅樓面供應,估計可提供逾千伙住宅供應。

源康街源順圍交界 將建小型商廈

至於另一幅位於源康街和源順圍交界,面積只有約1.1萬平方呎的政府、機構或社區用地,則會改劃成為商業發展,以地積比率9.5倍發展,預計可提供約10.2萬平方呎樓面,預計興建1幢小型商廈。

由於3幅用地屬於官地,政府透過將用地改劃並推出市場招標,相信可帶動該區慢慢由傳統工業區轉型成商住發展。

事實上,近年區內亦有工廈業主提出將工廈改裝或重建發展,其中規模較大為由冠華鏡廠持有的源順圍2號冠華大廈,提出以地積比率9.5倍重建,將會興建1幢23層高,連2層地庫的辦公室、食肆及商店等,總樓面達50.3萬平方呎。

在鄰近由捷和實業持有的小瀝源路8至14號捷和實業大廈及捷和中心,則提出全幢改裝成為商店及服務行業、食肆等用途,涉及樓面則約28.9萬平方呎。

(經濟日報)