Hong Kong property: cash-rich buyers make most of Peak distress amid 50% price slump

Distressed

sales in Hong Kong’s luxury property market have driven prices down by

as much as 50 per cent, with opportunistic buyers snapping up bargains, a

property consultancy said

Transactions in Hong

Kong’s super luxury property sector have been supported by

opportunistic, cash-rich buyers pouncing on distressed sales amid a

downtrend in sentiment, according to an property consultancy’s report on

Friday.

Most of these distressed

sales have been witnessed in the prestigious area of The Peak at prices

averaging 50 per cent below their Covid-era valuations, the property

consultancy said

“This sharp decline in

prices has been largely attributed to several instances of distressed

sales, where property owners were compelled to sell to settle

outstanding debts,” the report said.

In July, the consultancy

brokered the sale of four mansions at 46 Plantation Road, which were

sold for HK$1.1 billion (US$141 million). The houses were among several

assets the family of Ho Shung-pun, a low-key clan of real estate

developers in Hong Kong, had pledged as collateral for HK$1.6 billion of

private credit loans.

The consultancy also

brokered the sale of a house that once belonged to China Evergrande

Group chairman Hui Ka-yan. The ultra-luxury property on The Peak sold

for HK$838 million.

“As veteran investors and

property owners began to face financial difficulties, these resulted in

sharp price cuts for the emergency sale of such properties,” an agent

said.

The agent said overall

property prices in Hong Kong have adjusted since last year, and continue

to trend downwards this year, despite the government’s withdrawal of

all property cooling measures in late February. The downturn has

affected commercial properties as well, which have experienced a huge

drop in rents and selling prices.

Hong Kong’s lived-in home

prices fell 1.9 per cent in July from the previous month, dragging the

official benchmark to its lowest level in nearly eight years, according

to data from the Rating and Valuation Department.

The agent said that about

10 years ago, banks readily approved loans for investors to buy

properties during the low-interest rate environment.

The agent said investors

had not faced serious difficulties from the rising interest rates until

the end of last year, which pushed Hibor, or Hong Kong interbank offered

rate, above 5 per cent, pressuring mortgage repayments. At the same

time, rents of commercial buildings and retail shops also fell, the

agent added.

“As a result of these two

factors, [property owners’] cash flow has been hit, affecting

valuations,” the agent said. “Banks started to call loans from

individual investors, which forced property owners to sell their assets

at significantly reduced prices.”

The agent has been involved in many of Hong Kong’s significant transactions this year.

“We’ve been targeting

some of the distressed companies and individuals as early as 2022,”

another agent said. “The Peak currently has over 100 houses, which have

been put up on the market for sale, both primary and secondary, and the

number of sellers with financial urgency has risen to double digits.”

Some cash-rich buyers are

eagerly monitoring the prices, which have come down at least 30 per

cent from their highs, the agent added.

Looking ahead, the agent

said the property market may stabilise towards the end of following the

Federal Reserve’s interest rate cuts. Fed chair Jerome Powell gave the

clearest indication of a rate cut as soon as this month in a recent

speech at the bank’s Jackson Hole meeting.

The market may steady only a bit as the impact of the rate cuts may not materialise immediately, the agent said.

The agent added that the

downturn in the property market this time has been no worse than the

Asian financial crisis 27 years ago.

“Even the rich owners may

have faced difficulties this time, but the depth and breadth of the

property market adjustment is comparable to that in 1997,” the agent

said.

The agent predicted that

as there are still many owners selling their properties at significantly

reduced levels, the prices of the properties will continue to trend

down.

“The adjustment in the property prices has not yet ended.”

(South China Morning Post)

外資代理行:甲廈價格料續回落 下半年跌幅度5%至10%

投資市場面對挑戰,高昂的融資成本,逼使貴重物業組合持有人以折扣價出售非核心資產,有外資代理行預計今年下半年甲廈價格跌5至10%。

該行代理表示,持續高昂資金成本推動投資者以折扣價賣資產,銀行不願向商業物業提供貸款,限制投資需求,現金充裕的買家成為贏家。

投資者吼回報5至6厘物業

該行另一代理指, 香港房產市場面臨重大挑戰,港元升值和高息影響本地經濟,導致遊客消費下降。深圳新購物商場吸引港人到內地消費,導致核心街舖租自2019年起跌50%。

現金充裕的私人投資者和機構瞄準回報達5至6厘物業,惟高回報通常為新界區物業,2024年下半年可能有更多高回報放盤出現。

大手買賣金額按年跌47%

就非住宅大手買賣,2024年上半年僅錄99億,較2023年上半年下降47%,惟今年第二季度仍有一宗全幢出售交易,香港都會大學斥資10億購入紅磡成木酒店。商廈則以折扣價出售,由高盛及凱龍瑞以16億收購和發展的全新寫字樓88WL,僅以7億售予本地投資者,賣方遭受重大虧損。美國銀行中心兩個樓層造價較高峰時跌近60% ,皇后大道中9號29樓單位成交價亦較高位下挫60%。

(星島日報)

更多88WL寫字樓出租樓盤資訊請參閱:88WL寫字樓出租

更多上環區甲級寫字樓出租樓盤資訊請參閱:上環區甲級寫字樓出租

更多美國銀行中心寫字樓出售樓盤資訊請參閱:美國銀行中心寫字樓出售

更多皇后大道中9號寫字樓出售樓盤資訊請參閱:皇后大道中9號寫字樓出售

更多中環區甲級寫字樓出售樓盤資訊請參閱:中環區甲級寫字樓出售

觀塘偉業街全幢商廈延遲拍賣

由私募基金持有的觀塘偉業街全幢商廈東九匯,原訂於本周三拍賣,現時決定延遲,尚未落實時間。

暫未定日期及開價

私募基金基滙資本及數位共同投資者就觀塘偉業街133號全幢商廈東九匯,原本委託一間外資代理行於9月4日 (星期三) 公開拍賣,該行發言人昨日表示,拍賣將延遲舉行,日期稍後公布,項目暫未定拍賣開價。

該全幢總建築面積約192857方呎,每層面積14710方呎,提供區內同類型商廈少有大樓面設計,目前出租率約76%,平均呎租約30元。該廈於1969年落成,樓高13層連天台。

東九匯前身為長輝工業大廈,基滙資本2013年以9.3億向「舖王」鄧成波購入,斥2.7億作翻新及作活化商業用途,2015年入伙,並於2017年7月將項目50%業權,售予SILKROAD基金及其他投資者,作價約10億。

(星島日報)

更多東九匯寫字樓出租樓盤資訊請參閱:東九匯寫字樓出租

更多觀塘區甲級寫字樓出租樓盤資訊請參閱:觀塘區甲級寫字樓出租

Snack food producer Four Seas snaps up Hong Kong office space as bargains lure buyers

Grade A office buildings in Kowloon have lost about half of their value since the market peaked in end-2018

The slump in Hong Kong’s

commercial property market may be ending, as opportunistic buyers like

Four Seas Mercantile Holdings snapped up office space in Kowloon at a

discount, after prices fell to the lowest level in almost six years.

The snack food

manufacturer agreed to buy 25,000 sq ft of office units in Kwun Tong for

HK$205.4 million (US$26.3 million), it said in a Hong Kong stock

exchange filing on Monday. That works out to HK$8,226 per square foot,

or 12.5 per cent below the asking price in the same building.

“With limited new demand

and weak market sentiment, the prices of certain commercial buildings in

Hong Kong have decreased significantly to a relatively low level,”

chairman Stephen Tai Tak-fung said in the filing. “The acquisition

represents a good investment opportunity.”

The group agreed to buy

the entire 31st floor of a grade A office building on 41 King Yip Street

with naming rights, and another office unit on the 21st floor of a

building known as The Vision in the same area. They also include seven car parking spaces and certain signage space.

The seller is a unit of Max Paramount Business, an offshore company ultimately owned by a certain Choi Kin-yeung.

The acquisition

underscores the depressed state of Hong Kong’s property market. Grade A

offices in Kwun Tong and Kowloon Bay have lost about half of their value

since the market peaked at 22,298 per square foot in the fourth quarter

of 2018, according to government data. Distressed assets made up

three-quarters of citywide sales in the first six months this year,

according to a property agency.

“Grade A office capital

values have already dropped by 43 per cent from the peak in late 2018,

and there are expectations of interest-rate cuts” in the coming months,

an agent said. “Some investors may consider entering the market early.”

Four Seas did not immediately reply to an email seeking further comment.

The new office units will

provide rent savings in the long run, as well as improve the working

environment for its employees, Tai said.

The group operates a

retail chain selling snack foods and confectioneries in Hong Kong,

mainland China and Japan. The group markets snacks such as Calbee,

Haribo and Pocky and sells the Maid Brand of sausage and ham products.

It also operates restaurants in Hong Kong and mainland China.

Four Seas had been renting office space at the Manhattan Place

in Kowloon Bay since 2018. The group sold its office and warehouse in

Sai Kung in 2017 for HK$368 million, making a HK$320 million profit on

the deal, according to its previous stock exchange filing.

(South China Morning Post)

For more information of Office for Sale at The Vision please visit: Office for Sale at The Vision

For more information of Grade A Office for Sale in Kwun Tong please visit: Grade A Office for Sale in Kwun Tong

For more information of Office for Lease at Manhattan Place please visit: Office for Lease at Manhattan Place

For more information of Grade A Office for Lease in Kowloon Bay please visit: Grade A Office for Lease in Kowloon Bay

Six boutique hotels valued at $10b put up for sale

Regal Real Estate

Investment Trust (1881) and Regal Hotels International (0078) plan to

sell six hotels in the urban area, whose market valuations amount to

HK$10 billion, local newspaper Mingpao reported.

Regal REIT and its hotel

arm both saw widened deficits in the first half, as the losses expanded

with increased finance costs and higher fair value losses on financial

assets.

The hotels on sale are

all boutique properties, including iclub To Kwa Wan Hotel, iclub

Fortress Hill Hotel, iclub Sheung Wan Hotel, iclub Wan Chai Hotel, iclub

Mong Kok Hotel and iclub AMTD Sheung Wan Hotel, with a total of 1,411

rooms, equivalent to one room averagely worth about HK$7.09 million.

The sizes of the rooms in the hotels range from 151 to 700 square feet.

Most of the rooms are studios, but there are also several family suites and two-bedroom units.

The news of the sale

comes on the heels of a report that New World Development (0017) is

putting up its K11 Art Mall in Tsim Sha Tsui for sale to ease a cash

crunch.

The company predicted its

core operating profits in the fiscal year 2024 may decrease by 18 to 23

percent compared to a year earlier, in a range of HK$6.5 billion to

HK$6.9 billion.

JP Morgan said that if

NWD wants to sell K11 Art Mall, it means that its liquidity is tight

because the mall is a core asset and has symbolic significance for the

group.

Morgan Stanley said that if the firm completes the sale of the mall, the expected net debt ratio would fall to 63 percent.

Hong Kong interbank

offered rates, on which the borrowing costs of most developers' bank

loans are based, continued to remain at relatively high levels during

the first half of the year, weighing on the liquidity of these companies

and pushing them to implement more active capital recovery strategies.

(The Standard)

四洲斥逾2億購觀塘甲廈2層樓面

過去多年市況大上大落,有用家完美示範「高沽低吸」,四洲集團2017年沽售西貢自用廠房後,剛自置物業,斥資2.05億購入觀塘敬業街甲廈部分樓面及廣告位,兼連大廈命名權。

四洲集團以2.05億購入觀塘敬業街41號甲廈雲訊廣場,包括31樓建築面積約16969方呎,21樓2號單位,建築面積約8000方呎,地下5個車位,地下2層2個車位,廣告位及大廈命名權,物業將作為自用,平均呎價約8226元。

連7個車位及大廈命名權

該集團指,自2017年出售自用物業以來,集團一直租用辦公空間,購入物業後能使集團長期穩定發展。由於新增需求有限,市場氛圍疲弱,本港部分商廈價格大幅跌至較低水平,考慮到鄰近類似物業市價;以及集團之業務發展,認為購入物業為投資良機,長遠而言可節省辦公室租金。

原業主蝕讓逾40%沽貨

四洲集團2017年沽西貢康定路1號四洲集團大廈及康定路1號四洲食品網匯中心,作價分別3.68億及2.5億,涉資共6.18億,呎價逾4000元。

偉華集團創辦人蔡經陽、「小巴大王」馬亞木於2018年4月以15.83億購入項目前身僑新工廠大廈,補地價轉商用涉10.13億,樓面呎價7888元,加上建築費及利息各約5000元及1500元,成本呎價14388元,蝕讓逾40%沽貨。該宗為大廈首錄成交。

西貢5幢廠房放售市值9.5億

由鄧成波家族持有的西貢康定路

1、2、6、7及9號五座全幢廠房放售,物業可轉作長者宿舍,市場估值達9.5億。有外資代理行代理表示,該五座物業坐落西貢對面海,佔地計約129526方呎,總建築面積達約383579方呎,每座面積介乎53158至100583方呎,可改裝現代化倉儲或物流中心,亦可補地價重建住宅。該項目亦已獲批重建5幢安老院舍及相關設施。

(星島日報)

更多雲訊廣場寫字樓出售樓盤資訊請參閱:雲訊廣場寫字樓出售

更多觀塘區甲級寫字樓出售樓盤資訊請參閱:觀塘區甲級寫字樓出售

旺角花園街地舖1.25億易手 連部分外牆廣告位回報高達6厘

淡市下,核心區舖位低價沽售,買家得以收取高回報,旺角花園街旺段巨舖,建築面積近3000方呎,連部分外牆廣告位,投資者以1.25億承接,回報高達6厘。

旺角花園街18至24號華園閣地舖,由一間老牌建築商持有,建築面積約2996方呎,外牆1、2及5號廣告位,以1.25億成交,平均呎價4.17萬。

目前,該舖租客包括4間食肆及外牆廣告,唐記包點月租11.5萬、三不賣 (涼茶店) 10.5萬、日船章魚小丸子8.8萬,4、5及6號舖深鴻燻鵝冰室31.3萬,外牆廣告位月租3630元,合共62.463萬,新買家料回報約6厘。

投資者每呎4.17萬購入

原業主於1999年2月以5400萬買入該巨舖,儘管低價沽貨,持貨25年帳面獲利7100萬,物業升值1.22倍。

盛滙商舖基金創辦人李根興表示,現在難於向銀行借錢,市場資金緊張,預期「all cash 」購買,才有此回報水平!該排舖位於煙廠街及登打士街之間,位處馬會旁邊,人流極旺,4名租客租用6間舖,回報高達6厘,十分抵買。

該舖位由老牌家族持有,多年來一直未見放售,淡市下才有此價格,有待美國減息、市況回復較正常時,該位置每間舖平均賣2500萬至4000萬,套現2億絕對不難。

持貨25年升值1.22倍

他補充說,該地舖門闊約80呎,非常闊,實用面積約2200呎,深約30至45呎。

灣仔謝斐道415至421號積福大廈地下B及C號舖,建築面積約1938方呎,以3000萬成交,租客Tapas餐廳。

原業主於1972年4月分別以18.3萬買入B及C號舖,合共36.6萬,持貨52年,帳面獲利2963.4萬,物業升值81倍。

(星島日報)

大道中巨舖月租80萬 名牌時裝零售商進駐

國際拍賣行蘇富比年前承租中環遮打大廈商舖部分,一個面積約2.4萬方呎巨舖作為藝廊,該處前身意大利時裝零售商Giorgio Armani搬遷新址,承租皇后大道中9號嘉軒廣場,面積逾6000方呎,月租逾80萬。

租期長達5年

知情人士透露,中環皇后大道中9號嘉軒廣場地下7至9號舖,由Giorgio Armani承租,租期由2024年9月至2029年8月,長達5年,租約已於土地註冊處登記,惟未見登記租金。

市場人士表示,該巨舖面積逾6000方呎,月租約80萬,平均呎租約133元,惟另一說法月租逾100萬,平均呎租167元。該巨舖前身租客WOAW GALLERY,為一間提倡與推動當代藝術的國際畫廊。

舖位前身為畫廊

Giorgio Armani舊址為遮打大廈地下及1樓,面積2.4萬方呎,屬複式旗艦店,由2002年進駐,年前國際級拍賣行蘇富比首度進駐街舖,承租該巨舖開設旗艦藝廊,並於今年7月27日開幕。

Armani早於1982年在港開設首間專門店,並拓展本地和中國市場,該集團設計、製造、分銷及零售旗下一系列品牌時裝產品,包括衣服、飾物、眼鏡、手錶、家居用品、香水和化妝品。

(星島日報)

更多遮打大廈寫字樓出租樓盤資訊請參閱:遮打大廈寫字樓出租

更多皇后大道中9號寫字樓出租樓盤資訊請參閱:皇后大道中9號寫字樓出租

更多中環區甲級寫字樓出租樓盤資訊請參閱:中環區甲級寫字樓出租

價格回調 資金重投核心區

近期核心區甲廈及舖位均錄大手買賣,反映當價格大幅回調後,資金重投核心區物業。

近期核心區連錄大手物業成交,甲廈方面,焦點落在中環中心,錄得2層大手買賣,分別66樓及75樓,由同一買家承接。現時66樓面積約26,967平方呎,由商務中心租用,而75樓面積約23,901平方呎,現由內地電訊企業租用,兩層樓面合共50,868平方呎,以約14.2億元沽出,呎價約2.8萬元。

中環中心極高層 呎價較高峰跌半

是次涉及大廈極高層單位,可享極開揚維港景觀,屬區內最優質的甲廈單位,故造價明顯較高。翻查資料,對上一宗相近樓層買賣,為內企於2017年以約7.38億元向太和控股 (00718) 購入中環中心79樓全層,以總面積約13,213平方呎計,呎價約55,854元,一度創下全港寫字樓呎價最高紀錄。以最新成交計算,呎價已跌約一半。

市場人士指,是次買家以星展銀行呼聲最高,該集團一直持有中環中心多層自用,並租用部分單位。

兩層單位原業主為投資者陳秉志,早年夥拍多名投資者合組財團,以約402億元向長實購入75%業權,平均呎價約3.3萬元,其後多名投資者分樓,惟每層購入價未有公布,但相信仍要蝕讓。

彌敦道地舖 呎價約5萬

舖位方面,核心區尖沙咀連錄成交,消息指,彌敦道86號地下舖位易手,面積約4,000平方呎,以約2億元成交,呎價約5萬元。該舖位於尖沙咀彌敦道最核心位置,正對清真寺,人流極為暢旺。舖位現由化粧品以約58萬元租用,回報率約3.5厘。原業主於1970年以約488萬元購入舖位,持貨54年轉手,獲利約1.95億元,升值約40倍。

另同區加拿芬道37及39號,上月亦以約4.2億元沽出,物業2幢相連5層高之商住物業,總地盤面積約2,875平方呎,物業總面積約1萬多平方呎,現時地下租客包括有藥房、飲品店、手機配件等,整項物業每月租金收入約78.3萬元,項目可重建為1座約3.45萬平方呎銀座式商廈。

翻查資料,物業由鄧成波家族持有,波叔早年分階段進行收購,包括2016年以約3.2億元購入加拿芬道37號,據悉兩物業合共涉及約9億元收購。去年該家族曾把物業放售,叫價約5億元,惟未獲承接,近期更遭接管。若按最新市值計,已較當年收購成本價大幅貶值。

分析指,核心區物業在過往數年價格大幅調整,而市場憧憬減息在即,經濟可望轉好,核心區物業反彈力料較高,故現率先入市。

(經濟日報)

更多中環中心寫字樓出售樓盤資訊請參閱:中環中心寫字樓出售

更多中環區甲級寫字樓出售樓盤資訊請參閱:中環區甲級寫字樓出售

位於鰂魚涌的泓富產業千禧廣場,最大優點是地點方便,而物業提供中細單位,非常靈活。

泓富產業千禧廣場位處鰂魚涌英皇道663號,地點屬核心商業地段英皇道。交通方面,由鰂魚涌港鐵站出口步行至該廈僅兩分鐘,而大廈門口為巴士、電車站,交通非常方便。而大廈鄰近東隧入口,來往九龍相當便利。另外,大廈地庫為停車場,方便駕車人士。

其他配套上,附近設有少量餐廳及酒樓,若前往太古坊一帶,餐廳選擇更多。

近年英皇道亦有不少新甲廈出現,泓富產業千禧廣場於1999年落成,而物業樓齡約25年,設備上即使或不及同地段部分新甲廈,業主亦有為物業進行翻新,包括地下大堂非常光猛,而個別分層大堂亦換上時尚設計,質素上得以保持。

每層8千呎 可間多個單位

物業樓高32層,總樓面約217,955平方呎,共設多部升降機通往各層。大廈入口連接英皇道及渣華道,比鄰北角海逸酒店及北角政府合署,四通八達。

大廈每層面積8,000平方呎,可分間成數10單位,面積由566平方呎起,由於單位間隔選擇多,適合不同類型,特別合中小型公司使用。

景觀上,中高層1至8號單位可擁攬維港全景,相當舒適,另一面望向山景,同樣開揚。

據了解,目前大廈出租率逾88%,租戶類型多,包括有資訊科技、廣告公司等。

物業由泓富產業信託 (00808) 持有,現旗下擁數項寫字樓物業,出租率頗為理想。

數單位招租 每呎叫租22元起

泓富產業千禧廣場地點佳,現物業數單位進行招租,意向呎租約22元起。

面積1363呎 備寫字樓裝修

業主現推出數單位放租,包括906至7室,面積約1,363平方呎,提供寫字樓裝修及傢俬,意向呎租約22元,另1011室,面積約961平方呎,亦連同傢俬,同樣呎租約22元。

至於較高層放租單位為2901至3室,面積約2,163平方呎,每呎叫租約22元。

同區租務上,同地段的英皇道1063號錄全層租務,涉及物業中高層,面積約10,238平方呎,上月以每呎約35元租出。另英皇道商廈Foyer中層05室,面積約2,471平方呎,成交呎租約30餘元。

(經濟日報)

更多泓富產業千禧廣場寫字樓出租樓盤資訊請參閱:泓富產業千禧廣場寫字樓出租

更多Foyer寫字樓出租樓盤資訊請參閱:Foyer 寫字樓出租

更多鰂魚涌區甲級寫字樓出租樓盤資訊請參閱:鰂魚涌區甲級寫字樓出租

The owners

of the 52-room, four-star hotel in Sai Ying Pun have lowered the asking

price to HK$600 million from HK$1 billion previously

The worsening slump in Hong Kong’s property market is pushing owners to deepen the discounts of assets already on the market.

The Connaught, a

29-storey hotel in Sai Ying Pun, adjoining the core business zone of

Central, is being offered at a 40 per cent discount to its initial

asking price.

The owners of the

52-room, four-star hotel with a gross floor area of 41,705 sq ft have

dropped the price to HK$600 million (US$77 million) from HK$1 billion

previously, according to a statement from two agencies who’s the joint

agents for the sale.

The asset is just one of

many that have been put for auction by landlords and investors in recent

months. It is owned by a joint venture of Hong Kong-based Hanison

Construction and New York-based private equity real estate specialist

Angelo Gordon, sources said.

On Monday, another agency

said that it has been appointed as the sole agent for the sale of five

en-bloc industrial buildings in Sai Kung with a gross floor area of

383,579 sq ft. The buildings are valued at HK$950 million. The property

“holds significant potential for conversion into a high-end senior

living community”, according to the agency.

In the first half of the

year, sales of distressed property in Hong Kong surged to about three

quarters from the typical 10 per cent of such levels in previous years,

according to an estimate by another property agency. With interest rates

at a 23-year high, asset owners have found it increasingly difficult to

service debt, the property agency said.

“Despite the unstable

global economy, the hotel investment market has demonstrated outstanding

performance in the past two quarters,” an agent said.

“The revival of the

inbound tourism industry, coupled with the Hong Kong government’s effort

to promote the Quality Migrant Admission Scheme, will propel the growth

of the entire hotel investment market,” the agent added.

In February, co-living

brand Dash living and fund manager Prudential Investment Management

acquired the Ovolo hotel in Sheung Wan for HK$320 million, or an average

price of about HK$12,300 per square foot.

The Connaught enjoys a

“strategic location advantage”, as it is a few minutes’ walking distance

from the Sai Ying Pun MTR station and the Hong Kong-Macau Ferry

Terminal, another agent said.

The hotel can benefit

from Hong Kong’s talent scheme aimed at attracting high-quality

professionals globally for career development, the agent said.

“The property is

well-served as a suitable accommodation for company management,” the

agent added. “With only an MTR station away from the University of Hong

Kong, it is perfectly positioned to function as a dormitory for senior

teaching staff.”

The closing date for the hotel tender is October 23.

(South China Morning Post)

Hong Kong property deals slump to 6-month low as market-boosting measures wear off

Overall

real estate transactions in August fell 10 per cent month on month to

4,729 units, while value declined 20 per cent to US$4.4 billion

Hong Kong’s property

market lost some of its zip in August, with overall property

transactions slumping to the lowest since February when cooling measures

were still in place.

Real estate deals,

comprising new and lived-in homes, office units, car parking slots,

shops and industrial spaces, fell 10 per cent month on month to 4,729

units, and declined by 33 per cent from six months ago, according to the

Land Registry data released on Tuesday.

Overall deal value fell

about 20 per cent month on month to HK$34.3 billion (US$4.4 billion),

but was up by more than 50 per cent compared with February, the data

showed.

On an year-on-year basis, the volume in August was 1.5 per cent higher, while the value was 1.6 per cent lower.

Home sales slipped for

the fourth consecutive month to 3,654 units, a 1.9 per cent decrease

from July and a six-month low since 2,375 were sold in February. The

value amounted to HK$28.47 billion, a 20 per cent slump from HK$35.7

billion in July.

“Home sales transactions

fluctuate with the market sentiment regarding interest rates, resulting

in periods of both activity and inactivity,” an agent said.

Property registrations will continue to remain at low levels until the interest rate cuts are implemented, the agent added.

Starting in March, the

Hong Kong government scrapped all property cooling measures such as the

Special Stamp Duty, which was levied on homebuyers who flipped their

property within two years of purchasing it. This led to a surge in

transactions, with sales in April rising to their highest since July

2021.

The exuberance was short-lived, with deals falling back to the 5,000 level since June.

The market is widely

anticipating that the US Federal Reserve will start easing rates later

this month, a development that could quadruple home sales this month

compared with August, according to a local property agency.

With the local currency

pegged to the US dollar, Hong Kong’s monetary authorities are expected

to follow any easing by the Fed. Hong Kong’s interest rates currently

stand at a 23-year high.

A cut in interest rates

could see developers launching at least six new projects with a total of

2,800 flats, according to another local property agency.

The high borrowing costs

have weighed on home prices, with developers extending discounts to

levels seen several years ago. Wang On Properties launched 60 units at Finnie

in Quarry Bay in the last week of August at prices ranging from

HK$17,502 to HK$23,470 per square foot, about 30 per cent lower than the

initial launch of Henderson Land’s The Holborn, in the same area, in 2021.

Secondary home prices,

meanwhile, fell to a near eight-year low in July, according to the

latest reading of the Rating and Valuation Department.

“It is anticipated that

the overall property transactions in September may see a slight increase

with a month-on-month rise of nearly 4 per cent, testing the 4,930

mark,” the agent said.

(South China Morning Post)

Mega projects gear up for launch

Twin Victoria and

Cullinan Sky in Kai Tak are among at least four new mega projects

planning to put homes up for sale this month, hoping to ride the wave of

an expected boost in sales from the imminent US Federal Reserve's

interest rate cut.

Twin Victoria, developed

by China Overseas Land & Development (0688), is expected to be

launched this week with at least 141 flats in the first batch.

The project opened three

show flats yesterday, of which one is being decorated and redesigned

from a two-bedroom to a one-bedroom unit.

It will offer a total of

702 flats measuring between 244 and 1,770 square feet, spanning studio

to three-bedroom homes as well as some special units.

Sun Hung Kai Properties's

(0016) Cullinan Sky will release its sales brochure as early as next

week and put flats on the market this month.

The project is divided

into four areas. The first batch will be mainly from its Elite Zone,

with the smallest unit measuring around 250 sq ft.

Elsewhere in the primary market, Great Eagle (0041) will have 133 units at Onmantin Phase IIA in Ho Man Tin up for sale on Friday.

The project sold some of

its three- and four-bedroom units in tender earlier, then released its

first price list last week, offering 84 flats at an average HK$20,772

per sq ft after discounts. Buyers can purchase up to four units.

The Parkland in Yuen

Long, developed by Lai Sun Development Company (0488), uploaded its

prospectus yesterday, set to be launched in the short term.

The finished project offers 112 units, comprising one- and two-bedroom flats ranging from 265 to 494 sq ft.

CK Asset's (1113) The Coast Line in Yau Tong launched Mid-Autumn Festival offers amid keen competition.

Homebuyers who buy a

studio or two-bedroom unit in The Coast Line II can get a gold gift

coupon worth around HK$39,800, and the buyer of the last three-bedroom

home in The Coast Line I could gain a gold dragon with the value around

HK$99,800.

The rental market shares

the upbeat momentum. Henderson Land Development (0012) put 23 of the

remaining units at One Innovale in Fanling up for rent, with the monthly

rent for a studio starting at HK$9,500.

It also offers eight

one-bedroom flats leasing between HK$11,100 and HK$12,600, 10

two-bedroom units ranging from HK$15,800 to HK$16,600, and four

three-bedroom flats with monthly rent up to HK$24,800.

Rentals for four-bedroom flats remain up for discussion with tenants.

(The Standard)

興盛創建放售西環酒店 全幢意向價6億

由興盛創建持有的西營盤干諾道西138號THE CONNAUGHT減價放售,由10億減至6億,呎價約1.44萬。

有代理表示,THE CONNAUGHT酒店位處西營盤干諾道西138號,樓高29層,總建築面積約41705方呎,於2019年完成翻新工程,現共提供52個房間,每個房間均可飽覽180度維港景。截標日期為2024年10月23日中午12時正。

2018年購入價7.3億

另一代理表示,儘管環球經濟仍不穩定,酒店投資市場表現不俗。今年2月初,本地共居品牌Dash Living夥拍外資基金保德信PGIM,以3.2億承接上環皇后大道286號奧華酒店,呎價1.23萬。

據了解,業主最初叫價10億放售全幢,現下調目標價至6億,累減4億或40%,呎價約1.44萬,按最新叫價計算,每個房間價值約1154萬。

平均每個房間值1154萬

酒店前身為服務式住宅太極軒138,興勝創建於2018年以7.3億收購並將之翻新為酒店,當時,發展商曾表示,預料每呎翻新費用約1000至2000元,料日後月租收益約290萬。若以酒店總樓面計算,翻新費亦至少逾4170萬。

(星島日報)

航天城11 SKIES 明年第二季起開放

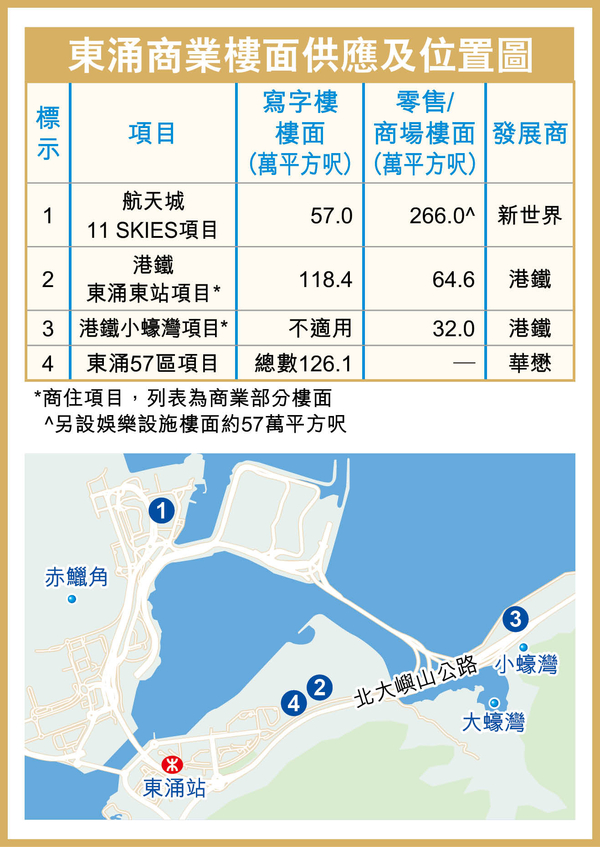

機場及東涌一帶發展加快,其中總樓面達到380萬平方呎的航天城11 SKIES項目陸續落成,零售及娛樂體驗設施部分,將在明年第二季陸續開放。

根據資料顯示,連同赤鱲角機場在內,東涌及周邊未來有4個大型商業項目,合共為區內增逾660萬平方呎商業樓面,其實中規模最大屬於航天城11 SKIES,而港鐵 (00066) 則分別在東涌東站、小蠔灣兩個項目上,合共擁有逾220萬平方呎商業樓面。

投資逾200億 備娛樂餐飲零售

航天城11 SKIES位於機場二號客運大樓,跟亞洲博覽館之間,由新世界 (00017)

所發展,屬於大型綜合項目,總樓面達到380萬平方呎,將會提供大型零售、娛樂設施,及3幢合共約57萬平方呎的甲級寫字樓K11 ATELIER 11

SKIES,總投資額高達約200億元。

11 SKIES在零售部分提供約266萬平方呎,包括逾800間商舖,另外設有57萬平方呎的沉浸式體驗娛樂設施。首階段娛樂設施將於明年第二季陸續開放,零售、餐飲等服務則會配合機場與航天城整體項目的發展時間,擬於2025年第4季起逐步投入服務。

至於寫字樓方面,K11 ATELIER 11 SKIES總樓面約57萬平方呎,由3幢甲級商廈組成,早在2022年7月已經陸續入伙,辦公室的單位面積介乎約1,696至33,868平方呎,吸引不少金融機構、健康醫養及初創企業進駐。

另一方面,隨着港鐵東涌東站及小蠔灣站的發展,港鐵在區內兩個大型商住項目亦將陸續推出,住宅外,亦擁有約220萬平方呎的商業樓面,其中183萬平方呎來自東涌東站項目。

港鐵2項目 料年內重新招標

該項目位於東涌第113區,佔地約82萬平方呎,總樓面約678萬平方呎,當中7成屬於住宅樓面,亦設有商業零售及辦公室樓面,分別涉約64.6萬及118.4萬平方呎。

港鐵曾經在去年11月推出東涌東站1期招標,其中包括8.8萬平方呎的商場樓面,惟最終流標收場,港鐵計劃最快今年內重新招標。

至於小蠔灣項目佔地約323萬平方呎,總樓面達到926萬平方呎,其中大部分作住宅發展,涉及約2萬伙,並設有逾32萬平方呎的商場。

大中華首間KidZania 57萬呎娛樂設施

新世界 (00017) 旗下機場航天城11 SKIES設有57萬平方呎的娛樂設施,包括當中大中華區首間KidZania趣志家兒童職業體驗樂園於今年7月底至9月初試營運,樓高3層與近30個國際及本地品牌合作。

11 SKIES設有多項大型娛樂設施,包括香港首間動感飛行影院「飛越天際」、韓國最大沉浸式多媒體藝術博物館ARTE MUSEUM、以柏靈頓熊為主題的室內親子娛樂體驗,以及KidZania趣志家兒童職業體驗樂園。

其中KidZania Hong Kong香港趣志家早前試運,提供近70個逼真職業角色體驗,包括七大「香港獨家」創意體驗如財富管理中心、智慧城市科技工作坊、兒童運動健康的綜合體育館、中式糕點烘焙坊等。

3層高 集職業角色體驗動感影院

至於,動感飛行影院方面,以香港風貌為主題,透過數碼技術、無邊界熒幕等先進科技,將香港日與夜的美景展現於13米球形熒幕上。

(經濟日報)

代理行:工商舖買賣連跌3個月

有代理表示,整體工商舖買賣持續下跌,惟望美國9月落實減息後會扭轉劣勢。今年8月全港共錄271宗工商舖買賣,較7月份284宗再跌4.6%,連跌3個月,創近5個月最少,反映7月下旬至8月初期間,股市下跌及高息環境持續影響。

該代理續指,月內各類物業中,以店舖跌幅最急,按月挫22.1%至60宗;商廈表現疲弱,跌13.2%,工廈逆市回升7.1%。

工廈錄165宗登記升7%

該行另一代理指,8月份工廈買賣登記止跌回升,反映部分資金趁低吸納,宗數佔比達60.9%,按月增約6.7個百分點。初步數字顯示,8月全月工廈共錄165宗買賣,按月漲7.1%,終止兩連跌,為近3個月最旺,總值為19.95億,按月顯著升27.3%,創自2023年11月以來的10個月新高。

店舖買賣挫逾20%僅60宗

該代理表示,商廈買賣未見好轉跡象,8月只錄46宗按月挫13.2%,為工商舖中最少類別,總值相應跌5.6%金額只錄10億,同為最少類別,且為5個月最低。

該行另一代理指,店舖買賣跌勢加劇,除連跌3個月外,更創自4月份以來5個月低位。8月份只錄60宗,按月跌幅擴大至22.1%,總值也跌14.2%,僅10.81億,為近6個月以來最少。

(星島日報)

上環帝權商廈5750萬易手 涉大廈35%業權「台灣張」張彥緒沽貨

由資深投資者「台灣張」張彥緒持有的上環帝權商業大樓基座及一籃子物業,佔全幢大廈35%業權,以5750萬易手,平均呎價5807元,持貨20年升值1.4倍,買家為一間基金,作為投資用途。

上環德輔道西32至36號帝權商業大樓地庫、地舖、閣樓、1樓及2樓全層連部分天台,總建築面積約9901方呎,同時連大廈命名權及大廈外牆使用權,地舖及閣樓外牆設矚目戶外廣告,上述出售部分佔全幢業權35%。

平均呎價5807元

該一籃子物業,早前意向價約9800萬放售,最終以5750萬易手,減價4050萬或幅度41%,平均呎價5807元。

張彥緒於2004年6月以2388萬購入上述商廈,並於於2017年12月物業作內部轉讓,作價達1.4億,若撇除內部轉讓不計,持貨20年帳面獲利3362萬,物業升值約1.4倍。

市場消息指,上述物業由多名租客承租,包括地舖海味店屬於長情租客,新買家為一間基金公司,料回報逾5厘。

該廈位處地段屬著名「海味街」,聚集海味及南北行等商店,帝權商業大樓1968年落成,位於德輔道西、高陞街及皇后街交界,樓高17層高,大廈擁有999年地契期限。該廈距離港鐵上環站步程約10分鐘,西營盤站約5分鐘步程。

持貨20年升值1.4倍

張彥緒活躍於市場,去年4月,沽售灣仔會展廣場辦公大樓中層02、08至12室,作價2.55億,建築面積約8206方呎,呎價約3.1萬,張彥緒於2009年以8041萬購入,帳面獲利約1.75億,升幅約2.1倍。

(星島日報)

更多會展廣場辦公大樓寫字樓出售樓盤資訊請參閱:會展廣場辦公大樓寫字樓出售

更多灣仔區甲級寫字樓出售樓盤資訊請參閱:灣仔區甲級寫字樓出售

深水埗舊樓批強拍令 底價1.83億

由財團早年併購及申請強拍的舊樓項目,近期陸續獲土地審裁處批出強拍令,最新深水埗福華街舊樓昨批出強拍令,底價為1.83億,對比2022年申請強拍時市場對整個項目連同僭建物市場估值1.9223億,低出約923萬或約4.8%。

上述舊樓由一家名為Dream Big Development Limited公司於2022年申請強拍,當時福華街54及56號持有91.67%業權,而福華街58及60號則持有92.5%業權,直至審訊時前者增至95.83%業權,後者增至100%業權。

持有逾九成業權

據判詞指出,申請人曾委託結構工程師對該舊樓進行結構評估,由於大樓現時維修狀況不佳,在許多方面已過時,無論物理上或功能上都未能符合現代建築標準和法定要求。而且維修成本與重建成本不成比例,故重建發展是合適做法。再者申請人已採取一切合理步驟取得全部業權,故批出強拍令。

項目地盤面積約4620方呎,若以地積比率9倍發展,涉及可建總樓面約41580方呎。現址現為2幢6層物業,地下為商舖,樓上為住宅樓層,舊樓分別於1972年及1977年落成入伙。

(星島日報)

投資者陳洪楷連購舊樓 「淡市是撈底好時機」

投資者陳洪楷早前購尖沙咀全幢商住樓,市場矚目,最新涉足舊樓市場,連購香港仔田灣登豐街2個舊樓。

他購入登豐街2號5樓及4號5樓,面積各564方呎,合共1128方呎,作價309萬,平均呎價2739元,他接受本報查詢回應,該地段舊樓規模龐大,近年恒基已強拍部分舊樓,他預期單位月租各1萬,回報高逾7厘,造價重返2005年水平,長線博收購!他更強調:「淡市是撈底好時機,繼續在舊樓市場尋寶。」

田灣兩舊樓作價309萬

登豐街2至12號、田灣街2至10號及石排灣道83至103號,佔地31647方呎,可建總樓面逾28.4萬方呎。

回報逾7厘 長線博收購

他今年5月向「木器大王」傅世彪家族購入尖沙咀柯士甸道108號耀基大廈全幢商住樓,總面積約20689方呎,呎價約7250元,打造服務式住宅,力吸上班人士及內地生租客。

(星島日報)

Quiet market awaits rate cuts

Sales of old homes fell over the weekend as buyers

waited for a possible US Federal Reserve interest rate cut and more new

project launches.

The market is also waiting to see what measures

Chief Executive John Lee Ka-chiu might unveil to stimulate the economy

in his third policy address next month.

The city's 10 major housing estates saw eight

deals over the weekend amid poor weather compared to 10 to a week

earlier, the lowest in six weeks, according to a property agency

An agent said impending rate cuts will ease lending costs, encouraging the homebuyers to purchase affordable new flats.

Homeowners, too, are waiting for rate cuts to raise selling prices.

Attractively priced projects in Kai Tak launched in the past week also drew buyers away from the secondary market.

KT Marina

1 in Kai Tak recorded five deals over the weekend worth a total of

HK$32.4 million. The project, co-developed by K Wah International

(0173), Wheelock Properties and China Overseas Land and Investment

(0688) has sold 24 flats in three days.

In the commercial market, "Minibus King" Ma Ah-muk's family has put the second floor of the Peninsula Centre

in Tsim Sha Tsui on the market for HK$420 million, after selling

another commercial property, Eco Tree Hotel on Des Voeux Road West by

public tender several weeks ago, according to another property agency.

(The Standard)

For more information of Office for Sale at Peninsula Centre please visit: Office for Sale at Peninsula Centre

For more information of Grade A Office for Sale in Tsim Sha Tsui please visit: Grade A Office for Sale in Tsim Sha Tsui

Hong Kong rents set to hit record high as talent influx fuels demand

The rental

index is about 3 per cent away from the peak seen in August 2019, a jump

that is not entirely implausible, a property agency said

Rents in Hong Kong are

set to climb to a record high this year, surpassing the previous peak in

August 2019, because of robust demand from newly arrived residents and

prospective homebuyers currently sidelined by high mortgage rates,

according to analysts.

With the rental home

index in July rising by 1.1 per cent month on month to 194.1, the gauge

is 6 points shy of the peak of 200.1 recorded in August 2019, according

to official data.

More rent increases are

in the offing, which could spur developers to shift their unsold flats

to the leasing market instead of selling them, analysts said. In such an

event, rents could go past the HK$21.30 (US$2.73) to HK$41.48 per

square foot per month range reached five years ago.

“The current market conditions are clearly characterised by limited supply and robust leasing activity,” an agent said.

The rental index will

continue its upward trajectory throughout September and likely reach an

all-time high this year, although the margin of increase may be modest,

the agent added

The agent said that for

the rental index to hit a record, it has to register a year-on-year jump

of 8.2 per cent in August, an “optimistic” scenario but “not entirely

implausible”. In July, rents surged 6.6 per cent year on year.

“With more international

students renting units and a continuous influx of skilled professionals,

rents are expected to further increase by 1.5 per cent in August and

September, respectively,” another agent said. “This could drive rents up

by nearly 4.2 per cent in the third quarter.”

The agent said in the

last three months of the year, rent increases were likely to moderate to

2 per cent, which would still be enough to push the annual gain to 9.5

per cent, taking the rental index past the previous high of 200.1. In

2023 the gauge rose to 186.0, following a 6 per cent increase in leasing

costs.

As of July, the Hong Kong

government’s scheme to attract talent to the city had drawn 93,000

applications, of which more than 73,000 were approved, according to

official data. Of those, 60,300 had already arrived in the city.

A potential interest-rate

cut in Hong Kong later this month is unlikely to dampen demand in the

leasing market, analysts said. With the US Federal Reserve widely

anticipated to start easing its policy stance, Hong Kong monetary

authorities are expected to follow suit.

“The impact of a rate cut

on the leasing market is likely to be positive in the short term,

primarily due to the potential influx of talent attracted by a more

accommodative business and economic environment,” the first agent said.

With the interest-rate

cut expected to be gradual, leasing demand is not likely to

significantly shift to the sales market, the agent added.

The second agent differed

slightly with the industry insider’s views. A rate cut is likely to

boost the number of buyers entering the market, with more likely to

transition from renting to buying, which could slightly dampen rental

demand.

“However, with skilled

professionals continuing to arrive in Hong Kong and renting apartments,

rents will still have a certain level of support,” the agent added.

Meanwhile, with

developers still holding a large inventory of unsold flats, the leasing

market is becoming an increasingly viable option, according to the

agent.

“Rental demand is

currently very strong and rental income remains stable, while property

prices have yet to stabilise,” the agent said, adding that developers

could consider shifting their properties from sale to rentals.

For example, Henderson Land has put 34 units for lease at The Henley

III in Kai Tak from HK$16,000 to HK$17,000 a month, while in Fanling,

the developer has 23 units at the One Innovale for lease at a starting

price of HK$9,500 a month.

As of July, Hong Kong

developers had 22,300 unsold residential units, about 1.7 per cent

higher than the 21,900 they had at the end of 2023, according to another

property agency.

In the next three to four years, as many as 109,000 new flats are expected to flood the market, according to the housing bureau.

“Developers are exploring other options amid the market downturn,” another agent said.

(South China Morning Post)

中環歷山大廈呎租約100元 律師樓承租約2.3萬呎屬升級搬遷個案

商廈租賃氣氛略有改善,市場錄1宗升級搬遷個案,一間大型律師樓由金鐘力寶中心遷往中環,向中環大業主置地承租區內歷山大廈接近2.3萬方呎樓面,平均呎租約100元。

市場消息透露,曾由佳士得藝廊承租的中環歷山大廈其中2層樓面已告租出,該2層為22及23樓全層,面積各約11400方呎,合共約22800方呎,業內人士料月租約228萬,平均呎租約100元。租客來自金鐘力寶中心,為一間國際級大型律師樓。

租客來自金鐘力寶中心

該間律師樓原本承租力寶中心一座8樓及15樓全層,建築面積分別14890方呎及13344方呎,合共約28234方呎,估計呎租約50元,月租約141萬。知情人士續說,由於力寶中心實用率介乎75%至78%,力寶中心該2層樓面實用面積共約2.2萬方呎,該宗租賃屬升級搬遷,租客遷至更高級數甲廈,承租樓面面積與舊址相若。力寶中心該2層分別由2名業主持有,在獲悉租客通知搬遷後,業主各以意向每呎43及45元放租單位。

上述歷山大廈22及23樓面,前身租客為佳士得亞太總部,承租該廈合共3層半樓面,總面積約4萬方呎。佳士得早於2021年預租The Henderson 4全層,新總部面積增加至5萬方呎,亦是升級搬遷個案。該拍賣行將於本月26及27日舉行拍賣,亦是全新亞太區總部落成後的首屆拍賣。

曾由拍賣行佳士得承租

早前,置地旗下的同區遮打大廈,早前亦錄一宗租客擴充規模個案,一名長情客本身已承租該廈13樓及15樓2全層樓面,涉約3.6萬方呎,早前一口氣新租該廈16個散單位及17樓全層,面積分別為7000方呎及1.8萬方呎,面積多達2.5萬方呎。

(星島日報)

更多歷山大廈寫字樓出租樓盤資訊請參閱:歷山大廈寫字樓出租

更多The Henderson寫字樓出租樓盤資訊請參閱:The Henderson 寫字樓出租

更多遮打大廈寫字樓出租樓盤資訊請參閱:遮打大廈寫字樓出租

更多中環區甲級寫字樓出租樓盤資訊請參閱:中環區甲級寫字樓出租

更多力寶中心寫字樓出租樓盤資訊請參閱:力寶中心寫字樓出租

更多金鐘區甲級寫字樓出租樓盤資訊請參閱:金鐘區甲級寫字樓出租

8月份工商舖 按月量跌價升

減息前工商舖交投仍較為淡靜,有代理行統計,8月份工商舖錄218宗成交,按月微跌。

該行統計,8月份工商舖買賣量跌價升,共錄得約218宗工商舖買賣成交,較上月微跌約8.4%,對比2023年同期則跌約31.66%。至於成交金額方面,月內錄得多宗大手成交,帶動全月共錄得約60.79億元,較上月增約1.2倍,按年對比亦增加約35.45%。

商廈買賣金額 按月增3.4倍

8月份工商舖物業買賣以商廈最為矚目,數據顯示,8月份商廈錄得約26宗買賣成交,成交金額錄得約35.02億元,當中成交金額按月及按年分別飆升約3.4倍及6.3倍,月內錄得至少3宗逾億元成交。

當中金額最大為中環皇后大道中99號中環中心,66樓及75樓兩個全層樓面易手,涉及總樓面面積共約51,088平方呎 (未核實),成交價約13.5億元,平均呎價約2.9萬元,新買家為星展銀行,而原業主則為資深投資者陳秉志。

工廈成交金額錄得約17.08億元,按月大增約64.7%,月內亦錄得大手成交,其中職業安全健康局以約1.48億元購入香港工業大廈地下A及B號舖連7個車位,業主為英皇集團主席楊受成,持貨18年帳面獲利約1.2億元,物業升值約4.3倍。

(經濟日報)

更多中環中心寫字樓出售樓盤資訊請參閱:中環中心寫字樓出售

更多中環區甲級寫字樓出售樓盤資訊請參閱:中環區甲級寫字樓出售

廣東道海星大廈全幢170萬獲續租 鐘錶品牌進駐十多年 新約較高峰低六成

核心零售區舖位租金大幅回落,由意大利鐘錶品牌PANERAI (沛納海) 承租十多年的尖沙咀廣東道及北京道交界單邊全幢舖位旗艦店,最新以每月約170萬元續租,較高峰期調整六成,屬該品牌租用全幢舖位以來的租金新低。

據悉,PANERAI剛續租廣東道2號海星大廈全幢,物業坐落於廣東道及北京道交界,對面為法國奢侈品牌Louis

Vuitton (LV)

的海港城旗艦店,全幢共12層高,總建築面積合共9182方呎,最新以月租約170萬元續租,呎租約185元,租期為3年至2027年。

曾經是全球最大專門店

PANERAI可說是物業的「長情租客」,早於2010年已租用海星大廈地下C、D及E舖連1樓,合共建築面積約1268方呎,整個舖位面向北京道,當年月租高達68萬元,呎租達536元。

由於隨後有大量內地豪客來港購買奢侈品,迎來零售業高峰,PANERAI於2012年向業主洽租海星大廈全幢,包括地舖及樓上原用作寫字樓的單位,務求把物業打造成旗艦店。PANERAI成功租用海星大廈全幢,月租為380萬元,呎租約414元,一度是PANERAI全球最大專門店。

直到2015年,雖然當時奢侈品銷售額已較高位回落,但為力保旗艦店巨舖,PANERAI仍願意加租近12%,至425萬元續租,呎租升至約463元,亦成為海星大廈歷來月租金額新高。

在2018年,PANERAI租約再度到期,由於本港零售業已不如前,故首度獲業主減租,以每月300萬元續約,每月少付125萬元租金,跌幅為29.4%,呎租約327元,但這次租約長達6年。

少付130萬 歷來最平租約

在經歷疫情及重新通關後,本港零售業恢復速度緩慢,而且昔日租金高昂的廣東道名店街已累積多間吉舖待租,租金水平亦大不如前。由於PANERAI租約臨近到期,業主為了挽留優質租客,故大手減租130萬元或43.3%,至最新月租170萬元,成為PANERAI進駐海星大廈全幢以來,月租最低的一份租約。而與2015年租金巔峰水平比較,月租更大挫255萬元或60%。

雖然PANERAI是次只屬續租個案,但已是今年廣東道名店街內較矚目的舖位租務成交。今年7月,廣東道116至120號海威商業中心地下B及C舖連1樓,建築面積合共約4980方呎,由本地護膚品牌JaneClare以每月80萬元租用5年,呎租約161元,則是年內廣東道名店街涉及月租最大的新租賃個案。

(信報)

更多海威商業中心寫字樓出租樓盤資訊請參閱:海威商業中心寫字樓出租

更多尖沙咀區甲級寫字樓出租樓盤資訊請參閱:尖沙咀區甲級寫字樓出租

製衣廠商呎價1.3萬購中環中心

早前市場盛傳中環皇后大道中99號中環中心一個低層單位,以呎價僅約1.3萬元低價易手,有關買賣終於曝光,由一名製衣廠商斥資4150萬元購入,呎價13034元。

資料顯示,中環中心22樓11室,建築面積約3184方呎,上月以4150萬元成交,呎價13034元,創該廈逾20年呎價新低。單位現時由基金管理公司以每月逾11.6萬元承租,呎租約36.5元,租金回報近3.4厘。據悉,買家為振利製衣相關人士,該公司於西營盤干諾道西188號香港商業中心擁有多個自置寫字樓單位。

中環中心22樓全層原由資深投資者蔡志忠持有,於2018年8月把全層分拆成12個細單位出售。是次易手的11室屬於該層拆細後面積最大的單位,由一名投資者於2019年4月斥資1.14億元購入,當時呎價高達35804元,如今以低價沽出,持貨近5年半,賬面大蝕讓7250萬元,損手幅度達63.6%。

企業廣場2期每呎5000元 13年低

此外,九龍灣常悅道3號商廈企業廣場2期7樓5至6室,建築面積共約3315方呎,以1657.5萬元易手,呎價5000元,創該廈近13年的呎價新低。

(信報)

更多中環中心寫字樓出售樓盤資訊請參閱:中環中心寫字樓出售

更多中環區甲級寫字樓出售樓盤資訊請參閱:中環區甲級寫字樓出售

更多企業廣場寫字樓出售樓盤資訊請參閱:企業廣場寫字樓出售

更多九龍灣區甲級寫字樓出售樓盤資訊請參閱:九龍灣區甲級寫字樓出售

共享辦公空間 租中環中心全層

中環中心全層寫字樓約2.6萬平方呎樓面,獲共享辦公空間租用。本地共享辦公空間bela Offices,租用中環中心48樓全層,作為全新的旗艦共享辦公空間。該集團指,新辦公室擁360度維港海景和山景,將提供250個工作站,預計將於2024年10月開業。

據悉,是次為今年第3度擴充,之前分別於華懋中心I期 (One Chinachem Central) 和Two Harbour Square開新據點,集團合共在港擁7分店。

較早前,觀塘Two Harbour Square 25樓全層,面積約2.6萬平方呎,以每呎約20元租出,新租客為本地共享辦公室品牌BELA OFFICES。該層樓面原由共享空間wework租用,2018年租用Two Harbour Square共2層,其後放棄,其中一層現由BELA OFFICES租用。

(經濟日報)

更多中環中心寫字樓出租樓盤資訊請參閱:中環中心寫字樓出租

更多華懋中心I期寫字樓出租樓盤資訊請參閱:華懋中心I期寫字樓出租

更多中環區甲級寫字樓出租樓盤資訊請參閱:中環區甲級寫字樓出租

更多Two Harbour Square寫字樓出租樓盤資訊請參閱:Two Harbour Square 寫字樓出租

更多觀塘區甲級寫字樓出租樓盤資訊請參閱:觀塘區甲級寫字樓出租

有代理行表示,銅鑼灣中國太平大廈一期中層01室,建築面積約1980方呎,意向呎租約33元,月租約6.5萬元。

該行指出,物業間隔方正實用,外望市景,並配備現代化寫字樓裝修,適合各類型行業使用。此外,物業還提供特長免租期。物業位於銅鑼灣的心臟地帶,附近的購物商場包括利園及時代廣場。

(信報)

更多中國太平大廈寫字樓出租樓盤資訊請參閱:中國太平大廈寫字樓出租

更多利園寫字樓出租樓盤資訊請參閱:利園寫字樓出租

更多時代廣場寫字樓出租樓盤資訊請參閱:時代廣場寫字樓出租

更多銅鑼灣區甲級寫字樓出租樓盤資訊請參閱:銅鑼灣區甲級寫字樓出租

Home prices to rebound 5pc, says Morgan Stanley

A Morgan Stanley analyst has predicted interest

rate cuts to lead to a 5 percent rebound in local property prices and

help lift stocks of the real estate sector next year.

Nonetheless, prior to the rebound, home prices

would continue to extend the fall from 4.66 percent for the first seven

months to 8 percent for the whole year.

Morgan Stanley analyst Nick Lord believes banks in

Hong Kong would lower their prime rates by 0.125 percentage point every

time the US Federal Reserve cuts the interest rate by 0.25 percentage

point.

It is predicted that the actual mortgage interest rates would drop to 3.25 percent by the end of next year.

Interest rate hikes were responsible for the 30 percent fall in home prices since 2021, according to the analyst.

The investment banker believes the correction in

local home prices is cyclical and the sector will recover next year amid

rate cuts.

Local real estate stocks rose yesterday. Link Real

Estate Investment Trust (0823) climbed 3.6 percent to be the

best-performing blue-chip stock.

Meanwhile, Hang Seng Bank (0011) and Standard

Chartered Hong Kong are understood to have resumed cash rebates for home

mortgages, following BoC Hong Kong (2388). The rates for cash

incentives vary from 0.1 to 0.2 percent of the loans.

In the primary market, sale of 50 units at Phase 1 of KT Marina

in Kai Tak starts today despite typhoon Yagi. The developers including K

Wah International (0173), Wheelock Properties and China Overseas Land

& Investment (0688) hiked the maximum discounts to 38.5 percent for

the selected 50 units.

Also in Kai Tak, Phase 1 of the project on 19

Shing Fung Road was named Double Coast I. The project, jointly developed

by Wheelock Properties, Henderson Land Development (0012), China

Overseas and New World Development (0017), offers 361 units and sale is

planned for this month.

On the other hand, only one new project was

approved for presale by the Lands Department last month. It involves a

site owned by Chinachem in Sai Kung, on which 40 units are being built.

Developers have also applied for presale consent

for a project in Sha Tin. Developed by Wing Tai Properties (0369) and

Vanke Overseas Investment (1036), the project provides 240 units.

In other news, the number of completed private

homes increased by 13 percent month-on-month to 1,608 units in July, a

six-month high.

(The Standard)

恒基旗下中環The Henderson 一個約1600方呎單位租出,市場消息指,料呎租達150元。

料平均呎租150元

知情人士指,根據土地註冊處資料,The Henderson 33樓3301A室租出,租期由2025年2月至2027年9月。他續表示,該單位面積約1600方呎,租客為日本一家著名律師樓,由於屬於細單位,呎租較高,料高達150元,月租約24萬。

The Henderson大手租客包括加拿大退休金計劃投資局 (CPPIB),由同區約克大廈搬至該廈。拍賣行佳士得租用4層涉約5萬方呎,作為集團在港首個常設拍賣中心和藝廊。國際投資公司凱雷集團(Carlyle)租用約2萬方呎樓面。

(星島日報)

更多The Henderson寫字樓出租樓盤資訊請參閱:The Henderson 寫字樓出租

更多約克大廈寫字樓出租樓盤資訊請參閱:約克大廈寫字樓出租

更多中環區甲級寫字樓出租樓盤資訊請參閱:中環區甲級寫字樓出租

德祥灣仔全幢商廈 6億洽購至尾聲

近期商廈交投明顯增加,德祥旗下灣仔軒尼詩道全幢商廈,獲內地客以6億洽購至尾聲快易手,呎價約1萬餘元,8年蝕約1.9億元。

內地投資者出價 呎價約1萬

市場人士指,灣仔軒尼詩道230號全幢,獲財團積極洽購。涉及物業為於灣仔傳統核心地段,物業樓高32層,地盤面積約3,746平方呎,總樓面約55,622平方呎,1至5樓為停車場,7至35樓為寫字樓,每層面積逾2,000平方呎,現時樓面主要由業主自用。消息稱,近日該廈獲一內地投資者,出價約6億元洽購,已貼近業主意向價,料快將易手,呎價約1萬餘元。

翻查資料,該廈前身為卓能廣場,由本地老牌家族卓能集團持有,曾作總部之用。2014年,卓能集團放售該廈,叫價約8.8億元,期間獲財團洽購。直至2016年尾,德祥地產以7.85億元購入,期後更斥資為物業進行翻新,包括地下大堂等。如今持貨8年,帳面蝕約1.95億元。

德祥地祥近期亦有沽貨動作,包括5月份以2.6億元,沽出中環美國銀行中心高層全層總部單位,連4個車位,成交呎價約1.87萬元,德祥地產將售後租回一年,月租65萬元,並有一年續租權,而單位由信和集團或相關人士承接。

(經濟日報)

更多美國銀行中心寫字樓出售樓盤資訊請參閱:美國銀行中心寫字樓出售

更多中環區甲級寫字樓出售樓盤資訊請參閱:中環區甲級寫字樓出售

觀塘甲廈低水 租售成交增

觀塘近期連錄買賣及租務成交,由於售價及租金低水,吸引企業買入樓面及搬遷,令成交明顯上升。

觀塘全新甲廈錄得用家入市個案,經營食品生意的四洲集團公布,斥逾2.05億元購入觀塘敬業街41號雲訊廣場兩層樓面,分別為31樓,面積約16,969平方呎,另連7個車位、若干廣告位及大廈的冠名權,同時亦購入廈21樓2號辦公室,面積約為8,000平方呎,平均呎價約8,226元。

集團指,自2017年出售自有物業以來,集團一直租用辦公空間,購入物業後能使該集團長期穩定發展。由於新增需求有限,市場氛圍疲弱,本港部分商業樓宇價格已大幅下跌至較低水平,考慮到鄰近類似物業之市價;以及集團之業務發展,認為購入物業為投資良機,長遠而言可節省辦公室租金。

敬業街雲訊廣場 每層1.6萬呎

雲訊廣場坐落於觀塘敬業街,去年底落成,物業3至32樓為辦公室樓層,每層面積約1.5萬至1.6萬平方呎,而高層單位可享全海景,成物業賣點。是次售出一層半樓面,屬項目首宗買賣。現時大廈多層樓面仍在放售,包括頂層特色單位,而個別樓層正獲洽購。

該廈由資深投資者林子峰、偉華集團及「小巴大王」馬亞木家族合組財團持有。資料顯示,上址原為僑新工廠大廈,財團於2018年斥約15.8億元購入地盤作發展。業主去年尾曾推出市場放售,低層單位呎價由8,000餘元起,每層料涉資約1.2億元,當時未獲承接。

Two Harbour Square 連錄全層租務

租務方面,同區Two Harbour Square連環錄全層租務,其中25樓全層,面積約2.6萬平方呎,以每呎約20元租出,新租客為本地共享辦公室品牌BELA OFFICES,於2021年8月在上環開設第一個據點,其後於中環、上環和尖沙咀區擴充,近日更於中環中心新增據點。

翻查資料,該層樓面原由共享空間wework租用,2018年租用Two Harbour Square共2層,提供超過900張辦公桌,惟近年大幅收縮,放棄該廈兩層,其中一層現由BELA OFFICES租用。據消息指,另一層樓面近日亦獲承租,涉及2.6萬平方呎,由建築公司寶嘉租用,呎租料約20元。

分析指,近年觀塘商業配套已成熟,並有新甲廈落成,同時因供應較多,租金及售價仍處低水。對用家來說,屬好時機購入該區樓面自用。租客方面,因東九龍每呎租金仍處約20餘元水平,可作搬遷節省成本,故觀塘甲廈租售成交上升。

(經濟日報)

更多雲訊廣場寫字樓出售樓盤資訊請參閱:雲訊廣場寫字樓出售

更多觀塘區甲級寫字樓出售樓盤資訊請參閱:觀塘區甲級寫字樓出售

更多中環中心寫字樓出租樓盤資訊請參閱:中環中心寫字樓出租

更多中環區甲級寫字樓出租樓盤資訊請參閱:中環區甲級寫字樓出租

更多Two Harbour Square寫字樓出租樓盤資訊請參閱:Two Harbour Square 寫字樓出租

更多觀塘區甲級寫字樓出租樓盤資訊請參閱:觀塘區甲級寫字樓出租

中環皇后大道中全幢 14億標售

核心區方面,中環老牌業主標售皇后大道中全幢商廈皇后大道中心,意向價約14億元。

有外資代理行表示,有業主標售中環皇后大道中152號全幢商廈皇后大道中心,截標日期為2024年10月8日 (星期二) 正午12時。

總樓面約8萬呎

物業為1幢28層高之甲級商業大廈,地下至15樓用途靈活,可作銀行、商舖、餐飲或零售用途,17樓至30樓則為寫字樓用途。

物業地盤面積約4,030平方呎,總商業面積約80,876平方呎,每層平均面積由2,531至3,733平方呎,為一梯一伙設計。

據悉業主意向價約14億元,呎價約1.7萬元,預計回報率逾3厘。翻查資料,項目由鍾氏家族收購近10多年,整合業權後進行重建,並於2020年落成。

(經濟日報)

更多皇后大道中心寫字樓出租樓盤資訊請參閱:皇后大道中心寫字樓出租

更多中環區甲級寫字樓出租樓盤資訊請參閱:中環區甲級寫字樓出租

Centaline buys hotel for student housing

Centaline Group, which

operates the largest real estate agency network in Hong Kong, has

splurged HK$180 million on its first student apartment project in Tsim

Sha Tsui.

The group plans to

transform the 63-room Popway Hotel it acquired, near the Polytechnic

University, into a student housing project offering about 150 beds. The

acquisition price came in at HK$7,300 per square foot, and an additional

HK$20 million is earmarked for renovations.

The investment marks the

first step of the group's goal to invest in 2,000 to 3,000 beds over the

next two to threes years, aiming to make Hong Kong one of the largest

student housing investment markets in Asia, said Kavis Ip, president of

Centaline Investment.

Centaline is optimistic

about the strong demand in the local student apartment market and

expects a stable investment return amid the city's pledge to expand

quotas for nonlocal students at public universities.

Home to five of the

world's top 100 universities, Hong Kong is stepping up to become a

global education hub by attracting talent, with the government proposing

to double the quota for nonlocal students at eight public universities

to 40 percent last year.

Ip added that Centaline

has a solid track record in student housing investments in the United

States and the United Kingdom. Centaline earlier said it spent US$16

million (HK$124.8 million) in April to acquire a student apartment

project in Georgia in the United States, which saw all 148 beds leased

out.

Student apartment businesses have been a hot sector in the city recently.

In June, the Hong Kong

Metropolitan University said it acquired a hotel in Hung Hom for student

accommodation and renamed it MU88. The purchase price was said to be

nearly HK$1 billion, or at a record high of HK$15,000 per sq ft,

according to a property consultancy.

Earlier in 2021, AEW

Capital Management acquired Hotel Sav in Hung Hom for HK$1.65 billion

and then turned it into a student hostel called Y83. The project

achieved an occupancy rate of over 90 percent in the past two years, the

property consultancy said.

(The Standard)

中原購珀薈酒店作學生宿舍 成交價1.8億翻新後提供150個牀位

中原投資落實在港首個學生公寓項目,斥資1.8億購入尖沙咀珀薈酒店,並計劃投資2000萬進行翻新,將之改裝成提供約150個牀位的學生公寓,預期平均每個宿位月租約8000元,淨租金回報率料約4厘。

中原投資總裁葉明慧接受查詢時表示,公司過去一直在美國及英國等地投資學生公寓,並且獲得理想成績。由於現時本港學生公寓市場規模只有數十億,預期五年後將增加至逾400億,因此看準時機回港投資。

她又透露,預期項目平均每個宿位月租約8000元,計劃每季或每半年收取一次租金,料淨租金回報率達4厘。

斥資2000萬翻新

葉明慧又表示,長遠看好學生公寓市場,相信能為投資者帶來穩定回報,是次投資為公司拓展本港學生公寓市場第一步,未來還將繼續增加相關投資和發展。

她指出,公司目標在未來2至3年間,投資2000至3000個牀位,希望將本港打造成亞洲區最有規模的學生公寓投資市場之一,吸引更多環球基金及資本來港投資,又透露現時仍有相關項目在洽商中。

中原投資董事總經理江若雯表示,學生公寓市場一直是環球投資者投資熱點,隨着來港升學非本地學生數量增加,學生住宿需求跟隨飆升。她又說,公司樂於通過其在學生公寓行業的經驗,以及集團的研究部和代理網絡支持下,與本地及海外投資者踏足本港學生公寓投資市場。

每個宿位月租8000元

資料顯示,珀薈酒店位於尖沙咀漆咸道南117號,佔地面積2000方呎,酒店樓高20層,曾於去年9月以3.8億放售,早前減價至2.4億再度推出,最終以1.8億易手。該酒店擁有63個房間,每個房間作價約286萬,若以總樓面計算,平均呎價約7332元。

3至4分鐘步行至理大

中原投資表示,計劃斥資約2000萬替酒店進行翻新及改裝,將之打造成學生公寓,並配備現代化設施,包括24小時保安、高速網絡、休憩區、學習區等等,以滿足學生對居住環境的需求。項目步行至理工大學僅需3至4分鐘,公司相信是學生公寓投資最佳的地理位置。

(星島日報)

尖東半島中心全層4.2億放售

核心區優質舖位供應罕有,有代理表示,尖東麼地道67號半島中心二樓全層,建築面積約57240方呎,意向價約4.2億,平均呎價約7338元。

平均呎價7338元

該代理表示,物業為市場罕見單一全層大面積商鋪,設多個出入口,可透過商場扶手電梯及升降機前往,亦設有獨立扶手電梯,可由地面直接前往物業,應付大量人流,電力及洗手間設施充裕。物業亦設有寬闊落地玻璃窗,可望噴水池景。

該代理續指,物業鄰近港鐵尖東站,多間五星級酒店及多座高級寫字樓包圍,商業活動頻繁,附近安達中心提供大量車位,方便駕車前往。物業適合大型教育機構作市區校舍,免稅品店,醫療集團及百貨公司。

(星島日報)

更多半島中心寫字樓出售樓盤資訊請參閱:半島中心寫字樓出售

更多尖沙咀區甲級寫字樓出售樓盤資訊請參閱:尖沙咀區甲級寫字樓出售

荃灣兩幢工廈標售 市場估值9億

華潤資本持有的荃灣橫窩仔街36至50號兩幢工廈,現址卓悅集團中心標售,市值9億,地盤面積約20223方呎,建築面積約223804方呎,物業已獲規劃許可發展1幢29層高住宅連社褔設施。

有代理表示,該物業位於橫窩仔街大單邊,兩幢14層高工廈,地下為車場、上落貨區及貨倉用途,其他樓層則為貨倉或廠房用途。

獲批住宅連社褔設施

上述物業原由卓悅持有,2022年3月,卓悅全資附屬公司卓悅投資,與華潤資本旗下CR Capital

Investment (Cayman) Limited

(「CRCI」),訂立有限合夥協議成立基金及作認購協議,涉資5.5億,各佔75%及25%。該基金同日斥資9億向卓悅收購卓悅集團中心。上述物業目前由傲林有限公司持有,董事為華潤資本相關人士。

該代理表示,物業正對未來新鴻基集團橫窩仔街商住項目

(前安泰工業中心),項目擬興建一幢34層高住宅大廈,並包括幼兒中心,料將來可提供465個中小型住宅單位。而去年底同區內之合福工業大廈由美國黑石集團夥拍迷你倉連鎖集團「儲存易」以港幣5.6億購入,平均呎價為4009元,反映出全幢工業物業在整體投資市場上仍具一定吸引力。

儘管現時環球經濟壓力大,但減息預期不斷增強,投資者不妨藉此機會趁低購入物業作自用或重建。

(星島日報)

房協罕見放售旗下舖位商廈 涉及11項物業 「指導價」370萬至1.36億

房協罕有放售旗下舖位與商廈,合共涉及11項,並為物業標示「指導價」,由370萬的寫字樓,至涉資1.36億的巨舖,金額選擇多。

市場消息透露,房協旗下一批物業早前委托代理行估價,昨日該行召集20多間代理行開會,公布出售詳情,該批包括10項舖位及1項商廈單位,分布港九新界,以中細價舖為主導,截標日期10月10日。本報昨日向房協查詢,惟直至截稿時未獲回覆。

預期回報約5厘

市場人士透露,該批物業逐件訂有「指導價」,由370萬至1.36億不等,預期擁5厘回報,「指導價」是賣方願意出售的最低價,惟最後價高者得。以指導價計算,11項物業涉資約4.08億。

最貴重為荔枝角道168號萬盛閣平台地下1、2、3、4、5及6號舖,租客惠康超市及麥當勞月租共66.6萬,指導價1.36億,計算回報5.9厘。元朗大棠道41至59號金朗大厦地舖,由爭鮮以28萬承租,指導價8500萬。

共涉資4.08億

共有2項「指導價」只有370萬,其中,北角七姊妹道2、4、6、8及8A 號及書局街6及8號昌苑地下1A舖,面積648方呎,由長者服務中心以每月1.85萬承租。

有代理分析,招標價高者得,相信指導價買不到,西環羲皇台1號寫字樓,面積1868方呎,指導價370萬,平均每呎僅1980元。

上環文咸東街125及129號及永樂街147號萬和閣地下1號舖,面積712方呎,便利店月租5.3萬,以指導價1650萬計算,每呎2.3萬。

(星島日報)

息口料回落 財團物色全幢物業

近期市場錄得多宗全幢物業獲洽購,相信因息口預計回落,全幢物業投資價值開始出現,故財團現進行洽購。

全幢物業近期獲財團垂青,消息指,灣仔軒尼詩道250號全幢商廈,獲財團積極洽購。涉及物業為於灣仔傳統核心地段,物業樓高32層,地盤面積約3,746平方呎,總樓面約55,622平方呎,1至5樓為停車場,7至35樓為寫字樓,每層面積逾2,000平方呎,現時樓面主要由業主自用。

消息稱,近日該廈獲一內地投資者出價約6億元洽購,已貼近業主意向價,料快將易手,呎價約1萬餘元。

前卓能廣場 現6億獲洽

翻查資料,該廈前身為卓能廣場,由本地老牌家族卓能集團持有,曾作總部之用。2014年,卓能集團放售該廈,叫價約8.8億元,期間獲財團洽購。直至2016年尾,德祥地產以約7.85億元購入,期後更斥資為物業進行翻新,包括地下大堂等。如今持貨8年,帳面料蝕約1.85億元。

另外,住宅全幢租賃項目獲財團留意。消息指,太極軒集團旗下灣仔及佐敦兩服務式住宅,獲外資基金約7.5億元洽購,有望短期內易手。

灣仔太極軒 涉107伙

兩項太極軒服務式住宅項目於市場放售,近日有獲外資基金洽購,包括為灣仔莊士敦道138號太極軒138

(CHI138),提供107個住宅單位,面積介乎於290至2,400平方呎,包括開放式、1房及2房單位、3房複式單位以及頂層全層特色單位。按資料顯示,開放式單位月租約2.3萬元起,而1房月租約3.7萬元。

另佐敦彌敦道314至316號太極軒314 (CHI314),提供59個住宅單位,面積介乎於410至1,400平方呎,單位類型包括開放式、1房及2房單位,單位目前月租約2.4萬元起。

該集團早於兩年前已放售上述兩項目,連同西環太極軒120號,惟過往兩年未有售出。直至7月份,集團以約1.88億元,沽出西環太極軒120號,涉及約2.3萬平方呎及19伙單位。消息稱,集團近期加快降價推售另外兩項目,並獲財團以約7.5億元洽購,有望短期內成交。

消息透露,洽購財團包括外資基金,包括近兩年積極參與本港物業市場的黑石基金。該基金自2021年起,積極投資本港工廈迷你倉市場。分析指,近一年因息口高企,投資成本高,特別全幢物業涉及較大金額,令投資氣氛轉弱。隨着業主近期大幅降低叫價,加上預計息口即將回落,令財團重新對全幢物業感興趣,預計交投將增加。

(經濟日報)

西環頤庭酒店 5.88億標售

酒店可靈活作改裝,「小巴大王」馬亞木家族標售的西環頤庭酒店,市值約5.88億元。

項目位於德輔道西160號,樓高24層,總批則建築面積約66,144平方呎,於2015年改建為酒店,提供93間客房,中高層房間均可享維港海景。而物業地下至6樓為商業部分,地下至4樓現時由餐飲及水療中心承租,5至6樓可用作辦公室,而酒店大堂則設於7樓。

可改裝學生宿舍

有代理表示,項目最大亮點是非常適合改裝為學生宿舍。酒店位於港鐵西營盤站出口上蓋,與香港大學站只有一站之隔,可滿足附近學生宿舍的強勁需求。

(經濟日報)

偉華蔡敬業:商廈漸便宜吸用家

最近觀塘錄企業入市買商廈個案,偉華置業執行董事蔡敬業指,當價格開始便宜,即吸引用家買樓面,相信隨着減息市況會轉好。

上星期市場錄得一宗本地企業買樓面個案,涉及四洲集團斥逾2億元,購觀塘雲訊廣場近兩層樓面作新總部,呎價約8,000餘元。物業發展商偉華置業蔡敬業指,近期不少用家睇樓,「不論私人企業甚至公營機構,亦加快睇樓,相信因價格回調至較便宜水平,長遠買樓面自用化算,亦因減息在即,近來商廈氣氛定比年初好。」至於租務市場上,集團旗下黃竹坑偉華匯租務未算快,他坦言企業在租樓面上,考慮更加多,「始終搬遷涉及成本,現階段擴充的客人不算多,故選擇原址續租。反而個別企業會趁價低,考慮買樓面。」

包裝生意升幅理想

本業為美容產品包裝生產商,蔡敬業表示生意穩定,今年更有理想升幅,「若與去年比較,升幅高逾5成,因為我們的包裝產品吸引一些品牌注視,與我們合作,而他們採用新包裝後生意又有增長。」

(經濟日報)

更多雲訊廣場寫字樓出售樓盤資訊請參閱:雲訊廣場寫字樓出售

更多觀塘區甲級寫字樓出售樓盤資訊請參閱:觀塘區甲級寫字樓出售

更多偉華匯寫字樓出租樓盤資訊請參閱:偉華匯寫字樓出租

更多黃竹坑區甲級寫字樓出租樓盤資訊請參閱:黃竹坑區甲級寫字樓出租

New Uppland flats come with incentives

Gold Coast Bay's The Uppland

announced several incentives yesterday including help pay up to 2.25

percent of ad valorem stamp duty or AVD for homebuyers who purchase

specific units in the project.

As the Mid-Autumn

Festival and National Day are upcoming, the developer released the 3A

and 4A price lists with limited time offers yesterday to cater to the

hot market demand.

Buyers can enjoy up to

1.5 percent AVD offers on the purchase of designated studios or

one-bedroom units, and up to 2.25 percent AVD offers if they buy

designated two-bedroom units.

Besides, the project has

cooperated with furniture producer Design Concept to issue furniture

coupons. Homebuyers who purchase star-class studios including Rooms H,

J, M and N in Tower three and Rooms F and G of Tower 5B on or before

October 6 can receive a "Star Furniture" coupon worth about HK$100,000.

In addition, homebuyers

who purchase a 767-square-foot three-bedroom with storage room unit in

the price list 4A will enjoy a priority to subscribe or rent a parking

place.

The project, developed by

Early Light International, has sold nearly 50 percent of the units or

342 flats since it went on sale in July.

The Uppland,

the first phase of The Gold Coast Bay, offers 692 flats and 90 percent

of them are standard units with sizes from 204 to 767 sq ft. The project

has nine home types spanning from studios to three-bedroom with storage

room homes, as well as several special units.

Meanwhile, The Yoho Hub II

in Yuen Long, developed by Sun Hung Kai Properties (0016), will launch

show flats and release a new price list as early as next week.

Novo Land

3B Phase in Tuen Mun, also developed by Sun Hung Kai Properties,

released the fifth price list to offer 78 flats with average price per

sq ft after discount at HK$12,354 and the cheapest unit at HK$3.09

million.

The homes measure between

252 and 675 sq ft, with price ranging from HK$3.09 million to HK$8.11

million after discounts. There are 37 units with prices below HK$4

million.

Upper Central in

Mid-levels West, developed by Yuzhou (1628), released a sales brochure

yesterday. This residential building with 85 units has been leased as

serviced apartments since it was reconstructed in 2020.

(The Standard)

內地金融機構逆市擴充 再租環球貿易廣場每呎70

共承租4.5萬呎 較原有樓面增1.5倍

甲廈錄擴充個案,內地金融機構租用九龍站環球貿易廣場 (ICC) 全層3.5萬呎樓面,呎租約70元,屬同廈擴充。家族辦公室租中環中心低層全層,呎租約40元。

市場消息指,九龍站環球貿易廣場錄得全層租務,涉及物業69樓全層,面積約3.5萬平方呎,以每呎約70元租出。由於屬物業高層,故享有優質景觀。消息稱,新租客內地金融機構遠東宏信,業務涉及金融、貿易、諮詢、投資等,總部設於上海。

遠東宏信香港總部 去年啟用

據了解,該集團早前租用環球貿易廣場極高層2個單位,分別為66樓8000平方呎,以及67樓約1萬平方呎單位,合共約1.8萬平方呎,當中67樓單位屬集團總部,於去年初啟用。由於集團業務擴張,現決定放棄66樓單位,而轉租69樓全層3.5萬平方呎單位,換言之合共使用4.5萬平方呎,比原有樓面增加1.5倍,可見集團長看好綫在港發展。

環球貿易廣場為九龍區指標甲廈,物業今年錄得最大租務,涉及物業中低層3層樓面,總樓面達10萬平方呎,呎租約60元,新租客金管局,屬整合業務兼搬遷節省成本。

家辦租中環中心全層 呎租40

另一方面,中環甲廈市場同樣錄得企業擴充個案,市場消息稱,中環中心近日錄全層租務,涉及低層全層,面積約2.6萬平方呎,以每呎約40元租出。據悉,新租客為家族辦公室,該集團網頁指,業務為超高淨值人士和家族提供全方位服務,總部位於香港,業務遍及亞洲,包括內地及新加坡等。據了解,該家族辦公室原租用同廈細單位,現擴充業務至全層。

其次,中環中心日前亦有出現全層擴充業務,涉及中環中心48樓全層,面積約2.6萬平方呎樓面,獲本地共享辦公空間Bela Offices租用。該集團指,新辦公室擁360度維港海景和山景,將提供250個工作站,預計將於2024年10月開業。

九龍區新甲廈方面,消息指,長沙灣南商金融創新中心中層B09室,面積約577平方呎,以每呎約24元租出。

(經濟日報)

更多環球貿易廣場寫字樓出租樓盤資訊請參閱:環球貿易廣場寫字樓出租

更多尖沙咀區甲級寫字樓出租樓盤資訊請參閱:尖沙咀區甲級寫字樓出租

更多中環中心寫字樓出租樓盤資訊請參閱:中環中心寫字樓出租

更多中環區甲級寫字樓出租樓盤資訊請參閱:中環區甲級寫字樓出租

更多南商金融創新中心寫字樓出租樓盤資訊請參閱:南商金融創新中心寫字樓出租

更多長沙灣區甲級寫字樓出租樓盤資訊請參閱:長沙灣區甲級寫字樓出租

尖沙咀逾百萬呎樓面 發展商廈

尖沙咀的商業用地供應罕有,發展商普遍需要透過收購舊樓以在區內插旗。據本報粗略統計,目前區內至少有8個重建項目正在進行,總樓面面積涉約102萬平方呎,大部分擬作商廈發展。

香檳大廈B座業權統一 恒地版圖增

據本報統計,區內現時至少有8個重建項目正在進行,總樓面涉約102萬平方呎,普遍擬發展為商廈,而其中規模最大的屬於由海員俱樂部與帝國集團合作的前海員之家,將會重建為1座40層高酒店,總樓面約34.7萬平方呎,當中由發展商營運的酒店樓面涉約30萬平方呎,另約5萬平方呎樓面需預留給海員俱樂部作教堂及會所。

至於在區內亦持有美麗華商場及酒店等的恒地

(00012),於今年初亦為收購多年的香檳大廈B座完成強拍程序。發展商於今年1月以底價約17.3億元,成功統一項目業權。據發展商指,項目重建後的總樓面涉約14.7萬平方呎。事實上,同系的美麗華商場及酒店正位於香檳大廈旁邊,料若香檳大廈B座成功重建後,將會產生協同效應,並將有望擴展其原有逾200萬平方呎樓面的商業王國。

鄧成波家族持有大部分業權的尖沙咀加連威老道61至73號舊樓項目,於2017年亦曾申請強拍,惟項目最終在2021年流拍。若重建為商業項目,以最高地積比率約12倍計,可建總樓面約13萬平方呎。

同時,樂風集團等持有的尖沙咀漢口道35至37號恕園大樓,去年亦已獲屋宇署批出建築圖則,並獲准重建1幢21層高商廈,涉及總樓面約11.5萬平方呎。發展商原於2022年就項目申請強拍,當時項目的現況市值逾6.3億元,惟最後因成功收購項目全數業權,故不需循強拍途徑統一其業權。

漢口大廈批商住用 分層戶達110伙

另外,有發展商擬在其商業項目加入住宅元素,新世界 (00017)

旗下的漢口大廈,於今年6月亦已獲屋宇署批准建1幢24層高的商住項目,總樓面涉約13.9萬平方呎,當中非住宅樓面佔比較多,佔約9.9萬平方呎。發展商於去年3月循強拍途徑以約21.3億元投得項目。如按今年初獲城規會批准的方案,除了辦公室及商店外,項目亦將提供110伙分層住宅。

而以往曾屬於區內購物熱點的栢麗購物大道,在約2年前向城規會申請改劃為食肆及商店等用途,發展自助餐廳、咖啡室及茶室等,方案亦於2022年底獲城規會批准,但現並未見任何實際重建的部署。

(經濟日報)

One Wood Road unveils first price list

One Wood Road in Wan

Chai, developed by Vantage International, launched its first price list

yesterday after not achieving any transactions in tender since it was

put on sale in June.

The 10 flats are priced

at an average of HK$23,003 per square foot, with the cheapest being a

two-bedroom flat at HK$9.85 million.

The average price per sq

ft is 13 percent lower than other projects in the same district launched

seven years ago. The flats, which all 460 sq ft in size, are priced

between HK$9.85 million and HK$11.67 million after discounts.

A property agency said

the project is located in a core area of Hong Kong Island. When

finished, the agency predicts it will lure homebuyers who are after

practicality.

In other news, a

532-sq-ft one-bedroom flat with a storage room at The Avenue in Wan Chai

sold for HK$10.01 million, with a price lower than HK$20,000 per sq ft.

The flat was bought in 2013 for HK$9.55 million, and the seller booked a

profit of HK$460,000.

In other news, Emperor

Hotels Group's rental project in Central, was named The Unit Soho

yesterday. The occupancy rate of the first batch of 20 pre-rental units

reached 90 percent, with the price for furnished units as high as HK$120

per sq ft, the company said.

(The Standard)

bossini進駐栢麗大道 月租20萬

舖王「一拆四」 租金較高峰跌8成

核心區舖位錄租務,尖沙咀栢麗購物大道「舖王」獲本地時裝品牌堡獅龍(bossini,00592) 租用,料月租約20萬元。該舖高峰期曾由珠寶行周生生以300萬元租用,遷出後業主決定「一拆四」,如今租出其中3舖,月租跌幅8成。

尖沙咀彌敦道111至181號栢麗購物大道地下2號舖及1樓,面積分別為790及786平方呎,總面積約1,576平方呎,現由bossini租用,近日已圍上廣告板,將開設「bossini.X」店,短期內開業。

2020年內企非凡領越收購bossini,而集團今年曾表示,考慮到主流運動服裝競爭激烈,故發展單車服裝,目標今年下半年在中港推出全新的bossini.X概念店,計劃年內在內地開設約100間店、在港開5至10間店,相信栢麗大道舖作首間單車概念店的bossini.X。集團同系鞋店Clarks,亦租用是次成交的比鄰地下及1樓舖位,月初已開業。

2012年零售高峰 周生生300萬租

是次bossini租用舖位,月租料約20萬元內,呎租約127元。翻查資料,栢麗購物大道地下G1至G4號舖連1樓1至2號舖的複式舖位,由本地老牌家族持有,地下面積約2,866平方呎,1樓面積約2,894平方呎,合共約5,760平方呎。

該舖屬栢麗購物大道第一批舖位,樓底特高門面闊,加上鄰近清真寺及港鐵站出口,稱得上栢麗大道「舖王」。資料顯示,周生生在2008年起租用上述舖位,2012年零售高峰期月租加至300萬元,呎租逾500元,直至2021年決定棄租。當時正值疫情,業主僅把舖位作短租。

去年中港通關,業主再推出招租,惟反應仍屬一般,決定把舖位「一拆四」,分成4個地下及1樓複式舖,每個千餘平方呎,月租約12萬元起招租,如今3舖位獲承租,現剩餘最後一組舖位待租,意向月租約20萬。預計所有舖位租出,合共涉約60萬元,已較高峰期租金跌約8成。

據一間代理行統計,7月份4大核心消費區商舖空置率統計上,尖沙咀區最新空置率錄得7.9%,較2021年2月的高點 (17.26%) 下跌9.36個百分點,創下自2015年9月 (8.54%) 至今近9年的新低。

代理行︰租金降至5萬 始吸引商戶

不過,栢麗大道目前吉舖頗多,例如頭段地下24號舖及1樓,面積合共約1,322平方呎,曾由時裝店以9.5萬元租用,早前已遷出,業主以每月10萬元放租。另外頭段兩組複式舖,均由謝瑞麟

(00417) 租用,近期已暫停營業,其中地下G5至G6舖及1樓3A至3B舖位,面積逾5,000平方呎,近期更被業主追討租金。

整條栢麗購物大道仍較冷清,該行代理分析,大道位處彌敦道,對面為多個大型商場,並可連接至加連威老道、金馬倫道等,故人流集中於該地段而非栢麗大道。該代理認為,栢麗大道舖位租金跌至最低5萬元起,開始吸引商戶承接。整體核心區舖市上,該代理認為核心區租務持續改善,惟市場上仍有吉舖之待消化,料租金趨向平穩。

(經濟日報)

業主變陣吸商戶 旗艦店大舖拆租

本港整體零售數字一般,商戶對後市較為審慎,大手租舖的個案減少,業主亦變陣出擊,把原本旗艦店分拆招租,以免長期交吉。

訪港旅客數字仍平穩,核心區舖位租務近月加快,而成交月租多屬20萬至約50萬元,以往市場逾百萬元大手租務實在不算多,商戶租用的樓面普遍亦降低,大樓面旗艦店需求較疫情前少。

分拆細舖租金吸引 免長期交吉

據政府統計處數字,7月零售業總銷貨總額291億元,較去年同期下跌11.8%,差過預期,亦屬連續數月下跌。事實上,因本地經濟一般、內地客消費放緩,餐飲、零售亦面對經營上挑戰,整體而言商戶擴充上非常審慎,以高租金租大樓面舖個案減少。

有見及此,業主亦變陣出擊,把原本品牌租用的複式舖,以分拆形式招租。除了上述提及的栢麗大道「舖王」外,同區加連威老道20至22A號瑞生尖沙咀酒店基座,早年曾由體育服裝以逾200萬元,租用地庫至2樓4層,品牌去年遷出,業主一直放租,未獲承接下決定分拆樓面出租,近日物業地庫獲本地茶餐廳以約10萬元租用。

由於商戶對後市仍較審慎,負擔月租亦有所降低,複式舖分拆後月租由百萬元,降至每個10萬至20萬元起,吸引較多類型商戶進駐;同時在高息環境下,業主亦可有租收,提供防守能力。

(經濟日報)

國際時裝品牌 趁租平重啟擴充

多個時裝品牌於疫情期間大舉收縮,如今通關加上核心區舖位租金回調,近期漸見國際及本地時裝品牌重新擴充。

西班牙MANGO 租中環泛海大廈舖

時裝品牌以往曾是核心區舖位租務主力,佔用較大樓面舖位,特別是核心區多層複式舖,高峰期時裝品牌Forever

21、Abercrombie & Fitch (A&F)

及GAP等,先後大舉租核心區複式舖作旗艦店,月租涉數百萬至千萬元。疫情時生意大跌,加上租金高企,故不少品牌收縮,大幅減舖。

隨着核心區舖位租金近年錄得逾半以上跌幅,租金漸達可負擔水平,吸引國際時裝品牌重啟擴充,包括西班牙時裝品牌MANGO承租中環泛海大廈地下及1樓舖位,物業面積合共約1.9萬平方呎。租約由今年9月至明年8月,月租約125萬元,明年9月至2026年8月,月租約130萬元,最後1年月租135萬元,按年加幅約4%,租金較高峰期跌6成。該品牌在港設有面積較細分店,如今趁租金平擴充。

另一連鎖時裝店、美式服裝品牌A&F近期重新在港擴充,連同旗下另一品牌HOLLISTER Co.於今年第四季進駐新城市廣場,該店涉及面積逾1萬平方呎,將成為A&F新界區首間全新摩登假日概念店。據悉,該品牌同時租用銅鑼灣希慎廣場1樓約6,000平方呎舖位,月租料約60萬元。該舖曾由GU時裝租用,早前已預告遷出。

(經濟日報)

更多泛海大廈寫字樓出租樓盤資訊請參閱:泛海大廈寫字樓出租

更多中環區甲級寫字樓出租樓盤資訊請參閱:中環區甲級寫字樓出租

更多希慎廣場寫字樓出租樓盤資訊請參閱:希慎廣場寫字樓出租

更多銅鑼灣區甲級寫字樓出租樓盤資訊請參閱:銅鑼灣區甲級寫字樓出租

94 Yuen Long flats to go on sale

The Yoho Hub II

in Yuen Long, developed by Sun Hung Kai Properties (0016) will launch

at least 94 flats in its new price list as early as next week.

The news comes after a 927-square-foot flat in The Yoho Hub II rented for HK$40,000 a month recently, a new high for rents in Yuen Long, according to a local property agency.

The Yoho Hub II

consists of Tower 6 and Tower 8. The first two rounds of sales for the

project were launched in May and the flats were all from Tower 8. In the

second round of sales, the average price after discounts was HK$15,639

per sq ft.

The 94 flats will be from Tower 6.

With the Mid-Autumn Festival fast approaching, many new projects are rolling out sales promotions.

The Square Mile series

from Henderson Land Development (0012), in a tie-up with five property

agents, will offer the first three buyers of new homes in each of the

five projects catering coupons worth HK$10,000, with a total of 15

coupons on offer. The series has so far sold 2,068 flats and raked in

HK$12.7 billion.

Another property agency said that as rents continue to rise in the city some tenants will shift from renting to buying a flat.

According to another property agency, the rental yield of The Quinn Square Mile in Mong Kok, one project in the series, is 3.5 percent per annum.

Meanwhile, El Futuro

in Sha Tin, developed by CK Asset (1113), will launch festival

incentives with another property agency, giving the first five new

homebuyers a free-spending credit offer worth HK$56,000. The promotion

runs until October 15.

Koko Rosso and Koko Mare

in Lam Tin, developed by Wheelock Properties, announced with another

property agency that the first 10 homebuyers of two-bedroom flats with

an open kitchen can each get a furniture coupon worth about HK$8,888.

(The Standard)

中環廠商會大廈全層每呎1.2萬售 中環乙級商廈 持貨14年僅升值1.6%

中環乙級商廈錄一宗成交,位處德輔道中133號的廠商會大廈全層單位,建築面積3200方呎,以每呎12188元易手,原業主持貨接近14年,帳面僅升值1.6%。

中環德輔道中133號 (干諾道中64號) 廠商會大廈14樓全層,建築面積3200方呎,以3900萬易手,平均呎價12188元。

3200呎作價3900萬

原業主於2010年11月以3838萬購入,帳面獲利62萬,持貨接近14年物業升值不足2%,接近平手離場。據了解,原業主一直自用單位,是次交吉交易。

買家為一名從事玩具、禮品及體育用品貿易的陳姓商人,大本營設於區內永安集團大廈高層單位全層。

據了解,買家是次購入商廈作為投資用途,以該廈呎租約45元計算,回報逾4厘。

該名新買家亦於3年前購入中環中心投資,於2021年7月,斥資8628.4809萬向「磁帶大王」購入中環中心3911室,建築面積2769方呎,平均呎價高達31161元,單位望開揚樓景及山景。

投資者料回報逾4厘

上述廠商會大廈,向來極少買賣,該宗為今年首宗買賣,2023年及2022年「零」成交,2021年則錄2宗成交,該廈19樓全層,建築面積3200方呎,於2021年7月以7750萬易手,平均呎價24219元,該廈10樓全層,建築面積一樣,於2021年9月以6300萬易手,平均呎價19688元。最新買賣造價較2021年高位下跌接近50%。最新造價重返2010年水平。

於2010年,該廈錄4宗成交,除了上述原業主購入單位外,同年12月,該廈17樓全層,建築面積3200方呎,以3980萬易手,平均呎價12438元,原業主則於同年1月以3288.8萬購入該單位。

有代理表示,粉嶺安樂門街28號福成商業大廈一單位,建築面積約2098方呎,意向價980萬,平均呎價約4671元。 該廈坐落粉嶺安樂村工業區,大部分為物業單一業權。

(星島日報)

更多廠商會大廈寫字樓出售樓盤資訊請參閱:廠商會大廈寫字樓出售

更多永安集團大廈寫字樓出售樓盤資訊請參閱:永安集團大廈寫字樓出售

更多中環中心寫字樓出售樓盤資訊請參閱:中環中心寫字樓出售

更多中環區甲級寫字樓出售樓盤資訊請參閱:中環區甲級寫字樓出售

更多永安集團大廈寫字樓出租樓盤資訊請參閱:永安集團大廈寫字樓出租

更多中環區甲級寫字樓出租樓盤資訊請參閱:中環區甲級寫字樓出租

荃灣TML廣場1060萬售 持貨7年蝕讓7%

荃灣新式工廈TML廣場錄一宗蝕讓成交,其中一個單位以1060萬易手,原業主持貨7年帳面蝕讓約7%。

荃灣海盛路3號TML廣場17樓A2室,建築面積約1747方呎,以1060萬易手,平均每呎6068元。

原業主於2017年1月以1142.1萬購入,持貨7年帳面蝕讓82.1萬,物業貶值約7%。於2019年6月之前,該廈成交呎價逾1萬,現時較高位回落30%至40%。

較高位回落逾30%

有代理表示,長沙灣青山道660號百生利中心低層B室放租售,建築總面積約3303方呎,意向價約1050萬,平均每方呎約3179元,意向租金約4.8萬,平均每方呎約14.5元。

該代理表示,該單位外望街景,樓底高度約10呎2吋,樓面負重約250磅,現連寫字樓裝修,大廈採用一梯兩伙設計,另有2部載貨升降機,大廈位處核心工商地段,臨近長沙灣廣場第1期及羅氏商業廣場,步行至港鐵荔枝角地約3分鐘。

百生利意向價1050萬

該代理補充,上址坐落於青山道,坐擁多個住宅群,臨近長沙灣廣場及潮人和文青集中心地D2 PLACE ONE及D2 PLACE TWO,食肆及商戶林立,大廈對上一宗成交在2022年3月以1090萬錄得,單位為高層4室,建築總面積約2373方呎,呎價約4593元。

(星島日報)

更多TML廣場寫字樓出售樓盤資訊請參閱:TML廣場寫字樓出售

更多荃灣區甲級寫字樓出售樓盤資訊請參閱:荃灣區甲級寫字樓出售

更多長沙灣廣場寫字樓出租樓盤資訊請參閱:長沙灣廣場寫字樓出租

更多 D2 PLACE ONE 寫字樓出租樓盤資訊請參閱:D2 PLACE ONE 寫字樓出租

更多 D2 PLACE TWO 寫字樓出租樓盤資訊請參閱:D2 PLACE TWO 寫字樓出租

更多長沙灣區甲級寫字樓出租樓盤資訊請參閱:長沙灣區甲級寫字樓出租

甲廈價低位有承接 料交投回穩

近期甲廈業主出現大幅降價放盤,漸見有用家承接,相信隨着減息在即,甲廈交投回穩,租售價可稍為喘定。

據一間代理行的10大指標甲廈統計,8月僅錄1宗買賣,涉及美國銀行中心中高層04至07及13室,面積約6,632平方呎,由一間金融財務公司租用,月租約22萬元,租約期至2025年11月。單位上月初以1.21億元沽出,呎價約18,245元,屬於市價水平,以成交價計算租金回報率約2.2厘。

美國銀行中心 4年蝕17%

翻查資料,單位曾由美國商會於2020年以約1.45億元沽出,由活星地產集團創辦人兼主席李耀湘或相關人士承接。相隔4年沽出,業主蝕約2,400萬元離場,單位貶值約17%。

今年美國銀行中心先後錄2宗全層買賣,包括德祥地產 (00199) 以約2.6億元沽出30樓總部全層連4個車位,不計車位價值,呎價約18,700元,創逾10年新低。

至於中環中心,本月錄得一宗大額買賣,涉及物業66樓及75樓,由同一買家承接。現時66樓面積約26,967平方呎,由商務中心租用,而75樓面積約23,901平方呎,現由內地電訊企業租用,兩層樓面合共50,868平方呎,以約14.2億沽出,呎價約2.8萬元。市場人士指,是次買家以星展銀行呼聲最高,該集團一直持有中環中心多層自用,並租用部分單位。此外,同廈22樓11室,面積約3,184平方呎,新近以約4,200萬元沽出,成交呎價約13,191元,屬多年來新低。

信德中心海景戶 呎租48元

該行代理表示,近期甲廈錄低價成交,相信因個別業主面對現實,大幅降價,而有企業見價格回調,決定買樓面自用,故甲廈價低位漸見承接。

後市上,該代理認為近期甲廈租金表現並不差,如上環信德中心招商局大廈中層單位,面積逾4,000平方呎,成交呎租約40元,另信德中心西座中層海景單位,面積約1,100平方呎,成交呎租約48元。他分析,甲廈租金在大幅回調後,近期已稍為喘定,可支持買賣價企穩,並預計減息在即,準買家會轉為積極洽購甲廈單位,故預計今年交投可望回穩。

(經濟日報)

更多美國銀行中心寫字樓出售樓盤資訊請參閱:美國銀行中心寫字樓出售

更多中環中心寫字樓出售樓盤資訊請參閱:中環中心寫字樓出售

更多中環區甲級寫字樓出售樓盤資訊請參閱:中環區甲級寫字樓出售

更多信德中心寫字樓出售樓盤資訊請參閱:信德中心寫字樓出售

更多上環區甲級寫字樓出售樓盤資訊請參閱:上環區甲級寫字樓出售

Big housing rebound predicted, deals jump

Fifteen transactions were recorded in Hong Kong's 10 major housing

estates over the weekend ahead of an anticipated US interest rate cut.

This came as an eminent Hong Kong economist said he expects a

significant rebound for the local property market as interest rates are

lowered.

Transactions at the 10 blue-chip estates nearly doubled during the

weekend, compared to eight deals a week ago, according to a local

property agency. The 15 deals represented a half-year high, the agency

said, adding that the number of estates that recorded no deals also

narrowed to two during the period.

Many buyers rushed to snap up high-quality second-hand flats ahead of

the expected rate cut, driving a strong rebound of transactions, an agent said

.

Another local property agency also reported 15 deals at the 10 major estates over

the weekend amid a lack of large-scale new project launches, alongside

rate-cut expectations.

If Hong Kong's mortgage rates could come down, overall residential

transactions see a boost by the end of the year, and the primary market

in particular will perform better, another agent said.

This came as Lam Pun-lee, former associate professor at The Hong Kong

Polytechnic University, said the current downturn in Hong Kong's

property market is the smallest among the four adjustment cycles the

city has experienced, and he expects the upcoming US interest rate cut

will help the market bottom out .

Historical data shows that the property market often continues to fall

for three to six years, with a drop of about 30 percent to 60 percent,

Lam said.

However, property prices can often recover for more than 10 years after

hitting a bottom, which would be "quite a substantial rebound," he

added.

In other news, a new report from the first agency showed that starter homes

have been the hardest hit among property foreclosure deals. Flats priced

under HK$7 million accounted for 90 percent of those flats whose owners

were unable to pay the mortgages.

As of August, the number of home foreclosures has reached over 340,

marking a fresh high in 17 years and surpassing the levels seen during

the 2008 financial tsunami.

(The Standard)

中環新世界大廈呎租75元 健身美容中心進駐涉全層逾萬呎樓面

在經濟疲弱的背景下,金融和專業行業對傳統寫字樓需求大減,然而,健身、醫療美容等行業需求仍然持續增長,核心甲廈由「辦公樓」走向「半零售化」。中環新世界大廈全層面積逾萬方呎,由健身美容中心進駐,平均呎租75元。

中環新世界大廈27樓全層原本由新創建使用多年,早前新創建遷至長沙灣地標甲廈南商金融創新中心,該27樓全層亦成功租出,市場消息透露,該全層面積約10270方呎,新租戶健身美容中心承租,平均呎租約75元,月租約77萬。

業內人士指出,隨着新世界自用旗下長沙灣新落成地標甲廈「83瓊林街」多層樓面及區內同系甲廈,中環新世界大廈騰出部分樓面出租,此策略性安排,既帶旺旗下重鎚打造的九龍西商業圈,亦可透過出租核心區甲廈增加收入。

面積約10270呎 月租77萬

事實上,近期甲廈租客結構出現變化,金融及專業行業在經歷貿易戰、疫情、經濟不景面對壓力,對傳統甲廈需求減少。

隨着人們注重健康,對自我提升的重視,健身、醫美行業及教育等半零售行業需求持續上升,陸續進駐甲廈以填補空檔,甲廈大業主亦升級設施以開拓新客源。

元朗溱栢地舖近億元沽

新世界就旗下中環新世界大廈作銳意轉型,去年引入健康、專業醫美及醫療行業,由疫情前佔大廈的10%增加至當時35%,提高整體出租率,該類型行業普遍簽下較長租約。

新世界近年沽售旗下非核心物業。元朗溱栢6間地舖,今年年初以意向價1.1億放售,新近以近1億沽售。代理指,買家為區內資深投資者,看好「北部都會區」發展,購入作為收租用途,計劃租予零售餐飲,估計投資回報近5厘,上述6間地舖面積介乎650至5200方呎。

今年3月,新世界以40億沽出愉景新城商場,隨後以1.15億售出西貢傲瀧商場,旗下長沙灣甲廈83永康街賣現樓,首批入場費約721萬,呎價介乎約1.2萬至1.4萬。

該27樓原本由新創建使用,早前新創建遷至長沙灣甲廈,該全層由健身美容中心承租。

(星島日報)

更多新世界大廈寫字樓出租樓盤資訊請參閱:新世界大廈寫字樓出租

更多中環區甲級寫字樓出租樓盤資訊請參閱:中環區甲級寫字樓出租

更多南商金融創新中心寫字樓出租樓盤資訊請參閱:南商金融創新中心寫字樓出租

更多PORTAS寫字樓出租樓盤資訊請參閱:PORTAS寫字樓出租

更多長沙灣區甲級寫字樓出租樓盤資訊請參閱:長沙灣區甲級寫字樓出租

更多永康街83號寫字樓出售樓盤資訊請參閱:永康街83號寫字樓出售

更多長沙灣區甲級寫字樓出售樓盤資訊請參閱:長沙灣區甲級寫字樓出售

代理:指標甲廈售價連跌11個月

商廈租售價持續下跌。地產代理報告指出,8月指標甲廈售價按月跌約0.3%,連跌11個月,而乙廈售價則按月跌約2.4%。租金方面,甲乙廈租金按月分別跌約1.5%及1.9%。上月亦錄7宗指標甲廈成交,按月持平。

售價按月跌約0.3%

8月最矚目的是星展銀行以約13.43億購入中環中心66樓及75樓全層,平均呎價約26,402元,與中環區內市價相若。租務方面,矚目的為工銀亞洲以月租約500萬租用紅磡海濱廣場1座多層樓面。

料「以價換量」蔓延至乙廈

代理表示,最新的整體指標乙廈售價已回落至2015年水平,相信「以價換量」情況將蔓延至乙廈市場,目前中環區商廈平均呎價約2.5萬,是8年以來新低。金鐘區平均呎價更低見1.8萬左右,重回2012年水平。

(星島日報)

更多中環中心寫字樓出售樓盤資訊請參閱:中環中心寫字樓出售

更多中環區甲級寫字樓出售樓盤資訊請參閱:中環區甲級寫字樓出售

更多海濱廣場寫字樓出租樓盤資訊請參閱:海濱廣場寫字樓出租

更多紅磡區甲級寫字樓出租樓盤資訊請參閱:紅磡區甲級寫字樓出租

Speculator makes $261,000 killing in under two months

A property speculator has made a rare killing of a

little more than a quarter of a million dollars in the span of under

two months, despite Hong Kong's downbeat housing market.

The investor bought five flats at SkyeHi

in Tuen Mun for a total of more than HK$15 million when the developer

K&K Property launched sales of the last 33 flats in the project in

July.

But they have now sold one of them - a

265-square-foot one-bedroom unit bought for HK$2.94 million - for HK$3.2

million, making a profit of 9 percent or HK$261,000 in less than two

months, according to local media reports.

The seller had opted for a 120-day payment

deadline on the unit but paid the entire amount in advance to be able to

resell the flat, according to the reports.

The other four flats are now being offered at prices that are HK$300,000 higher than their original cost, the reports said.

Meanwhile, The Yoho Hub II's

Tower Six in Yuen Long has opened show flats after releasing a new

price list for 94 flats, with the cheapest priced at HK$6.83 million.

In other news, KT Marina

I in Kai Tak saw six deals yesterday worth a total of HK$36 million for

developers K Wah International (0173), Wheelock Properties and China

Overseas Land and Investment (0688).

The project launched 12 more selected flats with

discounts as high 35.75 percent to cater to robust demand after it

released Mid-Autumn Festival incentives. The cheapest is a 306-sq-ft

one-bedroom unit priced at HK$4.87 million after discounts.

(The Standard)

跨企鍾情新甲廈 美資租啟德AIRSIDE萬呎

新甲廈吸引商戶搬遷成交,消息指,觀塘The Millennity 1.5萬平方呎單位,獲玩具公司租用,呎租約30元,集團早前沽出同區俊匯中心甲廈自用單位。另啟德AIRSIDE 1萬平方呎樓面,獲美資藥業公司租用。

市場消息稱,觀塘全新甲廈The Millennity錄得租務成交,涉及中層單位,面積約1.5萬平方呎,呎租料約30元。

早前1.33億 沽俊匯中心總部

據悉,新租客為一家玩具公司,該集團本身總部在東九龍俊匯中心,早前他們沽出俊匯中心28及29樓連天台,物業面積合共約21,154平方呎,並連同一個約1,608平方呎平台,以及5個車位,以1.33億元易手,平均呎價6,287元。沽出樓面後,現轉租同區全新甲廈,而使用樓面有所收縮。

The Millennity去年入伙,今年亦獲不少新租客承租,包括科技大學租用30及31樓兩層,面積合共約3.8萬平方呎,呎租料約30元。

新甲廈受跨國企業歡迎,消息稱,啟德AIRSIDE中低層單位,面積約1萬平方呎,以每呎約30元租出。據悉,新租客為一家美國藥業公司,該集團原租用鰂魚涌太古坊柏克大廈,現搬至AIRSIDE,作提升物業級數。

九龍區商廈租務較活躍,消息指,九龍灣恒生中心錄全層租務,涉及物業低層全層,面積約2.6萬平方呎,呎租約25元。據悉,該層樓面由港鐵承租,公司總部一直設於該廈,去年集團擴充,租用物業中層2層,每層面積2.6萬平方呎,合共約5.2萬平方呎,若連同是次成交,集團於該廈已佔用至少4層。

另港島區租務上,資料顯示,灣仔大新金融中心12全層,以及13樓單位,獲香港個人資料私隱專員公署續租,涉及約61.5萬元。至於中環美國銀行中心低層12室,面積約732平方呎,成交呎租約47元。

(經濟日報)

更多The Millennity寫字樓出租樓盤資訊請參閱:The Millennity寫字樓出租

更多觀塘區甲級寫字樓出租樓盤資訊請參閱:觀塘區甲級寫字樓出租

更多AIRSIDE寫字樓出租樓盤資訊請參閱:AIRSIDE寫字樓出租

更多啟德區甲級寫字樓出租樓盤資訊請參閱:啟德區甲級寫字樓出租

更多俊匯中心寫字樓出售樓盤資訊請參閱:俊匯中心寫字樓出售

更多觀塘區甲級寫字樓出售樓盤資訊請參閱:觀塘區甲級寫字樓出售

更多柏克大廈寫字樓出租樓盤資訊請參閱:柏克大廈寫字樓出租

更多鰂魚涌區甲級寫字樓出租樓盤資訊請參閱:鰂魚涌區甲級寫字樓出租

更多大新金融中心寫字樓出租樓盤資訊請參閱:大新金融中心寫字樓出租

更多灣仔區甲級寫字樓出租樓盤資訊請參閱:灣仔區甲級寫字樓出租

更多美國銀行中心寫字樓出租樓盤資訊請參閱:美國銀行中心寫字樓出租

更多金鐘區甲級寫字樓出租樓盤資訊請參閱:金鐘區甲級寫字樓出租

博士倫提價7%續租沙田物流中心

逆市下,工廈物業租金及售價跌幅相對少,部分工廈還錄提價承租,沙田火炭嘉民沙田物流中心 (第2期) 17及18樓,面積約26428方呎,由眼科護理產品博士倫續租,月租396420元,較三年前提價7%。

月租39.6萬續約3年

博士倫承租上述物業,由2019年開始每次續租均提價,由2019年10月至2021年10月租期兩年,月租343564元,平均呎租13元,直至2021年10月續租三年,直至2024年10月,月租369992元,平均呎租14元,提價7.6%,最新由2024年10月至2027年10月,租期三年,月租396420元,提價7%,平均呎租15元。

業內人士指,儘管新式物流倉供應增加,惟租金相對高,一些傳統物流倉本身租金平,需求穩定,錄提價承租,雖然整體來說,倉庫租賃錄得下跌,惟跌幅較商廈細。根據一間外資代理行數據,2024年第二季倉庫租金按季跌0.4%,租賃活動以續租為主。

平均每呎15元

該行又指,工業物業市場正在應對錯綜複雜環境,勞動力短缺促使租戶升級至效率更高、位置更方便的專用倉庫。另一方面,北部都會區棕地發展項目收地工作展開,將衍生搬遷需求,帶動租賃活動。

(星島日報)

尖沙咀藥妝店罕簽6年長租約 20萬進駐美麗都大廈舖 平高峰近半

核心旅遊區舖位空置率高,不少舖位已丟空多時,舖位一旦有租戶承租,業主紛希望簽署長租約鎖定租客。尖沙咀美麗都大廈一個鄰近區內大型商場K11

Art Mall的地舖,丟空接近3年,近期終以每月20萬元由藥妝店租用,雖然舖位租金較高位折讓近一半,但仍獲業主簽署6年的長租約。

鄰近K11 Art Mall 已丟空3年

剛租出的舖位為尖沙咀彌敦道54號美麗都大廈地下35號舖,建築面積約900方呎,位於麼地道及碧仙桃路交界單邊,鄰近K11 Art Mall,今年4月以每月15萬元放租,但據悉最終以20萬元租出,呎租約222元,較4個多月前的叫租,不減反增5萬元或33.3%。

租客為一家藥妝店,舖位租約長達6年,至2030年8月才屆滿,屬市場罕有舖位租予非國際零售品牌,卻可獲超過3年特長租約的個案。

上述物業原由資深投資者黎永滔持有,今年4月以「蝕讓價」3050萬元售出,呎價約3.39萬元。黎永滔於2007年7月以6280萬元買入此舖,持貨逾17年,賬面虧蝕3230萬元,物業貶值51.4%。以最新租金計算,業主可收取的租金回報高達7.9厘。

該舖在今次租出之前,已丟空接近3年。據資料顯示,舖位曾由一家行李箱品牌自2013年起租用長達8年,最初月租高見37.5萬元,呎租約417元;及後在2018年獲減租41.3%至22萬元,呎租降至約244元續約,直至2021年10月租約期滿結業。如今舖位再度租出,較2013年高位每月租金大跌17.5萬元或46.7%。

參考同區鄰近租賃個案,尖沙咀加拿分道15至19號立誠大廈地下A舖,與美麗都大廈地舖相距不足2分鐘步程,建築面積約900方呎,新近獲一家藥妝店以每月9.5萬元租用,呎租約106元,租期只有2年。該舖原租戶為珠寶店,舊租金為13.8萬元,租金下滑31.2%。

淡市下業主願鎖定租金收入

另外,尖沙咀漢口道53號地下及閣樓,地下建築面積約1000方呎,閣樓建築面積約800方呎,合共建築面積約1800方呎,今年6月起由一家海味成藥店以每月22萬元租用,呎租約122元,據悉租期為3年。此舖位於2013至2016年期間曾由連鎖珠寶店周大福

(01929) 以月租80萬元租用,呎租高達444元,目前租金較高峰期低58萬元或72.5%。

業內人士分析,在舖市好景時,一般位於核心旅遊區的舖位租約只有2至3年,業主期望租約屆滿後,原租戶可以較高價錢續約或轉換新租客。但近年不少舖位已丟空多時,空置率高,當個別舖位獲新客租用,業主亦不介意簽訂較長年期租約,以鎖定租金收入。

(信報)

More Southside flats to go on sale

Phase 3C of The Southside, jointly developed by CK Asset (1113) and MTR Corporation (0066) in Wong Chuk Hang, has been named Blue Coast II and sales are expected to launch next month.

The project consists of two towers, offering 558 two-bedroom to four-bedroom flats. The first phase of the Blue Coast

or phase 3B of The Southside was launched in April, with 571 flats sold

as of yesterday. It minted HK$10.8 billion for its developer, with the

average price for a flat in the project standing at HK$19 million or an

average of HK$25,000 per square foot.

Justin Chiu Kwok-hung, CK

Asset's executive director, predicted home prices to remain close to

the present level as the room for prices to drop further is "not large"

since the impending US Federal Reserve's rate cuts would bolster the

local property market.

In other news, a new compulsory sale for Haven Court in Causeway Bay will not be held.

Haven Court was acquired

by Soundwill (0878) more than 10 years ago but the compulsory sale in

April was aborted after Soundwill did not attend. As the compulsory sale

order became invalid on August 29, Soundwill said a second compulsory

sale auction would not be held for the building.

(The Standard)

宏基資本大廈全層連四車位叫價9022萬

有代理行表示,觀塘宏基資本大廈低層全層連4個私家車位,建築面積約12029方呎,意向售價約9022萬元,呎價約7500元,以交吉形式出售。

該行指出,上述全層物業視野開揚,坐擁全郵輪碼頭海景,配以落地玻璃大窗,附設寫字樓裝修。

宏基資本大廈徒步前往港鐵牛頭角站僅需數分鐘。

(信報)

更多宏基資本大廈寫字樓出售樓盤資訊請參閱:宏基資本大廈寫字樓出售

更多觀塘區甲級寫字樓出售樓盤資訊請參閱:觀塘區甲級寫字樓出售

金朝陽不提上訴 希雲大廈取消拍賣

金朝陽 (00878)

最新公告交代銅鑼灣希雲大廈強拍的最新進展,發展商指,上訴法庭已於9月2日公布駁回其上訴的判決,並裁定出售命令的3個月有效期,只能再延長3個月一次,因此出售命令的有效性於8月29日之後,不再具有任何法律效力。而該集團經過諮詢其專業顧問後,將不會提出上訴,即項目不會再舉行拍賣。

此後,土地審裁處通知根據出售命令委任的受託人,並就受託人單方面申請進一步延長出售命令的期限,以進行第二次拍賣作出回覆,表示不會批准延期。

受託人其後通知該集團,其會按照強拍條例第7 (3)

條的規定,在土地註冊處撤銷出售命令的登記,因此將不會進行第二次拍賣。各方將回復至作出強制出售申請前的狀態,即如從未作出出售命令。而據該集團董事所深知、盡悉及確信,不收購或出售希雲大廈的不分割份數,不會對其產生直接財務影響。

希雲大廈位於銅鑼灣禮頓道128至138號、希雲街2至30號,比鄰為同由金朝陽發展的曦巒。金朝陽於2019年申請強拍,至今年2月獲土地審裁處以底價24.25億元批出強拍令,惟在今年4月「流拍」收場。其後發展商曾向土地審裁處申請延長拍賣期限至8月29日,及申請下調拍賣底價至與該地段的市值一樣,不過土審最終僅批准延期,卻未有調整底價。

(經濟日報)

九龍灣新商廈第一集團中心地下兩舖位,合共以6,000萬元沽出。

觀塘世達兩銀主盤 1490萬易手

資料顯示,九龍灣全新商廈第一集團中心地下01及2號舖易手,物業1號單位面積約2,760平方呎,以3,500萬元沽出,另2號舖面積約2,382平方呎,以2,500萬元沽出,合共涉資約6,000萬元。據悉,目前1號舖位由電動車AION埃安租用,另2號舖仍交吉。

據了解,兩舖位均由發展商第一集團沽出。該集團今年中展開拆售。

另外,觀塘工廈世達中心兩銀主單位以1,490萬元易手,物業4年間貶值一半。資料顯示,觀塘巧明街錄得兩宗登記,涉及物業低層C及D室,面積分別約2,383及2,858平方呎,合共約5,241平方呎,以1,490萬元成交,呎價僅約2,842元。

翻查資料,原業主於2020年以3,100萬元購入上述單位,惟其後業主多番加按物業,及後淪為銀主盤。如今以1,490萬元沽出,單位貶值1,610萬元,幅度達52%。

(經濟日報)

更多第一集團中心寫字樓出售樓盤資訊請參閱:第一集團中心寫字樓出售

更多九龍灣區甲級寫字樓出售樓盤資訊請參閱:九龍灣區甲級寫字樓出售

旺角MK居停放售 全幢市值2.95億

旺角長沙街11號MK居停全幢酒店放售,擁有101個房間,全幢市值2.95億。

有外資代理行代理表示,MK居停全幢樓高19層,建築面積約26140方呎,提供101個房間,望都市景,項目於疫情前高峰期月租約240萬。當下旅遊業未完全復甦,若以營業額減半計算,預期月租約120萬,預期回報近5厘。截標日期2024年10月9日。

提供101個房間

該代理又說,最近兩年間酒店/旅館成交項目中,新買家多改裝學生宿舍或長租公寓,使酒店在短時間內消失逾約1000個單位。

MK居停與彌敦道僅一街之隔,有利遊客前往多個地標性旅遊景點,如西洋菜街市集、朗豪坊、舊油麻地警署、油麻地戲院及電影中心等網紅打卡熱點,更鄰近多個24小時運作的粵港直通巴士站,為國內旅客提供便利,MK居停距離高鐵站僅數分鐘車程。

料回報近5厘