Link's $766m bid wins site at Anderson Road

Link Asset Management, the manager of Link Real

Estate Investment Trust (0823), has won a commercial site in Kwun Tong

for HK$766 million, or HK$5,501 per square foot, which is in line with

market expectations.

The site on Anderson Road, known as Lot 1078 in

Survey District 3, has an area of about 5,880 square meters and the

maximum gross floor area is 12,936 sq m, according to the Lands

Department.

The lot's market valuation ranged from HK$550 million to HK$905 million, or from HK$4,000 to HK$6,500 per sq ft.

The plot is the first of a pair of commercial

sites available for sale within the Anderson Road Quarry Development. It

is also the second government land won by Link seven years after its

HK$5.86 billion bid for a commercial site on Hoi Bun Road in Kowloon

Bay, where its headquarters is located.

Other tenderers included Sino Land (0083), CK Asset (1113), Sun Hung Kai Properties (0016) and Chinachem.

Link said it intends to develop the land into a

community commercial facility, including retail facilities, a fresh

market, and car parks to serve the daily needs of more than 30,000

population as a number of public developments and subsidized housing

estates in the district are completed in the coming years.

The site will be connected to public transport via

an adjacent interchange. A covered pedestrian footbridge and lift

system, both to be built by the government, will connect Link's Sau Mau

Ping Shopping Centre and other residential estates in the Sau Mau Ping

district.

The project is required to be completed by end of June 2028.

Previously, the government sold two residential sites in the area.

In 2018, Chinachem acquired Lot No 1068 at a

consideration of HK$3.11 billion for private residential development,

which is now known as Mount Anderson, which will provide 334 flats by

2023.

In 2020, CK Asset acquired Lot No. 1069 at a price

of HK$4.95 billion to build 1,700 units of private and subsidized

starter homes.

In other news, a consortium has applied for a

compulsory sale of Comfort Mansion in Happy Valley, which is valued at

over HK$600 million.

And a property at No 28A and No 28B Grampian Road

in Kowloon has been granted a compulsory sale for redevelopment with a

reserve price of HK$404.25 million, the auctioneer said.

(The Standard)

Transitional

flats play pivotal role in easing Hong Kong’s housing crunch as city

looks to secure enough land supply, official says

Short-term

policies are necessary to alleviate the plight of underprivileged

residents, Undersecretary for Housing Victor Tai says

Average waiting time for public rental flats is six years, double the government’s pledge of three years

Transitional

homes have played a pivotal role in easing Hong Kong’s shortage of

public flats while authorities look to secure enough land supply, the

deputy housing chief has said.

Undersecretary

for Housing Victor Tai Sheung-shing on Wednesday said short-term

policies were necessary to alleviate the plight of underprivileged

residents. He was officiating a commencement ceremony ahead of the

construction of more than 1,000 transitional homes and a community

service building in Kam Tin by next year.

“Distant

water cannot quench a fire nearby,” Tai said, citing a Chinese proverb.

“We need to take forward every short-term measure to ease difficulties

faced by public housing applicants and residents living in undesirable

environments.”

He added that

transitional housing was an important policy that showed cooperation

among the community, the business sector and the government.

The

policy is a 2018 government initiative to help low-income groups living

in poor conditions, such as subdivided flats, who have not been able to

move to public housing.

The average waiting time for public rental flats in Hong Kong is six years, double the government’s pledge of three years.

As

of August, the government has identified land for 21,700 temporary

flats, of which more than 5,000 are currently in use, while the rest are

under construction or study.

The

government has identified 350 hectares of land for 330,000 public flats

to fulfil demand for housing over the next 10 years, but two-thirds of

the homes can only be built between 2027 and 2032.

The Kam Tin project,

which is among the coming transitional housing schemes, will provide

1,028 flats in a 200,000 sq ft site along Kam Po Road and cost more than

HK$576 million (US$73 million).

Its

operator, the pro-establishment New Territories Association of

Societies (Community Services) Foundation, is aiming to construct three

four-storey buildings in September 2023 to accommodate around 2,800

residents, who are currently either public housing applicants or

families living in undesirable environments like subdivided units.

A

two-floor community service building, featuring a supermarket,

restaurant, clinic and a self-serve laundry shop, will also be built.

The centre will also offer interest classes, counselling and career

training services.

“These

community services will serve both the transitional housing residents

and the neighbourhood to foster interaction between them,” said Leung

Che-cheung, president of the New Territories Association of Societies.

Leung

added that the district’s rural community had been supportive of the

project despite construction leading to the closure of a public road.

Located

within a five-minute walking distance from Kam Sheung Road railway

station, the operator said it expected the site to be fully occupied

next year when it opened, while residents would sign a three-year

contract and could potentially extend their stay.

“We hope that residents can stay until they can be housed in public housing,” Leung said.

The site is temporarily leased by the developer Henderson Land Development until 2027.

The

government’s assessment committee on funding transitional housing

projects led by undersecretary Tai held a meeting on Tuesday, approving

changes to five schemes to provide an additional 260 flats, increasing

the total number to 2,415.

The

amendments included doubling the number of flats for a housing estate

in Choi Hung operated by Lok Sin Tong to 331 to accommodate a total of

778 residents by increasing the number of floors in the building from

four to eight.

Lok

Sin Tong will also relocate 108 modular housing units to the Choi Hung

site from another transitional housing estate in Sung Wong Toi Road, a

site due to be returned to the government by next year. It will be the

first transitional housing estate to reuse such flats.

Secretary

for Housing Winnie Ho Wing-yin pledged to locate sites which would

allow occupants of transitional flats to stay there longer following her

first visit as minister to several of the city’s subdivided flats in

July.

(South China Morning Post)

政府放寬隔離檢疫政策後,增加商務人士來港意慾,間接利好寫字樓買賣活動。

上環信德中心連接着港澳碼頭,對於不少企業需穿梭中港澳來說十分便捷,加上上環區寫字樓造價對比中區相宜,單位面積選擇多,因而成為不少中外企業進駐的商廈,物業升值潛力更大。而位處上環信德中心招商局大廈中層,現以公開招標形式放售,意向價約1.4億元。

有代理表示,業主委託以公開招標形式放售,為上環干諾道中168號信德中心招商局大廈 17樓12至16室,建築面積合共約6,223平方呎,意向價約1.4億元,平均每呎叫價約22,497元,截標日期為10月31日。項目屬上環區內罕有大樓面單位,同時為港島區知名甲級海景商廈,而標售的單位更可享有開揚維港景致,份外耀眼。至於物業會以交吉形式放售,部分樓面附有整齊裝修及來去水位,可即買即用。

上環區罕有大樓面 眺望維港景

信德中心位於上環干諾道中168至200號,由信德中心有限公司發展,於1986年落成,區分作東、西翼2座大廈組成,其中東翼早年由酒店改建為商廈,現名為招商局大廈,樓高42層,每層樓面面積逾25,000平方呎,單位面積介乎700餘至25,000餘平方呎不等,單位間隔四正,當中大部份單位可享維港海景,其餘以眺望中、上環一帶城市景為主。而基座為信德中心商場,設有不少食肆及商店。

據資料顯示,信德中心招商局大廈成交以租務為主,反映出業主甚為惜售,同時物業回報吸引,而市場新近錄得信德中心招商局大廈中層05室,面積約1,267平方呎,以每平方呎約51元租出,月租約65,000元。

鄰近新海濱地 前景看俏

另一代理表示,信德中心招商局大廈位於港鐵上環站上蓋,附近又設有電車及多綫巴士路綫,交通便利,地理位置優越。而信德中心設有大型停車場和商場,配套一應俱全。而今次放售項目鄰近中環民耀街新海濱3號的商業地王,平均地價約3.1萬元,預料今番出售物業升值潛力極為優厚,相信招標物業對用家更具吸引力,不論自用或投資都相當有潛力,預料項目洽購反應會見理想。

(經濟日報)

更多信德中心寫字樓出售樓盤資訊請參閱:信德中心寫字樓出售

更多上環區甲級寫字樓出售樓盤資訊請參閱:上環區甲級寫字樓出售

遠展逾20億 放售油麻地灣仔酒店

今年酒店買賣表現不俗,發展商趁機放盤。消息指,遠東發展 (00035) 旗下酒店集團,放售油麻地及灣仔酒店,合共涉逾20億元。

海景絲麗酒店 市值11億

市場人士指,遠東發展旗下帝盛酒店集團,委託測量師行放售兩項酒店。其中海景絲麗酒店,位於油麻地上海街268號,鄰近駿發花園,距離油麻地港鐵站僅數分鐘步程,因位於油尖旺核心地段,地點頗理想。

該酒店於1993年落成,地盤面積約5,402平方呎,總樓面約67,826平方呎,項目樓高20層,2至18樓為客房,每層提供約12至16間房,提供268間房。因疫情關係,物業現時作檢疫酒店用途。據悉,物業市值約11億元,平均每房價值約410萬元。

另一幢放售物業為灣仔皇后大道東至377號香港麗悅酒店,位置上略為偏離灣仔核心地段。物業於1997年落成,地盤面積約4,093平方呎,總樓面約61,136平方呎,物業樓高29層,設有兩層商舖,3至19樓為客房,合共提供142間房,現時亦作檢疫酒店之用。物業市值約10億元,每房價值約704萬元,兩項酒店合共涉約21億元。

疫情衝擊下,本港長達兩年多零遊客,酒店自然最受衝擊物業。不過,近一年市場錄得多宗大額酒店買賣,新買家趁低價購入酒店,改裝成共居,作長綫收租。

(經濟日報)

領展7.7億奪安達臣道首幅商地

每呎樓面地價5501元 發展社區商業設施

領展 (00823) 擊退4組財團,成功以7.66億元,奪前觀塘安達臣道石礦場首幅商業地,每平方呎樓面地價約5,501元,符合市場預期。集團表示,日後將會發展為社區商業設施。

領展行政總裁王國龍稱,集團將可持續發展標準融入項目中,並為區內居民營造一個理想的租戶組合,藉以滿足消費者不斷演變的需求。該區未來數年將有多個公共發展項目及資助房屋屋苑落成,集團擬將該用地發展為社區商業設施

(包括零售設施、鮮活街市及停車場),以滿足區內將逾3萬人人口的日常所需。

接有蓋天橋 連接旗下秀茂坪商場

項目亦將與運輸交滙處,及政府將興建的有蓋行人天橋和電梯相連,並將連接領展旗下秀茂坪商場及區內其他住宅群,方便居民乘搭公共交通工具。有測量師指,由於項目位處民生區,相信是次由具豐富屋邨商場營運經驗的領展投得,對項目發展有利。

該地比鄰觀塘安達邨,佔地約6.3萬平方呎,總樓面面積約13.9萬平方呎,於上周五(26日)截標,共接獲5份標書,包括:信置

(00083) 、新地 (00016) 、領展、長實 (01113)

及華懋。地皮估值約5.6億至10億元,每呎樓面地價約4,000至7,200元,反映成交價屬市場預期之內。

事實上,領展在觀塘持有多個商業及屋邨商場項目,包括海濱道77號海濱滙的寫字樓項目、鄰近是次成交地皮的寶達商場、順利商場、秀茂坪商場、曉麗商場等,可見集團是次進一步擴大區內勢力。

至於領展對上一次投得商業項目要數到2016年2月,集團當時以59.1億元奪得旺角彌敦道700號項目,並已發展為「T.O.P This is Our Place」。至於上述同區的海濱滙則同由領展夥拍南豐於2015年以58.6元奪得。近期領展亦頗踴躍參與競投商業地,包括西九文化區藝術廣場大樓、銅鑼灣加路連山道商業用地等。

(經濟日報)

更多海濱匯寫字樓出租樓盤資訊請參閱:海濱匯寫字樓出租

更多觀塘區甲級寫字樓出租樓盤資訊請參閱:觀塘區甲級寫字樓出租

更多彌敦道700號寫字樓出租樓盤資訊請參閱:彌敦道700號寫字樓出租

更多旺角區甲級寫字樓出租樓盤資訊請參閱:旺角區甲級寫字樓出租

荃灣愉景新城商場 中資60億洽購

新世界放售非核心物業 或成今年最大額買賣

發展商加快推非核心物業,早前傳出新世界 (00017) 放售非核心物業,消息指旗下荃灣愉景新城商場獲中資洽購,估計涉資近60億元。該商場總樓面達64萬平方呎,若最終落實,將成今年最大額物業買賣。

較早前市場傳出,新世界正暗盤放售數項非核心物業,其中價值最高為荃灣D‧PARK愉景新城。業內人士稱,該項目獲發展商、外資、內房,甚至本地房地產基金等視察及研究,由於項目具規模,加上荃灣消費人口持續上升,故獲財團出價洽購。

新世界暫未回應交易

據悉,當中以一家中資最為積極,估計涉資約60億元,若最終易手,將成今年最大手物業買賣成交。

消息亦指,是次新世界放售商場,亦為新買家提供租金回報保證。本報就有關消息,向新世界查詢,截稿前暫未獲回覆。

消息稱,洽購財團以華潤集團最為積極,事實上,華潤集團今年非常活躍於本港物業市場上,如今年中,集團向嘉里

(00683) ,購入嘉里 (沙田) 貨倉及嘉里 (柴灣)

貨倉兩項物業,作價分別23.3億及22.9億元,合共涉及約46.2億元,以成交價計,為今年最大金額買賣,收購後作集團旗下華潤物流之用。

華潤今年活躍物業市場

另外,集團旗下華創建投,6月份斥13.6億元,購入大埔運頭塘商場。該集團早前曾表示,未來將會續向民生區商場發展,故對D‧PARK愉景新城感興趣。

位於荃灣的D‧PARK愉景新城,為荃灣大型屋苑愉景新城基座商場,樓高3層,總樓面達63萬平方呎,連同逾千個車位,絕對為區內大型商場之一,而項目連接港鐵荃灣站,亦鄰近荃景圍一帶大型屋苑,故消費人口主要為區內客。商場合共約140間店舖及旗艦店,主要為民生商戶包括快餐店、家品店、教育中心等。

目前商場出租率逾9成

商場由新世界及香港興業 (00480)

合作發展,97年落成,2010年新世界斥資約13.78億元,向香港興業購入商場及車場5成業權。其後新世界為物業進行租戶重組以及重新定位,據了解,近年商場打造成以親子為主題,包括商場設中央公園等,周末吸引家庭客前來,據了解,目前商場出租率逾9成。

新世界今年暫未有大型住宅樓盤推售,而銷售集中於商業項目,其中近一年多推出長沙灣荔枝角道888號全新甲廈項目,銷情不俗,當中獲南洋商業銀行大手購入3層,現大廈易名為南商金融創新中心。同時間,集團亦推出部分非核心物業,若價錢合適,可出售套現,投放在其他項目身上。

數字顯示,今年大額買賣物業相對較淡靜,大額商舖成交,主要來自地區商場,包括近日中國海外 (00688) 以約4.25億元,沽出土瓜灣海悅廣場商場,買家為俊業集團。

(經濟日報)

更多南商金融創新中心寫字樓出租樓盤資訊請參閱:南商金融創新中心寫字樓出租

更多南商金融創新中心寫字樓出售樓盤資訊請參閱:南商金融創新中心寫字樓出售

更多長沙灣區甲級寫字樓出租樓盤資訊請參閱:長沙灣區甲級寫字樓出租

更多長沙灣區甲級寫字樓出售樓盤資訊請參閱:長沙灣區甲級寫字樓出售

民生區商場抗跌 今年投資焦點

加息在即,投資者尋找較高回報及穩健物業,而中港尚未通關,核心區商舖前景仍不明朗。相比之下,民生區商場出租率高、抗跌力強,相信為今年投資焦點之一。

代理行數據顯示,2017及2018年,均錄逾400宗大手買賣

(5,000萬元以上物業),近年整體回落,2021年有所反彈。但因年初疫情嚴峻,今年首7個月暫錄471億元成交,僅為去年一半,宗數亦只是去年35%。香港加息在即,預計對投資市場進一步衝擊,金額及宗數有可能再下跌。

投資物業關鍵之一是回報率,若加息提高投資成本,對機構投資者來說,便會尋求較高回報率物業,以抵銷息口上升的影響。在商舖市場上,核心區商舖過去兩年因疫情關鍵,租金及售價作出明顯調整,漸出現投資機遇。

不過,若旅客未重返,核心區舖位空置率偏高的問題難以解決,故租售價反彈力度有限。目前政府實施「3+4」檢疫措施,對推動外地旅客訪港消費始終不高,加上中港通關更是無期,核心區商舖市況變化不多,投資者亦卻步。

出租率高 本地消費仍穩定

持續兩年多疫情,令民生區商場成投資對象,畢竟地區商場出租率高,本地消費仍穩定,而商場內的租戶如超市、快餐店等,疫情下生意沒受明顯衝擊,物業抗跌力較強,而今年大手商舖成交,幾乎全屬民生商場包括大埔、土瓜灣及荃灣,料今年民生區商場仍是財團重點留意對象。

(經濟日報)

跑馬地愉華大廈申強拍

近年財團紛紛透過併購豪宅地段舊樓,申請強制拍賣以增土地儲備,繼日前有財團申請強拍跑馬地翠景樓之後,持有毗鄰愉華大廈的財團,最新亦向土地審裁處申請強拍,以統一業權發展,目前持有項目逾80%業權,市場估值逾6.11億。

土地審裁處文件顯示,位於黃泥涌道59及61號、雲地利道36及38號的愉華大廈,由一家名為PRECISE

LUCKY LIMITED的公司申請強拍,該公司持有約80.59%業權,現餘下8個單位未成功收購,包括Hongkong Bank

Trustee

Limited持有黃泥涌道61號一個低層物業,市場估值約1336萬,該8個單位市場估值約1229萬至1667萬,市場對整個項目估值6.1124億。

市場估值逾6.11億

上址現為一幢商住物業,地下為商鋪,樓上為住宅,樓齡約58年。由於該舊樓毗鄰馬場,落成後料不少單位可享馬場景,而且鄰近銅鑼灣核心商業地段,因此極具重建價值。今年6月財團委託測量師調查顯示,上址地盤面積5648方呎,若以地積比率9倍發展,涉及可建總樓面約50832方呎。

值得留意的是,早前一家名為Sonic Success

Limited的公司,向土地審裁處申請強拍上述舊樓毗鄰的翠景樓,現持有約83.33%業權,市場對整個項目估值7.0681億。與此同時,黃泥涌道63至65號安美大廈,早前曾錄19宗成交,包括16個住宅單位及3個鋪位,總成交額涉及約4.12億,不排除上述項目由同一財團併購,料屆時會整合發展。

九龍城舊樓本月23日拍賣

此外,由財團併購的九龍城嘉林邊道28A至28B號,早前獲土地審裁處頒下強制售賣令,仲量聯行將於9月23日,安排拍賣該物業,底價4.0425億。據土地審裁處文件顯示,上址現為1幢3層高舊樓,早於1950年落成入伙,樓齡約72年。該舊樓佔地10070方呎,現劃為「住宅

(乙類)」用途,若以地積比率5倍重建,可建總樓面約50350方呎。

(星島日報)

Hong Kong, mainland China to see office rents decline through 2022 amid Covid-19 policies, while Singapore, Seoul surge

Hong

Kong and most mainland cities will see office rents slide in the second

half of the year, according to a property consultant’s forecast

Seoul

and Singapore top property consultancy’s forecast for 22 markets, while

Hong Kong, Guangzhou and Tokyo will see the largest drops

Office

property markets in Hong Kong and mainland China are likely to see

declining rents for the rest of the year, according to a consultancy

ranking that places them in the bottom half of a list of 22 Asia-Pacific

markets.

“Hong

Kong SAR and mainland China are lagging in terms of rental growth,” a

property consultant said. “We have also revised down our full-year

expectations of the two markets.”

Guangzhou,

which ranks 21st on the list, is tipped to see rents tumble by 3 per

cent for the rest of the year following a 1.1 per cent decline recorded

in the first half of the year, according to the consultancy. The vacancy

rate in the city is likely to ease slightly, to 16.1 per cent from the

current 16.4 per cent.

Only

Tokyo fares worse, with the forecast calling for a 3.1 per cent slide

in office rents, following a 1.6 per cent decline so far this year, the

consultancy said. The Japanese capital’s vacancy rate is likely to

worsen to 3.1 per cent from 2.1 per cent.

Hong Kong, meanwhile, ranks 20th, with rents pegged to fall 2.5 per cent.

Office

rents in Shanghai are forecast to retreat 0.9 per cent, while those in

the tech hub of Shenzhen are estimated to see a 0.7 per cent slide.

Among

Chinese cities, only the capital Beijing is expected to see office

rents rise, with the consultancy predicting they will improve by 0.5 per

cent – placing the city in the 13th spot.

Singapore’s

office market is likely to be the second-best performer with 8.3 per

cent rent growth this year. Seoul tops the consultancy’s list with an

anticipated 14.8 per cent increase in rents.

While

most major markets in the region have opened to international visitors

provided they are fully vaccinated, mainland China and Hong Kong still

require visitors to quarantine upon arrival, on top of a plethora of

Covid-19 tests.

China, the world’s second-largest economy, grew at a slower-than-expected 0.4 per cent pace last quarter, reflecting the toll of wide-ranging lockdowns

in the capital Beijing and financial hub Shanghai, which hammered

economic output and likely put the nation’s 5.5 per cent growth target

for this year out of reach.

Meanwhile, Hong Kong’s economy slipped into a recession in the second quarter,

contracting by 1.4 per cent from a year ago. In the first three months

of the year, the gross domestic product slumped 3.9 per cent, leading

officials to downgrade the growth forecast for the second time this

year. Hong Kong’s economy is now tipped to contract by as much as 0.5

per cent or grow by as much as 0.5 per cent.

“The

continued closure of the border between Hong Kong and China mainly

affects the recovery of Hong Kong in regards to attracting mainland

companies and the return of Chinese tourists,” the consultant said.

The impact on the office property market

is apparent in Hong Kong. According to data from another property

consultancy, the vacancy rate for prime office space in July inched up

to 9.6 per cent from 9.4 per cent in June – close to the record high of

9.8 per cent recorded in September 2021.

With 2.8 million square feet of new prime space

hitting the market this year, supply will reach a level not seen since

2008, when it stood at 3.5 million sq ft, according to another property

consultancy.

(South China Morning Post)

Homes go on sale for Mid-Autumn

Miami Quay I

in Kai Tak may unveil its first price list today, offering at least 130

flats and kicking off sales for the Mid-Autumn Festival, said the

developers.

This came as

the Bank of East Asia (0023) raised the cap on Hong Kong interbank

offered rate-linked loans by 0.25 percentage points to 2.75 percent.

Developed

jointly by Wheelock Properties, Henderson Land Development (0012), New

World Development (0017) and Empire Group, phase one of Miami Quay

provides 648 homes in total.

The

project features one or two-bedroom units, so the developers expect it

will attract young buyers, small families and investors.

Elsewhere,

Sun Hung Kai Properties (0016) is expected to start sales of 164 units

at Park Yoho Bologna in Yuen Long at the end of September.

Andy

Chan Hon-lun, the developer's real estate agency general manager, said

phase three of Park Yoho will be put for sale at a market price.

SHKP said about 3,000 homes at the project have been sold so far.

In

other news, China's large residential builder Vanke (2202) said it will

launch a new project on Yee Kuk Street and Hai Tan Street in Cheung Sha

Wan, offering over 500 new homes in small and medium size.

Vanke

said it expects to put the redevelopment project for sale next year,

after winning two compulsory sale tenders for HK$852 million.

(The Standard)

金鐘海富中心細單位每呎34元租出 交吉逾一年 面積1442方呎

受疫情及加息因素影響,核心區甲廈租金持續受壓。由活星地產創辦人兼主席李耀湘持有金鐘海富中心二座中層單位,於交吉逾一年後,以「一拆二」形式,簽下兩年長租,呎租34元,創該甲廈過去12年呎租新低水平,回報亦低見1.5厘。

市場消息指出,金鐘海富中心二座中層1C室,建築面積約1422方呎,新以每呎約34元租出,月租約48348元,據地產代理指出,上述單位於2020年底連同毗鄰D室一併租出,月租12萬,以建築面積約3314方呎,租戶於去年中撤出,業主將單位「一拆二」形式放租,上址另一單位仍交吉放租,意向呎租35元。

據地產界人士透露,上述業主為活星地產創辦人兼主席李耀湘,於2020年11月以8616.4萬購入,以建築樓面3314方呎計,每呎造價約2.6萬,以最新租金計,回報僅1.56厘。代理亦指出,海富中心二座呎租罕現跌穿每呎35元水平,惟受疫情及美國聯儲局加息等利淡因素打擊,現今甲廈租務市場觀望氣氛籠罩,故上述租金已屬貼市價水平。

呎租創12年新低

據代理行資料顯示,該甲廈於今年以來僅錄兩宗租務成交,成交呎租分別為42元及47元。該廈近期低位租金為二期低層9室,於2020年9月以每呎約38元租出,以建築面積約1155方呎計,月租約43890元。

活星地產李耀湘持有

翻查資料,李耀湘為活星地產創辦人,近年亦活躍於物業買賣,中環雲咸商業中心 27樓全層於去年10月以7650萬成交,原業主為李耀湘等人,持貨約13年後帳面獲利約4866萬,此外,李氏於去年中亦4.7億購入山頂倚巒單位,面積3581方呎,呎價約13.12萬,創該屋苑成交價及呎價新高。

據一間外資代理行統計資料顯示,今年7月甲廈空置樓面衝上1000萬方呎大關,創歷來新高水平,等同五幢國際金融中心二期,空置率高達12.3%,加上新供應「排隊」出場,涉及面積達700萬方呎,預測今年底空置率將攀升至14.8%,將打破自1999年紀錄,因空置樓面高踞不下,料明年整體甲廈租金跌約5%至10%。

另一方面,有代理表示,荃灣青山公路611至619號東南工業大廈中層D至E室,建築面積介乎約7184至14368方呎,意向價約2729萬起,呎價約3800元。

另一代理指,灣仔道113至117號得利商業大廈1樓全層,建築面積約3875方呎,以交吉及按現狀形式出售,意向價約4650萬,呎價約1.2萬。

(星島日報)

更多海富中心寫字樓出租樓盤資訊請參閱:海富中心寫字樓出租

更多金鐘區甲級寫字樓出租樓盤資訊請參閱:金鐘區甲級寫字樓出租

更多雲咸商業中心寫字樓出售樓盤資訊請參閱:雲咸商業中心寫字樓出售

更多中環區甲級寫字樓出售樓盤資訊請參閱:中環區甲級寫字樓出售

更多國際金融中心寫字樓出租樓盤資訊請參閱:國際金融中心寫字樓出租

更多中環區甲級寫字樓出租樓盤資訊請參閱:中環區甲級寫字樓出租

早前由佳源持有的中環皇后大道中9號中層單位,早前獲投資者張肇桓以9500萬承接,上址最新以招標形式放售,意向價約1.3億,呎價約3.89萬。

投資者張肇桓放售

有代理指出,中環皇后大道中9號 14樓3室現以招標形式放售,總建築面積約3335方呎,物業以現狀連租約出售,意向價約1.3億,截標日期為今年10月11日 (星期二) 正午12時正。

代理表示,物業於今年6月份成交價為9500萬,該成交是原業主和財務機構的財務安排,並不能真正反映物業現時的真正價值,因此該財務機構現招標出售,意向價約1.3億,平均呎價約38981元。

意向呎價3.89萬

代理稱,中環甲廈屬市場罕有供應,區內近期亦頻錄逾億元大手買賣,包括荊威廣場頂層、南華大廈中層全層等。

(星島日報)

更多皇后大道中9號寫字樓出售樓盤資訊請參閱:皇后大道中9號寫字樓出售

更多荊威廣場寫字樓出售樓盤資訊請參閱:荊威廣場寫字樓出售

更多南華大廈寫字樓出售樓盤資訊請參閱:南華大廈寫字樓出售

更多中環區甲級寫字樓出售樓盤資訊請參閱:中環區甲級寫字樓出售

共享工作空間營運商IWG於今年3月,向太古承租旗下金鐘皇后大道東8號 (8QRE) 辦公大樓18層,總樓面逾6.7萬方呎,開辦共用空間Spaces,已錄兩全層租出。該項目提供900個辦公位置,為Spaces於本港第7個據點,亦令IWG旗下品牌包括Spaces、Regus及Signature於本港據點擴展至18個。

該項目佔地逾67000方呎,涉及18層樓面,提供逾900個辦公位置,包括188間私人辦公室、單人固定辦公桌及企業專屬樓層,以滿足不同規模公司的需求。新中心特設有兩層「商務俱樂部」開放空間讓會員與更廣泛的專業社群互動交流。

IWG辦公中心使用率增80%

IWG香港及大灣區區域經理 Paul MacAndrew 表示,市場對混合辦公模式寫字樓需要大增,目前,皇后大道東8號已錄2層全層租出。至於IWG其他辦公中心,今年6月份使用率明顯增長,較2月份升逾80%,IWG目標為年內為其全球網絡新增1000個據點的目標出發。

據地產代理指出,上述共享工作空間項目位處金鐘區,屬甲廈市場一綫地段。

(星島日報)

更多皇后大道東8號寫字樓出租樓盤資訊請參閱:皇后大道東8號寫字樓出租

更多灣仔區甲級寫字樓出租樓盤資訊請參閱:灣仔區甲級寫字樓出租

外資代理行:未全面通關 港島甲廈租金料跌5%

甲廈租金仍偏軟,即使近日稍為放寬隔離措施,有代理行認為,在未全面通關下,今年港島甲廈租金料跌約5%。

據該行每月商廈統計上,7月份整體甲廈租金稍下跌,中環最優質甲廈呎租約133.8元,按月跌0.9%,而中環整體甲廈租金為113.1元,按月跌1.3%。至於邊緣區跌幅較高,上環及灣仔區租金分別按月跌2.1%及2.5%,而鰂魚涌跌2.8%,為各區跌幅最高。

租務成交上,近日甲廈租務成交,不少來自中資機構。九龍站環球貿易廣場 (ICC) 55樓逾半層樓面、以及56樓全層,總面積約5萬平方呎,以每平方呎約75元租出。按該廈高層單位高峰呎租達100元計,如今租金水平已回調約25%。

中金公司租環球貿易廣場 5萬呎

新租客為中資金融機構中金公司,主要業務為協助公司集資上市、包銷等。過去2年,多間內企來港IPO上市,令該行生意提升。由於預計下半年將有中概股回歸,中金公司業務料進一步擴大,故進行擴充,而今年整體甲廈租務大手成交,幾乎全為搬遷個案,是次屬今年最大手擴充樓面個案。

此外,環球貿易廣場同時錄得另1宗中資機構租務,涉及物業高層大半層樓面,約2.8萬平方呎,以每呎約75元租出。新租客為瑞禾航空資本,該機構主要業務為飛機租賃,以及資產管理等,總部設於香港。公司目前租用中環國際金融中心一期低層單位,涉及約4,000多平方呎,如今搬至環球貿易廣場作大幅擴充。

翻查資料,是次錄得2宗中資機構擴充個案,樓面原來均由德意志銀行租用,該銀行近年放棄部分樓面,是次涉及3層樓面,德意志銀行曾尋求頂租,最終合約完結而遷出。

空置率升至9.2%

至於中環新甲廈預租情況,將於明年落成,恒地 (00012) 旗下中環 The Henderson 於早前錄得第2宗租務,承租的是國際投資公司凱雷集團 (Carlyle Group),涉及約2萬平方呎樓面,呎租料約130元。

該行指出,受第2季度經濟表現弱於預期的影響,商業氣氛受抑制。大部分租戶推遲他們的房地產決策,令租賃活動大幅度下跌。由於港島區寫字樓需求短缺,7月份港島區整體空置率飈升至9.2%,是2003年沙士疫情後的歷史新高。

該行稱,在全面放寬邊境限制之前,預計甲廈業主更願意提供靈活的租賃條款,並進一步調低租金,以應對即將推出市場的新超甲廈供應。直至今年年底,預計港島寫字樓租金會由當前水平再進一步下降3至5%。

(經濟日報)

更多環球貿易廣場寫字樓出租樓盤資訊請參閱:環球貿易廣場寫字樓出租

更多尖沙咀區甲級寫字樓出租樓盤資訊請參閱:尖沙咀區甲級寫字樓出租

更多國際金融中心寫字樓出租樓盤資訊請參閱:國際金融中心寫字樓出租

更多The Henderson寫字樓出租樓盤資訊請參閱:The Henderson 寫字樓出租

更多中環區甲級寫字樓出租樓盤資訊請參閱:中環區甲級寫字樓出租

資策推威靈頓街商廈 呎價2.16萬起

商廈買賣方面,近日銀座式商廈交投轉多,資本策略 (00497) 現推售中環銀座商廈「威靈頓街92號」(92 Wellington Street) 重建項目,現先推7層,每層面積約2,300平方呎起,呎價約2.16萬元起。

每層2371呎起 明年落成

中環威靈頓街92號重建項目,地盤面積約2,883平方呎,樓高23層,總樓面約5.5萬平方呎,將於2024年落成。

資本策略表示,率先推出項目7層樓面發售,分別為5、7至9、15、17及19樓,每層面積約2,371平方呎起,至約3,000餘平方呎。定價方面,平均呎價約由2.16萬元至2.39萬元,如9樓全層,面積約2,941平方呎,定價6,646萬元,呎價約2.26萬元。

據了解,去年集團已部署銷售,最初預計平均呎價約2.8萬元,惟近1年多市況轉弱,是次定價已較去年最初部署時,降價約23%。

(經濟日報)

啟德跑道區兩商地保留 有望今通過

規劃署:有助維持旅遊中樞活力

政府早前提出將5幅啟德商業地改劃為住宅地,不過城規會於6月考慮有關的申述及意見後,建議保留其中位兩幅於跑道區的用地作商業用途,只將當中3幅改劃為住宅。方案將於今日再經城規會審議,而規劃署表示拒絕接納相關的反對聲音,意味該兩幅用地或有望保留作商業用途。

城規會計劃保留作商業用途的兩幅用地位於跑道區,分別為4C區4號及5號用地。而是次會方就此再接到4份申述,當中有兩份支持保留商業用途,其餘兩份均為反對意見。

反對意見:市區房屋供應重要

表示支持的兩份申述分別為一名個別人士及環美航務。前者認為將用地保留作商業用途,可確保啟德發展區保持其活力,並提出將公共運輸服務營辦商及運輸署應考慮開設新的路綫,以連接跑道區與不同港鐵站等建議。而兩者均認為當局該提供足夠的泊車位設施,以配合上述兩用地的商業發展項目及郵輪碼頭,及提出在4C區5號用地或4B區5號用地的東南部分開設一個公共運輸交滙處。事實上,環美航務有份營運及管理啟德郵輪碼頭。

至於其餘兩份反對意見均由個別人士提出,他們主要認為,若用地改劃為住宅用途,對市區的短中期房屋供應十分重要,不應過分着重發展商的利益。不過,考慮到上述兩用地適合作商業用途,並有助維持旅遊中樞的活力和郵輪碼頭的經營前景等主要因素後,規劃署拒絕接納上述的反對意見。這意味城規會今日考慮上述申述後,意味該兩幅用地或有望保留作商業用途。

事實上,政府早在去年財政預算案公布將啟德5幅商業地改劃成住宅的方案,將提供近487萬平方呎樓面面積,涉及6,000個住宅單位供應,相當於政府一年土地供應目標1.29萬伙近半,如上述兩幅商業地成功保留,意味最終或減少約1,720伙住宅供應。

(經濟日報)

大南街商住銀主盤 3950萬沽 5載貶8%

銀主盤趨勢蔓延至全幢物業,深水埗大南街一幢商住大廈,由銀主以3950萬元售出,物業5年間貶值350萬元。

資料顯示,上述大南街180號,地下為商舖,1及2樓為寫字樓,3至5樓為住宅,總建築面積約4411方呎,由銀主以3950萬元售出,平均呎價約8955元。

據了解,原業主於2017年斥資4300萬元購入,去年疑因物業斷供而淪為銀主盤,現作價較5年前購入價賬面跌350萬元或8.1%。

另一邊廂,土瓜灣馬頭圍道123號地下,建築面積1040方呎,獲市建局斥資2758萬元收購,呎價約26519元。據了解,原業主於2019年11月才以2468萬元購入上址,持貨不足3年,賬面賺290萬元或11.8%。

皇九單位意向價1.3億

商廈市場方面,有代理表示,中環皇后大道中9號 14樓3室,建築面積約3335方呎,以現狀連租約出售,意向價約1.3億元,呎價約38981元,截標日期為10月11日。

上址今年6月由內房佳源國際 (02768) 以9500萬元售予肇才教育創辦人與行政總裁張肇桓。

該代理稱,該成交是原業主和財務機構的財務安排,並不能反映物業的真正價值,因此該財務機構委託該行進行標售。

(信報)

更多皇后大道中9號寫字樓出售樓盤資訊請參閱:皇后大道中9號寫字樓出售

更多中環區甲級寫字樓出售樓盤資訊請參閱:中環區甲級寫字樓出售

Hong Kong’s Swire Properties zeroes in on Shenzhen as part of its US$12.7 billion, 10-year investment plan

Swire

plans to bring its Taikoo Li and Taikoo Hui mixed-use projects, which

have been successful in other mainland Chinese cities, to Shenzhen

The

Hong Kong-listed firm recently signed a cooperation agreement with the

Futian district government of Shenzhen to develop a retail-led

commercial project

Swire Properties will expand its retail property business in Shenzhen as part of its HK$100 billion (US$12.7 billion) investment plan over the next 10 years.

The Hong Kong-listed company is keen to grow its retail assets in the Greater Bay Area in Shenzhen besides Hong Kong and Guangzhou, said chief executive Tim Blackburn at a briefing last week.

“The

challenge for us is continuing the Greater Bay [Area] story which, at

the moment, is Shenzhen. That is where we want to be able to bring a

Taikoo Li or a Taikoo Hui concept,” said Blackburn.

Taikoo

Li and Taikoo Hui are Swire’s mixed-use property projects in China. On

the mainland, the company has such developments in Beijing, Shanghai,

Guangzhou and Chengdu.

Swire’s

HK$100 billion investment plan unveiled in March is broadly divided

into three main components. About HK$30 billion has been earmarked for

reinforcing office developments, HK$20 billion for residential projects

in Hong Kong and Southeast Asia, and HK$50 billion for Taikoo Li and

Taikoo Hui projects in China’s tier one cities, specifically in the

Greater Bay Area.

He

added that the company would like to build on the success of its Taikoo

Hui project in Guangzhou, which “has been our flagship for more than a

decade”.

While

the scope of the Shenzhen project “will be entirely determined by the

size of the site and the planning parameters”, Swire’s “retail projects

are generally between one and 1.5 million square feet”, Blackburn said.

Swire

recently signed a cooperation agreement with the Futian district

government of Shenzhen. The company will work closely with the local

authorities to develop a new commercial project and introduce premium

international retail brands with a focus on culture and the arts to

support the district in lifting its profile.

“The

Futian district government is keen to take advantage of our extensive

experience and expertise in urban regeneration, as well as our creative

approach to placemaking” to transform neighbourhoods, Swire said in a

statement.

Swire

has a clear understanding of what the government is looking for,

Blackburn said. Swire has had a team in Shenzhen since 2019 scouring for

sites, but has yet to zero in on a location.

“To

choose one site, we probably look at 100. That is how you know how

complex the process is, in order to meet all our criteria,” Blackburn

said.

Generally,

the development period from acquisition to completion is between four

to five years, depending on the scale, he added.

Swire’s

focus in Shenzhen will be retail-led and is unlikely to include an

office component. The city has ample supply of grade A office space,

which has pushed up the vacancy rate to 15.5 per cent in the second

quarter, according to a property consultancy.

“In

short term, the issue of oversupply exists, the liquidity/lettable rate

of the stock will be slower compared to last year, the vacancy rate

will be pushed up and the rent is likely to remain flat,” the property

consultancy said in its Shenzhen office market report.

“We

have very clear ideas on where we want to invest and how much we want

to invest in each of those projects,” Blackburn said, adding that that

the project in Shenzhen would most likely be a joint venture.

The company has previously resorted to this route in Xian, where it had formed a 70:30 joint venture for the HK$10 billion project.

Last

week, Chinese Premier Li Keqiang sounded another warning about China’s

economy at a State Council meeting, saying companies were “facing more

difficulties than in 2020” – during the initial outbreak of the

coronavirus – and called for more reform.

China’s Communist Party will hold its twice-a-decade congress next month and it comes against the backdrop of an economy dogged by constant Covid-19-related disruptions, a looming population crisis and soaring youth unemployment.

Blackburn

said Swire was comfortable investing in the Chinese mainland, pointing

to the group’s 150-plus year history in the country.

“Will

we continue our investment decisions in the Chinese mainland? The short

answer is yes,” he said. “Irrespective of the short-term volatility,

during this period of Covid, we still see the fundamentals.”

(South China Morning Post)

Miami Quay prices attract plenty of home hopefuls

Miami Quay I in Kai Tak plans to put another 65 flats on the market, which are expected to see a 5 to 10 percent hike in prices.

Co-developed

by Wheelock Properties, Henderson Land (0012), New World Development

(0017) and Empire Group, the project had received over 500 checks for

130 flats on the first price list by Saturday, making the batch 2.8

times oversubscribed.

The first batch goes on sale over the upcoming Mid-Autumn Festival weekend.

Ricky

Wong Kwong-yiu, an executive director of Wheelock Properties, said

about 7,000 visitors were in attendance at an exhibition hall, with more

than 50 percent of them current residents of Kowloon, especially people

living or working in Kowloon East.

About 25 percent were from Hong Kong Island and the rest from the New Territories and other parts.

And many of the would-be buyers were young people.

About

70-80 percent of them intend to purchase a property for themselves

while the remainder aimed to buy the property for investment.

The Miami Quay development features three residential buildings that can offer a total of 648 flats.

The first price list for Miami Quay I was released last Friday and included 130 flats.

There

are studios plus one-bedroom, two-bedroom and three-bedroom flats on

the list, with prices ranging from HK$5.24 million to HK$14.6 million.

So square-foot prices are from HK$20,339 to HK$23,839.

The average price is HK$22,452 per sq ft, which is the lowest seen in the district during the past two years.

Wong

said the prices of these units are indeed attractive in the market, and

he believes there will be room for increases of 5 to 10 percent when

more flats are added.

Amid

sales of a large project, the picture of sales in the 10 major housing

estates in the secondary market was mixed over the weekend.

A property agency's 10 major housing estates only recorded eight transactions during the weekend - a five-week low.

But another agency recorded 10 transactions, a week-on-week increase of 11.1 percent.

The

decrease of transactions recorded by the first agency was seen to be

mainly due to the fact that the pandemic in Hong Kong has risen again,

with tens of thousands of confirmed cases in a single day, and that

caused a decline in property viewing activities.

(The Standard)

太古地產:核心區甲廈租金 中期看穩

彭國邦指應盡快與國際通關 令商業市場回正軌

疫情衝擊商業市道,太古地產 (01972) 行政總裁彭國邦 (Tim Blackburn) 認為,本港應盡快與國際通關,令商業市場重回正軌,並指寫字樓租金已見底,通關後新需求可重臨,而住宅樓價受加息影響等僅屬短綫,長遠仍可平穩發展。

疫情令封關持續近3年,對跨國商業活動造成衝擊,寫字樓需求下降。據測量師行數據,目前整體本港甲廈空置率近10%,為近10多年來新高。

港背靠中國優勢 跨企必選擇

坐擁多個大型寫字樓項目的太古地產,早前公布最新營運數字,截至上半年,集團兩大商業重鎮,太古廣場及太古坊整體出租率仍高達97%及96%,整體出租率為96%,彭國邦指,疫下集團寫字樓仍保持理想出租率,「核心區甲廈租金已有所調整,但現已見底回穩,中期來說相信會穩定。」

封關成為跨國商務往來的重要阻礙,他認為,在新政府上場後已有正面進展,包括近期「3+4」檢疫措施,但並不足夠,希望是全面通關,現時很多地區也全面開放。對於有個別機構,近一年把總部遷至新加坡,令香港國際金融城市地位或受動搖說法出現。

彭國邦指,暫未見旗下租戶出現此情況,亦強調香港擁背靠中國優勢,「對跨國企業來說,因要到不同地方經商,他們搬總部或只是暫時性。但長遠來說,若機構睇重內地市場,必須選擇在港設辦公室。」

疫情期間在家工作興起,他不相信傳統辦公室因而被取代,「辦公模式一定會有轉變,在疫情前,曾有共享空間會代替傳統辦公室的說法。現時很多機構提供更彈性上班時間及地點,工作生活平衡,若機構可提供良好工作環境,便可吸納人才。」彭國邦說。

他指,集團旗下太古坊二座今年第4季落成,樓面已獲5成預租,他透露大廈設計甚有心思,提供很多公共地方迎合新需求,強調辦公室受歡迎與否,關鍵是大廈質素及管理。

中長綫住宅需求 仍理想

至於住宅市場上,最近樓價有所調整,彭國邦認為,住宅價格有調整受不同原因影響,包括加息、經濟不明朗因素,「相信只是短綫衝擊,中長綫住宅需求仍理想。」他指,集團過往發展大型屋苑太古城、半山豪宅等,而2023至2026年將有數項目,包括灣仔EIGHT

STAR STREET、黃竹坑站4期、柴灣中巴車廠,以上本年投得灣仔皇后大道東地皮,將提供多元化的住宅供應。

(經濟日報)

更多太古廣場寫字樓出租樓盤資訊請參閱:太古廣場寫字樓出租

更多金鐘區甲級寫字樓出租樓盤資訊請參閱:金鐘區甲級寫字樓出租

更多太古坊寫字樓出租樓盤資訊請參閱:太古坊寫字樓出租

更多鰂魚涌區甲級寫字樓出租樓盤資訊請參閱:鰂魚涌區甲級寫字樓出租

未來10年 重點投資內地一綫城市

今年為太古地產 (01972) 成立50周年,行政總裁彭國邦 (Tim Blackburn) 指,集團對本港及內地投信心一票,未來10年將投1,000億元,一半投資中國內地,並集中一綫城市。

彭國邦稱,太古地產計劃在未來10年,投資1,000億元擴展公司業務,於香港、中國內地和東南亞三地發展一系列新項目。三分之一資金會投放在香港,繼續擴建和優化太古坊及太古廣場兩大核心投資物業組合。

500億資金投資內地市場

另外,公司計劃將超過一半的資金投資於中國內地市場,「過往集團在內地市場發展理想,包括太古匯等項目,未來主力發展一綫城市,預期未來10年公司佔中國內地物業組合的總樓面面積將增加1倍。」

對於近期內地房地產出現不少債務問題,令到房地產市場受到衝擊,彭國邦指出相關內房出現問題為住宅市場,而集團在內地發展全為商業項目不受影響,而集團仍然非常看好前景。

至於大灣區發展方面,彭國邦指集團將在深圳開設酒店,未來亦會在深圳物色新項目,因留意到商廈空置率較高,故將主力發展零售項目。

(經濟日報)

更多太古廣場寫字樓出租樓盤資訊請參閱:太古廣場寫字樓出租

更多金鐘區甲級寫字樓出租樓盤資訊請參閱:金鐘區甲級寫字樓出租

數據中心需求殷 租金穩步上 代理:料未來1年升3%

數據中心於疫市下「異軍突起」,有外資代理行代理接受本報訪問時表示,科技發展一日千里,加上疫情帶動,令電子商貿發展迅速,企業對數據中心需求與日俱增,惟今市場可作數據中心的工廈供應有限,供不應求,令數據中心於疫市下炙手可熱,買家以機構性投資者為主力,料該類物業未來一年租金升約3%。

該代理指出,儘管受疫情及美國聯儲局加息等利淡因素洗禮,工商鋪市場觀望氣氛揮之不去,然而,全幢酒店及工廈於今年上半年仍受捧,該類物業防守力較高,該行統計資料顯示,今年第二季逾億元成交金額涉183億,當中工廈物業佔47%,涉及買賣金額達86%,因工廈受工廈活化政策支持,隨着市場進入5G大時代,新經濟需求如數據中心及凍倉等應運而生,該類物業均可透過工廈改裝而成,可為物業增值

(Value-added),成為機構投資者追逐目標。

此外,該代理亦指出,全幢酒店如出一轍,因可改裝作長租公寓或共享空間,為物業釋出潛在價值,帶動該類物業於上半年頻錄大手買賣。

工廈佔買賣金額達86%

當被問及數據中心於疫市下炙手可熱,該代理分析指,因受疫情打擊,推動電子商貿需求、亦因居家工作日趨盛行,帶動企業對網絡及數據需求上升,刺激市場對數據中心需求穩步上揚,然而,市場可作數據中心用途的工廈有限,政府每年推出工業用地僅寥寥可數,若以現有工廈改裝,數據中心需要較高供電量及空間支緩,故一般舊式工廈不能直接改裝,市場上的同類放售物業亦相當罕有,造成市場供不應求,料該類物業明年整體租金上升約3%。

第2季甲廈負吸納量17.7萬方呎

另一方面,該代理亦為甲廈市場「把脈」,代理指出,整體租務市場於今年第二季曾稍回暖,惟通關尚未有正式時間表,市場仍缺乏新動力,今年第二季市場錄負吸納量17.7萬方呎,待租率

(空置樓面加於未來12個月市場放租樓面)

約13.8%,加上正值供應高峰期,環顧今年達290萬方呎樓面出台,明年亦有大量樓面「排住隊」出場,料整體待租率持續上升。

然而,受政府早前落實推出「3+4」檢疫措施,為甲廈市場釋出正面訊息,加上中資企業對中環甲廈可說「情有獨鍾」,若中港兩地於年底前可通關,料中資企業勢將「回歸」,屆時可帶動核心區甲廈租金回穩。

(星島日報)

Miami Quay sells at 10 per cent discount as Kai Tak developers grapple with monorail loss in a slowing housing market

Wheelock

Properties, Henderson Land Development, New World Development and

Empire Group priced the first 130 units of Miami Quay at HK$22,452 per

square foot

The price is about 10 per cent cheaper than the Monaco Marine that launched in the same area in April, and 2.3 per cent less than One Victoria that launched in June 2021

A

housing project at Kai Tak launched with a 10 per cent discount to the

area’s prevailing price, as developers grappled with the sudden loss of

mass-transit access and reduced commercial presence in Hong Kong’s

former airport site amid a slowing market.

Wheelock Properties, Henderson Land Development, New World

Development and Empire Group priced the first 130 units of their Miami

Quay apartments at HK$22,452 per square foot on average after discounts,

about 10 per cent cheaper than the Monaco Marine that launched in the same neighbourhood in April.

The

first phase of Miami Quay, comprising 648 flats in three tower blocks,

is scheduled for completion in August 2023. As the second housing

project to go on sale on the former runway, Miami Quay’s price is also

2.3 per cent lower than the average price by its predecessor One Victoria, which launched in June 2021 at HK$22,977 per sq ft.

“Overall

it’s cheaper,” said Sam Chi-yung, chief strategist at Patrons

Securities in Hong Kong, adding that the 2020 decision to scrap a

monorail link between Kai Tak and East Kowloon has affected home prices,

as did the conversion of three commercial parcels in the area to

residential use. “Higher interest and mortgage rates will affect the

ability to repay, which indirectly affects sales.”

[Kai

Tak] appears to be mostly residential,” Sam said. “Home prices in a

place with only residential [property] will not be as high as where

there is also commercial use.”

The entry price of Miami Quay is HK$5.24 million (US$667,590) for a flat that measures 250 square feet (23 square metres).

The

price was set below the market price to attract the attention of young

buyers and small families, said Wheelock Properties’ managing director

Ricky Wong Kwong-yiu. It could be on sale in the Mid-Autumn Festival

holiday next weekend at the earliest, he added.

The

average price of second-hand homes has fallen in Hong Kong, as a

resurgent Covid-19 outbreak – and the quarantine rules to contain it –

has driven the city into a technical recession. A property agency’s

index which is a gauge of lived-in homes, fell 0.8 per cent to 173.22

for the week that ended on August 28, the lowest since March 2019.

The index may fall a further 1.9 per cent until the Mid-Autumn Festival next week, the agency said.

Some

buyers are taking advantage of falling prices to enter the market,

aiming to get ahead of the curve before the rising interest rates

imposed by monetary authorities spill over into higher mortgage

payments.

The

number of residential, commercial and industrial properties as well as

parking spaces rose 4.8 per cent to 5,238 transactions in August as more

buyers piled in amid the falling prices.

The

most affordable prices – usually associated with the smallest units –

are finding ready buyers. Wang On Properties launched its Larchwood micro-apartments

in western Mong Kok, featuring units as small as 181 sq ft, as cheap as

HK$3.83 million. The developer sold 33 units, or 40 per cent of the 83

flats on offer, as of 6:30pm, agents said.

Hong

Kong’s government set a 280 sq ft minimum size last December for flats

built on government land. However, private projects that were not

subject to lease modifications and land exchanges were still not covered

by the minimum flat size requirement.

The

tiniest flat measures 181 sq ft, slightly larger than a standard

car-parking space of 130 sq ft, and costs HK$4.18 million after

discounts. The cheapest flat at HK$3.83 million measures 206 sq ft. The

average price of the 83 flats is at HK$22,421 per sq ft after discounts.

Another 15 Larchwood flats will go on sale on Sunday.

(South China Morning Post)

啟德兩商地保留 少1720伙住宅供應

城規會昨日再審議,有關保留兩幅位於啟德跑道區用地作商業用途的申述及意見,並表示拒絕接納相關反對申述,即兩幅用地將獲保留作商業之用。

上述兩幅獲保留的用地分別為4C區4號及5號用地。會方早前就此再接到4份申述,當中有兩份支持保留商業用途,其餘兩份屬反對意見。

對於由一名個別人士,及有份營運啟德郵輪碼頭的環美航務所提出的支持意見,城規會表示備悉。同時,會方表示不接納其餘兩份反對意見,意味該兩幅用地將保留作商業用途。

政府在去年財政預算案已公布,將啟德5幅商業地改劃成住宅的方案,涉及6,000個住宅單位供應,而是次決定保留兩幅商業地後,最終住宅供應將減少約1,720伙。

西貢綠化地 建330伙住宅

另外,城規會早前計劃將一幅比鄰西貢打鼓嶺新村的綠化用地,改劃成私人住宅用途,提供約330伙。而改劃遭長春社等反對,主因是擬議房屋發展違反「綠化地帶」的規劃意向,並不能應付市民對可負擔房屋供應的需求,加上當局應考慮其他土地供應選項,如棕地及閒置土地。

不過,經會方於昨日審議後,會方同樣拒絕接納所有反對申述,因此方案獲城規會通過,日後將增加約330伙住宅供應。

(經濟日報)

銅鑼灣舊樓強拍添變數

近年銅鑼灣一帶不少舊樓紛紛被財團併購,其中有財團早於2020年向土地審裁處申請強拍的銅鑼灣勿地臣街10及12號舊樓,昨獲該處頒下判決書,指小業主曾去年7月遞交4份專家報告,最終有3份專家報告不被法庭接納,另外申請人在14日內與小業主確認是否提出撤銷部分修訂異議通知書的申請,若未能協商可向法庭申請指示。

另外,早前獲太古地產申請強拍的鰂魚涌華廈工業大廈,於上月低層A室,成交價5950萬;業界透露,上址建築面積4220方呎,呎價約1.41萬,原業主早於1972年約26.5萬購入,帳面獲利約5923.5萬,物業期間升值逾223倍。太古地產發言人表示,華廈工業大廈早於18年申請強拍,最新對上述工廈單位作出收購,該工廈強拍進行中,料與毗鄰仁孚工業大廈作合併發展,以作辦公樓及其他商業用途,總樓面約77.9萬方呎。

(星島日報)

Prices rise at Miami Quay

Miami Quay I

in Kai Tak has released its second price list of 65 flats, with prices

ranging from HK$6.44 million to HK$21.15 million, up 5 to 10 percent

over the first batch.

The first batch of 130 flats had received more than 800 checks over the weekend.

The

project, developed by Wheelock Properties, Henderson Land Development

(0012), New World Development (0017) and Empire Group, attracted more

than 30,000 visitors to both its online exhibition and show flats at The Gateway, Harbour City in Tsim Sha Tsui over the weekend.

Ricky

Wong Kwong-yiu, executive director of Wheelock Properties, expects the

first round of sales will be launched on the Mid-Autumn Festival

holiday.

Wong said a four-bedroom unit featuring a skyline view will be up for sale by tender in the first round as well.

In

other news, a private equity fund acquired a shop on Queen's Road West

for HK$20.5 million. Bridgeway Prime Shop Fund has bought 20 stores for

about HK$430 million so far this year, expecting shop prices will be

steady before the year end if quarantine-free entry is rolled out in

November.

(The Standard)

For more information of Office for Lease at The Gateway please visit: Office for Lease at The Gateway

For more information of Grade A Office for Lease in Tsim Sha Tsui please visit: Grade A Office for Lease in Tsim Sha Tsui

Hong Kong property sellers roll out perks and promotions, but a bathtub video gets one agency into slightly hot water

Developers

and agencies offer perks including Japan travel, water park

memberships, festive craft activities and dining vouchers to drum up

sales

A property agency removes a promotional video that featured a female agent in a bath towel showing off a large tub

Some

Hong Kong property companies are pulling out the stops to secure sales

in a downbeat market amid falling home prices, offering a range of perks

and – in the case of one agent – appearing in a bath towel in a video

to entice potential buyers.

In

addition to lower prices, developers and agencies have recently offered

perks including subsidies for travel to Japan, water park memberships,

hot-water dispensers, festive celebrations and dining vouchers to drum

up sales.

“There

will be more discounts for promoting sales in the primary market in the

short term,” an agent said, adding that the market will also see more

alternative promotional tactics, like videos and gifts.

Prices

of second-hand homes have fallen in Hong Kong as a resurgent Covid-19

outbreak – and the quarantine rules to contain it – have driven the city

into a technical recession.

A

market index which is a gauge of lived-in home prices compiled by a

property agency, fell 0.8 per cent to 173.22 for the week that ended

August 28, the lowest since March 2019. The index may fall a further 1.9

per cent before the Mid-Autumn Festival on September 10, according to

the agency.

Hong

Kong had 41,684 property agents active in August, a four-month high,

but only 5,238 property deals were completed, according to data from the

Estate Agents Authority and Land Registry. That equates to a ratio of

eight agents per deal.

Amid

this competitive environment, one female property agent appeared in a

bathtub, wrapped in a bath towel, in a video about Longfor Group’s Upper

Riverbank development in Kai Tak. A property agency posted the video in

late August but removed it after it sparked criticism, “online

bullying” and even “doxxing”, according to a statement from the agency.

The

video was meant to show the “spacious bathroom and an extra-large

bathtub”, the agency said in defending both the agent and the video,

adding that the agent was wearing clothing underneath the towel.

“The

front-line colleague did not have any indecent actions or inappropriate

statements in the whole film,” the agency said. “Before the short film

was released, it had been reviewed, and there was no indecency in the

video. After the production of the short film was completed, it was also

confirmed and agreed by the seller.”

The

number of housing transactions rose 12.7 per cent to 4,137 in August

after a four-month low in July as more buyers piled in amid the falling

prices and promotional lures. Some buyers are aiming to get ahead of the

curve before rising interest rates imposed by monetary authorities

spill over into higher mortgage payments.

Developers and agents have offered the following enticements recently.

A

property agency offered the first three buyers of certain properties in

Japan a subsidy of 2 million yen (US$14,234.8) for travel to Japan,

according to the company’s statement in early September. The offer lasts

until September 30.

The

first 10 people buying three- or four-bedroom flats at Grand Victoria

in Cheung Sha Wan – developed by Wheelock Properties, Sino Land, K Wah

International and SEA Group – in September through a specific agency

will get dining vouchers worth HK$5,000.

At

Soyo in Mong Kok, developed by Excel Billion Group Holdings and Chun Wo

Development Holdings, the first five buyers in September will get two

free annual memberships for Water World at Ocean Park. The first five

buyers through a specific agency get instant hot water dispensers.

Vanke Holdings (Hong Kong) Company has been giving its club members materials for use in craft activities at the showroom of VAU Residence in Cheung Sha Wan for the Mid-Autumn Festival, Father’s Day and Mother’s Day.

(South China Morning Post)

上月錄367宗工商鋪買賣 代理行:料後市維持低水平

疫情表現反覆,有代理行綜合土地註冊處資料顯示,8月份錄367宗工商鋪註冊,按月只增加1宗,金額錄47.89億,按月減少約18.8%,該行指出,雖然政府並未收緊防疫措施,但市場觀望氣氛濃厚,料後市不會有驚喜,仍然維持低水平。

商鋪註冊量四個月低

上月工廈及商廈註冊分別按月升約4.3%及5.1%,各錄195及83宗。商鋪註冊按月跌約11.0%,最新報89宗,為最近四個月以來低位。8月份整體宗數報367宗,按月升約0.3%,即只較上月多出1宗,數字繼續在今年低位徘徊。8月份金額錄47.89億,按月挫約18.8%。

按金額劃分,除了500萬以下及逾1億物業外,其他金額類別註冊量按月下跌。500萬以下物業共錄189宗,按月升17.4%。逾1000萬以上至2000萬物業,共錄50宗,按月下降約20.6%。逾2000萬至5000萬錄17.1%按月跌幅,8月共錄34宗。逾5000萬至1億最差,只錄5宗登記,按月急挫58.3%。8月逾1億錄8宗,按月增加4宗,商廈及鋪位各佔3宗,金鐘海富中心二座13樓全層以約1.93億成交,鋪位包括西貢翠塘路1A號Centro全幢商場作價約4.22億,中環安蘭街18號28及29樓全層作價約1.7億。

市場靜候反彈時機

該行代理表示,近日本港疫情反彈,雖然政府未縮減食肆每枱人數、堂食時間等,但市場觀望氣氛濃厚,上月工商鋪註冊宗數繼續低位徘徊,並預料在現況下,工商鋪買賣將維持較低水平。

(星島日報)

更多海富中心寫字樓出售樓盤資訊請參閱:海富中心寫字樓出售

更多金鐘區甲級寫字樓出售樓盤資訊請參閱:金鐘區甲級寫字樓出售

更多安蘭街18號寫字樓出售樓盤資訊請參閱:安蘭街18號寫字樓出售

更多中環區甲級寫字樓出售樓盤資訊請參閱:中環區甲級寫字樓出售

市建觀塘商業項目明截意向

本港疫情反覆,整體商業氣氛不景氣,市建局亦調整觀塘市中心第4和第5發展區「巨無霸」商業項目的酒店、寫字樓及商業零售組合比例推出,包括可放棄興建酒店、商業樓面最多102萬方呎等,以打造區內新地標,並於明日

(7日)截收意向書;綜合市場估值介乎約184.1億至259.9億,每呎樓面地價由8500至12000元。

業界:料財團出價保守及審慎

有測量師表示,項目發展規模大,故市建局亦調整該項目發展酒店、寫字樓及商業零售組合比例,以增加彈性,而且近期商業市道未見好轉過,未來商業樓面供應相當充裕,相信發展商出價會保守及審慎。

另一測量師指出,近年寫字樓空置率高企,預測甲級商廈和核心商店的租金走勢偏弱,在加息和市場不明朗的環境下,相信發展商的入標價必然保守。綜合市場估值介乎約184.1億至259.9億,每呎樓面地價由8500至12000元。

市場估值184億至259億

觀塘市中心項目是市建局歷來規模最大的單一重建項目,以五個區域進行分階段發展,該項目為最後一個發展區域,地盤面積為27.56萬方呎,可建總樓面約216.59萬方呎。

該項目早前向城規會提交修訂申請,調整酒店、寫字樓及商業零售組合比例,增加項目彈性,當中酒店部分不設樓面下限至最多34.44萬方呎,意味中標財團可選擇不興建酒店或最多提供400間酒店客房。

總樓面216萬呎

而寫字樓部分則修訂為70.89萬至137.37萬方呎,最後商業用途樓面 (商店及服務行業、食肆、娛樂場所及教育機構),則修訂為69.97萬方呎至102萬方呎。若規劃許可獲城規會批准,該局會據「浮動規劃參數安排」推出招標。

(星島日報)

李寧開旗艦店 200萬租廣東道巨舖

租金較高峰跌7成 核心區今年最大額租務

核心區舖位租金經過大幅調整後,吸引個別品牌趁機開旗艦店。內地體育服裝品牌李寧 (02331),以每月約200萬元,租用尖沙咀廣東道新港中心逾7,000呎複式舖,成品牌首間香港旗艦店。是次租務為今年核心區最大額商舖租務成交,租金較高峰期跌7成。

尖沙咀新港中心錄得一宗大手舖位租務成交,涉及物業包括:地下及1樓,屬複式舖位,由於新港中心位處尖沙咀最核心零售地段廣東道,故商場街舖價值甚高。據了解,複式舖以約200萬元租出。由於年初受第5波疫情衝擊,零售進一步受挫,今年市場甚少大手商舖租務成交,是次涉及約200萬元月租,為今年核心區錄得最大額租務成交。

新港中心複式舖 共7700呎

據了解,新租客為內地服裝李寧,近日舖外已貼上品牌標誌,預計第四季開業。李寧為內地龍頭運動服裝,產品包括球鞋、輕便運動服裝,並贊助國家跳水隊、乒乓球隊等,更與國際級體育明星合作,包括前NBA球星韋迪 (Dwyane Wade) 推出「Way of Wade」系列,球鞋甚受歡迎,亦反映品牌在國際上地位。

李寧早年曾在港落戶,不過規模只是商場內面積較細舖位,是次斥200萬元租新港中心7,700平方呎複式舖,為品牌在港旗艦店,將會售賣籃球鞋、羽毛球、瑜伽產品等。消息稱,該品牌亦正物色核心區如中環,開設大型店舖。

周生生數月前遷出 高峰700萬租

翻查資料,該店舖地下面積5,243平方呎,1樓建築面積2,443平方呎,原由連鎖金行周生生 (00116) 自2005年開始承租,月租高達700萬元,直至數月前合約期滿遷出。如今李寧以約200萬元承租,租金下跌約逾7成。

事實上,目前由華置 (00127) 及華創建投持有新港中心,因疫情衝擊令出租率偏低,特別區內大型品牌旗艦店先後遷出,例如其中一複式舖,地下至2樓,總面積共約10,140平方呎,曾由國際品牌Burberry租用,今年亦棄租。

至於商場內另一組巨舖,面積逾4萬平方呎,由時裝H&M租用,租約今年中完結,曾一度貼出即將結業告示,最終業主與租客續短租一年。

業界:市況待明年才有反彈

疫情下持續封關,零旅客之下零售商紛紛減成本,放棄核心區舖位,令空置率上升。有外資代理行數字顯示,2017年核心區舖位空置率約4%,而踏入2020年疫情爆發,空置率升至最高逾18%,現時稍為回落至約16.5%,仍處偏高水平。租金方面,該行數據顯示,4大核心區平均呎租約252元。

另一外資代理行代理分析,核心區舖位租金經過多年調整後,現時處於低水平,實在「跌無可跌」,惟目前後市仍有不明朗因素,零售品牌始終未有大幅擴充意慾。另一代理認為,目前品牌對於核心區部署開業仍較為審慎,相信整體市況要等明年才明顯有反彈機會。

(經濟日報)

更多新港中心寫字樓出租樓盤資訊請參閱:新港中心寫字樓出租

更多尖沙咀區甲級寫字樓出租樓盤資訊請參閱:尖沙咀區甲級寫字樓出租

檢疫措施放寬 激活商業氣氛?

商舖租金由高峰期下挫,令品牌重新感興趣來港開業,以打造品牌聲望。惟放寬檢疫措施後,尚未出現大量旅客來港,相信要待香港與內地及國際完全通關,才令零售商重拾信心擴充。

趁租金跌 打造品牌聲望

在零售高峰期時,尖沙咀廣東道及銅鑼灣羅素街,數千呎複式舖,月租動輒數以百萬元,甚至千萬元計,當中更是一舖難求。疫情後旅客絕迹,核心區舖位單計近兩年租金已下跌4至5成,從高峰期更下瀉7至8成,如今在廣東道以200萬元,可租用兩層複式舖,對品牌來說較易負擔,亦可以在最優質地段開業,有助品牌宣傳。

從實際營商角度,若缺乏旅客到訪,於核心零售區大手租舖開業不易計數,畢竟難以單靠本地客生意維持。

政府於8月份,推出「3+4」入境檢疫措施,縮短酒店隔離期,希望便利訪港旅客及商務人員,從而令本港及國際盡快接軌。措施實行一個多月,核心區商舖租務未見明顯加快,仍然吉舖處處,似乎新措施不足以激活商業氣氛。

部分品牌 現階段採觀望

據多間商舖租務代理透露,暫未見有大量零售品牌因應新措施,而變得積極擴充業務。對零售商來說,香港零旅客已持續近3年,對何時完全通關難以掌握,何況即使通關後,旅客重返的速度及數量仍難與以前相比,故對大部分品牌來說,現階段仍是採觀望態度,寧等待完全通關落實,才作出租舖擴充也未遲。

(經濟日報)

栢麗大道複式舖 展覽商60萬租用

近年興起藝術展覽,更趁核心區大樓面舖位交吉而承租,尖沙咀栢麗大道前周生生複式巨舖,獲一家展覽商租用。

尖沙咀彌敦道111至181號栢麗購物大道地下G1至G4號舖連1樓1至2號舖的複式舖位,地下面積約2,866平方呎,1樓面積約2,894平方呎,合共約5,760平方呎,舖位早前租出,月租料約60萬元。

據了解,新租客為一家從事展覽業務公司,租用兩層大型複式舖,日後料作展覽用途包括NFT等藝術展覽。租約方面,據悉是次料涉及1年或以上租期。

租金較高峰期跌約8成

翻查資料,周生生2008年起租用舖位,月租高達215萬元,其後2012年續租,月租加4成至300萬元,而近年自由行旅客消費放緩,租金回落,估計跌至約100多萬元。按現時月租約60萬元計,租金較高峰期跌約8成。

藝術展覽近年在港頗受歡迎,在核心區吉舖增加下,不少展覽商短租舖位。如中環皇后大道中59至65號泛海大廈地舖及1樓,總樓面約19,075平方呎,曾由TOPSHOP時裝租用,舖位於2020年中交吉,去年獲藝術展覽會主辦機構短租,舉行香港首個大型藝術科技體驗展Digital

Art Fair Asia,屬亞洲首個展示世界級新媒體藝術、NFT加密藝術實體展覽,為期約1個月。

(經濟日報)

更多泛海大廈寫字樓出租樓盤資訊請參閱:泛海大廈寫字樓出租

更多中環區甲級寫字樓出租樓盤資訊請參閱:中環區甲級寫字樓出租

全幢住宅租務穩健 吸財團注意

近期大手買賣成交上,全幢住宅所佔比例提高,由於住宅租務穩健,加上日後或可進行拆售,故吸引不少財團留意。

在投資物業中,商舖及商廈交投相對淡靜,而大手成交上,連環錄得全幢住宅買賣。包括Weave Living表示,與領盛合作,成立價值1.4億美元 (約10.9億港元) 的合營企業,並以2.75億元購入半山羅便臣道68號全幢住宅物業。該廈由本地老牌家族持有多年,Weave Living方面表示,項目總樓面約2.6萬平方呎,屬一梯一伙設計,入市因價格較便宜,並看好住宅租務市場。集團將加以翻新,作長綫收租項目。

Weave Living購半山住宅 擬收租

Weave Living今年已於香港和新加坡收購合共4個物業,現時在兩地持有共10個物業,提供約1,500個住宿單位。最新與領盛成立的合營企業,總投資價值為4億美元 (約31.2億元)。早前集團與安祖高頓 (Angelo Gordon) 及保德信房地產 (PGIM Real Estate) 等合作。至於是次合資的領盛過去曾在港投資物業,對上一次在港進行買賣,為2012年以23.68億元沽出佐敦彌敦道諾富特酒店。

另外,何文田The

Argyle全幢住宅租賃項目,早前以5.8億元成交。該物業位於亞皆老街,鄰近勝利道及太平道,位置理想。物業於2015年落成,由萬泰發展,項目地下及1樓為商舖,舖位面積約6,165平方呎,6至29樓為住宅,總建築樓面約36,997平方呎,而住宅部分實用面積約23,032平方呎,以市值約5.8億元計,建築面積呎價約1.56萬元。

項目合共提供36伙,實用面積由約440至980平方呎,採2至3房設計,並設有特色戶。萬泰於2016年把物業推出進行招租,入場費約2.3萬元起,呎租約54元起。是次新買家為本地投資者朱鴻鈞,購入作收租

另外,建灝地產早前以約11.4億元,向鄧成波家族購入九龍城蔚盈軒。項目樓齡4年,樓高29層,總建築面積約8.4萬平方呎,合共提供92個單位,由1至4房不等,以11.4億元成交,呎價約1.35萬元。翻查資料,項目原為豐泰持有住宅項目銅璵,在2017年由鄧成波以13億元購入,並且改裝成為長者服務式住宅命名為蔚盈軒。若以11.4億元成交價計,鄧成波家族蝕1.6億元離場。

分析指,由於核心區商廈及舖位,租金及售價在低位徘徊,空置樓面不少,投資價值上或欠穩健。相比之下,住宅租務市場仍平穩,優質地段住宅出租率甚高,財團轉向投資全幢住宅,收租上較為穩定。此外,買家購入日後可因應市況進行拆售套現,靈活度較高,料在住宅市場相對平穩下,全幢住宅可吸引資金承接。

(經濟日報)

中環振邦大廈 交通便合服務業

中環振邦大廈屬區內老牌物業,勝在位處皇后大道中心臟地段,非常便利,適合服務業。

中環振邦大廈位於皇后大道中58至62號,絕對為大道中最中心位置,比鄰娛樂行、皇后大道中100號等,地點為最大優勢。交通上,由港鐵中環站出口步行至該廈,僅需數分鐘,而大道中與中環其他主要地段連接,故附近有巴士、電車站等,四通八達。

樓上每層 可分間數單位

此外,附近亦有人氣日本超市,以及近一年多新開業的中環街市等,注入不少新動力及人流。

值得一提,該廈不少商戶涉及美容等服務業,故交通便利成關鍵。

配套上,大道中一帶有多個大型商場,亦鄰近蘭桂坊,餐廳食肆多不勝數。

大廈於1968年落成,樓齡高加上沒有太多翻新,故難免有較陳舊感覺。地下入口要步行多級樓梯才到達電梯大堂,稍為不便。

項目樓高10層,總樓面約9.1萬平方呎,樓上每層可分間成數單位,最細單位約700至800平方呎起,適合中小型公司使用。景觀方面,大廈主要望向皇后大道中樓景。

買賣較少 去年呎價見16398

買賣及租務方面,大廈買賣成交較少,去年物業7樓5室,面積約805平方呎,以約1,320萬元成交,呎價約16,398元。另外本年7月,物業高層單位,面積約1,400平方呎,以約2,000萬元易手,呎價約14,286元。

租務上,今年大廈錄數宗租務,年初低層單位,面積約962平方呎,以約3萬元租出,呎租約32元,至於年中低層商舖部分,面積約5,890平方呎,成交月租約47.1萬元。

最近一宗租務為7月,一個面積約1,436平方呎的中層單位,以每月4.1萬元租出,呎租約29元。

(經濟日報)

更多娛樂行寫字樓出租樓盤資訊請參閱:娛樂行寫字樓出租

更多皇后大道中100號寫字樓出租樓盤資訊請參閱:皇后大道中100號寫字樓出租

更多中環區甲級寫字樓出租樓盤資訊請參閱:中環區甲級寫字樓出租

低層單位放售 呎價叫1.9萬

中環振邦大廈放盤少,現物業低層單位,以每呎1.9萬元放售。

有代理表示,物業位於中環皇后大道中58號振邦大廈9樓A室,面積約1,400平方呎,叫價約2,660萬元,呎價約1.9萬元。

同時招租 每呎41元

據了解,業主一直自用作美容院,保養得宜,現時亦以呎租41元招租,單位裝修簡潔亮麗,亦配備來去水位。除可作傳統寫字樓用途外,亦適合作美容、髮型屋及醫療等相關行業,租客類別多元化,且同幢大廈內亦有經營美容中心、診所及各類樓上舖,可為同類行業帶來協同效應。

該代理續稱,近期中區可作樓上舖的商廈買賣氣氛熾熱,短短1周內先後錄得多宗買賣成交,如由大鴻輝集團持有的雲咸街1號南華大廈7樓全層,最近以呎價約29,175元易手,涉資約1.2億元;而威靈頓街1號荊威廣場高層全層則以約1.1億元成交,呎價約25,017元。

至於另一宗安蘭街18號頂層複式單位連天台,亦以作價約1.7億元售出,即平均呎價約3.48萬元易手,反映中環區商廈備受市場注目。

(經濟日報)

更多荊威廣場寫字樓出售樓盤資訊請參閱:荊威廣場寫字樓出售

更多南華大廈寫字樓出售樓盤資訊請參閱:南華大廈寫字樓出售

更多安蘭街18號寫字樓出售樓盤資訊請參閱:安蘭街18號寫字樓出售

更多中環區甲級寫字樓出售樓盤資訊請參閱:中環區甲級寫字樓出售

CIFI changes course for a $1.3b sale

CIFI (0884) switched its plan to sell its property

at No 101 and 111 King's Road to Wang On Properties (1243) and APG

Strategic Real Estate Pool for HK$1.34 billion instead of three of its

major shareholders.

The deal could bring a gain of HK$21.8 million to

CIFI. The net proceeds from the disposal amounted to HK$681 million

after estimated expenses, and will be used as general working capital.

The Chinese developer bought the previous Sing Pao

Building and its parking lot for HK$1.88 billion in 2018. The building

is under demolition and will be redeveloped into a residential project

with commercial space, which is expected to be completed in 2026.

It planned to sell 60 percent equity of the

property to its major shareholders but later sold all the interests to

Wang On Properties and APG Strategic Real Estate Pool.

Meanwhile, CIFI's contracted sales dropped 6.46

percent monthly to 15.06 billion yuan (HK$16.99 billion) in August,

while the sold gross floor area slid 11 percent to 1.01 million square

meters from a month ago.

In other news, a state-owned company in the

northeast city of Shenyang is reportedly set to take over the remaining

7.56 billion yuan worth of shares of Shengjing Bank (2066) held by China

Evergrande (3333).

And another developer, China Overseas (0688), has

obtained a 100 million pound (HK$903.49 million) sustainable loan for

five years, arranged by BOC Hong Kong (2388).

(The Standard)

3,341 flats await presale consent

Thousands of new homes are expected to enter the

Hong Kong market shortly, with six projects 3,341 flats applying for

presale consent in August, and the number of private flat completions

rising by a quarter month-on-month in July.

Among the new applicants, Henderson Land

Development's (0012) phase 2 and 3 of One Innovale in Fan Ling will

offer 408 and 565 flats respectively, data from the Lands Department

showed.

The department also approved three projects involving 2,305 flats in August, up by 42.3 percent from the previous month.

Newly approved projects include phase 2 of a

residential project at 15 Shing Fung Road in Kai Tak, co-developed by K

Wah International (0173), Wheelock Properties and China Overseas Land

& Investment (0688) and providing 1,221 flats.

Meanwhile, 1,131 private homes were completed in

July in the city, up by 25.4 percent from the previous month, the Rating

and Valuation Department said.

The total number of private homes completed in the

first seven months was 13,195, accounting for 57.7 percent of the

government's estimate of 22,851 homes.

In urban renewal projects, the Urban Renewal

Authority has invited developers to submit bids for Wing Kwong Street

and Sung On Street Development project in To Kwa Wan, which had

attracted 31 expressions of interest.

In the commercial market, New World Development (0017) has applied to rebuild the former industrial building now known as Koho in Kwun Tong into a 288,000-square-foot commercial building, increasing the plot ratio by 20 percent

And Sino Land (0083) has put up for sale three commercial floors in Kowloon Bay for HK$1.5 billion.

In the primary market, Miami Quay I

in Kai Tak has received 1,000 checks for 195 flats on the first two

price lists as of Monday, making them more than four times

oversubscribed.

Wetland Seasons Bay

in Tin Shui Wai , meanwhile, is expected to upload the sales brochure

and unveil the first price list within this week, the developer Sun Hung

Kai Properties (0016) said.

In other news, an application has been submitted

for a compulsory sale of Bonny View House, an old residential building

in Happy Valley with an estimated value of HK$522 million.

(The Standard)

For more information of Office for Lease at KOHO please visit: Office for Lease at KOHO

For more information of Grade A Office for Lease in Kwun Tong please visit: Grade A Office for Lease in Kwun Tong

Li-Ning, Dior among luxury brands flocking to Canton Road in ‘iconic’ Tsim Sha Tsui with eye on Hong Kong’s borders reopening

Tsim

Sha Tsui is an iconic business district, says Li-Ning, which is paying

HK$2 million a month for a new 7,000 sq ft flagship store on Canton Road

Tsim Sha Tsui ‘a great location for brands to make a statement to the market’: property consultant

Tsim

Sha Tsui’s Canton Road – once buzzing with tourists – has over the past

two years become largely deserted, as the border between Hong Kong and

mainland China remained closed to stem the spread of the coronavirus

pandemic.

In

recent months, however, this retail haven has been showing signs of

recovery, with Chinese and western brands choosing the district for

flagship stores or the expansion of their current foot print despite the

continued absence of tourists.

There

are several likely reasons for this: landlords have become more

flexible with lease terms; retailers are anticipating the reopening of Hong Kong’s border; and brands are tapping the local population, which is willing to spend more on luxury items given that the city’s current quarantine requirements discourage them from travel.

Li-Ning,

China’s biggest sportswear maker, for instance, is leasing a 7,000 sq

ft shop on Canton Road for HK$2 million (US$254,827) a month, 70 per

cent lower than the previous tenant’s lease, according to local media.

The store in Silvercord, 30 Canton Road, will be Li-Ning’s first flagship store in Hong Kong and is expected to open this year.

“Tsim Sha Tsui is an

iconic business district in Hong Kong,” a Li-Ning spokesman said on

Tuesday. The Li-Ning Hong Kong Canton Road flagship will allow local

consumers to “fully experience Li-Ning’s professionalism in sports

products and services, and better understand our brand philosophy of

‘anything is possible’,” he added.

In 2018, before

anti-government protests engulfed the city and triggered a decline in

the number of tourists visiting Hong Kong, and before the coronavirus

pandemic upended tourism, mainland Chinese visitors spent HK$7,029 each

per trip. They made up more than three quarters of Hong Kong’s visitors

that year and were considered the lifeblood of the retail industry.

Tourism has contributed an estimated 32 per cent of the city’s services

output in recent years, up from 21 per cent in 2003.

“Brands

choose Tsim Sha Tsui for expansion mainly because the market is

anticipating the reopening of borders in the near future,” a property

agent said. “This is also a great location for brands to make a

statement to the market.”

When

the border with China reopens, Tsim Sha Tsui – only about a

seven-minute taxi ride away from West Kowloon station, the sole station

in Hong Kong for the Guangzhou-Shenzhen-Hong Kong Express Rail Link –

might be a likely first stop for mainland Chinese tourists.

While

all of Hong Kong’s popular retail districts have seen a decline in

rents, the Tsim Sha Tsui area is arguably the worst affected by the

absence of tourists.

Since 2019, when the

Covid-19 pandemic broke out, rents in the district have declined by 40

per cent, according to the property consultancy. According to another

property consultancy, prime street shop rents in Tsim Sha Tsui fell 32

per cent in 2019, 25 per cent in 2020 and 6.1 per cent last year. As of

the second quarter of this year, shop rents were flat.

But things might be looking up for Tsim Sha Tsui.

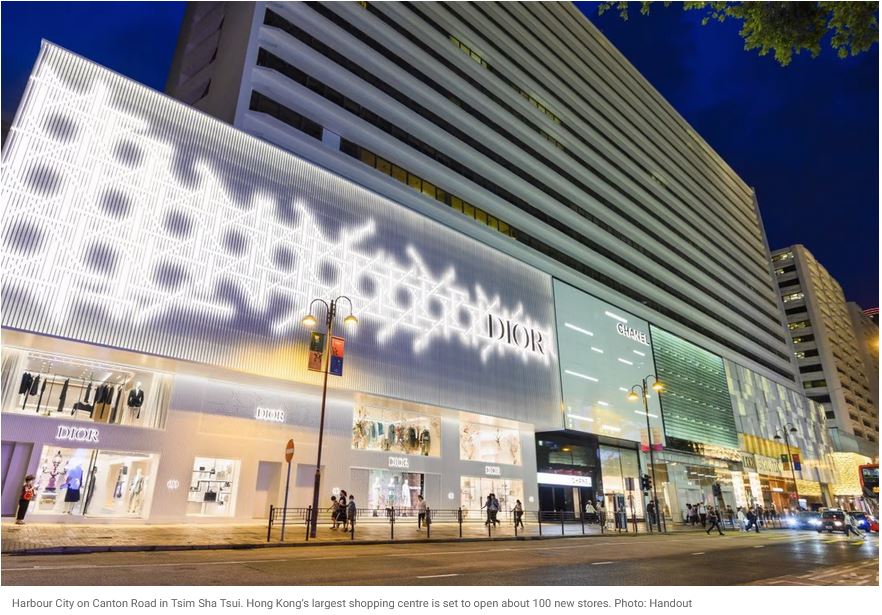

Harbour

City, which is Hong Kong’s largest shopping centre and is located on

Canton Road, is set to open about 100 new stores, including those of

European luxury brands, by the end of the year. So far, it has opened

more than 70 stores including Hong Kong’s largest Dior shop with nearly

10,000 sq ft across two floors of the mall. A Miu Miu speciality store

also launched on Canton Road this year.

Another

newcomer is Casa Loewe’s only store in Hong Kong, which spans 5,000 sq

ft across two floors. Other brands such as Patek Philippe, Breitling, A.

Lange & Sohne, Lanvin, Parisine and Malin+Goetz have also opened

stores in the shopping centre this year.

“Harbour

City has consistently strengthened its tenancy mix with world-famous

brands, which have brought growth in footfall and car park utilisation,”

said a spokesman for the mall. “As a result, in January to August,

Harbour City’s footfall and car park utilisation on weekends and

holidays increased by over 10 per cent compared to last year.”

Swiss

and French luxury jewellers Piaget and Van Cleef & Arpels will also

open stores at Harbour City later this year and the next, respectively.

Meanwhile, Hong Kong

retail sales rose 4.1 per cent in July to HK$28.3 billion, provisional

figures from the government show. In June, the sales of jewellery,

watches, clocks and valuable gifts – considered the luxury category –

rose 2.3 per cent from a year ago, according to the Census and

Statistics Department.

(South China Morning Post)

For more information of Office for Lease at Silvercord please visit: Office for Lease at Silvercord

For more information of Grade A Office for Lease in Tsim Sha Tsui please visit: Grade A Office for Lease in Tsim Sha Tsui

信和持有的九龍灣國際交易中心頂層3相連全層樓層放售,意向價近15億。有代理表示,國際交易中心29至31樓,每層面積約27457方呎,合共約82371方呎,以意向呎價約1.8萬計算,每層意向價約4.94億,總金額約14.82億。

意向呎價1.8萬

該代理指,物業位處頂層,享城市及啟德郵輪碼頭景,曾獲知名體育品牌承租,不過,現時以每呎約33元招租。國際交易中心坐落宏照道和宏泰道交界,採用玻璃外牆設計,鄰近企業廣場、富臨中心等甲廈,交通完善,可步行至港鐵九龍灣站,黃氏分析,內地早前放寬入境隔離政策,由「14+7」縮減為「7+3」,與內地商務往來活動將復甦。

(星島日報)

更多國際交易中心寫字樓出售樓盤資訊請參閱:國際交易中心寫字樓出售

更多企業廣場寫字樓出售樓盤資訊請參閱:企業廣場寫字樓出售

更多富臨中心寫字樓出售樓盤資訊請參閱:富臨中心寫字樓出售

更多九龍灣區甲級寫字樓出售樓盤資訊請參閱:九龍灣區甲級寫字樓出售

新世界觀塘 KOHO 申重建商廈

新世界持有的觀塘 KOHO,新近向城規會申請放寬20%地積比重建。

據文件顯示,項目位於觀塘鴻圖道73至75號,目前屬「其他指定用途」註明「商貿」,申請略為放寬地積比率限制,以作准許辦公室、商店及服務行業和食肆用途。

申放寬20%地積比

該廈佔地面積約20000方呎,地積比由12倍略為放寬至14.4倍,即增加2.4倍或20%,以重建一幢樓高29層商廈,涉可建總樓面約288002方呎。

申請人指,擬議發展符合「其他指定用途」,註明「商貿」地帶規劃意向,將提供額外商業樓面面積,以回應起動九龍東。

(星島日報)

更多KOHO寫字樓出租樓盤資訊請參閱:KOHO 寫字樓出租

更多觀塘區甲級寫字樓出租樓盤資訊請參閱:觀塘區甲級寫字樓出租

DUTYZERO「衝出」東涌租核心區鋪 進駐中環銅鑼灣 租金大減50%至68%

零售商趁疫市插旗設據點,專賣酒類及食品的DUTY ZERO「衝出」東涌,進駐中環銅鑼灣,一口氣承租兩個地鋪,中環新顯利大廈地鋪月租25萬,平均每呎156元,較舊租金跌約50%,銅鑼灣羅素街金朝陽中心地鋪,月租約35萬,每呎476元,租金更大跌約68%。

DUTYZERO目前2家店鋪均位於東涌,分別為赤鱲角機場及東薈城,主力做遊客生意,近日,趁疫市下突破框框,衝出東涌,於黃金地段連環租鋪,其中,中環德輔道中8A至8C號新顯利大廈地鋪,建築面積約1600方呎,以每月25萬租出,平均呎租156元,消息人士透露,DUTYZERO更一簽三年約,而且當到達一定生意額,將會與業主分成。

新顯利大廈呎租156元鎖三年約

新顯利大廈鄰近置地廣場,位處中環核心商業區,該鋪位舊租客為服裝店,月租逾50萬,最新租金大減50%。

羅素街鋪呎租476元跌68%

除了中環外,DUTY ZERO更吼準曾以貴租聞名世界的羅素街,承租38號金朝陽中心D號鋪,建築面積735方呎,月租約35萬, 平均呎租476元,該鋪位對上長租為愛彼表 (Audemars Piguet),今年初撤出,當時月租約110萬,最新租金大跌約68%。

李寧200萬租新港中心鋪

有代理表示,疫市下飲食主導鋪市,金朝陽中心原由英國名牌BURBERRY租用的複式鋪,早前亦由「變形金剛」為主題的餐廳進駐。

內地體育服裝品牌李寧,以每月約200萬元,承租尖沙嘴廣東道新港中心約7700方呎複式鋪,開設首家香港旗艦店,舊租客周生生,高峰期月租曾高達700萬,新租金跌70%。

內房基金凱龍瑞發展的灣仔軒尼詩道333號全新商大厦,最新沽售地鋪,1227方呎,以約5800萬易手。旺角廣東道1054號地下連入則閣,建築面積約1000方呎,租客合益肉食,成交價約2230萬,原業主於1968年5月以10萬買入,持貨54年升222倍。

(星島日報)

更多新顯利大廈寫字樓出租樓盤資訊請參閱:新顯利大廈寫字樓出租

更多置地廣場寫字樓出租樓盤資訊請參閱:置地廣場寫字樓出租

更多中環區甲級寫字樓出租樓盤資訊請參閱:中環區甲級寫字樓出租

更多金朝陽中心寫字樓出租樓盤資訊請參閱:金朝陽中心寫字樓出租

更多銅鑼灣區甲級寫字樓出租樓盤資訊請參閱:銅鑼灣區甲級寫字樓出租

更多新港中心寫字樓出租樓盤資訊請參閱:新港中心寫字樓出租

更多尖沙咀區甲級寫字樓出租樓盤資訊請參閱:尖沙咀區甲級寫字樓出租

旭輝13.38億沽北角項目 宏安與匯集基金聯手承接

內地發展商旭輝控股集團,旗下與宏安合營的旭輝地產,出售北角英皇道商業項目,作價13.38億,買家為宏安及匯集基金,各佔50%權益。

旭輝公布,旗下與宏安地產合營、持股60%的非全資附屬公司旭輝地產202006有限公司,出售炮台山英皇道項目全部權益予宏安地產等公司,總代價為13.37735億。旭輝早前曾宣布,以6.74億出售項目60%權益予大股東林中、林偉及林峰,有關交易已取消。

新買家各佔50%權益

今番交易連兩家公司,近11.3億未償還金額,母公司旭輝為賣方擔保人。買方為華王有限公司,由宏安地產及APG

SPV各擁50%權益。APG SPV為APG Strategic Real Estate Pool (匯集基金)

於荷蘭成立的存託機構,由荷蘭退休基金為集體投資而成立。

公布指出,該宗交易所得款項淨額約6.81億,用作營運資金,並估計可錄收益約2180萬。

取消早前交易安排

該項目英皇道101號及111號,佔地面積約12695方呎,前身商廈,曾由新目標集團以約18.8億收購,目前拆卸中,計畫重建住宅項目,料2026年完成。今年6月底估值20億。

該交易原以6.74億在8月10日售予與集團股東林中、林偉及林峰。董事會認為,是次新交易與原出售事項類似,新出售事項收取現金較原出售事項多約800萬元,同時估計多約1192.5萬,預計9月底前落實。

(星島日報)

市建土瓜灣項目突擊招標 「一口價」定勝負 賣樓逾60億按比例分紅

市建局馬不停蹄推出發展項目,除觀塘市中心第4和第5發展區「巨無霸」商業項目今日截收意向之外,該局昨日突然推出土瓜灣第四個以「小區模式」發展的榮光街/崇安街發展項目招標。消息透露,發展商需自行提出「一口價」,以價高者得決勝負,日後售樓收益達60億以上須按比例分紅,最高達五成。該項目市場估值綜合約30.6億至36.2億,每呎樓面地價約1.1萬至1.3萬。

市建局於土瓜灣第四個以「小區模式」發展的榮光街 /

崇安街發展項目,挾市區及鐵路沿綫優勢,昨日正式招標,招標條款隨即曝光。市場消息透露,項目售樓收益達60億後,中標財團須與市建局分紅,達標後首1億須分紅兩成,其後分紅比例以每1億為一組遞增,當收入達63億以上,分紅劃一為50%,若以項目總樓面約27.86萬方呎計,相當於每方呎售價逾2.15萬便需要分紅,而且發展商須向市建局自行提出「一口價」建議,將成為勝負的關鍵。

售樓逾63億須分紅50%

至於商場部分,市建局及中標財團共同持有,租金收益由中標財團及市建局以「七三」比例瓜分,租金收入中標財團佔七成,其餘三成則歸市建局;發展商可以向市建局要求出售非住宅部分,但須獲市建局首肯。另外,項目設有限呎條款,住宅單位面積不得少於300方呎,同時規定最少一半單位面積不可超過480方呎。

該項目於上月初完成招收意向書程序,合共接獲31份意向書,該局昨日正式邀請31家發展商及財團入標競投,並於10月6日截標。市建局指出,招標遴選小組將評審收到的標書,並於稍後就批出該發展項目的發展向市建局董事會提交建議,由董事會作最終決定。

商場租金「七三」分帳

項目位於銀漢街44至54A號 (雙數) 及榮光街72至118號 (雙數),鄰近港鐵土瓜灣站,步行前往約5至6分鐘;地盤面積約3.1萬方呎,可建總樓面約27.86萬方呎,發展規模是目前已推出項目中最細,估計可以提供約560伙住宅。

招標條款顯示,成功取得該項目的發展商及財團,須按發展協議中列明有關土瓜灣小區發展的「總體設計要求」作為興建新發展項目的藍本,與毗鄰重建項目產生協同效應,以達致整個小區的重整及規劃更完整及一體化,促進該小區的連接性與步行環境,並以更具特色的「地方營造」及智慧元素,提升該區的宜居性。

標價備受市場關注

有測量師指出,上述項目屬市區罕有新供應,料財團入標時會參考毗鄰已批出的項目價格,認為在加息環境下,是次批出價格參考指標,將備受市場關注。

另一測量師表示,近期政府批出地價有回調迹象,惟未來供應重鎮仍集中於土瓜灣、深水埗等一帶,而且近年市建局以小區發展的大型重建項目罕有,估計屆時收約10份標書。綜合市場消息指,參考去年同區批出項目每呎樓面地價,預計該項目估值30.6億至36.2億,每方呎估值約1.1萬至1.3萬。

(星島日報)

恒基嘉里長實瓜分3項目

市建局昨日正式邀請發展商及財團入標競投的土瓜灣榮光街 / 崇安街項目,為該局於過去約一年多,推出招標的第4個同區發展項目,而之前招標的3個項目,中標發展商分別為恒基、嘉里及長實,涉及金額合共逾197.7億。

三項目涉逾197.7億

市建局於去年6月,就土瓜灣庇利街/榮光街項目邀請發展商遞交意向書,最終接獲36份意向書,同年7月正式招標,8月截標時合共接獲6份標書,最後恒基於9月以81.89億投得,直至今年2月恒基引入帝國集團及希慎興業合作發展。該項目地盤面積約7.97萬方呎,預計可建總樓面逾71.7萬方呎,料可提供1150伙住宅及11.9萬方呎商業樓面。

至於鴻福街 /

銀漢街項目,市建局於去年9月邀請發展商提交發展意向書,合共接獲36份意向書,同年10月招標,11月截標時合共接獲8份標書,結果嘉里於12月以超過55.87億投得。該項目地盤面積約4.93萬方呎,可建總樓面最多約44.38萬方呎,預期可提供665伙住宅及7.4萬方呎商業樓面。

去年11月,市建局就鴻福街、啟明街及榮光街的四合一項目招收意向,合共接獲31份意向書。項目隨後於今年1月招標,2月截標時合共接獲7份標書,最終由長實以59.96億投得。該項目地盤總面積約5.85萬方呎,可建總樓面上限約52.68萬方呎,預期可提供約890伙住宅。

(星島日報)

會德豐跑馬地舊樓申請強拍

傳統豪宅區住宅地供應短缺,不少財團密密透過舊樓併購,以申請強拍增土儲;跑馬地黃泥涌道一系列相連地段的舊樓、包括翠景樓、愉華大廈及安美大廈,短短兩周內先後向土地審裁處申請強拍,均由會德豐地產提出申請,以擴大其跑馬地重建版圖,最新一宗為安美大廈目前持有逾85%業權,市場估值5.2億;發展商指,未來將整合發展,以重建為豪宅項目,涉及可建總樓面逾15萬方呎。

梁志堅:將重建為豪宅

會德豐地產主席梁志堅回覆查詢時指,未來上述項將整合發展,屆時將會重建為豪宅項目。

近年會德豐地產積極擴大跑馬地併購版圖,近日連環申請強拍黃泥涌道一系列相連地段的舊樓以統一業權發展,最新一宗為安美大廈,目前持有約85.6%業權,現餘下8個單位並未成功收購,包括7個住宅單位及1個商鋪,其中住宅單位市場估值約597萬至1448萬,而商鋪估值約560萬,市場對整個項目估值5.2252億。

據土地審裁處文件顯示,安美大廈位於黃泥涌道63及65號,位於跑馬地黃泥涌道及雲地利道的豪宅地段,毗鄰馬場,落成後料不少單位可享馬場景色;同時鄰近銅鑼灣核心商業地段,極具重建價值。

現址為一幢樓高13層的商住舊樓,地下為商鋪,樓上為住宅樓層,該舊樓早於1971落成入伙,至今樓齡約51年。文件顯示,項目地盤面積5172方呎,目前坐落於「住宅 (甲類)」地帶,若以地積比率9倍發展,涉及可建總樓面約46548方呎。

3地盤合併可建15.4萬呎

事實上,該公司積極擴展跑馬地版圖,上述舊樓毗鄰的愉華大廈、翠景樓日前已向土地審裁處申請強拍,前者申請強拍時持有約80.59%業權,市場對整個項目估值6.1124億;後者翠景樓申請強拍時持有約83.33%業權,而市場對整個項目估值7.0681億。上述3個地盤合併發展,地盤面積擴展至17191方呎,若以地積比率9倍重建發展,涉及可建總樓面約154719方呎。

除上述項目外,會德豐地產夥拍培新集團、於今年3月透過強拍途徑,以底價17.32億,成功統一雲地利大廈舊樓業權。上述地盤面積約17595方呎,現時規劃為「住宅

(乙類)

6」用途,若以地積比率約5倍重建發展計,預計可建總樓面約87975方呎,以上述強拍價計算,每呎樓面地價約19687元。當時發展商指將盡快開展相關程序如申請拆卸物業等,預計項目最快於3年或以後推出市場。項目位於跑馬地黃泥涌道及雲地利道的豪宅地段,落成後料不少單位可享馬場景色。

深水埗海壇街舊樓獲批強拍

另外,由財團持有的深水埗海壇街227B至227C號舊樓,最新獲土地審裁處批出強拍令,底價為1.2億,對比去年4月申請強拍時市場估值約1.0013億高出1987萬或19.8%。上述舊樓現址為一幢樓高6層的商住物業,地下為商鋪,樓上為住宅,並於1960年落成,至今樓齡約62年。上述地盤面積約2322方呎,若以9倍地積比率作商住發展,涉及可建總樓面約20898方呎。

(星島日報)

旺角安康寧商廈2.8億放售

旺角老字號藥房「安康寧藥房」江氏家族,放售近半世紀的安康寧商業大廈,市值約2.8億,平均呎價約1.58萬。

旺角太子彌敦道792號安康寧商業大廈,佔地約1612方呎,1982年落成,樓高14層,包括3120方呎地庫及地下商鋪,1至14樓為寫字樓,涉及約1.5萬方呎樓面,總樓面即約1.8萬方呎,物業將以現狀及交吉出售。

老牌家族自用40年

有代理表示,該全幢業主為安康寧藥業家族,自用物業40年,首次在市場上放售,由於大廈交吉出售,投資者或基金可迅速打造「主題」商廈。

(星島日報)

啟德跑道區2用地 保留作商業用

近年商業氣氛受創,啟德一帶陸續有商業地流標收場,政府遂於去年表示有意將區內5幅商業地改劃成住宅,以提供約6,000伙住宅,但城規會最終於上周決定,保留當中位於跑道區的2幅商業用地,即約138萬平方呎商業樓面獲保留。

改劃啟德5幅商業地的計劃早前受阻,城規會隨後於6月否決其中2幅位於跑道區商業地的改劃建議。上周會方再審議有關保留該2幅用地作商業用途的申述及意見,並表示拒絕接納相關反對申述,意味2幅用地將獲保留作商業之用,住宅供應最終會減少約1,720伙。是次2幅獲保留的用地分別為4C區4號及5號用地,比鄰啟德郵輪碼頭,其總樓面分別涉約79.4萬平方呎及58.2萬平方呎。

2商業地 料供應138萬呎樓面

事實上,啟德一帶的商業地發展可謂一波三折,上述2幅用地均曾於2019年連環流標,當中4C區4號用地原於2019年5月由高銀投得,其後遭集團在同年6月撻訂,而第2度招標後,最終亦於同年9月流標。至於4C區5號用地則早於2019年1月,因為發展商出價未達政府底價而同樣流標收場。

但是,觀乎整個啟德區發展,區內的商業配套日漸成熟,預計今年至2024年,將有4個大型商業及體育項目落成,為該區新增約400萬平方呎商業樓面。前述的4個項目較近港鐵啟德站,當中規模較大的南豐旗下商業地標項目 AIRSIDE,預料於今年第4季正式開幕,總樓面逾191萬平方呎,總投資額達320億元。

AIRSIDE 預計第4季開幕

同樣屬大型商業項目、早於2016年由利福國際 (01212)

以約73.88億元投得的啟德第1E區2號商業地,亦擬發展2幢樓高18至19層高的雙子塔式商廈,並設4層地庫,其中1幢則發展為大型百貨公司崇光

(SOGO) 分店,總樓面逾109萬平方呎,其中9成樓面作零售用途,而項目將會在明年緊接推出。

此外,遠東發展 (00035(

於2019年以約24.46億元奪得的承啟道商業地,將發展為酒店及寫字樓,供約400個酒店房間,及12層高 (計入地庫)

的寫字樓及零售商廈,涉及總樓面約34.4萬平方呎,料於2024年落成。項目的辦公室部分早前以約33.8億元出售予中電 (00002)

,將成集團的新總部。而啟德體育園亦將提供約64.6萬平方呎的零售及餐飲設施,早前日式百貨公司AEON已宣布承租啟德體育園舖位9年,涉及金額約3,730萬元。

(經濟日報)

更多AIRSIDE寫字樓出租樓盤資訊請參閱:AIRSIDE 寫字樓出租

更多啟德區甲級寫字樓出租樓盤資訊請參閱:啟德區甲級寫字樓出租

PARK PENINSULA 綜合多元化地段

經過多年規劃,前身是啟德機場的啟德發展區其發展日漸成熟,近年陸續有多個私人住宅項目入伙。今年7月,在跑道區上持有土地的9間發展商更合組公司,將跑道區建構為一個全新綜合多元化地段—PARK PENINSULA。

9間發展商共同打造

上述9間發展商包括華懋集團、帝國集團、中國海外 (00688)、遠東發展 (00035)、恒地

(00012)、嘉華國際 (00173)、新世界發展 (00017)、新地

(00016)及會德豐地產。他們均在跑道區分別以獨資或合資形式持有9幅用地,涉逾萬伙住宅,總樓面達636萬平方呎,佔整個跑道區單位總數逾8成。

跑道區屬前啟德國際機場的跑道部分,三面環海,翻查資料,政府近年在跑道區合共批出11幅用地,涉及逾700萬平方呎樓面。早前有份參與的發展商亦透露,將藉此與政府相關部門、區內持份者及NGO溝通,合作舉辦休閒及慈善活動。至於交通方面,目前正爭取在PARK

PENINSULA每一個項目設有穿梭巴士往返港鐵站,方案日後或有機會落實。

(經濟日報)

Kwun Tong job gets 24 expressions of interest

The Urban Renewal Authority's Kwun

Tong town center redevelopment project's areas four and five, which have

introduced flexibility in plot ratios in shaping a building complex

with government facilities and commercial operations, has received 24

expressions of interest.

The Kwun Tong spread is the URA's largest-ever single redevelopment project spread across five areas.

The

last phases of the redevelopment cover 25,595 square meters. Upon

completion there can be a maximum total gross floor area of 201,220

square meters.

The authority initiated what it calls "floating planning parameters" in the tender of the project.

Under

this arrangement, the total gross floor area is unchanged but

flexibility will be given to the successful developer or consortium to

determine the actual areas within specified ranges for office, hotel and

other commercial uses.

It

has also been noted when it comes to flexibility the Planning

Department did not object to a plan for building 75 flats on Kennedy

Road.

That project at

33-35 Kennedy Road, which is owned by Keith Kerr, a former chairman of

Swire Properties (1972), had applied for the redevelopment to a 28-story

residential building.

In the primary market, Miami Quay I

at Kai Tak will launch its first round sale with 138 units next Monday.

There will be 137 flats on the price list, and one will be sold via

tender.

Dah Sing Bank

(2356) has meanwhile raised the mortgage rate cap by 0.2 percentage

points to 2.85 percent, which takes the number of banks in Hong Kong

that have raised the mortgage rate cap to 10.

But Bank of China Hong Kong (2388) and Hang Seng Bank (0011) have not raised the cap.

A

property agency said that Hong Kong home prices fell 2.4 percent in the

second quarter, making it 145th in the world in the property price

trend ranking.

Yet

despite the weak performance of residential property prices in Hong Kong

there has not been a significant fall in prices due to headwinds such

as interest rate hikes and a rebound from the pandemic, agent said.

On

the commercial property front, another agent said that the vacancy rate

of Grade A offices reached 11 percent as of July - the highest since

2008 - because social unrest and the pandemic had affected Hong Kong's

economy during the past three years.

And

in the overseas property market, Chinachem Group bought the London

headquarters of social media company TikTok for 158.5 million pounds

(HK$1.41 billion) yesterday.

(The Standard)

市建觀塘「巨無霸」商業項目收24份意向

市建局歷來規模最大的單一重建項目,觀塘市中心第4和第5發展區「巨無霸」商業項目,昨日截收意向,合共接獲24份意向書,除大型發展商之外,亦吸引多家中型財團。

市建局表示,該局董事會設立遴選小組,將會按照訂定的入圍準則,就發展商項目發展經驗及財政能力,從收到意向書中,挑選符合資格發展商,並將根據董事會已批准主要招標條款,邀請入圍發展商,提交合作發展標書。

該項目將興建一個地標式、綜合政府設施及商業發展的建築群,不但增加觀塘核心地段的民生和經濟活力,亦為市中心營造社區節點和連接周邊的門戶,作為九龍東新地標。項目亦將提供政府、機構或社區設施樓面,以及大型休憩空間供市民享用,改善地區整體環境。

據現場所見及綜合市場消息,多家本地大型和中型發展商都有遞交意向書,包括長實、新地、恒基、信和、會德豐地產、鷹君、華懋、遠東發展、中國海外,另有多家不知名財團。

有測量師表示,由於項發展規模大,涉及投資額十分大,地價連同建築費及其他支出,估計投資額高達逾300億,相信大型發展商及財團才會積極入標。綜合市場估值介乎約184.1億至259.9億,每呎樓面地價由8500至12000元。

估值約184.1億至259.9億

另一測量師指出,項目規模及投資額大,估計最終只有3至4個財團入標;參考東九龍寫字樓呎租約25元至28元,個別優質物業能逾30元,項目估計數年後落成,屆時合理呎租約40元水平。

觀塘市中心項目是市建局歷來規模最大的單一重建項目,以五個區域分階段發展,該項目為最後一個發展區域,地盤27.56萬方呎,可建總樓面約216.59萬方呎。

可建總樓面216.59萬呎

為應對持續疫情及市況,市建局在該項目標書將試行「浮動規劃參數安排」,容許成功取得本項目的發展商及財團,在總樓面保持不變前提下,調撥指定範圍內商業樓面面積作辦公、酒店和其他商業用途;當中,商業樓面不可少於69.966萬方呎,需設於低層樓層,以保持項目位處觀塘區策略性位置的「市中心」特色。

該項目早前向城規會提交修訂申請,調整酒店、寫字樓及商業零售組合比例,增加項目彈性,當中酒店部分不設樓面下限至最多34.44萬方呎,意味中標財團可選擇不興建酒店或最多提供400間酒店客房。寫字樓部分則修訂為70.89萬至137.37萬方呎,最後商業用途樓面

(商店及服務行業、食肆、娛樂場所及教育機構),則修訂為69.97萬方呎至102萬方呎。

(星島日報)

「環保」甲廈受捧空置率處偏低水平

當今社會較過往更講環保,尤其疫市下,健康生活成為大眾追求目標, 有代理指出,近年不論發展商起樓,大機構承租物業,焦點都放在「環保」商廈,期待物業在省電,排廢等環保方面達到水平,令用家擁有健康的工作環境。

有代理表示,近年來,「環保」甲廈盛行,截至今年7月,通過環評認證的甲廈總實用面積達2830萬方呎,佔甲廈總供應量38%,該類型商廈更受捧,空置率因而較普通甲廈低4.3個百分點。受發展商及用家追捧,在新供應方面,70%原定於2022年竣工的甲廈,已獲臨時認證,料明年更飆升至81%。

空置率低4.3個百分點

「環保」商廈建築成本並非特別高,另有代理解釋,環保在於投入心思及策劃,令物業更節能 (節省水電),空氣流通,管理妥善,只要好好加以策劃,建築成本並不因而提高;近年,亦有業主重新打造現有已落成的商廈,加入環保元素,那麼,視乎不同的個案,費用大約為建築費的5%至20%。

「環保」商廈受客戶追捧,有大型保險公司由核心區遷觀塘,為響應環保,並訂下在2024年前達致炭中和的目標。

另一代理指出,未來商廈供應龐大,租戶選擇多,業主尋求不同途徑挽留及吸引租戶,環保成為吸客元素,尤其疫市下大家更注重健康。

根據代理行資料,截至今年7月,整體甲廈空置率攀升至11.3%,自2008金融海嘯以來最高,2022至2026年將有約1500萬方呎全新供應,業主可透過環保,提高其物業的競爭力。

(星島日報)

財團申強拍旺角兩舊樓

由財團併購的旺角聯業樓、東安樓最新向土地審裁處申請強拍,以統一業權發展,目前平均持有逾93%業權,市場估值逾1.76億。

據土地審裁處文件顯示,聯業樓位於利業街11及13號,而東安樓則位於利業街15號,由一家名為恒亞投資公司向該處申請強拍,前者聯業樓持有約92.86%業權,後者東安樓則持有約95%業權,兩幢舊樓計平均持有約93.93%業權,整個項目市場估值約1.7619億。

市場估值逾1.7億

聯業樓現址為一幢6層物業,地下為商鋪,樓上為住宅樓層,樓齡約50年。東安樓則為一幢9層高物業,地下為商鋪,樓上為住宅樓層,樓齡約51年。

項目位處油麻地、旺角商業地段,具重建價值,步行前往港鐵油麻地站約6分鐘步程,上址地盤面積5033方呎,坐落於「住宅 ( 甲類)」地帶,若以地積比率8.5倍發展,涉及可建總樓面約42781方呎。連同上述項目,土地審裁處今年迄今共錄20宗強拍申請個案,已超過去年全年16宗,並多出4宗。

另外,由The Development Studio創辦人兼主席簡基富 (Keith Kerr) 旗下灣仔堅尼地道33至35號項目,早年申建75伙住宅方案今年初遭城規會拒絕後;該公司今年中「捲土重來」、並維持原有其發展參數再向城規會申請放寬8.3%高限,以建一幢樓高28層的住宅,以提供75個住宅單位,可建總樓面約61624方呎不變;最新獲規劃署不反對,城規會將於周五

(9日) 舉行會議審議時,料會「開綠燈」通過。

(星島日報)

跑馬地舊樓掀財團併購熱 群雄「爭土儲」 至少7項目將重建豪宅

市區豪宅地皮新供應罕有,近年跑馬地舊樓頓成財團收購對象,目前已知至少有5個財團在區內「插旗」發展,涉及7個併購中或已完成併購的項目,另有2個現樓新盤仍在銷售當中,令區內形成群雄割據新局面;會德豐地產最矚目涉4個項目。

近年市區優質地皮供應,不少財團透過併購舊樓增土儲,據本報統計,區內有不少財團進行併購,已知至少有5個財團「插旗」,當中最矚目為會德豐地產密密擴展其區內版圖發展,日前接連向土地審裁處申請強拍翠景樓、愉華大廈及安美大廈三幢舊樓,總市場估值逾18.4億,若上述3個地盤合併發展,地盤面積擴展至17191方呎,以地積比率9倍重建發展計,涉及可建總樓面約154719方呎。

會德豐持4項目最矚目

除上述項目外,會德豐地產夥拍培新集團於今年3月以底價17.32億,成功統一雲地利道15號雲地利大廈業權;該項目地盤面積約17595方呎,可建總樓面約87975方呎。

另外,亦有財團於區內「插旗」密密併購項目,如同區禮頓道2及2A號及黃泥涌道161至173號一系列舊樓,早於2019年起獲財團併購,當中黃泥涌道167號馨閣7個單位,總作價超過2億。據指,總地盤面積約1萬方呎,可建總樓面約9萬方呎。

恒隆藍塘道洋房套現逾25億

除併購的項目外,亦不乏已完成併購的項目,其中,培新集團去年曾斥資約12.399億購入大坑道341至343號住宅項目雅居,以上述物業總樓面面積約1.8萬方呎計算,平均呎價收購高達6.9萬;當時該公司曾指,計畫將上述項目重建發展為低密度住宅。

另外,同區亦有不少豪宅新盤仍積極銷售當中,恒隆持有的藍塘道23至39號現樓洋房項目,共提供18座洋房,迄今已售出8座洋房,合共套現逾25億。

遠中集團旗下Eight Kwai Fong Happy Valley,迄今共售出32伙,套現逾4.1億。

(星島日報)

觀塘區成功打造成九龍新商貿區,續有新興寫字樓陸續進駐區內,而不足10年樓齡的中海日升中心,罕有交吉放售。

有代理表示,觀塘中海日升中心近日有低層單位罕有交吉放售,單位面積約1,426平方呎,業主現意向價約2,852萬元,平均呎價約20,000元。

內部間隔四正 鄰近港鐵站

中海日升中心於2015年落成,樓高35層,設有豪華冷氣大堂,地下至2樓設有10多間食肆,3樓至9樓則為停車場,商廈單位內部間隔四正,用途多元化,由於大廈配套完善,食肆商舖為大廈帶來人流及消費力,故一直深受用家歡迎,低層商舖空置率長期維持低水平。

另外其位置亦見優越,坐落於駿業街核心工商業地段,比鄰城東誌二座-友邦九龍大廈及城東誌一座-安盛金融大樓等東九龍地標商廈,屬區內甲級商廈之一,位置優越,距離港鐵觀塘站僅5分鐘步程,附近備有多條巴士綫往返港九、新界各區,交通極為便利。加上物業鄰近區內大型商場apm及觀塘廣場等,配套一應俱全。

至於參考市場最新成交,其中極高層B室,面積約1,590平方呎,以約2,385萬元沽出,平均呎價約15,000元,另高層單位,面積約2,964平方呎,以每平方呎約38元租出,月租約11.3萬元。

該代理續指,近年觀塘區發展迅速,在鐵路效應帶動下,增加區內物業的升值潛力,商業氣氛更加濃厚,加上周邊大型商業項目相繼落成,觀塘區內的工商物業受注目程度大增,不少舊樓成為發展商及財團積極收購的對象,區內發展前景絕對不容忽視。

(經濟日報)

更多中海日升中心寫字樓出售樓盤資訊請參閱:中海日升中心寫字樓出售

更多觀塘區甲級寫字樓出售樓盤資訊請參閱:觀塘區甲級寫字樓出售

更多城東誌寫字樓出租樓盤資訊請參閱:城東誌寫字樓出租

更多觀塘區甲級寫字樓出租樓盤資訊請參閱:觀塘區甲級寫字樓出租

信和集團及帝國集團旗下首個位於港島南區的甲級商業合作項目Landmark South,有關建築工程現已進入最後階段。項目將打造成區內嶄新的文創及藝術孕育地標。

信和集團執行董事李正強表示,Landmark South 採用頂尖的建築規格及已獲多項綠色認證。配合近年黃竹坑的蛻變發展,結合甲級辦公室、零售、餐飲、藝術與創意社區於一身。是次項目與藝發局成為夥伴,由項目設計階段開始,已經與藝發局展開協商,一直保持緊密溝通,確保物業建築工程能夠配合藝發局在 Landmark South 內各項藝術設施的規劃、設計、功能和需要。

信和集團資產管理董事蔡碧林表示,Landmark South 自今年初開始招租, 接獲不少來自創意行業如室內設計、畫廊及建築師樓的租務查詢。

香港藝術發展局藝術空間、研究及發展總監陳安玲表示,Landmark South 大廈設備完善,藝發局位於此新落成大廈的新址作永久辦事處外,同時會開設及營運一個約5000方呎的展覽及多用途藝術空間、一個藝術資訊中心及27間以優惠租金租予藝術家的工作室。藝發局新辦公室及設施預計將於明年初啟用,而藝術工作室的招租工作將於本月中開始。

Landmark South 目前的招租進度理想,首批租戶已如期開始進駐。項目位於21樓的示範單位,以及位於8樓,佔地9200方呎的空中花園現已開放予有興趣的租戶參觀。

(信報)

更多Landmark South寫字樓出租樓盤資訊請參閱:Landmark South寫字樓出租

更多黃竹坑區甲級寫字樓出租樓盤資訊請參閱:黃竹坑區甲級寫字樓出租

Evergrande's HQ seized

China Evergrande's (3333) Hong Kong

headquarters has been seized by a lender after failing to sell the

building twice due to its default on loans, the Financial Times reported

yesterday.

The report

came as the winding-up petition hearing of the debt-burdened developer

was adjourned again to November 28, Hong Kong's High Court said

yesterday.

Meanwhile, in

China's embattled property sector, the city of Zhengzhou vowed to start

building all stalled housing projects within 30 days, by making good

use of special loans, asking developers to return misappropriated funds

and encouraging some real-estate firms to file for bankruptcy. The local

government required about 60 real estate companies to continue the

construction of 72 suspended projects no later than early October, and

to hire third-party auditors to account for the balance of funds.

(The Standard)

九龍灣高銀金融國際中心全幢將易手 南豐出價65億奪標呼聲最高

疫市下大手買賣暢旺,九龍灣高銀金融國際中心於上月底截標後,多名準買家積極競投,該全幢即將「名花有主」,本報獲悉,發展商南豐出價最積極,高達65億,奪標呼聲最高,預期兩個星期內落實交易,將成為今年最大宗買賣,平均呎價7629元。