In a change of plans, CSI Properties (0497) is now

seeking to turn a site which once housed an iconic Hong Kong tea house

into a 30-story commercial and residential tower with 175 homes.

Under a new proposal to the Town Planning Board,

the developer aims to turn the site on 152 to 164 Wellington Street in

Sheung Wan into a tower with flats, shops and dining places.

To be built on a site of 6,618 square feet, the

tower would offer 175 flats with an average size of 342 sq ft, three

storys for shops and two for outlets such as clubs and gymnasiums.

The Lin Heung Tea House, whose history dates back

nearly 100 years, once occupied the ground and first floors of the Tsang

Chiu Ho building on 160-164 Wellington Street.

But the dim sum restaurant, which opened in 1926, shut its doors in August 2022, marking an end to its 96-year history.

CSI Properties bought the Tsang Chiu Ho building

in 2019 for HK$450 million and last year the TPB approved a proposal to

redevelop the property into a 25-story commercial building with a total

floor area of about 99,000 sq ft.

The new application shows that CSI prefers a mixed-use tower, through the total floor area has been reduced by 30 percent.

Meanwhile, Lofter said will release the first

price list of Elize Park in Mong Kok next week for least 30 flats and

hinted it would not price them at low levels like its rivals.

(The Standard)

Hong Kong property: Templeton joins China Re in relocating to Two International Finance Centre as office rents fall

Franklin Templeton, which has leased 21,700 sq ft on the 62nd floor of Two International Finance Centre, will shift from its present premises in Chater House

Hong Kong’s

office rents fell 0.5 per cent month on month in November, while the

vacancy rate rose to 12.9 per cent from 12.6 per cent

Hong Kong’s Two International Finance Centre

(Two IFC) seems to be the preferred address for the banking and finance

sector, as office vacancy rates rise and rents fall in the city.

Just a week after China

Re Asset Management, a state-owned reinsurer, said it would relocate to

the grade A tower in the core Central business area, US asset manager

Franklin Templeton confirmed it was moving to a bigger office in the

building that also houses the Hong Kong Monetary Authority’s

headquarters.

“The new office space at International Finance Centre

will be larger, significantly larger, than our current space,” a

Franklin Templeton spokeswoman said. The company, which has been based

in Chater House, another prime office tower in Central, for the past 22 years, did not say when it planned to move to the new office.

Based in San Mateo, California, Templeton is a global multi-asset manager overseeing about US$1.6 trillion of funds.

In November, average

monthly rents for Hong Kong offices fell by 0.5 per cent to HK$52.30

(US$6.70) per square foot, while vacancies edged up to 12.9 per cent

from 12.6 per cent in October, according to the latest data from an

international property agency.

The decline in office

rents has triggered many tenants to upgrade to premium buildings in the

heart of Central, according to the property agents.

Located on 8 Finance Street, the International Finance Centre complex consists of two skyscrapers, a shopping centre, as well as a Four Seasons Hotel. One International Finance Centre opened in 1998 and Two International Finance Centre in 2003.

While

the Franklin Templeton spokeswoman declined to give details about the

lease deal, citing confidentiality, another property consultancy said

the company had taken up 21,700 sq ft on the 62nd floor of the 88-storey

Two International Finance Centre.

The

fund manager will be paying HK$130 per square foot or HK$2.99 million a

month for the space, according to local media reports.

Lease transactions so far this year in Two International Finance Centre

have ranged between HK$130 and HK$150 per square foot, data from a

local property agency’s website showed. In 2023, leases were between

HK$120 and HK$160 per sq ft. The peak price achieved in 2022 was HK$180

per square foot, about 28 per cent higher than the least expensive deal

so far this year.

Franklin Templeton has been operating from the 17th floor of Chater House on 8 Connaught Road, Central, since 2002, where it had leased 18,397 sq feet of prime office space.

Leases in Chater House

ranged between HK$130 and HK$199 per square foot from 2018 to 2022,

according to data compiled by another local property agency.

The first local property agency last week confirmed China Re had leased 6,740 sq ft on the 41st floor of Two International Finance Centre for HK$150 per square foot, or just over HK$1 million a month.

China Re was previously based in Three Exchange Square, where it had leased 5,000 sq ft on the 12th floor for HK$130 per square foot, or HK$750,000 a month.

(South China Morning Post)

For more information of Office for Lease at International Finance Centre please visit: Office for Lease at International Finance Centre

For more information of Office for Lease at Chater House please visit: Office for Lease at Chater House

For more information of Office for Lease at Exchange Square please visit: Office for Lease at Exchange Square

For more information of Grade A Office for Lease in Central please visit: Grade A Office for Lease in Central

蓮香樓上環舊址棄商廈建商住

香港百年老式茶樓「蓮香樓」2022年正式結業,其舊址上環曾昭灝大廈,業主資本策略最新向城規會提交新方案,放棄商廈發展,申請重建一幢樓高30層的商住大廈,提供175個住宅;業界人士指,現時甲級寫字樓空置率達16.4%,創出歷史新高,發展商棄商廈發展亦屬正常,而且住宅可租可售,靈活度較寫字樓高。

據城規會文件顯示,項目位於上環威靈頓街152至164號,目前屬「商業」及顯示為「道路」的地方,申請擬議分層住宅及商店及服務行業和食肆用途。

項目地盤面積約6618方呎,以興建一幢樓高不多於30層,包括3層平台及2層會所的商住大廈,以提供175伙,平均每伙面積約342方呎,可建總樓面約59947方呎。

平均每伙面積342呎

另有8893方呎非住用樓面,換言之,整個項目可建總樓面約68840方呎,對比去年5月獲屋宇署批建一幢25層高商廈,可建總樓面約9.9萬方呎,大減約3萬方呎。

申請人指,零售/餐飲設施設於地下至1樓,並面對威靈頓街及鴨巴甸街,而住宅部分則位於樓上,毗連發展的地下大都設有零售/食肆用途。

業界:寫字樓空置率16%

整體甲級寫字樓空置率達16.4%,涉及樓面約1430萬方呎,創出歷史新高;有測量師表示,雖然住宅總樓面較純高業發展低,惟目前寫字樓空置率高,難以出租,而轉住宅發展,可租可售,靈活度大增。

由財團持有的土瓜灣鼎新大廈,最新向城規會申請商住發展,共提供76伙住宅單位。項目地盤面積約4200方呎,以興建一幢樓高26層,另有2層地庫的商住大廈,共提供76伙,可建總樓面約3.15萬方呎。

油塘住宅項目料開綠燈

宏安地產持有的油塘工業大廈第4座,去年7月向城規會申請放寬兩成密度,以興建2幢綜合用途樓宇,合共提供676伙,每伙單位面積不少於280方呎。最新獲規劃署不反對有關申請,城規會於周五 (26日) 審議時料會通過。

另外,由財團持有的銅鑼灣 The Garden House 及 The Lane House 酒店,去年12月向城規會申請將部分樓面改裝為酒店,兩者額外增加2間酒店房間,涉及樓面約5832方呎。最新獲規劃署不反對。

(星島日報)

去年工商舖買賣減13% 今年望增1成

利息高企影響下,去年工商舖買賣淡靜,有地產代理行認為今年投資移民計劃等利好因素下,買賣成交將反彈1成,當中相對看淡商廈。

成交金額734億挫54% 近3年低

據該行統計,2023年全年累計工商舖買賣共錄得3,838宗登記,較2022年的4,431宗再跌13%,連跌兩年,創下歷史次低水平,較2020年的史上低位只多出5宗,反映股市表現不濟及加息對市場帶來的影響。

此外,全年買賣登記金額更急挫54%,僅錄得733.75億元,為近3年新低及近15年次低。

該行代理認為,去年下半年息口急升、加息壓力持續困擾,而且股市表現每況愈下,導致復甦勢頭受壓。

展望今年,該代理認為恢復通關後,各行業復甦進度較預期慢,整體經濟尚存不少挑戰,惟仍有相關政策,利好工商舖,當中以新資本投資者入境計劃將於年中重啟,投資金額更大增至3,000萬元,當中容許投資1,000萬元在非住宅房地產市場,而工商舖類別物業定必將受惠。

工商舖三範疇上,該代理認為工廈及舖位市場相對看好,對商廈市道未感樂觀,有見近期港股欠佳,加上息口暫仍高企,企業擴充意慾低迷,今年商廈買賣登記宗數仍有機會再跌至700宗的歷史次低水平,按年恐再減少7%,而成交金額也料相應下跌5%至300億元水平。

(經濟日報)

尖東大富豪夜總會舊址 140萬租出

租金返十年前 擬拓娛樂餐飲展覽等

舖市大手租務回暖,尖東新文華中心地庫5萬呎舖位,即前大富豪夜總會舖址,現以約140萬租出。消息指新租客為一家綜合娛樂公司,將結合娛樂、餐飲、展覽等用途。

消息指,尖沙咀東部科學館道14號新文華中心地下及地庫租出,該舖地下面積約6,000平方呎,地庫面積達5萬平方呎,合共約5.6萬平方呎,以約140萬元租出。

宏安大廈5層巨舖 料月租百萬

該舖曾為尖東地標,大富豪夜總會舖址,而夜總會於2012年結業,其後業主把舖租予免稅店「富豪匯」,售賣化粧品、金飾、名牌時裝等,主打內地旅客,月租約135萬元,惟早年亦已結業。

該舖一直招租,直至近月終租出,租金重回十年前水平。

市場人士透露,新租客為一家財團,計劃把該6萬呎舖址,打造成一個綜合娛樂場地,據知情人士透露,涉及設施包括餐飲、娛樂場所、會議及展覽場地等,形式近似會所,暫未知會否有夜總會成分。

尖東大富豪夜總會可謂見證香港紙醉金迷年代,於1984年開業,創辦人羅焯於1996年更以1.86億元購入舖址。夜總會於2012年正式結業,業主亦曾以約3億元放售舖址,未獲承接。

隨着舖租回調,加上通關後旅客重返,漸吸引娛樂相關行業,租用核心區大樓面舖位。

「玩具大王」蔡志明持有旺角亞皆老街宏安大廈基座5層巨舖,獲經營多種不同娛樂相關事業的東方棕泉老闆莫應光及相關人士租用,涉及物業面積約2.5萬平方呎,料月租約100萬元。據了解,該多層舖位曾經由連鎖影音店百老匯租用多年,每月租金曾達400萬元,不過在疫情期間遷出,舖位一直交吉,部分地舖則作短租。

業界:帶動尖東消費 商舖租務

有本港代理認為,前大富豪夜總會樓面巨大,是次獲財團租用,涉及投資定以數千萬元計,故肯定對消費者來說帶來一定吸引力。該代理指出,80、90年代尖東曾非常繁盛,亦是本港夜生活的重要地區,若有新租戶進駐,料可帶動整個尖東區消費,繼而推動區內商舖租務。

(經濟日報)

更多新文華中心寫字樓出租樓盤資訊請參閱:新文華中心寫字樓出租

更多尖沙咀區甲級寫字樓出租樓盤資訊請參閱:尖沙咀區甲級寫字樓出租

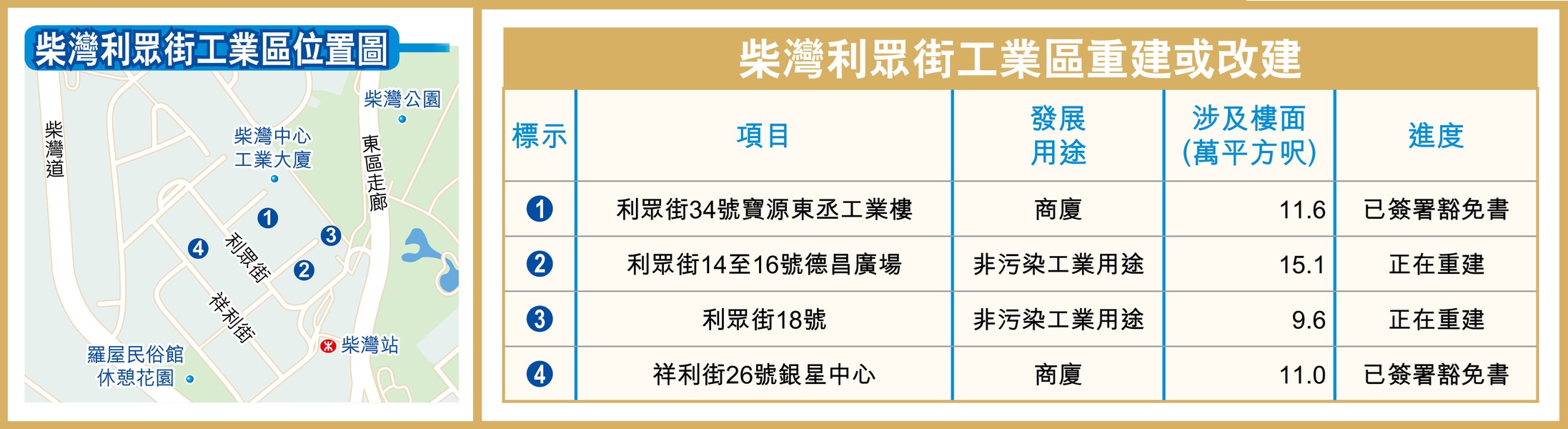

利眾街工業區 2廈已展開重建

港鐵柴灣站周邊的工業區,近年有工廈陸續展開重建,當中利眾街2幢由興勝創建 (00896) 持有的工廈正展開重建,將提供約24.7萬平方呎樓面。

雖然柴灣屬於以住宅為主的社區,不過由於區內設有貨物裝卸碼頭,亦造就在現時港鐵站周邊的利眾街及祥利街一帶,以及碼頭區分別設有兩個小型的工業區。當中佔地約44.7萬平方呎的利眾街工業區,由31幢工廈組成,大多數屬於規模較細的工廈、樓齡較舊,業權亦比較分散,只有5至6幢屬於單一業權,相對較新已經是樓齡約12年的東貿廣場。

德昌廣場轉型新式工廈

利眾街工業區轉型不算太快,過去幾年錄得幾宗工廈重建或者改建個案,包括屬於房委會旗下,樓齡逾60年柴灣工廠大廈,基於保育理由,改建成為公屋華廈邨,早已經在2016年入伙。

至於目前正在進行的重建項目則以興勝創建旗下2個利眾街重建項目為主,分別由該財團以合共近17億元購入。當中與南豐合作重建的德昌廣場,原本屬於1幢舊式工廈,但原業主德昌電機在過去幾年成功全幢改裝成11層高的商廈,總樓面面積約9.6萬平方呎。興勝與南豐以約9.48億元購入後,便申請放寬地積比率由12倍增加20%至14.4倍,以地盤面積約10,515平方呎計算,可重建1幢28層高,非污染工業用途,即新式工廈,總樓面約15.14萬平方呎,較原有樓面多出逾58%。

美利倉大廈增建4成樓面

另一方面,位於利眾街18號美利倉大廈,佔地約6,685平方呎,原本為16層高工廈,興勝創建在以約7.35億元購入後,申請放寬地積比率至14.4倍重建,已經在2022年4月完成清拆,預計會重建成1幢26層高的新式工廈,可建樓面約9.6萬平方呎,相較原有樓面6.8萬平方呎,增加4成多樓面。

至於改裝活化方面,位於利眾街34號的寶源東丞工業樓,數年前則簽訂特別豁免書,可增加作食肆、展覽廳、辦公室、商店及娛樂場所等10多項用途。

(經濟日報)