Wheelock gets three buildings in Staunton Street for $529m

Wheelock

Properties acquired three residential buildings in Staunton Street in

Sheung Wan at the reserve price of HK$529 million through a compulsory

sale yesterday.

The

property, with a registered site area of approximately 4,333.55 square

feet, is currently a pair of seven-story commercial/residential

composite buildings completed in 1968, and Wah Yee Mansion, which is a

sixstory complex completed in 1971, according to a property agency.

Caine Hill,

a nearby new project developed by Henderson Land Development (0012),

cost around HK$30,000 per sq ft when it was put on the market last year.

Managing

director Ricky Wong Kwong-yiu said this was the company’s second site

acquisition through compulsory sale this year, after No. 15 Ventris

Road.

The site, with a

buildable area of 36,000 sq ft, will be developed into a prime

residential project at the core of the central business district where

supply is tight, he said, adding that the project may be put up for sale

in three years.

On

recent proposals about lowering the compulsory sale application

threshold for old buildings, Wong welcomed new measures from the

government which would help speed up urban renewal while ensuring fair

treatment with regard to owners’ interest.

Commenting

on the recent performance of the residential market, Wong said prices

have begun to recover some of the lost ground in the second quarter, and

the strong demand amid tight supply should ensure support for home

prices, despite the onset of US rate hikes and other external factors.

In the primary market, Lohas Park phase 11B in Tseung Kwan O has been named Villa Garda I, which provides 592 homes.

The project is jointly developed by Sino Land (0083), K Wah International (0173), and China Merchants Land (0978).

K Wah said the project is pending presale consent and it has confidence that the sales will be launched next month.

In Tai Po, Sun Hung Kai Properties (0016) said sales of 188 homes at phase 1 of Silicon Hill

will take place on Friday, when the city celebrates the Dragon Boat

Festival. On sale are 170 units on price lists and 18 via tender, the

developer said. The 170 flats, with areas from 291 sq ft to 661 sq ft,

are priced from HK$4.97 million to HK$11.35 million after discounts, or

HK$16,006 to HK$20,254 per sq ft.

(The Standard)

Show flats on way at Symphonie project

Henderson

Land Development (0012) says the first batch of The Symphonie in Cheung

Sha Wan will be unveiled next week at the earliest.

Sales

brochures and show flats will also be ready by then, said Thomas Lam

Tat-man, a general manager of Henderson's sales department.

The

project provides 262 units ranging from 261 to 573 sq ft and 85 percent

of them have one or two bedrooms, Lam said, adding that sales may take

place this month.

In Tai Po, Sun Hung Kai Properties (0016) said it has collected more than 2,200 checks for the 170 flats at phase 1 of Silicon Hill,

meaning the homes are 12 times oversubscribed. The 170 flats, with

areas from 291 sq ft to 661 sq ft, are priced from HK$4.97 million to

HK$11.35 million after discounts. A total of 188 homes will be put on

the market on Friday, including 170 units on price lists and 18 via

tender.

Meanwhile, SHKP's project with CK Asset (1113) in Tuen Mun was named Grand Jete yesterday.

The

800-home project will be developed in two phases. The first, with 400

flats is expected to be launched this month, CK Asset said.

(The Standard)

Golden Financial fails to sell Hong Kong skyscraper as it struggles to pay debt

Goldin

Financial Holdings Ltd. said the sale of its eponymous Hong Kong

skyscraper failed to complete in a blow to the embattled property firm’s

attempts to repay debt.

The agreement by receivers to sell the Goldin Financial Global Centre was

terminated and the deposit paid by the purchaser was forfeited,

according to a statement to the Hong Kong stock exchange. The company

did not elaborate on why the deal was not completed.

The

office tower is at the heart of an asset grab by creditors as Goldin

Financial struggles to make timely payments on its outstanding debt. The

flagship building of tycoon Pan Sutong’s firm was seized by creditors

in September 2020.

The

company had said in a filing in March that all outstanding loans and

notes will be satisfied if the transaction is completed.

The

building is estimated to have a value of around HK$10 billion (US$1.3

billion), local media reported earlier. The 27-story super grade A

office located in Kowloon Bay includes a single floor area of around

35,000 square feet, according to the company’s website.

Goldin

Financial was informed by the purchaser that it will dispute the

alleged wrongful termination, and the deal will be subject to the

outcome of the legal proceedings, according to the statement.

Shares

of Goldin Financial have been suspended in Hong Kong since April 1

after it failed to publish earnings ahead of the March 31 deadline.

(The Standard)

For more information of Office for Lease at Goldin Financial Global Centre please visit: Office for Lease at Goldin Financial Global Centre

For more information of Grade A Office for Lease in Kowloon Bay please visit: Grade A Office for Lease in Kowloon Bay

Hong Kong education group signs US$20.6 million lease to open its first international school in Kowloon East

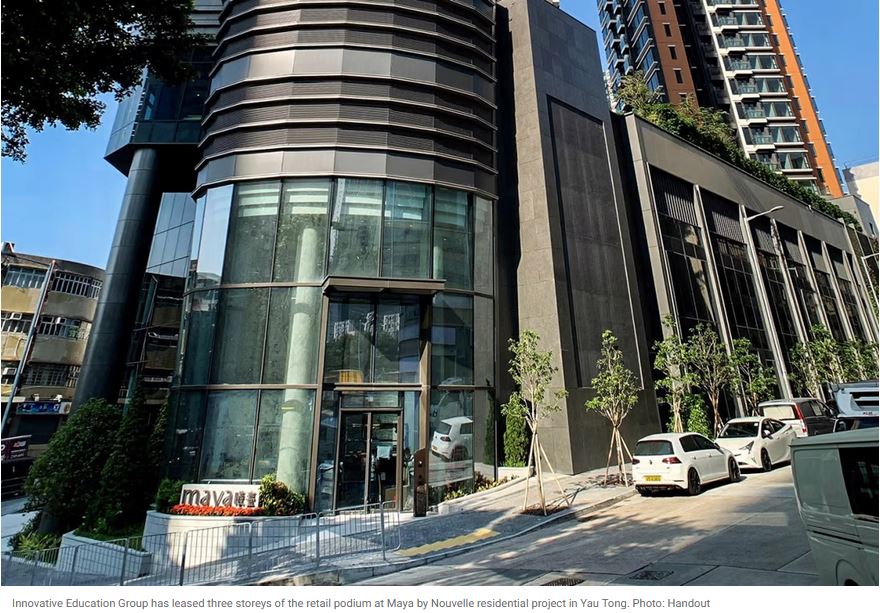

Innovative

Education Group has leased nearly 50,000 sq ft of space in the retail

podium at Maya by Nouvelle residential project in Yau Tong

The school will offer an international curriculum for students from grades seven to 13 from September 1, says founder Thomas Qi

A

Hong Kong-based education group plans to open its first international

school in Kowloon East, after signing a leasing deal worth at least

HK$162 million (US$20.6 million) over 10 years on Tuesday.

Innovative

Education Group has leased the bottom three storeys of the retail

podium at Maya by Nouvelle residential project in Yau Tong spread over

49,600 sq ft for an average monthly rent of HK$1.35 million, the largest

retail leasing transaction in Kowloon East so far this year.

“I

believe that Hong Kong will see an increasing number of international

schools,” said Thomas Qi, founder and principal of Innovative Education

Group.

Inno

Secondary School will offer an international curriculum for students

from grades seven to 13 from September 1, the start of the new academic

year.

“We

are actively adopting the Mastery Transcript Consortium (MTC) learning

models into our curriculum, which is the most advanced and disruptive

assessment method in the world, as well as A-levels, in the hopes that

students will be able to pursue their passions and career pathways

freely,” Qi said.

MTC is an international group of private and public secondary schools

founded in 2017 by Scott Looney, head of Hawken School in Northeast

Ohio.

Qi

said that half of the students are Hongkongers, 40 per cent from the

mainland and the rest from other countries. The school charges fees of

about HK$188,000 per year across all grades.

Hong Kong has seen an exodus of pupils and teachers as part of a wave of emigration following the introduction of the national security law. Some 15,000 students had left the city up to July 2021 since the law was implemented a year earlier.

Another

survey released on Monday showed a record number of both teachers and

students departed campuses in the 2020-21 academic year. Each school

lost an average of 7.1 teachers in 2020-21, with the figure standing at

3.9 in 2019-20 and 4.2 in 2018-19.

“I

used to worry about [the expat exodus in Hong Kong],” said Qi, adding

that he also found a lot of expat teachers want to come to Hong Kong.

He

said that 70 per cent of the teachers hired are from overseas. The

school interviewed 150 foreign teachers and hired six from countries

like Belgium, South Africa, and the UK.

The

school plans to limit the number of students to fewer than 60 for the

first year, Qi said, adding that the applications have exceeded the

number of spots available, leading to students being put on a waiting

list.

Qi said the group also planned to open a primary school and kindergarten in the next three to five years.

On financial and operational problems plaguing Hong Kong’s international schools, Qi said he was not concerned.

“If

you operate a school well, there is definitely no need to worry,” said

Qi. Since the group has the landlord’s explicit support, there will not

be much of a problem, he added.

Nick

Tang Ho-hong, CEO of Wang On Properties, said the company was pleased

to lease 50,000 sq ft of space in Maya by Nouvelle’s retail podium in

such a difficult retail environment.

“The

commercial lease transaction will help propel Yau Tong into one of the

upscale residential areas in East Kowloon,” Tang said.

(South China Morning Post)

中環中心呎租65元低20% 地產投資公司進駐

甲廈逐步走出疫情陰霾,市場頻錄承租個案,惟租金仍彈升乏力。由外號「磁帶大王」陳秉志持有的中環中心高層單位,新獲地產投資公司以每呎約65元承租,低市價近20%。

上址為中環中心67樓5室,建築面積約2264方呎,景觀以山景為主,外望少量海景,新以每呎約65元租出,月租約147160元,租戶為地產投資公司。

「磁帶大王」陳秉志持有

陳秉志接受本報查詢,證實單位已租出,他並表示,疫情走勢持續穩定,市場已逐步走出第五波陰霾,料整體市況逐步向好,中港兩地一旦通關,估計市場有力迅速復甦。

然而,據大型工商鋪代理行資料顯示,該甲廈高層近期呎租均高見每呎80元以上,其中,該廈高層10室於上月以每呎約80元租出,月租約198960元,若以市值呎租約80元計,上址最新租金低市價約近兩成。

中保集團大廈高層每呎29元租出

此外,中環區內商廈亦頻錄承租,其中,中保集團大廈高層10室,屬海景優質戶,建築面積1030方呎,新以每呎約29.1元租出,月租約29973元,上一手租金為每呎約33元,故最新租金下跌約12%。據地產代理指出,上址業主於1988年以179萬購入,以最新租金計,回報高約20厘水平。

同區蘭桂坊1號亦錄承租個案,該甲廈低層單位,建築面積約917方呎,新以每呎約43元租出,月租約39431元。

(星島日報)

更多中環中心寫字樓出租樓盤資訊請參閱:中環中心寫字樓出租

更多中環區甲級寫字樓出租樓盤資訊請參閱:中環區甲級寫字樓出租

更多中保集團大廈寫字樓出租樓盤資訊請參閱:中保集團大廈寫字樓出租

更多上環區甲級寫字樓出租樓盤資訊請參閱:上環區甲級寫字樓出租

油塘曦臺商場月租高達135萬 區內今年最大宗租賃 啟迪教育開設國際學校

東九龍錄大手鋪位租賃,啟迪教育集團承租油塘曦臺商場,以開辦國際學校,涉及總面積約49600方呎,租期超過10年,平均月租135萬,為東九龍今年以來最大宗商鋪租賃,平均呎租約27元。

啟迪教育集團承租油塘曦臺商場,涉及地下,1樓及2樓所有商業樓面,總面積約49600方呎,十年租金總額高達1.62億,為期逾10年,平均月租135萬,為東九龍今年以來最大宗商鋪租賃,平均呎租為27元。

總面積約4.96萬方呎

啟迪教育集團創辦人兼校長祁文迪表示,將以全新概念發展國際學校中學部,以開辦一諾中學 (Inno Secondary School),是一所為七至十三年級學生提供全日制課程的私立學校,集團曾考慮選址中環及奧運站等,最後落實油塘區,鍾情區內環境及配套,運動場、圖書館及行山景點,適宜辦學校,招生反應不俗,首階段全校6個年級,合共收生不多於60人,部分年級滿額,目前已錄取學生當中,半數為本港學生,四成來自內地,約一成為外國學生,每年學費18.8萬。

租約為期逾10年

他又指,集團目標為5年後全校學生增至500人,3至5年開辦小學及幼稚園部,8至10年覓地建永久校舍。儘管近年不少外國人士離港,無礙國際學校運作,該校七成職員來自海外,之前招聘時,共有150位外籍教師來應徵者,最終6人獲聘,來自英國、比利時及南非等地。

有外資代理行表示,隨着疫情進一步緩和,整體鋪市空置率漸回落,民生區商場空置率由2020年第四季5.4%,改善至2021年第四季4%。民生區商場租金於2021年第四季按年跌0.2%,跌幅較去年收窄。該代理認為現在鋪市已見底,預期未來市況改善。

宏安地產行政總裁鄧灝康指出,曦臺為宏安地產和旭輝合作發展,有關租賃是東九龍今年以來最大宗的,有助推動油塘新住宅區發展。旭輝控股海外投資及融資總監吳輝揚表示,夥拍宏安地產發展曦臺,住宅銷售反應熱烈,零售平台也覓得優質租客。

(星島日報)

核心區鋪位空置率按月微升

有代理行指出,四大核心區於今年4月空置率錄全綫上升,幅度介乎0.05%至0.16%,惟按年比較錄大幅下跌。

代理:按年比較皆大幅改善

有代理表示,今年4月各大核心區鋪位空置率走勢平穩,個別區份微升,與上月比較,差幅由約0.05%至0.16%,但按年各區表現則大見轉好。4月份中環商鋪空置率錄約13.60%,按月微升約0.06%,按年同期大幅回落約7.02%,屬最明顯的改善區域。其次為銅鑼灣,4月份錄到約5.40%,較3月份增添約0.05%,對比去年同期則明顯遞減5.12%。灣仔最新鋪位空置率為14.01%,按月提升約0.16%,按年比較就見下降約1.06%。

該代理續稱,尖沙嘴區按年變幅顯著下降,該區4月份商鋪空置率錄得10.47%,較3月份輕微上調0.09%,對比去年4月大幅減6.76%。旺角區商鋪空置率不變,4月份錄8.85%,按年遞減3%。

中環區表現佳 按年回落7.02%

該代理分析,雖然月內各區空置率略見微升,但整體表現對比一年前顯著改善,以餐飲業最進取,市場近期較矚目租務個案為銅鑼灣羅素街38號金朝陽中心地下A、B號及1樓,總面積約5200方呎,獲餐飲集團A La Carte預租以開設「變形金剛」主題餐廳,市傳成交月租約100萬,呎租約192元。

(星島日報)

更多金朝陽中心寫字樓出租樓盤資訊請參閱:金朝陽中心寫字樓出租

更多銅鑼灣區甲級寫字樓出租樓盤資訊請參閱:銅鑼灣區甲級寫字樓出租

栢麗大道求「翻身」 申改食肆變打卡勝地

在疫情陰霾下,旅客量大減,昔日曾風光一時的尖沙咀栢麗購物大道亦要變陣,剛向城規會申請改劃為食肆及商店等用途,發展自助餐廳、咖啡室及茶室等,希望吸引更多人流到訪,成區內另一地標。

上述的申請範圍屬於彌敦道111至139號、143至161號及165至181號栢麗購物大道地下及1樓,地盤佔地約5.82萬平方呎,現劃為「休憩用地」用途,而申請人栢麗購物大道業主立案法團指,擬將該項目改劃為「食肆」及「商店及服務行業」,並以地積比率約1.41倍發展,計劃提供任何類型的商店及服務行業,及主要提供小食茶點的食肆,包括自助餐廳、咖啡室及茶室,總樓面涉約8.22萬平方呎。

值得留意的是,為減低對九龍公園環境及於彌敦道成齡樹 (即已長至接近最高生長高度的樹) 影響的風險,計劃建議為「食肆」用途設置「不超過50%總樓面面積」的限制。

代理:租戶組合可趨多元化

申請人認為,項目是構成香港歷史和特色重要的一部分,尤其是它所代表的香港經濟繁榮的形象。由於尖沙咀區的經濟環境轉變及旅遊購物者的減少,令店舖關閉及城市活力下降,因此建議從城市規劃方面取得一些彈性,以便日後將一些現有的零售商店轉變為更多樣化、更具特色的其他商業用途。

此外,申請人會為擬建項目增加趣味點/打卡位,以應對社會經濟和市場的變化,並可為此彌敦道最寬闊的一段提升公共空間的趣味性,供香港本地居民及遊客享用。

有代理指,目前項目的舖位商戶,主要為售賣服裝、電器及珠寶等,惟受到疫情、旅客遞減等因素影響,零售行業承租意慾減少,交吉情況亦相對嚴重,業主叫租價亦見克制。該代理相信,若改劃成功,令租戶組合更趨多元化,必可增加消費人流,令項目活起來,屆時舖價將有所提升。

(經濟日報)

4綫滙聚 帶動金鐘商業樓面需求

東鐵綫過海段於5月中旬正式通車,金鐘從此變成「超級轉車站」,成為4綫交滙的核心地帶,進一步提高其發展潛力及對該區商廈及商舖的需求。未來金鐘預計將有罕見的大型商業樓面供應,單計金鐘廊及高等法院用地,已將會為該區新增逾250萬平方呎的商業樓面。

兩商業項目 新增逾250萬呎樓面

屬於金鐘指標商場之一的金鐘廊,於多年前已經構思重建,而去年底政府正式就開展金鐘廊重建發展計劃的擬建道路工程刊憲。雖然擬建的道路工程因曾接反對意見,需按法例調解,但發展局去年曾表示,待法定程序完成後,局方將會適時把用地納入賣地表中。據市場推算,地皮最快有機會於1至2年內推出,估值高達逾280億至300億元,每平方呎樓面地價約2.8萬至3萬元。

金鐘廊用地規模頗大,實屬近年該區規模較大的商業樓面供應。據規劃署文件顯示,地皮計劃分兩部分發展,當中東面鄰近統一中心的地盤佔地約6.7萬平方呎,擬重建48層高商廈,其中38層為寫字樓,涉約86.2萬平方呎,而西面地盤 (即現有金鐘廊行人通道) 則會保留,提供約2.6萬平方呎餐飲及零售樓面,兩地盤合共提供逾100萬平方呎的商業樓面。在東鐵綫過海段通車後,相信亦有望進一步帶動日後的商舖及商廈成交。

高等法院用地 規模僅次中環海濱地王

而另一規模龐大的區內商業地供應,是位處金鐘廊對面的高等法院用地。該用地估計佔地約10萬平方呎,早年政府亦曾研究將其騰空,以作商業發展。如以地積比率15倍發展,將可提供多達150萬平方呎商業樓面,估計規模將僅次去年由恒地 (00012) 奪得的中環新海濱3號商業地王。

由於中環、金鐘一帶為本港的傳統商業核心地帶,而且地皮供應罕有,每逢一推售即吸引發展商競投,當中位於中環、金鐘交界有兩個重建項目最快明年落成,其中一個為美利道地王項目,發展商恒地早於2017年以每平方呎樓面地價約5萬元投得,並將重建成1座36層,另設5層地庫的甲級商廈,總樓面面積約46.5萬平方呎,並已命名為

The Henderson,將於2023年落成。另外,長實和記大廈重建項目長江集團中心二期亦將會重建1幢樓高約41層的商廈,總樓面面積涉逾49萬平方呎。

(經濟日報)

更多統一中心寫字樓出租樓盤資訊請參閱:統一中心寫字樓出租

更多金鐘區甲級寫字樓出租樓盤資訊請參閱:金鐘區甲級寫字樓出租

更多The Henderson寫字樓出租樓盤資訊請參閱:The Henderson 寫字樓出租

更多長江集團中心二期寫字樓出租樓盤資訊請參閱:長江集團中心二期寫字樓出租

更多中環區甲級寫字樓出租樓盤資訊請參閱:中環區甲級寫字樓出租

Dorsey & Whitney has taken up 3,500 sq ft of space at Alexandra House in Central

Office rents in Central are currently a third lower at HK$116 (US$14.8) per square foot compared with the peak of HK$170 in 2019

International

law firm Dorsey & Whitney relocated on Wednesday to a 3,500 sq ft

prime office space in Hong Kong’s main business district of Central,

making it the latest law firm to take advantage of an office glut.

Such moves have offered some relief to office landlords

in the city, who have been struggling as overall office vacancy rates

remained stubbornly high at 9.4 per cent in March and April, according

to a property agency.

Dorsey’s office used to be in Pacific Place

in the neighbouring district of Admiralty, where it stayed for more

than two decades. It employs about 20 legal professionals in Hong Kong.

The new office is in Alexandra House,

a Hongkong Land property with 37 floors of office space above a retail

podium called Landmark Alexandra that houses luxury brands such as Dolce

& Gabbana, Prada, Saint Laurent and Tory Burch.

“Our

new home in Hong Kong brings us much closer to our clients in the heart

of Central,” said Simon Chan, head of Dorsey’s Hong Kong office.

“Moving to this prestigious location and more efficiently using our

space were two of the driving factors in our move.”

The

move puts the firm within walking distance of clients, the stock

exchange, banks, financial institutions, conglomerates, family offices,

and local law firms that it serves and collaborates with, Chan said.

The 110-year-old Minneapolis-headquartered law firm opened its Hong

Kong office in 1995. It has 20 locations across the US, Canada, Europe

and Asia-Pacific.

The

Hong Kong office has served as crucial connector both into Asia and

from Asia to the US and the rest of the world. It provides services such

as dispute resolution and assistance for cross-border mergers and

acquisitions, corporate finance and international capital markets

transactions.

“Our

team in Hong Kong is committed to the highest quality service to

clients, and our new location is one more way that we invest in that

commitment,” said Dorsey managing partner Bill Stoeri.

Dorsey’s relocation follows that of New York-headquartered White & Case, which opened in April a 25,000 sq ft office across three floors at York House, Central, also owned by Hongkong Land.

“We

have seen a trend of well-performing businesses looking to move to

Central or relocate within Central” due to the upgrade in quality, said

Neil Anderson, director and head of office, commercial property at

Hongkong. “Recent leasing activity in Central underlines its continuing

resilience and value at the nexus of the capital markets and business

community in Hong Kong.”

The

average prime office rent in Central currently stands at HK$116

(US$14.8) per square foot, nearly 32 per cent lower than the peak of

HK$170 in 2019, according to a property agent. Overall prime office

rents in Hong Kong have fallen by more than a quarter to HK$53 per

square foot.

“We

do see multinational companies relocating within or to Central, or

upgrading their space to higher-quality buildings in various

sub-markets,” the agent said. “The reasons are rental savings, better

specifications of buildings and other long-term business strategies.”

The

office property market would have been more active if Hong Kong had not

been hit hard by the fifth wave of the pandemic, according to another

property agency.

“Landlords are beginning to speak to occupiers about potential early lease renewals to retain existing tenants,” agent said.

The

agency which had originally anticipated a slight recovery of around 1

per cent for the year, now expects overall Hong Kong and CBD grade A

office rents to correct by 5 per cent.

Another

agency however, expects office rents to trend higher. Rents in Central

could rise between 5 and 10 per cent, and overall Hong Kong office rents

by as much as 5 per cent, agent said.

(South China Morning Post)

For more information of Office for Lease at Alexandra House please visit: Office for Lease at Alexandra House

For more information of Office for Lease at York House please visit: Office for Lease at York House

For more information of Grade A Office for Lease in Central please visit: Grade A Office for Lease in Central

For more information of Office for Lease at Pacific Place please visit: Office for Lease at Pacific Place

For more information of Grade A Office for Lease in Admiralty please visit: Grade A Office for Lease in Admiralty

Henderson Land says John Lee’s pledge to speed up housing and land supply will benefit homebuyers, the government and developers

Co-chairman

Peter Lee says developer will help Hong Kong’s next leader with scheme

to provide training and mentoring to 1,000 junior secondary school

students living in subdivided flats

We believe that the demand in the second half will be strong, co-chairman Martin Lee says

Henderson Land Development, which was founded by Lee Shau-kee, Hong Kong’s second-richest man,

said it expected that a pledge by John Lee Ka-chiu, Hong Kong’s next

leader, to speed up housing and land supply would benefit homebuyers,

the government as well as developers.

“We

agree that Hong Kong should boost the supply of land in both quantity

and quality, as mentioned by chief executive-elect John Lee,” Martin Lee

Ka-shing, Henderson Land’s co-chairman and Lee Shau-kee’s younger son,

said at an annual general meeting held on Wednesday.

Peter

Lee Ka-kit, Henderson Land’s other co-chairman and the founder’s elder

son, said that Henderson Land would help John Lee complete his pilot

scheme and help 1,000 junior secondary school students living in

subdivided flats with training and mentoring programmes. “The scheme

will offer 1,000 children a better future and help to narrow the gap

between the rich and the poor,” he said.

Henderson Land

is betting on a recovery in Hong Kong’s housing market in the second

half of this year, as the city’s Covid-19 outbreak is brought under

control. “Social distancing controls have been relaxed, and we believe

that the demand in the second half will be strong,” Martin Lee said,

adding that the company was planning to roll out the 2,800-unit Baker

Circle project in Hung Hom.

Baker Circle

is expected to be put onto the market for sales this month at the

earliest, and is one of the biggest urban residential redevelopment

projects by a private developer in Hong Kong.

Henderson Land has spent more than 20 years and billions of dollars on

property acquisitions for Baker Circle, which will have a total gross

floor area of about 1 million sq ft. It will include an almost 1

kilometre long pedestrian street inspired by Coal Drops Yard, a shopping

area near King’s Cross in London.

On

the mainland, Peter Lee said that due to the recent lockdown in

Shanghai, projects in the city had been delayed by about half a year.

“Most of the places have reopened today and our work can be resumed. We

will try to catch up in the second half,” he said.

Shanghai ended its two-month-long citywide lockdown on Wednesday, allowing 2.67 million businesses to resume operations.

Henderson

Land has six commercial properties for leasing, including offices and

shopping centres, in Shanghai. Its commercial complex Lumina Shanghai in

Xuhui Riverside District is currently under construction and is

expected to be launched this year.

(South China Morning Post)

11,292-home plan for Yuen Long rejected

Sun

Hung Kai Properties (0016) and Hongkong Land's 2019 application for an

11,292-flat project in Shek Wu Wai in Yuen Long was rejected by Town

Planning Board yesterday.

The

project is located at San Tin/Lok Ma Chau and the future development of

the area has not yet been formulated, therefore the rezoning

application was not supported, the board said. The developers said they

were aware of the TPB's decision and that they had submitted another

rezoning application earlier in May this year, which would be more in

line with the government's latest planning and development framework.

(The Standard)

遠東金融中心呎租55元減25% 放盤5個月獲承租

受疫情打擊,核心區甲廈租金急下滑。消息指,金鐘遠東金融中心中層單位以每呎約55元租出,較舊租下跌約25%。

市場消息指出,金鐘遠東金融中心中層2室,建築面積約2703方呎,新以每呎約55元租出,月租約148665元,惟上址上一手租金為每呎74元,因租戶有意撤出,故業主今年初率先將物業放租,至今五個月,近期租戶約滿,單位亦速獲承租,租金明顯下滑,但屬貼市價水平。

租金回報3厘

據代理指出,上址業主於2012年以5946.6萬購入,呎價約2.2萬,享回報約3厘水平。據代理資料顯示,該甲廈今年以來錄5宗租務個案,成交呎租介乎48元至55元,最新個案為該甲廈中層4室,建築面積2980方呎,今年4月以每呎約55元租出,月租約16.39萬。

力寶中心每呎44元租出

另外,同區甲廈力寶中心亦錄承租個案,消息指,該廈2座低層8室,建築面積1925方呎,新以每呎約44元租出,月租約8.47萬。上址舊租金每呎55元,故最新租金下跌約2成。

業內人士分析指,由於力寶中心業權分散,不少單位交吉,業主議價空間較闊,疫情爆發期間,甲廈供過於求,拖累租務需求急劇萎縮,租金明顯受壓。

本報統計資料顯示,金鐘力寶中心於去年第四季平均呎租約54.1元,較兩年前急挫約34%,屬十大甲廈中於疫市期間跌幅「最傷」甲廈。

(星島日報)

更多遠東金融中心寫字樓出租樓盤資訊請參閱:遠東金融中心寫字樓出租

更多力寶中心寫字樓出租樓盤資訊請參閱:力寶中心寫字樓出租

更多金鐘區甲級寫字樓出租樓盤資訊請參閱:金鐘區甲級寫字樓出租

凱龍瑞上環商廈意向4.5億

隨疫情放緩,業主亦趁勢放售旗下物業。有外資代理行表示,由凱龍瑞基金持有的上環永樂街58號全幢商廈物業,以招標形式放售,項目樓高21層,總建築樓面2.01萬方呎,共提供20層商業空間,地下設有一個鋪位,意向價為4.5億,呎價約22388元。

信和工中短炒獲利66萬

代理指出,該物業位於上環商業核心區,價錢吸引並具有命名權,料對用家及投資者均具吸引力。資料顯示,凱龍瑞基金早前以招標放售謝斐道303號全幢商廈及毗鄰的海外信託銀行大廈41個車位,市值共18.5億。

另外,工廈市場亦錄短炒獲利個案。有代理表示,九龍灣啟祥道9號信和工商中心7樓1室,建築面積約2119方呎,位處大單邊,以約868萬易手,呎價約4096元。原業主為區內資深投資者於去年11月以約802萬購入,持貨僅約半年帳面獲利約66萬,物業期間迅速升值約8.2%。

此外,另一代理表示,觀塘偉業街170號豐業工業大廈1樓A室,建築面積約1526方呎,以意向月租約3.5萬招租,呎租約23元。

(星島日報)

更多海外信託銀行大廈寫字樓出售樓盤資訊請參閱:海外信託銀行大廈寫字樓出售

更多灣仔區甲級寫字樓出售樓盤資訊請參閱:灣仔區甲級寫字樓出售

太古坊二座租6層 疫後港島最大手

中信銀行「升級」 租甲廈逾13萬呎每呎約50元

甲廈新需求疲弱,而大手租務僅屬搬遷。今年入伙的太古坊二座錄得大手成交,中信銀行 (國際) 租用物業6層逾13萬呎樓面,為疫後港島區最大手甲廈租務,該銀行原租用同區太古地產 (01972) 旗下德宏大廈,是次搬遷可提升寫字樓級數,呎租料約50元。

港島甲廈錄得一宗大手租務,涉及今年即將落成的鰂魚涌太古坊新商廈,太古坊二座多層獲承租,涉及低層及中層各3層樓面,合共6層樓面,以每層面積約2.2萬平方呎,涉及逾13萬平方呎。按面積計,為疫情後港島區最大手甲廈租務成交個案。

據了解,新租客為大型中資機構中信銀行,該集團租用本港多幢物業,包括位於太古坊的德宏大廈多層,是次搬至同屬太古地產旗下物業,而太古坊二座為全新甲廈,質素大幅提升,而租用樓面則相若,未有擴充。

今年落成的太古坊二座,近日錄得另一宗全層成交,涉及物業中層全層逾2萬平方呎,呎租料約50元,新租客為顧問公司Boston Consulting,該公司原租太古坊一座約1萬平方呎單位,如今搬至二座,樓面有所擴充。

中區4月呎租103 本年累跌1.1%

太古地產早年啟動太古坊重建計劃,一座已於2018年入伙,而康和大廈及和域大廈,重建為總樓面面積約100萬平方呎的「太古坊二座」,預計今年中入伙。據悉,現時大廈預租率逾半,除了中信銀行外,另一大租客為瑞士私人銀行寶盛集團 (Julius Baer Group Ltd),租用物業4層共約9.18萬平方呎樓面,呎租約50元。該集團原租用中環交易廣場等,搬遷可大幅節省租金開支。

疫情下甲廈租金仍在低位徘徊,據一間外資代理行數據顯示,4月中區甲廈呎租約102.5元,本年暫累跌約1.1%,跌幅不算多,而港島東最新報48.8元,今年累跌約2%,而全港整體租金今年跌不足1%,按年跌2.5%,反映過去一年甲廈租金跌勢已喘定。

該行代理指,首季本港爆發第5波疫情,睇樓活動急停,至近日疫情緩和,機構睇樓活動明顯增加。該代理指,受環球疫情影響,各跨國機構取態仍非常審慎,主要考慮節省成本,極少擴充個案,而搬遷涉及成本包括裝修費等,故部分選擇續租。

甲廈高峰租跌25% 再跌空間微

該代理預計,因商業活動略為增加,部分機構考慮搬遷可節省開支及提升寫字樓級數,相信今年下半年租務個案上升。租金方面,她指甲廈租金從高峰期回落約25%,相信再下跌空間不多,惟空置樓面仍不少,故租金較為平穩,暫難明顯反彈。

(經濟日報)

更多太古坊一座寫字樓出租樓盤資訊請參閱:太古坊一座寫字樓出租

更多太古坊二座寫字樓出租樓盤資訊請參閱:太古坊二座寫字樓出租

更多德宏大廈寫字樓出租樓盤資訊請參閱:德宏大廈寫字樓出租

更多鰂魚涌區甲級寫字樓出租樓盤資訊請參閱:鰂魚涌區甲級寫字樓出租

更多交易廣場寫字樓出租樓盤資訊請參閱:交易廣場寫字樓出租

更多中環區甲級寫字樓出租樓盤資訊請參閱:中環區甲級寫字樓出租

企業「只搬不擴」 商廈空置暫難減

本港仍未與多國通關,新需求維持疲弱,搬遷而乏擴充,令空置樓面仍多,加上今明兩年大量新供應,空置率勢仍在高水平。

甲廈空置11.6% 近10年新高

受長達兩年疫情衝擊,本港與內地以至歐美地區採嚴謹檢疫政策,商務往來大幅減少,導致甲廈租務活動變得頗為淡靜。據一間外資代理行數據顯示,本港甲廈最新空置率為11.6%,屬近10多年來新高,空置樓面近千萬平方呎,為歷史上最多,可見疫情衝擊之巨大。

近兩年甲廈租務因新需求下跌,故多個季度出現甲廈負吸納情況,直至去年尾情況有所改善。不過,第5波疫情殺到,令甲廈租務再度受打擊。現時疫情緩和,相信可吸引個別機構重新部署,租務氣氛可望稍轉好。

即使最近甲廈租務活動少許增加,新成交個案主要為搬遷個案。事實上,機構作出搬遷,吸納一批新樓面同時,原租用樓面騰出待租,對整體空置率實在變化不大。因此一日未落實通關,內地及海外機構未能來港進行視察,擴充活動仍然偏少,甲廈新需求仍疲弱。

新供應將臨 租務預計不佳

另一商廈市場負面因素為新供應,據數據顯示,今明兩年為甲廈高峰期,本年將有為430萬平方呎樓面推出,明年再有達320萬平方呎供應,兩年合共逾750萬平方呎樓面。以今年新落成項目,預租情況普遍不算理想。本身空置樓面近千萬呎,兩年新增700萬平方呎樓面,將令甲廈空置率維持高水平一段長時間。

(經濟日報)

九龍區方面,多宗甲廈租務均屬搬遷而縮減規模,如美資公司租用觀塘創紀之城5期寫字樓1.3萬平方呎,涉及縮減半數樓面。

原租用九龍灣宏天廣場

市場消息指,觀塘創紀之城5期20樓單位,面積約1.3萬平方呎,以每平呎約30元租出。該廈為apm商場樓上,為觀塘區甲廈指標。據悉,新租客為一家美資企業,從事採購業務。該機構原租用九龍灣宏天廣場約2.7萬平方呎單位,是次搬遷縮減逾半樓面,而寫字樓級數略為提升。

同區屢錄縮減業務個案,消息指,觀塘宏利廣場 (前稱國際貿易中心) 3.6萬平方呎樓面,以每平方呎約30餘元租出。據悉,新租客為船務公司,原租用同區建生廣場約4.3萬平方呎,是次搬遷縮減7,000呎單位。此外,較早前旺角新世紀廣場全層2.6萬平方呎樓面,獲電子品牌樂聲牌租用,品牌亦大幅縮減逾萬呎樓面。

東九甲廈質素新租金低

分析指,由於環球疫情影響不少行業,故經濟仍有隱憂下,機構多進行縮減成本,而東九龍甲廈質素新而租金偏低,故仍錄不少租務活動。租金方面,因東九龍空置率高達15%,租金仍在低位。

另東九龍租務上,消費指,九龍灣宏天廣場高層10B室,面積約1,719平方呎,以每平方呎約23元租出。另同區國際交易中心中層11B至12A室,面積約1,000平方呎,成交呎租約18元。

(經濟日報)

更多創紀之城寫字樓出租樓盤資訊請參閱:創紀之城寫字樓出租

更多宏利廣場寫字樓出租樓盤資訊請參閱:宏利廣場寫字樓出租

更多觀塘區甲級寫字樓出租樓盤資訊請參閱:觀塘區甲級寫字樓出租

更多宏天廣場寫字樓出租樓盤資訊請參閱:宏天廣場寫字樓出租

更多國際交易中心寫字樓出租樓盤資訊請參閱:國際交易中心寫字樓出租

更多九龍灣區甲級寫字樓出租樓盤資訊請參閱:九龍灣區甲級寫字樓出租

更多新世紀廣場寫字樓出租樓盤資訊請參閱:新世紀廣場寫字樓出租

更多旺角區甲級寫字樓出租樓盤資訊請參閱:旺角區甲級寫字樓出租

Market sizzles as Tai Po flats sell out

Both the primary and secondary property markets performed well over the long Tuen Ng festival weekend.

Sun Hung Kai Properties (0016) launched another batch of 153 homes at phase 1 of Silicon Hill in Tai Po on the back of selling all the 170 flats in the first round of sales last Friday.

The

batch, which comprises studio units to three-bedroom units, is priced

from HK$3.8 million to HK$10.9 million after discounts, or from

HK$16,427 to HK$20,354 per square foot.

These homes on average cost HK$17,661 per sq ft and have a market value of around HK$1.3 billion, the home builder said.

The sales may take place as early as Saturday, it said.

The first round of sales generated HK$1.37 billion in contracted sales and it had also sold two homes via tender, SHKP said.

An

848-sq-ft three-bedroom flat with a 435-sq-ft rooftop was sold for

HK$18.84 million, or HK$22,212 per sq ft, and the other home also with

three bedrooms was sold for HK$12.62 million, or HK$21,000 per sq ft, it

added.

In the

second-hand market, home sales at 10 major housing estates rose 14.3

percent, or two to 16 cases over the weekend, which was a six-week high

and remained in the double-digit level for the twelfth consecutive

weekend, a property agency said.

The turnover will increase to 21 if Friday's sales are included, it stated.

An agent said that there were not many new homes in the market during the Dragon Boat Festival holiday apart from Silicon Hill, which boosted the performance of the secondary market.

The

agent expects that the second-hand market sentiment to be stable as the

sector gradually recovers from the hit in the first quarter.

Another property agency also recorded a 14.3 percent growth in the number of transactions over the weekend to 16.

Although

second-hand home sales remained active, the property agency's home

price index slipped last week, reflecting that the overall property

prices were under pressure in the wake of the launches of new projects,

the agent said.

The agent believes that the market will continue to focus on first-hand properties this month and new home sales may top 2,000.

(The Standard)

工商鋪錄436宗按月升16% 代理行:料後市平穩發展

本港疫情陰霾漸消退,投資氣氛稍有回暖,工商鋪註冊量齊升。有代理行綜合土地註冊處資料顯示,工商鋪5月份註冊量錄436宗,按月升約16.6%,金額錄67.77億,按月躍升約43%。該行認為,市場上負面氣氛漸消退,預料後市交投平穩發展。

逾億元註冊錄14宗

5月份工商鋪各板塊宗數及金額全綫上升。工廈及商鋪註冊分別按月升約21.7%及13.7%,最新分別錄241及116宗。商廈註冊量則按月上升6.8%,最新報79宗,再創今年以來單月最高。5月份整體註冊宗數最新報436宗,按月升約16.6%。

若按金額劃分,5月份註冊量最多的為500萬以下的物業,共錄221宗,按月升約11.1%。逾500萬以上至1,000萬的物業,共錄93宗,按月急升約57.6%。逾2000萬至5000萬物業錄7.7%按月跌幅,5月共錄36宗。逾5000萬至1億物業表現較遜,錄10宗登記,按月跌41.2%。5月逾1億物業表現不俗,按月漲升2.5倍,註冊宗數錄14宗,按月增10宗,當中9宗為工廈註冊,包括葵涌達利大廈16樓1至8室及17樓1至4室,以約2.64億成交。

股市波動影響投資氣氛

該行代理表示,內地早前爆發疫情、俄烏戰爭等而實施的封控措施,令全球供應鏈受到一定程度衝擊,影響投資氣氛,雖然近日出現感染群組,但隨着食肆堂食限制和營業時間放寬,負面氣氛開始退卻,不過,最受市場關注的通關仍然未有消息,預料在未有重大利好消息出現前,後市仍繼續平穩發展。

(星島日報)

代理行:工商鋪價量連升3個月

環球經濟未見明朗,加上俄烏戰事持續,股票走勢反覆,資金流入工商。有代理行統計,5月份市場共錄約404宗工商鋪買賣,涉及總金額約112.15億,對比上月分別遞增約13.16%及21.99%。

當中工廈受追捧,月內錄得四宗逾億成交,大額交易亦有利增強投資者信心,月內工廈買賣成交量佔整體約60%。

該行代理表示,5月份錄得宗大額成交所動,工廈表現最突出,5月份工廈錄約245宗交,佔整體成交量約60%,成交金額則近70億元,佔整體成交金額約62%,最大宗為嘉里建設以作價約46.2億沽出兩個分別位於沙田及柴灣的貨倉予華潤物流,暫成今年度最大宗工廈買賣。外資基金表現積極。市場消息指,粉嶺業暢街6號新中國洗衣集團大廈全幢作價以約4.5億易手,預計將項目轉作凍倉用途以作長線收租。

工廈成交佔整體約60%

同時,5月份商鋪買賣宗數亦見平穩,錄得約100宗水平,主因涉及多宗市區重建收購。如樂風集團於月內夥拍外資基金成功收購尖沙嘴漢口道31至37號舊樓大部分業權,料總收購金額約15億,並計畫申請強拍統一業權以重建成甲廈。

該代理分析,隨着本港疫情漸趨緩和,本地發展商亦積極吸納舊樓以增土地儲蓄。

此外,該代理認為,香港作為國際金融中心,金融地位穩固,工商鋪市況正全面復甦,不少發展商、財團及投資者都積極入市,大額成交陸續出現,為投資者打下強心針。內地疫情受控,兩地通關安排有望推進,預計工商鋪買賣將愈見頻繁。

(星島日報)

何文田The Argyle全幢 7億洽至尾聲

住宅租務需求強勁,帶動相關投資。消息指,何文田The Argyle全幢住宅租賃項目,獲財團7億元洽購至尾聲,料短期內易手。

何文田The Argyle全幢,正獲財團洽購。該物業位於亞皆老街,鄰近勝利道及太平道,位置理想。該項目由萬泰持有作收租,消息指,項目獲以7億元洽購至尾聲。

商住大樓 現提供36伙住宅

物業於2015年落成,項目地下及1樓為商舖,舖位面積約6,165平方呎,6至29樓為住宅,總建築樓面約36,997平方呎,而住宅部分實用面積約23,032平方呎,以市值約7億元計,建築面積呎價約1.9萬元。

項目合共提供36伙,實用面積由約440至980平方呎,採2至3房設計。項目6至20樓為2房及2房 (連套房) 間隔,實用面積分別為約440及645平方呎。而21至29樓為Simplex特色戶,採3房 (連套房) 及工人房設計,實用面積約980平方呎,另會所提供雅座及健身室等設施。

業主於2016年把物業推出進行招租,入場費約2.3萬元起,呎租約54元起,租期由6個月起至兩年。

據了解,項目以部分交吉及部分連同現有租約出售,住宅部分出租率約85%,租金收入約85萬元,商業部分全數租出,分別由餐廳、超市及教育中心租用,全幢每月租金收入約113萬元,按7億元洽購價計,回報近2厘。

(經濟日報)

工廈進可攻退可守 基金追捧

代理:活化作數據中心 絕對有前景

投資市場以工廈表現一枝獨秀,有外資代理行認為,工廈「進可攻退可守」,既有增值空間而收租亦穩定,深得基金追捧。該行指,數據與市民生活息息相關,故工廈活化成數據中心絕對有前景。

據該行數據,去年大手買賣投資市場上,商廈、舖位等均不及工廈出色,2021年共錄57宗大手工廈成交,佔整體比例約33%;涉及金額289億元,佔總金額39%。踏入2022年,即使第5波疫情出現,工廈亦獲資金追捧,截至上月尾,共錄22宗大額工廈成交,佔44%;而涉及金額為131.2億元,佔52%。換言之,今年大額買賣中,半數來自工廈成交。

疫情緩和,大手買賣開始出現,成交集中在工廈,先有美資基金Nuveen以近29億元購入葵涌集運中心全幢,該物業總樓面面積約26.62萬平方呎,呎價高見1.09萬元。兩星期前,嘉里 (00683) 更以約46億元,沽出火炭、柴灣兩項貨倉物業,買家為華潤物流,料購入自用。

該行代理指出,工廈投資市場近年出現明顯變化,「數年前,工廈工作室拆售興起,財團購入工廈樓面再進行拆售。近兩年工廈大額投資形式有變,多涉及全幢物業,而成交比例高達5成,是前所未有。」

該代理指,近兩年工廈買家中,外資基金所佔比例頗高,「環球資金非常充裕,外資基金特別增設亞洲房地產基金,能夠在短時間內籌集10億至20億美元,於1至2年內買物業,才可以向投資者交代。基金既有增值空間,收租亦穩定,防守性高。」該代理分析,工廈勝在進可攻退可守,「防守方面,工廈出租率偏高,過去半年,工廈不論分層及物流貨倉,空置率近乎歷來最低,租金沒有下跌空間,更相信會微升,故收租夠穩定。早年基金集中買寫字樓,惟近年經常有租戶退租消息,空置率高,外資基金寧夥拍本地營運商投資工廈,進可攻退可守。」

疫情令消費模式改變 工廈需求大

疫情令商舖、商廈需求降,而工廈卻受捧。該代理指,疫情令消費模式改變,「網購增加,而在疫情下物流的流轉受影響,積存貨物時間較長,故需要更多貨倉,令物流及貨倉重要性提高。」除此之外,外資基金黑石、Brookfield以及新加坡StorHub,近月不斷購入觀塘、沙田等分層工廈,發展迷你倉業務,同樣反映財團看好倉庫市場。

該代理認為活化措施下,不少財團把工廈轉作數據中心,「今次活化工廈措施最大分別,是逾一半申請傾向改建數據中心。」該代理指,疫情下數據中心更有前景,「數據中心與生活息息相關,市民需要在家工中,加上網購等,雲端服務需求只會提升,因此數據中心前景理想,吸引改裝。」

(經濟日報)

東鐵過海效應 火炭工廈潛力高

政府推出工廈補地價標準金額,有利工廈轉住宅用途。有外資代理行代理認為,東鐵綫過海段通車後,火炭工廈轉用住宅潛力更高。

工廈重建「標準金額」補地價先導計劃實施1年多,工廈可補地價重建商業項目或住宅。事實上,住宅在港長期供不應求,工廈轉作住宅有商機。事實上,長實 (01113) 去年曾向城規會提出改劃申請,把比鄰火炭站附近用地,由「工業」用途改劃為「住宅 (戊類)」、「政府、機構或社區」、「休憩用地」,可興建24座28至38層的住宅樓宇,並將提供4,706伙住宅。

工廈區轉住宅 較發展北都快

另外,荃灣大窩口工業區一帶7個項目工廈重建項目中,涉及約182萬平方呎樓面正在進行,當中沙咀道一帶漸轉型成住宅區,包括新地 (00016) 牽頭的住宅項目,提供約1,330伙。

該代理指出,若把火炭、荃灣等兩工廈地改成住宅,已提供6,000多伙單位。該代理指,「兩大發展商希望在工業區補價重建住宅,既可積極提供更多住宅,而若透過標準補地價金額,可縮短補地價時間,發展商可貨如輪轉,故值得留意。」該代理指,工廈重建住宅勝在夠快,「個別港鐵沿綫工業區,已有一定交通配套。相比起政府發展北部都會區,要長達十多年時間,工廈區轉住宅快得多。」

地區上,該代理認為火炭區非常適合,因東鐵綫過海段通車後,沙田及火炭來往港島區時間縮短,工廈轉住宅的潛力最好。至於會否推動財團入市購工廈,他認為機會不高,「現時適合大型發展商持有工廈作牽頭角色,聯同區內其他業主一起申請。對外來財團來說,購入工廈需要一大筆資金,再補地價及建築等,成本太高。」

(經濟日報)

有代理行表示,尖東新東海商業中心1樓6個相連單位放售,總面積約2400方呎,業主意向售價約5400萬元,呎價約2.25萬元。

該行指出,物業現時由多間餐廳及零售用戶租用,每月租金合共約13.5萬元。單位附設來去水位,適合營運多種行業,物業更設有外牆招牌,宣傳效益巨大。

(信報)

更多新東海商業中心寫字樓出售樓盤資訊請參閱:新東海商業中心寫字樓出售

更多尖沙咀區甲級寫字樓出售樓盤資訊請參閱:尖沙咀區甲級寫字樓出售

Hong Kong’s property market regains mojo as deals hit 10-month high in May

Overall

property transactions jumped 63.8 per cent month-on-month to 7,949 in

May, which was also the highest since 9,957 clocked in July 2021

Sales of new homes saw the biggest jump in May, rising nearly fivefold to 1,492 units from the previous month

Hong

Kong’s property market picked up momentum in May, with deals hitting a

10-month high, building on the gains of the previous month as homebuyers

returned after the fifth wave of Covid-19 was brought under control.

Total

transactions, including residential, commercial and industrial

properties as well as parking spaces, rose 63.8 per cent month-on-month

to 7,949 in May, according to data from the Land Registry. It was also

the highest total since 9,957 deals were completed in July 2021.

“As

the pandemic continues to stabilise, the government has gradually

relaxed social distancing measures, helping to lift property market

sentiment,” a property agent said.

The

brisk second-hand transactions, coupled with the enthusiastic response

of buyers to many new launches, led to a significant increase in the

overall number of deals in May, the agent said.

The

May figure was more than double the 3,828 transactions in March. The

biggest jump was for new homes, sales of which skyrocketed nearly

fivefold to 1,492 from the previous month.

The most popular projects included the first phase of Grand Mayfair, which sold 701 flats, and Monaco Marine, which sold 267 homes.

Ricky

Wong Kwong-yiu, managing director of Wheelock Properties, expects

sales of new homes to remain at around 1,500 in the coming months as

developers speed up launches, taking advantage of an improvement in

sentiment following the easing of the fifth wave of the coronavirus

pandemic.

A 1,206 sq ft flat with a rooftop at K Wah International’s K Summit

development in Kai Tak on Thursday sold for HK$48.3 million (US$6.16

million), or HK$40,050 per sq ft. Both figures are the highest for the

project.

Chinachem

Group sold three duplex flats at the luxury project Bisney Crest in Pok

Fu Lam in two days. One of them, measuring 1,640 sq ft, sold for HK$60

million on Wednesday.

Sino Land sold one flat at 133 Portofino in Sai Kung measuring 1,076 sq ft on Sunday for HK$21.8 million.

On

the outlook for this month, a property agent said that transactions are

likely to drop by as much as 18 per cent to around 6,550.

“In

the second-hand residential market transactions are slowing down as

owners have become more ambitious [with asking prices] and some have

even raised asking prices, narrowing the room for bargaining,” the agent

said.

Coupled

with new residential launches that are competing for buyers, the number

of second-hand transactions may soften by 20 to 30 per cent this month,

the agent added.

Another agent expects that the overall sales figure in June to decline by up to 12 per cent to around 7,000 in June.

“Second-hand

bargain properties have been purchased, and sales have slowed down,”

the agent said. “The primary market is seeing launches with restrained

pricing, which has diverted second-hand buying power.”

(South China Morning Post)

Hong Kong homebuyers mark Dragon Boat Festival by buying all flats at Sun Hung Kai’s Silicon Hill project in New Territories

Silicon Hill’s first round is priced 6 per cent lower than the average price of lived-in homes at SHKP’s St Martin development

Young buyers are betting on the future of Pak Shek Kok, a property agent said

Hong

Kong homebuyers turned out in droves on the Dragon Boat Festival

holiday on Friday and snapped all homes that Sun Hung Kai Properties

(SHKP) offered in New Territories, despite an expected hike in interest

rates and the city’s weakened economy.

All 170 homes put on the market at Silicon Hill

in Pak Shek Kok in the city’s northeastern Tai Po district were sold as

of 5pm, agents said. Another 18 homes had been offered through tender

and the results of these bids have not been made public yet.

The

project comprises three phases and 1,871 homes, and its first round was

priced at an average of HK$17,498 (US$2,230) per square foot, 6 per

cent lower than the average price of lived-in homes at St Martin, which

is a 10-minute walk away from Silicon Hill and was launched by SHKP four years ago.

“Many

young buyers, aged around 30, bought their first homes, as the total

price was not that high. They were also betting on the future of Pak

Shek Kok, where the launch of a new MTR station has been confirmed,” a

property agent said.

The

city’s home market has been robust in recent months, defying an

expected interest rate hike and still weak economic growth. The cost of

buying a house locally is rising, with the benchmark one-month Hong Kong

Interbank Offered Rate (Hibor) expected to rise to 1.5 per cent in the

third quarter of this year. It will follow the same upwards trajectory

as the higher interest rates set by the US Federal Reserve and the Hong

Kong Monetary Authority.

At

the same time, the local jobless rate in the three months ending April

rose to 5.4 per cent, its highest level in 12 months, and about 206,100

people were out of work in this period.

At

the same time, a price index of lived-in homes compiled by the Hong

Kong government edged up 0.4 per cent to 390.8 in April and was about

1.5 per cent shy of the 396.9 recorded in May 2019.

Analysts

said they expected the increase in May to amount to 1.5 per cent, which

meant the index could break this record. And if the index rose by about

1 per cent in June, it could climb to the unprecedented 400-point mark.

The cheapest unit on offer at Silicon Hill

was a 291 sq ft studio priced at HK$4.96 million. About 3,200 bids were

received for the first batch, which means about 18 people were vying

for every unit on sale.

“It

is mainly due to the easing of the Covid-19 outbreak. Homebuyers expect

things will bottom out in the second half,” another property agent

said. New home sales were expected to rise to 2,000 units this month, as

new developments gradually enter the market, the agent added.

(South China Morning Post)

4月商廈買賣 78宗今年新高

有代理表示,商廈買賣登記已在首季見底,經4月反彈後,5月料重越百宗的相對高水平,而6月可續看俏。根據土地註冊處數據,2022年4月全港共錄78宗商廈買賣登記 (數字主要反映2至4星期前商廈市場實際市況),較3月的49宗大增59%,為連跌4個月後首現反彈,並創今年以來的高位。

4月商廈登記實現量值齊升,當中成交金額更激增1.74倍,主因是5,000萬元以上大額登記急升,帶動4月商廈買賣登記金額重上20.54億元,為連跌3個月後一舉反彈至今年新高。至於,4月最矚目的單一登記項目為灣仔會展廣場辦公大樓21樓2室,涉及合約金額2.02億元;而同址的22樓2室及23樓2室,同樣各自以2.02億元登記。

億元以上物業 買賣升5倍

按物業價格劃分,在7個價格組別的登記量當中,錄得6升1跌。在升幅者中,以1億元或以上組別的5倍升幅最凌厲,月內登記量由3月的1宗激增至4月的6宗;而5,000萬至1億元以內組別亦大漲3.5倍,錄得9宗登記。

至於登記量最活躍的是介乎200萬至500萬元以內的細價組別,月內錄得22宗,按月亦升1.75倍;而唯一逆市錄得跌幅者為銀碼在1,000萬至2,000萬元以內的中價組別,登記量按月減少23%,錄得10宗買賣登記。

以地區劃分,在該行觀察的11個分區當中,共有7區的登記量按月上升;當中更有3區「破蛋」及2區倍升的佳況;破蛋者包括西營盤/堅尼地城區、九龍灣區及沙田區。至於灣仔/銅鑼灣區買賣登記量按月急增3倍,勁錄28宗,成為月內最活躍的觀察區,主要受惠灣仔會展廣場辦公大樓21至23樓合共錄得18宗登記所帶動。至於觀塘區在低基數下,亦錄得2倍升幅,月內錄得3宗登記。

代理指出,原本受第5波疫情遏抑的商廈,於疫情轉緩後隨即出現顯著反彈,反映資金重拾入市信心,料在防疫措施逐步鬆綁下,有利整體經濟表現回勇,利好商廈後市持續反彈。再者,東鐵綫過海段通車後,日後往返新界及市區,以至跨境穿梭深圳及大灣區更為便捷,當中會展設立新站後,尤其利好灣仔一帶商廈市道。因應疫情持續改善;5月截至27日止,商廈買賣登記已剛好錄得100宗,料全月最終可達110宗,屆時將有力創9個月新高,並預期6月可續於高位徘徊。

(經濟日報)

更多會展廣場辦公大樓寫字樓出售樓盤資訊請參閱:會展廣場辦公大樓寫字樓出售

更多灣仔區甲級寫字樓出售樓盤資訊請參閱:灣仔區甲級寫字樓出售

美心主席 7.5億購白建時道獨立屋

傳統豪宅地段錄大額買賣,渣甸山白建時道獨立屋以約7.5億元易手,呎價近10萬元,新買家為美心集團主席伍偉國。

消息指,渣甸山白建時道6號屋易手,物業原由本地廠家持有,據資料顯示,持有物業公司註冊中董事名字換上wu wei kuo Michael,為本地大型飲食連鎖品牌、美心集團主席兼董事總經理伍偉國。

呎價約9.4萬 總樓面7986呎

翻查資料,物業早年曾由本港富豪「大劉」劉鑾雄持有,並自住多年。2001年大劉以1.3億元把物業售予經營電子業務的億利達劉氏家族,該家族持有物業21年,沽貨獲利約6.2億元,升值近5倍。資料顯示,由2013至2017年,業主曾數度把物業加按。

美心集團成員鍾情渣甸山,2019年渣甸山睦誠徑3號洋房以約2.41億元沽出,實用面積約4,969平方呎,平均呎價約4.85萬元,由伍偉國妻子羅寶盈購入。

疫情緩和後,超級豪宅成交亦有所增加,上月尾資本策略 (00497) 牽頭發展的渣甸山超級豪宅皇第錄大手買賣,涉及地庫、地下、1及2樓B室連兩個車位,實用面積4,178平方呎,連4,207平方呎花園,成交價約3.34億元,呎價高達8萬元,刷新項目成交價及呎價紀錄外,呎價亦創渣甸山分層住宅新高。

(經濟日報)

商廈物業出現銀主盤成交,市場消息透露,沙田石門商廈京瑞廣場二期有4個高層相連單位淪為銀主盤,最新以3677.67萬元售出,呎價低見9665元,屬該廈近5年來呎價首度跌穿1萬元大關。

4相連銀主盤3678萬沽

據了解,是次易手的銀主盤單位為安群街1號京瑞廣場二期22樓E至H室,總建築面積約3805方呎,以3677.67萬元成交,呎價9665元。自2017年8月後,該廈全部成交單位呎價俱逾1萬元,故最新成交創近5年呎價新低。資料顯示,原業主於2015年6月一手購入物業,當時作價2819.89萬元,呎價為7411元,最新成交價較7年前高857.78萬元或30.4%。

另外,宏基資本 (02288) 旗下灣仔謝斐道218號商廈樓花項目 Novo Jaffe 上月開售,僑福集團董事長黃幼華或有關人士斥4299萬元購入19樓全層,建築面積約2243方呎,呎價約19166元。

(信報)

更多京瑞廣場寫字樓出售樓盤資訊請參閱:京瑞廣場寫字樓出售

更多石門區甲級寫字樓出售樓盤資訊請參閱:石門區甲級寫字樓出售

更多 Novo Jaffe 寫字樓出售樓盤資訊請參閱:Novo Jaffe 寫字樓出售

更多灣仔區甲級寫字樓出售樓盤資訊請參閱:灣仔區甲級寫字樓出售

EC Healthcare building to go up in Tsim Sha Tsui

EC Healthcare (2138), backed by

Adrian Cheng Chi-kong, chief executive of New World Development (0017),

will spend HK$275 million forming a joint venture to raise a medical

building in Tsim Sha Tsui.

Construction

of the building, with an estimated lettable floor area of 103,000

square feet, is expected to be completed by the fourth quarter of 2024,

EC Healthcare said yesterday.

EC

will hold a 30 percent stake in the joint venture company, and enter

into a lease for the entire building for an initial term of five years

with an option to extend for a further five years. It will also have

naming rights to the building.

Meanwhile,

shares of NWD rose 3.8 percent after FTSE Russell reversed a decision

and kept the developer as a constituent of the FTSE EPRA/Nareit

Developed Asia Index.

Also, New World has named its Grade A commercial building at 888 Lai Chi Kok Road in Cheung Sha Wan the NCB Innovation Centre.

(The Standard)

For more information of Office for Lease at NCB Innovation Centre please visit: Office for Lease at NCB Innovation Centre

For more information of Grade A Office for Lease in Cheung Sha Wan please visit: Grade A Office for Lease in Cheung Sha Wan

For more information of Office for Sale at NCB Innovation Centre please visit: Office for Sale at NCB Innovation Centre

For more information of Grade A Office for Sale in Cheung Sha Wan please visit: Grade A Office for Sale in Cheung Sha Wan

Redevelopment at Jardine's Lookout to be leased

SEA

(0251) has had second thoughts on a property at 89-93 Tai Hang Road on

Jardine's Lookout it acquired for HK$627 million last year.

The property comprises 15 residential units with an aggregate gross floor area of approximately 22,000 square feet.

SEA

had intended to redevelop the site into a luxury residence for sale

when it signed the deal last year. But it has now decided to redevelop

the property into a luxury project as a long-term investment for lease,

seeing that course as the most cost-effective option.

(The Standard)

Hong Kong real estate owners seek alternative uses for retail complexes and hotels amid tourism slump

The

owners of Park Lane Shopper’s Boulevard in Tsim Sha Tsui want to turn

the 50-store complex into a food and beverage destination

Sun

Hung Kai Properties secures Town Planning Board nod to convert its

Royal View Hotel in Tsuen Wan West into a residential project

Some Hong Kong retail

landlords and hotel owners are seeking to convert their properties into

restaurants and housing to counter rising store closures and lower

occupancy rates, as the two-year tourism slump shows no signs of ending.

The

owners of Park Lane Shopper’s Boulevard on Nathan Road in Tsim Sha

Tsui, one of Hong Kong’s four major tourist belts, last Friday submitted

an application to turn the 300-metre long, 50-store complex along the

boulevard into a food and beverage destination.

The

proposed change will replace the retail stores with cafeterias, coffee

shops and tea houses on the ground and first floors of the landmark

shopping destination for tourists and locals since 1986.

The

retailers are seeking a change “as a market response to the structural

shifts in the socio-economic context of Tsim Sha Tsui and wider Hong

Kong in recent years, especially amid a decline in tourists, which has

resulted in store closures and affected the urban dynamics in the area”,

the Incorporated Owners Park Lane Shopper’s Boulevard, which represents

the landlords, said in their application to the Town Planning Board

(TPB).

The

proposed uses are “critical for adding flexibility and resilience to

the local economy in responding to the recent changes”, the application

said.

Hong Kong’s strict travel curbs have brought the city’s tourism

industry to a standstill since the coronavirus pandemic started more

than two years ago. Tourist arrivals plunged 94 per cent from 43.8

million in 2019 to 2.7 million in 2020, and fell by another 98 per cent

to 65,721 in 2021, according to data from the Hong Kong Tourism Board.

“The

proposed change reflects the prevailing retail market demand,” a

property agent said. “Even after the reopening of the border, the food

and beverage sector will continue to be a sustainable trade, and modern

dining concepts will do well in Hong Kong.”

Another agency also expects food and beverage outlets to attract more local customers and draw more footfall to the area.

“If

the food and beverage options are of high quality and coupled with the

boulevard’s trees and ambience, similar to the Champs-Élysées in Paris,

it can also attract overseas tourists with its vibe,” another agent

said.

Meanwhile, the slackening demand for hotels is prompting developers to convert their hotels into residential use.

Last Thursday, Sun Hung Kai Properties

(SHKP) became the latest builder to secure approval from the Town

Planning Board to convert a hotel – its waterfront Royal View Hotel in

Ting Kau, Tsuen Wan West – into a residential project.

The

proposed changes will see the 15-storey building converted into 661

flats of varying sizes and will include a day care centre for the

elderly with 60 places, according to the document from the planning

authority.

It

said the existing building will remain unchanged as “only minor

addition and alteration work would be required [and] housing units could

be delivered within a short period of time”.

SHKP’s proposal comes after CK Asset Holdings secured approval from the planning board to convert two hotels for residential use over the past 18 months.

CK

Asset, the flagship company of retired tycoon Li Ka-shing, received

permission in December 2020 to convert its 1,100-room Harbour Plaza

Resort City in Tin Shui Wai into a 5,000-unit housing project. And in

February last year, it received the green light to convert its 800-room

Horizon Suites in Ma On Shan into a residential development with up to

758 flats.

“The

proposed conversion makes sense as the full recovery of the city’s

tourism industry is still far from certain,” a surveyor said.

(South China Morning Post)

新世界發展 (00017) 旗下位於長沙灣荔枝角道888號的全新甲廈正式命名為「南商金融創新中心」(NCB Innovation Centre)。

項目最高三層早前以近12億元連命名權出售予南洋商業銀行,樓面面積共涉及超過6.5萬方呎,折合呎價約1.75萬元,創同區大額成交及呎價新高紀錄,並會保留單位自用,反映銀行及金融業對區內及粵港澳大灣區前景具有信心。

項目2樓提供超過7000方呎平台花園,並以綠化園林設計為主題,提供寬闊開揚的休憩空間。項目ESG要求符合金融業的高端需要,亦切合未來企業發展趨勢。

(信報)

更多南商金融創新中心寫字樓出租樓盤資訊請參閱:南商金融創新中心寫字樓出租

更多南商金融創新中心寫字樓出售樓盤資訊請參閱:南商金融創新中心寫字樓出售

更多長沙灣區甲級寫字樓出租樓盤資訊請參閱:長沙灣區甲級寫字樓出租

更多長沙灣區甲級寫字樓出售樓盤資訊請參閱:長沙灣區甲級寫字樓出售

甲廈租金回調 機構趁機搬遷

疫情緩和後,甲廈租務稍增,亦錄大手成交。成交個案大部分為搬遷,反映機構趁甲廈租金回調,搬遷可節省成本,或作為辦公室升級。

疫情放緩後,寫字樓租務持續向好,有外資代理行發表報告指出,社交距離措施放寬下,4月甲級寫字樓市場得以重拾動力。由於租戶需求持續增長且有新供應落成,整體甲級寫字樓市場錄得24.9萬平方呎的淨吸納量。隨着新供應落成,4月底整體市場的空置率維持在9.4%。中環空置率微升至7.4%,而東九龍空置率為12.8%,仍然為各主要分區市場中最高。

4月整體市場租金保持平穩。主要分區市場中,中環租金月內微升0.1%,尖沙咀則按月下跌0.9%,屬分區市場中最大跌幅。

中資升級辦公室 租太古坊多層

港島甲廈近日錄得一宗大手租務,涉及今年即將落成的鰂魚涌太古坊新商廈。太古坊二座低層及中層各3層樓面,合共6層樓面,以每層面積約2.2萬平方呎計算,涉逾13萬平方呎。按面積計,為疫情後港島區最大手甲廈租務成交個案。新租客為大型中資機構中信銀行 (國際),該集團租用本港多幢物業,包括位於太古坊的德宏大廈多層,是次搬至同屬太古地產 (01972) 旗下物業,而太古坊二座為全新甲廈,質素大幅提升,而租用樓面相若,未有擴充。

太古坊二座錄得另一宗全層成交,涉及物業中層全層逾2萬平方呎,呎租料約50元,新租客為顧問公司Boston Consulting,該公司原租太古坊一座約1萬平方呎單位,如今搬至二座。

九龍區方面,亦錄得租戶搬遷個案,涉及旺角新世紀廣場全層單位,面積約2.6萬平方呎,以每平方呎約28元租出,屬市價水平。據了解,新租客為樂聲牌Panasonic,品牌現時租用尖東華懋廣場,涉約4萬平方呎樓面,現由尖東搬至旺角,縮減逾3成樓面。另外,同廈一個約1.5萬平方呎單位,獲奶粉品牌美素佳兒租用,呎租料約28元。該租客原租用同區朗豪坊商廈,呎租逾40元,搬遷可節省部分租金開支。

分析指,疫情緩和,睇樓活動重啟,多間大型機構重新審視部署,令近期租務活動稍增。由於環球疫情衝擊經濟,令不少機構對後市仍審慎,故擴充個案不多,搬遷成交主要為機構縮減業務。另外,由於甲廈租金從高峰期回落2至3成,吸引機構趁機搬至質素較高的商廈,相信下半年租務活動將加快。

(經濟日報)

更多太古坊寫字樓出租樓盤資訊請參閱:太古坊寫字樓出租

更多德宏大廈寫字樓出租樓盤資訊請參閱:德宏大廈寫字樓出租

更多鰂魚涌區甲級寫字樓出租樓盤資訊請參閱:鰂魚涌區甲級寫字樓出租

更多新世紀廣場寫字樓出租樓盤資訊請參閱:新世紀廣場寫字樓出租

更多朗豪坊寫字樓出租樓盤資訊請參閱:朗豪坊寫字樓出租

更多旺角區甲級寫字樓出租樓盤資訊請參閱:旺角區甲級寫字樓出租

更多華懋廣場寫字樓出租樓盤資訊請參閱:華懋廣場寫字樓出租

更多尖沙咀區甲級寫字樓出租樓盤資訊請參閱:尖沙咀區甲級寫字樓出租

凱龍瑞尖沙咀商廈 醫思健康入股

疫情後醫療需求上升,凱龍瑞基金旗下尖沙咀商廈重建項目,現獲醫療集團參與合作,涉資2.75億。

項目打造醫生大廈

醫思健康 (02138) 公布,向亞洲聯合基建 (00711) 及凱龍瑞集團管理旗下尖沙咀商廈業權一家合資公司認購30%股權,總額不多於2.75億元,涉及可出租樓面面積約10.3萬平方呎,主要用作醫療中心及其他臨床用途。據了解,是次涉及物業為尖沙咀金馬倫道35至37號重建商廈項目。

凱龍瑞中國香港首席執行官何震東指,是次屬香港首次基金及醫療集團合作發展項目,而物業打造成醫生大廈,更切合目前市況。他指,項目將於2024年落成,原先打算分層拆售,如今獲醫療集團注資,故日後改為把物業全幢出售。

翻查資料,凱龍瑞於2018年,斥資6.5億元購入尖沙咀金馬倫道35號87.5%,並申請強拍,其後基金再向小巴大王馬亞木購入尖沙咀金馬倫道37號全幢,涉4.48億元,呎價約1.9萬元,合併後進後重建。

(經濟日報)

九龍城兩舊樓招標 估值約3億

九龍城侯王道93及95號兩幢舊樓,透過代理行招標出售,該業主已併購逾4年,獲得全數完整業權,截標日期為7月8日。市場估計物業市值約3億元。

兩幢4層高物業均是於1952年落成,地下為商舖,樓上為住宅,將以交吉及現有狀況出售。該物業佔地約3,042平方呎,可以最大地積比率為9倍重建發展。根據馬頭角分區大綱圖編號S/K10/28,物業現址劃為「住宅 (甲) 2類」用途,可作住宅連商舖基座發展。

(經濟日報)

爪哇6.3億 奪大坑道公僕合作社

有外資代理行公布,渣甸山大坑道89至93號公務員合作社住宅地盤,全部業權悉數售出,計及補地價的總收購成本約6.27億元,每呎收購成本約2.8萬元,買家為爪哇集團 (00251) 。

物業總地盤面積為1.1萬平方呎,現狀為一幢5層高公務員合作社住宅物業,地下至4樓全屬住宅單位。物業於1959年入伙,根據地契所訂最大可重建樓面面積約為22,000平方呎,可建成6層,包括停車場。

該行代理表示,渣甸山屬傳統東半山豪宅地段,亦是名人聚居之地,在市場上放售可遇難求,因此吸引發展商的青睞。

(經濟日報)

衙前圍道全幢物業7380萬沽 長情業主割愛 60年升值359倍

政府放寬防疫措施帶動工商鋪交投轉活,市場再錄大手成交。消息透露,以暗盤形式放售的九龍城衙前圍道全幢商住樓,以約7380萬易手,呎價1.3萬,原業主持貨60年,帳面獲利7359萬,物業期間升值359倍。據業內人士指出,上址具合併重建價值,成交價屬合理水平。

綜合市場消息指出,九龍城衙前圍道54號全幢商住樓,地鋪及閣樓建築面積2671方呎,2樓至5樓為住宅,每層面積747方呎,項目總樓面5659方呎,以7380萬售出,平均呎價約13041元。據悉,上址原業主早於1962年以20.5萬買入,持貨60年帳面獲利7359萬,期間升值359倍。

平均呎價13041元

據地產代理指出,上址地鋪位置現時由食肆以每月8.7萬租用,門面闊約20呎,租約期至今年底屆滿,以成交價計,租金回報約1.4厘。

盛滙商舖基金創辦人李根興指,上址於市場上以暗盤形式放售,並迅速獲承接,料買家為投資老手,成交呎價屬貼市價水平,該項目亦鄰近市建局重建地盤,故料買家購入冀獲收購。

有代理稱,政府於多年前已積極發展九龍城區,因區內舊樓樓齡多達五十年以上,發展潛力甚大,加上自港鐵屯馬綫開通後,令沿綫地區交通配套進一步完善,帶動人流及消費力急增,吸引發展商及投資者紛於區內「插旗」發展。

事實上,衙前圍道近期頻獲發展商「吼準」發展,資料顯示,興勝創建於去年底以1.95億購入該街道55號,以可建樓面2.43萬方呎計,每呎地價8033元。

此外,興勝創建亦於2017年初以2.4億購入鄰近的衙前圍道57A號舊樓,料作合併發展。

業界:料作合併重建

另一方面,區內市建區項目亦進行得如火如荼,市建局早前公布,開展九龍城衙前圍道及賈炳達道發展計畫,地盤面積逾39.8萬方呎,涉及3個地盤,料合共提供4350伙中小型住宅。

據悉,北面地盤位於賈炳達道公園範圍內,東面地盤則連接太子道東及打鼓嶺道休憩花園。

(星島日報)

霍英東家族尖沙嘴商廈逾15億轉讓予霍震宇霍麗娜等

霍英東家族繼上月轉讓山頂普樂道洋房後,旗下尖沙嘴文遜大廈全幢商廈,消息指亦以逾15.33億轉讓予霍震宇及霍麗娜等人持有的公司,而上述買賣涉及稅款約1.165億。

市場消息指出,尖沙嘴彌敦道74至78號文遜大廈,於上月初以15.33億易手,買家為霍震宇及霍麗娜等人持有的公司,據悉該物業原業主為霍震寰、霍震霆及林錫鎏等人,故是次買賣後,意味上述人士不再持有該物業。

涉及稅款達1.165億

據地產代理指出,上址為霍英東家族核心物業之一,一直持有作長綫收租用途,該商廈位處尖沙嘴區核心地段,鄰近港鐵站出入口,周邊車水馬龍、人流不斷,屬各大商戶「兵家必爭之地」,上址鋪位現時由金行租用,月租180萬。

普樂道洋房3.7億轉讓

資料顯示,已故全國政協副主席霍英東名下遺產近300億,長房兄弟姊妹今年初因爭議家族公司的股份回購問題而對簿公堂,爭產案重啟後近一個月,最終達成大和解,霍家長房二房三房簽妥一份保密和解協議而令爭產案告一段落。由家族成立近七十載的霍興業堂置業有限公司,所持有的山頂普樂道二號大宅,本月初以約3.7億轉讓予長房兩姊弟霍麗娜和霍震宇,二人分別持有67%及33%業權。

(星島日報)

Mega Hung Hom project gears for first sales

Henderson

Land Development (0012) is poised to launch sales of the first homes at

its 2,800-flat Baker Circle redevelopment in Hung Hom.

The

Baker Circle Dover tower will offer 324 flats including 84 studios, 194

one-bedroom, 42 two-bedroom, and four special units, with sizes ranging

from 200 square feet to 570 sq ft.

The sales brochure and show flats will be unveiled soon and sales could take place as early as next week, the developer said.

Baker

Circle consists of nine blocks, which will be built in three phases,

providing a gross floor area of more than 1 million sq ft.

In Tai Po, Sun Hung Kai Properties (0016) said the second round of sales of 198 flats at phase 1 of Silicon Hill will take place on Saturday.

Of

the homes on offer, 190 will be sold on price lists - ranging from

HK$3.8 million to HK$11.34 million after discounts, or from HK$16,427 to

HK$20,354 per sq ft - while eight will be tendered.

In

Tuen Mun, the sales brochure of Grand Jete, SHKP's project with CK

Asset (1113), is expected to be released this week at the earliest.

Grand Jete will offer 400 homes including 240 one-bedroom, 120 two-bedroom, and 40 three-bedroom units, CK Asset said.

The

flats range from 263 to 722 sq ft in size and five showflats are

expected to open shortly, with sales launched within the month.

In Kai Tak, Wheelock Properties put 120 homes at Monaco Marine on sale on Friday, including 21 flats in low-rise buildings.

These

homes cover areas from 324 sq ft to 768 sq ft and are priced from

HK$8.2 million to HK$19.4 million after discounts, or from HK$23,170 to

HK$29,974 per sq ft.

Separately,

the number of new homes completed in April was 1,896, up by 1.46 times

from a month ago. The aggregate completion in the first four months of

this year reached 9,979, 1.43 times more than a year ago, data from

Rating and Valuation Department showed.

(The Standard)

疫市擴充 「士多」租九龍灣商廈全層

涉恒生中心2.6萬呎 每呎24元

疫下網購行業有所擴充,網購平台「士多」租用九龍灣恒生中心全層2.6萬呎商廈,呎租約24元,屬擴充。另八達通亦擴充,租用 Manhattan Place 7,000呎單位。

市場消息指,九龍灣恒生中心錄得全層租務成交,中層面積約2.6萬平方呎,以每平方呎約24元租出。該廈位於九龍灣港鐵站上蓋,交通便利。據了解,新租客為網購平台「士多」(Ztore),該品牌原租用長沙灣工廈,如今因應業務擴張,故租用商廈作擴充之用。

疫情下市民網購大幅提升,而「士多」生意亦有所增加,該機構於第5波疫情期間,亦表示宣布招聘逾100人。另外,去年該平台75%股權,亦獲電視廣播 (00511) 收購。

八達通租 Manhattan Place 極高層

另消息指,九龍灣 Manhattan Place 極高層單位,面積約7,000平方呎,以每平方呎約30元租出,新租客為八達通,該機構早於十多年前租用該廈作總部,如今業務有所擴充。

另同區其士商業中心中層09室,面積1,812平方呎,成交呎租約22元。另尖沙咀星光行高層35室,面積約894平方呎,以每平方約30元租出。

有代理表示,有業主放售觀塘海濱道133號萬兆豐中心兩單位,當中15樓B室,面積約2,058平方呎,意向價約2,572.5萬元,呎價為12,500元;另同廈27樓I室,面積約1,567平方呎,呎價約11,359元,意向價約1,780萬元。

(經濟日報)

更多Manhattan Place寫字樓出租樓盤資訊請參閱:Manhattan Place 寫字樓出租

更多其士商業中心寫字樓出租樓盤資訊請參閱:其士商業中心寫字樓出租

更多九龍灣區甲級寫字樓出租樓盤資訊請參閱:九龍灣區甲級寫字樓出租

更多星光行寫字樓出租樓盤資訊請參閱:星光行寫字樓出租

更多尖沙咀區甲級寫字樓出租樓盤資訊請參閱:尖沙咀區甲級寫字樓出租

更多萬兆豐中心寫字樓出售樓盤資訊請參閱:萬兆豐中心寫字樓出售

更多觀塘區甲級寫字樓出售樓盤資訊請參閱:觀塘區甲級寫字樓出售

尖沙咀9重建項目 香檳大廈規模最大

尖沙咀區內重建活躍,目前至少有9個重建項目,合共提供約112萬平方呎樓面,當中以有60年歷史的香檳大廈B座重建計劃規模最大,預計可提供14.7萬平方呎。

增建112萬呎商用樓面

尖沙咀屬於發展成熟的商業區,區內新增的商業用地供應罕有,發展商惟有透過收購區內舊樓進行重建,故此區內大部分新增商業樓面供應,均來自舊樓併購或者大型項目重建。據統計,區內至少9個重建項目正在進行,涉及約112萬平方呎樓面,有8個屬於舊樓收購重建而來,只有由帝國集團跟海員俱樂部合作的中間道11號「海員之家」重建項目不屬於舊樓收購。

在多個舊樓收購項目之中,以位於金巴利道16至20號的香檳大廈收購最為矚目。香檳大廈在上世紀60年代落成,曾經是九龍區最高物業,由於恒地 (00012) 系內在鄰近持有美麗華廣場及酒店,發展商早在10年前已經展開收購。

香檳大廈分A及B座,當中以B座收購比較順利,已經達至逾8成業權,並在兩年前申請進行強拍統一業權,若果獨立展開重建,單計B座地盤面積約1.23萬平方呎,規劃為商業用途,可建商業樓面約14.74萬平方呎。

漢口道2舊樓 一申強拍另擬建甲廈

至於鄰近海防道的漢口道一帶近年亦有不少舊樓獲收購,當中新世界 (00017) 或相關人士早在2016年已經開始收購漢口道43至49A號漢口大廈,目前已持有88.596%業權,亦已經申請進行強拍。

漢口大廈樓齡約60年,現樓為1幢樓高11層的商住大廈,地盤面積約11,565平方呎,規劃為商業用途,地積比率為12倍,重建樓面約13.9萬平方呎。而鄰近的漢口道31至37號近期亦獲基金收購,樂風集團夥拍BentallGreenOak及施羅德資本,據指已經收購97%,總收購價逾15億元,地盤面積約9,650平方呎,總可建樓面面積約11.58萬平方呎,擬重建甲級商廈。

另外,原本由資本策略 (00497) 收購的亞士厘道重建地盤,在兩年前以約17.6億元轉售予建灝地產,目前正興建21層商廈,總樓面約10萬平方呎,每層樓面約5,500平方呎,預計將於2023年初落成。

(經濟日報)

尖沙嘴銀主商廈意向價2億

尖沙嘴柯士甸路一幢銀主商廈標售,銀主將意向價調低,最新為2億,平均每呎1.1萬。

平均呎價1.11萬

拍賣行發言人表示,柯士甸路28號全幢商廈,物業屬銀主盤,全幢交吉推出標售,地盤面積1531方呎,地下至3樓為商鋪,4樓至18樓為寫字樓,今次意向價較早前調低,平均每呎約11156元。

該發言人表示,今番屬於第二次推出招標,截標日期為6月30日,銀主意向價亦由逾2億,調低至最新的2億水平,該廈於1999樓落成,樓齡23年,樓高19層,地下至3樓合共4層,為商鋪用途,建築面積由1325方呎至1435方呎,合共約5462方呎,4至18樓總建築面積為12465方呎,全幢總建築面積約17927平方呎,以意向價計算,平均每方呎約11156元。物業擁有高樓底,地鋪為5米,頂樓4米,其餘樓層為3.15米,現時以交吉形式標售,並於6月30日截標。

該發言人續說,該物業有潛力打造為全新主題概念商廈,由該廈步行至佐敦港鐵站,需時約五分鐘,柯士甸路為區內特色食街,附近住宅及商廈林立,聚集食肆及商戶,鄰近九龍木球會及特色精品酒店Page148等。

(星島日報)

灣仔商住樓5966萬售出 投資者許教武等承接

向來鮮有商鋪及全幢物業買賣的灣仔太原街,錄得1宗全幢商住樓易手,作價5966.8萬,買家為資深投資者許教武等人。

持貨48年升值196倍

灣仔太原街11號全幢商住樓,上月以5966.8萬易手,買家包括許教武、許智豪、周燕珊及朱苑林,屬於上市公司辰罡科技要員,市場消息透露,許教武經營小巴及的士生意,並於90年代涉足建築生意,本身亦是資深投資者,他亦持有毗鄰9號全幢商住樓,今番增持物業,料作為投資用途。

太原街11號全幢早於1959年落成,樓齡63年,現址6層高,地下為商鋪、1至5樓為住宅,物業總樓面約3244方呎,平均呎價約1.84萬。原業主於1974年12以30萬購入該全幢,持貨48年,帳面獲利5936.8萬,物業升值196倍。

太原街有眾多售賣玩具店鋪,因此有「玩具街」之稱,該處舊樓林立,街道兩旁為排擋,極具特色。

力寶中心每呎25849元沽

金鐘力寶中心二座3203室,建築面積約1149方呎,以每呎25849元,涉資2970萬,買家錢乃驥或有關人士,錢氏為華僑銀行集團前行政總裁。原業主於1996年以2120萬購入力寶中心二座32樓2至3室,建築面積共2500方呎,呎價約8480元,是次沽售一個單位,若以呎價計算,升值2.2倍。市場消息指,該單位為原業主自用,將會售後租回單位,平均呎租約40元,料新買家回報約1.8厘。

(星島日報)

更多力寶中心寫字樓出售樓盤資訊請參閱:力寶中心寫字樓出售

更多金鐘區甲級寫字樓出售樓盤資訊請參閱:金鐘區甲級寫字樓出售

觀塘萬兆豐中心單位,建築面積約2058方呎,意向價約2572.5萬,平均呎價1.25萬,料回報約2.85厘。

有代理表示,海濱道133號萬兆豐中心15樓B室,面積約2058方呎,意向價約2572.5萬,呎價12500元,單位面向維港,備簡約裝修,將以股權轉讓形式交易。業主為本地投資者,於2015年5月以呎價約1.22萬購入單位放租,連約出售,租客德資藥廠,月租6.1萬承租至2023年7月,料回報約2.85厘。

另一個放售單位為27樓I室,面積約1567方呎,呎價約11359元,意向價約1780萬,該單位內部相當新淨,面向市景,自2012年3月由本地專業人士以呎價約6510元購入後,早年作自用,至近年業務重組,才出租單位,現時月租約3.2萬,料回報約2.15厘。陳氏指出,萬兆豐中心空置率僅約1.8%,較4月份觀塘區甲廈空置率約10.27%低。

藥廠租約回報2.85厘

另一代理表示,灣仔灣仔道230號佳誠大廈高層B及C室,建築面積約2053方呎,意向價約2800萬,折合每呎約1.36萬,有議價空間,單位間隔四正實用,外望開揚山景。由該廈徒步至港鐵銅鑼灣及灣仔站分別約6至9分鐘。

(星島日報)

更多萬兆豐中心寫字樓出售樓盤資訊請參閱:萬兆豐中心寫字樓出售

更多觀塘區甲級寫字樓出售樓盤資訊請參閱:觀塘區甲級寫字樓出售

Hung Hom show flats to open

Henderson Land Development (0012) will open show flats of The Baker Circle Dover in Hung Hom this weekend.

The

sales brochure may be unveiled today and the first price list with at

least 65 units may be released within the week, said Thomas Lam Tat-man,

a general manager of Henderson's sales department.

The tower

offers 324 flats, including 84 studios, 194 one-bedroom, 42 two-bedroom,

and four special units, with sizes ranging from 200 square feet to 570

sq ft.

The Baker Circle redevelopment project consists of nine

blocks which will be built in three phases, providing a total of 2,800

flats.

In Tai Po, Sun Hung Kai Properties (0016) has raked in more than HK$63.8 million after selling five homes via tender.

Meanwhile,

a real estate agency expects that overall property market sentiment to

further improve in the second half of this year as the economy is set to

pick up and Covid subsides.

An agent estimates that new home

sales will jump 91 percent to 10,500 in the second half from a

projection of 5,500 in the first half.

Secondary home sales will

also soar 36 percent to about 30,000 in the second half from about

22,000 in the first half, the agent said.

The property agency plans to open 30 additional branches and recruit 1,000 more employees in the six months from July.

Separately,

Secretary for Development Michael Wong Wai-lun said the government

plans to consult a Legislative Council panel on the "new land first"

proposal in the fourth quarter of this year.

The proposal is to

enable early implementation of the title registration system on newly

granted land first, which will enable industry practitioners and the

public to benefit from the new system as early as possible, Wong wrote

in a reply to LegCo.

Compared to the present deeds registration

system, which gives no guarantee to title, the title registration system

will provide greater assurance and certainty of property titles, he

said, adding that all key stakeholders have expressed support in

principle for the "new land first" proposal.

(The Standard)

東鐵過海段通車帶動啟德甲廈租金 每年料升5%

有外資代理行指出,啟德近年發展迅速,隨港鐵東鐵綫過海段通車後,令配套進一步完套,區內租金較傳統核心區折讓達50%,備受金融保險業、電訊及共享工作空間等新興行業追捧,故區內甲廈租金前景值得看俏,料於明年起每年平均租金上升約5%。

該行代理指出,疫情打擊下,過去數年間甲廈需求稍回軟,但受近期疫情放緩帶動,令甲廈租務市況見改善,近期洽租問盤量明顯彈升。

洽租問盤量明顯彈升

該代理續指,早前疫情期間,需求主要來自物流、資訊科技及網購等行業,惟踏入今年4月份,金融保險業、零售、採購及珠寶行業等「百花齊放」,近期市場浮現新興行業包括生物醫藥及電訊等行業,惟各行各業對辦公室樓面面積持續減少,幅度介乎15%至25%,惟未必因為裁員或減省營運規模,早前疫市下,靈活辦公模式逐步受企業所接納,逐漸成為大方向,目標呎租現「兩極化」,較保守的企業大多瞄準價廉物美的寫字樓,目標呎租約30元以下,希望承租優質物業的企業,目標呎租則於40元以上。

提供罕有大樓面供應

該代理亦指,啟德區提供罕有甲廈大樓面供應,每層達五萬方呎,需求來自金融及保險業等,加上近年興起的共享工作空間,對寫字樓樓面有特定要求,環境一定夠大及寬敞,才可以打造出具質素的共享空間,故令大樓面寫字樓有價有市。

目標呎租低見30元

該行另一代理指,各大企業希望進駐中環及金鐘傳統核心商業區,然而租金過於昂費,故政府早年致力發展CBD2,由九龍灣、觀塘及新蒲崗等地區,故九龍東地區形成一個全新商業結構,環顧現今啟德與中環金鐘租金折讓達50%、與油尖旺區折讓達30%,甚具競爭力,有力吸引部分跨國公司從核心區搬入。

(星島日報)

均輝集團1.06億購日昇相連戶

隨疫情走勢持續放緩,帶動工商鋪市場交投轉活,市場再錄大手成交。消息指出,觀塘日昇中心中層3及4室,屬相連單位,於上月底分別以5603萬及5085萬售出,合共涉資約1.068億,買家為均輝集團相關人士,以總樓面20958方呎計,每呎造價約5099元。

事實上,均輝集團近期活躍於工商鋪市場,資料顯示,該集團於上月亦以3950萬購入西半山摩羅廟街26至28號建興樓地鋪,呎價約3.59萬。

此外,商廈市場亦錄大手成交,據代理指出,中環擺花街1號、及威靈頓街交界一號廣場,該商廈低層1至4室,總建築樓面約4005方呎,以約6375萬易手,平均呎價約1.59萬。

據悉,原業主於2011年以4165萬購入,持貨11年帳面獲利2210萬,物業期間升值約53%。

(星島日報)

更多一號廣場寫字樓出售樓盤資訊請參閱:一號廣場寫字樓出售

更多中環區甲級寫字樓出售樓盤資訊請參閱:中環區甲級寫字樓出售

栢麗大道鋪呎租77元跌34% 交吉1年始租出重返86年水平

受疫情等因素衝擊,令昔日遊客「打卡」勝地尖沙嘴栢麗大道風光不再、吉鋪處處,拖累租金急下滑,該地標購物大道於交吉約一年後,新以約5.9萬獲零售商承租,並長約3年,呎租低見77元,較上一手長租租金急挫約34%;業內人士指出,上述租金貼近該大道於1986年落成時租金水平,中港兩地尚未通關,遊客絕迹下,料該街道租金將持續受壓。

有代理指,尖沙嘴彌敦道111至181號栢麗購物大道地下64號A鋪,建築面積約766方呎,新以約5.9萬租出,呎租僅約77元,租戶為具旅行社背景的零售商,並以3年長約租用上址。

零售商取代鐘表行進駐

該鋪於去年中曾獲另一零售商以約6萬元短租,至於上一手長租為數年前由鐘表珠寶行以約9萬租用,故最新租金較上手長租約跌約34%。

另一代理稱,上址最新租金較當年「沙士」更低,栢麗大道早於1986年落成,當年呎租約60餘元至70元水平,上述租金重返上世紀80年代水平,更直逼當年落成時租金水平,反映疫情對核心區鋪市影響之大,儘管近期疫情稍回穩,惟中港兩地尚未通關,栢麗購物大道向來主攻遊客客源,現今市場消費力疲弱,料租金持續調整。

事實上,栢麗購物大道早前已頻錄大幅減租個案,57號A鋪,建築面積約766方呎,於去年底以約5萬獲健康食品店承租,呎租約65.2元,較上一手租金8.5萬急挫逾4成。

月租5.9萬 簽約3年

上址亦於年前錄大幅蝕讓個案,由資深投資者李耀華持有的29號至30號連1樓巨鋪於2020年以2.1億售出,持貨8年帳面勁蝕逾2.2億。

尖沙嘴栢麗購物大道早於八十年代中拆售,由於業權分散,業界認為重返昔日光輝歲月難度較大,近年上址租售價均顯著回落,該大道業主立案法團早前亦向城規會提出申請改劃,計畫將項目「休憩用地」改劃「食肆」及「商店及服務行業」,因應近年來經濟環境改變,尖沙嘴區旅遊購物者減少,導致店鋪關閉及城市活力下降,建議從城市規劃取得彈性,以便日後將現有零售商店轉變為更多樣化、更具特色的其他商業用途,吸引更多人流。

(星島日報)

Nomura Securities Said to Surrender Floor at Hong Kong’s Two IFC

Japan’s Nomura Securities is

surrendering an entire floor in Hong Kong’s second-tallest office tower,

having terminated its lease for the 26th floor at Two International Finance Centre last month, according to local media accounts.

After

handing back the 23,076 square foot (2,143 square metre) floor, Nomura

is retaining about half the space it had initially taken up when it

leased close to six floors in the tower three years ago, analyst said.

The

securities brokerage firm is scaling down its Hong Kong office space

amid the city’s economic slowdown, with the stock exchange having helped

just 17 companies raise a combined HK$14.9 billion ($1.8 billion) in

IPO proceeds over the first quarter – about 89 percent less than during

the same period last year, according to a reporting by S&P Global

citing stock exchange data.

As Nomura shrinks its footprint, financial services firm Jefferies Hong Kong is said to be taking over the 26th floor of Two International Finance Centre, as it shifts from its long-time home just over a kilometre (0.62 miles) away on the 22nd floor of CK Asset’s Cheung Kong Center

in Central. In April, Jefferies had also agreed to lease units 10 to 12

on the building’s 27th floor – which Nomura had given up in 2020,

according to local media reports.

Exits and Upgrades

With

Nomura’s latest hand-back taking place about two years after it

surrendered 56,000 square feet (5,202 square metres) of space at Two International Finance Centre,

the firm’s downsizing this year means that since 2019 the firm has

given up about 56 percent of what had once been a 140,000 square foot

presence in Two International Finance Centre.

Before

giving up the 26th floor, the Japanese brokerage firm was paying a

monthly rent of about HK$3 million for the space, or around HK$130 per

square foot per month, local media reported.

Current rents at Two International Finance Centre,

which was jointly developed by Hong Kong’s Sun Hung Kai Properties,

Henderson Land and utility provider Towngas, average around HK$120 to

HK$130 per square foot per month, according to market sources.

Although

these rental rates represent the highest in Central, the cost to occupy

space in the 88-storey tower has fallen by 25 percent since the first

quarter of 2019, analyst said, with average rents in Greater Central in

the first quarter of this year down about 30 percent from the same

period in 2019 to an average of HK$97.80 per square foot per month.

Rents at Cheung Kong Center, which average HK$110 per square foot per month, are only slightly lower than Two International Finance Centre,

said analysts who spoke with Mingtiandi. However, the tower’s

waterfront location, access to the city’s Central and Hong Kong MTR

stations, and its connection to the IFC mall – which is part of the same

commercial complex – could be reason enough for companies like

Jefferies to shift to the iconic complex, analyst said.

Last

month, Central district’s biggest landlord Hongkong Land welcomed a

former tenant back to its office portfolio after 15 years, announcing

that global law firm White & Case had taken up three floors at York House,

the developer’s Grade A office tower at 15 Queen’s Road. The move

followed a 2.5 percent year-on-year decline in average rents at the

developer’s Hong Kong office portfolio to HK$117 per square foot per

month in 2021, according to Hongkong Land’s latest annual report.

High Vacancy

Nomura’s remaining tenancy in the Two International Finance Centre, which is currently 97.5 percent occupied, spans floors 30 to 32, and will expire in December of 2023.

Its lease surrender at Two International Finance Centre

last month paralleled a slight increase in Central district’s vacancy

rate, which in April edged up 0.1 percentage points from the preceding

month to 7.4 percent, according to a property agency’s report.

News

of Nomura’s downsizing comes as firms continue to scale back their

footprints in the city. Since the second half of 2020, multinational

banks in Hong Kong have downsized their offices by at least 312,000

square feet, including Deutsche Bank giving back 104,000 square foot at

SHKP’s ICC in West Kowloon, according to an another report published by another agency in April.

“Many

financial services firms are adopting flexible working practices as a

more permanent way of working and are typically downsizing on lease

expiry,” the agency said.

About

11 million square feet of new Grade A office supply is scheduled to be

added to the Hong Kong market between 2022 and 2025 with minimal

pre-commitments from occupiers, according to the property agency. This

surge of new space could result in 17.2 million square feet of office

supply over the next four years, with the agency predicting that vacancy

could rise as high as 17.7 percent.

(Mingtiandi)

For more information of Office for Lease at International Finance Centre please visit: Office for Lease at International Finance Centre

For more information of Office for Lease at York House please visit: Office for Lease at York House

For more information of Office for Lease at Cheung Kong Center please visit: Office for Lease at Cheung Kong Center

For more information of Grade A Office for Lease in Central please visit: Grade A Office for Lease in Central

For more information of Office for Lease at International Commerce Centre please visit: Office for Lease at International Commerce Centre

For more information of Grade A Office for Lease in Tsim Sha Tsui please visit: Grade A Office for Lease in Tsim Sha Tsui

灣仔全層商廈4935萬易手

宏基資本旗下灣仔商廈項目 Novo Jaffe 高層全層,為連平台特色戶,以約4935萬售出,買家為新世界鄭氏家族人士,購入自用。

市場消息指出,由宏基資本發展的灣仔謝斐道218號商廈 Novo Jaffe 28樓,建築面積2243方呎,以4935萬成交,平均呎價22002元,買家為新世界鄭氏家族相關人士。

新世界鄭氏家族成員承接

據代理指出,上址為連平台特色戶,外望海景,該廈僅設4層同類物業,買家購入自用;本報昨日就上述消息向新世界作出查詢,惟於截稿前未獲回覆。該商廈亦錄另一宗成交,為27樓全層,建築約2243方呎,以約5079.9萬售出,呎價約22648元。

中環順安商業大廈低層9B室,建築面積約750方呎,以約1485萬售出,呎價約1.98萬;另外,尖沙嘴永安廣場中層6室,建築約1382方呎,以約1768.96萬售出,呎價約1.28萬。

(星島日報)

更多 Novo Jaffe 寫字樓出售樓盤資訊請參閱:Novo Jaffe 寫字樓出售

更多灣仔區甲級寫字樓出售樓盤資訊請參閱:灣仔區甲級寫字樓出售

更多永安廣場寫字樓出售樓盤資訊請參閱:永安廣場寫字樓出售

更多尖沙咀區甲級寫字樓出售樓盤資訊請參閱:尖沙咀區甲級寫字樓出售

鴨脷洲地盤擴大規模 宏安6100萬收購商廈

宏安地產在疫市下仍積極併購舊樓,繼早前最新購入香港仔鴨脷洲大街一幢舊樓住宅及部分地鋪,最新購入該廈1樓全層,物業屬商業契,涉資6100萬。

宏安地產加快收樓步伐,最新購入鴨脷洲大街128號順利大廈1樓1至4室,作價6100萬。該物業原業主為中華基督教禮賢會,於1982年以約228萬購入,持貨40年帳面勁賺5872萬,物業升值逾26倍。宏安亦於今年4月,購入該廈14個住宅及3個地鋪,涉資逾1.64億,至今合共以2.24億收購該廈業權。順利大廈位處鴨脷洲大街128及130號,事實上,宏安地產目前持有鴨脷洲大街120、122、124及126號,隨着收購該廈,將進一步拓大地盤規模。

區內坐擁多個項目

宏安早前接連為鴨脷洲大街的舊樓申請強拍,分別位於鴨脷洲大街17至19號海德樓,和鴨脷洲大街21至23號與平瀾街5B號花洲大樓,還有鴨脷洲新市街37至39號南德大樓,宏安已持有3項目介乎83.33%至94.74%業權。發展商曾表示,上述3項目將會一併重建,合共組成面積近7000方呎地盤,若以地積比率9倍計,項目可重建樓面約6.3萬方呎。

鴨脷洲在鐵路通車及「躍動港島南」計畫推動下,發展商紛於區內「插旗」興建地標,區內舊樓掀起收購潮,除了宏安之外,樂風集團亦夥拍新加坡的房地產私募股權投資公司SC

Capital

Partners,收購平瀾街2至4A號和好景街26至28號的大部分業權,以作住宅項目重建;該地盤面積約4000方呎,可建總樓面約35000方呎,總收購價約4.18億,每方呎樓面地價約11943元。該公司計畫重建為港島南區的標誌性建築,屆時所有住戶均可享香港仔海峽和海濱長廊景觀。

發展商紛進駐插旗

莊士中國更早於2019年斥資4.55億收購鴨脷洲大街26至32號舊樓,地盤面積約4320方呎,早年亦獲批建一幢樓高27層的商住物業,涉及住宅樓面約35787方呎,整個項目可建總樓面約39767方呎。不少發展商或財團併購鴨脷洲大街一帶舊樓,如恒基早年已於區內插旗,其中鴨脷洲大街71號已發展為精品式住宅逸南。

(星島日報)

資本中心單位叫價2030萬

有代理表示,灣仔資本中心13樓09室,面積約967方呎,業主意向售價約2030萬元,呎價約2.1萬元。

該行指出,單位間隔四正實用,擁城市景觀,另配備全辦公室裝修,加上是次為交吉交易,買家可即買即用,非常方便。大廈配備8部載客電梯及1部載貨電梯,方便用戶上落。

(信報)

更多資本中心寫字樓出售樓盤資訊請參閱:資本中心寫字樓出售

更多灣仔區甲級寫字樓出售樓盤資訊請參閱:灣仔區甲級寫字樓出售

以轉讓形式放售 Jessville估值20億

由前首席大法官楊鐵樑岳父譚雅士家族持有的薄扶林豪宅項目Jessville,正由代理行以公司轉讓形式推出市場放售,市場估值逾20億元,該項目正招收意向書,7月22日截止。

薄扶林豪宅項目 7.22截意向

該項目位於薄扶林道128號,包括樓齡達91年、經保育和活化的三級歷史建築Jessville Manor,以及2019年建成的分層住宅大樓Jessville Tower,總實用面積約3.9萬方呎。

Jessville

Tower樓高14層,提供28個單位,3房和4房間隔,單位實用面積1358方呎及1431方呎,據悉,該大樓去年推出招租,約一半單位獲承租,集中低層戶,月租約7萬至8萬元,是次以連租約方式發售。至於Jessville

Manor已改建成提供4個特色單位的大宅,將以交吉形式易手。

負責該項目放售事宜的代理表示,有興趣的財團等須於7月22日下午5時正或之前將已簽妥的意向書正本 (以正式合約為準),遞交到萊坊位於灣仔的辦公室。

有代理表示,Jessville

Manor屬三級歷史建築,在市場上十分罕有,而Jessville

Tower所有單位都可以享受開揚的山景和海景,私密度很高,有見港島區新建豪宅項目供應非常短缺,該項目具潛力可拆售,勢吸引發展商和投資者等垂青,預計市場反應正面。

(信報)

外資代理行看好新甲廈 吸引租客搬遷

甲廈租務市場稍為轉好,有外資代理行認為,由於整體甲廈租金有所調整,故相信下半年租務活動加快,而新落成甲廈可吸引機構搬遷。

據該代統計最新甲廈空置率,整體空置數字仍偏高,核心區中環及金鐘區,空置率高見9.4%,而非核心區東九龍亦升至15%,整體甲廈空置率達11%,為近10多年新高。

該行代理認為,甲廈新需求仍較為疲弱,「未通關情況下,中資機構未能來港,跨國企業則普遍縮減樓面,加上今年甲廈新供應多,相信年尾空置率再升,達12至13%,為近10多年新高。」

該代理指出,今年首季受第5波疫情衝擊,導致睇樓活動大減,近兩個月疫情緩和,租務活動有所加快,「情況類似去年第4波疫情完結,租務即加快。近日業主亦主動聯絡準租客,相信機構加快租務決定,料下半年租務宗數勢將上升。」

倘通關 中環尖沙咀率先反彈

新需求上,該代理指近年租金下跌,主要因空置率上升,特別是空置樓面較多地區。該代理相信,若中港通關,核心地段會受捧,「中資機構喜歡中環及尖沙咀,故若通關,核心地段租務及租金,會率先反彈。」

近日港島甲廈錄得一宗大手租務,涉及今年即將落成的鰂魚涌太古坊二座合共6層樓面,涉及逾13萬平方呎。按面積計,為疫情後港島區最大手甲廈租務成交個案。新租客為中信銀行 (國際),屬同區搬遷。

疫情下 共享空間辦公需求增

該代理分析,在整體甲廈租金下跌,可吸引租客搬遷,「現時租客搬遷普遍縮減樓面,因疫情影響,在家工作等靈活辦公概念興起,機構減少新租樓面。但並不代表減開支,現時很多租客會趁機租用新落成甲廈,作提升級數,或由工廈搬至商廈,令搬遷同時提升辦公室質素。在租金調整後,新落成甲廈有優勢。樓齡老化的商廈,未來有需要進行翻新。」

近1年共享空間辦公室錄不少新租個案,她認為,疫情令靈活辦公更受捧,而大業主旗下有共享空間租客更有利,「疫情期間,不少公司採在家工作策略,員工未能返回辦公室工作,個別寧短租共享空間辦公桌使用,故疫情下需求上升。同時間,共享空間適合公司短租數月,可省裝修費。甚至當租客希望作短暫擴充,成立特別項目小組,但不想租用新樓面,便可於同廈的共享空間辦公室短租數月,故相信共享空間仍有擴充潛力。」

(經濟日報)

更多太古坊二座寫字樓出租樓盤資訊請參閱:太古坊二座寫字樓出租

更多鰂魚涌區甲級寫字樓出租樓盤資訊請參閱:鰂魚涌區甲級寫字樓出租

啟德配套齊 商業前景佳

租務活動勢增加,地區上,有外資代理行代理指,啟德配套全面,加上有大型商業項目,非常睇好該區前景。

對於下半年租務較活躍地區,該代理相信,港島區方面,較睇好鰂魚涌及銅鑼灣兩區,「鰂魚涌因有大型項目落成,而銅鑼灣租金已有調整,商廈質素亦頗新。」

九龍區方面,該代理指特別睇好啟德區。事實上,今年南豐旗下 AIRSIDE 將入伙,項目涉及200萬平方呎,投資額高達320億元。

AIRSIDE 將入伙 涉200萬呎

該代理認為,過去數年啟德住宅概念較重,「其實啟德是一個非常全面地區,有商業、住宅,又有大型運動場,日後若發展地下街等,該區前景更佳。最近港鐵東鐵綫過海段通車,交通更為方便,而 AIRSIDE 提供商場及商廈各100萬平方呎樓面,是地標項目,絕對值得留意。

(經濟日報)

更多AIRSIDE寫字樓出租樓盤資訊請參閱:AIRSIDE 寫字樓出租

更多啟德區甲級寫字樓出租樓盤資訊請參閱:啟德區甲級寫字樓出租

觀塘禧年均輝申建商廈 今闖關

均輝集團持有的觀塘大業街1號禧年大廈、偉業街111號均輝中心,早前申請合併重建成30層高商廈,獲規劃署不反對「放行」,有望今天於城規會獲批。

據規劃署指,兩幢工廈均在1980年建成,其中偉業街111號曾經在2018年全幢改裝成寫字樓,雖然發展局認為已活化的工廈並不是「活化工廈2.0」的目標,但考慮到放寬地積比率,可增加更多商廈供應;而起動九龍東辦事處則指重建符合九龍東轉型核心商業區的方向。

禧年大廈及均輝中心共佔地9,978平方呎,申請項目地積比率由12倍增加20%至14.4倍,擬建1座30層高商廈,樓面約14.4萬平方呎,當中禧年大廈原由興勝創建 (00896) 持有,曾申請重建酒店,去年由均輝6.28億元購入後便計劃將兩物業合併發展。

(經濟日報)

連鎖飲食35萬 租莊士敦道兩層舖

上手體育品牌70萬租用 租金跌半

疫後仍以餐飲擴充為主,灣仔莊士敦道兩層合共約7,500呎舖位,獲連鎖飲食集團以約35萬租用,開設牛肉麵及日式餐飲等。該舖曾為體育品牌以70萬租用,租金跌一半。

消息稱,由灣仔莊士敦道74至80號地下及1樓巨舖租出,物業面積合共約7,517平方呎,以每月約35萬元租出。該舖正對修頓球場,鄰近利東街商場,故平日人流頗旺。據悉,新租客為連鎖餐飲集團Cafe

Deco Group,由於舖位面積甚大,故集團將開設多間餐廳,包括台灣「段純貞牛肉麵」、台式飲品店以及一間日式餐廳。

疫情緩和 餐飲積極擴充

翻查資料,該舖對上租客為運動服裝品牌Under Armour,早年以約70萬元承租舖位,早前遷出,如今換上餐飲,租金跌約一半。疫情緩和後,餐飲擴充相對積極,趁核心區一綫地段租金回調,搶佔地舖。

近日灣仔莊士敦道錄得舖位租務,多屬餐飲相關,如莊士敦道20至26號地下02號舖,面積約4,773平方呎,以每月約28萬元租出,新租客為茶餐廳。物業前租客月租約35萬元,新租金較前租金下跌約兩成。

另有代理表示,深水埗桂林街127號地下A2、A3及A4號舖位,面積約367平方呎,意向價約7,350萬元,三個舖位合共租金約17.3萬元,回報率約2.8厘。

(經濟日報)

SEA Holdings Pays $79M for Hong Kong Build-to-Rent Project

Hong Kong’s SEA

Holdings this week acquired its second luxury residential site in four

months, and is on the way to building a HK$900 million ($114.6 million)

housing project targeting wealthy mainland tenants in the city’s

Jardine’s Lookout neighbourhood.

Having

paid a total of HK$627 million to acquire full ownership of Loong Fung

Terrace, an aging residential block on Tai Hang Road, the local

developer now plans to develop up to 22,000 square feet (2,043 square

metres) of luxury rental housing on the Hong Kong Island property.

The

company’s decision to develop the property on a build-to-rent basis

rather than for sale as condos reversed an earlier plan, with SEA noting

a recent exodus of senior professionals and the city’s closed borders

as driving its decision to hold the property for the long term.

“Since

the beginning of this year, there have been increasing reports of

professionals and senior management people who are upper-income and

high-net worth individuals leaving Hong Kong and might not return

again,” the company said in its announcement to the stock exchange.

“Further, the opening of the border with China was delayed due to

COVID-19 pandemic.”

Lookout Luxury

With

high-end residential prices on Hong Kong island having slid 1.7 percent

during the first quarter, according to a property consultancy, SEA

acknowledged a slip in demand for high-end properties and also pointed

to the Russia-Ukraine war as denting buyer confidence in explaining its

rationale for pursuing a rental strategy. At the announced

consideration, SEA Holdings is paying the equivalent of HK$28,000 per

square foot of floor area for the residential property.

Spanning

an 11,000 square foot site on 89-93 Tai Hang Road, the Loong Fung

Terrace is located less than 15 minutes’ drive from both the Hong Kong

Jockey Club in Happy Valley, and the MTR Wan Chai station, with analysts

pointing to the future value of the project as a luxury housing asset.

“Situated

on a rare residential lot in Jardine’s Lookout, a prestigious location

for the rich and famous to set up homes, the property enjoys good

prospects and thus the attention of developers,” a property consultant

said, which brokered the sale of the property.

Leasing

rates for residential properties in Jardine’s Lookout currently fall

within the HK$40 to HK$60 per square foot per month range, another

property consultant said. Depending on the size of completed units,

monthly rents for SEA Holdings’ project could be in the HK$60 per square

foot range or higher, the consultant added.

“Considering

the location of Tai Hang as a traditional luxury residential area, we

expect SEA Holdings to build slightly larger units (averaging) 1,000 to

1,500 square feet in size, with a total of approximately 15 to 20 luxury

flats,” the consultant said.

Jardine’s

Lookout, home to billionaires such as Joseph Lau of Chinese Estates,

Gordon Wu of Hopewell Holdings, and family members of Hong Kong’s late

“King of Gambling” Stanley Ho, is an affluent residential area located

less than 5 kilometres (3.1 miles) downhill from Wheelock’s Mount

Nicholson project, which has repeatedly set records for Hong Kong’s most

expensive homes.

In

the same neighbourhood, Nan Fung Development, which co-developed Mount

Nicholson with Wheelock project, last year acquired 17 units at Jardine

Court for a potential redevelopment project through a series of

purchases that totalled over HK$1 billion.

Civil Servants Sell Out

On

the sales side, new homes in Jardine’s Lookout trade for at least

HK$70,000 per square foot of floor area, another property consultant

said. “Not many transactions are recorded in (the area) each year, due

to low housing supply, though the area enjoys accessibility to Central

district and Causeway Bay.”

Should

SEA Holdings choose to sell homes in the project rather than hold the

property for long-term investment, the per-square-foot price of each

unit could cost between HK$40,000 and HK$50,000, property consultant

said.

The

developer had won full ownership of the property from the Civil

Servants Cooperative Building Society (CBS) Scheme – which governs homes

built under an initiative to house civil servants in Hong Kong. Under