Confidence in Fan Ling buying queue

Henderson Land Development (0012) yesterday sold 46 of 143 flats on the price list for its second round of sales at One Innovale-Bellevue in Fan Ling.

The

143 homes, ranging from 228 to 501 square feet and covering studios and

one-bedroom, two-bedroom and three-bedroom flats, were being sold at

discounted prices of HK$3.33 million to HK$7.13 million, or HK$13,681 to

HK$17,137 per square foot.

There were also 12 homes for sale by tender.

One

potential buyer said he was optimistic about the future development of

the Northern Metropolis, and he was also cheered by moves to do away

with quarantine rules and cuts in interest rate stress testing.

So he had decided to lay out more than HK$6 million to purchase a three-bedroom flat that would be for personal use.

About 80 percent of the hopeful buyers were people born after 1990, according to a property agency.

The

agency also said that people who bought flats for themselves to live in

accounted for about 80 percent of the purchasers while the rest were

buying for long-term investment.

The

agency also expects that after the completion of the project rents will

reach about HK$45 per square foot, with a yield of more than 3 percent.

Another agent agreed the buying mood had improved with the easing of

quarantine rules last week and the cut of the interest rate stress

testing requirement for property mortgage lending

Although

the number of transactions in the primary market last month was just

602, a half-year low, the agent added that he expected the SAR

administration's continuing measures to boost the local economy would

help the property market.

As

social activities pick up and market sentiment recovers, he estimates

there will be 1,500 transactions in the primary market this month.

But

the other agency is less upbeat about the secondary market, predicting

it could be reporting 6,800 transactions for the third quarter, marking a

low point over 15 quarters. That is seen with the secondary market

being weak due to the impact of the pandemic and the interest rate

hikes.

Transactions in

the third quarter decreased by 37.3 percent quarter on quarter, and

their total value was about HK$57 billion. That was also a drop of 41

percent compared with HK$96.5 billion in the second quarter.

The

agency added that the impact of the government's relaxation of

quarantine measures and the lowering of interest rate stress testing

requirement for property mortgage lending last month would be reflected

in transactions at the end of October.

On

a more positive note, another property agency counted 99 transactions

involving shops in August. That was 4 percent better than July, when

there were 95 transactions.

(The Standard)

Hong

Kong property: why the end of quarantine will not end the pressure on

rentals market, with resident departures still a concern

End

of quarantine will help city get back to normal but analysts say the

move may only provide limited support for struggling rental market

The

city’s property sector has to contend with a slowing economy, a stock

market fall, rising inflation, higher interest rates and resident

departures

Investment

professional Eva Wu, a British national, has terminated her rental

contract in Hong Kong ahead of flying back to the UK in December for a

long holiday.

The

small flat, located at Mountain View Mansion in the busy Wan Chai area,

measures 283 sq ft and has a rent of HK$11,000 (US$1,401) a month. Wu

will rent another flat on her return in February, and given the recent

downward trend in rents as more expats leave the city for good after

years of strict Covid-19 restrictions, she is hoping for a better deal.

“There

has really been quite an impact [on rents]. Many people made a decision

at the beginning of the year to leave, heading off to places like

Singapore,” said Wu. “However, there may be fewer [leaving] now after

the need for hotel quarantine was axed.”

From

September 26, overseas travellers will no longer be confined to hotel

rooms for quarantine upon arrival after Hong Kong finally ended some of

the world’s toughest travel restrictions, in a step aimed at

reconnecting the isolated financial centre with the world.

While

the change will help the bustling city get back to normal, analysts say

the move may only provide limited support for Hong Kong’s struggling

rental market, which may not fully recover until all restrictions are

lifted and the mainland border reopened.

Hong

Kong’s rents are currently expected to fall 5 to 10 per cent by the

year-end, according to analysts, after years of breakneck growth before

the pandemic hit.

“In terms of the property market, [the end of quarantine] will not alter overall sentiment,” a property agent said.

“It

will help stem an outflow of people and talent,” the agent said. “[But]

we will not see significant increases in expats until mid-to-late 2023

as we need to see all restrictions and mask-wearing requirements

lifted.”

The

city’s property sector has had to contend with a slowing economy, a

stock market fall, rising inflation, higher interest rates and the

knock-on effects of Russia’s invasion of Ukraine, which has upset global

supply chains. But it is the wave of departing residents, fed up with

strict pandemic restrictions and Hong Kong’s enactment of a new national

security law in 2020 among other personal reasons, that has been a

major hit.

Once

a go-to destination for high-flying expatriates, more than 113,000

residents – including many expatriates who had earned permanent resident

status – left Hong Kong in the 12 months through June, according to

government data. That is about double the population loss for the

previous year, creating a talent shortage in the financial hub.

The

official index for overall housing rents has declined 1.6 per cent on

year to 179.7 in August, according to data from the Rating and Valuation

Department. It has slid 10.2 per cent since the peak of 200.1 in August

2019.

For

example, in the Central and Western district – which houses the

financial centre – rents have fallen by around 15 per cent from the high

in 2019 because of emigration, a poor economy and an interest rate

upcycle, another agent said.

In

broad terms, rents are about 5 per cent cheaper than last year,

according to another agent. The agent added that there was a smaller

rise in rents over the summer – typically the high season – and that he

had seen less than half the number of expats looking to rent than in

previous years.

“The

market has fewer corporate tenants”, meaning those that typically have a

housing allowance from their firms, the agent said. “Compared to

previous years property owners are worried about the emigration wave and

the early termination of leases. So there have been bigger discounts.”

Another agent expected that rents to fall 5 to 10 per cent by the end of the year along with the general decline in home prices.

For

instance, at Heng Fa Chuen located in the Eastern district of Chai Wan,

one flat measuring 659 sq ft was last week leased at HK$19,500, 22 per

cent less than the asking rent, after being on the market for over four

months, according to information from another property agency.

Meanwhile,

an market index on housing rents, which surveys agents on their market

outlook, sank 36.5 per cent from late April to 38.52 for the week ended

October 2, reflecting a wider rental market adjustment, according to an

agency.

After

the summer high season, when mainland students typically flock to the

city before school semesters begin in September, the number of leases

declined. City One Shatin saw only about 60 leases in September, down

about half from 118 leases in August, according to the agency.

Meanwhile,

rents in Kowloon have fallen for five consecutive months, according to

the agency. Laguna City in Lam Tin saw rents fall the most in the past

five months, down 4.8 per cent to HK$28.1 per sq ft. There is also

expected to be an increase in the supply of rental listings in Kowloon

with the completion of more large housing estates.

“In

the past, landlords were very aggressive in increasing rents, causing

tenants to turn to other units,” an agent said. “It has not been like

that in the past two years. Instead, rent has been reduced to keep the

tenant.”

And

the pressure on luxury housing rents has been relatively higher than

that for the mass market, another agent said. Anxious owners are now

offering discounts and longer rent-free periods, the agent said.

“For

the expat market, we have seen more departures than arrivals in recent

months,” the agent said. However, we do think the peak for departures

has passed, with the number falling from a few months ago, the agent

added.

For listings with rents above HK$80,000 a month or for large units above 2,000 sq ft, demand remains weak, the agent said.

Investment professional Eva Wu still expects the market to remain weak, and is hopeful of reducing her own rent.

“It’s difficult, there is no reason to ask people to return after working [elsewhere] for just a few months,” said Wu.

“Unless the border with the mainland reopens … there will not be much of a rebound if we simply rely on returning expats.”

(South China Morning Post)

月商廈買賣氣氛突高漲 連錄4宗「超級大刁」 高銀金融國際中心全幢矚目

今年以來,商廈市況一潭死水,比較去年價量齊跌,不過,上月市場氣氛突然高漲,連錄4宗「超級大刁」,最大宗的為九龍灣高銀金融國際中心全幢,涉資逾65億,大買賣亦包括新世界沽售長沙灣永康街商廈項目逾51%業權,作價近30.8億。

根據本報統計資料,今年以來,涉資逾億元的商廈暫錄15宗,涉資135億,比較去年同期23宗涉資173億,價量齊跌,而且,涉資金額集中於上個月,買賣氣氛突高漲,連錄4宗「超級大刁」,該4宗涉資約117億,金額佔今年以來整體買賣的87%,可見上月市場之暢旺。其中,九龍灣高銀金融國際中心全幢,該宗買賣至今未知買家身分,涉資逾65億,另一說法則指約70億。新世界亦剛於上周沽售長沙灣永康街商廈項目51%權益,買家為新加坡基金Ares SSG Capital Management,作價30.88億。

資深投資者羅守輝亦沽貨止賺,中環皇后大道中118及120號聯盛大廈全幢商廈,作價2.98億易手,平均呎價2.78萬,他於2002年7月以3038.8萬購入上址,持貨逾20年,帳面勁賺2.676億,升值近9倍,買家為杜家駒。還有,旭輝控股沽出炮台山英皇道101號及111號商廈60%股權,涉資13.4億,買家為宏安地產及荷蘭退休基金。

基金30.8購長沙灣商廈

有代理表示,疫市下,工商鋪當中以商廈「最傷」,上月大手買賣以低價主導,九龍灣高銀金融國際中心全幢,市傳以約70億易手,平均呎價只有7000多元,區內商廈平均呎價逾萬元,若該成交屬實,無疑對區內商廈市場大力地「踩了一腳」,更市況雪上加霜;中環聯盛大廈全幢商廈呎價2.98萬,亦屬低水平,項目屬於銀座式商廈,亦屬疫市下受影響的項目。

代理:低價成主流

該代理又說,綜觀上月4宗大買賣,並非市場上主流,目前,分散業權的甲廈交投淡靜,原因是商廈買家一般並非用家,而是投資者居多,在持續疫市下,商廈出租率不理想,連核心區中環空置率亦高達9%至10%,整體市場空置存量多達1000多萬呎,明年更有機會逾2000萬方呎,創歷來新高,令投資者卻步。

(星島日報)

更多高銀金融國際中心出租樓盤資訊請參閱:高銀金融國際中心出租

更多九龍灣區甲級寫字樓出租樓盤資訊請參閱:九龍灣區甲級寫字樓出租

赤柱豪宅地王估值逾百億

政府日前公布今季賣地計畫,將推出3幅住宅地,其中2幅更屬百億豪宅地王,當中最矚目為赤柱環角道豪宅地,可建總樓面逾48萬方呎,是該區有大型新供應,並季內屬百億地王之一,該地綜合市場估值介乎約168.1億至206.5億,每方呎估值約3.5萬至4.3萬。

每呎約3.5萬至4.3萬

上述地皮為赤柱環角道豪宅地 (鄉郊建屋地段第1204號),鄰近舂坎角一帶的豪宅物業,如昭陽花園及壁如花園等。項目地盤面積約25.51萬方呎,涉及可建總樓面約48.02萬方呎,估計可提供約650伙,是區內近年最大型的地皮新供應,料日後可發展規模較大的豪宅屋苑。綜合市場估值,上述地皮估值介乎約168.1億至206.5億,每方呎估值約3.5萬至4.3萬,有力問鼎百億地王寶座。

資料顯示,對上一次批出的同區賣地表地皮,為建灝於2016年以28.11億投得的赤柱黃麻角道128號項目,以該地可建總樓面22.6萬方呎計,當時每方呎樓面地價約12436元;意味該區相隔6年再有新供應。

有測量師表示,上述估值過百億地王發展規模大,比山頂文輝道還要大,而項目屬於豪宅地段,料大部分單位享有海景,由於豪宅單位往往需要時間消化,投資期較長,相信入標的發展商或財團不多,料在目前市況下出價必然保守。

另一測量師指出,由於地盤面積大,並且位處豪宅地段,而且在加息後推出,認為該地皮可以成功出售,相信成交價具指標性作用,亦反應發展商對豪宅市況走勢看法。

(星島日報)

New home sales hit in downsizing

A total of 3,560 home transactions

were recorded in the primary market in the third quarter, down about 6.6

percent from 3,811 in the second, according to a property agency.

Total

turnover plunged by about 38.5 percent from about HK$43.98 billion in

the second quarter to about HK$27.04 billion, as primary-market deals

were dominated by small and medium-sized units, resulting in a sharp

decline in the value.

The agency said Novo Land

phase 1A and 1B in Tuen Mun recorded the largest number, followed by

One Innovale phase one and two in Fan Ling North, and the two projects

saw a total of 2,377 transactions.

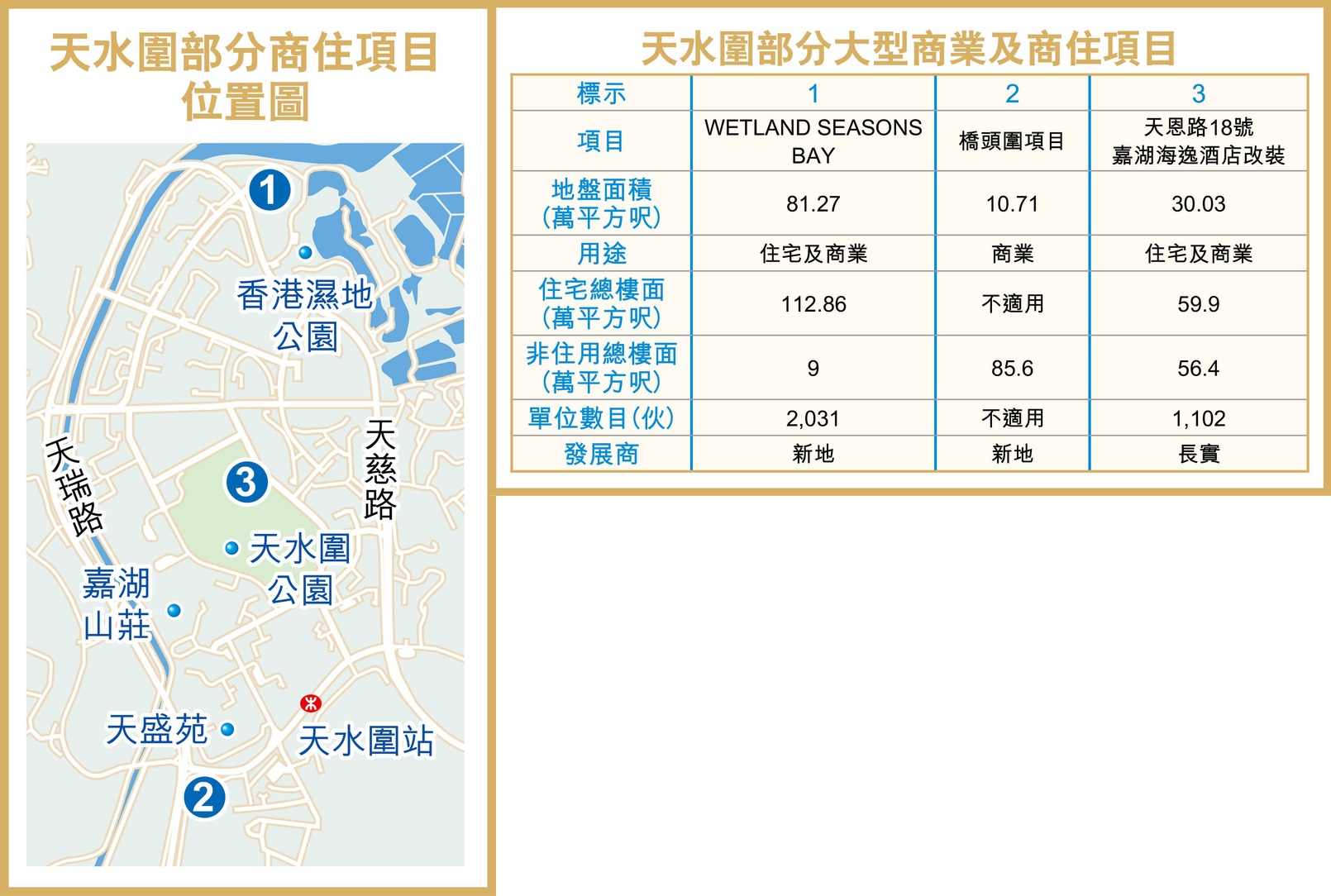

Meanwhile, Wetland Seasons Bay

phase three, a Sun Hung Kai Properties (0016) project in Tin Shui Wai,

sold three units through tender yesterday, with the total price coming

in at more than HK$40.72 million.

The

highest bid was for 1,121-square-foot villa RV2, which includes 669

square feet of garden area and sold for HK$15,26 million, or about

HK$13,609 per foot.

Another

agency said there were 47,886 property deals and total turnover of

HK$465.93 billion in the first nine months of 2022, down 36.6 percent

and 34 percent, from 75,568 transactions and HK$705.69 billion in the

same period of 2021.

It

expected the total number for 2022 to be about 65,000, which would be

the lowest in 27 years since record-keeping began in 1996, beating the

low of 70,503 set in 2013.

In

other news, the vacancy rates of grade-A offices in Kowloon in August

was about 11.73 percent, down by about 0.36 percentage points month on

month, with Tsim Sha Tsui District seeing a significant drop.

(The Standard)

Property agency says Hong Kong property sales to plummet to 27-year low this year, as Covid-19 curbs, higher interest rates bite

If the agency forecast holds, 2022 will record the lowest annual property transactions tally since 1996

Sales volumes likely to decline by 15 per cent, but last year was a record year, another agency says

Property

transactions in Hong Kong are expected to fall to historic lows this

year, according to a local property agency, with the first half of the

year affected by Covid-19 lockdowns and the second half hit by rising

interest rates.

Property

sales are likely to hit 65,000 this year, the agency said. If the

forecast holds, it will be the lowest annual property transactions tally

since 1996, according to government records. The previous record low,

of 70,503 registrations, was reported in 2013.

“In

the first nine months of the year, there were 47,886 total sales of

residential, parking, industrial and commercial properties with a total

value of HK$465.9 billion [US$59.4 billion],” an agent said . “The

number of transactions [for the whole of 2022] will be lower by 36.6 per

cent, while the value will decline by 34 per cent, compared to 2021.”

The city imposed its most stringent social-distancing measures

since the coronavirus pandemic began early 2020, at the start of the

year. The lockdown effectively ground the market to a halt, with very

few sales events being organised for new launches.

Moreover,

Hong Kong has been raising rates since March in lockstep with the US

Federal Reserve. The Hong Kong Monetary Authority has now raised its

base interest rate five times this year to 3.5 per cent, a 14-year high.

Commercial banks such as HSBC and Bank of China (Hong Kong) raised

their prime rates last month to a four-year high, making it costlier to

fund big-ticket purchases such as housing.

A

total of 8,968 new residential units worth about HK$98.9 billion were

sold in the first nine months of the year, the agency said. This tally

is 30.1 per cent lower compared with the same period in 2021 while the

total value is 44.9 per cent lower.

The

sales of new homes for the whole of 2022 are likely to reach about

12,000, a nine-year low after the 9,753 units sold in 2013.

Sales

in the secondary market stood at 25,383 units, worth about HK$226.3

billion in the January to September period, the agency said, with volume

down by 40.1 per cent and value by 41.3 per cent, when compared with

last year.

The

sales of lived-in homes this year are expected to fall to 34,000 units,

potentially a 27-year low, the agency said. The previous historic low

was recorded in 2016, when 34,657 lived-in homes changed hands.

In

August, the prices of lived-in units fell by 2.6 per cent on average to

their lowest level in three-and-a-half years, government data shows.

The sales of homes this year are likely to fall by 30 per cent to 50,000 to 53,000 units, another agent said.

“In

the first six months of the year, during the fifth wave of the Covid-19

infections here in Hong Kong, the market was really quiet,” another

agent said. “Sales volumes are likely to decline by 15 per cent this

year, but last year was a record year for us.”

The

second half is likely to be worse than the first six-month period, as

homebuyers grapple with higher interest rates, the agent added.

(South China Morning Post)

九龍區甲廈空置率11.7% 代理行:按月減0.36個百分點

九龍商業區商廈租金廉宜,空置率亦改善,有代理行資料顯示,最新整體指標商廈空置率錄約11.73%,按月減低0.36個百分點,當中尖沙嘴區寫字樓空置情況改善,最新數字為10.17%,按月遞減1.64個百分點。

該行代理表示,8月份九龍區整體指標商廈空置率錄約11.73%,對比7月份回落0.36個百分點,按年減低0.8個百分點,其中尖沙嘴明顯減少,由7月份約11.81%,減低1.64個百分點至約10.17%,惟對比2021年同期遜色,較之前高出1.87個百分點。

新港中心呎租34元減23%

最近新港中心一座中層10室,面積約1450方呎,以呎租約34元獲租客承租,比舊呎租約45元,減幅約23%。同時,尖東甲廈林立,該地段8月份寫字樓空置率錄12.04%,按月減低0.70個百分點,按年對比則上升0.67個百分點。旺角區8月甲廈空置率按月升1.07個百分點至約5.07%,但實質為九龍商業區中最低,對比2021年同期更大幅減低2.49個百分點。

旺角區空置率5.07%最低

該代理續稱,九龍東方面,觀塘區指標商廈空置率有所改善,最新錄約9.56%,按月遞減0.21個百分點,按年跌幅達2.96個百分點,九龍灣因甲廈樓面供應過剩,九龍灣8月份空置率錄約19.42%,比7月上升0.41個百分點,按年略微減少1.04個百分點,但未來數年續有大型寫字樓項目發展,相信區內商廈空置率短期內難以回落。

(星島日報)

更多新港中心寫字樓出租樓盤資訊請參閱:新港中心寫字樓出租

更多尖沙咀區甲級寫字樓出租樓盤資訊請參閱:尖沙咀區甲級寫字樓出租

商廈買賣暫錄210宗按季跌23%

今年以來商廈市場吹淡風,利嘉閣指出,今年第三季料錄210宗,按季跌23%,寄望疫情改善,限制措施再度鬆綁,年內可以通關市況得以逆轉。

有代理表示,近月市況不就,商廈買賣徐徐下跌,綜合土地註冊處數據,2022年8月份全港共錄70宗商廈買賣,較七月份的78宗再跌10%,連跌3個月,創近5個月最少。

8月份商廈買賣量跌值升,登記金額激增41.95倍,主因月內錄2宗疑屬內部轉讓巨額登記的中環交易廣場個案,共涉資518.01億,金額錄歷史性新高的527.26億;不過若撇除相關登記後,月內實際登記總值9.25億,按月跌近25%。

按價格劃分,在7個價格組別登記量當中,錄三跌四升。在跌幅者中,以5000萬至1億以內組別86%跌幅至只有1宗最急劇;而2000萬至5000萬以內及1000萬至2000萬以內組別亦分別大跌85%及71%,各自僅錄2宗及5宗登記,拖低整體表現。

代理行:憧憬年內通關後逆轉

該代理指出,總結第三季商廈登記料只有約210宗,將較次季的273宗大減23%。至於今年最後一季,如果疫情持續減退,入境檢疫限制進一步放寬至「0+0」,則第四季商廈跌勢可以喘定。

(星島日報)

更多交易廣場寫字樓出租樓盤資訊請參閱:交易廣場寫字樓出租

更多中環區甲級寫字樓出租樓盤資訊請參閱:中環區甲級寫字樓出租

正八集團部署明年5億掃貨 廖偉麟:鋪位商廈價格未見底

近年來,正八集團主席廖偉麟成為淡市勇者,不斷出手買賣,不過,近期轉趨觀望,指在防疫措施「0+0」之前,不再出手買貨,鋪位商廈價格未見底,惟相信距離見底不遠,集團部署明年以5億掃貨;而早前購入的上環南和行大廈一籃子鋪位及商廈,則已取消交易。

廖偉麟於今年2月,以1.38億購入上環南和行大廈物業,成交期長達半年,項目早前已取消交易,他指出,取消交易屬個別事件,亦是商業決定,與市況沒有關係,賣方已退回訂金,基於保密條款,不方便透露詳情。

取消南和行大廈物業交易

雖然如此,向來活躍市場的他,近期已轉趨向觀望, 他指出:「除了疫情持續,市場進入加息周期外,料想不到的是,打仗持續長時間,為全球經濟帶來負面影響,更令利息加得兇狠。」疫情持續無期,市況急速改變,目前,他採取觀望態度,暫未打算出手入市。

市況離底不遠 寄望通關

他續說,現時入境隔離「0+3」,比大家預期短,不過,若與其他地區比較,香港競爭力並不足夠,對經濟提振作用有限。「不過,基於0+3的出現,比大家預期中的3+4跨進一大步,因此,我相信0+0即將會出現。」

他指出,為了顧及經濟,相信政府會隨時、或最遲聖誕節前後,宣布恢復通關,一日未通關,經濟難於向好,市況仍然在回落中,現時,鋪位及商廈價格尚未見底,但他相信距離見底不遠,當通關後,市況不會即時恢復,需時至少數個月甚至半年時間,才能夠回氣,甲廈及核心區鋪市將受到帶動。

料通關後市況需時恢復

過去兩、三年間,廖偉麟連環買賣物業,當中至少有4項屬短綫買賣,持貨兩至三年間,賺幅由13%至35%,成為淡市奇葩,不過,亦有部分物業即使低價吸納,但市值跟隨市況縮水,例如,海富中心22樓單位,他購入呎價高逾2.9萬,當時低市價逾20%,近期,湯臣集團購入13樓銀主盤,最新呎價不足2萬,不過,對他來說沒有關係,他有能力看長約,期待好市時善價而沽。

他手上仍然有「子彈」,伺機出擊,廖偉麟表示,他目前手持5億,將會待宣布「0+0」時,開始尋找盤源,估計明年開始掃貨,目標未有改變,仍然是位處旺區鋪位、乙廈及甲廈。

(星島日報)

更多南和行大廈寫字樓出售樓盤資訊請參閱:南和行大廈寫字樓出售

更多上環區甲級寫字樓出售樓盤資訊請參閱:上環區甲級寫字樓出售

更多海富中心寫字樓出售樓盤資訊請參閱:海富中心寫字樓出售

更多金鐘區甲級寫字樓出售樓盤資訊請參閱:金鐘區甲級寫字樓出售

啟德住宅地王估值逾百億

近年本港商業氣氛不景氣,政府早前成功將啟德3幅商業地改劃作住宅發展,當中2幅已納入賣地表,其中有力挑戰百億地王的2A區4號、5 (B) 號及10號合併招標用地,涉及可建總樓面約138萬方呎,綜合市場估值約165.6億至193.2億,每方呎估值約1.2萬至1.4萬。

啟德區近年有多幅商業地以流標收場,政府早前計畫將區內5幅商業用地改劃作住宅發展,其中3幅成功改劃,跑道區2幅商業地則保留作商業用途。其中,曾以商業地方式推出、並以流標收場的2A區4號、5 (B) 號及10號合併招標地皮,最快於季內以住宅地方式招標。

可建總樓面逾138萬方呎

上述地皮由三個地塊組成,並合併成一個項目招標,佔地規模較大,地盤面積約17.25萬方呎,涉及可建總樓面約138.02萬方呎,料可提供約1750伙,是今季賣地計畫推出住宅地中最大。該地由於分割為三塊大小不一的地皮,影響設計彈性,景觀方面料以面向市區景為主。

測量師說,上述項目地盤面積較大,由於鄰近港鐵站、九龍城及土瓜灣一帶,配套設施較為充足,相信項目日後落成推出時,區內不少商業配套及地標建築已經落成;即使近期該區規劃有轉變,惟該地對財政收益大,由於發展規模大,料以合組方式入標,以分散風險。

料發展商合組財團入標

測量師表示,區內3幅商業地成功改劃作住宅地中,以上述用地最大,涉及投資額大,預計發展商出價保守。另外,該地最接近港鐵宋皇臺站,料日後不少單位可享九龍城一帶都市景,參考早前商業地皮招標條款,相信中標者要提供社福設施。

資料顯示,上述合併招標項目曾於2020年5月以商業用地方式推出招標,當時僅截收4份標書,惟出價未達政府就該用地所定的底價,以流標收場,其後改為住宅用地推出。

(星島日報)

觀塘市中心重建項目 料掀爭奪戰

市建局將在今季推出觀塘市中心第4及5區重建項目,可建樓面達216.6萬平方呎,屬於近年規模最大的商業項目之一,加上位於港鐵觀塘站旁中心地段,屬於兵家必爭之地。

觀塘市中心重建早在1998年由市建局前身的土地發展公司公布,直至到2007年才正式啟動,涉及裕民坊、物華街、協和街及康寧道等,分為5區發展,前3區屬於住宅或商住項目,餘下屬於裕民坊的部分則為商業發展。

可建樓面216萬呎 罕有大規模

按照第4及5區過往的規劃,基座將會興建逾百萬平方呎的大型商場,並興建1幢60層高的商廈,最頂層作為酒店用途,連同項目內的公共運輸交滙站、社區設施,總樓面約216.6萬平方呎樓面。

市建局早前因應市場意見,修訂方案加入「浮動參數」概念,即容許發展商在酒店、辦公室及商場3種不同商業用途樓面中可以有限度調撥,選擇最適合自己發展的方案,而維持總樓面216.6萬平方呎不變。

今季內招標 估價逾119億

例如,酒店樓面由約34.44萬平方呎,變成彈性介乎0至34.44萬平方呎,換言之,日後發展商可以選擇興建最多為400間酒店房,或不興建酒店;而商場部分樓面則由約102萬平方呎,減至介乎約69.97萬至102萬平方呎;辦公室樓面上限由約70.89萬平方呎,增加至約137.37萬平方呎。

項目早在今年8月初已經開始收意向書,並在上月7日截收,合共接獲24份意向書,市建局預計將於今季內正式招標。市場就地皮估值約119.1億至210億元,每呎樓面地價約5,500至9,700元,連同建築成本,總投資將會達200億至300億元。地皮佔據觀塘市中心地段,旁邊是港鐵觀塘站,南面是觀塘商業區、北面為觀塘住宅區,成為來往兩區的必經之路,有相當戰略價值。

特別是過住新地 (00016) 在觀塘道一帶先後發展多期的創紀之城系列商廈,當中創紀之城5期商場apm更因比鄰港鐵站優勢,盡吸透過鐵路交通上、下班的觀塘上班族人流,將來裕民坊重建成的商場、商廈相信跟創紀之城5期有互相競爭因素,故此市場相信,新地會有興趣競投,以鞏固其商業王國。

(經濟日報)

更多創紀之城寫字樓出租樓盤資訊請參閱:創紀之城寫字樓出租

更多觀塘區甲級寫字樓出租樓盤資訊請參閱:觀塘區甲級寫字樓出租

安達臣小型商業地 料發展民生商場

觀塘區最近一幅批出的商業地,屬於位置在安達臣道石礦場的小型商業地,由領展 (00823) 以約7.66億元投得,每呎樓面地價約5,501元,高出市場預期。

該幅商業地面積只有6.3萬平方呎,可建樓面約13.9萬平方呎,在商業地而言,屬於偏細的規模,由於地皮遠離觀塘市中心地段,只屬於民生住宅區,故此相信領展投得後,將會以發展民生商場為主。

同區地皮季內推 可建11萬呎

除了上述地皮外,安達臣區內還有另一幅商業地將於今季推出。該幅用地地盤面積合共約5.7萬平方呎,可建樓面約11萬平方呎,較早前領展投得的商業地規模更小,而且地皮由2部分組成,位置相隔一段距離,其中一部分只能興建一些小型商舖,發展潛力有限,地皮估值約5億至6.4億元,每呎樓面地價約4,500至5,780元。

未來觀塘仍然有不少商業地推出,規模最大為鄰近翠屏河的茶果嶺道商業地,佔地約10.4萬平方呎,可建樓面達123.8萬平方呎,過往亦曾經納入在賣地表內。至於其餘大型商業地還包括觀塘行動區商業地、勵業街商業地,3幅未推出由政府持有的商業地合共涉及多達241萬平方呎樓面。

(經濟日報)

星共享工作間進駐長江集團中心 The Great Room港設第二據點 放眼亞太

近期來自新加坡的公司或基金積極來港尋找機會,除有基金大手購入香港住宅及商廈物業作投資外,在新加坡成立的共享辦公室營運商The Great Room亦在港設立新據點,於核心商業區中環租用頂級商廈長江集團中心全層作為集團於香港第二個共享工作間。The Great Room創辦人及行政總裁洪可珈 (Jaelle Ang) 接受本報訪問時表示,香港是全球一個重要的金融中心,地位毋庸置疑,進駐中環主力服務高端客戶,更是擴大集團亞太區版圖的最重要一步。

末季啟用 市值呎租150元

The Great Room於2019年首度進駐香港市場,租用非傳統核心商業區鰂魚涌太古坊一座全層成首個據點,事隔3年,該集團租用中環長江集團中心45樓全層,作為香港第二個據點的選址,將於今年第四季開幕。

資料顯示,長江集團中心45樓全層可租用面積21334方呎,2018年由虛擬貨幣衍生產品交易所BitMEX租用,當時呎租高達約212元。據現時最新市值呎租,已回落近三成至約150元。

洪可珈直言,因為香港已取消入境酒店隔離安排,多個大型國際活動及會議將舉行,鼓勵不少企業重返香港開展業務,有助推動香港恢復作為金融及商務中心的地位,加上新工作模式興起,現時正是公司開拓新據點的絕佳時機。

她續稱,香港是一個重要的金融中心,對全球企業具有吸引力,目前仍有不少商界領袖或企業的決策人士居住在香港,故集團視香港為發展亞太地區市場最重要的一個戰略地區,「若不能贏得香港市場,就贏不到亞太區市場。」(One

cannot win Asia-Pacific without winning Hong Kong. )

The Great Room新據點落戶中環核心地段,洪可珈指出,中環一直是全港寫字樓空置率最低的地區,長江集團中心地理位置優越,大廈租戶更包括多家國際知名企業。而旗下共享工作間的會員有來自科技、金融、法律及專業顧問服務機構的企業,對高質素、設備齊全的共享空間需求上升,使用其中環共享工作間的用戶,可與金融、銀行、資產管理的世界級企業辦公室看齊。

洪可珈:擬拓京滬日本市場

The Great Room中環新據點設有22間私人辦公室,包括兩間企業辦公室,最大的一間可容納50人。至於私人辦公桌 (Dedicated Office) 每張每月租金由1.55萬元起;每張流動辦公桌 (Hot Desk) 月租則由3600元起。太古坊一座的The Great Room會員亦能使用中環共享工作間的設施。

資料顯示,現時中環區內亦有多間共享辦公室,目前私人辦公桌月租由6000元至1萬元;流動辦公桌則每月3000至8000元。

洪可珈認為,新冠肺炎是加速共享辦公室發展的催化劑,不少企業已陸續採用混合工作模式,令工作地點、時間更有彈性。香港與其他城市相比,寫字樓租金高昂,靈活的工作空間可讓企業更易應對商業環境的不確定性。在疫情後,集團在太古坊一座的辦公室中,有三分之二的查詢來自從未使用過共享辦公室服務的公司,由此可見新需求不斷增加,故對本港共享工作間的前景充滿信心。

The Great Room現時在新加坡、香港和泰國曼谷3個市場發展,洪可珈透露,中環將是集團第十個開設的據點,未來將繼續於香港擴大版圖,更有意拓展上海、北京、日本東京等新市場,期望一兩年內把亞太地區的據點增加一倍。

(信報)

更多長江集團中心寫字樓出租樓盤資訊請參閱:長江集團中心寫字樓出租

更多中環區甲級寫字樓出租樓盤資訊請參閱:中環區甲級寫字樓出租

更多太古坊寫字樓出租樓盤資訊請參閱:太古坊寫字樓出租

更多鰂魚涌區甲級寫字樓出租樓盤資訊請參閱:鰂魚涌區甲級寫字樓出租

Hong Kong property sales post modest results in October debut as homebuyers await new policies, expect further rate increase

Henderson Land Development’s One Innovale-Bellevue in Fanling sold 45 flats on Sunday, around one-third of the 143 units on offer

The outlook for property sales in the fourth quarter is not optimistic because of a possible further increase in interest rates

Hong Kong’s first weekend property sale this fourth quarter posted modest results, as homebuyers took a wait-and-see approach ahead of another interest rate increase, and key policy announcements in the city and the mainland later this month, analysts said.

Henderson Land Development’s One Innovale-Bellevue project in Fanling, located in the city’s planned Northern Metropolis area, sold 45 flats on Sunday, according to property agent.

While

that number represented around one-third of the 143 flats on offer, the

agent said the response was within expectation because Sunday’s sale

was the second conducted by the developer within a week. On September

27, Henderson Land sold 231, or 95 per cent, of 243 flats on offer.

“[Sunday’s]

result is not bad for a second round of sale,” the agent said. “The

project mainly caters to young people who are first-time buyers and can

only afford small-sized new flats.”

The entry price at One Innovale-Bellevue, which is designed to have a total of 1,600 flats, is HK$3.07 million for a unit that measures 221 square feet.

The Henderson Land project’s location in the Northern Metropolis is expected to benefit from the government’s plan, which was announced last year, to develop the area into an information technology hub near the border with mainland China.

“Local

homebuyers are taking a wait-and-see approach, as they want to know

what new property policies will be announced by the Hong Kong government

in the coming policy address, as well as the latest developments from

mainland China’s 20th Congress later this month,” the agent said.

Hong Kong Chief Executive John Lee Ka-chiu on Saturday said he was in the final stage of drafting his maiden policy address, set to be delivered on October 19.

China’s 20th Party Congress, which will commence on October 16, is expected to herald a third term for President Xi Jinping as the Chinese Communist Party’s head, while ushering in a new leadership team.

Sunday’s modest debut of property sales this fourth quarter reflects the short-term pressure on Hong Kong’s housing sector from rising interest rates globally.

The results come after a weak third quarter amid rising interest rates, according to another agent.

“The

outlook for fourth-quarter property transactions is not optimistic

because it is widely expected that the US and Hong Kong will continue to

increase interest rates,” the agent said. “The best-case scenario would

be that fourth-quarter home prices and transactions maintain the level

reached in the third quarter.”

Lived-in home prices in the city fell by 0.8 per cent

in the week ended September 18, according to the a market index. They

retreated by a cumulative 6.1 per cent in 10 straight losing weeks, and

by 11.2 per cent from the record-high in August 2021.

The

number of lived-in home transactions in the third quarter could reach

about 6,800 deals valued at HK$57 billion, which would be the lowest

number since 5,159 transactions worth HK$44.52 billion were recorded in

the fourth quarter of 2018, according to the agency. That number of

deals would represent a 37 per cent decrease from the second quarter,

when the value dropped by 41 per cent.

First-hand

property sales, meanwhile, reached about 4,150 transactions, up 33 per

cent than the second quarter and the highest since the 4,635 deals

recorded in the fourth quarter last year. Their value, however, declined

by 5.5 per cent to HK$36 billion, which reflected how most new flats

sold in the previous quarter were small units.

The agent said that resulted from the decision by major developers to aggressively market new projects for sale.

Hong

Kong’s 10 major banks last month increased their prime rates by 12.5

basis points to 5.125 per cent or 5.375 per cent. That means payment on a

typical HK$5 million, 28-year loan with a 2.75-percentage point

discount to the prime rate will increase by 1.6 per cent, or HK$323, to

HK$21,029 per month, according to a local mortgage broker.

Hong

Kong’s currency has been pegged with the US dollar since 1983, which

means the city followed US interest rates. Although the US Federal

Reserve has increased interest rates by 300 basis points this year,

analysts expect it will further raise interest rates by another 125

basis points around the year’s end as part of efforts to tame high

inflation.

(South China Morning Post)

外資代理行:末季甲廈空置率 持續高企

入境措施有所放寬,有外資代理行認為,市場仍需時消化大量甲廈新供應,料第四季甲廈空置率持續高企,非核心區壓力較大。

據該代理行每月商廈租金走勢上,中環最優質甲廈呎租約130.6元,按月跌約2.4%,而整體中環租金亦跌1.2%。至於邊綫地段,如上環、銅鑼灣及鰂魚涌,租金均稍為下跌。九龍區方面,尖沙咀租金按月跌1.1%,按年跌約1.8%。至於空置樓面較多的東九龍,最新呎租約28.8元,按月跌不足1%。

寫字樓租賃疲弱 港島呎租約73元

該行指,空置率創歷史新高的壓力下,香港島寫字樓的整體租金在8月份進一步下跌。寫字樓租賃依然疲弱,很多租戶選擇續租而非搬遷。港島區目前平均呎租約72.9元,今年累跌約3.6%。甲級寫字樓的吸納需求主要來自共享工作空間和政府機構。共享工作空間營運商正在積極尋求優質寫字樓作營運。其中新加坡共享空間品牌the

Great Room,於核心區增租樓面,租用中環長江集團中心2.1萬平方呎。

TEC中環新據點開幕 出租率85%

靈活辦公空間需求不俗,德事商務中心 (TEC) 位於中環士丹利街28號新據點近日開幕,成為集團在港第13個據點。涉及該廈全幢19層,總樓面約5.5萬平方呎。集團指,出租情況不俗,現時出租率已達85%。

據悉,新據點提供500個辦公位,設有共享樓層以及多個獨立辦公室。TEC指,隨着近期擴張,已經佔據中環和金鐘的甲級靈活辦公市場總面積的65%,有助鞏固業務。

核心區供應上,長實 (01113) 旗下中環和記大廈重建而成的長江集團中心二期,將於明年落成。長實再公布標準樓層全層面積約1.73萬平方呎,採用方正及無中柱式設計,並稱提供靈活多變的實用空間,強調戶戶可享維港海景。項目樓高41層,總建築面積達55萬平方呎,標準辦公室樓層建築面積約17,300平方呎,樓層採用方正及無中柱式設計,為租戶提供靈活多變的實用空間。

九龍區方面,該行指,寫字樓交易以細面積為主,營商信心轉差,以及中國內地和跨國公司缺乏需求驅動因素,預計九龍區寫字樓租賃仍將面臨壓力。

該行指,疲弱的營商環境預計持續,業主將提供更多創新和靈活的租賃計劃,以留住和吸引租戶。雖然政府已放寬邊境限制,但市場仍需要一段時間來吸納大量的寫字樓供應,預計下一季空置率將保持高企,特別是非核心區,租金將面臨壓力。九龍方面,料全年九龍區寫字樓市場的整體租金增長將在0至2%之間。與港島一樣,由於租賃活動在8月份繼續放緩,大多數租戶都持觀望態度。

(經濟日報)

更多長江集團中心寫字樓出租樓盤資訊請參閱:長江集團中心寫字樓出租

更多長江集團中心二期寫字樓出租樓盤資訊請參閱:長江集團中心二期寫字樓出租

更多中環區甲級寫字樓出租樓盤資訊請參閱:中環區甲級寫字樓出租

買賣方面,近期商廈罕有錄得全幢成交,涉及九龍灣高銀金融國際中心,以約70億元易手,成今年最大額商廈買賣。

總樓面92萬呎 出租率約7成

本年5月,外資測量師行獲接管人委託,標售九龍灣高銀金融國際中心全幢商廈,並於上月尾截標。據悉,項目正式售出,成交價料涉約70億元。成交價計,為今年最大手物業買賣成交。至於對上一宗最大手甲廈買賣,為去年由億京合組財團,以約105億元購入九龍灣國際展貿中心。該物業樓高31層,總面積約92萬平方呎,每層面積約3.5萬平方呎,據悉未計高銀使用樓層,現時出租率約7成,呎租約27至33元。按物業總樓面約92萬平方呎計算,成交呎價僅約7,608元。

翻查資料,高銀於2011年7月以34億元投得該商業地皮,項目於2016年入伙,一直作集團總部及收租用途。惟近兩年高銀金融陷入財困,故高銀金融國際中心多次傳出放售,及曾多次抵押。

(經濟日報)

更多高銀金融國際中心出租樓盤資訊請參閱:高銀金融國際中心出租

更多九龍灣國際展貿中心寫字樓出租樓盤資訊請參閱:九龍灣國際展貿中心寫字樓出租

更多九龍灣區甲級寫字樓出租樓盤資訊請參閱:九龍灣區甲級寫字樓出租

Hong Kong property developer New World expects housing market to feel the squeeze from rising interest rates

Housing market will gradually recover as there is still strong demand for homes, says CEO Adrian Cheng

Hong Kong-listed developer posts an 8.5 per cent increase in full-year profit to US$159.2 million

Hong Kong’s housing market will be under pressure in the short-term from rising interest rates globally, the CEO of New World Development (NWD) said on Friday, after the property developer posted a modest 8.5 per cent rise in full-year profit.

“Such

a turbulent market is stressful for everyone and we managed to record

some gain in earnings,” Adrian Cheng Chi-kong, who is also the executive

vice-chairman, said in an online briefing to discuss the results.

He

said that property buyers in the city have adopted a wait-and-see

attitude amid a tightening interest rate cycle globally. “Buyers need

some time to digest, which will lead to downward pressure on Hong Kong’s

property market in the short term.”

The

company’s net profit for the year ended June 30, 2022, rose 8.5 per

cent from a year ago to HK$1.05 billion (US$159.2 million), while

underlying profit, excluding changes in the valuations of properties,

rose 1.8 per cent to HK$7.08 billion. Revenue was flat at HK$68.2

billion.

New

World’s revenue generated from property sales plunged 23 per cent year

on year, mainly dragged by a 80 per cent drop in contracted sales in

Hong Kong.

Hong

Kong’s housing market remains mired in a slump, reflecting the impact

of higher interest rates and the city’s coronavirus restrictions. Home prices fell by 2.26 per cent in August to their lowest level in three and a half years and have retreated 6.5 per cent this year.

The Hong Kong Monetary Authority has raised its base interest rate five times this year to

3.5 per cent, a 14-year high, in lockstep with hawkish US Federal

Reserve rate increases. Banks such as HSBC and Bank of China (Hong Kong)

raised their prime rates last week to a four-year high, making it

costlier to fund big-ticket purchases such as housing.

“But we believe it [the housing market] will recover gradually, as there is still strong demand for homes,” Cheng said.

Asked

about his views about the new Hong Kong government led by Chief

Executive John Lee Ka-chiu and easing of quarantine measures, Cheng said

that the administration was handling the situation pretty well.

“We

hope to see more relaxation and want the city to host more events,

bring back some talent and reboot Hong Kong’s economy,” he said.

After

more than two years of efforts to prevent coronavirus infections, Hong

Kong lifted its Covid-19 hotel quarantine policy for all arrivals from

September 26, adopting a “0+3” model.

New

World said it was targeting revenue of HK$30 billion from property

sales this year, split evenly between Hong Kong and mainland China.

The

company’s K11 Musea shopping centre in Kowloon recorded a year-on-year

increase of 9 per cent in sales during the period, while total footfall

amounted to around 20 million.

The

developer said that the increase in sales was mainly driven by better

performance of its top tier international brands tenants, including

jewellery and watches as well as personal care and beauty.

It has proposed a second-half dividend of HK$1.5 per share, bringing the full year dividend to HK$2.06 per share.

(South China Morning Post)

油塘榮山工廈 申建29層甲廈

油塘榮山工業大廈最新向城規會申請將用地由「綜合發展區」地帶改劃為「商業 (1)」地帶,並以地積比率約11倍重建1幢29層高 (另設5層地庫) 的甲級商廈,總樓面約54.5萬平方呎。

申請人指,包括上述項目在內的「綜合發展區」用地早前已獲批作綜合發展,而申請地點亦已獲批建酒店,但申請人強調,該獲批申請並非由是次申請地點的土地擁有人提出,因此申請人不會落實其酒店發展。

另外,葵涌業成街14至15號工廈亦申建1幢20層高 (包括2層地庫及1層平台)的新式工廈,總樓面約16.19萬平方呎。項目於7月已獲屋宇署批出建築圖則。

(經濟日報)

安達臣地中標價高次標72%

上月底領展以7.66億力壓4財團,投得觀塘安達臣道對出商業地,地政總署昨以不具名方式,公布其餘4份落選標價,出價介乎7000萬至4.4488億,樓面呎價約503至3195元,其中首兩標出價已見明顯差距,中標價較次標高出約72.2%,可見領展以志在必得價投地。

最低標價7000萬

次標出價約4.4488億,與中標價相差約3.2112億,樓面呎價則約3195元,而中標價較次標高出約72.2%;緊接其後出價約4.188億,與中標價相差約82.9%;另有兩個財團以「執雞」價投地,出價約7000萬及1.253億,樓面呎價僅503及900元;而最低標出價僅7000萬,樓面呎價約503元,與中標價相差近10倍。

(星島日報)

佳寧娜申強拍青山道舊樓遭拒

土地審裁處就長沙灣青山道300至306號舊樓的強拍申請公布判決,土地審裁處指出,大業主就當中個別地段持有的業權份數,未達申請門檻,決定拒絕該申請。資料顯示,上址的大業主包括佳寧娜集團 (00126) 等。

(信報)

Goldman Sachs tips home prices to fall for two years

Goldman Sachs forecast that home prices in Hong Kong will fall by 15 percent this year and another 15 percent in 2023.

That came as more shop deals were recorded in Central, Tsim Sha Tsui and Causeway Bay.

Hong

Kong's property market has dropped sharply by about 8 percent since the

year, mainly due to the mortgage-related one-month Hong Kong interbank

offered rate soaring by 250 basis points recently and local banks

raising their prime rates.

Based

on expectations that the Federal Reserve is set to raise interest rates

to 1.5 percent in the first three months of next year, Goldman Sachs

believes there are downside risks to the Hong Kong property market.

Amid

expectations of a reopening of the border with the mainland, there was a

clutch of transactions involving shops in Central, Tsim Sha Tsui and

Causeway Bay, including the Luen Shing Building in Central sold by

veteran property investor Francis Law Sau-fai for HK$275 million, an

appreciation of eight times in 20 years.

Law bought it in 2002 for about HK$30.39 million and held it for about 20 years, making a paper profit of about HK$245 million.

A

shop owned by veteran property investor Choi Chi-chung in Mei Foo Sun

Chuen was sold to a southeast Asian buyer for HK$13 million, or HK$8,491

per square foot.

With its monthly rent being HK$35,000, the yield is about 3.2 percent.

Since

2019, the vacancy rate of shops has gradually increased, with the total

exceeding 140 football pitches due to the huge pressure piled on by

rents.

For its part, the

Land Registry received 4,835 notifications of sales and purchase

transactions in September, a drop of 7.7 percent from August and 34.7

percent year on year.

Total turnover was HK$34.8 billion, down 62 percent month on month and 48 percent year on year.

In the primary market, Wetland Seasons Bay

phase 3, a Sun Hung Kai Properties (0016) project in Tin Shui Wai, has

received about 900 checks for its third round of sales, or an

oversubscription of over 19 times for the 45 units on the list.

(The Standard)

Hong Kong home prices could nosedive 30 per cent through 2023 as interest rates repel buyers, Goldman Sachs forecasts

The American investment bank issues a pessimistic revision of an earlier forecast that predicted a 20 per cent decline

High

mortgage rates will continue to reduce affordability and keep investors

away without better economic conditions or more policy support, the

bank says

Hong

Kong home prices are set to plummet by as much as 30 per cent by the

end of 2023, as sharply increasing interest rates continue to make homes

less affordable and repel investors from the market, according to

Goldman Sachs.

The

American investment bank, after revising its forecast downwards on

Tuesday, now expects prices to fall by 15 per cent in both 2022 and

2023, compared with year-end 2021 levels, followed by no change in 2024.

It had earlier predicted that prices would fall by a total of 20 per

cent through 2024.

“This

view change is due to a faster-than-expected rise in and higher

medium-term level of Hibor, and hence mortgage rates,” the bank said in a

report, referring to the Hong Kong interbank offered rate. “This would

continue to pressure affordability, [and] keep investors away from the

market unless macro or policy becomes more supportive.”

Hibor

is the interest rate banks charge each other for borrowing money. The

one-month Hibor has soared to over 2.5 per cent – the highest level in

more than 2.5 years.

Goldman

Sachs’ forecast came after prices of lived-in homes fell by 2.3 per

cent in August to their lowest level in three-and-a-half years,

according to government data.

The

Hong Kong Monetary Authority (HKMA) has lifted its base interest rate

five times this year to 3.5 per cent, a 14-year high, in lockstep with

the US Federal Reserve. Commercial banks including HSBC and Bank of

China (Hong Kong) raised their prime rates to a four-year high.

The HKMA also asked banks to lower the threshold on interest-rate stress testing for mortgage lending.

Goldman

Sachs noted that home prices have dropped by about 8 per cent

year-to-date due to the rapid rise in the one-month Hibor and the recent

prime rate hike, which came on September 22.

“With

another 150 basis points of Federal [Reserve] rate hikes expected by

the first quarter of 2023, we expect further downside risks to the

residential property market, which could mean continued price falls and

low transaction activity,” the report said. “We believe a 30 per cent

price correction is more likely.”

Other

factors include a supply of properties that is gradually rising with

higher plot ratios for farmland and the release of more public supply.

Meanwhile, the city’s border with mainland China is largely closed and

an emigration wave has led to the biggest decline in the number of

households in Hong Kong in 25 years, according to the report.

This

supply-demand dynamic would not be threatening, in and of itself, for

residential property prices, but comes at the same time rates are rising

and household incomes remain stagnant, exaggerating the pressure on

prices, the report said.

Meanwhile,

the total number of property transactions, including residential,

commercial and industrial properties as well as parking spaces, fell 7.7

per cent month over month and 34.7 per cent year over year in

September, recording a six-month low of 4,835, according to data from

the Land Registry.

Transaction

value hit a 32-month-low of HK$34.8 billion (US$4.4 billion), down 62

per cent from August and 48 per cent from September 2021.

Property transactions are likely to hit a historic low of 65,000 this year,

according to a forecast by a property agency. That would be the lowest

level since 1996, according to government records. The previous record

low of 70,503 registrations was reported in 2013.

A

lack of macroeconomic and policy catalysts has kept investors on the

sidelines, with the next key event being Hong Kong Chief Executive John

Lee Ka-chiu’s policy address on October 19, the Goldman Sachs report

said.

(South China Morning Post)

Li Ka-shing’s CK Asset pays US$586 million for Hong Kong land parcel subject to government’s minimum flat-size rule

The

plot of land on Castle Peak Road sold for HK$3,522 per square foot, far

below the HK$6,500 it was expected to fetch in an earlier failed tender

An

April tender for the parcel – the first subject to the government’s

minimum flat size requirement – failed to attract any bids that met the

reserve price

CK

Asset won a tender for a parcel of land in Tuen Mun for a price lower

than market expectations after an earlier tender – the first subject to

the government’s minimum flat-size requirement – failed to attract any

satisfactory bids in April.

The

flagship developer of tycoon Li Ka-shing’s family won the parcel on

Castle Peak Road – Tai Lam, Tuen Mun in northwestern Hong Kong for

HK$4.6 billion (US$586 million), the Lands Department said on Wednesday.

Henderson Land Development Company, Sino Land, Grand Ming Group Holdings and Sun Hung Kai Properties also bid for the parcel.

The

price translates to just HK$3,522 per square foot, “slightly lower than

the lower limit of market expectations”, according to a surveyor.

When

it was first launched in April, another surveyor valued the land at

HK$6,000 to HK$6,500 per square foot, or HK$7.8 billion to HK$8.5

billion. In July, the surveyor slashed the valuation to HK$5,000 to

HK$5,500 per square foot, or HK$6.5 billion to HK$7.2 billion.

“The

size of the land and the amount of investment are relatively large,”

the surveyor said. The land can yield 1.31 million sq ft of gross floor

area and at least 2,000 flats, Lam said.

The tender in April attracted only five bids, none of which met the government’s reserve price.

The now successful tender shows that the government is adapting to

market changes and adjusting the reserve price according to market

conditions, which can also ensure future housing supply, the surveyor

added.

“Coupled with the recent market conditions, developers are expected to be more cautious in their bids,” the surveyor said.

Last December, the Hong Kong government set a 280 sq ft minimum size for flats built on government land.

The

relaunch of the Tuen Mun site “in a short time” after the original

tender failed, “reflected the government’s determination to let the

people live in bigger homes”, think tank Our Hong Kong Foundation said

in July.

Chinese

President Xi Jinping instructed John Lee Ka-chiu, Hong Kong’s Chief

Executive, on the 25th anniversary of the city’s handover to China, that

his administration should “strive to deliver” what “the people of Hong

Kong desire – a better life, a bigger flat, more business start-up

opportunities, better education and better elderly care”.

(South China Morning Post)

尖沙嘴港威大廈每呎逾45元租出

近期尖沙嘴甲廈連錄承租個案,其中,港威大廈三座-保誠保險大廈高層01至02及14室,面積約4300方呎,意向呎租53元,市場消息指以逾45元承租,月租19.35萬。另外,港威大廈六座高層08至09室,建築面積約3199方呎,亦以每呎約40元租出,月租約12.8萬。港威大廈一座低層10至11室,建築面積約2700方呎,以約38元租出,月租約10.26萬,同廈中層04及06室,建築面積約4944方呎,以每呎約39元租出,月租19.28萬。

區內海洋中心亦連錄承租,中層03室,面積約1076方呎,以約36元租出,月租3.87萬,中層10及11室,面積約4950方呎,以35元租出,月租約17.33萬,海洋中心低層01至03室,面積約6162方呎,則以約33元租出,月租約20.33萬。

海洋中心每月3.87萬承租

有代理表示,港威大廈地點好,大厦質素及條件佳,相對整個海港城,該廈質素最高,亦最受捧,疫市下租金硬淨,視乎不同座向、大小及不同質素單位,租金較2018年高位跌幅只有5%至10%;至於海洋中心,樓齡較高,租金相宜。該代理又說,上月九龍寫字樓租務保持平穩,買賣則錄得萎縮。

(星島日報)

更多港威大廈寫字樓出租樓盤資訊請參閱:港威大廈寫字樓出租

更多海洋中心寫字樓出租樓盤資訊請參閱:海洋中心寫字樓出租

更多尖沙咀區甲級寫字樓出租樓盤資訊請參閱:尖沙咀區甲級寫字樓出租

財團每呎1.5萬收購黃大仙舊樓 涉10幢物業 住宅總金額涉4.8億

市區土地資源有限,財團均面對一地難求的局面,近年不少發展商變陣,透過舊樓收購藉以申請強拍增加土儲;舊樓林立的黃大仙未來發展潛力亦看高一綫,近年該區舊樓更掀起併購潮,未來區內勢將「大變天」;本報獲悉,黃大仙銀鳳街33至59號一列舊樓群被財團吼中,並於月前接觸業主並出價收購,據了解每方呎收購價大約1.5萬至1.6萬不等,單計住宅部分涉及收購金額約4.8億至5.12億。

本港土地供應短缺,市區「靚地」更是賣少見少,近年有不少財團轉向舊樓埋手,密密併購發展,上述銀鳳街33至59號一列舊樓群,涉及約10幢樓高5至6層的商住舊樓,地下為商鋪,樓上為住宅樓層;最近獲財團出價收購,據了解,該財團以每方呎1.5萬至1.6萬不等向小業主提出收購價建議。上述銀鳳街舊樓群涉及最少約76個住宅單位,單位面積由263至535方呎,住宅部分總樓面大約3.19萬方呎,以每方呎1.5萬至1.6萬收購價計,單計住宅部分涉及金額至少約4.8億至5.12億,另有約15個地鋪。

涉最少約76個住宅

銀鳳街33至59號舊樓群,早於1970年至1973年之間落成,至今約49至52年樓齡;若將來透過合併地盤重建發展,地盤面積擴展至約1.14萬方呎,如以地積比9倍作重建發展,涉及可建總樓面約10.34萬方呎,是近年市區中罕見的大型地盤。

該批舊樓群位於竹園銀鳳街及環鳳街交界,屬大單邊位置,項目鄰近有不少購物及娛樂設施,如黃大仙中心、鳳德商場、竹園街市、雙鳳街街市,同時鄰近竹園體育館、鳳德公園等;交通方面,鄰近港鐵黃大仙站,步行前往約11分鐘步程,而且毗鄰亦有多條巴士及小巴路綫行走,交通及生活配套便利,極具重建價值。

可建總樓面10萬呎

參考鄰近私樓平均呎價,如區內指標屋苑現崇山目前平均呎價約1.74萬,該屋苑1座低層A室新近以1409萬售出,屬面積794方呎的3房單位,呎價約1.77萬;而鑽嶺一個低層D室的1房單位以448萬易手,以面積211方呎計,呎價約2.1萬。

另外滙豪山中層A室單位,新近以660萬易手,以面積439方呎計,呎價約15034元;而同區居屋翠竹花園9座中層E室,面積484方呎,兩房戶,新近以525萬 (自由市場價) 成交,呎價約10847元。

有業內人士指,近年市區新供應少,過往推出招標的市區用地均面對激烈競爭,入場門檻高,近年不少財團已轉向具重建價值的舊樓埋手,其中舊樓林立的黃大仙是一個熱門地區之一,據了解,現時已有不少財團插旗收購。

而且目前整體樓市氣氛未如理想,加上成交量相對淡靜,樓價亦有所回軟之際,業主往往需要減價沽貨,認為財團在舊樓收購時,不排除有部分小業主叫價態度會軟化。

(星島日報)

市區土地供應少區內掀收購熱

近年黃大仙區發展步伐加快,由舊區漸蛻變成新晉商住社區,不少私人財團密密向舊樓埋手併購,單計宏安地產已成功透過強拍途徑統一區內2個舊樓項目。

事實上,毗鄰的鳴鳳街及環鳳街一帶舊樓近年收購活動活躍,宏安地產已成功透過強拍途徑統一區內2個舊樓項目,包括今年2月以底價2.57億統一飛鳳街31至41號舊樓業權,連同該公司收購的飛鳳街45號合併發展;值得留意的是,上述飛鳳街31至45號舊樓已於今年3月獲屋宇署批出建築圖則,獲批建1幢樓高19層高的商住項目,住宅部分涉及可建總樓面約7.8萬方呎,另有1.5萬方呎非住宅樓面,料提供約250伙。

飛鳳街項目料提供250伙

該公司去年亦以底價8.05億統一鳴鳳街26至48號舊樓業權,上址由3個地段組成,包括26至32A號乾豐大廈、34及36號鳳凰樓,以及38至46號舊樓,總地盤面積約9630方呎,可建樓面面積約8.67萬方呎。

除本地發展商收購外,內地發展商武夷集團繼2017年底以1.12億購入鳴鳳街18至20號全幢舊樓後,今年2月再下一城成功併購毗鄰的22至24號全數業權,預料該兩個地段地盤合併後面積約3600方呎,現規劃為「住宅 (甲類) 1」用途,地積比率9倍計,涉及可建總面積約3.24萬方呎的商住物業。

除財團併購外,市建局行政總監韋志成今年5月初曾指,加強市區更新工作,市建局在九龍城、黃大仙等多個舊區開展地區規劃研究,制訂合適的市區更新計畫。

(星島日報)

長實逾46億低價 奪屯門限呎地

樓面呎價3522返6年前 趙國雄:投資額逾130億

長實 (01113) 動作頻頻,上周沽出半山豪宅後,隨即以逾46億元購入屯門「限呎」住宅地,每平方呎樓面地價3,522元,低於市場估值下限,較兩年前同區地價低逾4成,重返6年前地價水平。長實預計總額超逾130億元,並表示對香港地產市道前景極具信心。

今次批出的屯門青山公路大欖段「限呎」住宅地,今年4月曾經招標,惟最終未及政府底價而流標,今次重推於上周截收5份標書。地政總署昨日公布,地皮最終由長實以46.01億元投得,每平方呎樓面地價約3,522元,較市場估值下限約48億元 (每平方呎樓面地價約3,700元),低出約5%,稍遜於市場預期。

指對港地產前景 極具信心

掃管笏對上一次批出的地皮,為佳兆業 (01638) 於2020年,以每平方呎6,005元投得屯門第48區地皮,今次地價相較低出4成。若果跟比鄰地皮的 OMA by the Sea,在2016年6月由永泰地產 (00369) 以每平方呎約3,343元投得相若,可見今次地價重回約6年前水平。

長實執行董事趙國雄稱,集團一直積極參與投地,全因對香港地產市道前景極具信心。他又提到,地皮面積大、建築上有一定難度,且涉及的單位數量多,估計連同地價及發展費用計算,投資總額料超過130億元。至於長實與新地 (00016) 合作的飛揚,項目於2018年底以逾17.31億元完成補地價,每平方呎補地價約4,990元。

估計落成後 呎價賣逾1.36萬

若果以總投資額130億元計算,計及「10%發水樓面」、8成實用率等因素,項目預計落成後實用呎價約1.36萬元便有合理利潤,參考EPRC經濟地產庫資料,地皮周邊近半年平均成交實用呎價約1.36萬至1.63萬元,而長實旗下飛揚近期平均呎價則約1.54萬元。

有測量師直言,鑑於地皮位處斜坡,而且規模大,加上中間設有油站,增加日後發展時的困難及成本,相信是次售價已經反映該等因素,形容成交價為「筍價」。該測量師又直言,是次長實中標與上周沽出半山西部項目的關連不大,相信長實「低價就買」。

地皮上周接獲5份標書,與今年4月首次招標相同,其餘4家入標財團,包括恒地 (00012)、新地、信置 (00083) 及佳明 (01271),全數以獨資形式競投。

(經濟日報)

長實換貨高賣低買 雙贏補土儲

長實 (01113) 在短短一周使出「連環技」一買一賣,將半山豪宅盤沽貨,換貨低價吸納屯門限呎地,將建新界上車盤;這邊廂在樓市高峰期鎖定利潤套現,那邊廂則補充了土地儲備,維持貨如輪轉的策略。

長實近年在地產市道再次變得活躍,大約每半年就有不少大手買賣。先在買地方面,由2020年起至今5度投得官地及市建局項目,合共涉資逾265億元,單是今年8個月內,已經斥逾百億元投得土瓜灣項目,及今次屯門掃管笏地皮。

近期策略 低吸上車大型地皮

至於沽貨方面,長實單是今年3月沽出倫敦商廈,以及上周以208億沽出半山西部豪宅21 BORRETT ROAD項目,共套現達332億元,不但成功鎖定了項目利潤,亦對其現金流有相當幫助,單是沽出的兩個大型項目,已經足夠抵銷過去幾年買地開支。

長實近期的策略,是沽出貴重的重磅項目套現,然後趁低吸納地價較低,並主攻上車的大型地皮,例如今次屯門大欖限呎地,以及觀塘安達臣道的「港人首置盤」地皮,兩地每平方呎樓面地價均約3,000多至4,000多元,地皮均主攻上車客源,可見長實重回過往「貨如輪轉」、薄利多銷的營運模式。

據一間代理行統計,上季第三季新盤成交量共錄3,560宗,9成屬於金額在1,000萬元以下上車盤,而逾千萬元以上成交僅364宗,按季減少7成,反映上車購買力主導市場。

(經濟日報)

星共享空間 中環據點末季開幕

新加坡共享工作空間品牌The Great Room,早前預租中環長江集團中心2.1萬平方呎,將於今年第四季開幕。

據了解,全新的工作間設有22間私人辦公室,包括兩個企業辦公室 (Enterprise Units),而私人辦公室中的會籍由1.55萬元起,而流動辦公桌 (Hot Desk) 每月會籍則由3,600元起。The Great Room創辦人及行政總裁洪可珈 (Jaelle Ang) 指,香港為品牌在亞太區業務擴展策略中非常重要的跳板,未來將放眼悉尼、上海、北京及東京等地。

(經濟日報)

更多長江集團中心寫字樓出租樓盤資訊請參閱:長江集團中心寫字樓出租

更多中環區甲級寫字樓出租樓盤資訊請參閱:中環區甲級寫字樓出租

羅守輝2.75億沽中環聯盛大廈

銀行雖然加息,但市場仍不乏全幢物業大手成交。據土地註冊處資料,中環皇后大道中110至120號聯盛大廈全幢,最近成功售出,作價2.75億元。

據了解,原業主為資深投資者羅守輝,於2002年以約3039萬元購入該廈,持貨約20年轉手,賬面獲利約2.45億元,物業升值約8.06倍。

聯盛大廈樓高約11層,鄰近中環中心,地盤面積約1127方呎,總樓面面積約10704方呎;按上述成交價計算,呎價25691元。

(信報)

更多中環中心寫字樓出售樓盤資訊請參閱:中環中心寫字樓出售

更多中環區甲級寫字樓出售樓盤資訊請參閱:中環區甲級寫字樓出售

更多中環中心寫字樓出租樓盤資訊請參閱:中環中心寫字樓出租

更多中環區甲級寫字樓出租樓盤資訊請參閱:中環區甲級寫字樓出租

羅守輝「減磅」放售12乙廈物業 總意向價逾5億 加佣至3%促銷

聯儲局半年五度加息,本港亦自2018年以來再次跟隨調高利率,樓市氣氛轉差,投資物業市場交投再減,投資者遂積極放售物業。綜合市場消息及資訊,資深投資者、裕泰興家族成員羅守輝及有關人士大規模放售旗下乙級商廈物業,涉最少12項,俱為全層單位,意向價總值逾5億元,並加佣至3%促銷。

俱為全層單位 11項處灣仔

據了解,羅守輝及有關人士正放售12項乙級商廈物業,當中11項來自灣仔區,餘下1項則在油麻地,大部分都在2010至2017年期間購入,現時每項物業叫價由2180萬至6500萬元,涉及總值逾5.07億元。代理透露,為加快物業出售速度,賣家近期加佣至3%,較正常1%多出兩倍。

當中,叫價最高的物業為灣仔告士打道221至226號海聯大廈7樓全層,建築面積4721方呎,叫價為6500萬元,呎價約13768元。該層現分間為4個單位,享全海景,當中兩個租出,月租共19.3萬元。該層於2017年以4818萬元購入,目前放售價較買入價高1682萬元或34.9%。

同一時間,亦有放售同一地段告士打道166至168號信和財務大廈1樓及2樓兩層,每層建築面積3050方呎,現每層以3812.5萬元放售,呎價約12500元,合共價值7625萬元。至於灣仔軒尼詩道258號德士古大廈2樓全層,建築面積約4200方呎,半年前已經以5796萬元放盤,上月降價至4536萬元,呎價約10800元,減幅逾兩成,雖然如此,仍較2014年的買入價2748.9萬元,高出65%。

油麻地商廈入市半年即覓買家

羅守輝及有關人士除放賣已購入一段時間的物業外,亦有商廈單位「即買即放」,例如今年3月才以1420萬元向資深投資者「舖王」鄧成波家族購入油麻地彌敦道570至572號基利商業大廈4樓全層,建築面積約2154方呎,連一個約1054方呎平台,目前正以2180萬元放盤,呎價約10121元,較半年前購入價高760萬元或53.5%。

是次在市場上推售的12項乙級商廈物業,有10個在2006年至2017年期間購入,入市成本較低,故12項物業總購入價逾3億元,若以放售價總值逾5.07億元沽出,料仍可獲不俗利潤。

事實上,羅守輝及有關人士今年初仍有購入物業投資,包括商廈及地舖等,但3月起開始積極沽售物業,至今半年間已最少賣出12項物業,包括全幢商廈、地舖、乙級商廈全層及工廈全層,合共已套現最少約6.5億元;其中最大宗為9月以2.75億元售出中環皇后大道中118至120號一幢商廈。

(信報)

更多德士古大廈寫字樓出售樓盤資訊請參閱:德士古大廈寫字樓出售

更多灣仔區甲級寫字樓出售樓盤資訊請參閱:灣仔區甲級寫字樓出售

Only big guns stay in fray for To Kwa Wan project

The big four local developers

including CK Asset (1113), Sun Hung Kai Properties (0016), Henderson

Land Development (0012) and Wheelock Properties were among seven bidders

for the Urban Renewal Authority's Wing Kwong Street / Sung On Street

development project in To Kwa Wan.

The project had attracted 31 expressions of interest in August and the URA had invited all 31 developers/consortia to bid.

The

other bidders included Sino Land (0083), China Overseas Land &

Investment (0688) and Emperor International Holdings (0163).

The

project, which covers a site area of 2,876 square meters, is planned to

provide a maximum total gross floor area of 25,884 sq m upon

completion.

A surveyor expects the project to be valued at about HK$3.34 billion as it has a harbor view and also near the Tuen Ma Line.

The

residential part of the project is expected to provide about 230,000

square feet with 560 small and medium flats. The commercial and retail

parts will be about 46,000 sq ft.

The winning bidder will pay a dividend to the URA when the sale proceeds exceed HK$6 billion.

The project includes a shopping mall in which the developer will have a 70 percent stake, with the URA holding 30 percent.

There

are restrictions on the size of the flats for the project. The area of

the flats should not be less than 300 sq ft and half of the flats should

be less than 480 sq ft.

Last

month, Henderson Land won the bid for an old building in To Kwa Wan via

a compulsory sale with a reserve price of HK$1.21 billion, a move

further expanding its development in the area.

Meanwhile,

the owner of a flat at the Grand Marini in Lohas Park took a HK$380,000

hit after selling the unit for HK$10.3 million, down from the HK$10.68

million paid for the property in 2019.

In

other news, office rents fell by 2.3 percent quarter-on-quarter but the

decline is expected to narrow in the fourth quarter with an annual

decrease ranging from 3 to 5 percent, according to a property agency.

Meanwhile,

the street store vacancy rate in Causeway Bay was 5.3 percent and

Central was 8.5 percent. They have fallen to their lowest levels since

the pandemic, despite some being short-term leases, while vacancy rates

in Tsim Sha Tsui and Mongkok in Kowloon rose slightly to 16.7 percent

and 12.5 percent, respectively.

(The Standard)

金鐘力寶中心每呎33元租出

受疫情等因素衝擊,核心區甲廈租金急下滑,金鐘力寶中心最新錄1宗承租,一個中層單位,於交吉半年後,以每呎33元租出。

上址為力寶中心一座高層03室,建築面積約1299方呎,以每呎33元租出,該鋪位開則一般,景觀望政府總部,舊租客於今年3月遷出,交吉半年始租出。

單位交吉約半年

早前,力寶中心一座中層6室,建築面積約2100方呎,以每呎約45元租出,月租約9.45萬,租戶於今年2月租約屆滿遷出,舊租每呎53元,業主亦將單位重新放租,故最新租金較舊租金下跌約37%,屬貼市水平。

事實上,該甲廈於疫市下租金備受壓力,資料顯示,該廈2座高層相連單位,再早前以每呎約49元租出,較舊租金急挫逾3成;據業內人士指出,力寶中心於疫市租金跌幅「最傷」,主要因為該甲廈早已賣散業權,各小業主於租務市場上可謂「各自為政」,為免單位丟空,業主願減租吸客。

至於買賣方面,該甲廈早前成交為2座高層2室,屬多按物業,建築面積1341方呎,以3710萬售出。地產代理指出,2016年起業主曾3次向多家財務公司承造按揭,成交價屬市價水平,買家為中資企業。

(星島日報)

更多力寶中心寫字樓出租樓盤資訊請參閱:力寶中心寫字樓出租

更多金鐘區甲級寫字樓出租樓盤資訊請參閱:金鐘區甲級寫字樓出租

外資代理行:受新商廈預租帶動 上季寫字樓淨吸納量18.3萬呎

整體寫字樓租務淡靜,租金持續下調,根據一間外資代理行數據,整體甲廈租金按季回落2.3%,年初至今累跌4%,並以尖沙嘴區和中區超甲廈的跌幅較明顯,分別按季跌3.1%和2.4%,各區平均租金從2019年4月份高位至今累跌29%。第三季整體淨吸納量,主要受新落成甲廈預租面積所帶動,錄18.3萬方呎。

該行代理表示,隨着防疫及隔離措施放寬,相信第四季度租金下跌幅度有望收窄,將橫行一段時間,預測全年租金跌幅介乎3%至5%。

整體甲廈租金按季跌2.3%

吸納量方面,第三季整體淨吸納量,主要受新落成甲廈預租面積所帶動,錄18.3萬方呎,加上季內約有200萬方呎新寫字樓樓面落成,促使整體待租率由第二季的13.8%升至16.1%,整體待租面積逾1000萬方呎。

鋪位空置下跌,銅鑼灣和中環空置率下降至5.3%及8.5%,為疫情以來低位,但部分租約屬短租,九龍區尖沙嘴和旺角空置率則分別微升至16.7%及12.5%。

料明年鋪租重拾動力

該行另一代理表示,踏入傳統節日旺季,短期租約將更受歡迎,料商鋪空置率在年底前進一步改善。租金方面,除非政府再推出更多利好零售市場的政策,否則預期街鋪租金到明年上半年後才能重拾動力。

民生區商鋪如元朗、屯門相對平穩,惟核心區街鋪持續受壓,銅鑼灣和尖沙嘴鋪租按季分別跌1.9%及1.2%,年初至今分別累跌7.6%和5.1%。

(星島日報)

上月錄311宗工商鋪註冊

有代理行綜合土地註冊處資料顯示,上月工商鋪註冊量錄311宗,按月下跌15.3%,註冊金額錄36.22億,按月減少約24.4%。該行預料,註冊數字於進一步通關前將維持較低水平。

代理行:按月跌15.3%

9月份工商鋪註冊宗數全綫下跌。工廈及商鋪分別按月降約11.3%及10.1%,各錄173及80宗。商廈註冊量按月跌約30.1%,錄58宗。9月份整體註冊宗數最新錄311宗,數字再度跌至今年低位,按月挫約15.3%。9月份整體註冊金額錄36.22億,按月跌約24.4%。

造價逾億註冊僅錄4宗

除5000萬以上至1億物業,其他金額全錄下跌。註冊量最多的為500萬以下物業,共錄164宗,按月跌13.2%。逾500萬以上至1000萬共錄66宗,按月下降約18.5%。逾1000萬以上至2000萬共錄39宗,按月下降約22%。逾2000萬至5000萬錄5.8%按月跌幅,共錄32宗。逾5000萬至1億微升,共錄6宗,按月升20%。9月逾1億物業按月急挫50%,註冊宗數僅錄4宗,按月減少4宗,包括灣仔告士打道200號新銀集團中心12樓全層及尖沙嘴半島中心作價分別1.55億、1.05億。

(星島日報)

更多新銀集團中心寫字樓出售樓盤資訊請參閱:新銀集團中心寫字樓出售

更多灣仔區甲級寫字樓出售樓盤資訊請參閱:灣仔區甲級寫字樓出售

更多半島中心寫字樓出售樓盤資訊請參閱:半島中心寫字樓出售

更多尖沙咀區甲級寫字樓出售樓盤資訊請參閱:尖沙咀區甲級寫字樓出售

市建土瓜灣「小區」項目收7標書 大中小財團群起角逐 「一口價」成關鍵

市建局土瓜灣第四個以「小區模式」發展的榮光街

/

崇安街發展項目,於昨日截標,該局公布合共接獲7份標書,吸引多家本地大中小型發展商以獨資方式競投,另有發展商合組財團競投。業界人士指,項目位處市區,發展規模適中,出價已考慮加息及其他因素;綜合市場估值約30.6億至36.2億,每方呎估值約1.1萬至1.3萬。

榮光街

/

崇安街發展項目於8月初共收31份意向書,上月初邀請31家財團入標競投,昨日結束約兩個月的招標程序,市建局昨公布,合共接獲7份標書,數目與該局於同區的鴻福街及啟明街四個重建項目合併發展相同。綜合記者現場所見及市場消息指,吸引多家「本地薑」競投,包括長實、新地、恒基、會德豐地產、英皇及鷹君,而信和夥拍招商局置地合組財團,遞交有關項目標書。

市建局指,該局董事會設立的招標遴選小組將評審各標書,並會就批出項目發展協議向董事會提交建議,由董事會作最終決定。

會德豐何偉錦:出價考慮加息

會德豐地產高級經理 (物業發展) 何偉錦表示,該項目鄰近鐵路站,而且日後落成後部分單位可享海景,初步計畫主打細單位,並透露集團以獨資方式入標,出價已考慮近期市況及加息因素。

英皇蔡宏基:發展規模適中

英皇國際物業經理蔡宏基指出,集團以獨資方式競投,出價已考慮加息及其他因素;認為項目規模適中,而且地皮可享較優質海景,而且土瓜灣「小區」發展成熟,加上本港住屋剛性需求強烈,料發展中小型單位為主。

有測量師指,項目規模適中,將來部分單位可享遠海景,認為價錢有保證;不過由於該項目位於整個「小區」的邊陲,且商業部分有一定限制,如共同持有年期及分成等。

另一測量師表示,項目地盤面積細,涉及投資額不多,項目東南至東北面靠近學校,建築物較矮,料日後單位可享土瓜灣避風塘海景。綜合市場估值約30.6億至36.2億,每方呎估值約1.1萬至1.3萬。

該項目鄰近港鐵土瓜灣站,步行前往約5至6分鐘;地盤面積約3.1萬方呎,可建總樓面約27.86萬方呎,發展規模是目前已推出項目中最細,估計可以提供約560伙。市場消息指出,項目售樓收益達60億後,中標財團便須與市建局分紅,達標後首1億須分紅兩成,其後分紅比例以每1億為一組遞增;當收入達63億以上,分紅劃一為50%。而且發展商亦須向市建局自行提出「一口價」建議,將成為勝負的關鍵。

商場部分,屬市建局及中標財團共同持有,租金收益由中標財團和市建局以「七三」比例瓜分,租金收入中標財團佔七成,其餘三成收益則歸市建局;另外,該項目設有限呎條款,面積不得少於300方呎,同時規定至少一半面積不可超過480方呎。

(星島日報)

憧憬通關 啟德甲廈兩年首錄租務

跨企進駐 AIRSIDE 約3.75萬呎 呎租30較意向跌4成

憧憬通關,企業趁租金回落租全新甲廈。南豐旗下啟德地標甲廈 AIRSIDE 招租兩年後首錄預租,全層約3.75萬平方呎獲跨國採購公司租用,呎租料約30元,遠較招租期間跌約4成。業界人士認為,若續放寬入境措施,可進一步刺激商廈租務。

市場消息指,即將落成的啟德 AIRSIDE,錄得首宗寫字樓租務成交,涉及物業22樓全層,面積約3.75萬平方呎。據悉,新租客為一家跨國採購公司,主要業務為生產及採購家庭電器、廚具等。據了解,該租客原租用大角咀嘉運大廈約2萬多呎辦公室,由於業主將重建物業,故需尋找新寫字樓,現搬至全新甲廈,兼作出樓面擴充。

南豐246億奪地 打造啟德新地標

消息稱,是次成交呎租約30元,翻查資料,南豐於2020年尾時開始為 AIRSIDE 進行招租,當時環球出現疫情近1年,因應市況業主方面表示項目商廈部分意向呎租約40元,已較原先的呎租50元向下調。

可是疫情下持續封關,商務活動暫緩,衝擊商廈租務,而該廈於本年初,曾一度傳出有中資銀行旗下證券公司洽租,惟最終未有成事,直至近日才獲租客首進駐。招租長達兩年,按成交呎租計,較預先下調約4成。相信是次因首宗成交,業主提供少許優惠,料通關後租務增加,呎租有力回升。

南豐於2017年以246億元,投得啟德商業地皮,打破當時賣地紀錄。項目樓高47層,當中30層為寫字樓,涉及120萬平方呎,而商廈每層面積約3.2萬至5.3萬平方呎,其中10至18樓為相連樓層,每層達5.3萬平方呎,可謂全港極為罕有。另物業基座多層為商場,涉及約70萬平方呎,預租情況不錯,相比之下,寫字樓部分則租務較慢。據了解,整個項目總投資金額高達340億元,寫字樓近日正式入伙,成啟德新地標。

巧明街98號 Agnes B預租

東九龍為甲廈新供應重鎮,而區內大型項目漸獲商戶留意,市場消息指,新地 (00016) 旗下巧明街98號新甲廈項目錄預租,涉及物業2座,約1萬平方呎樓面,成交呎租約30元。據了解,新租客為時裝品牌Agnes B,該品牌原租用太古城中心商廈,如今搬遷可提升物業質素,兼可節省少許租金。

新地旗下觀塘巧明街98號九巴車廠重建項目今年尾落成,提供約115萬平方呎樓面,其中約50萬平方呎商場。據了解,暫時該廈已獲大手預租,包括積金局租用8萬平方呎樓面,作整合業務及擴充。

政府放寬入境措施至「0+3」,料可推動商務活動,有代理指出,近日商廈租務查詢稍增,普遍跨國機構仍待「0+0」正式落實,企業可重新部署地區業務,以及海外機構來港設立辦事處,新需求有望出現,可帶動商廈租務活動轉活躍。

該代理預計,若與內地成功通關,對九龍區租務將有更大刺激作用,因尖沙咀、紅磡及九龍站甲廈租戶,不少為從事中港業務公司,或中資大型機構,可進一步刺激租務活動。

(經濟日報)

更多AIRSIDE寫字樓出租樓盤資訊請參閱:AIRSIDE 寫字樓出租

更多啟德區甲級寫字樓出租樓盤資訊請參閱:啟德區甲級寫字樓出租

更多創紀之城寫字樓出租樓盤資訊請參閱:創紀之城寫字樓出租

更多觀塘區甲級寫字樓出租樓盤資訊請參閱:觀塘區甲級寫字樓出租

商廈供應增 租金短期難「復常」

持續放寬防疫措施,無疑可帶動商務活動。不過,商廈市道面對最大問題,是供應過剩及空置率高,在新需求下,租金也難明顯反彈,而新甲廈質素上較佳,會有一定優勢。

今明兩年供應高峰 共逾千萬呎

疫情至今近3年,因入境措施嚴謹,令商廈租務市場極為淡靜。疫情前每年商廈平均吸納量約170萬至200萬平方呎,但因疫情出現,跨國商務活動大幅降低,本港商廈租務活動,疫情期間絕大部分為搬遷個案,機構在搬遷過程大部分亦沒有擴充,導致出現負吸納情況。因此,若「0+0」實施,海外大型機構,可重新派員來港視察及洽商,租務活動必會加快,需求預計上升。

需求可望陸續復常,可是商廈供應過剩是一大問題。今明兩年為甲廈供應高峰期,合共逾千萬平方呎樓面落成,分布中環、東九龍、港東島及長沙灣等地,每區均有大型項目。

同時,現時甲廈空置率約10%,市場上已有千萬平方呎空置樓面,連同大批新供應,即使市道復常,也難在三兩年間消化,可以預期甲廈租務活動改善,但業主在租金叫價上,因競爭大而略為降低,故租金難以反彈。兩年多的疫情,甲廈租金已有3成調整,若有新需求帶動,進一步下挫機會不高,料較平穩發展。

由於空置樓面多,租客選擇亦多,故除了租金差別外,物業質素成為租客選擇重要條件之一。新落成的甲廈,始終單位樓底高,設備最新,業主亦不敢叫價進取,故在租務市場上搶客時,較舊式商廈優勝。

(經濟日報)

Home buyers put plans on hold

Home transactions in major housing

estates in Hong Kong fell as buyers adopted a wait-and-see attitude

before the Chief Executive's policy address on October 19 despite

sellers making deeper price cuts.

A

property agency recorded six transactions over the weekend in the 10

major housing estates it tracks. That was four less than the previous

weekend to hit a 10-week low.

An

agent said that despite the price cuts in the secondary market and no

new projects for home buyers, the prospective purchasers were waiting to

see if there could be news that could work to their advantage emerging

from the Chinese Communist Party's congress in Beijing or from the

policy address.

"There

might be no relaxation measures for the property market in the policy

address, but there will be an opportunity to relax the restrictions on

mainland people and foreigners coming to Hong Kong to buy properties,"

the agent said.

"Both buyers and sellers are waiting for more clarity on the market conditions before making any moves."

However,

as reflected in a more active viewing volume, prospective buyers do

appear optimistic about prospects than in the third quarter, especially

after a lowering of the interest rate stress testing requirement.

The agent believes that an announcement on housing policy in the policy address will indeed trigger property purchases.

(The Standard)

Invesco relocates to Hongkong Land’s Jardine House, seizing on rising office vacancies, falling rents in Central

US money manager has leased 33,000 sq ft in the iconic Jardine House from November 1

The

relocation trend in the Hong Kong office property market is likely to

continue well into 2023 amid falling rents, according to a property

agency

With

prime office vacancy rates at record highs and rents continuing to

slide in Hong Kong’s main business district of Central, tenants are

making the most of the situation and moving to prestigious addresses.

US money manager Invesco is relocating its regional headquarters to Hongkong Land’s Jardine House.

The

firm has signed a lease for 33,000 sq ft in the iconic building, known

for its distinctive round windows, overlooking the Victoria Harbour from

November 1.

“We believe that Invesco is moving back into Central

as part of a wider trend we are seeing in the market of a flight to

quality,” said Neil Anderson, director and head of office, commercial

property, at Hongkong Land.

The companies did not provide any details about the lease.

“With

Hong Kong as the heart of our regional operations, it’s rare to have

this unique opportunity to move into one of the most iconic buildings in

Central,” said Terry Pan, CEO for Greater China, Southeast Asia and

Korea at Invesco.

The

relocation trend in the Hong Kong office property market is likely to

continue well into 2023, according to a property agency.

“Moving

within the same district is always part of the trend of flight of

quality moves,” agent said. “With rents now more attractive across the

submarkets and landlords becoming more flexible, some of the tenants

definitely will take this chance to look for premises in the more prime

and central location and premises with better management or facilities.”

With

some 2 million sq ft of new office space available in Hong Kong as of

the end of the third quarter, the vacancy rate has risen to 16 per cent,

up from 13.8 per cent in the second quarter, the agent said. Overall

office rents declined by 2.3 per cent in the same period.

The move to Jardine House marks Invesco’s return to Hongkong Land’s Central portfolio. From 1998 to 2005, Invesco occupied two floors in Three Exchange Square, which is owned by Hongkong Land. It then moved to Champion Tower, also in Central, occupying space comparable to its new lease in Jardine House.

Rents in Champion Tower and Jardine House

are comparable, averaging around HK$88.20 (US$11.2) per square foot at

the former and HK$90 per square foot at the latter, according to

analysts.

As

of the first half of the year, banks, asset managers and other

financial services companies accounted for more than 40 per cent of

Hongkong Land’s office tenant profile in Central, according to the

landlord.

The

current downturn in Hong Kong’s office property market has been

described by another property agency as its “longest and deepest”.

The property consultancy said that an additional 8.2 million sq ft of office space expected in the next two years coupled with record-high vacancies, will drag rents down by as much as 5 per cent this year and by another 5 to 10 per cent next year.

“There

are multiple reasons companies relocate, even within the same

district,” another agent said. “This could be to accommodate

fluctuations in size, changes in workplace or management direction that

may require a different approach to real estate.”

The agent gave the example of Christie’s move to The Henderson in 2024, which will allow the auction house to accommodate a change in their strategy.

“Sustainability

scorecards are increasingly being used by businesses as they shortlist

and sign up to new leases,” the agent added.

(South China Morning Post)

For more information of Office for Lease at Jardine House please visit: Office for Lease at Jardine House

For more information of Office for Lease at Exchange Square please visit: Office for Lease at Exchange Square

For more information of Office for Lease at Three Garden Road please visit: Office for Lease at Three Garden Road

For more information of Office for Lease at The Henderson please visit: Office for Lease at The Henderson

For more information of Grade A Office for Lease in Central please visit: Grade A Office for Lease in Central

力寶中心每呎租33元 平近年新低

近日,金鐘力寶中心一個單位,以每呎33元,平該廈近年新低價,自從疫情以來,力寶中心早於去年2月及5月皆錄得呎租33元,當衡量單位不同質素時,33元可以是廉價,但亦可能是市價。

力寶中心於2010年6月曾錄呎租32元,呎租33元,則屬過去約11年新低紀錄。

「三角」則實用率62%

最新租出的1座高層03室,建築面積約1299方呎,該單位屬「三角」則,實用率只有62%,單位內有頂心柱,景觀為政府總部,不過,擁有玻璃房間,裝修很不錯,舊租客於今年3月遷出,交吉半年始租出。

去年5月以每呎33元租出的是優質單位,1座32樓D室,建築面積約2343方呎,位處高層,面向正車立位,且外望開揚山景,舊租客為律師行以每呎55元租用,遷出後,於2019年6月起放租,初時每呎叫租65元,最後丟空近兩年後,以每呎33元租出,月租約7.73萬。該單位由內地客持有,於2017年3月以2.05348億購入32樓C室及D室,建築面積7898方呎,以平均呎價2.6萬計算,回報只有約1.5厘。

2021年2月,力寶中心一座26樓3B室,建築面積2230方呎,以每月約7.4萬元租出,呎租約33元。

(星島日報)

更多力寶中心寫字樓出租樓盤資訊請參閱:力寶中心寫字樓出租

更多金鐘區甲級寫字樓出租樓盤資訊請參閱:金鐘區甲級寫字樓出租

上月工商鋪買賣約246宗 代理行:連續3個月下跌

受加息陰霾影響,工商鋪市場淡靜。據本港一間代理行統計,9月份共錄約246宗買賣,金額約126.26億。宗數連續三個月下跌,按月跌逾20%,為2020年4月後新低,金額則見上升,主因月內錄全幢甲廈成交。

宗數按月減約28%

該行代理表示,根據資料,9月份共錄約246宗工商鋪買賣,按月減約28%,連續三個月跌勢,是今年度首次跌破300宗水平,亦是2020年4月後新低。金額共約126.26億,較8月份躍升約1.15倍,最矚目的為九龍灣啟祥道17號高銀金融國際中心易手,作價約70億,成為今年以來暫錄最大額成交。酒店成為另一項投資焦點。有共居品牌斥資約32億連環購入觀塘旺角兩幢酒店,分別為觀塘悅品海景酒店及旺角旭逸酒店。

高銀金融國際中心全幢最矚目

該代理指,工廈市場同樣呈量跌價升。9月份工廈成交宗數約158宗,按月回落約20%;金額約30.70億元,較8月份升約25%。9月份僅錄得約62宗,金額約20.44億;對比上月表現未見理想,分別急跌約47%及25%,單月宗數更為2020年7月後新低。

該代理認為,整體工商鋪市場受疫情及加息等利淡因素影響,表現回落,但長遠而言,本港疫情受控,加上入境檢疫安排放寬,為全面通關締造有利條件,加上《施政報告》及中共二十大即將舉行,提振經濟預計成為重點,相信屆時工商鋪投資氣氛被帶動,當中核心區商鋪可望率先反彈。

(星島日報)

更多高銀金融國際中心出租樓盤資訊請參閱:高銀金融國際中心出租

更多九龍灣區甲級寫字樓出租樓盤資訊請參閱:九龍灣區甲級寫字樓出租

中環一號廣場意向呎價1.6萬

中環商廈一向受投資者及用家追捧,有代理表示,中環擺花街1號一號廣場7樓04室連約出售,面積約1341方呎,意向價約2150萬,呎價約1.6萬元。

參考大廈以往紀錄,2018年曾錄1宗低層單位成交,呎價高達2萬,現時其他單位業主大多叫價每呎2萬或以上,是次放售單位屬「低水」。

料回報約2.79厘

該代理表示,該單位間隔四正,配備寫字樓裝修,享城市景觀,連約出售,料買家享回報約2.79厘,大廈採用玻璃幕牆設計,設3部載客電梯。

大廈距離港鐵中環站,需時5分鐘步程,附近有多條巴士綫,大廈鄰近中環至半山扶手電梯,為該區飲食零售核心。

上月錄391宗車位註冊

據代理行綜合土地註冊處資料顯示,9月份純車位註冊量錄391宗,較8月份480宗按月跌約18.5%,並自2020年5月後首度跌穿400宗水平,創逾2年 (28個月) 新低。

該行代理指出,隨着近數月純車位交投回落,導致第三季宗數僅錄1,605宗,比起第二季2053宗按季回落約21.8%,與第一季1733宗相比亦跌約7.4%,創9個季度新低。

(星島日報)

更多一號廣場寫字樓出售樓盤資訊請參閱:一號廣場寫字樓出售

更多中環區甲級寫字樓出售樓盤資訊請參閱:中環區甲級寫字樓出售

華瑞看好中港市場前景 購半山波老道豪宅擬分拆出售

長實集團上月底公布,以總代價逾207億,悉售港島半山波老道超級豪宅項目未售單位及全部車位,買家為新加坡基金LC

Vision

Capital。長實執行董事趙國雄表示,集團一直維持貨如輪轉的策略,因此價格合適便決定出售。負責成立及管理上述基金的華瑞資本,其合夥人阮思玲則表示,這是該基金首次投資物業市場,亦是華瑞重返香港後第一項投資,又說會繼續與長實及投資者研究,令該項投資價值最大化,包括以適當的價格出售相關的住宅單位和停車場車位。

LCVisionCapital購入

趙國雄表示,長實是發展商,所以一直維持貨如輪轉的策略,旗下物業只要價格合適便會出售,又透露早前亦曾有其他買家洽購,只是出價未達要求,所以未有達成協議。他又說,是次出售所得資金,將會用作其他投資,例如最近集團亦有競投政府招標的土地,因此不會考慮派發特別股息。

保留資金作其他投資

對於有指今次長實是「賣平咗」,趙國雄指買家是整批購入該項目,因此給予折扣很正常,又稱有關交易去年底開始洽談,歷時大約9個月,期間本港豪宅價格沒有太大變動。

他又說,由於買方要計算內部回報率,若一次過動用龐大資金進行投資,會影響其回報,因此長實為買家提供融資安排。他又說,由於交易是以股份轉讓形式進行,因此買方可以隨時分拆出售,長實將會替買方負責銷售事宜,價格則由對方決定。

管理資產達60億美元

阮思玲表示,購入該項目後會保留作收租用途,抑或分拆出售,暫時還未有最終計畫,但會繼續與長實及投資者進行研究,令該項投資價值最大化,並會以適當的價格出售相關的住宅單位和停車場車位。

她又說,華瑞於2017年成立,與對沖基金不同,公司屬多家族辦公室,管理資產規模達60億美元,今次購入波老道項目,是華瑞重返香港後第一項投資,選擇香港是因為看好中港市場前景,又形容這是對香港、大灣區及中國內地有信心的表現。

阮思玲指出,未來數年中國經濟表現將會一枝獨秀;大灣區去年本地生產總值,已經相當於加拿大,並且高過韓國。香港方面,根據新加坡的經驗,當全面恢復通關之後,相信反彈會很快。

她又稱,內地提出發展數據中心的策略,其中一個重點是將大灣區打造成數據中心樞紐,當企業陸續進駐之後,需要聘請高管及專業人才,他們對高端豪宅的居住需求,會為這類物業帶來支持。

問及在港還有沒有其他投資,阮思玲說暫時沒有,但會對所有投資項目持開放態度,又指作為多家族辦公室,目標是替高資產淨值家族及企業家,制訂合適的投資方案,因此不會集中某一項資產類別,又透露華瑞目前已經與超過十五家投資銀行連接。

對所有投資持開放態度

對於最近相繼有新加坡資金購入本港貴重物業,是否意味本港物業市場已經出現拐點,她說買入波老道項目,其中一個考慮因素為是否有合理回報,不代表其他新加坡資金對香港的看法。

阮思玲又期望香港政府提供更多政策支持,例如架構配合及稅務優惠,藉此吸弔更多家族辦公室來港。

長實於上月底公布,以公司股份轉售方式,出售波老道21號項目未售出的152個住宅單位,以及242個住宅停車位、31個電單車位予新加坡基金LC Vision Capital,總代價逾207.66億,住宅部分呎價6.2萬,估計獲得收益63億。

(星島日報)

靈活辦公室需求升 疫下加速發展

TEC朱雙珠:寬入境帶動商業活動 氣氛轉好

放寬入境檢疫措施可推動租務,商務中心品牌TEC認為,香港作為金融中心,應該持續放寬措施以帶動商業活動。集團亦指,疫情加快靈活辦公模式,未來尚有很大發展空間,故續物色據點擴充。

疫情持續兩年多,商務活動受嚴重影響,直至近日政府放寬入境措施至「0+3」,TEC港澳台董事總經理朱雙珠 (Nadia Zhu) 認為,新措施是正面消息,惟認為仍然不足夠,「作為一個國際金融中心,香港怎能持續封關?現喜見0+3的出現,當然完全放寬最好。」

她預計,放寬至完全通關,不能肯定一下子商務活動大幅增加,至少氣氛明顯轉好。日後舉辦金融峰會,可帶動商務活動。

第3季共享新租務 佔整體1成

整體商廈租務市場受疫情影響,近一年整體頗為淡靜,而在疫情期間,卻造就靈活辦公室興起,相關品牌紛擴充。據一間外資代理行數字顯示,在2021至2022年,分別有21.9萬及16.4萬平方呎商廈租務成交,涉及共享空間、靈活辦公室,單計今年第三季,已佔整體商廈新租務約1成。

她指出,跨國公司對靈活辦公空間的需求持續上升,而靈活辦公空間將永久成為辦公空間策略的一部分,疫情更是加速靈活辦公 (FLEX) 發展。整體甲廈空置率高,她指靈活辦公室與傳統甲廈有點不同,「當市場出現變化,機構有需要縮減業務,更會對商務中心、靈活辦公樓面感興趣。」

TEC疫市下擴充,集團位於中環士丹利街28號新據點近日開幕,成為集團在港第13個據點。涉及該廈全幢19層,總樓面約5.5萬平方呎,提供500個辦公位。中心設有專屬的休憩樓層,設有餐飲,以及共享辦公樓層,現時出租率已達85%,以開業個多月來說相當不錯。

據了解,該物業為中環老牌業主早年進行重建,今年落成,而TEC與業主是次屬合作模式發展,並非傳統業主與租客關係,朱雙珠指此模式有利雙方日後續尋找機會。

分店選址上,多間共享空間品牌積極擴充,分店遍布港九,而TEC暫時主力發展核心區,在13個據點上,幾乎全數位於中區,另3據點設於港島東太古坊,總樓面合共約30萬平方呎,她指隨着TEC的近期擴張,品牌已經佔據中環和金鐘的甲級靈活辦公市場總面積的65%,優勢有助鞏固業務。對於未來擴充計劃,她謂只要地點合適,不一定要在核心區,會續尋找機會。

(經濟日報)

卓悅棄守旺角 單邊舖結業 傳時裝店40萬承租 較舊約平27%

受新冠肺炎疫情影響,旅客數量大跌,尤其主要來港購物的內地自由客銳減,令一眾主攻內地客的零售商難以度過零售寒冬。本地化妝品零售商卓悅 (00653) 近年屢傳欠租,原來已低調將旺角所有分店結業,包括最後一個據點西洋菜南街及山東街交界約2700方呎大型舖位,亦在近期關店,據知舖位隨即以每月約40萬元租出。

高峰期打通毗鄰 每月逾250萬

卓悅在旺角最後一家分店位於旺角西洋菜南街7至19號好望角大廈地下19號舖,建築面積約2700方呎,屬西洋菜南街及山東街交界大單邊舖,在近期終告結業,舖位並已圍板並拆卸裝修。據代理透露,舖位已獲一家時裝店承租,月租料約40萬元,呎租約148元。

據了解,卓悅早於1999年起已在好望角大廈地下開設分店,當時只租用地下19號舖的其中部分舖位,建築面積只有約1000方呎。其後因自由行熱潮帶動生意額,不斷作擴充,直至2012年時打通好望角大廈地下17至19號舖租用成為旗艦店,建築面積達5200方呎,高峰期月租逾250萬元。

直至2017年,由於零售業境況大不如前,舖位月租已減至128萬元,較高位下跌近半。惟受社會運動及疫情接連重挫,好望角大廈地舖業主曾在2020年中入稟高院向卓悅追討欠租。直到同年底,卓悅一度擬放棄該旗艦店,最後決定減租建築面積約2500方呎的17號舖,而保留大單邊的19號舖,月租支出大削57%至約55萬元。至於17號舖,最終更由主要競爭對手莎莎

(00178) 租用。

不過,由於香港長時間未開放通關,旅遊區生意難復全盛時期水平,卓悅亦只好決定棄守旺角,關閉區內租用時間最長的最後一家分店。而最新時裝店租金,較卓悅舊租低27.3%。

西洋菜南街曾有4分店

據資料顯示,卓悅在疫情爆發前的2019年,在旺角區內共有7間分店,當中有4間位於西洋菜南街。不過,在疫情及飽受欠租問題困擾下,卓悅已經大幅收縮規模,直至今年初,旺角僅餘好望角大廈地下,以及旺角中心地下兩間分店。隨着旺角中心地下分店在6月份已結業,加上最新好望角大廈地下都關門大吉,該品牌正式撤出旺角。而卓悅的官方網頁顯示,該品牌全港只餘下6間分店,旅遊區只有尖沙咀、銅鑼灣和中環各有一間店舖。

至於在今年6月結業的彌敦道688號旺角中心地下GSA至GSS舖分店,丟空至今4個月仍為吉舖。該舖位由7個舖位打通而成,總建築面積4222方呎,卓悅在2008年起租用,租金由最初30.5萬元,直至結業前約58萬元,呎租137元。目前業主以50萬元放租,較卓悅舊租低8萬元或13.8%;另業主考慮將舖位間細出租。

卓悅近年新舊股東糾紛不斷,其創辦人葉俊亨與妻子鍾佩雲在2020年初將40.4%卓悅股份,售予現任主席兼大股東陳健文,二人不再是集團的主要股東。2021年鍾佩雲曾入稟高等法院,向卓悅子公司卓悅化粧品批發中心追討欠款,而葉俊亨亦向卓悅主席陳健文提出追討欠款,但葉俊亨及鍾佩雲被指與集團利益出現重大衝突,在2021年6月29日的股東特別大會上被罷免職務。

(信報)

Hong Kong’s reopening to revive office market from its longest and deepest slump, but upswing in rents will have to wait

The

reopening of Hong Kong’s borders and a stabilising pandemic will act as

a catalyst for moribund office market, says Swire Properties’ Don

Taylor

Additional

office space of 8.2 million sq ft expected in the next two years and

record high vacancy rates are likely to push rents lower this year and

next, says property consultancy

Demand

for office space in Hong Kong will receive a boost from the city

opening up to the rest of the world, but the segment still faces

significant headwinds in the short to medium-term, according to one of

the city’s largest landlords.

“With

the gradual reopening of the international borders and the pandemic

starting to stabilise, we anticipate that this could prove to be a

catalyst for demand,” said Don Taylor, director of office at Swire Properties,

noting that this would allow in-person inspections of real estate and

also removes some of the uncertainty for international companies with

regional offices here.

There

is no doubt that, in the short to medium-term, the Hong Kong office

market is up against some uncertainty, he added. “Given the current

state of the Hong Kong economy, slowing growth in the Chinese mainland,

the imbalance between demand and supply in the local office market, as

well as the real threat of a global recession, rents are likely to

remain under pressure into next year.”

But,

given Hong Kong’s growing importance to the future of the Greater Bay

Area and as a global financial centre, there will be continued demand

for high quality grade A office space, he said.

The

city’s economy shrank 1.4 per cent in the second quarter of this year,

following a 3.9 per cent contraction in the first three-month period,

confirming fears that stringent social-distancing curbs had affected

economic activity far more adversely than initially estimated. In

August, the government further cut its annual forecast for the city’s

economy to between 0.5 per cent growth and 0.5 per cent contraction. It

previously estimated growth of 1 to 2 per cent.

Meanwhile,

China’s economy has also seen a considerable slowdown, as Beijing

clings to a zero-Covid policy that has hobbled business operations

across the country. The world’s second-largest economy grew at a slower-than-expected 0.4 per cent in the second quarter, reflecting the toll of wide-ranging lockdowns

in the capital Beijing and financial hub Shanghai. The lockdowns

hammered economic output and are also likely to put the nation’s 5.5 per

cent growth target for this year out of reach.

The

additional office space of 8.2 million sq ft expected in the next two

years, according to a property consultancy, on top of the already record-high vacancies

this year, estimated at 9.6 million sq ft as of March, is tipped to

drag rents down by as much as 5 per cent this year and by another 5 to

10 per cent next year.

The current downturn in Hong Kong’s office property market has been described by the agency as its “longest and deepest”.

Demand

from mainland Chinese firms accounted for as much as a fifth of leasing

transactions in Hong Kong before a property market downturn in 2019.

But with China’s borders staying closed, demand from mainland companies

is likely to remain soft, agent said.

“In

the three years between 2016 and 2018, for instance, mainland Chinese

firms leased an average of 750,000 sq ft of grade A office space per

annum,” the agent said.

Between

March 2019 and March 2022, the real estate footprint of mainland

Chinese companies grew by only 35,000 sq ft, according to the

consultancy. On the other hand, demand from western firms shrank by between 1.3 million sq ft and 1.4 million sq ft.

Swire Properties is set to launch Two Taikoo Place

in Quarry Bay. The 42-storey office tower with a gross floor area of 1

million sq ft is slated for occupancy before the end of the year.

Majority of its portfolio tenants, however, are western firms.

“In our Pacific Place

portfolio, just under a quarter of our tenant base is from the Chinese

mainland,” Taylor said. “That figure for Taikoo Place is significantly

lower but growing. We’ve always maintained a diverse and balanced tenant

base across our portfolio, both in terms of nationality and the sectors

they operate in.”

Despite

the prevailing uncertainty and current state of the market, Swire’s

core portfolio, which includes both Taikoo Place and Pacific Place, has seen occupancy in the high 90 per cent range, said Taylor.

Two Taikoo Place

has so far secured commitment for 50 per cent of its space, he added.

Its tenants include Julius Baer, which will take up four floors spanning

close to 100,000 sq ft, and two other banks that will lease close to

200,000 sq ft. Other tenants are Amundi, BASF and Boston Consulting

Group.

Other new office property supply expected this year includes AIRSIDE in Kai Tak and 98 How Ming Street in Kwun Tong. These will increase new office supply to 5 million sq ft, according to another property consultant.

An

agent said that the gradual resumption of international travel will

have a positive effect on office leasing activity and demand in the next

few months.

“However,

record-high vacancies and a supply boom will ensure rents soften

further and stay at low levels” in the short-term, the agent added.

(South China Morning Post)

For more information of Office for Lease at Two Taikoo Place please visit: Office for Lease at Two Taikoo Place

For more information of Grade A Office for Lease in Quarry Bay please visit: Grade A Office for Lease in Quarry Bay

For more information of Office for Lease at Pacific Place please visit: Office for Lease at Pacific Place

For more information of Grade A Office for Lease in Admiralty please visit: Grade A Office for Lease in Admiralty

For more information of Office for Lease at AIRSIDE please visit: Office for Lease at AIRSIDE

For more information of Grade A Office for Lease in Kai Tak please visit: Grade A Office for Lease in Kai Tak

For more information of Office for Lease at 98 How Ming Street please visit: Office for Lease at 98 How Ming Street

For more information of Grade A Office for Lease in Kwun Tong please visit: Grade A Office for Lease in Kwun Tong

長實海韻軒酒店申改建1503伙

疫情下本港酒店業為重災區之一,部分財團決定將酒店轉作住宅發展。長實旗下紅磡海韻軒海景酒店向城規會申請全幢改裝,以提供約1503個住宅單位及約442個酒店房間,當中酒店房間數目較現時大減約78%。

據城規會文件顯示,項目位於紅磡紅樂道12號,目前屬「商業 (3)」地帶,申請擬議分層住宅及准許的酒店、商店及服務行業和食肆用途並略為放寬私家車 / 貨車公眾停車場的總樓面面積。

住宅總樓面逾80萬呎

地盤面積約106994方呎,住宅部分總樓面約802090方呎,非住宅樓面約401756方呎。擬議發展將現時的海韻軒酒店改建成約1503個住宅單位及約442個酒店房間,當中酒店房間數目對比現時的1980個,大幅減少1538個或約78%。

現時該酒店共有3幢物業,是次改建住宅分布於第1座及第2座,而第3座則作酒店用途。據發展計畫,在較低樓層則設有零售和餐飲設施。在優化地下至二樓的空間布局以容納所需的內部運輸設施、住宅和酒店大堂、機電設施等後,擬議發展能提供一個約149135方呎的公眾停車場。

酒店房大減約78%

由於所提供的總樓面面積比核准圖規定作提供私家車/貨車公眾停車場的不少於175453方呎的總樓面面積減少約15%,因此需要略為放寬私家車 / 貨車公眾停車場的總樓面面積。

申請人指,擬議發展計畫能在短期內提供約1503個住宅單位,與政府增加房屋土地供應的政策相符。而且設獨立的出入口、電梯大堂等能夠將同一樓宇內的住宅及酒店用途實際分開,並不會構成 協調問題及避免對將來住客造成滋擾。

而且紅磡海濱原定旅遊發展計畫從未實現,申請地點作為尖沙嘴東部酒店中心區的擴展部分的功能已逐漸減弱。該地區有充足酒店房間供應,以應付預期旅遊業復甦期間的需求。擬議發展計畫不會增加現時建築物的高度或體積,因此楷梯式的高度和視覺走廊將能保留。

資料顯示,上述項目曾在2018年獲屋宇署批建兩幢29層高的商廈,以及1幢2層高的物業,總樓面約110.73萬方呎。

(星島日報)

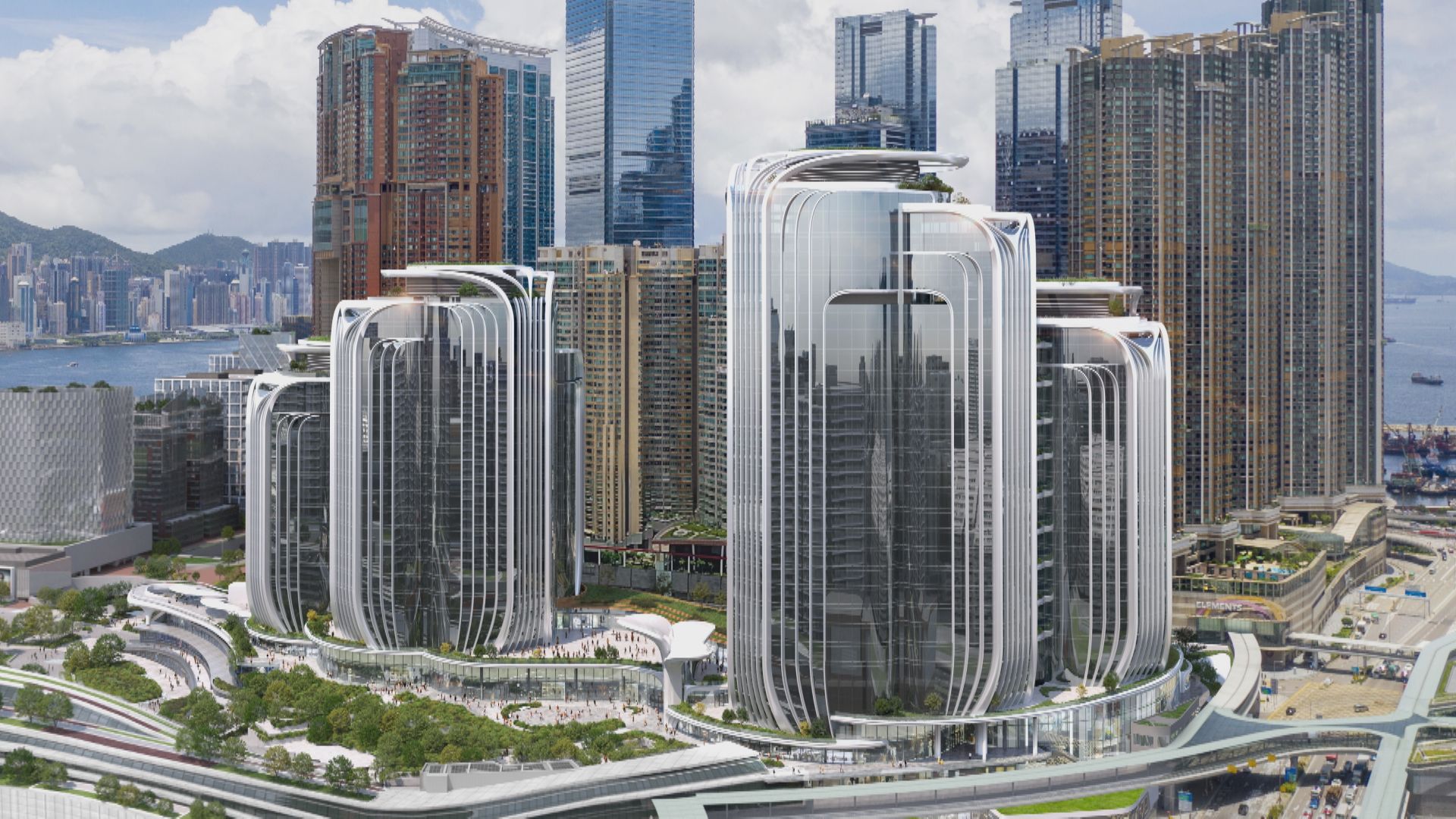

UBS will move to SHKP's West Kowloon project

Sun

Hung Kai Properties (0016) said UBS will be the first anchor tenant of

its multi-tower development atop the High-Speed Rail's West Kowloon

Terminus.

The Swiss bank

will relocate its Hong Kong operations to the top nine floors of the

tallest tower, taking up a floor area of approximately 250,000 square

feet.

Though the rents have not been made public, the developer might refer to its other office tower in the same area - the International Commerce Centre

- where monthly rents currently range from HK$80 to HK$90 per square

foot, a property agent said. But the agent said the prices could change,