Shimao’s

founder Hui Wing Mau and his daughter Hui Mei-mei are asking for HK$1.6

billion (US$205 million) for levels 31 and 32 of The Center in Hong Kong.

The

two floors have a combined floor plate of about 50,000 square feet

(4,645 square metres), according to a sales kit seen by South China

Morning Post.

Shimao Group’s founder is putting two floors of the world’s priciest office tower on the market for sale, as even one of China’s more restrained real estate developers digs into his own pockets to pare a looming debt load.

Shimao’s

founder Hui Wing Mau and his daughter Hui Mei-mei are asking for HK$1.6

billion (US$205 million) for levels 31 and 32 of The Center in Hong Kong, with a combined floor plate of about 50,000 square feet (4,645 square metres), according to a sales kit seen by South China Morning Post.

Hui, also known as Xu Rongmao in mainland China, was among the nine-member consortium that bought the 73-storey tower in early 2018 for HK$40.2 billion.

Hui, who paid HK$8 billion for nine of the 73 floors at Hong Kong’s

fifth-tallest building, was not available for comment, and spokespeople

at Shanghai-based Shimao did not immediately respond to requests for

comment.

Shimao

is “relying on asset disposals and extending some short-term maturities

to improve liquidity,” said Fitch Ratings, which cut the company’s

credit rating to B- from BB last week. “Shimao’s ratings reflect

decreasing margin of safety in liquidity amid deteriorating market

confidence.

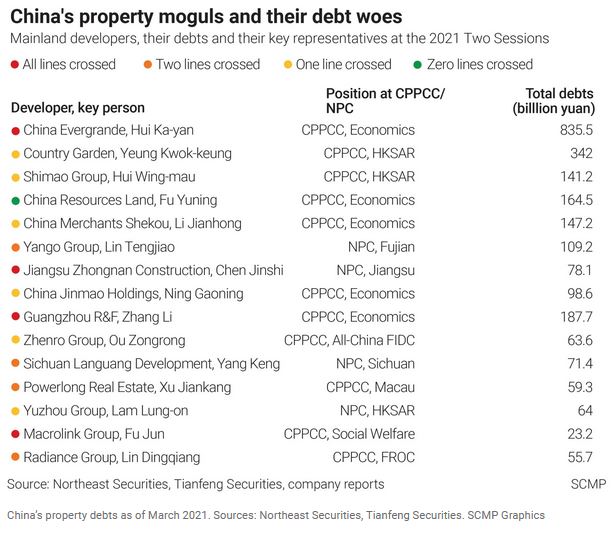

Shimao

is seen as one of China’s more conservative borrowers, in a property

industry where most developers rely on bank loans to finance their land

purchases and constructions, amid a tight cap on prices and sales. The

company was rated green under the Chinese central bank’s debt criteria

when it announced its interim result in August 2021, a sign of

compliance with the so-called three red lines of debt limits.

Shimao, China’s eighth-largest real estate developer by sales last

year, faces 20 billion yuan (US$3.2 billion) of payments this year from

onshore bonds and offshore notes, Fitch said. The company also faces

debt obligations such as trust financing and around 10 billion yuan of

asset-backed securities, of which 5.6 billion yuan is due this year.

Shanghai

Shimao Construction Company, one of Shimao’s units, missed a US$101

million project loan guaranteed by the Hong Kong-listed group last week,

according to a notice sent to investors by China Credit Trust (CCT),

the trustee for the loans. The unit denied defaulting “on any loan in

the open market,” and said that its failure to pay what was owed would

not trigger demands for redemption.

That

did little to prevent Shimao’s bonds and shares from plunging, as

investors scrambled for sanctuary from high-yield debt. Shimao shares

rose 4.1 per cent to HK$5.03 in Hong Kong on Tuesday, down by 72 per

cent in six months.

Besides

the two floors on the market, Hui and his daughter own levels 36, 37,

55, 56, 62, and 63 through a shell company, while the founder owns the

top floor under his name. The building skipped three floors with

inauspicious numbers as is customary among Hong Kong’s skyscrapers.

Levels 32, 56, and 76 were pledged last October to the Hong Kong branch

of DBS Bank, according to land records.

Level 31, currently

serving out a lease for a monthly rent of HK$2 million, or HK$83 per

square foot, is asking for HK$801.6 million. Level 32, currently vacant,

is asking for HK$806.2 million, according to the sales document.

The Center,

completed in 1998, is an entire steel structure without a concrete

core. Its iconic lobby was featured in the 2008 Hollywood movie The Dark Knight. The last time a sale was recorded at the building was in July 2021, when the 25th floor was sold for HK$674.5 million.

Tycoon Li Ka-shing’s flagship company CK Asset Holdings

developed and owned 48 floors at the building, after Malaysian

developer Guoco Group bought 11 floors. Nine of the 11 floors were sold

to Singapore’s DBS Group Holdings in 1998, while CK sold the 60th and

79th floors in 1999, according to The Center’s sales brochure.

(South China Morning Post)

For more information of Office for Sale in The Center please visit: Office for Sale in The Center

For more information of Grade A Office for Sale in Central please visit: Grade A Office for Sale in Central

Hong Kong retail space may surge by record amount in 2023 as mall owners aim to catch returning tourists

The

amount of new space for shops could quadruple from just over a million

square feet this year to about 4 million sq ft in 2023, according to

Savills

Retail

landlords are trying to time the opening of their shopping malls to

coincide with the return of tourists after the city’s borders reopen

Hong Kong may see a

record amount of new retail space come to the market in 2023 as

landlords try to time the opening of their shopping malls to coincide

with the return of tourists after the city’s borders reopen.

With several large

projects in the pipeline, the amount of new space for shops could

quadruple from just over a million square feet this year to about 4

million square feet in 2023, according to property agency.

“There is hope that land

checkpoints may reopen in the second half of 2022 which would help

retail businesses, especially in the New Territories submarket,”

property agent said.

The agent said that the dramatic increase in supply might lead to “some moderation” of rental growth in noncore areas in 2023.

The largest supply of new

retail space came in 2019, at over 2.3 million sq ft, which included

the opening of the K11 Musea shopping centre in Tsim Sha Tsui, according

to the agency.

The five-year average between 2017 and 2021 was 956,000 sq ft.

New supply will remain

low in 2022, at just over a million sq ft. Nan Fung’s Airside mall in

Kai Tak is among the major projects due to open this year.

With a total investment of HK$32 billion (US$4.11 billion) behind it, Airside is set to open in the fourth quarter of 2022.

“Consumers are adaptive

to the new normal [of living with the pandemic]. Retail business has

been picking up since the second quarter of 2021,” said Billy Hui,

executive director of Hong Kong property at Nan Fung Development.

With anti-pandemic

measures including strict border control, the number of leisure visitors

remained close to zero in 2021, according to the Hong Kong Tourism

Board.

The city’s retail sales

have been largely recovering since hitting a trough in early 2020 caused

by the double whammy of social unrest and the initial outbreak of

coronavirus.

“In recent years, we have

been forming strong partnerships with tenants by introducing customised

measures to support them whenever necessary,” said Hui. “Our resilient

approach has led us to respond to the new normal flexibly.”

The retailers at Airside will span fashion, lifestyle, entertainment, kids and families, wellness and dining.

“We are keen to

collaborate with our retailers to co-create a place that brings people

back to nature and encourages interactive experiences,” Hui added.

“Retailers are confident about the mix of residential development in the

surrounding areas and the dynamic workforce in Kai Tak.”

Among the projects due

next year is Sogo’s twin commercial blocks in Kai Tak, which will

provide about 1.1 million sq ft of space mainly for retail, including a

Sogo department store.

“There will theoretically

be most of the brands you see in Causeway Bay. But as a new landmark,

there will definitely be some things so far not seen in Hong Kong,” said

Poon Fuk-chuen, company secretary at Sogo operator Lifestyle

International Holdings.

The amount of rent

charged to tenants may take its lead from Telford Plaza, Megabox in

Kowloon Bay and the nearby Mikiki shopping centre, Poon added. “We will

maintain Sogo’s original market positioning. We have been targeting

purchasing power in the mid to mid-higher [range].”

Yuen Long’s Yoho Hub

mall, with a floor area of nearly 110,000 square feet, is now entering

the planning stage and is expected to open in 2023, said Jessica Wong,

deputy general manager of leasing at Sun Hung Kai Real Estate Agency.

“After the project is

completed, it will join with Yoho Mall to become the largest leisure and

shopping district in the western and northern New Territories,” she

said.

At present, Yoho Mall,

the landlord’s existing shopping centre in Yuen Long, has more than 1.1

million square feet of floor space.

(South China Morning Post)

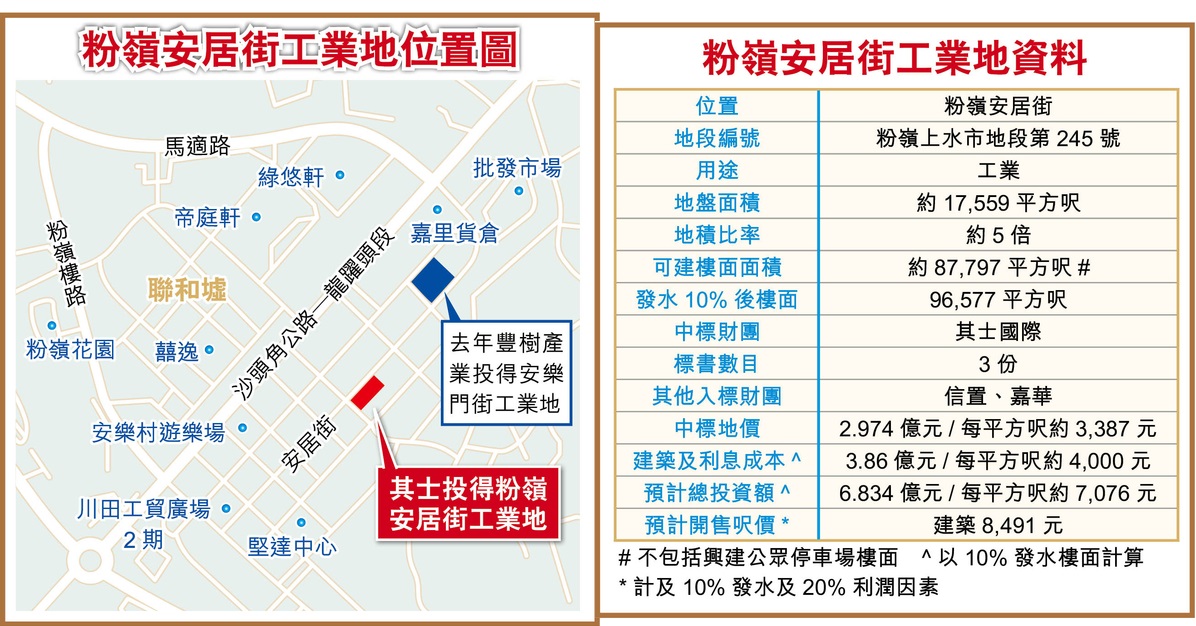

今年首幅工業地 其士2.97億投得

粉嶺安居街每呎3387 低估值下限4%

今年首幅截標的粉嶺安居街工業地,終由其士國際 (00025) 以2.974億元投得,每呎樓面地價約3,387元,並較市場估值下限稍低。有業內人士認為,中標價較市場預期低,主要與項目發展規模細,租客行業受局限有關。

粉嶺安居街工業用地於上周五截標,並僅接獲3份標書,當時其士國際獨資入標,而信置 (00083) 及嘉華 (00173) 亦到場遞交標書。以標書數目計算,屬2011年政府主動推地以來、單計工業用地的新低紀錄。

區內地價 較1年前低約1成

而地政總署昨日公布,地皮由其士國際以2.974億元投得,以可建樓面87,797平方呎計算,即每呎樓面地價約3,387元,較市場估值下限

(約3.1億元)

略為低約4%。值得一提的是,去年初由豐樹產業以約8.13億元投得的安樂門街工業地,每平方呎樓面地價約3,750元,當時創下新界北區工業地新高。相比之下,這意味區內地價較1年前低約1成。

連同建築成本、10%「發水」及利息成本等計算,預計項目總投資額逾6.8億元,每平方呎發展成本達7,076元。假設利潤為兩成,日後推售的建築呎價將約8,491元,較區內過去半年的二手舊式工廈建築呎價約3,246元,高約1.6倍。

值得留意的是,去年區內接連錄得全幢工廈買賣,當中樂業路5號川田工貿廣場2期全幢以2.7億元沽,並由香港房屋協會接貨,呎價逾6,170元。此外,外資基金Silkroad去年初曾斥資3.21億元,買入安全街10及12號的堅達中心,呎價約3,580元。

有測量師指出,是次入標數量比預期少,而且中標價較預期低,相信兩者與疫情有關,故財團態度較為審慎。他又相信,發展商會用作現代物流相關倉庫用途。

另一測量師認為,鑑於樓面面積達20萬平方呎的地皮才會較適合發展數據中心,所以是次入標者欠缺一些數據中心的營運者。該測量師亦稱,北部都會區發展仍處於初步階段,因此今次入標的情況及中標價,或反映發展商對區內工商項目持審慎態度。

綜合市場資訊,截標前地皮估值介乎約3.1億至約4億元,每平方呎樓面地價約3,500至4,600元。

(經濟日報)

黃竹坑6工廈重建 增115萬呎商業樓面

黃竹坑區工廈重建加快,區內未來幾年有6個工廈重建項目,合共提供逾115萬平方呎樓面,包括帝國集團去年就區內工廈重建補地價共13.4億元。

受惠於活化工廈2.0政策,黃竹坑區內工廈重建亦有所加快,未來區內8個商業項目供應之中,便有6個屬於工廈重建,合共提供約115萬平方呎樓面,當中帝國集團於去年11月便就區內黃竹坑道36號、63號兩個工廈重建項目補地價,將會興建兩幢商廈。

帝國集團兩項目 補地價逾13億

而帝國集團亦在區內先後收購天豐工業大廈及仁孚香港仔車廠兩幢工廈作重建,當中以約17億元購入84%業權的天豐工業大廈,發展商及後成功收購餘下業權,預計重建後可提供27.4萬平方呎樓面;至於仁孚香港仔車廠項目,可建樓面約16.4萬平方呎。其中黃竹坑道36號前身為仁孚香港仔車廠,帝國集團於2017年以約15.6億元購入,早前補地價約5.3億元,屬於以「標準金額」方式補地價,每呎補地價約3,232元,預計興建1幢約16.4萬平方呎樓面的商廈,預計2023年落成。

另外,前身為天豐工業大廈的黃竹坑道63號則補地價約8.1億元,該地盤將發展為一幢25層高全新商廈,提供約27.4萬平方呎樓面面積。

Landmark South 料今年落成

除了兩個工廈重建項目外,帝國集團亦夥拍信置 (00083) 於2016年以約25.3億元,投得業勤街商貿地,成為甲級商廈 Landmark South,集辦公室、零售、餐飲、藝術與創意社區於一身,物業樓高28層,總樓面面積約28.5萬平方呎,預計將在今年落成。

由資深投資者蔡經陽成立的偉華集團,包括黃竹坑道24號信誠工業大廈,集團由2013年開始收購,將會興建1幢27層商廈 (另設3層平台),總樓面約29.39萬平方呎。發展商亦在去年以約10.08億元完成補地價,每平方呎補地價約3,430元。

除了工廈重建外,區內其中一個規模最大的商業項目,則為港鐵 (00066)

黃竹坑站上蓋港島南岸項目的商場部分「The

Southside」。港島南岸屬於黃竹坑站車廠上蓋項目,除了分為6期共發展約5,400伙私人住宅外,在第3期部分尚設有一個可建樓面約50.59萬平方呎的大型商場,發展商長實

(01113)

在商場建成後須交還給港鐵。項目商場預計2023年落成,設有5層商舖樓層,有約150間商戶,提供約235個停車場車位,計劃引入不同類型的商戶,包括娛樂及大型綜合超市等。

(經濟日報)

更多Landmark South寫字樓出租樓盤資訊請參閱:Landmark South寫字樓出租

更多黃竹坑區甲級寫字樓出租樓盤資訊請參閱:黃竹坑區甲級寫字樓出租

進出口及貿易 佔工廈樓面4成

根據規劃署剛完成的《2020年全港工業用地分區研究報告》指出,已經劃為商貿區用途的黃竹坑,區內有4成樓面作為進出口及零售貿易用途。

據規劃署報告指出,黃竹坑商貿區佔地約8.6公頃,涉及36幢私人工廈,在過去幾年區內有6幢工廈重建,除了一幢改裝成為酒店、一幢重建為工廈外,其餘4幢工廈在重建過程。

創意文化行業佔5%

按照報告指出,區內工廈最主要作為貨倉用途,佔了區內工廈樓面4成,而作為辦公室及工業用途的樓面均佔整體比例15.7%,分別涉及約100萬平方呎樓面,其餘則為酒店、數據中心及空置用途。

若果以行業類型為劃分,黃竹坑區內工廈最多為進出口及零售貿易行業,佔用了約188萬平方呎樓面,佔整體比例達44%,其次則為專業行業、資訊科技行業等組成的「其他非製造業行業」亦佔了26%。另外,值得留意的是,區內亦有5%樓面的工廈用作創意及文化行業。

受到疫情打擊商廈市道,黃竹坑商廈亦受影響,其中連卡佛在去年便退租黃竹坑甲級寫字樓 One Island South 一層近2萬平方呎樓面,轉租予香港大學旗下醫學院使用,呎租約35元。

(經濟日報)

更多One Island South寫字樓出售樓盤資訊請參閱:One Island South寫字樓出售

更多黃竹坑區甲級寫字樓出售樓盤資訊請參閱:黃竹坑區甲級寫字樓出售

遠洋7.05億統一大華大廈業權

屯馬綫全面通車後,九龍城區內舊樓併購明顯加快。九龍城大華大廈昨日舉行公開拍賣,底價為7.05億,結果由遠洋集團在無對手下的情況下,以底價投得,成功統一業權發展,每呎樓面地價約11886元。發展商指,項目將重建為約100多伙的住宅,主打中小型單位,預計最快明年底推出。

將重建100多伙住宅

九龍城衙前塱道3至13號大華大廈項目,昨日進行強拍,底價為7.05億,第一口叫價1500萬,其後每口叫價1000萬,結果由手持「18號」牌的遠洋集團香港常務副總經理楊樂宇,在無對手下以底價投得,成功統一業權發展。上址現為一幢6層高商住物業,設有2條公用樓梯,地下、1至3樓為護老院,另有7間地鋪,樓上4及5樓每層有10伙住宅,合共提供30伙,早於1967年落成,至今樓齡約55年。項目地盤面積約7030方呎,現劃為「住宅

(甲類) 2」用途,若以8.43倍地積比率重建,可建樓面約59314方呎。項目鄰近港鐵宋皇臺B2出口,步行前往不足2分鐘,出入便利。

遠洋集團助理總經理甄振宏表示,料今年樓市審慎樂觀,近期內房陰霾只屬短期影響,中長遠對香港有信心。楊樂宇則指,集團看好今年樓價,現正推售旺角千望,另大嶼山南嶼嵩林現正進行裝修,有望今年推出。至於今次收購的大華大廈項目,則最快明年年底推出。

市場人士指,料今年的強拍宗數會增加,參考過往强拍宗數,正常每年全年錄約32至35宗强拍,惟去年較少,只有16宗,相信因為之前疫情,令法庭工作延遲,强拍個案亦隨之滯後,料今年可回復正常,全年强拍宗數料錄約30宗。

有代理表示,由於市區土地供應不足的問題日益加劇,因此九龍傳統住宅物業仍然極具投資價值,料將會有更多發展商在市區物色具潛力的舊樓重建。

(星島日報)