Luxury home deals soar 131pc to record high

Hong Kong saw a record 199

transactions for luxury residential homes worth over HK$100 million in

the first three quarters of 2021, up 131.4 percent from a year ago and

23.6 percent higher than 2018 when the market was also buoyant, real

estate consultancy said.

The

market value of luxury homes dropped 12.6 percent over 18 months

between mid-2019 and end-2020 but on entering 2021, as prices were

perceived to have sufficiently corrected, buying sentiment began to

return and the number of transactions rose, according to the

consultancy’s research.

Consequently,

prices of luxury homes have rebounded 5.7 percent in the nine months

since the beginning of this year, though they are still 7.6 percent

below their peak.

the

consultancy expects that a total of 478 residential homes with areas of

more than 160 square meters will be completed this year, an increase of

83.8 percent over last year.

It

said the supply of these residences will remain comparatively high in

the years to come with 429 expected in 2022 and 332 expected in 2023.

Despite

a somewhat higher supply of large-size homes in the near term, truly

luxury units in desirable locations will continue to be acquisition

targets by wealthy buyers, it added.

Meanwhile,

Henderson Land Development (0012) has acquired a residential site in To

Kwa Wan through a compulsory sale with a reserve price of HK$962

million.

The developer

controlled 96.24 percent of the ownership of the site, which is a

61-year-old building at the junction of 58 to 70 Lok Shan Road, 1 to 9

Lai Wa Street, and 18 to 20 Ha Heung Road.

The

site may be included in a nearby redevelopment project in Lai Wa Street

and To Kwa Wan Road, which covers about 42,500 square feet and a

buildable area of over 374,300 square feet, according to the developer's

interim report.

Separately, 13 homes at Grand Victoria II in West Kowloon will be put on sale on Saturday.

In

other news, Sino Land (0083) said it will launch four major residential

projects next year, providing a total of 5,000 units. The developer has

cashed in HK$24 billion by selling 1,873 homes, or 94 percent of the

total units at its Grand Central project in Kwun Tong.

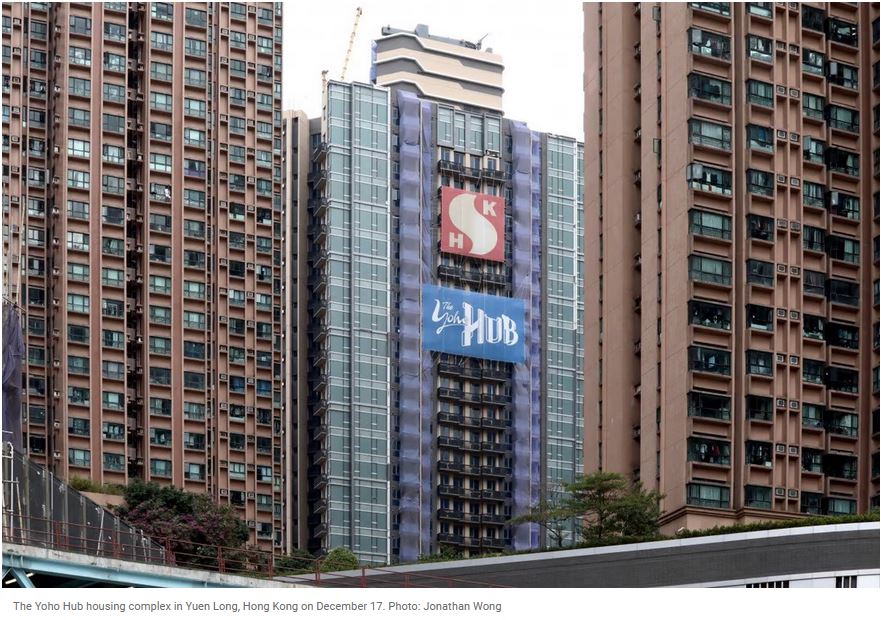

And

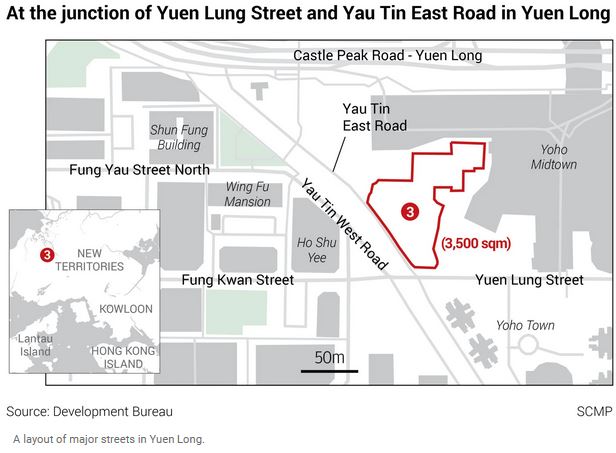

Sun Hung Kai Properties (0016) said that its new project, the Yoho Hub

atop Yuen Long Station with a total of 1,030 units, is expected to

receive pre-sale consent this week.

(The Standard)

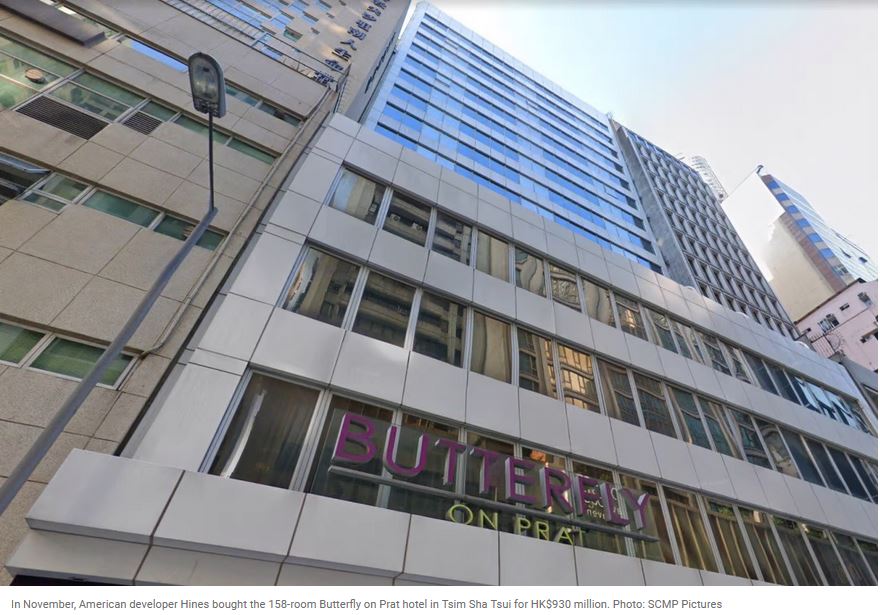

Demand driving prices up, says Far East boss

Far

East Consortium International's (0035) managing director Chris Hoong

Cheong-thard expects Hong Kong's property prices will keep rising,

driven by the strong demand, and the company will continue to sell its

non-core assets including small parking lots and hotels not directly

managed under its own brand.

Despite

the government's proposals to increase land and residential supply,

Hoong believes no substantial changes will be seen in the next three to

four years. And as for the medium term, he thinks that the inflation-led

increase in construction material prices will be reflected in property

prices.

Analysts had

said the HK$7.96 billion Kai Tai property that the company bought in

partnership with New World Development (0017) from Kaisa Group (1638)

was too expensive, but Hoong said some of the work on the project had

already been completed, which would save them lot in terms of cost and

time.

The residential project is expected to be completed in 2024 or in 2025, he added.

The

developer's interim net profit more than tripled to HK$1.07 billion

from a year ago while the interim dividend declared remained unchanged

at 4 HK cents. The profit surge was mainly due to the 115 million

(HK$1.2 billion) disposal of the Dorsett City London and revaluation

gains attributable to Hong Kong and Singapore properties. Revenue for

the six months ended September slightly rose to HK$3.12 billion, of

which hotel operations income increased by 81.2 percent year-on-year to

HK$658.56 million.

(The Standard)

Henderson continues to build up its land bank in Hong Kong, invests over US$1.1 billion in redevelopment projects

Land

Tribunal approves application from Henderson to buy out a building in

To Kwa Wan earmarked for development for HK$962 million

In

September, Hong Kong’s third largest developer won another

redevelopment project offered by the Urban Renewal Authority in the same

area for HK$8.2 billion

Henderson Land Development, which earlier this month bid a record HK$50.8 billion (US$6.5 billion) for a harbourfront commercial plot in Hong Kong, is gradually boosting its land bank in other parts of the city.

Hong

Kong’s third largest developer by market capitalisation has invested

more than HK$9 billion in Kowloon’s To Kwa Wan area since the MTR

station opened in June.

Henderson

on Tuesday completed the acquisition of a 100 per cent stake in a

61-year-old eight-storey residential building under the Land (Compulsory

Sale for Redevelopment) Ordinance through its wholly owned subsidiary

Asia Bright Enterprises. The Land Tribunal approved an application from

Henderson to force a compulsory sale for the building at a reserve

valuation of HK$962 million.

“We

will redevelop the building with a focus on small to medium-sized

flats,” said Augustine Wong Ho-ming, executive director of Henderson

Land.

Developers

are increasingly seeking redevelopment opportunities in urban areas in

view of limited land supply from the government. Fifty-eight

applications for compulsory sale orders were under process as of

September. These applications have been increasing over the past couple

of years, rising from 22 in 2019 to 27 in 2020, government data shows.

The

upcoming project on the site, located at the intersection of Lok Shan

Road, Mei Wa Street and Ha Heung Road, will have a total gross floor

area of 91,764 sq ft, with the valuation working out to HK$10,438 per

square feet, according to property consultancy, the auctioneer for the

compulsory sale.

Two

months earlier, Henderson won another redevelopment project offered by

the Urban Renewal Authority in the same area for HK$8.2 billion.

“The

opening of the Tuen Ma Line has unlocked the redevelopment potential of

To Kwa Wan and will lead to an increase in housing demand in the area,”

property consultant said. “Given the lack of land supply in urban areas

is expected to worsen, we believe that old buildings in urban

residential areas will continue to be well sought-after.”

To

Kwa Wan MTR station is on the Tuen Ma line, the city’s longest rail

corridor at 56km with 27 stations. It links the east and west of the New

Territories and includes interchange stations on the existing railway

network.

The

Tuen Ma line’s first phase, connecting Wu Kai Sha and Kai Tak by way of

Tai Wai, Hin Keng and Diamond Hill, opened in February last year. The

rest of the line running from Kai Tak to Hung Hom through Sung Wong Toi,

To Kwa Wan and Ho Man Tin opened in June this year.

The

opening of the To Kwa Wan MTR station is expected to have a big impact

on residential developments in the area, another property consultant

said, who estimated the construction cost for Henderson’s latest

acquisition would be around HK$6,500 per sq ft.

“The

landscape in To Kwa Wan is expected undergo a dramatic change. There

are about 20 redevelopment projects under construction or in the process

of compulsory sale,” the consultant said.

“It will take about 15 years to complete all the potential redevelopments that are under way,” the consultant said.

(South China Morning Post)

Hong Kong property firms pick up assets on the cheap from stricken mainland Chinese developers

A joint venture between Far East Consortium and New World snapped up land at Kai Tak from Kaisa Group for just over US$1 billion

Sharpview Investment recently took a majority stake in a project at Mid-Levels from China Aoyuan Group for HK$900 million

Mid-sized

Hong Kong property firms are picking up residential plots at heavily

discounted prices from cash-strapped mainland Chinese developers who are

speeding up asset sales to repay debt.

Far

East Consortium International recently snapped up two land parcels, one

of which was from the heavily indebted Kaisa Group Holdings.

“We

may allocate more resources to increase our land bank in Hong Kong

after we cashed in on our overseas property investments,” Chris Hoong

Cheong Thard, managing director of Far East Consortium.

Since

2015 the developer has diversified its property investments in various

markets like Singapore, Malaysia, Australia and Britain, maximising its

investment opportunities by taking advantage of different property

cycles.

Highly

indebted Chinese developers, from China Evergrande Group to Kaisa, have

been trying to buy time with partial repayments and debt restructurings

in recent months as they have faced a liquidity crunch after Beijing

instituted new rules design to stem speculative bubbles in the

residential property sector.

Last

week River Riches, a 50:50 joint venture between Far East and New World

Development affiliate Modern Culture acquired a plot in Kai Tak, the

site of city’s former airport, from Kaisa. The duo paid HK$7.9 billion

for the land, much lower than the plot’s audited value of HK$9.8

billion.

“We struck the Kai Tak deal very fast,” he said, adding that the price works out to HK$13,829 per square foot.

It

was about 5 per cent lower than the HK$14,497 per square foot for a

neighbouring site that was sold to a consortium of Wheelock Properties,

New World, Henderson Land Development and Empire Group in November 2018.

The

joint venture between Far East, controlled by the family of David Chiu,

and New World, which is majority owned by the family of the Cheng

Kar-shun, is not new.

The

pair jointly developed the Artra residential project in Singapore,

selling all 400 units when it was launched in October last year.

In

Australia, Far East and the Cheng family’s private investment arm, Chow

Tai Fook Enterprises, were part of a consortium that won a contract to

develop a multipurpose resort development in Brisbane, Queensland, in

2015. The A$3.6 billion (US$2.6 billion) Queen’s Wharf Brisbane will be

fully operational in 2024.

On

Monday, Far East announced its net profit jumped 206 per cent to

HK$1.07 billion for the six months to September. The hefty increase in

earnings was partly due to the sale of its four-star hotel Dorsett City

London for £115 million (US$153.2 million) and improvement in hotel

operations after shifting of focus to quarantine stays.

Far

East also bought another residential parcel in Lam Tei, Tuen Mun, from

the family of “shop king” Tang Shing-bor who died in May, Hoong said,

without disclosing the price.

The

Tang family has been selling down its portfolio at deep discounts,

after its hospitality business collapsed because of the social unrest in

2019 followed by the coronavirus outbreak.

Far

East’s previous land acquisition came three years earlier in August

2019 when it won a hotel site in Kai Tak for a lower-than-expected

HK$2.45 billion. Located next to the proposed Kai Tak Sports Park, the

firm said it planned to develop a four-star hotel with 300 to 400 rooms

and an office tower at a total investment of HK$4.5 billion, including

the land cost.

The

Kai Tak plot acquired from Kaisa will yield a total gross floor area of

574,733 sq ft, with flats likely to go on sale as early as 2023, Hoong

said.

A

surveyor said that mainland developers have built up a strong presence

in Hong Kong’s property market, either by taking part in government

tenders or acquiring old buildings for redevelopment, in the past five

to seven years.

Acquiring

land from struggling mainland Chinese developers “will become an

alternative for land replenishment among Hong Kong developers who have

strong balance sheets”, the surveyor said.

China

Aoyuan Group said it sold a 86 per cent stake in the 54-year-old Yin

Yee Mansion at Robinson Road, Mid-Levels, for HK$900 million through its

wholly owned subsidiary Aoyuan Property (Hong Kong) to Sharpview

Investment Development, according to a filing to the Hong Kong stock

exchange on November 14.

The mainland developer said the group expect to recognise an estimated loss of HK$176.6 million from the deal.

“Offloading assets will be one of the fastest ways for cash-strapped developers to raise cash flow,” another surveyor said.

(South China Morning Post)

「慕詩陳」5.52億放售中遠大廈全層

新一波疫情為市場蒙上陰影,資深投資者亦趁勢沽貨。由外號「慕詩陳」、慕詩國際主席及行政總裁陳欽杰持有的上環中遠大廈全層以意向價5.52億放售,呎價約2.8萬。

平均呎價2.8萬

有代理表示,上環皇后大道中183號中遠大廈23樓全層,面積約19746方呎,將以部分交吉及部分連約放售,以公司股權轉讓交易,意向呎價約2.8萬,涉資約5.52億,物業可享海景及山景;當中06至12室,面積約9005方呎,現租客為大型貴金屬投資公司,月租約46萬,租期至2022年6月,截標日期為2022年1月12日。

慕詩國際主席及行政總裁陳欽杰,早於2009年9月以1.99億購入上址。而慕詩國際有關人士早前沽出鰂魚涌柯達大廈二期多個單位,涉資約8500萬。

屯門護老院鋪月租逾18萬

本報昨日報道,屯門青山公路新墟段250號彩暉花園地下1A號鋪,建築面積6000方呎,意向價6800萬,平均呎價約11333元,上址由護老院承租,月租並非約1.81萬,而是約18.1萬,租期至2023年2月,特此訂正。

(星島日報)

更多中遠大廈寫字樓出售樓盤資訊請參閱:中遠大廈寫字樓出售

更多上環區甲級寫字樓出售樓盤資訊請參閱:上環區甲級寫字樓出售

中環中心低層細戶 呎租40 十個月最平

商廈租金低位徘徊,中環皇后大道中99號中環中心一個低層細單位,近日以每方呎40元租出,屬今年1月後該廈呎租新低。市場消息指出,中環中心22樓10室,建築面積約1810方呎,以每月約7.24萬元租出,呎租約40元。

每月7.24萬元 回報1.4厘

上述全層單位由資深投資者蔡志忠在2018年起拆售,是次租出的單位在2019年初以6335萬元售出,呎價為3.5萬元,以最新月租計算,租金回報低見1.4厘。中環中心近期成交呎租由58至80元。今年1月同層7室,建築面積約1908方呎,以每月約7.44萬元租出,呎租約39元;最新租出的單位的呎租僅較之略高。

此外,同廈55樓3、5至7室,建築面積約8671方呎,現由基金公司自2019年起以每月82.4萬元租用,呎租約95元。據了解,單位剛以65.9萬元續租多3年,呎租下跌20%至76元。中環中心55樓全層由世茂集團 (00813) 主席許榮茂持有。

(信報)

更多中環中心寫字樓出租樓盤資訊請參閱:中環中心寫字樓出租

更多中環區甲級寫字樓出租樓盤資訊請參閱:中環區甲級寫字樓出租

恒基統一土瓜灣舊樓業權 底價9.6億購入 併毗鄰物業擴規模

市區土地供應罕有,不少發展商透過強拍舊樓以增加土儲,由恒基併購長達6年的土瓜灣落山道、美華街及下鄉道舊樓,昨天舉行強制拍賣,由恒基在無對手下,成功以底價9.62億摘下該舊樓業權。

上述項目位於土瓜灣落山道58至70號、美華街1至9號及下鄉道18至20號,上月中旬獲土地審裁處頒下強制售賣令,底價9.62億;昨天在舉行公開拍賣,結果由手持「8號」牌的恒基執行董事黃浩明,在無對手下以底價投得,成功統一業權發展。

該舊樓現為樓齡約61年的商住物業,地下為商鋪,樓上則為住宅樓層,地盤面積約10196方呎,現為「住宅 (甲類)」用途,如重建成商住發展,預計可建總樓面約91764方呎。

發展中小型單位

資料顯示,恒基已就土瓜灣道68A至70C號申請強拍,而據恒基年報顯示,計畫將上述地盤土瓜灣道,連同是次獲批強拍令的項目合併發展,總地盤面積增至4.2萬方呎,料重建後自佔商住總樓面約37.4萬方呎。

總地盤面積4.2萬呎

黃浩明指出,上述落山道舊樓項目併購時間長達約6年,未來發展中小型單位為主,詳細設計未落實,由於鄰近仍有併購項目,故未能透露投資總額。

黃浩明:倡降強拍門檻

對於政府擬研究降低強拍門檻,黃浩明認為,降低強拍門檻對市區重建有幫助,唯要在發展與私有產權之間取得平衡,認為可以適度進行調整,建議降至七成最有實際作用,而某些特定區域或特殊情況可考慮進一步降低強拍門檻百分比。

而本月初市建局同區截意向書的鴻福街、啟明街及榮光街的4個重建項目的合併發展,集團亦有興趣入意向書。另外,油塘灣項目補地價仍進行上訴當中。

對市建同區項目具興趣

代理表示,屯馬綫通車釋放土瓜灣的重建潛力,並帶動區內的住屋需求。未來市區土地供應短缺的問題將持續加劇,相信市區舊樓住宅物業將備受市場追捧。

資料顯示,連同昨以底價投得的項目,恒基今年迄今循強拍途徑已成功統一6個舊樓項目,涉及金額約67.88億,若計及本月中旬舉行強拍的西半山羅便臣道94、94A及96號舊樓項目,即合計共7個項目,涉及總金額約73.101億。

(星島日報)

元朗全幢物業減租28% 每呎85元重返五年前

受疫情等因素打擊,鋪市陰霾密布,鋪租持續調整。消息指,元朗大馬路全幢物業,於交吉約一年後,以約25萬獲美容中心承租,呎租約85元,租金急挫約28%,並重返約五年前水平。

市場消息指出,青山公路-元朗段、(簡稱大馬路) 83號全幢,為地下、一樓及二樓,總樓面約2940方呎,於交吉約一年後,新約25萬獲美容中心承租,呎租約85元,該鋪早前由卓悅化妝品以約35萬承租,故租金急挫約28%,租金亦重回約五年前水平。

資料顯示,該街道近期矚目成交為毗鄰、即元朗大馬路81號全幢,於去年中以9500萬易手,平均呎價3.23萬,原業主為卓悅化妝品創辦人葉俊亨,持貨6年慘蝕4000萬,物業貶值約29%。

全幢三層高涉2940方呎

另一方面,代理表示,觀塘道370號創紀之城3期高層01室,單位面積約4092方呎,佔約半層樓面,意向呎價約1.25萬,涉及總額約5115萬,可以買賣公司形式交易。

代理稱,前述單位位於大廈高層,可望開揚山景,景色怡人,物業配備基本寫字樓裝潢及間隔,可即買即用。代理稱,創紀之城3期由新鴻基地產發展,設施配套齊全,為質素信心保證,為今番物業增值。代理補充,是次單位亦作出租,意向月租約8.6萬元,折合平均呎租約21元。

(星島日報)

更多創紀之城寫字樓出租樓盤資訊請參閱:創紀之城寫字樓出租

更多觀塘區甲級寫字樓出租樓盤資訊請參閱:觀塘區甲級寫字樓出租

沙田小瀝源轉型住宅 區內將變天

住宅供應緊張,政府積極就工業用地進行檢討,而近日規劃署建議就沙田小瀝源、涉約80.5萬平方呎的工業地改劃為住宅。同時,近年沙田石門積極轉型為新興商貿區,區內數個商廈及酒店已經相繼落成及提供服務。

政府在70年代發展沙田新市鎮時,將石門一帶打造成工業區,增加區內的就業機會。不過,隨着工業向北移,該區工廈用途漸漸改變,多座已經轉型作工業外的用途。此外,社會對房屋需求殷切,工廈重建漸成新增房屋供應的出路。

而根據規劃署最新《全港工業用地檢討》文件顯示,署方建議將位於沙田小瀝源、鄰近港鐵第一城站的工業用地,改劃為「住宅 (戊類)」用途。

7工廈建議改劃住宅

是次建議改劃的用地,鄰近第一城站及愉翠苑,佔地約80.5萬平方呎,以發展貨倉及製造業為主。改劃地點現涉及7座工廈,包括由捷和集團持有的捷和中心、金利來集團 (00533) 旗下的金利來集團中心、新地 (00016) 旗下載通 (00062) 的九巴巴士廠、太古可口可樂廠、冠華鏡廠旗下冠華大廈、及業權較分散的沙田工業中心A及B座等。

值得留意的是,上址的中央位置為載通旗下巴士廠,捷和實業大廈及捷和中心正申請改裝成為寫字樓及零售用途,另亦有一宗正申請重建商業發展,預計兩項申請佔小瀝源工業面積約26%。至於位於小瀝源源康街及源順圍交界、由新地持有,並已發展為帝逸酒店的用地,則屬商業用途。

石門成新興商貿區

事實上,近年政府批出多幅石門的商業地,而該一帶亦相繼有多個商業項目推出,成為新興商貿區,吸引不少商店進駐。當中同由新地發展的W

LUXE,早前再度重推餘貨單位。發展商於2015年10月以6.7億元投得的安耀街商貿地,當時每平方呎樓面地價3,886元,現時已發展為1幢26層的商廈。

至於石門站旁邊的商業地皮,亦已發展為京瑞廣場1期及2期。項目均由億京發展,總樓面約100萬平方呎,並已經分拆業權。受惠於屯馬綫開通,自第2季起,該項目的商舖交投轉旺。

(經濟日報)

更多京瑞廣場寫字樓出售樓盤資訊請參閱:京瑞廣場寫字樓出售

更多石門區甲級寫字樓出售樓盤資訊請參閱:石門區甲級寫字樓出售

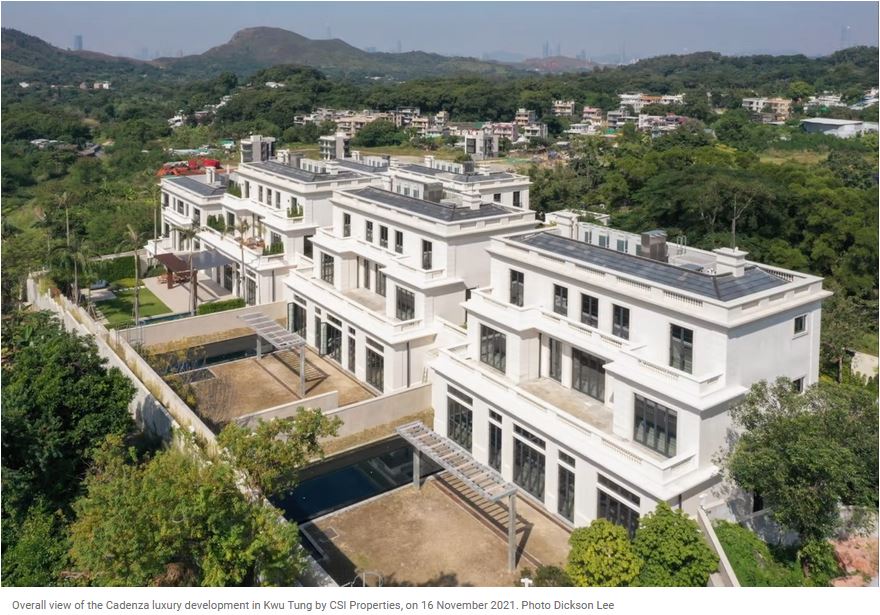

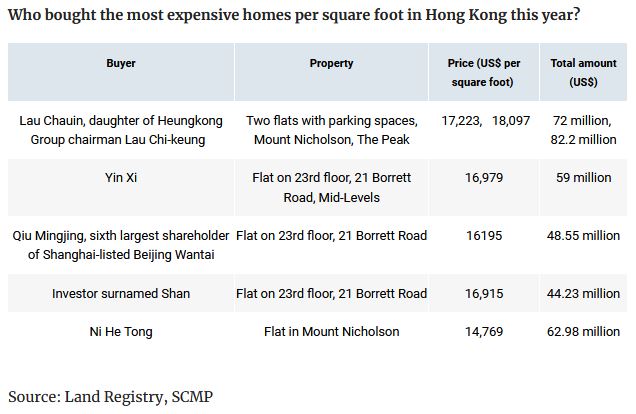

Hong Kong luxury home sales recover from Covid-19-induced slump, to hit record high this year

Transactions

of upscale homes worth more than HK$100 million (US$12.8 million)

reached HK$46.4 billion in the first 11 months of the year.

Sales this year are on track to exceed the last record of HK$46.6 billion set in 2018.

Sales

of luxury homes in Hong Kong are likely to hit a record high this year,

after activity slumped last year as buyers stayed on the sidelines

because of the Covid-19 pandemic.

Transactions

of homes worth more than HK$100 million (US$12.8 million) in the first

11 months of the year reached HK$46.4 billion (US$5.95 billion), nearly

matching the all-time high of HK$46.6 billion achieved in 2018,

according to property agency.

“If

transactions in December exceed HK$200 million, a new record will be

set this year,” property agent said. The value of luxury residential

transactions from January to November was 60 per cent higher than the

HK$29 billion for the whole of 2020, the agent added.

The

surge in luxury home sales has been remarkable given that the city’s

borders have been closed since early last year to stem the spread of

Covid-19, which has kept some offshore capital from entering the market.

The

listing of several mainland Chinese companies on the Hong Kong stock

exchange is likely to have boosted appetite for upscale homes in the

city from the newly minted billionaire founders of these companies,

market observers said.

A total of 71 companies raised US$35.9 billion in the first nine months

of the year through initial public offerings (IPOs) and secondary

listings in Hong Kong, according to data compiled by Refinitiv. Seven of

the 10 largest IPOs were US-listed Chinese tech companies seeking

second or dual primary listings in the city.

Deals

for 224 luxury residential units were concluded so far this year, 33.3

per cent higher than the 128 in 2020, with about half of the buyers from

mainland China, property agency’s data showed.

Tang

Lai Ching, the wife of SF Express founder Wang Wei, spent HK$493.2

million on three luxury properties in Mid-Levels in January, local media

reported.

“Despite

the sales velocity being slower for some of the newly launched

projects, the prices [of luxury homes] increased 4.5 per cent,” the

agent said.

Hong

Kong’s luxury property market saw a correction between mid-2019 and

end-2020, a period marked by the anti-government protests and four waves

of the Covid-19 pandemic, according to another property agency. Prices

fell 12.6 per cent during the period.

As of the third quarter this year, prices of luxury homes had rebounded by 5.7 per cent.

“Despite

a somewhat higher supply of large size units in the near term, truly

luxury units in desirable locations will continue to be acquisition

targets by wealthy buyers both as a dwelling and prime investment

asset,” agent said.

“Looking

ahead, the capital values of luxury residences are likely to follow the

momentum in transaction volume and nudge higher amid the recovery.”

(South China Morning Post)

上環中遠大廈全層4.2億易手 結好控股沽貨平均呎價2.12萬

新一波疫情急升溫,甲廈市場前景未明朗,由結好控股持有的上環中遠大廈低層全層,於交吉約一年後,以股權轉讓方式易手,作價4.2億,呎價約2.12萬,估計出售虧損約2620萬。

結好控股公布,以4.2億售出上環中遠大廈10樓全層,面積19745方呎,呎價約21271元,估計出售虧損約2620萬,買賣以股權轉讓方式進行,出售事項所得款項淨額約4.15億,將用於集團一般營運及房地產等投資。

料虧損約2620萬

根據通告指出,買家為本港註冊公司,主要業務為投資控股,該公司實益擁有人為呂凌雲及盧芝蘭。市場消息透露,買家為永豐金融集團相關人士,該集團從事多元化金融業務,包括貴金屬實貨買賣等;本報昨日就上述消息向永豐金融查詢,惟於截稿前未獲回覆。

交吉約一年

據業內人士指,上址交吉近一年,今年初曾於市場上放租,位處低層,景觀以樓景為主。有代理指,上述成交呎價仍企穩兩萬以上,屬不俗水平,環顧核心區內甲廈近期成交呎價介乎2.4萬至2.95萬,成交屬市價水平。面對新變種病毒Omicron來勢洶洶,該代理回應指,新一波疫情對甲廈市場並未帶來即時的負面影響,核心區甲廈企業為金融行業為主,於疫情下具防守力,料整體市況有勢平穩。

高層全層每呎2.8萬放售

據代理資料顯示,該甲廈近期成交疏落,對上成交於去年5月,為該廈低層全層,面積27808方呎,以5億售出,呎價約17980元;另一成交為中層8室,面積1343方呎,於同月以3626萬售出,呎價2.7萬。

事實上,該甲廈近期亦錄資深投資者放售個案,由外號「慕詩陳」、慕詩國際主席及行政總裁陳欽杰持有的該甲廈高層全層以意向價5.52億放售,呎價約2.8萬。據悉,業主陳欽杰於2009年9月以1.99億購入上址。

此外,商廈市場亦頻錄買賣,消息指,尖沙嘴利就商業大廈低層,面積約2000方呎,以2250萬售出,呎價約11250元;旺角慶華商業大廈中層B室,面積967方呎,以約785萬售出,呎價8118元。

(星島日報)

更多中遠大廈寫字樓出售樓盤資訊請參閱:中遠大廈寫字樓出售

更多上環區甲級寫字樓出售樓盤資訊請參閱:上環區甲級寫字樓出售

近期港府與內地商討有關通關事宜,預計可刺激兩地經濟交流,為本港寫字樓市場注入動力,而且中環海濱商業地王以高價批出,代表不少發展商對香港核心區甲級寫字樓市場前景充滿信心,亦吸引不少發展商積極入標。

近日,有業主趁勢將持有的中環美國銀行中心,屬於高層單位推出市場租售,單位已設有精美寫字樓裝修及傢俱,放賣意向價約2.18億元,平均呎價約3.65萬元;意向月租約45元。

呎價約3.65萬 同時放租

除了物業附近一帶的地段吸引之外,物業本身具備不少優勢,位置亦鄰近港鐵金鐘及中環站,由金鐘站及中環站的出口步行約3至5分鐘便到該物業,十分方便。附近一帶亦有不少巴士路綫連接各區,為商客提供更多的交通選擇,而且在餐飲方面亦有大量中西美食提供,方便商客進行商務餐飲。

有代理表示,位於中環夏慤道12號美國銀行中心中高層04至07及13室,總面積約5,968平方呎 (未核實),項目同時放售及招租,放售意向價約2.18億元,平均呎價約36,500元;放租則叫價每平方呎約45元,涉及月租約26.8萬元。

該代理稱,是次放售單位位處大廈中高層,享有開揚海景及翠綠山景,並且附有華麗裝修傢俱,方便買家或租客節省時間及成本,屬現時市場上最受歡迎的盤源類別。

該代理續稱,美國銀行中心質素上乘,大多業主具實力且惜售,翻查資料,今年該廈錄得兩宗買賣個案,其中位於同層的15室,面積約1,375平方呎 (未核實),成交呎價約3.68萬元。

新商地王帶動 刺激中區氣氛

今次業主叫價貼市,加上單位備有精緻裝修及傢俬,進一步增加物業競爭力。

同時,中環新海濱商業地王於11月初以歷史高價批出,直接刺激中區甲廈市場氣氛,大型發展商願意斥巨額投資中環甲廈項目,為散戶投資者注入強心針。代理相信,是次租售物業為中區知名指標商廈,大廈質素配套有保證,料會吸引投資者或租客洽詢。

(經濟日報)

更多美國銀行中心寫字樓出售樓盤資訊請參閱:美國銀行中心寫字樓出售

更多金鐘區甲級寫字樓出售樓盤資訊請參閱:金鐘區甲級寫字樓出售

更多中環區甲級寫字樓出售樓盤資訊請參閱:中環區甲級寫字樓出售

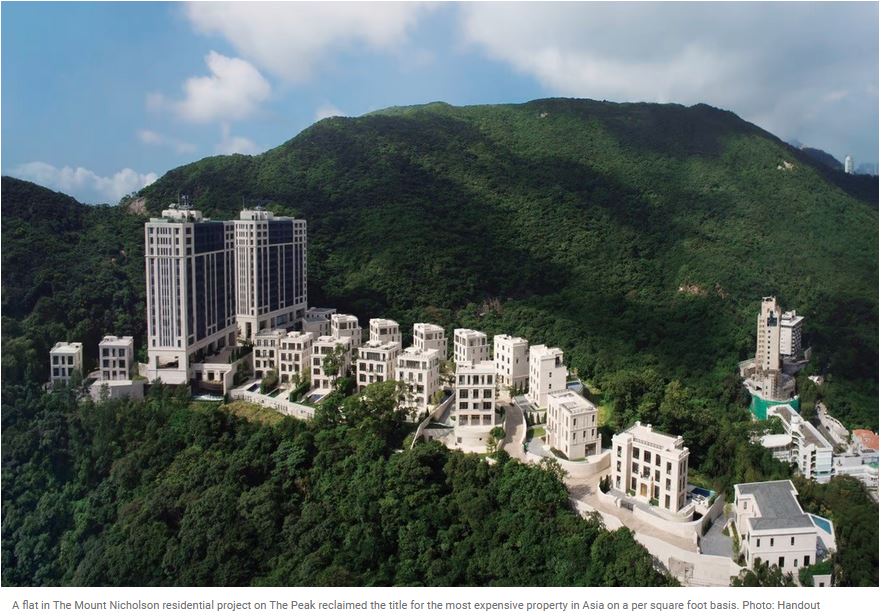

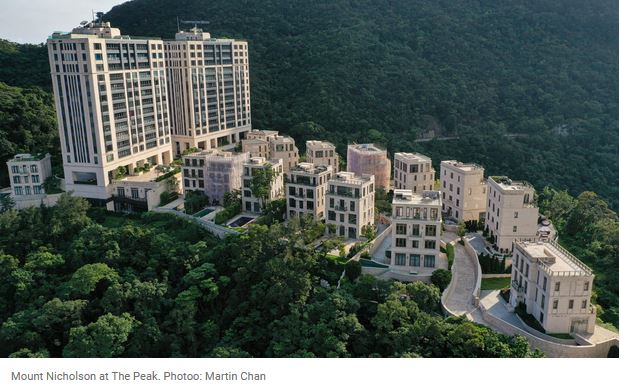

君豪石金禹 就港豪宅加按1億

多年來掃近28億物業 涉MOUNT NICHOLSON洋房等

近年在香港購入28億元物業的內房君豪集團總裁石金禹,據資料顯示,近日先後將持有的山頂豪宅向財務公司加按,包括借取約1億元二按。

石金禹或相關人士近年在香港掃入眾多豪宅及商廈,包括2017年及2019年以17.8億元購入山頂MOUNT NICHOLSON三間洋房、2017年9月以7.4億元購入甲廈中環中心頂樓單位,以及市傳在今年初以2.4億元「買殼」購入山頂倚巒雙號屋,多年來掃入近28億元物業。

不過,據市場消息指,石金禹或相關人士近期陸續就持有物業加按,包括在今年11月先後就山頂MOUNT NICHOLSON兩間洋房、倚巒雙號屋,以及中環中心頂樓加按。

中環中心已累積「三按」

其中,最先加按的是中環中心頂樓單位,石氏等在今年6月向恒生借取二按,其後再在11月10日就MOUNT NICHOLSON雙號洋房向財務公司借取二按,再在上月中一併將MOUNT NICHOLSON、倚巒兩間洋房以及中環中心向財務公司加按借取1億元,其中中環中心累積已經「三按」。

據資料顯示,石金禹為君豪集團總裁,據君豪集團網頁顯示,該公司2010年成立,屬於內地一間以房地產開發、酒店商用、倉儲物流等業務為主的公司,在杭州、新疆、哈爾濱、深圳、四川等地擁有地產項目,總資產值達400億元。亦有外媒在今年7月曾報道,該財團以7,200萬元英鎊購入英國倫敦金融城Bavaria

House項目,將會重建成44層高商廈。

近期在中央三綫紅綫政策下,不少內房企業資金鏈緊張,因而抵押在香港物業,包括早前傳媒報道,世茂集團股東許榮茂家族向星展銀行抵押持有的中環中心3層商廈,以取得14億元貸款。

另外早前恒大 (03333) 主席許家印或相關人士抵押山頂3間洋房物業。

(經濟日報)

更多中環中心寫字樓出租樓盤資訊請參閱:中環中心寫字樓出租

更多中環中心寫字樓出售樓盤資訊請參閱:中環中心寫字樓出售

更多中環區甲級寫字樓出租樓盤資訊請參閱:中環區甲級寫字樓出租

更多中環區甲級寫字樓出售樓盤資訊請參閱:中環區甲級寫字樓出售

九龍灣年近年發展迅速,區內商貿氛圍漸見成熟,該區恩浩國際中心高層全層,以意向呎租約22元放租,月租約25萬。

有代理表示,九龍灣常悅道1號恩浩國際中心32樓全層,面積約11430方呎,以每月約25萬招租,呎租約22元。

物業位處大廈高層,三面單邊,可觀望開揚園景及海景,樓底約4.15米高,空間感強,屬優質單位。

美善同道鋪意向1900萬

另一方面,另一代理表示,土瓜灣美善同道1號美嘉大廈地下12號鋪,面積約800方呎,以意向價1900萬放售,較早前的2000萬,減幅約5%,呎價約2.37萬。單位門闊約12呎,由汽車維修公司承租多年,擁穩定回報,物業鄰近半山壹號等私人住宅。

傳奧創中心全幢八億放售

另一方面,綜合市場消息指出,由中國奧園持有的葵涌活化商廈項目AOffice46奧創中心。

該項目全幢以8億放售,據悉,該項目業主於3年前以9.5億購入。

(星島日報)

更多恩浩國際中心寫字樓出租樓盤資訊請參閱:恩浩國際中心寫字樓出租

更多九龍灣區甲級寫字樓出租樓盤資訊請參閱:九龍灣區甲級寫字樓出租

德輔道中地鋪7238萬售 持貨九年僅升值3.6%

核心區罕現銀主盤鋪位成交,中環德輔道中歐陸貿易中心地鋪,以7238萬易手,呎價約19萬,低市價約一成,物業於9年升值僅約3.6%。

盛滙基金創辦人李根興指,德輔道中21至23號歐陸貿易中心地鋪,面積約380方呎,為銀主盤,以7238萬易手,呎價約19萬,低市價約一成,該鋪由便利店以20萬承租,料回報約3.3厘。原業主於2012年以6980萬購入,9年升值約258萬。

呎價19萬貴絕全港便利店

李根興表示,上述鋪位位處中環核心區,區內億元以下鋪位買少見少,疫市下便利店鋪位受捧,上述呎價貴絕全港便利店。

彌敦道僑建大廈地鋪1.33億沽

消息指,油麻地彌敦道566號僑建大廈地鋪,建築面積約2600方呎,以近1.33億易手,呎價51923元,買家為明興水務原偉強。原業主為資深投資者陳宗武,於2000年9月以4200萬購入上址,帳面大幅獲利9100萬,升值逾2.1倍。該鋪位屬彌敦道旺段罕有盤源。

電氣道地鋪3000萬易主

天后電氣道13至41號凱旋大廈地鋪,面積約850呎,以約3000萬售出,呎價約3.52萬,該鋪由地產代理行以7.5萬租用,料買家享租金回報約3厘。據悉,原業主於2004年2月以350萬買入,持貨17年帳面獲利約2650萬,物業期間升值約7.5倍。

(星島日報)

更多歐陸貿易中心寫字樓出售樓盤資訊請參閱:歐陸貿易中心寫字樓出售

更多中環區甲級寫字樓出售樓盤資訊請參閱:中環區甲級寫字樓出售

九龍城嘉林邊道舊樓申強拍 已收集98%業權 市場估值逾1.6億

近年市區優質土地供應罕有,不少財團透過強拍途徑增加土儲;最新有財團併購的九龍城嘉林邊道28A至28B號舊樓,向土地審裁處申請強拍,以統一業權發展,目前該財團集齊逾98%業權,市場對整個項目估值逾1.6億。

據土地審裁處文件顯示,是次申請強拍的財團持有28A號100%業權,而28B號則持有96.875%業權,即平均持有約98.4375%業權,目前餘下1個物業並未成功收購,估值約327.6萬;市場對上述整個項目估值約1.68911億。

上述地盤面積10070方呎,現劃為「住宅 (乙類)」用途,若以地積比率5倍重建發展計,可建總樓面約50350方呎。現址為1幢樓高3層的舊樓,該廈早於1950年落成入伙,至今樓齡約71年。該項目鄰近碧桂園發展新盤瓏碧,距離港鐵宋皇臺站約15至20分鐘步程,具重建價值。

尚餘一伙未成功收購

是次申請強拍的財團為金楓集團有限公司 (Gold Focus Holdings Limited),資料顯示,該公司今年8月中旬曾以近7000萬收購香港善一堂道德協會持有的嘉林邊道28B號2樓單位,當時金楓集團公司董事為梁逸文及鄭榮財。

事實上,自港鐵屯馬綫全面通車後,九龍城發展步伐亦漸加快,除上述項目外,今年初亦有財團申請強拍毗鄰的嘉林邊道26A及26B號、聯合道13A及13B號舊樓,市場估值約1.7593億;地盤面積約8000方呎,可建總樓面約40000方呎,當時申請強拍的財團為南悅投資

(香港)、南都環球 (香港)、盛添控股 (香港) 公司,上述3家公司董事均為徐凱祥、林潞、楊偉成,其中徐凱祥為內地投石私人智庫創辦人。

可建總樓面約5.03萬呎

上述嘉林邊道28A至28B號項目為今年以來土地審裁處接獲的第14宗強拍申請,對比去年同期34宗,勁減20宗,跌幅高達58.8%。

(星島日報)

沙田冠華大廈每月140萬租出

活化商廈備受大型企業追捧,市場再錄大手租賃成交。消息指,電動車巨頭Tesla承租沙田冠華大廈地下及1樓,月租高達140萬,平均每呎約20元,料創今年以來區內工商鋪最大手租務成交。

電動車巨頭Tesla進駐

市場消息指出,沙田冠華大廈部分地下及1樓,總樓面約7萬方呎,獲Tesla以約每呎約20元承租,月租高達140萬。翻查資料顯示,Tesla早前宣布,於上址開設本港第四間品牌體驗中心,首階段開放是新車展覽專區。

據地產代理指出,上述呎租屬市價水平,惟月租140萬料創區內工商鋪今年以來涉資最大的租賃成交。

涉部分地下連一樓全層

另一方面,工廈市場交投不俗,九龍灣區項目頻錄承接,消息指,景發工業中心一個地廠,面積約1186方呎,以約4000萬售出,呎價33726元;同區企業廣場亦錄承接,消息指,該項目3期低層7室,面積約2200方呎,以約2000萬售出,呎價約9090元。

此外,市場消息指出,大埔太平工業中心2座低層B室,面積約3574方呎,以約1160萬售出,呎價約3245元;火炭富騰工業中心低層1室,面積約2391方呎,以約970萬沽出,平均呎價約4056元。

(星島日報)

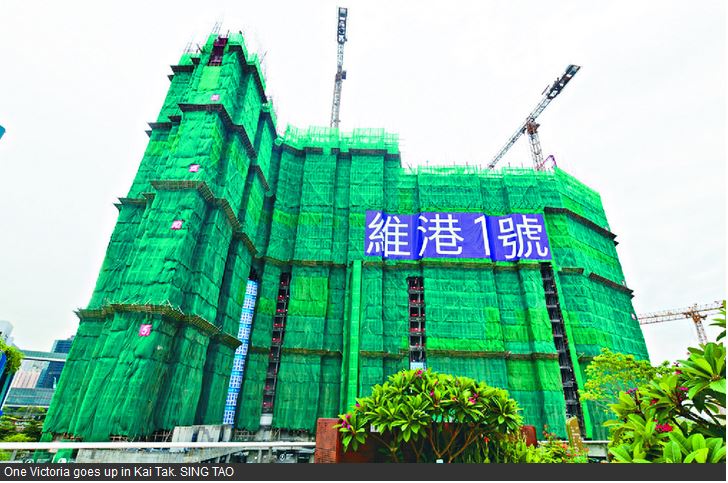

173 Kai Tak flats go on sale

China

Overseas Land and Investment (0688) released 173 flats in the sixth

price list of One Victoria at Kai Tak, at an average price of HK$25,515

per square foot after a maximum 13.5 percent discount is applied.

The

new list offers flats ranging from 348 to 656 sq ft, with the

discounted price ranging from HK$25,017 to HK$32,178 per sq ft.

The developer has collected more than HK$5.9 billion after selling 541 flats since sales launched in July.

At

Central, One Central Place which offers 121 units, has received presale

consent and released the sale brochure yesterday, developer Sino Land

(0083) said. The single building project includes 116 standard units

ranging from 383 to 992 sq ft and five special units ranging from 393 to

1,028 sq ft.

In Ngau Tau Kok, The Aperture is expected to release the first price list today and will start receiving checks on Saturday at the earliest.

Meanwhile,

the Land Registry recorded 7,239 sale and purchase agreements for all

building units received for registration in November, up 15.8 percent

from October and roughly the same number from a year ago. The total

amount for sale and purchase agreements was HK$63 billion,up 2.7 percent

over October but 4.5 percent lower year-on-year.

(The Standard)

Bosch租銅鑼灣新商廈全層 作旗艦店

疫情下,奢侈品大手租務減少,反而家品店相繼擴充,如德國家電品牌Bosch,租用銅鑼灣新商廈的全層舖位作旗艦店。

HDH Centre 商廈 12月落成

亨利發展集團位於銅鑼灣伊榮街1號的集團總部綜合式商廈,將於2021年12月落成,並命名為 HDH Centre (亨利集團中心)。該集團指,項目1樓全層,獲德國家電品牌Bosch租用,據悉面積約2,500平方呎,作為Bosch Home Appliances Showroom (博西華家電旗艦陳列室)。Bosch家電發言人表示,品牌家電旗艦店從中環移師銅鑼灣,旨在開拓年輕高消費客群。

HDH Centre 總建築面積約8.2萬平方呎,樓高25層,1樓為商舖,3至8樓為特色餐廳樓層。11至25樓是甲級標準寫字樓樓層,一梯一伙,其中21至22樓為複式樓層設計。

事實上,疫情下港人在家時間較以往多,令家電生意不跌反升,而品牌紛趁核心區舖位租金平作擴充。

如家電品牌德國寶,早前進駐銅鑼灣Fashion Walk,開設佔地2.7萬呎全新生活概念旗艦店 (Lifestyle Flagship Store)。新店佔地兩層,地下層展示德國寶全綫電器產品,2樓有廚房組合、傢俬專區等。

(經濟日報)

更多 HDH Centre 寫字樓出租樓盤資訊請參閱:HDH Centre 寫字樓出租

更多銅鑼灣區甲級寫字樓出租樓盤資訊請參閱:銅鑼灣區甲級寫字樓出租

天梭表20萬租羅素街舖 租跌75%

憧憬通關 奢侈品「名店街」疫後首宗租務

奢侈品零售商憧憬通關在即,趁租金大幅下調提早重啟擴充。銅鑼灣羅素街一地舖,獲天梭表 (TISSOT) 以20萬元租用,較舊租大跌75%,與高峰期比較更急挫近9成。是次成交為接近兩年疫情以來,羅素街首宗鐘錶店租舖個案。

銅鑼灣羅素街近日錄得罕有舖位長租個案,消息指,羅素街59號地下B4號舖租出,該舖面積約900平方呎,獲長租客以每月約20萬元租用,租期為3年。該舖位於羅素街尾段,屬時代廣場通往希慎廣場必經之路,為區內一綫地段。該舖曾由鐘錶店租用,去年初已遷出,期間由不同商戶作短租,包括早前由手機零件店租用,經過年半交吉及短租後,直至近日獲長租客承接。

消息指,新租客為Swatch Group旗下天梭表 (TISSOT) 租用,該舖曾租用利園山道27號A至D號地下多年,亦即是次新址對面。據悉,品牌去年6月遷出該舖,當時月租約60萬元,如今以約每月20萬元,租用對面新舖。

翻查資料,是次新租務的羅素街59號舖位,多年來因市況起跌,租金出現大變化。2009年,舖位曾由化粧品店以約60萬元租用,其後零售高峰期,瑞士高級鐘錶品牌JAQUET DROZ以160萬搶租,呎租高達1,800元。

雷達錶80萬租用 去年遷出

其後於2016年隨着零售回落,韓國化粧品innisfree以60萬租用,租金已從高峰回落。該舖對上的長租客為雷達錶 (RADO),2018年以約80萬元租用,去年遷出。按是次最新租金僅20萬元計,按對上租金跌約75%,若與最高峰期比較,大跌約88%。

疫情持續近兩年,令核心區零售商戶出現巨大變化,單計近一年多,羅素街商舖的商戶近乎「有出無入」,商戶遷出後乏長租客承接,導致吉舖處處。如羅素街尾段,目前大部分舖位為短租或交吉。疫情以來,地段便先後有勞力士等名錶店遷出,而金朝陽中心地下的愛彼錶,據悉亦將於明年遷出。是次天梭表租用舖位,為羅素街接近兩年以來,首宗鐘錶店新租個案。

業界:核心區租務仍會淡靜

據代理統計顯示,疫情令商舖租金下跌,現時核心區商舖租金較2018年,下跌近4成,而核心區商舖空置率,則由2018年最低4%,升至現時約17%,核心區如尖沙咀、旺角等,均是吉舖處處。

有業界人士認為,中港通關似乎在即,惟仍有不少變數,包括變種病毒出現,未知會否延遲通關計劃。代理指,奢侈品如鐘錶珠寶,絕大部分生意來自旅客,未來一年旅客會否大幅度重臨仍是疑問,故奢侈品仍是非常審慎,近期漸有鐘錶品牌重新租舖,主因租金出現大幅調整,才考慮個別重新落戶,但僅屬少數,他相信核心區舖位租務仍會相對淡靜。

(經濟日報)

更多希慎廣場寫字樓出租樓盤資訊請參閱:希慎廣場寫字樓出租

更多時代廣場寫字樓出租樓盤資訊請參閱:時代廣場寫字樓出租

更多金朝陽中心寫字樓出租樓盤資訊請參閱:金朝陽中心寫字樓出租

更多銅鑼灣區甲級寫字樓出租樓盤資訊請參閱:銅鑼灣區甲級寫字樓出租

工商鋪錄517宗買賣

疫市下工商鋪交投仍不俗,據代理指出,上月工商鋪錄517宗成交,連跌4個月後首度回升7.3%,惟同期註冊金額錄78.21億,按月下跌2.2%;該行預期中港兩地有機會於短期內通關,料後市走勢平穩。

代理:按月回升7.3%

有代理行綜合土地註冊處資料顯示,上月工商鋪各板塊註冊宗數全綫錄按月上升,其中,商廈註冊量最新報105宗,按月增加23.5%,增幅為各板塊之中最高。工廈及商鋪註冊量亦分別按月上升1.5%及8.7%,最新分別錄275及137宗,期間整體註冊宗數為517宗,為連跌四個月後首次回升,按月上升約7.3%。11月份依然錄得多宗大額成交註冊,註冊金額錄78.21億,按月微跌約2.2%。

金額78億按月跌2.2%

逾1億的物業則表現最好,註冊宗數按月躍升1.17倍,11月共錄得13宗,按月增加7宗,當中3宗為工廈物業註冊,商廈物業及鋪位物業則各佔5宗,其中鋪位註冊更涉資超過15億元,包括美孚新邨萬事達廣場多個鋪位及堅尼地城浚峯基座地下及1樓商鋪分別以約4.55億及3.92億成交,而工廈成交則包括以約3.9億成交的觀塘航空科技大廈全幢。

該行代理表示,近日中港恢復部分通關的進度稍有進展,本地民生消費亦保持穩定,民生區鋪位的投資氣氛暢旺,而近日多個寫字樓新盤亦為該板塊的投資市場帶來支持,反映不少投資者對本港零售及寫字樓前景仍然持正面態度。

(星島日報)

新蒲崗東傲呎價9600元易手 創區內工廈新高 樓花期逾半年

工廈物業有價有市,由麒豐資本與傅老榕家族旗下廣興置業集團合作發展的新蒲崗重建工廈項目東傲,樓花期逾半年,昨日至少連沽10伙,其中有一個單位,成交呎價高見9600元,創同區工廈新高。

正當近日教協低價沽售新蒲崗商廈,呎價不足9000元,區內一個樓花期逾半年的工廈,以每呎9600元易手,創區內工廈新高。

由麒豐資本與傅老榕家族旗下廣興置業集團合作發展的新蒲崗重建工廈項目東傲,昨日至少連沽10伙,合共涉資約1.026億,成交價介乎697.92萬至1550.56萬,呎價則介乎8600元至9600元,其中,低層03室,面積1762方呎,以1550.56萬售出,呎價約8800元;至於項目成交呎價最高單位為中層02室,面積738方呎,以708.48萬售出,平均呎價約9600元,屬區內新高。

麒豐資本等發展

麒豐資本創辦合夥人暨投資總監洪英偉稱,該項目首批單位為VIP大手客時段,售價相當克制,料下周加推單位應市,客源仍傾向大手買家,具一定提價空間,項目於日後再加推單位予散客,現時客源七成為投資者、三成為用家。

對於項目單日連沽至少10伙,並套現逾億元,洪英偉指對銷情感滿意,項目為區內於過去15年以來首個全新工廈拆售項目。對於新變種病毒Omicron來勢洶洶,洪氏認為,疫情走勢難以預測,惟中港兩地有機會通關,屆時將對工商市場帶來刺激作用。此外,該項目亦傳出大手成交,市場消息指出,該項目低層全層,面積約7912方呎,以7000萬售出,呎價約8847元。

單日沽10單位 套現逾億元

資料顯示,該項目樓高24層,全層建築面積由1萬至1.5萬方呎,共提供193個工廈單位,面積由約700至2900方呎,預計於明年下半年落成;發展商早前指出,項目傾向先售予大手或全層買家,及該項目屬同區罕有供應,故有機會保留一半樓面長綫收租。上址前身為美華工廠大廈,麒豐資本在2018年8月向興勝創建以12.5億購入,每呎樓面地價約7000元,創當時九龍東工廈地價新高。

早前,教協沽售新蒲崗萬廸廣場低層3個單位,以3860萬元售出,以面積4534方呎計,呎價約8513元,原業主今年3月以5942萬購入,持貨僅8個月,帳面勁蝕約2082萬元,物業期間貶值約35%。

(星島日報)

Secondary home sales rise over the weekend

A property agency recorded 13 deals

at ten blue-chip estates over the weekend, up by 8.3 percent from last

week, with transactions staying in double digits for the fourth

consecutive week.

The

agent said that the rise was partly because sales of new homes slowed

slightly, amid market optimism over the expected border reopening.

Meanwhile, more new flats are set to hit the market. In Ngau Tau Kok, The Aperture

was at least 4.5 times oversubscribed after receiving more than 550

checks for 100 flats in the first batch. And at 17 Caine Road in Sheung

Wan / Central, Caine Hill, which provides 187 flats, could open sales as

early as this month after releasing the sales brochure last Friday, the

developer Henderson Land Development (0012) said.

(The Standard)

工商鋪錄約464宗買賣 代理行:按月上升14%

工商鋪受捧,大宗交易陸續湧現,據代理行統計,11月市場共錄約464宗工商鋪成交,涉及總金額約104.18億,對比10月份分別遞增約14%及37%。月內三個類別均錄逾億元成交,反映市場對工商鋪前景具信心,大額交易亦有助帶動中小額投資者入市信心。該行預測,工商鋪受惠多個利好政策,投資回報相對穩健,加上近期全新工廈全面開售,令工商鋪持續升溫。

金額錄約104億按月升37%

該行代理表示,資料顯示,11月份工商鋪共錄約464宗成交,對比上月回升約14%,不論工、商、鋪類別都上升,總計亦比2020年11月多出約20%。總成交金額同見理想,共錄約104.18億,按月遞增約37%,對比去年同期約145.71億就減少約28%。資料顯示,2020年11月份錄鰂魚涌太古城中心一座全幢成交,作價逾98.45億。

領展收購柴灣貨倉矚目

該代,理續表示,11月最大宗成交為全幢工廈,領展公佈以約27億收購柴灣嘉業街60號全幢貨倉大廈。鋪市以宗數取勝,連錄多宗逾億元成交,資深投資者黎永滔以約1.83億售出中環德己立街17至19號德和大廈地下01及01A號鋪。沉寂多時的商廈亦錄交易,結好控股以約4.2億售出上環中遠大廈10樓全層。

該代理認為,過往年底,投資者「收爐」或外遊,今年封關下,旅遊受限,加上工商鋪多個新盤推出,刺激市況熾熱。

(星島日報)

更多英皇道1111號 (前稱太古城中心一座) 寫字樓出租樓盤資訊請參閱:英皇道1111號寫字樓出租

更多鰂魚涌區甲級寫字樓出租樓盤資訊請參閱:鰂魚涌區甲級寫字樓出租

更多中遠大廈寫字樓出售樓盤資訊請參閱:中遠大廈寫字樓出售

更多上環區甲級寫字樓出售樓盤資訊請參閱:上環區甲級寫字樓出售

西環大道西巨鋪1.7億易手 「磁帶大王」陳秉志等承接 料回報逾四厘

「磁帶大王」陳秉志活躍於市場,今年連環沽貨,同時亦出手購入物業,市場消息透露,最新為西環皇后大道西巨鋪,建築面積逾12664方呎,作價1.7億,平均呎價1.26萬,料回報逾4厘,夥拍他的為港置鋪位部前高層陳偉材,多年前晉身投資者。

陳秉志今年第三度出手買貨,最新購入西環皇后大道西489至499號、德輔道西442號美新樓A及B座地下,A座1樓,A座2樓4室及5個平台,地鋪共約8061方呎,1樓約4237方呎,2樓擁有一個住宅,實用面積366方呎,另5個平台,若以總樓面12664方呎 (未計5個平台) 計算,平均呎價1.26萬。

夥拍陳偉材購入物業

陳秉志證實購入物業,並強調作為長綫收租,預期未來2至3年回報逾3厘。他又說,隨着疫情受控,有秩序通關,經濟將陸續向好。

今番夥拍陳秉志購入物業,為港置鋪位部前高層陳偉材,陳偉材表示,適逢碰上動亂及疫症,鋪市大跌,是吸納機會,除非再有第三宗壞消息,否則隨着通關及一切恢復正常,鋪位租售價勢必向上。他續說,鋪市最差時間已成過去,目前處谷底反彈,該巨鋪現時月入40多萬,1樓全層交吉,意向月租10多萬,料悉數租出後,回報4至5厘,開心業主割愛!

平均呎價1.26萬

陳偉材曾任代理,20年前認識陳秉志,多年來為他購入不少鋪位。

鋪市高峰期,陳氏曾為投資者拆售過不同物業,令他在行內贏得「神童」的稱號,近年一更晉身投資者,同時亦從事物業按揭工作。

而上述巨鋪原業主為蘇姓投資者,於2007年以約6176萬購入,持貨14年,帳面獲利逾1億。

陳秉志今年以來沽售15件物業,包括重磅物業中環中心,合共套現近20億,物業包括甲廈、鋪位及豪宅等,分布港九及新界各區,他亦表示,由於物業持有多年,故趁勢沽貨止賺,適時重新部署,瞄準民生區鋪位。

他今年以來三度出手購入物業,除了上述巨鋪外,他亦夥拍投資者蔡志忠購入美孚一籃子鋪,作價4.55億,此外,亦與投資者林子峰購入荃灣石圍角商場連578個車位及葵涌安蔭商場連355個停車位,成交價分別是7.33億及5.62億。

(星島日報)

更多中環中心寫字樓出售樓盤資訊請參閱:中環中心寫字樓出售

更多中環區甲級寫字樓出售樓盤資訊請參閱:中環區甲級寫字樓出售

賈炳達道公園地 擬重置九龍城街市

市建局計劃重整九龍城舊區的土地規劃,透露將研究在賈炳達道公園重置九龍城街市等社區設施,以一地多用模式興建全新政府設施大樓;更會善用地下空間加建泊車位,優化九龍城小區的道路網絡,提供更多休憩空間。

市建重整九龍城舊區的土地規劃範圍由東面沙浦道一帶,涵蓋至西面聯合道土地,面積約18公頃、涉及500多幢樓宇和政府設施,當中逾半大廈樓齡超過50年。市建局行政總監韋志成發表網誌指出,九龍城舊區有3大市區更新挑戰,包括舊樓重建、政府設施重置和地區活化3個範疇,有需要利用新規劃方法,包括轉移地積比、街道整合,以至「一地多用」模式,克服挑戰。

一地多用 建政府設施大樓

他指出舊啟德機場搬遷後,九龍城區內放寬高度限制,吸引發展商重建,卻沒有加強區內規劃,出現單幢式重建。而侯王道一帶有市政大廈、門診等設施,搬遷及重置難度大;還有九龍城舊區歷史悠久,街舖食肆林立,也是地區經濟集中地,在重建過程中要保留區內小街小舖氛圍,挑戰甚大。

韋志成透露在參考地區意見後,市建局將研究重整賈炳達道公園的休憩及康樂設施,劃出部分公園用地,以一地多用模式興建全新政府設施大樓,用作搬遷九龍城街市等社區設施;他估計重建之後,可提供的社區設施樓面是現時3倍多,更會善用地下空間加建泊車位。

因應區內沙浦道重建項目擬建地下廣場連接九龍城及啟德新區,局方會研究將地下廣場與周邊道路和公園一併重整,成為連接新舊社區的主要門廊。他說市建局將為九龍城舊區土地作整全規劃,務求大幅改善舊區環境,達致新舊樓宇共融,包括試行「小區規劃復修」模式,為衙前圍道一帶不同樓齡、不同樓宇狀況的舊樓,提出針對性維修方案,達至舊區環境整體更新。

有測量師稱,支持市建局採用「小區規劃」模式落實九龍城區重建,認為區內樓宇低矮僅十層以下,日後可重建成近30層高,具重建潛力,也可提供更多社福設施及泊車位,有助改善區內環境。

(經濟日報)

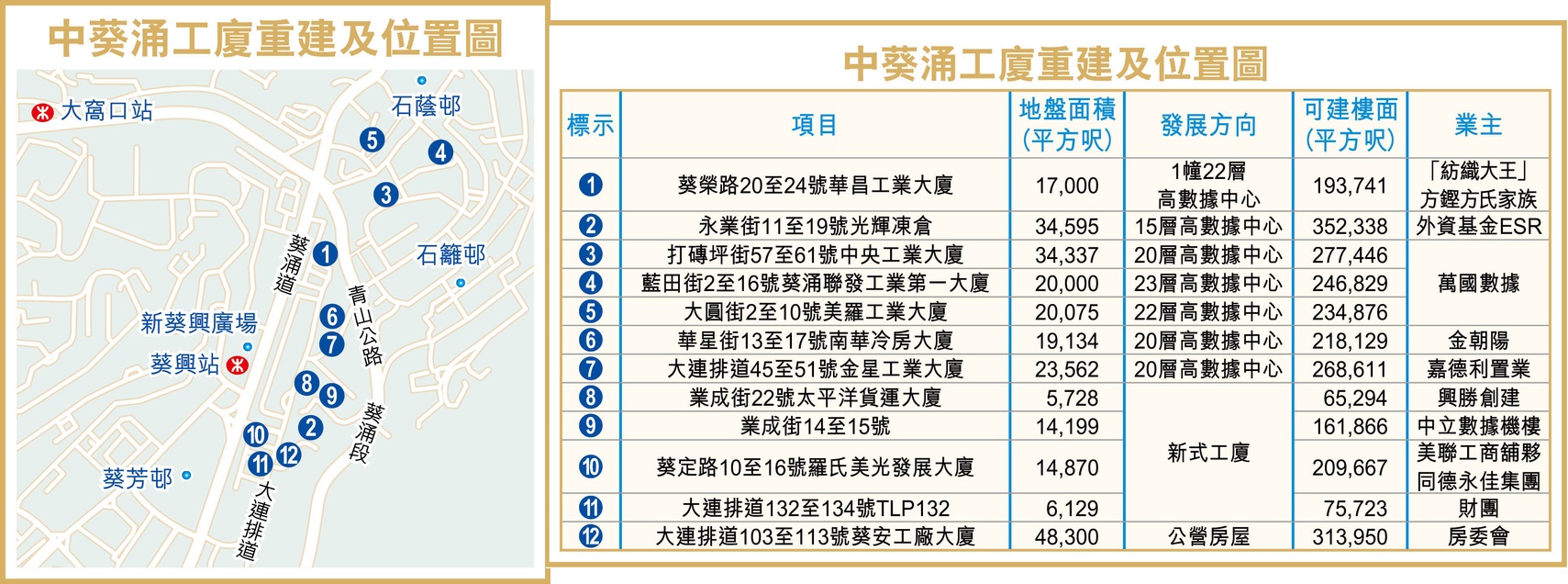

數據中心租金 過去5年累升逾2成

協會會長李松德:供應將增400萬呎 價格趨穩

過去5年,數據中心的租金或服務費累積增長20至30%;不過,香港數據中心協會會長李松德透露,未來5年數據中心樓面供應將增加50%或400萬平方呎,服務費價格將趨向平穩,科學園不應再低價批地建數據中心。

李松德指出,過去5年香港數據中心在租金或服務費上,都錄得數個百分點的升幅。不過,他指出,現時全港數據中心的樓面大約800萬平方呎,但隨着近年私人市場透過工廈活化、競投政府工業地等,預計未來5年數據中心樓面將增加400萬平方呎,相當於現有樓面的50%,因此預期,數據中心租金或服務費的價格將會趨平穩。

須增加需求 引入高端數據中心

「數據是石油、是黃金。」李松德認為,在AI人工智能、5G網絡、大數據發展帶動下,數據中心仍然有發展潛力,而現時香港數據中心發展遇上的困難不是土地不夠,而是需求問題。

政府若果想推動香港成為亞太區的數據中心首選地點的話,李松德指,應該注重在增加需求,以科學園為例,應該積極引入創科產業或高端數據中心行業,而不是以低廉的地價批出予一般數據中心。他認為,私人市場亦有能夠營運及增加數據中心供應,政府應該從提供基建及人才方面提供協助。

按照市場數據顯示,近一、兩年活化工廈計劃申請約64宗,合共樓面面積近1,500萬平方呎,暫時至少有7宗申請開設數據中心,涉及208萬平方呎樓面,將於2022至2024年落成。業界估算,之後可能有更多活化工廈申請是開設數據中心。

(經濟日報)

心光新校舍落成後 交換薄扶林地予九倉

心光盲人學校日前向城規會申請將薄扶林校舍重建成豪宅,據心光方面回應指,現時跟九倉 (00004) 交換東涌土地以進行重建,預計須5年以上才能建成新校舍,之後才會交出薄扶林道土地予九倉。

有逾60年歷史的薄扶林心光盲人學校,早在10年前已經有意重建,當時跟恒隆地產 (00101) 合作,由後者負責物色地點重置學校,並取得土地重建成住宅項目,惟項目一直未獲城規會批准,直至近日心光盲人學校才向城規會申請重建。

東涌建新校舍 料需時逾5年

據心光方面回覆指,將跟九倉交換地皮,但不屬於合作夥伴。新校選址在東涌,要五年以上才建成。在新校舍落成前,即使薄扶林道重建的申請獲城規會批准重建,九倉亦不能進行重建。心光指,學校學生仍會在薄扶林道上課,直至在東涌的新校建成取得校舍註冊後學生往新校舍上課,才會交出薄扶林道土地給九倉,形容新舊校舍屬於無縫銜接。

據了解,該幅東涌新校舍用地屬東涌西第36A區,位於滿東邨對面,鄰近日後的東涌西港鐵站,現時規劃「政府、機構或社區」用地,將會興建4層高建築,重置心光盲人院暨學校、心光恩望學校等設施。

按照《東涌谷分區計劃大綱圖》顯示,該幅東涌用地原意是興建一幢社區綜合大樓,在原有規劃下,九倉所持有用地有機會遭政府收地,現時跟心光展開換地重建,屬於「雙贏」方案。

心光在薄扶林的現有校舍,將以地積比率1.9倍重建成5幢9層高住宅大樓,總樓面約13.2萬平方呎,將提供83間低密度豪宅。

(經濟日報)

東傲呎價首破萬 新蒲崗活化工廈樓花新紀錄

由莎莎國際 (0178) 主席郭少明兒子郭浩泉等人創辦的麒豐資本,伙拍傅老榕家族旗下廣興置業集團發展的新蒲崗七寶街1號活化工廈樓花項目東傲,首推近一周銷情理想,麒豐資本創辦合夥人暨投資總監洪英偉指,項目首階段推出的5層單位

(包括3樓、11樓、12樓、15樓及16樓),已售出逾9成單位,套現超過6億元,其中最大手買家,以逾1.21億元購入項目16樓全層,單位面積12769方呎,呎價約9500元。

大手客逾1.2億購全層

洪英偉補充,項目今加推17及20樓部份單位發售,即錄高價成交,其中20樓07、09及10室,獲大手客以約3500萬元購入,以單位面積共3154方呎計,呎價逾1.1萬元。資料顯示,若以呎價1.1萬元計,料創新蒲崗拆售活化工廈呎價新高。他又指,項目下周將會有新樓層推出,並有加價空間。

(明報)

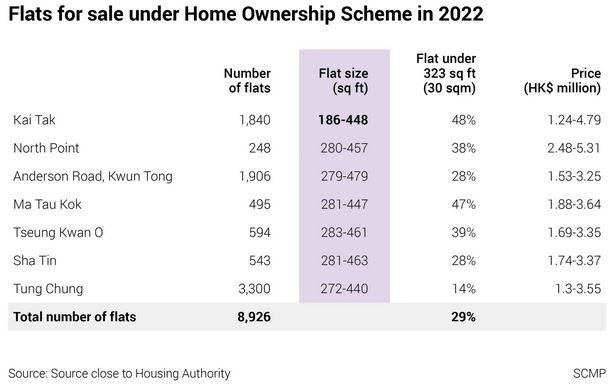

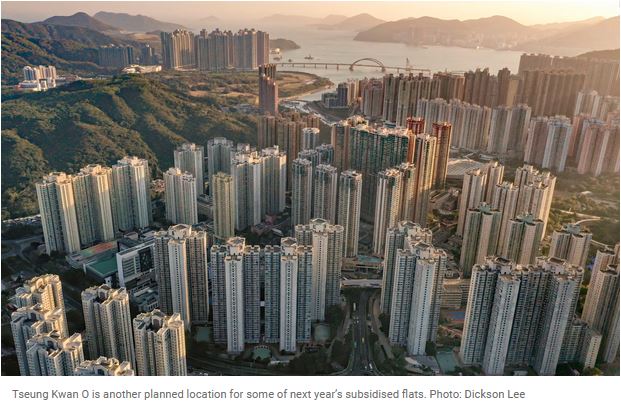

Over 780 shoebox flats in Hong Kong’s subsidised home ownership scheme still unsold despite more than a month on market

As

of Friday, 254 of the flats at Kai Chuen Court in Kowloon, offered

under the Green Form Subsidised Home Ownership Scheme, still have not

found buyers; all are smaller than 200 sq ft

Other

unsold units under the scheme include 537 flats in Tsing Yi and Chai

Wan, with about 98 per cent of them smaller than 189 sq ft

More

than 780 shoebox flats put on the market in Hong Kong’s latest batch of

subsidised housing units have gone unsold for over a month, even as all

the larger flats offered under the scheme were quickly snapped up.

The

Housing Authority offered up a total of 2, 649 new flats for sale under

the Green Form Subsidised Home Ownership Scheme (GSH) on October 29,

including 2,112 units at Kai Chuen Court, which is situated above the

Diamond Hill MTR station in Kowloon. Half of the units at Kai Chuen were

sized between 184 sq ft and 287 sq ft.

However,

as of Friday, 254 of the Kai Chuen flats remained unsold, accounting

for 12 per cent of the estate. All of them were smaller than 200 sq ft.

Cleresa

Wong Pie-yue, chairwoman of the authority’s subsidised housing

committee, acknowledged that the smaller flats were less popular.

“We

thought flats in Diamond Hill would be welcomed by the buyers given

their urban location, but apparently it’s not exactly what we expected,”

she said. “We should seriously look at the proportion of different flat

types for GSH and see what can be done to cater to buyers’ needs.”

The

sales this year also included 537 unsold GSH flats left over from last

year’s batch, mostly at Ching Fu Court in Tsing Yi, but with a dozen

located in Dip Tsui Court in Chai Wan on Hong Kong Island. About 98 per

cent of those flats are smaller than 189 sq ft. So far, only 10 of those

flats have been sold.

The

GHS flats, built by the authority, are sold exclusively to public

housing tenants or those likely to be allocated a public rental flat

within a year. The programme was introduced in 2016 to provide homes for

sale at significantly less than market price.

The unsold flats at Diamond Hill were priced between HK$1,223,400 and HK$1,456,400, or about 50 per cent off the market value.

In

its marketing drive, the authority produced videos showing a virtual

model of how furniture could be squeezed into the tiny flats. In one of

the videos, which touted a “gentle chic style”, a two-seat sofa, a

double bed and a refrigerator were packed into a 186 sq ft studio,

though there was little space left for a dining table or a wardrobe.

So-called

nano flats – often unofficially defined as homes smaller than 200 sq ft

– have grown in popularity with developers in recent years based on the

assumption they would appeal to first-time buyers priced out of bigger

units but eager to get a foot on the property ladder.

However,

the units’ tiny living spaces have also drawn criticism, and the Urban

Renewal Authority has stopped building flats smaller than 300 sq ft.

In

light of the criticism, the government is even considering setting a

minimum flat size for the private market, while also pledging to

increase the size of public housing units in the long run.

The

Housing Authority received a total of 72,000 applications for this

batch of GSH homes, which included some 800 second-hand flats.

About

59,000 of the applications came from families. All eligible applicants

were invited to select the flats of their choice on different dates

starting from late October.

More

than 8,000 applicants have been invited so far, but only 36 per cent

showed up. Just 25.7 per cent have actually made a purchase.

Anthony

Chiu Kwok-wai, executive director of the Federation of Public Housing

Estates, said he believed Kai Chuen Court could still attract some

buyers, especially those who planned to resell the flats after a few

years of living in them.

“The price could properly rise in some years considering its location and good traffic connections,” Chiu said.

Currently,

owners of such homes can resell the flats at a freely negotiated price

from the third year of purchase in a so-called secondary market, where

buyers are either tenants of public rental housing, or those on the

waiting list for such homes.

“But

after all, the authority should revise the flat designs in their

projects. Otherwise, why would a public housing tenant want to leave

their bigger flat for a smaller one?” Chiu added.

(South China Morning Post)

SwatchGroup30萬租羅素街鋪

市場預期中港兩地於短期內有機會通關,為核心區鋪位市場釋出正面訊息,吸引國際鐘表品牌「回歸」一綫地段,消息指,銅鑼灣羅素街地鋪獲Swatch Group旗下天梭表以約30萬承租,呎租約321元,較上一手長租約的租金下挫逾6成。

市場消息指出,上述為銅鑼灣羅素街59號地下B4號,面積933方呎,以每月租金約30萬獲Swatch Group旗下天梭表 (TISSOT) 承租,為期3年,呎租約321.5元,據悉,該鋪於過去一年分別由時裝店及手機配件店短租,期間月租僅約10萬,該鋪對上一手長租戶為Swatch Group旗下另一鐘表品牌,當時租金約80萬,故該集團是次「回歸」,租金下跌約62.5%。

較前租金跌逾六成

資料亦顯示,Swatch Group早於2012年已租用該鋪位,當時月租高達165萬,及後於2018年續租時,租金調整至80萬,故最新租金較高峰回落約81%。

此外,同區啟超道16號地下至2樓巨鋪,面積約3400方呎,市傳獲口罩店以約20萬短租,呎租約58.8元,據悉,該鋪早前由珠寶鐘表行以約135萬租用,故租金下跌約85%。

(星島日報)

Presale applications fall in November

Three projects involving a total of

1,476 flats filed applications of presale consent in November, a 77.6

percent drop from October, according to the Lands Department.

So

far, 30 residential projects with a total of 16,011 flats have been

pending approval as of the end of last month, the highest number since

August 2018.

The

department only granted two presale consents covering 123 units in the

month, down around 90 percent from 1,221 units in October.

Separately,

Hong Kong saw only 161 private residential flats completed in October,

down 73 percent from September, the latest data from the Rating and

Valuation Department showed.

In

the first ten months, a total of 11,329 private residential units were

completed, accounting for 62.15 percent of the government's full-year

estimation of 18,228 units.

Class

B units, which range from 40 square meters to 69.9 sq m, took up more

than half of the built flats, followed by Class A units with salable

areas less than 40 sq m which accounted for slightly over 30 percent in

the ten months.

In the primary market, The Aperture,

Hang Lung Properties' (0101) new project in Ngau Tau Kok, has received

more than 1,000 checks and is expected to launch sales as early as this

weekend.

In other property news, a building on Austin Road was sold for more than HK$800 million under compulsory sale.

(The Standard)

中環永安集團大廈低層單位以約5600萬易手,呎價約2萬,屬市價水平。

市場消息指出,上述為中環永安集團大廈低層03室,面積2800方呎;據代理資料顯示,該甲廈近期成交疏落,對上成交追溯至去年11月,為該廈5樓9室,面積約1476方呎,以3100萬售出,每呎造價約21003元;另一成交為16樓全層,於去年4月以2.86億售出,以面積11062方呎計,呎價約25854元。

平均呎價二萬

此外,尖沙嘴新文華中心亦錄成交,消息指,該廈B座低層中層11至12室,面積約3025方呎,以約3115.75萬售出,呎價約1.03萬;旺角天成大廈中層B室,面積約632方呎,以約471.9萬售出,呎價約7468元。

明興水務放售灣仔地盤

有代理表示,灣仔皇后大道東72至76號商住重建地盤現以招標形式放售,項目地盤面積約2114方呎,現有建築面積約12201方呎,截標日期為明年1月13日。

該代理表示,上址為乙類地盤,現狀為一幢10層高商住樓宇,地下為商鋪,1樓至3樓為辦公室,4樓至9樓為住宅,以地積比10倍重建,可建樓面約21140方呎,市場估值約3.5億;市場消息指出,上址由明興水務或相關人士於去年4月以2.53億購入。

(星島日報)

更多永安集團大廈寫字樓出售樓盤資訊請參閱:永安集團大廈寫字樓出售

更多中環區甲級寫字樓出售樓盤資訊請參閱:中環區甲級寫字樓出售

更多新文華中心寫字樓出售樓盤資訊請參閱:新文華中心寫字樓出售

更多尖沙咀區甲級寫字樓出售樓盤資訊請參閱:尖沙咀區甲級寫字樓出售

遠展33.8億售啟德地予中電作新總部

遠東發展 (035) 公布,分拆啟德體育園鄰近辦公室項目予中電 (002),作價三十三億八千萬元,有關地段建築面積涉及十七萬四千方呎,平均呎價一萬九千四百元。中電將積極參與該辦公室的設計和施工,屆時將成為中電新總部。

建築面積逾17萬呎

遠展表示,昨日與中電簽定買賣協議,向對方出售鄰近啟德體育園發展項目的非工業部分,包括辦公室部分,作價三十三億八千萬元,有關地段建築面積將為一萬六千二萬平方米,即約十七萬四千方呎,平均呎價一萬九千四百元。至於另外的酒店部分則由遠展繼續持有,建築面積約一萬五千四百平方米,約十六萬五千方,中電會以轉讓契約方式,向遠展交還酒店部分。

雙方亦訂立協調協議,中電可全權酌情要求對現有辦公室部分設計作出修改及設計變動,惟須獲相關政府部門批准,而有關中電要求對附加設計執行的額外成本,以及對現有辦公室部分設計作更改,將加入作價之中,作為完成後調整一部分。

有關啟德的綜合發展項目是遠展於二零一九年以二十四億四千萬元投得,當時呎價約七千一百元。項目由辦公室部分、一家擁有四百間客房的帝盛酒店部分以及零售空間組成,遠展就在整個項目將完成前分拆酒店部分,而中電地產將積極參與辦公室部分的設計和施工,屆時將成為中電新總部。

遠展認為,出售事項將可變現該地塊及發展項目的價值,並將所得收益得以變現及資本可循環投資,以及增加流動資金及減少資產負債淨額。遠展預期所得款項淨額,將用於建設該發展項目及該集團的一般營運資金。

今次交易項目,遠展按公平值約有四億三千八百萬元收益,已於九月三十日的未經審核財務報表確認,預期進一步公平值收益約為五億元,將於完成前或完成時確認。

遠展董事總經理孔祥達孔祥達表示,非常高興能夠為啟德綜合發展項目辦公室部分找到買家,施工正按計劃推進,期待其旗艦帝盛酒店於啟德體育館於二零二四年開始迎接首批觀眾時同時開幕。

(星島日報)

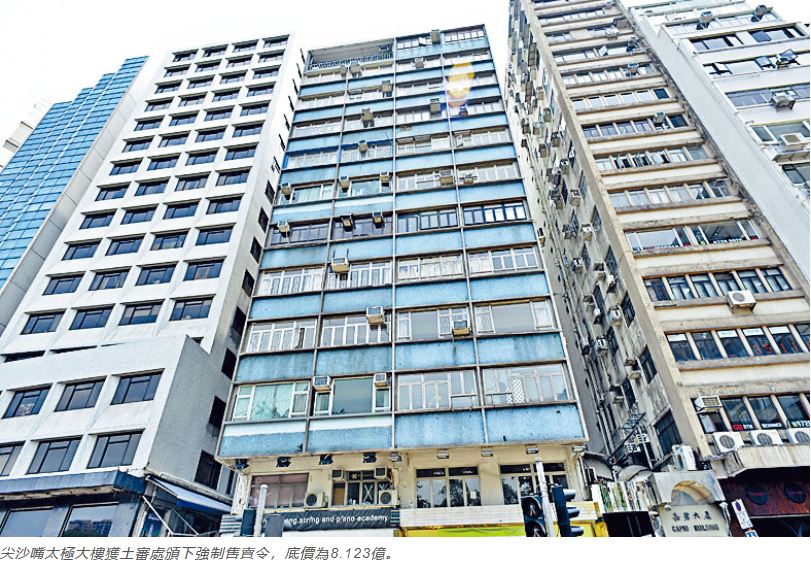

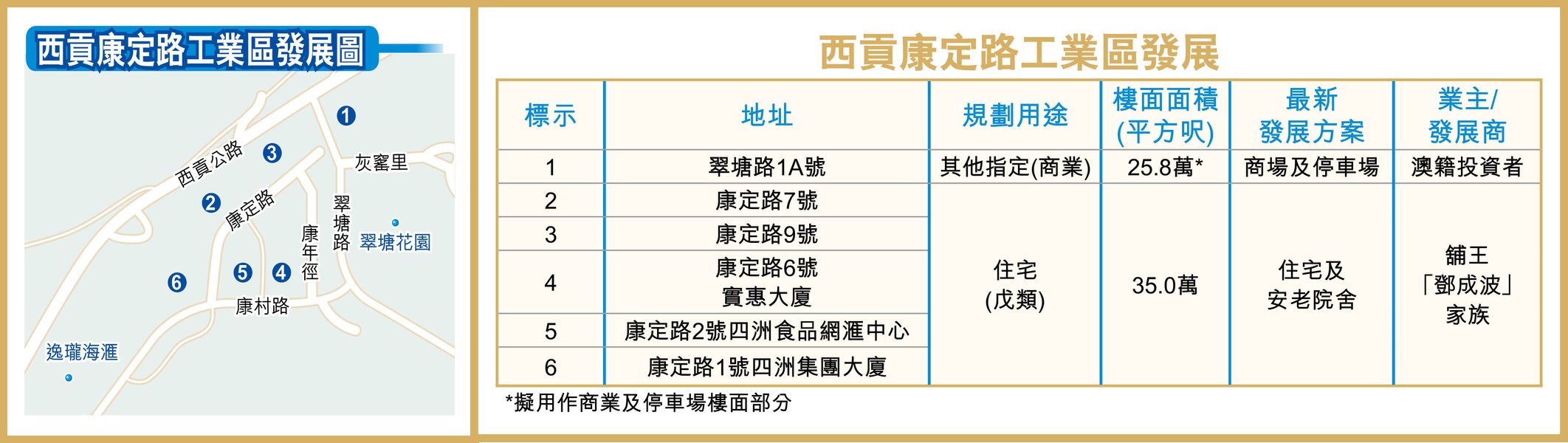

尖沙嘴舊樓批強拍底價8.12億

由財團併購的尖沙嘴太極大樓,最新獲土地審裁處頒下強制售賣令,底價為8.123億,對比2019年5月申請強拍時市場估值約5.34億,高出2.783億、幅度52%。

較19年估值高52%

據土審處文件顯示,項目位於柯士甸道132至134號的太極大樓,該財團由申請時持有約83.333%業權,目前餘下6個物業並未成功收購,昨日獲該處批出強拍令,底價8.123億。

可建9.5萬呎商廈

據判詞指出,申請人曾委託結構工程師對該舊樓進行結構評估,認為大樓的維修狀況很差,建築物的結構框架已經嚴重惡化,維修成本與重建成本不成比例,即使進行維修工程,該類工程只會對建築物的現有狀況帶來適度改善,而建築物將繼續保持不合標準,而且維修成本也會隨結構框架的惡化而增加。再者申請人已採取合理步驟收購餘下業權,故批出強拍令。

上址現為一幢12層商住物業,地下為商鋪,1樓為寫字樓,2至11樓為住宅,早於1967年落成,至今樓齡約54年;地盤面積約5441方呎,現規劃為商業用途,若以地積比率約12倍重建發展,可建約65292方呎。

曾由「鋪王」家族收購

資料顯示,上述項目由已故「鋪王」鄧成波家族早於2016年購入逾八成業權, 並於2018年獲一名澳門投資者以6.28億洽購,唯該買賣最終告吹,其後於2019年5月向土審處申請強拍以統一業權發展。最新市場消息指,該項目於今年8月以約4.5億易手,據指新買家為資深投資者朱鴻鈞。

據土審處資料顯示,該處年初迄今暫批出22宗強拍令;而強拍申請個案則暫錄14宗,對比去年同期的34宗申請,大減20宗,跌幅達約58.8%。

(星島日報)

東傲呎價1.15萬創同區新高

由麒豐資本與傅老榕家族旗下廣興置業集團合作發展的新蒲崗工廈東傲,自推出以來,市場反應不俗,該項目高層單位以呎價1.15萬成交,再創區內工廈呎價新高。

麒豐資本創辦合夥人暨投資總監洪英偉稱,新蒲崗工廈東傲2003室,面積約727方呎,新以約836.05萬售出,呎價約11500元;資料顯示,該項目同層7,9及10號單位獲大手客以約3500萬承接,每呎造價約1.1萬,創區內工廈呎價新高,故是次成交將該紀錄再推高約4.5%。

較舊紀錄高出4.5%

該項目樓花期逾半年,該項目早前推出3,11,12,15及16樓,已售出逾90%單位,套現逾6億,其中16樓全層,建築面積12769方呎,成交呎價9500元,涉資逾1.21億。

洪英偉對銷情感滿意,項目為區內於過去15年以來首個全新工廈拆售項目。對於新變種病毒Omicron來勢洶洶,洪氏認為,疫情走勢難以預測,惟中港兩地有機會通關,屆時將對工商市場帶來刺激作用。

資料顯示,該項目樓高24層,全層建築面積由1萬至1.5萬方呎,共提供193個單位,面積約700至2900方呎,預計明年下半年落成。上址前身為美華工廠大廈,麒豐資本在2018年8月向興勝創建以12.5億購入,每呎樓面地價約7000元,創當時九龍東工廈地價新高。

(星島日報)

屯門民生物流意向價14.8億全幢形式放售 投資者張順宜持有

近期工廈受捧,市場頻錄大手買賣,「物流張」張順宜趁勢放售旗下民生物流中心全幢,意向價14.8億,物業現時月租240萬,並具重建價值,新買家攻守皆宜。

近年來,屯門工業區變天,嶄新商廈及工廈紛落成,「物流張」張順宜就旗下民生物流中心全幢申重建,擬重建一幢樓高18層 (另設2層地庫) 工廈,根據城規會文件顯示,地積比將由9.5倍,放寬兩成至11.4倍,停車場設於部分地面及兩層地庫,其餘為工作室或倉庫等用途,總樓面約41.5萬方呎。

料樓面呎價3575元

他趁全幢工廈受捧,推出放售,意向價14.8億,料樓面呎價3575元。若以現址總樓面約317626方呎計算,平均呎價約4659元,較同區東亞紗廠工業大廈呎價4802元為低。現時項目月租240萬,新買家進守皆宜。民生物流中心位於屯門洪祥路3B號,佔地約36314方呎,原名田氏中心第九座,張氏12年前購入物業。

近年,屯門區內有12宗工廈重建或者改裝申請,涉及工商業樓面逾250萬方呎,隨着發展商及財團大肆在區內發展,將呈現煥然一新局面。

屯門工廈區規模細,僅有約70幢工廈,整齊乾淨,鄰近西鐵屯門站,交通方便,再加上屯門赤鱲角隧道等基建陸續落成,變身容易,多年來,區內已有工廈活化作酒店。

寬地積比20%重建工廈

近期,英皇國際持有的屯門兩幢工廈,分別為新安街13號寶泰工業大廈和15號山齡工業大廈,最新;已向城規會遞交新發展方案,申請將上述兩工廈單獨重建,可建總樓面維持22.8萬方呎。

顧氏家族第四代顧曉楠創立的智銳物業,近年亦斥10億重建杯渡路99號的凍倉成1幢新式工廈,樓高18層,總樓面約24萬方呎,提供338個工作室單位,面積約447至3203方呎。

物業並擁有特色單位,並擁有約2000方呎共享樓層,提供桌球室、會議室等設施讓租客使用。

(星島日報)

東九龍租金較便宜,現九龍灣恩浩國際中心高層招租,意向月租約25萬元,平均呎租約22元。

高層11430呎 月租約25萬

代理表示,九龍灣常悅道1號恩浩國際中心32樓全層,面積約11,430平方呎,現以月租約25萬元招租,平均呎租約22元。物業位於高層,三面單邊開揚,可觀望園景及海景,加上約4.15米高樓底,空間感十足。

該代理稱,恩浩國際中心於2013年落成,設備齊全,高層及低層各有3部載客升降機及1部載貨電梯,低層設有3層停車場以及少量商舖,為上班族帶來便利。物業由億京發展,設施保養得宜,業主同時以月租約4,000元將一個車位推出市場放租。

該代理續稱,常悅道一帶為商廈集中地,例如億京中心、創豪坊、企業廣場二期及商業廣場。資料顯示,恩浩國際中心相若樓層全層樓面,同樣面積新近以約41萬元租出,成交呎價約36元。

(經濟日報)

更多恩浩國際中心寫字樓出租樓盤資訊請參閱:恩浩國際中心寫字樓出租

更多億京中心寫字樓出租樓盤資訊請參閱:億京中心寫字樓出租

更多企業廣場寫字樓出租樓盤資訊請參閱:企業廣場寫字樓出租

更多九龍灣區甲級寫字樓出租樓盤資訊請參閱:九龍灣區甲級寫字樓出租

觀塘Eastcore處旺區 質素媲美新商廈

觀塘Eastcore為活化商廈,業主斥資翻新及改裝後,物業外形及內在設備全面提升至商廈質素。

該廈位於觀塘道398至402號,屬統一業權的商廈。交通配套方面,Eastcore的位置偏旺,交通配套十分齊全,巴士路綫亦能往各區,而鄰近港鐵觀塘站A2出口,由出口步行約5至7分鐘便到該物業,集合不少良好交通配套,可以為商客提供不同形式的商務體驗。

餐飲配套方面,Eastcore鄰近不少大型商場,例如apm、創紀之城可以為商客提供全面的商務餐飲,由該物業步行5至8分鐘步行便到該處,而附近一帶有廉價便宜的餐廳,相信滿足商客對商務餐飲的要求。

共8舖位 大部分已租出

Eastcore前身為嘉域工業大廈,活化工程剛於最近完成並正式入伙。而且物業剛完成工程後,質素可媲美新落成商廈,外型物業原為舊式工廈,現換上玻璃幕牆,另每層樓面亦與商廈規格無異。該物業樓高共15層,設有3部升降機,可往返各樓層,每層面積約1,786至12,814平方呎。

大廈地下為停車場,而地下及1樓為商舖,合共提供8個舖位,面積約數百平方呎起,據悉大部分已租出。另外2至15樓為寫字樓,5至15樓每層可分間成6個單位,一般來說,最細單位為3室,面積約1,786平方呎,最大單位為1號室,面積約8,712平方呎。景觀方面,單位全數望向觀塘道樓景,甚為開揚。

每單位備獨立冷氣系統

物業設施新簇,配套與時並進。每個單位備有獨立冷氣系統,可以24小時自由出入,令租客工作時間更具彈性。同時該物業大堂採雲石設計,盡顯氣派。

項目前為嘉域大廈,物業於1981年落成,總樓面約19.8萬平方呎。大鴻輝主席梁紹鴻早於2012年,逾8.7億元購入觀塘嘉域大廈大批工廈樓面,呎價約3,000元,購入嘉域大廈逾9成業權,打算把工廈活化成商廈項目。財團趕工廈活化尾班車,不惜高價統一舊樓業權,集團購入嘉域大廈地下單號車位,涉1,300萬元沽出,創當時全港單一車位價新高,統一業權後,業主即斥資進行改裝。

(經濟日報)

更多創紀之城寫字樓出租樓盤資訊請參閱:創紀之城寫字樓出租

更多觀塘區甲級寫字樓出租樓盤資訊請參閱:觀塘區甲級寫字樓出租

工商舖11月464買賣 按月價量升

工商舖物業獲市場追捧,大宗交易陸續湧現,帶動最新工商舖交投按月價量齊升。據代理統計,11月市場共錄得約464宗工商舖買賣成交,涉及總金額約104.18億元,對比10月份分別遞增約14%及37%。

代理資料顯示,11月份工商舖市場共錄得約464宗買賣成交,對比上月回升約14%,不論工、商、舖類別均錄升幅,總計亦比2020年11月多出約兩成。至於總成交金額表現同見理想,11月共錄得約104.18億元,按月遞增約37%,而對比去年同期約145.71億元就減少約28%。資料顯示,2020年11月份錄得鰂魚涌太古城中心1座全幢成交,作價逾98.45億元。

業主議價收窄 買家加快入市

工商舖市場11月大額成交增多,3個類別於月內均錄得逾億元交易,反映買家對工商舖物業前景看好。11月最大宗成交為全幢工業項目,領展 (00823) 公布以約27億元收購柴灣嘉業街60號全幢貨庫大廈。而舖位市場則以宗數取勝,連錄多宗逾億元成交,例如資深投資者黎永滔以約1.83億元售出中環德己立街17至19號德和大廈地下01及01A號舖。沉寂一段時間的寫字樓市場於11月都錄得大額交易,為結好控股

(00064) 作價約4.2億元售出上環中遠大廈10樓全層。大額成交帶動市況氣氛,投資者願意斥巨額入市證明其對物業後市樂觀,可刺激中小額買家信心。

代理表示,過往年底前節日氣氛旺盛,不少投資者都「收爐」或外遊,而今年受新冠肺炎影響,旅遊受限,加上工商舖有多個新盤推出,全面刺激市況熾熱,又有不少業主議價空間逐步收窄,帶動更多買家加快落實入市。預計工商舖市況將會持續升溫,成交量料會呈穩步上揚趨勢。

(經濟日報)

更多中遠大廈寫字樓出售樓盤資訊請參閱:中遠大廈寫字樓出售

更多上環區甲級寫字樓出售樓盤資訊請參閱:上環區甲級寫字樓出售

明興水務放售灣仔地盤 市值逾3.5億

樓市自疫情後迅速回勇,有大業主趁勢放售地盤。第一太平戴維斯指,灣仔皇后大道東72至76號商住重建地盤,現放市場上招標放售,並於下月13日截標。項目由明興水務 (0402) 或相關人士於去年4月以2.53億元購入,連同三成辣稅在內,總成本近3.3億元,而據悉項目現時市值逾3.5億元。

項目位處皇后大道東頭段,屬灣仔傳統商業旺區,地盤總面積約2,114方呎,現有建築面積約12,201方呎,物業為乙類地盤,可重建地積比率高達10倍,現狀為一幢10層高商住樓宇,地下為商舖,1樓至3樓為辦公室,4樓至9樓為住宅。

代理表示,參考同區新落成住宅物業,例如位於星街的Eight Star Street的近期成交價,其單位實用呎價可達35,000至50,000元,今次放售物業,重建落成後,無論是商舖或住宅部分都將享有更大潛力,相信將會備受用家及投資者垂青。

(明報)

外資基金2.8億放售牛頭角3萬呎巨舖

恒隆 (0101) 九龍灣皓日推售在即,同區業主放售大樓面商業項目。高力資本市場及投資服務部董事楊誠峰指,由外資基金持有的九龍灣牛頭角道55號利基大廈地下全層、S座1樓及2樓全層、C及D座1樓及2樓寫字樓D、E、F,總實用面積約30,000方呎,現叫價約2.8億元放售,呎價即約9333元。他表示,物業現時由優質連鎖租戶全部承租,租金收入穩定,回報率極高,將以現況連租約出售。

上述物業位於牛頭角道及觀塘道交界,屬牛頭角商業核心地段,毗鄰淘大花園,人流極為暢旺,九龍灣Don

Don

Donki即位於出售物業毗鄰的淘大商場內,可見區內民生商戶需求極大;距離港鐵九龍灣站僅5分鐘步程,而各主要交通工具均可到達。區內圍繞多個大型屋苑、屋邨,如德福花園、得寶花園及彩盈邨等,大部份均設有零售商舖、商場及餐廳。

(明報)

Far East Consortium International to sell Kai Tak plot

Developer Far East Consortium

International (0035) said it plans to sell the non-industrial portion

including the office portion of a land adjacent to the Kai Tak Sports

Park to CLP Group (0002) for HK$3.38 billion.

The

32,000-square-meter site, which is under development and undergoing

construction includes the 16,621.89-sq-m non-industrial portion with

offices and the 15,378.1-sq-m hotel portion.

The

hotel portion of the land will be assigned to its subsidiary prior to

completion of the transaction, it said in an exchange filing last night.

The

non-industrial part of the land was accounted for as an investment

property in the financial statements and a fair value gain of

approximately HK$438 million was recognized based on the mark-to-market

value as of September 30, 2021.

It is expected that further fair value gains of approximately HK$500 million will be recognized before and/or upon completion.

This

came after its chairman David Chiu Tat-cheong said he will fully

withdraw from the daily operation of i-Cable Communications (1097) but

may buy some shares to support the TV company in the future.

Local

tycoon Henry Cheng Kar-shun spent HK$208.9 million boosting his stake

in the i-Cable last month and he took up the role of chairman while Chiu

became vice-chairman this month.

Chiu

said he thinks Cheng will be the right person for the job and he is

pleased to see that Cheng wants to push i-Cable to the next level.

(The Standard)

To Kwa Wan project draws interest of big guns

The

Urban Renewal Authority had received a total of 31 expressions of

interest for the combined development of four projects located at Hung

Fook Street, Kai Ming Street and Wing Kwong Street in To Kwa Wan, after

the invitation for submissions closed yesterday.

New

World Development (0017), China Overseas Land & Investment (0688),

Nan Fung Group and Wheelock Properties are said to be among the ones

that filed the expressions.

A

review panel under the URA board will shortlist developers based on

their development experience and financial capability and invite them to

submit tenders.

The

four projects with a total site area of 5,438 square meters covering two

adjoining sites, namely Hung Fook Street/Kai Ming Street and Wing Kwong

Street/Kai Ming Street, will provide a total gross floor area of 48,942

sq m upon completion.

In the primary market, Manor Hill

in Tseung Kwan O unveiled the fourth price list offering 200 units at

an average discounted price of HK$22,955 per sq ft, nearly 10 percent

higher than the first batch launched more than a month earlier, the

developer Kowloon Development (0034) said.

In Ngau Tau Kok, The Aperture,

which will launch the first round of sales of 100 flats on Saturday,

received at least 1,200 checks, according to the builder Hang Lung

Properties (0101).

And in Kai Tak, The Henley

III by Henderson Land Development (0012) also launched its latest price

list yesterday, providing 41 flats at an average price per sq ft of

HK$28,060 after discounts.

In

other news, a property consultancy expects Hong Kong property prices to

rise by about 3 percent year-on-year next year as more buyers are

entering the market in the low-interest-rate environment.

It expects 73,000 home transactions to be recorded this year, with the number will falling to 60,000 to 65,000 next year.

(The Standard)

Property consultancy predicts 3pc hike for home prices

Property

consultancy expects Hong Kong property prices to rise by about 3

percent year-on-year next year as more people are entering the market in

the low-interest-rate environment.

The

projected increase slows down compared to this year, mainly because

property prices have reached historic highs, and if the border between

Hong Kong and China reopen next year, the prices of luxury homes are

expected to rise by 3-5 percent, it said.

the

consultancy said that residential rents will increase about 2 percent

year-on-year in 2022, underperforming the property prices, and the

annual rental returns are expected to remain at a low level of about 2

percent.

It also

anticipated that about 73,000 home transactions will be recorded this

year, while that of next year will fall back to 60,000 to 65,000.

Government

land sale revenue could reach HK$100 billion to HK$110 billion in 2021

driven by large commercial land sold in Central and Causeway Bay and the

2022 revenue is expected to drop to between HK$40 billion and HK$60

billion, it said.

(The Standard)

Offices may decamp to Hong Kong’s Causeway Bay amid rental crash in the world’s costliest retail strip

The

monthly net office rent in Causeway Bay averaged HK$60.4 (US$7.74) per

square foot, about half the charge in Central, according to property

consultancy

Central’s October rent rose 0.5 per cent from a month earlier, while Causeway Bay was unchanged

Causeway

Bay looks increasingly more appealing as an office address, amid the

rental crash in what was until recently the world’s most expensive

retail shopping district.

The

monthly net office rent in the district between Hong Kong’s Wan Chai

and Quarry Bay averaged HK$60.4 (US$7.74) per square foot, just about

half the HK$113.6 per square foot in the city’s Central financial hub,

according to property consultancy. Central’s October rent rose 0.5 per

cent from a month earlier, while Causeway Bay was unchanged.

“Causeway

Bay’s rent is between Central and Quarry Bay,” property consultant

said. “Compared with Wan Chai, office buildings in Causeway Bay are

newer and of higher quality, which are also reflected in the discrepancy

in rents and vacancies.”

The

district, particularly the Russell Street thoroughfare, commanded the

world’s most expensive retail rents for six consecutive years until

2020, boasting flagships by such luxury designers as Burberry, La Perla

and Prada. The Italian designer Prada left Russell Street last year after months of street protests and Covid-19 pandemic, a departure that forced the landlord to slash rents by 44 per cent to fill the vacancy, kicking start a domino effect that weighed on rental charges throughout the district.

One

investor betting on Causeway Bay’s potential as a prime office zone is H

Development Holdings Limited, which counts the 28-storey retail

commercial complex Henry House and the 24-floor Biz Aura office building

in its property portfolio. H Development recently completed the

redevelopment of a commercial building in Causeway Bay, the 25-storey HDH Centre on Irving Street.

“HDH Centre

is our flagship for 2021, a Grade A commercial complex located at the

heart of Causeway Bay and primed to become a landmark in the community,”

said Eric Ng, H Development’s chairman. “The group is optimistic about

the market and potential of Causeway Bay.”

One of HDH Centre’s

first tenants is the German home appliance brand Bosch, which will

relocate its flagship from Central to occupy the entire first floor. The

building’s third to eighth floors will be dedicated to food and

beverage outlets, and the rest for office tenants.

“We

place great emphasis on the Hong Kong market, hence we are very

selective when considering the new location for our Hong Kong flagship

store,” a Bosch spokesman said. “HDH Centre

is a new completed complex with stylish architectural design. It is

conveniently located at the heart of Hong Kong’s commercial and

entertainment hub... A mere three-minute walk from Causeway Bay MTR

station, convenient transport means a high number of visitors from time

to time. Relocating our showroom to Causeway Bay puts us in a better

position to reach our targeted premium customers.”

In Tower 535 on Jaffe Road also in Causeway Bay, co-working giant IWG has taken over the space vacated by rival WeWork.

On Causeway Bay’s waterfront, the Mandarin Oriental Hotel Group shuttered The Excelsior hotel in 2019 to redevelop the site into a 26-storey office tower at a cost of US$650 million, scheduled for completion in 2025.

Companies,

particularly those that do not require marquee addresses to impress

customers, have been driven out of the Central district by its record

rental charges, decamping to Hong Kong’s outlying districts such as

Quarry Bay or Tsim Sha Tsui. Causeway Bay, with its crowded streets, and

high-end shopping centres, had not been high on the selection list

until now, the consultant said.

Grade-A

office rents on Hong Kong Island may increase by between 5 and 10 per

cent, especially in Central, Admiralty and Wan Chai, the property

consultancy said.

As

several companies have recently expanded their footprints or moved back

to Central, the office rents in the district are likely to rise faster.

This in turn will add appeal to Causeway Bay as a good alternative for

corporate offices.

“Given

its status, the quality of [the area’s] buildings and other

attractions, the office rental market in Central is expected to recover

and rise much faster while rents in Causeway Bay are likely to take time

to fully recover,” the property consultant said.

(South China Morning Post)

For more information of Office for Lease in HDH Centre please visit: Office for Lease in HDH Centre

For more information of Office for Lease in Tower 535 please visit: Office for Lease in Tower 535

For more information of Grade A Office for Lease in Causeway Bay please visit: Grade A Office for Lease in Causeway Bay

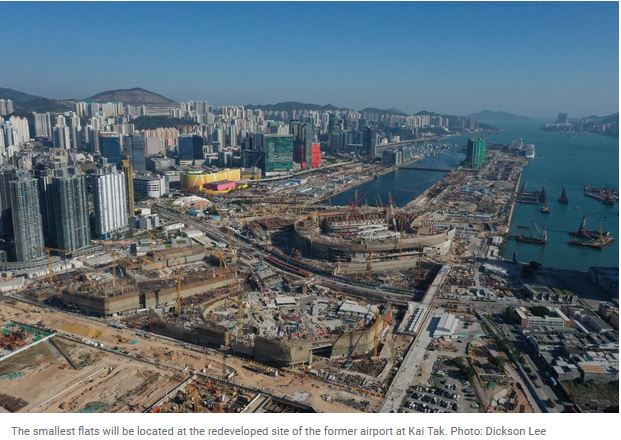

Outlook dims on Kai Tak’s waterfront land as Hong Kong’s Northern Metropolis plan and land conversion add to city’s supply glut

Five

plots of housing land at Kai Tak, valued at a combined HK$71.3 billion

(US$9.15 billion), may fail to live up to expectations when they go on

sale, analysts said

One of the plots was sold last week at a discount of 10.8 per cent from its purchase price in 2018

A

distressed sale last week at Hong Kong’s former Kai Tak airport site

has clouded the outlook of the city’s property market, as an expected

glut of residential land weighs on prices.

Five

plots of land at Kai Tak, valued together at up to HK$71.3 billion

(US$9.15 billion), may fail to live up to expectations when they go on

sale, analysts said. The parcels - yet to be converted from commercial

land into residential usage - can yield about 5,800 average-size flats,

according to the rezoning proposal in Hong Kong’s 2021-2022 budget

announced in February by Financial Secretary Paul Chan Mo-po.

Another

factor that puts a cap on prices is the city government’s plan to

develop the Northern Metropolis in the New Territories, where at least

900,000 homes may be built over the next 20 years to accommodate 2.5

million people and alleviate Hong Kong’s crowdedness.

“Land

prices may soften, rather than be on the rise,” a surveyor said. “The

likely supply in Kai Tak and the Northern Metropolis will relieve

upwards pressure. The [slump] in the stock market will also make

developers more prudent in making their bids.”

Kai

Tak, where Hong Kong’s main airport operated from for more than seven

decades until 1998, measures 323 hectares (798 acres). It is an

important part of the transformation of eastern Kowloon into a central

business district to sustain the city’s development, first outlined in

2011 by former Chief Executive Donald Tsang.

Since

then, Kai Tak has grown into an upscale residential area, especially on

the narrow strip of land protruding into Victoria Harbour where the

former airport runway was, as it offers seafront view on three sides.

KWG Group Holdings and Longfor Group have launched their Upper Riverbank

apartments, where a four-bedroom ground floor flat with a garden sold

in October for HK$79 million.

A

number of Chinese developers – exemplified by the voracious asset buyer

HNA Group before it went bust in January – snapped up Kai Tak’s plots

at record prices in late 2016 and early 2017, driving land prices to

between HK$15,000 and HK$18,000 per square foot.

The

former airport’s transformation puts the impetus on Kowloon Bay and

Kwun Tong nearby to drive the area’s development as a central business

district, said Leo Cheung, adjunct associate professor at the University

of Hong Kong.

“If proper provisions of infrastructure have not been sufficiently provided, pressure on land prices is expected,” he said.

Prices

have corrected since those heady days. Kaisa Group, one of the Chinese

developers now buckling under debt, last week sold a plot of Kai Tak

land for HK$7.9 billion (US$1 billion) in cash and assumed debt, a

discount of 10.8 per cent to the price that a distressed rival paid in

2018.

Kaisa’s

Area 4B Site 4 was bought by a venture backed by New World Development

and Far East Consortium International. Next to it, Area 4C Site 4 is

valued at HK$14.5 billion, while Area 4C Site 5 may be worth HK$11.8

billion, according to another surveyor.

Two

of the five rezoned housing land face the Victoria Harbour at the end

of the former runway, with the most breathtaking view among all other

residential parcels in Kai Tak.

“Land

prices could be very volatile [in Kai Tak], depending on changes in

market condition and sentiment,” and could “easily vary by more than 10

per cent,” the surveyor said.

(South China Morning Post)

Blackstone, SilkRoad turn Hong Kong’s industrial property into a hotspot with 54 per cent jump in investment

Global

real estate funds accounted HK$17.3 billion or 61 per cent of

industrial property transactions so far this year, up from 21 per cent

share in all of 2020

Hong

Kong’s industry revitalisation programme could boost supply and test

market resolve on investment returns over the next two years

Global

institutional funds have stepped up their purchases of industrial

property in Hong Kong this year by 54 per cent, as Covid-19 continues to

support bullish demand for data-centre and cold-storage facilities.

They

spent HK$17.3 billion (US$2.2 billion) or 61 per cent of total

transactions of such assets so far this year, according to a property

agency based on deals valued above US$10 million threshold. The funds

invested HK$11.2 billion or just over one-fifth of the total in all of

2020.

“New

industrial-related businesses such as data centres, cold storage and

self-storage are in keen demand, which encourages some value-add

potential of old warehouse buildings,” an agent said.

Covid-19

cases have continued to spread as new and more infectious variants

emerged, underpinning consumption patterns that fuel demand for

logistics assets in the city. As a result, growing e-commerce has

fuelled aggressive buying by global real-estate funds, industry

consultants said.

Among

recent notable transactions, US private equity giant Blackstone

acquired an industrial building named Elegance Printing Centre in Shau

Kei Wan on Hong Kong Island for HK$500 million.

Industrial

assets in Tuen Mun in New Territories have also become a key target for

global funds with at least three major deals recorded in the third

quarter.

CR

Logistics paid HK$2.24 billion for the first phase of East Asia

Industrial Building and HK$695.4 million for Mineron Centre, according

to data published by another agency. Silkroad Property Partners paid

HK$1.1 billion for several units and floors in Block C of Hang Wai

Industrial Centre, its fifth acquisition in its Hong Kong portfolio.

Investors,

however, are facing one drawback as the surge in investment has shrunk

returns. The sector will also need to contend with rising supply as old

buildings are redeveloped.

“Robust

investment sentiment for warehouse assets so far this year has already

pushed prices up by 6.8 per cent and yields down to 3.3 per cent, an

all-time low, indicating diminishing investment returns,” property agent

said.

The

Hong Kong government has approved 57 applications to demolish old

industrial buildings over the past three years under its revitalisation

programme, adding 12.7 million sq ft of space into the market. Given the

success, the policy is being extended to October 2024.

A

total of 7 million sq ft of new warehouse space is expected to come on

stream over the next two years, the agent said. With little

pre-commitment so far, this is expected to test market resolve when the

new supply enters the market, the agent added.

In

the immediate term, however, demand for logistics assets appears to be

sustainable as the local and global supply chains continue to recover.

That makes the industrial property sector more appealing, given the

downward pressure in rents for office and retail properties in the city.

“It

is a global trend and it will support the rental for data centres and

warehouses,” another agent said. “The low entry ticket prices have

turned industrial buildings into a hotspot among global funds.”

(South China Morning Post)

本港疫情走勢平穩,為甲廈市場釋出正面訊息,核心區頻錄承租個案,消息指,中環皇后大道中八號高層全層,於交吉約10個後,以每呎約115元租出,較舊租輕微下跌約4%。

交吉10個月始錄承租

據代理指出,中環皇后大道中八號高層全層,面積約3012方呎,以每呎約115元租出,月租約346380元,據悉,上址於今年2月交吉至今,舊租金為每呎120元,故最新租金微跌約4%,屬市價水平。

代理指,隨疫情走勢持續平穩,現今甲廈空置率逐步改善,惟整體租金表現仍備受壓力,隨踏入年尾,部分業主希望於農曆新年前將單位租用,令議價空間逐步擴闊,故近期甲廈租金均見折讓。

卡佛大廈每呎61元租出

據代理行資料顯示,該甲廈近期租賃交投疏落,對上承租個案為該甲廈高層全層,於去年6月以336830元租出,以面積2591方呎計,呎租約130元;另一宗為中層全層,面積約3012方呎,於去年1月以361440元租出,平均呎租約120元。

此外,中環區內商廈亦頻錄承租個案,消息指,卡佛大廈高層07B室,屬醫務層,面積359方呎,以每呎約61元租出,月租約21899元;同區歐陸貿易中心中層03A室,面積約952方呎,以每呎約52元租出,月租約49504元。

(星島日報)

更多皇后大道中八號寫字樓出租樓盤資訊請參閱:皇后大道中八號寫字樓出租

更多卡佛大廈寫字樓出租樓盤資訊請參閱:卡佛大廈寫字樓出租

更多歐陸貿易中心寫字樓出租樓盤資訊請參閱:歐陸貿易中心寫字樓出租

更多中環區甲級寫字樓出租樓盤資訊請參閱:中環區甲級寫字樓出租

上環全幢乙廈7000萬售

新一波疫情來勢洶洶,惟市區全幢物業仍備受追捧。上環皇后大道中全幢乙廈以約7000萬易手,原業主持貨17年帳面獲利約5920萬,物業期間升值約5.48倍。

綜合市場消息指出,上環皇后大道中323號全幢以約7000萬易手,原業主於2004年以約1080萬購入,持貨17年帳面獲利約5920萬,物業期間升值約5.48倍。據業內人士指出,上述地鋪連閣樓為鋪契,至於項目1至5樓則為寫字樓,成交價貼近市場價水平。

17年升值5.48倍

另一方面,代理表示,西營盤德輔道西1號低層全層商廈,單位面積約1616方呎,以意向價約1800萬放售,呎價約1.11萬。黃氏表示,上述單位間隔四正實用,獨立全層配備分體冷氣及內置洗手間,大廈設有兩部客梯,適合各行業進駐設立總部。單位景觀開揚,外向干諾道西天橋,廣告效益盡收眼底。物業地理位置優越,該項目鄰近港鐵上環站,交通配套不俗。

德輔道西商廈意向呎價1.11萬

據代理行資料顯示,該商廈近期頻錄買賣,其中,20樓全層,面積約1088方呎,以今年11月以約938萬易手,呎價約8621元;另一宗為項目高層全層,面積1088方呎,於今年9月以1200萬售出,呎價約11029元。

(星島日報)

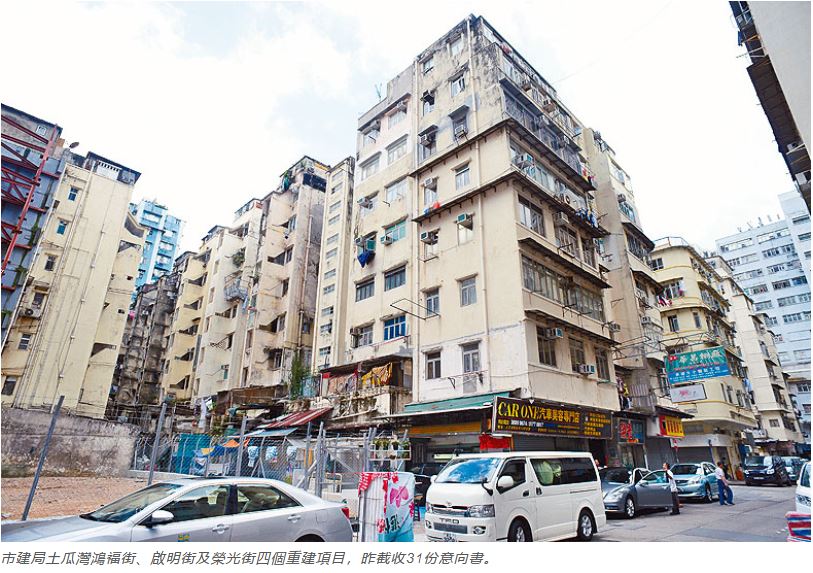

市建土瓜灣項目截收31份意向

近年市區大型發展項目供應罕有,市建局土瓜灣第三個以「小區模式」發展的鴻福街、啟明街及榮光街四個重建項目、合併為一個項目發展,挾市區及鐵路沿綫住宅的優勢,昨日截收31份意向書,雖較同區首兩個小區項目的36份意向書數目為少,但市場反應仍算理想。

意向書較同區兩項目少

市建局昨公布,項目截收31份意向書,意向書數目對比該局今年6月及9月、同樣截收36份意向書的同區首兩個以小區發展項目 (庇利街/榮光街、鴻福街/銀漢街項目) 略為減少5份,若以該局住宅項目計,則是自17年3月截收28份意向書的大角嘴福澤街/利得街需求主導重建項目後的逾4年半以來最少。

市建局指,該局董事會設立的遴選小組,將會按照訂定的入圍準則,就發展商及財團的項目發展經驗和財政能力,從收到的意向書中挑選符合資格的發展商及財團;並將根據董事會已批准的主要招標條款,邀請入圍的發展商及財團提交標書。

據現場所見及綜合市場消息,多家本地大型和中型發展商都有遞交意向書,包括長實、新地、恒基、會德豐地產、信和、南豐、新世界、華懋、英皇國際、遠東發展、帝國集團、泛海國際、中國海外、招商局置地、爪哇控股,另有多家不知名財團等。

英皇國際物業經理蔡宏基表示,該盤屬市區項目,並具地皮發展規模,遞交意向書希望取得標書作詳細研究,他透露綜合所有因素後,集團出價較為進取,傾向以獨資方式入標。

估值逾60億

有測量師指出,雖是次意向書數目對比同區首兩個項目有所減少,唯市場反應仍然理想,是次項目發展規模較大,若連同建築費在內,料發展成本將過百億,不排除部分中小型發展商因而未有遞交意向書,料將來可截獲6至8份標書,傾向為大型發展商為主。

上述重建項目由啟明街分隔兩個相鄰地盤,總地盤面積約5.85萬方呎,預計兩個地盤可建總樓面約52.68萬方呎。成功取得項目的財團,須按發展協議中列明土瓜灣小區發展的「總體設計要求」,作為興建新發展項目藍本,與該局毗鄰重建項目產生協同效應。綜合市場消息指,參考今年9月同區首個批出項目每呎樓面地價約1.14萬作指標,預計該項目估值約60億至66億,每方呎樓面地價約1.14萬至1.3萬。

(星島日報)

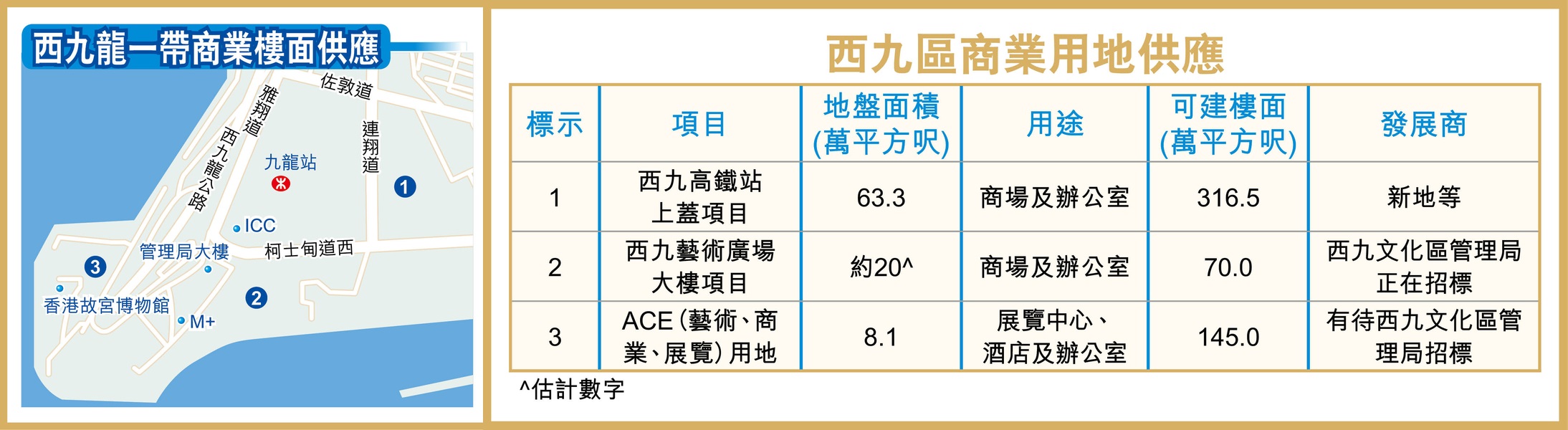

西九區商業見雛形 供應達386萬呎

隨着西九文化區發展逐漸成形,將陸續推出商業用地供應,早前就以BOT模式 (建造、營運及移交) 就區內藝術廣場大樓項目,總樓面面積約70萬平方呎,連同新地 (00016) 西九高鐵站項目等,區內未來幾年商業樓面供應將達386萬平方呎。

該幅藝術廣場大樓用地屬於西九文化區第3B區,位於興建中的演藝綜合劇場旁邊,鄰近M+博物館以及西九管理局辦公室大樓,將興建3幢商業大樓組成,總樓面面積合共約70萬平方呎,包括67.2萬平方呎的辦公室樓面,以及2.7萬平方呎作為零售 / 飲食 / 娛樂用途,當中前方的1幢商廈更屬臨海項目,擁有整個維港海景。

文化區建3商業大樓 共70萬呎

今次西九管理局並不是以傳統形式批地,而是採用BOT (建造、營運及移交) 模式出售,中標的發展商負責藝術廣場大樓項目的設計、建造、融資、市場推廣、租賃、管理和維修工作,並獲得34年營運權,期間須在租金上向西九管理局作分紅,而且今次亦要求發展商在簽訂合約後須先分兩期繳交租賃期的部分租金。

現時九龍站甲級商廈環球貿易廣場 (ICC) 租金料約70至80元水平,若果參考這個價錢,西九項目預計每月租金可達4,900萬至5,600萬元,每年租金約5.9億至6.7億元,以30年期計算,總租金收入將達177億至201億元。

除了藝術廣場大樓用地外,西九管理局亦曾經在去年就西隧出口上方的ACE (藝術、商業、展覽) 用地招標,用地佔地約8.1萬平方呎,總樓面約145萬平方呎,計劃在故宮博物館的北面興建一個50萬平方呎的展覽中心,以及在西隧上方興建一個U形的酒店及辦公室,涉及87.3萬平方呎樓面,及7.4萬平方呎的零售及餐飲樓面。

新地高鐵站商地 建兩商廈

項目在去年4月開始招標,於去年底截標,不過西九文化區管理局最後認為招標反應遜於預期,決定暫停ACE項目的招標工作。

另外,新地在2019年以422億元投得的西九高鐵站商業地,地積比率為5倍,在今年初獲批准,由3幢「波浪型」的商廈,改為興建兩幢「鑽石型」商廈,樓高20至30層,總樓面約316萬平方呎,寫字樓部分涉及樓面逾256.18萬平方呎,較已批方案減少約1成樓面。而零售方面,以約0.95倍發展計,可建面積涉逾60.27萬平方呎,則較之前增加約9成。

(經濟日報)

更多環球貿易廣場寫字樓出租樓盤資訊請參閱:環球貿易廣場寫字樓出租

更多尖沙咀區甲級寫字樓出租樓盤資訊請參閱:尖沙咀區甲級寫字樓出租

Second-highest harborfront bid 27pc lower than Henderson's

The second-highest

bid for the New Central Harbourfront site was only HK$37.1 billion, 27

percent lower than Henderson Land Development's (0012) offer of HK$50.8

billion, the Development Bureau revealed yesterday.

The

combined score of the lost tender was 84.86, the bureau said, adding

that Henderson, the successful tenderer, settled the full premium in

early December and the tender process has been completed.

All

the six tenders the government received passed the requirements for

non-premium proposals. However, the premium offers of four of the

tenders were lower than the reserved price and as such failed to meet

the requirement for the premium aspect. In other words, only two -

including Henderson's - were regarded as conforming tenders fulfilling

both the premium and non-premium requirements, the bureau said.

The

total investment for the 516,300-square-foot site at Man Yiu Street is

HK$63 billion, the biggest outlay ever for a project in Hong Kong,

according to Henderson.

Meanwhile,

Henderson's new project Caine Hill in Sheung Wan is expected to unveil

the first price list today, offering at least 50 units, and sales could

be kick off before Christmas.

In

the primary residential market, a new project at 63 Soy Street in

Mongkok, which will offer 120 flats, is expected to launch sales this

month. Named Soyo, the tower will offer studio units ranging from 152 sq

ft to 228 sq ft.

In Lam Tin, a new round of sales at Koko Hills

involving 101 homes - 85 in a price list and 16 via tenders - will be

launched on Saturday, the developer Wheelock Properties said. The units,

ranging from 366 sq ft to 770 sq ft, are priced at HK$21,315 per sq ft

on average after discounts and the whole batch is worth HK$1.01 billion.

Separately,

the disbanded Hong Kong Professional Teachers' Union sold its interests

- shops and units - in Wing Tak Mansion in Causeway Bay for HK$160

million last month.

The

union purchased the property in the 90s for HK$22.98 million and earned

a paper gain of HK$137 million after the transaction.

It has sold all the properties it owned since the official disbandment in September for a total of HK$430 million.

(The Standard)

中環商地王奪標價 較次標高37%

恒地 (00012) 以508億元奪得中環新海濱3號用地,政府公布,較次高標價371億元,高出37%或137億元,即大部分發展商出價均低於市場估值下限,顯示市場出價普遍較審慎。

恒地於上月3日以508億元投得中環新地王,據發展局公布,中標者已按時於12月初完成繳付全數地價,整個投標程序已完成,故此公布餘下標價。

次標出價371億 傳為新地

是次招標共接獲6份標書,所有標書在非價格建議方面均取得合格成績,惟其中4份標書由於出價低於政府於截標當日所訂定的底價,因此未能達到價格建議的基本要求。換而言之,包括恒地在內,只有兩份標書在價格建議和非價格建議兩方面符要求。

因此,發展局最終只公布餘下次高標價的入標價,該財團出價371.09億元,即每呎樓面地價約22,983元,只是剛好高於市場估值下限據市傳,該出價371億元的發展商為新地 (00016)。

由於今次招標採用雙信封制,政府亦落選標書的設計方案,總評分為84.86分,較恒地的得分100分,只是略低15%,反映兩間發展商在設計上的得分相當接近。新地的設計方案外形似一艘船,由4幢商廈組成,共用一個大的花園平台,中高層及天台則橫跨相連。

有代理指,市場普遍覺得「有買貴無買錯」,分別只是有多貴,特別是心態上是否以「志在必得」出價,亦認為出價是今次賣地的最主要考慮因素,因各大發展商都是找國際知名建築師去設計,設計分數相若,主要以地價分勝負。

(經濟日報)

近年政府積極發展啟德區的土地,將該區的5幅商業地將改為發展住宅項目,料東九龍一帶商業用地供應減少,將利好區內現有寫字樓的需求,會以質素優越的指標商廈先行,吸引企業搶先機落戶,佔據優質甲廈樓面。

新近有業主看準市況,將九龍灣甲級商廈恩浩國際中心高層海景全層推出市場招租,意向月租約25萬元,平均呎租約22元。

雖然該物業的地段較偏僻,由物業步行至港鐵九龍灣站需步行約10分鐘路程,但勝在附近有不少的交通配套,如巴士及小巴往返各區,若前往地鐵站亦可乘搭MegaBox提供的免費專車前往九龍灣地鐵站,為商客提供更方便快捷的乘車體驗。至於餐飲方面附近有MegaBox商場,該處提供大量中西美食選擇,方便商客進行商務餐飲。若喜愛平價美食可到附近一帶的工業飯堂進行餐飲,相信可以滿足不同商客對餐飲的需求。

11430呎高層 呎租約22元

代理表示,該招租物業位於九龍灣常悅道1號恩浩國際中心32樓全層,面積約11,430平方呎 (未核實),現時以每月約25萬元招租,平均呎租約22元。物業位處大廈高層,三面單邊,可觀望開揚園景及海景,加上約4.15米高的樓底,空間感十足。代理稱,恩浩國際中心落成僅約8年,配套設備仍見新簇,並設有高層及低層分流升降機,有助疏通上班人流,節省時間。

超高層全層 意向呎租36

該代理補充,業主同時推出大廈一個車位放租,意向月租約4,000元,方便駕駛的用家,增加物業的吸引力。

該代理續稱,恩浩國際中心鮮有全層樓面放租,資料顯示,現時大廈僅有兩個全層招租盤源,另一個為大廈超高層全層,面積同約11,430平方呎 (未核實),意向呎租約36元。資料顯示,恩浩國際中心對上一宗全層租賃個案為低層全層,面積約12,263平方呎 (未核實),去年初以呎租約23元租出。對比之下,今次物業位處大廈高層,叫價更具競爭力。該代理表示,是次招租物業氣派非凡,為核心商業區罕有全層甲廈供應,而且業主開價合理,預料物業洽詢情況會見踴躍。

(經濟日報)

更多恩浩國際中心寫字樓出租樓盤資訊請參閱:恩浩國際中心寫字樓出租

更多九龍灣區甲級寫字樓出租樓盤資訊請參閱:九龍灣區甲級寫字樓出租

宏利香港宣布將位於觀塘國際貿易中心正式改名為宏利廣場,由12月8日起生效,作為該寫字樓的旗艦租戶,宏利共租用四層,合共14.5萬平方呎辦公室樓面,將容納最多3400名宏理代理人。

此項租約於今年四月簽訂,是本港自2019年7月以來最大宗甲級寫字樓租務成交,亦是自2018年4月以來九龍東最大宗。

宏利指,新辦公室配合公司代理人數目每年雙位數增長的長遠願景,加快業務發展。宏利香港及澳門首席行政總監戴明鈞指,宏利致力在逐步通關後繼續滿足內地訪港旅客的需求,在港擁有超過1.1萬人代理團隊,在頂尖的辦公設施支援下,可更有效地提供優質服務,以配合公司持續擴展。

宏利廣場是宏利於九龍東的第四座甲級辦公大樓,以助公司實現在香港以至大灣區內的長遠業務增長的雄圖願景。全新裝修的四層寫字樓將初步容納2,400名代理人,而全面投入使用後可容納3,400名代理人。

(經濟日報)

更多宏利廣場寫字樓出租樓盤資訊請參閱:宏利廣場寫字樓出租

更多觀塘區甲級寫字樓出租樓盤資訊請參閱:觀塘區甲級寫字樓出租

教協1.6億 沽銅鑼灣舖位

銅鑼灣堅拿道西15號永德大廈地下8、9號舖連3個單位,總面積共約1萬平方呎,以約1.6億元易手,呎價約1.6萬元,略低於市價。資料顯示,原業主為教協 (香港教育專業人員協會),於1992至1993年期間購入該批物業,合共涉約2,298萬元,持貨近30年沽貨,升值約6倍。

教協近3個月,全數推售旗下物業,其中包括以3,860萬元,沽出新蒲崗大有街萬迪廣場9樓F、G、H舖,面積約4,534平方呎。教協於今年3月以約5,942萬元購入,持貨約8個月,帳面蝕讓2,082萬元,蝕幅約35%。另外,機構亦以1.75億元,沽出旺角好望角大廈8樓和9樓兩層,以及約5,500萬元,售出旺角中橋商業大廈7樓全層。連同是次出售銅鑼灣舖位,教協旗下4項物業已全數沽出,合共套現約4.3億元。

(經濟日報)

寶聲6480萬購獅子石道鋪 統一全幢舊樓業權

去年11月,市場出現歷來首宗強拍「流拍」個案,九龍城獅子石道一幢舊樓有兩個鋪位未被收購,發展商寶聲在獲得強拍令後,缺席強拍收樓。至今相隔一年,寶聲繼今年中,透過私人協商買入一個鋪位,最近再下一城,以6480萬購最後一間地鋪,成功統一全幢舊樓業權。兩個鋪位收購價更比較透過強拍,節省約1200萬。

上述鋪位為獅子石道73號地鋪連閣樓,寶聲於上月以6480購入,若然按照法庭批出強拍令,該舊樓拍賣底價2.23億,該地鋪所佔全幢舊樓約30.7%,發展商須支付73號地鋪業權約6850萬,最新收購價較強拍令價格,節省約360萬。

去年11月缺席強拍會

寶聲亦於今年年中,收購獅子石道75號地鋪,作價5800萬,較法庭批出的強拍令6700萬,節省約900萬,寶聲在獲得強拍令後,放棄強拍,採取自行協議收購,最終以合共1.28億收購最後兩個鋪位,節省約1200萬。

寶聲集團董事長陳耀璋接受本報查詢時表示,事件擾攘一年,本來計畫11月強拍收樓,最終現時才成功,拖延一年,雖然帳面節省逾千萬,不過,該地盤投資額逾3億,大部分舊樓亦已清拆等候重建,此一年間支付利息少說逾600萬,實際省下金額並不多。

陳耀璋:法庭高估地盤價值

他表示,當時,集團與鋪主各自聘請測量師為物業估價,最終法庭接受小業主一方意見,從而高估地盤價值,低估重建成本,發展商預期建築費1.3億至1.5億元,對方預期只有8000萬,同時認為未來售價每呎達2.4萬至2.6萬,集團認為不可能這麼高,因而缺席強拍。

他又強調,估價於2019年10月進行,其時已發生動亂事件,並非旺市。經過今次事件,日後更加密切跟估價師及律師溝通,務求準確。73及75號舊樓將合併獅子石道65至71號地盤,佔地共約8000方呎,估計可建樓面約7萬方呎,基座為小商場,樓上住宅150至200伙,大部分定價1000萬以內,主力興建「袖珍」單位,開放式為主,高層擁靚景,間隔一房或兩房戶,九龍城是名校區,可吸納家庭客。

私人協商連購兩地鋪

獅子石道73及75號舊樓,多年前由陳樹渠家族旗下寶聲收購,餘下兩間地鋪未接受收購,寶聲申強拍統一業權,獲得法庭批出強拍令,並於去年11月舉行拍賣會,惟發展商未出席,導致出現歷來首次「流拍」事件。

(星島日報)

長沙灣GCC3累售44單位

第一集團控股有限公司董事魏深儀表示,旗下長沙灣大南西街

1018 號工廈環球商貿廣場三期

(GCC3),至今累售44個單位及部份車位,銷售額逾10億,涉及樓面約8.7萬方呎,佔整個項目33%樓面。項目呎價介乎9500至13100元,預計於2022年第二季落成。

佔整個項目33%

該項目樓高 26 層,設有 3 層地庫停車場,2 樓至 29 樓為工作室樓層,共設 154個單位,單位面積由 1451 方呎至全層 10842方呎,另設特色單位,享獨立平台,項目所有單位以裝修標準交樓,方便買家收樓使用,預計於 2022 年第二季落成。由該廈步行兩分鐘即達荔枝角港鐵站。

該廈前身為廣隆泰大廈,為一幢9層高的工業大廈,地盤面積約14790方呎,總樓面約162,299方呎,由第一集團於2018年以12.5億購入,平均呎價約7670元,若以地積比率12倍計算,可重建樓面面積約18萬方呎,平均樓面成本呎價約7043元。

(星島日報)

外資代理行:明年甲廈租金料升5%

疫情走勢平穩,為甲廈市場釋出正面訊息,據本港一間外資代理行指出,料明年整體甲廈租金上升約5%,中環區升幅將高於大市,料該區升幅達一成。

中環區升幅跑贏大市

該代理行昨日發表市場報告指,隨本港疫情受控,住宅及工商鋪調整期已完結,料整體物業市場於明年將全面復甦,於甲廈市場方面,儘管空置率因新供應增加持續高企,惟該行預期明年整體甲廈租金有機會上升約5%,以各區劃分,以中環區最值得看俏,料該區租金升幅介乎5%至10%。