The

buyer, LC Vision Capital 1, is an offshore fund managed by Sino Suisse

Capital, a closely held money manager run by Albert Liu

It’s ‘a good deal’ for CK Asset as mainland buyers are shut from border restrictions, property consultancy says

Hong Kong’s richest tycoon Li Ka-shing is selling one of Asia’s priciest residential projects

in the city to a Singapore-based wealth manager, surprising the market

with one of the biggest deals amid a slump in the economy.

Li’s

flagship property company CK Asset Holdings agreed to sell its project

known as 21 Borrett Road at Mid-Levels for HK$20.8 billion (US$2.6

billion) to pocket a HK$6.3 billion profit, according to a stock

exchange filing late on Wednesday. The transaction is expected to be

completed by March 2025, it added.

The

buyer, LC Vision Capital 1, is an offshore fund founded by Sino Suisse

Capital, a closely held money manager run by Albert Liu, former head of

high net-worth client management for China at UBS Asset Management.

The

21 Borrett Road luxury project comprises 152 residential units, 242 car

parking spaces and 31 motorcycle parking spaces. CK Asset had earlier

contracted to sell four residential units and eight car-parking spaces

to third-party buyers.

The

transaction with Sino Suisse covers 148 unsold units, each with one

accompanying car-parking space, and an additional 86 car and 31

motorcycle parking spaces, according to the filing. The units were

priced at HK$62,000 per square foot, while the excess car and motor

parking spaces were pegged at HK$5 million and HK$300,000 each,

respectively.

“It

is a very good deal for CK Asset,” property consultant said. “Although

on the surface the average price tag is below what it sold previously at

the project, it is not an easy job to find one single buyer to take all

the remaining units at one go in this market, which is at the beginning

of a downside cycle.”

Hong

Kong’s real estate market has been hit hard in recent years by the

coronavirus pandemic in early 2020 and social unrest throughout 2019.

The ultra luxury market, which is mainly supported by mainland Chinese

buyers, has been in the doldrums under more than two years of border

shutdown and travel restrictions.

Luxury properties in Hong Kong depreciated faster than anywhere in the world in the first half of this year with a 3 per cent drop in capital value, according to another property consultancy.

The

consultant said that recent transactions of 21 Borrett Road apartments

fetched about HK$80,000 per square foot on average. That is still a far

cry from the record set by the project in February 2021, when a 3,378 sq

ft unit changed hands at HK$136,000 per square foot. The previous

record was held by flats 12C and 12D at Mount Nicholson in Hong Kong, also one of Asia’s priciest home addresses.

CK

Asset’s share price fell 6.7 per cent to HK$46.35 in Hong Kong trading

on Wednesday, as investors are worried about Li family’s business

exposure to the UK amid a slump of the British pound. The stock has weakened 13 per cent over the past six months, while the Hang Seng Index slumping 21 per cent.

“Even

if the borders reopen, we are not sure whether the mainlanders’ money

will flow back into Hong Kong’s luxury housing market,” the consultant

said. “So at this moment, it is definitely a right decision to seal a

deal, when you can find a buyer to pay a reasonable price.”

(South China Morning Post)

Hong Kong home prices fell in August to lowest since February 2019, unlikely to be boosted by ‘0+3’ quarantine relaxation

Prices of homes in Hong Kong fell by 2.26 per cent in August, their largest monthly decline since November 2018

Official property price index for the whole year will fall by around 8 per cent, property consultant says

The prices of homes in Hong Kong

fell by 2.26 per cent in August to their lowest level in

three-and-a-half years, and are unlikely to get much support from the

city’s reduced Covid-19 hotel quarantine requirements.

An

index measuring overall home prices slumped to 368.2 in August from

376.7 in July, according to official data released on Wednesday by the

Rating and Valuation Department. Prices for flats of at least 752 sq ft

fell 2.3 per cent in August, while prices for flats smaller than that

decreased by 0.83 per cent. The August reading is the lowest since

February 2019, when it settled at 367, government data shows.

It is also the largest sequential monthly decline since November 2018, a property consultant said.

“It

is expected that the official index will continue to find the bottom in

September,” the consultant said. “As the HKMA [Hong Kong Monetary

Authority] relaxes the threshold for stress testing, property prices are

expected to bottom out in the fourth quarter, and the official property

price index for the whole year will fall by around 8 per cent.”

Home

prices have so far this year retreated by 6.5 per cent, and reflect the

impact of higher interest rates and the lingering effects of Hong

Kong’s coronavirus restrictions.

The HKMA has raised its base interest rate

five times this year to 3.5 per cent, a 14-year high, in lockstep with

hawkish US Federal Reserve rate increases. Commercial banks such as HSBC

and Bank of China (Hong Kong) raised their prime rates last week to a

four-year high, making it costlier to fund big-ticket purchases such as

housing.

The government has also scrapped hotel quarantine for international arrivals.

“The

epidemic has begun to ease, and the entry quarantine has become ‘0+3’,

which brings some good news for overall market sentiment. But purchasing

power is still insufficient in the short term, and overall transaction volumes

remain at a low level and are expected to fall by about 30 per cent

year on year to 50,000 to 53, 000 transactions,” the consultant said.

The

higher interest rates are also likely to make new properties buyers’

preferred investment choice, as prices of new homes will compete with

the secondary market, further weighing on second-hand property in the

coming months, the consultant added.

The

HKMA on Friday also asked banks to lower the threshold for

interest-rate stress testing for mortgage lending, relaxing the rule for

new borrowers.

Meanwhile, overall home rents

increased slightly in August, rising by 0.73 per cent from July, which

could also provide cushion to landlords. It was the third consecutive

month of increases in rents.

“Home

prices are sensitive to interest-rate increases, especially when the

upswing is too fast,” a surveyor said. The continuing rebound in home

rents could help improve property yields despite rising mortgage payment

costs and interest costs, the surveyor added.

(South China Morning Post)

Hong Kong home prices drop 2.3pc in August to lowest in 3.5 years

Hong

Kong private home prices fell 2.256 percent in August from a month

earlier to the lowest since February 2019, official data showed on

Wednesday, as market sentiment was hurt by rising interest rates.

The

drop in home prices in one of the world's most unaffordable housing

markets last month followed a revised 1.44 percent decline in July.

Home

prices in the financial hub have fallen 6.5 percent in the first eight

months of this year. The property price index was at 368.2 in August,

slipping from an all-time peak of 398.1 in September last year.

Rising

mortgage costs and a bleak economic outlook have deepened pessimism

among homeowners, while home prices for the full year are expected to

drop around 10 percent, the first fall since 2008.

Hong

Kong banks raised their best lending rate by 12.5 basis points last

week, the first-rate hike in four years, following the U.S. Federal

Reserve's third straight rate increase of 75 basis points.

JP

Morgan head of Asia property research, Cusson Leung, said the

smaller-than-expected rate hike was a positive but the property market

would likely continue to soften in 2023 due to a weak global economy.

However, he expected the decline to be moderate.

"In

order for sentiment to turn around, we'd need the help of a better

economy and a better stock market," Leung said, adding that a reopening

of the border with mainland China would also boost demand.

Hong

Kong financial chief Paul Chan said last week he did not see a sharp

risk to the city's real estate market nor a need to adjust property

control measures.

Hong

Kong's de facto central bank last week relaxed a mortgage stress test

requirement following the best lending rate hike, helping property

buyers to borrow more from banks.

(The Standard)

Home prices feel bite of rising rates

Home

prices fell 2.26 percent last month from July to the lowest since

February 2019, data showed yesterday, as sentiment was hit by rising

interest rates.

But

rents rose for two consecutive months at 0.7 percent amid reservations

about buying at this time and some mainland students renting homes.

Home prices fell 6.5 percent in the first eight months, Rating and Valuation Department data shows.

The property price index was at 368.2, slipping 7.5 percent from an all-time peak of 398.1 last September.

Prices

for small and medium-sized flats fell 2.3 percent month on month, while

homes above 1,076 square feet also slipped by 0.8 percent. They

declined by 7.4 and 6.2 percent last month from a year ago.

Rising

mortgage costs and a bleak economic outlook have deepened pessimism

among owners, while home prices are expected to drop around 10 percent

for the year, the first fall since 2008.

Banks

raised prime rates by 12.5 basis points last week, the first rate hike

in four years, following the third US consecutive rate increase of 75

basis points.

JP Morgan

Asia property research head Cusson Leung Kai-tong said the

smaller-than-expected rate hike was a positive but the market would

likely continue to soften in 2023 due to a weak global economy.

The

news came as Hongkong and Shanghai Banking Corp launched a new mortgage

plan with a fixed rate of 2.75 percent for the first two years.

The

rate is even lower than that of its other mortgage plans of 2.875

percent and will be calculated based on the Hong Kong interbank offered

rate with a cap after two years.

(The Standard)

長實208億 沽半山波老道超豪宅

成港歷來最大額住宅成交 料帶來63億元收益

長實 (01113) 大手沽港資產,以207.66億元,售出半山西部21 BORRETT ROAD項目,予新加坡華瑞資本,為香港歷來最大額住宅單一成交,呎價6.2萬元,較樓盤已售單位平均低出3成,預計可為長實帶來約63億元的收益。

長實位於半山西部的波老道21號超級豪宅21 BORRETT ROAD,分兩期發展,共提供181伙,於2021年初推售第1期項目,至今累售33伙,最高呎價曾達13.6萬元,一度成為「亞洲樓王」。

長實昨日突然宣布,將項目1期餘下單位,連同第2期合共152個住宅單位 (包括4伙已售出而未完成交易)、242個住宅車位及31個電單車車位,一併出售予新加坡資產管理公司華瑞資本 (Sino Suisse) 旗下LC Vision Capital,總金額約207.66億元,屬於2017年11月長實以402億元沽出中環中心後、最大手沽貨。

通告指出,今次涉及單位的總實用面積32.78萬平方呎,以每個住宅單位附帶1個車位計算,平均呎價6.2萬元,較樓盤現時售出的33伙平均實用呎價8.7萬元,低出3成。而每個住宅車位估值則約500萬元、每個電單車位約30萬元。

長實昨收報46.35元 跌6.6%

長和集團 (00001) 昨收報43.45元,跌1.8元或3.978%;而長實昨收報46.35元,跌3.3元或6.647%。

是次買家新加坡基金華瑞資本 (Sino Suisse),於2017年成立,創辦人為劉中興,並於當年同時取得新加坡金融管理局所頒發執照。至於劉中興在創立華瑞之前,擔任瑞銀集團新加坡分公司董事總經理暨全球超高淨值中國國家團隊負責人。

華瑞資本過往在港未有投資物業。據該公司網頁顯示,華瑞資本為家族辦公室與超高淨值資產人士提供資產規劃、財富管理等。公司曾預計,華瑞資本的資產管理規模未來3年內將達到70億美元,5年內將超過100億美元。而華瑞曾經在2020年,10月以8.1億元,購入軟件公司亞信科技 (01675) 6.8%股權。

長實已收買家20.8億訂金

消息人士指,是次交易對買賣雙方均屬公平有利,並締造雙贏局面。對於長實而言,物業發展與銷售一向是集團核心業務,日常以「貨如輪轉」策略營運,今次向單一買家全數出售波老道尚待推出之單位,能有效率地鎖定可觀利潤。對買家而言,以「大手優惠價」購入香港頂級豪宅,具高投資值博率。

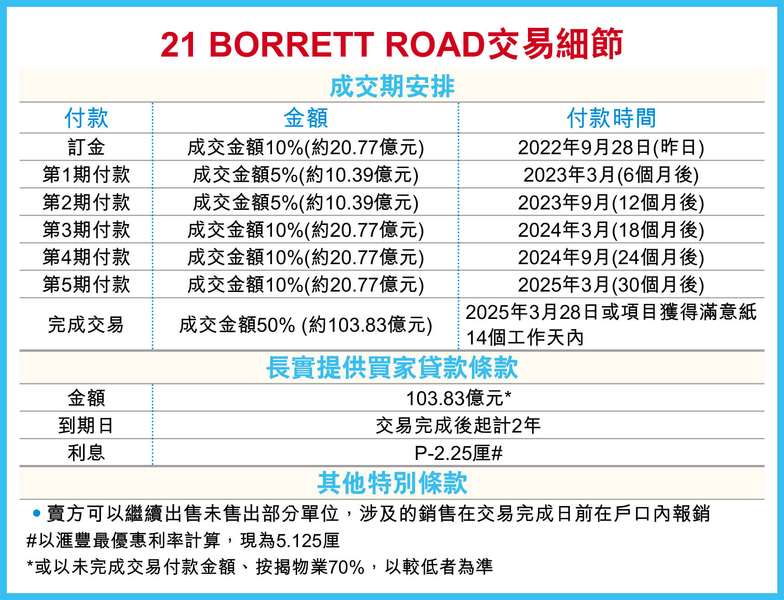

是次長實巨額「大刁」成交條款複雜,以成交安排為例,買家繳交了樓價10%,即約20.8億元訂金,其後佔成交價40%的餘款將分5期,按每6個月付款一次,餘下50%的約103.83億元餘額,須在2025年3月28日,或項目取得滿意紙後14個工作天清繳,成交期長達兩年半。

除了有長成交期之外,今次長實將在2025年成交完成交易時,為買家提供貸款,最多涉及103.8億元或以物業估值7成按揭,貸款在成交期後2年到期,每個月須還款並支付P-2.25厘 (滙豐最優惠利率,現為5.125厘) 的利息。

(經濟日報)

更多中環中心寫字樓出售樓盤資訊請參閱:中環中心寫字樓出售

更多中環區甲級寫字樓出售樓盤資訊請參閱:中環區甲級寫字樓出售

高位賣樓套現 看淡短期樓市?

本地「大孖沙」長實 (01113) 突然以逾200億元,沽出西半山21 BORRETT ROAD。業內人士認為,不排除有個別發展商看淡短期本港樓市發展,故先行加快套現;同時,近期英鎊滙率下瀉,或令於該地有較多投資項目的發展商,需要資金運行。

業界:中環中心有前科 聰明之舉

有市場人士認為,此成交與數年前長實賣出中環中心的舉動類似,形容此屬「聰明之舉」。據估計,是次發展商賣出該住宅套現,或因他們認為有其他資產更值得投資,亦某程度上是看淡本港樓市發展。不過,市場人士認為,本地其他發展商未必會出售旗下住宅項目予外資基金,因為這並非其餘發展商的作風。

有代理指,鑑於中港兩地遲遲未通關,美國接連加息,而且中美關係依然緊張,未來1至2年的經濟環境料持續低迷,因此這類豪宅項目散貨有難度。而該代理亦認為,是次的成交價在「今時今日屬於合理價位」,故比起推售該項目,長實是次賣出項目予基金,可讓資金回籠速度更快,亦反映發展商並不看好本地樓市表現。

學者:成交價頗高 基金看好樓市

中大經濟系副教授莊太量亦認為,長實是在高位套現,亦反映發展商短期內看淡本地後市發展,但另一角度而言,是次的成交價頗高,可見接貨的外資基金看好本港樓市。同時,由於長實在英國有多個投資項目,可謂「落重注」,加上近期英鎊滙率持續下跌,不排除英國的項目需要更多資金運行。

資深投資者林一鳴直言,目前的成交價較市價低約1成半左右,相信長實想更快套現資金,並看淡後市發展才會沽貨,又預計在1年後回望,現時成交價會是「靚價」。雖然對於外資基金接獲感到驚訝,但相信外資看好本地樓市發展,才會選擇接貨。

(經濟日報)

更多中環中心寫字樓出售樓盤資訊請參閱:中環中心寫字樓出售

更多中環區甲級寫字樓出售樓盤資訊請參閱:中環區甲級寫字樓出售

長和系海外資產 近期亦頻沽售

除了沽售香港豪宅新盤外,長實 (01113) 及同系長和 (00001) 近期亦密密沽售資產,前者曾經在年初124億元沽倫敦商廈,後者則先減持英國水廠、電訊發射塔資產高達400億元資產。

長實今年3月宣布以12.1億元英鎊,以當時滙價相等於123.9億港元,售出「5 Broadgate」的商業辦公單位連車位,相較其在2018年6月的購入價102.5億港元 (10億英鎊),投資3年半,連租金收入等大賺48億港元。

港售樓 今年沽飛揚暫套12億

至於長和方面,更成功獲英國競爭及市場管理局批准,以37億歐元、以當時滙價約324億港元的現金及股份予西班牙電訊商,亦在早前減持英國食水及污水處理廠25%予基金KKR,套現80億元。

與此同時,早前亦曾經傳出長實、長建 (01038) 和電能 (00006) 共同持有的英國電網項目UK Power Network,獲基金出價高達1,500億元洽購,惟最終未有售出。

香港方面,長實今年推售的新盤不多,除了銷售南區淺水灣道90號、沙田名日 ‧ 九肚山餘貨單位外,全新盤暫時只有跟新地 (00016) 合作的屯門飛揚,目前推出第1期售出逾210伙,套現逾12億元。

(經濟日報)

長實旗下中環和記大廈,於2019年拆卸重建,即將落成地標甲廈長江集團中心二期,提供55萬呎樓面,戶戶擁海景。

長江集團中心二期樓高41層,總建築面積達55萬方呎,標準樓層建築面積約17300方呎,採用無中柱式設計;該廈其中建築特色是所有樓層,均選用寬度約2.7米的玻璃幕牆配以側核心筒設計,任何面積單位,均坐擁維港景。

全層可提供四個單位

該廈考慮不同企業不同需求,提供多樣化面積及間隔方案,標準樓層可提供四個獨立單位,大廈並設置空中花園,因應近年疫情,增設免觸式智能系統及持續空氣淨化等設施。大廈採取雙電梯大堂設計,分為東西兩座。除全層租戶外,每層東、西座的租戶,分別可擁有企業專屬樓層地址、專屬私人電梯大堂及獨立出入口,甫步出電梯,即可直達公司接待大堂。

前身為和記大廈

該廈辦公室內均設洗手間,毋須與其他租戶共用,該廈擁有雙上落客區設計,方便租戶進出夏愨道和琳寶徑,並提供185個車位。

長江集團中心二期前身為和記大廈,該廈於70年代,曾作為港交所辦事處、獲多利證券公司、地鐵公司臨時總部等,曾是區內名廈。

(星島日報)

更多長江集團中心二期寫字樓出租樓盤資訊請參閱:長江集團中心二期寫字樓出租

更多中環區甲級寫字樓出租樓盤資訊請參閱:中環區甲級寫字樓出租

北海中心呎價10250元低15%沽 灣仔指標乙廈造價重返7年前

灣仔指標乙廈北海中心,向來炙手可熱,疫市下卻錄一宗蝕讓買賣,其中一個優質單位,以每呎10250元易手,低市價15%,原業主持貨7年虧損6%;最新造價亦重返七年前。

市場消息透露,北海中心中高層F室,建築面積約1477方呎,以每呎約10250元易手,涉資1513.9萬,該單位位處大廈單邊,屬優質單位,原業主於2015年5月購入,作價1607萬,一直自用至今沽貨,持貨7年,帳面虧損93.1萬,幅度為6%。該單位市值呎租約30元,新買家料回報3.5厘。市場人士指出,七年前,該廈單位普遍呎價為1萬餘元水平,造價重返七年前。

持貨7年蝕讓6%

對上一宗同類型成交為去年4月,該廈26樓F室 (上述單位樓上),建築面積1477方呎,以股權方式轉讓,呎價約1.25萬,涉資約1846萬,若以此比較,最新成交價低18%。

北海中心是區內指標商廈,受用家及投資者追捧,上述26樓F室由正八集團主席廖偉麟沽貨,年前作短綫買賣。廖偉麟於2020年12月趁疫市「低撈」,購入北海中心26樓A、B及F室,建築面積共約3937呎,作價約3680萬,平均呎價9350元,當時該單位呎價之低,亦令市場嘩然。

較2018年高位跌約30%

然後,去月3月,他率先沽出26樓A室及B室,面積2460方呎,套現3148萬,平均呎價約1.28萬;接着4月,再沽售26樓F室。他共套現4994萬,持貨3個月帳面獲利1314萬,物業升值逾35%。

於2018年間商廈高峰期,北海中心高層F室,曾以2158萬成交,創下每呎約14611元新高紀錄,最新售價較高位跌約30%;不過,比較起中環中心、力寶中心及美國銀行中心,普遍跌幅高逾40%至50%,該廈售價相對平穩。

北角城中心呎價9500元放售

有代理表示,北角炮台山英皇道250號北角城中心高層,面積約3260方呎,意向價約3100萬,平均呎價約9509元。陳氏補充,該單位間隔實用,大玻璃面向英皇道,屬於優質單位,可即買即用或出租。

(星島日報)

更多中環中心寫字樓出售樓盤資訊請參閱:中環中心寫字樓出售

更多中環區甲級寫字樓出售樓盤資訊請參閱:中環區甲級寫字樓出售

更多力寶中心寫字樓出售樓盤資訊請參閱:力寶中心寫字樓出售

更多美國銀行中心寫字樓出售樓盤資訊請參閱:美國銀行中心寫字樓出售

更多金鐘區甲級寫字樓出售樓盤資訊請參閱:金鐘區甲級寫字樓出售

更多北角城中心寫字樓出售樓盤資訊請參閱:北角城中心寫字樓出售

更多北角區甲級寫字樓出售樓盤資訊請參閱:北角區甲級寫字樓出售

金利豐 (01031) 行政總裁朱李月華私人持有的中環商廈金利豐中心,原本於去年中把全幢大部分樓面租予一家新成立的醫療集團,並簽約10年,惟近日業主突把1至26樓推出市場放租,意向呎租60至130元,意味該醫療集團提早退租。

租期十載 僅用逾年

市場人士透露,位於皇后大道中35號的金利豐中心近日除地下外,所有樓面均推出市場放租。當中,1至3樓及5樓可作寫字樓、零售或餐飲用途,建築面積約1958至3125方呎,意向呎租60至130元,月租約15.9萬至25.5萬元。至於7樓至26樓則為寫字樓用途,每層建築面積約1982方呎,低層意向呎租75元起,而高層單位呎租叫價為90元,每層單位涉及月租約14.9萬至17.8萬元。據悉,業主可接受大手洽租或只承租一層的租戶。

資料顯示,金利豐中心原為舊式商廈,朱李月華於2014年7月斥逾16億元購入,其後重建成新商廈。項目在2020年落成,地舖出租予先施錶行 (00444) 旗下FRANCK MULLER作旗鑑店,而樓上單位在去年中租予新創辦的嘉仁專科醫療集團,租約長達10年,令該廈成為醫療中心。該醫療中心今年完成裝修,已曾使用部分樓層。

不過,嘉仁專科醫療集團僅租用逾1年,該批樓面便推出市場放租,部分樓層連現狀醫療中心裝修出租,意味原租戶有意提早離場。

而目前同區位於心臟地帶的「醫生大廈」如皇后大道中38至48號萬年大廈及皇后大道中68號卡佛大廈等,近期成交呎租約60至70元。

尖咀商廈呎租失守30元關

另外,商廈租金持續尋底,尖沙咀力寶太陽廣場低層10室,建築面積約1409方呎,由順豐速運以每月約4.09萬元租用,呎租跌穿30元大關,僅約29元,呎租重返該廈2012年的10年前水平。資料顯示,上述單位於2018年時曾以每月5.5萬元租出,呎租約39元,即最新租金較2018年下跌25.6%。

(信報)

更多金利豐中心寫字樓出租樓盤資訊請參閱:金利豐中心寫字樓出租

更多卡佛大廈寫字樓出租樓盤資訊請參閱:卡佛大廈寫字樓出租

更多萬年大廈寫字樓出租樓盤資訊請參閱:萬年大廈寫字樓出租

更多中環區甲級寫字樓出租樓盤資訊請參閱:中環區甲級寫字樓出租

更多力寶太陽廣場寫字樓出租樓盤資訊請參閱:力寶太陽廣場寫字樓出租

更多尖沙咀區甲級寫字樓出租樓盤資訊請參閱:尖沙咀區甲級寫字樓出租