CIFI (0884) switched its plan to sell its property

at No 101 and 111 King's Road to Wang On Properties (1243) and APG

Strategic Real Estate Pool for HK$1.34 billion instead of three of its

major shareholders.

The deal could bring a gain of HK$21.8 million to

CIFI. The net proceeds from the disposal amounted to HK$681 million

after estimated expenses, and will be used as general working capital.

The Chinese developer bought the previous Sing Pao

Building and its parking lot for HK$1.88 billion in 2018. The building

is under demolition and will be redeveloped into a residential project

with commercial space, which is expected to be completed in 2026.

It planned to sell 60 percent equity of the

property to its major shareholders but later sold all the interests to

Wang On Properties and APG Strategic Real Estate Pool.

Meanwhile, CIFI's contracted sales dropped 6.46

percent monthly to 15.06 billion yuan (HK$16.99 billion) in August,

while the sold gross floor area slid 11 percent to 1.01 million square

meters from a month ago.

In other news, a state-owned company in the

northeast city of Shenyang is reportedly set to take over the remaining

7.56 billion yuan worth of shares of Shengjing Bank (2066) held by China

Evergrande (3333).

And another developer, China Overseas (0688), has

obtained a 100 million pound (HK$903.49 million) sustainable loan for

five years, arranged by BOC Hong Kong (2388).

(The Standard)

3,341 flats await presale consent

Thousands of new homes are expected to enter the

Hong Kong market shortly, with six projects 3,341 flats applying for

presale consent in August, and the number of private flat completions

rising by a quarter month-on-month in July.

Among the new applicants, Henderson Land

Development's (0012) phase 2 and 3 of One Innovale in Fan Ling will

offer 408 and 565 flats respectively, data from the Lands Department

showed.

The department also approved three projects involving 2,305 flats in August, up by 42.3 percent from the previous month.

Newly approved projects include phase 2 of a

residential project at 15 Shing Fung Road in Kai Tak, co-developed by K

Wah International (0173), Wheelock Properties and China Overseas Land

& Investment (0688) and providing 1,221 flats.

Meanwhile, 1,131 private homes were completed in

July in the city, up by 25.4 percent from the previous month, the Rating

and Valuation Department said.

The total number of private homes completed in the

first seven months was 13,195, accounting for 57.7 percent of the

government's estimate of 22,851 homes.

In urban renewal projects, the Urban Renewal

Authority has invited developers to submit bids for Wing Kwong Street

and Sung On Street Development project in To Kwa Wan, which had

attracted 31 expressions of interest.

In the commercial market, New World Development (0017) has applied to rebuild the former industrial building now known as Koho in Kwun Tong into a 288,000-square-foot commercial building, increasing the plot ratio by 20 percent

And Sino Land (0083) has put up for sale three commercial floors in Kowloon Bay for HK$1.5 billion.

In the primary market, Miami Quay I

in Kai Tak has received 1,000 checks for 195 flats on the first two

price lists as of Monday, making them more than four times

oversubscribed.

Wetland Seasons Bay

in Tin Shui Wai , meanwhile, is expected to upload the sales brochure

and unveil the first price list within this week, the developer Sun Hung

Kai Properties (0016) said.

In other news, an application has been submitted

for a compulsory sale of Bonny View House, an old residential building

in Happy Valley with an estimated value of HK$522 million.

(The Standard)

For more information of Office for Lease at KOHO please visit: Office for Lease at KOHO

For more information of Grade A Office for Lease in Kwun Tong please visit: Grade A Office for Lease in Kwun Tong

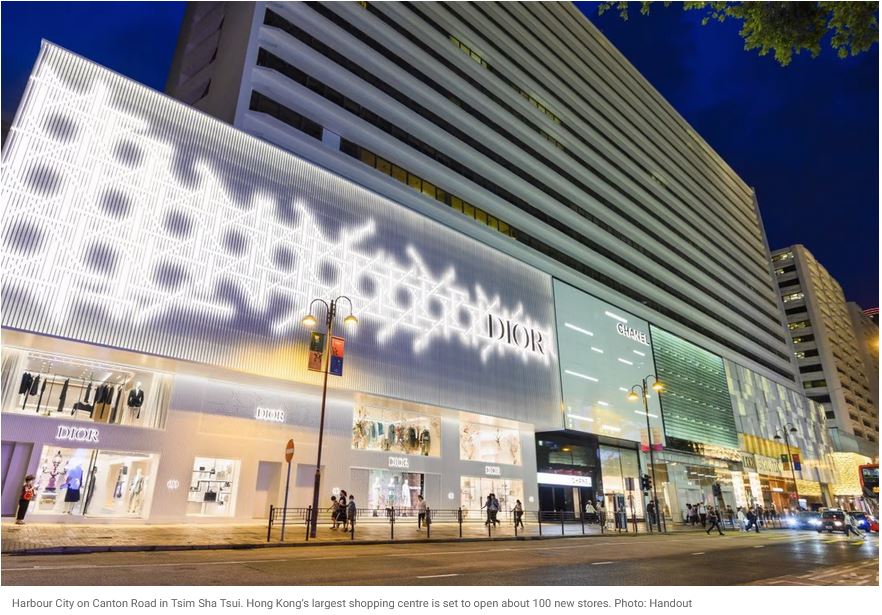

Li-Ning, Dior among luxury brands flocking to Canton Road in ‘iconic’ Tsim Sha Tsui with eye on Hong Kong’s borders reopening

Tsim

Sha Tsui is an iconic business district, says Li-Ning, which is paying

HK$2 million a month for a new 7,000 sq ft flagship store on Canton Road

Tsim Sha Tsui ‘a great location for brands to make a statement to the market’: property consultant

Tsim

Sha Tsui’s Canton Road – once buzzing with tourists – has over the past

two years become largely deserted, as the border between Hong Kong and

mainland China remained closed to stem the spread of the coronavirus

pandemic.

In

recent months, however, this retail haven has been showing signs of

recovery, with Chinese and western brands choosing the district for

flagship stores or the expansion of their current foot print despite the

continued absence of tourists.

There

are several likely reasons for this: landlords have become more

flexible with lease terms; retailers are anticipating the reopening of Hong Kong’s border; and brands are tapping the local population, which is willing to spend more on luxury items given that the city’s current quarantine requirements discourage them from travel.

Li-Ning,

China’s biggest sportswear maker, for instance, is leasing a 7,000 sq

ft shop on Canton Road for HK$2 million (US$254,827) a month, 70 per

cent lower than the previous tenant’s lease, according to local media.

The store in Silvercord, 30 Canton Road, will be Li-Ning’s first flagship store in Hong Kong and is expected to open this year.

“Tsim Sha Tsui is an

iconic business district in Hong Kong,” a Li-Ning spokesman said on

Tuesday. The Li-Ning Hong Kong Canton Road flagship will allow local

consumers to “fully experience Li-Ning’s professionalism in sports

products and services, and better understand our brand philosophy of

‘anything is possible’,” he added.

In 2018, before

anti-government protests engulfed the city and triggered a decline in

the number of tourists visiting Hong Kong, and before the coronavirus

pandemic upended tourism, mainland Chinese visitors spent HK$7,029 each

per trip. They made up more than three quarters of Hong Kong’s visitors

that year and were considered the lifeblood of the retail industry.

Tourism has contributed an estimated 32 per cent of the city’s services

output in recent years, up from 21 per cent in 2003.

“Brands

choose Tsim Sha Tsui for expansion mainly because the market is

anticipating the reopening of borders in the near future,” a property

agent said. “This is also a great location for brands to make a

statement to the market.”

When

the border with China reopens, Tsim Sha Tsui – only about a

seven-minute taxi ride away from West Kowloon station, the sole station

in Hong Kong for the Guangzhou-Shenzhen-Hong Kong Express Rail Link –

might be a likely first stop for mainland Chinese tourists.

While

all of Hong Kong’s popular retail districts have seen a decline in

rents, the Tsim Sha Tsui area is arguably the worst affected by the

absence of tourists.

Since 2019, when the

Covid-19 pandemic broke out, rents in the district have declined by 40

per cent, according to the property consultancy. According to another

property consultancy, prime street shop rents in Tsim Sha Tsui fell 32

per cent in 2019, 25 per cent in 2020 and 6.1 per cent last year. As of

the second quarter of this year, shop rents were flat.

But things might be looking up for Tsim Sha Tsui.

Harbour

City, which is Hong Kong’s largest shopping centre and is located on

Canton Road, is set to open about 100 new stores, including those of

European luxury brands, by the end of the year. So far, it has opened

more than 70 stores including Hong Kong’s largest Dior shop with nearly

10,000 sq ft across two floors of the mall. A Miu Miu speciality store

also launched on Canton Road this year.

Another

newcomer is Casa Loewe’s only store in Hong Kong, which spans 5,000 sq

ft across two floors. Other brands such as Patek Philippe, Breitling, A.

Lange & Sohne, Lanvin, Parisine and Malin+Goetz have also opened

stores in the shopping centre this year.

“Harbour

City has consistently strengthened its tenancy mix with world-famous

brands, which have brought growth in footfall and car park utilisation,”

said a spokesman for the mall. “As a result, in January to August,

Harbour City’s footfall and car park utilisation on weekends and

holidays increased by over 10 per cent compared to last year.”

Swiss

and French luxury jewellers Piaget and Van Cleef & Arpels will also

open stores at Harbour City later this year and the next, respectively.

Meanwhile, Hong Kong

retail sales rose 4.1 per cent in July to HK$28.3 billion, provisional

figures from the government show. In June, the sales of jewellery,

watches, clocks and valuable gifts – considered the luxury category –

rose 2.3 per cent from a year ago, according to the Census and

Statistics Department.

(South China Morning Post)

For more information of Office for Lease at Silvercord please visit: Office for Lease at Silvercord

For more information of Grade A Office for Lease in Tsim Sha Tsui please visit: Grade A Office for Lease in Tsim Sha Tsui

信和持有的九龍灣國際交易中心頂層3相連全層樓層放售,意向價近15億。有代理表示,國際交易中心29至31樓,每層面積約27457方呎,合共約82371方呎,以意向呎價約1.8萬計算,每層意向價約4.94億,總金額約14.82億。

意向呎價1.8萬

該代理指,物業位處頂層,享城市及啟德郵輪碼頭景,曾獲知名體育品牌承租,不過,現時以每呎約33元招租。國際交易中心坐落宏照道和宏泰道交界,採用玻璃外牆設計,鄰近企業廣場、富臨中心等甲廈,交通完善,可步行至港鐵九龍灣站,黃氏分析,內地早前放寬入境隔離政策,由「14+7」縮減為「7+3」,與內地商務往來活動將復甦。

(星島日報)

更多國際交易中心寫字樓出售樓盤資訊請參閱:國際交易中心寫字樓出售

更多企業廣場寫字樓出售樓盤資訊請參閱:企業廣場寫字樓出售

更多富臨中心寫字樓出售樓盤資訊請參閱:富臨中心寫字樓出售

更多九龍灣區甲級寫字樓出售樓盤資訊請參閱:九龍灣區甲級寫字樓出售

新世界觀塘 KOHO 申重建商廈

新世界持有的觀塘 KOHO,新近向城規會申請放寬20%地積比重建。

據文件顯示,項目位於觀塘鴻圖道73至75號,目前屬「其他指定用途」註明「商貿」,申請略為放寬地積比率限制,以作准許辦公室、商店及服務行業和食肆用途。

申放寬20%地積比

該廈佔地面積約20000方呎,地積比由12倍略為放寬至14.4倍,即增加2.4倍或20%,以重建一幢樓高29層商廈,涉可建總樓面約288002方呎。

申請人指,擬議發展符合「其他指定用途」,註明「商貿」地帶規劃意向,將提供額外商業樓面面積,以回應起動九龍東。

(星島日報)

更多KOHO寫字樓出租樓盤資訊請參閱:KOHO 寫字樓出租

更多觀塘區甲級寫字樓出租樓盤資訊請參閱:觀塘區甲級寫字樓出租

DUTYZERO「衝出」東涌租核心區鋪 進駐中環銅鑼灣 租金大減50%至68%

零售商趁疫市插旗設據點,專賣酒類及食品的DUTY ZERO「衝出」東涌,進駐中環銅鑼灣,一口氣承租兩個地鋪,中環新顯利大廈地鋪月租25萬,平均每呎156元,較舊租金跌約50%,銅鑼灣羅素街金朝陽中心地鋪,月租約35萬,每呎476元,租金更大跌約68%。

DUTYZERO目前2家店鋪均位於東涌,分別為赤鱲角機場及東薈城,主力做遊客生意,近日,趁疫市下突破框框,衝出東涌,於黃金地段連環租鋪,其中,中環德輔道中8A至8C號新顯利大廈地鋪,建築面積約1600方呎,以每月25萬租出,平均呎租156元,消息人士透露,DUTYZERO更一簽三年約,而且當到達一定生意額,將會與業主分成。

新顯利大廈呎租156元鎖三年約

新顯利大廈鄰近置地廣場,位處中環核心商業區,該鋪位舊租客為服裝店,月租逾50萬,最新租金大減50%。

羅素街鋪呎租476元跌68%

除了中環外,DUTY ZERO更吼準曾以貴租聞名世界的羅素街,承租38號金朝陽中心D號鋪,建築面積735方呎,月租約35萬, 平均呎租476元,該鋪位對上長租為愛彼表 (Audemars Piguet),今年初撤出,當時月租約110萬,最新租金大跌約68%。

李寧200萬租新港中心鋪

有代理表示,疫市下飲食主導鋪市,金朝陽中心原由英國名牌BURBERRY租用的複式鋪,早前亦由「變形金剛」為主題的餐廳進駐。

內地體育服裝品牌李寧,以每月約200萬元,承租尖沙嘴廣東道新港中心約7700方呎複式鋪,開設首家香港旗艦店,舊租客周生生,高峰期月租曾高達700萬,新租金跌70%。

內房基金凱龍瑞發展的灣仔軒尼詩道333號全新商大厦,最新沽售地鋪,1227方呎,以約5800萬易手。旺角廣東道1054號地下連入則閣,建築面積約1000方呎,租客合益肉食,成交價約2230萬,原業主於1968年5月以10萬買入,持貨54年升222倍。

(星島日報)

更多新顯利大廈寫字樓出租樓盤資訊請參閱:新顯利大廈寫字樓出租

更多置地廣場寫字樓出租樓盤資訊請參閱:置地廣場寫字樓出租

更多中環區甲級寫字樓出租樓盤資訊請參閱:中環區甲級寫字樓出租

更多金朝陽中心寫字樓出租樓盤資訊請參閱:金朝陽中心寫字樓出租

更多銅鑼灣區甲級寫字樓出租樓盤資訊請參閱:銅鑼灣區甲級寫字樓出租

更多新港中心寫字樓出租樓盤資訊請參閱:新港中心寫字樓出租

更多尖沙咀區甲級寫字樓出租樓盤資訊請參閱:尖沙咀區甲級寫字樓出租

旭輝13.38億沽北角項目 宏安與匯集基金聯手承接

內地發展商旭輝控股集團,旗下與宏安合營的旭輝地產,出售北角英皇道商業項目,作價13.38億,買家為宏安及匯集基金,各佔50%權益。

旭輝公布,旗下與宏安地產合營、持股60%的非全資附屬公司旭輝地產202006有限公司,出售炮台山英皇道項目全部權益予宏安地產等公司,總代價為13.37735億。旭輝早前曾宣布,以6.74億出售項目60%權益予大股東林中、林偉及林峰,有關交易已取消。

新買家各佔50%權益

今番交易連兩家公司,近11.3億未償還金額,母公司旭輝為賣方擔保人。買方為華王有限公司,由宏安地產及APG

SPV各擁50%權益。APG SPV為APG Strategic Real Estate Pool (匯集基金)

於荷蘭成立的存託機構,由荷蘭退休基金為集體投資而成立。

公布指出,該宗交易所得款項淨額約6.81億,用作營運資金,並估計可錄收益約2180萬。

取消早前交易安排

該項目英皇道101號及111號,佔地面積約12695方呎,前身商廈,曾由新目標集團以約18.8億收購,目前拆卸中,計畫重建住宅項目,料2026年完成。今年6月底估值20億。

該交易原以6.74億在8月10日售予與集團股東林中、林偉及林峰。董事會認為,是次新交易與原出售事項類似,新出售事項收取現金較原出售事項多約800萬元,同時估計多約1192.5萬,預計9月底前落實。

(星島日報)

市建土瓜灣項目突擊招標 「一口價」定勝負 賣樓逾60億按比例分紅

市建局馬不停蹄推出發展項目,除觀塘市中心第4和第5發展區「巨無霸」商業項目今日截收意向之外,該局昨日突然推出土瓜灣第四個以「小區模式」發展的榮光街/崇安街發展項目招標。消息透露,發展商需自行提出「一口價」,以價高者得決勝負,日後售樓收益達60億以上須按比例分紅,最高達五成。該項目市場估值綜合約30.6億至36.2億,每呎樓面地價約1.1萬至1.3萬。

市建局於土瓜灣第四個以「小區模式」發展的榮光街 /

崇安街發展項目,挾市區及鐵路沿綫優勢,昨日正式招標,招標條款隨即曝光。市場消息透露,項目售樓收益達60億後,中標財團須與市建局分紅,達標後首1億須分紅兩成,其後分紅比例以每1億為一組遞增,當收入達63億以上,分紅劃一為50%,若以項目總樓面約27.86萬方呎計,相當於每方呎售價逾2.15萬便需要分紅,而且發展商須向市建局自行提出「一口價」建議,將成為勝負的關鍵。

售樓逾63億須分紅50%

至於商場部分,市建局及中標財團共同持有,租金收益由中標財團及市建局以「七三」比例瓜分,租金收入中標財團佔七成,其餘三成則歸市建局;發展商可以向市建局要求出售非住宅部分,但須獲市建局首肯。另外,項目設有限呎條款,住宅單位面積不得少於300方呎,同時規定最少一半單位面積不可超過480方呎。

該項目於上月初完成招收意向書程序,合共接獲31份意向書,該局昨日正式邀請31家發展商及財團入標競投,並於10月6日截標。市建局指出,招標遴選小組將評審收到的標書,並於稍後就批出該發展項目的發展向市建局董事會提交建議,由董事會作最終決定。

商場租金「七三」分帳

項目位於銀漢街44至54A號 (雙數) 及榮光街72至118號 (雙數),鄰近港鐵土瓜灣站,步行前往約5至6分鐘;地盤面積約3.1萬方呎,可建總樓面約27.86萬方呎,發展規模是目前已推出項目中最細,估計可以提供約560伙住宅。

招標條款顯示,成功取得該項目的發展商及財團,須按發展協議中列明有關土瓜灣小區發展的「總體設計要求」作為興建新發展項目的藍本,與毗鄰重建項目產生協同效應,以達致整個小區的重整及規劃更完整及一體化,促進該小區的連接性與步行環境,並以更具特色的「地方營造」及智慧元素,提升該區的宜居性。

標價備受市場關注

有測量師指出,上述項目屬市區罕有新供應,料財團入標時會參考毗鄰已批出的項目價格,認為在加息環境下,是次批出價格參考指標,將備受市場關注。

另一測量師表示,近期政府批出地價有回調迹象,惟未來供應重鎮仍集中於土瓜灣、深水埗等一帶,而且近年市建局以小區發展的大型重建項目罕有,估計屆時收約10份標書。綜合市場消息指,參考去年同區批出項目每呎樓面地價,預計該項目估值30.6億至36.2億,每方呎估值約1.1萬至1.3萬。

(星島日報)

恒基嘉里長實瓜分3項目

市建局昨日正式邀請發展商及財團入標競投的土瓜灣榮光街 / 崇安街項目,為該局於過去約一年多,推出招標的第4個同區發展項目,而之前招標的3個項目,中標發展商分別為恒基、嘉里及長實,涉及金額合共逾197.7億。

三項目涉逾197.7億

市建局於去年6月,就土瓜灣庇利街/榮光街項目邀請發展商遞交意向書,最終接獲36份意向書,同年7月正式招標,8月截標時合共接獲6份標書,最後恒基於9月以81.89億投得,直至今年2月恒基引入帝國集團及希慎興業合作發展。該項目地盤面積約7.97萬方呎,預計可建總樓面逾71.7萬方呎,料可提供1150伙住宅及11.9萬方呎商業樓面。

至於鴻福街 /

銀漢街項目,市建局於去年9月邀請發展商提交發展意向書,合共接獲36份意向書,同年10月招標,11月截標時合共接獲8份標書,結果嘉里於12月以超過55.87億投得。該項目地盤面積約4.93萬方呎,可建總樓面最多約44.38萬方呎,預期可提供665伙住宅及7.4萬方呎商業樓面。

去年11月,市建局就鴻福街、啟明街及榮光街的四合一項目招收意向,合共接獲31份意向書。項目隨後於今年1月招標,2月截標時合共接獲7份標書,最終由長實以59.96億投得。該項目地盤總面積約5.85萬方呎,可建總樓面上限約52.68萬方呎,預期可提供約890伙住宅。

(星島日報)

會德豐跑馬地舊樓申請強拍

傳統豪宅區住宅地供應短缺,不少財團密密透過舊樓併購,以申請強拍增土儲;跑馬地黃泥涌道一系列相連地段的舊樓、包括翠景樓、愉華大廈及安美大廈,短短兩周內先後向土地審裁處申請強拍,均由會德豐地產提出申請,以擴大其跑馬地重建版圖,最新一宗為安美大廈目前持有逾85%業權,市場估值5.2億;發展商指,未來將整合發展,以重建為豪宅項目,涉及可建總樓面逾15萬方呎。

梁志堅:將重建為豪宅

會德豐地產主席梁志堅回覆查詢時指,未來上述項將整合發展,屆時將會重建為豪宅項目。

近年會德豐地產積極擴大跑馬地併購版圖,近日連環申請強拍黃泥涌道一系列相連地段的舊樓以統一業權發展,最新一宗為安美大廈,目前持有約85.6%業權,現餘下8個單位並未成功收購,包括7個住宅單位及1個商鋪,其中住宅單位市場估值約597萬至1448萬,而商鋪估值約560萬,市場對整個項目估值5.2252億。

據土地審裁處文件顯示,安美大廈位於黃泥涌道63及65號,位於跑馬地黃泥涌道及雲地利道的豪宅地段,毗鄰馬場,落成後料不少單位可享馬場景色;同時鄰近銅鑼灣核心商業地段,極具重建價值。

現址為一幢樓高13層的商住舊樓,地下為商鋪,樓上為住宅樓層,該舊樓早於1971落成入伙,至今樓齡約51年。文件顯示,項目地盤面積5172方呎,目前坐落於「住宅 (甲類)」地帶,若以地積比率9倍發展,涉及可建總樓面約46548方呎。

3地盤合併可建15.4萬呎

事實上,該公司積極擴展跑馬地版圖,上述舊樓毗鄰的愉華大廈、翠景樓日前已向土地審裁處申請強拍,前者申請強拍時持有約80.59%業權,市場對整個項目估值6.1124億;後者翠景樓申請強拍時持有約83.33%業權,而市場對整個項目估值7.0681億。上述3個地盤合併發展,地盤面積擴展至17191方呎,若以地積比率9倍重建發展,涉及可建總樓面約154719方呎。

除上述項目外,會德豐地產夥拍培新集團、於今年3月透過強拍途徑,以底價17.32億,成功統一雲地利大廈舊樓業權。上述地盤面積約17595方呎,現時規劃為「住宅

(乙類)

6」用途,若以地積比率約5倍重建發展計,預計可建總樓面約87975方呎,以上述強拍價計算,每呎樓面地價約19687元。當時發展商指將盡快開展相關程序如申請拆卸物業等,預計項目最快於3年或以後推出市場。項目位於跑馬地黃泥涌道及雲地利道的豪宅地段,落成後料不少單位可享馬場景色。

深水埗海壇街舊樓獲批強拍

另外,由財團持有的深水埗海壇街227B至227C號舊樓,最新獲土地審裁處批出強拍令,底價為1.2億,對比去年4月申請強拍時市場估值約1.0013億高出1987萬或19.8%。上述舊樓現址為一幢樓高6層的商住物業,地下為商鋪,樓上為住宅,並於1960年落成,至今樓齡約62年。上述地盤面積約2322方呎,若以9倍地積比率作商住發展,涉及可建總樓面約20898方呎。

(星島日報)

旺角安康寧商廈2.8億放售

旺角老字號藥房「安康寧藥房」江氏家族,放售近半世紀的安康寧商業大廈,市值約2.8億,平均呎價約1.58萬。

旺角太子彌敦道792號安康寧商業大廈,佔地約1612方呎,1982年落成,樓高14層,包括3120方呎地庫及地下商鋪,1至14樓為寫字樓,涉及約1.5萬方呎樓面,總樓面即約1.8萬方呎,物業將以現狀及交吉出售。

老牌家族自用40年

有代理表示,該全幢業主為安康寧藥業家族,自用物業40年,首次在市場上放售,由於大廈交吉出售,投資者或基金可迅速打造「主題」商廈。

(星島日報)

啟德跑道區2用地 保留作商業用

近年商業氣氛受創,啟德一帶陸續有商業地流標收場,政府遂於去年表示有意將區內5幅商業地改劃成住宅,以提供約6,000伙住宅,但城規會最終於上周決定,保留當中位於跑道區的2幅商業用地,即約138萬平方呎商業樓面獲保留。

改劃啟德5幅商業地的計劃早前受阻,城規會隨後於6月否決其中2幅位於跑道區商業地的改劃建議。上周會方再審議有關保留該2幅用地作商業用途的申述及意見,並表示拒絕接納相關反對申述,意味2幅用地將獲保留作商業之用,住宅供應最終會減少約1,720伙。是次2幅獲保留的用地分別為4C區4號及5號用地,比鄰啟德郵輪碼頭,其總樓面分別涉約79.4萬平方呎及58.2萬平方呎。

2商業地 料供應138萬呎樓面

事實上,啟德一帶的商業地發展可謂一波三折,上述2幅用地均曾於2019年連環流標,當中4C區4號用地原於2019年5月由高銀投得,其後遭集團在同年6月撻訂,而第2度招標後,最終亦於同年9月流標。至於4C區5號用地則早於2019年1月,因為發展商出價未達政府底價而同樣流標收場。

但是,觀乎整個啟德區發展,區內的商業配套日漸成熟,預計今年至2024年,將有4個大型商業及體育項目落成,為該區新增約400萬平方呎商業樓面。前述的4個項目較近港鐵啟德站,當中規模較大的南豐旗下商業地標項目 AIRSIDE,預料於今年第4季正式開幕,總樓面逾191萬平方呎,總投資額達320億元。

AIRSIDE 預計第4季開幕

同樣屬大型商業項目、早於2016年由利福國際 (01212)

以約73.88億元投得的啟德第1E區2號商業地,亦擬發展2幢樓高18至19層高的雙子塔式商廈,並設4層地庫,其中1幢則發展為大型百貨公司崇光

(SOGO) 分店,總樓面逾109萬平方呎,其中9成樓面作零售用途,而項目將會在明年緊接推出。

此外,遠東發展 (00035(

於2019年以約24.46億元奪得的承啟道商業地,將發展為酒店及寫字樓,供約400個酒店房間,及12層高 (計入地庫)

的寫字樓及零售商廈,涉及總樓面約34.4萬平方呎,料於2024年落成。項目的辦公室部分早前以約33.8億元出售予中電 (00002)

,將成集團的新總部。而啟德體育園亦將提供約64.6萬平方呎的零售及餐飲設施,早前日式百貨公司AEON已宣布承租啟德體育園舖位9年,涉及金額約3,730萬元。

(經濟日報)

更多AIRSIDE寫字樓出租樓盤資訊請參閱:AIRSIDE 寫字樓出租

更多啟德區甲級寫字樓出租樓盤資訊請參閱:啟德區甲級寫字樓出租

PARK PENINSULA 綜合多元化地段

經過多年規劃,前身是啟德機場的啟德發展區其發展日漸成熟,近年陸續有多個私人住宅項目入伙。今年7月,在跑道區上持有土地的9間發展商更合組公司,將跑道區建構為一個全新綜合多元化地段—PARK PENINSULA。

9間發展商共同打造

上述9間發展商包括華懋集團、帝國集團、中國海外 (00688)、遠東發展 (00035)、恒地

(00012)、嘉華國際 (00173)、新世界發展 (00017)、新地

(00016)及會德豐地產。他們均在跑道區分別以獨資或合資形式持有9幅用地,涉逾萬伙住宅,總樓面達636萬平方呎,佔整個跑道區單位總數逾8成。

跑道區屬前啟德國際機場的跑道部分,三面環海,翻查資料,政府近年在跑道區合共批出11幅用地,涉及逾700萬平方呎樓面。早前有份參與的發展商亦透露,將藉此與政府相關部門、區內持份者及NGO溝通,合作舉辦休閒及慈善活動。至於交通方面,目前正爭取在PARK

PENINSULA每一個項目設有穿梭巴士往返港鐵站,方案日後或有機會落實。

(經濟日報)